Abstract

Shortly before the 2011 Libyan revolution, consumers’ subsidies were rapidly increased by the regime in an effort to reduce social discontent. In the aftermath of the revolution, these subsidies became important for people’s subsistence, but also a very heavy burden for the state budget. Since then, the Libyan government has been confronted with the necessity of reforming subsidies in a politically and socially complex environment. This paper uses household survey data to provide a distributional analysis of food and energy subsidies and simulate the impact of subsidy reforms on household wellbeing, poverty, and the government’s budget. Despite the focus on direct effects only, the results indicate that subsidy reforms would have a major impact on household welfare and government revenues. The elimination of food subsidies would reduce household expenditure by about 10 percent and double the poverty rate while saving the equivalent of about 2 percent of the government budget. The elimination of energy subsidies would have a similar effect on household welfare, but a larger effect on poverty while government savings would be almost 4 percent of the budget. The size of these effects, the weakness of market institutions, and the current political instability make subsidy reforms extremely complex in Libya. It is also clear that subsidy reforms will call for some form of compensation for the poor, a gradual rather than a big bang approach, and a product-by-product sequence of reforms rather than an all-inclusive reform.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

Libya has a long history with consumers’ subsidies to cover food and energy products. Subsidies were first introduced in the early 1970s and continued with various degrees of coverage until the late 2000s when a first serious attempt to reform the system was launched. The reform process was quickly reversed shortly before the 2011 revolution in an attempt to reduce social discontent. That move could not stop the revolution, and it resulted in a major cost to the state budget during the postrevolution period already characterized by a declining economy and political instability.

Subsidies were not the only source of economic distortions in Libya under Muammar Gaddafi’s rule, but the combination of subsidies and other distortionary policies deprived the Libyan economy of the fundamental set of incentives that drives a market economy and made both the population and private firms dependent on the state’s support (Chami 2012; Charap 2013). Functioning markets are among the foundations of functioning democracies, and a reform of the subsidy system is a step forward in the direction of a functioning state. However, subsidy reforms are politically complex and economically costly for the population and cannot be implemented without a preliminary assessment of the reforms’ implications.

This chapter provides for the first time a distributional analysis of food and energy subsidies in Libya and simulates the impact of subsidy reforms on household well-being, poverty, and the government budget. We assess the benefit that different population income groups derive from subsidies, the social cost of subsidy reforms for the different segments of the population, and the government gain from increases in prices of subsidized goods. Information on the distributive incidence of subsidies and the social impact of reforms is essential to design compensation mechanisms that may accompany subsidy reforms and alleviate the burden of reforms for the poor. This chapter also provides some tentative estimates of the effect of cash compensations and some considerations on how subsidy reforms could be implemented.

Despite the focus on direct effects only, the results indicate that subsidy reforms would have a major impact on household welfare and government revenue. The elimination of food subsidies would reduce household expenditure by about 10%, double the poverty rate, and save the equivalent of about 2% of the government budget. The elimination of energy subsidies would have a similar effect in terms of household welfare but a larger effect on poverty; government savings would be almost 4% of the budget. The size of these effects, the weakness of market institutions, and the current political instability make subsidy reforms extremely complex in Libya. It is also clear that subsidy reforms will call for some sort of compensation in cash, a gradual rather than a radical approach, and a product-by-product sequence of reforms. This chapter offers an initial set of considerations that can be used by policy makers for preparing a reform plan.

This chapter is structured as follows: the next section presents an overview of Libya’s food and energy subsidy program and its evolution. Following the overview is an introduction to the baseline data and assumptions made. The next two sections present the results for the distributive incidence of subsidies and reform simulations for food and energy subsidies. The concluding sections discuss the political economy of reforms, summarize the main findings, and consider possible future subsidy reforms.

Evolution of Subsidies

Libya’s ample subsidy program dates back to 1971 when a national institute was created to oversee consumption of essential goods. The system covers a number of food and energy products, as well as public services (water, sanitation, education, and garbage collection), medicines, and animal feed. Subsidies are regulated by a compensation fund that determine prices with the objective of keeping essential consumption items at affordable prices and protect consumers from major global price shocks.

Since the early 2000s food subsidies have significantly increased, imposing a toll on the government budget. Data from Libya’s Price Regulation Fund show that the nominal cost of food subsidies has increased from less than LD (Libyan dinar)172 million in 2001 to more than LD 2 billion (1 billion equals 1000 millions) in 2012. Over the years, the basket of subsidized goods has seen some variation, from a minimum of three products in 2009 to a maximum of 12 products after the 2011 revolution, with flour, semolina, and rice consistently subsidized since 2001. A process of subsidy reforms took place between 2005 and 2010, but at the outbreak of the revolution, these reforms were rolled back almost entirely. This move led to a significant increase in the cost of food subsidies from 1.1% of gross domestic product (GDP) in 2010 to 2% of GDP in 2012 (Table 5.1). As a share of government expenditure, food subsidies also doubled from 2 to 3.8% between 2010 and 2012. Flour, sugar, rice, vegetable oil, and semolina represent the lion’s share of the cost of food subsidies to the government.

Food subsidies vary between 39 and 96% of the market price, and they are well above 80% for most products (Table 5.2). They are administered under a system of individual quotas regulated by the Ministry of Economy. Subsidized food products are made available in fixed per capita quantities at cooperatives throughout the country, except for subsidized flour used to bake bread which is distributed to bakeries directly. Quotas are identical for all individuals and have remained unchanged for more than a decade. The quantities are very generous and exceed an individual’s nutritional needs.Footnote 1 As indicated in Table 5.2, these quantities generate about 4570 calories per person per day—more than double the level recommended by the World Health Organization (WHO) or the Food and Agriculture Organization (FAO). Initially, eight food products were made available under this system: flour, wheat, barley, rice, oil, sugar, tea, and salt. But the list gradually increased over the years to include items such as pasta, coffee, tomato paste, milk for children, and others.

Despite some attempts to control the food subsidy system, significant leakages and abuse are believed to occur. Individuals need to be members of a cooperative to be able to shop there. Because individuals are also able to buy these goods on the free market at liberalized prices, not all Libyans are cooperative members, particularly among wealthier households. Although there are no centralized membership records or other mechanisms to control “double-dipping,” Libyan authorities estimate that the total number of cooperative members in the country exceeds the population size, suggesting that abuses of the quota system are widespread.

Energy subsidies were also introduced in 1971 and are currently administered by the National Oil Corporation under the authority of the Ministry of Oil. The subsidies cover five products: gasoline, diesel, liquefied petroleum gas (LPG), kerosene, and electricity. Between 1995 and 2000 subsidies on these products were already on the rise, increasing from around 234 million dinars in 1995 to 404 million in 2000 and with the largest subsidies accorded to diesel and electricity (Waniss and Karlberg 2007). The largest increases occurred during the 2000s before the revolution because of the inability of the regime to increase retail prices during the global rise in oil prices. Energy subsidies continued to increase after the revolution, reaching an estimated peak of LD 6.3 billion in 2012. Energy products are universally subsidized, at rates exceeding 85% of the products’ market value (Table 5.3), with the highest subsidies provided for LPG and kerosene.

It is important to stress that estimates of subsidies in Libya vary significantly across sources. For example, government figures for 2012 indicated that the total amount for food and energy subsidies in 2012 was LD 9.5 billion, equivalent to about 9.2% of GDP,Footnote 2 while the IMF, by including estimates on electricity and other subsidies, reaches an amount of LD 14.8 billion or 13.8% of GDP (IMF 2013). These estimates vary in absolute terms and relatively to GDP. Absolute estimates vary partly because what is considered a subsidy is not fixed and partly on whether subsidies include or exclude administrative costs. Estimates of subsidies as percentage of GDP can also vary because GDP figures are themselves volatile estimates in Libya due to weak national accounts and the prominence of oil as a source of revenues. Despite these caveats, it is clear that consumers’ subsidies in Libya are among the highest in the North Africa and Middle East (MENA) Region (Zaptia 2013).

Baseline Data, Assumptions, and Limitations

The analysis provided in this chapter is based on the 2007–08 Libyan Household Expenditure Survey (LHES), with all figures presented in the distributional and simulation analyses estimated at 2013 prices. This survey is the most recent household expenditure survey administered by the national statistical agency and the only survey available in Libya today for this type of analysis. With 2007 as the starting point, data are projected from 2008 to 2013 using official population estimates and IMF estimates for inflation and real GDP growth for the period 2008–13 (Table 5.4).

This chapter focuses on the direct effects of subsidy reforms.Footnote 3 This is not a major constraint for the case of food subsidies, but is an important limitation for energy subsidies. Given that food subsidies in Libya are subject to a quota system, the share of subsidized food products that could be used in the production of other goods is likely to be negligible.Footnote 4 For example, although sugar can be an input to the production of many processed food products, the quota system in place makes it unlikely that sugar used in food production is actually bought at subsidized prices. We will therefore assume that indirect effects for food are relatively small.Footnote 5

The treatment of bread in the analysis requires a number of assumptions. We have information on subsidized prices and quantities of flour (and yeast) for bakeries, both of which are supposed to be used in making bread, but we only have household expenditure data on bread. We translate the flour subsidy into a bread subsidy as follows. We estimate that 1 kg of bread requires 1 kg of flour, and given disparate prices of bread across bakeries in Tripoli we assume that a 100 g baguette is sold for 5 Libyan dirhams. Therefore, the price of a kilogram of bread is LD 0.5. We are therefore able to map the household expenditure on bread first into a quantity of bread (using the 5 dirhams per 100 g baguette) and then into a quantity of flour, and present these information under the heading “Flour (bread)” in the chapter tables.

Although indirect effects are small in the case of food products, they are likely to be significant in the case of energy products. The reason is that energy subsidies in Libya are universal and very large in magnitude, and energy products are an important input in a number of production processes. Therefore, the effect of increasing energy prices on consumer prices is likely large, particularly if producers pass on the associated increases in production costs to consumers. However, input-output data for the Libyan economy were not available, and indirect effects could not be estimated.

The survey data suggest that Libyan households are large and their aggregate consumption is a low share of GDP (Table 5.5). Libya has a small population, estimated at just below 6.4 million and about 1 million households. Aggregate annual household expenditure is estimated at LD 12.5 billion, implying that annual expenditure per capita is about LD 1967. Households in the poorest two quintiles are large, at 9.5 and 7.4 members per household, respectively. On average, these household sizes are larger than those in neighboring countries. For example, household size in Morocco is 6.5 for quintile 1 and 5.9 for quintile 2, and in Tunisia these figures are 5.8 and 5.0, respectively. Aggregate household expenditure in Libya is only about 12% of GDP.Footnote 6 This number is atypical of the North African Region, where surveys indicate that household expenditure is usually around two-thirds of GDP; but it is not totally surprising when we look at comparative data for other oil rich countries such as Qatar, Saudi Arabia, and Algeria where household expenditure as percentage of GDP can vary between 11 and 35%.Footnote 7 Household final consumption is essentially a small fraction of output as a whole because oil dominates the economy (producing more than two-thirds of GDP). Only a small share of oil proceeds accrues to households via wages and public transfers, while a bigger share accrues through subsidies, which do not appear in actual expenditure.

In what follows, the incidence and impact analyses are presented separately for food products and energy products. The analysis is conducted separately because of the different subsidy systems (universal for energy but quota-based for food), which require a different setup for the subsidies simulation model. Also, differences in the relative importance of indirect effects call for a different approach to interpreting the results. The analyses that follow are based on SUBSIM, a subsidies simulation package produced by the World Bank (www.subsim.org).

Food Subsidies

This section provides a distributional analysis of food subsidies to better explain who benefits from subsidies. It also provides a simulation of subsidies reforms to discover who would suffer the most from the partial or total removal of subsidies.

The Distribution of Food Subsidies

Food subsidies are relatively progressive, but a third of them do not reach households. In this section, we quantify the size of subsidies received by households at different income levels. The results suggest that food subsidies are relatively progressive in Libya, mostly thanks to the quota system by which they are administered. However, only about 65% of the budgetary costs of subsidies reach households. The difference is probably explained by “leaks” from the subsidy system, including waste from illegal resale of subsidized items outside of the quota system at near market prices and perhaps by administrative costs that cannot be clearly separated and accounted for.

Our estimates are an upper bound of the subsidies received by households. The reason is that the analysis is based on the assumption that all households purchase the entire amount of quotas to which they are entitled.Footnote 8 That assumption may not always be the case as some households may choose not to go to cooperatives to purchase products at subsidized prices—as is reported for a nonnegligible share of Libya’s population (mostly middle- and upper-income tranches). In the absence of information on the share of households taking advantage of the quota system in their food purchases, it is more conservative to assume that households take the maximum advantage of the benefit available to them so as not to underestimate the impact of any reform on the population. This assumption also compensates for the nonobservable leakages due to “double dipping.”

Households allocate about 9.3% (LD 1.2 billion) of their total expenditure on subsidized food products, if we consider the share bought under the quota system and the share bought at market prices (Table 5.6). About 22.2% of this amount is expenditure on quotas at subsidized prices, and the rest is on the same products bought on the free market. This finding may seem at odds with the fact that quotas provide generous quantities, but richer households are unlikely to shop at cooperatives, which administer quotas. Rich households may opt for better quality and more expensive products, and poorer households may also consume a share of better quality brands not available in the quota system. Indeed, for most of these food products, the market may offer several better quality options that may be preferred by the rich and poor alike. Also and more importantly, expenditure on quotas is low because prices are low under the quota system as compared to the market prices. For some products, like flour-bread and milk for children, the total expenditure is only on quotas, and there are no purchases of these products at nonsubsidized prices. For products such as bread, which is also sold outside cooperatives, the quota system is not binding.

In terms of quantities, households consume approximately half of the food products via purchases made under the quota system at subsidized prices and buy the other half at market prices (Table 5.7). Given the larger size of poorer households and their greater reliance on quotas, the first and second quintiles consume products at subsidized prices in higher quantities than the richer quintiles. The share of products bought via the quota system varies from 30.6% for semolina to 100% for milk for children and flour for bread. Flour for bread and pasta are the subsidized products with the largest consumption. These products are basic staples for Libyans, and quotas for these products are larger than those for other products.

Poorer households spend a much greater share of total expenditure on subsidized food items than richer households. Indeed, while expenditure on food products at subsidized prices represents 9.3% of total household expenditure (Table 5.8) on average, this share is higher for the first (12.32%) and second (10.68%) quintiles and falls to 7.12 for the fifth quintile. The larger size of poorer households explains part of this observation. If we focus on quotas only (the share bought at subsidized prices), the first quintile’share is 3.61% against the fifth quintile share of 1.07%.

The importance of food subsidies for poorer households is even more apparent when we look at the distribution of expenditure shares by population percentiles. Figure 5.1 plots the share of expenditure on food products at subsidized prices, relative to total expenditure, by population percentiles. The negative slopes indicate that poorer households devote a larger share of their total spending on food bought under the quota system than richer households (for all products except milk for children.) In other words, food is a larger component of the consumption basket of poorer households.

The poorest quintiles benefit the most from the monetary value of subsidies (Table 5.9), except for milk for children. This result sets Libya apart from other countries in the Region, where food subsidies tend to be slightly regressive because richer households consume more food overall and because subsidies are universal, unconstrained by a quota system.

The per capita data suggest that subsidies benefit all people equally, with the exception of flour used for bread and milk for children.Footnote 9 Figure 5.2 plots the total monetary value of food subsidies per capita on the y axis and the population percentiles on the x axis. The curves are flat, indicating everyone across the spectrum of the population derives the same monetary value from food subsidies. Again, this result is not surprising given that the quota system is established on a per capita basis, allocating the same quantity of food at subsidized prices to every individual regardless of the income bracket.

Simulation of Food Subsidy Reforms

This section simulates subsidy reforms and estimates the impact on household welfare and the government budget. We consider two scenarios: a 30% decrease in the subsidy for each product and the total elimination of all subsidies. Note that a 30% decrease in the subsidy on each product would result in a different price increase for each product. Table 5.10 reports the current subsidized price for each product under the quota regime, the unit subsidy, the price after a 30% reduction in subsidy (final price, scenario 1) and the price after the elimination of all subsidies (final price, scenario 2). The last price is equivalent to the market reference price we consider for each product.Footnote 10

Eliminating all food subsidies (scenario 2) would result in exceptionally high price increases. The price of flour used in making bread would need to increase by almost 26 times to reach the market price, and prices of flour, semolina, and rice would need to increase more than 11 times. Even in the case of milk for children, the product with a price currently the closest to the market price, a 60% increase would be needed to match the market price—a significant price increase.

These price increases would affect the poor in greater proportion than the rich. The total monetary impact of a complete removal of subsidies (scenario 2) on households would be equivalent in magnitude to the total estimated monetary value of subsidies received by households, namely LD 1.3 billion (Table 5.11).Footnote 11 The total impact of a 30% reduction in subsidies (scenario 1) is estimated at LD 385 million. The impact would be regressive in that poorer households would be affected more than richer households, as indicated by the greater loss in per capita spending for lower quintiles (Table 5.12). This result is to be expected because food subsidies were shown to benefit the poor in greater proportion. For example, with an elimination of subsidies, the first quintile (the poorest 20% of the population) would bear a cost of LD 348 million. And at 18.9%, the decline in per capita spending of the lowest quintile if food subsidies were eliminated is nearly four times that of the highest quintile (4.9%). This would be a disproportionate cost for poorer households.

The direct impact on government expenditure from the complete removal of subsidies (scenario 2) would be equivalent to the total impact on household welfare, namely LD 1.3 billion—equivalent to 2.8% of government expenditure (Table 5.13).Footnote 12 Under a partial reduction of subsidies (30% in the case of scenario 1), the total impact on government expenditure would be greater than the impact on household welfare. Under scenario 1, the total impact on government expenditure would amount to LD 660 million, compared to LD 385 million for the impact on household welfare (Table 5.11). This difference is explained by the fact that when subsidies are not totally removed we have two potential causes for lower government expenditure, the first resulting from the increase in subsidized prices (which is equivalent in size to the impact on household welfare) and the second resulting from the reduction in quantities consumed by households at these higher subsidized prices. If subsidies were totally eliminated, this second effect would disappear given that no quantities would be sold at a subsidized price.

Should a gradual approach to reform be considered, measuring the government budgetary impact may help with the decision regarding the sequencing and size of subsidy reforms. Figure 5.3 traces, for each product, the impact of a proportional reduction in subsidy (shown in percent on the x axis) on government expenditure in absolute values (measured in LD on the y axis). The impact would differ across products because of different quantities consumed, different initial levels of subsidies, and different price changes associated with a specific subsidy reduction. The fastest decline in government spending would result from first reforming the subsidy on flour used in bread production and then that on vegetable oil. We note that the curves are not linear, implying decreasing marginal returns in terms of lower government spending should prices increase. This result is explained mainly by the importance of the decrease in consumed quantities in response to price increases.

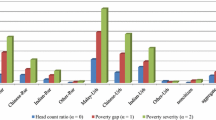

Removing subsidies on food products would have a significant negative impact on poverty (Table 5.14). We estimate poverty in Libya based on both the international poverty line ($1.25 per day)Footnote 13 and an updated national poverty line (LD 966.26 per person per year).Footnote 14 Using the national poverty line, poverty is estimated at about 14.4% of the population. If food subsidies were eliminated, poverty would rise by about 2.8 percentage points under scenario 1 and by 9.6 percentage points under scenario 2. Price increases of flour (for bread), rice, and vegetable oil would contribute the most to a rise in poverty. Using the international poverty line would lead to a prereform poverty rate of 8.5% and a reform impact of 2.0 percentage points for scenario 1 and 8.1 percentage points for scenario 2.

Along with greater poverty, income inequality (approximated by expenditure) would rise from 30.2 to 33.2% following a complete elimination of food subsidies. This prediction is consistent with the finding that food subsidies are pro-poor. Note that inequality in Libya is very low: at 30.2%, the Gini coefficient is one of the lowest values in the MENA Region. For example, the latest Gini coefficient for Morocco estimated in 2007 was above 40%, and that for the Arab Republic of Egypt, where inequality is believed to be very low, was around 32% in 2011.

A cash transfer of LD 175 per capita per year targeted to the poorest quintile would be enough to keep poverty unchanged under the scenario of full subsidy elimination (Fig. 5.4). An increase in poverty from 8.5 to 16.5% implies that poverty remains concentrated in the bottom quintile following the price reform. Therefore, targeting that share of the population would be sufficient to maintain poverty unchanged at the prereform level. This targeted transfer system would cost the government LD 340 million per year. Given that savings from the price increases would amount to LD 1.3 billion as calculated, the net gains to the budget from full subsidy elimination and cash compensation to the population in the first quintile of LD 175 per capita would be LD 943 million. If targeting the first quintile was not possible, extending that level of transfer to the entire population would raise the budgetary cost to LD 1.1 billion per year. In this case, total net gains to the budget from subsidy reform and cash transfers would be much lower, at LD 165 million per year.

The impact of subsidy reform on quantities consumed would also be significant (Table 5.15). It is useful to look at this impact because it gives an idea of the changes required in production and imports of food products bought via the quota system and to better understand the impact on government revenues. When compared to the initial quantities consumed under the quotas, changes would vary from −13.7% for milk for children to −62.3% for bread flour. The impacts are also quite flat across quintiles, although the impact on the first quintile would be lower for all products.Footnote 15

Energy Subsidies

The benefits to households from energy subsidies are multiples of those derived from food subsidies—households in the lowest quintile derive 2.5 times more monetary benefit from energy than from food subsidies, and that ratio increases gradually to 6.5 times for the upper quintile.

The analysis in this section covers five energy products: gasoline, diesel, electricity, LPG, and kerosene. Gasoline is the main energy product used by the road transport sector for individuals—both in private cars and taxis, as there are no other means of public transportation. Diesel is consumed mainly by businesses (for transportation) and by the electricity generation company. Electricity and LPG are almost universally consumed. Half of the kerosene sold on the market goes to the air transport sector, and the rest is likely used by lower-income households as a substitute for electricity, but no data are available to corroborate the latter hypothesis.

The Distribution of Energy Subsidies

Gasoline and electricity represent the bulk of energy consumption and, together with other energy products, are heavily consumed by the rich. Gasoline and electricity take up more than 90% of household energy consumption, which corresponds to the same share of government spending on subsidies. Subsidies for these two products are clearly regressive in absolute terms. An individual in the upper quintile benefits 3.5 times more from subsidies on electricity and gasoline than an individual in the bottom quintile. That ratio is 2.8 and 2.7 for diesel and LPG, respectively.

Households’ direct benefits from energy subsidies are close to LD 2.5 billion, which represents only about a third of the total cost to the budget of energy subsidies.Footnote 16 Given the extremely low subsidized prices, energy products represent a very small share of household expenditure—about 3% of total expenditures, equivalent to LD 370 million (Table 5.16). Gasoline and electricity represent the greatest share, while expenditure on kerosene is very low. The share of household spending on energy products is slightly higher for poorer households (3.6%) relatively to richer households (2.5%). The share of expenditure on LPG shows the largest difference across quintiles (Table 5.17), suggesting that it is used more intensely by poorer households.

Compared to other countries in the North Africa Region, the share of expenditure on energy products in Libya is more homogeneous across quintiles. This finding corroborates the result we found in analyzing food subsidies, namely that the income distribution in Libya is comparatively more flat, with lower inequality, compared to other countries in the Region. Particularly striking is the distribution of gasoline and diesel expenditure. The poorest quintile of households spends on gasoline 85% of what the richest quintile spends and twice as much for diesel. Indeed, data on car ownership from the household survey confirm that most households in Libya own at least one car and that the share of nonowners, 25.8% (Table 5.18), is rather homogeneously distributed across quintiles. This finding, which is atypical for countries at similar levels of per capita income, is likely explained by the very low cost of gasoline and the availability of cheap old cars.Footnote 17

Highly subsidized prices have led to excessive consumption of energy products in Libya. The household survey data imply that households consume an estimated 1.13 billion liters of gasoline per year, equivalent to about 177 L per capita (Table 5.19).Footnote 18 To put that into context, we have extracted comparable data from the World Bank database on energy consumption for Libya and other countries in 2010.Footnote 19 These data suggest that per capita gasoline consumption in Libya in 2010 was 281 L, which is far greater than the household survey data imply, much higher than per capita consumption in Italy (225 L) or France (159 L) for that year, and far higher than the world average (187 L). Per capita gasoline consumption in Algeria, another oil producer, is reported at 96 L in the World Bank’s database. These statistics all point towards significant gasoline overconsumption in Libya. The same conclusion holds when comparing electricity consumption in Libya to that of other countries.

Figure 5.5 confirms that the expenditure share of energy products is low for both the poor and rich, although the share is higher for the poor, which is shown by the negative slope of some of the curves depicted in the figure. The differences between quintiles are not perceptible for diesel and kerosene partly because these products are consumed in very small quantities but also because these products follow a different pattern across quintiles. The share of kerosene expenditure in total expenditure in particular is flat across quintiles.

Households derive substantial benefits from energy subsidies. We estimated the total value of direct energy subsidies received by households at LD 2.5 billion (Table 5.20)—6.7 times higher than total household expenditure on these products. About LD 1 billion of this total derives from gasoline and LD 1.1 billion from electricity. These numbers underscore the significant share of subsidy incorporated in energy prices in Libya: on average, the government should increase energy prices by 670% to reach market levels and eliminate subsidies.

Energy subsidies in Libya are regressive (in absolute value), or pro-rich, which can be seen by looking at the distributional analysis on a per capita basis. Figure 5.6 shows per capita subsidies (y axis) across population percentiles (x axis) for each subsidized energy product. All curves are positively sloped, which indicates that richer households receive higher amounts of subsidies per capita. The regressive feature of energy subsidies is less pronounced for the cases of kerosene and diesel, consistent with the proposition that these products are consumed more intensively by the poorer population. This feature is most pronounced for gasoline and electricity, the two products whose subsidies generate the biggest cost to the government budget.

Simulations of Energy Subsidy Reforms

Energy subsidy reforms are expected to have a significant direct impact on households. Consistent with gasoline and electricity being the main energy products consumed by households, we find that reducing subsidies on these two items would have a far larger impact on household real income and poverty, as well as on the government budget, than reducing subsidies on other energy products. Presumably, the impact on productive sectors would also be large. Given the considerable price adjustments necessary to eliminate subsidies and the consequent impact on household welfare, a gradual approach to subsidy reform would be preferable, even if a cash compensation scheme is put in place.

As in the case of food subsidies, we simulate two scenarios: a 30% cut in subsidies for each product and a 100% decrease (total elimination) of subsidies. Recall that a 30% cut in subsidies would result in a different price increase for each product because prices vary across products. Table 5.21 reports for all energy products considered the initial subsidized price, the unit subsidy, the price following a 30% reduction in subsidy (final price, scenario 1) and the price after the elimination of all subsidies (final price, scenario 2). The last price is equivalent to the market reference price that we consider for each product.

The elimination of subsidies (scenario 2) would lead to exceptionally large price increases. The price of kerosene would need to rise 12.1 times to match the market price; that of gas LPG would need to rise by a factor of 10.5; and those of gasoline, diesel, and electricity would need to rise by seven or eight times. Gasoline, the product with a price currently the “closest” to market price, would still undergo a price increase of 7.15 times to match the market price. These gaps are the largest observed between subsidized and market prices in North Africa and Middle East Region and represent a real challenge for reform.

The direct cost of a complete elimination of subsidies to households is estimated at LD 2.5 billion (Table 5.22), equivalent to the total amount of direct subsidies received by households. This is a very large sum, representing almost 20% of total household expenditure. A 30% reduction in subsidies on each product would cost households LD 0.75 billion. These costs would be rather evenly distributed across quintiles with the exception of the first quintile, which would bear a much lower cost than the rest. The quintile that would bear the greatest cost is the third. In per capita terms, removing subsidies would cost more to the upper quintiles, as expected given the result that energy subsidies are regressive. Nonetheless, because energy expenditure represents a higher share of total expenditure for the poor, the per capita loss of the lower quintiles represents a larger share of their total per capita spending (Table 5.23), although the difference is not as stark as we found it to be in the case of food subsidy reforms.

Eliminating all energy subsidies (scenario 2) would create direct savings of LD 2.5 billion to the government budget—the same amount as the total direct value of subsidies to households (Table 5.24). This amount is equivalent to 3.83% of total government expenditure. The removal of gasoline subsidies alone could create direct savings of 1.6% of government expenditure, and the removal of subsidies on electricity about 1.75% (Table 5.24). A 30% reduction in subsidies on all products (scenario 1) would create LD 1.22 billion in direct savings to the government budget, which is more than one-third of the decline in spending under the 100% reduction scenario (scenario 2). As explained for the case of food subsidies, with a partial reduction in subsidies we have two sources of reduced government spending, the first resulting from higher subsidized prices and the second resulting from lower quantities consumed by households at these higher prices. If subsidies were totally eliminated, this second effect would disappear given that no quantities would be sold at a subsidized price.

Reforming gasoline and electricity prices would bring the greatest savings to the government budget. Figure 5.7 illustrates, for each energy product, the direct impact on government expenditure (measured on the y axis in LD) versus a percentage reduction in subsidy (x axis). The values that correspond to 30 and 100% reductions are the same as those reported under the two scenarios in Table 5.24. For all products, government expenditures are a decreasing function of subsidy reduction. The marginal returns to reducing subsidies would diminish as prices get closer to market levels, because fewer and fewer quantities would be bought at subsidized prices given fixed household expenditure levels.

Energy subsidy reforms could have a substantial impact on poverty. A 30% reduction in subsidies, assuming unchanged consumption patterns, would increase poverty (measured by the national poverty line) by four percentage points, from 18.5 to 22.5% (Table 5.25). The increase in poverty following a total elimination of subsidies would be significantly higher, at 17.7 percentage points, resulting in a postreform poverty rate higher than 36%. These projections are commensurate with the magnitude of price adjustments that would be needed under either reform scenario. The products that would explain most of the rise in poverty under the two scenarios are gasoline and electricity. The rise in poverty would also be accompanied under scenario 2 by a rise in inequality, estimated at 3.1 percentage points. These estimates are among the highest when compared with those for other countries in the Region such as Morocco, Tunisia, Egypt, or Jordan, in part because of the higher level of subsidies in Libya compared to these countries.

A number of factors can help attenuate the negative impact of energy subsidy reform. A gradual and sequenced approach to energy subsidy reform, across products and across time, would help to make room for simultaneously working on improving public service delivery, so that households and productive sectors are able to gradually adjust to the new economic realities. Moreover, the poverty impact of energy subsidy reform discussed here is purely monetary and therefore does not take into consideration inevitable substitution patterns that would result when a reform is introduced. Such substitutions would be greatly facilitated if the reform were gradual and accompanied by complementary measures to provide other options for citizens in terms of services, for example, more efficient electricity production or the introduction of public transportation networks.

The impact of subsidy reform could also be attenuated through cash transfers. A transfer of LD 243 per capita per year targeted to the first quintile would be sufficient to restore poverty to the prereform level of 8.5% under the scenario of full subsidy elimination and using the international poverty line of USD 1.25 per person per day (Fig. 5.8). This targeted transfer system would cost the government LD 471 million per year. Alternatively, because poverty would jump by almost 18 percentage points if all energy subsidies were eliminated, the government may decide to target the transfers to the first two quintiles. The per capita amount required to bring poverty back to 8.5% in this case would be LD 245, costing the government LD 845 million per year. Yet another possibility to restore poverty to the prereform level would be a universal transfer of LD 243 per capita per year, costing the government LD 1.5 billion annually. Given that direct savings from the price increases would amount to LD 2.5 billion (Table 5.24), the net gains to the budget from full subsidy elimination and cash compensation to the population in the first quintile of LD 243 per capita would be about LD 2 billion. If targeting the first quintile is not possible, extending a transfer of LD 243 per person per year to the entire population—sufficient to maintain poverty at 8.5%—would reduce the net gains to the budget from subsidy reform and cash transfers to about LD 1 billion per year.

Energy price increases would also be expected to reduce consumption (Table 5.26).Footnote 20 Based on our assumptions, a 30% reduction in energy subsidies would reduce the quantities of energy products consumed by 46% for electricity, 52.7% for kerosene, and 40% for gasoline and diesel. The estimated impact on quantities would also vary across quintiles. For kerosene, for example, the impact would be greater for richer households, but for other products such as diesel and LPG the impact would be the greatest for the second quintile.

The Political Economy of Reforms

Attempts at subsidy reforms were made during the decade that preceded the revolution, but they did not last. In the early 2000s, following the removal of international sanctions, Libya embarked on a reform path to modernize and open up its economy (Vandewalle 2011), and cutting subsidies seems to have been an important part of that program (Wahby 2005). Despite widespread opposition among the population, the government proceeded with the reform, raising fuel, diesel, and electricity prices in 2005 and completely liberalizing the price of some food products. By 2006 only four food products were still subsidized: flour, rice, semolina, and pasta. In 2007 the government also eliminated the subsidy on pasta, and to compensate the population tried to put in place a transfer system of 4 dinars per capita, per month. The government, however, was unable to dispense this cash transfer. Still, subsidies remained restricted to flour, rice, and semolina until early 2011 when Gaddafi, in an attempt to quell the revolutionaries’ demands, extended food subsidies back again to 12 items.

The political economy of the Gaddafi period was entirely driven by the leader’s decisions, and these decisions served budget interests or short-term political objectives. The post-Gaddafi period has been characterized by internal conflicts among various factions that participated in the revolution and by a very volatile political environment, making reforms difficult to implement and the possibility of a public debate on subsidy reforms almost impossible. High oil and gas prices that characterized the period between the revolution in 2011 and the first half of 2014 helped to boost government revenues, but the internal conflict over natural resources limited the possibility to exploit oil reserves to their full potential. The most recent slump in the price of crude oil, which began in June 2014, and the continued internal instability are contributing to increase the pressure on government finances while keeping subsidy reforms difficult to implement from a political perspective. Libya therefore remains the most extreme of the cases in the MENA Region in terms of the size and variety of subsidies, in terms of weight of subsidies on the government budget, and in terms of lack of reforms, and it will be very unlikely to see a reform of the subsidies system anytime soon.

Despite this very complex environment, reforming subsidies remains an important question for the Libyan government. In February 2013 the Ministry of Economy conducted a survey of a sample of 931 adult citizens aged 18 to 95 living in 25 cities. The University of Tripoli analyzed results and found that about 70% of the respondents were in favor of a policy that would eliminate subsidies and replace them with cash transfers, although only 28% thought that compensation via cash subsidies should be targeted to the poor only. Libyans believed that they are entitled to subsidies as a means to distribute national wealth to most citizens, but they would trade low subsidized prices for a cash benefit.

The government announced several times the intention to reform subsidies. In April 2014 it made public the intention to introduce smart cards for the purchase of fuels and stated the intention to eliminate subsidies within three years. In July 2014 it committed to substitute goods and fuel subsidies for cash subsidies by January 2015. According to the Libya Herald it was the first time in Libya’s history that such a move was promised, and this in spite of the political instability (Zaptia 2013). Yet, at the time of this writing, no substantial reform had been implemented, and political instability was deteriorating further.

Summary and Recommendations

This chapter provided a food and energy subsidy incidence analysis as well as an impact analysis for two alternative reform scenarios for Libya. The results provide information for each subsidized good in terms of the subsidy’s impact on household welfare and on poverty. This section briefly reviews the key findings and discusses the main issues that would still need to be addressed for a more comprehensive picture of subsidy incidence and reform analysis.

Food subsidies save households some 10% of annual expenditure and eliminating them would have a significant effect on poverty. Table 5.27 summarizes the results of the food subsidy analysis. Household expenditure loss would reach 3.1% under scenario 1 and 10.2% under scenario 2. The incidence of subsidies would drop from 10.2% in the prereform scenario to 7.4% under scenario 1 and zero under scenario 2. Subsidy reform would reduce government spending by about 1% under scenario 1 and 2% under scenario 2 (but additional savings from lower administrative costs and less waste/smuggling would also materialize). The poverty impact would be particularly stark: depending on the poverty line used, poverty would rise from 8.5 (or 14.4%) to 10.5% (or 17.3%) under scenario 1 and to 16.6% (or 24%) under scenario 2. Inequality would also rise.

Although food subsidies are relatively progressive, a significant share, about 35% of government spending on these subsidies, is wasted, which would support a move to replace them with cash transfers. This chapter’s analysis can provide guidance for the size of cash transfers that would compensate for food subsidy reform. One can look for guidance in the estimates of the per capita monetary value of subsidies received by the various quintiles of the population (Table 5.28). For example, under a scenario of full subsidy elimination, maintaining the poverty rate constant at 8.5% is feasible if a per capita transfer of LD 175 per year is allocated to the population in the first quintile. If the objective is rather to compensate the population falling in the first quintile for the totality of their loss, the transfer could be LD 180 per capita, again granted only to the population in that group. And if the objective is to compensate the average member of the population (a way to address in part the needs of the middle class in a compensation scheme), cash transfers could amount to, for example, 201 LD per year, per person, which is the average monetary value that a Libyan person derives from food subsidies today.

The above examples dealt with eliminating all subsidies in one step but, alternatively, another possibility may be to sequence the reform over products and over time. Price liberalization could start with items, such as semolina, that are likely to have a small impact on households and move onto bigger ticket items over time.Footnote 21 This approach may be easily followed in Libya because it was implemented in the past between 2007 and 2010 with only three food items subsidized, flour, rice, and semolina. Yet another possibility, given the generous caloric content of the quotas, could be to start reducing the quantities of all food items under the quota system gradually before eliminating subsidies altogether at a later point in time.Footnote 22

Energy subsidies save households about 26% of annual expenditure, and their elimination would also significantly impact poverty. Table 5.29 summarizes the aggregate results for an analysis of energy subsidies. Household expenditure loss would reach 6% under scenario 1 and 19.9% under scenario 2. These amounts are larger than those for food subsidies, given the larger subsidized component underpinning energy prices in Libya today, compared to that in food prices. Subsidy reform would reduce government spending by about 1.9% under scenario 1 and 3.9% under scenario 2. The impact would, however, be only a partial impact on the government budget because factors such as indirect effects and effects on productive sectors are not incorporated in the analysis, nor are other factors such as smuggling. The impact on poverty would be high with a rise in poverty from 8.5% under the international poverty line (or 14.4% under the national line) to 11.2% (or 18.2%) under scenario 1 and to 21.7% (or 30.4%) under scenario 2. This rise in poverty would also be accompanied by a rise in inequality of 3.2 percentage points.

Clearly, energy subsidy reform would have a huge impact on the Libyan economy, which calls for gradualism. Full liberalization would imply price increases of between 7 and 10 times the existing prices, in a context where alternatives (such as more efficient production processes for electricity or public means of transportation) are not available. It would therefore seem imperative that energy subsidy reform be planned in stages, with a product-by-product approach, gradually liberalizing them over a number of years, and along with significant improvements in service delivery in related areas (electricity, transport, and so forth.). This approach would help improving efficiency and contributing to lower energy consumption. For the electricity sector in particular, it would be important to first improve performance at all levels of production and distribution while tariffs are slowly increased.

Although more analysis is needed to develop a suitable subsidy reform plan, this chapter suggests a number of broad recommendations. The complete elimination of all subsidies in one stroke with no compensation to households could result in a sharp increase in poverty and could affect the middle class severely and lead to social unrest.Footnote 23 A radical approach to subsidy reforms in Libya during this particular historical period is not advisable.

A less drastic approach would be to reduce subsidies in sequential steps over an extended period of time. Morocco and Tunisia have followed this approach, achieving significant budget savings without social unrest. It is also advisable to implement reforms one product at a time starting with the products that affect the poor the least. Other considerations may be important as well, for example, the importance of not delaying reforms where substantial waste is clearly established. Other things being equal, this approach would suggest starting with petroleum products rather than food products and with gasoline rather than LPG. This chapter provides information that helps making choices on priority products based on the importance of each product for different groups of households.

The elimination or reduction of subsidies would also call for targeted cash transfers. Compensation could be provided to the bottom 20 or 40% of households in the form of coupons or cash transfers. Such reforms could result in significant budget savings and no increases in poverty. The difficulty of this approach resides in the better targeting of households, and specific systems would need to be in place to ensure that such targeting is operationally feasible. If the country does not develop such effective systems, targeted subsidies may result in substantial waste of resources. A universal transfer is a second best option, but would still reduce the burden on government expenditure.

This chapter provided only part of the information required to put in place subsidy reforms. Much more work and preparation will be needed to prepare a feasible reform agenda. In particular, a few areas stand out for further work. First, it will be important to assess, in the context of the existing formal and informal support mechanisms in Libya, whether a new cash transfer system is really needed to compensate for subsidy reform and for what product. Second, if a transfer is needed, the next question is how best to introduce it in the context of existing social safety nets and/or what reforms to these safety nets are needed to support subsidy reforms. Also, actual mechanisms to disburse the transfers might need to be created and may be costly. Third, a strategy for phasing out the transfers may also be needed, particularly if targeting cannot be achieved. Fourth, broad consultation needs to be conducted with all sectors affected by the reform to address any negative impacts. Beyond the impact on households, energy subsidy reforms will probably have significant impact on producers, and such impact will need to be assessed and factored in the reform. Fifth, a communication strategy in Libya would seem to be even more important than in other countries given the size and sensitivity of subsidies and the current political fragility. These aspects are all beyond the scope of this study but need to be tackled in preparing for subsidy reforms.

Notes

- 1.

The quantities provided within the quota system are not negligible. For example, a family of four is entitled to the following quotas at subsidized prices each month: 8 kg of sugar, 800 g of tea, 4 kg of tomato paste, 6 L of vegetable oil, 10 kg of rice, 12 kg of flour, 4 kg of semolina, and 6 kg of pasta. These quantities are well above the total amount of calories necessary for a family of four for one month.

- 2.

Preliminary data on government spending in 2012 indicated that food, electricity, and other energy subsidies cost, respectively LD 2.1 billion, 1.1 billion, and 6.3 billion to the budget.

- 3.

Direct effects represent the impact of subsidies via subsidized products consumed by households. Indirect effects represent the impact of subsidies via nonsubsidized products consumed by households that use subsidized products as a production input.

- 4.

Anecdotal evidence suggests that because not all households actually take advantage of the quota system for their food purchases, some of the surplus subsidized food ends up being used as cattle feed or input to the production of sweets in bakeries for the case of sugar and flour. No data are available to quantify these observations, and if animal raising and bakeries are household activities, these effects would be captured in the direct effects estimations. A share of subsidized food products is reportedly smuggled and sold illegally in supermarkets, thereby depressing market prices. Some effect from removing subsidies on these products may filter through to market prices, but that effect is likely to be small.

- 5.

We note here that this paper’s analysis does not capture the administrative costs of subsidies, which may be large given the system of quotas administered through cooperatives.

- 6.

Although no data are available, hydrocarbons are believed to constitute about two-thirds of GDP in Libya, suggesting that estimated aggregate expenditure could be about 35% of nonoil GDP.

- 7.

- 8.

We make that assumption when the survey provides no separate expenditure data for subsidized versus nonsubsidized quantities for a given product.

- 9.

Household sizes are different across quintiles, with poorer households also being the largest. It is therefore useful to also look at per capita estimates in addition to per household estimates to assess whether or not food subsidies are progressive.

- 10.

Market prices were obtained from the Ministry of Economy dated for the first quarter of 2013.

- 11.

Note that these are upper bound estimates based on Laspeyres estimations.

- 12.

Estimates of the budgetary impact of alternative reform scenarios do not take into account savings from lower administrative costs of managing the subsidy program and from leakages of the subsidy program (e.g., smuggling).

- 13.

We convert $1.25 to Libyan dinars using the 2009 purchasing power parity (PPP) exchange rate data (1 LD = $0.74-PPP, latest available data) and inflation for the period 2009–13. We find the equivalent universal poverty line for 2013 to be LD 821.42 per person, per year, which is lower than the national poverty line of LD 966.3 per person, per year leading to lower poverty rates.

- 14.

To estimate the national poverty line, we use the 2003 poverty line—which was estimated at LD 593.6 by staff of Libya’s Office of Statistics but not endorsed officially—and CPI inflation between 2003 and 2013. This national poverty line estimate corresponds to LD 2.65 per day, or about $2 at the actual exchange rate. The national poverty line estimate represents 49% of the average per capita expenditure of households (LD 1967).

- 15.

These results are entirely dependent on the choice we made regarding the point elasticity at market price and the shape of the demand curve. Other assumptions would lead to different results, and these findings should be taken with caution. Note, however, that the final results on household welfare are not affected by the choice of elasticity and demand curve as these estimates depend only on the initial expenditure and the price change (relative changes in quantities consumed of subsidized and nonsubsidized products do not affect the overall welfare effects given that we consider a hard budget constraint).

- 16.

The budget data do not include administrative costs associated with the subsidy system.

- 17.

Anecdotal evidence suggests that the stock of cars in Libya is quite old. Many low-income people drive run-down cars and keep doing so because of cheap gasoline and the lack of alternative transportation means.

- 18.

The authorities had budgeted for 4.47 billion liters of gasoline to be sold on the market in Libya in 2013.

- 19.

See http://data.worldbank.org. The data were converted from kilograms to liters on the basis that 1 L of petrol weighs 0.711 kg.

- 20.

These results are entirely dependent on the choice we made regarding the point elasticity at market price and the shape of the demand curve. Underlying our analysis are demand curves that depict the same elasticity for all households but differ in elasticity across products, with the difference depending on the gap between market price and subsidized price. For energy products, we assumed a point elasticity of −0.5 at the free market price. This estimate and a linear demand curve function are then used to estimate the point elasticity at the subsidized price.

- 21.

A caveat to our analysis is that it does not take into consideration the nutritional consequences of food subsidy reform. Such an analysis may be needed before arriving at a view on how small the impact is on households particularly if the reform is not accompanied by cash transfers.

- 22.

The current basket of subsidized products provides more than twice the amount of adult calories intake as recommended by WHO or the FAO. If we consider that children make up the majority of household members in poor households of six to seven people, the amount of calories allocated within the quota system may be between two and three times the calories needed. This finding would justify a reduction in quotas based on the level of individual calorific needs. Quotas could be cut by half, for example, which would be equivalent to reducing food subsidies by half, saving more than 1 percent of government spending.

- 23.

This chapter’s analysis does not take into account new transfers enacted by the government in 2013 (such as transfers to heads of households and transfers for minors). A complete picture of the impact of subsidy reform on poverty and the middle class will require including these in the assessment.

References

Chami, R. 2012. Libya Beyond the Revolution: Challenges and Opportunities. International Monetary Fund. http://www.imf.org/external/pubs/ft/dp/2012/1201mcd.pdf.

Charap, J. 2013. Note on Subsidy Reform in Libya. IMF Country Report No. 13/151, Washington, DC: International Monetary Fund.

FAO (Food and Agriculture Organization). 2003. Food Energy: Methods of Analysis and Conversion Factors. Food and Nutrition Paper 77, ftp://ftp.fao.org/docrep/fao/006/y5022e/y5022e00.pdf.

IMF (International Monetary Fund). 2013. Libya: Selected Issue. IMF Country Report. 13/151, Washington, DC: International Monetary Fund.

Vandewalle, D. 2011. Libya: Post-War Challenges. African Development Bank Economic Brief, September. http://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/Brocure%20Anglais%20Lybie_North%20Africa%20Quaterly%20Analytical.pdf.

Wahby, E. 2005. Libya: Economic Reforms Anger Citizens. Carnegie Endowment, June 20. http://carnegieendowment.org/files/Wahby.pdf.

Waniss, O., and E. Karlberg. 2007. The Libyan Economy: Economic Diversification and International Repositioning. Berlin, London: Springer.

Zaptia, S. 2013. The IMF and the Vexing Issue of Reforming Subsidies: Ramifications for Libya. Libya Herald, Tripoli. http://www.libyaherald.com/2013/04/17/the-imf-and-the-vexing-issue-of-reforming-subsidies-ramifications-for-libya/.

Acknowledgements

The authors thank the Libyan authorities for the information, comments, and advice provided throughout the study. In particular, we thank the staff at the Ministry of Economy, Ministry of Finance, Ministry of Planning, and the Central Bank who provided excellent support during the various missions to Tripoli. The World Bank country and regional teams provided essential logistical support and various World Bank staff contributed with comments and advice. They are Marouane El Abassi, Bernard Funck, Khalid El-Massnaoui, Fanny Missfeldt-Ringius, Maria Vagliasindi, and Heba Elgazzar. Any errors are the sole responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Araar, A., Choueiri, N., Verme, P. (2017). The Quest for Subsidy Reforms in Libya. In: Verme, P., Araar, A. (eds) The Quest for Subsidy Reforms in the Middle East and North Africa Region. Natural Resource Management and Policy, vol 42. Springer, Cham. https://doi.org/10.1007/978-3-319-52926-4_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-52926-4_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-52925-7

Online ISBN: 978-3-319-52926-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)