Abstract

The oil price shock is considered as a major contributor to economic fluctuation. In this paper, we investigate whether the impulse responses of different macroeconomic variables and financial variables to the oil price shock and the effect of interest rates change. And we also use Granger Causality Test to evaluate the correlation between oil prices, stock markets and gold prices. Estimation results based on the U.S. data suggest that: (1) The oil price shock has a significant impact on inflation, stock markets and gold prices and it also has a short-term impact on interest rates. (2) Co-movement of oil prices, stock markets and gold prices exist. (3) Changing interest rates as monetary policy can induce price puzzle in order to reduce the inflation caused by the oil price shock.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Since 1970s, the changes in the price of oil have been considered as an important indicator of economic fluctuation by many macroeconomists. And they are likely to affect financial markets and economies simultaneously. For example, crude oil spot prices, measured using West Texas Intermediate crude oil, still stayed at $20 per barrel in 2001 and the next 7 years had witnessed a steady increase to $124 per barrel, followed by a sharp decrease in 2009. Meanwhile, it is obvious that Dow Jones Index and gold prices experienced the similar movement from 2001 to 2009. Furthermore, the past study has explained the macroeconomic effects of oil shocks and the influence of oil price change on stock markets and gold prices. Kettering concludes that the increase in gold and oil prices would exert an adverse impact on the stock market movements [12]. And Darby [4] and Hamilton [10] were the first two economists to assess the impact of oil shock on U.S economy, who finds statistically correlation between the increase in crude oil price and real GNP growth for the U.S. economy (1948–1972 and 1973–1980). Hooker also argues that oil price effects on GDP of America changed qualitatively in 1980s [10]. As Blanchard and Gali points out, the effect of the increase in oil price has become mild in recent years [2].

Several economists [7, 13] also investigate whether the response of monetary authority behavior affects oil price changes. Tatom [14, 15] and Bernanke et al. [1] indicated that the rise in interest rates occurred prior to the economic downturn, which provided a possible explanation for recessions due to oil price shocks. However, Hamilton and Herrera subordinate the role of monetary policy in occurrence of contractions [6].

The purpose of this paper is to use vector autoregression (VAR) model to examine two hypotheses based on the current data: (1) Impact of crude oil price change can affect Real Gross Domestic Product (GDP), Consumer Price Index (CPI) and interest rates, (2) Co-movement of the oil price, stock markets and gold prices exist. (3) Interest rate change in U.S. can alleviate the negative influence from the oil price shock.

According to Hamilton, ‘Vector autoregression(VAR) is a statistical model used to capture the linear interdependencies among multiple time series and VAR models generalize the univariate autoregression (AR) models [5]’. In this paper, we use VAR model to examine the impulse responses of other variables with respect to the price shock of crude oil and the interest rate change. And from impulse responses graph, correlation between oil price and macroeconomic effects can be illustrated. In addition, Granger Causality Tests will be used to examine the interaction between oil prices, stock index and gold prices. Consequently, VAR model and Granger Causality Tests are two approaches used in this article.

In this paper, the estimation results from VAR model based on U.S. quarterly data confirm that the oil price shock can lead to a series of changes among variables including inflation, interest rates, Dow Jones Index and the gold price. The increase in the oil price is expected to enhance the inflation instantaneously. Meanwhile, the oil price shock may affect stock market price negatively and contribute to an increase in the gold price. However, the effect on real GDP in U.S. is not significant. Furthermore, the VAR model also shows that the interest rate in U.S. is not expected to influence the oil price inversely on average. And the response of real GDP to enhancement in interest rates is prolonged negative. Lastly, according to Granger Causality Tests, the existence of co-movement of oil prices, the stock market prices and gold prices is significant.

The structure of the paper is as follows: Sect. 50.2 describes the VAR model used in the paper. Section 50.2.1 explains the selection of variables; Sect. 50.2.2 provides the VAR model background; and Sect. 50.2.3 justifies the identification strategy. Section 50.3 investigates the results of impulse responses and Granger Causality Test. In Sect. 50.4, concise summary and possible extension are presented.

The oil price shock can be considered as a herald of economic fluctuation. Hence, most manufactory companies need hedge against the financial risks based on the change of the oil price.

2 Methodology

2.1 Data

The variables used in the model include crude oil prices, the consumer price index (CPI), Real Gross Domestic Product (GDP), Dow Jones Average Index, interest rates (bank prime loan rate) and gold prices. Oil prices in the paper use quarterly average spot market prices on West Texas Intermediate crude oil, which is widely considered as a benchmark for world oil markets. Gold prices use mean value of quarterly gold Fixing Price in London Bullion Market based on U.S. Dollars (a benchmark for pricing the majority of gold products and derivatives throughout the world’s markets). Dow Jones Industrial Average, also called the Industrial Average, is price-weighted average price of 30 stocks of publicly-owned companies, and is the second oldest and most-quoted U.S. market index after the Dow Jones Transportation Average.

We examine quarterly data for the period between 1973Q2 and 2012Q1. The first oil crisis erupted in October 1973, when the Organization of Arab Petroleum Exporting Countries (OAPEC) claimed an oil embargo. According to Hudson, on 15 August 1971, the United States had to terminate convertibility of the dollar to gold [11]. By February 1973, the price of gold had risen to $42.22 amazingly; by June 1973 the price of gold was $120 per ounce. Hence, 1973Q2 is selected as the start of the data in our model.

In addition, the data (oil prices, GDP, CPI, interest rates, Dow Jones Average Index and gold prices) are available from the Federal Reserve Bank of St. Louis. GDP, CPI and used in the VAR model are seasonally adjusted. For modeling purposes, all variables, with the exception of interest rates, are expressed in natural logarithms (log).

2.2 VAR Model

In this section, a VAR model is established in order to describe the macroeconomic effects including the influence on financial market brought by oil price shocks. The VAR model used in the paper is defined as follows:

where \(Y_t\) is \(p\times 1\) vector of observations on the dependent variables, \(u_t\) are independent \(N(0,H_t)\) random vectors. And the error covariance \(H_t\) can be written as:

where \(\sum \nolimits _t\) is a diagonal matrix and \(A_t\) is the lower triangular matrix.

Our VAR model is based on quarterly data for VAR model (50.1) is:

2.3 Identification Strategy and Lag Length

where subscript \({oil}\) denotes \(\log ({oil})\), \({gdp}\) denotes \(\log ({gdp})\), cpi denotes \(\log ({cpi})\), \(r\) denotes \(\log (\text {interest rates})\), \(djx\) denotes \(\log (\text {dow jones index})\), and \(gold\) denotes \(\log (gold)\).

In the system, oil prices do not react contemporaneously to shocks to other variables; GDP is not only affected by the oil price shock; inflation dose not respond contemporaneously to impulse from interest rates, Dow Jones Index and gold prices, but is affected by oil prices, GDP and inflation; interest rates as impulse can affect oil prices, GDP, CPI; Dow Jones Index is only not affected simultaneously by gold prices; and gold prices are influenced by all shocks.

As for the lag length, the number of lags is empirically determined to choose 2, because quarterly data is used in this VAR model.

3 Results

3.1 Impulse Response

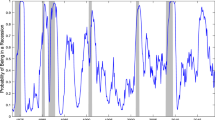

Impulse response to an oil price and interest rate change shock from 1973Q2 to 2012Q1 are shown in Figs. 50.1 and 50.2 respectively.

3.2 Granger Causality Test

Furthermore, the response of Dow Jones Index was delayed and negative, whilst the movement of the gold prices was simultaneous with the crude oil price. According to Table 50.1, the statistical results from Granger Causality Tests indicate that the oil price, the gold price and the stock market index are influenced by each other, which implies the existence of causality between the stock price, the gold price and the oil price.

3.3 Result Analysis

To analyze the intrinsic relationship between these variables, the critical role that oil plays in the economy is irreplaceable. Firstly, gasoline and diesel fuel are used as primary transportation fuels, which are derived from the crude oil. Therefore, the cost of production and transportation will rise along with the short-term increase in the oil price, which implies that the oil price shock may induce a worldwide surge in commodity prices and underlying inflation. In addition, facing the drastic growth in commodity prices, many people will choose to smooth consumption. The adverse factors including higher cost and lower profit hamper economic development and have a negative impact on the stock market. And low return in the stock market and potential high inflation are likely to encourage people to purchase gold as investment or speculation, which tends to trigger a sustained increase in the price of gold. Hamilton asserts an essential role for oil price increases as one of the main cause of recessions in U.S, since the increases in the price of oil haunt prior to the most recession [4, 5].

If the increase in oil prices seems to be prolonged, many firms may decide to invest in more energy-efficient capital and move from energy-intensive to energy-efficient firms, which is likely to induce an increase in unemployment during adjustment. And the adjustment costs often amplify the influence of oil prices shock and exert long-term negative effects on the economy. Additionally, facing prolonged increase in oil prices, people might try to substitute oil with alternative energy and this behavior response to the oil price shock is able to trigger an indirect inflation. According to Hojjat, one particularly salient example is that the rising price of petroleum in 2007–2008 not only increased the transportation costs of food, but also spurred the society to utilize biofuel as the alternative [8]; however, inadequate agricultural production could not cater to the rising demand of biofuel production and cereals for food consumption, thereby promoting the increase in the price of crops such as Maize.

However, all impulse response results correspond with the preceded expectation, except the real GDP. Cologni and Manera explains that ‘a negative long-run effect of oil prices on excess output is not rejected by data [3]’. According to Hooker, one potential explanation (why oil prices change does not Granger cause macroeconomic variables in U.S.) is that the crude oil prices has been endogenous since 1973. So Hooker introduces ‘net oil price increase’ (NOPI) into VAR model to investigate the correlation between oil prices shock and U.S. Economy [9].

4 Conclusions

In this paper, we have examined the impulse responses of various economic indicators to oil price shocks. Based on U.S. data, the VAR model suggested that (1) on average, there is positive relationship among oil prices, inflation, interest rates and gold prices; the relationship between oil prices and stock prices is negative; the correlation between oil prices and real GDP is not significant. (2) Granger Causality tests confirms the existence of co-movement of oil prices, stock prices and gold prices. (3) Interest rates is ineffective in reducing the inflation due to oil price shock.

Possible future research efforts will follow Hooker [9], introducing ‘net oil price increase’ (NOPI), to assess the impact from oil price shocks on U.S. Economy. Secondly, potential asymmetry impact from oil price shocks need be taken into consideration. Furthermore, it is possible to introduce time-varying structural VAR method to investigate the effect of oil price shock in different periods.

References

Bernanke B, Gertler M, Watson M (1997) Systematic monetary policy and the effects of oil price shocks. Brookings Papers on Economic Activity 1:91–142

Blanchard O, Gali J (2007) The macroeconomic effects of oil shocks: why are the 2000s so different from the 1970s? In: NBER working paper, 13368, National Bureau of Economic Research

Cologni A, Manera M (2008) Oil prices, inflation and interest rates in a structural. Energy Econ 30:856–888

Hamilton J (1983) Oil and the macroeconomy since World War II. J Polit Econ 91:228–248

Hamilton J (1994) Time series analysis. Princeton University Press, Princeton

Hamilton J, Herrera A (2004) Oil shocks and aggregate macroeconomic behavior: the role of monetary policy. J Money Credit and Banking 36:265–286

Herrera A, Pesavento E (2009) Oil price shocks, systematic monetary policy and the great moderation. Macroecon Dyn 13:107–137

Hojjat T (2009) Global food crisis–food versus fuels. Competition Forum 7(2):419–426

Hooker M (1996) What happened to the oil price-macroeconomy relationship? J Monetary Econ 38:195–213

Hooker M (1999) Oil and the macroeconomy revisited. In: Board of governors of the Federal Reserve System, FEDS working paper, divisions of research and statistics and monetary affairs, Federal Reserve Board

Hudson M (2003) Super imperialism: the origin and fundamentals of U.S world dominanc. Pluto Press, London

Kettering R (2006) The changing relationships between gold, oil, and stock prices. In: Allied academies international conference, pp 37–40

Kilian L, Lewis L (2009) Does the fed respond to oil price shocks? In: working paper, University of Michigan, Ann Arbor

Tatom J (1982) Are there useful lessons from the 1990–91 oil price shock? Energy J14:129–150

Tatom J (1988) Are the macroeconomic effects of oil price changes symmetric? Carnegie-Rochester conf ser on public policy 28:325–368

Acknowledgments

First of all, I would like to express my gratitude to my advisor, Prof. Fujiwara, who has given me constant help. Then I would like to thank my family members, who have been pouring out their encouragement to me.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Zhou, S., Wang, D. (2014). The Macroeconomic and Financial Effects of Oil Price Shocks. In: Xu, J., Cruz-Machado, V., Lev, B., Nickel, S. (eds) Proceedings of the Eighth International Conference on Management Science and Engineering Management. Advances in Intelligent Systems and Computing, vol 280. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-55182-6_50

Download citation

DOI: https://doi.org/10.1007/978-3-642-55182-6_50

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-55181-9

Online ISBN: 978-3-642-55182-6

eBook Packages: EngineeringEngineering (R0)