Abstract

This study was to focus on the patterns of economic booms (bull markets) and recessions (bear markets) among world stock exchanges such as Europe (Euro Stoxx), USA (S&P 500), Asia (SSE composite index and Nikkei 225 index) and ASEAN (FTSE ASEAN). Monthly data was collected during 2000 to 2016. Econometrically, we employed Markov Switching Bayesian Vector Autoregressive model (MSBVAR) to determine regional switches within these financial data sets as well as CD-Vine copula approaches was used to explore the contagions and patterns of structural dependences. To clarify the connectional details in each type of switching regimes, the results presented the Elliptical copula was chosen and it indicated these monthly collected data contained symmetrical dynamics co-movements. In addition, it implied the stock markets were assumed to have small fluctuations since the governments had stable policies to control the risk and asymmetric information in financial markets efficiently. Base on CD-Vine copula trees, the results indicated Asia and European stock markets had a strongly dependence in economic booms and recessions during the pre-crisis period (2000 to 2008). Conversely, in the post-crisis period, the US stock market and ASEAN stock market became the strong dependence with Europe. This meant that capital flows was mostly transferred between Europe and Asia financial markets during the pre-crisis periods (2009 to 2016). After that, the direction of capital flows were changed dramatically to the US stock market in the post-crisis periods. Predictively, this seems that the capital flows will return to European and US financial market, which these two continents have a strongly long-term financial dependence and deeply positive diplomacy.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Because the financial crisis negatively affected the economic system in the United States during 2008, triggered by collapse in house prices, and caused the Great Recession. This leaded the world economy to be suffered dramatically (Bloomberg 2009). This was the underline of the global financial crisis and caused European banks to enormously lost their liquidity in the ABS market. Moreover, the reliance on US currency for European banks had been sharply decreased (Lane 2013). Additionally, this can be seen from the low expansion rates of GDP in ASEAN, US, Europe, Japan and China during the period between 2000 and 2015, which were respectively represented in Figs. 1 and 2. For the pre-crisis (2000–2008), GDP in these five countries slightly grew up. In particularly, the economic expansion rate of japan did not change. In the post-crisis (2009–2015), this can be seen that the economic growth in many countries around the world continuously grew up. This is because the effect from the transferences of capital flows in the term of financial markets. Accordingly, this paper intensively explored a structural cycling pattern between them in the Worlds Stock Exchanges as well as rare financial structural dependences, and these findings can be the solution to understand the deeply financial structures between major stock markets around the world that is useful information for supporting domestic and foreign investors to predict and plan their investments.

2 The Objective and Scope of Research

The objective of this research is to explore the pattern of structurally financial dependences in bull and bear markets among stock markets in US, Europe, Asia, and ASEAN during 2000 to 2016. The monthly time-series data such as in S&P 500 index (US), Europe (the Euro Stoxx), China (SSE composite index), Japan (Nikkei 225 index) and ASEAN (FTSE ASEAN) were collected to be considered, and they were divided into 2 periods: pre-crisis (2000 to 2008) and post-crisis (2009 to 2016).

3 Methodology

3.1 The Markovian Switching Bayesian VAR Model

This paper has two steps to determine the pattern of structural dependences among the capital markets. First, the Markov Switching Bayesian VAR model was employed to determine regime changes within data, and examine correlations among the European, US, Asia and ASEAN stock market. This found regimes for bull and bear markets.

The Markovian switching is constructed by combining two or more dynamic models via the Markovian switching mechanism (Hamilton 1994) and this can be shown in Eq. 1.

-

\(\varepsilon \) = i.i.d. random variables with zero means and variances \(\sigma _{t}^{2}\)

-

\(|\beta |<1.\)

This is stationary AR (1) processed with mean \(\alpha _{0}/ (1- \beta ) \)when \(S_{t}\) = 0, and it switches to another stationary AR (1) process with mean \((\alpha _{0}+\alpha _{1})/(1-\beta )\) when \(S_{t}\) is changed from zero to one. Then it provided that \(\alpha _{1}\ne 0\), this model admits two dynamic structures at different levels, depending on the value of state variables \(S_{t}\).

The evaluation of the latent variable drives regime changes, \(S_{t}\), is governed by the first-order Markov chain condition with constant transition probabilities expressed as the (SxS) transition probability matrix (P):

Bayesian statistics was applied to do econometrical estimations, and this inference allows us to obtain a joint posterior distribution of parameters and latent variables. Bayesian simulated methods are well suited to estimate Markov Switching models (Kim and Nelson 1999). Conditionally, the value at risk (VaR) analysis allows parameters of the model to be considered as random variables. Generally, the typical VAR analysis is often constrained by the limited size of data sets, which are not compatible models with large numbers of parameters. The Bayesian method tackles this over-parameterisational problem by assigning initial probabilities into many parameters. Furthermore, the construction of a BVAR model will reduce the complexities involved future extensions (Canova 2007).

3.2 ARMA-GJR Model for Marginal Distributions

Technically, the CD-Vine copula was adopted to estimate the pattern of structural dependences among stock markets. We will find the major stock markets of bull and bear markets in pre-post crisis. ARMA-GJR model was used to conduct marginal distributions for the copula model. The form of the ARMA (P, Q)-GJR (K, L) model can be expressed as Eq. 4.

where \(\varSigma _{i=1}^{p}\phi _{i}<1,\omega>0 ,\alpha _{i}>0,\beta _{i}>0,\alpha _{i}+\gamma _{i}>0 \) and \(\varSigma _{i=1}^{k}\alpha _{i}+\varSigma _{i=1}^{l}\beta _{i}+\frac{1}{2}\varSigma _{i=1}^{k}\gamma _{i}<1\). The formulas (4) and (6) are call mean equation and variance equation, respectively; the formula (5) describes the residual \(\varepsilon _{t}\) is consist of standard variance \(h_{t}\) and standardized residuals \(\eta _{t}\); the leverage coefficient \(\gamma _{i}\) is applied to negative standardized residuals. In addition, the standardized residual are assumed to be the skewed student-t or skewed generalized error distribution and the cumulative distributions of standardized residuals are formed to plug into copula model.

3.3 Copula

The fundamental theorem is based on the concept of (Sklar 1959) and this can be shown in Eq. 7,

-

F: n-dimensional distribution with marginal \(F_{i}\) , i = 1, 2, 3

-

\(x_{1},x_{2},\ldots ,x_{n}\) :random vectors

-

C: n-copula for all \(x_{1},x_{2},\ldots ,x_{n}.\)

The function C is a distribution function that has uniform margins between zero and one, and it is labelled as the copula function. It binds the univariate margins F1 and F2 to produce bivariate distribution F.

3.4 The C-D Vine Copulas Construction

Vine copula models are graphical representation to specify pair copula constructions (PCCs) introduced by (Joe 1996). These models are consequently developed by Bedford and Cook (2001, 2002). Basically, a principle for constructing multivariate copula generated from the product of bivariate pair copula was statistically described as canonical (C-) vines and (D-) vines by Aas et al. (2009). This contribution was a flexible model since bivariate copulas can easily accommodate complex structural dependences such as asymmetric dependences or strong joint tail behaviors (Joe et al. 2010). Based on previous reviews, this has been already pointed out the estimated patterns of relation among financial markets in world exchanges are defined as \(X=x_{1},x_{2},x_{3},x_{4},x_{5}\), with marginal distribution function \(F_{1},F_{2},F_{3},F_{4},F_{5}\), and corresponding densities. As a result, it can be written as Eq. 8.

where C is the copula associated with F via Sklar theorem. From Eq. 5, it can be determined the conditional density of \(x_{2}\), and given \(x_{1}\) as

and

and

and

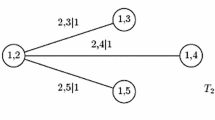

Therefore, the five-dimensional joint can be shown in terms of bivariate copula \(c_{1,2}\), \(c_{2,3|1}\), \(c_{1,3}\), \(c_{3,4|1,2}\), \(c_{1,4}\), \(c_{2,4}\), \(c_{4,5|1,2,3}\), \( c_{1,5}\), \(c_{2,5}\), \(c_{3,5}\) Based on graphical of canonical (C-) and D-vines copula was presented by Fig. 3.

Considering Fig. 3, on the left-panel trees represented the decomposition of a five-dimensional joint density function. The circled nodes are on the first-tree and it showed the four marginal density functions, \(f_{1}, f_{2}, f_{3}, f_{4}, f_{5}\). The remaining nodes on the other trees are not used in the figure. Each edge corresponds to a pair-copula function.

On the other hand, on the right-panel trees represented the decomposition of five-dimensional joint density functions. The circles nodes showed the five marginal density functions written as \(f_{1}, f_{2}, f_{3}, f_{4}, f_{5}\). Each edge is labeled with the pair-copula of the variables. The edges in level i become nodes for level \(i+1\). The edges for the first tree are labeled as 1,2, 2,3, 3,4 and 4,5. The second tree has edges labeled as 1, 3|2, 2, 4|3 and 3, 5|4. The third tree’s edges were labeled as 1, 4|23 and 2, 5|34. Finally, the tree number fourth has only one edge labeled as 1, 5|234 (Durante and Sempi 2009).

3.5 Bivariate Copula Families

The package CD-Vine provides a wide range of bivariate copula families, which are divided into two major classes such as elliptical and Archimedean copulas (Joe 1997 and Nelsen 2006). Elliptical copulas are directly obtained by inverting Sklar Theorem (Eq. 7). Given a multivariate distribution function F with invertible margins \(F_{1}\) and \(F_{2}\), then

-

C: F is elliptical

-

\(u_{1},u_{2}\) \(\in \) [0, 1]

-

F: distribution functions of invertible marginals \(F_{1},F_{2}\),

which are also implemented in CD-Vine, and they are the multivariate Student-t copula. Consequently, this type of copula models can be expressed in Eq. 20,

-

\(\rho \in \) (−1,1) and is dependence parameter

-

\(\nu \): degree of freedom for student t copula \(\nu > 2\).

Which \(t_{\rho ,\nu }\) is the multivariate Student-t distribution function contained correlation parameters, \(\rho \) and \(\nu \), \(t_{\nu }^{-1}\) denotes the inverse univariate Student-t distribution function with \(\nu \) degrees of freedom. Both copulas are obviously symmetric and have lower and upper tail dependence coefficients.

Multivariate Archimedean copulas, on the other hand, are defined as

where: \([0,1]\cdots [0,\infty ]\) is a continuous strictly decreasing convex function such that \(\varPsi (1)= 0\) and \(\varPsi ^{-1}\) is the pseudo-inverse,

-

\(\varPsi \) is called the generator function of the copula C.

In addition, this paper implemented the common single parameter, which is in the Archimedean family (Clayton copula). This is a more flexible structure allows non-zero lower and upper tail to be the different dependent coefficient (Nelson 2006), then the Clayton are defined as

-

parameter range: \(\theta >0\)

-

\(Kendall 's^\tau \): \(\frac{\theta }{\theta +2}\),

-

Tail dependence (lower, upper): \((2^{\frac{-1}{\theta }},0)\).

4 Data Description

The world stock exchanges data considered in this study consisted five largest economics, for instances, the United States stock market (S&P 500 index), European stock markets (the Euro Stoxx), China stock market (SSE composite index), Japan stock market (Nikkei 225 index) and ASEAN stock markets (FTSE ASEAN). Basically, all of data was transformed to be standardized residuals of monthly log return observations (203 observations).

Considering Fig. 4, it provided the descriptive index returns of monthly data in world exchanges during 2000 to 2016. Furthermore, Table 1 presents the generally statistical data.

5 Empirical Results of Research

5.1 The Results of Marginal Testing for Copula Model Estimation

Based on the LM-test, this already confirmed that all of residual terms was satisfied for marginal models, which were employed to estimate the CD-Vine copula models. Additionally, the result of the KS testing already indicated that the marginal model is efficiently specified to estimate the CD-Vine copula model (Table 2).

5.2 The Estimated Results of the Bull and Bear Markets in Pre-crisis and Post-crisis Periods Based on the Markovian Switching Bayesian VAR Model

Expressly, the results were represented in Table 3 showed that the Markovian Switching Bayesian VAR model computationally estimated the fluctuated regimes of five financial stock indexes. Econometrically, the regimes are defined as Bull and Bear market. First, the index of the S&P financial market contained boom periods rather than recessions, which were 113 months and 90 months, respectively. Second, Euro stock indexes had recession situations more than expansions, which were 94 months and 109 months, respectively. Third, the financial market in China (SSE) included expanding times more than recessions, which were 110 months and 93 months, respectively. Forth, Japanese financial equity (Nikkei 225) contained booming situations more than recessing times, which were 109 months and 94, respectively. Lastly, the financial market in South East Asia (FTSE ASEAN) had the fluctuated situations between bull and bear markets, which had 103 months for the booming periods and 100 months for recessions.

5.3 The Estimation Results of the Contagion and Pattern of Structural Dependences Toward World Exchanges in Bull and Bear Markets Based on CD-Vine Copula Approach

There are two kinds of copula estimations. Elliptical and Archimedean copulas were used to estimate the pattern of dependences among world exchanges. The estimated result was investigated by CD-vine copula approach and it was represented in Appendix A. The best model based on AIC and BIC is Elliptical copula, which is the T-copula model. Accordingly, this result based on CD-vine indicated that there is a contagion among the two periods, which are the pre-crises periods (2000–2008) and post-crises periods (2009–2016).

5.4 The Results of Estimation in the Pattern of Structural Dependences Among Five Stock Markets of Economic Boom (Bull Market) and Economic Recession (Bear Market) Based on CD-Vine Trees from T-copula

5.4.1 Pre-crises Periods (2000–2008)

-

(a) The Elliptical t-copula of C-vine in Bull and Bear markets

As we see in Fig. 5, the financial market in Europe was assumed to be the central place that capital inflows and outflows were transferred during the post-crises periods. Obviously, in the Bull situation, the markets between Europe and Asia (ASEAN, Japan, and China) were the strongly structural dependence in terms of capital flows. Similarly, in the Bear market, the Asian financial market still strongly depended on the recessing time in the European market, but the US financial market had a weakly structural dependence with European in the post-crisis periods. As a result, this implied that the capital flows had been mostly transferred between Europe and Asia during 2000 to 2008.

-

(b) The Elliptical t-copula of D-vine in Bull and Bear markets

Considering Fig. 6, the D-vine copula model provided the different structural dependence from the C-vine model. In other words, the estimated result stated that the Asean stock market strongly depended on the Japanese financial market. This structural dependence was stronger than the pair of European and Asean. Accordingly, this can be indicated that most of capital inflows were transferred around Asia continent for bull situations during the pre-crises periods. On the other hand, for recessing times during pre-crises periods, the D-vine result (as seen details in Fig. 7) showed that capital inflows were inversely moved from Asean to Europe, but the structural dependence between the US financial market (Euro stoxx) and European market are quite weak.

5.4.2 Post-crises Periods (2009–2016)

-

(a) The Elliptical t-copula of C-vine in Bull and Bear markets

Considering into C-vine’s trees in Fig. 8, the European financial market and Asia stock indexes were a strong dependence during 2009 to 2016. In other words, capital inflows were still exchanged intensively between European and Asian stock markets after the economic crisis, especially the subprime crisis, had been passed. Conversely, US and Japanese stock markets became the strongly structural dependence with the European financial market in recessing periods.

-

(b) The Elliptical t-copula of D-vine in Bull and Bear markets

According to details of the D-vine copula in bull periods during the post-crises periods (as seen in Fig. 9), it is obvious that US and Asean stock markets strongly depended on the Euro financial market. This can be implied that capital inflows from Europe had been started to change the direction from Asian continent to North America. However, the structural dependences of financial markets between Asia, North America, and Europe were still strong in the post-crises periods. On the other hand, speaking to details of the D-vine copula in bear periods during the post-crises periods (as seen in Fig. 10), the result showed that capital inflows were transferred inside Asia continent rather than internationally moving to other continents in the recessing time during 2009 to 2016.

6 Conclusion

For this paper, the patterns of structural dependences among world stock exchanges were successfully estimated. Empirically, the section of MSBVAR results were confirmedly divided the five financial indexes into two periods, including economic boom (bull markets) and economic recession (bear markets). This explained that all of five financial markets contained cyclical movements and fluctuated time-series trends, which cannot be directly estimated by assumptions of linearity. This study also found that there is a contagion among these financial indexes as well as two types of copula models, including Elliptical and Archimedean, were investigated. However, the Elliptical copula is chosen to estimate collected variables in this paper. The study on the structural cycling patterns clarified the Elliptical t-copula indicated the information is symmetric. This implied that investors could easily receive same information inside these five financial markets (Nermuth 1982). Therefore, this stated that governments have freedom choices to interfere the financial markets or let them adjust themselves to have an independently stable system for controlling risks and asymmetric information in their financial structures. Interestingly, the prior research of Lemmon and Ni (2008) found that speculative demands for equity options were positively related to most investor sentiments. Especially, if they have high leverage, they are also perfect vehicles for speculation. This empirical research confirmed that the Elliptical copula was suitable to estimate stock markets in this paper.

Specifically considering Elliptical CD-vine copula’s results (t-copulas), in the pre-crisis (2000–2008), this seemed that capital flows were mostly transferred between Europe and Asia stocks in both bull and bear markets, but there was a small capital flow between US and European financial markets. In other words, there was the strongly structural dependence of European and Asia stocks since the financial crisis in US was starting, and this cause negatively impacted the confidence rate of financial sectors in US during that period. In the post-crisis (2009–2016), similar to the result of the pre-crisis periods, the capital flows between Europe and Asia were still a strong dependence in bull situations, and the financial markets between US and Europe were defined as a structural independence, meaning that capital flows from these two continents mostly moved out to other places rather than domestically transferring. Interestingly, in recessing time, the CD-vine copulas’ results indicated that the direction of capital flows from Europe to US stock markets (North America) had been returned since US’s economy was systematically recovered. Hence, this can be implied that the transference of funds, especially from Europe to US financial markets, would be predictively increased in the upcoming future, and financial investments in US can be positively mentioned.

References

Avdulai, K.: The Extreme Value Theory as a Tool to Measure Market Risk. Working paper 26/2011.IES FSV. Charles University (2011). http://ies.fsv.cuni.cz

Behrens, C.N., Lopes, H.F., Gamerman, D.: Bayesian analysis of extreme events with threshold estimation. Stat. Model. 4, 227–244 (2004)

Chaithep, K., Sriboonchitta, S., Chaiboonsri, C., Pastpipatkul, P.: Value at risk analysis of gold price return using extreme value theory. EEQEL 1(4), 151–168 (2012)

Christoffersen, P.: Evaluating interval forecasts. Int. Econ. Rev. 39, 841–862 (1998)

Einmahl, J.H.J., Magnus, J.R.: Records in athletics through extreme-value theory. J. Am. Stat. Assoc. 103, 1382–1391 (2008)

Embrechts, T., Resnick, S.T., Samorodnitsky, G.: Extreme value theory as a risk management tool. North Am. Actuar. J. 3(2), 30–41 (1999)

Ernst, E., Stockhammer, E.: Macroeconomic Regimes: Business Cycle Theories Reconsidered. Working paper No. 99. Center for Empirical Macroeconomics, Department of Economics, University of Bielefeld (2003). http://www.wiwi.uni-bielefeld.de

Garrido, M.C., Lezaud, P.: Extreme value analysis : an introduction. Journal de la Socit Franaise de Statistique, 66–97 (2013). https://hal-enac.archives-ouvertes.fr/hal-00917995

Hamilton, J.D.: Regime Switching Models. Palgrave Dictionary of Economics (2005)

Jang, J.B.: An extreme value theory approach for analyzing the extreme risk of the gold prices, 97–109 (2007)

King, R.G., Rebelo, S.T.: Resuscitating Real Business Cycles. Working paper 7534, National Bureau of Economic Research (2000). http://www.nber.org/papers/w7534

Kisacik, A.: High volatility, heavy tails and extreme values in value at risk estimation. Institute of Applied Mathematics Financial Mathematics/Life Insurance Option Program Middle East Technical University, Term Project (2006)

Kupiec, P.: Techniques for verifying the accuracy of risk management models. J. Deriv. 3, 73–84 (1995)

Manganelli, S., Engle, F.R.: Value at Risk Model in Finance. Working paper No.75. European Central Bank (2001)

Marimoutou, V., Raggad, B., Trabelsi, A.: Extreme value theory and value at risk: application to oil market (2006). https://halshs.archives-ouvertes.fr/halshs-00410746

Mierlus-Mazilu, I.: On generalized Pareto distribution. Rom. J. Econ. Forecast. 1, 107–117 (2010)

Mwamba, J.W.M., Hammoudeh, S., Gupta, R.: Financial Tail Risks and the Shapes of the Extreme Value Distribution: A Comparison between Conventional and Sharia-Compliant Stock Indexes. Working paper No. 80. Department of Economics Working Paper Series, University of Pretoria (2014)

Neves, C., Alves, M.I.F.: Testing extreme value conditions an overview and recent approaches. Stat. J. REVSTAT 6, 83–100 (2008)

Perez, P.G., Murphy, D.: Filtered Historical Simulation Value-at-Risk Models and Their Competitors. Working paper No. 525. Bank of England (2015). http://www.bankofengland.co.uk/research/Pages/workingpapers/default.aspx

Perlin, M.: MS Regress - The MATLAB Package for Markov Regime Switching Models (2010). Available at SSRN: http://ssrn.com/abstract=1714016

Pickands, J.: Statistical inference using extreme order statistics. Ann. Stat. 3, 110–131 (1975)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Financ. 26, 1443–1471 (2002). http://www.elsevier.com/locate/econbase

Sampara, J.B., Guillen, M., Santolino, M.: Beyond Value-at-Risk: Glue VaR Distortion Risk Measures. Working paper No. 2. Research Institute of Applied Economics, Department of Econometrics, Riskcenter - IREA University of Barcelona (2013)

Taghipour, A.: Banks, stock market and economic growth: the case of Iran. J. Iran. Econ. Rev. 14(23), 19–40 (2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix A

Appendix A

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Sriboonchitta, S., Chaiboonsri, C., Singvejsakul, J. (2018). The Understanding of Dependent Structure and Co-movement of World Stock Exchanges Under the Economic Cycle. In: Kreinovich, V., Sriboonchitta, S., Chakpitak, N. (eds) Predictive Econometrics and Big Data. TES 2018. Studies in Computational Intelligence, vol 753. Springer, Cham. https://doi.org/10.1007/978-3-319-70942-0_41

Download citation

DOI: https://doi.org/10.1007/978-3-319-70942-0_41

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-70941-3

Online ISBN: 978-3-319-70942-0

eBook Packages: EngineeringEngineering (R0)