Abstract

Different field trials and corresponding acceptance studies with new technologies were carried out between 2010 and 2013 at the Chair of Energy Economics at the Karlsruhe Institute of Technology (KIT). Those involved Electric Vehicle (EV) users, Liquefied Petroleum Gas (LPG) and Compressed Natural Gas (CNG) vehicle users as well as persons with strong interest in EV and smart energy home technologies. In order to characterize early adopters the same item-sets concerning attitudes regarding climate change, prices and innovations as well as corresponding socio-demographic characteristics were used throughout all these studies. Survey datasets originating from these studies are joined to be analyzed together. Regression methods are applied in order to characterize early EV adopters based on a subsample of EV company car users in the French-German context. A binary logistic regression model explaining private EV purchase intentions is developed. According to this model, early private EV adopters are likely to have a higher level of income, to have a household equipped with two or more cars and to travel more than 50 km a day, not necessarily by car. This model additionally shows that possibilities to experience EV (e.g. by test drives) are important leverages to support adoption of EV by private car buyers. Respondents who already decided to privately purchase an EV show significantly lower general price sensitivities than the LPG and CNG vehicle users.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The European aim of reducing Greenhouse Gas Emissions (GHG) by 80 % by the year 2050 compared to 1990 (European Commission 2011) will cause changes in the transportation sector as today it accounts for about 19 % of the total European GHG emissions (Eurostat 2013a), with a continuously increasing share. As individual road transportation is responsible for the main share of those emissions (Eurostat 2013a), significant changes seem unavoidable with regard to the share of passenger cars running on alternative fuels (cf. Kay et al. 2013).

Vehicles running on liquefied petroleum gas (LPG), compressed natural gas (CNG), and on electricity (EVFootnote 1) have been discussed as a more energy-efficient and climate-friendly means of individual transportation. Cars running on LPG and CNG have been on the market for several years and 500,867 (LPG) respectively 79,065 (CNG) were on German roads by January 2014 (KBA 2014). Even though those two technologies have the highest share among cars with alternative fuels, LPG and CNG cars account for only about 1 % of the total German passenger car fleet (KBA 2014).

Due to positive developments in the battery technology (Thielmann et al. 2012), battery electric vehicles (BEV) have undertaken a rebirth in the last years. Currently around 40 different EV are offered on the German market (Eckl-Dorna and Sorge 2013) and 12,156 cars were registered on January 1st, 2014 (KBA 2014). Although the market seems dynamic (on a low level), the market stage is somewhat earlier compared to LPG and CNG. At the same time German policy measures are strongly aiming at entering the mass market with EV. Accordingly, the government pronounced the ambitious targets of 1 Million EV in 2020 and 6 Million EV in 2030 (BMVBS 2011). Assuming that the German passenger car fleet remains constant, that means that about 2.5 % respectively 15 % of the passenger cars would be substituted with EV. Even though policy measures have predominantly been targeting to technology developments that are supportive to the supply side of four-wheeled EV (cf. Bundesregierung 2009), a strong market penetration of electric two-wheelers can already be observed. Over one million pedal electric cycles (pedelecs) and electric scooters (e-scooters) are already on German roads (Dütschke et al. 2013).

Policy measures are needed in order to extend the success of electric drives from pedelecs and e-scooters to passenger cars capable of being charged in a smart way. But at whom should the measures supportive to EV diffusion target? Who are the first potential buyers of EV and how can they be characterized? Do these early EV adopters resemble early adopters of other technologies, such as LPG/CNG and smart energy home technologies? If so, can we learn from those market experiences?

Smart energy home technologies are particularly focused on due to the fact that higher penetration rates of EV will have an increasing impact on the electricity system (cf. Jochem et al. 2013). A higher share of EV in the car fleet will increase power demand during peak hours in residential areas considerably, if EV are not charged in a controlled “smart” way. Possible solutions to this challenge could be provided by demand side management solutions, such as automatic delayed EV charging (cf. Jochem et al. 2013). The technical solutions needed to make smart charging possible are based on Information and Communication Technologies (ICT) and discussed as smart technologies, such as charging spots with smart meters.

In this article early adopters are characterized as individuals who have already been using or are actively interested in innovations and are therefore likely to adopt these innovations when the markets reach early adopter phase. Up to now, this has not been the case for the markets of smart energy home technologies (cf. Bundesnetzagentur 2011) and EV (cf. Wietschel et al. 2013). The EV market is in a very early phase, i.e. only innovators already took the decision to purchase an EV in Germany. Unlike that, LPG and CNG early adopters already took the purchase decision, as this market is in an advanced position compared to the market of EV and smart energy home technologies (cf. Dütschke et al. 2011).

In order to characterize innovators and early adopters of EV the authors compare innovators and early adopters from different studies considering their price sensitivities, their environmental awareness as well as their innovativeness. Furthermore, the authors look at early EV adopters’ attitudes towards EV and try to identify their willingness to purchase an EV according to their mobility behavior, their experience levels with EV as well as socio-demographic characteristics.

This article has the following structure. A literature review (2) is conducted before the survey subsamples under consideration are presented and characterized by analyzing corresponding environmental awareness, price sensitivities, innovativeness as well as socio-demographic characteristics (3). Furthermore, regression approaches are applied to explain potential willingness to privately purchase an EV within the next years based on fleet EV users’ attitudes and norms, their mobility behaviors, their experience levels with EV as well as their socio-demographic backgrounds (4). After a brief summary and conclusion the outlook discusses how one of the models could be applied to the existing representative mobility studies (e.g. ENTD,Footnote 2 MiDFootnote 3) in order to derive conclusions about EV adoption potentials within the next years in France and Germany (5).

2 Literature Review

2.1 Theory on Diffusion of Innovations

According to Rogers (2003), the diffusion of new products such as EV takes place in several steps depending on the share of customers that adopt the new product over time. In the first stage, so called innovators try these new products as soon as they are offered on the market. They usually make up for about 2.5 % of the population. Assuming that all vehicles on German roads (43.9 Million, cf. KBA 2014) would be replaced with EV, the main users of somewhat more than one million EV would all be called innovators. Afterwards early adopters follow (13.5 %). Then the early and late majority (34 % each) and at last the so called laggards (16 %) who are not really interested in new products follow.

As adoption can be described as decision making process of individuals to finally accept an innovation, using stated preference survey data in order to identify the early adopters of an innovation seems appropriate (cf. Bass 2004)

2.2 Characterizing Early EV Adopters Based on Stated Preference Survey Data

Wietschel et al. (2012) identify early adopters of EV in Germany until 2020 on the basis of surveys and group discussions with EV users focusing on their economic, attitudinal and socio-demographic backgrounds. They indicate that the probability of privately purchasing an EV among current users is highest for men in the beginning of their 40s, with a higher socio-economic status and most likely having a technical profession. This potential customer group is likely to live in multi-person households with several vehicles, which tend to be in rural areas or in the outskirts. However, selling EV only to this group will not be sufficient in order to target one million EV until 2020. According to Wietschel et al. (2012) about 50,000 vehicles could be sold to this group annually. About 80,000 vehicles would be needed to be sold annually to private customers to reach the German goal of one million EV. In order to derive conclusions about the diffusion process Wietschel et al. (2013) characterize innovators as EV users (0.5 % of the population), early adopters as individuals interested in EV with purchase intention (1 % of the population) and the early majority as individuals without purchase intention but interested in EV (48 % of the population). The remaining share of the population are identified as laggards and as such not interested in EV today.

Hackbarth and Madlener (2013) conduct a discrete choice analysis based on survey data they collected in Germany. They applied a mixed logit model in order to derive conclusions about potential demand for Alternative Fuel Vehicles (AFV) in Germany, particularly for plug-in cars. Results indicate that relatively young, well-educated and environmentally-aware survey participants who have the possibility to plug in their car at home and undertake numerous urban trips are most sensitive to AFV adoption. Opposing the findings of Mabit and Fosgerau (2011) and Ziegler (2012) the model of Hackbarth and Madlener (2013) explaining EV purchase intentions does not observe significant influences of the variables gender, number of children and number of cars in the household.

Glerum et al. (2013) forecast EV demand by accounting for attitudes and perceptions. Their analyses are based on stated preference surveys with personalized choice situations involving conventional cars and EV. Swiss survey participants were interviewed at the beginning of 2011. They characterize target EV customers as public transportation users living in households owning several cars, with high incomes and rather young. Furthermore, they find that the introduction of a large incentive (5,000 CHF) on the purchase price of an EV can promote its choice, whereas too-high operating costs (5.40 CHF/100 km) can discourage it.

Ensslen et al. (2012) point out that a quite high number of EV users participating in the fleet test CROME could envision purchasing an EV within the next ten years. Less than 20 % stated not to be willing to do so, about 35 % stated being willing to do so and about 45 % of the respondents were undecided. According to Ensslen et al. (2013a) potential early EV adopters are likely to live in rather rural French areas due to favorable total cost of ownership (TCO), a relaxed parking situation in small municipalities and a high average number of cars per household, which compensates for the range-specific disadvantages most EV have. Annual car mileage is on average higher for people living in small municipalities, which makes TCO favorable. Additionally, French adopters benefit from EV purchase incentives. By the time the survey took place a bonus of 7,000 € was provided by the French government. Furthermore, French adopters benefit from comparably lower electricity costs (cf. Eurostat 2013b) which additionally improve TCO calculations for French EV adopters. After the EV users were experiencing the EV for about a year, user acceptance was studied with a second survey. Ensslen et al. (2013b) analyze BEV users’ attitudes and norms potentially influencing BEV purchase decisions in the French-German context. The authors stress that French BEV users are more concerned about climate change than their German counterparts. Furthermore, their results show, that the French respondents indicate a higher innovativeness level. On the other hand the German respondents indicate to a higher degree that having BEV as company cars has a positive external communication effect. Also, highly significant differences can be observed concerning the French and German BEV users’ degrees of satisfaction with the BEVs’ CO2 emission characteristics. Although Wietschel et al. (2012) as well as Ensslen et al. (2013a) point out BEVs’ advantages in less urbanized areas (due to an easy access to charging possibilities at home and better TCO values), users living in rather urban municipalities indicate higher degrees of satisfaction with different characteristics of BEV (e.g. low CO 2 emissions, sufficient range) (cf. Ensslen et al. 2013b).

Peters et al. (2011a) describe that energy-relevant purchase decisions of consumers for a passenger car can to a large extent be explained by psychological factors like attitudes towards more fuel-saving vehicles and awareness of problems related to fuel consumption. Therefore, Peters et al. (2011a) extended Rogers’ theoretical framework specifically for EVs and determined an additional dimension called social norm influencing the EV adoption process. Peters et al. (2011b, 2013) base their theoretical framework explaining households’ purchase decisions of fuel efficient vehicles in Switzerland on a theoretical model of Bamberg and Möser (2007) which includes psychological factors including social and personal norms, problem awareness and perceived behavioural control.

Dütschke et al. (2011) derive conclusions about policy measures supportive to EV diffusion on survey data received from LPG and CNG adopters collected in the end of the year 2010 from individuals who indeed purchased a LPG or CNG car. According to their results, motives to purchase LPG and CNG cars are rather not likely being linked to an innovative technology. Economic aspects are most important, followed by ecological aspects. Accordingly EVs have a decisive advantage as they have the image to be environmentally friendly. At the point of time of the survey a big disadvantage of EV were their comparably high purchase prices. According to the survey participants information concerning LPG and CNG cars were preferably collected by talking to other users during the decision making process. Dütschke et al. (2011) conclude that strategies like field trials could be supportive for EV diffusion, as they could be contributive to a better perception of the reliability and safety of the EV technology. Several other studies are supportive to the field trial strategy, too, as they mention positive reactions of individuals who have tested and used EV (cf. Peters and Dütschke 2010, Peters and Hoffmann 2011). Peters et al. (2011a, b) recommend providing low-threshold opportunities to test EV to consumers, especially for marketing campaigns and promotional measures, as EVs’ driving characteristics are often perceived as very positive.

Frenzel et al. (2015) characterize early German EV adopters based on a large survey sample of 3.111 private and professional EV users. Their results show that private EV users are predominantly highly educated men with higher incomes. On average they are around 51 years old and so older than persons buying new conventional cars. The majority of EV users rather live in small towns and rural areas. Despite a high environmental awareness 80% of the households own a second car, particularly if the EV is an all-electric BEV. Concerning professional EV users Frenzel et al. (2015) show that majorly small organizations with up to 49 employees and up to nine vehicles in the fleet use EV.

Plötz et al. (2014) answer the question who will buy EV in Germany by focusing on two subquestions. These are answered by two different methodological approaches and datasets. On the one hand the question who is willing to buy an EV is analyzed based on survey data from responents with different levels of interest in EV including EV users. On the other hand the question who should buy an EV is analyzed by calculating TCO (c.f. chapter 2.3.) of EV based on individual car mileages provided in a representative German mobility study. Results indicate that private EV buyers in Germany comprise middle-aged men with technical professions living in rural or suburban multi-person households owning a large share of vehicles in general. They tend to profit from the economical benefits of EV due to their annual vehicle kilometers travelled and the share of inner-city driving. They show a comparably high willingness to buy EV and their comparably high socio-economic status allows them to purchase EV.

2.3 Identification of EV Adopters in Representative Datasets

The early adopters in representative mobility studies are mostly identified by rational choice decisions such as TCO. Emotional and maybe “irrational” reasons for buying an EV are neglected. This subchapter provides a brief overview on studies identifying early EV adopters in representative studies based on rational choice.

Mendes Lopes et al. (2014) identify the households to whom limited range BEV would be a plausible choice based on a rule-based screening methodology. Households in the Lisbon Metropolitan Area in Portugal are classified according to a set of indicators (e.g. home location, daily trips). Five profiles are defined which correspond to an increasing probability of including BEV in their choice set. According to their results, BEV are only suitable for 1.8 % of the households in the Lisbon Metropolitan Area. Existence of financial incentives would increase the share of EV qualifying households to 6.2 %. However, even if prices would not be a barrier, BEV would only be suitable to 10.4 % of the households under consideration. According to their analyses, households with more cars, a higher household income, with adequate parking space and a travelling distance that fits to the limited range of BEV qualify for BEV.

Windisch (2013) conducted an analysis on the effectiveness of monetary demand-side policy measures (e.g. purchase primes) on EV diffusion of privately held vehicles. The author chose a disaggregate approach based on the database of the French National Transport Survey 2007/2008. Results of TCO calculations show that EV, BEV in particular, can be financially interesting to private customers under certain conditions. Furthermore, her results show that long-electric-range PHEV do not appear to be a financially viable alternative under any realistic vehicle usage assumptions. Her results show that around 35 % of the French households are adapted to the needs and limitations of a BEV, i.e. motorized households with access to parking infrastructure where recharge infrastructure could be installed and with vehicle usage behavior not being constrained by BEVs’ limited range. Furthermore, her results show that 51 % of the French households are compatible with a PHEV, i.e. motorized households with access to parking infrastructure that can be equipped with a battery recharging infrastructure. Her results even indicate that the need for private parking infrastructure is a more limiting factor to potential EV uptake than compatible EV usage behavior. Concerning the TCO calculations, her results show high sensitivities concerning EV qualifying households according to the purchase primes granted by the government. Under a 5,000 € purchase bonus buying a BEV is only rational for 3.5 % of the French households. A 7,000 € purchase bonus on the other hand makes it rational for about 28.2 % of the households to purchase a BEV. Her results show that in rather rural areas (Petite and Grande Couronne) a lot of the household are practically compatible with BEVs’ needs according to their driving patterns (17.3 % and 31.4 %). However, considering the TCO only 1.4 % respectively 3.0 % of the households in the Petite respectively the Grande Couronne area are EV qualified. In the urban center (Paris) on the other hand only 6.9 % of the households are practically compatible with BEVs. However, all of these household would also qualify for BEV from a TCO point of view when preferential parking tariffs for EVs would be introduced in urban centers. Furthermore, the ongoing decreasing battery price would lead to lower required purchase bonus payments as of today.

Wietschel et al. (2013) also base their analysis concerning EV diffusion in Germany on TCO calculations. For private and official car users their analysis was based on data from the German Mobility Panel (MOP 2012), additionally they also consider operational driving profiles of company fleet vehicles (cf. Fraunhofer ISI 2012). Overall 6,500 driving profiles formed the basis for their calculations. Framework conditions are described for three scenarios (pro EV, middle, contra EV) including the development of economic parameters (i.e. fuel prices, battery prices and electricity prices). TCO calculations can be performed considering infrastructure costs, limited supply of adequate EV models as well as increased willingness to pay for an EV. Their results show that depending on the scenario settings EV stock in Germany in 2020 varies between 50,000 and 1,400,000. Their results also indicate that the EV diffusion is sensitive to monetary demand side policy measures (purchase bonus payments up to 2,000 €). EV stock could be almost doubled until 2020 with a purchase prime of only 1,000 €. Main profiteer would be commercial fleets who would make up for almost 60 % of market growth.

Based on a TCO model Pfahl et al. (2013) show that only half of the targeted 1 million EV can be expected by 2020 in Germany without subsidies. They also find that small changes of parameters (e.g. increase of oil price, decrease of battery costs, etc.) can lead to significant higher numbers of EV on the German car market.

3 Characterization of Early Adopters

3.1 Data Used

In order to gain more information about possible early EV adopters and therefore about the possible diffusion process of EV, several studies that were conducted at KIT’s Chair of Energy Economics in the years 2010–2013 focusing on the attitudes of the study participants are joined and analyzed together. This is possible, as a set of several items concerning beliefs and attitudes was used throughout all studies using Roger’s theory of diffusion of innovations as conceptual framework (Rogers 2003). The participants differ with regard to their prior experiences and their stage of adoption with the technologies under study: no prior experience (interested, but no adoption), regular users (adoption, but no buying decision), adopters (real buying decision).

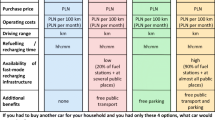

The following different technologies are considered: LPG and CNG vehicles, EV, as well as smart energy home technologies. Or more precisely, the following six subgroups are considered (cf. Table 1): (1) private LPG and CNG vehicle users with prior experience and with already accomplished buying decision, (2) survey participants interested in smart energy home technologies, (3) e-scooter users with prior experiences, (4) private EV users with (only) prior experience and already accomplished buying decision, (5) EV company car users with prior experiences, as well as (6) survey participants interested in EV predominantly not having experienced EV. The different groups are briefly characterized among others by their socio-demographic backgrounds.

-

(1)

The respondents grouped in the cluster CNG and LPG vehicle users come from Germany and are about as old as the EV company car users (5). It is noticeable that 95 % of this group’s respondents are male. Their level of education is somewhat lower than the educational level of the EV company car users. Furthermore, the LPG/CNG car users’ level of income is somewhat lower than the level of income of the EV company car users. These car drivers not only use their LPG/CNG car on a regular basis, but they have also bought these cars some time ago — they are thus customers that accomplished a real buying decision process. This dataset has also been used by Dütschke et al. (2011).

-

(2)

The persons of our sample interested in smart energy home technologies are also predominantly male (70 %). Their level of education is comparable to the EV company car users’ as the majority has completed their studies. On the other hand less of them have completed vocational education, but more of them have a high school degree at university entrance level. They are comparatively young and are predominantly living in the region of Karlsruhe. Supposedly many master students have participated in this survey, what would also explain the comparably low levels of income despite their final degrees (i.e. the Bachelor degree).

-

(3)

The e-scooter users are a group of KIT students with an average age of 23 years. They have used an e-scooter during a field operational test over the course of 5 weeks and were selected by application, thus a strong self-selection effect motivating first movers to apply is assumed (cf. Paetz et al. 2012a, 2013).

-

(4)

The private EV customers originate from the Stuttgart area and can be characterized as real innovators (cf. Rogers 2003), as they have really adopted the new technology (regular use as well as buying decision). It is noticeable, that 36 % of them have a monthly net household income above 7,000 EUR and their educational level is the highest, as 80 % of them have completed their studies (33 % of them at Ph.D. level). They are comparably young as they are on average 38 years old (cf. Paetz and Dütschke 2012).

-

(5)

The major part of the respondents in the group of EV company car users are about 44 years old, live in the Upper-Rhine region in Germany or in Alsace-Lorraine in France and have a high level of education. The majority has studied and a final degree. Their household incomes are comparably high. All of them experienced EV for a longer period of time. At the point of time when responses to the online survey were collected, they had experienced EV on average for about one year within the framework of the CROME project (cf. Ensslen et al. 2013b). This sample has further been increased by a dataset that was used by Paetz et al. (2012b) including 15 German EV company car users (cf. Paetz and Dütschke 2012)

-

(6)

The respondents who are interested in EV but did predominantly not have any experiences with EV at the point of time they were participating in the survey (77 %), come from Germany, are on average 37 years old, are predominantly male and their level of education is at about the same level as the sample’s of the persons interested in smart energy home technologies, i.e. most of them have completed their studies. On the other hand their level of income is comparably higher.

3.2 Methods Used

In order to derive conclusions about the different groups’ (cf. Table 1) environmental awareness, their price sensitivities as well as their innovativeness a principal component analysis (PCA) is applied. This is a statistical procedure used to discover structures and to convert a set of observations of possibly correlated variables into a set of values of linearly uncorrelated variables. According to each respondent’s evaluation of a set of statements (items) measured on a symmetric agree-disagree Likert scale different factors and corresponding individual factor scores are derived (cf. Table 3 in the Appendix and Backhaus et al. 2008). In order to compare resulting factor scores of the different groups’ attitude levels, Kruskal–Wallis one-way analysis of variance (Kruskal-Wallis ANOVA) is used (cf. IBM SPSS Statistics 2013a; Hartung et al. 2005), as Gaussian distributions cannot be assumed (detailed results of differences between the different groups’ respondents’ attitudes cf. Table 4 in the Appendix). Kruskal–Wallis ANOVA permits to determine whether the different groups’ mean values for the three factors differ significantly. This is the case for all three factors to a highly significant degree (p < 0.001 for all three factors.). In order to find out which of the subsamples differ from each other, pairwise comparisons are considered (cf. Dunn 1964; IBM SPSS Statistics 2012).

3.3 Results

By applying PCA to eight items three factors are derived. One measures the respondents’ environmental awareness, one their innovativeness and one their price sensitivities (cf. Table 3 in the Appendix and Figs. 1, 2 and 3). The quality of this factor analysis is mediocre as the Kaiser-Meyer-Olkin criterion of Sampling Adequacy is 0.631 (cf. Backhaus et al. 2008). In order to determine whether the scales that were used to measure the three dimensions mentioned before are internally consistent, Cronbach’s Alphas are calculated indicating that the scales measuring the respondents’ environmental awareness as well as their innovativeness are indeed interrelated to a sufficiently high degree, whereas internal consistency of the factor price sensitivity is not acceptable. More detailed information about the PCA including Cronbach’s Alphas as well as each items’ measure of sampling adequacy can be found in Table 3 in the Appendix. Furthermore, adjusted significance levels of Kruskal-Wallis ANOVA pairwise comparisons between the factor scores of the different samples can be found in Table 4 in the Appendix. Information on the following boxplot diagrams are available in IBM SPSS Statistics 2013b.

3.3.1 Environmental Awareness

Concerning different groups’ environmental awareness, significant differences can be observed between French and German EV company car users (5) and almost all other user groups (cf. Fig. 1 and Table 4 in the Appendix). Only private EV customers’ (4) environmental awareness is not significantly lower than the EV company car users’ (5). As about half of the respondents who are considered in group (5) are French, these differences might mainly be explained by the strong influence the French respondents’ had. According to Ensslen et al. (2013b) the French EV users within the CROME project are more worried about climate change than their German counterparts.

3.3.2 Innovativeness

Innovativeness of private EV customers (4) and CNG/LPG vehicle users (1) as well as of the respondents who are interested in smart energy home technologies (2) is to a significant degree higher than the innovativeness of those who are interested in EV (6) (cf. Fig. 2). Furthermore, innovativeness of respondents who are interested in smart energy home technologies (2) is significantly higher than innovativeness of respondents who are EV company car users (5).

3.3.3 Price Sensitivity

The sample of e-scooter users (3) is to a significant degree less price sensitive than the sample including persons who are interested in EV (6) and to a highly significant degree less price sensitive compared to the respondents who are interested in smart energy home technologies (2) and who are LPG and CNG vehicle users (1). As group (3) mainly consists of students this is highly surprising. However, due to the fact, that the usage of e-scooters is in another price range than the other technologies, the comparison might be biased. According to these findings private EV buyers (4) and e-scooter users (3) are least price sensitive. LPG and CNG vehicle users (1) are significantly more price sensitive as well as the respondents who are interested in smart energy home technologies. Respondents who are interested in EV (6) are to a degree of marginal significance more price sensitive than private EV buyers (4).

3.4 Limitations

Findings concerning price sensitivities of the respondents need indeed to be questioned, as Cronbach’s Alpha measuring the internal consistency of the scale which was designed to measure price sensitivities did not deliver acceptable results.

As the different datasets [(1)–(6)] were collected during different studies, the formulations of underlying questions might partly differ somewhat. Furthermore, the CNG/LPG adopters’ evaluations of items concerning the derived three factors (cf. Table 5 in the Appendix) needed to be transformed from a 7-point scale to a 6-point scale in order to make them comparable with the evaluations in the other datasets. This might bias the results, too.

Amongst others additional limitations concerning representativity of the sample should be mentioned. Some of the subsamples are very small and strong self-selection effects motivating first movers to participate in the different studies are assumed.

4 Intentions of Fleet-EV Users to Privately Purchase an EV

4.1 Data Used

In order to derive conclusions about BEV users’ further adoption intentions characterized by their potential future purchase decision, the dataset of the EV company car users of the CROME project (the major part of the respondents in group (5), cf. Table 1) is further analyzed together with data originating from an earlier survey about these EV users’ expectations that was distributed directly after the companies joined the CROME project. Joining the two datasets is possible due to the identifying user IDs that were attributed to the EV users at the beginning of the field test (cf. Ensslen et al. 2012, 2013a).

4.2 Methods Used

First a comparison between the attitudes and norms of the BEV company car users potentially willing to privately purchase an EV and those users who are not willing or who are undecided to do so is conducted. Therefore t-Tests, nonparametric Mann-Whitney-Tests and a binary logistic regression analysis are applied. Furthermore, the highly significant dependencies between the factor attitude towards EV and the users’ degree of satisfaction with different characteristics of the EV are analyzed and explained by applying linear regression analysis.

Additionally binary logistic regression analysis is performed in order to develop a model representing EV purchase intention by considering respondents’ socio-demographic backgrounds, mobility patterns and their EV experience levels.

4.3 Results

4.3.1 Attitudes and Norms Influencing EV Purchase Intentions

Ensslen et al. (2013b) derived five factors potentially important for individuals’ EV purchase intention by applying principal component analysis. The five factors under consideration are the individuals’ innovativeness, price sensitivity, environmental awareness, attitude towards EV as well as the perceived external image effect of EV.

According to these findings intentions to privately purchase EV within the next years can neither be explained by respondents’ environmental awareness nor by their price sensitivity (Fig. 4). According to t-Test results, respondents’ innovativeness on the other hand discriminates at a marginally significant level between respondents who could envision purchasing an EV within the next years and those who cannot or are undecided. Furthermore, the factors perceived external image effect of EV and attitude towards EV discriminate between the two groups at a (highly) significant level. The users’ perceived external image effect of EV was measured by four items. Attitude towards EV was also measured by four items. This factor is composed of items measuring EVs’ relative advantage (i) (I prefer driving an electric car to driving a conventional car, and The electric car excites me.), their compatibility with personal attitudes, needs and experiences (ii) (The electric car is useful in everyday life.) as well as their simplicity of use (iii) (Using the EV is easy.). According to Rogers (2003) these characteristics of innovations are crucial for individuals’ decisions to adopt or to reject an innovation. The factors innovativeness as well as perceived external image effect of EV further characterize EVs’ compatibility (ii) with personal values as well as their compatibility with individuals’ perceived social values and norms.

Arithmetic averages of PCA scores (second CROME survey, cf. Ensslen et al. 2013b) according to respondents’ answers concerning their intention to purchase an EV within the next years (first CROME survey, cf. Ensslen et al. 2012) (Statistical Tests: (Mann-Whitney-Test /T-Test): (˚/˚): p < 0.1, (*/*): p < 0.05, (**/**): p < 0.01, (***/***): p < 0.001, (n.s./n.s.): not significant. Original scale: Items were measured on the following scale: 1: Strongly agree, 2: Agree, 3: Agree somewhat, 4: Rather disagree, 5: Disagree, 6: Strongly disagree)

EVs’ innovation characteristics trialability (iv) and observability (v) are pre-conditions within the CROME project, as all of the respondents had the possibility to drive the EV as the EV are part of their companies’ fleets. Only at the beginning of the CROME field trial not all of the participants had already been using an EV (cf. Ensslen et al. 2013a), so importance of trialability can be analyzed. Detailed information about the methods and items used to measure (i)–(iii) as well as national factor scores for France and Germany can be found in Ensslen et al. (2013b).

In the beginning of the field trial participants were asked about their expectations concerning EV. As about 80 % of the respondents (cf. group (5), Table 1) had already experienced the EV when the survey about their expectations was distributed, additional data of a control sample of respondents interested in BEV was collected (cf. group (6), Table 1). Respondents were asked to which degree they think that different characteristics of EV will meet their expectations. The joined sample is divided into two subgroups. The subgroup which did not experience EV at all and the subgroup that experienced EV during at least one or two trips as driver or passenger. Results show that expectations of those who had not tested an EV before are lower, particularly concerning EVs’ driving characteristics, safety and reliability aspects as well as aspects covering operating costs of EV (cf. Fig. 5). Respondents with some experiences with EV are for example more likely to evaluate the driving pleasure and the acceleration of EV better than respondents without any experience.

In order to explain the relations between EV users’ attitudes and norms and their private EV purchase intention \(P_{a} (y = 1)\) within the next years, binary logistic regression analysis with the three (marginally) significant factors attitude towards EV, perceived external image effect of EV and innovativeness is conducted (cf. Fig 4, Eqs. 1 and 2 Footnote 4). Detailed information about the way these dimensions were measured can be found in Ensslen et al. (2013b).

with

Description of the variables:

- y :

-

Dependent variable representing potential EV purchase intention within the next years (0: Negative or Undecided/1: Positive)

- \(x_{a1}\) :

-

Individuals’ PCA score for attitude towards EV

- \(x_{a2}\) :

-

Individuals’ PCA score for perceived external image effect of EV

- \(x_{a3}\) :

-

Individuals’ PCA score for innovativeness

\(x_{a1} , x_{a2}\) and \(x_{a3}\) are provided in standard deviations (σ). Details on quality criterions of this regression can be found in Table 2, details on this binary logistic regression in Table 6 in the Appendix.

As attitude towards EV \(( {\text{x}}_{{{\text{a}}1}} )\) highly impacts individuals’ purchase intentions and high correlations between EV users’ degree of satisfaction with different characteristics of EV and \({\text{x}}_{{{\text{a}}1}}\) could be observed (cf. Ensslen et al. 2013b), these dependencies are further analyzed. Therefore linear regression analysis is performed. The independent variables in the following equation can explain more than half of the variation (n = 116; R2 = 0.536; Adjusted R2 = 0.506) of \({\text{x}}_{{{\text{a}}1}}\).Footnote 5

- \({\text{x}}_{{{\text{a}}1}}\) :

-

Attitude towards EV (σ)

- \({\text{x}}_{{{\text{b}}1}}\) :

-

Great driving pleasure

- \({\text{x}}_{{{\text{b}}2}}\) :

-

General satisfaction with EV

- \({\text{x}}_{{{\text{b}}3}}\) :

-

Safety of other road users when approaching noiseless

- \({\text{x}}_{{{\text{b}}4}}\) :

-

High safety when driving

- \({\text{x}}_{{{\text{b}}5}}\) :

-

High comfort when driving

- \({\text{x}}_{{{\text{b}}6}}\) :

-

Climate protection by low CO2 emissions

\({\text{x}}_{{{\text{b}}1}} - {\text{x}}_{{{\text{b}}6}}\) were measured on the following scale: (1) Not satisfied at all (2) Rather not satisfied (3) Rather satisfied (4) Completely satisfied

\({\text{x}}_{{{\text{a}}1}}\) represents PCA scores provided in standard deviations (σ).

Negative correlations between the attitude towards EV \(( {\text{x}}_{{{\text{a}}1}} )\) and the degrees of satisfaction with EVs’ characteristics can be observed concerning climate protection by low CO2 emissions \(( {\text{x}}_{{{\text{b}}6}} )\) as well as high safety when driving \(( {\text{x}}_{{{\text{b}}4}} )\). On the other hand \({\text{x}}_{{{\text{a}}1}}\) is positively correlated with individuals’ degree of satisfaction concerning driving pleasure, the general satisfaction level with the EV, individuals’ evaluations concerning safety of other road users when approaching noiseless and their indications concerning comfort level.

4.3.2 Explaining EV Purchase Intention with EV Users’ Experience Levels, Income, Nationality and Mobility Needs

The following equation describes dependencies between individuals’ intentions to purchase an EV within the next years and their mobility behaviors, their experience levels with EV, the number of cars in their households, their nationality, their income levels as well as their professional background as fleet manager (cf. Eqs 4 and 5 Footnote 6).

with

Description of the variables:

- y :

-

Dependent variable representing potential EV purchase intention within the next years (0: Negative or Undecided/1: Positive)

- \(x_{c1}\) :

-

Travelled mileage on a (work)day (0: < 50 km/1: ≥ 50 km)

- \(x_{c2}\) :

-

Fleet manager and user (0: No/1: Yes)

- \(x_{c3}\) :

-

Respondent has experienced EV during one or two trips as a driver or passenger (0: No/1: Yes)

- \(x_{c4}\) :

-

Respondent has not experienced EV so far at all (0: No/1: Yes)

- \(x_{c5}\) :

-

Net household income <4,000 € (0: No/1: Yes)

- \(x_{c6}\) :

-

Net household income ≥4,000 € (0: No/1: Yes)

- \(x_{c7}\) :

-

Car usage frequency: 1–3 days per week (0: No/1: Yes)

- \(x_{c8}\) :

-

Car usage frequency: 1–3 days per month or less (0: No/1: Yes)

- \(x_{c9}\) :

-

French respondent (0: No/1: Yes)

- \(x_{c10}\) :

-

Number of cars in the household (0-4 if x c10 ≤ 4/5 if x c10 > 4)

Strong dependencies between the independent variable \(x_{c4}\) describing whether the respondents have not experienced EV at all so far and the dependent variable EV purchase intention can be observed (the odds ratio Exp(B) is smallest for this variable). This should be further analyzed as this issue is supportive to the hypothesis that there might be wealthy districts where EV diffusion rates might be comparably higher as soon as some of the residents have adopted EV as innovators. This might be challenging the local distribution grids (Jochem et al. 2013 and Waraich et al. 2013).

4.3.3 Quality Criterions of the the Binary Logistic Regression Models

The quality criterions of both binary logistic regression models P a and P c are acceptable as values of Nagelkerke R2 as well as of Cox and Snell R2 serving as quality measure for the models, are at an acceptable level for both models (cf. Table 2, Backhaus et al. 2008). Furthermore, p-values for the Hosmer and Lemeshow Tests which analyzes the differences between the model results and the observed values are both not significant. Nevertheless, it needs to be addressed that uncertainties in all three models are high. Details of the models P a and P c are provided in Tables 5 and 6 in the Appendix.

4.4 Limitations

The independent variables \(x_{a2}\) and \(x_{c9}\) did not discriminate significantly between the respondents willing to privately purchase an EV within the next years and those not willing to do so. As these are the only variables in the models which are not significant (\(p_{{x_{a2} }} = 0. 1 2\) and \(p_{{x_{c9} }} = 0. 1 2\)) and the samples are relatively small (n a = 62 and n c = 180), the authors assume that these results are due to the small samples considered. As the models would not be working without the variables it is important to take them into account, even if they are not significant. Furthermore, it needs to be mentioned that the results might be biased somewhat as the surveys were completed in French and German languages. Additionally, amongst others limitations concerning representativity of the sample should be mentioned. Particularly self-selection effects of organizations and EV users participating in the CROME field trial need to be considered when the results are interpreted.

5 Summary, Conclusions and Outlook

During the last years rather low market penetration rates for EV were observable. So far there are some first movers called innovators who privately purchased EV. Furthermore, there are some companies that purchased EV for their car pools. The users of these EV cannot be described as real innovators, as their companies made the decision to purchase the EV. Nevertheless, these persons are using and experiencing the EV technology. Although this group’s innovativeness is comparably low, only one fifth of the respondents answered that they could not envision purchasing an EV within the next ten years (cf. Ensslen et al. 2012). These findings are supportive to the role of trialability for diffusion of innovations (Rogers 2003) and are supportive to Peters et al. (2011a, b) mentioning low-threshold possibilities to test EV in order to increase EV acceptance levels. Respondents who had the possibility to experience EV show comparably high levels of satisfaction with different characteristics of EV (cf. Fig. 5). This is further supported by analyzing who of the company EV users is rather willing to purchase an EV within the next years. According to the binary logistic regression model presented in this article, that was estimated based on survey data collected in the beginning of the French-German field operational test CROME, EV usage experience positively impacts EV purchase intentions. According to this model EV purchase intentions increase with a higher level of income, with a higher number of cars in the household and a daily mileage of more than 50 km not necessarily travelled by car. Furthermore, potential explanations for the fact that experiencing EV positively impacts EV purchase intentions are discussed. According to the results presented in this study EV purchase intentions can to a large part be explained by a factor representing the respondents’ attitude towards EV (cf. Ensslen et al. 2013b). This factor can be explained by the users’ degree of satisfaction with the EVs’ driving characteristics, their satisfaction with EVs’ safety characteristics as well as their satisfaction levels with EVs’ ability to protect the climate by comparably low CO2 emissions.

We have seen that early EV adopters differ from LPG and CNG users particularly concerning educational level, income and price sensitivity. In order to increase market shares of EV significantly and to reach early adopter stage (more than 2.5 % of cars are EV), EV sales activities should not only be targeted at individuals with low price sensitivities and high incomes. Furthermore, EV specific disadvantages compared to internal combustion engine vehicles, notably their comparably high prices and their limited range (cf. Fig. 5), give rise to the assumption that alternative business models targeting economic and range-specific aspects of EV could be supportive to early-stage EV diffusion. Considering that the battery is the most expensive part of an EV, already existing specific battery leasing options might reduce the initial high invest and so make EV affordable to a higher share of potential customers. As the economic perspective of an EV majorly depends on its vehicle miles travelled due to comparably lower variable costs (e.g. costs for electricity are lower than costs for fuel), business models like e.g. carsharing with EV could be a solution. First attempts to realize these business models can already be observed. However, whether they are going to be successful in the long run is unclear so far. Car sharing concepts might reduce the EV specific disadvantages, range and purchase price, from the users’ perspectives significantly.

If policy makers wish to take measures in order to support private EV diffusion at the current market stage, thinking about demand side policy measures targeting monetary and non-monetary aspects could be an option. Non-monetary measures should besides the development of public accessible charging infrastructure including adequate parking space particularly focus on establishing possibilities to experience EV (e.g. test drives, e-car-sharing) as EVs’ driving characteristics are exceeding the expectations. Possibilities to experience EV should particularly target opinion leaders within the early EV adopters, notably decision makers in organizations potentially being fleet managers. Furthermore, first stage marketing measures to potential private EV adopters should particularly target households with a high net income, equipped with two or more cars and having a high daily mileage. In order to further support possibilities to experience EV, policy makers could additionally think about providing incentives to make usage-oriented business models like e-car-sharing more attractive for potential operators.

Further analyses are planned in order to derive conclusions about EV users’ decision concerning the powertrain choice during their next car purchase decision. Furthermore, the question is going to be addressed which services are favorable from the users’ perspectives in order to compensate for BEV-specific barriers and how these should look like.

Furthermore, after first analyses have already been conducted, the binary logistic regression model explaining EV purchase intention with EV users’ experience levels, income, nationality and mobility needs could be applied to representative mobility studies in France and Germany (MiD, ENTD) in order to equip every individual in these studies with EV purchasing probabilities. Exogenous variables which are not available in these studies are their experience levels with EV. However, it can be assumed that these are currently rather small. Furthermore, the research question can be expressed where EV diffusion will take place first. Will this be the case in rather urban or rather rural areas? The research question where early EV adoption will take place should be focused on, as local bottlenecks in the electric power grids due to electric mobility might occur.

Notes

- 1.

EV is used as synonym for all vehicles including Battery Electric Vehicles or All-Electric Vehicles (BEV), Range Extended Electric Vehicles (REEV) and Plug-in Hybrid Electric Vehicles (PHEV).

- 2.

Enquête nationale transports et déplacements 2008.

- 3.

Mobilität in Deutschland 2008.

- 4.

Significance level of Wald statistic: p < 0.1; *: p < 0.05; **: p < 0.01; ***: p < 0.001.

- 5.

Significance level of t-test: °: p < 0.1; *: p < 0.05; **: p < 0.01; ***: p < 0.001.

- 6.

Significance level of Wald statistic: °: p < 0.1; *: p < 0.05; **: p < 0.01; ***: p < 0.001.

Please consider the reference categories provided in Table 5.

References

Backhaus K, Erichson B, Plinke W, Weiber R (2008) Multivariate Analysemethoden. Springer, Heidelberg

Bamberg S, Möser G (2007) Twenty years after Hines, Hungerford and Tomera: a new meta-analysis of psycho-social determinants of proenvironmental behaviour. J Environ Psychol 27:14–25

Bass FM (2004) Comments on a new product growth for model consumer durables the bass model. Manage Sci 50:1833–1840

BMVBS (Bundesministerium für Verkehr, Bau und Stadtentwicklung) (2011) Elektromoblilität—Deutschland als Leitmarkt und Leitanbieter. http://www.bmvi.de/SharedDocs/DE/Publikationen/VerkehrUndMobilitaet/elektromobilitaet-deutschland-als-leitmarkt-und-leitanbieter.pdf?__blob=publicationFile. Accessed 6 March 2014

Bundesnetzagentur (2011) „Smart Grid“ und „Smart Market“: Eckpunktepapier der Bundesnetzagentur zu den Aspekten des sich verändernden Energieversorgungssystems. http://www.bundesnetzagentur.de/SharedDocs/Downloads/DE/Sachgebiete/Energie/Unternehmen_Institutionen/NetzzugangUndMesswesen/SmartGridEckpunktepapier/SmartGridPapierpdf.pdf?__blob=publicationFile&v=2%20. Accessed 6 March 2014

Bundesregierung (2009) Nationaler Entwicklungsplan Elektromobilität der Bundesregierung. http://www.bmbf.de/pubRD/nationaler_entwicklungsplan_elektromobilitaet.pdf. Accessed 6 March 2014

Dütschke E, Schneider U, Peters A, Paetz A, Jochem P (2011) Moving towards more efficient car use—what can be learnt about consumer acceptance from analysing the cases of LPG and CNG. ECEEE 2011 Summer Study

Dütschke E, Schneider U, Peters A (2013) Who will use electric vehicles?. Working paper sustainability and innovation No. S 6/2013. Fraunhofer Institute for Systems and Innovation Research (ISI). http://www.isi.fraunhofer.de/isi-media/docs/e-x/working-papers-sustainability-and-innovation/WP06-2013_Electric_Vehicles.pdf. Accessed 7 March 2014

Dunn OJ (1964) Multiple comparisons using rank sums. Technometrics 6:241–252

Eckl-Dorna W, Sorge N-V (2013) Elektroauto-Markt wächst exponentiell, nicht linear. Interview with Kagermann, Henning. Manager magazin online 2013. http://www.manager-magazin.de/unternehmen/autoindustrie/a-901804.html. Accessed 12 July 2013

Ensslen A, Babrowski S, Jochem P, Fichtner W (2012) Existe-il des différences d’acceptation des véhicules électriques entre la France et l’Allemagne? – Premiers résultats de l’analyse scientifique du test de flotte Cross Border Mobility for Electric Vehicles (CROME). Proceedings of the 11ème séminaire francophone est-ouest de socio-économie des transports, Karlsruhe

Ensslen A, Jochem P, Schäuble J, Babrowski S, Fichtner W (2013a) User acceptance of electric vehicles in the French-German transnational context, in selected proceedings of the 13th WCTR, Rio de Janeiro

Ensslen A, Jochem P, Fichtner W (2013b) Experiences of EV users in the French-German context. In: Proceedings of EVS27-conference, Barcelona, Spain

Eurostat (2013a) Umwelt und Energie Datenbank. http://epp.eurostat.ec.europa.eu/portal/page/portal/climate_change/data/main_tables. Accessed 18 Sept 2013

Eurostat (2013b) Energy price statistics. http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Energy_price_statistics. Accessed 25 June 2013

European Commission (2011) A roadmap for moving to a competitive low carbon economy in 2050. http://ec.europa.eu/clima/policies/roadmap/documentation_en.htm. Accessed 3 March 2014

Fraunhofer Institute for Systems and Innovation Research (ISI) (2012) REM2030 Driving Profiles Database V2012

Frenzel I, Jarass J, Trommer S, Lenz B (2015) Erstnutzer von Elektrofahrzeugen in Deutschland. Nutzerprofile, Anschaffung, Fahrzeugnutzung. Berlin: Deutsches Zentrum für Luft- und Raumfahrt e. V. (DLR)

Glerum A, Stankovikj L, Thémans M, Bierlaire M (2013) Forecasting the demand for electric vehicles: accounting for attitudes and perceptions. Transportation Science, Articles in Advance, pp 1–17

Hackbarth A, Madlener R (2013) Consumer preferences for alternative fuel vehicles: a discrete choice analysis. Transp Res Part D Transp Environ 25:5–17

Hartung J, Elpelt B, Klösener K-H (2005) Statistik. Oldenbourg, München

IBM SPSS Statistics (2013a) Kruskal-Wallis one-way analysis of variance (nonparametric tests algorithms). http://pic.dhe.ibm.com/infocenter/spssstat/v21r0m0/index.jsp?topic=%2Fcom.ibm.spss.statistics.help%2Falg_npar_tests_kruskalwallis.htm. Accessed 18 Sept 2013

IBM SPSS Statistics (2013b) Beispiel: Boxplot. http://pic.dhe.ibm.com/infocenter/spssstat/v20r0m0/index.jsp?topic=%2Fcom.ibm.spss.statistics.help%2Fgraphboard_creating_examples_boxplot.htm. Accessed 18 Sept 2013

IBM SPSS Statistics (2012) Post hoc comparisons for the Kruskal-Wallis test. http://www-01.ibm.com/support/docview.wss?uid=swg21477370. Accessed 22 Oct 2013

Jochem P, Kaschub T, Fichtner W (2013) How to integrate electric vehicles in the future energy system? In: Hülsmann M, Fornahl D (eds) Evolutionary paths towards the mobility patterns of the future. Springer, Heidelberg

KBA—Kraftfahrt-Bundesamt (2014) Jahresbilanz des Fahrzeugbestandes am 1. Januar 2014. http://www.kba.de/cln_031/nn_125398/DE/Statistik/Fahrzeuge/Bestand/2014__b__jahresbilanz.html#rechts. Accessed 19 March 2014

Kay D, Hill N, Newman D (2013) Powering Ahead—The future of low-carbon cars and fuels. http://www.theengineer.co.uk/Journals/2013/04/22/i/k/h/powering_ahead-kay_et_al-apr2013-embargoed_copy.pdf. Accessed 7 March 2014

Kuckartz U, Rädiker S, Rheingans-Heintze A (2006) Umweltbewusstsein in Deutschland. Marburg. http://www.umweltbundesamt.de/publikationen/umweltbewusstsein-in-deutschland-2006. Accessed 10 March 2014

Lichtenstein D, Ridgway N, Netemeyer R (1993) Price perception scales. In: Bearden W, Netemeyer R, Haws K (2011) Handbook of marketing scales. SAGE Publications, Thousand Oaks

Mabit SL, Fosgerau M (2011) Demand for alternative-fuel vehicles when registration taxes are high. Trans Res D 16:225–231

Manning K, Bearden W, Madden T (1995) Innovativeness: consumer innovativeness. In: Bearden W, Netemeyer R, Haws K (2011) Handbook of marketing scales. SAGE Publications, Thousand Oaks

Mendes Lopes M, Moura F, Martinez LM (2014) A rule-based approach for determining the plausible universe of electric vehicle buyers in the lisbon metropolitan area. Transp Res Part A 59:22–36

MOP (2012) Mobilitätspanel Deutschland (MOP). http://www.clearingstelle-verkehr.de. Accedded 7 March 2013

Paetz AG, Dütschke E (2012) Auf dem Weg in die elektromobile Zukunft - Ein Zwischenfazit zur Elektromobilität im Alltag. SIV. news 1:45–47

Paetz A-G, Kaschub T, Jochem P, Fichtner W (2012a) Demand response with smart homes and electric scooters: an experimental study on user acceptance. http://www.aceee.org/files/proceedings/2012/data/papers/0193-000232.pdf. Accessed 7 March 2014

Paetz A-G, Jochem P, Fichtner W (2012b) Demand Side Management mit Elektrofahrzeugen – Ausgestaltungsmöglichkeiten und Kundenakzeptanz. 12th Symposium Energieinnovation. Graz, Austria. http://portal.tugraz.at/portal/page/portal/Files/i4340/eninnov2012/files/lf/LF_Paetz.pdf. Accessed 7 March 2014

Paetz A-G, Kaschub T, Pfriem M, Jochem P, Fichtner W, Gauterin F (2013) Is electric mobility a means for more sustainability?. In: Behavior, energy and climate change conference, Nov 2013, Sacramento

Parasuraman A (2000) The technology readiness index. In: Bearden W, Netemeyer R, Haws K (2011) Handbook of Marketing Scales. SAGE Publications, Thousand Oaks

Peters A, Dütschke E (2010) Zur Nutzerakzeptanz von Elektromobilität. Analyse aus Expertensicht. Fraunhofer Institute for Systems and Innovation Research (ISI). http://publica.fraunhofer.de/eprints/urn:nbn:de:0011-n-1450132.pdf. Accessed 7 March 2014

Peters A, Hoffmann J (2011) Nutzerakzeptanz von Elektromobilität. Eine empirische Studie zu attraktiven Nutzungsvarianten, Fahrzeugkonzepten und Geschäftsmodellen aus Sicht potenzieller Nutzer. Fraunhofer Institute for Systems and Innovation Research (ISI). http://isi.fraunhofer.de/isi-media/docs/service/de/presseinfos/Forschungsergebnisse_Nutzerakzeptanz_Elektromobilitaet.pdf. Accessed 7 March 2014

Peters A, Popp M, Agosti R, Ryf B (2011a) Electric mobility—a survey of different consumer groups in Germany with regard to adoption. ECEEE Summer Study proceedings. http://publica.fraunhofer.de/eprints/urn:nbn:de:0011-n-1834806.pdf. Accessed 7 March 2014

Peters A, Gutscher H, Scholz RW (2011b) Psychological determinants of fuel consumption of purchased new cars. Transp Res Part F Psychol Behav 14:229–239

Peters A, de Haan P, Scholz W (2013) Understanding car buying behavior: psychological determinants of energy efficiency and practical implications. Int J Sustain Transp doi:10.1080/15568318.2012.732672

Pfahl S (2013) When will electric vehicles capture the German market? And why? In: Proceedings of EVS27-conference, Barcelona, Spain

Plötz P, Schneider U, Globisch J, Dütschke E (2014) Who will buy electric vehicles? Identifying early adopters in Germany. Transportation Research Part A: Policy and Practice 67:96–109, doi:10.1016/j.tra.2014.06.006

Rogers EM (2003) Diffusion of innovations, 5th edn. Free Press, New York

SINUS (2012) Klimaschutz in Heidelberg. http://www.uni-heidelberg.de/md/journal/2013/02/14jan_heidelbergstudie_2012.pdf. Accessed 7 March 2014

Thielmann A, Sauer A, Isenmann R, Wietschel M, Plötz P (2012) Produkt-Roadmap Lithium-Ionen-Batterien 2030. Fraunhofer Institute for Systems and Innovation Research (ISI). http://www.isi.fraunhofer.de/isi-media/docs/v/de/publikationen/PRM-LIB2030.pdf. Accessed 7 March 2014

Waraich RA, Galus MD, Dobler C, Balmer M, Andersson G, Axhausen KW (2013) Plug-in hybrid electric vehicles and smart grids: investigations based on a microsimulation. Transp Res Part C 28:74–86

Wietschel M, Dütschke E, Funke S, Peters A, Plötz P, Schneider U (2012) Kaufpotenzial für Elektrofahrzeuge bei sogenannten „Early Adoptern“. Fraunhofer Institute for Systems and Innovation Research (ISI). http://isi.fraunhofer.de/isi-media/docs/e/de/publikationen/Schlussbericht_Early_Adopter.pdf. Accessed 7 March 2014

Wietschel M, Plötz P, Kühn A, Gnann T (2013) Markthochlaufszenarien für Elektrofahrzeuge. Fraunhofer Institute for Systems and Innovation Research (ISI). http://www.isi.fraunhofer.de/isi-media/docs/e/de/publikationen/Fraunhofer-ISI-Markthochlaufszenarien-Elektrofahrzeuge-Langfassung.pdf. Accessed 7 March 2014

Windisch E (2013) Driving electric? A financial assessment of electric vehicle policies in France. Paris

Ziegler A (2012) Individual characteristics and stated preferences for alternative energy sources and propulsion technologies in vehicles: a discrete choice analysis for Germany. Transp Res A 46:1372–1385

Acknowledgements

We would like to thank Verena Knödler and Mario Ostwald for their contributions and support concerning data collection and analyses. This research was made possible by the CROME project [ref. no. 01ME12002], the MeRegioMobil project [ref. no. 01ME9005] and the iZEUS project [ref. no. 01ME12013] funded by the German Federal Ministry of Economics and Technology (BMWi).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix A

Appendix A

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Ensslen, A., Paetz, AG., Babrowski, S., Jochem, P., Fichtner, W. (2016). On the Road to an Electric Mobility Mass Market—How Can Early Adopters be Characterized?. In: Fornahl, D., Hülsmann, M. (eds) Markets and Policy Measures in the Evolution of Electric Mobility. Lecture Notes in Mobility. Springer, Cham. https://doi.org/10.1007/978-3-319-24229-3_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-24229-3_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-24227-9

Online ISBN: 978-3-319-24229-3

eBook Packages: EngineeringEngineering (R0)