Abstract

This chapter draws conclusions and provides policy recommendations based on the findings of earlier chapters. This book has shown that, given the availability of large land resources and the low levels of current yields, Commonwealth of Independent States (CIS) countries are strong players in wheat global markets and have great potential to further increase their wheat production and exports, thus strengthening their contribution to global food security. Production growth can be achieved primarily by cultivating more land, increasing current yields and incorporating modern technologies into farming practices. However, the production potential of CIS countries can be realised fully only if the agricultural sector is supported by structural changes including (1) enhancing market institutions and property rights; (2) developing land markets, (3) improving access to credit; (4) creating a reliable and transparent policy-support framework (5), addressing climate and environmental challenges and (6) developing infrastructure.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

This chapter summarises the main findings of this book on developments in, and the potential future growth of, the wheat sector in Eurasia. More precisely, the chapter reflects on main developments in reform patterns and agricultural policies and summarises their impacts for the agricultural sector in general and the wheat sector in particular. The chapter also attempts to provide a set of policy recommendations conducive for promoting rural productivity growth and regional and global food security. This chapter references and draws heavily on material presented in earlier chapters of the book.

The Eurasian region covers Commonwealth of Independent States (CIS) countries that were formerly part of the USSR. The special emphasis of this book is the Russia, Ukraine and Kazakhstan (RUK) countries and Central Asia. However, Belarus and Caucasian countries (Armenia, Azerbaijan, Georgia) are also considered when relevant for comparison purposes. The Eurasian region is a key player in world wheat markets. RUK are important countries in the region and account for the majority of its wheat production and trade.

Although the agricultural sectors of CIS countries had a common structure and organisation during the Soviet period, after the dissolution of the USSR in 1991, development patterns and subsequent transition processes diverged considerably across CIS countries. During the Soviet period, the agricultural production was organised into large collective and state farms, the allocation of resources was centrally planned and resources (including land) were state owned. The transition processes, initiated in the early 1990s, aimed to reorganise the whole sector, and ranged from farm restructuring to the privatisation of resources. However, these process diverged considerably across CIS countries, which resulted in differences in terms of farm organisation, land privatisation, land use and agricultural policy choices. These structural differences have largely determined how the wheat sector has developed over the past decades; they also define its current status and determine its potential future growth.

2 Agricultural Reform Patterns in the Commonwealth of Independent States Countries

CIS countries implemented large-scale agrarian reforms during their transition processes, with the aim of creating market institutions and transferring agricultural assets (including land) from state to private ownership. Two principal reform elements that reshaped the whole agricultural sector in the region involved land privatisation and farm restructuring. In most CIS countries, privatisation involved the distribution of land shares to agricultural workers. The beneficiaries received paper shares which certified their entitlement to a certain amount of land without specifying a physical plot. The exceptions are Armenia, Georgia, Moldova and Tajikistan. Armenia and Georgia distributed physical plots to agricultural workers, whereas Moldova and Tajikistan initially adopted the same strategy as Russia and Ukraine but later converted land shares to physical plots. This farm restructuring aimed to reorganise production from large-scale collective and state-owned farms to small and medium-sized individual farms (Mathijs and Swinnen 1998; Lerman 2001; Rozelle and Swinnen 2004).

The land reform and farm restructuring initiated in CIS countries in the 1990s have created pre-conditions to reduce rural poverty and to improve food security in rural areas in two respects. First, they have increased household assets via one-off transfers of resources (land, livestock and farm machinery) from collective and state farms to households, thereby empowering rural populations to improve their welfare. Second, this asset transfer to individual farms has created conditions for increased agricultural productivity and food security in rural areas (Lerman, chapter “Privatization and changing farm structure in the Commonwealth of Independent States”).

However, the outcomes of these agricultural reforms vary greatly across CIS countries. The Caucasian CIS countries (Armenia, Azerbaijan, Georgia) have made the most progress in terms of land reforms and farm restructuring. At the other end of the spectrum are the Central Asian countries (CACs) (Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan), which have lagged in their implementation of reform and which have allowed the state to be heavily involved in their agricultural sectors. After more than 20 years of land reform, CIS countries still have not achieved the original goal of creating an institutional framework that determines the allocation of land resources based on market signals (Lerman, chapter “Privatization and changing farm structure in the Commonwealth of Independent States”; Shagaida and Lerman, chapter “Land Policy in Russia: New Challenges”; Rozelle and Swinnen 2004; Lerman 2012).

The causes of incomplete transition process vary across CIS countries largely being reflected in creating substantial transaction costs in agricultural markets associated with the costly reconfirmation of landownership rights, the costly conversion of land shares to physical plots, the incomplete cadastral registration of plots, the restrictions maintained on sale and rental markets and adoption of inconsistent and unpredictable agricultural policy framework (Shagaida and Lerman, chapter “Land Policy in Russia: New Challenges”).

3 Agricultural Policies

The transition process initially led to a significant reduction of state involvement in the agricultural sector in most CIS countries, but this was followed by a re-emergence of government subsidisation and state intervention in the sector over the past decade. Although CIS agricultural sector subsidies tend to remain below the levels observed in developed countries, market intervention is frequently used to regulate commodity prices. According to the Organisation for Economic Co-operation and Development (OECD), the producer support estimate (PSE) in total agricultural receipts in RUK dropped from more than 60 % before 1991 to below 15 % in 2011–2012. By comparison, the PSE in the USA, the European Union and Japan was 8 %, 19 % and 53 %, respectively, in 2011–2012 (Fig. 1).

There is a strong and growing involvement of the state in grain markets (including wheat) in CIS countries. An important role of state intervention is market stabilisation and price regulation and includes, to varying degrees among countries, price intervention, trade policies, support for storage, processing and transportation and investment in grain infrastructure and grain export facilities. However, in reality, the stabilising effects of state interventions are often ineffective and introduce a degree of uncertainty to the whole sector (Sedik, chapter “The New Wheat Exporters of Eurasia and Volatility”).

Subsidisation of wheat has increased over time but at varying degrees among the CIS countries. Agricultural policies give clear preferences to producer support across the CIS. For example, in Russia, price intervention dominates in the total support (Uzun and Lerman, chapter “Outcomes of Agrarian Reform in Russia”). In Uzbekistan, farmers operating under the state-procurement system have access to subsidised inputs for wheat, such as fertiliser, diesel and machinery services, as well as access to cheaper loans (Goletti and Chabot 2000; Robinson 2008; Pomfret 2008). In other CIS countries, price interventions and/or production subsidies are applied (Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”).

In RUK, market price intervention and input subsidies dominate wheat policies. According to the OECD’s PSE, the wheat sector tends to be taxed in Russia and Ukraine, whereas it is subsidised in Kazakhstan (Fig. 2). Temporary export-restricting policies are also often applied in RUK, in particular when production is adversely affected by bad weather conditions, and these are justified on the grounds of national food security. Examples of temporary grain export restrictions include the introduction of an export quota in Ukraine between July and October 2007, an export tax of 40 % on wheat in Russia, an export ban in Kazakhstan from April to September 2008, an export ban in Russia from August 2010 to June 2011 and a grain export quota in Ukraine from October 2010 to July 2011 (OECD 2011; FAPRI 2013; OECD 2013a; Fellmann et al. 2014).

State intervention in the wheat sector (or agriculture in general) is often motivated by food security concerns. This is particularly valid for Caucasian countries and CACs (e.g. Armenia, Georgia, Azerbaijan and Kyrgyzstan). The high dependence of most CACs on imports from RUK has created several challenges during the food crisis linked to regional production volatility and trade restrictions imposed by RUK countries. As a response, CACs have reinitialised their policies towards increasing self-sufficiency, mainly by providing several form of subsidies to boost domestic production (Robinson 2008; Götz et al. 2013; Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”).

Uzbekistan and Turkmenistan have some of the most highly state-regulated wheat sectors in the region. Uzbekistan maintains a state-procurement system under which farmers are assigned production targets at state-determined prices (which are lower than market prices) and have access to subsidised inputs such as fertiliser, diesel, machinery and credit. Only the excess production beyond the state set target can be sold at market prices. The state procurement policy also regulates the minimum cultivated area of wheat per farm, as well as the amount of fertiliser to be applied per hectare (Bobojonov et al. 2010; Kienzler et al. 2011; Goletti and Chabot 2000; Robinson 2008; Pomfret 2008; Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”)

Wheat production in Turkmenistan is also under a state-procurement system. All aspects of wheat production are controlled by the government. This includes the choice of land allocation, the biological varieties of wheat to be grown, the supply of seeds, land, water, fertilisers and herbicides, technical services, bank credits, the cost of inputs and services and, ultimately, procurement prices. The wheat sector is perceived as a strategic sector and is subject to the Zerno (Grain) programme adopted in 1991, the aim of which was to achieve full self-sufficiency in wheat production (Stanchin and Lerman, chapter “Wheat production in Turkmenistan: Reality and expectations”).

Even CACs that initially had relatively few interventions in agricultural production and trade also became more active in supply chains as a result of the export restrictions and uncertainties in wheat exports from RUK. For instance, Armenia—widely known for its liberal agricultural policy—introduced a grain self-sufficiency policy in 2008, similar to the approaches put in place in Uzbekistan and Turkmenistan (ICARE 2012). However, in contrast to Uzbekistan and Turkmenistan, Armenia opted to subsidise its grain producers instead of introducing a state regulated procurement system (Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”).

The state also supports several (semi-public) services in different CIS countries. Crop insurance is one such example (existing only in Uzbekistan and Kazakhstan). Uzbekistan subsidised insurance premiums during the years 1997–2001 but abolished this practice in 2002. The insurance penetration in Uzbekistan is nevertheless the highest among the CIS after Kazakhstan (where the insurance sector is still publicly subsidised) (Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”).

4 Agricultural Sector Impacts and Developments

4.1 Farm Structure

Land reforms in the 1990s led to the emergence of a dual farm structure in CIS. Two types of farms operate across the CIS: corporate farms (‘agricultural enterprises’) and individual farms. Corporate farms are transformed state and collective farms and are usually large in terms of land use. Individual farms are newly created agricultural operations and tend to be small in size and include family/peasant farms and household plots. The CIS countries with the highest individualisation of agriculture include Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan and Azerbaijan. In Russia and Ukraine, there has been a growth in individualisation, but corporate farms continue to dominate the sector. In Kazakhstan corporate farms continue to maintain a dominant position in the sector (Lerman, chapter “Privatization and changing farm structure in the Commonwealth of Independent States”; Shagaida and Lerman, chapter “Land Policy in Russia: New Challenges”; Pugachov and Pugachov, chapter “Agrarian reforms in Ukraine”).

The heterogeneity in farm structure is observable not only across the CIS but also within some CIS countries. For example, in Russia in 2000, corporate farms dominated in 23 % of Russia’s regions, individual farms dominated in 22 % of the regions, whereas 55 % of the regions had a mixed farming structure. Individual farming is observed mainly in eastern and northern regions of Russia, in ethnic republics (e.g. Tatarstan), and also in non-chernozem regions suffering from depopulation. Corporate farms, however, are observed in regions with the best natural and economic conditions (the Belgorod, Lipetsk, Moscow and Leningrad oblasts, Krasnodar and Stavropol’ territories) (Uzun and Lerman, chapter “Outcomes of Agrarian Reform in Russia”).

The extreme concentration of land into large agro-holdings is growing in some CIS countries. This development has been observed in Russia and Ukraine, in particular over the past 10 years. The growth of large agro-holdings largely happened as a result of informal and dysfunctional land markets, which led to the consolidation of large stretches of farmland by vertically integrated legal entities. Such corporations often control many other agricultural enterprises and cultivate hundred of thousands of hectares. Their access to a wide array of financing options has enabled them to initiate diversified activities along the full product chain, from input supply and basic crop production to agricultural processing and exports. For example, in Ukraine in 2013, the estimated number of agro-holdings was about 140. They control more than 6000 (40 %) other agricultural enterprises and 7.8 million hectares, with hundred of thousands of hectares each. In total, these agro-holdings produce and sell about half of all wheat, more than half of maize and rapeseed, one-third of sunflower products, three-quarters of sugar beet and over 80 % of poultry produced in the country. They also benefit from special tax privileges (Uzun and Lerman, chapter “Outcomes of Agrarian Reform in Russia”; Keyzer et al., chapter “Unlocking Ukraine’s production potential”).

4.2 Agricultural Credit

The agricultural sector in CIS countries suffers from a lack of reliable and accessible financing, which slows the growth and development of the sector. The main causes are the lack of overall macro-economic stability, which undermines existing financial institutions, the weak institutional frameworks that hinders the development of financial markets, weak management and accounting practices at farm level, a lack of credit demand, dysfunctional land markets, unstable policy framework, as well as the inherent risks that are traditionally associated with agricultural production (e.g. weather variability) (Schroeder and Meyers, chapter “Credit and Finance Issues in the Eurasian Wheat Belt”; Pugachov and Pugachov, chapter “Agrarian reforms in Ukraine”).

Constraints on demand are often limiting factors for agricultural credit in CIS countries. For example, for many Ukrainian and Kazakh small farms, a major barrier to obtaining additional financing is their inability to generate the sufficient documented cash flow to repay credit. Furthermore, many small farms operate in the cash market and do not have any financial records that lenders could use to assess their financial status (Homans et al. 2011; OECD 2013b). Ukrainian agricultural producers are often reluctant to use bank credit owing to their distrust of the banking system or to a lack of knowledge about the benefits of credit for their business (Homans et al. 2011). As a result, informal borrowing through family, friends and self-help groups is widespread in the country (Schroeder and Meyers, chapter “Credit and Finance Issues in the Eurasian Wheat Belt”). Micro-evidence from Kazakhstan shows that the greatest constraint to credit market growth is the lack of effective demand as a result of the low and uncertain returns from farm production (Petrick et al., chapter “More than pouring money into an ailing sector? Farm-level financial constraints and Kazakhstan’s “Agribusiness 2020” strategy”).

Common credit instruments used in CIS countries include bank lending, state-supported credit, systems of warehouse receipts, non-bank lending (e.g. credit unions, leasing and value chain financing) and informal borrowing. Kazakhstan is one of the CIS countries that has successfully introduced warehouse receipts. The country was able to build initial consensus among key stakeholders on the development of a warehouse receipt system, to adopt legal framework, to institutionalise the important elements of the system and to involve the financial system in its use from the early stages of development (EBRD 2004; Hollinger et al. 2009). As a result, a well-functioning system of warehouse receipts has proven to be rather successful in securing agricultural financing in the country (e.g. in 2010 over 30 % of the loans issued to agriculture were guaranteed by grain receipts) (OECD 2013b; Schroeder and Meyers, chapter “Credit and Finance Issues in the Eurasian Wheat Belt”).

State-subsidised credit is a common support policy in CIS countries in the form of interest subsidies for short-, medium- and long-term loans. In Ukraine, the amount of support was around 5 % of all input subsidies in 2010–2012. In Russia, the government’s credit subsidies have been on the rise since 2006 and are expected to represent a 23 % share of the total agriculture support for the period 2013–2020. In Kazakhstan, state credit support constitutes 7 % of the OECD PSE (Schroeder and Meyers, chapter “Credit and Finance Issues in the Eurasian Wheat Belt”).

Often, credit support is biased towards large farms in CIS countries. For example, in Russia, beneficiaries of credit subsidies are predominantly large farms and downstream borrowers. Small farms, households and cooperatives have typically received only a small fraction of the subsidised credit (Schroeder and Meyers, chapter “Credit and Finance Issues in the Eurasian Wheat Belt”; Pugachov and Pugachov, chapter “Agrarian reforms in Ukraine”).

Large farms have easier access to finance and more financing options than small farms. For example, in Ukraine, there is a ‘funding gap’ for farms of between 100 and 1000 ha in size. Smaller farms (less than 100 ha) can often obtain credit from credit unions. Farmers with over 1000 ha of land enjoy various sources of lending such as value chain financing, leasing opportunities and credit from national and regional banks. The medium-sized farms (100–1000 ha) are, however, too large to access financing from credit unions but too small to take advantage of other sources of financing available for larger farms (Homans et al. 2011; Schroeder and Meyers, chapter “Credit and Finance Issues in the Eurasian Wheat Belt”).

4.3 Productivity Impact

The main drivers of productivity during the transition period were (1) initial conditions of the levels of development, resource endowments and technology, (2) agricultural policy development (e.g. price liberalisation, subsidy reduction) and (3) land-reform choices. In general, the first driver had a mixed impact on productivity, depending on the type of initial conditions prevalent in a given country. Price liberalisation and subsidy reduction resulted in a fall in productivity because of a decrease in the terms of trade in agriculture. Land reform that returned land to its former owners and/or distributed physical plots to agricultural workers was more conducive to promoting productivity growth than the reform that distributed land shares to agricultural workers. This is because the first two types of land reforms resulted in relatively well-defined property rights which stimulated owners to invest in agricultural activities (Rozelle and Swinnen 2004; Swinnen and Vranken 2010).

The empirical evidence suggests that the individualisation of agricultural land led to productivity growth across the CIS. Countries dominated by small individual farms tend to have higher levels of productivity and welfare growth than countries dominated by large corporate farms. This is indirectly linked to land-reform choices. Countries that implemented land reforms where landownership rights were better defined led to higher levels of agricultural individualisation and thus also stimulated productivity growth (Lerman, chapter “Agrarian reforms in Ukraine”).

Land productivity development, however, followed different trends for corporate farms and family farms in Russia. The productivity of agricultural land fell between 1990 and 1998. Corporate farms’ productivity began to increase from 1998, and by 2012 it had more than doubled relative to 1998 to exceed pre-reform levels. In the case of family farms, however, land productivity dropped until the first half of 2000s. Only in recent years has the productivity of family farms stabilised. Despite these different trends, family farms use land more efficiently than corporate farms and their land productivity is consistently higher. In recent years, the production per hectare of family farms was double that of corporate farms (Uzun and Lerman, chapter “Outcomes of Agrarian Reform in Russia”).

Farm structure indirectly determines the agricultural products in which a country specialises and in which it has a competitive advantage on international markets. Corporate farms are large in size and thus are competitive in capital-intensive products and products with low labour-monitoring requirements (e.g. cereal production). Individual farms usually have more abundant labour and reduced access to capital and, hence, tend to be competitive and specialise in higher labour-intensive products (e.g. fruits and vegetables). CIS countries in which corporate farms dominate the agricultural sector (e.g. RUK) have a pre-condition to be competitive in cereal production (including wheat) and thus their agricultural sector tends to specialise in this production activity. However, an indirect effect of this specialisation in capital-intensive cereal production is lower labour use in agriculture and lower employment opportunities in regions where corporate farms dominate (Ciaian, et al. 2009; Kancs and Ciaian 2010, 2012).

An important effect of the transition reforms was the reduction of the agricultural area (land abandonment) in several CIS countries. According to Food and Agriculture Organization of the United Nations (FAO) data, in 2012 the total agricultural area had decreased by 23.6 million ha (–4 %) in CIS countries relative to the area in 1992, whereas the arable area had reduced by 25.6 million ha (–12 %). In Kazakhstan, Russia, and Ukraine, the reduction in the total agricultural (arable) area was –6 % (–35 %), –3 % (–9 %) and –1.5 % (–2.5 %), respectively.

5 Development of the Wheat Sector

5.1 Production

After an initial fall in production in the early 1990s, wheat production showed a positive upwards trend in CIS countries in the subsequent period. Wheat production had increased by around 50 % in 2012–2013 relative to 1995–1996 (Fig. 3). Production growth was driven by an expansion of the cultivated area and by yield increases. The wheat area expanded by 10 %, and yield increased by 35 % in 2012–2013 relative to 1995–1996 (Figs. 4 and 5). Despite this growth, wheat yields in the CIS are far below the yields of other world wheat-producing regions. The average wheat yield in CIS countries is around 40 % lower than the world average, more than two times lower than in China and more than three times lower than in France and Germany (Fig. 6).

The main producers of wheat in the CIS are RUK. These three countries together account for 90 % of the wheat area and 85 % of wheat production in the CIS (Figs. 3 and 4).

Self-sufficiency policies have stimulated wheat production in several CIS countries. The transformation of the wheat sector as a result of state intervention has been so intensive that several CIS countries have become self-sufficient or even net exporters of wheat. For example, according to FAO data, wheat production in Turkmenistan, Tajikistan and Uzbekistan expanded by a factor of 3.6, 4.6 and 7, respectively, in 2013 relative to 1992 (Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”; Stanchin and Lerman, chapter “Wheat production in Turkmenistan: Reality and expectations”).

Wheat production is highly volatile in the CIS. Wheat production in most CIS countries relies on rain-fed cultivation, which causes year-to-year fluctuations in yields as a result of variations in levels of rainfall (Fig. 5). These changes adversely affect the food security in all CIS countries, induce price fluctuations at regional and global levels and often trigger policy responses that often lead to significant market distortions (Sedik, chapter “The New Wheat Exporters of Eurasia and Volatility”; Araujo-Enciso et al., chapter “Eurasian grain markets in an uncertain world: A focus on harvest failures in Russia, Ukraine and Kazakhstan and their impact on global food security”).

Food security in the region is largely dependent on cereal production, most notably wheat. Some of the CIS countries (e.g. RUK) are able to meet their own cereal (including wheat) needs, whereas others (e.g. Tajikistan and Turkmenistan) rely on imports. However, the food security risk associated with wheat availability has diminished significantly owing to production growth in most CIS countries since the beginning of the transition process. The potential risks to food security faced by all CIS countries are now mostly confined to food price volatility arising from market volatility and instability and fluctuations in production that are attributable to weather conditions (Sedik et al. 2011; Fehér et al., chapter “Kazakhstan’s production potential”).

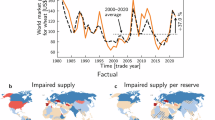

5.2 Trade

The CIS countries are gaining a growing share of the world wheat markets. The CIS has changed from being a net importer of wheat in the 1990s to being a net exporter in 2000s. CIS countries annually export around 25 million tonnes of wheat, which represented around 15 % of the total world wheat exports in 2011, up from 3 % in 1992. Net trade represented 19 million tonnes in the CIS in 2011, increasing from –28 million tonnes in 1992 (Figs. 7, 8, 9, and 10).

The expansion of wheat (and grain in general) exports from CIS countries can be attributed to a drop in livestock production during the transition period. During the Soviet period, the regime expanded the livestock sector and imported large volumes of feed (including grains). Agricultural restructuring during transition reversed these policies, causing a severe contraction in the livestock sector, which led to a significant increase in imports of meat and other livestock products, while grain (including wheat) exports expanded. The CIS livestock sectors revived during the 2000s but this did not reverse the trend in grain export growth. The growth in grain productivity has offset the growth in domestic grain demand (including feed), such that exports have continued to increase (Uzun and Lerman, chapter “Outcomes of Agrarian Reform in Russia”; Liefert and Liefert, chapter “The Development of the Eurasian Livestock and Grain Economies”).

The key CIS wheat exporters are RUK. According to FAO data, they account for more than 95 % of total CIS exports. In 2000 these three countries accounted for only 5 % of total world wheat exports. After five years, this proportion had more than doubled, varying between 14 % and 22 %. The OECD/FAO projections show that this region will continue to increase its market share to around 26–28 % of world wheat exports by 2022–2023 (Sedik, chapter “The New Wheat Exporters of Eurasia and Volatility”; Araujo-Enciso et al., chapter “Eurasian grain markets in an uncertain world: A focus on harvest failures in Russia, Ukraine and Kazakhstan and their impact on global food security”).

Other CIS (non-RUK) countries have reduced their import dependency. Self-sufficiency agricultural policies implemented in a number of non-RUK CIS countries have stimulated domestic production, thereby reducing their dependency on imports. Some of these countries have become net exporters of wheat and thus also contribute to regional food security. For example, around 40 % of Uzbek wheat is exported to Afghanistan, Azerbaijan and Iran. Wheat production in Uzbekistan is less volatile than in RUK. A comparative advantage of Uzbekistan’s rain-fed wheat production compared with that of RUK is the fact that production risks are not correlated. Although Uzbekistan is a net exporter, it simultaneously imports high-quality wheat because of the low quality of domestic wheat and its correspondingly limited applicability for baking (Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”).

CIS countries contribute to global cereal price volatility, mainly as a result of the nature of their wheat production and trade policy choices:

-

High production volatility in CIS countries (particularly RUK) is a reason for export volatility, which is further transmitted to global price volatility. Production volatility is induced by the reliance on rain-fed production systems, which leads to high year-to-year yield fluctuations as a result of weather-related phenomena. Other factors contributing to production volatility are low input use (e.g. fertilisers, plant protection), low levels of investments and the increase of winter-wheat cultivation to the detriment of spring wheat (especially in Russia) (Sedik, chapter “The New Wheat Exporters of Eurasia and Volatility”; Araujo-Enciso et al., chapter “Eurasian grain markets in an uncertain world: A focus on harvest failures in Russia, Ukraine and Kazakhstan and their impact on global food security”). In Ukraine, given that almost all wheat is winter wheat, there is a high vulnerability to frost and snow mould in the northern regions, whereas the southern regions suffer from droughts. Consequently, climatic variation results in large output swings, often around a 20–30 % difference from one year to the next, and under extreme weather conditions as in 2003, a decrease of up to 80 % (Keyzer et al., chapter “Unlocking Ukraine’s production potential”). Simulation analysis conducted using the AGLINK-COSIMO global model shows that lower wheat yields in RUK are a major source of uncertainty for international grain markets. Historically, harvest failures led to substantially lower RUK wheat exports (on average –15 % in Russia, –30 % in Kazakhstan, –38 % in Ukraine) and an increase in the wheat world market price (on average by 7 %) (Araujo-Enciso et al., chapter “Eurasian grain markets in an uncertain world: A focus on harvest failures in Russia, Ukraine and Kazakhstan and their impact on global food security”).

-

Export constraints in Ukraine and Russia have contributed to price volatility on world cereal markets. First, various export bans were introduced in Ukraine and Russia in years of low production. These induced a cascade effect in the entire global market by encouraging further export restrictions by other countries and higher global prices. Second, the export restrictions introduced by Russia and Ukraine temporarily reduced the degree of integration of domestic wheat in world wheat markets, thereby increasing market instability and reducing the supply response of producers. Third, the increased political uncertainty caused by government intervention decreased investment incentives, thus lowering long-term growth prospects in the region (Sedik, chapter “The New Wheat Exporters of Eurasia and Volatility”).

Important constraining factors for the future growth of wheat exports in the CIS are storage, logistics and the transport infrastructure. Logistics services and infrastructure are important prerequisites for market development and determine the competitiveness of the agricultural sector on global markets. There are constant problems associated with the development and the status of storage, logistics and the transport infrastructures in CIS countries. These are exacerbated by the fact that the infrastructure inherited from the previous communist system is import-oriented. The key challenge for CIS countries (in particular Russia and Ukraine) is to convert the existing infrastructure from one that is import-oriented to one that is export-oriented.

6 Wheat Production and the Export Potential of Commonwealth of Independent States Countries

Wheat production and exports have a strong potential to expand in the future in the CIS. CIS countries with a high potential to further expand production and export of wheat are RUK, as a result of their abundant land resources and yield growth prospects. Other CIS countries face greater challenges to achieving substantial growth in their wheat sector ranging from policy choices to environmental constraints. These challenges need to be addressed before non-RUK countries can become important players in ensuring food security in the region and beyond.

There are two ways in which wheat production can expand in CIS countries: the expansion of production into abandoned areas and productivity growth. For example, Russia has a relatively large amount of abandoned arable land, which represents a potential source of production and export growth. According to the 2006 Agricultural Census, 94 million ha (43 % of all agricultural land in Russia) is abandoned (Uzun and Lerman, chapter “Outcomes of Agrarian Reform in Russia”). With improved market conditions, the recultivation of abandoned land may boost grain exports in the medium term. Projections developed by Saraykin et al. (chapter “Assessing the potential for Russian grain export: A special focus on the prospective cultivation of abandoned land”) show that in the event of favourable developments in world grain prices, the abandoned land could be reclaimed for grains and could expand production by up to 6 million ha, which represents a 14 % increase relative to 2010 levels. However, in the case of exceptionally high world prices, expansion of the grain area may represent as much as 19 million ha (or a 44 % increase). The corresponding projected grain export growth is 9.4 million tonnes (or a 50 % rise relative to 2010 levels) and 21 million tonnes (more than a 100 % increase), respectively (Saraykin et al., chapter “Assessing the potential for Russian grain export: A special focus on the prospective cultivation of abandoned land”).

However, abandoned land is often of lower quality than cultivated land and may not be always suitable for wheat cultivation. Therefore, its contribution to potential wheat-production expansion is uncertain. For example, the abandoned area in Russia is located primarily in regions with a low bio-climatic potential and depopulated villages. This unused area is basically registered to defunct agricultural enterprises and inactive family farms. It is no longer used in production because of low soil fertility, as well as the administrative difficulties with demarcation and titling (Uzun and Lerman, Chapter “Outcomes of Agrarian Reform in Russia”).

In Kazakhstan, the potential for expansion of the wheat-cultivated area is limited. Local farmers face several challenges from sowing to harvest and access to markets. The most crucial challenges, which together impose the greatest constraints on wheat production, are threefold: competition with weeds for nutrients and moisture, pre-harvest losses owing to pests (e.g. plant diseases and herbivorous insects) and water scarcity (Fehér et al., chapter “Kazakhstan’s production potential”).

Further, the potential for growth in wheat production in Kazakhstan is highly dependent on global climate changes, which causes uncertainty as regards the prospect of sustainable growth in the wheat yield in this region. According to climate-change scenarios based on global climate modelling, further temperature increases with no significant increase in precipitation may lead to a drier climate. In addition, the climate zone boundaries may shift northwards, and wheat yields may be reduced by more than 25 % (Fehér et al., chapter “Kazakhstan’s production potential”).

The primary source of wheat-production growth in the CIS countries is yield improvement through the adoption of modern technologies and the improvement of management and farming practices. For example, in Ukraine, the potential to raise and stabilise cereal output through yield improvements is significant. The International Institute for Applied Systems Analysis (IIASA)-FAO global Agro-Ecological Zones study estimates that this potential is currently realised for only 40 % of the cultivated area given the soil and agro-climatic conditions. Ukraine’s full potential can be reached only with significant investments in modern irrigation technologies. The OECD projections indicate that Ukraine’s share in world wheat markets could rise to 20 % in the next decade, based on a small expansion of area and a continued yield increase (OECD-FAO 2014; Keyzer et al., chapter “Unlocking Ukraine’s production potential”).

An important factor that may affect the export potential of CIS countries is the future development of the livestock sector. In the event that growth in the livestock sector will be strong, larger domestic feed consumption will reduce the availability of wheat for exports. For example, although wheat production is expected to increase in Kazakhstan over the medium- to long-term time horizon (by around 30 % in the next four decades), exports are expected to decline (by around 30 % over the same period). This is because yield growth and the reduction in wheat losses are expected to be more than offset by the reduction of arable land and the increase in the domestic use of wheat for human consumption and animal feed (Fehér et al., chapter “Kazakhstan’s production potential”).

There are significant environmental challenges in the CIS countries that may put the future growth of the wheat sector in doubt, but these vary in importance across the region.

Water scarcity is often discussed as the main source of risk for agricultural production, particularly in Central Asian CIS countries. The agricultural production of a number of CIS countries (e.g. Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan) is heavily dependent on irrigation. Low levels of maintenance and investment have led to the deterioration of the irrigation and drainage infrastructure, which in turn has led to inefficiencies in water use and unreliable distribution. These infrastructural constraints, combined with institutional and governance problems and increasing water scarcity, are expected to limit the future agricultural growth of the region (Bucknall et al. 2003).

However, the impact of water scarcity on the wheat sector is not straightforward. For example, in Uzbekistan, wheat is mainly produced as a winter crop (and is thus rain-fed) and is usually less affected in water-scarce years, because water shortages in the region are mainly observed in the summer months and the water supply in winter seasons is more stable. As a result, allocation of farmland to wheat production may increase in Uzbekistan if the availability of water for irrigation declines in the future as farmers will tend to shift away from the cultivation of water-intensive crops (Bobojonov and Aw-Hassan 2014; Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”).

An important factor that may affect the future production of wheat is climate change, which may reduce wheat productivity in a number of CIS countries. For example, in Kazakhstan, the agro-ecological status for wheat production is expected to deteriorate in the long term. Projections indicate that the climate will become warmer and dryer, and the number of drought periods and weather extremes will increase, which may increase the agro-climatic risk to the cereal sector in Kazakhstan. Without adaptation of management practices, current wheat yields cannot be maintained in Kazakhstan. The main management practices that can attain higher yields include increases in input use, the adoption of new wheat varieties and investments in modern technologies (Fehér et al. chapter “Kazakhstan’s production potential”).

In Ukraine, nutrient imbalances have caused soil degradation in large parts of the country, which has had a detrimental effect on crop yields (including wheat). According to the National Report on Environment, soil erosion affected 57 % of arable land, of which some 32 % was affected by wind erosion, 22 % by water erosion and 3 % by a combination of both. Furthermore, the loss of organic matter in soils is substantial (around 0.6–1.0 tonnes annually) as a result of the excessive removal of crop residues from the fields. The problem is particularly relevant for Ukraine because of its nutrient imbalances across the territory, which means that nutrients in animal feed are not returned to the land of origin, and because of the large volumes of grain exports. If grain exports rise as predicted, nutrient outflows would increase, thus putting strain on future productivity growth. The loss of nutrients would need to be compensated by imports of chemical fertiliser, which will make grain (and wheat) production more expensive. All major grains exporters (including Russia) face similar challenges (Keyzer et al., chapter “Unlocking Ukraine’s production potential”).

Two potential large markets for CIS wheat exports are China and India. China and India face challenges in terms of limited resources, such as arable land, and agricultural productivity. The rising number of middle-income households and urbanisation in both countries will potentially increase the demand for grains. In addition, grain demand in China and India is expected to grow as a result of the increased demand for feedstock, which is associated with a dietary transition to a more meat-rich diet as a result of rising incomes (Wang and Ha, chapter “China’s Role in World Food Security”; Tripathi and Mishra, chapter “Wheat Sector in India: Production, Policies and Food Security”).

7 Policy Options to Improve Rural Productivity and Food Security

This book has shown that, given the availability of large land resources and the low levels of current yields, CIS countries have a great potential to further increase their wheat production and exports and thus strengthen their contribution to global food security. Production growth can be achieved primarily by bringing more land into cultivation, by enhancing current yields and by incorporating modern technologies into farming practices. However, the production potential can be realised fully only if the agricultural sector is supported by policy changes. Below we list key policy recommendations that may stimulate agricultural growth in rural areas in general and in the wheat sector in particular.

7.1 Complete Land-Reform Processes

To varying degrees among CIS countries, this will involve the completion of the conversion of land shares to land plots, the introduction of rules to enable the transparent enforcement of the physical delimitation of plots and the creation of physical access to plots, the completion of the cadastral registration of land plots, the removal of land market restrictions and the adoption and enforcement of regulations to protect land tenure rights (Lerman, chapter “Privatization and changing farm structure in the Commonwealth of Independent States”; Shagaida and Lerman, chapter “Land Policy in Russia: New Challenges”; Keyzer et al., chapter “Unlocking Ukraine’s production potential”).

7.2 Facilitate Institutional Changes to Promote the Distribution and Relocation of Land to Small Farms

Such policies may lead to the enlargement of household plots and to the creation and expansion of family farms. This could be achieved primarily by the finalisation of the process of land reform. Additional land can be distributed from the state reserve. There are large reserves of unused state-owned land in many CIS countries. In addition, large areas of agricultural land (more than 50 % of the total agricultural area in some countries) are managed inefficiently by large corporate farms, which achieve productivity levels that are substantially lower than the productivity of individual farms. Governments should create institutional framework supporting output and factor market development that would facilitate the relocation of unused land from the state reserve and under-used inefficient farms to more productive users (Lerman, chapter “Privatization and changing farm structure in the Commonwealth of Independent States”).

7.3 Encourage Development of the Land Market

Land markets provide a mechanism to relocate land from passive or inefficient users to active and more productive users. Land markets are conducive to productivity growth and, therefore, to increased food security. The basic prerequisites for land-market development are the enforcement of secure property rights and the transferability of landownership and land-use rights. In several CIS countries, legal restrictions and the incomplete enforcement of land tenure regulations still exist. This is most problematic in parts of Central Asia. Another prerequisite for the development of land transactions is the registration and titling of land. Modern registration and titling systems exist in all CIS countries, but the ‘titling coverage’ is generally limited, mainly as a result of complex administrative procedures and high costs. Simple and transparent registration procedures should be instituted with minimum transaction costs (Lerman, chapter “Privatization and changing farm structure in the Commonwealth of Independent States”).

7.4 Implement Land-Consolidation Programmes

Land consolidation can stimulate the growth of small farms. Effective consolidation programmes are driven by market mechanisms through free transactions between owners of fragmented plots (FAO 2010). Examples of such market-driven consolidation efforts are provided by the World Bank/FAO project in Moldova (2007–2009) or the US Agency for International Development project in Kyrgyzstan. In Moldova, a consolidation project reduced the number of land parcels by 23 %, thus significantly increasing the average parcel size. This consolidation activity furthermore encouraged elderly and inactive landowners to leave agriculture, which led to an increase of 32 % in the average size of farms (AGREX 2011; Lerman, chapter “Privatization and changing farm structure in the Commonwealth of Independent States”).

7.5 Reduce State Involvement in the Agricultural Supply Chain

Governments still play an important role in all stages of the supply chain in a number of CIS countries. These government supply chains coexist with privately operated supply chains. In Uzbekistan, for example, one of the main consequences of this is the lack of incentives to agricultural producers to improve the quality of their products, which is particularly relevant for flour production. In fact, management practices are geared towards maximising quantities. Hence, improving the supply chains and allowing price differentials to drive markets could ultimately motivate farmers in Uzbekistan to invest in quality-enhancing practices and technologies and make locally produced wheat competitive with high-quality imported wheat (Bobojonov et al., chapter “Future perspectives on regional and international food security, Emerging players in the region: Uzbekistan”).

7.6 Implement Fair Agricultural Support System that Is Equitable to All Producers, Including Small Individual Farms

This book has shown that the individualisation of agriculture has led to productivity growth in CIS countries (see also Lerman 2009; Swinnen and Vranken 2010; Macours and Swinnen 2002). However, small individual farms are often discriminated against in the allocation of agricultural subsidies. The fair treatment of these farms thus has the potential to function as a catalyst for their further development. Small individual farms could function as tools in poverty-reduction initiatives while also providing rural populations with access to food and employment.

7.7 Reduce Barriers to Trade and Refrain from Using Export Restrictions

Reductions in export quotas and/or export taxes in CIS countries could increase the welfare of both producers and consumers in the medium term. Avoiding measure that aim at the partial or complete ban of exports would contribute to a reduction in price volatility and instability on regional and international agricultural markets.

7.8 Adopt Policies that Address Environmental and Climate-Change Effects

Adverse environmental developments, climate change and increasing incidences of climate variability are likely to affect production levels, cropping patterns and land suitability in CIS countries. Strategies that may be adopted to cope with these effects could include: adopting drought-resistant wheat and/or other crop varieties, adapting wheat-cropping systems in response to climate change, investing in irrigation systems and supporting weather risk-management instruments.

7.9 Support the Development of Agricultural Financial Markets

Two crucial variables influencing potential wheat production and export growth in Eurasia are the establishment of financial institutions which may improve credit access to the farming sector and the modernisation of the transport and logistics infrastructure. The existing credit system limits the flow of financial capital for investments in agriculture. The absence of credit for replacing obsolete machinery and technology restricts the ability of the farming sector to enhance its efficiency and productivity. Investment in infrastructure is particularly required to enhance export channels, which involves the improvement of the handling and storage capacity of grain terminals along with investment in the transport infrastructure.

References

AGREX. (2011). Impact assessment of the land re-parceling pilot project in 6 villages: Final report. Chișinău, Moldova: AGREX.

Bobojonov, I., & Aw-Hassan, A. (2014). Impacts of climate change on farm income security in Central Asia: An integrated modelling approach. Agriculture, Ecosystems & Environment, 188, 245–255.

Bobojonov, I., Franz, J., Berg, E., Lamers, J. P. A., & Martius, C. (2010). Improved policy making for sustainable farming: A case study on irrigated dryland agriculture in Western Uzbekistan. Journal of Sustainable Agriculture, 34, 800–817.

Bucknall, J., Klytchnikova, I., Lampietti, J., Lundell, M., & Scatast, M. (2003). Irrigation in Central Asia, social, economic and environmental considerations. Washington, DC: World Bank.

Ciaian, P., Pokrivcak, J., & Drabik, D. (2009). Transaction costs, product specialisation and farm structure in Central and Eastern Europe. Post-Communist Economies, 21, 191–201.

EBRD. (2004). Grain receipts programme (Regional). http://www.ebrd.com/documents/evaluation/2004-warehouse-receipt-programmeagricultural-commodities-financing-programme.pdf

FAO. (2010). Voluntary guidelines on the responsible governance of tenure of land, fisheries and forests, first draft. Rome: FAO.

Food and Agricultural Policy Research Institute. (2013). Analysis of the asymmetric price transmission in the Ukrainian wheat supply chain, FAPRI-MU Report No 05-13. Colombia, MO: Food and Agricultural Policy Research Institute.

Fellmann, T., Helaine, S., & Nekhay, O. (2014). Harvest failures, temporary export restrictions and global food security: The example of limited grain exports from Russia, Ukraine and Kazakhstan. Food Security, 6, 727–742.

Goletti, F., & Chabot, P. (2000). Food policy research for improving the reform of agricultural input and output markets in Central Asia. Food Policy, 25, 661–679.

Götz, L., Glauben, T., & Brümmer, B. (2013). Wheat export restrictions and domestic market effects in Russia and Ukraine during the food crisis. Food Policy, 38, 214–226.

Hollinger, F., Rutten, L., & Kiriakov, K. (2009). The use of warehouse receipt finance in agriculture in transition economies. Rome: FAO Investment Center.

Homans, R., Khoruzhei, S., & Stoyanov, O. (2011). Regulatory and institutional barriers for increasing access to finance for small and medium-scale producers. Washington, DC: United States Agency for International Development.

International Center for Agribusiness Research and Education. (2012). Assessment of the wheat, barley and emmer wheat value chains in Armenia. Yerevan, Armenia: International Center for Agribusiness Research and Education.

Kancs, D., & Ciaian, P. (2010). Factor content of bilateral trade: The role of firm heterogeneity and transaction costs. Agricultural Economics, 41, 305–317.

Kancs, D., & Ciaian, P. (2012). The factor content of heterogeneous firm trade. World Economy, 35, 373–393.

Kienzler, K. M., Djanibekov, N., & Lamers, J. P. A. (2011). An agronomic, economic and behavioral analysis of N application to cotton and wheat in post-Soviet Uzbekistan. Agricultural Systems, 104, 411–418.

Lerman, Z. (2001). Agriculture in transition economies: From common heritage to divergence. Agricultural Economics, 26, 95–114.

Lerman, Z. (2009). Land reform, farm structure, and agricultural performance in CIS countries. China Economic Review, 20(2), 316–326.

Lerman, Z. (2012). Land reform and farm performance in Europe and Central Asia: a 20 year perspective, Discussion Paper No 2.12, Jerusalem: Hebrew University of Jerusalem, Department of Agricultural Economics and Management.

Macours, K., & Swinnen, J. F. M. (2002). Patterns of Agrarian transition. Economic Development and Cultural Change, 50, 365–394.

Mathijs, E., & Swinnen, J. F. M. (1998). The economics of agricultural decollectivization in East Central Europe and the Former Soviet Union. Economic Development and Cultural Change, 47, 1–26.

OECD. (2011). Agricultural policy monitoring and evaluation 2011, OECD countries and emerging economies. Paris: OECD Publishing.

OECD. (2013a). Review of agricultural policies: Kazakhstan 2013. Paris: OECD Publishing.

OECD. (2013b). Review of agricultural policies: Kazakhstan. http://www.oecd.org/tad/agricultural-policies/kazakhstan-review-2013.htm (accessed 16 February 2015)

OECD-FAO. (2014). Agricultural outlook 2014–2023. Paris: OECD Publishing.

Pomfret, R. (2008). Tajikistan, Turkmenistan, and Uzbekistan. In K. Anderson & J. Swinnen (Eds.), Distortions to agricultural incentives in Europe’s transition economies (pp. 297–338). Washington, DC: World Bank.

Robinson, I. (2008). World Food Programme regional market survey for the Central Asian Region. Food markets and food insecurity in Tajikistan, Uzbekistan, Kyrgyzstan, Kazakhstan, World Food Programme, Regional Bureau Middle East, Central Asia & Eastern Europe (OMC).

Rozelle, S., & Swinnen, J. F. M. (2004). Success and failure of reform: Insights from the transition of agriculture. Journal of Economic Literature, 42, 404–456.

Sedik, D., Kurbanova, G., & Szentpali, G. (2011). The status and challenges of food security in Central Asia, paper prepared for the third Central Asia Regional Risk Assessment (CARRA) Meeting, Astana, Kazakhstan, 14–15 April 2011. Budapest: FAO.

Swinnen, J. F. M., & Vranken, L. (2010). Reforms and agricultural productivity in Central and Eastern Europe and the Former Soviet Republics: 1989–2005. Journal of Productivity Analysis, 33, 241–258.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Ciaian, P., Gomez y Paloma, S., Mary, S., Langrell, S. (2017). Conclusions and Policy Recommendations. In: Gomez y Paloma, S., Mary, S., Langrell, S., Ciaian, P. (eds) The Eurasian Wheat Belt and Food Security. Springer, Cham. https://doi.org/10.1007/978-3-319-33239-0_18

Download citation

DOI: https://doi.org/10.1007/978-3-319-33239-0_18

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-33238-3

Online ISBN: 978-3-319-33239-0

eBook Packages: Economics and FinanceEconomics and Finance (R0)