Abstract

This paper examines the dynamic evolution process in London stock exchange and attempts to model stock survivability resilience in the financial networks. A big historical dataset of UK companies from London stock exchange for 40 years (1976–2016) was collected and conceptualized into weighted, temporally evolving and signed networks using correlation coefficients. Based on the legal definition of corporate failure, stocks were categorized into Continuing, Failed and Normal groups. Accordingly, we conducted analysis on (1) The long-term evolution process of the entire population with statistical inference and visualization. (2) Multivariate logistic modeling of survivability resilience using short-term network measures, degree ratio (\(r_{i}\)), node degree (\(k_{i}\)), and node strength (\(s_{i}\)). The results show an exponential market growth but with a “fission-fusion” behavior in network topologies, which indicates dynamic and complex characteristics of its expansion. On the other hand, regression and modeling outcomes show that the survivability resilience is correlated with \(k_{i}\) and \(s_{i}\). Moreover, the analysis of deviance suggests that the survivability resilience could be described, by and large, as a function of \(k_{i}\) since it contributes the most significant difference. The study provides a novel alternative to look at the bankruptcy in the stock market and is potentially helpful for shareholders, decision- and policy-makers.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

1 Introduction

The understanding of topological characteristics and interdependence between network components have been intriguing issues in network theory since such structures and interactions commonly exist in a wide range of academic fields [1, 18]. And those topological and interdependence measures often have a strong association with the performance of network components. In this paper, we attempt to investigate such association between statistical network measures and survivability of correlation-based interdependent stocks in a market.

In financial systems, categorizing corporate failure is essential in bankruptcy studies [13]. The most frequently found interdisciplinary application of networks and stocks’ survivability largely fell in forecasting bankruptcy with neural network methods, including genetic fuzzy models [14], artificial networks [28], and hybrid models [15]. Other types of models have also been proposed for centuries [17, 21]. The majority of those models were constructed based on corporate fundamentals, such as financial statement ratios, cash flows, and stock returns, etc. To the best of our knowledge, most of the studies on bankruptcy were focused on failed firms, but we found no attempts in bankruptcy studies which models the company resilience and survivability with statistical measures from network perspectives.

Complex networks usually have so complex topological structures that sometimes its visualization seems to be a “hairball”. Therefore, a considerable amount of network studies have been focusing on the methods for reducing and simplifying the network structure. For instance, the method of minimal spanning tree (MST) [3, 23], planar maximally filtered graph (PMFG) [22], threshold filtering mechanism [11], and winner-takes-all approach [5]. Several recent studies, on the other hand, focused on the methods of construction of interdependence, including commonly-held Pearson [10] and partial correlation coefficient [25], and covariance and Gaussian graphical model [26]. Apart from construction methods, some works have focused on studying collective behavior and overall correlation synchronicity in the stock market [9, 12]. For years, abundant writings in stock networks have been proposed such as [4, 11, 16, 20]. In these previous studies, the evolution process of stock networks was discussed briefly. Nevertheless, most of them were merely based on either a short time period or a small fraction of the population in a market [7, 11]. In addition, we also found that most of the previous studies neglected the negative signs/correlations between stock pairs.

Hence, we focus on all available trading stocks of UK corporates in London exchange and frame three-fold purposes as (a) To study the long-term evolution patterns in UK stock networks and analyze their particular dynamic features. (b) To construct the stock network as temporal weighted networks with signed edges, (unlike other previous works we took negative correlation coefficients into account) and propose a network measure, degree ratio \(r_{i}\), to illustrate the overall neighborhood of a node. (c) To characterize survivability resilience analysis of stocks, which remained perennially vital without bankruptcy for a long time, and to explore the highly descriptive parameters. We aim to answer: (1) How does a correlation-based network of stocks evolve in long-term observation? (2) How can we measure the overall neighborhood in signed networks? (3) What network-related measures can we identify as the highly contributed variables to characterize stock’s resilient behavior against bankruptcy?

The paper is organized as follows: Sect. 2 describes the data and methodology for network construction, followed by analysis of the dynamic evolving process in Sect. 3. In Sect. 4.1, three network measures are introduced and their statistical analysis are presented. Section 4.2 consists detailed results and discussion on survivability resilience, followed by final conclusions summarized in Sect. 5.

2 Data and Methodology

The data used in this paper are closing daily stock prices of 1415 UK companies (1542 companies in total) traded on London stock exchange from 1976 to 2016. This large historical data has been gathered from DataStream\(^{TM}\). In order to conduct the aim of this paper, we categorized failed companies and continuing companies based on the legal definition of corporate failure. For those which belong to neither of those two groups, we treated them as normal population. (1) Continuing group: those companies which are continuing to trade on the stock market for the entire 40 years. (2) Failed group: those companies which filed for any reason of bankruptcy within last four years of delisting are considered failed. (3) Normal group: those companies which initially listed at some point during the observation period and did not fail yet by end of the period.

The networks are constructed based on standard correlation coefficients. The coefficients were constructed using logarithmic return for stocks pairwise with a daily basis. Let \(r_{i}(t)\) and \(p_{i}(t)\) denote the log-return and close price of stock i at time t, respectively. The daily log-return can be expressed as follows:

where \(\varDelta t\) is one trading day, \(\varDelta t = 1\). Then we write coefficients \(c_{i,j}\) between stock i and j as:

where \(<.>\) indicates the mean value and \(\sigma _{i}\) is the standard deviation of the stock i in time series. The \(p-\)values were also computed for each coefficient and used as the threshold to filter out those too-weak correlations. In order to avoid severe topological information loss while pruning the edges (according to the evidence shown in study [11], the edge density of stock network drops sharply from \(c_{i,j}\) = 0.1), we set \(p-\)value threshold as 0.01 to eliminate weak correlations for \(-0.1<c_{i,j}<0.1\) and replaced them by “0”. We then constructed and symbolized the coefficients as edge weights to represent the intensity of connections. Similarly, edge signs were determined by the corresponding sign of coefficients.

3 Long-Term Temporal Network Evolution

For long-term observation, networks were constructed based on the yearly and half-yearly manner, which resulted in 40 and 80 networks in total, respectively. The growth of networks in terms of four attributes show an exponential increase in the number of nodes, n (Fig. 1(a)), the number of edges, m ( Fig. 1(b)), and the mean degree of the network, \(<k>\) (Fig. 1(c)). Following an expansion in n (growth rates of 0.03 for both sets) and m (growth rate of 0.1 for yearly and 0.05 for half-yearly), the density of networks, \(\rho \), gradually decreases (Fig. 1(d)). Interestingly, in subplot (a) different time windows have no significant influence on n at all. However, even having similar trends the plots (b), (c) and (d) illustrate an overall notable decrement in m, \(<k>\) and \(\rho \) constructed based on half-yearly window span comparing with those of yearly-constructed networks. It might be the effect of using smaller observation number to construct correlation coefficients.

Also, it can be seen from subplot (b–d) the network evolves with significant fluctuations. These static measures are strongly associated with the distribution and number of edges, indicating a dynamic shrinking-and-expanding behavior in sparsity and topology. This could be a set of responses of the market to external stimuli. Hence, although the number of nodes (the population of the market) was exponentially growing, the topology was evolving with a “fission-fusion” behavior.

Figure 2 indicates an explosive expansion in n and distribution of positive and negative edges with a “core-periphery-like” structure, wherein a few nodes are highly interconnected and the rest are sparsely connected around the core [24]. The color of the nodes corresponds to their degrees centrality, with red as high degree and green as low. Positive edges are indicated with yellow and negative in light blue. The thickness of the edges is proportionally depicted by their weights. One can see that most of the positive edges are concentrated around core area while negative edges are towards the periphery and a number of high-degree nodes form a core, which indicates an uneven distribution of edges and signs, i.e., nodes in core area have high tendency to positively connect to other high-degree nodes, but meanwhile, those nodes which have a large portion of negative connections are marginalized.

4 Survivability and Resilience Analysis

4.1 Short-Term Network Measures

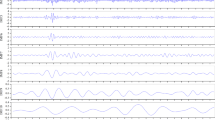

In this section, we discuss and present the acceptability of selected measures for characterizing purpose, that is we would like to have a feeling on what network measures could differentiate stocks in different groups. In order to analyze detailed variations of network measures in each group, we focused on last four years (2013–2016) and constructed networks with a smaller time window of 20 days. In total, there are 1043 trading days from 2013 to 2016 and, therefore, 53 networks were obtained and filtered by same \(p-\)value threshold applied previously.

Dynamic evolution of UK companies in London stock exchange from 1976 to 2016. The diameter of the network remains unchanged with small average path length during evolution. It shows a small-world effect in networks at each evolving step. Node color: red as high degree and green as low. Edge color: yellow as positive edges and light blue as negative ones. The thickness of the edges is proportionally depicted by their weights.

As mentioned before, negative correlations are normally neglected for topological simplification in most previous literature. However, the nodes with a large portion of negative correlations could have some characters that of great interests for understanding individual’s resilience and survivability. Hence, we paid equivalent attention to both positive and negative correlations in this paper to conceptualize our data as signed networks. It is important to notice that a negative edge literately represents the attribute of the edges as a negative relationship or opposite synchronization, yet not means low or absent interaction between nodes. Two nodes, on the contrary, could be highly interactive and have a strong relationship with negative edge [19].

Different signs on edges could potentially result in clustering phenomenon in balanced and almost-balanced topology [6]. Previous investigations have already shown that a network is clusterable if it is a balanced network [8] so that the edges, which cross boundaries and connect nodes in different cliques, would be negative ones, and positive ones are dispersed towards the center of a clique. This particular feature is similar to what we observed in evolution visualizations. Hence, we define a network measure, Degree ratio, which comprehensively reflects an overall layout of a node’s neighborhood, i.e., how central the node is in its own clique. Let \(k_{i}^+\) denotes the number of positive edges of node i and \(k_{i}^-\) denotes the number of negative ones, here, the degree ratio of a node \(r_{i}\) can be correspondingly defined as the following equation. In other words, the ratio is meant to reveal if there could be a possible explanation of survivability of nodes in terms of their associated number of negative neighbors and their positions in a clique.

We then calculated \(r_{i}\) for all nodes in each group and studied its distribution at end of each year. In Fig. 3(I), of particular note is the fact that the log-log plots of the Continuing group have obvious larger numerical values, compared to other two groups. On the other hand, there is a clear dynamic changing pattern can be observed for the Failed group. Figure 3(I-A) and (I-B) show that by end of 2013 and 2014 the degree ratio distribution of most stocks in the Failed group overlapped with that of the normal population. This indicates that most of the Failed stocks were acting normally by end of 2013 and 2014, that is, they were acting with the same characteristic as members of Normal group did. However, by end of 2016, the difference among three groups become significant as shown in Fig. 3(I-D). Note that a larger magnitude distribution in Continuing groups differs a gradual increasing gap between the Failed group and Normal population (see arrows).

The other two commonly-applied network measures are briefly explained as follows (for interested readers, the elaboration can be found in most of the network handbooks). Node degree is a straightforward nodal measure in complex networks, which provides an indication of the importance of the node in terms of the number of its neighbors. For an undirected network of n nodes, the degree \(k_{i}\) of node i can be expressed in adjacency matrix as:

Yook et al. [27] and Barrat et al. [2] studied Node strength \(s_{i}\) of network properties in weighted networks. It measures the importance of a particular node in terms of its connection intensity. The node strength is defined as the sum of the weights on its total connections/degree. Let \(W_{ij}\) denotes the edge weight matrix corresponding to adjacency matrix \(A_{ij}\), the strength \(s_{i}\) can be expressed as:

The Fig. 3(II-A to D) and (III-A to D) are the distribution of node degree and node strength for each group at the same time shots. The results show a similar tendency as revealed in degree ratio distribution. Thus, these three network measures could be appropriate to characterize the performance difference of stocks in each group.

4.2 Multivariate Logistic Modeling

Generalized linear models using logit transformation as link function was applied to perform multivariate logistic regression in both Continuing and Failed groups. The logit models depict the relationship between response probabilities and the predictors, node degree \(k_{i}\), degree ratio \(r_{i}\), and node strength \(s_{i}\), and were presented in the form as:

where \(\gamma \) is the target group, A is the intercept term of the model and B, C, and D are coefficients of the covariates. The members of the Normal group in modeling were overshadowed since we are primarily interested in identifying the highly-contributed network measures to stock survivability in Continuing and Failed groups. Therefore, we modeled both groups separately and transformed the dependent variable into binomial-distributed responses. For instance, in the modeling of survivability probability members in the Continuing group would be assigned by “1” and others would have values of “0”, and vice versa. Of particular note is, in Table 1, the fact that the coefficients for both Continuing and Failed groups by end of 2013 are estimated with relatively low discrepancy comparing with the results obtained in other years. It takes only a moment’s reflection to realize that it might be because the features of low survivability of stocks in Failed group were not prominent at that time.

In Continuing group (Table 1), estimated coefficients for Intercept, A, and Node degree, B, are relatively stable throughout entire four years with average of -3.01 and 0.006 respectively. Results from Degree ratio, C, and Node strength, D, on the other hand show instability and divergent features. Conversely, it is hard to identify any convergent and stability in coefficients of the Failed group, network measures in this group altered in each time, and this could imply the unusual behavior of a node during the course of becoming increasingly vulnerable until it failed, like violently fluctuated before bankruptcy. Therefore, we write models for both groups in 2016 as:

In order to investigate further, we performed an analysis of deviance to test the significance of the interactive predictors. Table 2 consists of significance result from coefficients estimation and analysis of deviance for each predictor. One could notice that the node degree and strength are the first two significant terms in coefficient estimation according to \(z-\)value tests. Most importantly, the regression can only show us how variation in predictive variables co-occurs with variation in response. What regression cannot show is a cause-and-effect relationship since causation needs extensive studies to be analytically demonstrated. All that regression analysis can tell us is the correlation exists among survivability resilience, node degree, and strength.

Nevertheless, observations from deviance column suggest that the node degree has the most significant difference in interaction terms. As can be seen from the Continuing group, node degree obtains high deviance in all three predictive variables, followed by degree ratio and node strength, with small differences between them (except 2014). It denotes that the degree of a node contributes more to the resilient response probability comparing with other two terms.

On the other hand, in the Failed group the deviance of node degree in first two years, 2013 and 2014, were not as high as them in the Continuing group. Yet in last two years (2015 and 2016, the delisted time for most of the stocks in the Failed group), the node degree regains its dominant role in deviance analysis, followed by increasing deviance in node strength. Therefore, there do, as well, exists a positive influential power of node degree for characterizing low-survivability response probability. Hence, the probability of resilience can be roughly depicted as a function of node degree.

5 Conclusion

To conclude, (1) Although the overall network growth follows an exponential expansion, there is a “fission-fusion” mechanism found in the network topology for 40-years evolution. Such fluctuation could be the response of the market to unexpected external shocks. (2) The network measure, degree ratio, acts as an effective metric in signed networks and provides information on neighboring edges. Nonetheless, no significant correlation was, in this case, found between stock survivability resilience and degree ratio, i.e., uneven distributed negative connections in stock networks do not necessarily imply the component survivability. Conversely, it has correlations with other two network measures, node degree, and strength. (3) Analysis of deviance implies that node degree could be one effective parameter to characterize the survivability resilience of UK equities in London stock exchange, but consideration of overall neighborhood, degree ratio and node strength in signed networks, seem to be less descriptive.

This study provides insights for quantitatively assessing and modeling of survivability resilience of UK stocks in London exchange market, and proposes a new perspective to measure company resilience and bankruptcy in interdependent complex networks with their statistical topological measures. The future research could further develop the investigation in following ways:

-

The network construction methods in this paper could be altered by using excess returns by drawing more detailed investment data rather than just daily returns from the stock price.

-

The modeling process could show considerations to company-related explanatory variables and other node centrality measures such as betweenness, closeness, transitivity and node entropy. Also one may reframe the models using multinomial regression analysis by bringing the Normal group into full play.

References

Barabási, A.L.: Network Science. Cambridge University Press (2016)

Barrat, A., Barthelemy, M., Vespignani, A.: Dynamical Processes on Complex Networks. Cambridge University Press (2008)

Bonanno, G., Caldarelli, G., Lillo, F., Mantegna, R.N.: Topology of correlation-based minimal spanning trees in real and model markets. Phys. Rev. E 68(4), 046–130 (2003)

Bonanno, G., Caldarelli, G., Lillo, F., Micciche, S., Vandewalle, N., Mantegna, R.N.: Networks of equities in financial markets. Eur. Phys. J. B 38(2), 363–371 (2004)

Chi, K.T., Liu, J., Lau, F.C.: A network perspective of the stock market. J. Empir. Financ. 17(4), 659–667 (2010)

Davis, J.A.: Clustering and structural balance in graphs. Hum. Relat. 20(2), 181–187 (1967)

Gao, Y.C., Wei, Z.W., Wang, B.H.: Dynamic evolution of financial network and its relation to economic crises. Int. J. Mod. Phys. C 24(02), p. 1350005 (2013)

Harary, F., et al.: On the notion of balance of a signed graph. Mich. Math. J. 2(2), 143–146 (1953)

Harmon, D., Lagi, M., de Aguiar, M.A., Chinellato, D.D., Braha, D., Epstein, I.R., Bar-Yam, Y.: Anticipating economic market crises using measures of collective panic. PLoS ONE 10(7), p. e0131871 (2015)

Heiberger, R.H.: Stock network stability in times of crisis. Physica A 393, 376–381 (2014)

Huang, W.Q., Zhuang, X.T., Yao, S.: A network analysis of the chinese stock market. Physica A 388(14), 2956–2964 (2009)

Peron, K.T., da Costa, F.L., Rodrigues, F.A.: The structure and resilience of financial market networks. Chaos Interdisc. J. Nonlinear Sci. 22(1), 013117 (2012)

Khoja, L., Chipulu, M., Jayasekera, R.: Analysing corporate insolvency in the gulf cooperation council using logistic regression and multidimensional scaling. Rev. Quant. Financ. Acc. 46(3), 483–518 (2016)

Kuo, R.J., Chen, C., Hwang, Y.: An intelligent stock trading decision support system through integration of genetic algorithm based fuzzy neural network and artificial neural network. Fuzzy Sets Syst. 118(1), 21–45 (2001)

Lee, K.C., Han, I., Kwon, Y.: Hybrid neural network models for bankruptcy predictions. Decis. Support Syst. 18(1), 63–72 (1996)

Mantegna, R.N.: Hierarchical structure in financial markets. Eur. Phys. J. B 11(1), 193–197 (1999)

Mossman, C.E., Bell, G.G., Swartz, L.M., Turtle, H.: An empirical comparison of bankruptcy models. Financ. Rev. 33(2), 35–54 (1998)

Münnix, M.C., Shimada, T., Schäfer, R., Leyvraz, F., Seligman, T.H., Guhr, T., Stanley, H.E.: Identifying states of a financial market. Sci. Rep. 2 (2012)

Newman, M.: Networks: an introduction. Oxford university press (2010)

Onnela, J.P., Chakraborti, A., Kaski, K., Kertesz, J., Kanto, A.: Dynamics of market correlations: taxonomy and portfolio analysis. Phys. Rev. E 68(5), 056–110 (2003)

Shumway, T.: Forecasting bankruptcy more accurately: a simple hazard model. J. Bus. 74(1), 101–124 (2001)

Tumminello, M., Aste, T., Di Matteo, T., Mantegna, R.N.: A tool for filtering information in complex systems. Proc. Nat. Acad. Sci. U.S.A. 102(30), 10421–10426 (2005)

Vandewalle, N., Brisbois, F., Tordoir, X., et al.: Non-random topology of stock markets. Quant. Financ. 1(3), 372–374 (2001)

Verma, T., Russmann, F., Araújo, N., Nagler, J., Herrmann, H.J.: Emergence of core–peripheries in networks. Nat. Commun. 7 (2016)

Xu, R., Wong, W.K., Chen, G., Huang, S.: Topological characteristics of the hong kong stock market: a test-based p-threshold approach to understanding network complexity. Sci. Rep. 7 (2017)

Xuan, X., Murphy, K.: Modeling changing dependency structure in multivariate time series. In: Proceedings of the 24th International Conference on Machine Learning, pp. 1055–1062. ACM (2007)

Yook, S.H., Jeong, H., Barabási, A.L., Tu, Y.: Weighted evolving networks. Phys. Rev. Lett. 86(25), 5835 (2001)

Zhang, G., Hu, M.Y., Patuwo, B.E., Indro, D.C.: Artificial neural networks in bankruptcy prediction: general framework and cross-validation analysis. Eur. J. Oper. Res. 116(1), 16–32 (1999)

Acknowledgements

The research was conducted at the Future Resilient Systems at the Singapore-ETH Centre, which was established collaboratively between ETH Zurich and Singapore’s National Research Foundation (FI 370074011) under its Campus for Research Excellence and Technological Enterprise programme. All authors contributed to the conception and design of the study, have read and approved the final manuscript. The authors declare no conflict of interest and would like to thank Dr. Aakil M. Caunhye for his help on access of the data.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Tang, J., Khoja, L., Heinimann, H.R. (2018). Modeling Stock Survivability Resilience in Signed Temporal Networks: A Study from London Stock Exchange. In: Cherifi, C., Cherifi, H., Karsai, M., Musolesi, M. (eds) Complex Networks & Their Applications VI. COMPLEX NETWORKS 2017. Studies in Computational Intelligence, vol 689. Springer, Cham. https://doi.org/10.1007/978-3-319-72150-7_84

Download citation

DOI: https://doi.org/10.1007/978-3-319-72150-7_84

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-72149-1

Online ISBN: 978-3-319-72150-7

eBook Packages: EngineeringEngineering (R0)