Abstract

This chapter focuses on nine money disorders that have been identified in the financial therapy literature. These include compulsive buying disorder (CBD), gambling disorder, workaholism, hoarding disorder, financial denial, financial enabling, financial dependence, financial enmeshment, and financial infidelity. Diagnostic criteria, psychological and financial symptoms, prevalence rates, and financial therapy interventions are explored.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Problem Gambling

- Pathological Gambling

- American Psychological Association

- Gambling Behavior

- Irrational Belief

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

According to the American Psychological Association (APA), the number-one stressor in people’s lives is money, above work, health, and children (APA 2012). While most Americans find money to be a source of stress in their lives, for some, this stress is a consequence of disordered money behaviors. Klontz and Klontz (2009) defined money disorders as “persistent, predictable, often rigid, patterns of self-destructive financial behaviors that cause significant stress, anxiety, emotional distress, and impairment in major areas of one’s life” (p. 129). Isolated financial mistakes or periods of overspending are not money disorders. Money disorders are not caused by the lack of money (Klontz et al. 2008a) and therefore the solution is not about having more money. People with money disorders typically have faulty beliefs about money and cannot change their behavior even though they know they should (Klontz and Britt 2012; Klontz and Klontz 2009). For some, money disorders are the result of emotional difficulties that cause them to act out financially to avoid feeling unresolved emotions (Gallen 2002).

Money disorders are “persistent, predictable, often rigid, patterns of self-destructive financial behaviors that cause significant stress, anxiety, emotional distress, and impairment in major areas of one’s life” (Klontz and Klontz 2009, p. 29)

Psychotherapists can diagnose at least two money disorders using the Diagnostic and Statistical Manual of Mental Disorders-5 (DSM-5™; APA 2013), namely, pathological gambling and hoarding disorder (HD). DSM-5™ disorders can typically be treated by qualified psychotherapists who can seek third-party insurance reimbursement for their services. The majority of the money disorders in this section, however, have not yet been identified by the mental health community. It is not surprising that money disorders have gone relatively unrecognized in the mental health field, as there is some evidence that mental health professionals are more likely to be money avoidant themselves (Klontz and Britt 2012). Financial planners will often come into contact with clients or the family members of clients who struggle with disordered money behaviors. While they will not “treat” the money disorder in the clinical sense, financial planners will often be called upon to intervene, provide recommendations, and provide referrals for individuals impacted by money disorders.

The money disorders explored in this chapter are compulsive buying disorder (CBD) , gambling disorder (GD), workaholism , HD, financial denial , financial dependence , financial enmeshment , financial enabling , and financial infidelity. These money disorders are among the most prevalent, reported, and studied in the financial therapy literature. For each money disorder, diagnostic criteria will be reviewed, prevalence rates presented where available, related psychological and financial symptoms explored, and research on interventions presented.

Money Disorders

Compulsive Buying Disorder

Compulsive buying is repetitive and associated with adverse psychological and financial consequences (Billieux et al. 2008)

Buying is a routine part of everyday life, but for some it can be unplanned, spontaneous, and associated with feelings of pleasure and excitement (Lejoyeux and Weinstein 2010). When buying is repetitive and associated with adverse psychological and financial consequences, it is identified as compulsive buying (Billieux et al. 2008). Compulsive buying is different from normal buying and is not about the items purchased, but about the need to obtain short-term relief from tension or negative feelings (Faber 2011). People who buy compulsively have a strong, uncontrollable preoccupation with buying, which causes significant personal and interpersonal distress (Kellett and Bolton 2009; Davenport et al. 2012; Dittmar 2004; O’Guinn and Faber 1989). The consequences of their buying patterns trigger emotional difficulties that are exacerbated by mood and anxiety disorders (Black 2001; de Zwaan 2011). Compulsive buyers use buying binges to enhance mood or relieve distress (Billieux et al. 2008; Kellett and Bolton 2009; Kukar-Kinney et al. 2009; Miltenberger et al. 2003; Thornhill et al. 2012); however, these feelings are generally followed by guilt and remorse (Faber 2011). Mueller et al. (2010) reported associations between compulsive buying and lifetime mood disorders, anxiety disorder, substance use disorder, substance dependence disorder, eating disorder, impulse control disorder (ICD), and obsessive– compulsive disorder (OCD).

Diagnostic Criteria

Researchers have typically considered compulsive buying as an impulse-control disorder not otherwise specified (ICD-NOS) in previous iterations of the DSM (Mueller et al. 2010), which could be classified as other specified disruptive, impulse-control, and conduct disorder, CBD, or unspecified disruptive, impulse-control, and conduct disorder in the DSM-5™ (APA 2013). Diagnostic criteria for compulsive buying were first proposed in 1994 and refined over time (McElroy et al. 1994). McElroy’s et al. (1994) diagnostic criteria for compulsive buying include the inappropriate preoccupations or impulses with buying or shopping as indicated by at least one of the following: (a) frequent preoccupations with buying or impulses to buy that are experienced as irresistible, intrusive, and/or senseless; (b) frequent buying of more than can be afforded, frequent buying of items that are not needed, or shopping for longer periods of time than intended; (c) the buying preoccupations, impulses, or behaviors cause marked distress, are time-consuming, significantly interfere with social or occupational functioning, or result in financial problems (e.g., indebtedness or bankruptcy); or (d) the excessive buying or shopping behavior does not occur exclusively during periods of hypomania or mania.

McElroy et al. (1994) reported that 70 % of patients presenting with compulsive buying described buying as pleasurable, resulting in a buzz, a high, or excitement. Compulsive buying can be assessed using a variety of screening instruments, including: (a) the Compulsive Buying Scale (CBS; Black 2007), (b) Yale–Brown Obsessive–Compulsive Scale–Shopping version (Y-BOCS-SV) (Monahan et al. 1996), (c) Questionnaire About Buying Behavior (QABB) (Lejoyeux et al. 1997), (d) The Canadian Compulsive Buying Measurement Scale (Valence et al. 1988), and the Klontz-Money Behavior Inventory (KMBI) (Klontz et al. 2012).

Psychological Symptoms

The diagnostic criteria for compulsive buying are used to describe symptoms of craving and withdrawal applied to buying behavior (Lejoyeux and Weinstein 2010). Although impulse purchases can be influenced by factors that promote a positive mood state, compulsive buying frequently occurs in response to negative emotions in an attempt to decrease the intensity of that emotion. The psychological consequence is usually a feeling of euphoria or relief from the negative emotion. This relief is generally short term and is followed by increased anxiety (Lejoyeux and Weinstein 2010). Compulsive buyers experience repetitive overpowering urges to purchase goods similar to the way that substance abusers experience feelings for their substance of choice. The goods purchased are in many cases useless (Lejoyeux and Weinstein 2010). Compulsive buyers are more interested in the acquisition than the product itself and typically have higher levels of sensation-seeking behaviors (Lejoyeux and Weinstein 2010).

According to Lejoyeux and Weinstein (2010), both impulsivity and compulsivity may play a role in compulsive buying . Due to their impulsivity, compulsive buyers are not able to abstain from purchasing. The high levels of impulsivity among those with CBD support the inclusion of CBD as a behavioral addiction with problems of impulse control. Higher impulsivity distinguishes compulsive buyers from individuals with OCD (Lejoyeux and Weinstein 2010).

Financial Symptoms

Availability of the Internet may promote compulsive buying, because it avoids face-to-face transactions and allows purchases to remain hidden. In addition, the Internet provides up-to-date information on products and pricing (Lejoyeux and Weinstein 2010). Adverse consequences of compulsive buying include substantial financial debt, legal problems, interpersonal conflict , marital conflict , and psychological distress, such as depression or guilt. For compulsive buyers, money and the opportunity to purchase are equivalent to a drug (Lejoyeux and Weinstein 2010).

Etiology and Prevalence

The behavioral manifestation of CBD may be due in part to socialization and trial and error learning that a particular behavior can provide relief from tension or negative feelings. The best estimate of the prevalence of compulsive buying in Western nations is between 5.5 and 8 % of the adult population (Faber 2011). Faber (2011) reported that when using the most extreme criteria, at least 1.4 % of the population suffered from compulsive buying. The vast majority of those with CBD are women, and the average age of onset is typically 30 years (Lejoyeux and Weinstein 2010). Klontz and Britt (2012) found that the money scripts (see Chap. 3) of money status, money worship, and money avoidance are significant predictors of CBD.

Interventions

Poor emotional self-regulation is integral to compulsive buying (Rose and Segrist 2012). Because of the false notions of compulsive buyers, such as fear of missing a buying opportunity or the tendency to overestimate the importance of an item, cognitive-behavioral therapy (CBT) may be an effective way to treat CBD (Lejoyeux and Weinstein 2010). Lejoyeux and Weinstein (2010) suggested that patients should first be evaluated for psychiatric comorbidity, especially depression, so that appropriate psychopharmacological interventions can be explored. Mitchell et al. (2006) found compulsive buying patients who received CBT showed significant reductions in the time spent buying and in the number of compulsive buying episodes. The treatment was designed to interrupt and control the problem buying behavior, establish healthy buying patterns, restructure maladaptive thoughts about buying, and develop coping skills. There have been few studies that assessed the effects of pharmacological treatment and none have shown any medication to be effective in treating CBD (Lejoyeux and Weinstein 2010). A specific treatment approach to compulsive buying is provided in Chapter 12.

Gambling Disorder

Gambling disorder is a “persistent and recurrent problematic gambling behavior leading to clinically significant impairment or distress” (APA 2013).

Pathological gambling was first identified as a psychiatric disorder in 1980 (Petry and Blanco 2012), although it is now referred to as GD and classified as an addictive disorder in the DSM-5™ (APA 2013). GD involves risking something of value in an effort to obtain something of greater value (APA 2013). Prior to the release of the DSM-5™, Jiménez-Murcia et al. (2013) characterized GD as persistent and recurring maladaptive patterns of gambling behavior. GD has high rates of comorbidity with mental disorders such as substance use, depressive disorders, anxiety disorders, and personality disorders (APA 2013).

Diagnostic Criteria

The criteria set forth by the DSM-5™ (APA 2013) defines GD as “persistent and recurrent problematic gambling behavior leading to clinically significant impairment or distress” (p. 585). It is characterized by at least four out of nine behaviors during a 12-month period, including: (a) restlessness or irritability when attempting to slow or stop gambling, (b) unsuccessful attempts to slow or stop gambling, (c) preoccupation with gambling, (d) chasing losses, and (e) dependence on others for money as a result of gambling.

Psychological Symptoms

Studies suggest that GD is associated with poorer health across all age groups and illnesses. Backaches, joint pain, and heart problems are all significantly related to gambling (Faregh and Derevensky 2012). Gambling among young people has been associated with disruptions in social relationships, substance use, delinquency, and criminal behavior (Hardoon et al. 2004). In addition to physical symptoms, disordered gamblers may experience negative psychosocial consequences, including debt, shame, guilt, depression, and loss of control (Shaffer et al. 2004). Evidence suggests that gambling is associated with autonomic arousal, such as rising blood pressure, heart rate, and mood (Shaffer and Martin 2011). Shaffer and Martin (2011) reported that individuals with psychiatric disorders are 17 times more likely to develop GD. They also found that individual’s with GD are: (a) 5.5 times more likely to have a substance abuse disorder, (b) 75 % have had an alcohol disorder, (c) 38 % have had a drug use disorder, (d) 60 % have a nicotine dependency, (e) 50 % have a mood disorder, (f) 41 % have anxiety disorder, and (g) 61 % have a personality disorder.

Financial Symptoms

Since money is the catalyst for gambling, the biggest problem faced by gamblers is debt (Grant et al. 2010). As a result, debt can lead to bankruptcy. While there is little research regarding GD and bankruptcy, as more states in the USA have legalized gambling, bankruptcies have increased remarkably (Grant et al. 2010). According to the Gambler Impact and Behavior Study(GIBS), 19 % of individuals with GD have filed for bankruptcy (Gerstein et al. 1999). Grant et al. (2010) found that individuals who filed for bankruptcy were more likely to have been raised in a dysfunctional family where gambling was used as a coping mechanism. Declaring bankruptcy for many individuals with GD could be due to the inability to cope with financial debt (Grant et al. 2010).

Etiology and Prevalence

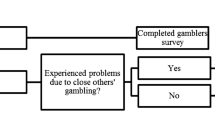

The lifetime prevalence of individuals with GD ranges between 0.5 and 10 % in the general adult population of North America (Jiménez-Murcia et al. 2013). Early studies suggested that approximately 3–5 % of a given population have some level of gambling problems (Faregh and Derevensky 2012). The proliferation of gambling opportunities and gambling’s widespread legalization have contributed to greater social acceptance of gambling (Petry and Blanco 2012). Most of the studies seem to indicate that males are more likely to exhibit gambling behavior. Males are also more likely to gamble in their youth, while the age of onset for females is over 40 years (Jiménez-Murcia et al. 2013).

As with any addiction, there are shared neurobiological, psychological, and social risk factors that influence GD (Shaffer and Martin 2011). The syndrome model of addiction (Shaffer et al. 2004) posits that addictions manifest into a specific form as a result of desirable subjective experiences associated with the objects of addiction (Shaffer and Martin 2011). The risk factors for activity-based addictions (e.g., gambling) are similar to substance-based addictions (Shaffer and Martin 2011). Genetics also plays a role in the risk of developing a gambling (Shaffer and Martin 2011). Environmental factors are also significant. Data from a national sample showed a greater prevalence of problem gambling with individuals living within 10 miles of a casino (Welte et al. 2001). However, recent empirical evidence has suggested that individuals adapt well to gambling opportunities and problematic gambling only increases during the short term, when people are exposed to new gambling opportunities (Shaffer and Martin 2011). Demographic risk factors for problem gambling are younger ages, males, unemployment, social welfare, large urban communities, lower academic achievement, and ethnicity, with African-Americans, Hispanics, and Asian-Americans being at higher risk (Johansson et al. 2009). Klontz and Britt (2012) found that money status scripts (i.e., beliefs associating net worth with self-worth) are a significant predictor of pathological gambling behaviors.

Interventions

Treatment for addictions, including GD, often involves a 12-step program (Petry and Blanco 2012). Organizations, such as Gamblers Anonymous (GA), have meetings in every state. According to Petry and Blanco (2012), a randomized study found that CBT in addition to attending GA meetings improves outcomes, suggesting that a combination of professional intervention and GA may be effective.

Petry and Blanco (2012) also found that GD predominately affects lower socioeconomic groups and suggested the need for a short, reliable, valid screening tool that could help uncover gambling problems early so that brief interventions could be instituted before more significant problems develop. Cognitive-behavioral interventions have shown some promise in treating GD, but training is needed in the use of manualized interventions because few providers are familiar with this approach (Petry and Blanco 2012). CBT style interventions include imaginal desensitization, cue exposure or cognitive restructuring, and debiasing techniques used by trained clinicians (Delfabbro and King 2012). Despite the many perspectives toward GD, treatment options typically consist of inpatient or outpatient therapy and self-help groups (Shaffer and Martin 2011).

A large portion of individuals with GD do not seek treatment, but incorporate self-initiated cognitive and behavioral control strategies to deal with problem gambling (Moore et al. 2012). Slutske (2006) reported that 40 % of pathological gamblers recovered without treatment. Self-help strategies to recover from GD include: (a) avoiding gambling venues, (b) stopping cold turkey, (c) lifestyle changes, (d) replacing gambling with other activities, (e) reminding oneself of the negative consequences, and (f) support from family and friends (Moore et al. 2012).

Although there are some medications that show promise in treating pathological gambling, there are no drugs approved by the Food and Drug Administration (FDA) for treating it. Pharmacological research is necessary because psychiatric comorbidity is associated with gambling severity and treatment for dual diagnoses is especially important (Petry and Blanco 2012). Part of the problem with treating GD is that it may not be covered by some insurance plans in the USA (Petry and Blanco 2012). An important future direction for GD research is to identify and test behavioral markers that can predict the development of GDs (Shaffer and Martin 2011).

Workaholism

Workaholism is a pattern of overindulgence in work, long work hours, working more than is expected, self-absorption in work, and compulsiveness to work, all which result in problems with relationships and health.

The term workaholism was derived from alcoholism and was first identified as an addiction to work, or a compulsion to work incessantly (Oates 1971). The terms workaholism, work addiction, or excessive work are now used interchangeably (Andreassen et al. 2012). Most definitions in current literature describe workaholism as a chronic pattern of overindulgence in work, long hours at work, working more than is expected, and self-absorption in work (Andreassen et al. 2012). Some researchers have modified workaholism by adding the caveat that the time spent working is not due to an external necessity (Snir and Zohar 2000). Some regard workaholism as a positive attribute, which indicates a person’s high level of motivation, while others emphasize the negative attributes of compulsiveness and rigidity (Andreassen et al. 2012). A distinction is also made between workaholism and engaged workers, with the difference being that engaged workers enjoy their work while workaholics are driven not by enjoyment but by a compulsive drive that is characteristic of most addictions (Taris et al. 2010).

Some view workaholism as a positive attribute.

As an addiction, workaholism is described as an uncontrollable motivation for work, in which an individual spends so much time and energy working that it hinders their personal relationships, leisure, and health (Andreassen et al. 2012). Workaholism is characterized by a repetitive search for pleasure, which comes from a specific dependency associated with abuse, craving, clinically significant stress, and compulsive dependence actions (Caretti and Craparo 009).

Diagnostic Criteria

Scott et al. (1997) reported three central characteristics of workaholics: (a) they spend a great deal of time on work, (b) they are preoccupied with work even when not working, and (c) they work more than is reasonably expected to meet their job requirements. Taris et al. (2010) further characterized workaholics by the inability to detach themselves from their work and by the number of hours spent working. Mosier (1983) defined it as working at least 50 or more hours per week. One of the problems with identifying workaholics is that besides number of hours worked per week there are few, if any, commonly used measures of workaholism other than those that are self-reported (Sussman 2012).

Caretti and Craparo (2009) proposed new diagnostic criteria for addiction, which may have implications for workaholism . They suggested that workaholics suffer from clinically significant impairment or distress caused by persistent and recurrent maladaptive addiction behaviors. An individual must have behaviors from the obsessivity, impulsivity, and compulsivity categories. In addition, addictive thoughts occur frequently or daily and interfere with social functioning and relationships. Klontz et al. (2008a, b) noted that workaholics share common characteristics of individuals with obsessive–compulsive personality disorder, including a preoccupation with control, perfectionism, orderliness, inflexibility, reluctance to delegate tasks to others, and excessive devotion to work at the expense of friendships and leisure.

Psychological Symptoms

Robinson (2000) conceptualized workaholism as a progressive addiction that attempts to resolve psychological needs, which can lead to an unmanageable life, family breakdown , and serious health issues. Interestingly, workaholism is associated with reduced actual physical well-being but not perception of physical well-being, which indicates that workaholics do not understand the impact their behavior is influencing their physical well-being (Britt et al. 2013). Workaholics develop a pathological connection to their work as a way to avoid intimacy and augment self-esteem (Nakken 1996). Workaholism has been associated with diminished levels of well-being, greater work–family conflict, and higher levels of job stress (Bovornusvakool et al. 2012). Scott et al. (1997) described some workaholics as those who have symptoms of OCD and engage in work related activities to remove obsessive thoughts. It is common that aspects of workaholism include perfectionist tendencies in addition to obsessive– compulsive elements that compel individuals to be meticulous in carrying out job functions (Bovornusvakool et al. 2012).

According to Scott et al. (1997), workaholics are typically isolated from others, do not spend time interacting with others, and have low levels of satisfaction with friends and family. Workaholics feel a sense of guilt when not working, cannot relax during leisure time, experience boredom in leisure activities (Oates 1971; Scott et al. 1997), and have high levels of worry and distress (Clark et al. 2010). Workaholics tend to have lower life satisfaction, which can be a consequence of being compulsive and dependent. Chamberlin and Zhang (2009) found that workaholism may be associated with physical health problems and lower levels of psychological well-being and self-acceptance. They also found that children of workaholic parents can be psychologically affected by their parents’ workaholic behavior.

For workaholics, focusing on work may provide a socially acceptable way to act on perfectionist tendencies and achieve accolades, since workaholism is the most rewarded of all the addictions (Bovornusvakool et al. 2012). Attaining recognition and achievement may elevate one’s mood; however, using work as a coping mechanism for negative emotions can lead to loneliness and dissatisfaction (Bovornusvakool et al. 2012). Van den Broeck et al. (2011) classified workaholism as a behavioral component of working excessively and a cognitive component of working compulsively. They found that the propensity to work compulsively is related to ill-health and is associated with feelings of coercion. In contrast, excessive work behavior is associated with joy and positive well-being (Van den Broeck et al. 2011).

Financial Symptoms

Time invested in work has been found to be positively related to financial needs (Major et al. 2002). Klontz et al. (2011) found that workaholism is associated with not only higher income but also higher levels of revolving credit. The negative effects of workaholism can also include emotional pain or feeling burnt out, little social activity, family conflict , driving while preoccupied, driving while on the phone, and driving while sleep deprived (Sussman 2012). While these potentially dangerous issues are happening, the workaholic may be receiving job promotions, salary increases, and praise from their employer and colleagues (Sussman 2012). According to Sussman (2012), many workaholics may be delaying their planned retirement in an effort to continue their workaholic lifestyle.

Etiology and Prevalence

Some of the literature suggests that workaholism is the result of feelings of insecurity, low self-worth, and avoidance of pain, fear, and intimacy (Chamberlin and Zhang 2009). Work may increase one’s self-esteem and provide a source of self-validation. From an external perspective, workaholics might believe that their parents’ love was contingent on their success and therefore work in an attempt to attain that love (Machlowitz 1980). Ng et al. (2007) suggested that disposition (i.e., desire for achievement and increased self-esteem), sociocultural experiences (i.e., use work as an escape for past experiences), and behavioral reinforcement (i.e., rewards for work, corporate culture that encourages overwork) lead to the precursors for workaholism. According to Ng et al., the antecedents to workaholic behavior are anxiety when not working, obsession with work, and working long hours, which affects personal life. Klontz and Britt (2012) found that money avoidance and money worship scripts (see Chapter 3) are significant predictors of workaholism.

Griffiths found that the integration of individual, situational, and structural characteristics of work can produce financial, social, physiological, and psychological rewards, which have the potential to induce addictive behavior due to the habitual reward and reinforcement. Piotrowski and Vodanovich (2006) suggested that workaholism develops from a combination of personality traits, home/family responsibilities, and internal and external stressors. The combination of individual and work factors leads to frequent and intense workaholic behavior. In the early stages of workaholism, praise and money at work are appreciated at home and the workaholic behavior is reinforced over time. This can eventually lead to work–home life imbalance.

Liang and Chu (2009) proposed that the key personality traits that lead to workaholism are obsessive compulsion, achievement orientation, perfectionism, and conscientiousness. While workaholism includes traits of high energy and achievement, it also includes negative traits such as narcissism, perfectionism, neuroticism, obsessiveness, and the tendency to blame others for work mistakes (Shimazu et al. 2010; Clark et al. 2010).

Interventions.

Few researchers have compared nonchemical addictions against other substance-related addictions, which has fueled skepticism in the addiction research community about issues like workaholism (Griffiths 2011). It has been suggested that workaholism is encouraged and is a socially acceptable addiction (McMillan and Northern 1995), suggesting that addiction treatment programs could be modified for use with workaholics.

Cognitive-behavioral strategies might include instructions on goal setting, developing the ability to derive enjoyment from work, techniques to create work–life balance, problem solving skills, and time management. These techniques can be utilized to reduce the tendency to be hard driven and to control the tempo of tasks to increase enjoyment. The central treatment assumption is that in order to heal workaholism, restoration of balance in one’s life is critical. Taking a holistic approach should include sleep, diet, exercise, relaxation, stress management, assertiveness training, and spiritual activity (Holland 2008).

Some researchers believe that rational emotive behavior therapy (REBT) is appropriate for workaholics. REBT is founded on the premise that dysfunctional behavior is caused not only by environmental factors but also by irrational thinking (van Wijhe et al. 2013). van Wijhe and colleagues suggested that irrational thoughts and cognitions play a critical role in self-defeating behaviors and workaholism. Chen (2007) argued that the root cause of workaholism was based on irrational beliefs, which causes the workaholic to be preoccupied with work. REBT offers a promising intervention because it focuses on restructuring a person’s irrational beliefs to more functioning beliefs (van Wijhe et al. 2013).

Other strategies that have been used for workaholism include motivational interviewing , group therapy, family therapy, inpatient treatment that removes the workaholic from work for some period of time (Sussman 2012), and experiential therapy (Klontz et al. 2008a).

Hoarding Disorder

Hoarding disorder takes a positive behavior like saving to an extreme.

HD has been identified as a money disorder because it not only includes the acquisition and retention of objects but also takes a positive behavior like saving to an unhealthy extreme (Klontz and Klontz 2009; Klontz et al. 2012). HD poses a serious public health problem, social costs to the public, and strain on families (Tolin et al. 2008; Frost et al. 2000) as well having a profound effect on one’s own health and safety (Frost et al. 2012). Relatively few studies have examined HD despite its prevalence and association with significant distress and functional impairment (Coles et al. 2003). Compulsive hoarders feel emotional attachments to their money and possessions, making it difficult for them to spend or discard accumulated items. Traditionally, hoarding has been seen as a symptom of OCD or obsessive–compulsive personality disorder (OCPD). However, hoarding behavior can be a problem in its own right and, as a result, HD was included as a mental illness in the DSM-5™ (APA 2013).

Diagnostic Criteria

The DSM-5™ criteria for HD include the following: (a) persistent difficulty parting with personal possessions, regardless of actual value; (b) a strong need to save items and distress associated with discarding; (c) the accumulation of possessions that congest and clutter active living areas and substantially comprises their intended use; and (d) symptoms cause clinically significant distress or impairment in social, occupational, or other areas of functioning. HD can be specified: (a) with excessive acquisition, (b) with good or fair insight, (c) with poor insight, or (d) with absent insight/delusional beliefs (APA 2013).

HD can lead to impairment of important areas of functioning, including maintaining a safe environment for oneself and others (Frost et al. 2012). Moving safely around the house can become difficult when the accumulation of possessions fill up and clutter the active living areas of the home or workplace and prevent normal use of the space (Frost and Hartl 1996). Klontz et al. (2012) found compulsive hoarding symptoms to be more common in men with lower levels of net worth.

Relating HD to finances, financial therapists have suggested that money hoarders have so much anxiety about not having enough money, that they may neglect even the most basic self-care activities and have great difficulty enjoying the benefits of accumulating money (Klontz et al. 2008b; Klontz and Klontz 2009). Forman (1987) described a financial hoarder as having a fear of losing money, distrust of others around money, and trouble enjoying money.

Psychological Symptoms

Hoarders save items for reasons related to sentimental attachment, usefulness, and aesthetic qualities to a point that possessions become an extension of the self (Belk 1988). Getting rid of an item can feel like losing a piece of oneself or like the death of a friend. Objects serve as reminders of important past events and provide a sense of comfort and security. As a result, hoarders are unlikely to share possessions. The hoarder’s identity is wrapped up in everything they own. Saving is not restricted to worthless or worn out things and many saved items are new and never used (Frost et al. 2012). Clinically significant impairment could also result from interpersonal stress related to the hoarding behaviors, including marital conflict and/or disapproval from family members or friends.

HD can resemble OCD in a number of ways—avoidance of discarding items for fear that it may be needed in the future, the avoidance of discarding because of an emotional attachment, and the fear of making a mistake as to what to discard. These avoidances and fears have been said to be similar to obsessions (Mataix-Cols et al. 2010). The difficulty in discarding possessions may be an obsession, while the avoidance of discarding a compulsion. However, unlike obsessions in OCD, thoughts related to hoarding or accumulating are not unwanted (Mataix-Cols et al.). Thoughts about possessions are not unpleasant to the hoarder and the distress they experience is usually due to the consequences of the hoarding (i.e., clutter, conflicts with loved ones) not the thoughts or the behavior. Hoarding is usually associated with positive emotions during acquisition and grief at attempts to discard (Mataix-Cols et al.). These emotions are not usually part of the OCD experience (Mataix-Cols et al.). It is believed that OCD behavior ebbs and flows over time, while hoarding begins early in life and exacerbates as time progresses (Tolin et al. 2008).

Financial Symptoms

From the beginning of modern psychology, hoarding has been considered a human instinct (James 1890) and represented as a strategy of self-preservation (Bouissac 2006). Humans will use time and effort to acquire artifacts, such as newspapers, radios, and television sets (Lea and Webley 2006). Hoarding behavior is adaptive and has obvious value for contingencies and emergency situations (Lea and Webley 2006), representing a dilemma in the sense that money hoarding behavior seems to mirror positive financial behavior (e.g., saving) but is taken to an unhealthy extreme (Klontz and Klontz 2009). As pointed out by Klontz and Klontz, saving is good, but it is also necessary to spend, which is something that money hoarders may be reluctant to do even for the most basic of necessities. Someone who hoards money may have a difficult time parting with it, not necessarily for fiscal reasons but because of the emotional attachment, and the comfort and security it provides. Resources hoarded for no extrinsic purpose can include artifacts that are also nonmaterial, such as bank account balances (Booth 2006). Unlike the hoarder of objects, the hoarder of money need not have stacks of coins or cash cluttering up the house to cause difficulty. Rather, the money hoarder can have just cognitive clutter that leaves little room for other thoughts or pursuits and results in clinically significant consequences.

Etiology and Prevalence

Studies show that hoarding develops as a result of conditional emotional responses to various thoughts and beliefs (Grisham et al. 2006). Hoarders often have an apprehension to discard possessions, which represents anxiety, avoidance of decision making, and discarding. Hoarders can exhibit excessive saving behavior, which is reinforced through feelings of pleasure associated with possessions and collecting. Contributors to HD include deficits in information processing, beliefs about emotional attachment to possessions, emotional distress, and avoidance behaviors (Grisham et al. 2006). Neziroglu et al. (2004) identified fear of losing information, indecisiveness, fear of making mistakes, inability to prioritize, fear of loss, fear of memory loss, and lack of organization as common traits of hoarders. Hoarding or saving may become part of one’s identity. Individuals who hoard tend to be single and often lack a personal connection with other people; therefore, they develop intensified attachments to possessions (Grisham et al. 2006). Some hoarders indicate that hoarding behaviors began as a result of a stressful event that occurred in the past, an event in which they had trouble coping with, and others report a slow and steady progression over their lifetime (Grisham et al.). Klontz and Klontz (2009) hypothesized that HD is a predictable response to a financial trauma and/or an early life of poverty or lack, and argue that the trauma of the Great Depression led to a generation of hoarders of money and objects. Klontz and Britt (2012) also found HD to be significantly correlated with other disordered money behaviors, including CBD.

Cromer et al. (2007) reported that hoarders are significantly more likely to have reported at least one traumatic life event. Prior to 1993, little research existed in the mental health literature related to hoarding behavior (Frost et al. 2012). Within the past two decades, hoarding has been identified as being a prevalent and serious condition (Mataix-Cols et al. 2010). Several studies have shown that the prevalence rate of clinically significant hoarding behaviors is 2–5 % of the population (Iervolino et al. 2009; Mueller et al. 2009; Samuels et al. 2008), nearly twice as high as the prevalence of OCD (Samuels et al.).

Interventions

Historically, interventions for hoarding behavior have been difficult because of poor response rates to therapy. When one considers the positive feelings about acquisition and the negative feelings about discarding associated with HD, poor responses to therapy are not difficult to understand. The most encouraging data have come from multimodal intervention that focuses on four main problem areas: (a) information processing, (b) emotional attachment, (c) behavioral avoidance, and (d) erroneous beliefs about possessions (Gaston et al. 2009). Motivational interviewing is used to address ambivalence and poor insight. CBT is used to help decrease clutter and resist the urges to accumulate. Cognitive restructuring is used to address the fear of discarding. This multimodal treatment is lengthy and success depends on the motivation of the patient (Gaston et al. 2009).

CBT has garnered the most support in the treatment of HD. An open trial of CBT designed for hoarding with 26 individual sessions and monthly home visits over 9–12 months revealed decreases in saving behavior and reduced clutter (Tolin et al. 2007). Turner et al. (2010) found improvements in clutter, reductions in acquiring and difficulty with discarding, and improvements in safety concerns with specialized CBT techniques for hoarding with a sample of elderly patients. Primarily home-based treatment, which lasted about 35 sessions, focused on motivational enhancement, cognitive skills, organization, decision making, and nonacquiring skills. In a waitlist, controlled trial of modified CBT hoarding treatment, Steketee et al. (2010) randomly assigned participants to immediate CBT treatment or a 12-week waitlist. After only 12 weeks, improvement from CBT was statistically greater than the waitlist on most hoarding severity measures.

CBT groups have also been shown to be effective. Muroff et al. (2012) found that weekly group CBT sessions along with nonclinician home visits over a 20-week period showed significant reductions in hoarding symptoms. Video-enhanced and web-based CBT has been an ongoing intervention since 1998 and appears to hold promise (Muroff et al. 2010). Some evidence has been shown to support the effectiveness of selective serotonergic reuptake inhibitor (SSRI) medications, such as paroxetine, clomipramine, fluoxetone, and sertraline in improving symptoms of HD (Saxena et al. 2007; Muroff et al. 2011). The efficacy of a combination of CBT and pharmacotherapy for hoarding requires further research (Muroff et al. 2011).

Other modalities have shown promise in the treatment of HD. Klontz and Klontz (2009) advocated resolving unfinished business associated with trauma as an approach to the treatment of money disorders (including compulsive hoarding), using an intensive group experiential therapy approach that has some empirical support for its clinical utility (Klontz et al. 2008a). Pekareva-Kochergina and Frost (2009) found that bibliotherapy group intervention conferred considerable benefit over a 13-week group intervention. Muroff et al. (2012) found that weekly group alCBT sessions along with nonclinician home visits over a 20-week period showed significant reductions in hoarding symptoms.

Financial Denial

Financial denial is a defense mechanism in which money problems are minimized or avoided to escape psychological distress.

Individuals exhibiting any type of money disorder, in order to cope with their difficulties, might avoid dealing with or not thinking about money (Klontz et al. 2008b). This can contribute significantly to financial difficulty. Klontz and Klontz (2009) described financial denial as a defense mechanism by which people minimize their money problems, or attempt to avoid thinking about them altogether to escape psychological distress. Burchell (2003) defined some individuals as having a somewhat confusing, irrational orientation toward their own personal finances, which leads to poor management and considerable cost. This avoidance phenomenon can be seen in other areas of finance as well. For example, Odean and Barber (1999) found that investors were much more willing to sell investments that were doing well rather than the poor-performing ones, also known as the disposition effect. Odean believed that the disposition effect has nothing to do with the investments, but more to do with the fact that people do not like to admit mistakes and go into denial and regret avoidance (Nicol-Maveyraud 2003).

Diagnostic Criteria

Burchell (2003) hypothesized three different ways to conceptualize dysfunctional orientations toward personal finance. First, the condition might be similar to dyslexia, where specific deficiencies are noted in only reading and writing, for instance. Second, irrational financial behavior may be caused by cognitive shortcomings in the way in which people process financial actions. Since people’s lives are so busy and complex, in order to avoid overload, they often take shortcuts rather than fully engage in processing information. By doing so, they create biases and/or errors in judgment (Burchell 2003). Third, irrational financial behavior may have an emotional cause. If people have negative emotions when dealing with financial issues, they may simply avoid thinking about their finances leading to suboptimal decisions and performance (Burchell 2003).

Burchell (2003) conducted a survey of 1000 British adults to assess the prevalence, correlates, and nature of financial denial , using the Financial Aversion Scale. According to Burchell (2003), financial aversion includes avoiding thinking about matters related to personal finance as they are associated with negative emotions including boredom, guilt, or anxiety. Avoiders do not prudently review their credit card and bank financial statements (Burchell 2003). Klontz and Britt (2012) found that money avoidance scripts and money worship scripts are significant predictors of financial denial, which includes efforts to avoid thinking about money, trying to forget about one’s financial situation, and/or avoiding looking at one’s bank statements (see Chapter 3).

Psychological Symptoms

Clinical pathology quite often involves excessive forms of avoidance. In many cases, the avoidance is an attempt to rid oneself of unwanted or undesirable feelings or emotions (Schlund et al. 2011). According to Burchell (2003), those in financial denial were not incompetent, spendthrift, impulsive, or unintelligent. Many were high achievers in other areas of their lives and understood the importance of sound financial management , but were entwined in a psychological syndrome, which made it unpleasant for them to deal with their issues of personal finance. According to Klontz et al. (2012), financial denial is a defense mechanism that is used to relieve anxiety that comes from financial stress. This is distinct from financial rejection, which is the act of ridding oneself of money and/or avoiding the accumulation of money (Klontz et al. 2012). People with low levels of self-esteem may be prone to this because they feel undeserving of having money (Klontz and Klontz 2009).

Financial Symptoms

Burchell’s (2003) study revealed some behavioral correlates of financial denial. Almost 30 % of people in financial denial did not know how much they had in their accounts on a weekly basis, compared to only 18 % in the rest of the population (Burchell 2003). Financial averse individuals were also five times more likely than the rest of the population to feel dizzy, physically ill, or immobilized by feelings and emotions regarding their finances. Klontz et al. (2011) found that financial denial was associated with lower levels of income, lower education, lower net worth, and higher revolving credit.

Etiology and Prevalence

According to Schlund et al. (2011), recent conceptualizations of anxiety disorders, like post traumatic stress disorder (PTSD), indicate that dysfunctional avoidance coping comes from a shift in the part of the brain that processes reward motivated behavior, to a part of the brain responsible for supporting aversively motivated avoidance behavior. Adaptive functioning reflects a balance between approach and avoidance systems. These imbalances are believed to contribute to human psychopathology (Schlund et al. 2011), but limited research exists on the subject.

Medintz et al. (2005) reported that rather than dealing with financial problems, many individuals choose to ignore them. A survey in the USA found that 36 % of respondents avoided thinking about their financial troubles (Medintz et al. 2005). The survey also found that 36 % of people go to great lengths to avoid financial reality, 17 % said they avoid thinking about money by refusing to look at statements or balances, and 16 % ignore financial news as a way to avoid the reality (Medintz et al. 2005).

In a study of financial aversion in British adults conducted by Burchell (2003), 51 % of the sample rated at least one item on a financial aversion scale as very true, while 84 % of the sample answered at least one of the five statements as either very true or mostly true. By these criteria, at least half of the population showed some symptoms of financial avoidance. Burchell’s study also divided the people with financial avoidance (or the “financial aversives”) by category and found that there was a significant proportion of financial aversives in high social classes. This seemed to indicate that financial avoidance was caused by psychological or social factors to which no segment of society was immune (Burchell). The study also found that as the population got older, the proportion of financially avoidant dropped. This could be due to life-cycle phenomena or a sign of a generational shift that younger people born in recent years have higher levels of financial phobia (Burchell).

Burchell (2003) also conducted in-depth interviews with those with high levels of emotional aversion to personal finance. Three theories were put forth as possible causes of financial aversion. The first he called frustrated prudence. Some financial aversives had been cautioned about financial responsibility growing up and others had experienced scarcity and poverty in their lives. Many had the intentions and the ability to provide financial stability for themselves, but because of external events they lost or were cheated out of their hard earned savings. This left them with feelings of anger and injustice. The way that they dealt with their psychological dissonance was through avoidance.

The second theory was procrastination. Some respondents reported keeping up with their finances, but once they let it slip for a few months, they began avoiding those tasks which increased their feelings of guilt and anxiety. The avoidance of activities through procrastination is typical in situations that are time- and effort-consuming, frustrating, and low in reward (Burchell 2003). Third was lack of confidence in dealing with financial information. While these theories were tentative, more empirical longitudinal research is needed to verify these findings (Burchell).

Interventions

In their experiential financial therapy approach, Klontz et al. (2008a) found stable and significant posttreatment reductions in participant’s levels of anxiety around money and improvements in financial health, which included one’s tendency to avoid thinking about money (see Chapter 7 for a discussion of experiential financial therapy). With the exception of this study, no known research is available on treatment to alleviate financial denial . The financial planning industry is uniquely positioned to help in this area. For example, in Burchell’s (2003) study, some of the participants were dismayed by the fact that someone who saves all of their life to purchase a home could have their home equity whittled away for long-term care needs. In this case, proper financial planning might avoid that scenario and the more people know about the techniques to accomplish that might alleviate some of the avoidance. More could also be done to protect consumers on the improper selling of financial products, which tends to intimidate the public and feeds their aversion. Greater importance can be placed on risk tolerance to make sure that people are not investing above their risk tolerance level, so that fluctuations in the market do not cause as much anxiety.

Financial Enabling

Financial enabling is the inability to say no when people continually ask for money (Klontz et al. 2008b).

Klontz et al. (2008b) defined financial enabling as the inability to say no when people continually ask for money. Financial enabling can have significant effects on the enabler and on the one that is being enabled. Enablers can experience problems with their own financial situation, including filing for bankruptcy while attempting to cover their own expenses and those of someone else (Klontz et al. 2012). A good example is parents taking care of adult children who should be able to support themselves (Klontz and Klontz 2009). Enablers and dependents absorb a sense of money as a pervasive influence and both tend to hide their behavior out of shame or guilt (Klontz and Klontz 2009).

Diagnostic Criteria

Klontz et al. (2012) identified financial enablers as individuals who give money to others even if they cannot afford it and have trouble denying request for money from friends and family. They developed a financial enabling scale, which included the following items: (a) I give money to others even though I can’t afford it, (b) I have trouble saying “no” to request for money from family or friends, (c) I sacrifice my financial well-being for the sake of others, (d) people take advantage of me around money, (e) I lend money without making clear arrangements for repayment, and (f) I often find myself feeling resentment or anger after giving money to others.

Financial enabling is the most common and chronic problems that financial planners witness among their clients (Klontz et al. 2008b).

Psychological Symptoms

Klontz et al. (2008b) noted that financial enabling is often done with the intent to bring family closer together, but can create anger and resentment, and damage relationships. Financial enablers may give money to others even though they cannot afford it, leading to financial problems. Price et al. (2002) found that financial strain increases symptoms of depression and can create feelings of being out of control. These out of control feelings can be detrimental to role functioning, emotional functioning, and health.

Financial Symptoms

Financial enabling has negative financial consequences. It has been found to be associated with lower net worth and higher credit card debt (Klontz et al. 2011). In financially hard times, it is more common for financial enabling to occur (Klontz and Klontz 2009). Because of economic hardships, more and more adults are relying on their parents for financial support. Unfortunately, this can have serious effects on the parent–child relationship as well as the financial health of both enabler and dependent. The relationships of financial enablers are so tangled up in money that they confuse emotional investments with money (Klontz and Klontz 2009).

Etiology and Prevalence

It is believed that money issues begin with childhood experiences as well as cultural influences and early learning. This reinforces patterns of learned behavior that meet psychological and emotional needs rather than practical financial needs (Goldberg and Lewis 1978). Financial enabling often results from the belief that money is synonymous with love. This may be a result of financial enablers having grown up in poverty and not wanting their children to experience the same depravity or having been spoiled as a child and learning how to express love to their children with money. Klontz et al. (2012) found some empirical support for this hypothesis, with financial enabling being significantly associated with lower socioeconomic status in the financial enabler’s childhood. An online poll by ForbesWoman and the National Endowment for Financial Education (NEFE) showed that almost 60 % of parents provide financial support to adult children who are out of school (Goudreau 2011b). Thirty-seven percent of the parents cited their own struggles and the fact that they do not want their children to struggle as they did (Goudreau 2011b). While no specific information on the prevalence of financial enabling is available, Klontz et al. (2008b) stated that “financial enabling appears to be one of the most common and chronic problems financial planners see among their clients” (p. 127).

Financial enablers use money as a way of compensating for guilt they feel from the past, to get closer to someone, and to feel important (Klontz and Klontz 2009). This is a way for the enabler to keep loved ones close and stay in control. While the intention may be good, the results often are not. Klontz and Klontz (2009) indicated that the longer that a dependent is supported financially, the more difficult it will be to develop their own financial skills. This can cause the dependent to become stunted both emotionally and financially. Financial enabling does not only apply to parent–child relationships but also to partners, spouses, friends, etc. Financial enablers believe that spending money on others gives their life meaning and earns them love and respect (Klontz and Klontz 2009).

Interventions

Little evidence is available on the treatment of financial enabling ; however, it may be treated similar to other problematic financial behaviors and other types of enabling. Klontz and Klontz (2009) advised that if someone realizes that they are a financial enabler, the first thing they should do is acknowledge their behavior does more harm than good. Sometimes gently saying “no” is the only way to break the cycle of dependence. The enabler should also remind him/herself that it is not about being cheap or uncaring; it is actually what is best for the dependent. Klontz et al. (2012) also suggested that teaching parents ways to respond to their children when they ask for money is a good way to begin the process early so that children do not become financially dependent adults (Klontz et al. 2012). Due to the relational nature of financial enabling, especially between parent and child, a systems theory approach may potentially be useful in the treatment of financial enabling.

Financial Dependence

Financial dependence is “the reliance on others for nonwork income that creates fear or anxiety of being cutoff, feelings of anger or resentment related to the nonwork income and stifling of one’s motivation, passion, and/or drive to succeed” (Klontz et al. 2012).

Financial dependence is defined as the “reliance on others for nonwork income that creates fear or anxiety of being cutoff, feelings of anger or resentment related to the nonwork income, and a stifling of one’s motivation, passion, and/or drive to succeed” (Klontz et al. 2012, p. 21). Individuals with lower levels of education and low income who are not married are the most likely to identify with financial dependence (Klontz et al. 2012). Financial dependence can be seen as related to dependent personality disorder (DPD; Klontz et al. 2008b). Bornstein (2012) referred to dependent behavior as interpersonal dependency, which is the tendency to rely on others for nurturing, guidance, protection, and support even when the ability to do so for oneself is possible. Human beings are all born dependent on others for their very existence and the longer one lives, the greater the likelihood that they will once again be dependent on others for activities of daily living (Bornstein 2012). As a personality trait, interpersonal dependency has been actively studied over the past few decades (Bornstein 2012). Some have categorized dependency into functional (physical) dependency and economic dependency (relying on someone else for financial support) (Rusbult and Van Lange 2003). Dependency differences can predict various aspects of social behavior and also have implications on health, psychological disorders, and the challenges of aging (Bornstein 2012). While DPD is not specific to financial dependence, it shares many of the same attributes.

Diagnostic Criteria

In their creation of a financial dependence scale, Klontz et al. (2012) included the following items: (a) I feel like the money I get comes with strings attached, (b) I often feel resentment or anger related to the money I receive, (c) a significant portion of my income comes from money I do nothing to earn (e.g., trust fund, compensation payments), (d) I have significant fear or anxiety that I will be cut off from my nonwork income, and (e) the nonwork income I receive seems to stifle my motivation, passion, creativity, and/or drive to succeed. The DSM-5™ includes eight criteria for DPD: (a) has difficulty making everyday decisions without an excessive amount of advice and reassurance from others, (b) needs others to assume responsibility for most major areas of his or her life, (c) has difficulty expressing disagreement with others because of fear of loss of support or approval, (d) has difficulty initiating projects or doing things on his or her own, (e) goes to excessive lengths to obtain nurturance and support from others, (f) feels uncomfortable or helpless when alone because of exaggerated fears of being unable to care for himself or herself, (g) urgently seeks another relationship as a source of care and support when a close relationship ends, and (h) is unrealistically preoccupied with fears of being left to take care of himself or herself (APA 2013).

In addition to the financial dependence subscale of the KMBI mentioned above (Klontz et al. 2012), self-report scales including the Interpersonal Dependency Inventory (IDI) and the Sociotropy-Autonomy Scale (SAS) could be used to assess dependency needs. The Rorschach Oral Dependency (ROD) test measures implicit dependency strivings with little or no awareness on the part of the patient (Bornstein 2012). Scores on self-reported dependency tests reveal how respondents view themselves, the extent to which they feel their dependency strivings are due to dispositional causes, and biases that affect their self-presentation (Bornstein 2012).

Psychological Symptoms

Miller (2003) described a dependent personality as a “pattern of submissive and clingy behavior stemming from an excessive need to be taken care of” (p. 421). Miller further asserted that dependents need people and fear only their loss of support. He suggested that dependents look to others for guidance and direction and can be diligent followers. The perception of dependents is that they are immature, needy, clingy, insecure, and weak. College students with high levels of dependency are associated with homesickness, social rejection, and roommate conflict. These issues can remain later in life, causing conflicts at work and the undermining of professional relationships (Miller 2003).

According to Klontz and Klontz (2009), individuals who suffer from financial dependence “live in a childlike world where the normal rules of finance are irrelevant. They have no real sense of how money works in the everyday world, nor do they feel they need to know” (p. 195). Research suggests that financial dependents are significantly more likely to believe that their self-worth is defined by their net worth and that more money brings more happiness (Klontz and Britt 2012). Financial dependency has been shown to lead to increases in child–parent conflict (Aquilino and Supple 2001). In some cases, financial dependence can be life-threatening. For example, in one study, 46 % of domestic violence victims reported that a lack of money was a significant factor in their decision to return to an abusive relationship (Anderson et al. 2003).

Financial Symptoms

Financial consequences of financial dependency can be that the well-being of the family (Maas 1990) or a specific family member (Schneider 2000) suffers as a result of trying to financially support a dependent for longer. Financial dependence can add to family tension due to the economic scarcity caused by the dependency. Financial dependence is associated with lower education and lower income, but higher socioeconomic status in childhood (Klontz et al. 2012).

Etiology and Prevalence

One thing that contributes to dependent personality orientation is overprotective and authoritarian parenting (Bornstein 2012). Bornstein suggested that these parenting styles tend to foster dependency by creating a helpless or vulnerable self-concept in the child. Overprotectiveness teaches children that they are fragile and ineffectual, and without a powerful caregiver would be unprepared to survive in the dangerous world. Authoritarian parenting can instill the belief that the way to succeed in life is to comply with the demands and expectations of others (Bornstein 2012). Another factor that contributes to dependency is culture. Cultures that are sociocentric (that value interpersonal traits) foster dependency by tolerating it in adults (Bornstein 2012). Gender role socialization also plays a role in dependency. Men tend to be less open about dependency needs and by late childhood have significant differences in self-reported dependency than their female counterparts. Studies reveal that women tend to be diagnosed with DPD at higher rates than men (Bornstein 2012). Infants that are easily startled and are difficult to soothe have a greater likelihood that they will develop a dependent personality later in life (Bornstein 2012). This may be due to an easily startled child revealing a predisposition to dependency because they are unable to soothe themselves without external support, or because the inability to calm the easily startled child might elicit overprotective parenting that instills in the child a fragile and ineffectual belief system (Bornstein 2012). Early-onset separation anxiety carries a greater likelihood that dependency will develop later in life (Silove et al. 2011). Dependent adolescents have high rates of peer group dependency, which makes them susceptible to negative peer influences. Dependent adolescents, like dependent children, experience high rates of loneliness and peer rejection, which also increases the chances that they will experience substance abuse problems and depression (Pritchard and Yalch 2009). In young adulthood, dependents can develop attachments to substitute caregivers or other figures of authority like professors, supervisors, or friends. Older dependents sometimes express dependency needs directly or by increased cognitive impairment that compels others to assume care (Bornstein 2012).

Interventions

Clients with dependency issues in many cases seek treatment for the adverse effects of their dependent behavior on friendships, relationships with romantic partners, and relationships with parents, siblings, children, or coworkers and supervisors at work (Kantor 1992; Paris 1998). Bornstein (2012) outlined several strategies to enhance the adaptive features of dependency. First, helping clients express dependency needs while gaining reassurance and strengthening close relationships is a key strategy. Another tactic is to help clients distinguish between unhealthy dependencies (e.g., avoiding responsibility) and more healthy dependencies (e.g., seeking help to acquire a new skill). An additional technique that can be useful is therapist modeling, where the therapist can model healthy dependent behavior including self-disclosure. The therapist might self-disclose how they were able to gain skill and confidence by working with a more skilled experienced mentor (Bornstein 2012).

Clinicians treating dependency issues need to be able to distinguish between dependency and passivity. Passive patients are not necessarily dependent and if a patient is dependent they will not always be passive. Dependent patients can become quite active when supportive relationships are threatened (Bornstein 2012). Dependent patients can also exhibit destructive behavior like suicidal ideation, domestic violence, and child abuse. Effective therapy requires identifying a dependent’s self-presentation strategies in different relationships and settings and their preferred methods of self-presentation when others are ineffective (Bornstein 2012).

Some clients present with multiple dependencies like someone who is both functionally and financially dependent. In those cases, where psychological difficulties are present in addition to functional or financial dependency, multimodal treatment with other mental health professionals may be indicated (Bornstein 2012). Dependents are skilled at reading interpersonal cues and meeting the needs of others. As such, they tend to surround themselves with others who support their pathology. A systems focused approach is useful in identifying areas of the social network that foster unhealthy behavior (Bornstein 2012).

Financial Enmeshment

Financial enmeshment is when parents use money to manipulate a child to satisfy an adult need.

Financially enmeshed parents become so entangled in the lives of their children that maintaining leadership in the household is compromised (Klontz et al. 2012). Enmeshed parents lack boundaries, and in cases of financial enmeshment , they cross the financial boundary with their children by involving them in adult financial issues and decisions. Parents sharing financial information with an age-inappropriate child, which causes anxiety and stress, can be considered financial enmeshment (Klontz et al. 2012). Financial enmeshment was originally coined financial incest by Klontz et al. (2008b) to describe when parents use money to manipulate a child or to satisfy an adult need. While not physically abusive, it is psychologically abusive and can be damaging to the child. An example might be when a parent discusses their financial woes with a child as a way to cope with the anxiety and stress associated with the financial problems.

Diagnostic Criteria

In their development of the KMBI, Klontz et al. (2012) developed a financial enmeshment scale. Scale items include examples of the inappropriate crossing of parent–child boundaries around money: (a) I feel better after I talk to my children (under 18) about my financial stress; (b) I talk to my children (under 18) about my financial stress; and (c) I ask my children (under 18) to pass on financial messages to other adults.

Psychological Symptoms

The enmeshed parent often looks like a loving parent and the child can be seen as well adjusted, which underscores the need for thorough assessment of the child’s vulnerabilities. Clinical examination and psychological testing can expose aspects of the parent–child relationship that might cause concern (Friedlander and Walters 2010). Strained relational dynamics between parent and child may also occur as a result of enmeshment. Financial enmeshment is associated with money status beliefs and a host of other money disorders, including CBD, GD, HD, financial dependence , financial enabling , and financial denial (Klontz and Britt 2012). This suggests that parents who suffer from other money disorders are more likely to also share inappropriate financial information with their minor children.

Financial Symptoms

Children of enmeshed parents are forced to take on an adult role in handling finances that can have long-term painful effects. A common financial effect for enmeshed children is difficulty meeting their own needs because of the caretaker role they have taken. It is common for caretakers to assume financial responsibility for the families for the rest of their lives. In addition, enmeshed children develop a feeling of inadequacy because they eventually realize that they will never be able to do enough and therefore will never be enough (Klontz and Klontz 2009). Adults who have experienced financial enmeshment are more likely to perpetrate the same behavior with their own children (Klontz and Klontz 2009). Research shows that higher net worth men are more likely to engage in financial enmeshment behaviors (Klontz et al. 2012).

Etiology and Prevalence

No data exist on the prevalence of financial enmeshment . In cases of enmeshment, the psychological boundaries between the parent and the child have not been adequately defined and established, but the child often has developmentally inappropriate difficulty separating from the parent (Friedlander and Walters 2010). The child may develop clinginess to the parent, difficulty attending school, and difficulty functioning in an age appropriate manner. Quite often, the child is aware of the enmeshed parents’ neediness and assumes the protective role for the parent. In some cases, the child actually takes on the caretaking role for the parent (Friedlander and Walters 2010). The parent and child are usually not aware of the problematic nature of their relationship and usually believe that they have an excellent relationship. Maladaptive behaviors and emotional dysfunction come from problematic thought patterns caused by a combination of genetic predisposition and early environmental influences (Beck et al. 1990). Financial enmeshment occurs when a parent cannot adequately distinguish between their needs and the needs of their child (Klontz and Klontz 2009). Financial enmeshment is often unconscious and triggered when a parent has unfinished business, such as their own blurred parent–child boundaries in their life or lack of a satisfying connection to their partner (Klontz and Klontz 2009).

Interventions

In an enmeshed relationship not specific to money, therapy should be considered primarily to address the needs and dependencies that are at the root of the enmeshment. Psychotherapeutic therapies are typically challenging and take considerable time. These therapies are often supplemented by strategic coaching, education, and redirection of the parent’s neediness to other more appropriate sources (Friedlander and Walters 2010). The child’s individual therapy should protect the child and help the child separate emotionally from the enmeshed parent. Therapy should also attempt to remedy the problem of separation and the sense of responsibility for the parent that the child feels. Individual therapy is supplemented with family therapy involving joint meetings where issues of enmeshment are addressed between parent and child. The enmeshed parent is able to learn that they do not need the child to need them, and the child can disengage from the role of caretaker (Friedlander and Walters 2010). Typically, a reason that enmeshed behavior occurs is due to a lack of an adequate support system. Klontz and Klontz (2009) recommended taking all of the frustration, anxiety, worries, and financial stress to a therapist to avoid involving the children in unresolved issues. If appropriate, the parent should discuss with the child that the parent is changing that behavior, and ask the child to let the parent know if they begin to engage in enmeshed behavior again. It is also important for the parent to confide in someone that he or she is changing their behavior so that he/she can be accountable to someone else (Klontz and Klontz 2009).

As with the other relationally focused money disorders (e.g., financial enabling and financial dependency), a systems therapy approach can be useful in treatment. Specifically, Bowen Family Therapy incorporates specific interventions to reduce anxiety and to be able to distinguish between thinking and feeling in order to create differentiation of self or independence of self from others (Nichols and Schwartz 2001). Bowen believed if a person can differentiate thoughts and feelings, then a person could change the functioning of the system or relationships within the system. As a result, the child or parent can break away from the enmeshed relationship and create a highly functioning relationship. Bowen Family Therapy is insight oriented and requires an awareness of the whole family through the use of a genogram or family diagrams that represent family members and relational patterns among members. Other interventions include detriangulation, which is the process of removing oneself from triangulation or the “detouring conflict between two people by involving a third person, stabilizing the relationship between the original pair” (Nichols and Schwartz 2001, p. 530).

Financial Infidelity

Financial infidelity is secrecy and dishonesty over money.

Financial infidelity is secrecy and dishonesty over money. It can become problematic when couples deliberately keep secrets about their finances or spending from their partner (Klontz and Klontz 2009). This type of secrecy can erode the foundation of any relationship. When a partner lies about money, the other partner begins to think about other things they may have hidden. In a survey commissioned by ForbesWoman/NEFE, one in three Americans admitted to lying to their spouses about money (Goudreau 2011a). According to a Creditcards.com poll, about 6 million US consumers have hidden financial accounts from their significant others (Prater 2012). Couples would rather talk about sex or infidelity rather than talk about how to handle the family finances (Atwood 2012). Many people grew up in households where no one talked about money, so there is no education on what role money plays in a family unit. Since money is taboo in families, people become adults with irrational beliefs, anxiety, and no idea how to handle money (Atwood 2012). As people enter into relationships, the anxieties begin to emerge.

Diagnostic Criteria

Financial infidelity includes any purposeful financial deceit between two or more individuals wherein, there is a stated or unstated belief in mutual honest communication around financial matters. As such, it can involve hiding or lying about spending, costs, giving, borrowing, investing, receiving, the existence of bank, brokerage, or retirement accounts, the balances of accounts and credit cards, credit histories, credit scores, etc.

Psychological Symptoms

Some individuals seek to acquire money and material possessions as a way to: (a) compensate for the lack of money in childhood, (b) to repair a self-image, which has been shattered, or (c) to validate oneself (Madanes 1994). Differences in gender and money exist, which can be a factor in acts of financial infidelity. Men tend to see the world as competitive with winners and losers. Women tend to see the world more as collaborative and democratic (Atwood 2012). These differing views about the world can lead to problems between the genders about money. These differences can lead to acts of financial infidelity in an effort to avoid discomfort or conflict in the relationship. According to Atwood (2012), in relationships, men want to merge the money, but keep control over it whereas women want to keep some of it separate. Money is often thought of as synonymous with love, and gifts are seen as a symbol of affection. Klontz and Britt (2012) found financial infidelity, as measured by an affirmative statement to the following item, “I hide my spending from my partner/family,” to predict CBD and financial enabling behaviors.

Financial Symptoms