Abstract

This study investigates the relative contribution of foreign direct investment (FDI), net official development aid (ODA) and personal remittances in the economic growth of African countries using the system GMM approach. It uses data from the World Development Indicators’ 2016 dataset spanning the period 1985–2015 for 50 African countries. The study analyzes the effects of these three external factors by categorizing African countries into low and middle-income countries. The system GMM results show that FDI, net ODA received and personal remittances have a positive impact on economic growth in low income African countries. But in middle income African countries FDA, net ODA received and personal remittances are not significant determinants of economic growth. Gross capital formation has a positive and significant effect in both low and middle income African countries. Financial depth, government expenditure on education and population growth have a positive and statically significant effect on economic growth in middle income African countries whereas openness positively and inflation rate negatively affects economic growth in low income African countries. From a policy perspective our findings suggest a need for policies that encourage remittances, foreign aid and FDI for economic growth in low income countries.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Developing countries are striving to achieve and sustain long run economic growth and in this process, they are confronted with various questions and policy options. The most prominent question that every country faces is: What actually determines economic growth ? This is a complicated question as the complex nature of economic structures means that there are various factors that can influence the economic growth of a country.

External factors such as FDI, migrant remittances (remittances hereafter), official development assistance (ODA) (foreign aid hereafter) play an important role in boosting economic growth and development in developing countries (Almfraji and Almsafir 2014; Imai et al. 2014; Tahir et al. 2015). However , researchers and policymakers have not been able to agree about the effects of these external factors on economic growth in developing countries . The reality is that FDI, remittances and foreign aid have grown significantly over the last couple of decades. However, despite their increased importance the combined impact of these variables on economic growth in developing nations is not considered sufficiently studied.

The neoclassical growth theory has been widely employed at the macroeconomic level to understand the impact of FDI on economic growth . Lucas (1988) and Barro (1991) argue that FDI not only supplements domestic investments but it also provides technology transfers that generate positive spillover effects in local firms in host countries which ultimately spur growth. However, FDI’s effect on economic growth has been an issue of long debate in development literature. Existing theories and empirical evidence on the effect of FDI on economic growth in developing countries can be categorized into the following broad views: first, those that claim a negative or neutral effect (Agosin and Machado 2005; Gui-Diby 2014; Herzer et al. 2008). Herzer et al. (2008) for example claim that ‘in the vast majority of countries, there exists neither a long-term nor a short-term effect of FDI on growth; in fact, there is not a single country where a positive unidirectional long-term effect from FDI to GDP is found.’ Their results also indicate that there is no clear association between the growth impact of FDI and the level of per capita income, the level of education, the degree of openness and the level of financial market development in developing countries . Second, those who claim positive effects mainly rooted in endogenous growth theories (De Mello 1997; Driffield and Jones 2013). Their findings are based on the argument that FDI’s effect depends on the degree of complementarities and substitution between FDI and domestic investments , macroeconomic stability , the institutional and legal framework, knowledge and human capital , trade openness and other socioeconomic and demographic characteristics .

In addition to FDI, the role of foreign aid in promoting economic growth is also a debatable issue and remains unsettled at both theoretical and empirical levels. Riddell (2007) summarizes the issues of foreign aid and economic growth from the proponents’ point of view. The issues include arguments based on an optimistic view of the impact of foreign aid on economic growth . This argument is primarily based on solidarity or humanitarian imperatives that stem as a response to extreme poverty and inequalities faced by individuals in the developing world . The opponents of aid take the view that it is a form of wealth distribution whereby poor people in rich countries send money directly to rich people in poor countries (Bauer 1972). Chenery and Strout (1966) suggest that foreign aid increases income levels and the rate of investments in the receiving economy by supplementing available resources. Studies such as those by Ehrenfeld (2004) explain that donor countries are to be blamed for the unproductive outcome of aid in most receiving countries as aid-tying practices and conditionalities redirect aid to benefit political elites. Burnside and Dollar (2000) argue that aid has a positive impact on growth in developing countries with good fiscal, monetary and trade policies but has little effect in the presence of poor policies. Easterly et al. (2004) re-estimated Burnside and Dollar’s (2000) results using new data and found far less evidence that aid had a positive impact on growth even when accounting for institutions. The effectiveness of foreign aid may be heterogeneous across countries and its impact varies over time depending on the type of aid. This is one reason that prompted us to categorize Africa into low and middle-income countries based on their income levels. Since growth is a complex process in which many other variables should be taken into account it is not surprising that literature has yielded such mixed result.

There is also controversy regarding the relationship between remittances and economic growth . Imai et al. (2014) argue that remittance flows have been beneficial to economic growth in developing countries through their direct effects on poverty reduction . However, the volatility of remittances harms economic growth . Giuliano and Ruiz-Arranz (2009) found that remittances had a positive impact on economic growth in countries that had lower levels of financial sector development. Catrinescu et al. (2009) argue that in countries with good financial intermediates, sound economic policies and institutions remittances have positive effects on growth. This is because they help reduce poverty, smooth consumption and relieve the capital constraints of the poor. According to their findings remittances exert a weak positive impact on long-term macroeconomic growth. This implies that there is a threshold that countries have to pass which renders the effects of remittances minimal. In contrast , Ahortor and Adenutsi (2009) found that remittances had a negative effect on economic growth since they drained highly skilled and active workers through migration and created over dependency on the external economy. Another argument concerning the harmful nature of remittances is that they are not used for direct productive investment purposes. Rather, these funds are spent on consumption, housing and land, which are seen as a loss of resources that would have otherwise been used for promoting long-term growth and development (Ekanayake and Halkides 2008) . Since the effects of remittances might be different across different countries with different income levels existing literature has to be tested under the categorization that we make based on income levels. The weakness of existing literature on remittances and economic growth is that they do not fully take into consideration the simultaneity effects with other external factors like FDI and foreign aid.

One common strand in empirical growth literature is that it examines the impact of the three external factors in isolation ignoring the impact of other known external growth factors. However, including all the three factors in the same growth regression model can explain the ambiguous results discussed earlier. So, allowing a simultaneity relationship between the variables gives more insights into the points of argument than dealing with the effect of a single variable in isolated terms. Specifically, FDI, foreign aid and remittances are all vital for economic growth and failure to control for them in a growth regression might result in an omitted variable bias. In the meantime, the problem of endogeneity in relation to estimation also needs to be addressed. Therefore, these kinds of problems heavily rely on the choice and use of the appropriate methodology.

Like Nwaogu and Ryan (2015) and Driffield and Jones (2013) our study also examines the effects of FDI, foreign aid and remittances on economic growth in developing countries . Nwaogu and Ryan (2015) examined the effects of these three external factors on regional economic growth in developing countries in Africa, Latin America and the Caribbean by employing a dynamic spatial model that allowed them to capture how growth in one country affected growth in neighboring countries. Their argument is that the income growth rate in one country may be affected by the growth rates in its surrounding countries. Driffield and Jones (2013) investigated the relative contributions of FDI, foreign aid and migrant remittances to economic growth in developing countries using the three-stage least squares method to account for the inherent endogeneities in these relationships.

We explore the relative contribution of these three factors in economic growth in low and middle income African countries using the system GMM based on its advantages over other methods. We also examined the effects of these variables by considering countries’ income levels based on the World Development Indicators’ 2016 dataset.

A number of studies have examined the impact of variables on economic growth in isolation, some of the researchers have studied pairs of variables without considering the effects of differences in countries’ income levels. Hence, their results depend on and are affected by a mix of host country and growth factors that they examine (Bhandari et al. 2007; Kosack and Tobin 2006; Ndambendia and Njoupouognigni 2010). The lack of a systematic study of these three variables and their joint impact on economic growth by taking countries’ income levels into consideration represents a serious gap in literature. Therefore, our study controls for all three external growth variables by categorizing African countries into low and middle income ones. Controlling for all three external factors eliminates possible omitted variable bias problems.

To the best of our knowledge, all the studies conducted on the effects of external factors on economic growth do not analyze the effects of FDI, foreign aid and remittances on economic growth by considering the differences in income levels in the developing countries (that is, low and middle income countries). The effects of these three external factors on economic growth might differ depending on the countries’ current income levels. Their effects might not be the same for low and middle-income countries .

2 The Theoretical Framework

The base growth model that we follow is derived from a model in the style of Solow (1956) where \( \theta \) is equal to 1. FDI, foreign aid and remittances are all introduced as components of investments by Burnside and Dollar (2000) and Catrinescu et al. (2009). Driffield and Jones (2013) also use this approach. We follow the approach model introduced by Herzer and Morrissey (2009) and Driffield and Jones (2013). The assumption is that foreign financial inflows finance investments that determine economic growth . The impact of each variable can be represented in an aggregate production function of the form:

where, \( Y_{t} \) is output, \( \beta_{t} \) is total factor productivity , \( K_{t} \) is capital stock and the parameter \( \theta \) measures the marginal product of the capital. For simplicity, we assume that the capital stock depreciates fully in each period so that the end-of-period capital stock \( K_{t} \) is equal to domestic investments \( ID_{t} \). Assuming further that investments are the aggregate of public and private investments and that public investments are partly financed by aid, whereas private investments are composed of gross capital formation , FDI and remittances, we can write the production function as:

where, \( {G}_{t} \) is government investment spending, \( {A}_{t} \) is foreign aid, \( DI_{t} \) is domestic investments , \( FDI_{t} \) is FDI and \( R_{t} \) is remittances. Foreign aid can influence growth directly or through public investments, whereas FDI and remittances generate growth through external private sources. Even though remittances are commonly considered only for financing domestic consumption a few studies point out the importance of remittances in economic growth through financing domestic investments (see Giuliano and Ruiz-Arranz 2009).

3 Data and Estimation Methodology

The issue of endogeneity is something that literature is trying to address. This problem is common in most cross-country growth research. In our case FDI, foreign aid and remittances are typically endogenous since they are common features of growth regression models. Burnside and Dollar (2000) argue for endogeneity of aid in growth regressions; Kosack and Tobin (2006) assert the endogeneity of aid and FDI on economic growth ; and Giuliano and Ruiz-Arranz (2009) stress the endogeneity of remittances for growth. Therefore, we need to adopt an econometric approach that is consistent and efficient in the presence of endogenous variables to ensure that the estimation of our model is unbiased. Different approaches can be followed to address the endogeneity problem by introducing an instrumental variable into the model. Consider the following equation:

Equation (3) contains country fixed effects which are correlated with the regressors and because of this the exogeneity assumption is violated. Therefore, we cannot apply the fixed and random effects models. Applying OLS/GLS, within group fixed effects and first difference fixed effects generates biased and inconsistent results because of corr\( \left( {Y_{it - 1} ,\alpha_{i} \ne 0} \right) \), cov[\( \left( {Y_{it - 1} - \bar{Y}_{i} } \right), \left( {U_{it} - \bar{U}_{i} \ne 0} \right) \)] and cov\( \left( {\Delta Y_{it - 1} ,\Delta U_{it} \ne 0} \right) \) respectively. This implies that this method of estimation does not solve the endogeneity problem. What is required is an instrumental variable estimator that can correct for correlated fixed effects and account for the endogeneity of regressors. Anderson and Hsiao (1981) proposed the IV two-stage least square (2SLS) method to solve this problem which will not generate an efficient estimator in case the model is over identified. Due to this limitation, Arellano and Bond (1991) proposed the difference-GMM estimator . The difference-GMM estimator is a IV estimator that uses the lagged value of all endogenous regressors and all the exogenous regressors as an instrument. If we use the two-step difference-GMM under the hetroscedasticity problem the standard error is downward biased. The correction for this two-step difference-GMM is proposed by Windmeijer (2005). The difference-GMM removes country-specific characteristics when using the time invariant regression included in the model. The bias and imprecision in the difference-GMM estimator occurs due to the double lagged level instruments for the difference. As Blundell and Bond (1998) state the instruments used in the standard first-difference-GMM estimator become less informative in two important cases: first, as the value of the coefficients of the autoregressive parameter increase towards unity; and second, as the variance of the country-specific effects increases relative to the variance of the transitory shock. Given these two cases the IV estimator performs poorly. Blundell and Bond (1998) attribute the bias and poor precision of the first difference-GMM-estimator to the problem of weak instruments. So, Arellano and Bover (1995) and Blundell and Bond (1998) proposed the system-GMM method.

Generally, even if the two-stage least squares and three-stage least squares are used in a simultaneous equation, our decision to use the system GMM is reasonable because according to the discussion earlier and those in Gui-Diby (2014), the two-stage least squares and three-stage least squares methods are special cases of generalized methods of moments.

Therefore, technically system GMM-estimators embody the assumption of endogeneity and employ moment conditions to generate a set of valid instruments for the endogenous regressors that can significantly improve efficiency (Blundell and Bond 1998; Kosack and Tobin 2006; Roodman 2006). The application of system GMM is thus justified in empirical growth research as an effective approach to deal with endogeneity bias and omission bias associated with growth regressions. We estimated the following equations to examine the effects of FDI, net ODA received and personal remittances received on economic growth as well as what affected their levels using the system GMM:

As given in Eq. (4) our dependent variable is gross domestic product (GDP) per capita growth \( \left( {GDP_{it} } \right) \). The other endogenous variables are FDI as a percentage of \( \left( {FDI_{it} } \right) \), official development assistance as a percentage of GDP \( \left( {ODA_{it} } \right) \) and migrant remittances as a percentage of GDP \( \left( {REM_{it} } \right) \).

The vector \( {\mathbf{X}}_{{{\mathbf{it}}}} \) contains a number of additional control variables: gross capital formation , trade as a percentage of GDP, total labor force, population growth , rate of inflation, broad money as a percentage of GDP (financial depth) and government expenditure on education and primary school enrolments.

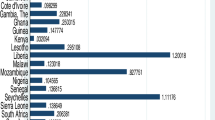

We use cross-country unbalanced panel data for African countries (low and middle-income groups) in the period 1980–2016. The data is obtained from the World Development Indicators’ 2016 database. The sample consists of 25 low income countries and 25 middle income countries.Footnote 1

However, the use of system GMM depends on the validity of additional instrument variables. To assess the validity of these additional instruments, Arellano and Bond (1991) and Arellano and Bover (1995) proposed the Sargan test of over-identification . Table 1 gives the Sargan test of over-identification which tests the validity of the instruments. The high P-values of these tests in our estimations ensure the validity of our model.

4 Empirical Findings

4.1 Description of the Data

Table 1 gives the summary statistics of the data for our dependent and independent variables. The average GDP growth rate in Africa was 3.8 with a standard deviation of 7.99. The maximum GDP growth rate was 149 recorded in 1997 by Equatorial Guinea. This might be because in 1996 Equatorial Guinea recorded the maximum FDI net inflows as a percentage of GDP in the history of Africa. And the least GDP growth rate was recorded in Libya in 2011 (62.07 percent). On average FDI net inflows as a percentage of GDP were 3.33 which, on average, deviated by 8.87 from the center. The average net ODA received as a percentage of GDP was 54.98. It varied from –11.96 to 666.79 with a standard deviation of 56.56. Average personal remittances received as a percentage of GDP were 4.18 which varied from zero to 99.82 with a dispersion of 9.46 around the mean value. The average inflation rate recorded for African countries was 42.26 which is high. It varied in the interval of –31 and 26,762. The minimum inflation rate was recorded in Equatorial Guinea in 1998 and the maximum was recorded in the Democratic Republic of Congo in 1994. The value of broad money as a percentage of GDP (financial depth) significantly varied in the dataset. Its mean was 96.50 with a large standard deviation of 2652.77 and it varied in the interval of –99.87 and 108,613.3.

4.2 FDI, ODA, Migrant Remittances and Economic Growth

Table 2, columns 1–3 give the results from estimating Eq. (4) using the sample of low and middle income African countries and all African countries pooled together. According to column 1 the coefficients of FDI net inflows, net ODA received and personal remittances received had positive and statistically significant effects on economic growth in low income African countries. This implies that these three sources of development financing were very helpful in economic growth in low income countries in Africa. Our result is consistent with Driffield and Jones (2013), Burnside and Dollar (2000), and Imai et al. (2014) . According to their findings FDI (Driffield and Jones 2013), foreign aid (Burnside and Dollar 2000; Driffield and Jones 2013) and remittances (Imai et al. 2014) had positive effects on economic growth in developing countries . In contrast , Chami et al. (2003) found that remittances had a negative effect on economic growth in both developing and developed countries. They argue that income from remittances may be plagued by a moral hazard problem, permitting migrants’ families to reduce their work efforts. At the same time control variables like openness (trade as a percentage of GDP) and gross capital formation were positive and significantly associated with economic growth in low income African countries.

Gross capital formation had a positive and significant effect in both low and middle income African countries, but when we compare the strength of the magnitude, middle income countries had a stronger magnitude than low income countries—a 10 percent increase in gross capital formation increased economic growth by 3.95 and 2.19 percent in low and middle income African countries respectively. This implies that the effect of gross capital formation was more effective in middle-income countries than in low income countries. Economic theories have also shown that capital formation plays a crucial role in models of economic growth and our results suggest that income growth can occur when developing countries are able to maintain capital formation. This result confirms the results obtained by Nwaogu and Ryan (2015). Inflation rate had a negative and statistically significant effect on economic growth in low income countries but it had a positive and no significant effect in middle-income countries . The lagged value of GDP was positively and significantly associated with economic growth in both low and middle income African countries.

However, according to column 2 in Table 2 which is estimated using a sample of middle income African countries the coefficients of FDI, foreign aid and remittances had no significant impact on economic growth in middle income African countries. This might be because of some institutional factors such as government effectiveness, political stability, rule of law and control of corruption which we do not include in our regression due to lack of data. It is not surprising that FDI, foreign aid, remittances and the other variables had different effects across countries . Easterly et al. (2004) also claim that the effectiveness of variables like foreign aid was heterogeneous across countries. In contrast, the lagged value of GDP , government expenditure on education, population growth and gross capital formation had a positive and statistically significant effect at the 1 percent level of significance while financial depth (broad money as a percentage of GDP) was significant at the 5 percent level of significance for economic growth in middle income African countries. The pooled regression in Table 2, column 3 shows that the coefficients of FDI, foreign aid and remittances had no significant impact on economic growth . This confirms that the impact of these three factors on economic growth was different across low and middle-income groups.

4.3 FDI and Economic Growth

Columns 1 and 2 in Table 3 give the results from estimating Eq. (5) using a sample of African low and middle-income countries . According to this table the lagged value of FDI net inflows, GDP, personal remittances received and gross capital formation were positively and significantly associated with the level of FDI in both low and middle income African countries. But the magnitude and level of significance of the variables was different. For example, personal remittances received was significant at the 5 percent level of significance for low income counties whereas it was statistically significant at the 1 percent level of significance for middle-income countries . This implies that the personal remittances received were more effective in pushing up FDI levels in middle income African countries.

The results in Table 3 also show that population growth had a negative and significant effect on FDI net inflows in middle-income countries whereas they had no effect in low income countries. Openness was positively and significantly associated with FDI net inflows in middle income African countries but it was not significant for low income African countries. Since openness gives rise to opportunities for importing the goods needed for production, foreign investors are encouraged to get investments. The effect of GDP was higher in middle income countries than in low income countries in Africa in terms of both magnitude and level of significance. Interestingly, the effect of gross capital formation on FDI was almost the same for both low and middle income African countries in terms of magnitude as well as level of significance. A 10 percent increase in gross capital formation increased FDI inflows by 5.9 and 5.2 percent for low and middle income African countries respectively. It was also significant at the less than 1 percent level of significance for both low and middle income African countries.

4.4 Official Development Assistance and Economic Growth

The results from estimating Eq. (6) using the sample of low and middle income African countries are presented in Table 4. The results in column 1 indicate that the lagged value of net ODA received, trade openness , gross capital formation and labor force had a positive and statistically significant relation with the level of net ODA received in low income African countries.

Column 2 also indicates that a lag of net ODA received, inflation rate, financial depth and primary school enrolments had a positive and statistically significant relationship with foreign aid received in middle income African countries. FDI net inflows had a negative and statistically significant relationship with foreign aid received in middle income African countries. The results in Table 4 indicate that the factors that significantly affected the level of foreign aid received were different for the two groups of countries. This implies that low and middle income African countries need to adopt different policies and approaches for attracting foreign aid.

4.5 Migrant Remittances and Economic Growth

The results from estimating Eq. (7) are given in Table 5. According to this table the lagged value of personal remittances received, FDI net inflows, openness (trade as a percentage of GDP) and primary school enrolments had a positive and statistically significant effect on the level of personal remittances received in both low and middle income African countries. Gross capital formation had a negative and statistically significant effect on the level of personal remittances received in middle income African countries only. Even though the factors that affected the level of personal remittances received by both low and middle-income countries were the same, the effect of personal remittances on economic growth was not the same for both groups of countries.

5 Summary, Conclusion and Policy Implications

This study analyzed the relative effect of FDI, net ODA and personal remittances on economic growth in African countries using the system GMM approach. It used data from the World Development Indicators’ 2016 dataset for the period 1985–2015 for 50 African countries. It analyzed the effects of these three external factors by categorizing African countries into low and middle-income countries .

The results show that FDI, net ODA received and personal remittances had a positive impact on economic growth in low income African countries. When we compare the effects of FDI, net ODA received and personal remittances received for low income African countries based on their coefficients and level of significance, personal remittances received were stronger than FDI and net ODA received in magnitude as well as in the level of significance. This implies that remittances are more important for economic growth in low income African countries. This result might also imply that migrant transfers in the form of remittances can ease families’ immediate budget constraints by strengthening crucial spending needs on food, healthcare and schooling expenses for children in low-income countries. This is expected to pave the way for the development of a formal financial sector which is essential for economic growth and development in these countries (Giuliano and Ruiz-Arranz 2009). Remittances by and large serve as an alternative to debt that helps alleviate individuals’ credit constraints in countries where micro-financing is not widely available (Giuliano and Ruiz-Arranz 2009). Therefore, policies that encourage migrants to remit via formal money transfer networks by reducing the cost of remittances, encouraging investments in the items that promote long term growth and encouraging formal migration will have a significant impact on improving economic growth in low income African countries via remittances.

Another finding of our study is that in addition to encouraging remittances, countries interested in increasing economic growth need to adopt suitable policies that attract FDI and also use the foreign aid received efficiently and effectively.

In middle income African countries FDI, net ODA received and personal remittances received were not significant determinants of economic growth . This implies that there should be certain conditions under which these factors have a significant impact on economic growth in the countries. As supported by other studies, poor governance indicated by high corruption forced the host countries to make less efficient use of funds (Curvo-Cazurra 2006). This implies that institutions are the key determinants of growth as perceived corruption in the host country and less property rights discourage FDI (Acemoglu and Johnson 2005). Therefore , it is important to test the effect that institutions have and their interaction terms with the targeted variables.

Our study also shows that gross capital formation , inflation rate and trade openness were significant determinants of economic growth in low income African countries and financial depth, gross capital formation , government expenditure on education, population and total population were significant determinants of economic growth in middle income African countries. Hence, policies that are suitable for good financial depth, increasing human capital through education, higher capital formation via investments, controlling inflation and greater trade openness stimulate economic growth in developing counties.

This shows that GDP , personal remittances received and gross capital formation were significant determinants FDI inflows in low income African countries and GDP, personal remittances received, gross capital formation , openness, financial depth and primary school enrolments were significant determinants in middle income African counties. This implies that countries interested in attracting more FDI flows on a sustained basis must adopt suitable policies. Policymakers in these countries should provide incentives and make efforts at greater trade openness , higher capital formation, reasonable financial depth and investing in human capital like education.

Trade openness , gross capital formation and total labor force were significant determinants of net ODA received in low income African countries and financial depth, inflation and primary school enrolments were significant determinants in middle income African countries. Our results also show that FDI net inflows, trade openness and primary school enrolments were significant determinants of personal remittances received in low income African countries and gross capital formation , FDI net inflows, trade openness and primary school enrolments were significant determinants in middle income African countries.

The policy implications of our findings are that countries should encourage remittances, foreign aid and FDI for economic growth in low income countries.

However, our study has limitations. One major limitation is that our model does not include the effect of institutions and their interaction terms with FDI, net ODA received and remittances received due to data constraints. It will be interesting and beneficial if the effects of institutions and their interaction terms with the targeted variables are also tested.

Notes

- 1.

Grouping of the African countries into low and middle-income countries is based on the World Development Indicators.

References

Acemoglu, D. and S.H. Johnson (2005). Unbundling Institutions. Journal of Political Economy, 113(5): 949–995.

Agosin, M. and R. Machado (2005). Foreign Investment in Developing Countries: Does it Crowd in Domestic Investment? Oxford Development Studies, 33(2): 149–162.

Ahortor, C.R.K. and D.E. Adenutsi (2009). The Impact of Remittances on Economic Growth in Small-Open Developing Economies. Journal of Applied Sciences, 9: 3275–3286.

Almfraji, M. and K.M. Almsafir (2014). Foreign Direct Investment and Economic Growth Literature Review from 1994 to 2012. Procedia-Social and Behavioral Sciences, 129: 206–213.

Anderson, T.W. and C. Hsiao (1981). Estimation of Dynamic Models with Error Components. Journal of the American Statistical Association, 976: 589–606.

Arellano, M. and O. Bover (1995). Another Look at Instrumental Variable Estimation of Error-Component Models. Journal of Econometrics, 68(1): 29–51.

Arellano, M. and S. Bond (1991). Some Tests for Specification of Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies, 58: 277–297.

Barro, R.J. (1991). Economic Growth in a Cross Section of Countries. The Quarterly Journal of Economics, 106(2): 407–443.

Bauer, P.T. (1972). Dissent on Development. Cambridge, MA: Harvard University Press.

Bhandari, R., D. Dharmendra, P. Gyan, and K. Upadhyaya (2007). Foreign Aid, FDI and Economic Growth in East European Countries. Economic Bulletin, 6: 1–9.

Blundell, R. and S. Bond (1998). Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. Journal of Econometrics, 87(1): 115–143.

Burnside, C. and D. Dollar (2000). Aid, Policies, and Growth. American Economic Review, 90(4): 847–868.

Catrinescu, N., M. Leon-Ledesma, P. Matloob, and B. Quillin (2009). Remittances, Institutions and Economic Growth. World Development, 37: 81–92.

Chami, R., C. Fullenkamp, and S. Jahjab (2003). Are Immigrant Remittance Flows a Source of Capital for Development? IMF WP/03/189.

Chenery, H. and A. Strout (1966). Foreign Assistance and Economic Development. American Economic Review, 56: 679–733.

Curvo-Cazurra, A. (2006). Who Cares About Corruption? Journal of International Business Studies, 37: 807–822.

De Mello, L.R. (1997). Foreign Direct Investment in Developing Countries and Growth: A Selective Survey. Journal of Development Studies, 34: 1–34.

Driffield, N. and C. Jones (2013). Impact of FDI, ODA and Migrant Remittances on Economic Growth in Developing Countries: A Systems Approach. The European Journal of Development Research, 25(2): 173–196.

Easterly, W., R. Levine, and D. Roodman (2004). Aid, Policies, and Growth: Comment. American Economic Review, 94(3): 774–780.

Ehrenfeld, D. (2004). Foreign Aid Effectiveness, Political Rights and Bilateral Distribution. Journal of Humanitarian Assistance. Available at: http://sites.tufts.edu/jha/archives/75.

Ekanayake, E.M. and M. Halkides (2008). Do Remittances and Foreign Direct Investment Promote Growth? Evidence from Developing Countries. Journal of International Business and Economics, 8: 58–68.

Giuliano, P. and M. Ruiz-Arranz (2009). Remittances, Financial Development and Growth. Journal of Development Economics, 90(1): 144–152.

Gui-Diby, S.L. (2014). Impact of Foreign Direct Investments on Economic Growth in Africa: Evidence from Three Decades of Panel Data Analyses. Research in Economics, 68: 248–256.

Herzer D. and O. Morrissey (2009). The Long-Run Effect of Aid on Domestic Output. Discussion Papers 09/01, University of Nottingham.

Herzer, D., S. Klasen, and F. Nowak-Lehmann (2008). In Search of FDI-Led Growth in Developing Countries: The Way Forward. Economic Modelling, 25: 793–810.

Imai, K., R. Gaiha, A. Ali, and N. Kaicker (2014). Remittances, Growth and Poverty: New Evidence from Asian Countries. Journal of Policy Modeling, 36: 524–538.

Kosack, S. and J. Tobin (2006). Funding Self-Sustaining Development: The Role of Aid, FDI and Government in Economic Success. International Organization, 60: 205–243.

Lucas, R.E. (1988). On the Mechanics of Economic Development. Journal of Monetary Economics, 22: 3–42.

Ndambendia, H. and M. Njoupouognigni (2010). Foreign Aid, Foreign Direct Investment and Economic Growth in Sub-Saharan Africa: Evidence from Pooled Mean Group Estimator. International Journal of Economic and Finance, 2: 39–45.

Nwaogu, U. and M. Ryan (2015). FDI, Foreign Aid, Remittance and Economic Growth in Developing Countries. Review of Development Economics, 19(1): 100–115.

Riddel, R.C. (2007). Does Foreign Aid Work? Oxford: Oxford University Press.

Roodman, D. (2006). How to Do Xtabond2: An Introduction to ‘Difference’ and ‘System’ GMM in Stata. Center for Global Development Working Paper 103. Available at: http://www.cgdev.org/files/11619_file_HowtoDoxtabond6_12_1_06.pdf/.

Solow, R.M. (1956). A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics, 70(1): 65–94.

Tahir, M., I. Khan, and A.M. Shah (2015). Foreign Remittances, Foreign Direct Investment, Foreign Imports and Economic Growth in Pakistan: A Time Series Analysis. Arab Economics and Business Journal, 10: 82–89.

Windmeijer, F. (2005). A Finite Sample Correction for the Variance of Linear Efficient Twostep GMM Estimators. Journal of Econometrics, 126(1): 25–51.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Appendix

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Gutema, G. (2018). The Role of Remittances, FDI and Foreign Aid in Economic Growth in Low and Middle Income African Countries. In: Heshmati, A. (eds) Determinants of Economic Growth in Africa. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-76493-1_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-76493-1_5

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-76492-4

Online ISBN: 978-3-319-76493-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)