Abstract

Increasing customer need for natural products of both high and well-defined activity has enhanced the use of biological materials, such as algal biomass. At the same time, algae transport and storage issues, concerning fresh seaweeds in particular, have led to the development of biomolecule isolation, including extraction. To the best of our knowledge, various approaches have been successfully applied in extracting biologically active compounds from algal biomass, among which solvent and temperature treatment are the most common. Considering novel methods, processing under high pressure (pressurized liquid and supercritical fluid extraction) and ultrasound-, microwave-, and enzyme-assisted extraction have been reported. The approaches differ in their efficacy and selectivity and extract purity, determining the usability of the final product in either bulk manufacturing or as a high-value material. Application of algae-based constituents in food and beverage products, dietary and feed supplements, cosmetics, and pharmaceuticals is being widely discussed. Recently, the usability of algae oil in the technology of biofuels has been extensively examined. In the current work, preparation of algal extracts and formulations for potential industrial use are discussed.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

5.1 Introduction

The extraction of natural materials has been practiced since the Paleolithic Period (Herrero et al. 2010) and was developed by various civilizations in a quite advanced manner (Chemat et al. 2012). In coastal and island regions, there is also a several-thousand-year tradition of using algal biomass for daily-life products – including food, feed and fertilizers, as well as specialized formulas related to health, body care, and beauty (Newton 1951; Hallsson 1964; Hoppe 1979; Chapman and Chapman 1980; Tseng 1981; Bradford and Bradford 1996; Caliceti et al. 2002; Dillehay et al. 2008; Craigie 2011; Perosa et al. 2015). Contrarily, the commercial potential of algal biomass and products thereof was largely untapped in continental Europe until the bulk production of polysaccharide colloids (phycocolloids) as foodstuff stabilizers and thickeners started in the interwar period (Naylor 1976). A breakthrough in public awareness about the health benefits of algae derivatives came after World War II – when a series of research activities on microalgal proteins led to the unexpected discovery of compounds showing antibiotic activity (Borowitzka 1995; Cornet 1998; Becker 2004). In parallel, the first report about algae extraction appeared (Milton 1952), describing the technology of liquid fertilizer further adapted for industrial-scale production. The development of liquefaction of algal biomass, performed since then, enabled easier transport, and hence wider application, of the derived products (Craigie 2011).

The global algae market is increasing, following customer demand for high-value food products, which has recently exceeded consumption of algae-based food. Such a trend has entailed the elaboration of several extraction methods that are both safe and efficient. In this chapter, recent trends in the processing of algal biomass into deliverables are reviewed.

5.2 Various Approaches to Algae Extraction for Obtaining Valuable Products

Conventional (traditional) extraction methods include inorganic and organic solvent processes, usually combined with heating, among which the Soxhlet technique, hydro-distillation, and alcohol-based maceration might be indicated (Wang and Weller 2006; Michalak and Chojnacka 2014). Such an approach is, however, both time- and energy-consuming and might influence the structure, and hence the properties, of the isolated compounds (Puri et al. 2012). The separation of the final product from the extractant also constitutes an environmental issue, as large amounts of production-related wastes containing chemicals are released (EPA 2014).

Over time, the large-scale use of organic solvents led to concern over environmental damage, which resulted in an international agreement – the Montreal Protocol (1989) – aimed at restricting the industrial application of ozone-depleting substances. As the protocol was gaining more signatories, the interest in deployment of new technologies increased (Ramsey et al. 2009). In parallel – since the early 1990s – green chemistry has been developed to limit the risk of chemical exposure for living organisms by reducing or eliminating the use and/or generation of hazardous substances (Ibañez et al. 2012; Chemat et al. 2012). To achieve this goal, principles of natural product extraction have been established to facilitate green-labelled processes:

-

I.

The implementation of innovation through variety selection and the involvement of plant-based renewables

-

II.

The use of alternative solvents, including, in particular, water or agro-solvents

-

III.

The reduction of energy consumption through energy recovery and the application of innovative technologies

-

IV.

The production of side streams and residues, instead of waste, capable of being valorized within the bio- and agro-refining industry

-

V.

The reduction of unit operations and favoring of safety, robustness, and control in processes

-

VI.

Aiming for non-denatured, contaminant-free, and biodegradable extracts

Following these guidelines enables to introduce solutions that are efficient in terms of raw materials, solvents, and energy consumption, including within industrial-scale activities (Chemat et al. 2012).

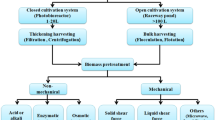

Traditional methods, reported in the late 1980s and 1990s, are still used for extraction of phycocolloids, including treatment of algal biomass with a hot alkali solution (alkali hydrolysis) and precipitation of fibers in the presence of inorganic salts and/or alcohol afterward (Armisen and Galatas 1987; McHugh 1987, 2003; Porse 1998). The process also enables to obtain soluble proteins and peptides (McHugh 2003; Kadam et al. 2013). At the same time, the large-scale use of organic solvents involves hexane, chloroform, and both methanolic and ethanolic alcohol to provide fractions of carotenoids, fatty acids, and phenolic compounds, respectively (Li et al. 2002; Borowitzka 2013a; Kadam et al. 2013). However, there are a number of researches concerning novel processes, such as pressurized liquid extraction (PLE), supercritical fluid extraction (SFE), and enzyme-, microwave-, and ultrasound-assisted extraction (EAE, MAE, UAE, respectively), which would meet the green extraction principles (Ibañez et al. 2012; Wijesinghe and Jeon 2012). Since the costs of novel methods are higher compared to conventional operations, they are dedicated mostly to high-value products, as follows:

-

PLE – phenolic compounds, fatty acids and xanthophylls

-

SFE, particularly with supercritical CO2 (SC-CO2) as the extractant – fatty acids and carotenoids

-

MAE – phenolic compounds and carbohydrates

-

UAE – phenolic compounds and minerals

-

EAE – carbohydrates, antioxidants

Moreover, both SFE and MAE provide efficient extraction of algae oil. Yet, there are still some obstacles to overcome in implementing the above mentioned approaches into industrial practice. EAE substrate specificity and operational conditions represent its main limitations, while PLE and MAE are not suitable for obtaining thermolabile compounds. In the near future, SFE and UAE are the most likely to be widely adapted into the large-scale production of algae derivatives (Kadam et al. 2013; Esquivel-Hernández et al. 2017 and relevant references therein).

5.3 Global Algae Market

Half of the net primary production of biomass is assumed to be aquatic (Bowles 2007). Indeed, global algae production is about 28.5 · 106 tonnes of fresh weight per year – besides catches from midwater outside the official statistics (FAO 2016), expected to accomplish a 5.3% increase in compound annual growth rate (CAGR) by 2024 (Transparency Market Research 2016). According to the available data, the production of microalgae is much lower compared to seaweeds because of different target applications, as well as cultivation issues and poor reflection in the worldwide reporting system (Borowitzka 1999; FAO 2016).

In commercial algal farming, Asian countries, particularly China and Indonesia, are predominant, as they represent more than 80% of global production. Such a market share is rooted in the traditional use of algae, with direct consumption (9 · 106 tonnes of fresh weight) and further processing for food and/or food additives remaining a great utilization of aquaculture (FAO 2014, 2016).

In 2012, the global algae market was worth US$ 6.4 · 109 (FAO 2014). At the same time, the revenue is expected to reach over US$ 1.1 · 109 at 7.4% CAGR by 2024 (Transparency Market Research 2016). There is steady growth in the market for algal metabolites, comprising, besides polysaccharides and derivatives, pigments, mainly carotenoids, and fatty acids (Esquivel-Hernández et al. 2017). The latter is also involved in the algae oil market, which constitutes an object of even greater interest (Grand View Research 2017a). The variety of biologically active compounds extractable from algal biomass enables to obtain products of different customer value. The overview of the current global algae market is shown in Fig. 5.1.

Among seaweed metabolites, phycocolloids, including alginates, agar, and carrageenan, are still of the greatest interest, as their market volumes are estimated at 2.5 · 104 (considering propylene glycol alginate of food and pharma grade only), 1.5 · 104, and 5.8 · 104 tonnes, respectively. Although sales of carrageenan are the highest, market development for that phycocolloid is currently quite slow, at 2% annual average growth rate (AAGR). The fastest-developing market is for agar, as it provides AAGR at a level of 7%. Contrarily, AAGR for alginates is negative, while their price is still high – US$ 14 per kg, as compared to US$ 9 for carrageenan and US$17 for agar (Porse and Rudolph 2017).

The volume of the phycocolloid market is reflected in its value, which reaches US$ 3.8 · 108 (Markets and Markets 2015), US$ 2.5 · 108 (Grand View Research 2017b; Mordor Intelligence 2017a), and US$ 7.6 · 108 (Micromarket Monitor 2017; Mordor Intelligence 2017b) for alginates, agar, and carrageenan, respectively. A review of the commercial application of phycocolloids is shown in Table 5.1.

When considering microalgae derivatives, carotenoids comprise a billion-dollar market, with astaxanthin in the leading position, US$ 4.0 · 108 (Algae Industry Magazine 2015; BCC Research 2015), and β-carotene in second place – US$ 1.7 · 108 (Grand View Research 2016; Borowitzka 2013a). Algae are an important source for industrial-scale production of carotenoids – providing 26 and 38% of the total contribution to the market revenue of astaxanthin and β-carotene, respectively. Approaches with different biologically originated materials, as well as fermentation and chemical synthesis, have also been implemented. The latter is, however, considered cost consuming and disadvantageous, particularly in regard to products for human consumption (Grand View Research 2016, 2017c). The commercial extraction of β-carotene from microalgae Dunaliella salina exceeds the processing of other natural sources, such as plants (including carrots, sweet potatoes, and pumpkins), fungi, palm oil, and microbial production (Borowitzka 2013b; Grand View Research 2016; Oilgae 2016). At the same time, the most known source of astaxanthin, microalgae Haematococcus pluvialis, is increasingly competing with krill, shrimp by-products, and yeast (Phaffia species) (Grand View Research 2017c; Transparency Market Research 2017), while remaining predominant toward Pacific sockeye salmon and Paracoccus bacteria (Transparency Market Research 2017).

As natural pigments, both astaxanthin and β-carotene are primarily used to improve the color of food products (Algae Industry Magazine 2016); however, various trends in their application have been developed (Borowitzka 2013a). The biggest share in the astaxanthin market (about 40%) belongs to the sector of feed additive enhancing pigmentation in aquaculture animals (fish, e.g., salmon and trout, and crustaceans, e.g., shrimp), which, however, mostly involves synthetic and microbial-derived compounds (Research and Markets 2015; Transparency Market Research 2017). Astaxanthin of natural origin, algae in particular, shows great antioxidant activity (determined by its oxygen radical absorbance capacity) and thus has become more profitable, being launched for food and beverages, nutritional and dietary supplements, and nutraceuticals (Enzing et al. 2014, Algae Industry Magazine 2015, BBC Research 2015, Research and Markets 2015; Grand View Research 2017c). The latter holds the second-biggest market share (about 32%), and the new concept of nutraceutical delivery with soft gels is projected to reach the fastest growth rate (Grand View Research 2017c).

Besides preventing oxidative stress, the compound also has capability for healing UV-induced damage, which has led to its successful use in the treatment of cardiovascular disease, neurodegenerative disease (Alzheimer’s, Parkinson’s), and both ophthalmic and orthopedic disorders (Enzing et al. 2014; Grand View Research 2017c). For the same reason, astaxanthin is applied as an antiaging agent in cosmetics, cosmeceuticals, and personal care products, forming the third-largest sector in terms of market share (about 18%) (Research and Markets 2015; Grand View Research 2017c; Transparency Market Research 2017).

Despite lower market value than astaxanthin, β-carotene was the first high-value compound extracted commercially from microalgae (Borowitzka 2013a) and is generally the most prominent carotenoid (BBC Research 2015). Being a precursor to vitamin A and both an antioxidative and anti-inflammatory agent, β-carotene is suited to a wide range of applications (Enzing et al. 2014; Grand View Research 2016), yet its use as a color additive (E 160a) seems to remain the most prominent (Commission Regulation (EU) No 1129/2011 of 11 November 2011). In fact, the food and beverage sector holds the leading market share, since it contributes one-third of the total revenue and shows a further upward trend. A slightly smaller market share, still 30%, belongs to dietary supplements, which are followed by cosmetics and personal care products – almost 22% of total revenue. The third-largest applicant sector involves a great variety of formulations, starting from bath and shower preparations, moving through face cleansers, aftershave lotions, shampoos, and hair conditioners, and ending at makeup and sun-care products (Grand View Research 2016). The beneficial health properties of β-carotene encourage its application in animal feed as well (Enzing et al. 2014).

According to the conventional approach, neither eicosapentaenoic nor docosahexaenoic acid (EPA and DHA, respectively) is an essential fatty acid. Yet, they are customarily classified as such due to functionality criteria (Hassam et al. 1977a, b; NIH 2016) and the limited efficiency of natural synthesis (Harris 2010). Since diets are usually low in EPA and DHA, and thus these fatty acids are commonly deficient, there is a great opportunity for the sectors of dietary and nutritional supplements to be advanced (Joint WHO/FAO Expert Consultation 2003). EPA- and DHA-based supplements held the biggest share – over US$ 1.0 · 109, in the revenue of the omega-3 ingredients market, which is valued at about US$ 3.5 · 109 and is expected to reach US$ 4.0 · 109 within the next 5 years. The other profitable area of application is divided into four sectors, as follows: functional food, infant formulas, pet food, and pharmaceuticals (Global Market Insights 2016). Relating to the latter, EPA and DHA ingredients show a protective effect against cardiovascular conditions, arthritis, and cancer (Joint WHO/FAO Expert Consultation 2003; Global Market Insights 2016). More than 75% of feedstock for omega-3 fatty acid production is fish oil, mostly from sardines and anchovies. However, its unpleasant organoleptic properties, along with the increasing popularity of the vegetarian lifestyle among customers, enhance the position of algae oil, currently at about 8% of market share, as an alternative source material (Global Market Insights 2016).

Though economically beneficial, the use of fatty acids for human consumption – including supplements, as well as foods and beverages – is the smallest applicant sector of the US$ 1.5 · 109-worth algae oil market. The leading market share belongs to fuel grade products, such as biodiesel, jet fuel, and gasoline, which provide almost 40% of the total revenue. Algae oil is also successfully applied, at about 30% of total revenue, to animal feed (Grand View Research 2017a).

Besides separate fractions, algal extracts within mixtures of biologically active compounds are also gaining attention. The applicability of such products will be reviewed in subsequent chapters of this book.

5.4 Conclusion

Algal biomass is a rich source of various biologically active compounds. In industrial production, phycocolloids, carotenoids, and essential fatty acids are of particular importance. Biofuel production from algae oil has also been exhaustively verified. While phycocolloids have been successfully extracted through the use of alkali hydrolysis, for the other constituents, novel techniques – improved in terms of efficiency, solvent use, and both time and cost consumption – have been developed. Among the known approaches, ultrasound-assisted and SC-CO2 extraction are considered promising for industrial implementation, yet the latter seems to be the most suitable to fulfill the market demand.

References

Algae Industry Magazine (2015) Boom in astaxanthin boosts carotenoid market. http://www.algaeindustrymagazine.com/boom-in-astaxanthin-boosts-carotenoid-market/. Accessed on 4 Sept 2017

Algae Industry Magazine (2016) Astaxanthin leading carotenoids market growth. http://www.algaeindustrymagazine.com/astaxanthin-leading-carotenoids-market-growth/. Accessed on 4 Sept 2017

Armisen R, Galatas F (1987) Production, properties and uses of agar In: McHugh DJ (ed) Production and utilization of products from commercial seaweeds, FAO Fisheries Technical Paper 288. FAO, Rome. ISBN 92-5-102612-. http://www.fao.org/docrep/X5822E/x5822e03.htm#chapter%201%20%20%20production,%20properties%20and%20uses%20of%20agar. Accessed on 4 Sept 2017

BCC Research (2015) The Global Market for carotenoids. https://www.reportbuyer.com/product/96628/the-global-market-for-carotenoids.html. Accessed on 4 Sept 2017

Becker W (2004) Microalgae in human and animal nutrition. In: Richmond A (ed) Handbook of microalgal culture: biotechnology and applied phycology. Blackwell Science, Oxford, pp 312–351

Borowitzka MA (1995) Microalgae as sources of pharmaceuticals and other biologically active compounds. J Appl Phycol 7(1):3–15

Borowitzka MA (1999) Economic evaluation of microalgal processes and products. In: Cohen Z (ed) Chemicals from microalgae. Taylor & Francis, London, pp 387–409

Borowitzka MA (2013a) High-value products from microalgae – their development and commercialization. J Appl Phycol 25(3):743–756

Borowitzka MA (2013b) Dunaliella: biology, production, and markets. In: Richmond A, Hu Q (eds) Handbook of microalgal culture. Wiley, Oxford, pp 359–368

Bowles D (2007) Micro-and macro-algae: utility for industrial applications. Outputs from the EPOBIO project. CNAP, University of York/CPL Press, Newbury

Bradford P, Bradford M (1996) Cooking with sea vegetables. Thorsons Publishing Group, Wellinborough

Caliceti M, Argese E, Sfriso A, Pavoni B (2002) Heavy metal contamination in the seaweeds of the Venice lagoon. Chemosphere 47:443–454

Chapman VJ, Chapman DJ (1980) Seaweeds and their uses. Chapman and Hall, New York

Chemat F, Vian MA, Cravotto G (2012) Green extraction of natural products: concept and principles. Int J Mol Sci 13(7):8615–8627

Commission Regulation (EU) No 1129/2011 of 11 November 2011 amending Annex II to Regulation (EC) No 1333/2008 of the European Parliament and of the Council by establishing a Union list of food additives (Text with EEA relevance) (n.d.)

Cornet JF (1998) Les photobioréacteurs. Biofutur 176:1–10

Craigie JS (2011) Seaweed extract stimuli in plant science and agriculture. J Appl Phycol 23(3):371–393

Dillehay TD, Ramirez C, Pino M, Collins MB, Rossen J, Pino-Navarro JD (2008) Monte Verde: seaweed, food, medicine, and the peopling of South America. Science 320(5877):784–786

Enzing C, Ploeg M, Barbosa M, Sijtsma L (2014) Microalgae-based products for the food and feed sector: an outlook for Europe. IPTS Institute for Prospective Technological Studies, JRC, Seville

Esquivel-Hernández DA, Ibarra-Garza IP, Rodríguez-Rodríguez J, Cuéllar-Bermúdez SP, de J Rostro-Alanis M, Rostro-Alanis M, Alemán-Nava GS, García-Pérez JS, Parra-Saldívar R (2017) Green extraction technologies for high-value metabolites from algae: a review. Biofuels Bioprod Biorefin 11:215–231

Food and Agriculture Organization of the United Nations (2014) The state of world fisheries and aquaculture. Opportunities and challenges, FAO, Rome. E-ISBN 978-92E-ISBN 978-92-5-108276-8-5-108276-8 pp 1–223. http://www.fao.org/3/a-i3720e.pdf. Accessed on 4 Sept 2017

Food and Agriculture Organization of the United Nations (2016) The state of world fisheries and aquaculture 2016. Contributing to food security and nutrition for all. FAO, Rome. ISBN 978-92-5-109185-2 pp 1–190. www.fao.org/3/a-i5555e.pdf. Accessed on 4 Sept 2017

Global Market Insights (2016) EPA/DHA (Omega 3) ingredients market size by application (dietary supplements, pharmaceuticals, functional foods, pet & animal feed, infant formulas), by source (anchovy/sardine, high concentrates, medium concentrates, low concentrates, algae oil, tuna oil, cod liver oil, salmon oil, krill oil, menhaden oil), industry analysis report, regional analysis, application potential, price trend, competitive market share & forecast, 2015–2022. https://www.gminsights.com/industry-analysis/EPA-DHA-omega-3-ingredients-market. Accessed on 4 Sept 2017

Grand View Research (2016) Beta-carotene market analysis by source (algae, fruits & vegetables, & synthetic), by application (food & beverages, dietary supplements, cosmetics, & animal feed) and segment forecasts to 2024. http://www.grandviewresearch.com/industry-analysis/beta-carotene-market. Accessed on 4 Sept 2017

Grand View Research (2017a) Algae oil market analysis, by grade (fuel, food, feed), by application (biofuel, dietary supplement, F&B, animal feed), by region (North America, Europe, Asia Pacific, South & Central America & MEA), and segment forecasts, 2014–2025. http://www.grandviewresearch.com/industry-analysis/algae-oil-market. Accessed on 4 Sept 2017

Grand View Research (2017b) Agar agar gum market analysis by product (powder, square, strips), by application (confectioneries, bakery & pastry, retail, meat, microbiological & molecular), by region, and segment forecasts, 2014–2025. http://www.grandviewresearch.com/industry-analysis/global-agar-agar-gum-market. Accessed on 4 Sept 2017

Grand View Research (2017c) Astaxanthin market analysis by source (natural [yeast, krill/shrimp, microalgae] and synthetic), by product (dried biomass/powder, oil, soft gels, liquid), by application, and segment forecasts, 2014–2025. http://www.grandviewresearch.com/industry-analysis/global-astaxanthin-market. Accessed on 4 Sept 2017

Hallsson SV (1964) The uses of seaweed in Iceland. Proc Int Seaweed Symp 4:398–405

Harris WS (2010) Omega-3 fatty acids. In: Coates PM, Betz JM, Blackman MR, Cragg GM, Levine M, Moss J, White JD (eds) Encyclopedia of dietary supplements, 2nd edn. Informa Healthcare, London, pp 577–586

Hassam AG, Rivers JPW, Crawford MA (1977a) Metabolism of gamma-linolenic acid in essential fatty acid-deficient rats. J Nutr 107(4):519–524

Hassam AG, Rivers JPW, Crawford MA (1977b) Potency of γ-linoleic acid (18: 3ω6) in curing essential fatty acid deficiency in the rat. Ann Nutr Metab 21(Suppl. 1):190–192

Hennig J, Jain M (2017) Algae products. Fish 2.0 investment insights. Available via Fish 2.0. http://www.fish20.org/9-news/440-report-algae-market-to-reach-45bn-by-2023. Accessed on 4 Sept 2017

Herrero M, Mendiola JA, Cifuentes A, Ibañez E (2010) Supercritical fluid extraction: recent advances and applications. J Chromatogr A 1217:2495–2511

Hoppe HA (1979) Marine algae and their products and constituents in pharmacy. In: Hoppe HA, Levring T, Tanaka Y (eds) Marine algae in pharmaceutical science, vol 1. Walter de Gruyter, Berlin, pp 25–119

Ibañez E, Herrero M, Mendiola JA, Castro-Puyana M (2012) Extraction and characterization of bioactive compounds with health benefits from marine resources: macro and micro algae, cyanobacteria, and invertebrates. In: Hayes M (ed) Marine bioactive compounds. Springer Science+Business Media, New York, pp 55–98

Joint WHO/FAO Expert Consultation (2003) Diet, nutrition and the prevention of chronic diseases. World Health Organ Tech Rep Ser 916(i–viii):1

Kadam SU, Tiwari BK, O’Donnell CP (2013) Application of novel extraction technologies for bioactives from marine algae. J Agric Food Chem 61(20):4667–4675

Li X, Fan X, Han L, Lou Q (2002) Fatty acids of some algae from the Bohai Sea. Phytochemistry 59:157–161

Markets and Markets (2015) Alginates & derivatives market by type (sodium alginate, calcium alginate, potassium alginate, pga, others), application (food & beverage, industrial, pharmaceuticals, others), & by region – Global Trends & Forecast to 2019. http://www.marketsandmarkets.com/Market-Reports/alginates-derivatives-market-77102420.html. Accessed on 4 Sept 2017

McHugh DJ (1987) Production, properties and uses of alginates. In: DJ MH (ed) Production and utilization of products from commercial seaweeds, FAO Fisheries Technical Paper 288. FAO, Rome. ISBN 92-5-102612-2. http://www.fao.org/docrep/x5822e/x5822e04.htm#chapter2production,propertiesandusesofalginates. Accessed on 4 Sept 2017

McHugh DJ (2003) A guide to the seaweed industry, FAO Fisheries Technical Paper 441. FAO, Rome, pp 1–105. ISSN 0429-9345, www.fao.org/3/a-y4765e.pdf. Accessed on 4 Sept 2017

Michalak I, Chojnacka K (2014) Algal extracts: technology and advances. Eng Life Sci 4(6):581–591

Micromarket Monitor (2017) Global Carrageenan Market research report. http://www.micromarketmonitor.com/market-report/carrageenan-reports-9953387913.html. Accessed on 4 Sept 2017

Milton RF (1952) Improvements in or relating to horticultural and agricultural fertilizers. British Patent 1952/664989

Montreal Protocol on substances that deplete the ozone layer (1989)

Mordor Intelligence (2017a) Global agar market – growth, trend and forecasts (2017–2022). https://www.mordorintelligence.com/industry-reports/agar-market. Accessed on 4 Sept 2017

Mordor Intelligence (2017b) Global Carrageenan Market – trends and forecasts: (2017–2022) (Segmented by types, applications, grades and geography). https://www.mordorintelligence.com/industry-reports/global-carrageenan-market-industry. Accessed on 4 Sept 2017

National Institute of Health (NIH). Office of Dietary Supplements (2016) Omega-3 fatty acids. https://ods.od.nih.gov/factsheets/Omega3FattyAcids-HealthProfessional/#en3. Accessed on 4 Sept 2017

Naylor J (1976) Production, trend and utilization of seaweeds and seaweed products, FAO Fisheries Technical Paper 159. FAO, Rome. ISBN 92–5–100091-3 pp 1–73. http://www.fao.org/docrep/005/ac860e/AC860E00.htm#TOC. Accessed on 4 Sept 2017

Newton GW (1951) Seaweed utilization. Sampson Low, London

Oilgae (2016) Business opportunities & market size of beta carotene. http://www.oilgae.com/non_fuel_products/betacarotene.html. Accessed on 4 Sept 2017

Perosa A, Bordignon G, Ravagnan G, Zinoviev S (eds) (2015) Algae as a potential source of food and energy in developing countries: sustainability, technology and selected case studies. Edizioni Ca’ Foscari – Digital Publishing, Venezia

Porse H (1998) Global seaweed market trends. Plenary presentation at the 16th International seaweed symposium, Cebu City, Philippines, 12–17 April 1998

Porse H, Rudolph B (2017) The seaweed hydrocolloid industry: 2016 updates, requirements, and outlook. J Appl Phycol. https://doi.org/10.1007/s10811-017-1144-0:1-14

Puri M, Sharma D, Barrow CJ (2012) Enzyme-assisted extraction of bioactives from plants. Trends Biotechnol 30(1):37–44

Ramsey E, Sun Q, Zhang Z, Zhang C, Wei G (2009) Mini-review: green sustainable processes using supercritical fluid carbon dioxide. J Environ Sci 21:720–726

Research and Markets (2015) Global astaxanthin market – sources, technologies and application. https://www.researchandmarkets.com/reports/3129287/global-astaxanthin-market-sources-technologies. Accessed on 4 Sept 2017

Thurmond W (2009) Biofuels and algae markets, strategies and commercialization outlook. Emerging Markets Online report. https://www.slideshare.net/tonya.m.britton/wil-thurmondemerging-markets-online. Accessed on 4 Sept 2017

Transparency Market Research (2016) Algae market, by application, by cultivation technology, and geography – global industry analysis, size, share, growth, trends, and forecast – 2016–2024. http://www.transparencymarketresearch.com/pressrelease/algae-market.htm. Accessed on 4 Sept 2017

Transparency Market Research (2017) Astaxanthin Market – global industry analysis, size, share, growth, trends and forecast 2016–2024. http://www.transparencymarketresearch.com/astaxanthin-market.html. Accessed on 4 Sept 2017

Tseng CK (1981) Commercial cultivation. In: Lobban CS, Wynne MJ (eds) The biology of seaweeds. University of California Press, Berkeley, pp 680–725

United States Environmental Protection Agency (EPA) (2014) 2014 toxics release inventory national analysis complete report. https://www.epa.gov/toxics-release-inventory-tri-program/2014-tri-national-analysis-complete-report. Accessed on 4 Sept 2017

Wang L, Weller CL (2006) Recent advances in extraction of nutraceuticals from plants. Trends Food Sci Technol 17:300–312

Wijesinghe WAJP, Jeon YJ (2012) Enzyme-assistant extraction (EAE) of bioactive components: a useful approach for recovery of industrially important metabolites from seaweeds: a review. Fitoterapia 83(1):6–12

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Dmytryk, A., Chojnacka, K., Rój, E. (2018). The Methods of Algal Biomass Extraction: Toward the Application. In: Chojnacka, K., Wieczorek, P., Schroeder, G., Michalak, I. (eds) Algae Biomass: Characteristics and Applications. Developments in Applied Phycology, vol 8. Springer, Cham. https://doi.org/10.1007/978-3-319-74703-3_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-74703-3_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-74702-6

Online ISBN: 978-3-319-74703-3

eBook Packages: Biomedical and Life SciencesBiomedical and Life Sciences (R0)