Abstract

With the development of IT industry, Chinese IT firms have become listed on overseas stock markets one after another. Decision-makers are mainly concerned about firms’ capacity and efficiency of raising funds overseas. In order to assess their performances, IT firms are defined as a two-stage production process. The first one is the operational process and the other is the market financing process. This paper aims to evaluate and analyze the operational efficiency and market efficiency of 28 Chinese IT firms listed on NASDAQ from 2008 to 2011 using the advanced DEA method. The study shows that the inefficiency mainly results from the market financing stage. Decomposition of the technical efficiency indicates that it is not the scale but the pure technical inefficiency or the week capacity of raising funds overseas lowered the market efficiency. Therefore, IT firms should cautiously choose financing by listing overseas under the current international economic downturn.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

2 Background

In the last decade of the twentieth century, the total output values of the information technology (IT) industry in China increased by 32.1 % each year, while the average annual growth rate of all industries and the state-owned economy during the same period was only 14.2 % and 9.7 % respectively. Obviously, the information technology industry has become a pillar industry of Chinese national economy (Lin-bo Jin 2003). During the period of the Eleventh Five-year Plan, the average sales of the whole industry increased by 28 % annually. By the end of 2008, the sales reached 630 million Yuan, accounting for about 5 % of GDP, and making a contribution of over 0.8 percentage points to the GDP growth. There are also fierce competitions among the IT firms, so it is extremely important for an IT firm to take effective measures to keep growing and maintain the competitive advantages.

Nowadays, Chinese IT firms try to earn more market shares and improve their competitiveness by listing at home and abroad. Being listed can bring funds for the fast growth of a firm. However, the capacity of the domestic capital markets is limited and many firms do not meet the requirements of the Chinese securities laws and regulations. So many decision-makers turn to the international markets, and more and more IT firms have determined to list abroad. How about the performances of Chinese IT firms listed overseas? Is it the proper time for these firms to go abroad to raise fund?

In order to evaluate the effectiveness of those IT firms, this paper attempts not only to analyze and compare the internal operation efficiency of listed IT firms, but also to assess the effectiveness of overseas listing using the advanced network data envelopment analysis (DEA), or the two-stage DEA method. From the perspective of input-output, we will observe by empirical study whether overseas listing has a positive impact on the performances of firms.

2.1 Literature Review

Since the DEA was proposed by Charnes et al. (1978), the performance evaluation with DEA is widely used in many industries (Sherman 1985; Rangan et al. 1988; Wang et al. 1997; Sathye 2003). The two-stage DEA model was first used in the performance evaluation on military recruitment by Charnes et al. (1986). They paved the way for the development of the network DEA (Charnes et al. 1986), which can be used to examine the internal structure of a system. The two-stage DEA was once used in the mental health care (Schinnar et al. 1990), in the education field (Lovell et al. 1994), in the commercial bank (Seiford and Zhu 1999), in the non-life insurance performance evaluation (Noulas et al. 2001), and in the Major League Baseball (Sexton and Lewis 2003).

Domestic researches on the evaluation of enterprise efficiency using the DEA started in the late twentieth century. Most researchers aimed to measure the efficiency of Chinese commercial banks (Han-tao Liu 2004; Yu Wei and Li Wang 2000; Xiang Zhao 2010; Ning Wang and Zhi Li 2006; Jian-hua Zhang 2003). Although there are several studies about listed IT firms using DEA method, they could not evaluate the overseas financing ability of those firms (Xiao-min Zhang and Zhi-ying Liu 2007; Xiang Li 2009; Hong-mei Tan 2010).

3 Methodology

3.1 Model

This paper divides the production process of listed IT firms into two stages. Stage 1 is the enterprise internal operational stage at which the enterprise transforms the input of assets and labors into output of gross and net profits. Stage 2, connected to Stage 1 in series, is the financing stage on the stock markets at which firms use intermediate variables or the outputs of Stage 1 to obtain the profits from the stock markets. The two-stage model as shown in Fig. 1 illustrates that IT firms utilize their own operational ability to gain funds on the overseas stock markets. The performances of the two stages obtained by the two-stage DEA are called operational efficiency and market efficiency respectively.

There are several two-stage DEA models that can be used to evaluate the overall and sub-process efficiency of the production process. In order to identify the sources of the low efficiency during the production, it is necessary to split the efficiency into the pure technical efficiency and the scale efficiency. These two efficiencies can be used to identify the management and scale inefficiency. Therefore this paper will use the model developed by Kao and Hwang (2011).

Suppose the inputs and outputs at Stage 1 are denoted as (X 1,X 2,…,X m ) and (Z 1,Z 2,…,Z q ), while at Stage 2, the inputs is the outputs of the first stage, i.e. (Z 1,Z 2,…,Z q ) and outputs is (Y 1,Y 2,…,Y s ). The overall technical efficiency in the case of constant returns to scale (CRS) or the CCR efficiency, denoted as E k , can be obtained by the linear programming model (1). The CCR efficiency of the stage one, denoted as E 1 k , can be estimated by model (2). The pure technical efficiency under variable returns to scale (VRS) or BCC efficiency for both stages, denoted as T 1 k and T 2 k , will be obtained by model (3) and model (4).

Because the capacity in raising funds is reflected in the second stage, so the BCC efficiency can be used to represent the ability of IT firms financing overseas. It has been shown that efficiencies calculated by models (1), (2), (3), and (4) satisfy the following efficiency equations (Kao and Hwang 2011).

Equation (5) indicates that the CCR efficiency (E k ) is the product of BCC efficiency (T k ) and the scale efficiency (S k ). Equation (6) means that the overall efficiency is the product of the efficiencies of Stage 1 and Stage 2 under both CRS and VRS.

Thus the performance of Stage 1 includes the CCR efficiency E 1 k obtained by model (2), BCC technical efficiency T 1 k obtained by model (3) and the scale efficiency S 1 k , which is E 1 k /T 1 k by (5). The performance of Stage 2 includes the CCR efficiency E 2 k , which is E k /E 1 k by (6), BCC technical efficiency T 2 k obtained by model (4) and the scale efficiency S 2 k , which is E 2 k /T 2 k by (5). The performance of overall process includes the CCR efficiency E k obtained by model (1), BCC technical efficiency T k , which is T 1 k × T 2 k by (6), and the scale efficiency S k , which is S 1 k × S 2 k by (6).

Hence the overall DEA efficiency E k will satisfy the following relationship.

Therefore, if a firm has a strong capacity of raise funds overseas, i.e. if T 2 k and S 2 k are large enough, the overall performance will be improved. The equations from (5), (6), and (7) can be used to detect the specific reasons for the inefficiency of listed IT firms such as if there are any ineffectiveness in the internal operation, or lack of capacity in collecting funds on the stock market.

3.2 Input and Output Indexes

According to previous researches, input indexes in the first stage consist of assets, equity, cost and labor. From a financial point of view, total assets, fixed assets, current assets and intangible assets are more available than others. This paper will choose the current assets and intangible assets as assets indexes. Total equity of common stock is chosen as the equity index and main business costs as the cost index. Indexes of the labor include the staff numbers and the proportion that technicians cover. As the latter is difficult to obtain and most employees in IT firms are technicians, we finally select the staff numbers as the labor index. The outputs of the first stage include incomes and gross profits which can be used to evaluate the internal operational efficiency. Yet the second stage will use the incomes and gross profits produced by the first stage as inputs; the net profit and earnings per share (EPS) as outputs to measure the external market efficiency. In summary, the selected inputs and outputs for two stages are shown in Fig. 2.

3.3 Sample and Data

At present, well-developed IT firms in China tend to get listed on NASDAQ in USA. By 2010, there were 47 listed IT firms. The data came from the annual reports of each firm. There were 28 IT firms remained for further study since 16 of them had incomplete data and 3 of them had delisted from the stock market. In order to observe the development of Chinese IT listed firms, this paper collected panel data of these 28 firms from 2008 to 2011.

IT firms involved in this study are Sina, Baidu, Sohu, NetEase, FocusMedia, ShandaGames, ChangYou, Elong, The9, PerfectWorld, Ctrip, JRJ, 51job, Linktone, Ku6, Kongzhong, VisionChina, AirMedia, UTStarcom, HiSoft, SpreadTrum, AsiaiNFO, TecFace, Grebtech, SKYEngine, CDCSoftware, MecoxLan and AutoNavi. According to amount of the operating income, they will be classified into three categories. Firms with operating income more than 100 million belong to large scale group, those with operating income within10–100 million and less than 10 million belong to the medium and small scale groups.

4 Results

The overall and two-stage efficiencies of IT listed firms are obtained by models above from (1), (2), (3), and (4) and equations of (5) and (6). Table 1 shows the average efficiency of each category, the overall average, variance and median from 2008 to 2011.

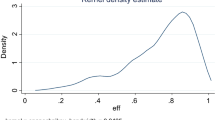

The overall average of technical efficiencies (CCR), which are between 0.3164 and 0.4856, uncover a greater technical inefficiency of listed IT firms. But the trend is going up although the average efficiency in 2009 was the lowest probably because of the impact of world financial crisis. Additionally, the gap between the mean and median is getting narrower, which indicates that more and more IT firms have a higher efficiency than the overall average.

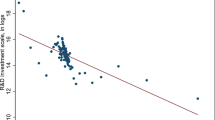

The total average operational efficiency (E 1) and the market efficiency (E 2) of two stages are shown in Table 2. It is obviously that E 1 of Stage 1, with means from 0.6525 to 0.7898, is higher than E 2 of stage 2, with means from 0.4062 to 0.5613. So it can be seen that although these 28 IT listed firms have a stronger capacity in operations, the capacity of raising funds from the overseas market is not so significant. On the other hand, it is the market efficiency that lowered overall technical efficiency.

From the view of scale, whether the overall average technical efficiency or both operational and market efficiency, the large IT firms performed better than small and medium ones. That is to say being listed brings more benefits to large firms than others, so listed firms can improve the performance level by expanding their scale appropriately.

Table 3 gives the total pure technical efficiency (T) and the scale efficiency (S), and the market efficiency (E 2) of Stage 2 (financing stage) has been decomposed into the pure technical efficiency (T 2) and the scale efficiency (S 2). It is shown that the overall pure technical efficiency is between 0.4170 and 0.6009 while the scale efficiency during the same period is between 0.7016 and 0.8183. So from this perspective, it is the pure technical efficiency, which reflects management ineffectiveness lowered the overall technical efficiency (E).

Moreover, the pure technical efficiency of Stage 2 is obviously lower than the scale efficiency. So the low pure technical efficiency of Stage 2 leads to the low overall market efficiency (E 2). But as a whole, both the pure technical and scale efficiency show a rising trend except that in 2009. In 2011, the median was already higher than the average, especially as for the scale efficiency (the median of 0.9665 is significantly higher than the mean of 0.8183), which illustrate that the scale efficiency of most firms is better than the overall average and their scores are very close to 1.

The overall pure technical efficiency (T) could be decomposed into the pure technical efficiency of the operation stage (T 1) and market stage (T 2), and the pure technical efficiencies for the two stages are shown in Table 4. On the whole, T 1 is better than T 2. So on average, it is the inefficiency of the financing stage leads to the inefficiency of whole IT firms. Moreover, as for the pure technical efficiency of two stages (T 1 and T 2), large scale firms performed better than small and medium ones except the market efficiency of small scale firms in 2010 and operation efficiency of middle scale firms in 2009. It is indicated that small IT firms have a higher capacity than others in recent 2 years in raising funds overseas. Although the pure market efficiency for small scale firms improved significantly recent years, the low average technical efficiency of these firms shown in Table 2 indicate that small and medium-sized listed firms will get a better performance by improving their innovation capacity and making more market shares.

5 Conclusions

This paper uses the new developed two-stage DEA model to measure the capacity and efficiency of IT firms listed on NASDAQ from 2008 to 2011. The results indicate that Chinese IT firms listed on NASDAQ show a larger technical inefficiency, which mainly results from the pure technical inefficiency or the management ineffectiveness. On the other hand, when dividing the IT firm into the operational stage and financing stage, we find that Stage 2 shows a low capacity in financing overseas. Moreover, this low financing capacity is also the result of management ineffectiveness, as indicated by the poor pure technical efficiency in this stage. Generally speaking, the large scale firms perform better than those small and medium ones. Additionally, the average of pure technical efficiency, scale efficiency and overall efficiency has shown an uptrend although there is a great inefficiency among those IT firms.

So we conclude that firstly Chinese IT firms should be very cautious before making a decision to financing overseas in the current international economic downturn environment since we find the low financing capacity of those listed IT firms overseas. Secondly, although there are some diseconomies of scale, the listed firms should focus more on the improvement of the internal management, including the adjustment of structure and utilization of human resources effectively. Thirdly, in terms of the operational and financing stage, IT firms should pay more attention on strengthening financing capabilities, especially the level of technical management. And finally, for those small and medium-sized firms, they should take the large IT firms as their benchmarks and continue to improve their competition advantage especially in the domestic market.

References

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444

Charnes A, Cooper WW, Golany B, Halek R, Klopp G, Schmitz E, Thomas D (1986) Two phase data envelopment analysis approaches to policy evaluation and management of army recruiting activities, Research report CCS#532, Center for Cybernetic Studies. The University of Texas at Austin, Texas

Han-tao Liu (2004) To measure the efficiency of commercial banks in China: the application of DEA method (in Chinese). Econ Sci 26(6):48–58

Hong-mei Tan (2010) DEA model based on information technology in China case study of performance evaluation of listed companies (in Chinese). Master’s thesis, Xihua University, Sichuan

Jian-hua Zhang (2003) DEA method on efficiency study of Chinese commercial banks and the positivist analysis from 1997 to 2001 (in Chinese). J Financ 46(3):11–25

Kao C, Hwang SN (2011) Decomposition of technical and scale efficiencies in two-stage production systems. Eur J Oper Res 211:515–519

Lin-bo Jin (2003) The development of information technology industry and the implementation of a leap from universal access to universal service (in Chinese). Manag World 19(6):24–38

Lovell CAK, Walters LC, Wood LL (1994) Stratified models of education production using modified DEA and regression analysis. Expert Syst Appl 27:329–351

Ning Wang, Zhi Li (2006) The application of DEA to the research of efficiency of commercial banks in China (in Chinese). Contemp Econ Manag 28(1):67–72

Noulas AG, Hatzigayios T, Lazaridis J, Lyroudi K (2001) Non-parametric production frontier approach to the study of efficiency of non-life insurance companies in Greece. J Financ Manag Anal 14:19–26

Rangan N, Gawbowski R, Aly HY, Pasurka C (1988) The technical efficiency of U.S. banks. Econ Lett 28:37–55

Sathye M (2003) Efficiency of banks a developing country: the case of India. J Bank Financ 148(3):662–671

Schinnar AP, Gould EK, Delucia N, Rothbard AB (1990) Organizational determinants of efficiency and effectiveness in mental health partial care programs. Health Serv Res 25:387–420

Seiford LM, Zhu J (1999) Profitability and marketability of the top 55 US commercial banks. Manag Sci 45(9):1270–1288

Sexton TR, Lewis HF (2003) Two-stage DEA: an application to major league baseball. J Prod Anal 19:227–249

Sherman G (1985) Bank branch operating efficiency: evaluation with data envelopment analysis. J Bank Financ 9(2):297–315

Wang CH, Gopal R, Zionts S (1997) Use of data envelopment analysis in assessing information technology impact on firm performance. Ann Oper Res 73:191–213

Xiang Li (2009) Research on DEA-based methods of information technology on performance evaluation of listed companies (in Chinese). Master’s thesis, Zhejiang Sci-Tech University, Zhejiang

Xiang Zhao (2010) The measurement of bank branches efficiency and analysis of influence factors, based on the empirical research of super efficiency DEA and Tobit model (in Chinese). Econ Sci 32(1):37–55

Xiao-min Zhang, Zhi-ying Liu (2007) An analysis of the efficiency of listed companies of information technology in China (in Chinese). Sci Technol Econ 1:15–19

Yu Wei, Li Wang (2000) The non-parametric approach to the measurement of efficiency: the case of China commercial banks (in Chinese). J Financ Res 43(3):88–96

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Ge, H., Li, Md., Gai, Y. (2013). Capacity and DEA Efficiency of Listed Chinese IT Firms Overseas. In: Qi, E., Shen, J., Dou, R. (eds) Proceedings of 20th International Conference on Industrial Engineering and Engineering Management. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-40063-6_49

Download citation

DOI: https://doi.org/10.1007/978-3-642-40063-6_49

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-40062-9

Online ISBN: 978-3-642-40063-6

eBook Packages: Business and EconomicsBusiness and Management (R0)