Abstract

The income of the Polish agricultural sector significantly increased after its accession to the European Union. The entry of Poland into the European Union brought about an investment boom in agriculture and accelerated farm modernisation. The profitability differs depending on the farm size and profile. According to Farm Accountancy Data Network (FADN) data, the highest family farm income was observed in farms producing grain-eating animals, while the lowest occurred in unspecialised farms. The highest level of subsidies was granted to producers of arable crops, and the lowest to famers specialising in horticulture. Nevertheless, the latter were more profitable than the former. The economic result in agriculture depends on the optimal use of labour, capital and land resources. The factor of management plays a crucial role in this regard.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Main Factors Influencing Profitability

The income of the Polish agricultural sector significantly increased after its accession to the European Union . A sudden increase of income was noted in 2004 (more than 20 billion zlotys against less than 10 billion zlotys in 2002 and 2003), namely in the first year after accession into the European Union and covering the Polish agriculture with the Common Agricultural Policy (CAP) income support system. In following years, the dynamics of income growth slowed down, yet a clear positive trend was observed. In nominal prices, the income in 2012 amounted to almost 37 billion zlotys, compared to less than 10 billion zlotys in the pre-accession period. The growing income of the sector, combined with employment reduction, resulted in a significant growth of income calculated per persons employed full time. In 2012, it was almost twice as high compared with the pre-accession period. The share of subsidies and grants in income increased from 15% to more than 50% as a result of the implementation of direct payments and other aid schemes (Wigier 2014: 41–42). The most important priority of the agricultural policy in Poland was to increase the competitiveness of the sector, but a number of activities within that priority were also related to supporting farmers’ income (Fogarasi et al. 2014).

In the 2004–2012 period, the cumulative value of support for the agri-food sector in Poland reached an enormous sum of 370 billion zlotys. It came from three main sources—a grant from the national budget to a special system of social insurance for farmers (KRUS ), a grant from the national budget co-financing the CAP, and payments from the EU budget. The largest share of these payments were subsidies to insurance (38%) and grants coming directly from the EU budget (more than 160 billion zlotys, or 35% of the above amount) (Wigier 2014: 43). The EU direct payments are the most common type of support; each year about 1.4 million Polish farmers use this form of support. The value of payments in the 2004–2012 period increased from approximately 6 billion zlotys to 14 billion zlotys per year. It reached an average of 9 thousand zlotys per farm, and this form of support is used by 87% of farms having an area of more than 1 ha (Wigier 2014: 42). In 2013, Poland received more than 5 billion euros from the CAP, including 2.8 billion for direct payments , 1.9 billion for rural development and 0.4 billion for market measures (European Commission 2015).

A nearly two-fold increase in Polish agricultural holdings’ income was observed in 2004—in the first year inside the European Union and the functioning within the CAP. In the next years, this trend continued. In 2008–2012, the average level of income per holding was 86 thousand zlotys, which was more than 40% more than in the first years of EU membership. A diversification of agricultural producers’ income was primarily due to the level of their productive resources, operating and investment subsidies , the economic situation in the agricultural market, as well as the costs of the factors of production used (Wigier 2014: 50).

An increase in the value of subventions had the decisive impact on the growth in the income of agricultural entrepreneurs in Poland in the 2004–2009 period. The share of subsidies in the income increased from 38.8% in 2004 to more than 60% in 2009. Subsequently, a significant decline of this share was observed. In 2011 it dropped below 50%, and in 2013 it was below 40% (Ministry of Agriculture and Rural Development 2014a: 24).

The average income obtained from agricultural activity in Poland grew by 90% from 2000 to 2008. The entry of Poland into the European Union brought about an investment boom in agriculture and accelerated farm modernisation . Preferential investment credits and the EU funds played a huge role in the process. The removal of trade barriers between Poland and the European Union showed high price competitiveness of domestic agricultural and food products (Mickiewicz and Mickiewicz 2010). During the initial years of Polish membership in the European Union, the most positive effect for profitability was observed in animal production, in particular on individual farms’ economic results on beef cattle and dairy cow breeding (Czternasty and Smędzik 2009). The gross operating surplus had the highest share in the gross value added of the Polish food industry and amounted to 55.64% in 2007. Costs connected with employment were also important, as they represented 41.82%. The gross operating surplus had the highest share in the gross value added contributed by agriculture, hunting and forestry (Jędruchniewicz 2010). The implementation of the CAP intensified the processes of specialisation and modernisation in Polish agriculture, which are reflected in the increase in the average farm size and agricultural productivity , but geographical disparities grew (Jezierska-Thöle et al. 2014). The effectiveness of productive potential in Polish agriculture is the highest in regions characterised by a high socioeconomic development (Nowak et al. 2015). The average work profitability in agriculture increased in real terms by 5.66% per year during the first decade of Polish membership in the European Union. The main causes of these favourable changes were increased productivity and subsidies (Golas 2016).

The average monthly available income of households of farmers amounted to 5043.97 zlotys in 2013, which was well above the income of households of employees (4289.01 zlotys) and almost as much as that of households of self-employed individuals (5164.13 zlotys). There was a much stronger dynamic of growth in the income of farmers’ households than in the rest of the economy over the period 2005–2013. In 2013, the income per capita in households of farmers was 1156.13 zlotys, including 812.89 zlotys of income from a private farm in agriculture, 150.78 zlotys of income from social security benefits , 123.27 zlotys of income from hired work, and some other less important sources of income (Central Statistical Office of Poland 2015: 250).

According to FADN data, family farm income in Poland rose from 25,920 zlotys in 2009 to 40,588 zlotys in 2013, mainly because of the faster growth of total output than total input (Table 2.1). The family farm income per a full-time employed person belonging to the family increased from 17,137 zlotys to 26,325 zlotys on average in the period under study. The costs of producing 100 zlotys of output decreased from about 93 zlotys in 2009 to less than 84 zlotys in 2012, but it increased in 2013 to 89 zlotys.

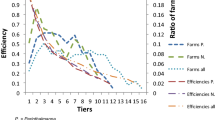

According to our expectations, the profitability differs depending on the farm profile. Table 2.2 presents FADN measures for five selected farm profiles: specialising in arable crops ; horticulture; milk cows; grain-eating animals; and not specialised in any direction (mixed). The highest output and family farm income (on average) was observed in farms producing grain-eating animals. This type of production requires the accumulation of considerable assets, which were generated by past investments. The lowest family income and income per person occurred in unspecialised farms. The highest level of subsidies was granted to producers of arable crops, and the lowest to famers specialising in horticulture. Nevertheless, the latter were more profitable than the former.

In the European Union , agricultural households tend to get a surprisingly high share of their income from non-agricultural sources, which makes their income situation comparable to the rest of the society. The income situation of EU farmers is increasingly affected by the phenomena of pluriactivity and farm diversification (Bryła 2009). The use of various definitions of a farmer and of an agricultural household across countries impedes international comparisons of farm income (Bryła 2010a). One of the principal determinants of income differentiation across EU member states is varying farm structures (Bryła 2010b).

The profitability of Polish farms depends, inter alia, on their size. The economic size of Polish farms is well below the EU average. Within the FADN , the economic size of Polish farms amounted to 10 European Size Units (ESU) (which is the equivalent of approximately 12 thousand euros), which constituted only one-third of the EU average in the period 2005–2009 (Ministry of Agriculture and Rural Development 2014b: 27). It is not only the area (soil quantity and quality as well as climatic conditions) that counts, but also the number of livestock per farm. Poland is far below the EU average. In 2010, the average pig farm in Poland had 39 animals compared to the EU average of 53. The Dutch farms had 1743 pigs on average, and the German ones had 459. As far as cattle farms are concerned, they had 11 animals on average in Poland compared to the EU average of 34, 87 in Germany and 121 in the Netherlands (Ministry of Agriculture and Rural Development 2014b: 27).

In Poland , there is a system of measuring profitability of certain types of agricultural production called AGROKOSZTY . The study was conducted in a sample of individual farms observed by FADN. Sampling was not random but focussed on market-oriented enterprises. In the system, quantitative and value data on production level, inputs and direct costs are collected according to a predefined methodology and standards. They allow for computation of the first category of revenue—gross margin . Costs were classified as direct if they could be attributed to an activity without any doubt, their level was proportional to the scale of production, and they had direct impact on the size of production (amount and value). The direct costs are different for crop and animal production. The direct costs in crop production consist of: seeding material, purchased fertilisers, plant protection chemicals, growth regulators, insurance directly applied to a given activity, specialist costs (including expenditure on crop production), specialist services and temporary leasing. The direct costs in animal production concern: animals to replace the stock, feeds (both bought and own), land lease of feeding area for less than a year, insurance of animals , medicines and veterinary means (including insemination material), veterinary services (insemination, castration, vaccination), and specialist costs (including expenditure on animal production), specialist services and temporary leasing. In calculating the gross margin , value-added tax (VAT) is not included (Skarżyńska 2014: 16–20).

The gross margin is the annual value of production from 1 ha of crops or from 1 animal , reduced by direct costs incurred to get this output . There are a few exceptions. For edible mushrooms , it is calculated per 100 m2 of production surface. In the case of poultry , it is calculated per 100 items. For bees, it concerns a family living in a hive. The gross margin is calculated as follows (Skarżyńska 2014: 24):

-

Production value

-

− Direct costs

-

= Gross margin without subsidies

-

+ Subsidies

-

= Gross margin

The estimated calculation of economic results of Polish agriculture in 2013 was as follows (million zlotys) (Ministry of Agriculture and Rural Development 2014a: 25):

1. | Production of the agricultural sector (A+B+C) | 96,386 |

A. | Crop and animal production | 91,774 |

B. | Subsidies to products | 1784 |

C. | Remaining production and services | 2827 |

2. | Indirect consumption | 57,634 |

3. | Gross value added (1−2) | 38,751 |

4. | Depreciation and amortization | 6487 |

5. | Net value added (3−4) | 32,264 |

6. | Other taxes | 2423 |

7. | Other subventions | 11,857 |

8. | Income from means of production (5−6+7) | 41,698 |

9. | Costs of hired labour | 4108 |

10. | Rent fees | 479 |

11. | Balance of paid and obtained interest | 1198 |

12. | Income of agricultural entrepreneurs (8−9−10−11) | 35,913 |

The calculation of agricultural income in Poland in 2014 according to the Economic Accounts for Agriculture was as follows (in million euros) (European Commission 2015):

Output of the agricultural industry | 22,799.5 |

− Intermediate consumption | 14,151.4 |

= Gross value added at basic prices | 8648.1 |

− Consumption of fixed capital | 1621.1 |

− Taxes | 528.6 |

+ Subsidies | 3569.5 |

= Factor income | 10,068.0 |

The factor income was 81.6% higher than in 2005.

In order to assess production and economic results and efficiency of input use, the following measures are used (Skarżyńska 2014: 26):

-

the ratio of production value to direct costs (the so-called direct profitability indicator )

-

direct costs incurred to produce one unit of output

-

direct costs incurred to produce one zloty of the gross margin without subsidies (the so-called gross margin competitiveness indicator)

-

the gross margin without subsidies per one unit of output

-

the share of subsidies in the gross margin

-

total labour inputs (both own and external) to produce one unit of output (the so-called labour intensity of production )

-

production output per one hour of total labour inputs (the so-called technical efficiency of labour )

-

production value per one hour of total labour inputs (the so-called economic efficiency of labour )

In 2013, out of the six analysed production profiles, the highest economic efficiency of labour was observed in rapeseed production, followed by wheat (Table 2.3). In the production of organic milk , the share of subsidies in the gross margin amounted to 15.1% (Skarżyńska 2014: 66).

The economic result in agriculture depends on the optimal use of labour , capital and land resources. The factor of management plays a crucial role in this regard. It applies to the characteristics and attitudes of farm managers . It has been estimated that the shrinking number of agricultural holdings in Poland is often due to failing to meet the requirements of economic rivalry and wrong managerial decisions.

It also needs to be emphasised that the institutional environment plays a crucial role in rural development. It includes local authorities, information and counselling centres, especially the networks of Farm Counselling Centres in Poland (Ośrodki Doradztwa Rolniczego—ODR), local promoters of entrepreneurship (foundations, associations, incubators) and loan providers. In the Polish institutional landscape, accession to the European Union caused an immense growth of importance of the Agency for Restructuring and Modernising Agriculture (Agencja Restrukturyzacji i Modernizacji Rolnictwa), the regional and county branches of which are responsible for managing the EU direct payments and various instruments of the agricultural and rural development policy (Wrzochalska 2014: 95).

One of my interviewees, who specialises in milk production , drew attention to the negative trends in his sector regarding profitability. As the milk quota is eliminated, the price of milk is stable or declines, even to 0.4 zloty per litre. At the same time, production costs grow due to the increase of prices of fertilisers and feeds.

Another interviewee, who specialised in pig production, complained about a long-term recession in his sector. Even if the consumer prices continue to be the same, the producers receive smaller and smaller shares of the price . The intermediaries take over a growing portion of the value added. Animal diseases and the Russian embargo make the situation even worse, especially when the domestic demand is stagnating. This point of view was confirmed in another interview with a pig producer who indicated an enormous loss of profitability due to lower prices of pigs.

Another interviewee mentioned that consumers pay an increasing attention to quality issues. It may constitute an opportunity for Polish agricultural enterprises, but at the same time, it means higher expectations and more stringent requirements.

2 Planning and Forecasting Profitability

One of the key variables in forecasting profitability is price. The price forecasts are done on the basis of statistical data, reports and industry analyses. There are several types of market information . Data on domestic and world prices constitute one of them. In the economic reality, it is hardly possible to talk about a single market price in a given period. Therefore, there are many sources of primary information on prices on agricultural markets. In Poland , they comprise (Figiel et al. 2014: 16):

-

the Warsaw Commodity Exchange (www.wgt.com.pl) and its platform e-WGT

-

the agricultural and fuel exchange called Rol-petrol (www.rolpetrol.com.pl)

-

the Internet Exchange called NetBrokers , addressed to firms operating on the agri-food market (www.netb.pl)

-

the information portal called Fresh-market.pl, which specialises in information concerning the fruit and vegetable branch

-

websites of wholesale markets

-

Internet portals of agri-food industry information services (e.g. www.farmer.pl, www.portalspozywczy.pl).

Skarżyńska (2014) built a forecasting model on the basis of data from 2011 to 2013 collected in the AGROKOSZTY system . The projection of production value, costs and economic effects concerns the following years: 2016, 2018 and 2020. The basic indicator to measure the effects was activity revenue with or without subsidies . It was calculated as follows:

The indirect costs cannot be attributed to specific products (production activities) when they are incurred. They are common for the whole agricultural holding . The indirect cost structure is as follows (Skarżyńska 2014: 114):

-

A.

Real indirect costs

-

(a)

General economic costs

-

Electricity

-

Heating

-

Fuel

-

Renovation

-

Services

-

Insurance (of buildings, property, vehicles)

-

Other (e.g., water, sanitation, phone)

-

-

(b)

Taxes

-

Agricultural

-

Other (forest , special activities, property)

-

-

(c)

Costs of external factors

-

Hired workers

-

Land lease

-

Interests

-

-

(a)

-

B.

Estimated indirect costs – depreciation

-

Buildings and structures

-

Machines and equipment

-

Transportation vehicles

-

Other (e.g., melioration, orchards, multiannual plantations)

-

The system of direct area payments consists of two components:

-

obligatory – the same across the European community

-

optional – chosen by the member state

The obligatory payments include:

-

single area payments (about 110 euros/ha)

-

green payments (for diversification of crops , maintaining permanent green areas and pro-ecological areas)

-

payments for young farmers (higher direct payments by 25%—62 euros/ha and direct subsidies of up to 100 thousand zlotys).

The optional subsidies include:

-

payments for small farmers (having the economic value up to 6 thousand euros; it may be a single payment up to 60 thousand zlotys and, if they sell their farm, a compensation of 120% of direct payments they would get until 2020)

-

production-related subsidies (for certain types of production, i.e., cattle , cows, goats, high-protein plants, hop, potato starch, sugar beetroot, tomatoes, strawberries, raspberries, flex and hemp)

-

additional payments (related to the specific area of the farm, about 41 euros/ha in Poland ),

-

transitory national support (it must be degressive—each year lower by five percentage points, in Poland it is granted for tobacco) (Skarżyńska 2014: 116–117)

The forecasts are affected by possible changes of yield, prices and costs. The yield is influenced by the hereditary properties of crops, environmental conditions (soil and climate), and agro-technical factors, including the structure of plantations, the time of planting, the quality and quantity of seeds, fertilisation, crop protection, and so on. The prices depend on the situation in national and international markets. The accession into the European Union made the CAP an important price-making factor in Poland . With the elimination of trade barriers among the member states, the impact of the European market is stronger. Apart from the volume of production and transportation costs , price levels on the markets of other member states and exchange rates play an increasing role. The situation of supply and demand is also important (Skarżyńska 2014: 132–133).

Table 2.4 contains a forecast of results for wheat . Yield is expected to grow by 1.2% per year. The average annual growth rate of prices may reach 2.2–2.6%. The rise in prices and higher yields will lead to a growth in revenue (in 2020, 27.8% more than in 2013). The direct costs are expected to grow by more than one-third until 2020, especially due to higher costs of the seeding material and mineral fertilisers. The indirect costs will grow less quickly than direct costs (by 26.8% from 2013 to 2020). As total costs will grow more quickly (by 30.0% until 2020) than production value by 2.2 percentage points, profitability of wheat production is expected to fall to 141.7% compared to 144.1% in 2013. However, the revenue will continue to grow, even though subsidies will stabilise (Skarżyńska 2014: 136–139).

Polish farmers predict their future economic situation much better qualitatively than quantitatively (Jedruchniewicz and Danilowska 2016).

References

Bryła, P. (2009). Wpływ Wspólnej Polityki Rolnej na sytuację dochodową rolników w Unii Europejskiej. Studia Europejskie, 3, 9–28.

Bryła, P. (2010a). Długofalowe tendencje zmian dochodów rolniczych w „starej” Unii. Wieś i Rolnictwo, 3, 118–134.

Bryła, P. (2010b). Uwarunkowania zróżnicowania dochodów rolniczych w Unii Europejskiej. Zeszyty Naukowe SGGW w Warszawie. Ekonomika i Organizacja Gospodarki Żywnościowej, 80, 5–17.

Central Statistical Office of Poland. (2015). Statistical yearbook of agriculture 2014. Warsaw: Central Statistical Office of Poland.

Czternasty, W., & Smędzik, K. (2009). Effect of the integration into the EU on the economic results of different types of individual farms in Poland. Economic Science for Rural Development Conference Proceedings, 20, 126–132.

European Commission. (2015). Member states factsheets. Poland. http://ec.europa.eu/agriculture/statistics/factsheets/index_en.htm. Accessed 21 July 2015.

Figiel, S., Hamulczuk, M., & Rembisz, W. (2014). Wybrane zastosowania modelowania ekonomicznego w analizie przesłanek konkurencyjnego rozwoju sektora rolno-żywnościowego. Warsaw: Institute of Agricultural and Food Economics.

Fogarasi, J., Wieliczko, B., Wigier, M., & Töth, K. (2014). Financing of agriculture and investment supports in agriculture. In N. Potori, P. Chmielinski, & A. Fieldsend (Eds.), Structural changes in Polish and Hungarian agriculture since EU accession: Lessons learned and implications for the design of future agricultural policies (pp. 55–76). Budapest: Research Institute of Agricultural Economics.

Golas, Z. (2016). The level and determinants of work profitability changes in the Czech and Polish agricultural sector in the years 2004–2014. Agricultural Economics/Zemedelska Ekonomika, 62(7), 334–344.

Jędruchniewicz, A. (2010). Role of agribusiness in wealth generation in Poland. Economic Science for Rural Development Conference Proceedings, 21, 139–144.

Jedruchniewicz, A., & Danilowska, A. (2016). Accuracy of economic situation projection in the Polish agriculture. Economic Science for Rural Development Conference Proceedings, 42, 228–234.

Jezierska-Thöle, A., Janzen, J., & Rudnicki, R. (2014). Agrarian-economic structure of agricultural holdings in Poland and East Germany: Selected elements of comparative analysis. Quaestiones Geographicae, 33(2), 87–101.

Mickiewicz, A., & Mickiewicz, B. (2010). Polish food sector in the European Union. Economic Science for Rural Development Conference Proceedings, 21, 45–51.

Ministry of Agriculture and Rural Development. (2014a). Program Rozwoju Obszarów Wiejskich na lata 2014–2020. Warsaw: Ministry of Agriculture and Rural Development.

Ministry of Agriculture and Rural Development. (2014b). Agriculture and rural economy in Poland. Warsaw: Ministry of Agriculture and Rural Development.

Nowak, A., Kamińska, A., & Krukowski, A. (2015). Regional differentiation of productive potential of agriculture and the effectiveness of its use in Poland. In A. Raupeliene (Ed.), Proceedings of the 7th International Scientific Conference Rural Development 2015(pp. 1–6). http://doi.org/10.15544/RD.2015.082. Accessed 13 July 2017.

Skarżyńska, A. (Ed.). (2014). Nadwyżka bezpośrednia z wybranych produktów rolniczych w 2013 roku oraz projekcja dochodów na 2020 rok. Warsaw: Institute of Agricultural and Food Economics.

Wigier, M. (Ed.). (2014). Food economy and rural areas in Poland – Structural changes and effectiveness of public policy. Warsaw: Institute of Agricultural and Food Economics.

Wrzochalska, A. (Ed.). (2014). Kapitał ludzki w procesach przemian strukturalnych wsi i rolnictwa. Warsaw: Institute of Agricultural and Food Economics.

Wyniki…. (2014). Wyniki Standardowe Polskiego FADN (rok obrachunkowy 2013). Warsaw: Institute of Agricultural and Food Economics.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Bryła, P. (2018). Profitability in Polish Agricultural Enterprises. In: Bryła, P. (eds) Managing Agricultural Enterprises. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-59891-8_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-59891-8_2

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-59890-1

Online ISBN: 978-3-319-59891-8

eBook Packages: Business and ManagementBusiness and Management (R0)