Abstract

The present comparative study is based on a survey conducted among the venture capital professionals of three major European countries, namely Germany, France, and the United Kingdom. It contributes to ongoing research on venture capital practices by linking theories on return expectations and perception biases to the European venture capital context.

Confirming prior empirical findings, our results highlight the important overconfidence biases prevalent in European venture capital, with almost 70 % of the respondents expecting their fund to do better than the average fund during the best venture capital vintage period to date.

Whilst this study does not determine whether the underlying causes of such biases differ from a country to another, it does show that unlike one might expect, cross-country differences in the venture capitalists’ perception biases are surprisingly negligible. Whether this finding suggests that venture capital policies should be coordinated, if not conducted, at a European level remains to be clarified however, for the causes for such biases remain unclear and may vary from a country to another.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

2.1 Introduction

In 2008, Medjad et al. conducted a study among French venture capitalists and entrepreneurs. They presented the study’s participants with a hypothetical seed/early stage venture capital fund and asked them to indicate their best estimate of the future financial performance of the fund. Their research findings strongly suggested that both French entrepreneurs and venture capitalists had a performance perception that was “disconnected from reality” (Medjad et al. 2011).

The results notably revealed the respondents’ tendency “to overestimate the notion of success and to underestimate that of failure.” Whilst acknowledging the limited scope of their study (it included a sample of only 22 venture capitalists and 30 entrepreneurs in France), Medjad et al. were determined to further investigate this puzzling perception bias. They suggested extending the research to other European countries so as to explore if, and to what extent, this perception bias was a European bias that called for a European response.

This is the purpose of this study. Using the same methodology, it expands the geographical scope of this research to Germany and the United Kingdom and contributes to the existing venture capital literature in two areas, namely perception biases and country-based cultural differences (Venkataraman 1997).

A growing body of research supports the idea that investors are prone to perception biases and irrational decision-making (De Bondt and Thaler 1994; Barber and Odean 2011; Coval and Moskowitz 1999; Hong et al. 2005), notably overconfidence (Zacharakis and Shepherd 2001).

In contrast, financial decision-making biases are seldom addressed from a comparative point of view. Existing studies mostly examine cognitive biases in the context of a single country, but to the best of our knowledge, no other study to date has directly researched cross-country differences in venture capitalists’ perception biases. This is a remarkable gap given that cross-country differences in venture capital markets are a rather well-documented and researched concept (Palacin 2008).

2.2 Cross-Country Differences in Venture Capital

2.2.1 Background

2.2.1.1 The Operation of a Typical Venture Capital Fund

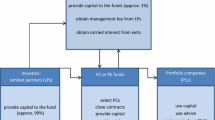

If the venture capitalists chose their investments wisely and are able to achieve successful exits, the returns are split between General Partners and Limited Partners. In a typical arrangement, the Limited Partners receive 99 % of all the proceeds until their initial capital investment has been fully repaidFootnote 1 – with the remaining 1 % going to General Partners.

Once this threshold is passed, the splits go 20 % to the General Partners and 80 % to the Limited Partners.Footnote 2 The 20 % distributed to venture capitalists after the hurdle rate has been passed, are called “carried interest.” This compensation scheme is generally thought to align the interests of the General Partners and the Limited Partners (Levin and Rocap 2013).

Additionally, venture capitalists receive a periodicFootnote 3 payment called the “management fee” calculated as a percentage of assets under management. The management fees typically range from 1 % to 2.5 % (Levin and Rocap 2013) and are meant to cover the venture capital firm’s administrative, deal sourcing and legal costs (CalPERS 2014).

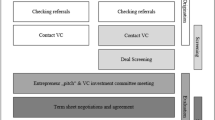

The operation of a venture capital fund

2.2.1.2 The Heterogeneity of Venture Capitalism

Even though US-style venture capitalism has spread to countries all over the world in the last decades and the number of international venture capital transactions has seen sharp increases (Aizenman and Kendall 2008), venture capital markets remain surprisingly local in many aspects.

In recent years, the idiosyncrasies and commonalities of different national venture capital markets increasingly attracted scientific interest. Indeed, a growing body of research now documents cross-country differences in venture capital markets. The institutional, legal and cultural environments as well as corporate governance systems are thought to notably influence the conduct of business (Groh et al. 2012).

The differences start with venture capital funds’ organizational forms. In Anglo-Saxon countries, VC firms are mainly organized as limited partnerships, whereas in France and Germany they have different organizational structures with – traditionally – far more involvement of banks (Jeng and Wells 2000). Similarly, the provenance of the funding differs dramatically by country. In Anglo-Saxon countries, a much larger fraction of funds has historically been provided by pension funds (Jeng and Wells 2000; EVCA 2012).

Furthermore, important differences in management styles of General Partners in various countries have been documented. Jeng and Wells (2000) find that General Partners in Germany and Japan are not as actively involved in managing their investments as they are in the US.

There also appear to be important country-level differences in venture capital firm’s investment behavior: empirical evidence suggests that Anglo-Saxon venture capitalists have a preference for convertible preferred equity securities, whereas venture capitalists from other countries prefer a variety of other instruments (Cumming 2008; Hege et al. 2003; Kaplan et al. 2007; Lerner and Schoar 2005).

Additionally, Schwienbacher (2004) finds important differences in syndicate size in US and European venture capital investments.

Finally, Stolpe (2003) argues that venture capital firms in the US usually focus on narrow fields of technology whereas European venture capitalists have a broader investment focus and a more opportunistic investment behavior.

Clearly, venture capital markets around the world are less homogeneous than one might expect. Many potential causes for differences in country-level VC behaviors and attitudes have been brought forward. For example, Hege et al. (2003) suggest that many country-level idiosyncrasies can be explained by the different stages of maturity of venture capital financing (i.e., venture capitalists behave differently in more mature venture capital markets than they do in less mature markets). Cumming et al. (2010) advance that cross-country differences in legality (such as legal origin and accounting standards) significantly influence the governance structure of venture capital investments.

2.2.2 The Relevant Markets

Below is a brief overview over select national venture capital markets. We first focus on the US venture capital market, for it is the most mature and by far largest venture capital market of the world. We then zoom in on the European venture capital markets covered by our survey, namely in France, Germany, and the United Kingdom.

These countries have been selected because they have significant similarities between them (thus allowing for direct comparisons) and at the same time present sufficient heterogeneity to create interesting opportunities for research.

2.2.2.1 Venture Capital in the United States of America

The United States are the World’s most mature and largest venture capital market. With total venture capital investments of $21.7bn, 3,826 deals and over $19bn raised by 202 funds in 2012, this highly competitive market has historically outperformed all others. Indeed, a report by the French Venture Capital and Private Equity association, AFIC, finds that US venture capital has historically outperformed European Venture capital by an average of 13.4 %Footnote 4 (AFIC 2013). In recent years, the performance gap between European and US VCs had narrowed but the US venture capital industry is still more profitableFootnote 5 (EVCA 2012). In their report on the profitability of venture capital investment in Europe and the United States, Rosa and Raade (2006) also find that US venture capital funds return cash sooner than their European counterparts, indicating that their returns are not only higher, but also are realized faster.

A particularity of the US venture capital market is the importance of institutional investors. Bottazzi and Da Rin (2002) note that institutional investors (such as pension funds) are by far the largest contributor to venture capital funds in the US whereas they account for much lower fractions of committed capital in other countries. It has been argued that the stability of the share of institutional investing in the US can be seen as a sign of the market’s maturity (Bottazzi and Da Rin 2002).

2.2.2.2 Venture Capital in Europe

With regards to its venture capital industry, Europe has been considered as an emerging market until recently (Hege et al. 2003). The €3.2bn invested by Venture capital firms in Europe in 2012 still seem minuscule compared to the €19.8bnFootnote 6 invested in the United States (EVCA 2013; NVCA 2013).

The small size of the European venture capital market may be explained by its underperformance: unsatisfactory risk-reward ratios are often cited as the main reason for practitioners’ hesitation to enter early-stage financing (Hege et al. 2003). Groh et al. (2012) argue that the tendency for European venture capital activity to lag other countries and regions is the result of shortcomings in a number of areas such as economic activity, entrepreneurial culture, depth of a capital market, taxation, investor protection and corporate governance, and the human and social environment.

Given the lack of private and institutional investment in early stage companies, European governments have become increasingly involved. The EVCA, the European Venture Capital Association, notes that government agencies contributed 40 % of capital fundraising in 2012 – making them the biggest VC contributors for the fourth consecutive year (EVCA 2012).

However, European venture capital markets are far from homogeneous, not only in terms of capital intensity but also in terms of sophistication, the United Kingdom being often cited as the most advanced of the European markets (Groh et al. 2008, 2012).

2.2.2.3 France

The foundation of venture capital in France was laid in the 1950s, when the French government created a network of local development agencies (Sociétés de Développement Régional) whose aim was to collect local savings and invest them in local small and medium-sized enterprises.

Today, France counts among the biggest European markets for venture capital. In 2012, it placed third in Europe, raising €721 million for 202 deals (Rooney 2013). The French market is thought to offer a strong and sophisticated framework for VC transactions as well as a consistent deal flow of high-quality, technology projects (Groh et al. 2012).

Nonetheless, France’s venture capital firms have on average underperformed stock markets. With an average IRR of −0.9 %, France’s VC returns lag far behind those of the UK or the US (AFIC 2013).

France ranks only 14th in the Global VCPE Country Attractiveness Index. In specific, venture capitalists and entrepreneurs bemoan France’s rigid and inflexible labor practices, unfavorable legislations for investors, less developed stock markets and culture of risk avoidance.

2.2.2.4 Germany

Like France, Germany has a long tradition of government support for the business sector that dates back to the post-World War II programs dedicated to rebuilding the German industry (Harrison 1990).

Today, Germany is Europe’s second largest Venture capital market after the UK according to Dow Jones VentureSource. In 2012, German venture capital firms raised €822 millionFootnote 7 for 189 deals (Rooney 2013). Bank-dependent and public venture capitalists still have an exceptionally large market share in Germany (Tykvová 2004). Market development is hampered by a culture of risk-avoidance (Jeng and Wells 2000) as well as bureaucratic hurdles to new company creations.

Moreover, German venture capital firms have underperformed in recent years: with an IRR of −1.7 % in 2012, Germany does even worse than its European neighbors (AFIC 2013). Nonetheless, as Western Europe’s most populated country and leading economy, Germany holds many promises for the venture capital industry.

2.2.2.5 United Kingdom

As a reaction to a small firm finance gap, a venture capital industry consisting of both public and private sector initiatives emerged in the UK in the early 1960s (Mason and Harrison 1991).

In 1980, a junior stock market (the Unlisted Securities Market) was created in London. Simultaneously, the government shifted its emphasis to tax-based incentives, starting with the Business Expansion Scheme (Pierrakis and Mason 2008). These measures were highly successful and the industry expanded rapidly: the number of venture capital funds in the UK grew from less than 30 in 1979 to over 150 in 1988. The investments grew even faster: from £20 million in 1979 to over £1 billion in 1988 (Mason and Harrison 1991).

Furthermore, the UK benefits from its shared culture and tight relationship with the US: practitioners report that American investors contribute an important part of the venture capital invested in the UK (Mance 2013).

Nowadays, the UK is the largest and most sophisticated European market for venture capital with €1.4 billion raised for 295 deals in 2012 (Rooney 2013). In the Global VCPE Country Attractiveness Index, the UK ranks second only to the US (Groh et al. 2012). In particular, London and Southern England are thought to have significant potential for start-up investments (Marston et al. 2013). The trade association BVCA reports that 2002-vintage venture funds delivered IRRs of 3.6 % (BVCA 2013). The UK venture capital industry thus did rather well in comparison to its European neighbors.

2.3 The Survey: Data and Methods

2.3.1 Sample

An online, multi-national study entitled “Venture Capital Performance Survey” was conducted amongst venture capital professionals with registered offices in France, Germany and the United Kingdom.Footnote 8

In line with the survey conducted in France by Medjad et al., only venture capital professionals working for funds involved in seed and early stage financing have been contacted. The sample includes a highly diverse group of venture capital professionals of all ages and backgrounds working for funds with a large range of different sectorial foci.

The survey sample data is broken down in the chart below:

Country | Number of invitations sent | Completed surveys (valid) | Response rate |

|---|---|---|---|

Germany | 276 | 31 | 11.2 % |

France | 166 | 39 | 23.5 % |

UK | 197 | 23 | 11.7 % |

Total | 639 | 93 | 14.5 % |

The response rate achieved is considerably better than the “10–12 % typical for mailed survey to top executives” (Hambrick et al. 1993, p. 407) and it fares at a level that is generally considered appropriate by the standards of cross-national research (Harzing 1999).

2.3.2 Survey Questionnaire: Construction and Description

Except for a few minor formal changes, the survey was based on a tri-lingual version in English, German and French of the questionnaire used by Medjad et al. in their survey of the French venture capital market. Accordingly, survey participants were presented with a hypothetical fund. The original text, as submitted to the survey participants, is shown below:

Assume you are a manager of a venture capital fund.

-

This fund is operated according to standard practices in terms of management fees and bonuses.

-

You have $32 million, net of management fees , to invest in start-up companies (venture capital stage).

-

The duration of the fund is 10 years , and the $32 million are invested during the first 4 years of operation.

On average, the fund:

-

Has to review 100 business plans to make 1 investment (this ratio is consistent with standard practices).

-

Invests $1.6 million per company in a total of 20 companies .

-

Owns each company’s stocks for a 6 years period ( holding period ).

You make two kinds of investments:

-

In “standard” companies , with standard risk and return on investment.

-

In “outstanding” companies with high risk and high return on investment.

The return on investment is expressed as a money-multiple of the initial investment, e.g.

-

“0” means that your investment resulted in a full loss,

-

“2” means that your initial investment is doubled … etc.

After having asked the respondents to assess the number of “outstanding” and “standard” deals per year (out of a total of 20 deals), the survey went on to ask the respondents to predict the exit multiples probabilities of these deals. The exact formulation was as follows:

Please, indicate below your estimate of the likely performance of a “standard” deal and of an “outstanding” deal.

-

1.

“Standard” Investment

Please indicate the probability of the financial outcome for a “standard” deal (total = 100 %). The first line indicates the probability leading to a money-multiple of 20. The last line indicates the probability leading to a net loss (zero-multiple).

20 | … | % |

10 | … | % |

5 | … | % |

2 | … | % |

1 | … | % |

0.5 | … | % |

0 | … | % |

Total | 100 | % |

The total sum of probabilities for this question had to add up to 100 %. The exact same exercise was repeated for the venture capitalists’ “outstanding” investments.

2.4 Results

The table below summarizes the money multiple (TVPI, or “Total Value To Paid-in Ratio”) and IRR return expectations for Germany, France and the United Kingdom.

Summary of descriptive statistics

Summary Statistics for … | Germany | France | UK | Average |

|---|---|---|---|---|

Proceeds from “standard” deals (M$) | 53.4 | 54.9 | 36.1 | 49.7 |

Proceeds from “outstanding” deals (M$) | 40.1 | 29.2 | 64.8 | 41.4 |

Total proceeds (M$) | 93.5 | 84.0 | 101.0 | 91.1 |

Net gain on investment (M$) | 53.5 | 44.0 | 61.0 | 51.1 |

Return on investment (%) | 15.2 % | 13.2 % | 16.7 % | 14.7 % |

TVPI (money multiple) | 2.3 | 2.1 | 2.5 | 2.3 |

Standard deviation of TVPI | 0.9 | 0.9 | 1.1 | 1.0 |

Standard deviation of return (%) | 6.0 % | 5.9 % | 6.9 % | 6.3 % |

Marginal return/Marginal risk | 5.0 | 6.0 | 6.8 | 5.8 |

We observe differences in expected portfolio returns, with venture capitalists from the United Kingdom expressing the highest average expected IRR (16.7 %), followed by Germany (15.2 %) and France (13.2 %).

As shown in the graph below, however, this is a mere variation in terms of degree but they do share the same bias, for in every case, their average return expectations are much higher than what can realistically be expected in their respective markets. According to the EVCA (2012), European venture capital presented an average pooled TVPI of 1.68 (the equivalent of an IRR of approximately 9 %) during its best vintage period to date (1990–1994).

In these results, one might see the confirmation of the impression that European venture capitalists’ return expectations are influenced by US-style investment outcomes which have historically averaged an IRR of 14.3 % (AFIC 2013).

Comparison between real and expected TVPI results per countryFootnote

The real performance data and exit multiples were retrieved from Thomson Reuters’ ThomsonOne database. The probability distributions of the exit multiples could not be retrieved from ThomsonOne due to inherent survivorship biases. We therefore used data from Weidig and Mathonet (2004) which in turn build upon Cochrane’s (2005) work.

Further, the survey data allows gaining a granular understanding of the origination of perception biases: in our survey, return expectations result from the respondents’ expected outcomes for “standard” and “outstanding” deals as well as the number of deals in each category. Respondents from different countries could potentially predict different outcomes for either one of these investment types. This would explain cross-country differences in return expectations.

However, our data suggest that this is not the case. As shown in the graph below, respondents seem to have quite homogeneous understandings of, and expectations for the two deal types in which “standard” deals yield an average gross return of 15.0 % (10.8 % net) and “outstanding” deals yield an average gross return of 25.7 % (21.1 % net). This is all the more surprising, as both concepts are somewhat vague.

Gross return expectations for standard and outstanding deals

The figure below provides further evidence for the homogeneity of return expectations within the participating countries. We observe that the respondents’ expected returns per deal type (as shown above) result from fairly similar expected exit multiple probability distributions. Furthermore, it becomes apparent that respondents attribute very different probability distributions to “standard” versus “outstanding” deals, in that “standard” deals are expected to have both a lower failure rate and result in a lower number of high exit multiples.

Expected TVPI (money-multiple) distributions by deal type

Since country-based differences in return expectations do not result from differences in the return expectations of “standard” and “outstanding” deals, they must result from differences in the expected number of standard and outstanding deals. As shown below, respondents in the United Kingdom typically forecast a much higher number of “outstanding” deals than their French counterparts.

Average numbers of standard and outstanding deals per country

Since outstanding deals are thought to yield higher returns on average, respondents who expect a larger number of “outstanding” deals, tend to forecast higher returns for their whole portfolio.

The differences in average portfolio compositions (the split between “standard” and “outstanding” deals) give us important information about the nature of the deals venture capitalists tend to make in each of the participating countries. We observe that French venture capitalists appear to be more “cautious,” expecting a larger number of “standard” deals, and fewer high risk-high reward “outstanding” deals. Whether this is due to the investment preferences of French venture capitalists, or to a lower number of available “outstanding” deals (i.e. the existing startup landscape) is a subject for future research.

Finally, we observe that, while the average return expectations vary, the relative standard deviationsFootnote 10 are very similar in all participating countries. They range from +/−40 % in France to +/− 43 % in the United Kingdom. These standard deviations can be interpreted as the averages of the volatilities that the individual respondents expect for their portfolios. Hence, venture capitalists in all three participating countries seem to foresee very similar volatilities (and thus risk) for their respective portfolios.

TVPI averages and (relative) standard deviations by country

The assumption that investors’ expected returns are higher than the real returns of venture capital funds is supported by the results. As predicted, venture capital professionals expect to achieve returns that, on average, would not even hold in the best vintage period to date.

The results summarized in the figure below yield several remarkable findings. Most importantly, venture capital professionals do not appear to significantly overestimate the probability of middle-to-high TVPI outcomes (5x or more). This discovery is rather puzzling, especially when compared to the existing literature on general investor over-confidence biases. While this result may partly be explained by differences in research methodologies used, such as the different time horizons analyzed and samples from different geographic areas,Footnote 11 the observed trends are in all likelihood too large to be accounted for by these factors alone.

The second noteworthy observation is that the participants overestimate the probability of middle-to-low TVPI outcomes (between 0x and 2x).

Further, the survey respondents vastly underestimate the danger of full losses: on average, they predicted that 22.5 % of the investments would end up as total losses against a real-life value of close to 30 % found in Weidig and Mathonet’s (2004) study.

Comparison between real and expected direct investment TVPI outcomes

2.5 Discussion

Our empirical findings provide strong evidence for the existence of a general overconfidence bias within the venture capital community. While this result was foreseeable, the extent of the overconfidence bias is striking: almost 70 % of the respondents expect their hypothetical fund to do better than the average fund TVPI (money-multiple) during the best vintage period to date (1990–1994).

Surprisingly, the analysis yielded findings suggesting that venture capitalists do not significantly overestimate the frequency of high TVPI outcomes. This result is quite remarkable, as, it allows a significant refinement of the prevailing claim – brought forward by Medjad et al. in the case of the French venture capitalist market – that venture capital professionals have a strong propensity to both overestimate the probability of success and to underestimate that of failure. In fact, they mainly seem to do the latter.

As pointed out at the outset, European venture capital firms operate in a heavily politicized environment that is both regulated and in many cases supported and subsidized by local and national governments. The reason of this important public involvement lies in the common perception that a buoyant venture capital industry is a driver of economic growth and innovation (Koschatzky 2000; Bottazzi and Da Rin 2002; Lerner 2002) as well as an accelerator of product and market development (Hellmann and Puri 2000).

Given the policymakers’ zeal to support the development of venture capital, what lessons does this study hold for regulators?

First, our findings shed a light on a blank spot, namely the frighteningly high failure rates of innovative startup ventures. The adverse effects of such outcomes on entrepreneurs and investors can be substantial. Ucbasaran et al. (2013) point out that the aftermath of business failure is often fraught with psychological, social, and financial turmoil. Governments should thus provide dedicated structures to cushion the entrepreneurs and investors against the immediate effects of business failure. Such improvement of the safety net for fallen entrepreneurs could greatly increase the appeal of entrepreneurial ventures, and given the relative homogeneity of the rate of start-up failures in Europe, this seems to be an area where the European Investment Fund could bring important insight.

Second, to turn to the central finding of our study, how should the overconfidence of the British, French and German venture capitalists be addressed?

Answering this question requires a prior understanding of the potential harmfulness of such bias.

In the previous study limited to the French Venture capital market, Medjad et al. (2011) assumed that “that the underperformance of the French venture capital [was] inevitably compounded by a gross misconception of success and failure by its actors.” Yet, this comparative study shows that this assumption does not hold. Whilst less spectacular than other findings, this is perhaps the most important finding of this study. Assessing cross-country differences in the levels of overconfidence, we found that France was, by far, the country with the lowest level of venture capital investor overconfidence both in absolute and relative terms. The United Kingdom sample exhibits the highest absolute levels of overconfidence, while Germany ranks first in relative numbers. If overconfidence was detrimental, both the venture capital industries of Germany and of the United Kingdom should fare much worse than the French one and this is not the case.

In sum, there is no evidence supporting the assumption that curving the overconfidence of its actors would benefit the venture capital industry. In fact, a certain level of overconfidence may even be beneficial for fund performance, because increased risk-taking facilitates the emergence of entrepreneurs who exploit new ideas (Bernardo and Welch 2001). Does this mean that this bias should then be neglected, or even encouraged? And by whom? From an ethical point of view, the answer is far from straightforward, to say the least.

2.6 Conclusion

The results of this comparative study beg for further research.

First, the inclusion of more countries both from Europe and from other continents would make the cross-country analyses more robust. Further research could thus use more extensive data samples from a larger number of countries to test whether the relationships found in the present study prevail in other national and cross-country contexts.

Second, this study confirms that many European venture capitalists’ return expectations are possibly influenced by the exceptionally high exit returns achieved by certain Silicon Valley companies. Therefore, the inclusion of US venture capitalists’ responses into a survey sample would be particularly interesting and could further the research on the differences between the venture capital industries in Europe and the United States.

Thirdly, this study only recorded the respondents’ estimates of outcome frequencies at a single point in time. Arguably, the present economic conditions in Europe are more likely to nurture pessimistic views, but until clear evidence is produced, the possibility that overconfidence may be a temporary mood rather than a lasting state of mind has not been definitely ruled out. Future studies should thus use longitudinal and time-lagged research designs to test the findings of this study and explore if they hold in the long run.

Finally, the question whether – and to what extent – a less national and more European approach of venture capital is justified is not fully answered by our study, which highlights significant similarities in terms of overconfidence, but does not identify the underlying causes of such bias and hence, does not determine the extent to which they may differ from a country to another. The European Investment Fund and the European Venture Capital Association may be important contributors to this necessary clarification.

Notes

- 1.

In many cases, the fund also returns previously agreed-upon interests to Limited Partners.

- 2.

- 3.

In most cases, the management fee is paid annually.

- 4.

14.3 % for the US against 0.9 % for European VCs.

- 5.

3.6 % for the US against −1.1 % for European VCs.

- 6.

$27.1bn., assuming an exchange rate of 1 U.S. dollar = 0.73 Euros (December 23, 2013).

- 7.

The German Venture Capital Association reports only €520 million of venture capital investments. This is probably due to terminological differences as to which transactions qualify as venture capital investments.

- 8.

Contact details were primarily obtained from the British Venture Capital Association (for the UK), the “Bundesverband Deutscher Kapitalbeteiligungsgesellschaften” (for Germany) and the “Association Française des Investisseurs pour la Croissance” and “BPI France” (for France).

- 9.

The real performance data and exit multiples were retrieved from Thomson Reuters’ ThomsonOne database. The probability distributions of the exit multiples could not be retrieved from ThomsonOne due to inherent survivorship biases. We therefore used data from Weidig and Mathonet (2004) which in turn build upon Cochrane’s (2005) work.

- 10.

The relative standard deviation was computed by dividing each country’s standard deviation by its respective sample mean.

- 11.

Lacking high-quality European data sets, Weidig and Mathonet (2004) used data from 5000 direct investments from the US rather than Europe for their analysis.

References

AFIC (2013) Performance nette des acteurs français du capital-investissement à fin 2012: comparaisons internationales. AFIC, Paris

Aizenman J, Kendall J (2008) The internationalization of venture capital and private equity. NBER Working Papers 14344. National Bureau of Economic Research. Cambridge, MA

Barber B, Odean T (2011) The behavior of individual investors. Working Papers Series. University of California. Davis, CA

Bernardo A, Welch I (2001) On the evolution of overconfidence and entrepreneurs. Yale School of Management Working Papers. Yale School of Management. New Haven, CN

Bottazzi L, Da Rin M (2002) Venture capital in Europe and the financing of innovative companies. Econ Policy 17(34):229–269

BVCA (2013) BVCA venture capital and private equity performance measurement survey 2012. BVCA Working Paper. British Private Equity & Venture Capital Association, London

CalPERS (2014) Private equity industry dictionary. http://www.calpers.ca.gov/index.jsp?bc=/investments/assets/equities/pe/pe-glossary.xml

Cochrane J (2005) The risk and return of venture capital. J Finan Econ 75(1):3–52

Coval JD, Moskowitz TJ (1999) Home bias at home: local equity preference in domestic portfolios. J Financ 54:2045–2073

Cumming D (2008) Contracts and exits in venture capital finance. Rev Finan Stud 21:1947–1982

Cumming D, Schmidt D, Walz U (2010) Legality and venture capital governance around the world. J Bus Ventur 25:54–72

De Bondt W, Thaler R (1994) Financial decision-making in markets and firms: a behavioral perspective. NBER Working Papers 4777. National Bureau of Economic Research. Cambridge, MA

EVCA (2012) 2012 Pan-European private equity performance benchmarks study. EVCA, Brussels

EVCA (2013) 2013 Pan-European private equity performance benchmarks study. Brussels

Groh A, von Liechtenstein H, Lieser K (2008) The European venture capital and private equity country attractiveness index(es). Working Paper. IESE Publishing, Barcelona

Groh A, von Liechtenstein H, Lieser K (2012) The global venture capital and private equity country attractiveness index 2012. IESE Publishing, Barcelona

Hadzima J, Bonsen (2014) The nuts and bolts of business plans. http://nutsandbolts.mit.edu/Presentations_Current/Session1-HadzimaPresentation2014.pdf

Hambrick DC, Geletkanycz MA, Fredrickson JW (1993) Top executive commitment to the status quo: some tests of its determinants. Strat Manag J 14(6):401–418

Harrison ME (1990) The West German venture capital market – an analysis of its market structure and economic performance, Europäische Hochschulschriften: Bd. 946. Peter Lang, Frankfurt am Main

Harzing AW (1999) Managing the multinationals: an international study of control mechanisms. Edward Elgar, Cheltenham

Hege U, Palomino F, Schwienbacher A (2003) Determinants of venture capital performance: Europe and the United States. Working Paper. LSE Ricafe, London

Hellmann T, Puri M (2000) The interaction between product market and financing strategy: the role of venture capital. Rev Financ Stud 13(4):959–984

Hong H, Kubik J, Stein J (2005) Thy neighboros portfolio: word-of-mouth effects in the holdings and trades of money managers. J Finance 60(6):2801–2824

Jeng L, Wells P (2000) The determinants of venture capital funding: evidence across countries. J Corp Finance 6:241–289

Kaplan S, Martel F, Strömberg P (2007) How do legal differences and experience affect financial contracts? J Finan Intermed 16:273–311

Koschatzky K (2000) The regionalisation of innovation policy in Germany: theoretical foundations and recent experience. Working Paper: Firms and Regions. Fraunhofer, Stuttgart

Lerner J (2002) When bureaucrats meet entrepreneurs: the design of effective “public venture capital” programmes. Econ J 112:73–84

Lerner J, Schoar A (2005) Does legal enforcement affect financial transactions? The contractual channel in private equity. Q J Econ 120(1):223–246

Levin J, Rocap D (2013) Structuring venture capital, private equity and entrepreneurial transactions. Wolters Kulwer, New York

Mance H (2013) UK venture capital boom slows. http://www.ft.com/cms/s/0/924b8050-f09a-11e2-929c-00144feabdc0.html#axzz2oaqsTIqt

Mason C, Harrison R (1991) Venture capital, the equity gap and the north–south divide in the UK. In: Green M (ed) Venture capital: international comparisons. Routledge, London

Marston L, Collins L, Bravo-Biosca A, Lane H (2013) Unchaining investment: barriers to US investment in UK internet and digital businesses. NESTA, London

Medjad K, Krieger E, Gerasymenko V, Grandsart R, Iselin F (2011) You said successful? Actual and perceived performance of venture capital in France. Int J Bus 16(4):353–366

NVCA (2013) Corporate VC Stats through 2013. http://www.nvca.org/index.php?option=com_contentandview=articleandid=344andItemid=103

Palacin J (2008) Innovation, venture capital and globalization: the role of public policies. UNECE Annual Report Economic Essay 2008(5)

Pierrakis Y, Mason C (2008) Shifting sands: the changing nature of the early stage venture capital market in the UK. Other. NESTA, London

Robinson D, Sensoy B (2011) Manager compensation, ownership and the cash flow performance of private equity funds (Working Paper). Duke University, Durham, NC

Rooney B (2013). European venture capital industry continues to decline. http://blogs.wsj.com/tech-europe/2013/01/28/european-venture-capital-industry-continues-decline/

Rosa C, Raade K (2006) Profitability of venture capital investment in Europe and the United States. Economic Papers Number 245. European Commission, Brussels

Schwienbacher A (2004) An empirical analysis of venture capital exits in Europe and in the United States. Mimeo/University of Amsterdam

Stolpe M (2003) Learning and signalling in the French and German venture capital industries. Kiel Working Paper Number 1156. Kiel Institute for the World Economy, Kiel

Tykvová T (2004) Who are the true venture capitalists in Germany? ZEW Discussion Papers Numbers 04–16. Center for European Economic Research, Mannheim

Ucbasaran D, Shepherd DA, Lockett A, Lyon J (2013) Life after business failure: the processes and consequences of business failure for entrepreneurs. J Manag 39(1):163–202

Venkataraman S (1997) The distinctive domain of entrepreneurship research. In: Katz DJ (ed) Advances in entrepreneurship, firm emergence and growth. JAI Press, Oxford

Weidig T, Mathonet P-Y (2004) The risk profile of private equity. Working paper. http://dx.doi.org/10.2139/ssrn.495482

Zacharakis AL, Shepherd DA (2001) The nature of information and overconfidence on venture capitalists’ decision making. J Bus Ventur 16(4):311–332

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Feider, M., Krieger, E., Medjad, K. (2015). Return Expectations from Venture Capital Deals in Europe: A Comparative Study. In: Peris-Ortiz, M., Sahut, JM. (eds) New Challenges in Entrepreneurship and Finance. Springer, Cham. https://doi.org/10.1007/978-3-319-08888-4_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-08888-4_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-08887-7

Online ISBN: 978-3-319-08888-4

eBook Packages: Business and EconomicsBusiness and Management (R0)