Abstract

Academic research in modern finance has been developing over the last decades. Many important contributions have been published in the main journals of the field. This paper analyzes scholarly research in finance by using bibliometric indicators. The main results are summarized in three fundamental issues. First, the citation structure in finance is presented. Next, the paper studies the influence of financial journals by using a wide range of indicators including publications, citations and the h-index. The paper ends with an overview of the most influential papers. In general, the results are in accordance with the expectations where the Journal of Finance, the Journal of Financial Economics and the Review of Financial Studies are the most popular journals and the USA is clearly the dominant country in finance.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Bibliometric studies are very common in the literature. They analyze quantitatively the bibliographic material. Due to the strong development of computers and internet, today it is a very popular field to assess the state of the art of a research area because the information is easily available to any scientific institution. The definition of bibliometrics has brought many discussions in the literature. A very common definition is the one provided by Broadus (1987) that clearly defined the topic considering future developments due to modern technologies. He stated that bibliometrics is “the quantitative study of physical published units, or of bibliographic units, or of surrogates of either”. Recently, several studies (Alonso et al. 2009) have provided deeper understandings of the concept including the work of Bar-Ilan (2008) that connected it with a more general framework that included scientometrics and informetrics.

The aim of this paper is to present a bibliometric analysis of the most fundamental research developed in finance since the creation of JF. For doing so, it is used the Web of Science (WoS) as the database for collecting the information because it is usually regarded as the most influential one for scientific research. Thus, this study provides a modern approach for analyzing the state of the art in finance from a bibliometric perspective. Its main advantage is that it analyzes the information considering a wide range of variables that permits to detect the weaknesses and strengths of a journal or a paper. Moreover, it provides an updated list of results that contributes to the knowledge in this field following previous works in this direction by Alexander and Mabry (1994), Chan et al. (2002), Chung et al. (2001) and Currie and Pandher (2011). The analysis is divided in two parts that can be classified in journal analysis and the most cited papers since 1946.

The paper focuses on the most relevant journals. It analyzes those journals with a strong financial orientation indexed in WoS that are usually found in the subject category of “business finance”. By doing so, it is assumed that only the most relevant journals in financial research are included because the aim of WoS is only to include those journals that accomplishes with high quality standards including a rigorous peer-review process and regular publication of issues without delays. Several indicators are used in order to analyze their quality (Merigó et al. 2015) including the number of papers and citations, the h-index and the impact factor provided by WoS – Journal Citation Reports (JCR). The results are in accordance with the common knowledge and previous studies (Chan et al. 2013), being JF, JFE and RFS the most influential journals.

An analysis of the most cited papers in financial research is also presented. This part of the work studies the 50 most cited papers in finance according to the results found in WoS. Thus, it is possible to get an overview of those papers that have a strongest impact in the scientific community. The results are more or less in accordance with the common knowledge where many of the well-known papers appear highly ranked in the list. For doing this, this paper is organized as follows. Section 2 presents a journal ranking in finance according to some bibliometric indicators. Section 3 studies the most cited papers in finance of all time. Section 4 summarizes the main results and conclusions of the paper.

2 Citation Structure in Finance

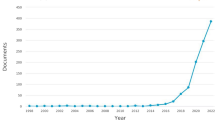

In April 2013, there were 39,440 papers in WoS in the 50 financial journals available in the WoS category of Business, Finance. If only articles, notes and reviews are considered, the number is reduced to 32,087. The global h-index of finance according to the 50 selected journals is 257. That is, 257 papers of the whole set of 39,440 papers have received at least 257 citations.

An important issue when analyzing the publication and citation structure is to consider the number of papers that have surpassed a citation threshold. This indicates the level of citation that most of the papers receive and permits to identify the number of citations that the top papers usually receive. Table 1 presents the general citation structure considering several citation thresholds and developing an annual analysis since 1983.

Only 54 papers have received at least 500 citations between 1983 and 2012 which represents 0.2 % of all the papers. About 9 % of the papers receive more than 50 citations. Focusing on the last 10 years, the citation level is very low because more time is needed in order to consolidate a huge number of citations. Only one paper has received more than 500 citations and a very low number of the papers have already surpassed the 50 citation threshold. However, it is expected that many of these papers will receive a lot of citations in the future because currently they are new papers that still have not reached a consolidated position in the scientific community.

3 Journal Rankings

This section presents a journal ranking according to the data available in WoS. The journals are ranked according to the h-index although many other indicators are included in order to get a complete picture of each of them. The reason for using the h-index is because it combines publications and citations in the same measure (Olheten et al. 2011). However, it has some limitations when dealing with journals with significant differences in the number of publications. Usually, a higher number of papers bring a higher h-index independently of the quality of the papers. Although it is more efficient that the total number of papers and citations, it still cannot totally control this issue. The other alternative is to consider the ratio citation/papers or the impact factor but the problem here is that very small journals may get higher positions although not many people take them into account. Table 2 presents the journal ranking. Although the ranking is established according to the h-index, the rest of the indicators give a complete view of each of the journals. Note that in the case of tie in the h-index, it is selected first the journal with the lowest number of papers because this indicates that with a lower number of papers it has been able to reach a higher h-index.

JF and JFE are clearly the most influential journals in finance. Next, it is found RFS that is growing a lot during the last years and JFQA. Note that JB ended publication in 2006 but if included in the ranking would appear in the fourth position before JFQA. More or less, the results are in accordance with the common knowledge being the most popular journals in the first positions (Alexander and Marbry 1994; Chan et al. 2013). However, some deviations are found due to the particular nature of the h-index that requires a consolidation process throughout time. Therefore, young journals that have been recently included in WoS appear in lower positions. In some cases, these can be seen as a deviation since some of these journals should probably appear in a better position including RF and EFM. But in general, the results seem to be logical.

4 The Most Influential Papers in Finance

Many papers have made fundamental contributions to the financial literature. Some of them have even led to the Nobel Prize in economics. This section tries to identify the most influential ones by analyzing the 50 most cited papers of all time according to WoS. This measure aims at identifying the influence and popularity that a paper has reached in the financial literature. However, several limitations may occur due to the specific research considered in each paper that may attract more researchers and citations than other very good papers but with less use in the scientific community. In general terms, it is assumed that the most cited studies represent the majority of the key papers in the financial literature although some exceptions may appear. Table 3 presents a list with the 50 most cited articles in finance.

The most cited papers are very well-known in the scientific community. Some of them have led to the Nobel Prize in economics including the paper by Markowitz, Sharpe, Vickrey and Merton. JF and JFE dominate the list with more than 80 % of the papers. Note that the last column of Table 2 shows the number of papers that each journal has in the top 50. Note that the results shown in Table 3 are in accordance with previous studies (Alexander and Marbry 1994; Chung et al. 2001; Arnold et al. 2003) although important deviations are found due to the evolution of financial research during the last years and the strong growth seen in WoS that has increased a lot the number of citations.

Regarding authors in the list, it is worth noting that Eugene F. Fama and Andrei Shleifer have published four of the top 50 papers. Michael C. Jensen also obtain remarkable results having three papers in the top 50. Kenneth R. French. Rafael La Porta, Florencio López De Silanes, Robert Merton, Stewart C. Myers and Robert W. Vishny have two papers each. Another interesting issue is that most of the papers come from American institutions and authors. Non-English speaking countries have a very low presence in the list. Currently, it seems that they are increasing their number of publications and citations but still far away from the USA.

Note that many key papers in finance have been published in a more general economic journal. Among others, it is found the famous paper of Black and Scholes (1973) published in the Journal of Political Economy (JPE) about the pricing of options that gave Myron Scholes the Nobel Prize in economics. Observe that this paper, if ranked in the list, would get the second position with 5253 citations. Table 4 presents an additional list of highly cited papers in finance that were not published in journals strictly dedicated to finance.

Apart from JPE, it is worth noting that American Economic Review and Econometrica are those journals that have also published many leading papers in financial research.

5 Conclusions

A general bibliometric overview of scholarly research in finance has been presented. Several fundamental issues have been considered including a journal analysis and the most influential papers in the field. A major result found in the paper is that the USA clearly dominates the field have the leading papers and authors in finance. Moreover, they are responsible for publishing the leading journals. The information has been collected through WoS that is usually regarded as the main database for academic research. The results are in accordance with the common knowledge being the most popular research ranked in the first positions.

This paper has provided a general bibliometric overview of financial research over the last decades. Although the results are in accordance with the common knowledge, it is worth noting that some important limitations may produce changes on the results shown in the paper. Therefore, the paper aims to be informative rather than trying to provide some general strict rankings.

References

Alexander Jr, J.C., Mabry, R.H.: Relative significance of journals, authors, and articles cited in financial research. J. Fin. 49, 697–712 (1994)

Alonso, S., Cabrerizo, F.J., Herrera-Viedma, E., Herrera, F.: H-index: A review focused on its variants, computation and standarization for different scientific fields. J. Inf. 3, 273–289 (2009)

Arnold, T., Butler, A.W., Crack, T.F., Altintig, A.: Impact: What influences finance research? J. Bus. 76, 343–361 (2003)

Bar-Ilan, J.: Informetrics at the beginning of the 21st century—a review. J. Inf. 2, 1–52 (2008)

Black, F., Scholes, M.: Pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973)

Broadus, R.N.: Toward a definition of “Bibliometrics”. Scientometrics 12, 373–379 (1987)

Chan, K.C., Chang, C.H., Chang, Y.: Ranking of finance journals: some Google scholar citation perspectives. J. Empir. Fin. 21, 241–250 (2013)

Chan, K.C., Chen, C.R., Steiner, T.L.: Production in the finance literature, institutional reputation, and labor mobility in academia: A global perspective. Fin. Manage. 31, 131–156 (2002)

Chung, K.H., Cox, R.A.K., Mitchell, J.B.: Citation patterns in the finance literature. Fin. Manage. 30, 99–118 (2001)

Currie, R.R., Pandher, G.S.: Finance journal rankings and tiers: An active scholar assessment methodology. J. Bank. Fin. 35, 7–20 (2011)

Merigó, J.M., Gil-Lafuente, A.M., Yager, R.R.: An overview of fuzzy research with bibliometric indicators. Appl. Soft Comput. 27, 420–433 (2015)

Olheten, E., Theoharakis, V., Travlos, N.G.: Faculty perceptions and readership patterns of finance journals: a global view. J. Fin. Quant. Anal. 40, 223–239 (2011)

Acknowledgments

Support from the European Commission through the project PIEF-GA-2011-300062 is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this paper

Cite this paper

Merigó, J.M., Yang, JB., Xu, DL. (2015). A Bibliometric Overview of Financial Studies. In: Gil-Aluja, J., Terceño-Gómez, A., Ferrer-Comalat, J., Merigó-Lindahl, J., Linares-Mustarós, S. (eds) Scientific Methods for the Treatment of Uncertainty in Social Sciences. Advances in Intelligent Systems and Computing, vol 377. Springer, Cham. https://doi.org/10.1007/978-3-319-19704-3_20

Download citation

DOI: https://doi.org/10.1007/978-3-319-19704-3_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-19703-6

Online ISBN: 978-3-319-19704-3

eBook Packages: EngineeringEngineering (R0)