Abstract

We use panel data techniques to analyze the debt and equity financing strategies of the non-financial firms operating in the G8 countries and the selected emerging economies and compare them with those adopted during the financial crisis of 2007–2008. For this purpose, we analyze corporate financial data of 9952 firms in the G8 and 10,531 firms in the emerging economies over 12 years (2003–2014) to understand the corporate financing strategies in two different business environments. We find an increase in corporate debt financing in the G8 as well as the emerging economies during the period of financial crisis. Specifically, the firms operating in the G8 increased short-term debt financing whereas the firms operating in the emerging economies increased long-term debt financing. We also find institutional factors playing their role significantly but differently during the period of financial crisis.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Since the great depression of 1930s, the world has seen three major financial crises known as: the dot.com bubble, the subprime crisis, and the European sovereign debt crisis. Among the three the subprime crisis (2007–2008) is viewed as the worst financial crisis on a global scale. During the subprime crisis, many financial institutions collapsed and resulted in a freeze in global credit markets (Erkens et al. 2012) that may have implications for corporate financing decisions. In this study, we intend to investigate the impact of subprime crisis on financing choices of the firms.

Corporate finance literature has evolved over time. During initial three decades of 1960s, 1970s and 1980s, the focus of the studies was the development of theories such as the trade-off theory, pecking order theory, and agency theory (DeAngelo and Mesulis 1980; Myers 1984; Myers and Majluf 1984). During 1990s, the focus of the studies was firm and country level determinants of corporate capital structure (Booth et al. 2001; Rajan and Zingales 1995). During 2000s, the studies shifted their focus towards cross country analysis of debt and equity choices (Gungoraydinoglu and Öztekin 2011; Jong et al. 2008) and investigated that debt and equity choices of the firms differ according to their operating environment. Some recent studies have also investigated the impact of financial crisis and institutional settings (Alves and Francisco 2015; Vermoesen et al. 2013). The objective and approach of this study is novel as compared to the earlier studies carried out in the field of corporate capital structure as this study aims to:

-

(i)

Evaluate the debt and equity financing choices of the firms before, during, and after subprime crisis;

-

(ii)

Evaluate the impact of subprime crisis on debt and equity financing choices of the firms of G8 and selected 16 emerging economies and compare the financing strategies of the firms of the two groups;

-

(iii)

Evaluate the influence of economic conditions and institutional factors on financing choices of the firms.

To carry out the objective of our study, we collect the data of the firms from 24 countries including G8 economies and 16 emerging economies over the years 2003–2014. We apply fixed-effects panel data technique on 75,666 firm-year observations for G8 economies, and 66,374 firm-year observations for 16 emerging economies. We find that the corporate debt financing has increased during the period of financial crisis irrespective of the economy in which they operate. However, the firms operating in G8 economies increased the short-term debt financing while the firms operating in 16 emerging economies increased the long-term debt financing during the period of financial crisis (2007–2008). We also find significant impact of institutional as well as country level variables on financing decisions of the firms.

Organization of the paper is as follows. Along with the introduction in Sect. 1, Sect. 2 builds theoretical framework and identifies determinants of corporate financing decisions. Section 3 describes the data and develops the econometric model grounded in the relevant literature. Section 4 discusses the context of the two different sets of business environments. Section 5 presents and discusses the results. Section 6 puts forward the conclusions and the policy implications. We provide references at the end.

2 Literature Review

2.1 Financial Crisis and Leverage

The financial crisis of 2007–2008, also known as subprime crisis, is considered as the worst financial crisis of the century. It started on 15th September 2008, when Lehman Brothers asked for Chapter 11 of bankruptcy protection. This act of Lehman Brothers sent shock waves all over the world that might have implications for corporate financing decisions. According to Frank and Goyal (2008), aggregate leverage remains stationary over the long periods of time but the market conditions do have its impact on leverage. The market conditions changed considerably during the period of financial crisis and made the investors risk averse. Due to risk aversive behavior of the investors and the financial mediators there was a considerable decline in the syndicated loans and the corporate bond markets during the period of financial crisis. Further, increased information asymmetry during the period of financial crisis affected capital markets and led the firms to use short-term debt as a substitute of long-term debt. Furthermore, increased agency costs between equity-holders and long-term bond-holders (asset substitution) due to investors’ risk aversion also affected the bond market. As a result, long-term capital supply decreased while cost of issuing long-term capital increased significantly and the firms had no choice but to issue short-term debt (Ivashina and Scharfstein 2010; Santos 2011). Although the financial crisis of 2007–2008 created credit shocks as well as liquidity problems however, it also effected leverage in a positive manner all over the world through the issuance of short-term debt (Custodio et al. 2013; González 2015; Vermoesen et al. 2013). By compiling the above reasoning, we put forward the following testable hypotheses:

- Hypothesis-1: :

-

Aggregate leverage remains stationary over the long periods of time.

- Hypothesis-2: :

-

Market conditions do have an impact on leverage decisions.

- Hypothesis-3: :

-

Firms use more debt as compared to equity during the period of financial crisis.

- Hypothesis-4: :

-

Firms use more short-term debt as compared to long-term debt during the period of financial crisis.

2.2 Economic Environment and Leverage

A number of empirical studies have concluded that economic environment of the firms do have an impact on their leverage decisions (Booth et al. 2001; Gungoraydinoglu and Öztekin 2011; Jõeveer 2013). Unlike the firm-level variables, economic conditions act differently on the financing decisions of firms operating in different institutional setting (Alves and Francisco 2015). In this study, we investigate two factors associated with economic environment: economic growth rate and inflation rate. We postulate that higher rate of economic growth provides more corporate investment opportunities to the firms that may require more external finances. Accordingly, economic growth is likely to be positively related with leverage. Alternatively, the firms may manage more revenue during the times of higher economic growth and consequently they have higher supply of internal funds and lesser need for external financing. Accordingly, economic growth may be negatively related with leverage. For inflation, the second economic factor we investigate, the trade-off theory postulates a positive association between tax shield and leverage (Modigliani and Miller 1963) as higher inflation rate provides an opportunity to have higher real value of tax deductions on debt. Accordingly, we expect a positive relationship between inflation rate and leverage. Empirically, Booth et al. (2001) found a positive but statistically insignificant impact of economic growth on corporate leverage for 10 developing countries. They concluded that real economic growth may positively affect book leverage, because firms are expected to raise more financing in the times of economic prosperity. Further, Jong et al. (2008) observed that economic growth does have some impact on corporate debt level in 42 countries and Bokpin (2009) found a negative relationship between economic growth and leverage and positive relationship between inflation rate and leverage for 34 emerging economies. Furthermore, Jõeveer (2013) also observed a negative association between inflation rate and leverage. In line with the above reasoning and empirical results, we formulate the following:

- Hypothesis-5: :

-

GDP growth rate is expected to be positively associated with leverage.

- Hypothesis-6: :

-

Inflation rate is expected to be positively associated with leverage.

We measure economic growth as GDP per capita growth rate and inflation as annual inflation (consumer prices) rate, consistent with previous studies (Ahsan et al. 2016c; Alves and Francisco 2015; Jõeveer 2013).

2.3 Financial Market Development, Business Environment and Leverage

The results of the studies carried out by La Porta et al. (1997, 1998) about institutional variables suggest that shareholders’ rights and creditors’ rights are very important to study the role of legal environment for corporate capital structure decisions. They observed that countries where investor protection is poor have very smaller financial (debt and equity) markets. Considering stages of market development, Demirguc-Kunt and Maksimovic (1996) observed that initial developments in stock markets produced high debt to equity ratios in 30 developing economies, whereas improvements in already developed stock markets lead towards substitution of debt with equity financing. While comparing civil law and common law systems, Ergungor (2004) explained that financial markets are more developed in the countries where common law courts are more effective as these courts provide protection to shareholders as well as creditors. Further, Alves and Ferreira (2011) found a direct relationship between leverage and stock market development and an inverse relationship between leverage and banking development using data of 31 countries. Their results are in line with Demirguc-Kunt and Maksimovic (1996) who show that initial development in capital markets lead towards high debt to equity ratios, specifically long-term debt. Furthermore, Muradoğlu et al. (2014) also found positive influence of stock-market development on leverage but their results for the relationship between banking development and leverage were inconclusive. However, a number of empirical studies found a positive relationship between banking development and short-term debt (Alves and Ferreira 2011; Demirguc-Kunt and Maksimovic 1996; Fan et al. 2012). They observe that the short-term debt is easy to monitor as compared to the long-term debt specifically when creditors’ right are not well-protected. Empirical studies have also found a positive relationship between stock market development and long-term debt (Alves and Ferreira 2011; Demirguc-Kunt and Maksimovic 1996). In line with the results of these studies, we expect a positive impact of banking development on short-term debt in countries with under-developed legal systems. Further, we expect a positive impact of stock-market development on long-term debt. Following previous studies (Alves and Francisco 2015; Jõeveer 2013), we measure legal conditions of a country by Corruption Perception Index (CPI) of Transparency International (TI) and expect the firms to be more leveraged operating in countries that are considered as more corrupt. For this purpose, we use total value of shares traded during a year as percentage of GDP for stock-market development and total domestic credit provided by the banks during a year as a percentage of GDP for banking development consistent with previous literature (Alves and Francisco 2015; Lee 2012). Following are our hypotheses regarding financial market development and legal environment of a country.

- Hypothesis-7: :

-

Stock market development has a positive relationship with long-term debt.

- Hypothesis-8: :

-

Banking development has a positive relationship with short-term debt.

- Hypothesis-9: :

-

Firms operating in countries that are considered more corrupt tend to be more leveraged.

2.4 Leverage and Firm Level Variables

Consistent with the previous literature (Ahsan et al. 2016a; Alves and Francisco 2015; González 2015), we take book as well as market leverage as dependent variable. We choose firms level variables (tax shield, growth, profitability, asset structure and firm size) that are most commonly used by previous empirical studies in the related field (Alves and Francisco 2015; Booth et al. 2001; González 2015; Sheikh and Qureshi 2014). In Table 1, we present all dependent and independent variables used in the study, their model name, measurement proxies and source name. We also explain dummy variables used in the study. We take 2007 and 2008 to represent the crisis period consistent with previous studies (Alves and Francisco 2015; Erkens et al. 2012; Ivashina and Scharfstein 2010; Kashyap and Zingales 2010).

3 Data and Methodology

3.1 Data

We draw our sample firms from 24 countriesFootnote 1 including developed (G8) as well as emerging economies. We obtain annual accounting and market data for the period from 2003 to 2014 from Osiris database for listed non-financial firms from the countries mentioned above. We omit the data of financial firms due to their regulated operating environment. Further, to avoid survivorship bias, we include both active and inactive publically traded non-financial firms.

We include a firm in our sample dataset that has non-missing values for the following heads in Osiris database: current liabilities, non-current liabilities, fixed assets, total assets, market value per share, book value per share, number of shares outstanding, tax payments, gross profit, net profit before extraordinary items, and interest expense. A firm with missing values on these heads has been excluded from our sample dataset. After all these steps of data cleaning, 9952 firms with 75,666 firm-year observations for G8 economies, and 10,531 firms with 66,374 firm-year observations for 16 emerging economies remain in our final dataset. Further, to reduce the impact of potential outliers we winsorize all firm-level variables at 1 % from both the sides (top and bottom) of the own variable distribution. We obtain the data for macroeconomic variables (inflation, GDP, capital market development, banking development) from the World Bank database (WDI) and for Corruption Perception Index from the Transparency International (TI).

3.2 Methodology

In order to analyze an unbalanced panel of 75,666 firm-year observations for G8 economies, and 66,374 firm-year observations for selected emerging economies, the study considers panel data analysis as an appropriate technique that is also used in akin studies (Ahsan et al. 2016b; Alves and Francisco 2015). Of the two contending models, random-effects model (REM) and fixed-effects model (FEM), we choose later following the nature of our dataset.Footnote 2 Further, the aim of the study is to find out the variations in the capital structure of the firms operating in G8 economies and emerging economies over the years from 2003 to 2014, therefore, FEM is the best choice for our analysis (Baltagi 2005). We present our model in the following equation:

where L it is one of the book and market measures of leverage (STBL it , LTBL it , STML it , LTML it ) for the ith firm at time t, X it are the firm level explanatory variables of ith firm at time t; Y t are the country level explanatory variables at time t; β x are the coefficients for the X it , β y are the coefficients for the Y t , β 0 is intercept, α i are panel (firm) fixed-effects, and ε it are the remainder error component for the ith firm at time t.

3.3 Descriptive Statistics

Table 2 represents summary statistics of all the proxies used to measure dependent and explanatory variables for G8 and emerging economies, separately.

The mean value 22.9 % for short-term book leverage and 22.3 % for long-term book leverage for G8 economies, and 33.9 % for short-term book leverage and 16.9 % for long-term book leverage for emerging economies indicate a higher use of short-term debt by the firms in emerging economies as compared to the firms in G8 economies. Furthermore, the mean value of 1.4 % for inflation rate for G8 economies and 5.1 % for emerging economies explain that emerging economies have experienced higher inflation rate as compared to G8 economies. On the other hand, the mean value of 1.2 % for economic growth rate for G8 economies and 6.2 % for emerging economies indicate that emerging economies have enjoyed higher economic growth as compared to G8 economies. Moreover, the mean value of 1.345 for stock-market development for G8 economies and 0.690 for emerging economies explain that the stock-markets of G8 economies are far more developed as compared to their emerging economies’ counterparts. However, corruption level in emerging economies is much higher (mean value of 4.102 for CPI for the emerging economies) as compared to that in G8 economies (mean value of 7.411 for CPI for G8 economies).

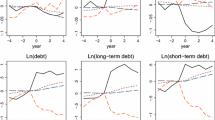

Figure 1a shows mean leverage ratios for G8 economies over the period under study. It depicts that both of the book leverage ratios for G8 economies remained almost smooth over the period under study, with a minor increase during the period of financial crisis (Hypothesis-1). But, we observe a jump in both of the market leverage ratios during the period of financial crises 2007–2008 suggesting that market conditions do have an impact on market leverage ratios of G8 economies (Hypothesis-2).

Figure 1b shows mean leverage ratios for emerging economies over the period under study. It depicts an increase in both of the market leverage ratios for emerging economies during the period of financial crisis (Hypothesis-2). But, we observe a decrease in short-term book leverage ratio and an increase in long-term book leverage ratio of emerging economies during the period of financial crises 2007–2008.

3.4 Robustness and Sensitivity Analysis

We use five firm level and five country level variables along with one dummy variable for the financial crisis 2007–2008. Further, we also use interaction term of the dummy variable with the country level variables. Autocorrelation and multicollinearity might be an issue for such a big database and a large number of variables. We find that Variation Inflation Factor (VIF) for interaction term of dummy variable with CPI t , SMD t , and BD t is more than 10 for different models (Nachane 2006; Ott and Longnecker 2001). To avoid multicollinearity issue, we use three models. In Model-1, we include five country level variables and dummy for the crisis period 2007–2008 along with five firm level control variables. In Model-2, we include five country level variables and interaction term of INF t , GDP t and CPI t with dummy for the crisis period 2007–2008, and five firm level control variables. Finally in Model-3, we include five country level variables and interaction term of SMD t, and BD t with dummy for the crisis period 2007–2008. In all three models we include five firm level control variables. To ensure validity and robustness of the results, we carry out some post estimation tests such as modified Wald test for group-wise heteroskedasticity in fixed effects regression model and Wooldridge test for autocorrelation in panel data. As a remedy for autocorrelation, we use robust standard errors adjusted for heteroskedasticity and clustered robust standard errors adjusted for clusters in panels (firms).

4 Empirical Results

4.1 Short-Term Leverage

In Table 3, we present the results of fixed-effects model for short-term leverage ratio for the G8 and the emerging economies. Panel-A presents the results of short-term book leverage (STBL it ) while Panel-B presents the results of short-term market leverage (STML it ). We include and exclude interaction term of country level variables with financial crisis dummy in different models to avoid multicollinearity. For the G8 economies, our models explain 13–15 % of the variations in short-term book leverage and 38–40 % of the variations in short-term market leverage. For the emerging economies, our models explain 13–16 % of the variations in short-term book leverage and 26–29 % of the variations in short-term market leverage.

The firms in operating in two different environments display opposing short-term debt financing behavior. The positive coefficients of D t (dummy for the crisis period 2007–2008) in Model-1 of Panel-A and Panel-B for the G8 economies suggest that the firms operating in these economies increased the use of short-term debt financing during the period of financial crisis, supporting our Hypothesis-4. On the other hand, negative coefficients of D t in Model-1 of Panel-A and Panel-B for the 16 emerging economies explain that the firms operating in these economies decreased the use of short-term debt financing during the period of financial crisis, opposing our Hypothesis-4.

Contrary to the Hypothesis-6, we find a significant negative relationship of INF t with STBL it as well as STML it for the G8 economies. This relationship turns positive during the crisis period (positive relationship of D*INF t with STBL it and STML it in Model-2) suggesting that the firms operating in the G8 economies increased the use of short-term debt financing during the period of financial crisis (supporting Hypothesis-4) may be due to easy access. On the other hand, we find a significant positive relationship of INF t with STBL it as well as STML it for the 16 emerging economies (supporting Hypothesis-6). This relationship turns negative during the crisis period (negative relationship of D*INF t with STBL it and STML it in Model-2) suggesting that the firms operating in these emerging economies decreased the use of short-term debt financing (opposing Hypothesis-4) with an increase in inflation rate during the period of financial crisis.

Further, we find significant positive relationship of GDP t with STBL it (supporting our Hypothesis-5) and negative with STML it in all three models for the G8 economies. The negative relationship of GDP t with STML it remains same during the crisis period (negative relationship of D*GDP t with STML it in Model-2 of Table 3 Panel-B). However, the positive relationship of GDP t with STBL it turns negative during the crisis period (negative relationship of D*GDP t with STBL it in Model-2 of Table 3 Panel-A) indicating that during the period of crisis the firms operating in the G8 economies may have relied on the supply of internal funds to fulfill their financing needs. On the other hand, we find a significant negative relationship of GDP t with STBL it as well as with STML it in Model-2 for the emerging economies that turns positive during the crisis period (positive relationship of D*GDP t with STBL it as well as STML it Panel-A and Panel-B of Table 3). These relationships indicate that under better economic conditions the firms operating in the emerging economies reduce their dependence on short-term debt but the squeeze during the crisis period forces them to raise short-term financing.

Furthermore, we do not find any significant relationship between SMD t and STBL it (Model-3 in Table 3 Panel-A) but we do find a significant negative relationship of SMD t and STML it and a significant positive relationship of BD t and STML it (Model-3 in Table 3 Panel-B), for the G8 economies. These significant relationships provide support for our Hypothesis-7 and Hypothesis-8 that the developed stock markets in the G8 economies discourage the use of short-term debt financing but at the same time developed banking systems encourage firms to use more short-term debt financing. During the crisis period, we find significant positive relationship of SMD t and BD t with STBL it as well as STML it (Model-3 in Table 3 Panel-A and Panel-B) for the G8 economies. These relationships support our Hypothesis-3 that the firms increase the use of debt financing during the period of financial crisis. For the emerging economies, we find a significant negative relationship of SMD t with STBL it and STML it , in favor of our Hypothesis-7. This relationship remains the same during the period of crisis (Model-3 in Table 3 Panel-A and Panel-B). Contrary to our Hypothesis-8, we find a significant negative relationship of BD t with STBL it and STML it , that turns positive during the period of crisis (positive relationship of D*BD t with STBL it as well as STML it in Model-3 of Table 3, Panel-A and Panel-B) favoring our Hypothesis-4.

Moreover, we find a significant negative relationship of CPI t with STBL it of the G8 as well as the emerging economies that turns positive during the crisis period (positive relationship of D*CPI t with STBL it and STML it in Model-2) suggesting that lower level of corruption builds owners’ faith in the system and consequently they increase the level of their equity investment in the firm reducing the use of debt financing in the G8 as well as the emerging economies supporting our Hypothesis-9. However, during the period of financial crisis the firms operating in the G8 as well as the emerging economies increased the use of short-term debt financing regardless of the level of corruption. We do not find any significant relationship between CPI t and STML it for both types of the economies.

4.2 Long-Term Leverage

In Table 4, we present the results of fixed-effects model for long-term leverage ratio for the G8 and the 16 emerging economies. Panel-A presents the results of long-term book leverage (LTBL it ) while Panel-B presents the results of long-term market leverage (LTML it ). For the G8 economies, our models explain 37–38 % of the variations in long-term book leverage and 35–36 % of the variations in long-term market leverage. For the 16 emerging economies, our models explain 12–13 % of the variations in long-term book leverage and 18–19 % of the variations in long-term market leverage.

The negative coefficient of D t in Model-1 of Panel-A supports our Hypothesis-4 and explains that the firms in the G8 economies decreased the use of long-term debt financing during the period of crisis. However, positive coefficient of D t in Model-1 of Panel-B for the G8 economies oppose our Hypothesis-4. Contrary to our Hypothesis-4, we find a positive coefficient of D t in Model-1 of Panel-A and Panel-B for the 16 emerging economies suggesting that the firms operating in these emerging economies increased the use of long-term debt financing during the period of financial crisis.

We find a significant negative relationship of INF t with LTBL it as well as LTML it for the G8 as well as the emerging economies that turns positive during the crisis period (positive relationship of D*INF t with LTBL it and LTML it in Model-2) indicating that the firms operating in these economies increased the use of long-term debt financing (opposite to our Hypothesis-4) with an increase in inflation rate during the financial crisis period.

Further, we find a positive but insignificant relationship of GDP t with LTBL it in Model-2, a significant negative relationship in Model-1 and Model-3, and a significant negative relationship with LTML it in all three models for the G8 economies. The negative relationship of GDP t with LTBL it as well as LTML it remains the same during the crisis period (negative relationship of D*GDP t with LTBL it and LTML it in Model-2 in Panel-A and Panel-B). On the other hand, we find a significant positive relationship of GDP t with LTBL it and a positive but insignificant relationship with STML it in Model-2 for the emerging economies that turns negative during the crisis period (negative relationship of D*GDP t with LTBL it as well as LTML it , Panel-A and Panel-B). These relationships explain that the firms operating in the emerging economies prefer to finance their business projects with debt financing (Hypothesis-5) but during the period of crisis these firms had to rely on available short-term debt along with their internal funds.

Furthermore, we do not find any significant relationship between SMD t and LTBL it (Model-3 Panel-A) but we do find a significant negative relationship of SMD t and LTML it (Model-3 Panel-B) for the G8 economies (opposite to our Hypothesis-7). For the emerging economies, we find a significant positive relationship between SMD t and LTBL it as well as LTML it for all three models (supporting our Hypothesis-7) that remains same during the crisis period (positive relationship of D*SMD t with LTBL it as well as LTML it , Panel-A and Panel-B). Further, we find a significant negative relationship between BD t and LTBL it for all three models for the G8 as well as the emerging economies that remains the same during the crisis period (negative relationship of D*BD t with LTBL it , Panel-A). However for LTML it , we find a significant positive relationship of BD t for the G8 economies and a significant negative relationship for the emerging economies during normal as well as crisis period.

Moreover, the relationship of CPI t with LTBL it of the G8 economies remains insignificant during normal as well as the crisis period, but we find a significant positive relationship of CPI t with LTML it for the G8 economies that remains positive during the crisis period (positive relationship of D*CPI t with LTML it in Model-2). On the other hand, we find a significant negative relationship of CPI t with LTBL it as well as LTML it for the emerging economies, explaining that lower level of corruption reduces the agency conflict and consequently the firms use lesser debt financing in the emerging economies (in favor of Hypothesis-9). However, during the financial crisis period firms operating in the G8 as well as the emerging economies increased the use of long-term debt financing regardless of the level of corruption in their economies.

5 Discussion of Results

The results indicate that book leverage ratios for the G8 remained almost stationary during the period from 2003 to 2014 with a minor increase during financial crisis (Fig. 1). On the other hand, we observe a decrease in short-term book leverage ratio and an increase in long-term book leverage ratio for the emerging economies during the period of financial crisis (Fig. 1). However, the two ratios revert back to their pre-crisis level. Our results highlight the sticky nature of corporate financial leverage in the two different contexts. Similar results of Frank and Goyal (2008) led them to demand a satisfactory theory that must explain as to why the firms keep leverage stationary and why the environment serves to maintain the leverage despite managerial differences. We observe that capital structure is path-dependent and support the connotation of Bhamra et al. (2008). We observe that path-dependence theory (Nelson and Winter 1982) may explain this observed sticky nature of book leverage. The results for market leverage however, reject our Hypothesis-1. Consequently, these results suggest a little amendment in Hypothesis-1. We can state that the book leverage is path-dependent and generally remains stationary over the long periods of time. In support of our Hypothesis-2, we observe changes in book leverage ratios in the emerging economies and a jump in market leverage ratios in both the contexts during the financial crises period suggesting that the capital market conditions do have an impact on corporate leverage decisions.

The results also indicate that during the period of financial crisis the firms operating in the G8 as well as the emerging economies increased the use of debt financing. However, their choice was different. The firms operating in the G8 economies increased short-term debt financing during the period of financial crisis, whereas the firms operating in the emerging economies increased long-term debt financing during the period of financial crisis (Tables 3 and 4). These results generally support our Hypothesis-3. We observe that these firms might be constrained by poor supply of internal funds due to financial crisis and the poor market conditions might also have restricted them to issue new equity. Resultantly, these firms had to raise debt to finance their needs. Another plausible explanation comes from agency theory that suggests that the stockholders try to pass on their risk to the creditors by raising debt during crisis. Further, increased use of short-term debt by the firms in the G8 countries possibly indicates that the firms consider the financial crisis as a temporary phenomenon and raise short-term debt to finance their needs whereas their counterparts in the emerging economies consider it a long-term phenomenon and raise long-term debt. Alternatively, it seems easier to raise long-term debt in the emerging markets as compared to the G8 economies even during the financial crisis. We also find that good economic conditions provide investment opportunities to the firms, irrespective of their country. The firms operating in the G8 economies raise short-term as well as long-term debt financing to avail these opportunities. However, during the period of financial crisis these firms reduce their debt dependence and consequently they forego their growth as well as profitability. On the other hand, good economic conditions helped the firms operating in the emerging economies to adjust their term structure by raising long-term debt and paying-off short-term debt during normal time periods whereas they raised short-term debt and paid-off long-term debt during the period of financial crisis.

The firms belonging to two different groups display similar long-term financing strategy whereas opposing short-term financing strategy while facing inflation not only during normal period but also during financial crisis. Normally, they decrease their long-term debt financing with an increase in inflation rate whereas during crisis they increase their long-term debt. For short-term debt, the firms operating in the G8 economies decrease their short-term debt with an increase in inflation rate whereas their counterparts in the emerging economies increase their short-term debt. However, during the period of financial crisis they do the opposite. Except for short-term debt in the emerging economies, these results reject our Hypothesis-6.

We find that stock market development does not have any significant effect on book leverage ratios of the firms operating in the G8 economies. The plausible reason may be that the stock-market of these countries are already developed enough that further development does not have any significant impact. On the other hand, stock-market development has a direct relationship with long-term debt of the firms in emerging economies, in line with Demirguc-Kunt and Maksimovic (1996) where they explain that initial development in stock market produces high debt to equity ratio in emerging economies.

Moreover, we find that lower level of corruption encourages the use of equity financing in the G8 as well as the emerging economies. However, during the period of financial crisis the firms operating in two different settings increase the use of debt financing regardless the level of corruption. Table 5 summarizes the hypotheses developed in the study and the observed financing behavior of the firms operating in the G8 as well as the emerging economies.

6 Conclusions Drawn and Policy Implications

The study analyzes the impact of recent financial crisis (2007–2008) on the business operations and investigates financing strategies adopted by the businesses during the financial crisis. This study carries out this analysis by comparing the strategies of the firms operating in the G8 economies with the firms operating in the 16 emerging economies. To accomplish this, the study applies fixed-effects technique on a panel data of 75,666 firm-year observations for the G8 economies and 66,374 firm-year observations for the 16 emerging economies. We observe a generally stick nature of the book leverage in two different contexts and consider that path dependence theory may provide a better explanation. We also find a major increase in the market leverage ratios of both types of the economies during the period of financial crisis. The results also highlight that the firms operating in the G8 as well as the emerging economies increased the use of debt financing during the period of financial crisis. Further, we find out that the firms operating in the G8 economies manage the impact of financial crisis with an increase in short-term debt financing while, the firms operating in the emerging economies do it by increasing long-term debt financing. We observe that raising long-term debt is seemingly easy in the emerging economies. The WDI databaseFootnote 3 shows that the 16 emerging economies have higher average non-performing loans to total gross loans ratio (6.8 %) as compared to that of the G8 economies (3.8 %) during the study period. Moreover, the 16 emerging economies are weaker as compared to the G8 economies on strength of legal rights index of WDI. The policy implication of our finding and the WDI data is that regulators need not only to reconsider the governance mechanism of their credit markets but also to improve the legal rights of the creditors to help develop their firms and the economies.

The results suggest that the firms operating in two different economic environments increased their debt with an increase in inflation rate during the financial crisis. We also observe that lower economic growth during the period of financial crisis hurts profitability of the firms operating in the G8 as well as the emerging economies and as a result these firms raise debt to finance their business activities. Further, we explore the role of stock-market development and find out that its impact was more significant during the period of crisis as compared to normal time periods for the G8 as well as the emerging economies. Furthermore, we find a positive impact of banking development on debt ratio of the firms during the period of crisis irrespective of their country. Moreover, we explore that the firms, operating in economies with higher level of corruption, have higher leverage ratio as compared to the firms operating in lower corruption level countries. But, level of corruption becomes irrelevant during the period of crisis and the firms increase their debt irrespective of corruption level of their operating economy. These results highlight the need for legislation to help curb corruption to help develop a resilient corporate arena.

The results of our study have impending policy implications as they imply that the recent financial crisis not only affected financing strategies of the firms but did so in a different way across different economies. Our results have confirmed the relevance of the stock-market development and banking development with corporate financing strategies.

Notes

- 1.

Canada, France, Germany, Italy, Japan, United Kingdom, United States, Russian Federation, Brazil, China, Egypt, India, Indonesia, Iran, Israel, Malaysia, Mexico, Nigeria, Pakistan, Philippines, Poland, South Africa, Taiwan and Turkey.

- 2.

According to (Wooldridge 2012) fixed-effects model has no problem to deal with an unbalanced panel data.

- 3.

References

Ahsan T, Man W, Qureshi MA (2016a) Mean reverting financial leverage: theory and evidence from Pakistan. Appl Econ 48(5):379–388

Ahsan T, Wang M, Qureshi MA (2016b) Firm, industry and country level determinants of capital structure: evidence from Pakistan. South Asian J Glob Bus Res (Forthcoming)

Ahsan T, Wang M, Qureshi MA (2016c) How do they adjust their capital structure along their life cycle? An empirical study about capital structure over life cycle of Pakistani firms. J Asia Bus Stud 10(3):276–302

Alves P, Francisco P (2015) The impact of institutional environment on the capital structure of firms during recent financial crises. Q Rev Econ Finance 57:129–146

Alves PFP, Ferreira MA (2011) Capital structure and law around the world. J Multinatl Financ Manag 21:119–150

Baltagi BH (2005) Econometric analysis of panel data, 3rd edn. Wiley, New York

Bhamra HS, Kuehn L-A, Strebulaev IS (2008) The aggregate dynamics of capital structure and macroeconomic risk. Rev Financ Stud 23(12):4187–4241. doi:10.1093/rfs/hhq075

Bokpin GA (2009) Macroeconomic development and capital structure decisions of firms. Stud Econ Financ 26(2):129–142

Booth L, Aivazian V, Kunt AD, Maksimovic V (2001) Capital structure in developng countries. J Financ 56(1):87–130

Custodio C, Ferreira MA, Laureano L (2013) Why are US firms using more short-term debt? J Financ Stud 108:182–212

DeAngelo H, Mesulis RW (1980) Optimal capital structure under corporate and personal taxation. J Financ Econ 8:3–29

Demirguc-Kunt A, Maksimovic V (1996) Stock market development and financing choices of firms. World Bank Econ Rev 10(02):341–369

Ergungor OE (2004) Market- vs. bank-based financial systems: do rights and regulations really matter? J Bank Financ 28:2869–2887

Erkens DH, Hung M, Matos P (2012) Corporate governance in the 2007–2008 financial crisis: evidence from financial institutions worldwide. J Corp Financ 18:389–411

Fan JPH, Titman S, Twite G (2012) An international comparison of capital structure and debt maturity choices. J Financ Quant Anal 47(01):23–56

Frank MZ, Goyal VK (2008) Trade-off and pecking order theories of debt. Handbook Empir Corp Financ 2:135–202

González VM (2015) The financial crisis and corporate debt maturity: the role of banking structure. J Corp Financ 35:310–328

Gungoraydinoglu A, Öztekin Ö (2011) Firm- and country-level determinants of corporate leverage: some new international evidence. J Corp Financ 17:1457–1474

Ivashina V, Scharfstein D (2010) Bank lending during the financial crisis of 2008. J Financ Econ 97(3):319–338

Jõeveer K (2013) Firm, country and macroeconomic determinants of capital structure: evidence from transition economies. J Comp Econ 41:294–308

Jong A d, Kabir R, Nguyen TT (2008) Capital structure around the world: the roles of firm- and country-specific determinants. J Bank Financ 32:1954–1969

Kashyap AK, Zingales L (2010) The 2007–8 financial crisis: lessons from corporate finance. J Financ Econ 97:303–305

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Financ 52(03):1131–1150

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny RW (1998) Law and finance. J Polit Econ 106(06):1113–1155

Lee B-S (2012) Bank-based and market-based financial systems: time-series evidence. Pac Basin Financ J 20:173–197

Modigliani F, Miller MH (1963) Corporate income taxes and the cost of capital: a correction. Am Econ Rev 53:433–443

Muradoğlu YG, Onay C, Phylaktis K (2014) European integration and corporate financing. Int Rev Financ Anal 33:138–157

Myers SC (1984) The capital structure puzzle. J Financ 39:575–592

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13(2):187–221

Nachane DM (2006) Econometrics: theoretical foundations and empirical perspectives. Oxford University Press, New Delhi

Nelson RR, Winter SG (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge, MA

Ott LR, Longnecker M (2001) Statistical methods and data analysis, 5th edn. Duxbury, Pacific Grove, CA

Rajan RG, Zingales L (1995) What do we know about capital structure? Some evidence from international data. J Financ 50(5):1421–1460

Santos JAC (2011) Bank corporate loan pricing following the subprime crisis. Rev Financ Stud 24(06):1916–1943

Sheikh NA, Qureshi MA (2014) Crowding-out or shying-away: impact of corporate income tax on capital structure choice of firms in Pakistan. Appl Financ Econ 24(19):1249–1260

Vermoesen V, Deloof M, Laveren E (2013) Long-term debt maturity and financing constraints of SMEs during the global financial crisis. Small Bus Econ 41:433–448

Wooldridge JM (2012) Introductory econometrics: a modern approach, 5th edn. South-Western, Cengage Learning, Mason

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Qureshi, M.A., Ahsan, T., Azid, T. (2017). Equity and Debt Financing Strategies to Fuel Global Business Operations During Crisis. In: Hacioğlu, Ü., Dinçer, H. (eds) Global Financial Crisis and Its Ramifications on Capital Markets. Contributions to Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-47021-4_22

Download citation

DOI: https://doi.org/10.1007/978-3-319-47021-4_22

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-47020-7

Online ISBN: 978-3-319-47021-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)