Abstract

The objective of this chapter is to introduce an increasingly popular business model known as the Energy Service Company (ESCO) model and bring to light the principal barriers to its widespread implementation both from the public and private perspectives. The ESCO model is essentially a “budget neutral” method of financing the purchase, installation and maintenance of energy efficient technologies. This concept, which incorporates notions of “third-party financing” and “energy performance contracting,” has been used successfully for quite some time in countries like the USA, the UK, and Germany. In this chapter, we will analyze the possibilities and limitations in the implementation of the ESCO model in a specific case study: the Barcelona municipal area in Spain.

We would like to express our thanks to all of the interview respondents who took the time to discuss essential issues with us and provide suggestions for our research. They enabled us to form realistic and current perspectives, both from the public and private spheres.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The growing demand for energy and the necessity to cut global greenhouse gas (GHG) emissions are the two foremost issues related to designing energy and environmental policies [8]. Nowadays, energy consumption accounts for around 85 % of global carbon dioxide (CO2) emissions worldwide, and it is at the heart of the transformation needed to move towards a low carbon economy. There is now a worldwide concurrence that the development and diffusion of a wide range of new technologies is an important mechanism to confront climate change and energy scarcity.

The International Energy Agency (IEA) estimates that energy efficiencyFootnote 1 measures can reduce up to 10–15 % of global CO2 per year at no additional cost [14]. Among the existing abatement options, the replacement of old windows and the introduction of better insulation are considered as two of the most cost-effective short term measures [20]. In fact, if the certain conditions are favorable [16] these investments could promise high positive economic returns [9, 21]. However, private investments in energy efficiency that at first glance might seem economically worthwhile are not always undertaken. This so-called “energy efficiency gap” [15] can be explained by existing barriers such as principal-agent problems, lack of access to capital, insufficient information, among others. Understanding these barriers is very important for the design of effective policies.

The ESCOs model is an interesting instrument that can help to overcome some of the most important barriers mentioned at the same time. An Energy Service Company (ESCO) is a company that is engaged in developing, installing, and financing comprehensive, performance-based projects that improve the energy efficiency or load reduction of facilities owned or operated by customers [2, 23]. ESCOs are seen as an important vehicle for promoting energy efficiency around the world as many case studies show [18, 24, 25]. Recent studies have also shown that the growth potential for the ESCO industry in many different countries is remarkable. For example, based on an a database of nearly 1,500 case studies of energy-efficiency projects, it was estimated that ESCO industry revenues for energy-efficiency related services in the US ranged from $1.8 to $2.1 billion in 2001 and that ESCO revenues increased at an average annual growth rate of 24 % during the last decade [10].

This chapter analyzes the possibilities and limitations in the implementation of the ESCO model for the case study of the Barcelona municipal area in Spain. Our aim is to select the instruments that are recommendable for the further development of the ESCO market based on the experience in other countries and, once we have seen to what extent they are implemented in Barcelona, propose how to unlock this energy savings potential. The methodologies used in our analysis consist of qualitative data collection methods such as content analysis, semi-structured interviews and a case study analysis. The semi-structured format was chosen because it offers a “bottom-up” perspective of the strengths and limitations of existing policies that are designed to foster the use of the ESCO model. However, a comprehensive review of the ESCO market in Catalonia, or a detailed examination of the relevant laws and regulations that apply to this market, is beyond the scope of this analysis.

The chapter is organized as follows: Section 2 introduces the ESCO model and how it can help to overcome the energy efficiency gap. Section 3 outlines the main barriers to the development of this market, taking into account the political and economic incentives available in Spain. Section 4 presents the current state of the ESCO market within the Barcelona metropolitan context in the public and the private sector. The final section is devoted to conclusions.

2 The Energy Services Company Model

An Energy Services Company (ESCO) is a tool to enhance the sustainable use of energy through promoting energy efficiency and renewable energy resources. The function of an ESCO is commonly known as Energy Performance Contracting (EPC). In other words, an ESCO takes the financial risk of developing and performing measures for an improvement in energy efficiency, and recovers the investment through the energy cost savings derived from that intervention (see Fig. 1).

Figure 2 depicts how the ESCO assumes the interaction with relevant players, eliminating the need for the client to deal with them. It shows that the ESCO’s remuneration is directly linked to the good performance of the various actors. Thus, the maximum energy savings are ensured for the client.

The basic steps of an ESCO project can be divided into two major phases: before and after the installation. At the beginning, a preliminary analysis of energy consumption patterns is carried out to evaluate the savings potential. Then, a detailed technical analysis is executed to detect inefficiencies. If the client decides to continue with the installation, a formal contract is prepared and the project is executed. Once the equipment is operating, a continuous guarantee phase starts and lasts until the contract terminates. During this period, the ESCO monitors the installation and takes any necessary corrective actions. In addition, a clause is usually included stipulating a periodic revision of energy consumption in order to correct for any deviations. For instance, if the actual consumption is less than expected, the energy cost savings may be shared between the ESCO and the client. On the contrary, if the client exceeds the expected consumption, the ESCO may assume the difference or, if stipulated in the contract, the client must pay the difference.

2.1 Technological Areas in Which the Model Can Be Applied

The application of the ESCO model is generally limited to the installation, renovation, implementation and/or maintenance of the following technologies: lighting, energy management devices and software, solar thermal for hot water and space heating, combined heat and power appliances, insulation, HVAC, cooking and refrigeration appliances and product manufacturing equipment [5]. ESCO projects vary in complexity depending on the characteristics of the technologies being used, the combination of technologies installed and the related regulations that need to be complied with in order to install each technology. Another important factor that determines the overall risk, and therefore economic viability, of an ESCO project is the degree to which future savings can be guaranteed. For instance, installing LED bulbs is considered “low-hanging fruit” for ESCOs because the savings are easily calculated and the regulatory procedures necessary for the project are minimal. On the other hand, HVAC replacements involve more complex permits and savings calculations, which may increase the perceived risk of the customer as well as that of the ESCO.

2.2 Drivers of the ESCO Industry

There are many conditions that have collaborated to the birth and continuous rise of the ESCO market. Over the next several years, the global ESCO industry is expected to maintain or exceed its current growth trajectory due to factors such as: (a) rising energy prices, (b) concerns surrounding increasing greenhouse gas emissions and climate change, and (c) challenges in obtaining sites and permits for new power plants and major transmission facilities [11]. As it can be seen, the main driving forces of these companies are not only “green” or environment related; they also have to do with economic and legal factors. Therefore, energy efficiency is also considered strategic for the future economic wellbeing of EU member states.

3 The Spanish ESCO Industry

While ESCOs have been operational on a large scale since the early 1990s, the energy service market in the European Union is far from utilizing its full potential, even in countries with a particularly developed ESCO sector. In the case of Spain, the ESCO model could act as an important means to reduce the country’s high dependence on foreign oil and natural gas. For instance, in 2010 domestic energy production accounted for only 25 % of the energy consumed, compared to the EU average of 47.2 % [17].

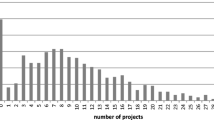

It is practically impossible to reliably estimate the number of players and the total size of the European ESCO market, mainly because the national markets are still rather individual and present particular characteristics. In Spain, there exists no official register of ESCOs, but according to a survey conducted by the European Commission Joint Research Centre Institute for Energy [7], the estimation is that around 15 companies are now operating in this field. The Institute of Energy Diversification and Savings (IDAE), the official state organization that makes decisions regarding energy-related projects in Spain, maintains an unofficial directory of 653 companies operating in Spain (309 in Catalonia) that categorize themselves as ESCOs [13]. Taking into account the significant difference between the estimates of these two organizations and considering the answers of our interview respondents, there is a clear need for an ESCO certification scheme and official directory. This confusion is detrimental to the generation of standardized offerings and an overall atmosphere of trust that is necessary for the widespread adoption of ESCO services in Spain.

According to the Building Performance Institute of Europe [6], large companies dominate the Spanish market, mainly because they have the financial capacity to assume the investment and returns in the long term. In 2007, this market was valued at over 100 million Euros. However in 2010, private companies estimated that the potential market for the national ESCO industry could be valued at €1.4–4 billion. This potential is large enough to attract foreign experienced firms which have been emerging throughout Spain in recent years. Among the national firms, there is a mix of large utilities, construction and multi-services companies and small and medium-sized companies. Most of them are oriented to the energy services sector as a way to diversify their activity. They are mainly operating in public buildings, cogeneration, district heating and street lighting [7].

Over the past few years, significant amount of publicity has been given to the ESCO model in Spain. It is praised on a daily basis on a number of internet media sites and is often a central topic at trade fairs related to construction and energy efficiency. This praise is most likely a result of the sharp decline in the national construction market, recent credit and public budget restrictions and increasing energy costs. In order to stay afloat, many established construction and maintenance companies have begun to diversify by offering ESCO services for renovation projects. Moreover, a number of young energy management companies have sprouted up, offering fully-integrated energy management services to private companies and public administrations. For instance, a growing number of Spanish cities and towns have contracted ESCOs to replace traditional incandescent street lighting with energy efficient LEDs, which have short payback periods and save considerable amounts of scarce public resources. Finally, the increase in energy costs in Spain is forcing consumers to make energy conservation and efficiency a priority. Although the ESCO model is a proven vehicle with which to unlock the country’s enormous energy savings potential, it is still new and widely unknown among Spanish citizens.

3.1 Public Support for Energy Conservation and Efficiency Programs

Starting in 2004, the Spanish government implemented various programs, most notably the E4 program (National Energy Efficiency Strategy) and Plan 2000 ESCO, in efforts to promote demand-side measures in the following sectors: buildings, industry, transport, agriculture, public services and appliances. This program supported the implementation of energy audits by subsidizing 75 % of the cost. Depending on the solutions proposed as a result of these audits, a subsidy was given in order to help finance the execution of the suggested actions. Also, the wind and solar industries were highly stimulated by generous feed-in-tariffs. However, given the current economic environment, the government has been forced to change its priorities. As a result, IDAE is expecting a drastic drop in money from the state, reduced from 61.4 million Euros in 2011 to 5.4 million Euros in 2012, as a result of proposed budget cuts.

Another budget-related issue is the expected reduction in the financial support electric companies are required to contribute to programs under IDAE’s Strategic Plan for Energy Efficiency. These contributions constitute the main financial support for a number of programs designed to improve and promote energy saving technologies. Thus, many planned energy efficiency programs are now paralyzed. Although each autonomous region has their own energy strategies, this constant decrease in state support for energy efficiency projects is considered a major barrier to the development of the ESCO market in Spain.

3.2 Spanish Legislation

The principal EU legislation related to ESCOs is the Directive 2006/32/EC on energy end-use efficiency and energy services. The directive stresses the importance of managing end-user demand for energy and the need to improve the security of the member states’ energy supplies through energy efficiency upgrades and increased generation from renewable sources. The directive also serves as a roadmap to reach international greenhouse gas emissions reductions targets that need to be attained in order to avoid disastrous impacts due to climate change. Additionally, the directive points out that, by supporting the development of energy efficient technologies, the European Community will become more innovative and competitive on the global stage. Our analysis focuses on the measures relating to increasing the availability and demand for energy services.

Each member state is responsible for enacting the appropriate legislation to carry out the objectives of the directive. The primary piece of legislation designed to achieve these objectives in Spain is the “Sustainable Economy Law”, Royal Decree Law 6/2010 [23]. The law has a specific section dedicated to the promotion of the ESCO market, which outlines measures consistent with the aforementioned EU directive. Unfortunately, as can be seen in the following summary table, interview respondents from both public and private entities recognize that the Spanish authorities have been ineffective in carrying out the European Commission’s suggestions (Table 1).

The insufficient compliance of these framework measures to establish a healthy ESCO market mainly stems from the negative impacts of the financial crisis which have drastically restricted public budgets and redirected resources. Notwithstanding, the majority of respondents believe that an adequate framework could be in place if only the state would carry out the currently established Royal Decree laws.

3.3 Barriers to the ESCO Industry in Spain

In addition to the hurdles caused by the Spanish government’s inability to comply with EU and Spanish legislation, we have identified a number of additional barriers to the development of the ESCO market in Spain, which we have grouped into the following five categories:

-

Administrative: Overall, local governments in Spain are composed of inefficient decision-making structures that are extremely difficult to change; the public procurement process is lengthy and inefficient and; administrative accounting systems are not set up to efficiently realize energy cost savings.

-

Technical: There are no standard and enforced measurement and verification protocols and; there lacks a neutral third-party institution that certifies the accountability of a particular ESCO.

-

Financial: There are no suitable financing schemes for the development of ESCOs and ESCO projects. Before the economic crisis, most ESCOs dealt with commercial banks for financing. However, now this source of financing has virtually disappeared. Currently, many ESCOs are financing projects with their own money which is unsustainable. High transaction costs decrease interest for both the client and the ESCO. ESCOs cannot justify the administrative costs to carry out small projects.

-

Informational: Citizens have limited awareness of energy efficient technologies; high perceived technical and financial risk and aversion to long payback periods. Split incentives: a renter pays the energy bill while the owner is responsible for any renovations. Thus, the owner has no incentive to invest in energy efficiency measures since the savings are captured by the renter. Likewise, the renter is not sure if she will live in the property long enough to recuperate such an investment.

-

Market-related: Each autonomous community has their own legislation and hierarchy related to energy generation and conservation. This represents an obstacle for ESCOs to expand into several regions and therefore reach a critical mass and obtain operational efficiencies.

Considering the reality that Spain is highly fragmented with respect to the particular energy policies and cultural environment found in each autonomous region, we became motivated to carry out an analysis of the ESCO market at the Barcelona metropolitan level.

4 The Barcelonian Framework

Barcelona is less pollutant compared to other globally important cities in a number of metrics, such as greenhouse gas emissions per inhabitant. For instance, in 2008, greenhouse gas emissions per capita in Barcelona were roughly half of those in London [4]. Even so, the government of Catalonia and the city of Barcelona are continuing to make great strides to maintain Barcelona as a clean and more energy efficient city.

The principal platform designed to achieve these goals is the Institut Català d’Energia (ICAEN) [12]. Its main functions are comprised of providing information about the Catalan energy sector, educational content regarding energy conservation and efficiency, financial aid for specific technology renovations, implementing relevant legislation, energy market statistics and targeted reports. With respect to ESCOs, they are trying to standardize the legal aspects of an ESCO project by providing model contracts and clauses.

Dialogue between ICAEN, as well as other governmental entities, and private ESCOs is facilitated by the recently formed Clúster d’Eficiencia Energética de Catalunya (CEEC). They also strive to engage the entire value chain, eliminate barriers to the ESCO market to increase investor confidence, negotiate with banks to create new financing options for ESCOs and provide support for EU R&D project applications. Currently, their main aim is to define projects according to their size and inherent characteristics in order to allow for ESCOs to specialize by project type. This will serve as a means to guarantee the quality and results of a venture.

With respect to local policy instruments to foster the adoption of energy efficiency products and services, the city of Barcelona appears to be quite proactive. The recently published Plan for Energy, Climate Change and Air Quality 2011–2020 (PECQ) provides a comprehensive analysis of the city’s energy consumption strengths and weaknesses as well as a clear roadmap for reaching new objectives.

4.1 The Solar Thermal Ordinance

One of the aims of the PECQ is to take advantage of Barcelona’s primary source of renewable energy: sunshine. The Solar Thermal Ordinance (STO), put into effect in 2000, requires all new construction and renovations to supply 60 % of the building’s sanitary hot water via solar thermal (ST) roof installations.

However, as with any new policy instrument, there are some gaps to be filled. The person responsible for solar energy projects at the Barcelona Energy Agency stated that due to underperformance, many installations only generate 30–40 % of a building’s sanitary hot water supply. This is the result of a moral hazard issue. The STO states that “the application of this ordinance will be done in each case depending on the best technology available.” However, construction companies often use inferior materials in order to minimize the cost of installing a ST unit. Furthermore, in the rare event that the city decides to perform an inspection of a ST unit, the company knows that a fine will not be imposed. The same moral hazard situation exists for maintenance companies hired for the ongoing operation of an installation.

The PECQ does not directly address these weaknesses in the STO, but suggests the need to update the ordinance to exploit the immense rooftop area, over 109 million square meters (in 2006), of the existing buildings by encouraging the installation both ST as well as PV units. It was expressed that the use of ESCOs to install ST units on existing multi-tenant apartment buildings was explored, but the small scale of the individual installations is apparently not financially attractive to ESCOs. However, as ST and PV technologies become more mature, prices will decrease and allow for shorter payback periods. This will help to decrease perceived risk, both for the installer and the homeowners’ association. Additionally, a more innovative ESCO contract could be devised by finding a way to pool together various installations of different homeowners’ associations in order to reach a desired profitability threshold. In any case, it is clear that Barcelona’s new solar policy should provide a favorable framework for the incorporation of ESCOs in order to maximize the benefits for citizens and local businesses.

4.2 Use of the ESCO Model in the Renovation of Public Buildings

The relevant legislation points out that public administration should be lead-user of the ESCO model to carry out measures for improving energy efficiency. They are required to communicate their actions and results to citizens and/or companies in order to encourage the widespread use of the model. The public entity responsible for energy efficiency and conservation projects in government buildings is the Barcelona Energy Agency (AEB in Catalonian). They have attempted to contract ESCOs to carry out renovations, but unfortunately, aside from a few education centers, the Liceu theatre renovation is the only exemplary ESCO project in Barcelonian public buildings. According to the AEB representatives interviewed, the absence of more examples of ESCO projects in the public sector is due to factors of the following nature:

-

Administrative: In order to make the necessary payments to the ESCO, the AEB must deal with two independently managed municipal accounts: the “investment account” and the “maintenance account”. The payments would be made by the investment account yet the energy costs savings would be captured by the maintenance account. This condition causes a split incentives issue, which prevents projects from going forward. The recently changed law dictating public procurement rules creates two main problems for ESCO projects. Firstly, the bidding process is now so long that it creates unusually high transaction costs for the ESCOs involved. Furthermore, the legal framework allows for collusion among bidders. For instance, bidding ESCOs enter in a quid pro quo situation by “exchanging” public projects. After winning the initial round, the selected companies enter into a “competitive dialog.” If their conditions are not met, then neither of them follows through. For this reason, many projects are left abandoned.

-

Technical: In general, ESCOs that have participated in the bidding process do not use a unified protocol to measure and verify energy savings. This makes it very difficult for the AEB to compare bids.

-

Financial: Many of Barcelona’s public buildings are old and need an integrated reformation to become energy efficient, which requires a large investment. Given the current economic situation and the lack of financing sources, not many ESCOs can carry out such a large project.

-

Informational: Diagnostic energy audits are performed by the AEB and then presented to interested ESCOs. Unfortunately, many times the companies claim that the audit results are not accurate since they do not allow for the desired profit margin. This adverse selection problem prevents many projects from moving forward.

To overcome some of these barriers, the AEB is taking certain actions. For example, the energy consumption of sixty (out of the approximately 2000) public buildings in Barcelona is currently being monitored through a generic, real-time software platform. The objective is to gather accurate data in order to calculate the energy consumption baseline for each building, thereby correcting the asymmetric information problem mentioned above. The agency plans to extend the use of this software to more buildings in different districts. As a solution for the administrative problem, the AEB noted that the Consortium for Education of Barcelona provides a decentralized management which allows education centers more budgetary autonomy. This has enabled a number of centers to carry out ESCO projects. The AEB suggested that this model be replicated for other types of public facilities in order to increase the number of ESCO projects throughout the municipal building portfolio [3].

4.3 A Case Study: Using the ESCO Model in the Private Arena

Sol Solar is a Barcelona-based company that designs and installs ST units. The company recently acted as an ESCO to develop and implement a ST project, consisting of 64.64 m2 of solar thermal panels, a 1,500 l cistern and a monitoring system, for a 30 year-old multi-tenant apartment building in the city of Barcelona. The objective was to reduce by 50–60 % the building’s natural gas consumption used for the supply of sanitary hot water. The contract stipulates that Sol Solar is responsible for the installation and maintenance for a period of 6 years as well as guaranteeing the stated reduction. The form of payment to the company is strictly based on the amount of natural gas saved as compared to a 2-year baseline level of consumption.

Sol Solar states that, acting as an ESCO, they face many of the barriers previously described in this analysis, notably informational barriers represented by the influence of bad references related to unsuccessful installations and the lack of confidence in the way the amortization and savings are calculated. To help overcome these barriers, to ensure the viability of the project and to allow for a contract that would be easy for the customer to understand, Sol Solar targeted buildings with certain consumption characteristics. Specifically, the technical feature essential for the successful implementation of the project was the existence of a centralized water heating system. The original agreement was that Sol Solar would cover 100 % of the cost of the installation, with ICAEN agreeing to reimburse 30 % and the City Council of Barcelona another 15 %. However, due to the fact that this was the first project of its kind in the city, the municipal legislation did not stipulate a viable formula to deliver the payment to the involved ESCO and in the end, a negative response was given. Therefore, the homeowners’ association agreed to be responsible for the uncovered 15 % of the installation costs. Additionally, during the 6-year contract period, the homeowners’ association pays the calculated monthly baseline amount; the actual consumption is paid to the natural gas company while the difference between the actual consumption and the baseline is paid to Sol Solar. It is also interesting to note that besides the kWh saved, Sol Solar’s monthly invoice informs the customer about the number of kilograms of CO2 avoided and the m3 of natural gas that do not need to be imported. Once a year, any deviations from the calculated consumption are resolved. When the contract terminates, ownership of the installation is turned over to the homeowners’ association, at which point they will only pay for their actual consumption (roughly 50–60 % less than the baseline consumption). If desired, Sol Solar shall offer a maintenance contract to ensure that the installation continues performing optimally in return for 10 % of the yearly natural gas savings.

During the first 3 months of operation, the installation has saved the equivalent of 30,000 kWh, representing a 32 % savings compared to the historical consumption during the same period. According to the president of the homeowners’ association, the results have been consistent and highly satisfactory in the first 8 months of operation. As a consequence, these significant savings have reversed the initial skepticism expressed by some neighbors. With regards to the expected barrier created by unfamiliar contract conditions and payback period calculations, our interviewee expressed that no difficulties were encountered. The only unforeseen issue was the necessary reinforcement of the roof in order to support the weight of the solar panels, which was a minor inconvenience. Worth mentioning is the fact that the project’s success has attracted international attention and has been visited by a commission interested in replicating it in the Italian residential sector (Table 2).

This demonstrates that existing ST technology is sufficiently mature and reliable to be financed via the ESCO model. However, our case analysis concludes that, in Barcelona, it has only been adopted by very few “innovators”. The Sol Solar example shows how an established local policy framework mechanism inspired a ST company to experiment using the ESCO model in an untapped market. The diffusion of this technology, as well as solar photovoltaic, throughout Barcelona’s residential buildings depends on the proper implementation of the soon-to-be extended STO. It is expected to provide the adequate mechanisms to foster the installation of both types of solar technologies on the roofs of existing buildings. We suggest that the updated version of the STO provide for a special fund to help cover initial installation costs in order to reduce the risk that most small ESCOs face when taking on a project and help to kick-start the market. Then, as solar technology prices fall and citizen awareness is generated, this fund should be gradually phased out to allow the market to become self-sustaining. Providing loan guarantees may also be an effective way to reduce financial risk for ESCOs.

5 Conclusions

This chapter introduces the ESCO model as an instrument to overcome the “energy efficiency gap,” and analyzes the case study of Barcelona, both from the public and private perspectives. The aim is to provide, based on the analysis of the international and national experience, what are the recommendable instruments for the further development of the ESCO market in Spain.

Our analysis has identified weaknesses in the ESCO ecosystem of the following nature: Administrative, Technical, Financial, Informational and Market-related. Thus, our conclusions will be organized into these categories.

5.1 Administrative

Our interviews with the actors involved in the Barcelona ESCO ecosystem have confirmed that there are fundamental limitations resulting from inefficient administrative structures, both at the city and national levels. First, procurement processes are too long and not designed to incorporate the distinctive characteristics of the ESCO model. This produces high transaction costs for ESCOs. Furthermore, based on recent attempts to carry out ESCO projects, Barcelona’s public bidding procedure has been unable to prevent collusion among bidders, leaving many projects abandoned. Another major administrative issue is the fact that the current city hall accounting system does not allow for the energy cost savings to be captured by the fund that pays for the renovation.

We find it very necessary for the Spanish government to eliminate the present barriers to the development of the ESCO market. In that respect, local city council/Provincial governments may be more agile than the Spanish government to overcome these barriers as they have a much better understanding of the local conditions. In addition, the full-scale implementation of a mechanism to certify buildings based on their energy efficiency is an essential starting point for gathering information in order to develop adequate policies.

Making fundamental and innovative changes to administrative structures is highly complex and involves the participation of many members of government. However, in our opinion, two types of reforms should be made to the current contracting law to be able to carry out ESCO projects: shorten the length of the public procurement process and adapt the conditions to the distinctive characteristics of the ESCO model.

5.2 Technical

To ensure promised energy savings have been achieved over the contract duration, there exists an internationally accepted procedure called the International Performance Measurement and Verification Protocol (IPMVP). The appropriate policy reforms should be made to make this protocol mandatory in Barcelona in order to assure customers that guaranteed savings have actually been delivered despite changes to variables related to climate, the building and its use over time.

5.3 Financial

Sol Solar’s case is just one demonstration of how new energy-saving technologies have been improving their performance, and therefore they provide a reasonable payback period with a continuously decreasing risk for investors.

Currently, the lack of adequate financing schemes for energy saving projects prevents small and medium-sized ESCOs from taking on large renovations. This is a major factor inhibiting the further development of Barcelona’s ESCO market. Currently however, due to the economic crisis, commercial financial institutions are more interested in the “low hanging”, easy projects, thus limiting activity with longer projects and in some client segments (for instance in the residential sector). Therefore, cash-flow based financing would be the appropriate solution for ESCO projects, where the bank would accept the stream of revenue coming from energy cost savings as collateral.

5.4 Informational

We have found that, in addition to true ESCOs, there are many companies that claim to be ESCOs but are not compensated in function of the energy cost savings generated by a renovation. We suspect that the local ESCO ecosystem could benefit from an official certification scheme specially designed for these companies. ESCOs could specialize in servicing customers with specific consumption profiles (schools, sports centers, supermarkets, etc.), generating higher quality services and minimizing skepticism of potential clients.

In addition, most of our interview respondents expressed that the lack of reliable data related to the building sector is one of the main obstacles for successful implementation of energy efficiency policies. The implementation of a professional and accountable energy audit scheme is recommendable in order to gather reliable information regarding the energy consumption profile of each building. This information would be helpful to establish an adequate work plan for future renovations.

Furthermore, the AEB’s buildings monitoring program should be extended to the rest of Barcelona’s public buildings and eventually to residential and industrial buildings. This would reduce the existing asymmetric information problem between the AEB and the bidder companies with regards to the audit results.

With respect to another identified asymmetric information problem, we believe that the incorporation of an ESCO contract into the new version of the STO could prove to be an effective solution for overcoming the above mentioned moral hazard issue. By forcing the construction or maintenance company to receive compensation strictly based on the amount of energy savings that are generated by the unit, the company would be incentivized to use the most effective materials to install the unit in order to ensure high efficiency, and thus, a quicker payback period.

5.5 Market-Related

On a national level, efforts should be made to unify the differing regional regulations relating to ESCOs. This would create conditions for a bigger and more attractive market, allowing for a critical mass to be reached. More competition will also lead to better quality energy services and lower prices for consumers. Additionally, a bigger, more competitive market would help Spain become more energy efficient, less contaminant and more energy independent.

In conclusion, we hope that the findings presented in this chapter have contributed to uncover the fundamental obstacles to the widespread implementation of the ESCO model in Barcelona, as well as throughout the rest of Spain. Some of the identified barriers are simply due to incomplete or inaccurate information while others are directly linked to bureaucracy and the insufficient implementation of government policies and procedures. Indeed, given the slow evolution of policy framework conditions, perhaps a deeper investigation into the role of financing institutions as an enabler of innovative business models in the energy efficiency space is warranted.

Notes

- 1.

Energy efficiency and conservation are different concepts. Energy conservation is defined as: “the absolute reduction in energy demand compared to a certain baseline, measured in energy units”; while energy efficiency refers to the improvement in the way energy is used to provide a product or service, and it is measured in units of output per energy unit [19]. What people really consume is not energy, but rather, energy services. Therefore, energy efficiency can help to provide the same level of energy services using a lower amount of energy [1].

References

Abadie LM, Chamorro JM, González-Eguino M (2012) Valuing uncertain cash flows from investments that enhance energy efficiency. J Environ Manag, 116, 113–124

Bertoldi P, Boza-Kiss B, Rezessy S (2007) Latest development of energy service companies across Europe: a European ESCO update. DG Joint Research Centre Institute for Energy, European Commission, Brussels

CEB (2012) Consorci d’Educació de Barcelona. http://www.edubcn.cat/ca/. Accessed June 2, 2012

Christopher KJS (2009) Greenhouse gas emissions from global cities. Environ Sci Technol, 43, 7297–7302

EU-ESCO (2012) European association of energy service companies. http://www.eu-esco.org/index.php?id=21. Accessed May 15, 2012

European Building Performance Institute of Europe. Europe's buildings under the microscope: A country-by-country review of the energy performance of buildings. http://www.europeanclimate.org/documents/LR_%20CbC_study.pdf

European Commission Joint Research Centre Institute for Energy (2010) Energy Service Companies Market in Europe - Status Report 2010. http://publications.jrc.ec.europa.eu/repository/bitstream/111111111/15108/1/jrc59863%20real%20final%20esco%20report%202010.pdf

Fouquet R (2013) Handbook on energy and climate change. Edward Elgar Publications, Cheltenham

Galarraga I, Heres Del Valle D, González-Eguino M (2011) Price premium for high-efficiency refrigerators and calculation of price-elasticities for close-substitutes: a methodology using hedonic pricing and demand systems. J Clean Prod 19(17–18):2075–2081

Goldman CA., Hopper NC, Osborn JG (2005) Review of US ESCO industry market trends: an empirical analysis of project data. Energy Policy, 33(3), 387–405

Hansen et al (2009) ESCOs around the world: lessons learned in 49 countries. The Fairmont Press, Inc, Lilburn

ICAEN (2012) Institut Català d’Energia. http://www20.gencat.cat/portal/site/icaen. Accessed June 13, 2012

IDAE (2012) http://www.idae.es/index.php/relmenu.364/mod.empresasservicios/mem.fbusquedaEmpresas. Accessed May 21, 2012

IEA (2009) International energy agency. Implementing energy efficiency policies: are IEA member countries on track? OECD/IEA, Paris

Jaffe AB, Stavins RN (1994) The energy-efficiency gap: what does it mean? Energy Policy 22(10):804–810

Gupta J, Ivanova A (2009) Global energy efficiency governance in the context of climate politics. Energ Effic 2(4):339–352

La Caixa (2012) Informe Mensual Marzo 2012. http://www.lacaixa.comunicacions.com/se/ieimon.php?idioma=esp&llibre=201206. Accessed June 5, 2012

Limaye DR, Limaye ES (2011) Scaling up energy efficiency: the case for a Super ESCO. Energ Effic 4(2):133–144

Linares P, Labandeira X (2010) Energy efficiency: economics and policy. J Econ Surv 24(3):573–592

McKinsey and Co (2009) Impact of the financial crisis on carbon economics: version 2.1 of the global greenhouse gas abatement cost curve

Peretz N (2009) Growing the energy efficiency market through third-party financing. Energy L J, 30, 377–403

Real Decreto-ley 6/2010 (2010) de 9 de abril, de medidas para el impulso de la recuperación económica y el empleo (2010) Boletín Oficial del Estado

Singer T, Lockhart N (2002) IEA DSM task X—performance contracting, country report: United States. International Energy Agency, Paris

Soroye KL, Nilsson LJ (2010) Building a business to close the efficiency gap: the Swedish ESCO experience. Energ Effic 3(3):237–256

Vine E (2005) An international survey of the energy service company. Energy Policy 33:691–704

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

The following respondents have been interviewed and/or responded to personal emails during the period February 2012–June 2012 (Table A.1).

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Bobbino, S., Galván, H., González-Eguino, M. (2015). Budget-Neutral Financing to Unlock Energy Savings Potential: An Analysis of the ESCO Model in Barcelona. In: Ansuategi, A., Delgado, J., Galarraga, I. (eds) Green Energy and Efficiency. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-319-03632-8_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-03632-8_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-03631-1

Online ISBN: 978-3-319-03632-8

eBook Packages: EnergyEnergy (R0)