Abstract

Despite the fact that Estonia is a small market, competition in the grocery retail sector remains intense with no single undertaking enjoying dominant position. Although the concentration levels on the national level are substantial, there is a significant number of rivals present in different geographic areas. Due to the specifics of the market structures (including production, processing and retail), competition rules will remain an efficient tool of addressing increasing market concentration or possible anticompetitive practices in the grocery retail. Although the effectiveness of the criminal enforcement of competition rules in Estonia can be questioned, this would apply equally to all industry sectors where competition can be harmed by unilateral or collusive conduct of the undertakings.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

According to the classic categorization, the Estonian legal system belongs to the Continental (Civil Law) European legal tradition, Romano-Germanic family with strong historical links with the German legal system, especially in the field of civil/private law.Footnote 1 The Estonian legal system is formally norm based, i.e., statutory law is the primary source of law. It should be noted, however, that the influence of EU law on the development of the Estonian legal system strengthened the role of the precedents, particularly those of the Supreme Court, which is empowered to interpret legal rules, especially in cases of legal lacunae, and to carry out constitutional review of the legislation. These general features and historical background of the Estonian legal system has predetermined the emphasis on the public antitrust enforcement, while private enforcement of competition rules remains virtually nonexistent.Footnote 2

As far as the substantive antitrust rules are concerned, Estonian competition law has been shaped under the influence of the EU rules and standards. According to the early comments on the harmonization of the Estonian competition rules with those of the EU, it was noted that “there is hardly anything in EU competition law that has not found its way into the Estonian Competition Act, often even word for word.”Footnote 3 This early harmonization of the substantive competition rules has signaled the intention of the Estonian state to follow the EU model in the domestic competition enforcement.Footnote 4 At the same time, Estonian legislator has made a policy choice in favor of multilevel public enforcement, which led to the current situation when competition rules can be enforced under administrative, misdemeanour and criminal procedural rules. This diversity in procedural frameworks combined with the technical constrains of the national competition authority (limited human and financial resources), and a combination of the antitrust and regulatory functions under the responsibility of the same authority has shaped the Estonian antitrust enforcement.

As the following sections of the present report shall demonstrate, the Estonian legislator has not adopted any competition rules or exemptions that would be specific to the grocery retail sector. This reflects the general approach to adopt sector-specific legislation for the regulated sectors, while unregulated industries remain subject to the general competition rules. Another important aspect is the enforcement of the general competition rules in the grocery retail sector, and in this sense Estonia exhibits a relatively low record of antitrust enforcement. This outcome has resulted, inter alia, from the emphasis on public enforcement, multiple procedural frameworks for enforcement and the limits in technical capacity of the national competition authority. Another important factor is the current competitive conditions in the grocery retail and its links with the agricultural and processing industries. The following sections highlight the economic, legal and institutional factors that explain the current situation with antitrust enforcement in the Estonian grocery retail market.

2 Economic Background

According to the Estonian Ministry of Agriculture,Footnote 5 in 2013 there were 965,907 ha of usable agricultural land in Estonia, the biggest share of which remains under dairy farming.Footnote 6 The plant fields are primarily used for growing cereals, oil cultures, potatoes and vegetables. As many other EU Member States, Estonia experienced significant consolidation of agricultural holdings with their number steadily decreasing, while the average used land per holding almost doubled during 2003–2007.Footnote 7 A large number of agricultural producers and processors of agricultural products are represented by the Estonian Chamber of Agriculture and Commerce.Footnote 8

The food processing accounts for 17 % of the total output of the Estonian processing industry.Footnote 9 This sector has also experienced substantial consolidation during 1998–2002. Since 1993, the interests of the Estonian food producers have been represented by the Association of the Estonian Food Industry.Footnote 10 In the specific food sectors, the following industry associations exist: Estonian Association of Bakeries,Footnote 11 Estonian Breweries Association,Footnote 12 Estonian Association of Alcohol Producers, Estonian Association of Cheese Producers, etc.Footnote 13

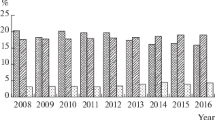

The grocery retail market is moderately concentrated with the three leading retailers (ETK, Rimi, Selver) accounting for about 60 % of the market.Footnote 14 Their interests are represented by the Estonian Traders Association.Footnote 15 According to the 2013 industry research, none of the retailers enjoys single dominance: ETK (19 %), Rimi (18 %), Selver (17 %), Maxima (15 %), etc.Footnote 16 Approximately 45 % of food retail is realized through department stores with retail space less than 100 m2 (22 %) and supermarkets with retail space between 100 and 400 m2, followed by large supermarkets with retail space of 1,000–2,500 m2 (10 %).Footnote 17

3 Legal Background

3.1 Competition Law

The Estonian Competition ActFootnote 18 applies to extraction of natural resources, manufacture of goods, provision of services and sale and purchase of products and services, as well as other economic activities, and therefore is equally applicable to the grocery sector.Footnote 19 Competition rules are applied to undertakings that are determined according to the functional approach related to the exercise of economic activity: “a company, sole proprietor, any other person engaged in economic or professional activities, an association which is not a legal person, or a person acting in the interests of an undertaking.”Footnote 20 Following this approach, the state, local governments, legal persons in public law and other persons performing administrative duties can be treated as undertakings if they participate in a goods market.Footnote 21 The agricultural sector is subject to competition rules only to the extent determined on the basis provided for in Article 42 TFEU.Footnote 22 The Competition Act includes a ban on unfair competitionFootnote 23 as well as prohibition of anticompetitive practices, which might lead to preclusion, elimination, prevention, limitation or restriction of competition.Footnote 24

The national equivalents of Articles 101 and 102 TFEU have been incorporated in the Competition Act, which has been in force since 2001, with the most recent amendments taking place on July 2013.Footnote 25 Besides adding anticompetitive exchanges of information to the list of prohibited anticompetitive practices, the relevant provision of the Competition Act mirrors Article 101 TFEU.Footnote 26 The prohibition of abuse of dominant position in the Competition Act follows the structure of Article 102 TFEU, adding the following to the list of anticompetitive unilateral practices: (1) forcing an undertaking to concentrate, enter into an agreement that restricts competition, engage in concerted practices or adopt a decision together with the undertaking or another undertaking, and (2) unjustified refusal to sell or buy goods.Footnote 27

The Competition Act does not contain any provisions that have been specifically aimed at the grocery retail market. However, certain forms of anticompetitive agreements and practices as well as abuses of dominant position might be especially relevant for the retail markets. For example, the Competition Act explicitly provides that a ban on fixing of prices or other trading conditions covers prices of goods, markups, discounts, rebates, basic fees and premiums, which is mostly aimed at the distribution (wholesale and retail) activities.Footnote 28 The provisions on the abuse of dominance explicitly mention unfair pricing, anticompetitive discrimination and refusal to deal.Footnote 29

Estonia has pursued the criminalization of competition infringements,Footnote 30 and certain violations of competition rules are considered criminal offences under the Penal Code that should be prosecuted in criminal proceedings initiated by the Prosecutor’s OfficeFootnote 31 upon request of the Estonian Competition Authority (the “ECA”)Footnote 32: repeated abuse of dominant positionFootnote 33; agreements, decisions and concerted practices restricting free competitionFootnote 34; repeated failure to perform obligations of undertakings in control of essential facilities.Footnote 35 Other infringements of competition rules are regarded as misdemeanors that should be prosecuted under the Code of Misdemeanour ProcedureFootnote 36: abuse of dominant position, implementation of concentration without permission, and the nonperformance of obligations by the undertakings in control of essential facility.Footnote 37

The behavior of grocery retailers besides competition law is mostly regulated by the consumer protection legislation. For instance, Consumer Protection Act imposes on retailers certain information and transparency requirements and prohibits a range of unfair commercial practices.Footnote 38 The general conduct of the retail trade is governed by the provisions of the Trading Act,Footnote 39 which lays down the registration and qualification requirements for traders and their personnel, conditions for labeling the products and displaying prices, etc. All of the above regulations are based on the principles of fairness and protection of weaker party. There are no specific rules on protecting a party with weaker bargaining power vis-à-vis large retailers in business-to-business transactions. These would be evaluated under the general principles of fairness and reasonableness embedded in the Law of Obligations Act.Footnote 40

3.2 Exemptions from Competition Law Prohibitions

The Competition Act provides for various categories of exemptions from the application of the national equivalent of Article 101 TFEU: de minimis exemptions,Footnote 41 individual exemptionsFootnote 42 in line with Article 101(3) TFEU and a set of block exemptions specified in the government’s regulations on the proposal of the Minister of Economic Affairs and Communications.Footnote 43 At the same time, there are no regulations or bylaws that would provide further guidance on various aspects of antitrust enforcement carried out by the ECA. There are no specific exemptions from the application of Competition Act that would be applicable to the retail grocery sector. There is no automatic exemption for small-scale farmers or suppliers of food products from application of competition rules. Their agreements on joint selling and other forms of cooperation vis-à-vis large-scale distributors would have to be analyzed under the national equivalent of Article 101 TFEUFootnote 44 and can be exempted under the general de minimis rules,Footnote 45 under the equivalent of Article 101(3) TFEUFootnote 46 or under the block exemption regulations.Footnote 47

3.3 Other Laws and Regulations Applying to the Retail and Grocery Sector

The conduct of the grocery retailers is subject to a number of general and sector-specific regulations. Consumer protection legislationFootnote 48 regulates general marketing activities, determines the rights of consumers as purchasers of the products and provides for organization and supervision of consumer protection and liability of retailers. The Trading Act lays down mandatory conditions for the conduct of trading activities, including registration, qualification and information requirements. The Advertising ActFootnote 49 regulates advertising activities that may be employed by the grocery retailers. In particular, it prohibits misleading advertisingFootnote 50 and restricts advertising directed at childrenFootnote 51 and advertising of alcoholic beverages.Footnote 52 In relation to the sale of alcohol products, sector-specific regulations impose numerous requirements and conditions on the way alcoholic beverages should be marketed by the retailers (retail locations, customers, labeling, displaying price, security measures, etc.), which significantly affects competition in relation to these products.Footnote 53

The conduct of trading activities is generally regulated by the Trading Act, which is equally applicable to the traditional brick-and-mortar stores as well as to Internet retail stores, which have to comply with specific provisions relevant to e-trade—the offer for sale or sale of goods or services on the Internet without the parties being simultaneously physically present.Footnote 54 It provides, inter alia, that Internet retail stores have to comply with registration, information and transparency requirements of consumer protection legislation, as well as general contract rules and Information Society regulations.Footnote 55 Generally, Internet stores are not active in grocery retail sector in Estonia. One of the major retailers attempted to introduce Internet-based ordering system where the consumers were able to pick up the preordered goods at the store, but due to the lack of popularity this service was discontinued.

The ECA does not have specific competences in the adoption or enforcement of specific regulations in the food retail sector. The Competition Act provides that the ECA “may make recommendations to state agencies, local governments and natural and legal persons as to the improvement of the competitive situation.”Footnote 56 The ECA regularly reports on its enforcement activities and expresses its position vis-à-vis competition on various markets through annual reportsFootnote 57 and official press releases.Footnote 58 There were no separate market inquiries conducted by the ECA in the retail grocery sector. Any market study activities were carried out in the course of regular antitrust investigations or merger control procedures.

The Competition Act prohibits only two types of unfair competition: (1) publication of misleading information, presentation or ordering of misleading information for publication or disparagement of competitor or goods of competitor,Footnote 59 and (2) misuse of confidential information or of employee or representative of another undertaking.Footnote 60 The existence of unfair competition prohibited by the Competition Act has to be established by the parties in a dispute held pursuant to the rules of civil procedure.Footnote 61 The unfair trading practices can be invalidated under the general contract rules concerning unfair standard terms and conditions.Footnote 62 However, the respective provisions are primarily aimed at protecting the consumers and do not contain any specific unfair trading practices that should be prohibited per se in business-to-business transactions.

4 Competition Law Enforcement

The 2010 amendments of the Penal Code have increased the sanctions imposed on a legal person for taking part in anticompetitive agreements up to 5 % of the annual turnover. In case of hard-core cartels, the fine could reach up to 10 % and cannot be less than 5 % of the annual turnover. Responsible natural persons for the involvement in a hard-core cartel will risk a pecuniary sanction or at least 1 year of imprisonment, which could be raised up to 3 years in case of hard-core cartels.Footnote 63

In case of anticompetitive agreements, abuses of dominant position, violations of merger control rules or any procedural infringements under the Competition Act (such as failure to supply the ECA with requested information, interference with dawn raids or failure to appear when summoned), the ECA can issue a precept requiring the natural or legal person concerned to refrain from a prohibited act, terminate or suspend activities that restrict competition, restore the situation prior to the offence.Footnote 64 If a person fails to comply with the precept, the ECA may impose penalty payments of up to EUR 6,400 on natural persons and up to EUR 9,600 on legal persons pursuant to the procedure regulated in the Substitutive Enforcement and Penalty Payment Act.Footnote 65

In relation to violations of competition rules that are treated as misdemeanours, the ECA conducts the proceedings and imposes pecuniary penalties: refusals to submit information or submission of false information (up to 300 fine unitsFootnote 66 for natural person and up to EUR 3,200 for legal person), abuse of dominant position (up to 300 fine units for natural person and up to EUR 32,000 fine for legal persons), enforcement of concentration without permission to concentrate (up to 300 fine units for natural person and up to EUR 32,000 fine for legal persons), nonperformance of obligations by undertakings in control of essential facilities (up to 300 fine units for natural person and up to EUR 32,000 fine for legal persons), failure to comply with special requirement concerning accounting (up to 300 fine units for natural person and up to EUR 32,000 fine for legal persons).Footnote 67

The ECA is unlikely to investigate cases of geographically isolated infringements. However, due to criminal prohibition of horizontal hard-core cartels, the ECA would be expected to investigate such cases if it becomes aware of such practices. In cases where harm to the general public interest could be subjectively assessed as insignificant, the relevant provisions of the Penal Code can be relied upon to impose symbolic fines on the convicted persons (both natural and legal) and leave them without criminal record. The decision to apply those provisions is with the prosecutors, and they have been applying those in cases of minor importance on many occasions.

In relation to leniency matters, the ECA has a very limited authority due to the fact that antitrust violations are criminalized and sanctioned in the criminal procedure before the court. Under the relevant provisions of the Competition Act, the ECA must confirm the receipt of leniency applications and forward them to the Prosecutor’s Office that is heading the criminal prosecution.Footnote 68

4.1 Competition Law Enforcement Against Anticompetitive Horizontal and Vertical Agreements

In 2010, the ECA commenced a cartel investigation concerning the retail of dairy products, involving both suppliers and retailers, where both horizontal and vertical concerns have been identified. Allegedly, one of the retailers complained to the ECA about the vertical agreements between a supplier of dairy products and another major retailer.Footnote 69 At the time of writing the case was still in the pretrial stage.

In 2012, a producer of alcoholic beverages and several retailers have been suspected of coordinating vodka prices. The producer was suspected of facilitating the coordination among the retailers.Footnote 70 As a result, the ECA’s investigation could lead to establishing the existence of a vertical resale price maintenance arrangement or horizontal price coordination facilitated by the supplier. At the time of writing the case was still in the pretrial stage.

ETK is a cooperative of small and medium retailers that has operated continuously since 1919.Footnote 71 In 2002, the ECA received a complaint from a private person alleging, inter alia, that (1) ETK maintained uniform transportation prices, which allowed the remote cooperatives (on the islands or countryside) to minimize their costs at the expense of the more centrally located members; (2) ETK applied a recommended pricing policy, which is contrary to Competition Act; (3) ETK mandated its members to purchase the main assortment of goods from the centralized stock and excluded those members that did not comply with this purchase obligation. The ECA considered that such cooperation was not illegal because it allowed members of the cooperative to compete with the major retail chains and therefore fostered competition on the grocery retail market.Footnote 72 The competition authority considered ETK as a single undertaking for the purposes of applying competition law. The ECA was of the opinion that even if the members of ETK would be considered as separate undertakings, their cooperation practices would be exempted under the national equivalent of Article 101(3) TFEU.Footnote 73 According to the ECA, ETK’s recommended retail prices, common transportation and purchasing arrangements did not have anticompetitive effect, although formally they could not be exempted under the national de minimis rulesFootnote 74 as ETK’s market share was around 20 %. The investigation was closed by a letter finding no violation of Competition Act.

As mentioned above, there are several ongoing investigations that concern large-scale retail grocery stores that, as reported by the media, have been allegedly involved in price coordination and limitation of competition among them. These cases concern both retailers and suppliers with possible horizontal and vertical competition issues. At the time of writing none of these investigations have resulted in the finding of an infringement or prosecution of the undertakings involved.

4.2 Resale Price Maintenance and Recommended Resale Prices

The resale price maintenance (RPM) can be prohibited under the national equivalent of Article 101 TFEU,Footnote 75 as opposed to purely recommended prices, when it is enforced by certain means that include withdrawal of the supply, providing of incentives, establishing of the monitoring of competitors’ prices on retail level and other measures facilitating price coordination. Another scenario that might be considered in relation to coordination of resale prices is a hub-and-spoke collusion with both horizontal and vertical dimensions where RPM can be effectively enforced. There are currently several cases being investigated by the ECA, the details of which are not public, that concern grocery retail sector and may include allegations of RPM. Some of them are likely to result in public court proceedings, which can shed light on their circumstances, as well as produce some court guidance on RPM, including how and when it can be considered an infringement of competition rules.

4.3 Abuses of Dominant Position

The Competition Act does not expressly prohibit abuse of buying power or abuse of economic dependency. There are no specific definitions of these concepts. Since the national equivalent of Article 102 TFEUFootnote 76 contains a nonexclusive list of actions of the dominant undertaking that can be qualified as abuse of dominance, the abuse of buying power or abuse of dependency is not therefore excluded.

The provisions of the Competition Act are not sufficiently clear in relation to the abuse of dominance test that should be applied to the conduct of the dominant undertaking. While the law does not explicitly prohibit the abuse of buying power or dependency, these abuses can take the form of imposition of unfair prices of other trading conditions, application of discriminatory practices or unjustified refusals to sell or buy goods and then can be caught by the prohibition provision.Footnote 77 Although in its enforcement practice the ECA has normally considered the anticompetitive effects of abusive conduct, the Supreme CourtFootnote 78 has demonstrated acceptance of the per se approach as well. In 2007, the Supreme Court held that Competition Act does not require the showing of anticompetitive effects in abuse of dominance cases.Footnote 79 The court reasoned that the existence of potential risk to competition is sufficient in itself, especially in relation to practices that have been characterized as per se abuses by the EU courts.Footnote 80

The Competition Act expressly prohibits direct or indirect imposition of unfair purchase or selling prices as a form of abuse of dominant position.Footnote 81 The notion of unfair prices encompasses excessive or abusively high prices. The test for pricing abuses has been clarified by the Supreme Court in the Eesti Telefon case.Footnote 82 Referring to the EU jurisprudence,Footnote 83 the court confirmed that evaluation of the reasonableness of prices of the dominant undertaking is in line with EU competition law.Footnote 84 The reasonableness of the price is determined on the basis of a comparison between the established price and the economic value of the product or service. This is generally in line with the two-prong test established by the CJEU in the United Brands case.Footnote 85 The comparison can also be done between the profit margin obtained by the dominant undertaking and the profits made in other similar markets where competition is present.Footnote 86 The court also held that the price might be excessively high even in the absence of profit because it is not fair to expect the clients/consumers of the dominant undertaking to cover the costs resulting from the inefficient economic activities of the dominant undertaking.Footnote 87 Some commentators welcomed the ECA’s assessment of prices in the industries where price competition is not possible due to the structure of the relevant markets.Footnote 88

In 2011, the ECA investigated excessive pricing in the Levira case, which concerned the market for terrestrial broadcasting services.Footnote 89 In its assessment, the ECA followed the United Brands test and the Supreme Court’s reasoning in Eesti Telefon. The ECA held that it should consider whether the pricing had a reasonable correlation with the economic value of the services provided. For that it was necessary to see whether the dominant undertaking had made profit that it could not have gained under ordinary and sufficiently competitive market conditions. According to the ECA’s 2011 Annual Report, “the Competition Authority proceeded from the determination of whether the ratio of the profitability and the economic merit of the service provided by Levira were reasonable.”Footnote 90 In its assessment, the ECA referred to the Supreme Court’s determination that “the unfair pricing may also be asserted by the fact that the undertaking would not have the possibility to sell its products or services at given price if it would not have the dominant position.”Footnote 91 The ECA considered Levira’s profitability to be too high, and the company decreased its profit margins in the course of the proceedings. In its Levira decision, the ECA also provided the elements of the predatory pricing test: (1) below-cost pricing, (2) exclusion of competitors, (3) possibility of recoupment for the dominant undertaking, (4) consumers obtaining short-term benefits in the form of lower prices but suffering from the elimination of competition in the long term.

5 Merger Control

There are no specific thresholds for retail or grocery retail sector. The ECA is in charge of evaluating the proposed mergers’ effect on competition once the general notification thresholds are met.Footnote 92 The substantive test for assessment of concentration mirrors the SIEC test under the EC Merger RegulationFootnote 93: “The Competition Authority shall prohibit a concentration if it is likely to significantly restrict competition in the goods market above all, by creating or strengthening a dominant position.”Footnote 94

5.1 Market Definition in the Grocery Retail Sector

The competition legislation provides little guidance on the definition of the relevant product market. The ECA’s Guidelines for Submission of Notices of ConcentrationFootnote 95 merely provide that the parties should determine their product markets on the basis of the definition of “goods market” as provided in the Competition Act: “goods which are regarded as interchangeable or substitutable (hereinafter substitutable) by the buyer by reason of price, quality, technical characteristics, conditions of sale or use, consumption or other characteristics.”Footnote 96 The product market in the merger control proceedings is considered by the ECA in line with EU practices. Based on the commercial space of the retail locations, the following were distinguished: hypermarkets, supermarkets, discount stores. All of these have been recognized as competing retail locations, but even when a narrow product market was defined in merger assessments (including only certain category of retail locations), the competitive pressure was still substantial. For example, in 2006, the ECA approved in Phase I proceedings a merger of two food retailers, OÜ VP Market and OÜ Soldino.Footnote 97 In that case, the ECA, referring to the EU Commission’s practice,Footnote 98 has defined the relevant product market as retail of food and groceries in nonspecialized stores. The practitioners have criticized the ECA for insufficient attention paid to the determination of the relevant market in its merger decisions, at least as far as nonhorizontal mergers are concerned.Footnote 99

The competition legislation provides little guidance on the definition of the relevant geographic market. The ECA’s GuidelinesFootnote 100 merely provide that geographic market “shall include the area in which the parties to the concentration engage in the sale and purchase of goods.” In the ECA’s practice, the geographic markets are defined in line with EU practice: a 30-min drive from the place of residence to determine the geographic areas of competing retailers. In the above-mentioned VP Market/Soldino case, the ECA defined the relevant market as the city of Narva and its vicinity, while in another merger case Tallinn and its vicinity were used as a relevant geographic market.Footnote 101

5.2 Merger Control and the Growth of Grocery Retail Networks

The concentration of grocery retail networks has not been considered problematic in the notified merger cases as sufficient competition was preserved. At the same time, even in case of anticompetitive concentrations, the existing tools of merger control (prohibitions and remedies) could be used in order to contain the rising concentration levels. The ECA has somewhat limited but quite diverse experience with merger remedies accepting both structural divestitures and behavioral commitments aimed at remedying anticompetitive effects of a merger.Footnote 102 This experience could be of great assistance once the Estonian merger control encounters a concentration that would raise anticompetitive concerns in the retail grocery sector. Finally, the consolidation of market power in the retail grocery sector can be constrained by the ECA’s power to prohibit anticompetitive mergers.Footnote 103 Already by its first prohibition decision issued in 2008, the ECA demonstrated that it is prepared to block concentrations that strengthen the dominant position even in case of minor acquisitions, which demonstrate a tendency of consolidation of market power through a series of acquisitions.Footnote 104 In that case, the ECA has prohibited a concentration in the pharmacy sector when pharmaceuticals wholesaler attempted to acquire a pharmacy that accounted for less than 1 % of the pharmaceuticals retail market. The ECA analyzed the acquisitions of the acquiring undertaking in the past 2 years and concluded that the notified concentration would not be the last but rather a part of the business strategy aimed at acquiring independent pharmacies, which might lead to significant reduction of competition in the long term. Although the ECA has been criticized for taking into account hypothetical future acquisitions in its merger assessment,Footnote 105 the above case demonstrated that the ECA is prepared to consider long-term market developments that can be influenced by applying merger control tools.

6 Conclusion

Despite the fact that Estonia is a small market, competition in the grocery retail sector remains intense with no single undertaking enjoying dominant position. Although the concentration levels on the national level are substantial, there is a significant number of rivals present in different geographic areas. As far as the bargaining power of the large-scale retailers vis-à-vis their suppliers is concerned, one should also acknowledge that both agricultural production and the food processing industry went through a process of consolidation, which has strengthened their bargaining position vis-à-vis grocery retailers. Due to the specifics of the market structures (including production, processing and retail), competition rules will remain an efficient tool of addressing increasing market concentration or possible anticompetitive practices in the grocery retail. Although the effectiveness of the criminal enforcement of competition rules carried out by the ECA and public prosecutors can be questioned, this would apply equally to all industry sectors where competition can be harmed by unilateral or collusive conduct of the undertakings.

Notes

- 1.

See Miil K, Kuusik J and Ruttu M (2013) UPDATE: Guide to Estonian Legal System and Legal Research. http://www.nyulawglobal.org/globalex/estonia1.htm. Accessed 22 May 2014.

- 2.

See Sein K (2013) Private Enforcement of Competition Law – the Case of Estonia. Yearbook of Antitrust and Regulatory Studies 6(8):129–139.

- 3.

Thielert J and Schinkel M P (2003) Estonia’s competition policy: a critical evaluation towards EU accession. European Competition Law Review 24(4): 175, available at http://arno.unimaas.nl/show.cgi?fid=463. Accessed 22 May 2014.

- 4.

See, generally, Clark J (1999) Competition Law and Policy in the Baltic Countries – A Progress Report. OECD, Paris. See also Vedder H (2004) Spontaneous Harmonisation of National (Competition) Laws in the Wake of the Modernisation of EC Competition Law. Competition Law Review 1(1):5–21.

- 5.

Põllumajandusministeerium, http://www.agri.ee/. Accessed 22 May 2014.

- 6.

Ministry of Agriculture (2014) Food, agriculture, rural life, fisheries in facts, http://www.agri.ee/sites/default/files/content/valjaanded/2014/trykis-2014-faktiraamat-eng.pdf. Accessed 22 May 2014.

- 7.

The Ministry of Agriculture reported that the number of agricultural holdings decreased by 36.7 %; however, the average area of agricultural land of the holding increased 1.8 times (from 21.6 ha to 38.9 ha). See http://www.agri.ee/agriculture-and-food/. Accessed 22 May 2014.

- 8.

Eesti Põllumajandus-Kaubanduskoda, http://www.epkk.ee/. Accessed 22 May 2014.

- 9.

Almost a third from it is formed by dairy products; 18 % meat products; 15 % bread, bakery and other products; and 9.5 % fish products. See http://www.agri.ee/agriculture-and-food/. Accessed 22 May 2014.

- 10.

Eesti Toiduainetööstuse Liit, http://toiduliit.ee/. Accessed 22 May 2014.

- 11.

Eesti Leivaliit, http://www.leivaliit.ee/. Accessed 22 May 2014.

- 12.

Eesti Õlletootjate Liit, http://www.eestiolu.ee/. Accessed 22 May 2014. The Estonian Breweries Association brings together three major beer producers (AS Saku Õlletehase, AS A.Le.Coq and AS Viru Õlu). It has adopted its Code of Ethics with the aim to “facilitate, through the self-regulation of advertising communication, responsible actions of breweries by following common standards.” See http://www.eestiolu.ee/code-of-ethics-in-english/. Accessed 22 May 2014.

- 13.

Eesti Juustuliit, http://www.juustuliit.ee/. Accessed 22 May 2014.

- 14.

Kusmin K (2010) Grocery retail in Estonia – does the competition work? 2010 Competition Day, available at http://www.konkurentsiamet.ee/?id=20076. Accessed 22 May 2014.

- 15.

Kaupmeeste Liit, http://www.kaupmeesteliit.ee/et/english-summary. Accessed 22 May 2014.

- 16.

See Country Report (2013) Grocery Retailers in Estonia. http://www.euromonitor.com/grocery-retailers-in-estonia/report. Accessed 22 May 2014.

- 17.

See Country Report (2013) Grocery Retailers in Estonia.

- 18.

Competition Act, passed 6 May 2011, RT I 2001, 56, 332, entry into force 10 January 2011. See, generally, Thielert J and Schinkel M P (2003) Estonia’s competition policy: a critical evaluation towards EU accession. European Competition Law Review 24(4):165–175.

- 19.

Competition Act, para 1(1).

- 20.

Competition Act, para 2(1). On the notion of undertaking in Estonian competition law, see Rüütel R, Konkurentsikeeld võib viia vangimajja [Definition of undertaking in competition law] Eversheds (2 May 2014), available at http://www.eversheds.com/global/en/what/articles/index.page?ArticleID=en/global/Estonia/en/definition-undertaking-competition-law. Accessed 22 May 2014.

- 21.

Competition Act, para 2(2).

- 22.

Competition Act, para 4(2).

- 23.

Competition Act, Chapter 7.

- 24.

Competition Act, Chapter 2.

- 25.

See European Competition Network Brief (2013) The Estonian Parliament amends its competition act, 15 July 2013, e-Competitions Bulletin, N° 58777.

- 26.

Competition Act, para 4(1)(4).

- 27.

Competition Act, paras 16(5) and (6).

- 28.

Competition Act, para 4(1)(1).

- 29.

Competition Act, para 16.

- 30.

See, generally, Proos A (2006) Chapter 17: Competition Policy in Estonia. In Katalin J. Cseres, Maarten Pieter Schinkel and Floris O.W. Vogelaar (eds), Criminalization of Competition Law Enforcement: Economic and Legal Implications for the EU Member States, Edward Elgar.

- 31.

Prokuratuur, http://www.prokuratuur.ee/. Accessed 22 May 2014.

- 32.

Konkurentsiamet, http://www.konkurentsiamet.ee/. Accessed 22 May 2014.

- 33.

Penal Code, passed 6 June 2011, RT I 2001, 61, 364, entry into force 1 September 2002, para 399(1).

- 34.

Penal Code, para 400.

- 35.

Penal Code, para 402.

- 36.

Code of Misdemeanour Procedure, passed 22 May 2002, RT1 I 2002, 50, 313, entry into force 1 September 2002.

- 37.

Competition Act, Chapter 9.

- 38.

Consumer Protection Act, passed 11 February 2004, RT I 2004, 13, 86, entry into force 15 April 2004.

- 39.

Trading Act, passed 11 February 2004, RT I 2004, 12, 78, entry into force 15 April 2004.

- 40.

Law of Obligations Act, passed 26 September 2001, RT I 2001, 81, 487, entry into force 1 July 2002.

- 41.

Competition Act, para 5.

- 42.

Competition Act, para 6.

- 43.

Government of Republic Regulation No. 197 of 30 December 2010 “Grant of Permission to Enter into Specialisation Agreements Which Restrict or May Restrict Free Competition (group exceptions)” (RT I, 04.01.2011,11); Government of Republic Regulation No. 60 of 27 May 2010 “Grant of Permission to Enter into Vertical Agreements Which Restrict or May Restrict Free Competition (group exceptions)” (RT I 2010, 23, 112); Government of the Republic Regulation No. 66 of 3 June 2010 “Grant of Permission to Enter into Motor Vehicle Distribution and Servicing Agreements Which Restrict or May Restrict Competition (Block exemption)” (RT I 2010, 28, 149).

- 44.

Competition Act, para 4.

- 45.

Competition Act, para 5.

- 46.

Competition Act, para 6.

- 47.

Competition Act, para 7. See, for example, Government of Republic Regulation No. 60 of 27 May 2010 “Grant of Permission to Enter into Vertical Agreements Which Restrict or May Restrict Free Competition (group exceptions)" (RT I 2010, 23, 112).

- 48.

Consumer Protection Act, passed 11 February 2004, RT I 2004, 13, 86, entry into force 15 April 2004.

- 49.

Advertising Act, passed 12 March 2008, RT I 2008, 15, 108, entry into force 1 November 2008.

- 50.

Advertising Act, para 4.

- 51.

Advertising Act, para 8.

- 52.

Advertising Act, para 28.

- 53.

Alcohol Act, passed 19 December 2001, RT I 2002, 3, 7, entry into force 1 September 2002.

- 54.

Trading Act, para 2(7).

- 55.

Trading Act, para 4(1)(11).

- 56.

Competition Act, para 61.

- 57.

The ECA’s annual reports are available at http://www.konkurentsiamet.ee/?id=23901. Accessed 22 May 2014.

- 58.

See http://www.konkurentsiamet.ee/?id=10461&op=archive. Accessed 22 May 2014.

- 59.

Competition Act, para 51.

- 60.

Competition Act, para 52.

- 61.

Competition Act, para 53.

- 62.

Law of Obligations Act, para 42.

- 63.

See European Competition Network Brief (2010) The Estonian Parliament adopts a new legislation on leniency and sanctions, 27 February 2010, e-Competitions Bulletin, N° 33407.

- 64.

Law Enforcement Act, passed 23 February 2011, RT I, 22.03.2011, 4, entry into force 1July 2014, paras 26-29., para 62(2).

- 65.

Competition Act, para 571.

- 66.

A fine unit is a base amount of a fine and is equal to four euros. Penal Code, para 47(1).

- 67.

Competition Act, paras 731, 735 - 738.

- 68.

Competition Act, para 781. See also Paas-Mohando K and Käis L (2013) Current Developments in Member States: Estonia. European Competition Journal 9(3):779–784; Favart M (2010), The Estonian Parliament introduces new leniency programme and harsher sanctions, 20 January 2010, e-Competitions Bulletin January 2010, N° 41652.

- 69.

According to the media reports, Prisma (retailer) complained about Selver (retailer) and Tere (dairy products supplier) practices. See http://arileht.delfi.ee/news/uudised/piima-kuriteo-kahtlus-lasub-kahel-eestimaisel-ettevottel.d?id=51283464, http://arileht.delfi.ee/news/uudised/prokuratuur-kaivitas-voimaliku-piimakartelli-uurimiseks-kriminaalmenetluse.d?id=33540637. All accessed 22 May 2014.

- 70.

See http://www.ohtuleht.ee/484324. Accessed 22 May 2014.

- 71.

Eesti Tarbijateühistute Keskühistu, http://www.etk.ee/. Accessed 22 May 2014.

- 72.

See http://www.ekspress.ee/news/paevauudised/majandus/etk-ulesehitus-meenutab-keelatud-kartelli.d?id=45762011, http://www.ekspress.ee/news/paevauudised/eestiuudised/konkurentsiamet-etk-ei-riku-seadust.d?id=46218769, http://www.delfi.ee/teemalehed/eesti-tarbijateuhistute-keskuhistu. All accessed 22 May 2014.

- 73.

Competition Act, para 6.

- 74.

Competition Act, para 5.

- 75.

Competition Act, para 4.

- 76.

Competition Act, paras 16(1)-(6).

- 77.

Competition Act, para 16.

- 78.

Riigikohus, http://www.riigikohus.ee/. Accessed 22 May 2014.

- 79.

Judgment AS Eesti Post No. 3-1-1-64-07 dated 5 December 2007, para 8.1.

- 80.

Judgment AS Eesti Post, para 4.1.

- 81.

Competition Act, para 16(1).

- 82.

Judgment AS Eesti Telefon No. 3-3-1-66-02 dated 18 December 2002.

- 83.

Case 26/75, General Motors Continental N.V. v. Commission of the European Communities, ECR 1975 I-1367.

- 84.

Judgment AS Eesti Telefon No. 3-3-1-66-02 dated 18 December 2002, para 15.

- 85.

Case 27/76, United Brands Company and United Brands Continentaal B.V. v. Commission of the European Communities, ECR 1978 I-207.

- 86.

Judgment AS Eesti Telefon No. 3-3-1-66-02 dated 18 December 2002, para 26.

- 87.

Judgment AS Eesti Telefon, para 26.

- 88.

See Tamm E (2007) Ebaõiglane hind. Turgu valitseva ettevõtja kohustuste analüüs konkurentsiseaduse rakenduspraktika alusel [Unfair Pricing. Analysis of the Obligations of an Undertaking in a Dominant Position, Based on the Implementation Experience of the Competition Act], Juridica, nr. 4, pp 263–273.

- 89.

ECA Decision No. 5.1-5/11-020 dated 16 September 2011, available at http://www.konkurentsiamet.ee/public/Otsused/2011/o2011_20.pdf. Accessed 22 May 2014.

- 90.

ECA 2011 Annual Report, p. 11, available at http://www.konkurentsiamet.ee/public/Aastaraamat/ANNUAL_REPORT_2011.pdf. Accessed 22 May 2014.

- 91.

Judgment AS Eesti Telefon No. 3-3-1-66-02 dated 18 December 2002, para 28.

- 92.

The general thresholds applied under the Estonian merger control regime are joint turnover of EUR 6,391,200 and individual turnover of EUR 1,917,350. Competition Act, para 21(1). See also Kalaus M (2002) Estonia: the new Competition Act introduces full merger control. European Competition Law Review 23(6):304–310.

- 93.

Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings (the EC Merger Regulation) OJ L 24, 2004, 1–22, Article 2(2).

- 94.

Competition Act, para 22(3).

- 95.

Guidelines for Submission of Notices of Concentration, Regulation No. 69 of the Minister of Economic Affairs and Communications of 17 July 2006 (RTL 2006, 59, 1062), entry into force 29 July 2006, para 8(2).

- 96.

Competition Act, para 3(1).

- 97.

Case 53-KO regarding concentration n° 29/2006, OÜ VP Market/OÜ Soldino, dated 1 December 2006. See Käis L (2006) The Estonian Competition Authority approves merger between two retailers on the basis of national merger regulation (VP Market and Soldino), 1 December 2006, e-Competitions Bulletin, N°21329.

- 98.

European Commission, 25 January 2000, Case COMP/M.1684, Carrefour/Promodes and 3 February 1999, Case COMP/M.1221, Rewe/Meinl and 15 November 2004, Case IV/M.3464, Kesko/ICA/JV.

- 99.

See Ginter C and Matjus M (2010) Assessment of nonhorizontal mergers in Estonia. European Competition Law Review 31(12):504–508. See also Kalmo H (2007) Definition of the Relevant Market in Merger Control: General Principles and Criticism of the Estonian Competition Board’s Practice. Juridica Abstract 10:715–726.

- 100.

Guidelines for Submission of Notices of Concentration, Regulation No. 69 of the Minister of Economic Affairs and Communications of 17 July 2006 (RTL 2006, 59, 1062), entry into force 29 July 2006, para 8(2).

- 101.

Case 48-KO Hansafood AS/AS Hüpermarket.

- 102.

See Svetlicinii A and Lugenberg K (2012) Merger remedies in a small market economy: the Estonian experience. European Competition Law Review 33(10): 475–481. See also Paas K (2006) Non-structural Corrective Measures in Checking Concentrations. Juridica Abstract 5:340–349.

- 103.

Competition Act, para 22(3).

- 104.

Decision No. 3.1-8/08-020KO Terve Pere Apteek OÜ/Saku Apteek OÜ dated 8 May 2008.

- 105.

See Kalaus T (2008) The Estonian Competition Authority issues its first merger prohibition taking into account both previous acquisitions and potential future acquisitions in the pharmacy services sector (Terve Pere Apteek/Saku Apteek), 8 May 2008, e-Competitions Bulletin, N°19964.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Svetlicinii, A. (2015). Estonia. In: Kobel, P., Këllezi, P., Kilpatrick, B. (eds) Antitrust in the Groceries Sector & Liability Issues in Relation to Corporate Social Responsibility. LIDC Contributions on Antitrust Law, Intellectual Property and Unfair Competition. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-45753-5_7

Download citation

DOI: https://doi.org/10.1007/978-3-662-45753-5_7

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-45752-8

Online ISBN: 978-3-662-45753-5

eBook Packages: Humanities, Social Sciences and LawLaw and Criminology (R0)