Abstract

This paper explores complementarities among innovation strategies in transition economies. Specifically, on the basis of data from the fifth round of Business Environment and Enterprise Performance Survey (BEEPS V), we have investigated the existence of possible complementarities between various types of innovation modes (product, process and non-technological (marketing and/or organizational) innovations) in their impact on the firm’s productivity. The study reveals complementarity between the following two combinations of innovations: product/process and process/non-technological innovations. Further, the results of the study show that only those combinations of innovation modes that assume all the types of innovations and/or the combination of process and non-technological innovations have positive and statistically significant impact on the firm’s productivity. In the paper, we account for the simultaneous occurrence of different types of innovation inputs—in-house knowledge generation and out-house knowledge acquisition activities—and estimate their joint effects on various modes of innovation. The study results suggest that implementation of internal research and development (R&D) strategy can stimulate not only technological innovations but non-technological innovative activity as well. However, we find that external knowledge acquisition strategy has positive and statistically significant effect on innovation output only when the firm’s innovation mix incorporates non-technological novelties.

The original version of this chapter was revised. An erratum to this chapter can be found at https://doi.org/10.1007/978-3-319-67916-7_34.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

A growing number of studies acknowledges innovation as the main driver of a productivity growth. The relationship between the firm’s innovative activity and its productivity performance has gained attention of scholars since the seminal research of Griliches (1979) and Pakes and Griliches (1980). In these studies, aimed at estimating returns to research and development (R&D) investments, the authors have modified the traditional Cobb-Douglass production framework by the introduction of a knowledge production function. The main assumption of this approach is that past and current knowledge (R&D investments) are necessary for generating a new knowledge (innovation), which in turn affects the firm’s output growth. This line of research has been further extended by Crepon et al. (1998). The model, henceforth referred as CDM, distinguishes innovation input (R&D) and innovation output (knowledge). Employing structural recursive model, CDM explains productivity by the knowledge or innovation output and innovation output by R&D. Applying this model to the sample of French manufacturing firms, Crepon et al. (1998) find that R&D intensity has positive and significant impact on innovation output and that innovation output, in turn, is an important predictor of the productivity of the firm. Recent studies of the link between R&D, innovation and the firm’s productivity, based on the CDM model, generally has proved the main findings of Crepon et al. (1998) for the developed countries (Loof et al. 2003; Janz et al. 2004; Mairesse et al. 2005; Griffith et al. 2006; Loof and Heshmati 2006; Hall and Mairesse 2006).

In transition economies, European Bank for Reconstruction and Development (EBRD) and the World Bank Group (the WB) has conducted a comprehensive study of the link between the innovation and firm’s performance (EBRD 2014). On the basis of data on more than 15,000 enterprises from the fifth round of Business Environment and Enterprise Performance Survey (BEEPS V), and using CDM model, the study reveals the significant impact of product, process and non-technological innovation on the firm’s productivity. R&D is found to be an important determinant of innovation output along with other factors such as the firm’s size and age, foreign ownership, education level of employees, usage of communications and access to finance.

Other CDM-based studies of innovation-productivity link in transition economies explore: the possible effect of technological innovation on firm’s productivity in Estonia (Masso and Vahter 2008); the strength of innovation-productivity relationship across various sub-branches of the services sector in Estonia (Masso and Vahter 2012); the impact of the government support on the manufacturing firm’s R&D expenditures, innovations and productivity in Ukraine (Vakhitova and Pavlenko 2010); the relationship of firm-level productivity to innovation and competition (Friesenbichler and Peneder 2016); the impact of the various types of innovation inputs (internal R&D and external knowledge acquisition) on the different non-exclusiveFootnote 1 forms of innovation outputs (product, process and non-technological innovations) (Berulava and Gogokhia 2016).

At the same time, some important issues related to the functioning of R&D-innovation-productivity link in catching-up economies still require further attention of academicians. In particular, the way that various types of innovation strategies (technological and non-technological innovations) interact with each other while affecting the firm’s performance is not well studied. Besides, existing researches, while formulating knowledge production function, rely solely on in-house R&D activity as an innovation input variable. The role of out-house knowledge acquisition in promoting the firm’s innovative activity remains relatively unstudied as well.

This paper aims at filling this gap by deepening the understanding of the performance of R&D-innovation-productivity link in transition economies. On the basis of the data from the BEEPS V survey, we explore some issues that remained relatively unexplored to the moment. First, we study complementarities between various types of exclusive innovation modes (product, process, marketing and organizational innovations) in their impact on the firm’s productivity. Second, we extend traditional CDM model by incorporating external knowledge acquisition (EKA)—an innovation input strategy alternative/complement to internal R&D investments; and by analyzing the joint impact of both input strategies on innovation output.

The rest of the paper is organized as follows. Section 2 examines the relevant literature. In Sect. 3, we turn to a discussion of the research methodology, including empirical strategy and measures. The data set and characteristics of the sample used in the study are described in Sect. 4. In Sect. 5, we discuss the empirical findings. The final remarks are presented in Sect. 6.

2 Literature Review

The concept of complementarity, also known as Edgeworth complementarity, refers to an idea that the economic value generated from simultaneous implementation of a number of activities or strategies is higher than their individual effects. On the basis of the lattice theory of supermodularity, a formal model of complementarity in economics and management area was developed in the works of Topkis (1978, 1987, 1998), Milgrom and Roberts (1990, 1995), Milgrom and Shannon (1994). Following these works and using properties of supermodular functions, an increasing number of studies explore complementarities of various facets of innovation activities: innovation policies; innovation inputs and innovation modes (Mohnen and Roller 2005; Cozzarin and Percival 2006; Schmidt and Rammer 2007; Percival and Cozzarin 2008; Martinez-Ros and Labeaga 2009; Polder et al. 2009; Ballot et al. 2011).

A special interest for the goals of the current paper represents the studies that focus on exploring complementarities between product, process and non-technological innovations. The possible complementarities between the various types of innovation are theoretically well-grounded (Schumpeter 1934, 1942). For instance, introduction of a product novelty (product innovation) may require, on the one hand, establishing new production processes and the acquisition of the new equipment and skills (process innovation) and, on the other hand, applying new approaches to the organization of business processes (organizational innovation). To be successful at marketplace, all these innovative processes must be supported by relevant marketing strategies (marketing innovation).

Empirically, a number of studies confirm the existence of complementarity between two types of technological innovation: product and process novelties (Kraft 1990; Martinez-Ros 2000; Miravete and Pernías 2006; Reichstein and Salter 2006; Martinez-Ros and Labeaga 2009). Kraft (1990) investigates the relationship between product and process innovations. Using a simultaneous equation model, he tests a hypothesis that these two types of innovation activities are related to each other. The study reveals a positive effect of product-innovation on process-innovation, while no significant effect of process innovation on the likelihood of the firm’s engagement in product innovation is found. Miravete and Pernías (2006), using a dataset of the Spanish ceramic tiles industry, empirically explore the existence of complementarity between product and process innovation. The results of the study show that there is significant complementarity between product and process innovations, which is mostly due to unobserved heterogeneity. The authors find also that small firms tend to be more innovative in overall.

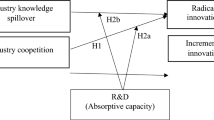

Martinez-Ros and Labeaga (2009), utilizing a database of Spanish manufacturing firms, study the role of persistence in the decision of firms to implement product and process innovations and to develop those innovations. The results of the study demonstrate that persistence is important in both innovation decisions and that complementarities between product and process innovations are important too. Similarly, the hypothesis of complementarity between product and process innovation forms has been proved in a number of other studies: Martinez-Ros (2000) study of a large sample of Spanish manufacturing firms; Reichstein and Salter (2006) research, based on a large scale survey of UK manufacturing firms. Owing to the theoretical and empirical evidence, discussed above, we hypothesize that in transition economies:

H1:

Product innovation and process innovation are complements in the firm’s production function.

Though usually, economic literature focuses on technological aspects of innovation (product and/or process), a number of recent research suggest that non-technological novelties such as marketing strategies and organizational changes can also enhance the firm’s efficiency and complement the contribution of technological innovations to productivity growth (Cozzarin and Percival 2006; Schmidt and Rammer 2007; Polder et al. 2009; Ballot et al. 2011; Doran 2012). Schmidt and Rammer (2007) analyze the determinants and the effects of non-technological (organizational and marketing) and technological (product and process) innovations, using the firm-level data from the German Community Innovation Survey (CIS). The study reports that determinants of both types of innovations are very similar, however, technological innovations have a substantially stronger effect on profit margin compared to the effects of non-technological innovations. The study finds that firms which combine technological innovations (product and process) with both organizational and marketing innovations perform much better in terms of sales and profit margins than those implementing only technological innovations.

Similarly, Cozzarin and Percival (2006), on the basis of the study of Canadian firm-level data, find that innovation is complementary to many organizational strategies and that the complementary strategies differ across industries. Polder et al. (2009), using the Netherlands firm-level data, find that organizational innovation has the strongest productivity effects. The study reveals positive effects of product and process innovation when accompanied by organizational innovation. Also the study provides evidence that product and process innovations are complements in the manufacturing sector only and that organizational innovation is complementary to process innovation in both manufacturing and service sectors.

Ballot et al. (2011), drawing from a large pooled sample of French and UK manufacturing firms, explore the existing complementarities between product, process and organizational forms of innovation. The results of the study suggest that the efficient strategies of innovation combinations are not the same for all the firms and that the nature of complementarities in the performance between the forms of innovation has a national context and are strongly dependent on the resources and capabilities of the firm. The study reveals two main combinations of innovative activities: the technological strategy (product/process innovations) and the structure oriented strategy (organization/product innovations). At the same time, the study does not favor the realization of the combination of the three strategies simultaneously, because of high costs and difficulties of their implementation. Doran (2012), using the Irish CIS firm-level data, estimates a knowledge augmented production function and tests the four different forms of innovation (organizational, process, new to the firm and new to the market innovation) for their supermodularity and submodularity. The study reports that the non-technological innovation, in the form of the organizational innovation, has a strong complementary relationship with the technological innovation. In particular, the study reveals that complementary relationships exhibit the following pairs of innovative activities: organizational and process innovation; organizational and new to the market innovation; and process and new to the firm innovation. Summarizing the existing empirical findings, we hypothesize that in transition economies:

H2:

Non-technological innovation and product innovation are complements in the firm’s production function.

H3:

Non-technological innovation and process innovation are complements in the firm’s production function.

3 Methodology

In this paper, we apply an augmented version of CDM model to study the structural relationships between R&D, innovation and productivity and to investigate complementarities between various innovation modes. In particular, the model is modified through accounting for the simultaneous occurrence of different types of innovation inputs—in-house R&D and out-house knowledge acquisition activities—and through the estimation of their joint effects on various modes of innovation. The most of recent empirical innovation research, based on CDM model, focuses mainly on internal R&D activity as a primary innovation input. However, some researchers (Mohnen and Hall 2013) argue that relying only on internal R&D, without investing in the acquisition of machinery, equipment and external knowledge, may be not enough for producing innovation outputs. Thus, studying the role and the impact of these two types of innovation inputs on the firm’s capabilities to produce new products or to introduce new processes and structures may have a certain research interest.

The model represents a three-stage recursive system which consists of four equations and where each stage is modeled as a determinant of the subsequent one. The first stage comprises two equations that estimate a firm’s decision to get engaged in knowledge development or acquisition activities. As already mentioned above, we modify the conventional CDM model by including a new equation for external knowledge acquisition, which serves as a determinant of innovation output along with internal R&D activity. Besides, the equations that account for the intensive margins of internal R&D and EKA are omitted in this model. The second stage involves the estimation of innovation or knowledge production function. The predicted values of the both innovation inputs, obtained at the previous stage, are used as determinants of innovation output. The innovation output equation employs dummy variables to reflect various exclusive combinations of product, process and non-technological (organizational and/or marketing) forms of innovation, which are similar to those in Polder et al. (2009). The final equation represents the output production function, where predicted values of innovation from the second stage, are used as an input. At this stage, to explore complementarities between product, process and non-technological forms of innovation, we estimate the impact of exclusive combinations of innovation modes on the productivity in an augmented production function. Like in Griffith et al. (2006), the model comprises all firms rather than only innovative ones. The model is estimated sequentially, step-by step, with predicted output of one stage employed as an independent variable at the next phase. Employing predicted values rather than actual ones allows to cope with the potential endogeneity problem. For identification purposes, in each equation (except the last one), some exclusion variables (instruments) are assumed. Besides, to correct the bias that can arise from using the predicted variables, the standard errors are bootstrapped. Below we discuss the specification of the model at each consecutive stage in more detail.

Stage 1: Innovation Inputs (Internal R&D and External Knowledge Acquisition) Equations

At this stage, two types of innovation inputs are distinguished: internal R&D and external knowledge acquisition. As already mentioned, unlike conventional CDM model, the actual model accounts only for the firm’s decision to invest or not in internal research/external knowledge acquisition and does not consider R&D/EKA intensity decisions. Taking into account the discrete nature of the response variables in both equations and the fact that the decisions to invest in R&D and to acquire external knowledge can be jointly determined, these two equations are defined as bivariate Probit model:

where \( {y}_{1i}^{\ast } \) is the latent R&D investment decision variable and y 1i is the indicator variable that equals 1 if a firm decides to invest in R&D. Similarly, y 2i is dummy variable, which equals to one when a firm makes investments in external knowledge acquisition and \( {y}_{2i}^{\ast } \) is the latent variable connected with it. The \( {\beta}_1^{\prime } \) and \( {\beta}_2^{\prime } \) are the vectors of parameters to be estimated, while ε 1i and ε 2i are error terms which are assumed to follow a joint normal distribution with zero mean and variance equal to 1. Another assumption with regard to error terms is that ε 1i and ε 2i are correlated with correlation coefficient ρ. The vectors x 1i and x 2i include the independent variables, which explain the firm’s decision to get engaged in R&D and in EKA respectively. In our model, both vectors generally share the same set of variables, with the only exception: while important determinant of the decision to invest in R&D is patent protection, in EKA equation this variable is replaced by intensity of computers usage. The explanatory variables included in x 1i and x 2i vectors are described in more detail below:

-

Patent—is a dummy variable, which shows whether establishment has ever been granted a patent (included in x 1i vector but not in x 2i vector).

-

Computers_usage—percentage of workforce that use computers regularly (included in x 2i vector but not in x 1i vector).

-

Financing_wc—financing of working capital variable. This variable reflects the percentage of the working capital financed by banks and non-bank institutions and is used to control for the imperfections of the financial markets.

-

University_degree—percent of full-time employees with university degree, reflects the quality of human capital employed by establishment;

-

Size—firm’s size, which contain three dummy variables: small (6–19 employees), medium (20–99 employees), and large (100 and more employees);

-

Age—log of the age of the establishment in years;

-

Foreign—dummy variable, which shows whether the foreigners have a majority in the ownership;

-

State—dummy variable, which indicates whether the state has a majority in the ownership;

-

Subsidy—is a dummy variable, which shows whether an establishment has received any subsidies from the national, regional or local government or from the European Union sources over the last three years.

-

Country and Industry dummies Footnote 2—which reflect country and industry fixed effects respectively.

The variable Subsidy as well as variables Patent and Computers_usage is considered as instruments for R&D and EKA indicators.

The two-equation system (1) is estimated simultaneously by simulated maximum likelihood estimation technique. Ignoring parameters to be estimated, the log–likelihood takes the following form:

The likelihood function (2) is built upon a bivariate probit model. Since the system of Eq. (1) represents seemingly unrelated equations model, the contributions to likelihood function discussed above are connected by the correlation coefficient of the error terms. The log–likelihood function is maximized using the Conditional Mixed Process program (CMP) (Roodman 2011), which applies GHK-type numerical simulation algorithm.

Stage 2: Innovation Output Equation (Multinomial Logit Model)

On the second step, predicted values of innovation inputs obtained on the previous stage are used to estimate knowledge production function. Generally, we consider three types of innovation output in this study: product, process and non-technological innovations. However, following Polder et al. (2009) and Ballot et al. (2011), in order to distinguish the firms that implement the different forms of innovation simultaneously, we apply the exclusive combinations of innovation modes. As a result, we obtain eight exclusive combinations of innovation modes, which are represented by the following dummy variables:

-

Innovation_000—no innovation form is implemented by a firm;

-

Innovation_001—a firm implements only the non-technological type of innovation;

-

Innovation_010—a firm implements only the process type of innovation;

-

Innovation_011—a firm implements only the process and non-technological innovations;

-

Innovation_100—a firm implements only the product type of innovation;

-

Innovation_101—a firm implements only the product and non-technological innovations;

-

Innovation_110—a firm implements only the product and process types of innovation;

-

Innovation_111—a firm implements all the three types of innovation.

Given eight types of innovation modes and following Ballot et al. (2011), in this study we apply multinomial logit model as the estimation techniques. We set the base category to be Innovation_000—the situation when none of innovation form is implemented by a firm. Then the probability that a firm i will choose j innovation mode can be determined as:

where x 3i is a vector of explanatory variables for a firm i, and \( {\beta}_j^{\prime } \) is vector of parameters for the choice j, to be estimated. The vector of explanatory variables x 3i includes the following indicators:

-

predicted probabilities of the firm’s engaging in internal R&D and in EKA activities, obtained from the previous stage;

-

Main Market—comprises three indicators—local, national, international—which signify that the main product is sold on the local, national or international markets respectively;

-

Email—dummy variable, which means that the establishment uses e-mail for communication with its business partners;

-

some explanatory variables used at the previous stage, such as: educational level, access to finance, size, age, ownership of the firm, country and industry controls.

Variables Main Market and Email serve as the instruments for innovation.

The model (3) implies computation of seven log-odds ratios of the following form:

The coefficients of the model are estimated through maximizing the log likelihood function:

where N is the number of subjects on which data have been collected. For each subject, d ij is defined equal to one, if a subject i chooses the alternative innovation mode j, and is defined as zero otherwise, for the J + 1 possible outcomes (Green 2003). Following Polder et al. (2009) and Ballot et al. (2011), we predict propensities for each possible combination of the innovation mode, and use them as innovation proxies at the next stage. To correct for bias, we use bootstrapped standard errors.

Stage 3: Augmented Production Function Equation

The last equation of the structural model estimates labor productivity using linear OLS regression. Productivity (y 4i ) is measured as a log of ratio of total sales to the number of employees and is modeled as a function of exclusive combination of innovation modes and a vector of exogenous variables x 4i . The model is formulated in the following way:

In this model the innovation is presented by the eight exclusive modes discussed in the previous section, where the Innovation_000 mode, which assumes no innovation activity, is used as a reference category. To cope with the potential endogeneity of innovation we employ the predicted propensities of exclusive combinations calculated at the previous stage. Compared to vector x 3i , the vector x 4i includes two additional variables:

-

Unofficial competition—dummy variable, which shows whether the establishment faces competition from unregistered or informal firms;

-

Location—dummy variable, which indicates whether the establishment is located in the capital city.

The \( {\gamma}_{klm}^{\prime } \) and \( {\beta}_4^{\prime } \) are the vectors of parameters to be estimated, while ε 4i is the error term which is assumed to follow a joint normal distribution with zero mean and variance equal to 1.

Testing Complementarities Among Innovation Strategies

The concept of complementarity between strategies or policies in the management area, rests upon the theory of supermodularity, developed in the works of Topkis (1978, 1987, 1998), Milgrom and Roberts (1990, 1995), Milgrom and Shannon (1994). According to these papers, the function f : R 2 → R is supermodular or has increasing differences in (X; Y) (and thus there is the complementarity between the two strategies—X and Y) if for all X ′ > X, f(X ′; Y) − f(X; Y) is non-decreasing in Y. To say distinctly, two strategies are complements of each other when introducing one of them while the other is already being implemented, results in higher marginal increase in the firm’s performance compared to the situation when the strategy is being implemented in isolation. The function that relates such strategies to the firm’s performance is called a supermodular function.

In this study, we apply, with small modifications, the supermodularity approach, used in Ballot et al. (2011), to test complementarity between product, process and non-technological forms of the innovation strategy. For instance, Ballot et al. (2011) explore the existence of complementarity between product, process and organizational innovations and distinguish between conditional and unconditional complementarity. According to the authors, any two strategies are unconditional complements if the complementarity between them occurs independently of the presence or absence of the third strategy. In this case, the firm’s performance function is supermodular in these two innovation strategies. When the existence of complementarity between two strategies is dependent on the presence or absence of the third strategy, such complementarity is called conditional. Following Ballot et al. (2011) we formulate three slightly modified sets of testable restrictions:

-

(1)

Complementarity between product and process forms of innovation:

R0: γ_110 − γ_010 − γ_100 > 0 (absence of non-technological innovation)

R0: γ_111 + γ_001 − γ_011 − γ_101 > 0 (presence of non-technological innovation)

R1: γ_110 − γ_010 − γ_100 = 0 (absence of non-technological innovation)

R1: γ_111 + γ_001 − γ_011 − γ_101 = 0 (presence of non-technological innovation)

where, γ_001—is regression coefficient of Innovation_001 dummy variable obtained from the estimation of augmented production function (6) and which reflects the semi-elasticity of productivity with regard to this innovation mode. Similarly, the terms γ_010; γ_011; γ_100; γ_101; γ_110; γ_111 represent regression coefficients of Innovation_010; Innovation_011; Innovation_100; Innovation_101; Innovation_110; Innovation_111 innovation mode dummies respectively. The simultaneous acceptance of the both R0 restrictions indicates the existence of a strict unconditional complementarity between product and process innovation and suggests that firm’s performance is supermodular in product and process innovation. If only one of R0 restrictions is true, then complementarity between product and process innovation is conditional on the presence or absence of the non-technological innovation. Vice versa, if one or the both expressions are proved to be negative then product and process innovations are conditional or unconditional substitutes of each other. The same logic applies to testing complementarities between other pairs of innovation strategies.

-

(2)

Complementarity between product and non-technological forms of innovation:

R0: γ_110 − γ_100 − γ_001 > 0 (absence of process innovation)

R0: γ_111 + γ_010 − γ_110 − γ_011 > 0 (presence of process innovation)

R1: γ_110 − γ_100 − γ_001 = 0 (absence of process innovation)

R1: γ_111 + γ_010 − γ_110 − γ_011 = 0 (presence of process innovation)

-

(3)

Complementarity between process and non-technological forms of innovation:

R0: γ_011 − γ_010 − γ_001 > 0 (absence of product innovation)

R0: γ_111 + γ_100 − γ_110 − γ_101 > 0 (presence of product innovation)

R1: γ_011 − γ_010 − γ_001 = 0 (absence of product innovation)

R1: γ_111 + γ_100 − γ_110 − γ_101 = 0 (presence of product innovation)

The acceptance of any of R0 restrictions in the first, second and the third sets of constraints, will provide support for the hypotheses H1 , H2 , H3 respectively, formulated earlier in the literature review section.

4 Sample and Data Description

The main source of the data for the research is the micro-level dataset from the fifth round of the BEEPSFootnote 3. The survey was conducted by the EBRD and the WB for 15,523 firms in 29 countries in the European and Central Asian regions in the period of 2012–2014. The sample was selected using stratified random sampling techniques. The following three levels of stratification were used in all countries: industry, establishment size and region. The more detailed description of the sampling methodology can be found in the Sampling Manual (World Bank Group 2009). However, the final sample used for the analysis is substantially lower than the initial one. Such a drastic reduction in the sample size mainly is the result of non-responses, which in turn is caused by the reasons that are not identified and thus that cannot be analyzed. Since we can only take into account this issue while making interpretation of the study results. Table 1 reports the descriptive statistics for the variables used in the model in different equations.

According to the table, on average 9.7% of firms invest in R&D, while 18.8% of companies prefer to acquire external knowledge. Product innovations have highest proportions among innovation output types (22.3%) followed by marketing innovations (21.1%), organizational innovations (19.6%) and process innovations (17.7%). Generally, 27.5% of firms perform either marketing or organizational innovations. On average, the labor productivity of firms is equal to 63,153 USD sales per employee. More than fifteen percent of the sample has ever been granted a patent, almost thirty-four percent of the employed have higher education and 45.3% of workforce use computers regularly. Only 8.3% of the companies in the sample receive subsidies from the government or EU and almost twelve percent of the working capital of the firms is financed from external funds. The average establishment employs 67 workers and the mean of the firms’ age in the sample is approximately 35 years. The highest proportion of the sample represents small firms (52.7%), followed by medium (31.9%) and large companies (12.9%). Almost two percent of the firms are owned by a state and 7.5% by foreigners. The firms mainly operate at local (57.9%) and national (35.3%) markets, while at global markets compete only 6.8% of the sample. About twenty-two percent of the companies are located in the capital city and 37.5% of the firms face with the competition from the unofficial entities. Almost ninety percent of the establishments use email for communication with their partners.

5 Empirical Findings

5.1 Innovation Input Stage

Table 2 presents the estimated results for the first stage of the modified CDM model. This stage comprises bivariate SUR probit model (system of equations 1), which specifies the probabilities of investing in R&D and in EKA. First, the results reveal that these two decisions are interdependent within the establishment, since the residuals of the corresponding equations are significantly correlated with each other. Thus the joint estimation of these two equations seems to be an appropriate decision. Further, we find that possessing of formal protection (patents, trademarks, licenses) and having the educated human resource stimulate investments in R&D (both effects are statistically significant at p < 0.01 level).

The analysis of marginal effects shows that availability of formal patent protection increases probability of R&D by approximately 10% (with a standard deviation of 0.013), while the marginal effect of one percent increase of personal with university degree is 0.001 (0.0001). The regular use of computers, in turn, increases the probability of the external knowledge acquisition (significant at 1% level). In particular, one percent increase in workforce that use computers regularly raises the probability of the external knowledge acquisition by 0.1% (with standard deviation of 0.0001). As expected, the likelihoods of the positive outcome for the both decisions (to invest in R&D and to acquire external knowledge), increase with the size of the firm, availability of subsidies, development of credit markets and foreign ownership.

In accordance with the Schumpeterian approach to innovation and findings from recent studies (Cohen and Klepper 1996; Crespi et al. 2014), the firm’s size is the important determinant of the firm’s decisions to invest in R&D and to acquire external knowledge. Larger establishments, enjoying economies of scale and scope and having greater market power, possess better opportunities to mobilize necessary financial resources, and thus they show higher propensity for innovation. Small and medium size establishments have substantially lower probability of such investments (statistically significant at 1% level in both equations), compared to large companies. Both R&D and EKA equations reveal similar marginal effects. In R&D equation marginal effects are: −0.06 (0.014) and −0.05 (0.013) for small and medium companies respectively; while in EKA equation the corresponding figures are −0.07 (0.014) and −0.04 (0.013).

As mentioned above, the probabilities of decisions to invest in R&D and to acquire external knowledge are also positively affected by availability of subsidies from government or international sources (statistically significant at p < 0.01 in both equations); development of credit markets (significant at 1% level in R&D equation and at 10% level in EKA equation); and availability of foreign ownership (significant at 10% level in R&D equation and at 1% level in EKA equation). These factors increase propensities of innovation via providing access to finance and ensuring transfer of external knowledge and skills (foreign ownership) to the companies.

The comparison of marginal effects shows that both subsidies and credit markets have slightly stronger impact on R&D decisions, while the availability of a foreign owner is a more prominent determinant in EKA equation. For instance, the availability of subsidies increases the probability of R&D by 7% (0.014) and the probability of EKA by 6% (0.015). At the same time, under foreign ownership the probability of EKA raises by 5% (0.016) while the probability of R&D only by 3% (0.017). Other controls, such as a firm’s age and ownership type exert no influence on R&D and EKA decisions.

5.2 Innovation Output Stage

The special interest for us represents the effects of two endogenous variables investment in R&D and acquisition of external knowledge on the exclusive combinations of various innovation modes. According to Table 3, internal R&D activity is the important predictor (statistically significant at p < 0.05) of innovation output. In-house R&D investments increase probability of occurrence for practically all exclusive combinations of its modes (the only exception is the combination of process and non-technological innovation). Thus, the study results suggest that internal knowledge inputs are, generally, effective in promoting innovation irrespective of their type. We also find that EKA strategy has the positive and statistically significant effect on innovation (at p < 0.01 level) only when the exclusive combinations of innovation modes include the non-technological form of innovation. In situation when innovation output strategy lacks non-technological innovation, EKA variable negatively effects the innovation output, but these impacts are not statistically significant. These results of the study, generally, conform (with some exceptions) the findings of Berulava and Gogokhia (2016) study that explores the impact innovation inputs on non-exclusive forms of innovation outputs. Also, in compliance with the existing empirical findings (Polder et al. 2009; van Leeuwen and Farooqui 2008), we find that the appliance of electronic communication promotes the innovation activities of the firm. This conclusion is true practically for all combinations of innovation types with the only exception when process innovation is conducted alone. Electronic communication facilitates the exchange of information between economic agents and in this way, it stimulates the innovation activities of firms.

However, small firms show higher probabilities for innovative activities compared to the large companies. This study result is supported by the existing empirical evidence. For instance, Conte and Vivarelli (2014) suggest that while larger firms are more likely to decide positively on the investment in R&D activity, smaller companies, among those who have already invested in knowledge, are more flexible in terms of producing innovative output. Besides, on the basis of the previous empirical studies (Pavitt et al. 1987) Hall (2011, p. 173) argues that “…the relationship between innovative activity and firm size is largely U-shaped, and that smaller firms show greater innovative activity than formal R&D activity.”

5.3 Productivity Stage

The final stage of our empirical model estimates the impact of exclusive combinations of innovation modes on the firm’s labor productivity. The results of this stage, presented in Table 4, suggest that the innovation output effects labor productivity positively and statistically significantly only when a firm performs all the three types of innovation or when it combines process with non-technological innovation.

If product and process modes of innovation are conducted separately, their impact on the labor productivity is negative (statistically significant at 5% level). Thus, pure technological innovative efforts, not supported by relevant marketing activities or organizational changes may have undesirable effect on the firm’s performance, at least in the short-run. Other combinations of innovation modes have no statistically significant impact on the firm’s performance. The results of the study, generally support the existing empirical evidence (Polder et al. 2009). However, there are some contradictions to the finding of Polder et al. (2009) that organizational (non-technological) innovation is the main source of productivity. We find no significant impact of non-technological innovation on productivity when it is conducted in isolation.

Other important predictors of labor productivity are foreign and state ownership, location in capital, and competing unregistered firms. When the majority of the owners of the firm is foreigner, the labor productivity increases by 33%; vice versa state ownership reduces productivity performance by 29%. Location in capital causes the increase in the outcome variable by 19%; while the competition against unofficial rivals reduces labor productivity by 8%. Human capital and credit market development also have statistically significant impact (p < 0.01) on labor productivity, though the magnitude of this effect is comparatively not so big. Besides, we have found no statistically significant effect of firm’s age and size on labor productivity.

5.4 Testing Complementarities Between Innovation Modes

In this paper, following Ballot et al. (2011) we test complementarity between three pairs of innovation strategies. In compliance with the existing empirical research, the results of the tests presented in Table 5 reveal no presence of supermodularity between the three modes of innovation. At the same time, we have found a number of cases of complementarity and substitutability between pairs of innovation modes dependent on the presence or the absence of the third innovation strategy.

In support of our H1 hypothesis, we find that the product and process pair of innovation strategies is characterized by complementarity when non-technological innovation is not performed (statistically significant at 1% level); in case when non-technological innovation is implemented, product and process innovations substitute each other (statistically significant at 10% level). It should be mentioned that if the former conclusion is generally in line with the existing research (Polder et al. 2009; Ballot et al. 2011), the latter one finds very scarce support in the empirical literature.

We find no complementarity relations between product and non-technological innovations. However, not in line with previous findings, the results of the tests indicate that these innovation modes are substitutes when the process innovation is present (statistically significant at 1% level). According to the results of this test, joined implementation of product and non-technological innovations does not represent a good option for a firm in transition. Thus, the empirical evidence provides no support for H2 hypotheses.

According to Table 5, process and non-technological innovations complement each other (statistically significant at 1% level), but only in the case when product innovation is not performed. Thus, the research hypothesis H3 is partially supported by the results of our analysis.

Summarizing three pairwise tests of complementarity, one may conclude that while performing all three innovation modes jointly has a positive impact on the firm’s performance, economically preferred options are either to choose pure technological innovation strategy (product&process modes) or to perform strategy oriented on the organizational restructuring, which combines process and non-technological innovations. These conclusions, in general, are similar to the findings of Ballot et al. (2011) study. The only exception is that our research finds process innovation (instead of product innovation) to be a complement of non-technological innovation.

6 Conclusion

This paper explores the existing interrelationships between innovation activities and productivity performance of firms as well as complementarities between innovation strategies in transition economies. Specifically, on the basis of BEEPS V dataset and using extended CDM model, we have investigated the existence of possible complementarities between various types of innovation modes (product, process, marketing and organizational innovations) in their impact on the firm’s productivity. The conventional CDM framework has been modified through accounting for the simultaneous occurrence of different types of innovation inputs—in-house R&D and out-house knowledge acquisition activities—and through the estimation of their joint effects on various modes of innovation. In compliance with the results of the previous studies, we have found that CDM model properly describes the existing interrelations between the firm’s innovation activity and its productivity performance in transition economies.

The important contribution of this paper is that it tests for complementarity between innovation strategies of firms in transition economies. Our tests reveal complementarity between the following two combinations of innovations: product/process and process/non-technological innovations. These results, generally, resemble the findings for developed (UK and France) markets (Ballot et al. 2011). The only difference is that for UK sample complementarity was proved for product and organizational innovation strategies, while in this paper complements are process and non-technological innovations. Following Ballot et al. (2011), we call the first pair of complementary innovations as technological strategy while the second one as restructuring strategy. Similar to Ballot et al. (2011), the key policy implication of our findings is that while performing all the three innovation modes jointly has a positive impact on the firm’s performance, economically preferred options are either to choose pure technological innovation strategy (product & process mode) or to perform organization restructuring oriented strategy (process/non-technological mode).

Concerning the links of various modes of innovation output to the firm’s productivity performance, our results show that only the combinations that assume all the types of innovations and process and non-technological innovation have positive and statistically significant impact on the firm’s productivity. Though these results generally support the existing empirical evidence (Polder et al. 2009), we have found no significant impact of non-technological innovation on productivity when it is conducted in isolation. Another vital point of this analysis is that conducting either product or process innovation in isolation will result in a negative productivity performance.

The findings of the study also suggest the firm’s decisions on in-house and out-house knowledge development processes are highly interdependent and generally share the same determinants. Both strategies of knowledge generation/acquisition require the availability of finance which can be ensured through: an easy access to financial markets; subsidies from a government or international donors; foreign direct investments. The latter may represent not only the important financial source but the source of advanced knowledge and know-how transfer as well. However, the primary supplier of finance necessary for stimulating innovations is the firm itself. We find that large firms substantially outperform small and medium enterprises in terms of innovation activity. According to Schumpeter, such an advantage of large firms in knowledge development process can be explained first of all by their capabilities to mobilize necessary financial resources. We think that main policy implication stemming from these study results is that providing ease access to financial resources is a crucial prerequisite for promoting knowledge development activity in transition economies. In support of the existing findings, we reveal that internal R&D activity is highly dependent on the patent protection. Thus, the enhancement of the legal framework and establishing the rule of law that secure the property rights can be considered as important ways for stimulating firm’s R&D investment decisions. Further, the study results show that the implementation of internal R&D strategy can stimulate not only technological innovations but non-technological innovative activity as well. Also, we have found that EKA strategy has the positive and statistically significant effect on the innovation output only when the firm’s innovation mix incorporates non-technological novelties.

This study provides some new insights on the functioning of the extended CDM model and on the complementarity between innovation strategies in transition economies. Still, cross-sectional nature of the dataset used in this study limits understanding of some important issues such as the impact of the firm specific factors on its innovation and productivity performance, dynamic relationships between R&D, innovations and the firm’s performance. We think that the appliance of panel data sets will allow scholars to clarify these issues.

Notes

- 1.

Firm performs at least one of the three forms of innovation; the specification does not clearly define which additional forms of innovation accompany the designated innovation form.

- 2.

The countries in the study are: Albania, Armenia, Azerbaijan, Belarus, Bosnia, Bulgaria, Croatia, Czech, Estonia, Georgia, Hungary, Kazakhstan, Kosovo, Kyrgyzstan, Latvia, Lithuania, Macedonia, Moldova, Montenegro, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Tajikistan, Turkey, Ukraine, Uzbekistan.

The industries in the study are: Manufacturing (Food; Wood; Publishing, printing and recorded media; Chemicals; Plastics and Rubber; Non-metallic mineral products; Fabricated metal products; Machinery and equipment; Electronics; Precision instruments; Furniture); Retail; Other Services (Wholesale; IT; Hotel and restaurants; Services of motor vehicles; Construction section; Transport; Supporting transport activities; Post and telecommunications).

- 3.

References

Ballot, G., Fakhfakh, F., Galia, F., & Salter, A. (2011). The fateful triangle complementarities between product, process and organizational innovation in the UK and France (TEPP Working Paper, No 2011-05, TEPP – Institute for Labor Studies and Public Policies) [online]. Accessed September 20, 2015, from https://halshs.archives-ouvertes.fr/halshs-00812141/document

Berulava, G., & Gogokhia, T. (2016). On the role of in-house R&D and external knowledge acquisition in firm’s choice for innovation strategy: Evidence from transition economies. Moambe. Bulletin of the Georgian National Academy of Sciences, 10(3), 150–158.

Cohen, W., & Klepper, S. (1996). A reprise of size and R&D. The Economic Journal, 106(437), 925–951.

Conte, A., & Vivarelli, M. (2014). Succeeding in innovation: Key insights on the role of R&D and technological acquisition drawn from company data. Empirical Economics, 47(4), 1317–1340.

Cozzarin, B. P., & Percival, J. C. (2006). Complementarities between organizational strategies and innovation. Economics of Innovation & New Technology, 15(3), 195–217.

Crepon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation and productivity: An econometric analysis at the firm level. Economics of Innovation & New Technology, 7(2), 115–158.

Crespi, G., Arias-Ortiz, E., Tacsir, E., Vargas, F., & Zuñiga, P. (2014). Innovation for economic performance: The case of Latin American firms. Eurasian Business Review, 4(1), 31–50.

Doran, J. (2012). Are differing forms of innovation complements or substitutes? European Journal of Innovation Management, 15(3), 351–371.

EBRD. (2014). EBRD transition report 2014: Innovation in transition. European Bank for Reconstruction and Development [online]. Accessed March 12, 2015, from http://www.ebrd.com/downloads/research/transition/tr14.pdf

Friesenbichler, K., & Peneder, M. (2016). Innovation, competition and productivity: Firm level evidence for Eastern Europe and Central Asia (WIFO Working Papers, No 516) [online]. Accessed March 20, 2016, from http://www.wifo.ac.at/wwa/pubid/58776

Green, H. W. (2003). Econometric analysis (5th ed.). Englewood Cliffs, NJ: Prentice-Hall.

Griffith, R., Huergo, E., Mairesse, J., & Peters, B. (2006). Innovation and productivity across four European countries. Oxford Review of Economic Policy, 22(4), 483–498.

Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. Bell Journal of Economics, 10(1), 92–116.

Hall, B. H. (2011). Innovation and productivity. Nordic Economic Policy Review, 2, 167–203.

Hall, B., & Mairesse, J. (2006). Empirical studies of innovation in the knowledge driven economy. Economics of Innovation & New Technology, 15(4/5), 289–299.

Janz, N., Loof, H., & Peters, B. (2004). Firm level innovation and productivity – Is there a common story across countries? Problems and Perspectives in Management, 2, 184–204.

Kraft, K. (1990). Are product- and process-innovations independent of each other? Applied Economics, 22(8), 1029–1038.

Loof, H., & Heshmati, A. (2006). On the relationship between innovation and performance: A sensitivity analysis. Economics of Innovation & New Technology, 15(4/5), 317–344.

Loof, H., Heshmati, A., Asplund, R., & Naas, S.-O. (2003). Innovation and performance in manufacturing industries: A comparison of the Nordic countries. International Journal of Management Research, 20(2), 5–36.

Mairesse, J., Mohnen, P., & Kremp, E. (2005). The importance of R&D and innovation for productivity: A reexamination in light of the 2000 French innovation survey. Annales d’Economie et de Statistique, 79/80, 489–529.

Martinez-Ros, E. (2000). Explaining the decisions to carry out product and process innovations: The Spanish case. The Journal of High Technology Management Research, 10(2), 223–242.

Martínez-Ros, E., & Labeaga, J. (2009). Product and process innovation: Persistence and complementarities. European Management Review, 6(1), 64–75.

Masso, J., & Vahter, P. (2008). Technological innovation and productivity in late-transition Estonia: Econometric evidence from innovation surveys. European Journal of Development Research, 20(2), 240–261.

Masso, J., & Vahter, P. (2012). The link between innovation and productivity in Estonia’s services sector. The Service Industries Journal, 32(16), 2527–2541.

Milgrom, P., & Roberts, J. (1990). The economics of modern manufacturing: Technology, strategy and organization. American Economic Review, 80(3), 511–528.

Milgrom, P., & Roberts, J. (1995). Complementarities and fit: Strategy, structure, and organizational change in manufacturing. Journal of Accounting and Economics, 19(2–3), 179–208.

Milgrom, P., & Shannon, C. (1994). Monotone comparative statics. Econometrica, 62(1), 157–180.

Miravete, E., & Pernías, J. (2006). Innovation complementarity and scale of production. Journal of Industrial Economics, 54(1), 1–29.

Mohnen, P., & Hall, B. H. (2013). Innovation and productivity: An update. Eurasian Business Review, 3(1), 47–65.

Mohnen, P., & Roller, L. (2005). Complementarities in innovation policy. European Economic Review, 49(6), 1431–1450.

Pakes, A., & Griliches, Z. (1980). Patents and R&D at the firm level: A first report. Economics Letters, 5(4), 377–381.

Pavitt, K., Robson, M., & Townsend, J. (1987). The size distribution of innovating firms in the UK: 1945–1983. Journal of Industrial Economics, 35(3), 297–316.

Percival, J. C., & Cozzarin, B. P. (2008). Complementarities affecting the returns to innovation. Industry and Innovation, 15(4), 371–392.

Polder, M., van Leeuwen, G., Mohnen, P., & Raymond, W. (2009). Productivity effects of innovation modes (Statistics Netherlands Discussion Paper 09033, The Hague) [online]. Accessed August 30, 2015, from https://www.cbs.nl/NR/rdonlyres/DD2A1AEF-A40B-4D71-9829-9CA81055400B/0/200933x10pub.pdf

Reichstein, T., & Salter, A. (2006). Investigating the sources of process innovation among UK manufacturing firms. Industrial and Corporate Change, 15(4), 653–682.

Roodman, D. (2011). Fitting fully observed recursive mixed-process models with CMP. The Stata Journal, 11(2), 159–206.

Schmidt, T., & Rammer, C. (2007). Non-technological and technological innovation (ZEW: Centre for European Economic Research, Discussion Paper # 07-052) [online]. Accessed August 30, 2015, from http://ftp.zew.de/pub/zew-docs/dp/dp07052.pdf

Schumpeter, J. A. (1934). The theory of economic development. Cambridge, MA: Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. New York, NY: Harper.

Topkis, D. M. (1978). Minimizing a submodular function on a lattice. Operations Research, 26(2), 305–321.

Topkis, D. M. (1987). Activity optimization games with complementarity. European Journal of Operations Research, 28(3), 358–368.

Topkis, D. M. (1998). Supermodularity and complementarity. Princeton, NJ: Princeton University Press.

Vakhitova, G., & Pavlenko, T. (2010). Innovation and productivity: A firm level study of Ukrainian manufacturing sector (Discussion Paper Series, DP27 June, Kyiv School of Economics& Kyiv Economics Institute) [online]. Accessed October 25, 2015, from https://core.ac.uk/download/files/153/6249395.pdf

van Leeuwen, G., & Farooqui, S. (2008). ICT, innovation and productivity. In Eurostat (Ed.), Information society: ICT impact assessment by linking data from different sources (Final Report, pp. 222–239) [online]. Accessed August 30, 2015, from http://www.scb.se/Grupp/OmSCB/Internationellt/Dokument/ICT-IMPACTS-FINAL-REPORT-V2.pdf

World Bank Group. (2009). Enterprise survey and indicator surveys sampling methodology [online]. Accessed October 25, 2015, from http://www.enterprisesurveys.org//~/media/GIAWB/EnterpriseSurveys/Documents/Methodology/Sampling_Note.pdf

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Berulava, G., Gogokhia, T. (2018). Complementarities of Innovation Strategies: Evidence from Transition Economies. In: Bilgin, M., Danis, H., Demir, E., Can, U. (eds) Eurasian Economic Perspectives. Eurasian Studies in Business and Economics, vol 8/2. Springer, Cham. https://doi.org/10.1007/978-3-319-67916-7_11

Download citation

DOI: https://doi.org/10.1007/978-3-319-67916-7_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-67915-0

Online ISBN: 978-3-319-67916-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)