Abstract

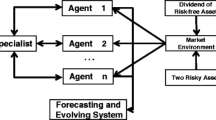

In this paper, a financial market model based on heterogeneous agent interacting is constructed. In this model, two types of agents (fundamentalist and trend follower) are assumed to exist in financial market, and contrarian investment strategy and inertia investment strategy are respectively applied by them and realized investment return is used as fitness index, so as to form a heterogeneous expectation for the future price of risky assets. When investors convert different faiths or investment strategies, their proportions are presented to be time-varying.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Meaning of Heterogeneity

There are two hypotheses for heterogeneity in general: differential information and differential interpretation. In the first hypothesis, information asymmetry problem is in existence. A group of individuals can acquire private information, but another group of individuals can only receive public information such as history price. Thus, information asymmetry makes heterogeneous expectation produced. The models of this aspect include the models proposed by Grundy and Kim [1]. In the second hypothesis, the same information is explained by investors in a different way. This hypothesis is supported by the empirical studies made by Kandel and Pearson [2]. Besides, this hypothesis was applied by some scholars to explain the reasons why stock prices steadily deviated from intrinsic values. Miller [3] proposed that profits could not be made by the investors having pessimistic faiths in stocks at the market without a short-mechanism, but optimistic investors would buy these stocks and make stock prices continuously higher because of reflecting optimistic faiths [3]. In addition, this hypothesis was proved empirically by Chen et al. [4], Diether et al. [5].

There are two types of heterogeneous agent interacting model usually: (1) rational trader or fundamentalist; (2) noise trader, chartist, or trend follower. The first thinks that stock price is decided by intrinsic value and is a discounting of the future cash flow of listed company, and thus certainly replies to value. The second believes that stock price is not completely decided by intrinsic value, and its changing trend can be continued in a short term. Therefore, investment return can be obtained with historical stock information and technology analytical means. The study of Frankel and Froot [6] on foreign exchange market shows that fundamentalists and chartists are symbiotic at the real financial market [6].

In this paper, a financial market model under the interaction of heterogeneous agents is proposed after the above analysis. In this model, realized investment return is used by investors as fitness index, thus forming a heterogeneous expectation for the future price of risky assets.

2 Fundamental Assumption of the Model

Financial market models of assets A and B are assumed to exist. Asset A is risk-free, can be supplied infinitely flexibly, and also its fixed annual return rate is r; asset B is risky and its net supply is 0, and its non-fixed cash flow paid at the end of t is \( y_{t} \) (an independent identically distributed random process). Risk-free asset A and risky asset B can be chosen by traders. If \( p_{t} \) is the ex price of asset A and also H types of traders exist in market, the total fortune of h type of investors in trading period \( \left( {t + 1} \right) \) can be expressed as follows.

In Eq. (11.1), \( R_{t + 1} \) is excess return and can be defined as follows.

\( Z_{h,t} \) is the demand of investor h on risky asset in trading period t. \( E_{h,t} \) and \( V_{h,t} \) are the conditional expectation and variance of investor h respectively when public information is known. Public information is expressed with \( I_{t} \) including the public information, such as historical stock prices, dividends, trading volume, and interest rate information acquired by traders in t and several periods before t.

The conditional expectation and variance of investor h on fortune in t are as follows respectively.

In addition, the traders are assumed as myopic mean–variance maximizers, and thus the problem traders are faced with can be changed as follows.

The demand of h type of traders on risky asset in t can be expressed as follows.

All types of investors are assumed to be with an unchanged risk aversion coefficient \( \left( {a_{h} = a > 0} \right). \) Also, the conditional variances of all types of investors related to \( R_{t + 1} \) are identical \( \left( {V_{h,t} \left[ {R_{t + 1} } \right] \equiv \sigma^{2} } \right). \) Thus, the Eq. (11.7) can be simplified as follows.

The proportion of h type of traders in all traders in t is assumed to be expressed with \( n_{h,t} , \) and thus the total residual demand of all traders on risky asset in t is as follows.

In Eq. (11.9), \( S_{t} \) is the total supply of risky asset at market in t. Also, attention should be paid to \( \sum\nolimits_{h = 1}^{H} {n_{h,t} = 1} . \)

3 The Trading System Applied in the Model

Heterogeneous agent models in current financial market of foreign countries are almost based on market maker rule. In typical market maker rule, the buying and selling prices of traded bonds are given by market makers, and there are no direct transactions between clients and bonds that are bought and sold from market makers. However, the bidding system is applied in China’s stock market. That is, business entrustments submitted by buyer and seller respectively, and then transaction is complete after entrustment prices are summarized together through a trading center. Therefore, a bidding system is applied in this model as price discovery mechanism, namely \( ED_{t} = 0. \) The total supply \( S_{t} \) and the total demand \( D_{t} \) can be seen as the function of price \( p_{t} , \) and thus the equilibrium price can be solved by ordering total supply which is equal to total demand. The total supply \( S_{t} = 0 \) of risky asset is assumed to be solved as follows in the known information set.

From Eq. (11.10), the equilibrium price can be solved as follows.

Now, considering only one type of rational traders exists in market, the equation below can be established according to the equilibrium price formula.

If all traders at market are expected rational traders, asset price is completely decided by the fundamental value of asset. The fundamental value can be expressed with the discounting of expected future dividend.

Obviously, fundamental value \( p_{t}^{*} \) relies on dividend process \( \left\{ {y_{t} } \right\}. \) \( \left\{ {y_{t} } \right\} \) is assumed to be an independent identically distributed random process, and also \( E_{t} \left[ {y_{t + k} } \right] = \bar{y} \) is a constant. Thus, the equation below can be established.

4 Formation of Heterogeneous Agent Expectation

In the following, heterogeneous expectations of different types of traders on future price and dividend are discussed. The price expectations of all traders are assumed to be as follows.

In Eq. (11.15), L is the decision time window of traders. The equation below can be obtained after Eq. (11.15) is substituted into equilibrium price formula.

To make Eq. (11.16) simpler, \( x_{t} \) is used for expressing the deviation value of price \( p_{t} \) relative to fundamental price \( p_{t}^{*} , \) namely.

The equation below is gained after Eq. (11.17) is substituted into Eq. (11.16).

The expectation \( f_{h,t} \) of all traders on future stock price deviation features the following linear form.

This type of traders is called as positive traders if \( g_{h} > 0 \) and strongly positive traders if \( g_{h} > 1 + r. \) However, it is called as reverse traders if \( g_{h} < 0 \) and strongly reverse traders if \( g_{h} < - \left( {1 + r} \right). \)

In this paper, the analysis framework of fundamentalist \( \left( {h = 1} \right) \) and chartist \( \left( {h = 2} \right) \) is applied. Fundamentalist thinks that asset possesses a fundamental value, and asset price will return to the fundamental value if deviating from it; asset can be sold with a price higher than its fundamental value if bought with a price lower than the fundamental value. The expectation of fundamentalist on asset price in \( t + 1 \) is assumed to be as follows.

In Eq. (11.20), v is the estimate of traders on the returning speed of price to fundamental value, and used for measuring the faith of traders in the returning of price to fundamental value. The expected price is equal to current price in t + 1 if v = 1. This suggests that fundamentalist believes market is effective, and thus current price is the best prediction on future price. However, the expected price is equal to the fundamental value of asset in t + 1 if v = 0. Therefore, it can be seen that the faith of traders in the returning of price will be more intense and price will more quickly return to fundamental value if v is closer to 0. For easy discussion, the extreme conditions (v = 0) is applied.

Combining the Eq. (11.15), the equation below can be solved.

According to historical price information, technical traders make expected price formed through extrapolating current price. According to Eq. (11.19), the equation below can be solved.

Equation (11.8) can be re-written according to Eqs. (11.22) and (11.23), as follows.

5 Fitness of Trading Strategy

Investment return realized by traders from t to t + 1 is calculated below.

Because of \( E_{t} \left[ {p_{{_{t + 1} }}^{*} + y_{t + 1} } \right] - (1 + r)p_{t}^{*} = 0, \) there is \( \delta_{t + 1} = p_{{_{t + 1} }}^{*} + y_{t + 1} - E_{t} \left[ {p_{{_{t + 1} }}^{*} + y_{t + 1} } \right]. \) It can be seen \( \delta_{t + 1} \) is a difference sequence relative to information set \( I_{t} , \) namely \( E\left( {\delta_{t + 1} \left| {I_{t} } \right.} \right) = 0. \)

The fitness of strategy is defined below. The total investment return realized by trader h in t is expressed with \( \pi_{h,t} , \) namely

The total fitness \( U_{h,t} \) is equal to the weighted average of total earnings of trader h from beginning to \( t, \) namely

The profit-making ability of traders to use certain investment strategy can be measured with \( U_{h,t} . \) \( \eta \ge 0 \) suggests that fitness has a certain form of “memory”. For easy analysis, the case \( \left( {\eta = 0} \right) \) is only discussed. That is, fitness only has a tie with the profit realized in the previous trading period.

6 Update of the Proportions of Traders

In each trading period, investors will adjust the strategy taken in next period according to the asset profit-making of last period. In this way, the proportions of all kinds of investors will change along with the change of the profit-making abilities of various trading strategies. Because traders possess a limited rationality, they tend to apply the most powerful profit-making strategy used in previous trading activities. Here, through the application of discrete choice probability, the rule of updating the proportions of traders can be obtained.

In above, \( C_{h} \) is the trading cost paid by trader h in the trading process. To the fundamentalist and technical trader in the model, \( C_{1} = C > 0 \) and \( C_{2} = 0 \) are ruled. In Eq. (11.29), \( \beta \) is called as intensity of choice. If \( \beta = 0, \) trading strategies are randomly selected by traders, namely the selection of trading strategies has nothing to do with the profit-making ability of strategies; if \( \beta = \infty , \) all traders are perfectly rational and select the trading strategies with the largest profit-making ability in history; if \( 0 < \beta < \infty , \) investors are with limited rationality. Because profit-making ability is history information, traders may not select the strategy with the largest profit-making ability in previous period.

7 Faith Evolution System

From Eqs. (11.18), (11.29) and (11.30), the relational expression of faith evolution system can be obtained as follows.

In above,

8 Conclusion

In this paper, financial market is assumed to comprise of two types of traders different expectations on future price: (1) fundamentalist; (2) chartist. These two types of traders are mutually converted, and their proportions are presented to be time-varying. This will trigger the fluctuation of asset prices, and subsequently premium rate effect can be produced.

References

Grundy BD, Kim Y (2002) Stock market volatility in a heterogeneous information economy. J Financ Quant Anal 37:1–7

Kandel E, Pearson ND (1995) Differential interpretation of public signals and trade in speculative markets. J Political Econ 103:831–832

Miller EM (1977) Risk, uncertainty, and divergence of opinion. J Finance 32:1151–1156

Chen J, Hong H, Stein JC (2002) Breadth of ownership and stock returns. J Financ Econ 66:171–175

Diether KB, Malloy CJ, Scherbina A (2002) Differences of opinion and the cross section of stock returns. J Finance 57(5):2113–2114

Frankel JA, Froot KA (1990) Chartists, fundamentalists, and trading in the foreign exchange market. Am Econ Rev 80:181–185

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Yu, Y. (2013). Financial Market Model Based on Heterogeneous Agent Interacting. In: Yang, Y., Ma, M. (eds) Proceedings of the 2nd International Conference on Green Communications and Networks 2012 (GCN 2012): Volume 2. Lecture Notes in Electrical Engineering, vol 224. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-35567-7_11

Download citation

DOI: https://doi.org/10.1007/978-3-642-35567-7_11

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-35566-0

Online ISBN: 978-3-642-35567-7

eBook Packages: EngineeringEngineering (R0)