Abstract

Using a “difference-in-differences” approach, we show that the share of entrepreneurs in Italy declined more in industrial districts than in comparable labour markets during the 3 years following the 2008 recession. We have examined alternative explanations of this finding, thus concluding that it is consistent with the idea that intense social interactions typical of industrial districts act as a multiplier that amplifies the response to shocks. However, we cannot exclude that this may translate into a positive effect on employment as the flows from entrepreneurship to employment appear to be greater within industrial districts.

This chapter summarizes and extends the empirical research reported in Brunello and Langella, 2016, Local agglomeration, entrepreneurship and the 2008 recession: evidence from Italian industrial districts, Regional Science and Urban Economics, 58, 104–114.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The effect of economic recessions on entrepreneurship is, in principle, ambiguous. By reducing income and wealth, they can lower the incentive to start or stay in business. At the same time, recessions shrink employment opportunities, and this could induce people to shift to self-employment as an alternative to inactivity and unemployment (see Fairlie 2013). Do these effects vary with local economic conditions and in particular with the presence of agglomeration economies?

Agglomeration economies are likely to affect economic activity and entrepreneurship, and there is ample evidence that suggests that this can be related to the presence of consumer/supplier linkages, entrepreneurial and knowledge spillovers and labour market pooling. Less is known, however, about their effects on how entrepreneurs react to recessions. In this chapter, we address this by focusing on the 2008 recession and on industrial districts, characterised by the prevalence of small- and medium-sized enterprises operating in the manufacturing sector, strong product specialisation, proximity and substantial social interactions.

Previous literature suggests that the effects of a recession on entrepreneurship can vary across comparable areas that differ in their degree of agglomeration for a number of reasons, some insulating local entrepreneurs, others favouring the propagation of the crisis. On the one hand, as remarked by Guiso and Schivardi (2007), the social multiplier and information spillovers, which characterise industrial districts, are likely to amplify the sensitivity to shocks (see also Glaeser et al. 2003). On the other hand, the density of industrial networks within districts may build a safety net of reciprocal support, thereby sustaining the ability to survive during a global recession. The literature on social capital suggests that industrial clusters are areas where the level of trust among people is higher (see Putnam 2000). This may facilitate the access to credit (Guiso et al. 2004b), as well as improve the economic performance of local banks, with protective effects on entrepreneurship when the local economy is in dire straits.

We run an empirical investigation, matching cross-section microdata from Northern and Central Italy,Footnote 1 where industrial districts are particularly widespread (see, for instance, Porter 1998), with local labour market indicators. Using micro-level data from the Italian Labour Force Survey from 2006 to 2011, we adopt a “difference-in-differences” setting (DiD) that compares the evolution of the share of entrepreneurs before and after the 2008 recession in two groups of travel to work areas, industrial districts (ID) and other comparable local labour markets (OLM). Local labour markets, as defined by the 2001 Italian Census, are travel to work areas, and IDs are a subset of these areas characterised by strong product specialisation and firm size homogeneity.

Our focus is on the bulk of Italian entrepreneurship, that is to say men aged 35–55Footnote 2 working in the Northern and Central areas of Italy. We find that the share of entrepreneurs has declined to a larger extent after the 2008 recession in areas with industrial districts than in other comparable labour markets. Measured in terms of the pretreatment average share, the estimated differential effect is between 5.3 and 5.7% (in absolute value), depending on the estimation method.

We discuss several mechanisms that may explain our empirical findings. Our analysis allows us to rule out several alternative explanations, including differences in industrial specialisation and composition, the propensity to export and access to credit and population density; we conclude that our results are consistent with the presence of social multiplier effects, as described by Guiso and Schivardi (2007). In models where such effects are present, agents take decisions facing an uncertain environment and having limited information. The behaviour of other agents allow them to increase their knowledge, and therefore the probability of observing other entrepreneurs provides an incentive to delay adjustments. Once someone acts, the revealed information could trigger further actions and start a self-reinforcing process that prompts many agents to undertake the adjustment within a short time span. Our interpretation relies on the idea that the intense social interactions typical of industrial districts facilitate information flows, thereby amplifying the effects of a shock in closely connected economies.

The chapter is organised as follows. Section 2 presents a model of agglomeration effects during a recession. In Sect. 3 we define industrial districts and present the data. The empirical strategy is described in Sect. 4, and results are presented and discussed in Sect. 5. Conclusions follow.

2 Agglomeration Effects in the Presence of Negative Shocks: A Model

We illustrate the economic interactions between local agglomeration effects, entrepreneurship and recessions using a simple economic model, which draws from Lucas’ model of entrepreneurial choice (see Lucas 1978; Guiso and Schivardi 2011, for a recent application).

2.1 Setup

Consider an economy composed of two local labour markets (or localities) that differ in their degree of agglomeration, captured by λ, with λ ≥ 1. Agglomeration effects originate from individuals and/or firms locating near each other in an area (see, for instance, Rosenthal and Strange 2003; Puga 2010). Geographical proximity creates externalities. The localization patterns of firms can either generate Marshall-Arrow-Romer (MAR) externalities, when industries specialise geographically and produce knowledge spillovers, or Jacobs externalities, driven by industrial diversification (Glaeser et al. 1992). The benefits associated to these externalities are a source of agglomeration effects.

In our model we assume that the sole source of agglomeration is the presence of an industrial district, where MAR externalities prevail and product specialisation contributes positively to agglomeration both by facilitating information flows among network members and by accelerating learning (Guiso and Schivardi 2011), which raises productivity. For simplicity, we posit that only locality 1 is endowed with an industrial district, while the other area is not characterised by any particular type of industrial agglomeration.

We assume that the total population of individuals inhabiting each locality is normalised to 1. Following Guiso and Schivardi (2011), we also assume that entrepreneurs set up their activities in the location where they were born. Workers, on the other hand, are fully mobile. Guiso and Schivardi (2011, p. 64) argue that, “…while complete entrepreneurial immobility is clearly extreme, the fact that entrepreneurs are less mobile than employees and tend to start their business where they were born finds widespread empirical support…”. They quote data from a survey of industrial districts by the Bank of Italy, as well as work by Michelacci and Silva (2007), who have shown that the vast majority of Italian entrepreneurs start a business in their place of birth.

Individuals residing in each locality are endowed with entrepreneurial ability xf, which we posit for tractability to be uniformly distributed on the support [0, 1], and choose to become entrepreneurs if expected profits from business activity—net of the setup costs c—are at least as high as expected income from either employment or unemployment; otherwise they choose to become employees.

We assume that λ1 > 1 and λ2 = 1. This normalisation simplifies the algebra without loss of generality. The timeline of events in this model is as follows: at the beginning of the time period, individuals in each locality choose whether to be entrepreneurs or employees. In the former case, they set up their business in the locality where they were born. In the latter case, they are free to move between localities and find a job. After this choice, production occurs, and output is sold at given prices (normalised to 1). In each locality, production is affected by the business climate, which is either normal or hit by a negative aggregate shock (a recession). Normal times and recessions occur with probability 1 − p and p. Rational individuals consider the business climate in their choice of occupation at the beginning of the period.

2.2 Employment Choice in Locality 1

For brevity, we only discuss equilibrium in locality 1. Define revenue in firm f as λxf[A + ln (1 + kf)], where kf is employment, g(kf) = [2 + ln (1 + kf)] g(kf) = [A + ln (1 + kf)] is the production function, and xf is entrepreneurial ability. Each firm is managed by a single entrepreneur. Agglomeration affects revenue, which is concave in employment, and positive even in the absence of employees. The business climate is captured by the additive shock ε, which is negative in a recession and equal to zero during normal times (again, a normalisation).

Expected profits for an individual with ability xf are given by

where w ≤ 1 is for wages.Footnote 3 In line with the institutional features of the Italian labour market, we assume that wages are set at the national rather than at the local levelFootnote 4 and that they vary with the shock ε. Individuals take the common wage w = w(ε) as given, with w a decreasing function of ε. Maximisation of expected profits with respect to kf yields

Equation (2) implies that higher wages reduce employment and that, conditional on the national wage, more talented entrepreneurs run larger firms. Let Ω1 be the threshold level of ability such that the individual with that ability is indifferent between being an entrepreneur and an employee. Under the conditions spelled out later in this section, individuals with higher ability become entrepreneurs and hire employees if xf > w/λ1, do not hire employees if Ω1 ≤ xf ≤ w/λ1 and become employees or unemployed if xf < Ω1. For brevity, we assume that Ω1 > w/λ1 so that entrepreneurs always have a positive number of employees. Since Ω1 < 1, this assumption requires that w < λ1.

Using (2) and the approximation ln(1 + k) ≅ k in the revenue function, expected profits for the entrepreneur with ability xf are \( E{\pi}_{1f}=w+\frac{{\lambda_1}^2{x_f}^2}{w}- p\varepsilon \), a convex function of ability. Total employment demand D1 in locality 1 is given by

Employees are free to find their job in either locality. Their income is equal to the national wage w if employed and to zero if unemployed. Defining the unemployment rate u as the ratio of the unemployed in the two localities to the total population, the probability of employment is 1−u. Since total supply to the employment sector is \( \underset{0}{\overset{\Omega_1}{\int }} dx+\underset{0}{\overset{\Omega_2}{\int }} dx={\Omega}_1+{\Omega}_2 \), unemployment u is the difference between supply and demand: \( u=1-\frac{\lambda_1}{4w}\left(1-{\Omega_1}^2\right)-\frac{1}{4w}\left(1-{\Omega_2}^2\right) \), an increasing function of the wage w and the thresholds Ωi and a decreasing function of the agglomeration effect λ1. Full labour mobility implies that the expected wage Ew = w(1−u) does not vary with the locality.

In each locality, the choice between entrepreneurship and employment is regulated by the arbitrage condition Eπi = Ew + ci. We assume that entry costs are lower in the more agglomerated locality so that c1 < c2 (see, for instance, Guiso and Schivardi 2011). The arbitrage condition holds in each locality, implying that Eπ1 + Ew − c1 = Eπ2 + Ew − c2 must be true, which yields

Using (4) in the definition of unemployment, the expected wage Ew can be written as

2.3 Equilibrium

In locality 1, expected profits net of expected wages and the setup costs are given by

Assumption 1. The following two conditions hold:

Conditions (7) and (8) are sufficient to guarantee that an interior equilibrium exists. The former condition states that the individual with lowest entrepreneurial talent (x = 0) prefers to be an employee, and the latter condition says that the individual with highest entrepreneurial ability (x = 1) chooses to be an entrepreneur. When these regularity conditions hold, expected profits—net of expected wages and the setup costs—intercept the abscissa at x = Ω1 < 1. Individuals with ability above the threshold Ω1 choose to become entrepreneurs, and individuals at or below the threshold are either unemployed or employees.

The arbitrage condition in locality 1, Eπ1 = Ew + c1, can be written as

The negative shock ε affects this condition both directly, by reducing expected profits, and indirectly, by altering the wage rate. In locality 2, where λ2 = 1, the threshold Ω2 is given by

By comparing (9) and (10), we establish the following:

Result 1: Ω1 < Ω2. The equilibrium share of entrepreneurs is higher in the more agglomerated locality. Furthermore, the marginal entrepreneur in locality 1 is less talented than the marginal entrepreneur in locality 2.

2.4 Comparative Statics and Agglomeration Effects

We investigate the effects of the negative shock ε and of the degree of agglomeration λ1 on local entrepreneurship by differentiating (9), which yields

where \( \Delta ={\lambda}_1\left[\frac{\lambda_1}{w}+\frac{\lambda_1+1}{4}\right] \) and

While the denominator Δ is positive, the numerator of (11) cannot be unambiguously signed. A negative shock ε has ambiguous effects on expected profits net of expected wages. On the one hand, net profits fall for any given wage; on the other hand, they increase because the shock reduces the national wage. If the former effect prevails, a negative shock reduce entrepreneurship in the locality by raising the threshold Ω1.

Next, consider the effect of the degree of agglomeration λ1 on the threshold value Ω1—Eq. (12)—and assume that Ω1 > 1/2, a plausible assumption given that the share of entrepreneurs is typically below 50% of the population. Under this assumption, the numerator in (12) is negative because λ1 > w for the condition Ω1 > w/λ1 to hold, and a higher degree of agglomeration reduces the threshold and increases the share of entrepreneurs.

Since average entrepreneurial ability in locality 1 is E[x| x ≥ Ω1] = 1 + Ω1, an increase in the level of agglomeration λ1 reduces E[x| x ≥ Ω1] by reducing Ω1 and attracting less talented individuals into business. On the other hand, when \( \frac{\partial {\Omega}_1}{\partial \varepsilon }>0 \), a negative shock that increases Ω1 raises average entrepreneurial ability by inducing the less talented to leave their businesses.

We are particularly interested in understanding whether and how the degree of agglomeration λ1 influences the response of local entrepreneurship to a negative shock in a recession. To investigate this, we compare the marginal effect of a negative shock on the threshold value of ability in the two localities that differ because of the presence of an industrial district, which affects agglomeration. Differentiating the arbitrage condition (4) with respect to the shock ε yields

Assume that \( \frac{\partial {\Omega}_i}{\partial \varepsilon } \) is positive. We know that \( \frac{1}{2{\Omega}_2}\left({c}_2-{c}_1\right)\frac{\partial w}{\partial \varepsilon }<0 \). However, since \( \frac{{\lambda_1}^2{\Omega}_1}{\Omega_2}=\frac{\Omega_2}{\Omega_1}+\frac{\left({c}_1-{c}_2\right)w}{\Omega_1{\Omega}_2} \) can be either higher or lower than 1, we cannot establish a priori whether \( \frac{\partial {\Omega}_2}{\partial \varepsilon } \) is larger or smaller than \( \frac{\partial {\Omega}_1}{\partial \varepsilon } \). We therefore turn to the empirical analysis.

3 The Data

The 2001 Census of Industries (Italian Statistical Institute—ISTAT) identifies 156 industrial districts in a set of 686 local labour markets. Based on this classification, we are able to assign people in our data set to either industrial districts or other labour markets. The definition of IDs that we use predates the 2008 recession and is therefore not affected by changes in industrial composition related to the economic crisis.

In the Census, industrial districts are local labour markets that satisfy the following criteria:

-

1.

Specialisation in the manufacturing sector, i.e. \( {l}_a=\frac{X_{am}/{X}_a}{X_m/X} \) > 1 where xam and xa denote the number of manufacturing employees and total employment in area a, and x.m and x.. are the corresponding figures at the national level.

-

2.

Relative high share of small and medium firms,Footnote 5 or \( {s}_a=\frac{x_{am}^{small}/{x}_{am}}{x_{.m}^{small}/{x}_{.m}}>1 \), where the superscript “small” indicates the number of employees in small- and medium-sized enterprises.

-

3.

Presence of a dominant manufacturing industry. Letting \( {l}_{as}=\frac{x_{as}/{x}_{am}}{x_{.s}/{x}_{.m}} \) denote the location quotient for each specific manufacturing industry s, the dominant manufacturing industry d is such that lad > 1 and the level of employment is maximum among the local specialised industries. For d, the following condition must hold: \( {s}_{ad}=\frac{x_{ad}^{small}}{x_{ad}}>0.5 \).

-

4.

Where there is only one medium-sized enterprise, the share of employment in small enterprises must exceed half that of the medium-sized firm.

Our data are drawn from the Italian Labour Force Survey (Italian statistical Institute—ISTAT), a quarterly survey on labour market conditions covering a representative sample of almost 77,000 households and 175,000 individuals per quarter. We have access to the microdata from the first quarter of 2006 to the last quarter of 2011, about 3 years before and after the start of the Great Recession, which is usually placed in the third quarter of 2008.

Using information on the place of residence, we assign individuals to local labour markets. We treat as entrepreneurs the individuals who meet all the following criteria: (i) self-employment status, (ii) decide their working time, (iii) work more than 480 hours per year, (iv) neither work exclusively on the customer’s premises nor are employed by a temporary agency and (v) operate as managers, professionals or in other skilled jobs. Criteria (ii) to (iv) exclude those who report self-employment status but are working as employees. Criterion (v) is used also by Faggio and Silva (2014) and allows us to exclude the self-employed who have selected this status because alternative employment opportunities are not available.Footnote 6

We retain only males aged 35–55 who are employed, self-employed, unemployed or inactive at the time of the interview and exclude those working in the public sector. We exclude females because of their low labour force participation; individuals younger than 35 because in several local labour markets, there are few entrepreneurs in this age group; and workers older than 55 because of their attrition into retirement.Footnote 7 Finally, we exclude Southern Italy because of its structural economic difference with the rest of the country.

Since the Labour Force Survey randomly selects a sample of municipalities, we can only identify 540 local labour markets in the data—out of a total of 686. The elimination of Southern Italy, of large urban areasFootnote 8 and of the areas outside the common support further reduces the sample to 247 local labour markets, 98 with industrial districts and 149 without districts.

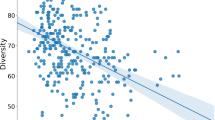

Figure 1 illustrates how the raw share of entrepreneurs has changed in treated and control areas during the period 2006–2011, before and after the 2008 recession. The figure shows that prerecession trends are not statistically different across treated and control areas, which supports our “difference-in-differences” strategy.Footnote 9 Before the recession, the share of entrepreneurs with and without employees was very similar in both areas. After the recession, the share remained more or less stable in control areas and declined in treated areas. Because of this, a statistically significant gap between the shares emerged in 2010 and early 2011.

4 The Empirical Model

As discussed in the Introduction, the effects of a recession can differ across comparable areas that vary in their degree of agglomeration, with some effects insulating local entrepreneurs and some others favouring the propagation of the crisis. In the ensuing empirical analysis, we compare the evolution of the share of entrepreneurs before and after the 2008 recession in areas with and without industrial districts. We estimate the following equation:

where Eiat is a dummy equal to one if the individual i in area a at time t is an entrepreneur (with or without employees) and to zero otherwise (employment, unemployment or inactivity); IDia is the treatment dummy that identifies the presence of industrial clusters in the local labour market; Post2008. Q3t is a dummy taking value one since the beginning of the 2008 recession, which we set in the fourth quarter of 2008 (see D’Amuri 2010) and zero otherwise; and Xit is a vector of individual level covariates, including age, education, marital status, the presence of children in the household and nationality. ϕt and λa are year by quarter and area fixed effects, respectively.

We estimate (14) using both a linear probability and a probit specification. Since neighbouring areas share a similar institutional setup, assuming that errors are independent across local labour markets is overly restrictive. Therefore, we cluster standard errors at the level of the province. The key parameter in this regression is β1, which measures the differential effect of the recession in treated and control areas. As mentioned above, a difficulty of this empirical analysis is that geographical areas may not be completely comparable, due to intrinsic differences that are not fully captured by the degree of agglomeration measured by the dummy ID.

To increase the comparability between treatment and control areas, we proceed as follows. First, we estimate a probit model using our sample of local labour markets during the pretreatment period, which goes from the first quarter of 2006 to the third quarter of 2008. We regress the dummy ID on a set of control variables that comprises log regional real exports and GDP,Footnote 10 the local unemployment rate, the index SP of industrial specialisation, computed as \( {SP}_{cs}=\frac{L_{cs}}{L_c} \), where Lcs is the sum of employees and self-employed workers in local area c and sector s, and Lc is the total number of workers in the area (Cingano and Schivardi 2004), the prevailing industrial sector, population density, dummies for the macro area (North-West, North-East or Center) and period dummies. Second, we compute the propensity scoreFootnote 11 and eliminate from our sample the 13 local labour markets with a propensity score falling outside the intersection of the support for the treated and the control group (Sianesi 2005). These areas are not comparable to the rest in terms of the selected vector of observables.

Applying this method, the average difference in the observables between treated and control areas after restricting the sample to the common support is reduced. Still, as reported in Table 1, important differences remain. For example, the local unemployment rate is 2.8% in treatment areas and 3.2% in control areas (t-test of the absolute difference: 1.57)Footnote 12; regional real exports are higher on average in the areas with industrial districts (t-test of the absolute difference: 2.81); the percentage of individuals with a college degree is 7 and 9% in the treated and control areas, respectively (t-test of the absolute difference: 2.85); population density (inhabitants per 100 km2) is significantly higher in treated areas (230.2 inhabitants per squared kilometre versus 140.5 in control areas—t-test of the absolute difference: 2.24); and the index of economic specialisation is 0.24, not statistically different in the two groups (t-test of the absolute difference: 0.42). These differences suggest that we include the vector X of control variables and of the area fixed effects in the model illustrated by Eq. (14).

5 Results

Table 2 presents our baseline results, which consist of two columns, one for the linear probability estimates and the other the probit model. We find that entrepreneurship is higher for natives, for those who are married and for the better educated. There is also evidence that entrepreneurship increases with age and the presence of children, although this is not the case when we use grouped data.

We estimate that the differential effect of the recession on entrepreneurship in treated areas relative to control areas—β1 in Eq. (11)—is negative and statistically significant at conventional levels. Evaluating percent chances at the pretreatment sample mean (0.227), we estimate that the probability of being an entrepreneur after the recession is between 5.28 (0.012/0.227) and 5.73 (0.013/0.227) percent lower in the areas with industrial districts than in comparable areas. These findings point out that the share of entrepreneurs in industrial districts has suffered more than in comparable areas because of the recession.

How do we explain that entrepreneurship has declined more after the recession in areas with industrial districts than in comparable areas? The literature suggests as a candidate the higher level of production specialisation typical of industrial clusters. Glaeser et al. (1992), for instance, find that industries grow slower in places where they are over-represented. There is also some evidence that specialisation accelerates firm exit. We believe that there are two reasons to exclude specialisation as the explanation of our findings: first, we detect no difference in the level of specialisation between treated and control areas (see Table 3). Second, we redefine the common support by excluding the specialisation index from the set of covariates determining the propensity score and add as additional regressor in the linear probability specification of Eq. (1) the interaction between Post2008.Q3 and a dummy variable equal to one for individuals living in local labour markets with a specialisation index above its median value before the recession and to zero otherwise. If specialisation was the story driving our results, we should find that the coefficient of this additional interaction is negative and statistically significant and that the coefficient associated to the variable Post2008.Q3*ID becomes statistically not significant. However, as shown in the first column of Table 3, our results are virtually unaffected by the introduction of the additional interaction.Footnote 13

Alternatively, our findings could be driven by the fact that industrial districts concentrate in specific production sectors, which may have been hit especially hard by the recession. As shown above, the main sectors that characterise industrial districts are textiles and apparel, furniture and house goods, leather and related products, machinery and equipment and food products. To verify this hypothesis, we apply the same procedure used for the specialisation index, adding to the baseline regression the interaction between the recession dummy and a dummy equal to one for local labour markets where the sectors above have an important share of total employment and to zero otherwise. Again, our results are qualitatively unchanged (Table 3, column 2), although the relevant coefficient becomes larger in absolute value.

Using employment data for the period 2008–2009, we also select the sectors that experienced declines in employment higher than the median. These are mining, utilities, retail and wholesale trade, transportation equipment, rubber and plastic products, textiles and apparel, furniture and house goods and machinery and equipment. We interact the recession dummy with a dummy equal to one for local labour markets where these sectors are important and to zero otherwise. As reported in column (3) of Table 3, adding this interaction does not alter the estimated “difference-in-differences” effect.

The differential effect of the recession in areas with industrial districts could also be driven by the fact that firms in these areas have a higher propensity to export than firms in other areas and therefore have been more exposed to the contraction of international demand. To illustrate, consider the four regions where industrial districts are more widespread (Lombardy, Veneto, Tuscany and Marche) and the four regions where they are less present (Liguria, Trentino, Umbria and Lazio). If we compare real GDP growth between 2007 (before the recession) and 2009 (after the recession) in the two groups of regions, we find that real GDP in manufacturing declined by 17.8% in the former group and by 19.1% in the latter group. Services were less affected, with a decline equal to 5.0 and 6.1%, respectively. These differences are small when compared with the performance of real exports, which plummeted during the same period by 20.1% in the regions where industrial districts prevail and by 9.0% in the other regions. We verify whether our findings are driven by different propensities to export by including real regional exports in our regression. If our results were driven by exports, this inclusion should affect in a significant way the estimate of β1. Yet column (4) in Table 3 shows that this is not the case.Footnote 14

Following Guiso et al. (2004a), our results could also be driven by differences in the access to credit across local labour markets rather than by the presence of industrial districts. To address this possibility, we collect two measures of credit accessibility for the pretreatment period: (a) the number of bank branches per thousand inhabitants and (b) the loan—deposit ratio.Footnote 15 For each variable we construct a dummy variable equal to one for values above the median and to zero otherwise and interact these dummies with the recession dummy Post2008.3 in Eq. (1). If access to credit was driving the uncovered differences, we should find that adding these interactions significantly reduces or even eliminates the differential effect associated to the presence of industrial districts. However, as shown in Table 3, column (5), this addition leaves our estimates broadly unaffected. We therefore rule out this explanation.

Lastly, we investigate whether our estimated effects are due to differences in population density by proceeding as in the previous cases. First, we redo our sample selection by excluding density from the probit equation defining the propensity score. Second, we add to Eq. (1) the interaction between the recession dummy Post2008.Q3 and a dummy equal to one for the local labour markets where population density before the treatment was above the median and to zero otherwise. As shown in Table 3, column (6), adding this interaction has virtually no effect on our estimates of coefficient β1. Thus, differences in population density do not explain our results.

A key difference between population density and industrial clusters as measures of local agglomeration is that the second emphasizes production similarity as well as proximity. As remarked by Guiso and Schivardi (2007), industrial districts are characterised by a high concentration of similar, supposedly connected firms, where social interaction is particularly intense. Both production similarity and stronger social ties facilitate information flows between network members and accelerate learning. Intense interaction gives rise to amplified responses to shocks, because “…the initial impulse is magnified by the response of the other members of the reference group” (Guiso and Schivardi 2007, p. 70). In their own study of Italian industrial districts, the authors find that firms in these areas “…should display a lower sensitivity to aggregate shocks in non-adjustment years and a higher sensitivity in adjustment years, because those should be the years in which the response to shocks is amplified by information flows…” (p. 88). Our results are consistent with Guiso and Schivardi (2007), inasmuch as we interpret the years after the 2008 recession as adjustment years.

In the thick labour markets that characterise industrial districts, the amplified response of entrepreneurs to negative economic shocks may also affect private employment as well as the transitions from entrepreneurship to employment, for instance because entrepreneurs closing their business in these areas find more easily a new job—as employees—in another firm in the same manufacturing industry, that demands the same industry—specific skills and is part of a common web of inter-personal relationships. The relevant literature defines this as a typical labour pooling effect, understood as the fact that thick labour markets facilitate the flow of workers across firms.Footnote 16

We explore this possibility in two ways: first, we look at the effect of the economic recession on private sector employment in industrial districts and in OLM areas and second, we look at average year-to-year transitions from entrepreneurship to employment in IDs and OLMs. Table 4 presents our estimates of Eq. (1) when the dependent variable is private employment, showing that the estimated value of β1 is positive and statistically significant at the 10% level of confidence—see column (1).Footnote 17 Table 5 presents instead the year-to-year inflow and outflow rates into and from entrepreneurship.Footnote 18 On the one hand, we find that inflow rates from employment into entrepreneurship have declined both in industrial districts and in other areas, with a sharper effect in the former (from 1.42 to 0.93%) than in the latter (from 1.05 to 0.76%).Footnote 19 On the other hand, the outflow rates from entrepreneurship into employment have increased in areas with industrial districts (from 1.26 to 1.96%) and decreased in other OLM areas (from 1.61 to 0.80%). This is consistent with the positive differential effect of the recession on employment in industrial districts.

We also find that in industrial districts, the increase in the flows from entrepreneurship to employment after the crisis is driven mainly by flows within the same industrial sector (from 0.65 to 1.29%), contrary to other areas, where these flows have declined (from 0.71 to 0.36%), suggesting that the agglomeration of firms in a dominant manufacturing industry—a typical feature of industrial districts—creates a pooled market for specialised workers and entrepreneurs with industry, specific skills, which facilitates mobility within the same industry.Footnote 20

6 Conclusions

We have investigated whether the presence of industrial districts—a source of local agglomeration effects—affects the response of local entrepreneurship to an economic recession. We compare the probability of being an entrepreneur before and after the 2008 recession in areas where industrial districts are present and in comparable areas, using a difference-in-differences approach. To do so we use cross-sectional individual data from the Italian Labour Force Survey (ISTAT). We find that entrepreneurship has suffered more after the recession in industrial districts than in other labour markets, especially among more experienced individuals. We have empirically explored several mechanisms that can explain this differential effect, including industrial specialisation and composition, the sector of production, differences in the level of exports, credit accessibility and the composition of talents. Our results suggest that none of these channels can credibly account for our findings.

We have argued that the social multiplier could partly explain our results. This effect suggests that if the industrial districts are characterised by intense social interaction as previous literature suggests, the effects of a shock can be amplified by those closely connected economies, in particular by accelerating information flows. Since the multiplier operates also in the presence of positive aggregate shocks, this leads us to speculate that the positive response of entrepreneurs to an economic expansion might be stronger in areas where industrial districts prevail. Some descriptive evidence also suggests that industrial districts are characterised by a higher flow from entrepreneurship to employment that may also smooth the negative impact on the local economy. Further analysis is though required to shed more evidence on this point.

Further analysis would be also required to assess whether the same findings extend also to other types of agglomerations, as cities. Moreover, the length of our data set does not allow to analyse whether the effects of the 2008 recession are temporary or permanent. Furthermore, our analysis relies on individual level data and focuses on labour market shocks. To shed more light on how industrial districts respond to recessions may require to explore how firms revenues and costs varies over the business cycle.

We plan to pursue some of these questions in our future research.

Notes

- 1.

We decided to exclude the South of Italy from this analysis due to the lack of this type of industrial agglomerations in the area. As we will further explain in the remainder of the paper, we also exclude large urban areas and local labour markets that show a limited level of comparability to industrial districts. The reason for this is to increase precision of our estimates, although, as we will discuss including those areas that does not alter the core of our findings.

- 2.

This is the age range that concentrates the bulk of the entrepreneurial rate. Very few entrepreneurs are observed below the age of 35, and we excluded people aged more than 55 due to high rates of attrition to retirement.

- 3.

This assumption is consistent with xf ∈ [0, 1].

- 4.

Wage bargaining in Italy occurs mainly at the national and sectorial level (Du Caju et al. 2009). Ammermuller (2010) find that wages in Italy do not respond to local unemployment. Guiso and Schivardi (2011) assume that the common wage is determined by the condition that national labour demand equals national labour supply.

- 5.

Small and medium enterprises are defined by the European Commission as firms having less than 250 employees and an annual turnover of up to EUR 50 million or a balance sheet total of no more than EUR 43 million (Commission Recommendation of May 6 2003). Italian industrial structure is characterised by the prevalence of SME. According to the Italian Statistical Institute (ISTAT), in 2013 the average firm size in Italy is of 3.7 employees.

- 6.

As discussed below, using a broader definition (self-employment status) does not affect qualitatively our empirical results.

- 7.

The average share of entrepreneurs with employees in 2006 was 11.5% for individuals aged 35–55, 6.4 for those aged 30–34 and 3.1% for individuals aged 25–29.

- 8.

We exclude urban areas such as Turin, Milan, Venice, Genoa, Bologna, Florence and Rome. We exclude large urban areas and the South of Italy in order to increase the precision of our estimates. South of Italy is characterised by the lack of the industrial agglomerations we focus on in this chapter, while large urban areas show a different industrial structure with respect to the rest of the country. Including those in the analysis does not substantially alter our results.

- 9.

Formal tests of the hypothesis that pretreatment tests are parallel are discussed below.

- 10.

Regional values are from the Italian regional accounts.

- 11.

The propensity score is defined as e(x) = Pr ob(ID = 1| X = x), the probability of being treated conditional on observables X.

- 12.

The low rate might seem surprising. Notice however that unemployment in Italy is the highest among those living in the South, who are excluded from our sample.

- 13.

- 14.

As in the previous experiments, as a preliminary step, we redefine the common support by excluding exports from the vector of covariates defining the propensity score. We have also experimented with real 2007 exports per local inhabitant rather than log real exports, with no qualitative change. Results are available from the authors upon request.

- 15.

Measures (a) and (b) are calculated for the time interval of 2004–2005 on the basis of municipal data (source: Banca d’Italia) aggregated at the local labour market level.

- 16.

Labour pooling as a feature of Italian industrial districts has been investigated by D’Addario, 2011, who finds that living in an ID area increases the probability of finding a job, and by Andini et al. (2012), who conclude that the two concepts are broadly unrelated.

- 17.

The estimated differential effect for the inactive (column (2) of the table) is very small and imprecisely estimated.

- 18.

These rates are computed by dividing the flows by the state variable in the previous year.

- 19.

Similar qualitative patterns emerge for inflows from out of the labour force to entrepreneurship.

- 20.

See De Blasio and Di Addario (2005).

References

Ammermuller, A. (2010). Wage flexibility in regional labour markets: Evidence from Italy and German. Regional Studies, 44(4), 401–421.

Andini, M., De Blasio, G., Duranton, G., & Strange, W. (2012). Marshallian labour market pooling: Evidence from Italy, Temi di Discussione Banca d’Italia, n.922, Rome.

Cingano, F., & Schivardi, F. (2004). Identifying the sources of local productivity growth. Journal of the European Economic Association, 2(4), 720–742.

D’Amuri, F. (2010). The impact of the great recession on the Italian labour market. Mimeo, Bank of Italy.

De Blasio, G., & Di Addario, S. (2005). Do workers benefit from industrial agglomeration? Journal of Regional Science, 45(4), 797–827.

Du Caju, P., Gautier, E., Momferatu, D., & Ward-Warmedinger, M. (2009). Institutional features of wage bargaining in 23 European Countries, the US and Japan. Ekonomia, 12(2), 57–108.

Faggio, G., & Silva, O. (2014). Self-employment and entrepreneurship in urban and rural labour markets. Journal of Urban Economics, 84, 67–85.

Fairlie, R. W. (2013). Entrepreneurship, economic conditions, and the great recession. Journal of Economics & Management Strategy, 22(2), 207–231.

Glaeser, E. L., Kallal, H. D., Scheinkman, J. A., & Shleifer, A. (1992). Growth in cities. Journal of Political Economy, 100(6), 1126–1152.

Glaeser, E. L., Sacerdote, B. I., & Scheinkman, J. A. (2003). The social multiplier. Journal of the European Economic Association, 345–353.

Guiso, L., & Schivardi, F. (2007). Spillovers in industrial districts. The Economic Journal, 117(516), 68–93.

Guiso, L., & Schivardi, F. (2011). What determines entrepreneurial clusters? Journal of the European Economic Association, 9(1), 61–86.

Guiso, L., Sapienza, P., & Zingales, L. (2004a). Does local financial development matter? The Quarterly Journal of Economics, 119(3), 929–969.

Guiso, L., Sapienza, P., & Zingales, L. (2004b). The role of social capital in financial development. The American Economic Review, 94(3), 526–556.

Lucas, R. E., Jr. (1978). On the size distribution of business firms. Bell Journal of Economics, 9(2), 508–523.

Michelacci, C., & Silva, O. (2007). Why so many local entrepreneurs? The Review of Economics and Statistics, 89(9), 615–633.

Porter, M. E. (1998). Competitive advantage: Creating and sustaining superior performance. New York: Simon & Schuster.

Puga, D. (2010). The magnitude and causes of agglomeration economies. Journal of Regional Science, 50(1), 203–219.

Putnam, R. (2000). Bowling alone. The collapse and revival of American community. New York: Simon & Schuster.

Rosenthal, S. S., & Strange, W. C. (2003). Geography, industrial organization and agglomeration. Review of Economics and Statistics, 85(2), 377–393.

Sianesi, B. (2005). Propensity score matching. London: Institute for Fiscal Studies/Mimeo.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Brunello, G., Langella, M. (2018). Italian Industrial Districts and the 2008 Recession. In: Belussi, F., Hervas-Oliver, JL. (eds) Agglomeration and Firm Performance. Advances in Spatial Science. Springer, Cham. https://doi.org/10.1007/978-3-319-90575-4_15

Download citation

DOI: https://doi.org/10.1007/978-3-319-90575-4_15

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-90574-7

Online ISBN: 978-3-319-90575-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)