Abstract

Due to recent global discussions about climate change and its possible consequences, the implementation of environmental policy instruments with the intent to counteract the current environmental developments has become increasingly important. Environmental regulation as policy instrument is supposed to reduce or ideally minimize emissions and pollution. However, the question arises how effective such regulations are. Further on, it is not obvious whether these policy instruments rather repress innovation and economic growth than induce a shift toward a greener technology. To address these questions we investigate an endogenous growth model in an environmental context, introduced by M. Rauscher (Green R&D versus end-of-pipe emission abatement: a model of directed technical change (Thuenen-Series of Applied Economic Theory, Working Paper 106), 2009). Rauscher investigates the impact of environmental standards on capital accumulation and R&D investments in an economy where both, brown (dirty) as well as green (clean) capital can be used in production. While Rauscher keeps the problem formulation rather general without assuming specific model functions, our focus is to apply optimal control theory to a specific scenario of this model.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

In recent years climate change and the possible consequences that human society might have to deal with, if further global warming cannot be stopped, have become one of the most important topics in science, politics and the world wide media. The scientific evidence that many key climate indicators are already moving beyond the patterns of natural variability defines this dramatic change as a world wide concern. Hence, the importance of climate mitigation has become undeniable. These indicators, including global mean surface temperature, global ocean temperature, global average sea level, northern hemisphere snow cover and Arctic sea ice decline as well as extreme climatic events, additionally come along with the risk of abrupt or irreversible climatic shifts, which might have devastating consequences for the entire world population. This underlines how urgent the need of climate actions has become (see Richardson et al. 2009).

In the 4th Assessment Report by the International Panel on Climate Change (IPCC 2007), scientific evidence on global warming, its damages and the importance of climate mitigation as well as the reduction of anthropogenic greenhouse gas (GHG) emissions are highlighted. According to their Synthesis Report, the industry sector, besides the energy supply and transport sectors, is one of the main sources of anthropogenic GHG emissions accounting for almost 20% of all GHG emissions (2004). The majority are CO2 emissions due to the use of fossil fuels, but also the emissions of other gases like PFCs, SF6, CH4 and N2O due to physical and chemical processes contribute to the overall CO2 emissions. Additionally, one has to consider the impact of industrial waste and wastewater on pollution. Further on, not only the sources are discussed in the IPCC (2007) but also a broad range of mitigation policy measures are suggested, which especially emphasizes the role of technology policies and the increasing need for more R&D efforts. In the Mitigation of Climate Change Report, some possible mitigation options for a greener technology are explained, such as fuel switching, including the use of waste material, advanced energy efficiency, the use of bioenergy and material recycling and substitution. As far as according policy instruments are concerned, they consider performance standards, subsidies, tax credits, tradeable permits and voluntary agreements as the most environmentally effective instruments.

Although these environmental policy instruments seem to be promising, the question arises how they can be utilized in the most effective way and whether strict environmental regulation has a supporting or repressing impact on innovation and economic growth. To address this issue, many economic growth models include the environment as an additional dimension in form of pollution that is modeled either as a by-product of production like in Kalkuhl et al. (2011) or Saltari and Travaglini (2011), or as a result of consumption, as in Bretschger and Smulders (2007). To reduce pollution in order to protect the environment, the possibility of end-of-pipe abatement often is added in such models, like in Lange and Moslener (2004), Rasmussen (2001), Antweiler et al. (2001) or Xepapadeas (1992). Instead of reducing pollution only after production, a different approach is to reduce pollution directly in the process of production by including a cleaner substitute for the pollutive production input or for the pollutive technology. Examples for this can be found in Cunha-e Sá et al. (2010), Hartley et al. (2010), Cassou and Hamilton (2004), Acemoglu et al. (2009) and Lehmijoki and Palokangas (2010).

We refer in our work to a recent paper by Rauscher (2009) who addresses this topic by constructing a simple dynamic environmental-economic model which considers capital accumulation, end-of-pipe emission abatement, R&D investments and knowledge spillovers in an endogenous growth framework. Rauscher investigates in a conveniently tractable way whether tighter environmental standards will induce a shift from end-of-pipe emission abatement to a process-integrated one and how these alternative policies effect R&D investments and growth. The model Rauscher employs is kept algebraically simple without specifying concrete functional forms. In this paper we introduce specific functional forms and apply optimal control theory to solve for the dynamic paths of the environmental-economic system.

The paper is organized as follows. In the next section we introduce the model, which is solved Sect. 3 by applying Pontryagin’s Maximum Principle. Numerical simulations, including a bifurcation analysis, are presented in Sect. 4. Section 5 concludes and gives an outlook for further research.

2 The Model

To investigate the effects of environmental standards on economic growth and R&D investments, we build on the model by Rauscher (2009), who considers a competitive market economy where a continuum of identical firms using identical technologies produce a homogenous GDP good. In this economy two types of capital are accumulated: first, there is conventional capital, also called brown capital, which is pollutive, secondly, a non-polluting green capital can be chosen. Additionally, the government sets environmental standards which the entrepreneurs are obligated to meet. The necessary abatement effort as well as the abatement costs depend on the stringency of these regulations. Consequently, firms adopting cleaner technologies have to spend less on end-of-pipe abatement. This benefit, however, comes at a cost because the required resources for green R&D could be invested otherwise profitably in conventional R&D. Instead of assuming different groups of agents, as frequently done in many other papers approaching this topic, Rauscher (2009) focuses on one type of agent in the private sector of the economy, who is a capital-owning entrepreneur doing his/her R&D in-house and who saves and consumes all at the same time. In case of perfect competition of the markets on which these agents interact, the simple homogenous-representative-agent model generates the same results as its more elaborated version with heterogeneous agents.

Maximizing his/her own profit, the representative agent has to consider the present value of future utility, given as

where C(t) is the consumption or dividend income, ln(C(t)) describes the utility level that the agent obtains from C(t) and r is the discount rate. Further on, ε specifies the exogenously given environmental quality determined by the government, which is represented by index between 0 and 1, with ε=0 denoting the laissez-faire scenario (any environmental regulation exists and therefore environmental quality is low) and ε=1 stands for the maximal attainable environmental quality. The private sector’s utility of environmental quality is denoted as u(ε) and will be set in the following as u(ε)=cε γ with c>0 and 0<γ<1.

The entrepreneurs use conventional capital K(t) and/or green capital G(t) to produce an output

Output is used for consumption, for the coverage of opportunity costs due to green and brown R&D investments and for end-of-pipe emission abatement. Note, that savings are not included in this model approach. The budget constraint is given as follows,

Note that as of here, we will often omit the time argument t for the ease of exposition. R K and R G denote the investments for R&D to generate new capital of types K and G, respectively. The parameter w∈[0,1] represents the exogenous opportunity costs. The abatement costs for achieving the binding environment constraints of the government are proportional to the installed conventional capital K. The costs per unit capital is given as χ(ε) which is increasing and convex in the stringency of environmental regulation, i.e. χ′>0, χ″>0, and will be set for this analysis as χ(ε)=aε β with a>0 and β>1.

The two types of capital accumulate through a Cobb Douglas production function with decreasing returns to scale and depreciate at fixed exogenous rates ϕ and ψ,

The existing capital stock itself has a positive feedback on the accumulation. Assuming that this positive feedback is weaker than the contribution of new technology due to R&D, the partial elasticity of production of the capital stock is supposed to be less than the one of the R&D investments. Hence, δ 1<δ 2 and σ 1<σ 2. Additionally, it is more likely that conventional capital is more established in the economy than green one and therefore accumulation is much easier. To take this imbalance into account, the partial elasticities of green capital G should at least not be greater than those of conventional capital K, i.e. σ 1≤δ 1 and σ 2≤δ 2.

Figure 1 shows the interrelations of the variables to illustrate the dynamics of the model. Starting from the capital stocks K and G, output F(K,G) is produced. Constricted by the available budget (3), the decision-maker has to determine the extend of R&D investments that are made for either brown (R K ) or green (R G ) capital or possibly both. These investments in turn influence the growth of the capital stocks K and G, respectively. Additionally, also the existing capital stock contributes to the accumulation.

Solving (3) for consumption C together with (1) leads to an optimal control problem with R K and R G as control variables and the two available types of capital as states, which is given as

3 Analytical Results

3.1 Derivation of the Canonical System

Summing up, we consider a discounted autonomous model with infinite planning horizon. To derive the necessary conditions for an optimal solution we consider the Lagrangian \(\mathcal{L}\) in current value notation, where \(\mathcal{H}\) denotes the Hamiltonian, \(\mathcal{C}\) the control and mixed path constraints and μ the vector of Lagrange Multipliers:

with the co-states (λ 0,λ 1,λ 2)≠0. The first order conditions are

where subscripts denote partial derivatives of multivariate functions. The complementary slackness conditions are

One can show that λ 0=1, without loss of generality. For the derivation of the canonical system one has to distinguish between the different cases of an interior arc and a boundary arc. In the first case none of the constraints are active and, due to the complementary slackness conditions in (11), (μ 1,μ 2,μ 3)=0. Hence, an optimal control should maximize the current value Hamiltonian, i.e.

and therefore

To prove that the Hamiltonian is strictly concave, the positivity of the co-states is necessary which can be shown by solving (12) and (13) for λ 1 and λ 2 respectively. This yields

Note that \(A_{R_{K}R_{K}}(K,R_{K})<0\) and \(B_{R_{G}R_{G}}(G,R_{G})<0\). The Hessian matrix of the Hamiltonian

therefore is negative definite and the Hamiltonian \(\mathcal{H}\) is strictly concave.

The optimality conditions in (12) and (13) allow to derive control functions depending on co-state and state variables (cf. conditions (7) and (8))

Substituting these control functions into the state dynamics (4) and (5) as well as into the adjoint equations (9) and (10) the canonical system in the state-co-state-space is given as

However, from an application orientated point of view it is often more convenient to transform the canonical system from the state-co-state-space into the state-control-space. Within this representation immediate interpretation of the results is more convenient (see Grass et al. 2008). Additionally, inserting the specific functions from above, the two controls from (7) and (8) are given only implicitly. Therefore, the derivation of the canonical system in the state-control space is even necessary.

Considering the specific functions from above, the first order conditions are

Solving (15a) and (15b) for λ 1 and λ 2 instead of the controls yields

By using the total time derivatives of the co-states

two equations for the control dynamics can be obtained. Together with the adjoint dynamics in (15c) and (15d) these control dynamics are given as

which yields the canonical system

with

and D 1 and D 2 being the first derivatives of the state dynamics with respect to the corresponding control

In the boundary arc case, the optimal controls do not necessarily maximize the Hamiltonian, i.e. \(\mathcal{H}_{R_{K}}=0\) and \(\mathcal {H}_{R_{G}}=0\) might not be fulfilled in the optimum. Hence, the approach to derive the canonical system in the state-control-space, as done in (15a)–(18), cannot be used. Instead, the optimal controls have to maximize the Lagrangian. Therefore, in case of one or even both control constraints being active, the partial derivatives of the Lagrange function with respect to the controls, \(\mathcal{L}_{R_{K}}=0\) and \(\mathcal{L}_{R_{G}}=0\), together with the active constraint equations yield the corresponding Lagrange multipliers and the control dynamics, while the adjoint equations can be used to calculate the co-states. The state dynamics remain the same just with the according control values inserted, i.e. R K =0 and/or R G =0. If, however, the mixed path constraint is fulfilled, the derivation of the according canonical system is more extensive. Assuming that the mixed path constraint is the only constraint being active, meaning that R K and R G are positive, the following DAEs have to be solved

where C defines the mixed path constraint and this time μ 3≥0. In order to transform these DAEs into ordinary differential equations (ODEs), total time derivatives have to be considered:

Inserting the according equations for \(\dot{K}\), \(\dot{G}\), \(\dot {\lambda_{1}}\) and \(\dot{\lambda_{2}}\) and solving the previous equations for \(\dot{R_{K}}\), \(\dot{R_{G}}\) and \(\dot{\mu_{3}}\) yields the equations for the controls. Note, however, that \(\dot{\lambda_{1}}\) and \(\dot{\lambda_{2}}\) include λ 1 and λ 2 respectively, and therefore also \(\dot{R_{K}}\), \(\dot{R_{G}}\) are both dependent on the co-state. For this reason the reduction of the canonical system to four dimensions is not possible anymore and one has to consider all six dimensions which are given as follows

where T denotes the target function

and Y and V denote the obtained results for the control dynamics, which we omit here because they are very complex and don’t allow any immediate insights.

3.2 Steady States

According to the maximum principle (see Grass et al. 2008), in the following the maximization problem (6a) subject to (6b)–(6l) will be solved by determining the stable manifolds arising from the canonical system which has been derived in the previous section. The steady states of the canonical system are determined by solving \(\dot{K}=0\), \(\dot{G}=0\), \(\dot{R_{K}}=0\), \(\dot {R_{G}}=0\) simultaneously. Considering the two state dynamics, the according roots are:

where subscripts denote the equation which is set to zero, respectively. Further on, also K=0 and G=0 would obviously be solutions. However, K and G occur in the denominator of \(\dot {R_{K}}\) and \(\dot{R_{G}}\) multiplicatively. Hence, for K=G=0 we find no feasible steady state solution of the canonical system. But since the intention of environmental policy is not to completely shut down the production, the main focus of this paper lies on the determination of steady states with a positive production output. Inserting the roots in (22) together with parameter values into \(\dot{R_{K}}\) and \(\dot{R_{G}}\), the intersection of the isoclines \(\dot{R_{K}}=0\) and \(\dot{R_{G}}=0\) determines the steady states. In this first approach only one steady state can be identified, which will be demonstrated in what follows.

3.3 Stability

To determine the stability of this steady state, the Jacobian matrix is used, which is given by

where subscripts denote partial derivatives again. Hence the characteristic polynomial is

which determines four eigenvalues

Considering the sign of the determinant

the various cases summarized in Table 1 can be distinguished.

3.4 The Laissez-Faire Scenario and the Introduction of Environmental Policy

For the numerical analysis we set the parameter values as summarized in Table 2. At first, an economy is considered in which no environmental standards at all are imposed, i.e. ε=0. In this laissez-faire scenario, the agent does not have to fulfill any environmental restrictions and therefore is completely free of abatement costs. However, this comes at the expense of environmental quality and consequently of the utility it yields. Anyway, as long as the utility of consumption is high enough to compensate for the loss of environmental quality, the agent’s capital accumulation is conceivable. Due to the fact that green capital is less productive than brown capital it is obvious that the agent will mainly use the polluting capital as much as possible. However, complete abandonment of green capital is not possible due to the assumption of a Cobb Douglas production function, but the green input factor is expected to be comparatively low. Figure 2 shows that the single steady state is at K=29,160, G=4,126 with control levels R K =4,453 and R G =1,187, which is a saddle point according to the first case in Table 1. Obviously K is dominant in production. The colored region in Fig. 2 corresponds to the admissible region according to the mixed path constraint C≥0.

In the next step, an economy with a medium environmental quality standard ε=0.4 is considered. As one can see in Fig. 3, this causes a big change in the position of the steady state. In this scenario, the saddle point is at K=714, G=981, R K =24 and R G =96. Due to the higher abatement costs, brown capital as dominant input factor has become too expensive. Green capital now is an essential substitute, despite its lower productivity. Comparing Fig. 3 with Fig. 2 one can see that the admissible region C≥0 shrinks with increasing ε.

Figure 4 finally shows the steady state for the basic model with constant returns to scale (CRS) in the production function, which is at K=904,808, G=104,374, R K =545,908 and R G =333,154. One can see that these equilibrium values are quite high, compared to the previous two scenarios. Also the admissible region expands with constant returns instead of decreasing returns to scale.

4 Optimal Paths

In this section, the matter of interest is to find trajectories converging toward the equilibrium and to get the corresponding projections that cover a significant part of the (K,G)-plane. For this purpose, the initial value problem approach is used. Hence, initial values for a backward solution of the four-dimensional canonical system need to be constructed first. However, note that only the stable manifold leads directly into the equilibrium. Consequently, this set of starting points has to be very close to the equilibrium, in order to stay on or at least close to the stable manifold. Additionally, also dominant directions in the convergence to the steady state have to be considered. Therefore, an appropriate ellipse around the equilibrium is generated from which these starting points are taken. To take the dominant directions into account, the eigenvectors with negative eigenvalues are used for the calculation according to the formula

where S is the calculated starting point, E denotes the equilibrium, and e 1 and e 2 are the corresponding eigenvectors. Within this calculation the values of the angle η are close to \(\frac{\pi}{2}\) and \(\frac{3\pi}{2}\). This comes along with the fact that in those cases cos(η) is close to zero and therefore the dominant directions are weighted less here (cf. Knoll and Zuba 2004). Based on these constructed initial values the canonical system is solved backward. The projection of the resulting four-dimensional optimal trajectories onto the (K,G)-plane leads to a phase portrait, from which those trajectories have to be chosen, which correspond to the given initial conditions. In Fig. 5 the phase portrait for ε=0.4 is depicted. Here, the crucial and obviously very narrow intervals for the angle η are [0.4999755π,0.4999756π] and [1.500024418π,1.500024419π].

As one can see in Fig. 5, some of the trajectories are divided into two parts. The first part, which is common for all and depicted in gray, corresponds to the backward solution of the system starting from the equilibrium. On the left hand side the trajectories are continued until K=0. On the right hand side, however, continuation aborts when the trajectories reach the boundary of the admissible region subject to the control constraint in (6d) where R K =0. This constraint is depicted in the figure as dashed black line. To enable further continuation of these trajectory paths, R K is constantly set to zero and calculation continues with the according canonical system where \(\dot{R_{K}}=0\). These second parts of the trajectories are depicted in black and their continuation is possible until they finally reach the admissible boundary of the mixed path constraint in (6f), where consumption, and therefore also utility from consumption, is zero.

4.1 Initial Points with an Equal Level of K and G

Figure 6 shows two trajectories from the phase portrait in the (K,G)-plane which both have initial points with almost equal levels of K and G. The first one starts at very low levels of brown and green capital which are smaller than the equilibrium values. Along the path to the equilibrium the levels of both types of capital increase. The second trajectory has its initial point at a high level of brown and green capital above the equilibrium values. Accordingly, the levels of capital decrease along the trajectory while approaching the equilibrium.

Figure 7 shows the optimal time paths in K, G, R K and R G along the trajectory starting at the lower level of capital. As one can see, the levels of both types of capital increase monotonously while converging toward their equilibrium values, where conventional capital in the beginning is a little bit higher than green capital. Nevertheless, green capital finally gets dominant. Considering the paths of the R&D investments, the levels of R K and R G initially increase very quickly. Therefore less time is needed to get close to their equilibrium values. In order to cause growth in the capital levels, initially high R&D investments are needed until the positive feedback of the capital stock on itself is effective enough to thwart the negative pressure of depreciation. Note that the level of R K even decreases after reaching a peak to slow down this positive feedback until growth and depreciation are perfectly balanced close to the equilibrium. Due to the fact that the production elasticity of R G is less than the one of R K , the behavior is different here. Higher investments are necessary to achieve the same effects and the R G level monotonously increases toward the equilibrium value.

In Fig. 8 the same paths are considered for the trajectory starting at the high capital level. Here the levels of both capitals are decreasing. Due to the almost equal initial level of K and G and the comparatively lower equilibrium level of K, the decline of K is stronger than in green capital. To switch off the positive feedback of K on its own stock completely, and therefore to boost the negative impact of depreciation, R K initially is even zero and only rises again to stop this decline, but stays at a very low level, though. Due to lower production elasticity the level of green R&D initially rises very quickly up to a peak to stop the negative pressure of depreciation. Then it slightly decreases again to finally remain at a level obviously higher than the one of R K .

4.2 Initial Points with One Type of Capital Being Dominant

As mentioned above the initial use of both capital types is assumed due to the use of a Cobb Douglas production function. However, situations in which one type of capital is definitely the dominant input factor, whereas the other one almost equals zero, are certainly of interest. Figure 9 shows two trajectories for such initial conditions. One either starts at a green capital-dominated production or in an initial point where K is used almost exclusively as production input. In both cases, the level of the dominant capital lies above the equilibrium values, while the level of the dominated capital is below its equilibrium level.

Figure 10 shows the optimal time paths in the case of an initially green capital-dominated production. In contrast to the previous case of an almost balanced initial mix of production, the behavior of the capital levels in this scenario are respectively opposed. Because green capital is dominant here, the level of G decreases while brown capital, starting at a very low level, rises up to the equilibrium value. Considering the R&D investments, the same behavior as in Fig. 7 can be observed, where R K rises up to a peak, then falls again and slows down the positive feedback, while R G increases monotonously. Summarizing this scenario it is interesting to see that R G is increasing while G is decreasing. In other words, green R&D investments are made so to keep G at a sufficiently high level.

Regarding the case of an initially brown capital-dominated production, the according optimal time paths are depicted in Fig. 11. Accordingly, in this case K decreases and G rises up to the equilibrium values. Again, R K is initially zero and rises up to slow down the decline, while R G rises up to a peak and then slightly decreases.

4.3 Bifurcation Analysis

In the previous sections, equilibria for specific values of ε were considered. However, the main focus of this paper is the investigation of the influence of the required environmental standards on the capital accumulation and hence on the production. We therefore apply bifurcation analysis is used with ε being the parameter to be varied. Although only one steady state has been detected so far, and hence the bifurcation diagram for the basic model is quite simple, it gives a first idea about the interrelation of the environmental quality and the usage of both types of capital as input in production.

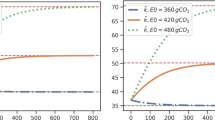

Figure 12 depicts the change of the equilibrium values under the variation of the environmental quality imposed by the government. For ε=0 (laissez-faire scenario) K is clearly dominant in production as already mentioned above. As one can see, increasing ε results in an immediate decrease of K due to the rising abatement costs per unit of brown capital. Also G decreases with growing environmental quality. This might seem a little bit astonishing at first sight, but comes along with the fact that, due to the Cobb Douglas production function, a complete abandonment of K as production input is impossible, and therefore a sufficiently small level of K has to be used which at the same time has an increasingly absorbing impact on the productivity of G. However, this decrease is much smaller than the one of K. The point of special interest is at ε=0.362. At this point, abatement gets so expensive that the use of green capital as dominant production input is more advantageous. In Fig. 13 changes of the equilibrium values of R K and R G over ε are shown. They behave quite similarly. Initially, R K is dominant until abatement gets too expensive and higher investments in green R&D are optimal. This change happens already at ε=0.263, i.e. earlier than for the capital stocks.

Note, however, that in this basic model increasing environmental standards in general have a diminishing impact on the production inputs, and therefore on production output, and furthermore on economic growth. As one can see in Fig. 14, the production is strictly monotonously decreasing.

In contrast, the utility function as depicted in Fig. 15 rises up to a peak before it decreases due to the trade-off between consumption and environmental quality. If ε is small enough, a small loss in consumption in return for a slightly better environment is advantageous. The utility-maximizing environmental quality is at ε=0.125.

In order to get a more qualitative comparison of the changing use of K and G in production with increasing ε, the percentage values of green and brown capital in total production are shown in Fig. 16. As one can see, the ratio of G follows a convex-concave shape. At the beginning, the usage of G is quite low and does not change much with increasing ε. In this area, the abatement costs are still too low to change the advantage of conventional capital. The inflexion point is at ε=0.362 where green capital starts to dominate conventional capital. From here on the ratio of G grows quite quickly until it converges to almost 100%. Note however, that 100% can never be reached. Accordingly, the ratio of K follows a concave-convex decrease.

In Fig. 17 the percentage values of the according R&D investments are depicted. Their development is similar, the only difference is the position of the inflexion point which is already at ε=0.263.

5 Conclusion

The aim of this work is to investigate how environmental regulation influences economic growth as well as R&D investments and whether or not they induce a shift to a greener technology.

As far as economic growth is concerned, it becomes obvious that increasing stringency of environmental regulation causes a decline in both types of capital and consequently also in production output. Therefore it rather represses than supports economic growth.

However, the analysis shows, that increasing environmental regulation indeed has a positive impact on the accumulation of green capital and on the increase of green R&D investments. This can especially be seen when the shares of capital levels and R&D investments under varying stringency of environmental standards are considered. Although both capital levels decline, increasing abatement costs even accelerate the decrease of brown capital levels so that in total production turns out to be greener the higher environmental quality standards are. The same applies for R&D investments.

To sum up, environmental regulation standards can cause a shift to greener production but only at the cost of reduced economic growth. Therefore, the introduction of additional environmental instruments, such as taxes or maybe subsidies, might be interesting and could possibly be helpful to achieve better results.

We want to close this paper with pointing out two further model extensions we would like to consider for future work. First, environmental quality so far is determined exogenously through the required standards set by the government. Hence, an interesting aspect would be to include an emission function E(K,G) describing the pollution during the production process. Second, a main assumption in the present model is that the abatement effort exactly equals the necessary level needed to satisfy the required standards. This, however, shall be adapted for future model approaches by considering the abatement share as third control so that an environmentally aware agent can abate even more than necessary for the standards.

References

Acemoglu, D., Aghion, P., Bursztyn, L., & Hemous, D. (2009). The environment and directed technical change (Working Paper 15451). NBER. http://www.nber.org/papers/w15451.

Antweiler, W., Copeland, B. R., & Taylor, M. S. (2001). Is free trade good for the environment? American Economic Review, 91(4), 877–908.

Bretschger, L., & Smulders, S. (2007). Sustainable resource use and economic dynamics. Environmental & Resource Economics, 36(1), 1–13.

Cassou, S. P., & Hamilton, S. F. (2004). The transition from dirty to clean industries: optimal fiscal policy and the environmental Kuznets curve. Journal of Environmental Economics and Management, 48(3), 1050–1077.

Cunha-e-Sá, M. A., Leitão, A., & Reis, A. B. (2010). Innovation and environmental policy: clean vs. dirty technical change (FEUNL Working Paper Series No. wp548). Faculdade de Economia, Universidade Nova de Lisboa.

Grass, D., Caulkins, J. P., Feichtinger, G., Tragler, G., & Behrens, D. A. (2008). Optimal control of nonlinear processes—with applications in drugs, corruption and terror. Heidelberg: Springer.

Hartley, P. R., Medlock, K. B., Temzelides, T., & Zhang, X. (2010). Innovation, renewable energy, and macroeconomic growth (Working Paper). Baker Institute for Public Policy.

IPCC (2007). Climate change 2007. Cambridge: Cambridge University Press.

Kalkuhl, M., Edenhofer, O., & Lessmann, K. (2011). Learning or lock-in: optimal technology policies to support mitigation (CESifo Working Paper Series No. 3422). CESifo Group Munich.

Knoll, C., & Zuba, D. M. (2004). Dynamic models of the US cocaine epidemic: modeling initiation and demand and computing optimal controls. Ph.D. thesis, TU Wien.

Lange, A., & Moslener, U. (2004). A bird in the hand is worth two in the bush? When do we prefer something certainly dirty to something perhaps clean? Journal of Risk and Uncertainty, 29, 35–51. 10.1023/B:RISK.0000031444.37497.26.

Lehmijoki, U., & Palokangas, T. (2010). Trade, population growth, and the environment in developing countries. Journal of Population Economics, 23(4), 1351–1370.

Rasmussen, T. N. (2001). CO2 abatement policy with learning-by-doing in renewable energy. Resource and Energy Economics, 23(4), 297–325.

Rauscher, M. (2009). Green R&D versus end-of-pipe emission abatement: a model of directed technical change (Thuenen-Series of Applied Economic Theory, Working Paper 106). Universität Rastock.

Richardson, K., et al. (2009). Synthesis report from climate change: global risks, challenges and decisions. Copenhagen: University of Copenhagen.

Saltari, E., & Travaglini, G. (2011). The effects of environmental policies on the abatement investment decisions of a green firm. Resource and Energy Economics, 33(3), 666–685.

Xepapadeas, A. (1992). Environmental policy, adjustment costs, and behavior of the firm. Journal of Environmental Economics and Management, 23(3), 258–275.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Moser, E., Prskawetz, A., Tragler, G. (2013). Environmental Regulations, Abatement and Economic Growth. In: Crespo Cuaresma, J., Palokangas, T., Tarasyev, A. (eds) Green Growth and Sustainable Development. Dynamic Modeling and Econometrics in Economics and Finance, vol 14. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-34354-4_5

Download citation

DOI: https://doi.org/10.1007/978-3-642-34354-4_5

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-34353-7

Online ISBN: 978-3-642-34354-4

eBook Packages: Business and EconomicsEconomics and Finance (R0)