Abstract

This chapter develops empirical measurements of the shape of airline firms’ cost functions as they relate to price variation of oil-based inputs and outputs during the 1998–2009 periods. Using the estimates, we assess the value-added potential for hedging and risk taking with respect to oil prices. We find reasons to believe that the potential value-added of hedging fuel costs with oil derivatives is somewhat limited on average, but that it varies across the business cycle. Our evidence helps explain why, although many airlines hedge, also many do not hedge, why hedging is incomplete, and why hedging intensity varies over time within many airlines.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

This chapter develops empirical measurements of airline firms’ cost functions as they relate to price variation of oil-based inputs and outputs during the 1998–2009 periods. Using the estimates, we assess the value-added potential for hedging and risk taking with respect to input prices.

The potential for corporate risk management to add value is a classic issue in finance. Under the perfect markets reasoning of Modigliani and Miller (1958), that potential is nonexistent because investors can replicate the firm’s risk management choices and arbitrage away any benefits. In more realistic settings, Smith and Stulz (1985) show that concavity in the relationship of a firm’s value with respect to a particular source of uncertainty opens the door to valuable risk management. Intuitively, if the probability-weighted downside effect on value when the uncertainty is resolved unfavorably more than offsets the upside effect of favorable resolution, then it can make sense to lay off the risk and take the value outcome associated with the expected value outcome of the risk driver. Mathematically, the point follows from Jensen’s inequality.

Smith and Stulz (1985) focus on specific examples such as progressive corporate tax codes (the tax bite is disproportionately greater on the pre-tax profits upside) and financial distress costs (the distress costs are disproportionately greater on the profits downside). Investors cannot replicate the firm’s managed tax or financial distress risk positions.Footnote 1 The converse reasoning also applies. If the probability-weighted upside effect on firm value when a risk is resolved favorably is greater than the probability-weighted downside effect if the risk is resolved badly, then expected value would not be enhanced by hedging. In that instance, it is better to let the risk take its course and accept the average results over time.

Froot et al. (1993) powerfully extend this intuition. Assuming that the availability of internal financing best enables firms’ optimal real investment plans, then it is valuable to hedge risks that tend to restrict internal funds available at times when investment opportunities are apt to arise. The key to valuable risk management is the correlation between the risk source and the firm’s investment opportunity set. A positive correlation between the value-effect of the risk outcome and the investment opportunity set implies that hedging can be beneficial. In other words, the value of hedging arises from an increased cost of capital (i.e., due to the need to finance externally) if risks turn out badly. The managerial implication is this: the cost drivers that ought to be hedged are the ones that bite harder at times when important investment projects ought to be undertaken. Similar to the Smith and Stulz (1985) reasoning, non-linearities are seen to be at the heart of the potential for value-added risk management. Under the Froot et al. (1993) logic, the non-linearities operate in the sense of shifts in the intensity of risk exposures across economic states. Firms with cost functions that are effectively convex because of greater sensitivity to a detrimental risk source during high-cost times would then benefit from hedging.

This chapter works directly from these seminal arguments to characterize the possibilities for and achievement of value-added risk management in an important industry facing a specific risk. Our focal industry is commercial airlines. Airlines are an interesting case because the direct effect of a clearly identifiable and economically predominant source of risk resides squarely within the cost function. There is no offset in revenue functions (unlike for oil producers, for example) so value effects from costs feed directly into equity value.

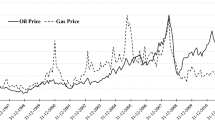

Most directly, the risk source is fuel costs. Jet fuel is, of course, a derivative product of crude oil, so airlines indirectly face oil price risk. There are reasons to expect that airlines’ fuel costs might be convex in oil price (i.e., absent any hedging). For example, oil prices, being generally pro-cyclical in recent times, tend to be highest when airline demand is strong. Airlines are therefore apt to use more high-priced fuel than low-priced fuel over time. Airlines can and do raise their prices when fuel cost is high, of course, but this offsetting benefit is limited by the elasticity of demand. Second, because airlines cannot shift away from jet fuel, they will bear higher costs when refining margins widen, which tends to happen at times of high oil prices. Finally, cost functions could be convex to the extent that fuel cost spikes correspond to upturns in economic activity overall (due to demand pressures on oil-related prices), straining airlines’ capacity to deliver their services given their level of fixed capital.

On the other hand, it is also plausible that cost functions might be concave. For example, cost functions would be concave to the extent that airlines can use oil price spikes as leverage to negotiate reductions in other cost factors (including by invoking bankruptcy). Moreover, if oil price shocks are an underlying cause of recessions, as described by, for example, Hamilton (2008) and Kilian (2008), then times of high oil prices might correspond to a weak investment opportunity set. Finally, cost functions could even be be roughly linear to the extent that airlines can operationally offset these various economic effects of variable fuel costs. A priori, then, it seems possible that either risk-taking or hedging with respect to oil prices might be the value-added recommendation for airlines.

Airlines do make fairly extensive use of energy-linked futures, forwards, options and swaps, suggesting that they are actively managing their operational risks with financial instrument hedges.Footnote 2 Importantly, however, it is not typically practical to hedge jet-fuel exposure directly, except perhaps over short horizons. In practice, airlines resort to hedging via derivatives linked to other oil markets, such as crude oil or refined distillate such as heating oil or even gasoline, all of which exhibit greater liquidity over a larger range of expiry dates. The implication is that airlines necessarily remain exposed to the basis risk. The essence of their basis risk in the case of jet fuel is essentially the time-profile of the refining margin between crude and jet fuel, or the time-profile of the price differential between other refined distillates and jet fuel. Thus, it is far from clear that risk management with oil derivatives is sure to add value.Footnote 3

Perhaps consistent with limits to value-added hedging, there does not seem to be any standard for hedging within the industry. Instead, hedge ratios vary across firms and time. News reports often put airlines hedging activities in the 20–40 % range [for example, see Peterson and Reiter (2008)]. Morrell and Swan (2006) report on hedging at a selection of airlines and over time. In 2004, hedge ratios varied cross sectionally from 0 to 82 % of fuel purchases. Over 1989–2003, American Airlines hedge ratio varied in the time series from 12 to 48 % of fuel purchases. The International Air Transport Association (IATA), which represents airlines around the globe, estimated that carriers would hedge 30 % of their fuel purchases in 2011, up from 10–20 % the previous year. Additionally, airlines are said to sometimes be discouraged from hedging on account of poor outcomes due to basis divergence between jet fuel and oil-related prices in the specific hedging markets [see, for example, Blas and Clark (2011) and Credeur et al. (2011)]. Morrell and Swan (2006) quote the CEO of British Airways as saying in a news report that no “sensible airline” believes hedging saves on fuel bills. For a recent industry-oriented discussion of airline hedging practice, considering both pros and cons, see Rivers (2012).

Building on the core ideas from risk management theory, our goal is to assess the potential for value-added oil price hedging/risk-taking in the airline industry, and develop evidence on whether the potential is being realized. To accomplish this, we use data on airlines’ physical fuel consumption, market prices, reported fuel costs, and reported non-fuel costs. We estimate three industry-level cost functions for airlines. Specifically, these are unhedged fuel cost functions, fuel cost functions that include important hedging effects, and total cost functions.Footnote 4

Estimated unhedged fuel cost functions are concave in oil prices. To the extent that our estimated functions fully capture the shape of actual cost functions, the unhedged cost function estimates suggest that airlines’ values would benefit from not hedging the risk.

A more conservative interpretation must acknowledge that our estimated functions can only map the shape of estimated functions within the range of the data, and hedging could be valuable because of the possibility of outcomes that are scarce in our sample. Additionally, our simple cost function specifications might be incorrect. To the extent that excluded influences correlate to the oil price factors we do include, actual cost functions could be less concave than we estimate.

Even acknowledging all this, a comparison across unhedged and hedged cost functions is highly informative. Our estimates imply that airlines do change the sensitivity and shape of their fuel cost functions by hedging. Unhedged fuel cost functions are flatter and less concave than hedged fuel cost functions. Moreover, oil price variation explains only about half as much of the variation in hedged fuel costs as compared to unhedged costs. Total costs are even less closely linked to oil prices. While it is natural that oil would explain less variation in total costs, given that non-fuel costs are also important, the distinction goes even further in that it is difficult to reject the null hypothesis of no oil price linkage. The clear implication is that both hedging activities and outcomes on non-fuel cost factors tend to offset the natural effect of oil prices on airlines unhedged fuel costs.

Further evidence consistent with this interpretation of strong hedge effects on costs comes from estimates of quarterly seasonals in airlines’ oil costs. Controlling for other factors, unhedged fuel costs are significantly higher in the third quarter (summertime) versus any other quarter of the year. This makes sense, as the press of business is traditionally greatest in the summertime, and it seems natural that resources usages would be stretched beyond their most efficient levels. In contrast, our evidence reveals no such pattern in hedged fuel cost or total cost. The implication is again that hedging tends to offset the natural effects of oil price on unhedged fuel cost.

We also find that airline costs tend to increase at the same time they invest the most in fixed capital. This suggests that management perceptions of investment opportunities are more optimistic during high-cost periods. This is about equally so whether we consider unhedged fuel costs, hedged fuel costs, or total costs. To the extent that growth in fixed capital reflects perceived investment opportunities, this comparison means airline managements do not hedge, on average, in a pattern that corresponds to changes in investment opportunities. Since airline investment opportunities may vary business conditions over time and across different classes of firms at a point in time, we double-check that our findings are robust to including controls for GDP and market share. We find the results robust.

We develop additional evidence to understand the potential for value-added by risk management, and indications as to whether the potential is realized, by considering airlines cost functions across regimes that likely correspond to different investment opportunities. Specifically, we consider high versus low oil price periods, and expansion versus contraction macroeconomic phases. If recessions tend to follow high oil price periods [see, for example, Hamilton (2008); Kilian (2008)], then high oil price periods signal weak investment opportunities. In principal recession periods themselves might correspond to weak opportunities (if the bad conditions are secular) or strong ones (if the bad conditions will soon lead to strong business conditions) or even a mix (if different recessions are, in fact, qualitatively different). Campbell et al. (2012) study recent decades from this point of view. Taking stock market booms-busts as a rough economic indicator, their evidence shows that downturns in the early 1990s were most connected with weak market-wide cash flow news (i.e., secular bad news). For a short time in early 2000s, downturns were most connected with weak market wide sentiment (i.e., temporary bad news). In the late 2000s, the cause was again bad cash-flow news. Thus, during our sample period most stock market downturns were linked to weak cash flow news, a secular problem that does not sow the seeds of its own reversal. Airlines are a very pro-cyclical industry. Viewed through this lens, recessions during our sample likely correspond mostly to weak investment opportunities for airlines.

We find that unhedged airline cost functions are less concave and less sensitive to oil price during sustained periods of high oil prices, and similarly during recessions. From the reasoning above, airlines investment opportunities were probably weak during both high oil price times and recession times. The implication for risk management from this second point of view [i.e., motivated by Froot et al. (1993)-type reasoning] contrasts somewhat with that obtained from simply examining the curvature of the cost function [i.e., motivated by Smith and Stulz (1985)-type reasoning]. Unhedged airline cost functions depend most on oil during strong investment opportunity periods–i.e., when low cash flows are most likely to constrain important future-oriented choices. The strength of this implication is offset somewhat in that unhedged cost functions are also the most concave at such times. We can see why different airlines might choose differently on risk management, and why the intensity of industry hedging would vary over time. In fact, hedge fuel cost function are different during recessions (versus expansions), but are not different during high oil price periods, consistent with such heterogeneity in managers’ choices.

Overall, the statistical evidence suggests that airlines can and do enact operational and hedging mechanisms for dealing with price variability that blunts the cost effect of fuel price spikes, on average. It is less clear that these activities add to value. On average, the shape of estimated cost functions suggests that it would be better not to hedge, though our estimates also suggest that hedging at some times and under some conditions can be more beneficial. Our results help provide an explanation for the fact that airlines tend not to fully hedge their fuel costs, and why their hedging behavior shifts around over time, even though a variety of fairly appropriate financial contracts are available.

A related strain of the empirical corporate risk management literature focuses on firms’ use of derivatives. Such studies assess the extent to which firms use derivatives or whether that use succeeds in reducing risk. Overall, these studies establish extensive derivatives use, but findings of value added are, in general, less conclusive. Some of these studies have focused on airlines in particular. For example, Carter et al. (2006) have investigated the relationship of stock price to reported derivatives usage and firm’s 10-K statements about the extent of hedging, finding the relationship to be positive. Another strain focuses on risk exposures, assessing whether firms show stock price exposure to specific and intuitive sources of risk (gold for gold miners, exchange rates for international firms, and so on). These studies are informative about firms actions and their outcomes. They have limited potential, however, to inform about the potential for risk management to add value.

We are not the first to apply the risk management theory to understand cost functions as we do. Our paper adds to a strain of the risk-management literature, exemplified by Mackay and Moeller (2007), that takes a very different and more direct approach from the papers mentioned above. Mackay and Moeller use the core risk management theory to motivate an extensive and insightful set of measurements along the same line as in our study, but for oil refiners. Our contribution for airlines is useful for the reasons outlined above, and additionally because it makes use of a special industry dataset for the first time we are aware in the literature. It is this dataset that allows us to compare unhedged costs versus hedging-influenced costs. At the same time, the nature of the dataset limits us from using econometric methods as sophisticated as Mackay and Moeller’s, we are more possibly subject to statistical biases, and thus our conclusions must be treated with some caution.

The remaining sections of this paper provide an informal discussion on the economics of hedging in the airline industry, describe our data set, report and discuss our empirical results, and conclude, respectively.

2 Airline Costs and Airline Risk Management

Airlines face substantial risk from many external sources, including jet fuel price volatility, interest rate and foreign currency changes, and macroeconomic revenue drivers. Among these, fuel price risk may be the most severe, at least over short periods, for two reasons. First, fuel prices are highly volatile. Second, fuel is the largest or second largest cost for most airlines. Due to the competitiveness of the industry, it is not always possible to pass higher fuel prices on to passengers by raising ticket prices over the short run. This suggests that fuel risk management might be a central issue for airlines. Airlines that want to stabilize operating expenses and assure bottom line profitability might seek to hedge fuel price exposure. Airlines that hedge could do so using either operational hedging mechanisms or financial derivatives mechanisms.

Operational hedging mechanisms include engaging in long-term contracts for fuel purchases, attempting to raise ticket prices in response to high fuel prices, and flying slower or less into-the-wind to preserve fuel when fuel is expensive. Airlines may also engage in some operational practices that have the same effect as forward contracts. For example, some airlines negotiate fuel pass-through arrangements with other airlines, whereby a larger airline assumes the risk of fluctuating fuel prices and shields a smaller airline. One major airline has even acquired a refinery as an operational hedge (Staff 2012).

Financial derivatives hedging mechanisms include futures, options, swaps and collars on jet fuel or other petroleum products such as crude oil, heating oil, or even gasoline. Hedging with jet fuel derivatives tends to be limited in quantity and time-horizon. Among the reasons are that over-the-counter derivatives do not trade in sufficient quantities to hedge all of the airlines jet fuel consumption, and jet fuel derivatives markets are rather illiquid in general. Further, no exchange-traded derivatives for jet fuels exist in the United States.

When refiners process crude oil, the main products are gasoline, middle distillates (heating oil, diesel fuel, and jet kerosene) and residual fuel oil. Since jet fuel is refined from crude oil, and heating oil is from the same part of the barrel during refining process, both of them are among the top choices to hedge jet fuel prices. Historically, most U.S. airlines have tended to hedge their exposure to energy costs mostly through the Chicago Mercantile Exchange futures contract on West Texas Intermediate crude and the NYMEX futures contract on heating oil. Options have been somewhat less popular, perhaps because of the cash outlay required to cover option premia. Most hedging is in plain-vanilla contracts, though exotics do exist. Such hedges are not perfect, and significant basis risk remains. For example, in the late 2000s, jet fuel tended to track more closely to Brent crude prices, even though U.S. airlines’ hedging was concentrated in derivatives settled to West Texas Intermediate crude prices. Getting the right mix of hedging strategies is claimed to be especially difficult.

As discussed in the introduction, finance theory indicates that risk-management with financial contracts and instruments can have value-added under at least two circumstances. First, risk management theory implies that the potential for that risk taking (hedging) to add value when cost functions are concave (convex) in the underlying source of risk, all else equal. Second, theory implies that valuable risk management adjusts the correlation of internal cash flows to investment opportunities to free the firm from dependence on more-costly external capital. Mackay and Moeller (2007) provide a rigorous example of the application of this theoretical reasoning to assess the potential for hedging value-added in an industry. They study oil producers over the period 1985–2000 to assess the extent to which cost, revenue, and profit functions are concave or convex in the price of oil. They report a two-edged potential for value added hedging in that both revenue and cost functions are concave. The recommendation for hedging policy, based on theory, would therefore be: hedge the revenues and leave the costs unhedged. Our study is an application of their basic idea to the airline industry. Because the oil risk exposure of the airline industry is essentially on the cost side, we focus there.

Some existing evidence suggests that such risk management adds value for airlines. For example, using a panel-data design, Carter et al. (2006) assess the relation between airlines hedging intensity, as reported in financial statements, and Tobin’s q (an index of firm value in excess of replacement cost). They conclude that airline firm value is positively related to hedging of future jet fuel needs. Their study includes controls for investment opportunities and derivatives usage overall. Studies like this would seem to establish that hedging is valuable in airlines. Yet airlines do not uniformly or completely hedge their fuel risk, according to news sources such as those referenced in the introduction. And there seems to be some pattern to the time series variation, where hedging increases as oil prices rise. For example, hedging was said to be more widespread during the pre-financial-crisis global run-up in oil prices, and many airlines ceased to hedge after prices fell in the crisis.

Other research (not focused on airlines) finds that it can be difficult to conclude whether firms are hedging or speculating using data that selectively characterizes their actions (e.g., derivatives use). As argued in, for example, Faulkender (2005), the problem is that a firm’s risk position is the amalgam of its real and financial market activities and choices. Focusing on, say, derivative market activities might mask other offsetting choices. In airlines, there is some reason to think that success in real activities correlates negatively to oil prices as far as costs are concerned, which alleviates some concerns from this perspective.Footnote 5 However, the point only pertains to the cost side. If high oil prices and strong economic activity tend to coincide, then airlines total value may be more positively correlated with oil prices. This reasoning is another motivation for our focus on the potential for risk management value added from the cost side.

Finally, it is worth noting that although classic empirical results in finance such as Chen et al. (1986) suggest that oil price risk is not a priced factor, some recent results such as Chiang et al. (2012) provide contrasting evidence. If systematic oil risk is priced in the financial markets, then widely-held firms that hedge it may be forced to pay as much for the insurance as it is worth to their investors. The best chance to understand the value of hedging might then be in private firms, whose owners may be less fully diversified. There the benefit might be perceived to outweigh the cost. One attractive feature of our data set is that it includes private firms. With this in mind, we turn to a discussion of our data.

3 Data

Our central data source is from the Research and Innovative Technology Administration (RITA), which provides a database suite organized by U.S. Department of Transportation. As regulated carriers, airlines are obliged to report a wide variety of operating, safety, ownership and financial data to the Department of Transportation on a quarterly basis. Among various databases from RITA, the central one for our purpose is the Air Carrier Financial Reports (Form 41 Financial Data) database, which provides detailed financial information on public and private airline companies. We have downloaded quarterly balance sheets (Schedules B-1 and B-1.1) and quarterly income statement (Schedules P-1.1 and P-1.2). In addition, we have downloaded quantity data on airlines’ jet fuel usage. After consolidating the various tables from RITA and eliminating those with extensive missing data, our sample includes 141 airline companies. The sample, based on the availability of RITA data, covers the first quarter of 1990 through the fourth quarter of 2010.

The RITA data provides two special advantages for a study like ours. The first is universality of coverage. All commercial airlines in the U.S. are regulated by the Department of Transportation, and must report their data. This means that we are able to include unlisted firms and smaller airlines that would be missed using other data sources. Second, the RITA data includes information on physical fuel usage as well as dollar fuel expense from financial statements. With this extra information, we can compute the fuel cost airlines would face if fully unhedged. Thus, we can assess the fuel cost risk that is inherent in their production process by calculating their “unhedged fuel cost” as the product of physical fuel usage and the market price of jet fuel.

From RITA financial statements, we also obtain another measure of fuel cost–one that is affected by hedging. For convenience, we will refer to this as the “hedged fuel cost”. Our terminology should be understood in light of GAAP hedge accounting rules. Generally Accepted Accounting Principles dictate that derivative assets, such as futures, options, and swaps on oil and oil products, should be marked to market on a regular basis. Gains and losses on every position in such assets must be reflected directly on the income statement, unless the specific position is pre-qualified for special hedge accounting treatment, and unless the position is periodically tested to assure that it continues to qualify. If the formal pre-qualification and the continuing qualification requirements are satisfied, then the gains or losses due to the derivative can be held away from the core of the income statement, and do not immediately affect net income (for example, being reflected in the broader “other comprehensive income” category). Under hedge accounting treatment, the qualified derivative asset gains or losses flow to the net income only at the same time as the realization of the cash flows that motivated the hedge. Thus, under hedge accounting treatment, the income (loss) due to the fundamental business activity associated with a hedge would be realized in income at the same time as the loss (income) associated with the offsetting hedge (except to the extent that the hedges are judged “ineffective”). The result of this offset is the source of our term “hedged fuel cost”.

Obtaining hedge accounting treatment for derivative positions is a rigorous undertaking for an airline. It requires a fairly sophisticated accounting function within the firm, for hedge accounting is a matter of substantial focus for auditors. Moreover, the accounting rules are complex, require frequent judgment calls and testing, and were under more or less continuous development during the years of our sample. Hedge accounting treatment tends to be used more by larger firms in general, and this seems likely to be the case with airlines as well. Also, hedge accounting treatment requires that the specific derivatives position can be linked in advance to a specific risk, as qualified by specific rules. In practice, the asymmetric nature of options gains and losses on some hedges (options, for example) often disqualifies them from hedge accounting treatment because they do not track symmetric cost effects sufficiently closely.

Importantly for our purposes, even without hedge accounting treatment, a firm that is, in fact, hedging its fuel costs will have somewhat similar gain-loss offsets on the income statement to the extent that it is partially hedged and that its current derivatives realizations (i.e., positions unwound in the quarter) are similar to the mark-to-market effects of its forward hedges. To the extent that firm’s hedging intensity is fairly stable over time (quantities and directions) and that oil price changes have a similar effect across the hedging term structure, a firm that follows a consistent policy of hedging will experience cash flows and derivatives gains/losses in offsetting directions. Thus, even for a firm that does not obtain hedge accounting treatment for its positions, the reported fuel cost on the income statement will, to an extent, have the nature of a “hedged fuel cost”.Footnote 6 For simplicity, we use this term, rather than the more-fully-descriptive but more-cumbersome “hedging-affected fuel cost”. The RITA data also provides each airline’s total cost, about which similar points can be made.

Table 1 provides summary statistics on some of the central variables for our cost function estimates. For Table 1 only, we report raw measures, i.e., not normalized by asset value. From the table, it is apparent that airlines’ sizes differ substantially. For the average firm/quarter over our sample period, sales revenue is about $500 million, with a standard deviation equal to about one-fifth of that average. The smallest firm/quarter observation on revenue in the data is only $560 thousand, and the largest is over $9 billion. Fuel usage also varies greatly, with a mean of almost 77 thousand gallons of jet fuel in a firm/quarter, a standard deviation of about 16 thousand gallons, but a maximum of 737 thousand gallons. Airlines’ market shares (based on costs) vary from almost 0 to 4 %. The table also reports some other relevant aspects of airlines’ financial statements, and similar wide variation is apparent.

Because we are interested in characterizing costs and potential value effects for the industry overall, we need some way of comparing and summarizing across these disparate-sized firms. Specifically, we need a normalization factor to use in regression analysis. Otherwise, regression error variances would vary according to firm size, violating standard assumptions. We choose to normalize by total asset value, so that the various types of costs are all expressed per thousand dollars of asset value in the regression data. This choice is driven by our purpose. We want to understand how the nature of cost functions and their non-linear sensitivity to oil prices might impact firm value. The most appealing concept of value in this setting is Tobin’s q, i.e., firm value per unit of replacement value. With a total assets normalizing factor, we are measuring costs on a similar basis.Footnote 7

4 Cost Function Curvature and Sensitivity to Oil Prices

In this section, we present and discuss the implications of estimates of cost determinants for our three categories of airline cost: unhedged fuel cost, hedged fuel cost, and total cost. We estimate a simple specification of costs, as normalized by total assets. We chose this specification on economic grounds, but also considering what can be implemented using the RITA data. As noted above, the data presents a special opportunity to include all US airlines, including privately owned ones, but, at the same time, does not provide for such a broad variable coverage as if we were to restrict the sample to large public companies.

The key cost factors of interest for our purposes are oil price and the square of oil price, including squared oil price is a simple way to allow for non-linearly oil sensitive costs. We also include some additional cost determinants in the specification based on several economic considerations. Bolton et al. (2011), in recent research, reason that firms’ cash holding and liquidity management policies interact with risk management to determine firm value. Therefore, we also include a measure of the growth in working capital as a control variable in our specification. Chen et al. (2011) argue that executive compensation is another important element of the linkage to value. Given the nature of our sample, we do not have compensation data available. Relying on the evidence in Emans et al. (2009) that compensation scales up with firm size and at a rate different than costs, we include a measure of the growth in fixed capital in our specification. Working capital and fixed assets also make sense in the cost specification on microeconomic grounds. Working capital relates to the firm’s efficiency, and fixed capital relates to economies of scale. Fixed costs are apt to increase when management is optimistic about business opportunities, and so this regressor also ties to hedging considerations. Finally, because the airline industry is subject to large seasonal swings in activity, we include in our cost specification dummy variables for the first, second, and third calendar quarter of the year, leaving the fourth quarter effect to be subsumed in the constant term. Because we use asset-scaled versions of all our measures in regressions, henceforth, we will use italics to indicate when we are referring to a variable that is normalized by assets.

4.1 Base-Case Model Estimates

Table 2 reports regression estimates for our base cost model as applied to the three cost measures, Unhedged fuel cost, Hedged fuel cost, and Total cost, respectively, in columns (1)–(3). Panel A reports OLS estimates with heteroskedasticity and firm-cluster robust standard errors. In Panel A, we report estimates for all regressors, to fully catalog the base case findings.

The estimated coefficients on Oil price are positive for all three cost functions, and estimated coefficients on Squared oil price are negative for all three cost functions. Thus, our estimated cost functions all tend toward concavity in oil price. Economically, the suggestion is that hedging the cost effects of oil price variation is apt to be counterproductive for value: the extra cost incurred for high oil price outcomes is more than offset with the cost savings for low oil price outcomes.

Several caveats are appropriate. We do have fully-specified cost functions, so we cannot say for sure that costs are literally concave in oil. There might be omitted variables, under the control of the firm, which happen to correlate with the price of oil within our sample. Therefore, we will focus more on comparisons of the extent of the concavity accords the various types of costs. The assumption is, then, that any such biases are stable across the cost categories, which seems reasonable.

Comparing the coefficients on Oil price and Squared oil price across the cost function types in Panel A, both the size and statistical significance of the estimated coefficients are attenuated. Additionally, the regression R-squared statistics decline across the cost function types. Finally, the Panel reports F-tests as to the combined influence of the two oil price regressors across each cost type, with the finding that the combined effect is statistically significant for Unhedged fuel cost and Hedged fuel cost but not for Total cost. Overall, the tendency of the cost function toward positive slope and concavity is smaller and weaker as we move from considering Unhedged fuel cost to Hedged fuel cost to Total cost. The implication is that firms in the airline industry, on average, use hedging to offset the sensitivity to oil price that is clearly apparent in their unhedged fuel costs. This is so to some extent as it impacts their hedged fuel costs, and to a more complete extent as it impacts their total cost. Given that the exposure offset involves a concave cost function, this may not be value enhancing.

Coefficients on the seasonal dummies are informative about hedging also. The summer (Q3) coefficient is significantly positive in the Unhedged fuel cost regression in Panel A, but not for the other cost types. Summer is the time of year when airlines’ passenger flow, and therefore fuel demand, is the strongest. It is not surprising that the demand pressure from the prime jet-fuel consuming industry would then lead to higher unhedged fuel costs in the summer: the industry would not be expected to operate its jets most efficiently at its time of greatest strain. These higher costs are apparently offset by financial or operating hedges before impacting Hedged fuel cost or Total cost, again evidence of industry-wide hedging on average.

The coefficients on one of the control variable provides interesting additional information about airline’s hedging choices. The coefficients on ∆ Fixed Capital in Panel A are not statistically significant for either fuel cost measure, but are positive and significant in the Total cost regression. This suggests that airlines’ non-fuel costs, but not their fuel costs, are highest at the time they invest in their fixed capital. In the view of airlines’ managements, and based on these OLS results, it does not appear that capital investment opportunities are strongest at the time of high fuel costs.

To check the robustness of these findings to reasonable variations in the estimation method, Panel B reports panel regression estimates of the same specification, now including firm fixed effects, with heteroskedasticty-robust standard errors. Findings in Panel B thus rely on time-series effects within each airline, preventing inference from being driven by differences in the economics of different airlines. For example, results on Squared oil price effects like those in Panel A could result if airlines that hedge happen to be ones that are also more flexible in dealing with extreme oil prices. In Panel B and subsequent regression tables, we suppress reporting on some control variables coefficients to save space and focus on more central coefficients.

Panel B reports that findings as to oil price effects and seasonal effects are robust to this alternative method. The positive slope of costs with respect to Oil price is somewhat more strongly statistically significant. However, findings on the relationship of costs to fixed capital changes are altered. The new finding is that all categories of cost are positively correlated with fixed capital growth. This suggests that management perceptions of investment opportunities are more optimistic during high-cost periods. Because the link between oil prices and investment opportunities is an important consideration under risk management theory, we are motivated to investigate the robustness of our findings extensively.

4.2 Costs and the Firm’s Industry and Economic Situation

Strictly speaking, airlines’ cost functions are derived from the firm’s production function, as conditioned on input prices. In the previous section, we have estimated a version of such a cost function. In this section, we amend the specification to include some useful additional conditioning variables regarding the firm’s situation and environment.

We are motivated by the finding in the previous section that airlines’ costs vary with their fixed capital growth. Capital investment choices are in turn motivated by firms’ situation in the product market. This endogeneity or omitted variable issue could have an effect on our estimates of oil price coefficients. To take an example rooted in the time series of the data, during business cycle upswings, oil prices might tend to be larger at the same time as airlines’ capacity is strained with business. The strain might contribute to costs being higher at the time of high oil prices. Alternatively, it might be the case that when firm’s product market positions are stronger they are better able to enact flexibilities to deal with high oil prices, leading to reduced costs. Overall, we want to be sure that our estimated oil price cost sensitivity parameters are more than an reflection of these or other similar non-oil effects. Therefore, in this section, we extend our estimates of cost determinants to include recent GDP growth (as a business cycle indicator) and market share (as an indication of firm’s product market success).

Table 3 reports the estimates of these extended cost functions. In Panel A, we add GDP growth as a regressor, and in Panel B we additionally include Market share as a regressor. Our findings above are not strongly driven by endogeneity/omitted variable issues of the type just discussed. The key specific finding, common to both panels, is that conclusions regarding the positive slope and concavity of the various cost functions are unchanged. Unhedged fuel cost is increasing in oil price and concave. Hedged fuel cost is increasing in oil price, but less reliably concave, suggesting that hedging has reduced some extreme cost outcomes. Total cost is not closely related to oil price, suggesting both that oil price sensitivity is offset in other operational ways, and that there are many other costs drivers besides oil prices.

The table also reports that the specific coefficients on GDP growth and Market share are at most weakly statistically significant, but that the statistical significance of the GDP growth effect is stronger for total costs than for fuel costs. This fits with evidence and reasoning in Chung et al. (2012), who find that cost of equity in unionized industries (a group that includes most airlines) has a countercyclical pattern, suggesting that risk is also countercyclical. Their interpretation is that unions are a serious impediment to operating flexibility, preventing firms from making appropriate adjustments in downturns, and that investors rationally take into account in discounting the stock. Pulvino (1998) shows that airlines bear the cost of fire-sales of assets in financial distress, which also suggests that risk is countercyclical to the extent that airlines incorporate systematic distress risk. Financial distress might aggravate any negative effects of high oil prices: Morrell and Swan (2006) cite their personal experience with airlines near or in bankruptcy, saying that bad credit make hedging impossible. Our Total cost results are weakly consistent with this reasoning, and the fact that we do not find such effects for fuel costs reinforces the notion that labor costs are the underlying source of the effect.

4.3 Airline Costs and the Investment Opportunity Set

4.3.1 Oil Price Regimes

To this point, our results suggest that risk-taking regarding the sensitivity of fuel costs with respect to oil prices would be more valuable on average than would hedging. Nonetheless, it also seems that some of the overall sensitivity and concavity of fuel costs with respect to oil prices is in fact offset by hedging. The overall picture so far is not clearly value-maximizing. Our estimates to this point are on average over time. In this section, we develop more time-and-condition specific estimates of the industry cost function to establish if the time-pattern of hedging improves the value-maximization picture. Anecdotally, the airline industry is known to incompletely and sometimes sharply scales back the overall level of hedging. Thus, in this section we are interested to learn if the mix of hedging and risk taking time periods is appropriate for value maximization.

Industry-wide investment opportunities might be stronger or weaker in high oil price regimes. Carter et al. (2006) provide evidence to suggest that airlines’ investment opportunities may be stronger during high oil price regimes. If so, then such periods would be the times when hedging has the most potential to add value, according to risk management theory (i.e., because bad cost outcomes during periods of strong investment opportunities might mean failing to exploit them due to lack of funds). On the other hand, Hamilton (2008) and Kilian (2008) have posited that oil price shocks may be an underlying cause of recessions to come. In that case, times of high oil prices might correspond to a weak investment opportunity set.

We estimate our full cost function (including the GDP and market share effects) as augmented to allow for different oil price effects during high oil price regimes. We accomplish this by adding two interaction-term regressors, both of which involve an indicator variable for quarters in which oil price is above the sample median. High oil interaction is defined as the product of the indicator variable and Oil price, and High oil square interaction is analogously defined as the product of the indicator variable and Square oil price.

Table 4 presents the results of estimating this augmented cost function as a firm fixed effects panel regression. In column (1) of the table, containing estimates for the Unhedged fuel cost function, our earlier finding remains intact overall–costs are increasing and concave in oil price, with a large and statistically significant positive estimated coefficient on Oil price and a large and statistically significant negative coefficient on Square oil price. The F-test statistics labelled “F-test (oil effects)” tests the joint hypothesis that the Oil price coefficient and the Square oil price coefficient are both equal to zero. That F-statistic is very large and soundly rejects that null hypothesis.

At the same time, the High oil interaction is strongly statistically significantly negative, and the High oil square interaction is strongly statistically significantly positive. These coefficients indicate that the cost function leans more toward convexity during high oil price regimes. The economic implication is that hedging might be more beneficial during such times. Anecdotal stories from the airline industry often suggest that hedging is more prominent during the high-price times, suggesting that the time pattern of hedging may make sense. The statistical conclusion is confirmed by a joint F-test on the interaction coefficients, labelled as “F-test (oil shift effects)” in the table, which strongly reject the null of no oil coefficient shift.

The same effects follow through to the Hedged fuel cost column, where the results are qualitatively similar but economically a bit smaller. This is consistent with the idea that hedging has offset some of the oil sensitivity. No strong oil shift effects are apparent for Total cost. Neither are strong oil effects present, similar to our earlier findings.

4.3.2 Business Cycle Regimes

If airlines’ investment opportunities and the nature of their cost functions vary across oil price regimes, it may also be the case that they vary across business cycle stages (expansions and contractions in macroeconomic activity). In Table 5 we show that this is exactly the case. Oil effect shifts in recessions are of a similar nature to oil effect shifts in high oil price regimes. That is, the industry Unhedged fuel cost function is less concave at such time, suggesting that hedging could be more valuable at such times. If recessions are a time when financial distress risk is enhanced, and/or when investment opportunities need to be taken for post-recession gain, then this makes economic sense. We note that the industry Hedged fuel cost function does not show such a shift, which suggests that the hedging policies are adjusted across expansion and contraction regimes to offset their effects on the oil sensitivity.

5 Conclusion

Airlines are an important industry, and historically a somewhat unstable one. Airline bankruptcies and recombinations are commonplace in the record. Additionally, airlines face serious commodity price risks in that jet fuel is one of their largest cost factors. For an already-stressed airline, it seems that a fuel price spike might take costs past a breaking point. Even for less-stressed airlines, there are strong possibilities that a fuel price spike could occasion a more-than-proportional cost increase, as the strain on the company’s operating capabilities increases, or could lead to cash shortfalls that, in turn, cause an airline to pass by on beneficial investments. The prima facie case that hedging might add value is easy to make.

When airlines hedge, it is typically using derivatives on oil products other than jet fuel. Thus, they face significant basis risks. Additionally, airlines have available a variety of operational risk-offsetting mechanisms that also might limit the marginal the value-added of financial hedges. Finally, airlines’ investment opportunities vary over time and with the business cycle, as do oil prices. It seems likely that the correlations among oil prices, fuel prices, investment opportunities, and business conditions may not be stable over time. All these factor complicate airlines hedging, and may limit its potential for value added.

Airlines do hedge significantly, but hedging is not universal within the industry nor do any firms hedge fully. Further, hedging intensity varies substantially over time for many airlines. We have developed empirical evidence for an explanation: airlines’ cost structures are such that the value-added to hedging is limited. Specifically, fuel costs on average tend toward concavity, suggesting that cost savings when oil prices drop exceed cost increases when oil prices spike. Furthermore, airlines total costs apparently include significant operational hedges to oil prices and significant basis differential effects between fuel costs and oil prices. We also develop evidence that the value-potential for hedging varies across the business cycle, helping to explain why airlines’ hedging intensity is dynamic.

Notes

- 1.

Even so, if the firm does enact hedges, the value added would be reduced to the extent that the risk being hedged corresponds to a priced factor in the security markets. Effectively, the firm would need to pay an insurance premium for the risk it lays off; this effect would be offset if the firm's reduced-risk profile results in a lower discount rate being applied to its cash flows by the market.

- 2.

Airlines typically state in annual reports that their derivatives use is for hedging purposes.

- 3.

News reports sometimes emphasize this point of view. For example, Freed (2012) reports that hedging losses turned a strong second quarter of 2012 operating profit into a loss overall for Delta Airlines.

- 4.

We measure costs relative to the asset size of the firm. Not only does this facilitate comparisons across airlines, which vary dramatically in size, but it also makes our estimates more economically meaningful. To the extent that a firm can adjust its asset base over time to match the rise and fall of its dollar costs, then it essentially already hedged against changes in the investment opportunities that those assets represent.

- 5.

That is, if oil price is high at the time of high demand by Western macroeconomies, and therefore high demand for air travel also.

- 6.

There is the logical possibility that it is an over-hedged fuel cost, i.e., that the total effect of the realizations and the marking-to-market takes cost exposure in the opposite direction from its natural one.

- 7.

Seat-miles, or the number of miles flown times the number of passengers carried on a flight, summed across all flights, is a commonly-used normalizing factor in the industry. However, a seat-mile normalization would leave a systematic firm-size effect, for smaller airlines inherently have fewer seat-miles across which to spread costs that do not vary directly with business activity (such as headquarters costs and even lumpy aviation equipment costs).

References

Blas J, Clark P (2011) US airlines rethink fuel hedging policy, Financial Times (2 March 2011)

Bolton P, Chen H, Wang N (2011) A unified theory of Tobin’s q, corporate investment, financing, and risk management. J Finan 66:1545–1578

Campbell JY, Gigli S, Polk C (2012) Hard times, University of Chicago Working Paper

Carter DA, Rogers DA, Simkins BJ (2006) Does hedging affect firm value? Evidence from the US airline industry. Finan Manage 35:53–86

Chen C, Jin Y, Wen M-M (2011) Executive compensation, hedging, and firm value. California State University Northridge working paper

Chen N-F, Roll R, Ross S (1986) Economic forces and the stock market. J Bus 59:383–403

Chiang I-HE, Hughen WK, Sagi JS (2012) Estimating oil risk factors using information from equity and futures markets. Vanderbilt University working paper

Chung R, Lee W-J, Sohn BC (2012) Labor unions and investment efficiency. Griffith Business School working paper

Credeur MJ, Schlangenstein M, Burkhardt P (2011) United, Delta profit at risk on ‘silent killer’ hedges, Bloomberg News Service (31 January 2011)

Emans A, Gabaix X, Landier A (2009) A multiplicative model of optimal CEO incentives in market equilibrium. Rev Finan Stud 22:4481–4917

Faulkender M (2005) Hedging or market timing? Selecting the interest rate exposure of corporate debt. J Finan 55:931–962

Freed J (2012) Hedging drives delta air lines to 2Q loss. SeattlePI.com (26 July)

Froot KA, Scharfstein DS, Stein JC (1993) Risk management: coordinating corporate investment and financing policies. J Finan 48:1629–1658

Hamilton JD (2008) Oil and the macroeconomy. In: Durlauf SN, Blume LE (eds) The new Palgrave dictionary of economics, 2nd edn. Palgrave MacMillan, Basingstoke, UK

Kilian L (2008) The economic effects of energy price shocks. J Econ Lit 46:871–909

Mackay P, Moeller SB (2007) The value of corporate risk management. J Finan 62:1379–1419

Modigliani F, Miller M (1958) The cost of capital, corporate finance and the theory of corporation finance. Am Econ Rev 48:261–297

Morrell P, Swan W (2006) Airline fuel hedging: theory and practice. Transp Rev 26:713–730

Peterson K, Reiter C (2008) U.S. airlines hedge less, let fuel cost exposure grow. Reuters News Service (March 13)

Pulvino TC (1998) Do asset fire sales exist? An empirical investigation of commercial aircraft transactions. J Finan 53:939–978

Rivers M (2012) Should airlines hedge their bets on fuel? Airline Business (July 25)

Smith C, Stulz R (1985) The determinants of fims’ hedging policies. J Finan Quant Anal 20:391–405

Staff (2012) (Investor Guide) Delta airlines (DAL) buys an oil refinery as the “ultimate fuel hedge”. InvestorGuide.com (15 May)

Acknowledgments

We acknowledge and greatly appreciate the contributions of Jiao Tu, who worked with us at the early stages of this project. We are extremely grateful for the advice and comments of the editors.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Laux, P.A., Yan, H., Zhang, C. (2014). Cost, Risk-Taking, and Value in the Airline Industry. In: Ramos, S., Veiga, H. (eds) The Interrelationship Between Financial and Energy Markets. Lecture Notes in Energy, vol 54. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-55382-0_2

Download citation

DOI: https://doi.org/10.1007/978-3-642-55382-0_2

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-55381-3

Online ISBN: 978-3-642-55382-0

eBook Packages: EnergyEnergy (R0)