Abstract

This chapter evaluates the aggregate macroeconomic effects of the quantifiable impact chains in ten impact fields for Austria: Agriculture, Forestry, Water Supply and Sanitation, Buildings (with a focus on heating and cooling), Electricity, Transport, Manufacturing and Trade, Cities and Urban Green, Catastrophe Management, and Tourism. First, the costing methodology used for each impact chain as well as the respective interface to implement them within the macroeconomic model are reviewed and compared across impact fields. The main finding here is that gaps in costing are mostly the consequence of insufficient data and for that reason, the two important impact fields Ecosystem Services and Human Health could not be assessed in monetary terms. Second, for the subset of impact chains which could be monetised, a computable general equilibrium (CGE) model is then used to assess the macroeconomic effects caused by these. By comparing macroeconomic effects across impact fields, we find that the strongest macroeconomic impacts are triggered by climate change effects arising in Agriculture, Forestry, Tourism, Electricity, and Buildings. The total macroeconomic effect of all impact chains—which could be quantified and monetised—is modest up to the 2050s: both welfare and GDP decline slightly compared to a baseline development without climate change. This is mainly due to (a) all but two impact chains refer to trends only (just riverine flooding damage to buildings and road infrastructure damages cover extreme events), (b) impacts are mostly redistribution of demand, while stock changes occurring as a consequence of extreme events are basically not covered and (c) some of the precipitation-triggered impacts point in opposite directions across sub-national regions, leading to a comparatively small net effect on the national scale.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Having assessed the macroeconomic effects of climate change impacts by impact field in Chaps. 8–19, this chapter looks into the aggregate effect when all impact chains which can be assessed in terms of costs are considered jointly.

Regarding climate change impacts, Sect. 21.2 provides an overview of the so called “impact chains” considered by impact field. Moreover, there are differences both in terms of available data and modelling approach across impact fields. Section 21.2 makes these differences transparent by assessing the quality of methodology and data by impact field.

The costs of climate change for the period 2016–2045 are defined as the difference between the average annual effect in the climate change scenario (mid-range climate change and reference socioeconomic development) for the period 2016–2045 and a baseline scenario (reference socioeconomic development without climate change) for the same period. Likewise, the costs of climate change for the period 2036–2065 (a more distant future) are the average annual differences between the climate change scenario and the baseline scenario for the period 2036–2065. In Sect. 21.3, we briefly describe the underlying development of the baseline scenario in our comparative static approach (i.e. relative to the CGE model’s base year 2008).

Regarding macroeconomic results with respect to the costs of climate change, the aim of this chapter is twofold: in Sect. 21.4, we draw comparisons across impact fields; in Sect. 21.5, we are interested in the overall effect of all quantified climate impact chains in Austria up to 2030 and 2050 as well as in the sectoral distribution of this effect. For both types of comparisons, it needs to be acknowledged that the number of impact chains considered is limited and that there is a substantial difference as to how broad or narrow the coverage is across impact chains and impact fields. Finally, Sect. 21.6 discusses our key findings by comparing them to results found in the literature.

2 Sectoral Costing Methods by Impact Field

Table 21.1 provides an overview of the impact chains by impact field and characterises the applied sectoral costing method. For some impact fields like Electricity, detailed sectoral models for Austria were used to assess the impacts of climate change, both in physical units (change in yield) and in economic units (change in profit margins, in costs, in investments, in demand). For the impact field Agriculture, land use and livestock scenarios from a sectoral model were applied. In other impact fields like Tourism or Transport, regression analyses were conducted based on Austrian data (e.g. based on overnight stays, road infrastructure damages) to derive an impact function which was then used to estimate future costs and benefits. Finally, for some fields (e.g. Catastrophe Management, Human Health, Cities and Urban Green) impact functions derived in international/European studies were applied to the Austrian data. When none of these approaches were available, expert guesses were used to estimate potential climate change costs (e.g. Forestry).

As can be seen from Table 21.1, only a subset of all identified impact chains could be estimated in terms of physical impacts (see column “sectoral costing method”). Moreover, a few of these quantified impact chains could not be monetised, either because it was unclear which types of cost/benefit would arise or because there was no secondary data available (see Ecosystem Services; Human Health). We decided, therefore, to include only well founded impacts into the macroeconomic assessment from impact chains which are well understood in terms of costs instead of biasing results with results from other impact chains where this is not the case.

The remaining columns of Table 21.1 indicate the quality of the sectoral costing with respect to the method applied, the impact cost data available, and the implementation interface within the macroeconomic assessment (CGE model, see Chap. 7). Whenever the sectoral costing model is based on and has been validated in different applications before, the method is assessed as good (column “Performance of sectoral costing: method”). If, instead, impact estimates are transferred from other studies/regions, the method is fair, while the method is classified as poor when it is solely based on expert judgment. Regarding quality of impact data (see column “Performance of sectoral costing: data”), the scale good refers to data which is available for many years with broad spatial coverage, while fair is used for data which is available for selected or some years and/or for some regions only. Poor data quality is used if data is only available for other countries or at the European level. Finally, implementation in the CGE model (column “Performance of sectoral costing: implementation”) is said to be good when the derivation of cost estimates is model based (e.g. yield model, electricity dispatch model) and when there is a clear mapping of impacts into cost categories (e.g. production cost categories, demand, land/labour/capital productivity). A fair implementation is also based on a mapping of impacts into cost categories but there is some mismatch or ambiguity in this mapping, e.g. because sectoral models and accounts are not well represented in the CGE model. For that reason, impact costs were transferred to the macroeconomic model in terms of relative changes (% changes) instead of directly transferring absolute numbers. Finally, no implementation in the CGE model was undertaken when impacts could not be quantified and monetised.

The last column of Table 21.1 indicates how relevant the omission of impact chains is for the overall assessment of economic costs (i.e. the social costs including external costs). According to expert judgment of the project team which comprised 19 institutions from all relevant disciplines, most impact chains with high relevance for climate change in Austria could be assessed, except for the two impact fields Ecosystem Services and Human Health. Also a considerable amount of climate change impacts of medium importance for the economic costs are included in the assessment, while impacts with low damage potential are in general not part of the assessment. Note that extreme events are captured only poorly, firstly due to the CGE model’s characteristics themselves (see Chap. 7) and secondly due to limited data availability. One important characteristic of the CGE model is that autonomous adaptation to price changes is happening, leading to lower costs compared to an assessment with no such adjustment processes. As a consequence, the macroeconomic costs of the impact chains which are assessed in the CGE model should be understood as a lower bound estimate for average annual climate change costs and benefits for Austria.

Moreover, it is important to note that damages are assessed at the national scale. While according to the climate scenarios for 2016–2045 and 2036–2065, changes in temperature point in the same direction across Austrian NUTS3 regions and across climate scenarios, changes in precipitation do not. As a consequence, many precipitation-triggered impacts are cancelled out across Austrian regions and hence the total effect for Austria is smaller than if changes would occur in the same direction across all regions.

In interpreting the results it is also important to consider that the current macroeconomic assessment quantifies average changes in the climatic periods 2016–2045 and 2036–2065 relative to the reference period 1981–2010 (monthly, seasonal and yearly averages) but not an exceptional year such as, e.g. a year in which a once in a century flooding occurs. Thus, macroeconomic effects represent the increase in annual macroeconomic costs averaged over several years. Second, extreme events are only covered for two impact chains (riverine flooding damage to buildings and extreme event triggered road infrastructure damages—and as mentioned in terms of annual average damage), but no other extreme events could be integrated on a sufficiently robust basis.

Regarding the comparison across impact fields, it is of high importance that different sectoral costing methods and models were used to assess the direct costs. It is well understood in the literature that different types of models may lead to different magnitudes of cost estimates, especially when some of them are bottom-up models (optimizing at NUTS3 level or lower) and others are top-down (working at the overall national scale only). However, not only is the class of models significant, but also the availability of suitable data, especially for rare events with high damage potential. While in some impact fields like natural catastrophes sufficient data is available from major flooding events in the past decade, this does not hold for other damages such as black-outs in the electricity sector. Therefore, any sectoral comparison drawn across impact fields in the following section has to be interpreted with extra care.

3 Implementation of Baseline and Climate Change Impacts in the CGE Model

3.1 Baseline 2030 and 2050 Without Climate Change

The main assumptions regarding the baseline scenario until 2030 and 2050 are the following (for a more detailed description of the shared socioeconomic pathways [SSP] see Chap. 6. For impact field specific baseline assumption see the respective chapter):

-

GDP growth: According to the shared socioeconomic pathway (SSP), we assume an annual growth rate of 1.65 % until 2050. Hence, the economy in 2050 is about twice as large as in 2008. All sectors grow at the same rate.Footnote 1 Therefore the production cost structures per unit are the same in 2008 and in 2050.

-

Production cost: In the electricity sector, a change in the generation mix is assumed towards a higher share of renewables and gas which leads to higher prices for electricity (see Chap. 14 for a more detailed description of how the baseline development was modelled). In accordance with the OECD-FAO agricultural outlook (OECD-FAO 2011), international price projections for 2020 underlie the production cost changes for agricultural products in 2030 and 2050 respectively (see Chap. 8 for details).

-

Climate policy: To consider the effect of the European Emissions Trading Scheme in the single country CGE model for Austria, we introduce an exogenously given CO2 emission permit price of €26.64/t CO2 in 2030 and €41.04/t CO2 in 2050 (according to the Current Policy scenario of the World Energy Outlook 2010, IEA 2010). Only those sectors which are covered by the current EU-wide emission trading scheme are affected by climate policy and are confronted with additional production costs for the emission of CO2. These sectors are: Electricity, gas, steam and air conditioning supply (ELEC), Manufacture of coke and refined petroleum products (COKE), Manufacture of basic metals and fabricated metal products, except machinery and equipment (META), Manufacture of rubber and plastic products and other non-metallic mineral products (PLAS) as well as Manufacture of paper and paper products (PAPE).

-

Subsidies and taxation: In sectors Agriculture as well as Water Supply and Sanitation we introduce cuts in subsidies (i.e. higher production taxes) by 2030 and 2050 to reflect the projected stepwise reduction in subsidies by 2020 and beyond. For details, see Chaps. 8 and 12.

3.2 Implementation of Impact Chains Across Impact Fields

Supplementary Material Tables 21.1–21.3 (online) show the parameter values which are used in the CGE model to represent the different impact chains. All values are expressed as the difference between the climate change impact scenario and the baseline scenario (reference socio-economic development, including sector specific policies). As explained in the model description and in the respective sectoral assessments in more detail (see Chaps. 7–19), the parameters represent changes in production costs, productivity, demand, investment, and changed public expenditures.

After implementing all of the quantified impact chains (see Sect. 21.2), results on sectoral output, GDP and welfare are obtained for the two future periods 2030 (representative for the yearly effects in the period 2016–2045) and 2050 (period 2036–2065). For GDP, the effect is decomposed into a real price effect and a quantity effect. The former describes the change of GDP which can be attributed to changes in real prices between the climate change and the baseline scenario, whereas the latter describes the change of GDP which is triggered by altered activity levels (output quantities). The sum of the respective price and quantity effects yields the total effect on GDP. As price changes of consumption goods are not relevant for a change in welfare, the correct measure for welfare is the quantity effect in isolation. In contrast, for GDP and sectoral output, both the values (price and quantity changes) and the contribution of prices and quantities to this total effect will be discussed.

4 Macroeconomic Effects of Climate Change: Comparison Across Impact Fields

The aim of this section is to compare the total macroeconomic effects triggered by climate change impacts in the different impact fields (see Table 21.1 for the list of the impact fields). Note that an impact field may subsume different economic sectors (e.g. impact field Tourism subsumes parts of the sectors Accommodation, Travel Agencies, Entertainment, Cultural Activities and Sports). An impact field is therefore not the same as an economic sector.

In this section, we compare across impact fields which direct and indirect effects are triggered by those impact chains that could be quantified and modelled in total in each impact field. Moreover, we analyze how these effects contribute to the total effect when all impact chains across impact fields are active simultaneously.

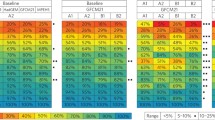

4.1 GDP and Welfare Effects Across Impact Fields and in Total

Figures 21.1 and 21.2 give an overview of the effects on GDP as well as on consumption and welfare which are shown for each of the impact fields’ single model runs as well as for the combined model run “all” (see Chaps. 8–19 for detailed explanations of the macroeconomic effects triggered by climate change in each impact field in isolation).Footnote 2 All effects are average annual effects when comparing the climate change scenario (mid-range climate change and reference socioeconomic development) to the baseline scenario (reference socioeconomic development) in the two periods under consideration: Year 2030 represents the annual average effect for period 2016–2045 whereas 2050 represents 2036–2065.Footnote 3

Average annual GDP effects of mid-range climate change (relative to baseline with reference socioeconomic development) by impact field and in total (2030 = period 2016–2045; 2050 = period 2036–2065). Impact fields: Agriculture (agr), Forestry (for), Water (wat), Electricity (ele), Buildings: Heating and Cooling (h&c), Transport (trn), Manufacturing and Trade (m&t), Cities and Urban Green (cug), Catastrophe Management (cam), Tourism (tsm), All impact fields (all). Note: For description of quantified impact chains by impact field, see Table 21.1

Average annual consumption effects (price + quantity effect) and welfare effects (quantity effect) of mid-range climate change (relative to baseline with reference socioeconomic development) by impact field and in total (2030 = period 2016–2045; 2050 = period 2036–2065) Impact fields: Agriculture (agr), Forestry (for), Water (wat), Electricity (ele), Buildings: Heating and Cooling (h&c), Transport (trn), Manufacturing and Trade (m&t), Cities and Urban Green (cug), Catastrophe Management (cam),Tourism (tsm), All impact fields (all). Note: For description of quantified impact chains by impact field, see Table 21.1

Before comparing the effects triggered in different impact fields, it is important to note that in many cases only some of the qualitatively identified climate impact chains have been quantified and therefore the comparability between impact fields is limited (see Sect. 21.3 above for details).

In general the effects in 2050 are stronger than in 2030 and in most of the cases the quantity effect dominates the results. Comparing results across impact fields, there are only two impact fields for which climate change triggers positive effects on GDP. Those are Agriculture (agr) with relatively large positive macroeconomic effects (due to higher productivity) as well as Buildings: Heating and Cooling (h&c) with much smaller positive effects. Regarding the impact field Agriculture (agr), the positive effect of about +280 million euros in 2030 and +500 million euros in 2050 is due to increased productivity which increases value added (and thus the contribution to GDP) but the effect on GDP originating from quantity effects only is either slightly positive (in 2030) or negative (in 2050). This positive macroeconomic effect via higher prices is mainly due to productivity gains in the agricultural sector which implies that households have lower expenditures on food and thus are able to expand their consumption for other goods and services which therefore become more expensive. As a consequence, the value of overall output increases due to higher agricultural productivity. Note, however, that many impacts with eventually negative consequences for the impact field Agriculture have not been quantified (see Chap. 8 for details). The effect in h&c (+20 million euros in 2030 and +40 million euros in 2050) is mostly attributable to quantity effects.

The strongest negative GDP effects are caused by climate change impacts in the impact fields Electricity (ele), Forestry (for) and Tourism (tsm). In each of the three cases, price and quantity effects are both negative, but the price effect plays a minor role. For impacts in ele the effect on GDP is −170 million euros in 2030 and with −470 million euros much stronger in 2050. The effect on GDP of climate impacts in Forestry is about −270 million euros in 2030 and −460 million euros in 2050. Regarding climate change impacts in Tourism, the effect on average annual GDP is −100 million euros in 2030 and −340 million euros in 2050.

For the remaining fields Water, Transport, Manufacturing and Trade and Cities and Urban Green, it is important to stress that the comparatively small macroeconomic effects are due to the incomplete coverage of impact chains in these fields because direct costs of many relevant impacts are not available. So the low numbers reflect the uncertainty involved, and not that impacts triggered in these fields might not lead to significant macroeconomic effects as well. For more details see Sect. 21.6.

When combining all of the quantified impact chains in one model run (see the bars labelled all in Fig. 21.1), the quantity effect on GDP is negative, but it is compensated for partly by positive price effects, which are mainly attributable to the impacts chains of Agriculture. The effect resulting from the combination of all impact fields is a lower GDP by 330 million euros (−0.08 %) per year in 2030 whereas it is 830 million euros lower (−0.15 %) in 2050.

Regarding the effects on consumption and welfare,Footnote 4 Fig. 21.2 gives an overview. In general the overall effect on consumption is larger than the effect on GDP. While investigating consumption effects, we differentiate again between price and quantity effect, where the latter offers one possible way to measure the actual effect on welfare. Across impact fields the direction of effects are similar to those of GDP. Concerning consumption and welfare there are two impact fields with positive effects due to climate change, namely Agriculture and Buildings: Heating and Cooling. The largest negative consumption and welfare changes emerge for the impact chains of Catastrophe Management, Electricity, Forestry, and Tourism. When combining all quantified impact chains into one model run, the effect on welfare is strongly negative: Due to climate change, average annual welfare is lower by 1 billion euros in 2030 (−0.33 %) and by 2 billion euros in 2050 (−0.48)%.

In Fig. 21.3 annual GDP and welfare effects for 2030 and 2050 are decomposed by impact field; the net effect is indicated by a black square, respectively. While the direction of effects on GDP and welfare is the same for each impact field, the different impact fields contribute differently in strength to the total GDP and the total welfare effect (i.e. when all fields are considered jointly). On the one hand, the effect triggered by impacts in Agriculture leads to smaller welfare than GDP effect, as agricultural productivity increase sets consumer budget free to demand other products and thus prices rise, which shifts GDP more strongly than welfare. The effects stemming from Electricity as well as Catastrophe Management have a stronger negative effect on welfare than on GDP (e.g. rebuilding the damages after floods raises GDP while only restoring the earlier welfare level). Taking these positive and negative deviations together, the total welfare effect (i.e. when all impact fields are considered jointly) is substantially stronger than the effect on GDP (see net effect in Fig. 21.3).

Decomposition of annual GDP (based on quantity and price changes) and welfare effects (based on quantities) of climate change (relative to baseline with reference socioeconomic development) by impact field and in total (2030 = period 2016–2045; 2050 = period 2036–2065). Impact fields: Agriculture (agr), Forestry (for), Buildings: Heating and Cooling (h&c), Electricity (ele), Tourism (tsm), Catastrophe Management (cam) and rest: Water (wat), Transport (trn), Manufacturing and Trade (m&t), Cities and Urban Green (cug). Note: For description of quantified impact chains by impact field, see Table 21.1

5 Macroeconomic Effects of Climate Change: The Overall Effect of all Quantified Impact Chains

While the focus of Sect. 21.4 was the comparison across impact fields, we now focus on all quantified impact chains in total and investigate the direct and indirect effects of them across the 40 sectors of our CGE model.

5.1 Macroeconomic Effects of all Quantified Impact Chains in Total

Table 21.2 gives an overview of the macroeconomic feedback effects across economic sectors which emerge when all quantified impact chains of all impact fields are implemented in the model (scenario ALL). All effects are again given as average changes of annual values in million euros (M€) relative to the baseline scenario without climate change but with reference socioeconomic development.

Regarding sectoral effects, we look at gross value added in order to classify if a sector is “gaining” or “losing”. Furthermore gross output value is given in Table 21.2 (i.e. sectoral output quantity valued at its market price). By subtracting sectoral intermediate demand from gross output value we obtain sectoral gross value added, which in turn is the contribution to GDP. The sectoral effect on value added therefore shows how the contribution to GDP changes by sector.

In terms of value added but also gross output value, there is one major sectoral winner, the construction sector. This is due to required investments for reconstructing climate change triggered damages to protective forest (impact field Forestry) and investment into additional electricity generation capacity (impact field Electricity).Footnote 5 Therefore sectoral gross value added of the construction sector rises by about +150 million euros in 2030 and by +250 million euros in 2050. In terms of gross value added (i.e. sectoral contribution to GDP), there are also positive effects for Agriculture and Food products due to higher agricultural productivity as well as for Trade and Repair of Motor Vehicles, reflecting the damages to privately owned cars originating from impact field Catastrophe Management (cam).

Regarding the sectoral losers we see that the public and private service sectors are negatively affected due to climate change impacts (due to higher public sector expenditures on Catastrophe Management as well as lower net income by households), as well as the energy sector (especially Electricity), and Accommodation (due to impacts on Tourism).

Summing up the effects on gross value added for all sectors gives the effect on GDPFootnote 6 which is −300 million euros in 2030 and −800 euros in 2050, leading to a lower economic growth rate by −0.08 %-points p.a. in 2030 and by −0.15 %-points in 2050. By looking at sectoral value added we see that positive and negative effects cancel each other out partly. Whereas the losing sectors lower GDP by about −500 million euros in 2030 (−1,100 million euros in 2050) the gaining sectors dampen this effect as they contribute more to GDP in the climate change scenario by about +190 million euros (+320 million euros in 2050). It is important to note that the effect on welfare is three to four times stronger than the effect on GDP (−0.33 % in 2030 and −0.48 % in 2050) as we correct for climate change induced “forced” consumption which does not enhance welfare (but GDP).

To investigate whether a sector is growing stronger or weaker or is even shrinking due to climate change (relative to the baseline), the effects on gross output value are less helpful as price effects may cancel out quantity effects. Hence, we are now interested in the effects on sectoral output quantities in isolation (no price effects included) which corresponds to sectoral activity. Figure 21.4 gives the sectoral changes in output decomposed into quantity and price effect in M€ for selected sectors.Footnote 7 Sectors CONT (Construction), AGRI (Agriculture), MOTO (Trade and Repair of Motor Vehicles) and FOOD (Food Products) expand their output in quantities and thus grow, whereas all other economic sectors shrink. The output increase in Construction is the result of additional investment necessary due to climate change, such as for catastrophe management, electricity supply but also for water and transport infrastructure. The top “losers” in terms of output quantity are ELEC (Energy including Electricity), ACCO (Accommodation), RSER (Rest of Services), TRAD (Trade), PUBL (Public Services), HEAL (Health), REAL (Real Estate) and FORE (Forestry). In general the effects are stronger in 2050 than in 2030 with a total effect of −1.0 billion euros in 2030 and −2.3 billion euros in 2050.

Average annual effect of all quantified impact chains on output (quantity and price effects) by sector compared to the baseline (2030 = period 2016–2045; 2050 = period 2036–2065). Note: For description of quantified impact chains by impact field, see Table 21.1

5.2 Effects on Public Budget

The effects of the quantified climate change impact chains on public budgets is depicted in Table 21.3. Starting with revenues, we see that climate change reduces the annual average budget by 230 million euros in 2030 (period 2016–2045) and by 500 million euros in 2050 (period 2036–2065). This is mainly attributable to lower labour tax revenues as unemployment increases. Next to that, lower production taxes (originating from lower economic activity and higher subsidies to Forestry and Water to deal with climate change impacts) as well as lower value added tax (originating from less consumption) contribute strongly to the negative effect on tax revenues. As annual revenues are lower in the climate change scenario, annual expenditures have to be lower by the same amount (by assumption public deficit does not increase and therefore expenditures have to adjust to revenues). However, government spending has to increase to cover higher unemployment benefits but also to finance needs for the impact fields Cities and Urban Green (cug) and Catastrophe Management (cam). Hence, to balance expenditures and revenues, transfers to private households are cut by 400 million euros in 2030 and by 820 million euros in 2050.

Summing up, the average annual public budget decreases due to climate change by 0.15 % in 2030 and by 0.24 % in 2050. This amount is equivalent to 1.2 % (1.8 %) of capital tax revenues in 2030 (2050) or equivalent to 0.8 % (1.2 %) of value added tax revenue and could therefore also be compensated for by raising tax rates in that order of magnitude.

It is a strong assumption in the macroeconomic model that government consumption expenditure is not allowed to change due to climate change (except for the effect originating in cug and cam) but that it is fixed. In the model this constraint is satisfied by a change of transfers to private households. Hence, whenever the government were confronted with higher (lower) consumption expenditures, transfers would be cut (raised).

In a separate model run, this constraint was lifted, to check whether the obtained results are robust when government consumption is flexible. It turns out that the effects on average annual GDP are stronger in that case (−0.12 % in 2030 and −0.19 % in 2050) as shown in Fig. 21.5. With flexible government consumption, the government is confronted with less revenue and is therefore forced to cut public consumption expenditures. As the typical government consumption goods and services are characterised by a relatively high labour intensity, the cut in government consumption leads to lower employment which in turn leads to lower labour tax income which feeds back to lower government consumption (a positive feedback loop emerges). Regarding sectoral activity effects, the sectors PUBL (Public administration and defence; compulsory social security) and HEAL (Health, social and residential care activities) are under the top losers in that case (compare Figs. 21.4 to 21.5). The detailed effects on government expenditures and revenues under flexible government consumption are given in the Supplementary Material Table 21.1.

6 Non-monetised Impact Chains and Model Limitations

The results presented reflect the damage to the Austrian economy triggered only by those impact chains which were quantified (and monetised) within the COIN project. Therefore it is important to be aware of the most important non-monetised impact chains and also of the limitations of the macroeconomic model (see also Chap. 7). First there are two impact fields where no monetization was carried out within the macroeconomic framework, namely Ecosystem Services as well as Human Health. Nevertheless those two impact fields are highly important for the agricultural sector (due to e.g. changes in pollination and pest control) and for the health sector (due to e.g. higher hospitalisation).

Second, within the remaining ten further impact fields a number of impact chains were not quantified. To give some examples: In Agriculture (sub-daily) heavy precipitation and hail events were not quantified. In the impact field Water, the decrease in precipitation in the vegetation period (water supply) as well as the increase in receiving water temperature (water sanitation) was not quantified. Regarding Buildings (heating and cooling), higher temperature levels in buildings and lower comfort of occupants due to higher temperature in summer could not be quantified. In the impact field Electricity, the change in supply and demand profiles and the change in reliability of electricity supply and change in probability of blackouts were excluded from the assessment (no natural hazards were included). In the impact field Transport, impacts of changes in precipitation were only considered for road infrastructure, but not for transport services nor for other transport modes nor for other climate change impact categories such as storm. In Manufacturing and Trade damages to infrastructure like office buildings or plants as well as delivery problems along the supply chain were not quantified. Regarding Cities and Urban Green loss of comfort in urban environments was excluded. In impact field Catastrophe Management, damages from storm events were not quantified. Finally, in impact field Tourism the change in the tourism sector’s water and energy demand as well as business interruptions due to natural catastrophes were not quantified. For further information of neglected impact chains see Table 21.1.

Regarding extreme events, these are only poorly captured in both the sectoral models but also by the type of macroeconomic model (CGE) which is based on average annual numbers for climatic periods 2016–2045 and 2036–2065. Regarding average changes in extreme events, those are captured in the impact fields Catastrophe Management (floods, but no storms), Water and Transport. Thus, all effects need to be understood as higher costs which occur for an average year in the respective period in case of climate change in Austria compared to a (hypothetical) situation without climate change.

In addition to those impact chains mentioned as neglected in quantification, some important limitations emerge from the macroeconomic model itself. One crucial point is that autonomous adaptation of sectors, households and the government is implicitly allowed for, as agents adjust perfectly to price changes triggered by climate change. This may understate the results compared to a model environment with less flexibility. Another drawback of the CGE model is that even for goods with regulated or globally-given prices (such as water or agricultural goods), prices are adjusting endogenously subject to normal free market interactions, which does not depict reality very well.

Finally, it is important to stress that we are investigating climate change in Austria. All effects which might emerge from climate change elsewhere, but which might e.g. lead to changes in agricultural prices on international markets with significant repercussions for Austrian agriculture, or a shift in tourism destinations with eventual consequences for Austrian tourism, but also migration from other world regions due to more severe climate change impacts there, are neglected.

7 Discussion and Conclusions

The main finding of this chapter is that the modelled impact chains add up to a total macroeconomic effect on GDP of −0.1 %-points per year on average for the period 2016–2045 and −0.2 %-points in 2036–2065 when comparing the climate change scenario to the baseline scenario without climate change. The effect on welfare is stronger in both periods (−0.3 %-points and −0.5 %-points), as welfare is corrected for climate change induced forced consumption which is not welfare enhancing. When only looking at output quantities and hence neglecting (mostly positive) price effects, the effect is slightly stronger. For welfare, effects are similar to GDP effects in direction but stronger in total (when all impact chains are considered jointly), and additionally they differ in magnitude by impact field.

The negative GDP and welfare effects are the result of the net effect of negative effects from climate change impacts originating in Electricity, Forestry, Tourism and Catastrophe Management on the one hand and positive effects on the other from climate change impacts originating in Agriculture (due to higher productivity) and Buildings: Heating and Cooling (due to reduced heating which more than compensates for higher demand for cooling). The contribution of the remaining considered impact fields (Manufacturing and Trade, Cities and Urban Green, Water, Transport) to the total GDP and welfare effect are much smaller but also negative.

The modest negative effect of all modelled impact chains is in line with most of the findings of the European cost assessments such as the FP6/7 projects ADAM (Aaheim et al. 2012) and PESETA (Ciscar et al. 2011, 2012), which find negative costs of climate change for the coastal areas of Southern Europe and positive consequences for northern Europe, with central Europe falling in between and thus having weak effects. Higher damage costs are found by the the ClimateCost project (Watkiss 2011) which—contrary to our analysis here—also includes health effects. This estimate is also summarised in European Commission’s climate impact assessment accompanying the adaptation strategy (EC 2013) and the EEA’s assessment (EEA 2012).

Even though our model based assessment has a broader coverage of impact chains and a broader coverage of impact fields (sectors) compared to the international studies, many effects which emerge by region or sector are cancelled out at the national scale. While we cannot investigate the regional difference in our macroeconomic analysis due to our national scale CGE approach, we can look into the sectoral effects. Here strongest positive effects emerge for the construction sector (due to higher investments), with negative effects on output values and value added for most other sectors. Strongest negative effects (in terms of value added by sector) emerge for public health and other service sectors as well as for the sectors accommodation, electricity, trade and real estate activities.

Finally, effects on public budgets are confined on the one hand by direct public expenditures to compensate for direct damages and on the other hand by higher expenditures for unemployment benefits, which are partly offset by cuts in other transfers to households.

It is important to note that the modest effect of all modelled impact chains has to be viewed with caution as there are several major limitations. First, the type of model used for the assessment (a computable general equilibrium model) allows endogenously for autonomous adaptation, leading to lower costs compared to an assessment which does not allow for such an adjustment. Second, extreme events are captured only poorly in the model environment. Third, many qualitatively identified impact chains were not quantified and not monetised. Fourth, climate change is assumed to occur in Austria; potential climate change impacts on other world regions are ignored. But these effects will work via international markets and could be highly relevant for a small open economy like Austria’s.

Notes

- 1.

Future economic and technological development is subject to high uncertainties. Nevertheless for the construction of the baseline scenario, assumptions concerning economic growth and technological development were necessary. We therefore applied the strong but also cautious assumption of homogenous growth across all economic sectors.

- 2.

A sensitivity analysis was performed regarding the interaction of different impact fields. When running the model for each impact field separately and summing up the effects on GDP, we obtained a very similar result as in the combined model run. Therefore the decomposition by impact field can be carried out by taking the shares of the separate model runs.

- 3.

Climate impact enhancing and climate impact diminishing socioeconomic development were defined differently for each impact field and also low range and high range climatic change were used only for the key climate parameter in each impact field. As a consequence, a joint macroeconomic analysis of these various specifications across impact fields is not possible.

- 4.

In this case we use the so-called “Hicksian equivalent variation”. In this sense welfare can be interpreted as the amount of money that is needed to be added to (or subtracted from) the household’s benchmark income in order to keep its utility at the same level as in the benchmark.

- 5.

Repair of roads and required additional investment in the water sector were also implemented but contribute much less to cost increases.

- 6.

Note that the sum of all sectoral effects on value added has to be corrected by indirect taxes and subsidies to obtain the actual effect on GDP.

- 7.

All winning sectors as well as all losing sectors with losses larger than 100 million euros in 2050 are shown separately.

References

Aaheim A, Amundsen H, Dokken T, Wei T (2012) Impacts and adaptation to climate change in European economies. Glob Environ Change 22(4):959–968

Ciscar J-C, Iglesias A, Feyen L, Szabó L, Van Regemorter D, Amelung B, Nicholls R, Watkiss P, Christensen OB, Dankers R, Garrote L, Goodess CM, Hunt A, Moreno A, Richards J, Soria A (2011) Physical and economic consequences of climate change in Europe. Proc Natl Acad Sci U S A 108(7):2678–2683

Ciscar J-C, Szabó L, van Regemorter D, Soria A (2012) The integration of PESETA sectoral economic impacts into the GEM-E3 Europe model: methodology and results. Clim Change 112(1):127–142

EC (2013) Commission staff working document. Impact assessment: Part 2 accompanying document to the communication from the commission to the European parliament, the council, the European Economic and Social Committee and the Committee of the Regions, an EU strategy on adaptation to climate change, SWD(2013) 132 final

EEA (2012) Climate change, impacts and vulnerability in Europe 2012. An indicator-based report. EEA Report No 12/2012

IEA (2010) World energy outlook 2010. International Energy Agency, Paris

OECD-FAO (2011) World agricultural outlook 2011. OECD/FAO, Rome

Watkiss P (ed) (2011) The ClimateCost project. Final report, vol 1: Europe. Stockholm Environment Institute, Stockholm

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Bachner, G., Bednar-Friedl, B., Nabernegg, S., Steininger, K.W. (2015). Macroeconomic Evaluation of Climate Change in Austria: A Comparison Across Impact Fields and Total Effects. In: Steininger, K., König, M., Bednar-Friedl, B., Kranzl, L., Loibl, W., Prettenthaler, F. (eds) Economic Evaluation of Climate Change Impacts. Springer Climate. Springer, Cham. https://doi.org/10.1007/978-3-319-12457-5_21

Download citation

DOI: https://doi.org/10.1007/978-3-319-12457-5_21

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-12456-8

Online ISBN: 978-3-319-12457-5

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)