Abstract

This chapter elaborates on the five cases investigated to explore the current industrial practice in sustainability, business models and modelling, business model innovation, and stakeholders. The cases include Riversimple and CLAAS from the Sustain Value project consortium and four other external companies. For confidentiality purpose, the names of the external companies and the interviewees at the six companies have not been revealed. The interviews were conducted based on semi-structured questionnaire. Brief overview of the case is provided. This is followed by an overall summary of findings and gaps, focusing on the company perspective on sustainability, business model and modelling, business model innovation and stakeholders in the value network.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Business Modelling Process

- Sustainable Consumption

- Notable Issue

- Industrial Symbiosis

- Business Model Innovation

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

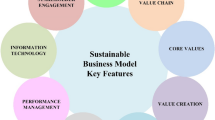

It was observed through literature that business model innovation is a key to business success (Chesbrough 2010, Lüdeke-Freund 2010 and Amit and Zott 2012). Likewise for embedding sustainability into businesses, authors such as Stubbs and Cocklin (2008), Lüdeke-Freund (2010), Schaltegger et al. (2011, 2012) and Porter and Kramer (2011) consider business model innovation and redesign to be essential in generating real (long-term, multidimensional) sustainable value. Key authors who have articulated a business modelling process include Teece (2010), Osterwalder and Pigneur (2005, 2010) and authors such as Richardson (2008) and Zott and Amit (2010) have contributed towards defining the elements of business model design (value proposition, creation, delivery and capture). Their focus has not been specifically on delivering sustainability, but they provide an extensive overview of the current state of the art and state of practice. Tukker and Tischner (2006), Baines et al. (2007), Stubbs and Cocklin (2008), Lüdeke-Freund (2010), and Anderson and White (2011) have contributed to academic and industrial research on sustainable business models and modelling. However, there is still a requirement for frameworks/processes and tools that support companies in thinking about and embedding sustainability into their business logic, everyday operations and exploring other forms of value (social and environmental) and analysing value exchanges (stakeholders). To support this understanding and analysis from literature, an empirical study was conducted.

This chapter elaborates on the five cases investigated to explore the current industrial practice in sustainability, business models and modelling, business model innovation and stakeholders. The cases include Riversimple and CLAAS from the SustainValue project consortium and four other external companies. For confidentiality purpose, the names of the external companies and the interviewees at the six companies have not been revealed. The interviews were conducted based on semi-structured questionnaire. A brief overview of the cases is provided. This is followed by an overall summary of findings and gaps, focusing on the company perspective on sustainability, business model and modelling, business model innovation and stakeholders in the value network.

2 Overview of the Cases

Desai (2002) suggests that ‘business and industry, as both producer and consumer of goods and services, affects economic and social development, resource consumption and the environment in a direct way’. A sustainable society and the associated sustainable manufacturing network is conceived as one that permits ‘pursuing individual and societal well-being’ without undermining the natural environment and without compromising inter-generational equity. ‘Sustainability issues in manufacturing and production are growing exponentially. Initially referring to environmental considerations, sustainability now also encompasses social and economical responsibilities’ (Burke and Gaughran 2007). The five cases below were selected given their use and implementation of sustainability initiatives and business modelling activities.

Company A

Company A is a wholly owned subsidiary of a large multinational firm. It is expanding into new areas of operations with a diverse portfolio of various product segments. Company A is one of the leading global sugar producers in the world and is also a major producer of biomass, processed to produce sugar, ethanol, furfural and many other products. It has operations in number of countries.

The Company has a decentralised approach to management and sustainability with a traditional governance structure. There is some coordination involvement at the Company level, but it primarily operates on a localised approach, so each factory can respond to local requirements and conditions. It has priority areas for sustainability, which include energy, supply chain standards, water, poverty alleviation, agricultural productivity and biodiversity. In addition, health and safety, governance and ethics are observed. The firm’s approach to sustainability is embedding the priority areas into the business decisions, strategy and processes/operations. The activities that take place under each priority have business reasons, to which sustainability is aligned. The business KPI’s (key performance indicators) includes sustainability objectives. They use stakeholder mapping to understand their relationships and interactions with the partners. The firm has synergies between their departments and other group firms.

Company A’s sustainability initiatives have been partly driven by necessity; for example, cane sugar production does not need external energy input because the cane has traditionally been burnt to generate energy. As such, there was no traditional focus on saving energy. However, changing the perspective—now excess cane is sold for paper incentivising them to minimise energy use. The industry as a whole is going towards co-generation, and adding greater value. They, now, consider their waste streams as co-product streams. Furthermore, industrial symbiosis (see Chap. “State of the Art Regarding Existing Approaches”) as they have developed, is dependent on having a critical mass of co-products (waste streams) to support the investment in secondary processing plants. Company A provides a comprehensive example of single firm industrial symbiosis model that integrates sustainability—within a firm or facility, combining the production of sugar with co-products.

Notable issues for business model and modelling:

-

Company A primarily applies an economic logic to sustainability

-

Size and scale of the firm is important for industrial symbiosis

-

Culture and mindset at Company A had an impact on the desire to an innovator

-

It is important to ensure that value is shared in the supply chain and the farmers are profitable—building a sustainable industry in partnership

-

For firms, particularly resource-stretched small companies, there needs a simple tool to help prioritise what is most important for the business

-

The challenges in climate change and population growth/demographic change in terms of—regulation, reputation and cost (of input)

Company B—Riversimple

The company is at an early start-up phase and was conceived to provide a personal and environmentally sustainable mobility solution (car) encompassing technology solution and full service provision, adopting a total systems perspective. Riversimple is based on a sale of service business model (PSS solution), which is about moving from resource consumption to resource efficiency. Current sales-based model rewards selling more and hence rewards the company directly for resource use; by shifting to a sale of service model, the company retains ownership and responsibility of the vehicle and its operating costs for the product life and so is incentivised to design and build for durability, longevity, and efficiency in use, and end-of-life solutions. The company has an innovative governance model, where the company’s stakeholder board elects the board of directors and executives. The stewards’ board oversees the board of directors, and the custodian body represents the owners in limited partnership structure. This model is considered to assist in enhancing interactions and collaboration between stakeholders, to deliver sustainable value (environmental, social and economic), by ensuring that financial interests are balanced with the interests of the other stakeholders.

Sustainable business modelling for the company has been ad hoc (influences from The Natural Step framework) and driven by visionary leadership. The breakthrough in the motor industry, according to the founder, will come in the way a car is put together, the business model and delivery system (systems integration). It can be very powerful, particularly where there is a disruptive technology. The founder believes that for car sector innovation, the barriers are not really technological, but business and politics. Furthermore, the innovation is not in the individual components, but comes out of the synergy between the elements of the car (carbon fibre, fuel cells, ultra-capacitors and electric motors). However, with respect to the PSS solution there are significant questions around consumer adoption and ownership and how this might hinder the business model. The role of fashion and status and financial investment needs further understanding as these may represent significant barriers. The aim of the business model and governance model was to better align the corporate interests with that of the consumer and the environment, but it is still somewhat hard to see how one avoids corporate demands for stimulating market growth and stimulating driving miles. Further clarification of the governance/ownership model is required.

Notable issues for business model and modelling:

-

Investor being an integral stakeholder of the business model for funds and commercialisation. The current corporate approach to sustainability largely relies on altruism, which is not a strong base.

-

Investor resistance to the model/structure needs further investigation and may provide insights into barriers/keys to sustainability—how other firms might go about introducing sustainability while avoiding some of the pitfalls.

-

The existing business models do not accommodate the innovation at Company B, who potentially have a sustainable business modelling process that integrates a broader range of stakeholders, redefines value to include environmental and social considerations with a novel governance model.

-

Importance on governance and policy implications.

-

The focus is on the performance of the whole system.

-

The role of branding/positioning in successful implementation of sustainability initiatives.

-

A larger social issue is the effect of a transition of ownership from the general consumer to corporate interests, given that ownership is often related to control

Company C

Company C is a technical ceramics company, in medical and dental, copiers and printers, and kitchenware, with 60,000 employees and worldwide operations. It has a decentralised ‘amoeba’ management structure autonomously. The Company is the UK sales and marketing subsidiary.

Sustainability has been rooted in the foundation of the business since start-up—although not specifically termed sustainability. Their approach significantly predates the concept. The founder is highly regarded and has funded several business schools that teach their ‘business philosophy’. The Company’s approach is either to try to introduce environmentally preferably solutions to an existing technology, or to develop technologies that are intrinsically environmental and socially responsible. Company C’s competitors use highly complex toner cartridges to perpetuate razor-blades business model.

Their model forces them to make highly complex/wasteful/intrinsically unsustainable products—estimate 47-m print cartridges go to landfill every year. Company C has deliberately gone down a path that is viewed as more sustainable. Company C’s new product was launched in the early 1990s as a ‘green’ solution. At the time, green was not on the agenda, so switched marketing to talk about total cost of ownership—typical saving 2/3 based on simplified and cheaper consumables. In 2001, green interest started to rise, so they established a green users’ network that became fairly influential in driving opinion and awareness. In the last years, awareness has reached mainstream, so the need for such a network is much reduced now, and may be disbanded, having achieved its purpose.

The Company has no direct sales to customer’s channel. It only sells through distributors, dealers and resellers. It has two distributors and about hundred resellers/dealers. Company C avoids the conflict between direct sales and channel distribution that occurs with some of their competitors.

Notable issues for business model and modelling:

-

Social and environmental activities have not specifically been identified as sustainability, because they have all been embedded in the way they do business—mindset and behaviour

-

Private sector is better than public sector at considering through life costs. The life duration that is considered is generally 5 years, which is up from 3 years—in part because the technology is more mature, so less likely to be rapidly obsolete

-

The company is clearly driving a lot of the sustainability initiatives from within. Nonetheless, regulation and legislation helps them persuade customers to change and demand change. Government to provide clarity on regulation and legislation

-

Education on sustainability initiatives—learning culture

-

A strong culture drives the sustainability ethos of the business. How might organisations go about realigning culture with sustainability values—employee indoctrination, role of the education system and workplace initiatives?

-

Engaging employees and customers about the company’s values. Certain businesses are now starting to select their partners based on a values match, rather than products and technology

Company D

The Company is a shelving and storage manufacturer and supplier. It was founded in the late 1950s as a radical design-driven company, introducing a modular and timeless design philosophy to product design. Its vision is to manufacture furniture to last as long as possible, be adaptable and infinitely reusable, and discreet (not subject to fashion trends). The company specifically avoids built-in obsolescence and eschews furniture fashion/trends. The key ingredient is trust, so that customer trusts that the company has their best interest in mind, the product will be around for a long time, they can extend/buy more as they need it, and the product is designed and manufactured for best possible service. The company’s business reflects longevity, durability, modularity, interchangeability, closeness to customer and sacrificing growth for the business model through its products. The company focuses on encouraging sufficiency, reducing environmental (waste, material use, carbon emissions) and social (working conditions, recruitment standards aligned with the company’s values) impacts while contributing towards improving the quality of life and facilitating sustainable consumption behaviour of consumers.

The Company’s model offers an example for sustainable business modelling—sustainability is embedded throughout the business, where vision, value and organisational culture drive the initiatives on sustainable consumption and production. However, the scale is very small, so the impact on society is equally small and there is a need for novel investment model to raise funds that breaks the attachment with accumulation of money and consumption.

Company D has actively reduced intermediaries in the distribution chain. It focuses on preferred suppliers, which equally reduces the network size, although could increase the value exchange within the network. The Company sources locally for most components and materials, and all small businesses. It actively aims to ‘infect’ their suppliers with the Company D philosophy and works with the suppliers to introduce cost savings, waste reduction.

Notable issues for business model and modelling:

-

Role of value/culture in driving sustainability

-

Extending Company E model to other product categories. For example into the building industry sector for provision of sustainable homes—well-built, long-lasting, efficient, attractive, and good long-term support (systems thinking approach).

-

Customer and Company committed to mutual benefit of each other—extended customer value or public customer value creation.

-

Consistency in policy

-

Ownership of the building to implement sustainability initiatives

-

Tough and lengthy recruitment process based firstly on character and secondly on skills-understanding peoples’ values takes time

Company E (CLASS)

CLAAS manufactures and supplies agricultural machines and systems. Their product range includes combines and harvesters; tractors; trailers; efficient agricultural systems—GPS steering, telematic operations optimisation and offers agricultural managements systems. As part of various research and development activities, CLAAS has developed new methods and architectures to improve agricultural value added. The Company is a wholly owned family business employing 9,000 employees, serving a global customer base. Headquartered in Germany, it has production facilities on 3 continents, and a global network of distributors. Major customer market segments in order of size are Western Europe, Eastern Europe (including Russia) and rest of the world (including USA, India and some businesses in Africa).

CLAAS is initiating sustainability projects, enabling extension of tools into new networks of machines and control systems, enterprise resource planning (ERP) systems and new business models for agriculture—improve efficiency of the hardware and the soil through better services. For example, better coordination of all machines in the harvesting process to improve use of the machinery improves fuel usage, minimising the harvesting time as it reduces risk of loss. Being wholly owned family business, the close link between the employees and the farming community is inherent to CLAAS.

The CLAAS model is about development, building and selling of machines through a dealership network. Follow-on sale of spare parts represents a second-revenue stream. There is an increasing focus on selling software systems, again offered as products. These are mainly sold with new products. Software retrofits are undertaken, but at present form only a small part of the business.

Change in customer structure will support development of new business models as farming is getting more and more professional. Farms are getting bigger, more professional and international. For example, a group of professional investors who partly own farms especially in Germany, the UK and France, use machines in a fleet in different regions and sometimes even countries. The farming processes are controlled by professional ‘Agricultural-Managers’ with a university degree. These types of farms are becoming more popular, especially after the political change in Eastern Europe. Simultaneously, the number of traditional small farms with engaged family workers is getting smaller or farming is done as a kind of ‘hobby’—influence on business models.

Notable issues for business model and modelling:

-

There is a natural focus on environmental issues due to the nature of the agricultural industry—caring for the soil, limiting pollution and resource efficiency

-

Innovation is first and foremost driven by economic opportunities associated with satisfying customer needs for process efficiencies and productivity improvements

-

Choice of better or less sustainable solutions is often dictated by the customers’ demands and budgets. CLAAS and their customers are not end-consumer facing, so see relatively little pressure from their customers for ‘green’ performance

-

Exploration of the family ownership and governance structure—how this influences sustainability initiatives and role of culture within the business—the close link between the employees and the farming community, which appears to be important for the business success

-

Climate change adaptation strategies seem important for this sector and may radically change demands and regional requirement specifications. Agricultural domain will be affected either positively or negatively, in different regions

-

Strong influence of subsidy/documentation policy of national/supranational institutions—agricultural domain faces a lot of documentation rules such as usage of pesticides or fertilizer

3 Findings from the Cases

The narratives from the industrial cases present and delineate current industrial practice in embedding sustainability into business models and the key areas of focus in rethinking about and developing a sustainable modelling process and tools. Tables 1 and 2 provide an overview of the key components explored during the empirical study and the findings.

There seems to be very few start-ups, SMEs and large firms, who are either already working or beginning to work towards the integration of sustainability into business models, modelling and business processes. The business modelling process is observed to typically be organic; corporate culture (norm and values) and governance model/structure of the firm impacts on the process and influences whether or not the business model successfully incorporates sustainability. If considered, sustainability is seen more as a detached or isolated concept. Within the stakeholder discussion, the interactions and understanding value from each stakeholder’s perspective is minimal given the dynamic and complex structure of value networks. Summary of gaps in practice is as follows:

-

It is difficult to embed sustainability thinking into business modelling for companies.

-

The thought and development of business models and sustainable business models and modelling is an organic process and requiring visionary leadership

-

Individual context for every organisation impacts on whether a business model is more sustainable

-

There is limited view on who the set of stakeholders are and the interaction/link between stakeholders—value network

-

There is a lack of tools that can be used by companies to evaluate novel business models and value networks

-

Governance, the role of corporate culture and the impact of external financing/shareholders are always relevant

-

Governance—decision-making and investor influence—companies A, B, D and E.

-

Corporate culture includes norms and values, incentives, selection process and ongoing training. This has been emphasised by companies A, B, D and E

-

Further understanding of the business model might better inform policy decision-making process

-

Greater emphasis might be placed on the ad hoc business model development approaches seen in practice, and the lack of any business model innovation tools being employed

-

Design (product and processes) is important—company A, B and F (processes), companies B, D and E (product)

-

Product–service system is often cited as a sustainable solution, but interesting that Company D does not operate this model themselves (some of their distributors do offer PSS), and there is a take-back programme in place (WEEE requirements)

-

Common to all companies—closed-loop models

4 Conclusions

The review of findings from practice together with the observations from literature contributed towards clarity on the design process and supportive tools for sustainable business modelling that will provide companies with an integrated solution to develop transform and implement a new sustainable value proposition. The following chapter presents overview of the use and test stage and the working sustainable business modelling (SBM) process and toolset.

References

Amit R, Zott C (2012) Creating Value through Business model Innovation. MIT Sloan Manag Rev 53(3):41–49

Anderson RC, White R (2011) Business lessons from a radical industrialist. St. Martin’s Grif-fin, New York

Baines TS, Lightfoot HW, Evans S, Neely A, Greenough R, Peppard J, Roy R, Shehab E, Bra-ganza A, Tiwari A, Alcock JR, Angus JP, Bastl M, Cousens A, Irving P, Johnson M, Kingston J, Lockett H, Martinez V, Michele P, Tranfield D, Walton IM, Wilson H (2007) State-of-the-art in product-service systems. Proc Inst Mech Eng, B J Eng Manuf 221:1543–1552

Burke S, Gaughran WF (2007) Developing a framework for sustainability management in engineering SME’s. Robotics and Computer-Integrated Manufacturing 1–8

Chesbrough HW (2010) Business Model Innovation: Opportunities and Barriers. Long Range Plan 432(3):354–363

Desai N (2002) Implementing Agenda 21: A United Nations Perspective. In: Dodds F, Middleton T (eds) Earth summit 2002: a new deal. Earthscan Publications Ltd, London, pp 21–30

Lüdeke-Freund F (2010) Towards a conceptual framework of business models for sustainability, in: Proceedings of the knowledge collaboration & learning for sustainable innovation, Conference, Delft, 25–29 October. Harvard Business Review Press

Osterwalder A, Pigneur Y (2005) Clarifying business models: origins, present, and future of the concept. Commun AIS 16

Osterwalder A, Pigneur Y (2010) Business model generation: a handbook for visionaries, game changers, and challengers. Wiley, New Jersey

Porter ME, Kramer MR (2011) Creating shared value. Harvard Bus Rev 89:2–17

Richardson J (2008) The business model: an integrative framework for strategy execution. Strat Change 17: 133–144

Schaltegger S, Lüdeke-Freund F, Hansen EG (2011) Business cases for sustainability and the role of business model innovation: developing a conceptual framework. Centre for Sustainability Management Leuphana University, Lueneburg

Schaltegger S, Ludeke-Freund F, Hansen EG (2012) Business cases for sustainability: the role of business model innovation for corporate sustainability. Int J Innov Sustain Dev 6(2):95–119

Stubbs W, Cocklin C (2008) Conceptualizing a “sustainability business model”. Organ Environ 21:103–127

Teece DJ (2010) Business models, business strategy and innovation. Long Range Plan, Bus Models 43:172–194

Tukker A, Tischner U (2006) New business for old europe: product-service development. Competitiveness and Sustainability, Greenleaf, Sheffield, South Yorkshire, England

Willard B (2005) The Next sustainability wave: building boardroom buy-in. New Society Publishers, Gabriola Island

Zott C, Amit R (2010) Business model design: an activity system perspective. Long Range Plan Bus Models 43:216–226

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Rana, P., Short, S.W., Evans, S. (2017). Practice Review of Business Models for Sustainability. In: Liyanage, J., Uusitalo, T. (eds) Value Networks in Manufacturing. Springer Series in Advanced Manufacturing. Springer, Cham. https://doi.org/10.1007/978-3-319-27799-8_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-27799-8_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-27797-4

Online ISBN: 978-3-319-27799-8

eBook Packages: EngineeringEngineering (R0)