Abstract

Mahmood underscores a third empirical regularity in the macro drivers of growth and jobs. Among conventional macro drivers, investment and savings climb in lockstep up the income ladder and explain consistently how countries move up from least developed to lower- and middle-income to emerging economies. Other drivers, such as exports, consumption, and government expenditure, provide a far less satisfactory explanation of this trajectory. The problem is that least developed countries tend to be trapped at low levels of savings and investment. However, in complement with physical capital, investment in human capital—ranging from primary education to higher-skilled intangibles—discriminates very well between developing countries and advanced economies. This is a major macro argument demonstrating the impact of productive employment on growth itself.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Chapters 2 and 3 have shown evidence of growth and employment outcomes improving going up the per capita income ladder. Long-run gross domestic product (GDP) per capita, that is, income growth over the past third of a century has been the highest for emerging economies (EEs), followed by lower- and middle-income countries (LMICs) and then least developed countries (LDCs). The quantum of employment growth accompanying this GDP growth, however, was not judged to be the best indicator of labour market outcomes in developing countries (DCs), being driven more by supply-side demographics, than by demand-side economics. The quality of employment was seen to be a complementary if not a better indicator of labour market outcomes. And internationally agreed upon indicators of job quality, which are vulnerability, the working poor, and labour productivity, again were observed to improve, in their growth over the past two decades for which this data was available, and in their levels, in moving up the income ladder.

However, if income per capita is such a strong determinant of long-run growth and employment, then there is a conundrum of a vicious circle for policy. If LDCs, LMICs, and EEs are locked into separate per capita income trajectories, giving distinct growth and employment trajectories, how can they break out of their predetermining income trajectories? The answer to this conundrum is to explain what determines income levels. And the first part of this book showed some evidence that per capita incomes depended on the sectoral composition of growth, in the manufacturing sector. There was also some evidence adduced, that manufacturing shares improved both GDP growth and job quality more than other sectors. Hence manufacturing allows a way out of the policy impasse. If manufacturing climbs up the per capita income ladder for DCs, then development of manufacturing would allow countries to climb up the income ladder, and hence also the GDP growth and job quality ladder.

But manufacturing is one determinant of income and growth à la Kaldor. Growth and development theory offer a number of other tested determinants of growth and incomes. The key determinants of long-run growth and incomes in the literature begin with the macro determinants. These are pre-eminently capital investment, from the classical tradition begun by Mill (1848), Marshall (1920), and Say (1821). There are the balanced versions of growth from Rosenstein-Rodan (1943), and the unbalanced version of growth from Hirschman (1958). Then there is the neoclassical tradition of growth models led by Harrod and Domar (see Harrod 1948) and Solow (1956, 1994). Endogenous growth theory makes a powerful distinction between physical capital and human capital, with its progenitors in Frankel (1962), Solow (1956), and Romer (1986). More sophisticated endogenous growth models like Grossman and Helpman (1991) have knowledge spillovers, of learning by doing, and increasing allocation of resources to these sectors increases the sustainability of growth. Kaldor (1966, 1967, 1975) and Joan Robinson (1953, 1962) posed a conceptual problem in separating physical from human capital when so much of both was embodied in technology. This conceptual knot is perhaps best untangled by the current literature on the contribution of intangibles to growth as in Dutz et al. (2012).

If accumulation of some sort is taken in the literature as a key determinant of growth, then a second body of literature focuses on the sources of demand, a major strand arguing for the primacy of exports, running from Ricardo (1821: chap. 7) and Mill (1844) to Heckscher (1991) and Ohlin (1935). A counter-strand to this ubiquitous theory of comparative advantage comes from Myrdal (1957) arguing that DCs are pressured by advanced economies (AEs) into primary commodity production. Singer (1950) and Prebisch (1962) show the declining terms of trade for such primary commodity producers compared to manufacturing. And Corden and Neary (1982: 829–31) demonstrate the prevalence of the Dutch Disease of exporting extractives appreciating the exchange rates and so driving down the competitiveness of manufacturing. Lin gives a more current version of comparative advantage, while Chang argues against it, to develop manufacturing to move up the income ladder. Hausmann et al. (2007) move the argument further into the content of exports, showing that complexity and sophistication in the goods exported explain growth better. Palley (2011) and UNCTAD (2013) echo Joan Robinson’s concerns about exports beggaring thy neighbour. The ILO has concerns about the unbalanced reliance of demand based on exports, leading to wage competition and the risk of a race to the bottom (Mahmood 2007; Mahmood and Charpe 2013).

This literature basically points to growth policy being based on three major drivers of growth. One is accumulation of capital, which is investment and savings. Another is exports. And a third, in juxtaposition to exports, is relatively greater balance in demand, between exports and consumption. Keynesian pump priming to raise aggregate demand also raises the possibility of government expenditures boosting growth.

This chapter finds that investment and savings shares explain per capita income consistently and well, in moving up the income ladder virtually in lockstep from LDCs to LMICs and to EEs. Export shares do not explain per capita incomes so consistently in moving up the income ladder. But most importantly, human capital and knowledge-based capital explain per capita incomes and their growth, in complement with physical capital, very well. This is a major macro argument demonstrating the impact of productive employment on growth itself. It is complemented in the next chapter by examining at the sectoral level, the impact of capabilities on enabling productive transformation.

2 Accumulation of Capital and Growth

All DCs have chosen to increase their accumulation of capital over time, observed from 1980 to 2010. They have done so in two ways, by increasing their share of investment in GDP, and by increasing their share of domestic savings in GDP. The shares of investment and savings climb up the income ladder, virtually in lockstep, from LDCs to LMICs and to EEs. It has also been possible to observe the separation of investment into physical capital and human capital. And the further separation of human capital into basic education, and more intangible knowledge-based capital. Such a complex growth equation does explain per capita incomes across DCs with a good level of significance.

2.1 Investment

Table 4.1 disaggregates GDP into its macro drivers of growth, consumption, investment, exports, and government expenditure. Consumption is axiomatically the largest driver of growth. And being a negative function of income, its share goes down from LDCs in the long-run band range of 70–80 percent of GDP, to LMICs with band range of 60–70 percent of GDP, and EEs with a band range of 45–60 percent of GDP.

Apart from consumption, the driver of growth that consistently separates LDCs from LMICs, from EEs, is investment. For LDCs, investment was in the long-run band range of 15–24 percent of GDP between 1980 and 2010. For LMICs, investment over this period picks up in lockstep to a band range of 22–32 percent of GDP. And for EEs, investment picks up further over this period to a band range of 27–36 percent of GDP.

Exports do not distinguish between LDCs, LMICs, and EEs, anywhere near as consistently as investment. In 1980, exports for LDCs were 16 percent of GDP, for LMICs 18 percent, and for EEs 17 percent. By 2010, exports for LDCs were 27 percent of GDP, for LMICs 24 percent, and for EEs 31 percent.

Table 4.2 shows that the global crisis hit exports over 2008–10, the most for EEs by 5 percent of GDP, and LMICs and LDCs by 2 percent of GDP each. The crisis does not appear to have affected investment in DCs in the same way. Which shows a logical decoupling between DCs and AEs in their domestic policy decisions, but an expected continued coupling in their trade links.

It is important to distinguish between shares in GDP, as given in Tables 4.1 and 4.2, and contribution to GDP growth as given in Table 4.3 and Fig. 4.1. In the 1980s, exports for LDCs and LMICs were weak, with investment contributing to growth more. In the 1990s, export growth picked up across all DCs, contributing to growth more. In the 1990s, both investment and exports have contributed almost equally to growth.

Drivers of growth, contribution to average annual GDP growth, 1980–2010. (Note: EE emerging economy, GDP gross domestic product, LDC least developed country, LMIC lower- or middle-income country. Source: Author’s estimations at the ILO, based on data from IMF, World Economic Outlook, April 2013, Hopes, Realities, Risks (Washington, DC: IMF, 2013); and the World Bank’s World Development Indicators, 2013)

Observed at a country level, gross fixed capital formation is again seen to climb the income ladder. Figure 4.2 shows that, for countries with gross fixed capital formation below 20 percent of GDP, this share was highest for LDCs, falling for LMICs and lowest for EEs by 2007, just on the eve of the crisis before investment levels became volatile.

Gross fixed capital formation as a percentage of GDP, 1980 and 2007. (Note: EE emerging economy, GDP gross domestic product, GCF gross capital formation, LDC least developed country, LMIC lower- or middle-income country. Source: Author’s estimations at the ILO, based on data from IMF, World Economic Outlook, April 2013, Hopes, Realities, Risks (Washington, DC: IMF, 2013); and the World Bank’s World Development Indicators, 2013)

2.2 Savings and Inflows

Savings as a share of GDP also moves up the per capita income ladder for DCs over the long run of 1980–2010.

Table 4.4 shows that savings have increased over time, for LDCs, LMICs, and EEs, from 1980 to 2010. Further, savings climb up the income ladder. For LDCs, the saving share in GDP was in a band range of 7 percent of GDP in 1980 and 18 percent in 2010. For LMICs, savings were in a band range of 19–28 percent of GDP over this period. And for EEs, savings were in the band range of 26–39 percent of GDP over this period.

The table also shows inflows between 1980 and 2010. Foreign direct investment (FDI) goes from under 1 percent of GDP for each of the income groups, LDCs, LMICs, and EEs, in 1980, to 3 percent of GDP for LDCs and EEs each, and near 2 percent of GDP for LMICs.

Official development assistance (ODA) and remittances have been more important for LDCs. ODA for LDCs has fluctuated between 1980 and 2010, but trends at just under 7 percent of their GDP. Remittances have increased over this period for LDCs, from 2 percent of GDP to over 6 percent. For LMICs, ODA has tapered off over this period, from under 3 percent of their GDP to 0.6 percent. For EEs, ODA has been negligible over this period. Remittances in LMICs have picked up over this period, from 2.5 percent of their GDP, to 4 percent. Remittances for EEs have remained under 1 percent of their GDP over this whole period.

Table 4.5 shows that the global crisis hit FDI by about half a percent for both LDCs, and EEs, and by about 1.5 percent for LMICs. ODA tapered off with the crisis by almost 1 percent for LDCs, negligibly for LMICs.

Observed at a country level, again, savings as a share of GDP climb up the income ladder. A higher incidence of countries has a higher share of savings in GDP, going from LDCs to LMICs to EEs (Fig. 4.3).

Savings as a percentage of GDP, 1980 and 2007. (Note: EE emerging economy, GDP gross domestic product, LDC least developed country, LMIC lower- or middle-income country. Source: Author’s estimations at the ILO, based on data from IMF, World Economic Outlook, April 2013, Hopes, Realities, Risks (Washington, DC: IMF, 2013); and the World Bank’s World Development Indicators, 2013)

2.3 Estimation of Drivers of Growth in the Literature: Accumulation

So, a long classical tradition in growth theory and development theory stretching from Mill (1848), Marshall (1920) and Say (1821) to Kaldor (1966) and Kuznets (1973) has considered the accumulation of physical capital as the major determinant of growth. This relationship between GDP growth and investment growth is on the whole largely well supported by the empirical literature. Kuznets (1973) finds that East Asian growth of over 8 percent per annum over a long period was well explained by investment levels in excess of 30 percent of GDP. Blomstrom et al. (1993, 1996), for 100 country data from 1965 to 1985, find that growth Granger-causes investment, but not vice versa, that investment Granger-causes growth.Footnote 1 Young (1994) again finds growth in the Asian newly industrialised countries correlated to capital accumulation. De Long and Summers (1991, 1993) find good correlations between investment shares and GDP for two samples of countries, and stronger for developing economies. Easterly and Rebelo (1993) also find this correlation for a cross section of 100 countries for 1970–1988. A dissenting note is struck by Auerbach et al. (1993).

Accumulation of capital comprises both investment and savings. The role of savings highlights the two-way causality possible with GDP growth. In the short run, savings could be a function of income à la Friedman’s (1957) permanent income hypothesis. But in the long run, growth becomes a function of savings. Hence this emphasis on savings from the Marshall–Mill tradition, to Rosenstein-Rodan (1943), to Lewis (1954), and the two-gap models of Chenery and Bruno (1962) with savings as one major gap.

The relationship between savings and GDP growth is largely well reported in the literature even if some ambiguity remains on the direction of causation. So, Carroll and Weil (1994) show a significant positive correlation between GDP growth and savings rates for a cross section of 64 countries. They also find that GDP growth Granger-causes savings, but not that savings Granger-cause GDP growth. Agrawal (2001), for seven Asian countries, and Anoruo and Ahmad (2001), for seven African countries, find two-way feedbacks between savings and GDP growth. Tang and Ch’ng (2012), for five ASEAN countries for 1970–2010, find that savings Granger-cause GDP growth.

But this rich strand of literature on physical capital accumulation makes a demarche from the neoclassical tradition of Harrod–Domar and Solow’s exogenously given growth, to differentiating between physical and human capital, never to return. Harrod and Domar (see Harrod 1948) take GDP growth to be determined by investment divided by the capital-output ratio. This ratio runs into a knife-edge problem of maintaining a steady state, because it has to equal the growth of the labour force and change in labour productivity. This is the first formal introduction of technical change. Solow (1956), to solve the Harrod–Domar knife-edge problem, allows the capital-output ratio to adjust over time, by making technical change exogenous. Kaldor (1957) and Joan Robinson (1967) acknowledged the role of technical change, but found it difficult to account for it, given that technical change was embodied in capital equipment.

While the role of technical change was accepted, Solow’s exogenous determination of it drew criticism from Schultz (1963), Arrow (1962), and Becker (1962), who argued for endogeneity of technical change through learning by doing. Endogenous growth theory takes off with Frankel’s (1962) model of a composite capital good which lumps physical capital with a technology level. Romer (1986) moves away from this notion of mongrel capital combining physical capital and human knowledge, by basing his empirical estimates of human capital on years of schooling and years of job training. This sparked off new growth theory, epitomised by Mankiw et al. (1992), with GDP growth established as a function of physical capital and human capital.

Human capital itself has come to be further differentiated, between lower-level skills associated with basic education, and the use of higher-skilled IT services associated with higher-level skills. Such intangible, knowledge-based capital is seen to account in early studies of the US for 10–20 percent of firm’s investment (Corrado et al. 2009; Dutz et al. 2012; Hulten and Hao 2012). One indicator of such intangible capital would be research and development (R&D) expenditure. However, Fennel (2014) notes a downward bias with low R&D estimates for low-income countries. For a better proxy available for LDCs, LMICs, and EEs, tertiary education is seen to be related to R&D expenditure, and much needed for higher-skill formation.

2.4 Econometric Estimation of Accumulation for 145 DCs

The tabular results for 145 DCs given above are not only well in keeping with the growth and development literature, but go a bit further. They show that physical investment and savings climb up the per capita income ladder, from LDCs to LMICs to EEs, explaining the separate trajectories of these income groups quite consistently. Exports too, climb up the income ladder, but not so consistently. This implies that DCs have used investment and savings as policy tools to climb up the per capita income ladder. It also implies that DCs can rely on this policy tool to further climb up the income ladder. Some econometric results add to this explanation of the use and impact of drivers of growth.

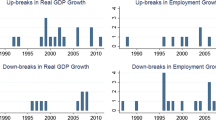

Figure 4.4 tests for Granger causality in examining these correlations. It shows that two-thirds of the DCs for which this data was available for the period 1980–2010 showed a significant positive correlation between investment and GDP per capita. In a quarter of the DCs, investment Granger-caused GDP. In 18 percent of the countries, GDP Granger-caused investment. While in another 21 percent of the DCs, there was two-way feedback. This is a more robust support for the general policy result that investment has been used to leverage DCs up the per capita income ladder and a viable policy tool for the future.

Direction of the Granger causality relationship found for gross capital formation and GDP per capita. (Note: EE emerging economy, GDP gross domestic product, K gross capital formation, LDC least developed country, LMIC lower- or middle-income country. Source: Author’s estimations at the ILO, based on data from the World Bank’s World Development Indicators, 2013)

Figure 4.4 also shows that 61 percent of the DCs tested showed a significant positive correlation between investment and growth of GDP per capita. In 30 percent of the DCs, investment Granger-caused growth of GDP per capita. In 11 percent of the countries, growth of GDP per capita Granger-caused investment. In another 20 percent of the DCs, there was two-way feedback.

Hence there is a two-step argument here:

-

(a)

Physical investment Granger-caused GDP per capita in 25 percent of DCs tested over 1980–2010

-

(b)

Physical investment Granger-caused growth in GDP per capita in 30 percent of the DCs tested over 1980–2010

Which implies that physical investment can be used by DCs to leverage both their incomes and its growth over time.

Figure 4.5 gives symmetric results for savings. In 57 percent of the DCs that could be tested for data between 1980 and 2010, savings were significantly positively correlated to GDP per capita. In 21 percent of the DCs, savings Granger-caused GDP per capita. In 18 percent of the DCs, GDP per capita Granger-caused savings. While in another 18 percent of the DCs, there was two-way feedback.

Direction of the Granger causality relationship found for savings and GDP per capita. (Note: EE emerging economy, GDP gross domestic product, LDC least developed country, LMIC lower- or middle-income country, SAV savings. Source: Author’s estimations at the ILO, based on data from the World Bank’s World Development Indicators, 2013)

Further, analogous to the investment result, in 52 percent of the DCs tested, savings were positively and significantly correlated to growth of GDP per capita. In 21 percent of the DCs, savings Granger-caused growth of GDP per capita. In 18 percent of the DCs, growth of GDP per capita Granger-caused savings. While in 13 percent of the DCs there was two-way feedback.

Which implies that savings can also be used by DCs to leverage their incomes and its growth over time.

3 Investment in Human Capital

Beyond investment in physical capital, it is important to examine the pattern of investment in human capital: that is, the contribution that education and training of the labour force make to growth. While the quantum of physical capital does play a role in explaining differences in GDP per capita, the relative investment in human capital adds more explanatory power, not least because physical and human capital may be complements. More broadly, human capital is a key factor in enhancing labour productivity and job quality, and hence GDP.

Moving from physical capital to human capital and intangibles. Figure 4.6 uses an OLS regression with fixed country effects to determine the impact of physical capital investment, human capital, and intangible knowledge-based capital on GDP per capita, for the DCs for which data was available from 1980 to 2012. The proxy variable used for human capital was average years of schooling, as the literature advocates. The proxy variable used for intangible knowledge-based capital was gross tertiary enrolment, again as the literature prompts.

Effect of gross capital formation, tertiary gross enrolment ratio, and average years of schooling on GDP per capita: fixed-effects (within) estimator. (Note: AYS average years of schooling, GCF gross capital formation, GDP gross domestic product, TGER tertiary gross enrolment ratio. The figure displays the coefficient estimates from a regression of GDP per capita on gross capital formation, tertiary gross enrolment, and average years of schooling. All coefficients are significant at the level of 0.01. Econometric specifications are available from the author. Source: Author’s estimations at the ILO, based on data from the World Bank’s World Development Indicators, 2013)

The equation shows a positive and significant correlation for all three variables. Physical capital has a coefficient of 0.16, showing that a 1 percent increase in physical capital investment leads to a 0.16 percent increase in GDP per capita. Average years of schooling has a coefficient of 0.09, which implies that a one-year increase in average years of schooling raise GDP per capita by 0.09 percent. Finally, gross tertiary enrolment has a coefficient of 0.01, which means that a 1 percent increase in tertiary enrolment increases GDP per capita by 0.01 percent.

So, in addition to accumulation of physical capital, DCs can also use human capital and intangible knowledge-based capital to leverage their income levels over time.

Further evidence is provided on causality by Fig. 4.7, which shows that in 56 percent of the DCs for which data was available, there was a positive correlation between primary enrolment as a proxy for human capital and GDP. In 16 percent of the DCs, enrolment Granger-caused GDP, while in 18 percent of the DCs, GDP Granger-caused enrolment. In 23 percent of the DCs, there was two-way feedback between GDP and enrolment.

Direction of the Granger causality relationship found for primary enrolment and GDP per capita and for tertiary enrolment and GDP per capita. (Note: EE emerging economy, GDP gross domestic product, LDC least developed country, LMIC lower- or middle-income country. Source: Author’s estimations at the ILO, based on data from the World Bank’s World Development Indicators, 2013)

The result for tertiary enrolment, as a proxy for intangibles and GDP is broadly similar. But there is a key difference in the variation across LDCs, LMICs, and EEs. Primary enrolment and human capital have the largest impact on GDP in LDCs. Tertiary enrolment and intangibles have the largest impact on GDP in EEs.

Figure 4.8 provides further detail of the channel through which human capital affects GDP growth, by decomposing this growth between 1991 and 2011 into physical capital, labour, human capital, and a residual taken to be total factor productivity (TFP) (see Inklaar and Timmer 2013). The traditional decomposition of GDP growth over time is usually in terms of just three elements: capital, labour, and TFP. However, the Penn World Tables and their methodology permit labour to be differentiated by educational levels. These educational levels allow labour to be weighted by primary-, middle-, and higher-level educational attainment. In effect this allows GDP growth to be decomposed into a fourth element, human capital.

Decomposition of GDP growth into physical capital, human capital, employment, and TFP components, 1991–2011. (Note: AE advanced economy, DC developing country, EE emerging economy, GDP gross domestic product, LDC least developed country, LMIC lower- or middle-income country, TFP total factor productivity. Growth decompositions are based on data for 55 DCs (12 LDCs, 16 LMICs, 27 EEs) and 37 AEs. Source: Author’s estimations at the ILO, based on data from Christian Viegelahn, ‘Decomposition of GDP Growth’, unpublished manuscript (ILO, Geneva, forthcoming); IMF, World Economic Outlook, October 2013, Transitions and Tensions (Washington, DC: IMF, 2013); ILO Trends Unit, Trends Econometric Models, October 2013; and Groningen Growth and Development Centre, Penn World Tables Version 8.0)

In comparing AEs with DCs as a group, physical capital does not appear to be a constraint for DCs (Fig. 4.8, panel A). However, physical capital does appear to be constrained for LDCs as it accounts for only 35 percent of GDP growth between 1991 and 2011. For LMICs, physical capital accounts for about 66 percent of GDP growth over this period, while for EEs it accounts for about 72 percent of GDP growth. But the more critical finding (Fig. 4.8, panel B) is in the role of human capital in AEs compared with DCs. Human capital accounted for about 11 percent of GDP growth between 1991 and 2011 for AEs. This was more than double the share of human capital in GDP for DCs. It is this difference in human capital that is likely to explain the much higher relative contribution of TFP for AEs, of almost one-quarter of total GDP growth compared with 18 percent of GDP growth for DCs.

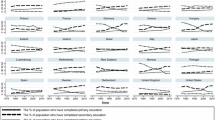

All DCs improved their educational outcomes between 1980 and 2007 (Fig. 4.9). In terms of attainment of an arbitrary threshold, say six years of schooling, the LDCs’ much lower base meant they have struggled to catch up with LMICs and EEs. Despite big improvements by LDCs, only two had average years of schooling above six years in 2007, compared with only one in 1980. The number of LMICs with above six years of schooling more than doubled, from 30 percent in 1980 to 62 percent in 2007. EEs made a huge improvement, from 25 percent above six years of schooling in 1980 to all but one country in 2007.

4 Exports and Growth: Literature and Evidence

4.1 The Literature

Trade theory has myriad strands to it, but focussing here on empirical evidence of its impact on growth. Ricardian specialisation on comparative lower cost advantage is meant to increase output in a two-country case, and by extension in a multi-country case (Ricardo 1821: chap. 7). Mill’s (1844) formalisation of Ricardo allows for the possibility of net loss for one country and gain for the second, if the exchange rate favours the cost ratio of the second country. Neoclassical comparative advantage in Heckscher–Ohlin also argues for country specialisation using its more abundant and hence cheaper factor. Trade is meant to result in equalisation of goods prices, factor prices, and wages (Heckscher 1991, Ohlin 1935). Hence the upward impact on DCs’ incomes. Evidence however is against factor price equalisation in Tovias (1982) and Bernard et al. (2002).

Myrdal (1957) observed trade specialisation of DCs in primary commodities, driven more by AE demand rather than the neoclassical notion of comparative advantage. Which would strengthen the backwash effects and maintain primary commodity sectors in DCs, rather than developing new ones. Prebisch (1962) and Singer (1950) observed declining terms of trade for primary commodities produced largely by DCs, from 1870 to the Second World War, giving rise to balance-of-payments problems, low-income growth, and increasing aid dependency. Much of the evidence from Singer and Gray (1988), Linnemann et al. (1987), and Kindleberger (1960: 367–68) concurs with declining terms of trade for primary commodities. Corden and Neary (1982: 829–31) observe that a Dutch disease of exporting extractive could appreciate the exchange rate and so lower the competitiveness of manufacturing and its development. Considerable evidence, for instance from Sachs and Warner (1995, 1999), Ismail (2010), and Cavalcanti et al. (2011), largely supports the Dutch disease argument.

Lin observes that industry plays a major role in economic growth, but that industrial strategy should not defy comparative advantage (Lin and Chang 2009; Lin 2011). Stiglitz (2011) disagrees with such a static notion of comparative advantage since it does not incorporate learning by doing to increase productivity. Chang elaborates that comparative advantage will not allow accumulation of human capital, because there will be no significant manufacturing sector to demand that human capital (Lin and Chang 2009). Chang cites Japan and South Korea as evidence of comparative advantage-defying strategies which moved into industries and adopted technologies that high-income countries had not done at similar stages of their development. McMillan and Rodrik (2011) specify that, to increase growth, such structural change must always ensure the movement of workers from less productive sectors to more productive ones. Hausmann et al. (2007) further show for 80 countries for 1994–2003 that exports matter, with the sophistication of the export basket increasing growth.

Further reservations on export-led growth come from Palley (2011) who recalls Joan Robinson’s beggar-thy-neighbour argument about one DC increasing its export competitiveness at the expense of others, especially given constant demand for exports. UNCTAD (2013) again cites reduced demand from AEs, and competition amongst DCs to provide bases for multinational corporations. The ILO has had a longstanding concern about wage competition and a race to the bottom in DCs’ attempts to increase their competitiveness (Mahmood and Charpe 2013). Favouring instead more balance in demand between exports and domestic consumption (Mahmood 2007).

4.2 Econometric Evidence on Exports and Growth for 145 DCs

The tabular evidence on exports seen above showed that the export share in GDP moved up the income ladder, but not as consistently as investment and savings. Figure 4.10 shows the considerable jump up in the share of exports in GDP, for most DCs across LDCs, LMICs, and EEs. Figure 4.11 shows its inverse, the ratio of consumption to export shares in GDP, to have fallen over time between 1980 and 2007, and to be the lowest for EEs, higher for LMICs and highest for LDCs.

Ratio of consumption over exports, as a percentage of GDP, 1980 and 2007. (Note: EE emerging economy, GDP gross domestic product, LDC least developed country, LMIC lower- or middle-income country. Source: Author’s estimations at the ILO, based on data from the World Bank’s World Development Indicators, 2013)

Figure 4.12 concurs by showing that while exports were significantly positively correlated to GDP per capita for 59 percent of the DCs tested, only in 17 percent of the DCs did exports Granger-cause GDP per capita. In 16 percent of the DCs, GDP per capita Granger-caused exports. While in 25 percent of the DCs, there was two-way feedback.

Direction of the Granger causality relationship found for exports (EXP) and GDP per capita. (Note: EE emerging economy, GDP gross domestic product, LDC least developed country, LMIC lower- or middle-income country. Source: Author’s estimations at the ILO, based on data from the World Bank’s World Development Indicators, 2013)

However, the figure also shows that in a third of the DCs, exports Granger-caused growth in GDP per capita. In 8 percent of the DCs, GDP per capita growth Granger-caused exports. While in 18 percent of the DCs there was two-way feedback. Hence a somewhat nuanced finding on exports as a driver of growth. Exports are not observed to help all DCs consistently in moving up the per capita ladder. However, they do Granger-cause growth.

Which recalls from the literature, that what you export matters. Figure 4.13 runs an OLS regression with fixed country effects for DCs that could be tested. It shows that the export share in GDP was significantly positively correlated to manufacturing, which had a coefficient of 0.71, and to industry with a higher coefficient of 1.0. Services had a much smaller coefficient, 0.19. The difference between industry and manufacturing is extractives. Hence while manufacturing did lead to increasing export shares, extractives increased export shares by more. The R-squared was low at just 0.2 (econometric specifications available from the author). Table 4.6 in the Appendix splits LDCs, LMICs, and EEs into more extractive-based countries and less extractive-based ones. It shows that for each of LDCs, LMICs, and EEs, non-extractive countries had a much lower share of exports compared to extractive-based countries.

Effect of manufacturing, industry, and services on exports: fixed-effects (within) estimator. (Note: GDP gross domestic product. Standard errors in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1. Source: Author’s estimations at the ILO, based on data from the World Bank’s World Development Indicators)

Notes

- 1.

Granger tests establish causality by using past independent variables to predict latter dependent variables.

References

Agrawal, Pradeep. 2001. The Relation Between Savings and Growth: Cointegration and Causality Evidence from Asia. Applied Economics 33 (4): 499–513.

Anoruo, Emmanuel, and Yusuf Ahmad. 2001. Causal Relationship Between Domestic Savings and Economic Growth: Evidence from Seven African Countries. African Development Review 13 (2): 238–249.

Arrow, Kenneth J. 1962. The Economic Implications of Learning by Doing. Review of Economic Studies 29 (3): 155–173.

Auerbach, Alan J., Kevin A. Hassett, and Stephen D. Oliner. 1993. Reassessing the Social Returns to Equipment Investment. Working Paper 4405, National Bureau of Economic Research, Cambridge, MA.

Becker, Gary S. 1962. Investment in Human Capital: A Theoretical Analysis. Journal of Political Economy 70 (5): 9–49.

Bernard, Andrew B., Stephen Redding, Peter K. Schott, and Helen Simpson. 2002. Factor Price Equalization in the UK? Working Paper 9052, National Bureau of Economic Research, Cambridge, MA.

Blomstrom, Magnus, Robert E. Lipsey, and Mario Zejan. 1993. Is Fixed Investment the Key to Economic Growth? Working Paper 4436, National Bureau of Economic Research, Cambridge, MA.

———. 1996. Is Fixed Investment the Key to Economic Growth? Quarterly Journal of Economics 111 (1): 269–276.

Carroll, Christopher D., and David N. Weil. 1994. Saving and Growth: A Reinterpretation. Carnegie-Rochester Conference Series on Public Policy 40: 133–192.

Cavalcanti, Tiago V. de V., Kamiar Mohaddes, and Mehdi Raissi. 2011. Growth, Development and Natural Resources: New Evidence Using a Heterogeneous Panel Analysis. Quarterly Review of Economics and Finance 51 (4): 305–318.

Chenery, Hollis B., and Michael Bruno. 1962. Development Alternatives in an Open Economy: The Case of Israel. Economic Journal 72 (285): 79–103.

Corden, W. Max, and J. Peter Neary. 1982. Booming Sector and De-Industrialisation in a Small Open Economy. Economic Journal 92 (368): 825–848.

Corrado, Carol, Charles Hulten, and Daniel Sichel. 2009. Intangible Capital and US Economic Growth. Review of Income and Wealth 55 (3): 661–685.

De Long, J. Bradford, and Lawrence H. Summers. 1991. Equipment Investment and Economic Growth. Quarterly Journal of Economics 106 (2): 445–502.

———. 1993. How Strongly Do Developing Economies Benefit from Equipment Investment? Journal of Monetary Economics 32 (3): 395–415.

Dutz, Mark A., Sérgio Kannebley Jr., Maira Scarpelli, and Siddharth Sharma. 2012. Measuring Intangible Assets in an Emerging Market Economy: An Application to Brazil. Policy Research Working Paper 6142, World Bank, Washington, DC.

Easterly, William, and Sergio Rebelo. 1993. Fiscal Policy and Economic Growth: An Empirical Investigation. Journal of Monetary Economics 32 (3): 417–458.

Fennel, S. 2014. The Role of Human Capital in Development. Unpublished manuscript, Economic and Labour Market Analysis Department, International Labour Organization, Geneva.

Frankel, Marvin. 1962. The Production Function in Allocation and Growth: A Synthesis. American Economic Review 52 (5): 996–1022.

Friedman, Milton. 1957. A Theory of the Consumption Function. Princeton: Princeton University Press.

Grossman, Gene M., and Elhanan Helpman. 1991. Innovation and Growth in the Global Economy. Cambridge, MA: MIT Press.

Harrod, Roy. 1948. Towards a Dynamic Economics: Some Recent Developments of Economic Theory and Their Application to Policy. London: Macmillan.

Hausmann, Ricardo, Jason Hwang, and Dani Rodrik. 2007. What You Export Matters. Journal of Economic Growth 12 (1): 1–25.

Heckscher, E. 1991. The Effect of Foreign Trade on the Distribution of Income. In Heckscher–Ohlin Trade Theory, edited and translated by Henry Flam and M. June Flanders, 43–69. Cambridge, MA: MIT Press.

Hirschman, Albert O. 1958. The Strategy of Economic Development. New Haven: Yale University Press.

Hulten, Charles R., and Janet X. Hao. 2012. The Role of Intangible Capital in the Transformation and Growth of the Chinese Economy. Working Paper 18405, National Bureau of Economic Research, Cambridge, MA.

Inklaar, Robert, and Marcel P. Timmer. 2013. Capital, Labour and TFP in PWT8.0. Unpublished manuscript, Groningen Growth and Development Centre, University of Groningen.

Ismail, Kareem. 2010. The Structural Manifestation of the “Dutch Disease”: The Case of Oil Exporting Countries. Working Paper 10/103, International Monetary Fund, Washington, DC.

Kaldor, Nicholas. 1957. A Model of Economic Growth. Economic Journal 67 (268): 591–624.

———. 1966. Causes of the Slow Rate of Economic Growth of the United Kingdom: An Inaugural Lecture. Cambridge: Cambridge University Press.

———. 1967. Strategic Factors in Economic Development. Ithaca: Cornell University Press.

———. 1975. What is Wrong with Economic Theory. Quarterly Journal of Economics 89 (3): 347–357.

Kindleberger, Charles P. 1960. International Trade and United States Experience: 1870–1955. In Postwar Economic Trends in the United States, ed. Ralph E. Freeman, 337–373. New York: Harper & Brothers.

Kuznets, Simon. 1973. Modern Economic Growth: Findings and Reflections. American Economic Review 63 (3): 247–258.

Lewis, W. Arthur. 1954. Economic Development with Unlimited Supplies of Labour. The Manchester School 22 (2): 139–191.

Lin, Justin Yifu. 2011. New Structural Economics: A Framework for Rethinking Development. World Bank Research Observer 26 (2): 193–221.

Lin, Justin, and Ha-Joon Chang. 2009. Should Industrial Policy in Developing Countries Conform to Comparative Advantage or Defy it? A Debate Between Justin Lin and Ha-Joon Chang. Development Policy Review 27 (5): 483–502.

Linnemann, Hans, Pitou van Dijck, and Harmen Verbruggen. 1987. Export-Oriented Industrialization in Developing Countries. Singapore: Singapore University Press.

Mahmood, Moazam. 2007. Macro Drivers of Growth in Asia. Unpublished manuscript, Asian Employment Forum, International Labour Organization, Geneva.

Mahmood, Moazam, and Matthieu Charpe. 2013. Can Wage Cuts Raise Growth? Unpublished manuscript, Economic and Labour Market Analysis Department, International Labour Organization, Geneva.

Mankiw, N. Gregory, David Romer, and David N. Weil. 1992. A Contribution to the Empirics of Economic Growth. Quarterly Journal of Economics 107 (2): 407–437.

Marshall, Alfred. 1920. Principles of Economics. 8th ed. London: Macmillan.

McMillan, Margaret S., and Dani Rodrik. 2011. Globalization, Structural Change and Productivity Growth. Working Paper 17143, National Bureau of Economic Research, Cambridge, MA.

Mill, John Stuart. 1844. Essays on Some Unsettled Questions of Political Economy. London: John W. Parker.

———. 1848. Principles of Political Economy, With Some of Their Applications to Social Philosophy. Vol. 2 vols. London: John W. Parker.

Myrdal, Gunnar. 1957. Economic Theory and Underdeveloped Regions. London: Methuen.

Ohlin, Bertil G. 1935. Interregional and International Trade. Cambridge, MA: Harvard University Press.

Palley, Thomas I. 2011. The Rise and Fall of Export-Led Growth. Working Paper 675, Levy Economics Institute, Annandale-on-Hudson, NY.

Prebisch, Raúl. 1962. The Economic Development of Latin America and its Principal Problems. Economic Bulletin for Latin America 7 (1): 1–22. Originally published as The Economic Development of Latin America and its Principal Problems (New York: United Nations, Department of Economic Affairs, 1950).

Ricardo, David. 1821. On the Principles of Political Economy and Taxation. 3rd ed. London: John Murray.

Robinson, Joan. 1953. The Production Function and the Theory of Capital. Review of Economic Studies 21 (2): 81–106.

———. 1962. Essays in the Theory of Economic Growth. London: Palgrave Macmillan.

———. 1967. Growth and the Theory of Distribution. Annals of Public and Cooperative Economics 38 (1): 3–7.

Romer, Paul M. 1986. Increasing Returns and Long-Run Growth. Journal of Political Economy 94 (5): 1002–1037.

Rosenstein-Rodan, P.N. 1943. Problems of Industrialisation of Eastern and South-Eastern Europe. Economic Journal 53 (210/11): 202–211.

Sachs, Jeffrey D., and Andrew M. Warner. 1995. Natural Resource Abundance and Economic Growth. Working Paper 5398, National Bureau of Economic Research, Cambridge, MA.

———. 1999. The Big Rush, Natural Resource Booms and Growth. Journal of Development Economics 59 (1): 43–76.

Say, Jean-Baptiste. 1821. A Treatise on Political Economy; Or, The Production, Distribution, and Consumption of Wealth. Translated from the fourth edition of the French, by C. R. Prinsep. London: Longman, Hurst, Rees, Orme and Brown.

Schultz, Theodore W. 1963. The Economic Value of Education. New York: Columbia University Press.

Singer, Hans W. 1950. The Distribution of Gains between Investing and Borrowing Countries. American Economic Review 40 (2): 473–485.

Singer, Hans W., and Patricia Gray. 1988. Trade Policy and Growth of Developing Countries: Some New Data. World Development 16 (3): 395–403.

Solow, Robert M. 1956. A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics 70 (1): 65–94.

———. 1994. Perspectives on Growth Theory. Journal of Economic Perspectives 8 (1): 45–54.

Stiglitz, Joseph E. 2011. Rethinking Macroeconomics: What Failed, and How to Repair it. Journal of the European Economic Association 9 (4): 591–645.

Tang, Chor Foon, and Kean Siang Ch’ng. 2012. A Multivariate Analysis of the Nexus Between Savings and Economic Growth in the ASEAN-5 Economies. Margin: The Journal of Applied Economic Research 6 (3): 385–406.

Tovias, Alfred. 1982. Testing Factor Price Equalization in the EEC. Journal of Common Market Studies 20 (4): 375–388.

UNCTAD (United Nations Conference on Trade and Development). 2013. Trade and Development Report, 2013. New York: United Nations.

Young, Alwyn. 1994. Lessons from the East Asian NICS: A Contrarian View. European Economic Review 38 (3–4): 964–973.

Author information

Authors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Mahmood, M. (2018). A Regularity in the Macro Drivers of Growth and Jobs: Accumulation of Physical Capital and Human Capital. In: The Three Regularities in Development. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-76959-2_4

Download citation

DOI: https://doi.org/10.1007/978-3-319-76959-2_4

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-76958-5

Online ISBN: 978-3-319-76959-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)