Abstract

Existing literature has covered carrier selection criteria in various surveys asking shippers to rate or rank selection criteria, but rarely modeled the final impact of criteria on the selection decision or even expected market shares of liner services. This paper examines the decision processes leading to a container liner service selection. Based on a series of qualitative interviews the paper maps the various paths that ocean container carrier decisions follow and illustrates the ocean carrier tender process in detail. From the process examination we develop implications for discrete choice experiments that could be used by researchers to develop choice modeling studies.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Ocean container transportation has experienced tremendous growth over the last decades and is expected to grow further in the years to come. Although widely recognized as commoditized services there have been ongoing discussions among researchers and practitioners if container liner shipping was a purely price-driven industry or if certain quality of service indicators also play significant roles when shippers decide about container carriers. Especially with the background of globalization and the integration of supply chains, service parameters such as transit time, reliability, customer service, information services, or environmental aspects could be expected to rise in importance. Existing literature has covered carrier selection criteria in various surveys asking shippers to rate or rank selection criteria, but rarely modeled the final impact of criteria on the selection decision or even expected market shares of liner services.

This paper covers some empirical pre-work towards the future development of a market share model using stated preference discrete choice methods. The primary research goal is to understand decision processes shippers follow when they select their ocean carriers in detail and to find anchor points and set-up for future discrete choice analysis.

2 Literature Review

2.1 Ocean Container Carrier Decision Process

The process of deciding for an ocean container carrier has not been widely discussed in the scientific literature. The most renowned study was probably carried out by Mary Brooks in: Brooks (1983, 1985b, 1990, 1995). She examines the application of the ‘Buygrid Framework’ on ocean container carrier selection. Brooks (1990) concludes that in the case of buying container liner services, decisions are largely similar for new task buys, modified rebuys or straight rebuys. She further concludes that the number of individuals involved, the information sources used, and the level of influence held by decision-makers were similar. She condenses to a 3 stage process model. Stage 1 covers the recognition of the need for a carrier choice and distinguishes between shipper internal decisions or decisions made by an external agent (e.g. a freight forwarder). In stage 2 the shipper develops a list of carriers. She filters this list based on availability of liner service(s) between origin and destination ports and other constraints [e.g. space availability, consignee requirements or company policies (Brooks 1983)]. The shippers’ final carrier decision follows in stage 3 by establishing a list of selection criteria and assessing carriers against them.

D’Este (1992) further specifies the selection process based on an example for Ro/Ro ferry choice in Australia. A first filter in D’Este’s process model eliminates all shipping services from the set of options that cannot perform the required task (this is analogue to stage 2 in the Brooks’ model). In the next step all feasible options are filtered that do not prove a minimum quality of service or maximum cost. According to D’Este (1992) in this stage shippers try to minimize the risk related to the transport decision. The process model then splits into a many baskets branch where shippers allocate a base level of volume to each feasible and satisfying shipping options and a discretionary branch where shippers further assess differences between carriers regarding a set of criteria and allocate transport volumes according to a resulting ranking of carriers. Mangan (2002) develops a similar process model for the port/ferry choice in Ireland. Additionally Meixell and Norbis (2008) provide an extensive overview of carrier and mode selection literature.

Both Brooks’ and D’Este’s studies present useful starting, but also offer room for further deep dives. Brooks for example does not specify the decision processes followed by external decision makers. Also the study does not distinguish between types of carrier decisions such as long-term contracts or spot market bookings. D’Este presents a more detailed process model, but uses a very specific sample.

2.2 Ocean Container Carrier Decision Criteria

Literature on ocean container carrier selection criteria is more extensively available than literature on the selection process. Most of the authors use stated preference techniques such as surveys with rating or ranking scales, some combine surveys and personal interviews. Again Brooks’ longitudinal study of Canadian shippers over the years 1983, 1985a, 1990 and 1995 is probably the most prominent one. Latest results presented by Brooks (1995) are illustrated in Table 1.

The cost of service turns out as the most important decision criterion, closely followed by the problem solving capability of the carrier personnel. Also the availability of equipment, documentation accuracy, and on-time delivery are highly ranked. Surprisingly transit time seems to be of no high importance to shippers in this 1991 survey, despite transit time was rated higher earlier (Brooks 1985a).

A number of more recent publications again focus on the selection of ocean (container) carriers for different regions [e.g. Lu (2003), Thai (2008), and Kannan et al. (2011)]. In a parallel study we analyzed selection criteria in the existing literature in more detail (Gailus and Jahn 2013). We conclude from this extensive literature review that the freight rate seems to play the most important role in ocean carrier selection, but numerous studies prove that service factors such as transit time, transit time reliability, service frequency, equipment availability, customer service, or quality of documentation also influence shippers’ decisions.

2.3 Choice Modeling of Ocean Container Carrier Selection

Only three publications could be identified that examine the ocean carrier selection with choice modeling methods. Tiwari et al. (2003) develop a combined port and carrier selection model using the discrete choice method on a sample of container shippings in China. However their primary focus lies on port selection factors (number of port calls, TEU volumes, number of berths and cranes, water depth, number of liner services, capacity utilization and fees). They only test three crude, carrier-specific factors: nationality, total TEU handled and number of vessels. Furthermore they do not cover the freight rate in their study.

Nind et al. (2007) compare choice preferences of shippers from China and those from New Zealand in the trade between both markets. They conclude that shippers on both ends of this particular trade lane differ significantly. While for Chinese shippers the one dominant decision parameter is the freight rate, New Zealand shippers decide more differentiated by including parameters such as service frequency, particular port calls, and accuracy besides the freight rate. The authors only reveal a narrow excerpt of results and methodology. For example they leave out the full list of attributes examined; also they do not develop results into a market share model for container shipping lines.

In a third publication from Asia, Wen and Huang (2007) develop a discrete choice model for carrier selection in the trade between Taiwan and the USA. Modeling results indicate that freight rate, transit time and reliability influence Taiwanese shippers’ decisions. Unfortunately results of these studies only provide indications for selected niches of the liner shipping market. They do not yet allow for derivation of a more general choice model, e.g. for market share modeling purposes.

3 Research Methodology

Semi-structured interviews are used to explore shippers’ decision processes. Shippers were recruited from both major groups of shipping line customers: cargo owners and freight forwarders. We ensured to interview shippers of small, medium and large size (measured in annual transport volumes). To allow for a conclusive perspective also major shipping lines were interviewed.

An interview guide structured in four main sections was used. Sections cover: basic company information, end-to-end decision and booking processes and responsibilities, decision criteria, and configuration issues for choice experiments. Interviews were conducted in person and lasted between 1.5 and 2 h. This gave enough room for open-ended questions and explorative deep dives. A major portion of time was spent on process identification and understanding. Participants were asked to provide insights on their selection processes and criteria at least differentiated into two major paths: spot market bookings and contract bookings.

All decision processes that were identified during the interviews are mapped as paths in a single chart which we call the “Navigational Chart of Container Bookings”. Paths always start with the cargo owner and end with the physical container carrier executing the transportation. Each path represents a structurally unique way a container booking (or a group of structurally identical bookings) follows until the physical carrier of the container(s) is determined. To generate paths booking processes identified in the interviews are clustered into groups of (almost) identical process steps, decision points and decision makers. Whenever one of the three dimensions varies a new path is opened up. Finally all paths are mapped in the chart including respective differentiating characteristics and decision points.

In a final step decision points along the paths mapped in the Navigational Chart are analyzed to identify possible anchor points for stated preference discrete choice experiments. This follows the idea that for each decision point mapped decision scenarios could be developed. These could be presented to a representative group of decision makers to collect stated preference choice data later.

Discrete choice models are defined by a certain experimental design. According to Hensher et al. (2005) important experimental design characteristics include: description of a choice situation, a set of choice alternatives distinguished by a number of attributes, a sample of decision makers, as well as a statistical design (which is not in the focus of this work). Hence this paper defines those experimental design characteristics for the decision points identified along the paths. To handle the high number of decision points identified, points are assigned to groups whenever experimental characteristics seem similar.

4 The Various Paths of Container Booking Decisions

4.1 Interview Sample from North-West Europe

Empirical results of this study are based on an interview sample of both container shippers and container liner carriers. Over a period of 3 months interviews with 19 container shippers and 6 container carriers were conducted. A total of 96 shippers and 20 carriers were contacted in a written form leading to a participation rate of 20 and 30 % respectively. Most of the shippers were of German origin, but most of them ship their containers over multiple North-Western-European ports or show global activity. Figure 1 shows selected demographic details.

Among the 19 shippers were 11 freight forwarders and 8 cargo owners. The interviewed companies vary in the size of their annual controlled container volumes from 800 TEU p.a. up to >300,000 TEU p.a. with the majority of shippers coming from medium container volume segments. Shippers interviewed furthermore cover all major industry segments with a slight focus on traditionally strong German segments such as automotive or industrial segments.

4.2 Navigational Chart of Different Container Booking Paths

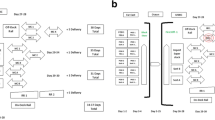

Figure 2 shows 20 different paths each representing a unique class of ocean carrier selection process identified from the interviews. From a carrier’s perspective each container booked on one of his vessels should have followed one of these paths. We identified three major dimensions, which drive differentiation of booking decision processes: process ownership, existence of a core carrier program, and type of contract between carriers and shippers. Two further dimensions were identified depending on process ownership: risk exposure (for freight forwarders) and booking execution (for cargo owners).

The first major dimension of differentiation is process ownership. The market splits into two major streams: cargo owners that select their ocean container carriers in-house and cargo owners that outsource the ocean carrier decision.

Existence of a core carrier program is the next dimension of differentiation. Core carrier programs are usually implemented by globally acting medium to large freight forwarders or large corporate cargo owners. In a core carrier program the shipper usually selects 5–10 ocean carriers as preferred carriers and allocates major volumes to those carriers. Core carriers are usually selected once a year, typically with regular (e.g. quarterly or monthly) review intervals. Core carrier selection takes place on the basis of shippers’ strategic considerations, carriers’ past operational performance, as well as contractual terms. In return for the core carrier status, carriers offer rate discounts, capacity reservations or financial kick-backs.

Contract bookings and spot market bookings are the major types of contracts, but differentiate further especially in a freight forwarder environment. Contract or tender bookings are characterized through a fixture of contractual terms, volume/capacity allocations and rates for a medium to long-term time frame. Interviews revealed contract periods between 3 and 24 months, while in the latter case a major rate review is performed after 1 year. Contract duration was in most cases 6 or 12 months. Tenders are usually issued by the cargo owners, but also freight forwarders tender with shipping lines, either for single large customers (so called Named Accounts) or groups of customers Group or Basket Accounts.

Spot market bookings are characterized through short-term and one-time shipping decisions. Volumes are often less projectable than in contract settings and carriers are assessed and compared for each single shipment. Spot market bookings usually contain 1–20 containers but could also reach small three digit numbers in extraordinary cases. Spot market business is also known as Freight All Kind or FAK business. Carriers regularly issue FAK rates, which shippers could use to request spot bookings spontaneously. Often carriers group shippers and issue individual grades of FAK rates to those groups depending on the importance of customers (Customer/FAK). If no close relationship exists between shipper and carrier, regular Spot/FAK transactions are based on general FAK rates and terms of carriers.

In case of process ownership by cargo owners a process differentiation through the booking execution was observed. Bookings are either done in house (own execution) or outsourced (external execution) to booking agencies or logistics providers (e.g. freight forwarders). But only booking, documentation, and accounting processes are outsourced not the carrier decision itself. If process ownership lies with freight forwarders another dimension of differentiation was observed in terms of the rate risk exposure freight forwarders are willing to take. In one path freight forwarders expose themselves to own risk by first engaging in a contract with their customers at a specified rate (without yet having a carrier quote). Negotiation and allocation of volumes with carriers takes place in a second step. In the other stream freight forwarders do not expose themselves to that type of risk by first collecting quotations from their shippers and using them to calculate their own offers.

4.3 Container Carrier Selection Processes

From our interviews we developed process maps to understand in detail how decision processes work. We found that process maps for spot market decisions are reasonably well reflected by D’Este (1992). There are some deviations especially in terms of the process of rate request, negotiation and confirmation. Therefore in this paper we focus on the other major contract type the “Contract/Tender” process. This process is run by both cargo owners and freight forwarders (for named account or basket/group businesses). Figure 3 shows a detailed process map for an example contract/tender booking process from the start of the tender process until the first container booking in context of the contract. An in-depth version of the spot decision process is available from the authors upon request.

4.4 Decision Makers

For a further examination of the ocean container carrier choices it is important to understand who the relevant decision makers are. According to our interviews again a differentiation of the type of contract and between freight forwarders and cargo owners seems reasonable, as well as a differentiation of the shippers’ size. Large cargo owners with regular tendering activity in most cases have a small dedicated team managing those tenders and the selection of core carriers. Teams are either lead by a corporate purchasing manager or corporate logistics manager supported by operative logistics and purchasing functions in international locations. Usually tender management teams are highly autonomous in managing the tender process and developing a proposal for the carrier selection. Responsibility for tendering activity in a freight forwarding environment is usually organized similar to the cargo owners. Most large freight forwarders have central tender management teams in their country/regional organizations, some additionally on a global level or even in the field sales organization. Small freight forwarders handle tenders either with a centrally responsible person or on business management level. Tender management teams are responsible for managing tenders regarding named account and group/basket account business.

In most cases those spot market booking decisions are made by operative staff. In case of cargo owners this is the local logistics responsible. In some cases operative functions in a purchasing organization get involved, especially in larger corporate settings or for larger container volumes. At freight forwarders spot bookings usually are placed by operative sales staff or booking desk clerks. Some decisions are influenced by middle management, e.g. in case of larger container volumes or towards the end of controlling periods when kick-back negotiations with carriers are coming up and volume thresholds should be reached. Occasionally freight forwarders also centralize spot market bookings. In these cases customer bookings are collected in the sales organization and queued in an internal system. A central booking team under supervision of a middle manager then places the bookings.

5 Implications for the Set-up of Discrete Choice Experiments

To develop choice models, researchers could use the Navigational Chart of decision processes to collect choice data and model the choices with statistical methods. Two major ways of choice data collection are available: revealed preference data (actual container bookings) or stated preference data (data containing virtual booking choices from experiments). We provide insights for the second approach.

As time and budget constraints place a burden on the number of choice situations that can be examined in a single study. Thus we argue for a re-combination of choice situations. From the interviews we believe that two major types of carrier selection decisions exist: contract decisions (representing paths 1–2, 10–13, and 17–20 in Fig. 2) and spot decisions (representing paths 3–9 and 14–16). The pooling of tender processes managed by either cargo owners themselves or freight forwarders seems reasonable, because in the majority of cases freight forwarders simply forward industry customers’ requirements. Consequently the decision situation is structurally similar. “Group/Basket Accounts” could be combined with this class of decision situations, because freight forwarders create their own tender situations by combining groups of smaller customers and volumes into one basket of higher volumes. Furthermore all types of bookings combined under contract decisions are usually made by experienced middle-management. Pooling of spot decisions also seems feasible. Decision processes are very similar: logistics or purchasing staff at a cargo owner, or booking desk staff at a freight forwarder compare carrier offerings for a single transport job. Table 2 summarizes our proposed approach for discrete choice studies of ocean container carrier choice.

6 Conclusions

The selection of ocean container liner carriers is a more complex decision situation than expected from an outside perspective. From our interviews we were able to identify 20 different decision paths that container bookings could follow. One of the most influential decision processes, the contract/tender process has been documented in a detailed way and thereby made available to the scientific discussion. To further assess and quantify relevant carrier selection criteria we propose to conduct stated preference discrete choice experiments for two major scenarios: contract decisions and spot decisions. Data should be collected in a way that an examination of various market segments (e.g. different industries, commodities, trade lanes, etc.) would be possible. Our interview series suggests that also the relevance of selection criteria should to be assessed in a more differentiated way than most existing literature provides.

References

Brooks MR (1983) Determinants of shipper’s choice of container carrier. A study of Eastern Canadian exporters. Ph.D. thesis. University of Wales, Department of Maritime Studies, Cardiff

Brooks MR (1985a) An alternative theoretical approach to the evaluation of liner shipping part II. Choice criteria. Marit Policy Manage 12(2):145–155

Brooks MR (1985b) Limitations in the carrier choice process: a study of Eastern Canadian exporters of containerisable cargo. Int J Phys Distrib Logistics Manage 15(3):38–46

Brooks MR (1990) Ocean carrier selection criteria in a new environment. Logistics Transp Rev 26(4):339–355

Brooks MR (1995) Understanding the ocean container market—a seven country study. Marit Policy Manage 22(1):39–49

D’Este GM (1992) Carrier selection in a RO/RO ferry trade part 2. Conceptual framework for the decision process. Marit Policy Manage 19(2):127–138

Gailus S, Jahn C (2013) Ocean container carrier selection in North Western Europe—qualitative empirical research towards a discrete choice model. In: Blecker T, Kersten W, Ringle C (eds) Pioneering solutions in supply chain performance management. Supply chain, logistics and operations management, vol 17. EUL, Cologne, pp 69–88

Hensher DA, Rose JM, Greene WH et al (2005) Applied choice analysis. A primer. Cambridge University Press, Cambridge

Kannan V, Bose SK, Kannan NG et al (2011) An evaluation of ocean container carrier selection criteria: an Indian shipper’s perspective. Manage Res Rev 34(7):754–772

Lu CS (2003) An evaluation of service attributes in a partnering relationship between maritime firms and shippers in Taiwan. Transp J (Am Soc Transp Logistics) 42(5):5–16

Mangan J (2002) Modelling port/ferry choice in RoRo freight transportation. Int J Transp Manage 1(1):15–28

Meixell MJ, Norbis M (2008) A review of the transportation mode choice and carrier selection literature. Int J Logistics Manage 19(2):183–211

Nind D, McAtamney M, Matear S et al (2007) Industrial service design in the Asia-Pacific shipping industry: a strategic paradox? Int J Logistics Syst Manage 3(4):419–428

Thai V (2008) Service quality in maritime transport: conceptual model and empirical evidence. Asia Pac J Mark Logistics 20(4):493–518

Tiwari P, Itoh H, Doi M et al (2003) Shippers’ port and carrier selection behaviour in China: a discrete choice analysis. Marit Econ Logistics 5(1):23–39

Wen CH, Huang JY (2007) A discrete choice model of ocean carrier choice. J Eastern Asia Soc Transp Stud 7:795–807

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this paper

Cite this paper

Gailus, S., Jahn, C. (2015). Ocean Container Carrier Selection Processes. In: Dethloff, J., Haasis, HD., Kopfer, H., Kotzab, H., Schönberger, J. (eds) Logistics Management. Lecture Notes in Logistics. Springer, Cham. https://doi.org/10.1007/978-3-319-13177-1_19

Download citation

DOI: https://doi.org/10.1007/978-3-319-13177-1_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-13176-4

Online ISBN: 978-3-319-13177-1

eBook Packages: EngineeringEngineering (R0)