Abstract

We address the estimation of asset correlation for credit risk assessment in the Italian market and its impact on SME credit access. The empirical evidence demonstrates that assumptions underlying the regulatory capital formula are not substantiated, and benefits received from the respect of granularity could be reduced or even removed. This outcome could depend on the positive relationship between asset correlation and default probability, the negative relationship between asset correlation and size and the positive link between default correlation and default probability. The regulatory impact is that the goal of levelling the playing field could fail, a regulatory arbitrage opportunity could be created and certain firms, clustered by size and industry, could suffer from the credit crunch.

JEL Classification: G21, G28, G32

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The credit crunch observed in economic systems once the financial crisis began can be defined as a macro-portfolio decision taken by large lenders in many countries.

On one side, part of this phenomenon was actually due to the use of internal ratings-based models and the subsequent procyclical effect. On the other side, credit availability was affected by the diversification estimate within every credit portfolio.

Our paper is aimed at finding out the concentration risk of the credit portfolios of small and medium enterprises (SMEs) and how regulation could affect lending decisions.

Within credit portfolio frameworks, correlation plays a fundamental role. Asset correlation can be defined for each pair of loans, but the absence of market data pushes banks to aggregate the analysis by groups of companies using a certain rule and to estimate the average asset correlation for each group. This rule is a key factor in estimating asset correlations and is crucial for calculating unexpected losses correctly.

Empirical asset correlations based on external ratings are believed to be critical when applied to loans. Some studies (see. Altman and Saunders 2001) evaluated the impact of internal ratings to estimate the credit risk for different categories of firms. Carey (2000) showed that the success of the internal ratings-based approach depends on the degree to which it considers dissimilarities in portfolio features, such as risk issues, granularity and maturities.

Many involved players (researchers, institutions and central bankers) expressed contradictory views on the Basel Committee proposal. Published in 2001, it suggested that the fair asset correlation value should have been 0.20, regardless of firm size and risk level. Dietsch and Petey (2002) proposed two parametric methods for estimating the credit risk of SMEs, showing that actual capital requirements are significantly lower than those expected when applying the first Basel II release. Lopez (2004), using data from the US, Japan and Europe that was estimated by rating agencies to compute asset correlation, found that firms with a higher default rate were less correlated. He suggested the coefficient range from 0.20 to 0.10 for asset correlation. Nonetheless, significant empirical evidence shows that credit risk based on agency ratings could be critical.

Altman and Saunders (2001) demonstrated that relying on traditional agency ratings may produce cyclically lagging capital requirements, rather than leading ones, and that the risk-based bucketing proposal lacks a sufficient degree of granularity. In keeping with the previous literature (Carling et al. 2002; Dietsch and Petey 2002; Calem and LaCour-Little 2001; Hamerle et al. 2003), they advised employing a risk weighting system that is more similar to the actual loss experience on loans. Some studies evaluated the impact of internal ratings to estimate the credit risk for different categories of firms. In particular, Carey (2000) showed that the success of the internal ratings-based approach depends on the degree to which it considers dissimilarities in portfolio features, such as risk issues, granularity and maturities (Jacobson et al. 2002; Carey and Hrycay 2001).

The discrepancy between loans to large corporations and those made to small and medium enterprises has been the focus of a variety of studies. Some of these studies have focused on the special character of small business lending and the importance of relationship banking for solving information asymmetries. The informative asymmetry puzzle particularly affects SMEs because of the difficulty in estimating their probability defaults (PDs) and fair value (Petersen 2004; Stein 2002) and managing the high frequency of marginal borrowers for small business credits (Berger et al. 2005).

These firms do not usually offer any type of reliable quantitative information because most of them are not obliged to record their numbers on balance sheets. Many studies devise ways to elaborate soft information (Petersen and Rajan 2002).

Other possible risk factors for small business loans are monitoring costs and recovery rates. Many studies confirm that these factors could also be associated with firm size (Degryse and Ongena 2005; Petersen and Rajan 2002; Allen et al. 2004; Schmit 2004; Perli and Nayda 2004).

These contributions from researchers and operators persuaded the Basel Committee to change the assignment of asset correlation based not only on level of risk but also on firm size in its final version. In the Bank Capital Accord (Basel II), the highest asset correlation for corporate exposures will apply to large companies with the lowest probabilities of default and will be raised from 0.2 to 0.24, while the lowest asset correlation applies to small firms with highest PD and will be decreased to 0.12.

Despite these changes, the Basel II Accord final version has been extensively criticized. Dietsch and Petey (2004) analyze observed default probability and asset correlation in French and German SMEs. Their study sampled data from the internal ratings systems of three large credit insurers: Coface in France, Allgemeine Kredit and Creditreform in Germany, and distinguished firms into four classes with turnover thresholds of 1, 7, and 40 million euros. Firms with turnover thresholds over 40 million euros are defined as large firms, and firms with turnover under 40 million euros are considered SMEs. In the analysis of default probabilities in French and German SMEs, the study also took into account the difference in risk classification, in addition to turnover. SME asset correlation coefficient decreases as firm size increases, while the observed asset correlation of large firms is greater than it is for SMEs in different risk classes. In addition, asset correlation among French SMEs shows a decreasing trend, which rises as risk class becomes lower, with the exception of SMEs in the lowest risk class, where asset correlation rises as risk class becomes lower. However, among German SMEs, the relationship between observed asset correlation and risk classification is not significant.

Dietsch and Petey (2004) also find that SMEs are riskier than large businesses and that PDs and asset correlations are not negative, as assumed by Basel II, but positively related to each other. In Taiwan, the results showed by Shen (2005) on the estimation of corporate asset correlation using a generalized factor model indicate that asset correlation is inversely related to firm size, which coincides with the finding of Dietsch and Petey (2004). However, the Shen study did not find a specific relationship between PD and asset correlation.

Although non-financial corporate debt (bond issues and privately issued debt) has become more common in the past 10 to 20 years, bank loans are still the prime source of business finance, especially for small and medium enterprises (SMEs). As a consequence, banks’ ex-ante assessment of the riskiness of loan applicants and their resulting decision to grant credit (or not) at some risk-adjusted interest rate, are of great importance for businesses. Bank regulators increasingly lean on the risk assessments made by banks: in the Basel Committee’s new capital adequacy rules, the so-called Basel II Accord (Basel Committee 2004), internal risk ratings produced by banks have been given a prominent role. Unlike previous regulation, the rules of Basel II will, for many large and internationally active banks, make the size of the required buffer capital contingent on their own appraisal of ex-ante individual credit risk.

Glennon and Nigro (2003) analyze small businesses’ repayment behaviour on Small Business Administration loans and determine that default characteristics can vary widely within the SME segment, depending on the original maturity of the loan.

Our study focuses on micro, small and medium-sized companies and is aimed at examining how the relationships between asset correlation, size and risk during the period 1997–2013 could have affected access to credit for non-financial companies.

The contribution is organized as follows: Sect. 8.2 analyses the regulation for credit risk exposures and portfolios, and how asset correlation affects capital requirements. Section 8.3 describes our sample. Section 8.4 explains the methodology we applied to estimate both default and asset correlations based on endogenous default probabilities. Section 8.5 presents the results, comparing the impact of regulatory asset correlation with empirical asset correlation and the impact for micro, small and medium firms. Section 8.6 presents the study’s conclusions.

2 Regulation

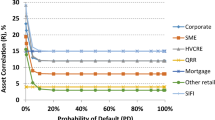

Certain of the findings of the empirical contribution previously quoted partially affected the final release of the Bank Capital Accord signed in Basel in 2004. In the New Accord, the asset correlation is a function of both the borrower’s size and its probability of defaulting. Specifically, asset correlations range from 0.12 to 0.24 and receive the highest value for large corporate exposures to large companies (LC) with the lowest probability of default. Its computation is based on the following equation:

where ρ(PD) ranges between 0.12 and 0.24.

Banks applying the internal rating-based approach (IRB) are allowed to adjust the previous formula for SMEs’ exposure (less than 50 million in sales):

where S denotes sales.

In the case where S > 50, the last term will take the value of 0, while for S < 5 it takes the value of 0.04. Ignoring the adjustment for the firm’s size, the asset correlation equals 0.24 for the lowest PD value and 0.12 for the highest PD value. Additionally, according to the size of the firm, either 0 or 0.04 is subtracted from the value of the asset correlation. For firms with sales ranging between 1 and 5 million euros, the assumed asset correlation is reduced by 0.04, whereas for large companies, i.e., those with sales greater than 50 million euros, there is no reduction of the assumed asset correlation at all. There is a linear relationship between these values.

When the size of corporate exposure is under one million euros, ρ(PD) is bounded within the interval [0.03, 0.16]. The main reason for this differential treatment is that small business loans and retail credits are generally found to be less sensitive to systematic risk. Their risk of default is thought to be largely of an idiosyncratic nature, and as a result PDs are assumed to be more weakly correlated than corporate loans. Another reason for the preferential treatment of retail credit lies in a technical assumption by the Basel Committee that maturities are expected to be shorter.

The estimation of asset correlation allows banks to use an internal rating-based approach to determine the regulatory capital (RC) through the following equation:

where R is the average asset correlation, obtained from the Basel asset correlation function, and LGD is the loss given default, which can be defined as the amount which is not recovered by the lender should the borrower fail. We estimated the regulatory capital using expected and empirical asset correlations. For each size class, we estimated the correlation coefficients, ranging from 0.92 to 0.98.

Following Eq. (8.3), the regulatory capital absorbed by the credit risk is based only on unexpected losses. This approach is coherent with the purpose to drive banks using the internal model to design appropriate accruals for expected losses.

This also leads to a reduction of the regulatory capital. One concern that was identified in the committee’s prior impact surveys was the potential gap of the capital required between the very different approaches for credit risk since the approval of the first Basel Accord in 1988.

Our study shows that empirical evidence for SMEs are far from adequately represented in regulatory formulae that were approved before the beginning of the financial crisis. Again, the innovations introduced by the Basel Committee in 2009 (Basel III) and the CRDIV (2013/36/EU) and CRR (Regulation EU, No 575/2013), which transposed those proposals within the European regulatory framework, did not change the supervisory formula to calibrate asset correlations. The recent debate to improve internal rating-based models has produced a consultative document (2016) including a number of complementary measures aimed to: (i) reduce the complexity of the regulatory framework and improve comparability; and (ii) address excessive variability in the capital requirements for credit risk. These proposals, in addition to others, provide greater specification of parameter estimation practices to reduce variability in risk-weighted assets (RWA) for portfolios where IRB approaches remain available and do not modify the asset correlation impact.

Our study remains relevant by providing findings that allow policymakers and other agents involved in the credit process to debate the opportunity for making risk-weighted assets and credit unexpected loss more reliable and closely linked to SME features.

3 Data

Over the last decade, the role of small and medium enterprises has increased. According to Eurostat data released in 2014, SMEs are approximately 99% of European enterprises and 92% of those are micro-enterprises. Aside from their quantity, the role of SMEs appears to be crucial in contributing to economic growth and employment: more than 90 million Europeans work for SMEs, and 57% of EU wealth depends on them. Between 2000 and 2013, SMEs contributed 86% to the net creation of work positions in the European Union. The average contribution to employment given by SMEs is higher than the value that they add, especially in such industries as manufacturing activities and information and communication services. In fact, it has been observed in some European countries that, due to their intrinsic features, small and medium enterprises have quite a low level of capital intensity and do not stand to benefit from economies of scale or the adoption and development of innovations.

Although SMEs play a relevant role in all EU member states, there are some differences among the various states. Some of these differences can be explained by the importance of particular branches of the national economy or by the institutional and cultural preferences for self-employment and/or family business. The importance of SMEs is particularly high in southern member states, such as Italy, Spain and Portugal. The role of SMEs in the Italian economic context is essential: in addition to representing the main industrial reality of its economy, the growth and development of the country depend on the capability of this segment to contribute to the creation of new jobs, to the development of innovations and, in general, to economic growth.

The Italian financial system is characterized by the centrality of banking intermediation, by the financing model of enterprises, and by the choices of saving allocation of families. According to Survey on the Access to Finance (SAFE) of small and medium-sized enterprises in the euro area (European Central Bank 2014), the financial structure of Italian SMEs is mainly bank-oriented and bank lending channel is more relevant than that of other European countries. More recently, the highest net percentages of SMEs reporting an increase in their need for bank loans were recorded in Greece (30%), Italy (14%) and France (12%). A financial system mainly based on bank loans corresponds to a scarcely developed capital market. The stock market is generally geared towards large enterprises, and in the last decade it has been downsized even more because of short-term adverse trends.

Many empirical studies examine two issues: the relationship between the development of stock markets and economic growth (finance and growth) on the one hand and the comparison of financial structures on the other, referring to bank-oriented systems and market systems (financial structure and growth). Regarding the first issue, empirical facts that were widely collected (King and Levine 1993; Beck et al. 2000) effectively proved the existence of a positive relationship between liquid stock markets and growth. Concerning the second issue, the most recent surveys show how the most developed financial systems have the tendency to part from the bank-oriented structure.

The data used in our analysis was collected from Aida (Bureau van Dijk), a large financial information provider. Our sample contains accounting data for 1.4 million Italian small and medium-sized firms during the years 1997–2013. According to the conventional SMEs definition, we distinguished firms in three size classes of turnover (Table 8.1). Micro-firms (i.e., those with turnover up to 2 million euros) represent 87% of the sample, whereas small firms (those with turnover between 2 and 10 million euros) represent approximately 10%, and medium firms are only 2.5%, with a turnover between 10 and 50 million euros. Our analysis focuses on the Italian sample for SMEs due to the concentration of the small-sized firms and their contribution to the whole GDP. Not surprisingly, their strong link with the banking system funds their financial needs.

The default probability (and, therefore, the rating notch) and the default state associated with each firm are the variables used in our study. In contrast to the other empirical studies previously quoted, the firm’s default probability is drawn by our rating system and not from external rating agencies or large banking institutions. Additionally, in our study we refer to unlisted companies, as opposed to firms issuing publicly traded debt, which are usually rated by the large international rating agencies.

In our analysis we refer to default as as dissolution of an Italian company (when the representative declares bankruptcy) applying to the court for the application of the Bankruptcy Act and for liquidation.

The risk classes shown in Table 8.2 were built by mapping the ranges of expected default frequencies estimated with our model with the Standard & Poor’s (S&P) scale. The A-rated companies are the best, F-rated firms the worst. It is worth highlighting that when we compared the S&P scale with the default frequencies drawn by our model, we found that the best firms of our sample correspond only with a BBB+ rating of S&P. This is why most of the companies fall within the A and B rating notches, while a lower percentage fall within speculative or non-investment grade (i.e., D or below).

4 Methodology

In the estimation of credit unexpected losses within portfolio models, the shape of the loss distribution is a crucial issue. The nature of the distribution tails could affect the amount of capital absorbed by the credit risk. Correlation changes observed among credit exposures transfer the risk from the mean to the tail of the loss distribution with a relevant impact on the economic and regulatory capital.

Financial literature (Fitch Ratings 2005; Düllmann et al. 2010) suggests three approaches to estimate asset correlations: (i) equity market-based information (or the equity-based approach), which can be applied only to borrowers or issuers listed in equity markets (Duan et al. 2003); (ii) ratings-based transitions (or the parametric approach), which cannot be easily applied to small firms whose distribution can hardly be defined (Gordy and Heitfield 2002; Kocagil and Liu 2008); and (iii) default-based correlation estimates or the model-free approach (Cassart et al. 2007).

To reduce the downward bias of default-based approaches (Düllmann et al. 2010) and to avoid any parametric assumption on their migration over time, we use data on rating transitions and defaults to explain the univariate and bivariate rating transitions. The cohort approach that we use for computing both the firm-level and joint default probabilities fits well with our sample, where the population of firms and defaults change over time. In order to make results easily construable, after all firms in the sample have been rated, we aggregated the risk classes that constitute the evaluation scale of our model into six grades mapping the S&P scale as shown in Table 8.2. The default state is added.

Because our observation period goes from 1997 to 2013, we created 17 one-year cohorts. The first cohort is constituted by the rated companies at the beginning of our time horizon (1997). We follow them for one year when the new rating is recorded. The defaulted companies during this first year will be deleted and will not be considered in the second cohort. The latter will be composed of sound firms recorded at the end of the first year plus the new rated firms at the beginning of the new year. This procedure will continue over the tth year (in our case, until 2013). The example in Table 8.3 shows how cohorts are built.

From the example in Table 8.3, we derive that the one-year default probability in the ith size or risk class is \( \frac{D_{i,t}}{N_{i,t}} \) , where D i , t is the number of firms in the ith size or risk class defaulted during the tth year, and N i , t is the total number of firms in the ith size or risk class during tth year. This is for each cohort.

As in our previous study (Gabbi and Vozzella 2013), we measure default correlation, following the approach developed by De Servigny and Renault (2002). For each cohort we compute the individual (p i , p i ) and joint default probabilities (p ii ), then we aggregate the cohorts to obtain the average default probability (ADP i ) for each size or risk class. First, we aggregate the cohorts to compute the average default probability (ADP i ) for the ith size or risk class. Formally:

where \( \frac{N_{i,t}}{\varSigma_{t=1}^T{N}_{i,t}} \) measures the relative weight of a given cohort.

Once the average default probability (ADP i ) is computed, we need to measure the joint default probability (JDP ii ), which measures the likelihood of two firms in a given size or risk class defaulting together and at the same time over a specified time horizon. In our case, we compute the joint default probability for a given year as the ratio between the number of firm pairs in a given size or rating class that moved towards default and the total number of pairs of firms. Formally:

where Def i , t indicates the number of firms defaulted in the ith starting size or risk class over tth year period, and N i , t indicates the total number of firms rated in the ith starting size or risk class at the beginning of the tth year period.

Because our purpose is to obtain an average default probability over our time horizon (1997–2013), we need to aggregate the default probabilities of each cohort. To that end, we weigh each cohort for the number of firms included in each one over t years as follows:

where \( \frac{N_{i,t}}{\varSigma_{t=1}^T\kern0.1em {N}_{i,t}} \) is the weight of each cohort in each year.

Finally, the average default probability (ADP i ) and the average joint default probability (AJDP ii ) are used as inputs in the default correlation formula as follows (De Servigny and Renault 2002; Bandyopadhyay et al. 2007):

Once we obtain the default probability (DP i ), the joint default probabilities (JDP ii ) and the default correlations \( \left({\rho}_{ii}^D\right) \), we have drawn the asset correlation values (ACV) for the ith size or risk class over the period 1997–2013 with the bivariate Gaussian copula.

5 Results

The empirical process to estimate the asset correlation of Italian micro, small and medium-sized firms by size and risk classes is modelled as follows: (1) computing the probabilities of default by applying a logit approach; (2) estimating the empirical asset correlation coefficients based on a Gaussian copula model and comparing them with the corresponding values of the regulatory framework.

Figure 8.1 shows a monotonic increasing configuration (continuous line) of asset classes, with the minimum value for micro firms and the maximum for the large cluster of our sample. When compared with the empirical asset allocation of Italian small firms we find not only different asset correlation values but also a non-monotonic curve shape. On the right scale of the figure, we show that there is no coherence in terms of dynamics but also, more importantly, none in terms of value.

Asset correlation and firm size (1997–2013). Regulatory asset correlation (Y-axis, left scale, dotted line) by size (X-axis) based on the formulas for small business vs. the empirical asset correlation estimated via Gaussian copula model (Y-axis, right scale, continuous line). For size we used the upper bound of each size class(Source: Our elaborations)

Empirical correlations (continuous line) appear to be close to zero, which implies a diversification impact higher than that introduced by regulators.

An even more significant difference can be observed when empirical and regulatory asset correlations are compared by risk class (Fig. 8.2). The shape of empirical asset correlation is completely inverted compared with that of regulatory asset correlation, except in the case of the best-rated companies. While the regulatory correlations assume that SMEs’ loan portfolios benefit with the lowest values, that is, the best diversification effect. We find correlations ranging from 1% to 5% with the reverse configuration.

Asset correlation and credit risk (1997–2013). Regulatory asset correlation (Y-axis, left scale, dotted line) by credit risk (internal rating notch, X-axis) based on the formulas for small business vs. the empirical asset correlation estimated via Gaussian copula model (Y-axis, right scale, continuous line)(Source: Our elaborations)

From a theoretical point of view, the findings contained in Fig. 8.2 are consistent with the financial accelerator rationalization approach (Bernanke and Gertler 1996). This means that a firm’s capacity to borrow essentially depends on the market value of its net worth, especially because lenders suffer with asymmetric information. Therefore, banks require borrowers to reinforce their ability to repay via collateral. When asset prices decline, borrower quality deteriorates. Consequently, firms become unable to roll over their debt with a negative impact on their investment. This creates a vicious cycle financial accelerator.

Part of the first draft of the 2004 Basel Accord argued that the risk-weight curve was too steep and too high. This means that SMEs would be penalized by very high-risk weights because of their higher default probability with respect to large firms. Consequently, the capital requirement for SMEs would be excessive, which can lead to credit rationing. This process would be exacerbated during recession periods, when default probability increases. To deal with this critique, the last version of the second Basel Accord (2004) introduced a negative relationship between asset correlations and default probabilities. This assumption means that firms with a lower default probability are expected to be more exposed to unexpected macroeconomic changes and systematic risk. In other words, firms with higher default probabilities should be less prone to joint defaults. If so, the negative relationship between default probability and default correlation would be reasonable. This point of view may reflect the intuition that large firms, operating in global markets and characterized, on average, by a better credit quality, are more sensitive to macroeconomic factors, whereas small firms, operating on local markets, are expected to be more sensitive to specific risk factors. Small firms’ flexibility to radical changes and new demands of consumers as described in the literature, at least for some sectors (OECD 2009), cannot compensate for shocks on demand and credit size.

Lopez (2004) confirms that average asset correlation is a decreasing function of the probability of default. His results suggest that firms with a lower credit quality (higher PD) are more subject to idiosyncratic risks than to common risk factors and, therefore, are characterized by a lower value of asset correlation. Das et al. (2007) find that firms with better credit ratings (lower PD) are more sensitive to systematic risk factors than firms with lower credit quality.

The different pattern between regulatory and empirical asset correlations by rating is confirmed for all the three size clusters of firms we analyzed.

The most relevant specificity can be observed for micro-firms (Fig. 8.3), which are companies with a turnover of under 2 million euros. The U-shaped empirical curve demonstrates that top quality firms diversify a bit less than medium quality ones (those rated C). However, the lower quality firms design an asset correlation behaviour consistent with the general observation commented on in Fig. 8.3.

Asset correlation for micro-firms by credit risk (1997–2013). Regulatory asset correlation (Y-axis, left scale, dotted line) by credit risk (internal rating notch, X-axis) based on the formulas for small business vs. the empirical asset correlation estimated via Gaussian copula model (Y-axis, right scale, continuous line)(Source: Our elaborations)

Companies with turnover above 2 million euros show an empirical pattern that is quite flat for almost all the rating notches, but for the last one ( F rating), the correlation estimates jump to an higher value, even though it is slightly lower than the regulatory coefficient (Figs. 8.4 and 8.5).

Asset correlation for small firms by credit risk (1997–2013). Regulatory asset correlation (Y-axis, left scale, dotted line) by credit risk (internal rating notch, X-axis) based on the formulas for small business vs. the empirical asset correlation estimated via Gaussian copula model (Y-axis, right scale, continuous line)(Source: Our elaborations)

Asset correlation for medium firms by credit risk (1997–2013). Regulatory asset correlation (Y-axis, left scale, dotted line) by credit risk (internal rating notch, X-axis) based on the formulas for small business vs. the empirical asset correlation estimated via Gaussian copula model (Y-axis, right scale, continuous line)(Source: Our elaborations)

Implemented in the credit policies, our findings would allow banks to better calibrate capital absorption by size and quality. Within the segment of small and medium firms, the pattern of asset correlations by risk appears to be inverted compared with the regulatory assumption.

Because empirical asset correlations are much lower than regulatory values, at least for Italy, Italian banks could reduce the cost of capital and, consequently, push up the credit supply with real and financial benefits.

Our findings support the revision of the regulatory framework to calibrate the asset correlation coefficients and face the procyclical issue, modelling the weight of small loans in credit portfolios according to the empirical evidence.

6 Conclusions

Our empirical results have important implications for both regulation and management of bank capital. First, the credit availability for small and medium enterprises, at least with the characteristics we can observe in Italy, can be directly and significantly affected by the way portfolio asset correlations are computed. Because there is a regulation that designs how banking capital is computed, financial intermediaries are forced to follow the rule because the capital management process drives the credit policy. When this standard rule is close to the empirical value of correlations, banks’ decisions are taken fairly. Otherwise, the credit market can be distorted. More precisely, we observed that the assumptions known as portfolio invariant occur when there is only a single systematic risk factor driving correlations across borrowers and when there is no exposure in a portfolio account for more than an arbitrarily small share of total exposure. These assumptions are refuted by the empirical evidence for Italian SMEs. Consequently, the regulatory capital framework overestimates the fair capital absorption for the smallest-sized firms. The impact of this miscalculation is a potential credit crunch due to the incorrect prices that these firms pay, regardless of their rating. This risk is not completely addressed by the countercyclical capital buffer proposed within the Basel III framework because the framework is not designed to consider how asset correlations actually change during cycles for the different firm categories.

Second, Basel regulation requirements considerably underestimate capital need for firms with the highest probabilities of default. This leads to a potential adverse selection process. A correction has been introduced within the Basel III framework, increasing the asset correlation values by 25%, but only among financial institutions. To minimize the identified risks, the regulatory framework should design asset correlations differently than as seen in the Basel II Accord. A calibration by size, default probability and industry would help regulators design a capital adequacy more fitted to retail credit portfolios. Within the segment of small and medium firms, the pattern of asset correlations by risk appears to be inverted when compared with the regulatory assumption. Moreover, a correction for country impact could be taken into consideration.

Our findings support the revision of the regulatory framework to calibrate asset correlation coefficients for each country, modelling the weight of small loans in credit portfolios according to the empirical evidence.

References

Allen, L., DeLong, G., & Saunders, A. (2004). Issues in the credit risk modelling of retail markets. Journal of Banking and Finance, 28(4), 727–752.

Altman, E. I., & Saunders, A. (2001). An analysis and critique of the BIS proposal on capital adequacy and ratings. Journal of Banking and Finance, 25(1), 25–46.

Bandyopadhyay, A., Tasneem, C., & Asish, S. (2007). Calibrating asset correlation for Indian corporate exposures. Implications for regulatory capital. The Journal of Risk Finance, 8(4), 330–348.

Basel Committee. (2004, June). International convergence of capital measurement and capital standards. A revised framework. Basel: Basel Committee on Banking Supervision.

Basel Committee. (2016, March). Reducing variation in credit risk-weighted assets – Constraints on the use of internal model approach, Consultative Document. Basel: Bank for International Settlements.

Beck, T., Levine, R., & Loayza, N. (2000). Finance and the sources of growth. Journal of Financial Economics, 58(1), 261–300.

Berger, N. A., Frame, W. S., & Miller, H. N. (2005). Credit scoring and the availability, price, and risk of small business credit. Journal of Money, Credit and Banking, 37(2), 191–222.

Bernanke, B., & Gertler, M. (1996). The financial accelerator and the flight to quality. Review of Economics and Statistics, 78(1), 1–15.

Calem, P. S. & LaCour-Little, M. (2001). Risk-based capital requirements for mortgage loans (The Federal Reserve Board, Financial and Economics Discussion Series, Working Paper 2001–60).

Carey, M. (2000). Dimensions of credit risk and their relationship to economic capital requirements (National Bureau of Economic Research, Working Paper Series No. 7629), pp. 1–39.

Carey, M., & Hrycay, M. (2001). Parameterizing Credit Risk models with rating Data. Journal of Banking and Finance, 25(1), 197–270.

Carling, K., Jacobson, T., Lindé, J., & Roszbach, K. (2002). Capital charges under Basel 2: Corporate credit risk modelling and the macroeconomy (Working Paper Sveriges Riksbank No. 145).

Cassart, D., Castro D., Langendries, R., & Alderweireld, T. (2007). Confidence Set for Asset Correlation, Mimeo.

Das, S. J., Duffie, D., Kapadia, N., & Saita, L. (2007). Common failings: How corporate defaults are correlated. Journal of Finance, 62(1), 93–117.

De Servigny, A., & Renault, O. (2002). Default correlation: Empirical evidence (Working Paper, Standard and Poor’s).

Degryse, H., & Ongena, S. (2005). Distance, lending relationship and competition. Journal of Finance, 60(1), 231–266.

Dietsch, M., & Petey, J. (2002). The credit risk in SME loans portfolios: Modelling issues, pricing and capital requirements. Journal of Banking and Finance, 26(2), 303–322.

Dietsch, M., & Petey, J. (2004). Should SME exposures be treated as retail or corporate exposures? A comparative analysis of default probabilities and asset correlations in French and German SMEs. Journal of Banking and Finance, 28(4), 773–788.

Duan, J. C., Gauthier, G., Simonato, J. G., & Zaanoun, S. (2003). Estimating Merton’s model by maximum likelihood with survivorship consideration (Working Paper, University of Toronto).

Düllmann, K., Küll, J., & Kunisch, M. (2010). Estimating asset correlations from stock prices or default rates – Which method is superior? Journal of Economic Dynamics & Control, 34(11), 2341–2357.

ECB, (2014). Survey on the access to finance of small and medium-Sized enterprises in the euro area. European Central Bank. Frankfurt, April.

Fitch Ratings. (2005). A comparative empirical study of asset correlations. New York: Mimeo.

Gabbi, G. & Vozzella, P., (2013). Asset Correlation and Bank Capital Adequacy. European Journal of Finance 19 (1), 55–74.

Glennon, D., & Nigro, P. (2003). An analysis of SBA loan defaults by maturity structure. Washington, DC: Mimeo.

Gordy, M., & Heitfield, E. (2002). Estimating default correlations from short panels of credit rating performance data (Working Paper, Federal Reserve).

Hamerle, A., Liebig, T., & Rösch, D. (2003). Credit risk factor modeling and the basel 2 IRB approach (Deutsche Bundesbank Discussion Paper).

Jacobson, T., Lindé J., & Roszbach K. (2002). Credit risk versus capital requirements under Basel 2: Are SME loans and retail credit really different? Mimeo

King, R. G., & Levine, R. (1993). Finance, entrepreneurship, and growth: Theory and evidence. Journal of Monetary Economics, 32(3), 513–542.

Kocagil, A. E., & Liu, J. (2008). Empirical assessment of asset correlations. In A. Resti (Ed.), Pillar II in the new basel accord. The challenge of economic capital. London: Risk Books.

Lopez, J. A. (2004). The empirical relationship between average asset correlation, firm probability of default and asset size. Journal of Financial Intermediation, 13(2), 265–283.

OECD. (2009). The impact of the global crisis on SME and entrepreneurship financing and policy responses. Paris: OECD.

Perli, R., & Nayda, W. I. (2004). Economic and regulatory capital allocation for revolving retail exposures. Journal of Banking and Finance, 28(4), 789–809.

Petersen, M. A. (2004). Information: Hard and soft, Kellogg School of Management, Northwestern University, Mimeo.

Petersen, M., & Rajan, R. (2002). Does distance still matter? The information revolution in small business lending. Journal of Finance, 57(6), 2533–2570.

Schmit, M. (2004). Credit risk in the leasing industry. Journal of Banking and Finance, 28(4), 811–833.

Shen, T. P. (2005). Empirical study on the effect of new basel accord on SMEs, project report commissioned by Joint Credit Information Center, Mimeo.

Stein, J. (2002). Information production and capital allocation: Decentralized vs. Hiearchical firms. Journal of Finance, 57(5), 1891–1921.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 The Author(s)

About this chapter

Cite this chapter

Vozzella, P., Gabbi, G. (2017). SME Credit Access After Basel III. Does Size (and Quality) Matter?. In: Rossi, S. (eds) Access to Bank Credit and SME Financing. Palgrave Macmillan Studies in Banking and Financial Institutions. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-41363-1_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-41363-1_8

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-41362-4

Online ISBN: 978-3-319-41363-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)