Abstract

Many countries across the globe are on the verge of experiencing a second wave of renewable energy adoption driven by the advent of intelligent energy storage systems. In this chapter we will explore the drivers of this new phase of a sustainable energy revolution and the role played by technology and business models on the basis of smart energy systems.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Storage as Enabler for Continuous Growth of Renewables

Significant research has gone into exploring the reasons for the different rates of adoption of renewable energy by countries across the globe in the last two decades. While in some countries photovoltaic (PV) installations are already less than what they were during their peak several years ago (e.g. Germany, Australia), others are just in the middle of their first boom in renewable energy (USA). However, the policy instruments and economic frameworks are very different in each market, leading to unique nuances in the development of each country. While some countries used feed-in tariffs to boost PV deployment (Germany, France, UK, Japan, Australia), others used tax credits to achieve the same goal (USA). Policies like net metering (Canada, USA, Italy) or tax depreciation (Italy) were also instruments as well as direct financial support (Croatia) and standards for a renewable energy generation portfolio (Australia, China, Republic of Korea, USA). The timing and choice of policy instruments have led to an environment in which significant local differences exist between countries when it comes to renewable energy deployment.

One of the early adopters of a comprehensive renewable energy development plan was Germany. After a feed-in tariff induced a boom in PV installations from 2005 to 2013, new installations quickly fell to the current level of just over 1000 MW of added capacity per year as the feed-in tariff was reduced to the current level of approx. EUR 0.12/kWh. While the reduction in incentives proved to have devastating effects on the German PV market, it also allowed new technologies and business models to develop. A prime example of such a development was the rapid introduction and advance of decentralized small-scale energy storage systems.

Grid-connected storage started to make an appearance in the German market from 2010. At that time, the feed-in tariff was significantly higher than the average retail rate of electricity, creating an environment where an investment into storage did not make financial sense. Instead, the early adopters of this technology focused more on emotional factors: freedom from future price increases, independence from the utility, and backup in case of power failure were all reasons contributing to the purchase decisions of early adopters (Fig. 1). However, like the situation with PV deployment, the market for storage products showed equally diverse characteristics across the globe. While some countries had a mix of financial support and incentives (Germany), others offered financial incentives, even though there was no financial case for storage (California). Simplifying legislation and permitting processes were another driving factor in some countries when it came to the deployment of distributed small-scale residential storage. Depending on the policy framework deployed, storage started to move from an early-adopters phase into the mainstream market at different speeds, with Japan and Germany at the forefront of this development.

As feed-in tariffs started to drop in Germany to their current level and retail prices for electricity continued to climb to about EUR 0.29/kWh, an additional component was added to the factors influencing the purchasing decision: return on investment (ROI). Optimizing self-consumption was no longer just an emotional decision; it started to make financial sense. With this, the early-adopter phase in Germany ended and storage started to enter the mainstream. Rather than being an accessory to a PV installation, storage started to become the driver behind more renewable energy installations with ca. 50 % of all residential PV systems in Germany being installed with storage in 2015 (Kairies et al. 2016). With a combination of financial and emotional factors, storage developed into an enabler of future growth in residential renewable electricity production.

The technical requirements for those early-generation systems were relatively straightforward: Optimize self-consumption during the day and make sure that the batteries are fully charged in the early evening. Relatively simple algorithms were used in those early systems to control the charge and discharge behaviour of the storage system to make sure batteries were sufficiently charged to last the individual consumer through the night. This was what we now characterize as the first wave of residential energy storage deployment.

Two factors, however, led to a change in the system design of storage systems towards a more intelligent approach to small-scale energy storage. First, with increased internationalization of small-scale, decentralized storage, the functionality requirements increased as well. Additional countries meant different additional business models, which storage systems needed to cater for. In addition to maximizing self-consumption, companies now developed a software platform that caters for backup power, time-of-use shifting, or peak shaving. The regulatory frameworks in each country brought with them additional requirements for the intelligence of the system.

The second factor driving the development of a more sophisticated approach to the controls surrounding energy storage was the move from a purely emotional buy towards a more rational, ROI-focused purchasing decision. While ever decreasing hardware cost was naturally conducive to a better ROI for the customer, smarter storage application had the power to further drive down payback periods and increase the ROI. Examples of this development was the deployment of daily weather forecast data to optimize charging strategies or the introduction of smart home ready storage systems by companies like sonnen to increase the level of autarky. End customers are able to turn on electrical appliances such as a dishwasher either using their sonnen smartphone app or letting the system automatically determine when to turn on those devices in order to maximize self-consumption. This was the second phase of residential energy storage deployment.

While decentralized storage got smarter over time, optimization happened only on the individual system level. Factors such as grid friendliness were a by-product rather than the declared goal of any system intelligence developed during this phase of the introduction of decentralized small-scale storage. What was lacking at this point were concepts on how to increase the individual and collective utility one could derive from storage systems by starting to utilize network effects once decentralized storage had reached a critical mass.

With this we see residential storage enter a new, the third, phase: virtually connecting decentralized storage systems to create benefits partially outside the location where the system is being installed.

While the first and second phases have already contributed to the growth of renewable generation capacity in early-adopter markets, we believe that it will be the value created by the third phase that will have the power to dramatically change the way people produce, distribute and consume energy. With this, distributed energy storage could become the catalyst for a worldwide transformation towards a carbon-neutral energy economy.

2 Storage as the Missing Piece for Sustainable Renewable Energy Markets

Connecting assets like energy storage, especially decentralized small-scale systems installed in private households, and renewable generation in a virtual power plant as the next phase of technology development will further drive the growth of renewable generation in many countries and will be the solution for sustainable renewable energy markets.

One can observe that markets for energy storage are evolving in those countries where already a high penetration of renewables in the electricity mix has been achieved and the energy market is facing the challenge of integrating fluctuating and volatile sources of energy in the existing energy market design and infrastructures. In particular, switching from a support programme based on fixed feed-in tariffs to more price-based mechanisms, for example direct marketing or the recently introduced new auction mechanisms in Germany, will drive the demand for flexible management to maximize the value of the renewable feed-in tariff compared to the investment security of a fixed tariff, which does not incentivize flexible management. Most types of renewable generation are intermittent, relying on weather, like solar and wind, and thus cannot be managed in a flexible way. Today only biogas plants and, with some restrictions, hydropower plants provide flexible loads to systems. The biggest portion of power generation in future will be based on solar and wind, which will require flexible management and especially energy storage as the missing piece to stabilize systems, as many energy studies in Germany have shown (Buttler 2015). Maximizing or optimizing the value of solar and wind generation will thus be the main challenge and interest for plant operators and owners. In Germany, for example, today already almost 20 % of electricity generation is covered by wind and solar (BMWi 2016).

The reduction or complete phase-out of fixed feed-in tariff schemes can be seen as a major tipping point in many countries when flexible management will be introduced by stakeholders in the energy market and is the main reason why new ways of marketing renewables will be designed and launched. Recent years have already witnessed a trend in Germany and other countries, like the UK or the Netherlands, towards new business models trying to find a way to optimize the marketing of renewable energy.

These new business models can be clustered into the following use cases and will be described subsequently:

-

1.

Grid-friendly renewable energy usage on site,

-

2.

Optimized renewable energy trading,

-

3.

Renewable energy retail.

Grid-friendly renewable energy usage on site

This use case is the typical so-called prosumer case, as described in Sect. 13.1 of this chapter. Usually the load profile of a typical household in Germany will allow for using 20–30 % of generated solar energy directly (Weniger et al. 2015). For commercial customers this figure can be significantly higher as the load profile shows high consumption during the day and thus matches with solar generation directly. Adding a storage system to the solar system will increase this value for a private household to 60–80 % depending on the size of the solar system and the size of the storage system as well as the consumption pattern (Weniger et al. 2015). In combination with electric heating, for example, solar self-consumption can reach up to almost 100 %. In many cases the household will still consume 25–30 % from the grid, while in some cases the combination of storage with micro CHP on site could allow customers to minimize grid consumption. A storage system allows end users to reduce the electricity bill by using more of their own generated solar energy. As several analyses show, the shrinking costs of solar and batteries will drive this use case to reach the mass market very soon (Franz 2016; Farid et al. 2016). Figure 2 shows the typical profile of a prosumer site in Germany.

An important building block of this use case is intelligent energy management, which allows one to schedule the discharging/charging of batteries taking into account solar and load forecasts as well as other generation assets and external requirements. For example, in Germany one regulation says that solar systems not equipped with a decentralized relay controlled by the distribution system operator (DSO) must limit solar feed-in to 70 % of the nominal power of the system, and in combination with storage—if the storage system is funded by the KfW subsidy program (KfW 2016)—even a 50 % limit is required. This is done to reduce the solar peak to relieve the grid but will lead to a loss of produced solar energy of up to 10 % per year as a result of the curtailment (Weniger et al. 2016). A storage system equipped with an intelligent energy manager as well as a load and production forecaster is able to avoid curtailment through delayed charging (Figs. 2 and 3) (Weniger et al. 2016).

This approach to intelligent peak shaving optimizes the use of renewable energy for end users and helps them maximize the value of their solar usage on site while at the same time helping to relieve the burden places on the grid. Several studies have shown the positive impact of smart battery systems for the integration of renewables. For example, an analysis by HTW Berlin determined that the installed capacity of solar in Germany could be doubled with no impact on grid infrastructure owing to peak shaving (Weniger et al. 2015). Furthermore, a study by Prognos showed that peak shaving- and forecast-based control of batteries would make it possible to avoid EUR 120 million in grid upgrades and investments in Southern Germany (Krampe and Peter 2015).

Optimized renewable energy trading

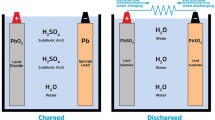

Efficient and profitable trading of renewable energy generation will be one of the major challenges facing plant operators and energy trading companies in the future energy system. Franz (2015) showed that decentralized energy trading will create tremendous value in Germany’s energy markets. Solar and wind are intermittent weather-dependent resources. Although excellent forecasting helps to minimize trading risks, optimizing profits is only possible under a regime of flexible management that makes it possible to hedge low and high price periods. One option to bring flexibility to the management of solar and wind assets is the installation of an energy storage system on site. This would make it possible to store energy when spot market prices are low and sell it on a delayed basis to the market when prices are high again to maximize profitability. One example of this is the solar park installed by Belectric in Alt-Daber, Germany, a 2 MW lead acid storage system that is the first project of its kind in Europe (Petersen 2014). Typically real-time trading of renewable energy is only attractive to traders for generation assets >100 kW or even >500 kW [cf. data of direct marketing companies in Franz (2015)]. This is due to the fact that the cost efficiency for trading small-scale assets is very poor for most trading companies because of the high operational costs, transaction costs and additional hardware costs per kilowatt. Thus, today this business model has clear limitations in terms of the size of assets, and the typical installation of storage systems at renewable sites for the primary use of optimizing energy trading is >100 kW to the megawatt scale. Minimizing these integration costs for small-scale assets is a major challenge. The example of the sonnenCommunityFootnote 1 in Germany shows that the combination of small-scale solar generation with smart storage systems on site, installed for the purpose of solar self-consumption, enables an automated and standardized low-cost process for integration in direct marketing.

Renewable energy retailing

Another innovative way to market renewables is by creating new energy tariffs for energy retailing. This means that a specific segment of energy consumers, whether private households or commercial customers, is interested in purchasing green electricity from a region or from known suppliers based on transparency of origin. Energy retail companies offer certificates of origin for the power they purchase or use platforms displaying the producing power plants to create transparency for their customers. Examples include the sonnenCommunity by sonnen GmbH in Germany, VandebronFootnote 2 in the Netherlands, and Open UtilityFootnote 3 in the UK. Consumers are willing to pay a premium for this transparency for several reasons. Green electricity supply of eligible sources at any given time, though, is only possible with a massive oversupply of renewables in the supplier’s portfolio, or storage can be used to manage the demand side using the battery as a flexible buffer for excess renewable electricity. The combination of storage-optimized demand-side management with storage installed on the site where the renewable energy is generated to optimize the supply side makes a virtual power plant. This makes storage the game changer that allows for managing and balancing supply and demand to optimize the whole portfolio. This has already been started by sonnen through the set-up of the sonnenCommunity, were a portfolio of solar and other renewable assets like biogas and wind, combined with the use of flexible storage units, is managed so as to unsure the demand of Community members is met at any time. This fleet forms the basis of the Community and is combined with a suitable portfolio of generation assets managed through virtual power plant software. The sonnenCommunity thus only manages assets owned by private homeowners or others. This model can be compared to the idea of Uber, AirBnB and others where the platform manages assets without owning them. New models like an “AirBnB of Energy” or a peer-to-peer energy platform can change dramatically the way energy is managed in the future. Prosumers can now be energy suppliers feeding their solar exports into the sonnenCommunity and provide it to others peer to peer (Fig. 4).

3 Outlook: Energy Storage Combining Multiple Use Cases Will Drive New Energy Markets Based on Renewables

In all the different models described in this chapter as new ways of marketing renewables, the combination of renewable energy generation with (aggregated) storage can be seen as the driver for new business models. Looking at the market for energy storage today there are examples of each use case described earlier. Although in most cases a primary use case as the main driver for renewable or storage investment can be identified, the profitability that will make it possible to bring these concepts to the mass market will be driven by a combination and optimization of different use cases.

Although already today several gigawatt-scale utility storage projects are in operation, under construction, or being planned, most of them are aimed at the primary use case to help stabilize the grid through frequency and voltage control; only a few are on the site of renewable power plants. According to the US Department of Energy’s (DOE) Energy Storage Database, 1.35 GW has been installed since 2012, most of it thermal storage (DOE 2016). In Germany alone 150 MW of storage systems will be installed by the end of 2016 to be offered mainly in the primary frequency control market (Franz 2016). As the market for primary frequency control is under pressure as a result of these new capacities, prices are already expected to decrease (ibid.). Thus storage operators like WEMAG in Germany are already looking into combining use cases to maximize value and stabilize the investment case (WEMAG 2016).

On the other hand, solar self-consumption is a mega trend in many countries at the residential and small commercial levels (Farid et al. 2016). Thousands of small-scale storage systems have been deployed in recent years and are expected to boom in the coming decades, as described in Sect. 13.1. Already today aggregators are trying to pool storage assets to build up a virtual power plant with several megawatts of capacity for the energy and grid service markets. This combination of use cases makes it possible to achieve a maximum utilization rate and value maximization through a second dispatch. On the one hand this is the combination of the primary use case of prosumers with energy trading and energy retailing. The combination of renewable energy marketing and storage as a demand response resource for grid services will allow companies to maximize value for investors. Especially behind-the-meter, prosumer storage allows for a combination of a broad variety of applications. Being producer, consumer and storage operator at the same time makes it possible to compound several different levels of value for investors. At the same time, aggregated behind-the-meter storage at the prosumer level can also be used for energy trading to hedge or to provide any needed grid support services for the grid.

For example, the Rocky Mountain Institute has assessed how combinations of different use cases can stack this value (Farid et al. 2016). As shown by Fitzgerald et al. (2015) and by Sterner et al. (2015), for the German market, energy storage can be used for a variety of grid services. Storage units can, for example, be dispatched at times when they are not being used by prosumers for frequency control, with the owner receiving a capacity and utilization payment, or they can be used for intraday trading for arbitrage, much like in the case of pumped hydro storage. The results of Fitzgerald et al. (2015) especially show that behind-the-meter storage systems give the broadest variety of use cases and offer the greatest opportunities for stacking value through multiple applications. Stacking value will be important for bringing storage to the mass market. This variety of possible use cases gives prosumers with storage assets a specific role in new approaches to marketing renewable generation. The primary use case is strong enough to attract investors, while additional applications increase the value and accelerate the time to market of new models. Thus prosumers are already investing in the required infrastructure to create new markets for renewables at a much lower interest rate. The flexibility to combine or optimize all use cases for customers is the key for models like the sonnenCommunity as the regulatory environment in many countries is still under development and can change in many directions. Thus also today many regulatory barriers exist to full deployment of multi-use cases, for example due to system fees that must be paid for behind-the-meter storage or a lack of smart meter technology roll-out.

Notes

- 1.

www.sonnenbatterie.de/sonnencommunity (Accessed 25 June 2016).

- 2.

www.vandebron.nl (Accessed 25 June 2016).

- 3.

www.openutility.uk (Accessed 25 June 2016).

References

BMWi. (2016). Erneuerbare Energien auf einen Blick. German Federal Ministry for Economic Affairs and Energy. Accessed June 25, 2016, from http://www.bmwi.de/DE/Themen/Energie/Erneuerbare-Energien/erneuerbare-energien-auf-einen-blick.html

Buttler, A. (2015, Januar). Kampf der Studien. VDI Vortragsreihe Kraftwerkstechnik.

DOE. (2016). DOE Global Energy Storage Database. Department of Energy. Accessed June 25, 2016, from http://www.energystorageexchange.org/projects/data_visualization

Farid, A., Anderson, N., Rosser, J., & Armstrong, C. (2016, February). Battery adoption at the tipping point. Berenberg Thematics.

Fitzgerald, G., Mandel, J., Morris J., & Touati, H. (2015, September). The economics of battery energy storage: How multi-use, customer-sited batteries deliver the most services and value to customers and the grid. Rocky Mountain Institute. Accessed June 25, 2016, from http://www.rmi.org/electricity_battery_value

Franz, S. (2015). Fit für die nächste Phase der Energiewende: Durch Speicher und Digitalisierung erfolgreiche Geschäftsmodelle finden. Energiewirtschaftliche Tagesfragen, 65(11), 43–45.

Franz, S. (2016, Januar). Neue Geschäftsmodelle in dezentralen und digitalisierten Strommärkten. Berlin: Studie Energy Business Lab des des Büro F.

Kairies, K., et al. (2016). Wissenschaftliches Mess- und Evaluierungsprogramm Solarstromspeicher. Jahresbericht 2016. Institut für Stromrichtertechnik und Elektrische Antriebe RWTH Aachen. www.speichermonitoring.de, Aachen 2016.

KfW. (2016). KfW-Programm Erneuerbare Energien “Speicher”—275 Kredit. Kreditanstalt für Wiederaufbau. Accessed June 25, 2016, from https://www.kfw.de/inlandsfoerderung/Unternehmen/Energie-Umwelt/F%C3%B6rderprodukte/Erneuerbare-Energien-%E2%80%93-Speicher-%28275%29/

Krampe, L., & Peter, F. (2015). Auswirkungen von Batteriespeichern auf das Stromsystem in Süddeutschland. Studie von prognos im Auftrag der sonnen GmbH, Berlin. Accessed June 25, 2016, from https://www.sonnenbatterie.de/de/neue-prognos-kurzstudie-nutzen-von-heimspeichern-fuer-geringeren-netzausbau-bislang-vollkommen

Petersen N. H. (2014). Belectric startet Stromspeicher am Solarpark Alt Daber. Accessed June 25, 2016, from http://www.photovoltaik.eu/Archiv/Meldungsarchiv/Belectric-startet-Stromspeicher-am-Solarpark-Alt-Daber,QUlEPTYyMDk4OCZNSUQ9MTEwOTQ5JlBBR0U9MQ.html

Sterner, M., Eckert, F., Thema, M., & Bauer, F. (2015). Der positive Beitrag dezentraler Batteriespeicher für eine stabile Stromversorgung. Forschungsstelle Energienetze und Energiespeicher (FENES) OTH Regensburg, Kurzstudie im Auftrag von BEE e.V. und Hannover Messe, Regensburg, Berlin, Hannover.

WEMAG. (2016). Eine Batterie für alle Fälle: WEMAG-Speicher zeigt Schwarzstartfähigkeit. WEMAG Press release. Accessed June 25, 2016, from https://www.wemag.com/ueber_die_wemag/presse/pressemeldungen/2016/20160127_Batteriespeicher_Schwarzstartfaehigeit

Weniger, J., Bergner, J., Tjaden, T., & Quaschning, V. (2015). Dezentrale Solarstromspeicher für die Energiewende. Hochschule für Technik und Wirtschaft Berlin, BWV Berliner Wissenschafts-Verlag GmbH, Berlin. Accessed June 25, 2016, from http://pvspeicher.htw-berlin.de

Weniger, J., Bergner, J., Tjaden, T., & Quaschning, V. (2016). Effekte der 50%-Einspeisebegrenzung des KfW-Förderprogramms für Photovoltaik-Speichersysteme. Hochschule für Technik und Wirtschaft Berlin, Berlin. Accessed June 25, 2016, from http://pvspeicher.htw-berlin.de

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Schott, B., Koch, O. (2017). Smart Battery Systems Driving Renewable Energy Markets. In: Herbes, C., Friege, C. (eds) Marketing Renewable Energy. Management for Professionals. Springer, Cham. https://doi.org/10.1007/978-3-319-46427-5_13

Download citation

DOI: https://doi.org/10.1007/978-3-319-46427-5_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-46426-8

Online ISBN: 978-3-319-46427-5

eBook Packages: Business and ManagementBusiness and Management (R0)