Abstract

In this article, we investigate the effect of demography on wealth inequality. We propose an economic growth model with overlapping generations in which individuals are altruistic towards their children and differ with respect to the age of their parent. We denote the age gap between the parent and their child as generational gap. The introduction of the generational gap allows us to analyze wealth inequality not only across cohorts but also within cohorts. Our model predicts that a decline in fertility raises wealth inequality within cohorts and, simultaneously, it reduces inequality at the population level (across cohorts). In contrast, increases in life expectancy result in a non-monotonic effect on wealth inequality by age and across cohorts.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Wealth Inequality

- Gene Disruption

- Average Financial Wealth

- Retirement Motive

- Representative Agent Approach

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The share of total wealth owned by the top 10% of the population has increased during the last decades in Britain, France, Sweden, and US (Piketty 2014), among many other countries. Inequality, in general, and wealth inequality, in particular, have become of main concern among policymakers and researchers, given that it can create political instability and prevent long-run economic growth (Alesina and Perotti 1996).

According to Piketty demography is one of the most important factors explaining wealth inequality. Specifically, demography can influence wealth inequality through: (1) changes in fertility, (2) changes in longevity, and (3) shifts in the age structure of the population. The first factors are related to the evolution of savings over the life cycle, the capital intensity of the economy (Bloom and Williamson 1998), and inheritances. Inherited wealth is frequently associated to the privileged and the lack of meritocracy, which prevents innovation (Piketty 2014). However, the effect of demography on inheritances (or bequeathed wealth) is not straightforward. On the one hand, if people live longer, wealth will be based largely on human capital (rather than on inheritances) and hence population aging will reduce wealth inequality. On the other hand, as rising longevity increases life cycle savings, wealth will be more unequally distributed across age groups and hence population aging will increase wealth inequality (Goldstein and Lee 2014). Also, the impact of fertility on wealth inequality is a priori ambiguous. If people have less children, the share of young individuals with low savings will fall and thus wealth inequality will be reduced (Vandenbroucke 2016). However, if people have less children, freeing up household’s resources, savings will increase and, consequently, wealth inequality will rise.

Given the myriad of offsetting effects, in this article, we are interested in disentangling the effect that demography has on wealth inequality through bequests. In particular, should we expect greater or lower wealth inequality in the face of population aging? What is the effect of demography on intergenerational wealth transfers and how will these transfers change wealth inequality? Answering these two questions requires a well-founded economic and demographic model. However, many models give more importance to the economic assumptions and oversimplify the demographic assumptions. Indeed, in many economic models the population is divided into a finite number of age groups, typically only two, and childhood is either neglected or assumed to be optimally chosen by children according to their own budget constraint. As a consequence, much of the age variation that occurs in real life is neglected and, therefore, many of the results, which often depend strongly on such assumptions, can be flawed.

To improve our understanding of the effect of demography on wealth inequality, we introduce more realistic demographic features in a standard continuous-time overlapping generations (OLG) models. Specifically, we characterize individuals not only by their age and time (cohorts) dimensions, but also through the age gap between parents and children (from now on generational gap). The introduction of the generational gap, as a third dimension, helps to better analyze wealth inequality, since we consider explicitly the existence of different types of individuals that differ according to the time and quantity of inheritance received. As recently acknowledged by Alvaredo et al. (2017), this is an important feature for understanding the aggregate wealth accumulation process, given that it avoids the unrealistic results of the representative agent approach (Kotlikoff and Summers 1981; Kotlikoff 1988; Modigliani 1988).Footnote 1 As far as we know, this is the first time that heterogeneity by generational gap is introduced into a theoretical OLG model. Further, following Tobin (1967) and Lee (1980), we consider that individuals face a probabilistic lifespan and two distinguishable periods over their life cycle. A first period of dependency, or childhood, in which individuals rely on the consumption decisions made by parents and a second period, or adulthood, in which individuals build up their own household, have children, determine the consumption of the household, and save. To compare our results to the recent paper by Onder and Pestieau (2016), we also assume individuals save for retirement motives and for the joy of giving bequest. In line with empirical findings, we consider parents are altruistic and maximize the bequest per capita left to each child (see section 2.2.3 in Arrondel and Masson 2006). To keep the model computationally tractable, while maximizing the available demographic information, we assume each household head represents the average individual within a cohort with a given generational gap.Footnote 2 Thus, under a perfect annuity market and the joy of bequeathing, the fraction of wealth annuitized by each individual will be associated to the probability of having children.Footnote 3 As the macroeconomic framework we assume a small-open economy in which wage rates and interest rates are determined in international markets.

We should stress that in this paper we abstract from other important channels (besides fertility, mortality, and the age structure) through which demography may affect inequality. In particular, wealth inequality can also be driven by differences in the population composition; e.g., gender. For instance, Greenwood et al. (2014) show for the US that the increasing positive assortative mating together with the increasing labor force participation of women explains the increase in household income inequality from 1960 to 2005. Another important source of increasing inequality is the rising proportion of single parenthood, whose children generally face later in life a disadvantaged position (Chetty et al. 2016). However, moving from a one-sex model to a two-sex model requires many additional assumptions and complex interactions that would prevent us to obtain unique results. For this reason we opted for excluding population compositional effects. We restrict our analysis on wealth inequality and its relation to demographic factors. We therefore exclude the effect of labor income inequality and the effect of pension systems on our decision variables, which trigger inequality when there are compositional changes in the population (Greenwood et al. 2014; Chetty et al. 2016).

Given the non linear properties of our optimality conditions, we cannot analytically solve the model and we need to rely on numerical simulations. Our results are based on the following principle: individuals whose parents are older receive their bequest earlier and capitalize it over a longer period of time. Thus, demography causes wealth inequality (within cohorts) because individuals with a greater generational gap, or age gap between parents and children, have a higher financial wealth over the life cycle. Moreover, wealth inequality diminishes with age given that wealthier individuals also have higher consumption.

The results are divided into the effect that demography has on wealth inequality at the individual level (within cohorts) and at the population level. At the individual level, our simulations suggest that a decline in fertility is associated to an increase in wealth inequality within each age group, while an increase in life expectancy has a non monotonic effect on wealth inequality at each age. At the population level, however, our simulations suggest that a decline in fertility reduces wealth inequality, while an increase in life expectancy has a small non monotonic effect on wealth inequality.

The paper is organized as follows: Sect. 2 introduces the demographic characteristics of each household, the different sources of wealth accumulation, and the preferences of the household head. In Sect. 3, we analytically solve the model and provide the intuition for wealth inequality. Section 4 introduces the population model and the aggregate physical capital wealth of the economy. In Sect. 5, we solve the model numerically and show how population aging reduces wealth inequality. We conclude and give suggestions for further research in Sect. 6.

2 Model

2.1 Households

The approach used here to represent the optimal household head’s decisions over the life cycle borrows from the model proposed by Yaari (1965). We extend this model in two dimensions. First, by taking into consideration the average number of children that a cohort bears over the life cycle and, second, by introducing an additional time dimension in the analysis: the age difference between the parent and the child or generational gap. We denote with the letter l the generational gap.

Individuals face death and a changing family size along their life span based on age-specific mortality and fertility rates, which vary across birth cohorts. Let us denote age by x and the year of birth by τ. We represent the individual lifetime uncertainty by the survival function

where S(x, τ) is the probability that an individual born in year τ survives to age x. The probability of surviving satisfies that S(0, τ) = 1 and S(ω, τ) = 0, where ω is the maximum age, and μ(a, τ) ≥ 0 is the mortality hazard rate at age a by the same individual. To account for the fact that households are comprised of a household head and dependent children, while household heads may also have non dependent children living in a different household, we build the following two demographic measures:

where n(x, τ) represents the total number of heirs, or offspring, of an individual born in year τ at age x. h(x, τ) is the size of the household measured in terms of equivalent adult consumers. The first term after the integral sign in Eq. (3), δ(x − l), reflects the equivalent scale of a child at age x − l relative to the consumption of the household head. Notice that due to the existence of mortality risk households are formed not only by offspring but also by orphans. For simplicity, we assume orphans are raised by surviving household heads belonging to the same cohort, which is being taken into account through the fraction \(\frac {S(l,\tau )}{S(x,\tau )}\).Footnote 4 The function m(l, τ) is the fertility rate of an individual born in year τ at age l and S(x − l, τ + l) is the survival probability of a child born in year τ + l to age x − l. Letter A represents the age at which individuals become independent and build up their own household.

Suppose there are three sources of wealth accumulation. Let us denote by k(x, τ, l) the wealth held by an individual born in year τ at age x whose parent is l years older. The first is the revaluation of the existing wealth via the sum of interests received on existing wealth, rk(x, τ, l), plus the mortality risk premiums received from annuitizing a fraction θ(x, τ) of the total wealth, θ(x, τ)μ(x, τ)k(x, τ, l). Given a laissez-faire economy, we assume for consistency that θ(x, τ) reflects the fraction of individuals at age x, born in year τ, who do not have children. This is equivalent to say that the fraction of individuals who have children, 1 − θ(x, τ), transfer all their wealth to their heirs, whereas the fraction of individuals who do not have children, θ(x, τ), fully annuitize their wealth. From Eq. (2) the probability of an individual born in year τ of not having children at age x isFootnote 5

The second source of wealth accumulation is the bequest received from the death of the parent, which we denote by B(x, τ, l). We assume parents split their wealth among their surviving offspring equally.Footnote 6 The amount of wealth received as a bequest by an individual born in year τ at age x from a parent who is l years older is

The first two terms on the right-hand side of Eq. (5) denote the probability that the parent dies at age x + l. The third term is the amount of wealth left by the parent at death, k(x + l, τ − l), and the last term is the fraction of wealth that corresponds to each offspring, which is given by

The numerator of (6) is the probability that an individual born in year τ − l at age x + l has at least one child (i.e. 1 − θ) and the denominator reflects the total number of living offspring (or siblings). For illustration, Fig. 1 shows the fraction of wealth annuitized as a function of the number of children within the cohort (θ) and the share of wealth that an individual receives as function of the number of offspring from the parent (η). From Fig. 1 we can see that an individual belonging to a cohort with an average of two offspring per adult (n = 2) annuitizes around 13.5% of her wealth and leaves around 43% of her wealth to each offspring. If an individual belongs to a cohort with an average of four offspring per adult (n = 4), she annuitizes around 2% of her wealth and leaves close to 25% of her wealth per child.Footnote 7

Comparing (4) to (6), and as illustrated in Fig. 1, it is worth stressing that for any number of children n > 0 the fraction of wealth received (η) is always greater than the fraction of wealth annuitized (θ).

The third source of wealth accumulation is savings out of labor income. We denote by y(x, τ) the labor income generated by the household head born in year τ at age x. The total consumption of a household run by a household head born in year τ at age x, whose parent is l years older, is denoted by c(x, τ, l). Let the labor income of an individual born in year τ at age x be given by Γ(τ + x)y(x), where Γ(τ + x) is the labor-augmenting technological progress and y(x) is the labor income profile which has an invariant shape over time with respect to age.

Adding all three sources of wealth accumulation we can represent the average change in wealth of a cohort born in year τ at age x, whose parent is l years older, as follows:

The first period in Eq. (7) corresponds to the accumulation of the average wealth before age A, while the second period represents the accumulation of the average wealth during adulthood. As it is standard, we assume individuals are born with zero wealth, i.e. k(0, τ, l) = 0.

2.2 Preferences

Suppose household heads have additively separable preferences that are represented by isoelastic functions U (that satisfy the Inada conditions: U ′ > 0, U ′′ < 0, with U being continuously differentiable, U ′(0) = ∞, and U ′(∞) = 0) of their own consumption and the average bequest left at death to each child. Assuming no subjective discounting, the expected utility of a household head born in year τ, whose parent is l years older (generational gap), is

Note that Eq. (8) extends Yaari (1965) expected utility by introducing the household size and the number of offspring. Parameter α ≥ 0 controls for the degree of altruism towards the children; that is, the subjective weighting for giving bequest. The second term inside the brackets represents the fact that the household head not only takes into account the amount of wealth bequeathed to each offspring, η(x, τ)k(x, τ, l), but also the time at which the bequest is given, \(\frac {S(x,\tau )}{S(A,\tau )}\mu (x,\tau )\). This last demographic function is the probability of dying at age x, conditional on having survived to age A, for the cohort born in year τ.

It is worth noting that the instantaneous utility functions used for consumption and for bequest are the same in (8). This specification guarantees the existence of a stable consumption path once that we consider an exogenous productivity growth in a general equilibrium model.

3 Analytical Solution

The consumption path c that maximizes the expected utility (8) subject to the constraint (7) is the one that solves the HamiltonianFootnote 8

where λ is the adjoint variable related to k and \(\tilde {S}\) denotes the probability of survival conditional on being alive at age A. We obtain the following first order condition (FOC)

Equation (10) determines the optimal consumption path. The dynamics of the adjoint variable is given by

Suppose from now on \(U(c)=\log (c) \). Then, the optimal consumption path can be characterized by the system of equations:

and the boundary conditions

The above system of equations is clearly non-linear. Nevertheless, analyzing the dynamics of the average consumption per adult we can give some insight about the implications of introducing children into the model. Differentiating (10) with respect to x and using (11) we obtain the dynamics of consumption

The first term in the right-hand side of (13) is the standard Euler condition when individuals purchase actuarially fair annuities and there is no subjective discount factor. The second term reflects the degree of impatience that arises from having children, whose size depends on the degree of altruism towards the children. For a positive second term, household heads become more patient. This is because household heads reduce their consumption in the present and postpone it to later periods. However, if the second term is negative, then household heads become more impatient.

Except for the trivial case that α = 0, a priori, nothing guarantees that the second term in the right-hand side of (13) will be either positive or negative. Indeed, given that the set of variables {c, k, n} evolve over the life cycle, we can expect periods in which household heads are patient and periods in which household heads are impatient. To illustrate this point, we show in Fig. 2 the degree of impatience at a given age x as a function of the number of children and the value of \(\alpha \frac {c}{k}\), which is a weighted measure of the consumption to capital ratio. The negative relationship between the ratio \(\frac {c}{k}\) and the number of children, n, is embedded in the expected utility. Indeed, we have from (8) that individuals maximize the value function according to the bequest received per offspring. Thereby, an increase in the number of children, n, leads to a fall in consumption, and hence an increase in savings, in order to maintain the same level of bequest per offspring. For any value of \(\alpha \frac {c}{k}\) above 1 − θ individuals become more patient (see the white area). In contrast, values of \(\alpha \frac {c}{k}\) below 1 − θ imply that individuals become impatient (see the gray area).

Bequest also affects household head’s behavior—i.e. consumption and saving—through a wealth effect. The wealth effect refers to changes in consumption due to changes in lifetime income. Assuming a fixed labor income profile for all individuals, then consumption and savings heterogeneity within a birth cohort can only be explained by the difference between the bequest given and the bequest received. This is clearly seen analyzing the lifetime budget constraint at birth. From (7) and using the boundary conditions (12c), the lifetime budget constraint of an individual born in year τ whose parent is l years older isFootnote 9

where T B (0, τ, l) is the bequest wealth at birth; that is, the expected present value at birth of the difference between the bequest received and the bequest given

A positive (resp. negative) T B (0, τ, l) implies that individuals will not only consume more (resp. less) than they expect to earn over their lifetime from work, but they will also start at age A with a higher wealth. Multiplying (15) by e rA∕S(A, τ) gives

Therefore, wealth inequality at age A is explained by differences in bequest wealth. Moreover, under the assumption that all individuals born at time t face the same fertility and mortality rates, differences in bequest wealth at birth are explained by the generational gap. In order to clearly see whether a greater generational gap positively impacts on bequest wealth, we differentiate B(x, l) with respect to l, see Eq. (5). Note that for expositional clarity we get rid of the time of birth. Thus, we have

According to (17) the impact on the bequest received of an increase in the generational gap depends on three components: (1) the evolution of the mortality rate of parents; (2) the rate of change in the financial wealth profile of parents; and (3) the rate of change in the share of wealth that each surviving heir receives. Note that the first component and the third component are frequently neglected in models that assume a constant mortality hazard rate and a fixed number of heirs. First, given that the mortality rate is an increasing function with respect to age when individuals are adults, the sum of the first three components inside the parenthesis is initially positive and it turns negative as the individual ages.Footnote 10 As a consequence, ceteris paribus (2) and (3), bequest received initially rises with an increase in the generational gap, since the senescence rate is greater than the probability of dying of the parent, and then it falls due to the increasing mortality rate of the parent. With respect to the second term in (17) that reflects the rate of change in the financial wealth profile, we know from the life cycle theory of saving that the financial wealth will be hump shaped with age. Therefore, an increase in the generational gap will reduce the effect of the rate of change in the financial wealth on bequest. And third, we have from (4) and (6) that the sign of the rate of change in the share of wealth that each surviving heir receives is equal to the sign of the inverse of the rate of change in the total number of heirs

Equation (18) implies that when the number of heirs starts declining (resp. increasing) a greater generational gap l will have a positive (resp. negative) impact on the bequest received. Hence, when n increases (18) will decrease, whereas when later in life n does not change, the mortality effect (as represented in the first term of Eq. (18)) dominates and thereby the rate of change in the share of wealth that each surviving heir receives increases.

To illustrate the combined effect of the three components in (17), or the effect of increasing the generational gap on bequest, Fig. 3 shows the average bequest received over the life cycle of two representative individuals, that belong to the same birth cohort but differ with respect to the age of the parent, who are 22 and 45 years older, respectively. Comparing both bequest profiles, we observe that individuals with older parents receive their bequest earlier. This demographic characteristic is key for explaining wealth inequality since those individuals who receive their bequest at young ages can capitalize it over a longer period of time. Moreover, the area below each bequest profile is fairly similar. Thus, wealth differences between individuals belonging to the same birth cohort are driven by the age at which the bequest is received, and not by the amount of bequest left.

Per capita bequest given (dashed) and received (solid) by generational gap. Notes: Units relative to the average labor income between ages 30 and 49. The first term in B(x, l) and k(x, l) denotes the age of the individual, x, while the second term denotes the generational gap, l. Both bequest profiles are derived using an annual interest rate of 3%, and fertility and mortality rates with an average TFR of 2.5 and a life expectancy of 65 years

To see the impact on financial wealth of receiving the bequest early in life, Fig. 4 shows the bequest wealth and the financial wealth by generational gap. In Fig. 4a it can be seen how bequest wealth at age A rises as the generational gap increases. Given that the area below the bequest profiles in Fig. 3 are roughly equal, the positive relationship between the bequest wealth, see (15), and the generational gap is explained by two discounting factors: the survival probability S(x) and the interest rate r. The higher the value of r and the lower the survival probability S(x), the more the bequest is discounted, and hence the lower the bequest wealth. Figure 4b shows how the financial wealth rises with increases in the generational gap between ages 25 and 65. The positive relationship between financial wealth and the generational gap persists over the life cycle, although the difference diminishes as individuals age.

Impact of the generational gap on bequest wealth and financial wealth. (a) Bequest wealth, T B (A, l). (b) Financial wealth, k(x, l). Notes: Units relative to the average labor income between ages 30 and 49. First age of making decisions, A, is set at 22. Like Fig. 3 all profiles are derived using an annual interest rate of 3%, age-specific fertility rates with an average TFR of 2.5, and mortality rates with a life expectancy of 65 years

4 Aggregation

Before aggregating the optimal life cycle decisions of our individuals and obtaining the aggregate measures, it is necessary to know the age distribution of the population. Under the assumption of a closed population, we will consider the same demographic information as explained at the household level (i.e. age-specific fertility and mortality rates). We will also consider that all individuals born at time t face the same fertility and mortality rates.

4.1 Demography

Let us denote by N(0, τ, l) the total number of births at time τ born from a parent of age l. Hence, the number of people born at time τ, from a parent l years older, that survive to age x = t − τ, with t ≥ τ, is

From (19) we can calculate the size of the population of age x = t − τ at time t as

Using the age-specific fertility rate, we can then calculate the birth sequence from a parent of age x = t − τ at time t as

Integrating over all ages of parents, and using (20) and (21), the renewal equation becomes

Note that if we substitute \(\int _{t-\omega }^{t} N(0,t,t-\tau )d\tau \) for N(0, t) and \(\int _0^\omega N(0,\tau ,l)dl\) for N(0, τ), Eq. (22) is the standard renewal equation.

Integrating over all birth cohorts and generational gaps, the size of the population at time t is

and the dynamics of our population in year t is

which is also the standard balancing equation of a closed population.

4.2 Aggregate Physical Capital Wealth

To obtain the law of motion for aggregate physical capital, we define aggregate stock of physical capital at time t, K(t), aggregate consumption at time t, C(t), and aggregate labor income at time t, Y l (t), by integrating the financial wealth, consumption, and labor income over all ages (i.e. x = t − τ) and generational gaps

Differentiating (25) with respect to time yields

From (7) and given the boundary conditions k(0, τ, l) = k(ω, τ, l) = 0, it follows

From (25)–(27) and after rearranging terms, we have

where the sum of the last two components of (30), which represents respectively the total bequest received and the total bequest given, is equal to zero. See a detailed proof in appendix section “Total Bequest Given Equals Total Bequest Received”. Note that (30) is the standard law of motion of the aggregate stock of capital in a closed economy. Hence, as it should be expected, the aggregate stock of capital increases over time when the total income generated in the economy—asset income plus labor income—exceeds total consumption.

5 Impact of Demography on Wealth Inequality

5.1 Data

Demographic Data

In order to understand the impact of demography on wealth inequality, we will set up scenarios with different combinations of life expectancies (LEs) and total fertility rates (TFR). To have a clear result—without mixing changes in the age-shape with changes in levels—, we calculate the life expectancy and the total fertility rates using the same underlying vital rates as followsFootnote 11

where \(\tilde {\mu }(x)\) and \(\tilde {m}(x)\) are, respectively, the average mortality hazard rate and the average fertility rate at age x observed in the selected years 1900, 1925, 1950, 1975, and 2000 in the US; and where β E and β F are, respectively, scaling factors that adjust the mortality and fertility profiles so as to match the life expectancy to ages ranging from 50 to 90 years old, and the total fertility rate from 1.5 to 5 births per woman. The population size of each age group will be derived by applying (31) and (32) to the population model presented in Sect. 4.1.

Economic Data

To complement our model with economic information, we assume individuals become independent and set their own household at the age of 22 (A) and live for a maximum of 110 years (ω). In order to generate in our model realistic age-specific saving and thus wealth profiles, we take the labor income per capita in the US in year 2003 from the National Transfer Accounts project (Lee and Mason 2011). Figure 5 shows the labor income profile normalized to the average labor income between ages 30–49. To have clear results about the effect of demography on the accumulation of capital, we assume the same labor income profile in all our simulations, i.e. y(x, τ) = Γ(τ + x)y(x) with Γ(τ + x) = 1 for all τ, x.

Labor income per capita in USA, 2003. Source: www.ntaccounts.org

The interest rate, r, is set at 3%, which roughly corresponds in a Cobb-Douglas production function to a capital-output ratio of 4 with capital share of 0.33 and a depreciation rate of 5% (Piketty and Zucman 2014). Finally, we set the degree of altruism towards the children, α, at 1.5 in order to get an average capital-to-output ratio of 4 in the median case scenario with a LE of 65 years and a TFR of 2.5 children per women.

5.2 Wealth Inequality

Our model works for any population structure and dynamics, however the results in this section are derived for a stable population. The model accounts for two sources of wealth inequality. At the cohort level, the inequality caused by the age at which individuals receive bequest and, at the aggregate level, the inequality caused by the age distribution of the population. First, we will focus on within cohort inequality and we will analyze the same effect across cohorts.

To analyze wealth inequality we will use the coefficient of variation

where \(\operatorname {V}[\boldsymbol {k}]\) is the variance of financial wealth and \(\operatorname {E}[\boldsymbol {k}]\) is the average financial wealth.

5.2.1 Within Cohorts

A novel characteristic of our model is the possibility of analyzing within cohort inequality driven by different fertility and mortality patterns. As we explained in Sect. 3, wealth inequality within the same birth cohort is caused by the fact that individuals receive their bequest at different ages (see Fig. 3). Children with older parents receive, on average, their bequest sooner than children with younger parents. As a consequence, the former group of children invest their inheritance over a longer period of time than the latter group, which has the potential to create large differences in wealth between individuals belonging to the same birth cohort.

To calculate wealth inequality within birth cohorts, we will use the coefficient of variation, \(c_C[\boldsymbol {k}(x)]=\sqrt {\operatorname {V}_C[\boldsymbol {k}(x)]}/\operatorname {E}_C[\boldsymbol {k}(x)]\), using the following definitions:

where \(\operatorname {V}_C[\boldsymbol {k}(x)]\) is the variance of the financial wealth at age x and \(\operatorname {E}_C[\boldsymbol {k}(x)]\) is the average financial wealth at age x.

From Sects. 2 and 3, we can identify four direct effects of an increase in fertility on the financial wealth profile and bequest. First, an increase in fertility lowers the bequest received given that the fraction of wealth that corresponds to each offspring falls (see Eqs. (5)–(6)). Second, since the proportion of childless individuals, that are assumed to fully annuitize their wealth, declines with the number of offspring, an increase in fertility is also accompanied with a reduction in the average interest on wealth due to the lower proportion of wealth annuitized (see Eq. (7)). Third, the increase in the number of children leads individuals to become more impatience (see Eq. (13) and Fig. 2). And, fourth, since the bequest given increases with the number of offspring, an increase in fertility leads to a decline in bequest wealth, i.e. T B (see Eq. (15)). Notice that the sum of the third and fourth effect reduces consumption early in life and increase it at old age. Thus, an increase in fertility implies a rise in savings early in life, which yields a higher average financial wealth, i.e. \(\operatorname {E}_C[\boldsymbol {k}(x)]\). In contrast, an increase in fertility reduces the variance of the financial wealth because of the fall in the bequest received. Therefore, an increase (resp. a fall) in fertility unambiguously leads to a reduction (resp. an increase) in wealth inequality within cohorts, given that the average financial wealth increases (resp. falls) and the variance decreases (resp. increases).

An increase in life expectancy has two major effects. First, a rise in life expectancy shifts the average age at death of any individual born in year τ towards older ages—i.e., μ(x, τ)S(x, τ) peaks at older ages—. Second, according to the life cycle model, an increase in life expectancy also increases savings for retirement motive in order to finance the additional years lived during retirement. As a consequence, an increase in life expectancy yields an increase in the average financial wealth. Combining both the demographic effect and the economic effect, we have that an increase in life expectancy not only raises the expected bequest, due to the increase in savings for retirement motive, but it also postpones the age at which the bequest is received (see Eq. (5)), which will imply an increase and a shift in the variance of financial wealth towards older ages.

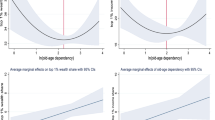

Figure 6 shows the impact of changes in life expectancy and fertility on wealth inequality over a cohort’s life cycle. The contour lines denote the combination of age and either life expectancy or fertility values that provide the same level of financial wealth inequality. Higher contour values indicate a higher wealth inequality.

Our simulations show three important results. First, in Fig. 6a,b it can be seen, for a given age x, that a decline (resp. increase) in fertility has no effect on wealth inequality when the LE is low. In contrast, when the LE is 80 years, a decline in fertility raises long run wealth inequality, while an increase in fertility reduces long run wealth inequality. The latter result is similar to that recently obtained by Onder and Pestieau (2016). As already explained, the greater wealth inequality associated to a fall in fertility is caused by a simultaneous decline in the average financial wealth and an increase in the variance. Second, in Fig. 6c,d it can be seen, for a given age x, that the effect of an increase in life expectancy on wealth inequality is non monotonic. In particular, when the initial life expectancy is low an increase in LE raises wealth inequality, while an increase in life expectancy reduces wealth inequality when the initial LE is high. The non monotonic behavior arises because of the postponement towards older ages of the bequest received. In particular, the highest variance is reached at the age equal to the difference between the life expectancy and the average generational gap. Thus, for instance, for a life expectancy equal to 65 and a generational gap of 25, we can see in Fig. 6d that the highest wealth inequality is reached around age 40. And third, it is worth noting that in all panels in Fig. 6 the wealth inequality decreases with age when the only source of inequality is driven by the generational gap. This is because the average financial wealth increases over the life cycle. This result implies, when all individuals face the same fertility and mortality, that the persistence in wealth inequality over the life cycle is not due to the generational gap.

5.2.2 Population

Our model also allows to analyze the population wealth inequality taking into consideration a realistic demographic structure. To calculate the wealth inequality of the whole population (N) through the coefficient of variation, \(c_N[\boldsymbol {k}]=\sqrt {\operatorname {V}_N[\boldsymbol {k}]}/\operatorname {E}_N[\boldsymbol {k}]\), we use the following definitions:

where \(\operatorname {V}_N[\boldsymbol {k}]\) is the variance of financial wealth of the population, \(\operatorname {E}_N[\boldsymbol {k}]\) is the average financial wealth of the population, K is the total assets held by the population, and N is the total population size.

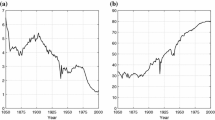

The impact of demography on population wealth inequality is explained by the inequality both within and across cohorts. Recall that in Sect. 5.2.1 we have dealt with wealth inequality within cohorts. The impact of changes in fertility and mortality on the financial wealth across age groups can be well accounted through the change in the mean-age of the population. Figure 7 shows the mean-age of the population that results from combining the alternative mortality and fertility rates using the population model introduced in Sect. 4.1. On the one side, we can see in Fig. 7 that for a given LE the mean-age of the population increases with lower fertility levels. For instance, with a LE of 60 years, a decline in TFR from 4 to 1.5 raises the mean-age of the population from 25 to 40 years. On the other side, for a given TFR, the mean-age of the population increases with higher life expectancy levels. However, it should be noted that the mean-age of the population is affected to a lower extent by a change in LE than by a change in TFR. For example, with a TFR close to population replacement, an increase in LE from 50 to 90 raises the mean-age of the population from 35 to 45 years.

Combining the results in Sect. 5.2.1 with Fig. 7, we can explain the impact of changes in fertility and mortality on the total wealth inequality. Our simulations indicate that a decline in fertility decreases the financial wealth inequality, regardless the life expectancy value (see Fig. 8). This result is explained by the fact that, although a decline in fertility yields an increase in the financial inequality within cohorts, the mean-age of the population increases significantly, as Fig. 7 shows, which is associated to lower financial wealth inequality (see Fig. 6). Figure 8 also indicates that the effect of a change in life expectancy on financial wealth inequality depends on the mortality level on the one side, and its impact on the financial wealth inequality which is rather small on the other. In particular, for a TFR level of 3, an increase in life expectancy, when LE is below 70 years, yields an increase in financial wealth inequality. In contrast, an increase in life expectancy above age 70 reduces the financial wealth inequality.Footnote 12 Applying the same strategy as with fertility, looking at Fig. 6c it can be seen that an increase in LE has a non monotonic effect on wealth inequality within cohorts, which is reinforced with the increase in the mean-age of the population.

6 Conclusions

In this paper we have estimated the impact that changes in fertility and life expectancy have on wealth inequality. We have implemented a small-open economy model populated by overlapping generations (OLG) in which individuals are characterized by three time dimensions: age, cohort (time), and generational gap (the age gap between the parent and the child). The last time dimension allows us to demographically generate wealth inequality within cohorts, since individuals receive their bequest at different ages, and to consider explicitly the fact that in reality people in the same cohort have different wealth trajectories.

Our results suggest that a decline in fertility increases wealth inequality, at the individual level. This is explained by the fact that the decline in fertility increases the proportion of bequest received, which raises the difference in financial wealth between those individuals who have already received their bequest and those individuals whose parents are still alive. At the population level, however, a fall in fertility reduces wealth inequality. This result is explained by two factors. First, wealth inequality diminishes with age given that individuals become wealthier with age. Second, the fall in fertility increases the share of older individuals. The combined effect of these two factors at the population level dominates the higher inequality at the individual level. Moreover, our simulations show that changes in life expectancy have a small non monotonic effect on wealth inequality.

The results should be interpreted with caution, since our model is based on key, but necessary, assumptions in order to focus on the effect of demography on wealth inequality. In particular, in this paper we have abstracted from changes in the population composition, such as gender, and from non demographic sources of inequality, such as income inequality, which might be positively correlated with wealth inequality at the individual level. However, even in this particular case, Goldstein and Lee (2014) have shown for the US, see Table 2, that a decline in fertility leads to a reduction in wealth inequality.

To conclude the paper, it is worth mentioning that the current version of the model is ready for analyzing the impact of demography over the demographic transition, and not just under different steady-state scenarios. Nonetheless, this model should be considered as a first step towards a full demographic-economic model that will allow us to better understand the consequences of population aging on inequality. In this direction, we plan to extend the model in order to analyze the effect that alternative transfer systems, such as the pension system, might have on our results. Moreover, we believe it is necessary to consider the impact of demographic heterogeneity by socio-economic status, such as education, on inequality, and to consider the effect of compositional changes in the population.

Notes

- 1.

Alvaredo et al. (2017) cope with the representative agent approach by assuming a dual population model with ‘savers’ and ‘rentiers’.

- 2.

A more realistic model, but also more complex and computationally burdensome, would be to assume a stochastic setting in which each individual also faces a probabilistic family size.

- 3.

At the individual level, this result is equivalent to say that only childless individuals annuitize their wealth, which is consistent with Yaari (1965) framework.

- 4.

\(\frac {S(x, \tau )}{S(l, \tau )}\) denotes the probability of individuals to survive up to age x given that they have been alive at l (at the age of childbearing). The reciprocal value thus divides the orphans to the surviving individuals of the same age-group. Note that \(\frac {S(l, \tau )}{S(x, \tau )} =e^{\int _{l}^{x} \mu (a, \tau ) \,\,\, da} \ge 1\) for l ∈ [x − A, x].

- 5.

For the derivation of (4) note that the fraction of x-year old individuals without children is reduced at age t (t ≤ x) by the fertility rate times the corresponding probability that the children survive up to age x − t (corresponds to age x of the individual). These dynamics can be formalized as \(\dot {\theta } (t, \tau )=- \theta (t, \tau )m(t, \tau )S(x-t, \tau )\) with t ∈ [0, x] and θ(0, τ) = 1. The solution yields (4).

- 6.

If the bequest is received before reaching the age A, we assume the household head raising the orphan commits to invest the inheritance and to pass it on to the orphan once the child reaches the age A.

- 7.

One should notice that by assuming a one-sex model, we are forced to unrealistically double the proportion of wealth annuitized. However, this is not the case for the fraction of wealth received, since the higher number of siblings, as a result of using a two-sex model, is offset by the fact that individuals receive the bequest from two parents.

- 8.

Every pair (c(⋅), k(⋅)) that fulfills the necessary optimality conditions (10)–(11) are a unique optimal solution of the household problem (9), since the Mangasarian sufficiency conditions (see Theorem 3.29 in Grass et al. 2008) are fulfilled. Note that the discontinuity of the dynamics of k at A is no contradiction since the time horizon of the household is [A, ω]. The behaviour during the period [0, A)is assumed to be determined by the parents.

- 9.

- 10.

Assuming a Gompertz-Makeham law of mortality, with μ(x) = ae bx + c where a, b, c > 0, the sum of the first three components inside the parenthesis of (17), denoted by f(x), is approximately equal to b − ae bl(e bx − 1). Thus, we have that f(x) > 0 for x < x 0 and f(x) ≤ 0 for x ≥ x 0, with x 0 > 0.

- 11.

Along the demographic transition age-specific fertility and mortality rates have not only decreased, but also changed in shape. Ceteris paribus, changes in the age shape of both demographic rates have an important impact on the generational gap (mean-age of childbearing) and the mortality variance. Hence, these two demographic processes also influence the bequest received and hence wealth inequality. However, given the limited space, we opt for investigating in this article only changes in level.

- 12.

The age threshold from which the effect of mortality on financial wealth inequality changes shouldn’t be considered as a fixed age. Indeed, using different age-specific mortality rates would result in a shift in the age threshold.

References

A. Alesina, R. Perotti, Income distribution, political instability, and investment. Eur. Econ. Rev. 40(6), 1203–1228 (1996)

F. Alvaredo, B. Garbinti, T. Piketty, On the share of inheritance in aggregate wealth: Europe and the USA, 1900–2010. Economica 84, 239–260 (2017)

L. Arrondel, A. Masson, Altruism, exchange or indirect reciprocity: what do the data on family transfers show? Handb. Econ. Giving, Altruism and Reciprocity 2, 971–1053 (2006)

D.E. Bloom, J.G. Williamson, Demographic transitions and economic miracles in emerging Asia. World Bank Econ. Rev. 12(3), 419–455 (1998)

R. Chetty, N. Hendren, L.F. Katz, The effects of exposure to better neighborhoods on children: new evidence from the moving to opportunity experiment. Am. Econ. Rev. 106(4): 855–902 (2016)

J.R. Goldstein, R.D. Lee, How large are the effects of population aging on economic inequality? Vienna Yearb. Popul. Res. 12, 193–209 (2014)

D. Grass, J.P. Caulkins, G. Feichtinger, G. Tragler, D.A. Behrens, Optimal Control of Nonlinear Processes: With Applications in Drugs, Corruption and Terror (Springer, Heidelberg, 2008)

D. Greenwood, N. Guner, G. Kocharkov, C. Santos, Marry your like: assortative mating and income inequality. Am. Econ. Rev. Pap. Proc. 104(5), 348–353 (2014)

L.J. Kotlikoff, Intergenerational transfers and savings. J. Econ. Perspect. 2(2), 41–58 (1988)

L.J. Kotlikoff, L.H. Summers, The role of intergenerational transfers in aggregate capital accumulation. J. Polit. Econ. 89(4), 706–732 (1981)

R.D. Lee, Age structure intergenerational transfers and economic growth: an overview. Rev. Écon. 31(6), 1129–1156 (1980)

R.D. Lee, A. Mason (eds.), Population Aging and the Generational Economy: A Global Perspective (Edward Elgar, UK, 2011)

A.J. Lotka, Théorie analytique des associations biologiques: Analyse démographique avec application particulière à l’espèce humaine. Actualités Scientifiques et Industrielles, No. 780. Paris, Hermann et Cie (1939)

F. Modigliani, The role of intergenerational transfers and life cycle saving in the accumulation of wealth. J. Econ. Perspect. 2(2), 15–40 (1988)

H. Onder, P. Pestieau, Inherited wealth and demographic aging. World Bank Group, Policy Research Working Paper 7739 (2016)

T. Piketty, Capital in the Twenty-First Century (Belknap Press of Harvard University Press, London, 2014)

T. Piketty, G. Zucman, Capital is back: wealth-income ratios in rich countries, 1700–2010. Q. J. Econ. 129(3), 1155–1210 (2014)

J. Tobin, Life cycle saving and balanced economic growth. In: Ten Economic Studies in the Tradition of Irving Fisher ed. by W. Fellner, et al. (Wiley, New York, 1967), pp. 231–256

G. Vandenbroucke, Aging and wealth inequality in a neoclassical growth model. Review 98(1), 61–80 (2016)

M.E. Yaari, Uncertain lifetime, life insurance, and the theory of the consumer. Rev. Econ. Stud. 32, 137–150 (1965)

Acknowledgment

We would like to acknowledge the comments and suggestions given by two anonymous referees. This project has received funding from the European Union’s Seventh Framework Program for research, technological development and demonstration under grant agreement no. 613247: “Ageing Europe: An application of National Transfer Accounts (NTA) for explaining and projecting trends in public finances”.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: Number of Offspring and the Fraction of Wealth Received

Number of Offspring

Similar to the foundation of the stable population theory by Lotka (1939), we will consider the total number of heirs of an individual at age x is a convolution of the fertility function with the survival probability. To simplify the notation and without loss of generality, in this proof, we get rid of the time at birth.

Let 𝜗(l) be the number of children born from an individual of age l. Let us assume that 𝜗(l) is an independently distributed random variable defined on the non-negative integers. Further let z i (a), with i = 0, …, 𝜗(l), denote the ith child of age a. Let z i (a) be a Bernoulli distributed independent random variable with probability S(a) (i.e. S(a) denotes the probability that the child survives up to age a). Then \(\mathcal {Z} (a,l)\) defining the total number of children of exact age a born from an individual of age l can be defined as

Assuming 𝜗(l) is distributed at the population level according to a Poisson with parameter m(l), where m(l) is the age-specific fertility rate at the exact age l. Then, the distribution of \(\mathcal {Z}(a,l)\) is a convolution of the fertility function with the survival probably

To find the distribution that results from (39) we use the characteristic function of \(\mathcal {Z}(a,l)\) as follows

Given that the characteristic function of the Bernoulli distribution is

Substituting (41) in (40) gives

which is the characteristic function of a Poisson process. Thus, we have

If we define the random variable total number of children of an individual with exact age x as

Then, from probability theory we have that the sum of Poisson processes is also a Poisson process. Hence, from (43) and (44) it follows

where the mean of \(\mathcal {N}(x)\) is equal to the total number of heirs, see Eq. (2), given that \(n(x)=\int _0^xm(l) S(x-l)dl\).

Fraction of Wealth Received

In order to derive (6) we must answer the question: what will be the expected fraction of wealth that corresponds to an individual if the parent dies at the exact age x? If the parent leaves one monetary unit as bequest, the wealth will be equally split between our individual and all the remaining siblings. From (45) we know that the number of offspring from a parent of x is a random number distributed according to a Poisson process. Therefore, the expected number of offspring from a parent of exact age x is, in this case, given by

Given that each unit of wealth will be split equally among the expected number of offspring, the fraction of wealth received by any offspring from a parent of age x becomes the inverse of (46),

which coincides with (6).

Appendix 2: Total Bequest Given Equals Total Bequest Received

For convenience we integrate with respect to age and generational gaps. Let us define all wealth transfers given at time t as

Equation (48) is the integral over all ages and generational gaps of the capital left as bequest at each age x in year t by individuals whose parents were l years older at the time of birth, i.e. \(k(x,t-x,l)\left [1-\theta (x,t-x)\right ]\), times the total number of people dying with those demographic characteristics, μ(x, t − x)N(x, t − x, l). Also, let us define all wealth transfers received as

Equation (49) is the integral over all ages and generational gaps of the average bequest received at age x in year t from the death of their parent at age x + l. From (5) we have that the bequest received only takes non zero values for l ∈ [0, w − x).

In order to prove that all wealth transfers given equal all wealth transfers received, we show that by substituting terms in (49) we get (48). The inverse is completely analogous and we leave it to the reader.

Proof

First, by substituting (19) and (21) in (49), we get

Using (5), defining a = x + l, and rearranging terms in (50), we have

Changing the order of integration in (51) and leaving outside of the inner integral those variables that do not depend on x gives

Expressing the inner integral of (52) in terms of the generational gap l = a − x gives

According to (2), the inner integral of (53) equals the average number of births of an individual born in year t − a at age a. Then, using (6) in (53), we have

Next, using the fact that \(N(a,t-a)k(a,t-a)=\int _0^{\omega }N(a,t-a,l)k(a,t-a,l)dl\) in (54), and assuming a = x, we have

which is equivalent to (48). □

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Sánchez-Romero, M., Wrzaczek, S., Prskawetz, A., Feichtinger, G. (2018). Does Demography Change Wealth Inequality?. In: Feichtinger, G., Kovacevic, R., Tragler, G. (eds) Control Systems and Mathematical Methods in Economics. Lecture Notes in Economics and Mathematical Systems, vol 687. Springer, Cham. https://doi.org/10.1007/978-3-319-75169-6_17

Download citation

DOI: https://doi.org/10.1007/978-3-319-75169-6_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-75168-9

Online ISBN: 978-3-319-75169-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)