Abstract

The issue of institutional design of competition authorities has attracted increasing interest since the early 2000 but requires further elaboration. This article attempts to fill some gaps by providing a general framework to examine a number of dimensions of this issue under three headings: the goals, the functions and the organization of competition authorities. While there is no unique institutional design which would fit all countries, a number trade-offs should be considered in designing a competition authority. These trade-offs may lead to different designs across countries depending on the local conditions. Ultimately choosing the best possible design for the competition authority given the local conditions is crucial to ensure that the competition authority is most effectively able to discharge its duties.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The issue of the institutional design of competition authorities has attracted increasing interest since the early 2000 for a variety of reasons.

Prominent among the reasons for which the issue of the institutional design of competition authorities has become an increasingly important topic of discussion is the fact that as competition authorities have become more prominent and powerful in a number of countries they have also become more conscious of the fact that they need to be (and to be seen to be) effective in discharging their duties. Thus in a number of countries, there have been recent changes in the institutional design of competition authorities (for example, in Europe, in Denmark, in the Netherlands, Spain and the United Kingdom) or there are changes contemplated (for example in Australia). Some of those changes have been partly spurred by economic constraints on government in periods of low growth (for example in the Netherlands), partly spurred by the desire to increase the effectiveness of the competition law system (for example in the United Kingdom), partly spurred by the desire to better integrate regulatory policy and competition policy (for example in Spain).

The fast increasing globalization of markets which has characterized the last decade of the twentieth century and the first decade of the twenty-first century has led to an increasing interest both in facilitating international trade and in promoting the convergence of competition law regimes in trading nations. This has led to reflections on what the competition law regimes should converge on. Although this debate has been largely focused on the substance of the competition analysis, it has also touched upon institutional issues. For example, there has been a lively debate on the importance of ensuring that competition authorities throughout the world are in a position to examine speedily transnational merger transactions which fall under their domestic merger control law and therefore on the importance of the adequate funding of competition authorities. Similarly, the question of the independence of competition authorities has been raised as some of the important exporters or foreign investors feared that they would be treated unfavourably by competition agencies in some countries in which such agencies seemed to be dependent on the national government or national dominant firms .

Furthermore, in a world in which a large number of countries have recently adopted a competition law and created a new competition authority (the number of competition authorities in the world has increased by at least 40 over the last 20 years), there has been an increasing demand on the part of developing countries for guidance on the institutional design they should adopt for their newly created competition institution.

Finally, a number of well known competition specialists have produced influential articles about the design of competition authorities. The most prolific and influential of those authors, Bill Kovacic, has had a long standing interest in the issue of institutional design and has long argued in articles and conferences that it was important for competition authorities to devote more attention to the issue of the relationship between the goals of competition law, the effectiveness of the agency and its institutional design.Footnote 1 Other prominent competition authors such as Philip Lowe or Eleanor Fox have also contributed to the discussion .Footnote 2

The scope of what one should consider to be the institutional design of a competition authority is extremely wide as it covers every aspect of the governance of the authority, of its internal organization and of its relationship with the outside (be it the government, parliament, the business community ). Rather than attempting to systematically cover all the bases this article focuses on a limited but significant number of dimensions of the institutional design of competition authorities which have been recently publicly discussed. It builds primarily on a set of OECD Competition Committee Roundtable on institutional design as well as on some OECD roundtables on issues related to specific dimensions of the institutional design of competition authorities which were held over the last 15 years. The OECD Competition committee held its first roundtable on the optimal design of a competition agency in its Global Forum on Competition in February 2003. It held a second roundtable on changes in the institutional design of competition authorities in December 2014 and again in the spring of 2015. In between the OECD Competition Committee held roundtables on the relationship between Competition Authorities and Sectoral Regulators in 2005 and on the Interface between Competition and consumer Policies in 2008. Besides the work of the OECD, the ICN also did work on institutional issues, for example through its Agency Effectiveness Project the results of which were presented In Kyoto during the ICN annual conference in 2008.

This chapter will discuss a number of questions related to the institutional design of competition authorities regrouped under three main themes: the goals of competition authorities, the functions of competition authorities and the organization of competition authorities.

For each theme we will show the diversity of situations prevailing across jurisdictions and explain the main justifications for each institutional design.

A short conclusion will follow.

2 The Goals of Competition Authorities

The question of what are the goals of competition authorities is by no means new and it has been the object of repeated discussions over the last 10 years. It was first discussed in the OECD Competition committee in May 1992. Then it was discussed in the OECD Global Forum on Competition in February, 2003.Footnote 3 Finally this issue was raised again in a recent debate on institutional changes at OECD in the December 2014.Footnote 4

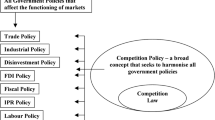

In 2003, the OECD secretariat noteFootnote 5 observed that “the basic objectives of competition authorities were to maintain and encourage the process of competition in order to promote efficient use of resources while protecting the freedom of economic action of various market participants”. It also noted that competition policy was also viewed to achieve or preserve a number of other objectives as well: pluralism, de-centralisation of economic decision-making, preventing abuses of economic power, promoting small business, fairness and equity and other, socio-political values.

Consumer surplus

A lively debate around the goals of competition law took place in the United States in the aftermath of the publication of Robert Bork “the Antitrust Paradox”Footnote 6 in the late seventies. The debate turned around the question of whether the standard for illegality under competition law should be a “consumer welfare” test or a “total welfare” test. However as Herbert Hovenkamp observedFootnote 7: “the volume and complexity of the academic debate on the antitrust welfare definition creates an impression of policy significance that is completely belied by the case law, and largely by government enforcement policy”. Indeed, as J. Kirkwood and R.H Lande found in 2008Footnote 8 and as Hovenkamp observed in 2013 the reality is that US enforcement agencies have consistently follow a consumer welfare standard.

Over time the narrow economic goal of protection of consumer surplus has gained wide acceptability.

Wider economic goals

However, whereas nearly all competition authorities are concerned with the protection of the consumer surplus, there are differences of opinion about whether the protection of consumer surplus is a natural result of competition or an underlying goal of competition law.

Furthermore, among the jurisdictions for which consumer surplus is indeed a goal of competition law, there are differences of opinion between those which consider that consumer surplus is the only goal of competition and those which consider that competition law enforcement may also have other economic goals.

Finally, among the jurisdictions for which consumer surplus is one of the economic goals of competition there are differences between those which consider that economic goals are the sole goals of competition law and those for which competition law may also have social or political goals.

In 2011 the International Competition Network published a document on “Competition Enforcement and Consumer Welfare”.Footnote 9 It recorded the responses to a 2010 ICN survey.Footnote 10 Many respondents stated that even if consumer welfare were an important end goal, economic growth in general and total welfare were the more specific goals of competition law.

In countries like Australia, Norway or Swaziland, the goal of competition law is the protection of total welfare rather than consumer welfare.

Thus, in Australia, the ACCC has powers to grant exemption from competition law in certain circumstances, such as where benefits to the public from the anticompetitive conduct outweigh the detriment that the conduct may cause. In assessing benefits to the public the ACCC may have regard to total welfare effects.

In Norway, the goal of the Competition Act is: “(…) to further competition and thereby contribute to the efficient utilization of society’s resources.”

The competition authority of Swaziland also uses a total welfare standard and noted in its response to the 2010 ICN survey that “besides consumers, there are other equally important stakeholders, such as competing businesses, and that this can lead to the importance of ensuring welfare of groups other than consumers”. The strategic goal of the Competition Authority of Swaziland is thus to promote active competition for the public benefit.

In Kenya competition law sometimes seeks to maximize producer and consumer surplus, not consumer surplus alone.

Among the countries that have a broader economic agenda than the strict promotion of consumer surplus, one may also include Germany, Hungary, Iceland, Ireland Korea, Switzerland or Uzbekistan. In Germany, according to a recent draft guideline issued by the Bundeskartellamt, the purpose of merger control is “to protect competition as an effective process,” which the draft guidelines explain “may sometimes coincide with protecting competitors.”Footnote 11 In Hungary, the goals of the competition law are the maintenance of effective competition and the promotion of efficiencies. The Icelandic Competition Act aims to promote effective competition and thereby increase the efficiency of the factors of production of society. According to the Irish Competition Authority, the primary goal of its work is to ensure competitiveness in the Irish economy, which will ultimately benefits the consumer (although the benefits of this law enforcement activity might not always be immediately clear to consumers). The main goal of Switzerland’s Cartel Act is to prevent the harmful economic or social effects of cartels and other restraints of competition.

Non-economic goals

Besides broader economic goals than the promotion of consumer surplus, a number of competition laws also have social or political goals. These might include, for example, the promotion of employment, regional development, national champions (sometimes couched in terms such as promoting an export-led economy or external competitiveness), national ownership, economic stability, anti-inflation policies, social progress, poverty alleviation, the spread of ownership stakes of historically disadvantaged persons, security interests and the “national” interest. In addition, a number of domestic competition laws in Europe include the Treaty of Rome objective of market integration within the European Union.

As the OECD Secretariat noted in 2011Footnote 12: “The specific objectives behind merger control (…) may differ between jurisdictions”. “(…) For example, protecting local or small and medium size competitors, achieving various socio-economic and socio-political objectives, protecting employment, encouraging enterprise, and achieving various industrial policy objectives including promoting the international competitiveness of the local economy and building strong national firms.”

In the note prepared for the discussion of the objectives of competition law and policy which took place in the OECD Competition Committee in 2003,Footnote 13 the Secretariat offered the view that: “Among OECD countries, there appears to be a shift away from use of competition laws to promote what might be characterised as broad public interest objectives, and use of public-interest based authorisation procedures, exemptions or political over-rides (collectively, “public interest objectives”) in competition laws, that contemplate a consideration of factors which extend well beyond what appear to be the generally accepted “core” competition policy objectives of promoting and protecting the competitive process, and attaining greater economic efficiency (the “ core competition objectives”)”.

In hindsight, this assessment seems to have been overly optimistic. It is true that countries which did not have a public interest provision in their competition law did not add such provisions to their competition law. But it is equally true that (1) a number of countries which had a public interest provision in their competition law did not eliminate them and that (2) a number of developing countries which have since adopted a competition law have included public interest provisions in their law.

Among the countries which had a public interest goals in their competition law and did not eliminate them (even if they use them sparsely) , one can mention Canada. The goals of competition law in Canada are to promote the efficiency and adaptability of the Canadian economy, to expand opportunities for Canadian participation in world markets while at the same time recognizing the role of foreign competition in Canada, and to ensure that small and medium-sized enterprises have an equitable opportunity to participate in the Canadian economy.

Similarly, the Korean competition law goals are a mix of economic and non-economic goals. Article 1 of Korea’s Monopoly Regulation and Fair Trade Act (MRFTA)Footnote 14 states that “The purpose of this Act is stimulate the creative initiative of enterprisers, to protect consumers, and to strive for the balanced development of the national economy by promoting fair and free competition through the prevention of the abuse of market dominance and excessive concentration of economic power by enterprisers and through regulation of improper concerted practices and unfair trade practices”.

With respect to the developing countries which have public interest clauses in their law one can mention that the Competition Act of South Africa and that of Namibia have very wide goals that are both economic and non-economic.

The purpose of the South African Competition ActFootnote 15 is to promote the efficiency, adaptability and development of the economy; to provide consumers with competitive prices and product choices; to promote employment and advance the social and economic welfare of South Africans; to expand opportunities for South African participation in world markets and recognize the role of foreign competition in the Republic; to ensure that small and medium-sized enterprises have an equitable opportunity to participate in the economy; and to promote a greater spread of ownership, in particular to increase the ownership stakes of historically disadvantaged persons.

Similarly, the Anti-Monopoly Law of China (the “AML”), which took effect in 2008, has a variety of goals including “the protection of fair competition in the market” and “the interests of consumers,” but also “the promotion of the healthy development of the socialist market economy.” Another stated objective of the Chinese AML is to protect the “lawful business operations” of undertakings in industries “controlled by the State-owned economy and concerning the lifeline of national economy and national security.”

The goals of single functions competition law institutions

There are three themes of discussion around the goals of competition law.

The first one is a discussion on why competition authorities’ goal should be to protect consumer surplus; the second is a discussion on why competition authorities should not have other goals besides the protection of consumer welfare and the third one is a discussion about why competition authorities should not have public interest goals.

First, the justification for following such a standard is usually that the balance between consumer welfare losses and the attributable efficiency gains would be too complicated for competition authorities to perform.

Second, the justification for competition authorities having only one (economic) goal is that non-competition policy mechanisms are generally superior for achieving noncompetition policy objectives. In other words, it is considered that restricting competition in order to achieve a broader policy objective, whether economic or not, will have inevitable anti-competition side effects, e.g. granting protected monopoly profit to a firm or firms.

Third the justification for not entrusting competition authorities with “public interest” goals is that broadly specified policy objectives can be ambiguous and as such are subject to “capture” or “hijack” by the politically strongest private interests, usually those of producers or workers. Thus de jure public interest objectives may de facto serve private interests.

Those justifications are not fully satisfactory.

First, with respect to whether competition authorities should follow a consumer surplus standard rather than a total welfare standard, we know that in doing so, competition authorities may not take into consideration efficiency gains which could outweigh the consumer loss due to the increase in price and reduction in output due to the anticompetitive nature of the practice or the transaction. Thus, using the wrong test may entail a social cost. On the other hand assigning a total welfare standard to the competition authority may lead it to err in its judgment because of the complexity of the assessment it has to do. Thus it may also entail a social cost. Assuming that society is risk neutral, the question is then whether the expected cost of the errors due to the adoption of a consumer welfare test (i.e. the probability of such an error multiplied by its cost when it happens) is larger or smaller than the expected cost of errors that would happen if the competition authority had to perform a more complex task by following a total welfare test. This a difficult question and we are not aware of any empirical work which would support the choice of a consumer surplus standard over that of a total welfare standard.

Second with respect to the idea that using a restriction in competition to achieve a broader policy objective will entail a social cost, this argument is convincing from society’s point of view only if the alternative ways to fulfill the broader policy objectives (presumably through another agency) do not entail social costs which larger than the ones incurred if the competition authority restricts competition to fulfill these objectives. If, for example, the agency in charge of fulfilling these other objectives has a higher chance of being captured or if the consequence of its actions is to restrict competition more than what the competition authority would have deemed necessary to fulfill those objectives, it may be that letting another agency fulfill these objectives may end up being more costly to society than entrusting the competition authority with the fulfilment of these objectives.

Finally, with respect to the argument that public interest goals may lead to a capture of the competition authority by private interest, one can argue that the competition authority will not be as easily captured as another agency dedicated to the fulfillment of these public interest clauses would be. Also, one could argue that the competition authority, precisely because it is in charge of promoting competition, will be more restrained in the enforcement of the public interest provisions than other parts of government would be.

Thus the objections to the fact that the competition authority may have to enforce public interest provisions when they enforce competition law are unconvincing because they fail to consider the possible costs of alternative solutions.

For sure, a number of critics of public interest provisions in competition laws would prefer that such provisions did not exist. They rightly point out that the enforcement of such clauses may lessen the intensity of competition and be contradictory with the objectives of competition law and policy. But what they fail to acknowledge is that in a number of countries, particularly developing countries (for example in South Africa or in China), the only alternative is between a competition law containing public interest provisions and no competition law at all. In this second best situation it is arguable whether or not such clauses should be tolerated.

The issue of the goal of competition law must also be considered in relation with the possibility of multiple functions of competition authorities, a question to which we now turn.

3 The Functions of Competition Authorities

The second dimension of institutional design we want to explore is the question of the functions of competition authorities.Footnote 16

Competition enforcement and consumer protection

The first sub-question is that of knowing if competition authorities should also be entrusted with consumer protection responsibilities. Over the recent years, quite a number of OECD countries have changed their institutional design from that point of view. For example, basing ourselves on the submission to a recently held roundtable on Changes in Institutional Design at the OECD Competition Committee (December 2014), it appeared that seven countries have merged the competition and the consumer enforcement functions in a single agency since the beginning of the century (Denmark (2010), Finland (2013), Ireland (2014), Italy (2007, 2014), Korea (2006, 2008), Lithuania (2000), Netherlands (2013)). But three jurisdiction have separated consumer protection from competition partly (in the case of the United Kingdom (2013–14)) or completely (in the case of Iceland (2005) and Japan (2009)). Finally, four countries (Brazil (2012), Bulgaria (over the last few years), Estonia (2008), Chinese Taipei (2005)) have considered merging those functions and decided against doing it. Altogether nearly half of the competition authorities of the OECD countries have consumer and competition law enforcement functions whereas the other half do not have a consumer protection function. In some countries, where there are several competition authorities, the picture is even more complex because one agency is a single function competition authority whereas the other one has both a competition and a consumer enforcement function (this is the case in the US where the US FTC has both competition and consumer protection enforcement functions whereas the DoJ is a single function competition authority and in France where the Autorité de la concurrence is a single function competition agency whereas the competition division of the Ministry of economic Affairs (DGCCRF) has both a competition enforcement function (at the local level) and a consumer protection function.

These figures reflect a certain ambivalence about the wisdom of merging the two functions. The arguments in favour of merging the functions and against merging them have been extensively researched in a background paper prepared by Allan Fels and Henry Ergas for the above mentioned discussion of Institutional changes in the OECD Competition Committee.Footnote 17

They, first observe that each of the two policies can be used to advance the goals also pursued by the other: “competition policy, by keeping markets effectively competitive, can reduce the work that needs to be done by consumer policy; consumer policy, by enhancing the ability of consumers to exercise choice, can help make markets more effectively competitive and force firms to compete on the merits, thereby supporting the ends of competition policy”. As former FTC Chairman Timothy Muris has said, “The policies that we traditionally identify separately as ‘antitrust’ and ‘consumer protection’ serve the common aim of improving consumer welfare and naturally complement each other.”Footnote 18

But Fels and Ergas also note that each policy can create challenges for the other.

They thus note that “ when a market becomes more exposed to competition than it was previously (say, because of the removal of trade barriers or deregulation), the incentives of market participants may change in ways that raise consumer protection concerns” and that in some sectors consumers may have a difficult time coping with the complexities of competition . Examples are numerous and would include the fact that the opening up to competition of a number of sectors in transition economies has led to deceptive practices that required consumer protection, that the introduction of competition into some public utility markets (such as electricity and telecommunications) has given an incentive to firms to lock in consumers so as to avoid losing customers to the competitors. Consumers may have difficulties dealing with complex pricing schemes on service markets (such as in banking) or be exposed to risks in competitive markets when they cannot assess the quality of services (such as on professional services markets).

Equally consumer protection may lessen competition both by imposing constraints on suppliers (such as a ban on comparative advertising or the imposition of regulatory standards) or by promoting transparency which may lead to a weakening of competition.

Fels and Ergas then assess the growing importance of behavioural economics and changes in the extent and functioning of markets on the debate on the relationship between the two sets of policies. They point out that in recent years researches in behavioural economics have explored issues about the inherent limitations on the quality and efficacy of consumer choice. Those studies have important implications for policy design, most obviously of consumer protection measures. It should also be noted that market forces may in some cases be important ways of addressing concerns about the efficacy with which consumers take complex choices, because firms in competitive markets have incentives to offer consumers solutions that allow potential gains from trade to be more fully realised. It remains, however, that there are cases where the two policies should interact and be coordinated (such as for example in professional services, health care).

Altogether according to Ergas and Fels, there are three major advantages to integrating the primary responsibility for competition policy and consumer policy within a single institution. There can be advantages from using those two as instruments that can be flexibly combined and more generally managed within a single portfolio of policy instruments; second there are possible gains from developing and sharing expertise across these two areas (for example to develop an understanding of the interaction between the supply side and the demand side of markets); and third the visibility and understanding of consumer and competition policies may be greater if they are integrated ion the same agency.

Whereas the second and the third advantages are widely recognized, there is less consensus about the usefulness of combining in a flexible way the policy instruments of competition law and consumer protection. For example, FTC Commissioner Maureen Ohlhausen recently statedFootnote 19 “In some cases, the FTC has blurred the line between competition and consumer protection—with respect to both the alleged violation and the remedy sought by the agency—to the potential detriment of effective and transparent enforcement in both areas. This blurring of the lines, while in some sense an integration of competition and consumer protection principles, is more accurately viewed as an improper and unhelpful muddying of the two disciplines”.

But integrating consumer and competition policy may also entail costs. There are differences in the nature of the instruments and in the ways in which the policies are implementedFootnote 20 more limited instruments in the case of competition policy than consumer policy, a large number of smaller cases in consumer protection, a small number of larger cases in competition enforcement, geographically localized policy in consumer protection and centralized policy in competition). These differences may create practical difficulties in the management of consumer protection and competition policy within a single organization.

Furthermore, because of these differences and the fact that consumer policy is inherently less centralized than competition policy, the degree of integration between these policy instruments may be difficult or impossible to achieve.

Finally commentators have mentioned other possible practical difficulties of integrating those functions within an agency such as the potential for one mission to dominate the other to the detriment of the latter, a lack of clarity of purpose of the agency, resulting in diminished support for the agency’s overall mission, the potential for “destructive rivalry” between the competing missions within an agency for prestige, headcount, and budgetary resourcesFootnote 21

As a result of these conflicting tendencies, Ergas and Fels conclude:

In practice, what appears most important is:

To ensure that the competition authority has in-house access to the skills involved in the formulation of consumer policy, and at the very least a watching brief with respect to consumer policy, as well as scope to intervene in consumer policy decisions that have material competition implications; and

That there be within government, an entity that has “whole of government” oversight of consumer protection, and that exercises that oversight in a manner mindful of competition concerns.

It is useful, keeping this approach in mind, to eek the perspective expressed by the competition authorities which have merged the two functions and by those which have decided against such a merger during the OECD roundtable on Institutional changes.

Among the countries which have recently merged the two functions (Denmark 2010, Finland 2013, Ireland 2014, Italy 2014, Korea 2008, Lithuania 2000, Netherlands 2013), the motivation most frequently mentioned in the OECD discussion on institutional changes are the increase in the effectiveness of both policies, the development of synergies between consumer policy and competition policy, and the development of expertise in the understanding of market mechanisms. Furthermore two countries (Ireland and the Netherlands) indicate cost saving as an important determinant of the merger of the functions and one country (Korea) indicates that the objective was to make consumer policy more consistent with competition policy.

Thus the reasons for which competition enforcement and consumer protection have been brought together in those countries are broadly in line with the complementary nature of the two policies outlined by Ergas and Fels and the desire to make both policies more effective.

For example, echoing the assessment of Ergas and Fels, the Irish contribution the OECD Roundtable on Institutional designFootnote 22 explained that the rationale for “amalgamation” of the two functions in this country rested on the idea “that combining competition enforcement, consumer protection and consumer awareness in one body will build a more effective organisation which is better equipped to foster a pro-competition culture across the economy. An independent authoritative body provides a source of consistent information to business and consumers about their rights, and provides administrative savings and skill enhancement through the pooling of information, skills and expertise. Competition authorities are expert in assessing how firms compete with one another thanks to an internationally accepted toolkit for competition analysis while the enforcement of consumer law brings awareness of problems that arise in business to consumer transactions even in markets that are competitive. In addition, the rapid rise of behavioural economics has given regulators deeper insight into how consumers actually make choices in competitive markets. The experience of deregulation has shown that supply side reform on its own is not sufficient to ensure that all consumers fully benefit from competition as there may be behavioural barriers which prevent consumers from making the best choices for themselves or indeed unfair commercial practices causing consumer harm before and after they buy. The increasing awareness of behavioural issues in competitive markets serves to reinforce the logic of having competition and consumer experts working side-by-side. In newly competitive markets there tends to be gaps in understanding among consumers and this confusion can be exploited by firms. This gap can be bridged by co-ordinating consumer and competition policy”.

In addition, the Irish competition authority considered that there could also be operational advantages from having the competition and consumer functions within the one regulator. It stated “For example, a competition case might raise concerns about consumer harm due to market power but there might be insufficient evidence or constrained resources to bring an enforcement action. Having a single agency overseeing both competition and consumer protection allows the different courses of action to be considered simultaneously”.

The contribution of Poland to the OECD roundtable on changes in institutional designFootnote 23 emphasized the particular complementarity of the two policies in transition economies where there is no widespread culture of market economy. It stated: “A consumer perspective in competition enforcement is of particular importance in transition economies, where market liberalisation is often, rightly, a key policy objective as a means of creating foundations for long-term growth and consumer welfare. However, short-term impact on consumers cannot be ignored. A liberalized market must from the start meet consumer expectations with regard to access, choice, price, quality, security and reliability, and must be independently regulated and enforced. From UOKiK’s experience, we often see that such liberalisation aimed at long-term benefits for consumers may result in short-term infringement of consumer rights. This is why we believe that impact assessment accompanying legal regulatory changes needs to include a consumer impact forecast for both the short and the long run. A competition and consumer protection agency is well placed to offer government a balanced view in this respect during the legislative process. It is also well positioned to counteract any short-term negative effects of market liberalization without jeopardizing its long-term benefits.

A practical example would be the electricity markets. Since the opening of residential retail markets in Poland in July 2007 there have been numerous problems with door-to-door selling. In this case, antitrust law is not the solution. This issue should be addressed through other means such as legislation on commercial practices, trade standards etc. Door-to-door selling became a major source of consumer dissatisfaction shortly after the retail market was fully opened up to competition. The bulk of consumer complaints focused on the fact that they were being misled into signing contracts to switch suppliers when they were under the impression that they were only agreeing to approve a visit from a consultant, obtain information or have their meters read. UOKiK is currently conducting a number of proceedings against the most aggressive suppliers. These cases show that market liberalisation may create incentives for unfair, deceptive and unlawful business practices, against which our consumer protection law is the only defence. Similar problems occurred during the liberalisation of the telecom market in the early 2000s. However, actions undertaken by the telecom regulator as well as the competition authority to create a diverse market along with consumer rights enforcement have led to a substantial improvement in the sector, as demonstrated by today’s fierce price and quality competition as well as fewer consumer complaints.”

It seems that the concerns about the difficulty of integrating the two policies have not been a major concern in those countries.

The objective of cost savings invoked by some countries may not be met to the extent that, as Ergas and Fels argue, the integration of both instruments may be quite challenging given their different natures. Yet it seems reasonable to assume that some cost saving can be achieved in the support functions (such as communication, personnel, general administration etc….) when the two instruments are merged in a single institution.

In those countries which merged the consumer protection and the competition authority, different concerns were raised at the time of the merger or shortly after.

In several case there was a negative reaction on the part of consumer representatives about the merger of the functions (for example in Korea) or a concern that either competition law enforcement would come to dominate consumer protection or that “easy” consumer protection cases would crowd out the “more difficult” competition cases. This last consideration was , for example, the reason advanced by the Monash Business Policy Forum in Australia to advocate the separation of the consumer functions from the ACCC. It argued that such a separation was necessary in order toFootnote 24 “free a potential bias in the present operation (of the ACCC) where consumer protection gets more enforcement work because it is easier law to prosecute”.

The difficulty of prioritization of cases in agencies that have both consumer protection and competition law enforcement functions was also mentioned in the contributions to the OECD Competition Committee Roundtable on Institutional Changes. For example, the contribution from FinlandFootnote 25 illustrated the problem it faced in the following way: “In the field of competition law, the legislation practically obligates the authority to prioritize between investigated cases and also gives the right not to investigate insignificant issues, whereas there are no actual provisions regarding prioritization in consumer affairs. However “The Consumer Ombudsman must be active especially in areas which are particularly significant for consumers or where it can be assumed that problems for consumers would most commonly occur”, but in practice as there is a lack of appropriate provisions regarding prioritising, enforcement has to be targeted at all the areas that are defined as being under the aegis of the Consumer Ombudsman”.

In some other case the agency felt it difficult to merge the different cultures of the consumer protection personnel and of the competition enforcers. Those concerns are understandable in light of the difference in the instruments described by Ergas and Fels.

But other concerns were also expressed with respect to the identification of a common strategy and the structure of the new institution.

Finally, in organizational terms it is worth noting that overall either the functions of consumer protection and competition are separated by law (Finland) or the enforcement of consumer protection, and competition are de facto separated (for example in Denmark and in the Netherlands). Ireland seems to follow a more integrated model than the other countries which have merged consumer protection and competition enforcement into a single body. In most cases, however, a number of support functions are merged, such as communication, policy and legislation, strategy.

The market analysis function is integrated (used both for consumer protection and competition enforcement) in Denmark and the detection function is integrated in the Netherlands.Footnote 26

Finally, it should be noted that in the countries which have decided to unbundle the consumer protection and competition enforcement functions and to create two separate institutions (Iceland and Japan) , the reason given was to increase the effectiveness of competition policy (in Iceland) and to increase the effectiveness of consumer policy (in Japan). These motives may be explained by the difficulty of agencies having the two functions to find the proper balance between them and to prioritize their enforcement activities. This is suggested, for example, by the contribution from Iceland to the OECD Debate on institutional changesFootnote 27 which stated: “In the view of the Icelandic Competition Authority (ICA), the move from a multifunctional design towards a single functional one has made competition enforcement and advocacy more effective. The fact that the ICA is “solely” responsible for competition enforcement and advocacy, enables a very clear goal-orientation, which in return facilitates prioritization and makes the Authority well equipped to tackle changes in the economic environment. The institutional design has enabled the ICA to put its weight on the most important tasks at any given time, and by that facilitate quality decisions and active advocacy and guidance. The prerequisite for quality decisions is the ability to attract and maintain high-level expertise. The current institutional design has served as a basis for success in this regard. The ICA has also been able to use its focus and goal orientation to prioritize cases with the aim to improve the length of procedures”.

The second sub-question is that of knowing whether the competition enforcement function should be merged with regulatory functions.

Competition and sectoral regulation

There is a diversity of situations throughout the world with respect to the relationship between competition law enforcement and the enforcement of sectoral regulations.

In Australia, for example, the ACCC has a range of regulatory functions in relation to national infrastructure industries as well as a prices oversight role in some markets where competition is limited. According to the Australian contribution to the OECD debate on Institutional changesFootnote 28 the regulatory functions of the ACCC include: “assessing access undertakings under the ‘National Access Regime’, which facilitates third party access to certain services provided by means of significant infrastructure facilities; a number of responsibilities regarding the National Broadband Network; supporting the development and operation of efficient water markets in the Murray-Darling Basin; and assessing notifications of price increases in relation to certain services (regional air services, services to airports and airlines, and certain services provided by Australia Post)”.Within this model there is a specificity with regard to the energy market. Under the Competition and consumer Act of 2010, the Australian Energy Regulator is an independent entity staffed and funded through the ACCC’s agency appropriation which has some regulatory functions mostly related to energy markets in eastern and southern Australia and which assist the ACCC with energy-related issues arising under the Consumer and Competition Act, including enforcement, mergers and authorizations. Thus in the field of electricity there are two, closely related, regulators, one of which is the ACCC.

At the other end of the spectrum, in the United Kingdom, the sectoral regulatorsFootnote 29 have powers to apply some aspects of competition law in relation to their particular industry sector. ‘Concurrently’ with the Competition and Markets Authority they enforce the prohibitions on anti-competitive agreements and abuse of dominance under Articles 101 and 102 TFEU and the UK national equivalents. They also have the power to make a Phase 1 market study and refer a market for a full Phase 2 market investigation by the CMA Panel. These competition powers are in addition to the sector regulator’s regulatory powers.

In between those two extreme models, a number of countries follow a “division of labor” model between the competition authority and the sectoral regulators. For example, in PortugalFootnote 30 “the powers to enforce and promote competition rules, to defend consumer’s interests as such, and to regulate markets are entrusted to different bodies: the Portuguese Competition Authority, the Directorate-General for Consumers and National Regulatory Authorities, respectively”.

In the recent years there have been changes in the allocation of regulatory and competition law enforcement powers. In a number of countries some of the regulatory functions were given to the competition authority. Such was the case, for example in Denmark (2009) where the competition authority was given regulatory functions in the water distribution sector, in Estonia (2008) where the competition authority was given regulatory functions in the energy, rail, and telecom sectors, in the Netherlands (2013) where the competition authority became the telecom and post regulator, in Spain (2013) where the competition authority became the airports, audio visual products, energy, rail, post, and telecom regulator or in Lithuania (2009, 2011) where the competition authority became the rail regulator.

Conversely in a few countries there was a movement to separate competition law enforcement from sectoral regulatory functions. Such was the case in Denmark (2010) where the Danish Energy Regulatory Authority was separated from the Competition Authority (at the same time that the consumer protection function was added to the competition authority) . This was also the case in Estonia in 2014 where the competition authority which had been given, in 2008, regulatory functions in the energy, water, heating , post, railway, airport, telecom, lost its regulatory functions in the telecom sector (which it previously shared with a technical regulator). As we shall see below there is also a lively debate in Australia on whether the ACCC should keep its regulatory functions.

The arguments in favour of entrusting competition authorities with regulatory functions are the following:

-

First the fact that the competition authority will have a more flexible range of instruments to promote and maintain competition, particularly in newly deregulated sectors.

-

Second, the fact that the competition authority may be better able to detect/manage policy or enforcement conflicts (e.g., ensuring that a competition remedy does not conflict with regulatory requirements or vice versa).

-

Third, the fact that the pooling of sectoral responsibilities may make the agency more adaptable to changing markets (e.g., where convergence is occurring such as in the information sector).

-

Fourth, the fact that there is less risk that the competition authority will be captured than the sectoral regulators because competition authorities deal with a wide variety of markets whereas sectoral regulators always deal with the same, comparatively small, number of regulated firms.

Along those lines, Ergas and Fels, examining the allocation of responsibility for regulating the former public utilities to the competition authority (as was done in Australia and in New Zealand) state: “The advantage of (this) approach, at least in theory, is that it extends the range of instruments that the authority can bring to bear. For example, it may be that the most efficient solution to a particular regulatory problem is to restructure the market in ways that promote competition and then more vigorously enforce the competition rules. By ‘internalizing’ into the same authority the competition and regulatory instruments, the authority may be more inclined to efficiently mix and match problems and instruments, avoiding the ‘silo mentality’ that can compromise good decision-making. At the same time, there may be instances where identifying the efficient regulatory solution requires an analysis of competition impacts, which such an integrated authority may find it easier to undertake”.

Against those possible advantages, there are a number of possible difficulties associated with the merging of regulatory and competition law enforcement responsibilities into a single entity.

A first category of difficulties may accrue from the complexity involved in managing different functions. As we saw when discussing the amalgamation of consumer protection and competition law enforcement, prioritization of cases and the efficient allocation of resources becomes more difficult as the number of different functions of the authority increases.

A second category of difficulty may come from the fact that, as the competition authority accumulates different functions, its support is eroded because it becomes more and more difficult for economic actors and the general public to understand what it does and to assess its quality and its accountability.

A third source of difficulty may be due to the complexity of mixing within the same organization staff members having different cultures and approaches (the ex-ante and prescriptive approach of regulators and the ex-post and legalistic approach of competition enforcers).

A fourth source of difficulty may be due to the loss of competition between sectoral regulators and the competition authority in advocating regulatory changes for the regulated sectors. This loss of competition between regulators may entail a social cost for society.

A fifth source of difficulty may be due to the fact that the goals which should be ascribed to an institution which is both a competition policy enforcer and a sectoral regulator are far from clear.

This last point was made by the Dutch contribution to the OECD debate on institutional changes.Footnote 31 As mentioned earlier, the Netherlands Authority for Consumers and Markets was created on 1 April 2013 through the consolidation of the Netherlands Consumer Authority (CA), the Netherlands Independent Post and Telecommunication Authority (OPTA) and the Netherlands Competition Authority (NMa). In its contribution the competition authority stated: “As ACM sees it, one of the authority’s strengths is its focus on consumers. This focus has not gone un-criticized within the Dutch system, where many commentators argue that ACM should more correctly focus on orderly market processes and on competition in the market, rather on the effects on consumer welfare. ACM’s Establishment Act determines that ACM is to ensure that markets function well, that market processes are orderly and transparent, and that consumers are treated with due care. (…) Eighteen months after the merger, ACM can raise these issues for discussion but cannot, as yet, give experience-based answers to these questions”.

Over and beyond the advantages and difficulties previously mentioned from entrusting sectoral regulatory functions to competition authorities, one should note that if regulatory oversight can be complementary to competition law enforcement (for example both may require a common vision of what the relevant markets are and it is clear that the possibility of effective competition on a regulated market is a function of both the structure of the market and the sectoral regulation applicable to it), the deregulation of a market and the establishment of a competitive market is a fundamentally different function than the protection of competition on a deregulated and structurally competitive market. The opening up of a formerly legally monopolized markets to competition, particularly in sectors where the incumbents are managing essential facilities, requires a number of ex ante decisions of an industrial policy nature to establish the possibility of competition such as: at which rhythm should entrants be allowed (to avoid too much competition among the entrants resulting in an inability for each of them to meaningfully compete with the incumbent); which entrants should be chosen; what should be the interconnection obligations of the incumbent monopolist both quality-wise and from the standpoint of the financial terms; what public policy is necessary to decrease the importance of the bottlenecks and to facilitate the development of infrastructures etc…. To discharge these functions it is not clear what the comparative advantage of a competition authority is.

Thus in a number of European countries (France, for example) the choice was made to entrust competition law enforcement and sectoral regulations to different agencies but to ensure that the two agencies would communicate on questions of mutual interest. Thus , for example, the Autorité de la concurrence in France has the duty when it deals with a competition issue in a regulated sector to ask the opinion the sectoral regulator on the technical issues underlying the competition question it deals with. The opinion of the sectoral regulator is not binding on the competition authority but it is made public and the competition authority must explain in its decision why it departs from the opinion of the sectoral regulator. Likewise when the technical regulator is dealing with a technical issue which may have an impact on competition, it must consult the competition authority on the implications for competition of the question it deals with.

Such arrangements allow each institution to fulfill its function and to have the input of the other institution without having to bear the costs of difficulties attached to multi-task institutions. Such a system requires, however a clear delineation of the responsibilities of each institution as well as a clear and transparent procedure for the exchange of opinions between the competition authority and the sectoral regulators. Yet it is not always the case that such responsibilities are clearly delineated and, for example, during a period in the nineties, Spain had a system where the competition authority and the sectoral regulator were simultaneously competent to deal with a number of issues which caused a certain amount of confusion and dissatisfaction. But when the system is well set up, as it is in France, it can run very smoothly to ensuring the cooperation and the consistency of the sectoral and the competition enforcement approaches.

The optimal arrangement when it comes to whether one should entrust sectoral regulatory functions to the competition authority may differ depending on the size of the country. Indeed smaller countries may have difficulties supporting separate institutions given their public resource constraints and the important weight attributed to possible economies of scope or economies of scale in those countries may tip the balance of advantages and costs in favour of multi-function agencies.

Finally, the choice of having a single function competition agency or a multifunction agency with sectoral regulatory powers or a system of cooperation between agencies may also be determined by the economic history and past experiences of the country in the area of deregulation.

For example, in the case of Australia , Ergas and Fels suggest that the decision to confer responsibility for economic regulation of telecommunications on the ACCC was shaped , among other factors, by the perception that the industry-specific regulator had not been a success and by the unfounded expectation that industry-specific telecommunications regulation would ‘wither away’, as a rapid transition to competition was envisaged. They explain the current debate over whether the sectoral regulation functions of the ACCC should be transferred to another institution by the fact that the historical factors in favour of the multi-function agency are not relevant anymore in Australia.

Similarly the contribution of Spain to the OECD debate on institutional changesFootnote 32 makes the point that the regulatory model for energy and telecommunications based on specialized regulators had been designed at the beginning of the liberalization process but that, as competition developed in both sectors and as the frontier between telecommunication and the digital economy became more blurred, the need for better coordination among sectoral regulators, on the one hand, and between sectoral regulators and competition law enforcers, on the other hand, required a different and more integrated regulatory system which led in 2013 to the creation of the new Spanish National Authority for Markets and Competition.

4 The Organization of the Competition Authority

A third set of question relates to how , given its assigned functions, the competition authority should be organized.

We will try to address the following questions: what are the respective advantages of the prosecutorial model and the administrative model of competition authorities? Should investigation and adjudication be separated? Should competition authorities have a single commissioner or have a board and, in the latter case, what the function of the board should be? How to ensure the independence of the competition authority be (and what one means by independence)? What are the ways to organize the funding of competition authorities? A final question will deal with the management of its resources by the competition authority (recruitment of staff, prioritization of cases, organization of the work between lawyers and economists).

Administrative versus prosecutorial model

In a prosecutorial model, the competition authority prosecutes the cases that it brings in an adversarial proceeding in a courtroom. In such a model the court is the decision maker and not the competition authority. This is, for example the case in the Us (for the Antitrust Division of the Department of Justice), Australia, Canada and Ireland as well as in some European countries (in Austria and in Sweden).

In an administrative model, the competition authority investigates and adjudicates cases. This model is the dominant model among European member states. It is also the model followed by the FTC in the United States and by a large number of countries throughout the world. The administrative model has itself two variants: the variant in which the authority’s decision are appealable to a general court (such as for example in France or in the EU) and the model in which the competition authority’s decisions are appealable to a specialized court (such as in Portugal or in the United Kingdom or in Mexico under the new law of 2013).

The question of whether a prosecutorial model is preferable to an administrative model was hotly debated recently both in the United Kingdom and in Switzerland, two countries which ultimately decided to stick with the administrative model. There was also some discussion along those lines in Germany.

The perceived legal advantage of a prosecutorial model is, first and foremost, the fact that the impartiality of the proceedings is better protected through the separation of investigation and adjudication in a judicial context than in administrative proceedings were those functions are combined in a single entity.

In Europe, however, this argument has not been successful. As mentioned by Slater, Thomas and WaelbroeckFootnote 33 “Traditionally, the view is taken that, it is sufficient for Commission decisions in antitrust cases to be subject to review by the Community courts and particularly by the Court of First Instance (“the CFI”), even if the Commission itself is not an “independent and impartial tribunal” under Article 6 ECHR”. The same view applies in the Member states which are (unlike the European Union) signatories of the European Convention on Human Rights. This view is based on the European Court of Human Rights Le Compte, Van Leuven and De Meyere v Belgium judgment,Footnote 34 in which the European Court stated that: “Whilst Article 6 par. 1 (art. 6-1) embodies the “right to a court” (….), it nevertheless does not oblige the Contracting States to submit “contestations” (disputes) over “civil rights and obligations” to a procedure conducted at each of its stages before “tribunals” meeting the Article’s various requirements. Demands of flexibility and efficiency, which are fully compatible with the protection of human rights, may justify the prior intervention of administrative or professional bodies and, a fortiori, of judicial bodies which do not satisfy the said requirements in every respect; the legal tradition of many member States of the Council of Europe may be invoked in support of such a system”.Footnote 35 , Footnote 36

Similarly in Member States which have signed the European Convention of Human Rights, the Le Compte, Van Leuven and De Meyere v. Belgium, judgment of the ECHR is seen as the basis on which administrative agencies even when they do not meet the standards of an independent and impartial tribunal are not considered to breach the right of parties to a fair trial provided that their decisions can be appealed to such an independent and impartial tribunal.

A second possible advantage of a prosecutorial model is the economic equivalent of the legal advantage previously discussed: a prosecutorial system to avoid the confirmation bias which is likely to characterize the administrative proceedings of a competition authority which acts as investigator and adjudicator.

The possibility of a bias is consistent with behavioural economics and has some empirical support.

Behavioural economics suggests that a confirmation bias occurs when people filter out potentially useful facts and opinions that don’t coincide with their preconceived notions. Behavioural economics holds that such bias affects perceptions and decision making in all aspects of our lives and can cause us to make less-than-optimal choices. Thus, if a competition authority is both a prosecutor and an adjudicator, it may be tempted to confirm and justify as an adjudicator its decisions to prosecute by finding the parties it has decided to investigate guilty of a violation or engaged in an anticompetitive transaction.

This theory has found support in a small number of empirical studies. For example, two economists analyzed the decisions of the US FTC when the FTC sat in appeal of its own administrative law judge decisions following previous FTC decisions challenging mergers and referring them to the FTC administrative law judge for adjudication (see footnote 36). They found that the appeal was much less likely to be successful when the FTC commissioners sitting in appeal were the same as the commissioners who had originally opposed the merger and more likely to be successful when the commissioners sitting in appeal were different from the commissioners who had originally objected to the mergers.

A third advantage of the prosecutorial model is held to reside in the fact that the judicial decision process is (often) more transparent than the administrative process and therefore more credible. This argument was invoked in the United Kingdom by those who were in favour of switching to a prosecutorial model during the discussions that led to the creation of the Competition Market Authority. Indeed, there were complaints about what parties and their counsels perceived to be the lack of transparency of the OFT decision making process and the impossibility to either know who made decisions or to be heard by the decisions makers.

However one should note that those arguments are somewhat inconclusive in the sense that one could conceive of an administrative model in which the prosecution and the adjudication would be separate and done by different staff members and in which the decision making would be transparent.

Thus even if one accepts the usefulness of the separation of investigation and adjudication and of the transparency of the process, it does not follow that the administrative model is necessarily flawed.

Finally, it is sometimes argued that the number of appeals would be lower if the courts rather than the competition authorities made the decisions and that this would save time and money in the enforcement system. This assertion, however is called into question by the fact that judicial proceedings can drag on for a long time. For example, the Annual Report of the Austrian Federal Competition Authority 2011 stated that “the proceedings before the Cartel Court often drag on for years without there being comprehensible reasons for their excessive length”. It mentions cases brought in 2004, 2007 and 2009 but not resolved by the end of 2011. In the case of Sweden, the court proceedings in the TeliaSonera abuse of dominance case started in December 2004 and the Stockholm City Court made a decision on 2 December 2011. Thus the court proceedings in this last case took 7 years (minus 2 years because of a reference to the ECJ).

The prosecutorial model is also frequently considered to have some drawbacks compared to the administrative system.

First, the Courts hearing the competition cases are often not specialized unlike competition authorities with the result that they are less likely to understand the underlying economic issues. The reason is that generalist judges for whom competition cases represent but a small minority of the cases on their dockets, have less incentive to invest their time in learning the intricacies of the economic underpinnings of competition law than specialized judges for whom competition cases represent a large portion (or the entirety) of their caseload. Thus the quality of the lower level decisions in the prosecutorial model may be an issue unless the relevant court is specialized.

Second, because competition cases are often seen as more complex and involving more work for the judges than the other cases coming to the court, because of the difficulty to understand the underlying economic issues, they may not be given a high priority by the courts resulting in delays in the court proceedings.

Altogether a number of the arguments offered in favour or against the administrative model or in favour or against the prosecutorial model appear not decisive. The only decisive advantage that the prosecutorial model offers is that it guarantees a separation between investigation and adjudication, something which is not guaranteed to the same extent in the administrative model.

Separation between adjudication and investigation

As mentioned earlier, within the administrative model several sub-models can exist reflecting varying degrees of separation between investigation and adjudication.

As the EC study on institutional design of competition authorities suggestFootnote 37 that two main configurations can be distinguished within the administrative model: “the first involves a functional separation between the investigative and decision-making activities of the single administrative institution whereby the inquiry is carried out by investigation services and the final decision is adopted by a board/college/council of this administrative institution. For example, in France and Spain a full functional separation between investigative and decision-making bodies has been set up, where their respective competences are carried out independently from one another. The second configuration follows a more unitary structure and does not have different bodies carrying out different steps in the procedure although there may be different divisions (e.g. a Competition department and a Legal department) inside these authorities that deal with separate aspects of the same case”.

The functional separation of adjudication and investigation is widely considered to have a number of advantages for the competition law enforcement process and to improve the quality of decisions.

The first benefit of the separation of investigation and adjudication is the possibility to avoid mistake by having “a second set of eyes” reviewing the evidence and the proposed qualifications.

This is, for example, largely why, previous to the creation of the CMA in the United Kingdom, merger enforcement was split between two institutions, the Office of Fair Trading and the Competition Commission. The OFT reviewed information relating to merger situations and, where necessary, referred any relevant mergers to the Competition Commission for further investigation if it is felt that the merger was likely to lead to a substantial lessening of competition within any market for goods or services in the UK. This system has now been abandoned with the creation of the Competition and Market Authority.

However within the CMA a separation has been kept between investigation and decision making in the context of the CMA for mergers reaching what was once referred to as a Phase 2 level of enquiries. “Phase 2” merger and market decisions must be made by a group drawn from a separately appointed panel of experts (the Panel) who are not CMA staff. The investigatory teams in the two phases are also largely different.

A second possible benefit from the separation of investigation from decision making within the administrative model is that more information is likely to be provided to the decision maker when the decision-maker is independent of both the investigator and the defense. Indeed in such a case neither party has an incentive to hide information.

A third advantage of the separation between investigation and decision within the competition authority making lies in the fact that the authority is perceived to be more respectful of due process and therefore more legitimate. For example, during the revision of the Mexican competition law which led to the creation of the Federal Economic Competition Commission (Cofece) and of the Federal Institute of Telecommunications (Instituto Federal de Telecomunicaciones) (IFT) in July 2013, the separation of investigation and adjudication in both institutions was seen as necessary in order to guarantee impartiality and objectivity of the competition authorities. Thus, the reform provided for a separation between the authority in charge of the investigation and the authority in charge of the resolution (both within each institution).

A fourth, and may be the most important benefit from the standpoint of the quality of the decision making process is the fact that the separation of investigation and decision making limits (somewhat) the risk of confirmation bias whereby an authority having invested a large amount of resources to bring a case against a firm or a set of firms has a natural tendency to legitimize its past efforts by finding the investigated firms in violation of the competition law.

If there are thus clear potential benefits of separating investigation and adjudication, some have questioned the importance of those benefits and others have pointed out that there are nevertheless costs and inefficiencies involved in keeping the two functions apart.

Belgium is, for example a country which underwent a change of institutional design of its competition authority in 2013. The contribution of Belgium to the Competition committee roundtable on institutional designFootnote 38 states that the newly established Belgian Competition Authority (BCA) is an autonomous authority with its own legal personality. It is managed by a board of four members appointed by the Government with a mandate of 6 years: the president, the competition prosecutor general (auditeur général), the chief economist and the general counsel. Formal cases are opened by the prosecutor general after hearing the chief economist. Investigations are managed by the prosecutor general who appoints one member of the investigation service in charge of the daily management of the case and one as ‘peer reviewer’. These three officers can together decide as auditorat (1) to bring the case before the Competition College, or (2) to settle the case, or (3) to drop the case. The Competition Colleges consist of the president and two assessors designated in alphabetic order from a list of twenty. They hear and decide the cases brought for them by the auditorat (or the parties who wish to appeal a decision of the auditorat to drop a complaint.

An interesting comment by the President of the BCA (who was the director general for competition of the Authority before the institutional change) is found in the Belgian contribution to OECD.Footnote 39 It states: “ I wish to reiterate, however, what was said in earlier surveys of the OECD and the IMF. As Director General in the previous authority in which I was member of the Board of the ministry of economic affairs, I never experienced the slightest restriction of the independence of the agency. This of course also held true for the Competition Council that was an administrative tribunal whereby the authority only act in formal infringement cases as the prosecutor”.

In administrative models in which a board independent of the investigatory team is called upon to make the final decision on a merger or on an antitrust violation three risks exist.

The first risk is that the board may lack means to monitor that quality and/or the quantity of the work done by the investigatory body of the same agency. The lack of possible feedback from the decision board to the investigatory arm of the competition authority may lead to a suboptimal use of resources and/or an ineffective process if the two parts of the administrative agency do not share the same vision of the goals of the institution.

First there is the risk that the decision-makers, because they have not participated in the investigation, may not know or understand as well as the investigatory team the implications of the results of the investigation. This could happen in some very fact intensive cases where the analysis requires the ability to put into context numerous elements revealed by the investigation. Even if the decision makers read the investigatory file they may not have as intimate a knowledge or understanding of this file as the investigators themselves who have spent many months painstakingly putting together its elements.

Alternatively, in some institution the decision-makers benefit from a second investigatory team, usually separate from the team which conducted the initial investigation.

The risk in that case is the opposite. Indeed the risk exists that there may be unnecessary duplication between the two successive investigations. This was, for example, frequently a complaint voiced by the business community when, previous to the creation of the CMA, merging businesses were faced by requests for information , first, by the Office of Fair trading and, second, when there was a reference to the Competition Commission by the staff of the Commission. The business community clearly felt that these repeated requests, often on the same points imposed on them an unnecessary cost. As mentioned earlier the CMA has since tried to alleviate the problem by including in the second phase investigatory team some members of the original investigatory team. But the trade-off between ensuring the independence of the investigatory and the adjudicative processes and making sure that the adjudicators are not entirely dependent on the information provided by the primary investigators is a tricky one.

The problem of the separation of the adjudication from the investigation is particularly acute in civil law systems when the decision maker is a court and when the court does not have separate investigatory powers or independent means of investigation. In such cases, the court may be in fact very dependent on the evidence and the economic interpretation of this evidence proposed by the prosecuting entity even if the defendants lawyers try to provide the court with whatever evidence would exculpate their clients. The court often cannot ask for additional or different investigations and the defendants do not have the powers of investigation of the prosecutor.