Abstract

The objective of this study is to examine the effect of the international financial reporting standards (IFRS) implementation on earnings management behavior in countries with high investor protection and strong legal enforcement. It does this by looking at a sample of 199 public listed companies from seven selected countries over a period of 15 years (before and after IFRS adoption). The results of this study suggest that in high investor protection countries, earnings management in general and accrual-based earnings management (AEM) in particular are more implemented during the IFRS application period than during the national generally accepted accounting principles (GAAP) application period. The study also suggests that earnings reports are more manipulated when firms face financial distress. However, it does not have enough evidence to conclude that real earnings management (REM) is more or less practiced after the transition to IFRS and whether there is a substitutional relationship between REM and AEM.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

With the objective to develop a single set of high quality, understandable, enforceable, and globally accepted financial standards based upon clearly articulated principles, the international financial reporting standards (IFRS) of the International Accounting Standards Board (IASB) have become a common language of accountants, investors, regulators, and business leaders. Since 2001, almost 120 countries have required or permitted the use of IFRS (IASB, 2015). Due to the differences between IFRS and national generally accepted accounting principles (GAAP), the adoption of IFRS may have impacts not only on accounting and financial reporting systems, but also on other areas of an organization including people, process, and technology, for example, information technology systems, tax reporting requirements, internal reporting, key performance metrics, and the tracking of stock-based compensation. This paper focuses only on the impacts of IFRS on the behavior of the company management in countries with high investor protection and strong legal enforcement.

According to McKee (2005), a company management has a vital interest in how earnings are reported and the executives need to understand the effect of their accounting choices so that they can make the best possible decisions for the company. The notion that investor’s reliance on accounting information to value stocks can provide managers incentives to manipulate earnings in order to influence short term share price performance or to show more stable financial figures is illustrated in previous studies (Dye, 1988; Healy & Wahlen, 1999). Moreover, prior research also documented that the executive compensation structures can lead to earnings management (EM) (e.g., Bergstresser & Philippon, 2006; Peng & Roell, 2008; Oberholzer-Gee & Wulf, 2012). Taken together, EM appears to be a universal phenomenon and deserves the attention of regulators, auditors, accountants, business professionals, accounting researchers, and investors and given the fact that earnings manipulation practice of the company management has affected the accounting quality of financial statements, EM behavior is chosen as a proxy for management behavior in this research. In this paper, EM is categorized into accrual-based earnings management (AEM) and real earnings management (REM).

Roychowdhury (2006, p. 336) defined REM as “management actions that deviate from normal business practices, undertaken with the primary objective to mislead certain stakeholders into believing that earnings benchmarks have been met in the normal course of operation.” On the other hand AEM refers to managers’ opportunistic use of the flexibility allowed under accepted accounting standards (e.g. GAAP, IAS, IFRS) to change reported earnings without changing the underlying cash flows. (Adapted from Zeyun, 2009)

Recent research suggests that high investor protection and strong legal enforcement systems are the necessary determinants of high quality financial statement numbers (e.g., Nabar & Boonlert-U-Thai, 2007; Francis & Wang, 2008; Houqe, Van Zijl, Dunstan, & Karim, 2011). Investor protection is defined as the power to prevent managers from expropriating minority shareholders and creditors within the constraints imposed by law (La Porta, Lopez-de-Silanes, Sheiler, & Vishny, 2002; Leuz, Nanda, & Wysocki, 2003; Enomoto, Kimura, & Yamaguchi, 2015). In the literature, investor protection has been considered as one of the important factors affecting the EM behavior of managers. Therefore, the research chose samples in selected countries with high investor protection rankings according to World Bank Group (2014) ratings 2014 and high legal enforcement scores (with updated data from 2000 to 2014) used in the study of La Porta et al. (1998), namely: Canada, Denmark, France, Hong Kong, Ireland, Norway, and United Kingdom. These seven selected countries had to meet other additional requirements, such as experiencing no hyper-inflation during the period of 2000–2014, adopting full IFRS, and making no modifications to IFRS. The purpose of this selection is an attempt to mitigate or decrease the potential effects of the country-specific factors on the consistency of the results of the research.

The aim of this paper is to give an answer to the question whether in countries with high investor protection, adopting IFRS will promote, deter, or not affect the degree of EM. Once the EM behavior is clarified, the answer will contribute to strengthen or weaken the prevailing opinion that adopting IFRS improves the quality of financial information and promotes comparability with global accounting practices. There are four hypotheses tested in the research to study the behavior of management regarding EM including AEM and REM.

Hypothesis Development and Methodology

Prior research provides mixed evidence and conflicting results on the effect of IFRS on EM behaviors. As mentioned previously, strong investor protection laws are fundamental conditions for high quality accounting since strong protection limits managers’ ability to acquire private control benefits, and reduces their incentives to mask firm performance. For example, Leuz et al. (2003) suggested that investor protection played an important role in influencing international differences in corporate EM. The weak legal environment might also facilitate opportunistic EM resulting in lower earnings quality (Ball, Kothari, & Robin, 2000; Leuz et al., 2003; Siegel, 2005). Hence, it may be argued that the increase or decrease in EM may be affected by investor protection rather than IAS only. The existing literature points to the need for the investigation of the effects of IAS on EM behavior in countries with high or low investor protection. This research will re-examine the notions that whether IAS increase, decrease, or not affect the manipulation of EM without the noise of investor protection and legal enforcement factors by choosing the samples in countries with high investor protection rankings and high legal enforcement scores. The paper did not compare the degree of EM between two groups: low and high investor protection but chose a sample of high investor protection countries to observe the degree of EM whether it is maintained, decreased, or increased before and after the adoption of IFRS. In a nutshell, there are two directions which the literature points out: either the implementation of IFRS will decrease or increase EM. Based more on the latter direction, the first hypothesis is developed:

Hypothesis 1

In high investor protection countries, earnings management during the IFRS application period was more implemented than during the national GAAP application period.

The value of aggregate EM has a (−) direction: the higher the value, the lower the degree of EM. Therefore, the symbol “<” stated in the alternative hypothesis stands for more implementation of EM and the symbol “≥” in the null hypothesis indicates less or equal degree of EM implementation.

Furthermore, firms can use multiple EM strategies, e.g., AEM and REM to manage their earnings (e.g., Cohen & Zarowin, 2010; Dechow, Ge, & Schrand, 2010; Badetscher, 2011; Kothari, Mizik, & Roychowdhury, 2016). Burgstahler and Eames (2006) documented in detail that both AEM and REM were managed upwards to avoid reporting earnings lower than analyst forecasts. As a consequence, Hypotheses 2 and 3 for AEM and REM are developed:

Hypothesis 2

In high investor protection countries, accrual-based earnings management during the IFRS application period was more implemented than during the national GAAP application period.

Hypothesis 3

In high investor protection countries, real earnings management during the IFRS application period was more often implemented than during the national GAAP application period.

The values of AEM and REM have also a (−) direction: the higher value represents lower degree of AEM and REM, respectively. Therefore, the symbol “<” in alternative hypothesis stands for more implementation of AEM/REM and the symbol “≥” in null hypothesis indicates a less or equal degree of AEM/REM implementation.

However, the managers tend to trade off using AEM and REM to achieve their objectives and they consider the two strategies as substitutes (Zang, 2007, p. 676). Prior research have also documented that managers prefer REM to AEM (e.g., Graham, Harvey, & Rajgopal, 2006; Roychowdhury, 2006; Cohen et al., 2010; Enomoto et al., 2015). Based on these arguments, it is expected that the companies might use both AEM and REM to edit reported earnings and that in high investor protection countries, it is predicted that the managers tend to avoid accrual-based earnings manipulations and to take advantages of REM techniques. Thus, the fourth hypothesis is developed in this research to test the relationship between AEM and REM. A negative correlation suggests substitutability between AEM and REM. It also suggests that managers tend to substitute AEM for REM.

Hypothesis 4

In high investor protection countries, during the IFRS application period accrual-based earnings management was negatively correlated with real earnings management.

To understand the effects of IAS on EM behaviors, several steps were taken. Firstly, patterns of aggregate earnings management (including aggregate EM, aggregate AEM, and aggregate REM) activities over the period of 14 years (2001–2014)Footnote 1 were plotted on charts to examine the effects of IFRS adoption on EM. Secondly, this study tested hypotheses to determine if different types of EM are maintained, increased, or decreased after adopting IFRS. Particularly, it focused on the comparison of AEM and REM during the IFRS application period and during the national GAAP application period. Lastly, it tested the hypothesis pertaining to the relationship of AEM and REM in countries with high investor protection, in a period of IFRS application. The measures of both AEM and REM were adapted from the methodology developed by Leuz et al. (2003), adopted by Cai (2008), and recently employed and further developed by Enomoto et al. (2015). The following subsection presents the explanations of measuring AEM and REM and their aggregate values.

For the purpose of plotting, the changes in patterns of EM activities on charts and of testing hypotheses, the aggregate AEM, aggregate REM, and aggregate EM are calculated as follows:

Aggregate AEM is the total of AEM1 (smoothing reported earnings by using accruals), AEM2 (correlation between the changes in accruals and changes in operating cash flow), and AEM3 (magnitude of accruals). Aggregate REM is the total of REM1 (sales and production manipulation) and REM2 (discretionary expenditure manipulation). Aggregate EM is the total of aggregate AEM and aggregate REM.

High value of aggregate AEM, aggregate REM, and aggregate EM suggests a low level of earnings manipulation. In aggregate AEM, the direction of AEM3 is reversed by multiplying with (−1) because it has an opposite direction as compared to other variables: the higher value of AEM3 suggests a higher value of earnings smoothing.

Empirical Results

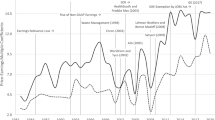

To have an overview of EM behavior in high investor countries, the aggregate EM, aggregate AEM, and aggregate REM of sample countries, excluding Canada due to its difference of IFRS adoption timeline, were calculated and plotted in Chart 35.1. Chart 35.1 indicates that as compared to the period before adopting IFRS, the aggregate levels of AEM after adopting IFRS are higher through years and the aggregate levels of REM after adopting IFRS are lower through years. This is inconsistent with the statement of Enomoto et al. (2015) that REM should be more constrained and that AEM should be less implemented in countries with strong investor protection. From the chart, it is of note that there are several points of time where the levels of aggregate EM and AEM changed significantly.

Firstly, in 2005, both AEM and REM increased significantly as compared to previous years. This may be explained by the fact that 2005 is the year of mandatory adoption of IFRS in six selected sample countries (excluding Canada) where all of their selected sample firms changed from national GAAP to IFRS. There are two explanations that may be interpreted: either IFRS’s increased financial reporting flexibility may provide more EM opportunities for firms or the change to new accounting standards may affect the levels of EM in short term, known as transition effects.

Secondly, AEM started to increase in 2008 and stayed at high level till 2012 and EM started to increase in 2009 and also stayed at high level till 2014. This trend might come from the effects of global financial crisis of which impact was felt broadly across the globe in 2008/2009. The 2008 financial crisis is considered by many economists to have been the worst financial crisis since the Great Depression of the 1930s.Footnote 2 This financial crisis may create or magnify incentives to manage earnings because during the crises, firms often experience a systematic decline in incomes. The reduced earnings might be attributed to macroeconomic shocks rather than to the poor performance by managers. Empirical evidence suggests that firms engage in aggressive EM during periods of financial crisis (Chia, Lapsley, & Lee, 2007; Johl, Jubb, & Houghton, 2007; Molik, Mir, & Khokan, 2013). Molik et al. (2013) also found that managers tend to time their earnings announcement (with earnings shocks) to occur soon after their industry peers’ warnings to minimize their apparent responsibility for earnings shortfalls.

Independent Samples t-Test for Hypothesis 1

An independent test was run on the data as well as 95 % confidence intervals for the mean difference. It was found that the degree of EM in the IFRS using period (1.211 ± 0.374) was significantly more than (the lower the value, the higher the degree of EM) the degree of EM in the national GAAP using period (1.445 ± 0.424), t (89) = −2.618, p = 0.010. The null hypothesis H10 = EM-IFRS ≥ EM-GAAP is rejected. The alternative hypothesis H11 = EM-IFRS < EM-GAAP is accepted. As a result of this test, it can be concluded that in high investor protection countries, EM during the IFRS application period is more implemented than during the national GAAP application period (Table 35.1).

Independent Samples t-Test for Hypothesis 2

An independent t-test was conducted on the data as well as 95 % confidence intervals for the mean difference. It was found that the degree of AEM in the IFRS using period (−0.101 ± 0.295) was significantly higher than (a lower value represents a higher degree of EM) the degree of AEM in the national GAAP using period (0.159 ± 0.385), t (89) = −3.506, p = 0.001. It means that the null hypothesis H20 =AEM-IFRS ≥ AEM-GAAP is rejected. The alternative hypothesis H21 =AEM-IFRS < AEM-GAAP is accepted. As a result of this test, it can be concluded that in high investor protection countries, AEM during the IFRS application period is more implemented than during the national GAAP application period (Table 35.2).

Independent Samples t-Test for Hypothesis 3

An independent samples t-test was performed on the data as well as 95 % confidence intervals for the mean difference. It was found that the degree of REM in the IFRS using period (1.297 ± 0.242) was insignificantly more than (a lower value represents for a higher degree of EM) the degree of REM in the national GAAP using period (1.321 ± 0.221), t (89) = −0.443, p = 0.659. Hence, there is not enough evidence to reject the null hypothesis: H30 = REM-IFRS ≥ REM-GAAP (Table 35.3).

On the one hand, the independent samples t-tests provided significant results to conclude that in high investor protection countries, EM in general and AEM in particular are more implemented during the IFRS using periods than during the national GAAP using period. Since higher EM indicates lower quality of financial reporting, it may be interpreted that in high investor protection countries, IFRS have not provided better quality of financial reporting. This may be because the increased financial reporting flexibility under IFRS provides more EM opportunities for managers. The higher flexibility under IFRS is reflected in choosing alternative accounting methods and permits measurements such as fair value accounting. Moreover, a principle-based accounting standard is embedded with lower specificity and more judgement from managers, which may result in higher opportunities for EM. On the other hand, the test failed to reveal a significant difference between the two groups of REM. It also means that in high investor protection countries, the degree of REM during the IFRS application period and during the national GAAP application period was quite similar. This behavior may be explained by the disadvantages of using REM. As explained, using REM may affect the future economic performance of the firm negatively and the firm may bear more costs as compared to AEM. Therefore, REM was maintained at stable levels in these countries between 2002 and 2014.

Testing Bivariate Correlation Between AEM and REM for Hypothesis 4

Before testing the bivariate correlation between AEM and REM, the auto-correlation between these two variables was calculated because the data are time-series data collected over 14 years. The Durbin–Watson test was performed and had a D–W value of 2.226. If the D–W value is close to 0 or 4, it indicates a strong or negative correlation amongst residuals. For data has strong auto-correlation, the bivariate correlation will be insignificant. In that case, the auto-regression should be run instead of bivariate correlation. The result is close to 2, meaning there is no serial correlation between variables.

Table 35.4 reports the Pearson correlation between the pooled aggregate AEM and aggregate REM. Consistent with Hypothesis 4, aggregate AEM is negatively correlated with aggregate REM (−0.106). However, the test is insignificant at p = 0.403 > 0.050. Hence, there is not enough evidence from the data to conclude that in high investor protection countries, in the period of IFRS application, AEM is negatively correlated with REM.

The bivariate correlation between AEM and REM was also tested in each single country, and there was only one case, namely France showing a significant negative relationship between the two variables: p = −0.599, Sig. = 0.031 (2-tailed). A negative correlation suggests substitutability between AEM and REM. The result suggests that in France managers tend to substitute AEM for REM. However, there is not enough evidence to state that in high investor protection countries (groups of selected sample countries) the correlation between AEM and REM is negative. It may be interpreted that REM may not be chosen as a substitute for AEM because its relative costs are higher than the costs of AEM. For example, it may be more expensive to depart from normal business practices for firms that are under pressure of high competition within the industry since it would reduce their competitive advantage relative to their industry peers which face less competition. Another explanation is that using REM results in higher levels of taxable income (Zang, 2012).

Conclusions

This paper studied the effects of IAS on management behavior of 199 public listed companies, particularly in countries with high investor protection and strong legal enforcement, namely: Canada, Denmark, France, Hong Kong, Ireland, Norway, and United Kingdom. Since EM was chosen as a proxy for the behavior of managers, it examined whether firms in high investor protection countries engage in EM, AEM, and REM more often during the IFRS using period than under the local GAAP using periods. This research is in line with many researchers identifying that EM increased after IFRS adoption (e.g., Lin & Paananen, 2006; Christensen, Lee, Walker, & Zeng, 2015; Ahmed, Neel, & Wang, 2012; Capkun, Collins, & Jeanjean, 2012; Salewski, Teuteberg, & Zülch, 2014). Furthermore, the study also tested the bivariate correlation between aggregate AEM and aggregate REM in the selected sample countries to examine whether firms trade off AEM and REM as substitute.

The results of this study show that in high investor protection countries, the degree of EM in general and AEM in particular increased after changing from national GAAP to using IFRS. This was mainly through greater use of discretionary accruals. Consequently, it can be concluded that in high investor protection countries, IFRS has not provided a better quality of financial reporting and that managers tend to take the opportunities of higher flexibility which this principle-based accounting standards have to engage in earnings manipulation to achieve a specific reported earnings objective. This paper will, hence, increase the investor’s awareness regarding high quality of financial reporting of IFRS because this study shows evidence that even in high investor protection and high legal enforcement countries, EM under IFRS has been practiced more than under national GAAP.

The research suggests that in high investor protection countries, the degrees of REM during these two periods were rather similar. The independent samples t-test did not reveal a significant difference between REM under IFRS and local GAAP. This may give spaces for future research on the behavior of REM in low investor protection countries to see how different the pattern of REM between low and high investor protection groups of countries is. Furthermore, except for the case of France, this study failed to find a substitutive relation between REM and AEM in samples of high investor protection countries. According to Bae, Tan, and Welker (2008) and Cai, Rahman, and Courtenay (2008), France has the highest score of difference between local GAAP and IFRS as compared to other countries in the samples. France gets 12 score, while others get lower scores, for example, United Kingdom gets 1, Hong Kong gets 3, and Canada gets 5. Difference between national GAAP and IFRS is the summary score of how domestic GAAP differs from IAS on 21 key accounting dimensions. Higher value represents more discrepancies between national GAAP and IFRS. This does point out the need for additional studies which should take the difference between national GAAP and IFRS as a control variable of choosing samples or examine the relationship between the behaviors of EM and differences between IFRS and domestic GAAP.

Furthermore, the statistical tests in this study were run only with a limited number of 2883 firm year observations as in Leuz et al. (2003), Enomoto et al. (2015), or in similar studies. However, limitation is unavoidable because of the high requirements for sampling sets in this research and the long time periods examined (15 year time series). Future research could extend this sample sizes to produce a more robust statistical result.

Notes

- 1.

A period of 15 years (2000–2014) was observed. However, the calculations in the measurements of this study were based on lagged values, depending on how the formulas are structured; the observed period could be reduced to 14 years (2001–2014 for AEM measurements) or 13 years (2002–2014 for REM measurements).

- 2.

Reuters, Three top economists agree 2009 worst financial crisis since Great Depression; Risks increase if right steps are not taken. Available from: http://www.reuters.com/article/2009/02/27/idUS193520+27-Feb-2009+BW20090227 (27 Feb 2009).

References

Ahmed, A. S., Neel, M. J., & Wang, D. (2012). Does mandatory adoption of IFRS improve accounting quality? Preliminary evidence. Contemporary Accounting Research, 30(4), 1344–1372.

Badetscher, B. A. (2011). Overvaluation and choice of alternative earnings management mechanisms. The Accounting Review, 86(5), 1491–1518.

Bae, K.-H., Tan, H., & Welker, M. (2008). International GAAP differences: The impacts on foreign analyst. The Accounting Review, 83(3), 593–628.

Ball, R., Kothari, S., & Robin, A. (2000). The effect of international institutional factors on properties of accounting earnings. Journal of Accounting and Economics, 29(1), 1–51.

Bergstresser, D., & Philippon, T. (2006). CEO incentives and earnings management. Journal of Financial Economics, 80(3), 511–529.

Burgstahler, D., & Eames, M. (2006). Management of earnings and analysts’ forecasts to achieve zero and small positive earnings surprises. Journal of Business Finance and Accounting, 33(5–6), 633–652.

Cai, L., Rahman, A. R., & Courtenay, S. M. (2008). The effect of IFRS and its enforcement on earnings management: An international comparison. http://ssrn.com/abstract=1473571. Accessed 16 Sept 2009.

Capkun, V., Collins, D. W., & Jeanjean, T. (2012). Does adoption of IAS/IFRS deter earnings management? Ph.D thesis, University of Iowa.

Chia, Y. M., Lapsley, I., & Lee, H. W. (2007). Choice of auditors and earnings management during the Asian financial crisis. Managerial Auditing Journal, 22(2), 177–196.

Christensen, H. B., Lee, E., Walker, M., & Zeng, C. (2015). Incentives or standards: What determines accounting quality changes around IFRS adoption? European Accounting Review, Forthcoming.

Cohen, D. A., & Zarowin, P. (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Finance, 50(1), 2–19.

Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2), 344–401.

Dye, R. (1988). Earnings management in an overlapping generation’s model. Journal of Accounting Research, 26(2), 195–235.

Enomoto, M., Kimura, F., & Yamaguchi, T. (2015). Accrual-based and real earnings management: An international comparison for investor protection. Journal of Contemporary Accounting and Economics, Forthcoming.

Francis, J., & Wang, D. (2008). The joint effect of investor protection and big 4 audits on earnings quality around the world. Contemporary Accounting Research, 25(1), 157–191.

Graham, J. R., Harvey, C. R., & Rajgopal, S. (2006). Value destruction and financial reporting decisions. http://ssrn.com/abstract=871215. Accessed 6 Sept 2006.

Healy, M. P., & Wahlen, M. J. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365–383.

IASB. (2015). International financial reporting standards IFRS ® (Red Book). London: IFRS Foundation.

Johl, S., Jubb, C. A., & Houghton, K. A. (2007). Earnings management and the audit opinion: Evidence from Malaysia. Managerial Auditing Journal, 22(7), 688–715.

Kothari, S. P., Mizik, N., & Roychowdhury, S. (2016) Managing for the moment: The role of real activity versus accruals earnings management in SEO valuation. The Accounting Review: March 2016, Vol. 91, No. 2, pp. 559–586.

La Porta, R., Lopez-de-Silanes, F., Sheiler, A., & Vishny, R. (2002). Investor protection and corporate valuation. Journal of Finance, 75(3), 1147–1170.

Leuz, C., Nanda, D., & Wysocki, P. (2003). Earning management and investor protection: An international comparison. Journal of Financial Economics, 69(3), 505–527.

Lin, H., & Paananen, M. (2006). The effect of financial systems on earnings management among firms reporting under IFRS. Business School Working Papers UHBS 2006-2.

McKee, T. E. (2005). Earnings management: An executive perspective. Mason, OH: Thomson.

Molik, T. A., Mir, M., & Khokan, B. R. M. M. (2013). Earnings management during the Global Financial Crisis: Evidence from Australia. Proceedings of International Business and Social Sciences and Research Conference 16–17 December 2013, Cancun, Mexico.

Nabar, S., & Boonlert-U-Thai, K. K. (2007). Earnings management, investor protection, and natural culture. Journal of International Accounting Research, 6(2), 35–54.

Houqe, M. N., Van Zijl, T., Dunstan, K., & Karim, A. W. (2011). The effect of IFRS adoption and investor protection on earnings quality around the world. The International Journal of Accounting, 47(3), 333–355.

Oberholzer-Gee, F., & Wulf, J. (2012). Earnings management from the bottom up: An analysis of managerial incentive below the CEO. Harvard Business School Strategy Uni Working Paper No. 12-056.

Peng, L., & Roell, A. (2008). Executive pay and shareholder litigation. Review of Finance, 12(1), 141–184.

Roychowdhury, S. (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics, 42(3), 335–370.

Salewski, M., Teuteberg, T., & Zülch, H. (2014). Short-term and long-term effects of IFRS adoption on disclosure quality and earnings management. http://ssrn.com/abstract=2398305. Accessed 19 Feb 2014.

Siegel, J. (2005). Can foreign firms bond themselves effectively by renting U.S. securities laws? Journal of Financial Economics, 75(2), 319–359.

World Bank Group (2014). Doing business. Protecting minority investor. http://www.doingbusiness.org/data/exploretopics/protecting-minority-investors.

Zang, A. Y. (2012). Evidence on the trade-off between real activities manipulation and accrual-based earnings management. The Accounting Review, 87(2), 675–703.

Zeyun, C. (2009). The choice between real and accounting earnings management. Ph.D thesis, University of Houston.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing Switzerland

About this paper

Cite this paper

Feldmann, B., Le, T.K. (2017). The Effect of International Accounting Standards on Management Behavior: A Study on Earnings Management Behavior in Countries with High Investor Protection. In: Benlamri, R., Sparer, M. (eds) Leadership, Innovation and Entrepreneurship as Driving Forces of the Global Economy. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-43434-6_35

Download citation

DOI: https://doi.org/10.1007/978-3-319-43434-6_35

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-43433-9

Online ISBN: 978-3-319-43434-6

eBook Packages: Business and ManagementBusiness and Management (R0)