Abstract

The Platinum Group Metals (PGMs) are of substantial technological prominence. They are also extremely rare, because of their low natural existence and their complicated extraction and refining process. To meet the future demand and preserve resources, it is essential to process end-of-life platinum-containing materials, such as catalytic converters. PGMs recovery from catalytic converters scrap commonly carried out by pyro/hydrometallurgical processes that involved thermal treatment followed by leaching and solvent extraction. This paper reviews current methods in used in the recovery of PGMs out of waste catalytic converters in Australia and discusses some of the key factors and opportunities in improving the existing methodologies. Emerging trends that are likely to affect the current or future PGM recovery are also explored.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

The Platinum Group Metals (PGMs) comprise platinum (Pt), palladium (Pd), iridium (Ir), osmium (Os), rhodium (Rh) and ruthenium (Ru) [1]. The elements of most commercial significance are platinum, palladium and, to a lesser degree, rhodium. The PGMs properties of commercial importance are their resistance to corrosion and oxidation, high-melting points, electrical conductivity and catalytic activity in the chemical, electrical, electronic, glass and motor vehicle industries. The automotive industry is the principal customer of PGMs. Autocatalytic converters in vehicles require palladium, rhodium, and platinum to convert exhaust emissions to water and carbon dioxide [2, 3]. Concentrations of precious metals in many End-Of-Life (EOL) products are much higher than those found in ore deposits [4]. Furthermore, the product represents a different and usually a much simpler matrix for metal separation, with less waste being generated, and a reduction in energy requirements to recover the target metal(s) as there is no need to remove large quantities of gangue material [5]. An automotive catalytic converter contains approximately 2000 g/mt of PGMs in the ceramic block, compared to average PGMs concentrations of <10 g/mt in most PGM mines [6]. Considering the high environmental impact of primary production of precious metals arising from low ore concentrations, difficult mining conditions, high energy and water use, high chemical consumption, large waste generation, and other factors, recovery of metals from EOL products is appealing. The key to high overall recycling rates is collection. Automotive catalytic converters are collected at a relatively high rate due to their ease of retrieval and intrinsic value. The global recycling rates for Pt, Pd, and Rh from automotive catalytic converters range from 50 to 55% [7, 8], indicating that around half of the catalytic converters produced are collected for recycling. The main focus of this paper is to review existing trends, and recycling strategies for platinum group metals in Australia .

PGMs State in Australia

PGMs are categorised as critical commodities in Australia . The critical commodities are defined as metals, non-metals and minerals that perform an essential economic function but are subject to a high risk of supply. The supply risk factors could be related to geological scarcity, a lack of substitution or recycling, geopolitical instability, a concentration of production and processing in particular countries or companies, a lack of large-scale markets, production only as a by-product and limited methods of recovery . Elements assessed as having category one (high critically) resource potential in Australia are rhodium, manganese, indium, platinum, rare earth elements and palladium. Table 1 compares demand in 2006 with projected demand in 2030, for platinum, palladium and copper in the emerging technologies sector (European Commission, 2010). In 2006 the demand from emerging technologies generally comprised only a small to moderate fraction of global production. Notably, projected annual demand in 2030 for indium, germanium and platinum all exceed current annual production (European Commission, 2010). Projected demand in 2030 is proportionately lower for silver, cobalt, palladium, titanium and copper. The data presented in Table 1 demonstrates that all of the elements listed could experience large to very large growth in demand by 2030.

Critical commodities assessed as having category one (high) resource potential in Australia are chromium, cobalt, copper, nickel, platinum-group elements (PGE), rare-earth elements (REE), and zirconium and critical commodities assessed as having category two resource potential in Australia are antimony, beryllium, bismuth, graphite, helium, indium, lithium, manganese, molybdenum, niobium, tantalum, thorium, tin, titanium, and tungsten. Supply of PGMs is dominated by South Africa and Russia; Australia has category one potential for discoveries of new resources due to favourable geology. Demand is expected to grow due to uses in vehicles, clean energy technologies and desalination. Table 2 presented the assessment of Australian potential to supply some of the critical commodities including PGMs.

Platinum-Group Metals Supply and Demand

According to figures published by Matthey [10], gross demand for platinum fell marginally in 2012 to 8.05 million ounces (Moz). Demand for platinum in auto-catalyst applications rose slightly in 2012 to 3.24 Moz. The demand for platinum in jewellery increased by 305,000 oz (oz) to 1.57 Moz while the gross industrial demand for platinum fell by 405,000 oz in 2012. Net identifiable physical demand for platinum in the investment sector reached to 455,000 oz in 2012, about 5000 oz lower than in 2011. Gross demand for palladium increased by 16% to 9.90 Moz in 2012. Gross demand for palladium from the auto-catalyst sector in 2012 reached an all-time high level of 6.62 Moz as a result of greater use of palladium in light duty gasoline vehicles in China and another rise in the ratio of palladium to platinum in auto-clasts for European diesel vehicles [11]. Demand for palladium in industrial applications fell by 100,000 oz to 2.365 Moz, while demand for jewellery fell by 60,000–445,000 oz but net physical investment demand switched from a negative of 565,000 to a positive of 470,000 or an increase of more than 1 Moz to 470,000 oz in 2012 [12]. A snapshot of the aforementioned data is also given in Fig. 3.

PGM Resources

Australia’s resources of PGMs remained unchanged at 4.7 tonnes in 2012. Western Australia (WA) and the Northern Territory (NT) hold all of Australia’s PGM Resources but additional resource in other States may be established [13]. However, the resource of PGMs in individual deposits within different State of Australia is often unrecorded, resulting in the overall unknown distribution of PGM resources [14]. Total identified resources of PGMs are about 276 tonnes. Of this amount, deposits that have only PGM resources account for about 51% of the total resources, although all of Australia’s production is as a by-product from PGM resources associated with nickel sulphide deposits in Western Australia [15]. Currently, 400 kg of the published PGM resource is accessible for mining while the balance of 4.3 tonnes occurs within national parks. The reason for this low Accessible figure for PGMs in Australia is that PGM resources are generally not reported by nickel-cobalt producers where PGMs are a by-product of nickel mining [16].

PGM Production

Australia’s PGM production (platinum and palladium) in 2012 amounted to 706 kg, which was very minor when compared to world standards [17]. The production was exclusively from nickel sulphide deposits hosted by Archean komatiitic rocks in the Yilgarn Craton of Western Australia [9]. Australia’s resource potential is high for discovery of major platinum-group element and chromium deposits [9]. Areas of known and inferred resource potential for these elements are shown in Fig. 1.

Platinum-group-metals deposit and platinum-group-metals-bearing nickel deposit [10]

Market Survey for PGM Recycling

The use of vehicles equipped with a catalytic converter resulted in the increase of world PGM demands. The market conditions of PGM, which influence their recycling, are rather volatile [18,19,20]. A market review was carried out and its outcome showed that, PGMs are mined almost exclusively in particular areas of Australia [21]. As their market operates under the influence of variable conditions, PGM prices show large variations; and some PGMs such as rhodium are not negotiable in stock market [22]. Rhodium production is associated with a concurrent production of substantial platinum amounts, which is undesirable [23]. Almost 81% of the rhodium mined is used for the manufacture of catalysts, compared with only 42% of platinum and only 8% of palladium [24]. The lack of considerable rhodium resources and the inability to satisfy the increased demands, which arose from the use of catalytic vehicles, resulted in the 10-fold increase of its price during the last decade [25,26,27].

Influence of Automotive Catalysts on PGM Demand and Prices

As shown in Fig. 2b, d, f, the global demand for platinum (Pt), palladium (Pd) and rhodium in auto-catalyst production between 2004 and 2013 had the highest levels among the other applications. The largest increase in demand for auto-catalyst (from 2009 onward) has come from Pd, which also had a considerable effect on the price of that metal (Fig. 2b). A sharp decline in the annual demand for Pt and Rh started roughly in 2008 and continued into 2010, and was mainly caused by the effect of global financial crises and falling stocks for these metals. The declining trend for Pd is slower as Pd withdrew from internal stocks within the automotive industry in 1999/2000. Since the use of automotive catalysts slowly started in the second half of the eighties, the PGM-demand curve shows a steady increase. Due to the recent strong market share of Diesel cars, the Pt demand for catalysts in Australia has been raised considerably. As can be seen from Fig. 2a, e, f, a strong discrepancy exist between PGMs supplies with South Africa being the largest supplier for Pt and Rh and Russia for Pd.

Platinum, palladium, and rhodium supply by region (a, c, e) and demand by application (b, d, f) since 2013 [10]

PGM Recycling Potential

With an average car life in Australia of over 15 years [28], the largest portion of the recyclable PGMs used for auto-catalysts is still on the roads. Total accumulative recycling quantities from end-of-life catalytic converters up to 2002 are estimated as 260 t globally [29]. In this context, the current car parks can be referred to as the “mine above ground”. Making use of this mine through recycling of car catalysts offers a valuable source for future PGM supply not only from an economical point of view but also in terms of securing sustainable supply of PGMs and decreases today’s heavy dependence on primary resources. Nevertheless, the share of secondary supply of PGMs for auto-catalysts is still insignificant [30]. The main reason might be that what we can recycle today from scrap catalysts commonly comes from catalyst production more than 10–12 years ago and at that time total PGM usage for this application was much lower [31]. So in a dynamically surging market, the recycling share seems to be insignificant. Extensive PGM-losses occur due to system leaks (e.g. scrap-car exports out of Australia) and inadequate operating of the recycling chain. However, with growing market maturity the recycling share has been improved lately. Figure 3 compared the global recovery of palladium (Pd) and platinum (Pt) from spent autocatalysts during 2008–2012. As it can be seen from Fig. 4, the global recovery of palladium increased by 4.5%, from 2008 to 2012, however for platinum the trend is quite variable in that the Pt recovery decreased sharply during 2008–2009 then slightly increased to the level of 2011.

Recovery of palladium (Pd) and platinum (Pt) from spent autocatalysts [32]

Flow chart of recovery of PGMs from waste catalytic converter via copper collection (a), Iron collection (b) [33]

PGMs Recovery Techniques

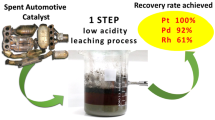

Selection of an efficient and economic recycling technique for PGM recovery out of waste catalytic converter mainly depends on catalytic supporter and PGM loading content and other base metals involved in the recovery process [30]. The spent catalytic converters are first separated, shredded, ground and then processed by either pyro/hydrometallurgical or a combination of both.

Pyrometallurgical Route

In the pyrometallurgical route , waste catalysts are melted by adding flux components and metal collectors at high temperatures to form PGM-containing alloys. These alloys are then used to extract PGMs through proper refining techniques. The smelting technology, which produces a PGM-containing alloy, is largely controlled by the addition of different collectors, such as copper, iron, lead, matte, etc. [34]. Among all existing methodologies such as vaporization and sintering, the smelting process is more promising however the basic operation can be further upgraded by utilising an appropriate flux and collector along with suitable pre-treatment technique [33]. The pyrometallurgical process may consist of primary pretreatment phases such as dismantling and incineration of nonmetallic components, calcination, or reduction. After that, high-temperature incineration is use in which an appropriate collector (base metal) such as lead, copper, nickel, etc., collects the PGMs and produces PGM-enriched alloy. Simultaneously the catalyst carrier, such as alumina, is melted with suitable fluxes to acquire a low-viscosity liquid slag [35]. While PGM separates from the slag the PGM containing alloy will be sent for purification. Selecting the right collector is critical in PGM recovery through the pyrometallurgical route . The important parameters in the collector selection include melting points, chemical properties of the collector and common solubility. Usually copper, lead, iron, matte and waste printed circuit board which contained the aforementioned metals are suitable as a collector for smelting of catalytic converter scraps. Other metals such as calcium, magnesium, and zinc generally lead to poor total recoveries of PGMs (<80%). Figure 4a shows copper collection process which consists of crushing, milling, homogenization, pelletizing, drying, melting, electrolysis, and refining [35]. The ceramic carrier of PGMs in waste catalyst converter generate a slag with less than 0.2 wt% copper after enrichment of PGMs into the molten copper. The created slag is then poured out of the furnace for recycling of valuable components [33]. The molten copper contained PGM is casted in anode form about 1 wt% PGMs for electrolysis. A slime with around 20–25 wt% PGMs is collected on the anode after electrorefining. High-purity copper (99.99%) is caught on the cathode. Figure 4b shows flow chart of recovery of PGMs from waste auto catalytic convertor through iron collection. Iron is a low-cost collector with high chemical affinity for PGMs to create solid solution [36]. In this method, crushed waste auto catalysts blended with iron ore. a reducing agent such as coke, and flux such as CO, are melted together in an electric arc furnace at a temperature of 1450 °C [34]. The alloy and slag can simply separate because of the large difference between densities of the obtained Fe-PGMs alloy and slag [37, 38].

Hydrometallurgical Route

In the hydrometallurgical route , PGMs are recycled by dissolving in aqua regia and acids, including hydrochloric acid, nitric acid and sulfuric acid, along with oxygen, iodine, bromine, chlorine or hydrogen peroxide [30]. The main process of recovering PGMs from spent catalyst by the hydrometallurgical process is shown in Fig. 5. In general, the waste auto catalytic converter is pre-treated under some settings to eliminate organic substances and carbon deposition on the surface, which is then followed by the hydrometallurgical treatment [30]. Finely-ground waste catalytic converter is dissolved by sulfuric acid in this manner and Pt and Pd are concentrated in the leached residue. According to Dong [30], a few dissolved PGMs can be recovered by a cementation process using aluminum powder as reducing agent. Some researchers have also investigated the recovery of PGM out of spent auto exhaust catalytic converter through pressure leach by sulfuric acid. In Australia , the prevailing hydrometallurgical route in use is through leaching of Pt and other PGMs. Leaching is usually carried out using different liquid mediums such as sulfuric acid, hydrochloric acid, nitric acid, sodium cyanide, chloride or iodide solutions to selectively extract PGMs from spent catalytic converter. The oxidizing agents are then added to improve the leaching efficiency of PGMs.

The principal flow sheet of PGM recovery by hydrometallurgical process [30]

The Method in Use

The dominant methodology in use in Australia for recovery of PGMs from secondary sources consists of a combination of pyrometallurgical, hydrometallurgical and electrolytic steps within one process. The PGMs contained wastes are mixed with a collector metal, such as Cu and smelted in a shaft furnace to extract the PGMs from the waste material by forming an alloy with the added metal (Fig. 6). The resulting Cu alloy contains up to 20 wt% PGMs [34]. Slag-forming agents are fed into the furnace to remove oxidic impurities. Afterwards, the Cu-PGM alloy is cast into anodes and subjected to electrolysis, through which PGMs are accumulated in the sludge. Alternatively, the alloy can be leached with sulfuric acid, with the PGMs remaining completely in the solid, undissolved residue. Subsequently the residue is treated comparably to original raw materials, starting with aqua regia leaching [34].

Proposal for an Improved Process

A potential method for recovery of PGMs contained in waste automotive catalytic converters is proposed in this section. The method entails pyrolytic concentration in an electric arc furnace followed by a subsequent electrochemical separation. We believe the approach holds promising recovery rate and is relatively simple to implement. The process starts with the melting of crushed automotive catalysts in an electric arc furnace to obtain a collector-metal with PGM content of up to about 30%. The collector-metal is then subjected to electrochemical separation. The charge to the electric arc furnace consisted of approximately 75% crushed catalytic converter, 16% lime, 5% finely dispersed coke and 4% collector-metal (iron-ore concentrate). The holding temperature inside the furnace is 1600 °C. Collector-metal in the form of cast-iron chips placed on the bottom of the furnace then crushed catalysts mixed with finely burnt lime poured into the furnace. The collector-metal added to the composition of the coke. This led to the PGMs combining with the collector-metal before the coke melted. The PGMs became coarser in the process and quickly settled onto the bottom of the furnace after the charge melted. This approach to collection shortens the process, while the introduction of iron-ore concentrate (99% FeO) and a reducing agent into the coke makes it possible for the collection to take place at the molecular level rather than the droplet level. Heat analysis showed that coke reduces the amount of recovered metal due to an increase in the temperature of the melt. The addition of a collector-metal to the coke decreases the volume of dust-gas emissions and increases PGM yield. The main advantage of the proposed method is that the formation of the collector-metal shortens the subsequent processing time and the chemical composition of the collector-metal can be reliably determined. Introduction of nitric acid is the next stage of the process which leads to a selective separation of PGMs. The amount of acid required is about 5% of the feed inlet to the furnace. This low consumption of acid makes the method more efficient and cost-effective than other acid-based technologies. However, similar to all other chemical conversion processes, this stage generates waste products and requires the use of some other waste treatment equipment [39].

Conclusion

The unique properties of platinum group metals and a lack of alternatives for their application in modern technologies, especially automotive industry underpin their strategic status. Due to scarcity and high value of these metals, there is an increasing interest towards their recovery from wastes , such as end-of-life auto catalytic converter . Recycling of metals from end-of-life products can augment supply in the future, given a sufficient price incentive and/or regulation. This paper presented an overview of PGMs resource and production in Australia . The supply and demand for PGMs and their potential recycling rate has also been discussed. The main processes for the recovery of PGMs from end-of-life automobile catalytic converter namely hydrometallurgical and pyrometallurgical have been explored and a new methodology for PGMs recovery has been proposed by the inclusion of a reducing agent and an ore-bearing material to the coke. The use of iron-ore concentrate and finely dispersed coke makes it possible to collect PGMs throughout the volume of the coke and maximize PGMs recovery. While recycling is not sufficient to alleviate all challenges associated with considerable growth demands, it can play a valuable role in improving the security of metal supplies. Finally, a better understanding of the risks associated with PGMs recycling is a critical factor for efficient recovery. The inclusion of the collector-metal such as iron-ore concentrate in coke makes it possible to shorten the holding time for the melt and reduce the volume of dust-gas emissions which is the foremost environmental benefit for the proposed method. It is equally important for the minimisation of environmental impacts arising from new recycling facilities, and for defining a comprehensive base to compare PGMs recycling with primary production. The values of the existing PGMs recovery facilities, based on the economic, technical and environmental factors, suggest that recycling projects are the most advantageous.

References

Suoranta T, Zugazua O, Niemelä M, Perämäki P (2015) Hydrometallurgy 154:56

Barakat MA, Mahmoud MHH (2004) Hydrometallurgy 72:179

Hoffmann JE (1988) JOM 40:40

Zhang J, Everson MP, Wallington TJ, Field FR III, Roth R, Kirchain RE (2016) Environ Sci Technol 50:7687

Froehlich P, Lorenz T, Martin G, Brett B, Bertau M (2017) Angew Chem Int Ed Engl 56:2544

Angelidis TN, Sklavounos SA (1995) Appl Catal A Gen 133:121

Moskalyk RR, Alfantazi AM (2003) Miner. Eng. 16:893

Shelef M, McCabe RW (2000) Catal Today 62:35

Skirrow RG, Huston DL, Mernagh TP, Thorne JP, Duffer H, Senior A (2013) Critical commodities for a high-tech world: Australia’s potential to supply global demand. Geoscience Australia Canberra

Mathey J (2013) Platinum 2013. http://www.platinum.matthey.com/media/1614079/platinum_2013.pdf

Chegwidden J, Kingsnorth DJ (2011) Present Inst Anal Glob Secur

Panayotova M, Panayotov V (2012) Univ Min Geol

Australia’s Identified Mineral Resources (2016). http://www.ga.gov.au/scientific-topics/minerals/mineral-resources/platinum#_edn1. Assessed 15 July 2017

Jaireth S, Hoatson DM, Miezitis Y (2014) Ore Geol Rev 62:72

Laznicka P (2014) Ore Geol Rev 62:259

Golev A, Scott M, Erskine PD, Ali SH, Ballantyne GR (2014) Resour Policy 41:52

Mudd GM (n.d.) Platin Met Rev 56:2

Massari S, Ruberti M (2013) Resour Policy 38:36

Schlinkert D, van den Boogaart KG (2015) Resour Policy 46:272

Binnemans K, Jones PT, Blanpain B, Van Gerven T, Yang Y, Walton A, Buchert M (2013) J Clean Prod 51:1

Golev A, Scott M, Erskine PD, Ali SH, Ballantyne GR (2014) Resour Policy 41:52

Pinkham M (1993) Am Met Mark 101:8

Mouza AA, Peolides CA, Paras SV (1995) Resour Conserv Recycl 15:95

Hageluken C (2006) METALL-BERLIN 60:31

Steel MCF (1991) Stud Surf Sci Catal 71:105

Rosso JP (1992) Chem Eng Prog 88:66

Gambogi J (2013)

Haque N, Hughes A, Lim S, Vernon C (2014) Resources 3:614

Nassar NT (2015) Global stocks and flows, losses, and recoveries of platinum-group elements. Yale University

Dong H, Zhao J, Chen J, Wu Y, Li B (2015) Int J Miner Process 145:108

Bertau M, Froehlich P, Brett B, Lorenz T, Martin G (2016) Angew Chem Int Ed

Matthey J (2013) Platin Today

Peng Z, Li Z, Lin X, Tang H, Ye L, Ma Y, Rao M, Zhang Y, Li G, Jiang T (2017) JOM 69:1553

Ghodrat M, Rhamdhani MA, Sharafi P, Samali B (2017) Metall Mater Trans E

Ivanović SZ, Trujuć VK, Gorgievski MD, Mišić LD, Božić DS (2011) 15th international research/expert conference, p 701

Fornalczyk A, Saternus M (2013) Metabk 52:219

Jha MK, Lee J, Kim M, Jeong J, Kim B-S, Kumar V (2013) Hydrometallurgy 133:23

Ghodrat M, Rhamdhani MA, Khaliq A, Brooks G, Samali B, Mater J (2017) Cycles Waste Manag 1

Ghodrat M, Rhamdhani MA, Brooks G, Masood S, Corder G (2016) J Clean Prod

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Minerals, Metals & Materials Society

About this paper

Cite this paper

Ghodrat, M., Sharafi, P., Samali, B. (2018). Recovery of Platinum Group Metals Out of Automotive Catalytic Converters Scrap: A Review on Australian Trends and Challenges. In: Lambotte, G., Lee, J., Allanore, A., Wagstaff, S. (eds) Materials Processing Fundamentals 2018. TMS 2018. The Minerals, Metals & Materials Series. Springer, Cham. https://doi.org/10.1007/978-3-319-72131-6_13

Download citation

DOI: https://doi.org/10.1007/978-3-319-72131-6_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-72130-9

Online ISBN: 978-3-319-72131-6

eBook Packages: Chemistry and Materials ScienceChemistry and Material Science (R0)