Abstract

Castelo de Sonhos, a gold deposit in Pará State, Brazil, has seen several phases of exploration since the mid-1990s. These programs have provided drill hole data, surface mapping of outcrops, geophysical surveys, geochemical surveys of soil samples, and preliminary metallurgical test work. All available data from these exploration programs have been integrated with recent advances in paleo-plate reconstructions, in modeling sedimentary depositional systems, in geostatistical simulation, and in data mining. This integration of ideas and methods from petroleum geostatistics, from classical statistics, and from plate tectonics makes it possible to predict the range of the project’s potential tonnage and grade and to assess the project’s upside and downside risk. This leads to an exploration target range that is probabilistically quantified, that is well grounded in data, in field observations and science, and that is testable through drilling. Not only does this quantitative risk assessment improve analysis of the project’s technical and economic viability but also, importantly, it builds confidence among investors whose support is critical for advancing the project.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Rising several hundred meters above the cattle-grazing lands of southern Pará State in Brazil (Fig. 1) is a plateau cut by a ravine (Fig. 2). In the 1970s and 1980s, garimpeiros (artisanal miners) worked the alluvial deposits on the flanks and the toe of the plateau, recovering hundreds of thousands of ounces of gold using manual methods to excavate and concentrate ore.

In 1995, Barrick Gold, reasoned that the likely source of the alluvial gold was a hard-rock deposit on top of the plateau. They launched an exploration program, initially searching for a granite-hosted gold deposit, but quickly recognizing that the host was a band of conglomerates that rims the plateau. After a small drill program, an extensive soil geochemistry survey, and a trenching program, Barrick closed the exploration program in 1996 and relinquished the mineral concessions.

Garimpeiros then moved onto the plateau, digging trenches and pits by hand near Barrick’s trenches, and near the up-dip projection of the best intervals in Barrick’s drill holes. Over the next decade, garimpeiros excavated near-surface mineralization along strike for several kilometers, to a depth of 12–15 m. In places, tunnels were dug into the face near the base of trenches, following well-mineralized bands 50–70 m into the wall (Fig. 3). The garimpeiro workings (garimpos) were not limited by lack of gold but by the difficulty of extending hand-dug slots and tunnels below the water table. The back-breaking and life-shortening work became physically impossible without access to explosives and mechanized equipment. By the late 2000s, garimpeiro activity had dwindled to a few aging “hobby farmers” who continued to be able to recover a few grams a day from the more prolific garimpos.

The past several years have been difficult for the mining industry. The price of gold, which flirted with $1,800/oz in 2012, had dropped to barely $1,000/oz by late 2015. The collapse in commodity prices made many once-promising projects unprofitable and caused funding for exploration to dry up. Mineral exploration is a risky and costly business; with most mineral prospects never going into production, exploration can be justified only when commodity prices are so strong that the cost of the many misses is covered by the few hits.

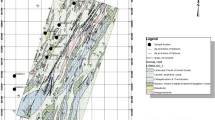

By late 2015, the Castelo de Sonhos project was in jeopardy of being shut down a second time. More than $1,000,000 was needed just to make the final land payments that would secure TriStar 100 % ownership of the project, and much more was needed to continue exploration. Even though the drilling continued to show promising potential, lack of funding limited the areal extent of TriStar’s drilling; by 2014, the last year of drilling, only 25 % of the 16 km of conglomerate outcrop and soil anomaly had been drilled (Fig. 4).

Although there were good showings of gold throughout the 250–300 m thickness of the conglomerate band, the drill holes targeted sweet spots, hunting for good news that was necessary to feed a cash-starved project. Very few holes penetrated the entire thickness of the conglomerate, leaving untested resource potential even in the limited areas that had been drilled.

Attracting more funding was made more difficult by a 2014 technical report that established a resource estimate of 180,000 oz of gold in indicated resources and 100,000 oz in inferred resources (Mello 2014). At this scale, the project became regarded as small, likely too small to ever become a modern industrial mine at current gold prices. It was difficult to communicate to weary and skeptical investors that this first resource estimate was “just a start” and that the project had great promise and potential.

The mining industry is littered with promises of pots of gold at the end of rainbows, with tales of the discovery of El Dorado, the fabled city of gold that the Spaniards never found. Mining promoters traffic in hyperbolic claims and wishful thinking. This is, in fact, a necessary part of sustaining investment through the high-risk phase of exploration. Many projects move forward only through sheer optimism. Exploration geologists have a tendency to fall in love with their discoveries, always maintaining faith that their project has much more potential than anyone has been able to document. Next year’s drilling will prove up that potential and vindicate their faith … if only someone would fund the project.

Against this backdrop of boundless optimism, discussions of a project’s potential are understandably met with a degree of cynicism and doubt. Arm-waving projections of blue-sky possibilities are rarely convincing to investors who have learned through experience to be suspicious of hype. This is where geostatistics makes a difference. An important difference. A project-saving difference.

This paper begins with an explanation of why mineral resources are conventionally reported as a single “best estimate” and why securities regulations limit one’s ability to present resource estimates in the probabilistic context that has become familiar in other areas of applied geostatistics. It presents the concept of an “exploration target range” and shows how this provides an opportunity to introduce probabilistic analysis from geostatistical simulations, showing a space of uncertainty that spans a range of possible grades and tonnages. The controls on gold mineralization in the Castelo de Sonhos deposit are discussed, analyzing and integrating all available information and data to support the view that this is primarily an ancient placer deposit, with free gold grains being deposited in a bed of gravels and pebbles that was later buried, cemented into solid rock, then uplifted to its present position. A methodology for geostatistical simulations is presented, one that draws on tools developed for oil and gas applications but relevant to this mining problem because the gold accumulated in a sedimentary environment similar to many petroleum reservoirs. Results of the conditional simulation study are shown, leading to a P10–P90 range that provides strong technical support for the belief that the preliminary resource estimate considerably understates the project’s true potential.

2 Mineral Resource Reporting: The Single-Estimate Tradition

Although the mining industry is the birthplace of applied geostatistics, mineral resource estimation makes little use of the conditional simulation tools that now dominate applied geostatistics in the many other areas where geostatistics is now applied. In practice, mineral resource estimation is still based on interpolation procedures that produce only a single estimate.

The vast majority of mining is conducted by public companies whose shares trade on stock exchanges. Governments and securities regulators, who want publicly traded companies to function with an accountability that builds public confidence in the stock market, have introduced regulations that constrain how mining companies report mineral resources. These securities regulations are intended to improve the comparability of resource estimates, so that one company’s “apple” is not another company’s “orange.” They also aim to make available to the public the data, scientific and technical information that support companies’ claims about their mineral resources.

Mining is becoming increasingly globalized. All of the world’s largest mining companies operate in several countries, as do many midsize companies. By the time they reach production, many mining projects involve partners from different countries. In order to facilitate reporting of a project’s mineral resources in the several jurisdictions where the partners are headquartered, and where they operate, the rules that govern reporting of mineral resources have gravitated toward a global norm. Although there are differences between the details of the securities regulations in each country, these differences are becoming smaller as many countries adopt rules that are similar to the JORC Code developed by the Australian Institute of Mining and Metallurgy and to Canada’s National Instrument 43-101.

At the same time that securities regulators require adherence to specific rules and definitions, they also encourage the use of best practice guidelines developed by professional organizations. In Canada, for example, National Instrument 43-101 recommends that the best practice guidelines of the Canadian Institute of Mining and Metallurgy (CIM) be followed.

Although the geostatistics community has developed many tools for building stochastic models that span a space of uncertainty, these have not found broad use in the mining industry because securities regulations for mineral resource reporting do not embrace the possibility of different but equally likely versions of a deposit’s grade and tonnage. National Instrument 43-101, for example, is unambiguous in its requirement that when multiple versions of a deposit’s grade and tonnage are presented, the report must make clear which of the alternatives is the single one being presented as the mineral resource estimate.

The single-estimate tradition is reinforced by best practice guidelines that present advice that focuses on the use of single-estimate interpolation procedures like kriging and inverse distance weighting. With decades of effort having gone into harmonizing regulations and guidelines in different countries, it is very unlikely that the single-estimate tradition of the mining industry can be undone.

2.1 Classification

Classification is the one purpose for which conditional simulation has gained some traction in mineral resource estimation. Regulations require that mineral resource estimates be classified into three categories that reflect different levels of confidence: “measured,” “indicated,” and “inferred,” from most confident to least.

Several mining companies and mining engineering consulting firms have developed a standard practice of classifying resources according to fluctuations in grade, tonnage, and metal content observed in multiple realizations from a conditional simulation study. But even when used for this purpose, conditional simulation is very rarely the direct basis for the reported estimate of the mineral resource; it informs only the choice of appropriate confidence categories for a resource estimate developed using a single-estimate procedure.

2.1.1 Exploration Target Range

Canadian and Australian regulations for the reporting of mineral resources explicitly permit the reporting of an “exploration target range.” Canada’s National Instrument 43-101 does not define what this is, a puzzling omission in a document that insists on adherence to standardized definitions and terminology. Fortunately, Australia’s JORC Code does give a definition, one that captures the sense of the term as it is generally understood throughout the mining world:

An Exploration Target is a statement or estimation of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade, relates to mineralization for which there has been insufficient exploration to estimate a Mineral Resource.

The requirement that grade and tonnage of an exploration target be reported as a range (and never as single estimates) makes conditional simulation ideal for the analysis and reporting of an exploration target.

3 Controls on Mineralization at Castelo de Sonhos

Reliable models of grade and tonnage in a mineral deposit depend on a good understanding of the controls on mineralization, the physical and chemical processes that brought gold to certain location, and not to others. This understanding informs models of spatial continuity, especially in the exploration stage, when the hard data are too few to permit robust analysis of experimental variograms. It also assists with the choice of appropriate trend models; quantification of an exploration target range is completely unconvincing if it consists simply of filling a large volume of rock with grades drawn from a homogenous distribution. Stationarity is never a comfortable assumption for mineral deposits; although it eventually becomes justifiable when the deposit is well drilled and local search neighborhoods require only an assumption of local stationarity, stationarity is a very difficult assumption to justify with sparse exploration drilling. This is largely the reason that best practice guidelines encourage mineral resource estimates to be tightly constrained to nearby drill holes. It is also the reason that the 2014 resource estimate for Castelo de Sonhos is so low. When best practice guidelines are followed, the resources (the blue areas in Fig. 4) tightly follow the available drilling. Establishing the full exploration target requires extrapolating beyond the available drilling, and this can be done well only when geologically sound trend models are used.

The existing exploration data from Castelo de Sonhos support two plausible views for the controls on gold mineralization. The first is a “syngenetic” view in which the gold arrived in the sedimentary host rock at the same time that the sediments were accumulating. The second is an “epigenetic” view in which the gold arrived long after the rocks were indurated, likely through mineralized fluids that percolated through the rock.

In the syngenetic view, free gold grains would have been moved by water and settled to the bottom when the velocity of the current was not sufficient to keep them in suspension, or to keep them as part of the bed load that rolls along the bottom. The primary direction of continuity would be stratigraphically horizontal, subparallel to bedding, and aligned with the current direction. Large-scale changes in gold grade would follow lithology, tending to be higher where large pebbles are more frequent and tending to be lower where the sediments are finer. These lithologic trends are due to the fact that the hydrodynamic conditions that cause gold grains to settle will also cause large pebbles to settle. The large-scale trends in gold grade would go from high in the proximal direction (nearer the source of the eroded gold grains) to low in the distal direction (further away from the source).

In the epigenetic view, gold would follow cracks and fissure, the high permeability pathways through which mineralized fluids could travel. Directions of maximum continuity would be aligned with these fractures; for near-surface deposits, these would be subvertical because the lack of a confining load on the top makes horizontal stress greater than vertical stress, and fractures tend to propagate perpendicular to stress. Large-scale trends in gold grade would reflect proximity to faults and fractures, with gold grades tending to be higher in brecciated rocks in fracture zones and lower as one moves into less fractured rock away from those zones.

There is geological evidence that supports both styles of mineralization. The coincidence of the conglomerate outcrop with the soil anomaly (Fig. 4) supports the syngenetic view because it suggests that the conglomerate was always the host rock and not merely a convenient stopping point where gold later came out of solution from mineralized fluids. Direct observations of thin gold films on fracture surfaces are consistent with the epigenetic view, as is anecdotal commentary on the presence of hematite alteration with high gold grades. Statistical analysis of the available data, however, confirms that the primary controls on mineralization are those of placer environment and that although gold was subsequently remobilized, it has moved only a short distance from the location where it was originally deposited among pebbles and gravels, likely in flowing water.

Figure 5 shows a schematic of the main lithologies in the Castelo de Sonhos Formation, which is composed of a conglomeratic band, 250–300 m thick, that sits between thicker units of arenite above and below. Within the main conglomerate band, there is a mixture of pebble-supported conglomerates (mC1), matrix-supported conglomerates (mC2), a micro-conglomerate (mC3), and conglomeratic arenites (mAC). The conglomeratic arenites are sandstones in which the occasional pebbles are so widely spaced that they don’t look like true conglomerates. In places where the pebbles are very widely spaced, the conglomeratic arenite looks exactly like the upper or lower arenite (mA).

Figure 6 shows side-by-side box plots of the gold grade distributions in the five lithologies, with the progression from left to right being proximal to distal: pebble conglomerates will occur closer to the source and the finer-grained arenites will occur further from the source. The gradual progression from high grade in the pebble-rich lithologies to low grade in the pebble-poor lithologies is consistent with the view that the hydrodynamic processes that caused pebbles to settle to the bottom also caused gold grains to settle at the same time.

Recursive partitioning (Breiman et al. 1984) provides additional statistical support for the view that the deposit is primarily an ancient placer. Figure 7 shows the recursive partitioning tree that separates high grade from low grade in the drill hole intervals coded as mC3, which is referred to as a “micro” conglomerate because it is composed entirely of small particles of gravel. The single most important factor in separating high-grade mC3 from low-grade mC3 is the thickness of the mC3 layer. Layers of micro-conglomerate less than 2 m thick have much higher gold grades (nearly 10×) than the thicker mC3 layers. This speaks to the likelihood that the micro-conglomerate acted like a natural sluice box, trapping gold that settled from the bed load above. When the same mass of gold grains is distributed in a thick mC3 layer, the gold grade ends up being lower than it does in a thin mC3 layer. For the thinner mC3 units, the next most important factor that separates higher grade from lower grade is the lithology of the overlying layer. If it is a matrix-supported conglomerate (mC2), the average grade is 3× that of the micro-conglomerates that are not overlain by a matrix-supported conglomerate. In order for bottom gravels to trap gold grains in a placer environment, the water velocity has to be sufficient to carry gold grains in the bed load, but not so high that the gold grains will be in suspension in the water column. Although the pebble-supported conglomerates likely reflect a higher water velocity, it is the matrix-supported conglomerates that would have been deposited in water that was flowing quickly, but not so quickly that there was a minimal bed load rolling at the bottom of the water column.

Other factors that support the syngenetic view include high recoveries of free gold using gravity methods in the preliminary metallurgical test, no gold in the lower arenite and very little gold in the upper arenite and only immediately above the conglomeratic band, and low variance in field measurements of the azimuths of paleo-current directions, typically from cross-bedding.

Although there are some factors that support the epigenetic view (visible gold on fracture surfaces and association of gold with hematite alteration), there are several factors that are inconsistent with an epigenetic explanation. There is no correlation between gold grades and proximity to faults or fractures, and the deposit does not contain any of the sulfide minerals, like pyrite and chalcopyrite that commonly occur with epigenetic deposits.

Placer deposits can form in many different depositional environments, including alluvial fans, braided streams, meandering rivers, fluvio-deltaic systems, and in near-shore marine environments. There is not yet enough field evidence to provide a strong opinion on the specific details of the depositional environment. Occasional hematite rims on quartz pebbles are consistent with subaerial deposition commonly seen in alluvial fans; but the low variance of paleo-current directions and the statistical evidence of subaqueous deposition (Fig. 7) point to something other than an alluvial fan. The lack of very fine-grained sediments is consistent with the separation of silts that occurs in the surface layer in a near-shore marine environment where fresh water from land meets salt water from the ocean.

Despite the lack of specific details on the depositional environment, several broad characteristics remain clear. The direction of maximum continuity will be parallel to stratigraphy, subhorizontal to bedding, and will follow sinuous channels of the type shown in Fig. 8. These types of channel geometries occur in all sedimentary environments where heavy mineral deposits form and at all scales.

Photographs showing sinuous channel geometries at several scales. From left to right: at the 10 km scale in the desert near Hamra Al Drooa in Oman (Kjell Lindgren, International Space Station, NASA); at the 100 m scale in the Thjorsa River near the Hofsjökull glacier, Iceland (Olivier Grunewald); and at the meter scale in heavy minerals in sand at Ventry Beach, Ireland (Jessica Winder)

The other characteristics common to all of the possible depositional environments are trends that will cause proximal-to-distal decreases in the water velocity and energy of environment, the frequency and size of pebbles, the proportions of pebble and clast-supported conglomerates, and average gold grade.

The ability to model these trends well and to capture the sinuous channel geometries in variogram models will significantly improve the realism of conditional simulations. If these characteristics are not honored, simulations will lack realism and will not inspire confidence in the attempt to quantify the exploration target range.

4 Plate Tectonics and Depositional Environment

Figure 9 shows a reconstruction of the continental plates 2.05 billion years ago (Eglington 2015), when a large supercontinent known as Nuna formed near the South Pole. In the 2 billion years since, the continental crust of Nuna has separated into four continental plates, two of which are now part of South America (the green plates on Fig. 9) and two of which are now part of Africa (the blue plates). There are several known lode gold deposits that date to 2.05 Ga or older and that can be traced back through time to their locations on Nuna (the orange triangles). These formed an arc that stretched across the continent, likely a ridge of volcanic mountains much like the modern Andes.

Zircon dates from Castelo de Sonhos place the formation of the conglomerates at 2.0–2.1 billion years ago, approximately the same age as two other paleo-placer gold deposits, Tarkwa in Ghana (2.1 Ga) and Jacobina in Brazil (2.0 Ga), both of which are now large operating mines. At the time that all three of these quartz-pebble conglomerates were forming, they sat near the shore, below lode gold deposits at higher elevations. Streams and rivers carrying eroded gold grains would have deposited their gold where the water velocity dropped, either in the alluvial plains or in the fluvio-deltaic region where rivers meet the sea.

5 Structural Geology

From its original flat-lying configuration, the band of conglomerates has been folded and faulted. The axial plane of the fold has been tilted to the northwest (in current UTM coordinates), and the hinge line has been tilted so that it dips to the southwest. The approximate horseshoe shape of the conglomerate outcrop (Fig. 4) is the result of the clipping of the folded conglomerate band against the current topography. The southern limb of the outcrop appears wider than the northern limb because of the tilt of the axial plane. The bedding has a shallow dip in the southern limb but is nearly vertical on the northern limb; so the apparent width in the southern limb is an oblique cut across the conglomerate band, while the apparent width on the northern limb is very close to the true perpendicular width.

There are two major faults that offset the conglomerate band, creating a small down-dropped block whose apparent shift to the east is due to the tilt of the fold.

A 3D model of the folding and faulting of the Castelo de Sonhos conglomerate band was created. This model allows one to wind back the clock, restoring the conglomerate band to its original depositional configuration by unfaulting, untilting, and unfolding. The original depositional configuration is the proper coordinate system for geostatistical analysis and simulation. Once conditional simulations have been built, the clock can be run forward, with the conglomerate band being folded, tilted, and faulted to bring it back to its configuration in current UTM coordinates.

6 Conditional Simulation Methodology

The simulation of gold grades at Castelo de Sonhos begins with a sequential indicator simulation (SIS) of the lithologies. This SIS procedure uses simple kriging (SK), with the local means defined by the proportion curves shown in Fig. 10.

In the vertical direction, there is a clear non-stationarity in the lithology proportions. In the oldest (deepest) layers of the conglomeratic band, there is very little of the pebble-supported conglomerate (mC1), and a lot of the conglomeratic arenite (mAC) and arenite (mA). Later during the period when the conglomerate was being deposited, the proportion of pebble-supported conglomerate increased, reaching a peak about 75 % of the way from the base of the conglomerate to the top. The vertical variation in lithology proportions is likely due to a combination of sea-level changes and changes in the sediment supply caused by uplift and erosion on the continental land mass of Nuna. Since the lithology proportions are not stationary, the conglomerate band was divided into six domains or “sequences,” choosing boundaries that were designed to create stationary lithology proportions within each sequence, i.e., between each consecutive pair of boundaries.

The horizontal proportion curves shown on the right of Fig. 10 require an assumption about the direction of sediment transport. Using lithologies observed in drill holes, and maximum pebble sizes observed in outcrops, the assumption was made that the paleo-current direction was northeast to southwest, approximately aligned with the plunging direction of the fold, an assumption that is consistent with the paleo-current direction implied by the paleo-plate reconstruction (Fig. 9). As one moves down-dip (southwest) from the north-south limb of the conglomerate outcrop, the proportions of the high-energy lithologies (mC1 and mC2) will tend to decrease, and the gold grades will also tend to decrease.

The SIS procedure is able to use locally varying directions of maximum continuity that are subparallel to simulated channel centerlines. These centerlines were created by borrowing a tool developed for oil and gas applications. Srivastava et al. (2013) presents a grid-less method for simulating the geometry of the centerlines of sinuous fluvio-deltaic channels, conditioned by lithology observations in well bores, with the conditioning data providing information on the proximity to sand channels. For Castelo de Sonhos, lithologies in drill holes provide information on the proximity of channels. The five lithologies were coded as integers from 1 to 5 in proximal-to-distal order: mC1 = 1, mC2 = 2, mC3 = 3, mAC = 4, and mA = 5. Within each drill hole, within each sequence, the average of these integer codes is a numerical summary of the energy of the environment. High-energy environments will have a low average, and low-energy environments will have a high average. The spatial trends in these average lithologies provide clues to the proximity to channels within each sequence.

Figure 11 shows simulated channel centerlines for the six sequences. The colored dots on this figure show the average lithology indicator for each drill hole, within the sequence boundaries. Red-to-yellow colors denote high-energy environments (low values of the average lithology integer), while green-to-blue colors denote low-energy environments (high values of the average lithology integer).

Figure 12 shows an example of the SIS lithology simulation on a stratigraphically horizontal slice at the middle of the conglomerate band, using the proportion curves (Fig. 10) for SK means, and using simulated channel centerlines (Fig. 11) to define local directions of maximum continuity.

Once lithology simulations have been created, grade simulations are done with SGS, using only the drill hole data that fall within the same lithology. Following the grade simulation, SIS is used to simulate broad zones of weak, moderate, and intense hematite alteration that slightly modify the gold grade. Figure 13 shows an example of the grade simulation and the alteration simulation. The left frame in Fig. 13 shows that the gold grades decrease in the down-dip (southwest) direction. This is due to the linkage between the samples and the lithologies; when the grade within the mAC region is estimated using only the mAC samples from nearby drill holes, the fact that the gold grades are generally low in mAC (Fig. 6) entails that the simulated gold grade will also be low.

7 Results

The procedure described in the previous section was used to create 100 realizations of lithology, of gold grade and of hematite alteration. For each of these, the gold that could be extracted profitably using open-pit mining methods was calculated. Figure 14 shows the histogram of the metal content of the 100 realizations. Table 1 shows the exploration target range based on the realizations corresponding to the 10th percentile (P10) and 90th percentile (P90) of the distribution of metal content.

This conceptual exploration target range is not a mineral resource estimate. Further drilling is required to calculate a mineral resource estimate that complies with the requirements of National Instrument 43-101. If this additional drilling is done, the eventual future resource may not fall within the range expressed in Table 1.

Despite being conceptual in nature, the quantitative risk assessment (QRA) that leads to the exploration target range was an important step in advancing the project. In the months since the results of the QRA have been available, the project has been able to inspire confidence in a large and growing group of people who have invested several million dollars in the project. In the current market, when there is little funding available for mineral exploration, a project like Castelo de Sonhos could not have been advanced without the sound technical analysis of future potential that geostatistical simulation provides.

Bibliography

Breiman L, Friedman J, Stone CJ, Olshen RA (1984) Classification and regression trees. Chapman and Hall, New York

Eglington B (2015) Supercontinent cyclicity: relevant data, constraints, limitations and aspects requiring particular attention, AGU Fall Meeting. American Geophysical Union, San Francisco

Mello R (2014). Mineral resources estimation for the Castelo de Sonhos project. TriStar Gold Inc: filed on www.sedar.com

Srivastava RM, Maucec M, Yarus J (2013) Grid-less simulation of a fluvio-deltaic environment, CSPG GeoConvention. Canadian Society of Petroleum Geologists, Calgary

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Srivastava, R.M., Appleyard, N., Pereira, E. (2017). Castelo de Sonhos: Geostatistical Quantification of the Potential Size of a Paleoproterozoic Conglomerate-Hosted Gold Deposit. In: Gómez-Hernández, J., Rodrigo-Ilarri, J., Rodrigo-Clavero, M., Cassiraga, E., Vargas-Guzmán, J. (eds) Geostatistics Valencia 2016. Quantitative Geology and Geostatistics, vol 19. Springer, Cham. https://doi.org/10.1007/978-3-319-46819-8_27

Download citation

DOI: https://doi.org/10.1007/978-3-319-46819-8_27

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-46818-1

Online ISBN: 978-3-319-46819-8

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)