Abstract

We propose a model for assessing the performance of generation mixes in a mean-variance context. In particular, we focus on the expected price of electricity and the price volatility that result from different generating portfolios that change over time (because of investments and retirements). Our valuation model rests on solving an optimization problem. At any time it minimizes the total costs of electricity generation and delivery. A distinctive feature of our model is that the optimization process is subject to the behavior of stochastic variables (e.g. load, wind generation, fuel prices). Thus we deal with a problem of stochastic optimal control. The model combines optimization techniques, Monte Carlo simulation over the decades-long planning horizon, and market data from futures contracts on commodities. It accounts for uncertain dynamics on both the demand side and the supply side. The aim is to assist decision makers in trying to assess electricity portfolios or supply strategies regarding generation infrastructures. To demonstrate the model by example we consider the case of Great Britain’s generation mix over the next 20 years. In particular, we compare three future energy scenarios and the contracted background, i.e. four time-varying generating portfolios. Major British power producers are covered by the EU Emissions Trading Scheme (ETS), so they operate under binding greenhouse gas (GHG) emission constraints. Further, the UK Government has announced a floor price for carbon in the power sector from 1 April 2013. The generation mix is optimally managed every period by changing input fuel and electricity output as required.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Risk-return trade-off

- Electricity planning

- Mean-variance analysis

- Stochastic processes

- Futures markets

- Optimal power flow

- Monte carlo

1 Introduction

Investments in power generation usually entail two types of effects: (i) portfolio effects, i.e. the interplay between a new power plant and the existing fleet of plants owned by a utility or located in a country; and (ii) option value effects, e.g. the flexibility to run on particular technologies at a higher or lower rate over time as uncertainty about the future unfolds. It has long been recognized that a proper valuation of investments in power generation needs to capture both effects [7]. In other words, if the optimal degree of fuel mix diversity is to be identified, we need valuation approaches that trade-off the expected returns and risks of increased portfolio diversification, in both a static and dynamic perspective.

Mean-Variance Portfolio (MVP) theory is well suited for the first task [25]. The standard framework envisages an investor that is confronted with a (financial) portfolio selection problem. As long as information about asset average returns, variances, and covariances is available, it is possible to map the whole set of assets and portfolios of assets on a risk/return diagram. Hence, provided the investor dislikes risk and likes return, it is possible to delineate the efficient frontier, i.e. the set of asset portfolios that either minimizes risk for a given level of expected return, or maximizes the latter for a given level of the former. Thus MVP theory allows investors to identify the range of efficient choices. Then it is up to the investor to identify the particular portfolio that best matches her/his individual preferences regarding expected return and risk (the optimal portfolio). MVP theory thus improves decision making in two ways: (i) by simplifying the portfolio selection problem (narrowing down the choice along the efficient frontier), and (ii) by sticking a number to the reduction of risk that diversification brings about.

MVP theory has been applied to real assets such as power plants with the aim of identifying the optimal portfolio of generation assets for a utility or a country [2–4, 8, 20, 21, 32]. Bazilian and Roques [7] provide a brief review of this literature alongside a number of state-of-the-art applications of MVP theory for electric utilities planning. Early MVP applications mostly took a national or societal perspective; they were based on power generating cost and concentrated on fuel price uncertainty. Some recent studies have instead adopted the viewpoint of private investors. Therefore they also take account of a broader set of risks: electricity price, emission allowance price, the co-movement of fuel, electricity, and carbon prices, among others.

In dynamic, uncertain environments the availability of a broad range of generation technologies and the flexibility to run on them at different rates are particularly valuable. However, this value is elusive. The Real Options approach (ROA) aims to quantify the value of a number of options that (project) managers have at their disposal (e.g. the investment timing, size, stages, and so on). See Dixit and Pindyck [14] and Trigeorgis [34].

When it comes to applying ROA to inform investments in power technologies, it is usually necessary to adopt relatively restrictive assumptions about the stochastic behavior of commodity prices. Besides, futures contracts on those commodities may well be available but their liquidity for the decades-long maturities that these infrastructures typically involve may falter. For a sample of ROA applications see Murto and Nese [26], Roques et al. [31], Nässäkälä and Fleten [27], Blyth et al. [9], Abadie and Chamorro [1].

Investors in liberalized electricity markets are naturally concerned about the expected return and the risk of their investments. At the same time, policy makers may guide investments in power plants in a particular direction (e.g. by adopting a societal, as opposed to private, perspective). We propose a model for assessing the performance of dynamic generation mixes in a mean-variance context. In particular, we focus on the expected price of electricity and the price volatility that result from different generating portfolios that change over time (because of new investments and decommissioning of old plants).

There is a stark difference between our approach and the MVP portfolio approach. The latter typically aims to identify a set of efficient fuel mixes that optimally trade off the risks and expected returns of diversified portfolios of generating plants. This ‘efficient frontier’, however, usually corresponds to a single-period uncertain situation, i.e. adopts a static perspective. Instead, we develop a dynamic, multi-period approach. We assess the performance of different generating mixes over decades. Similarly to the mean-variance approach, we can restrict ourselves to considering a handful of particular generation settings which are of interest to industry or policy makers. Our two measures can be plotted in the standard risk-expected cost (or return) space, just like in the portfolio approach. But they tell a rather different story, namely how our time-varying ‘portfolios’ behave over a multi-year period (in terms of electricity price).

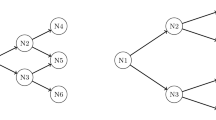

The model comprises two stages, namely simulation and optimization. The optimization model minimizes an objective function subject to constraints. The objective function considers two kinds of system costs: those of electricity generation and of unserved or lost load. The constraints can be split into two blocks concerning the physical and economic environment. Regarding physical uncertainty, power infrastructures are subject to failure. As for economic uncertainty, commodity prices display mean reversion and seasonality where appropriate. Load is similarly assumed to be seasonal and stochastic. The optimization provides, at any time, the level of generation from each technology and served load along with aggregate generation costs, carbon emissions, and allowance costs. We consider a 20-year time horizon (the one adopted in the UK Future Energy Scenarios). Over this period the network topology changes naturally as new stations start operation while others are decommissioned. Each year is broken down into 60 time steps (5 per month); i.e. the relevant period for the optimization problem is 1/60 year.Footnote 1

The optimization model is nested in Monte Carlo simulation. Needless to say, if simulations are to be realistic then we must work with numerical estimates of the underlying parameters from official statistics, market data, and the like. A single run determines the operation state of generation infrastructures over 60 × 20 = 1,200 consecutive time steps. The same holds for the value of stochastic load, wind- and hydro-based generation, fossil fuel prices, and carbon price. Under each setting, the optimization problem is solved: depending on the circumstances in place, generation is optimally dispatched subject to the network topology. Therefore, one simulation run involves 1,200 optimizations. We repeat the sampling procedure 750 times (so we solve 900,000 optimization problems). We thus come up with 750 time profiles of each variable of interest. Out of these simulations, we can determine several metrics (not only averages) and derive the cumulative distribution function of effects over major variables.

Therefore our model can assess the performance of a pre-specified generation fleet in terms of the resulting expected price and the standard deviation around that expectation. These two pieces of information fall naturally within the MV approach to portfolio theory. At this point, it is possible to assess the performance of the whole system (under different generation mixes) according to several other metrics, e.g. operation costs, unserved load, carbon emissions, etc. Comparing their relative performance sheds light on their respective advantages and weaknesses.

Of course, uncertainty about the future affects the rate at which future cash flows must be discounted to the present. Some related papers develop their analyses under two (or more) discount rates, e.g. Roques et al. [32]. Another usual practice is to assume a particular utility function that characterizes the tradeoff between risk and return [22]. One of the inputs to this function is the coefficient of risk aversion. Analyses are then developed under two, three or more levels of risk aversion [16, 33, 38]. In our approach, futures markets play a major role. In addition to their informational role, the use of futures prices allows discount at the risk-free interest rate. This fact sidesteps the discussion about the appropriate discount rate.

To demonstrate how the model works we undertake a heuristic application. In particular, we consider the UK Future Energy Scenarios up to 2032. We consider both base- and peak-load technologies, and also installed capacities of power technologies as scheduled by the UK Department of Energy and Climate Change (DECC) over the planning horizon (2013–2032). The UK is covered by the EU Emissions Trading Scheme (ETS), so their electricity generators operate under binding greenhouse gas (GHG) emission constraints. Note that the UK Government has announced a floor price for carbon in the power sector from 1 April 2013 with an initial value around 16 ₤/tCO2 to target a price for carbon of 30 ₤/tCO2 in 2020 and 70 ₤/tCO2 in 2030. Each generation portfolio is exogenously given but is optimally managed by changing input fuel and electricity output as required.

The paper is organized as follows. Section 2 introduces the theoretical model. Upon the distinction between the physical environment and the economic environment it presents the optimal dispatch problem. Then Sect. 3 shows a heuristic application to four dynamic generating portfolios assumed to provide a range of potential paths of Great Britain over the period 2012–2032. A section with our main findings concludes.

2 The Model

We propose a model for evaluating the performance of time-varying generation portfolios. The performance depends on factors that change over time, e.g. network topology, market structure, fuel and electricity prices, energy policy, environmental and climate policies, etc. Our valuation model rests on solving an optimization problem. At any time it minimizes the total costs of electricity generation and delivery; in this sense it draws on Bohn et al. [10]. A distinctive feature of our model is that the optimization process is subject to the behavior of the stochastic variables (e.g. load, fuel prices); thus we deal with a problem of stochastic optimal control, which is similar to that in Chamorro et al. [11]. We allow for the possibility that a fraction of the demand is unserved, but this has a non-negligible cost (thus, with the exception of extreme cases, in practice load is always served). Regarding market power or strategic bidding by power generators, we account for these issues through the profit margin of the electricity price-setting (or ‘marginal’) technology.Footnote 2

The model allows for random failures in physical facilities. Uncertainty stems also from load, wind generation, and hydro generation. We assume these follow stochastic processes with suitable properties (for example, seasonality or stationarity) that can be estimated from official statistics. Stochastic processes similarly govern the economic sources of uncertainty (fossil fuel prices and allowance prices). For estimation purposes, the ideal market data are composed of futures prices; this is important because (assuming the required liquidity/maturities are met) they enable us to estimate parameter values in a risk-neutral setting.Footnote 3

Our model does not address the question of the optimal time to alter the generation portfolios. We ignore inflation and efficiency targets at this stage. We abstract from access-pricing problems for new generators. The model allows a number of questions to be modeled and answered. Thus, in our base case climate policy makers commit themselves to a certain future path of the allowance price by setting a floor (i.e. carbon price evolves stochastically but always above a minimum threshold level). We run the model to assess the overall impact (both absolute and relative to the case without a floor price). Besides, we try different time-varying portfolios of generation facilities. This way the model can assist decision makers when confronted with challenging strategic choices.

We aim to evaluate the performance of long-term portfolios through the resulting electricity price and its volatility alongside the abatement of CO2 emissions. Since the probability distribution of these impacts can be asymmetric, we go beyond average values and derive whole distributions of effects. The electricity prices in particular can be used to check whether they are high enough to get a fair return on investments in any particular type of power technology.

The optimal power flow (OPF) algorithm dispatches generation assets in merit (least-cost) order subject to physical constraints. The economic dispatch problem is to find output for each available technology so as to minimize total (system) costs while meeting load plus line losses. At every time demand and supply must be balanced, and the Laws of Physics must apply in the network.

2.1 Physical Environment

Load. Load is assumed inelastic and stochastic while showing seasonality. D denotes the net demand for electricity from consumers. Pumped storage is a power technology that effectively consumes electricity; its contribution, P, has a negative sign. Therefore, the gross demand d is the sum of the realizations of two different stochastic processes computed as:

Depending on the infrastructure available, load can be fully served or not. The electricity actually served is denoted by s.

Future demand dispalys seasonality and is uncertain. We assume that the deseasonalized load evolves over time according to the following Inhomogeneous geometric Brownian motion (IGBM):

D is assumed to show mean reversion. L is the long-term equilibrium level toward which the present deseasonalized load tends. k is the speed of reversion toward that “normal” level. The instantaneous volatility of this load is denoted by \( \sigma \). \( {\text{d}}V_{t} \) is the increment to a standard Wiener process; it is normally distributed with mean zero and variance dt.

Generation capacity. S stands for a given particular power station, and its actual electricity generation is denoted by x with an upper bound \( \overline{x} \).

The coal (c), natural gas (g), and nuclear (n) fuel technologies in our model are prone to failure. We adopt a set of binary (Bernoulli) random variables for the possibility of any one contingency. We thus assume that each station \( S \) of type \( \left\{ {c,g,n} \right\} \) is in service for a fraction \( \varLambda \) of the year. Here \( c = \left\{ {1, \ldots ,\overline{C} } \right\} \) stands for coal plants, irrespective of whether they are operative or not. Note that \( \overline{C} \) is not fixed; it can change over time due to openings or closures on a planned schedule. Similarly, \( g = \left\{ {1, \ldots ,\overline{G} } \right\} \) and \( n = \left\{ {1, \ldots ,\overline{N} } \right\} \) refer to gas and nuclear plants.

We do not consider that wind (w), natural-flow or hydro (h), and pumped storage (\( p \)) stations can be ‘off’. All the intermittences for whatever reasons are modeled through the stochastic behavior of the load factor. The theoretical model assumed is an IGBM:

The standard notation for reversion speed, long-term value, and volatility holds (wind: \( k_{W} \), \( W_{m} \), and \( \sigma_{W} \); hydro: \( k_{H} \), \( H_{m} \), and \( \sigma_{H} \); pumped storage: \( k_{P} \), \( P_{m} \), and \( \sigma_{P} \)).

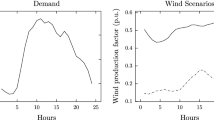

Generation from wind, natural flow and pumped storage stations is seasonal. Our simulations assume a seasonal behavior for renewable electricity, so the seasonality in each load factor must be previously identified (from historical time series).

We can define the activity vector \( a \equiv \left\{ {a_{c} ,a_{g} ,a_{n} ,1,1,1} \right\} \) across all its technologies \( f = \left\{ {c,g,n,w,h,p} \right\} \). Aggregate output electricity, denoted \( x \), comprises generation from all its energy sources \( f = \left\{ {c,g,n,w,h,p} \right\} \):

The maximum power that can be generated at a given time (t) by coal plants is \( a_{c} \overline{x}_{c} \). Therefore, the aggregate output electricity is bounded from above.

2.2 Economic Environment

Demand-side costs. According to Foley et al. [15], in liberalized electricity markets the sale of electricity at a profit is the main business focus with value of lost load (VOLL) playing a larger part than energy not served (ENS) (which was a key factor in the era of the state monopoly). Short run marginal cost-based pricing is generally not high enough to ensure this, so equilibrium involves a degree of ENS priced at VOLL. Thus in our model we have implicit rationing costs. The overall unmet load is computed as:

All consumers are assumed to have an identical and constant VOLL per unit, VOLL, for any level of electricity use. Thus demand-side costs equal the above difference times VOLL.

Supply-side costs. A major driver of stations’ short-term marginal costs is fuel cost (in addition to emissions cost). We assume that wind, hydro and nuclear stations bid a price of zero [37]; that pumped storage takes electricity from the network at the bottom of the price range; and that the prices of coal (C), natural gas (G), and carbon dioxide (\( A \)) evolve stochastically over time.Footnote 4

In a deregulated electricity market, economic costs include both explicit input (fuel) and output (emissions) costs, and a margin to get a ‘reasonable’ profit for the generation units. Its size (here assumed constant) crucially depends on the ‘marginal’ technology that sets the electricity price, and the scope for market power and/or strategic behavior by generators.

Generation costs comprise the (bid-based) costs incurred by all power technologies \( f = \left\{ {c,g,n,w,h,p} \right\} \). Since wind, hydro, and nuclear generators are assumed to bid a zero electricity price, these sources will be fully dispatched whenever available as long as load surpasses their availability: \( x_{w} = \overline{x}_{w} \), \( x_{h} = \overline{x}_{h} \), \( x_{n} = \overline{x}_{n} \). Noting that pumped storage stations tend to adjust their operation to the time when electricity prices are at the higher end, even above natural gas turbines, we assume their ‘cost’ function is a multiple of that of gas turbines, in our case, 1.10. Thus total generation costs are:

Here \( H_{G} \) and \( H_{C} \) denote the thermal efficiency of gas- and coal-fired stations, respectively. C and G denote the price (in €/MWh) of coal and natural gas, respectively, while A stands for the price (in €/tCO2) of carbon dioxide. In electricity markets where natural gas-fired stations are the usual marginal technology, the fixed margin \( M_{m} \) will be the ‘average’ or long-term clean spark spread.Footnote 5 When coal-fired plants or pumped storage stations are the marginal plants, we assume that they earn the same margin.

We assume that natural gas prices display a seasonal pattern, but that coal and carbon do not. The long-term prices of natural gas and coal are described by the following IGBM stochastic processes in a risk-neutral world:

Unrestricted carbon prices (e.g. those on the EU ETS) are assumed to follow a standard geometric Brownian motion (GBM):

Nonetheless, the UK has set a floor that effectively supresses downward paths below a certain limit. Therefore, the (restricted) time-t allowance price A t that serves as the basis for computing A t + 1 in our simulations obeys the scheme:

Thus, if B t > floor(t) the restricted carbon price and the unrestricted one are the same: A t = B t . Conversely, if B t < floor(t) then we have A t = floor(t).

Both G and C are assumed to show mean reversion. \( G_{m} \) and \( C_{m} \) denote the long-term equilibrium levels toward which current (deseasonalized) gas and coal prices tend in the long run. \( f_{G} (t) \) is a deterministic function that captures the effect of seasonality in gas prices. \( k_{G} \) and \( k_{C} \) are the reversion speeds toward the “normal” gas and coal prices. Regarding the price of the emission allowance, the parameter \( \alpha \) stands for the instantaneous drift rate of carbon price. \( \sigma_{G} \), \( \sigma_{C} \) and \( \sigma_{B} \) are the instantaneous volatility of natural gas, coal and carbon allowance. \( \lambda_{G} \), \( \lambda_{C} \) and \( \lambda_{B} \) denote the market price of risk for gas, coal, and allowance prices. \( {\text{d}}Z_{t}^{G} \), \( {\text{d}}Z_{t}^{C} \) and \( {\text{d}}Z_{t}^{B} \) are the increments to standard Wiener processes. They are normally distributed with mean zero and variance \( {\text{d}}t \); besides:

From the above stochastic differential equation for a commodity price under risk neutrality it is possible to derive a theoretical model for the futures price with any desired maturity. We estimate the parameters in this stochastic model using daily prices and non-linear least-squares regression (see [11], Appendix D). Upon estimation of the parameters we can simulate the behavior of commodity prices any number of times.

Economic dispatch. We assume that the system operator dispatches generating resources to minimize the total costs of generation and unserved energy. As is usually the case in electricity markets, nuclear, wind and hydro are assumed to be located at the bottom end of the ‘merit order’, i.e. they are the first technologies to enter the system. Consequently, the problem below solves for the generation level of coal- and gas-fired power plants (x c and x g , respectively) along with that of pumped-storage stations (x p ) and power served (s). A high VOLL implies in practice that the load will be served unless this is not technically feasible. The aim is to find an optimal vector of power generated \( \left\{ x \right\} \) and power served/consumed \( \left\{ s \right\} \) that minimizes system costs at any time:

Subject to:

The first two restrictions set the environment as determined by the operation state of the physical assets. The components of the power system are subject to limits. Besides, the power delivered is lower than or equal to the amount demanded. In other words, served load must fall between zero and total load (it is possible that some load is not met when cost is minimized).

The last three restrictions are the stochastic differential equations. Demand \( \left\{ D \right\} \) has an initial value and evolves seasonally and stochastically over time. The load factor of renewable, intermittent wind- and hydro-based generation stations \( \left\{ {W,H,P} \right\} \) is governed by a stochastic process. Similarly, the price of each commodity (coal, natural gas, and emission allowance) follows another Ito process. The increments to standard Wiener process \( {\text{d}}V \), \( {\text{d}}Y \) and \( {\text{d}}Z \) differ. \( {\text{d}}Z \) also differs for each commodity \( \left\{ {C,G,B} \right\} \) along with the terms \( a(X,t) \) and \( b(X,t) \).

3 A Heuristic Application to the British Power Sector

To illustrate the model by example we consider a single system that is initially given and fixed, namely Great Britain as of 2012. We abstract from the particular arrangements of the British wholesale electricity market [37], which does not operate as a pool.Footnote 6 The demonstration of our general approach is thus inspired by GB in that it uses plausible data, but with no claim as to accuracy for GB in detail.

Regarding load, UK official statistics take ‘Electricity available’ as the starting point for sales of electricity to consumers. This amount reflects the contribution from all stations including pumped storage P. Electricity available in 2012 amounted to 336.96 TWh. After subtracting transmission and distribution losses alongside theft, sales to consumers reached 308.41 TWh.Footnote 7 Value is sacrificed whenever load is lost. We assume VOLL = 2,500 ₤/MWh interrupted [30], or 2,904.44 €/MWh.

As for the generation capacity, the second column of Table 1 shows the generation mix by fuel source as of 2012. Based on UK DECC [35], coal-fired stations reach a thermal efficiency of 36 %, combined cycle gas turbines reach 47.7 %, and nuclear stations 39.8 %. “Wind” denotes both offshore and onshore wind. “Hydro” stands for “Other renewables”; hydro stations generate electricity by flowing water through turbines from sources naturally replenished through rainfall. “Pumped storage” denotes “Other (Oil/Pumped)”; the latter stations use off-peak electricity to pump water to a reservoir. They then release water to generate electricity at times of peak demand (they are not considered to be renewable sources; UK DECC [36]). The next column shows the number of power stations owned or operated by Major Power Producers classified by type of fuel. Our model assumes a fleet of identical average plants for each technology every year. The number and type of power stations is expected to change significantly in the years ahead.

Maintenance and other works make plants unavailable from time to time. We assume that natural gas plants are available 95 % of the time; nuclear plants 77 %; and coal plants 75 %. As for renewable sources, all the stations are active in principle but are intermittent. The time series of their metered output accounts for their active/inactive state and load factor in a unified form. We use these data to estimate the underlying parameters of wind generation, pumped storage and hydro generation; see Appendix Tables A.3, A.5, and A.7.

Any day we have futures prices of all contracts on natural gas with monthly, quarterly, seasonal (April–September and October–March), and yearly maturities on the European Energy Exchange (EEX, Leipzig). We collected these data over 231 days. Similarly for coal to be delivered in Amsterdam, Rotterdam, or Antwerp (so-called ARA coal). We also collected the prices of futures contracts on EU emission allowances traded on the Intercontinental Exchange (ICE; London); see Chamorro (2012), Appendix D. Using the futures prices on each day and non-linear least-squares, we derived the curve that best fits futures prices on that day; this provides an estimate of the parameters in the (risk-neutral) stochastic model. Upon the calibration on each of the sample days, we computed the corresponding average values in a second step; we use them as reasonable estimates of future behavior.

Concerning the economic dispatch, the system operator aims to find an optimal vector of power generated \( (x) \) and consumed \( (s) \) that minimizes the sum of (bid-based) generation costs and unserved demand costs subject to the restrictions stated above. The number of possible states of the system is \( 2^{(22\, + \,79\, + \,10)} \) in 2012; this figure will change as old plants are decommissioned and new plants start operation.

Our aim is to evaluate the performance of dynamic generation portfolios. We discount future cash-flows at the risk-free interest rate using risk-neutral parameters. We run 750 simulations each consisting of 1,200 steps over 20 years (i.e. five steps per month). At each step the optimal dispatch problem is solved subject to the restrictions then in place; i.e. we solve 900,000 optimization problems that minimize the sum of the bid-based costs of electricity generation and the cost of unserved load, subject to linear and non-linear restrictions. The solution to each problem defines the levels of generation and the power effectively served. Hence we compute the bid-based production costs, electricity price, and carbon emissions, among other variables. We follow the same steps with each generation portfolio. The comparison among them describes their (relative) performance in terms of the variable(s) involved.

3.1 Future Demand: Assumptions

We collected monthly load data from January 2002 to August 2013, i.e. 140 observations; see Fig. 1. Our base case analysis assumes that electricity demand shows mean reversion over time with a null rate of growth. Transmission and distribution losses alongside theft account for 9 % of overall demand over the sample period. We estimate a load function with seasonality; see Appendix Table A.1. The model is run with the same forecast demand under all the generation mixes considered.

3.2 Future Generating Portfolios

The UK has legislation in place setting limits on the emissions of greenhouse gases as far ahead as 2050.Footnote 8 Other legislation mandates a minimum level of renewable energy in 2020.Footnote 9 The 2012 Electricity 10 Year StatementFootnote 10 (or ETYS for short; [29] is the first GB document of its kind to be published. It forms part of a new suite of publications which is underpinned by the UK Future Energy Scenarios. The ETYS analysis is based around three future energy scenarios which provide a range of potential reinforcements and outcomes. Additionally, further analysis has focused on the contracted background, which includes any existing or future project that has a signed connection agreement with National Grid.

Gone Green (henceforth GG). This is the main analysis case for the ETYS. It assumes a balanced approach with different generation sectors contributing to meet the environmental targets. Gone Green sees the renewable target for 2020 and the emissions targets for 2020, 2030 and 2050 all met.

As Fig. 2 shows, coal capacity decreases dramatically over the period with a U-turn as new carbon capture and storage (CCS) capacity comes on line from 2025 onwards. This is due to the EU Large Combustion Plants Directive (LCPD) and Industrial Emissions Directive (IED). Gas/CHP generation capacity increases overall over the full period (6.3 GW). Nuclear capacity increases by a total of approximately 5 GW over the period. Wind starts from some 5 GW of capacity in 2012 but reaches 25 GW by 2020 and 49 GW by 2032. Hydro (including biomass and marine) increases from almost 2 GW currently to some 5 GW over the full period to 2032. Instead, generation capacity of pumped storage is cut in 50 % over the period.

Generation mix 2012–2032 under Gone Green future energy scenario [29]

Slow Progression (SP). Developments in renewable and low carbon energy are relatively slow in comparison to Gone Green and Accelerated Growth, and the renewable energy target for 2020 is not met until sometime between 2020 and 2025. The carbon reduction target for 2020 is achieved but not the indicative target for 2030.

This scenario places less emphasis on renewable generation. As Fig. 3 shows, coal capacity declines consistently to some 4 GW by 2032. Instead, gas capacity increases even more than before (10 GW more by the end of the period). Nuclear capacity remains fairly static. Growth in wind capacity is considerably slower in this scenario in comparison to Gone Green (capacity increases five-fold, not nearly ten-fold as before). Other renewables excluding wind remain fairly static. Pumped storage evolves basically as before.

Generation mix 2012–2032 under Slow Progression future energy scenario [29]

Accelerated Growth (AG). This scenario has more low carbon generation, including renewables, nuclear and CCS, coupled with greater energy efficiency measures and electrification of heat and transport. Renewable and carbon reduction targets are all met ahead of schedule.

This scenario shows a much steeper increase in the level of renewable generation capacity than the others, as Fig. 4 shows. Coal capacity shows a net decrease over the period to 2032 of approximately 12 GW, with a slight U-turn at the end combined with CCS. Gas-fired capacity shows a mild increase over the period. Nuclear generation decreases a bit initially and then increases with the introduction of new nuclear plant. Wind generation capacity increases 12-fold in this scenario. Hydro capacity (alongside marine and biomass) also increases steeply over the period to 2032. Pumped storage evolves basically the same way as before.

Generation mix 2012–2032 under Accelerated Growth future energy scenario [29]

Contracted Background (CB). This refers to all generation projects that have a signed connection agreement with National Grid. No assumptions are made about the likelihood of a project reaching completion. Assumptions regarding closures have only been made where there is an explicit notification of a reduction in Transmission Entry Capacity (TEC) or there is a known closure date driven by binding legislation such as the LCPD. The known LCPD closures entail a decrease in coal generation.

As Fig. 5 shows, this scenario has gas and nuclear generation capacities reaching their highest shares of the mix. There is also a large increase in contracted wind overall. Pumped storage falls short of the capacity levels assumed under Accelerated Growth.

Generation mix 2012–2032 according to the Contracted Background [29]

3.3 Carbon Price: Assumptions

Taxes on activities that have negative environmental impacts are an important component of both the tax system and the UK’s environmental policies [17]. The climate change levy (CCL) is an environmental tax on electricity, gas, solid fuels and liquefied petroleum gas supplied to businesses and the public sector. It encourages energy efficiency to help the UK meet targets for cutting greenhouse gases, including CO2 emissions. Transport taxes such as fuel duty, instead, are designed primarily to raise revenues for public expenditure.

The UK Government has introduced a carbon price support mechanism to support investment in low-carbon generation. From 1 April 2013 supplies of fossil fuels used in most forms of electricity generation are liable either to CCL or fuel duty. Supplies are charged at the relevant carbon price support rate, depending on the type of the fossil fuel used. The rate is determined by the average carbon content of each fossil fuel. The carbon price support rates for 2013–2014 represent the difference between the Government’s target carbon price (the floor) and the futures market price for carbon in the EU ETS in 2013. These tax rates are equivalent to 4.94 ₤/tCO2 in 2013–2014 [18].

The carbon price floor announced in Budget 2011 begins at around 16 ₤/tCO2 in 2013 and follows a straight line trajectory to 30 ₤/tCO2 in 2020, rising to 70 ₤/tCO2 in 2030 (2009 prices). The floor will increase at around 2 ₤/tCO2 per year from 2013 to 2020. The floor effectively eliminates the lower part of a number of random paths of the carbon price. This policy measure (as compared to an unconstrained carbon price) has a double effect: it increases the average carbon price while decreasing its volatility. It in turn affects power technologies in different ways. The model handles this floor.

3.4 Power Generation

Investments in power generation face a broad set of risks which affect competing technologies differently. The model solves for the generation level of several technologies and the amount of power served in each period. Hence it is possible to compute the cumulative power produced, and also a number of statistics of the underlying distribution. Figure 6 displays the role played by each technology on average under each scenario.

Figure 6 suggests that the AG portfolio delivers the most even levels of power generation in terms of the major technologies. CB has the most uneven portfolio from this viewpoint. Other renewables (hydro, biomass, …) and non-renewables (pumped storage, oil) play a minor role in any case.

Combined cycle gas turbines are set to become the major producers in the SP generating portfolio (less so in the GG portfolio). This is consistent with the relatively low development of renewable and low-carbon energy and the delay in meeting the environmental target. However, this situation is in sharp contrast with that in the CB portfolio. Indeed, it is here where gas-based generation reaches its minimum. Instead, nuclear stations appear as the major providers in the CB scenario.

We can relate these production levels to their respective capacities installed. This sheds light on the effective load factor of each technology which in turn affects their profitability.Footnote 11 Figures 7, 8, 9 and 10 show the results under each scenario.

Under the three future energy scenarios coal has a higher share in power generation than in capacity installed; however both shares are almost equal in the CB portfolio. The situation is the opposite regarding gas-fired power plants. This suggests they fall short of running at anything close to full capacity. The difference is sizeable in AG, and particularly acute in CB; in this latter portfolio, there is room for concerns about their prospective profitability. Similarly to coal, nuclear always reaches a higher share in terms of power delivered than installed capacity. The gap is most pronounced in the CB scenario. As for wind, the gap remains basically steady in all the portfolios other than CB, around seven percentage points. In the CB portfolio, the gap is almost zero with generation reaching its maximum share (30 %).

3.5 The Results in a Mean-Variance Context

It is well known that the various generation technologies display different risk-return profiles. Since each scenario puts a different emphasis on the competing technologies, the scenarios themselves show different risk-return profiles despite sharing a common demand pattern.

As already mentioned, the model minimizes costs by solving a dispatch problem one period after another. Each period the model determines an electricity price at which supply meets demand (this price is set by the marginal technology to enter the pool).Footnote 12 Thus there are as many electricity prices as periods or optimization problems. First these prices are discounted so as to get their present-value equivalents. Then we calculate the average or expected value alongside the standard deviation. Figure 11 displays the results under each scenario.

As Fig. 11 shows, GG and SP turn out to be almost indistinguishable from each other in terms of both average electricity price (€/MWh) and price risk.Footnote 13 They perform slightly worse than the AG scenario. The best performer is CB since it lies furthest to the left and to the south. Prices in this setting are so low because of the high share of zero-cost technologies entering the pool. Now, would nuclear plants be profitable at such low prices?Footnote 14 Would utilities change the way they bid in the power market?

Each of the 750 simulations delivers whole paths of a number of variables. For example, we have 750 levels of the electricity price from 2013 to 2032. Figure 12 shows the frequency distributions under each of the generation portfolios as envisaged in ETYS 2012. Most cases (and the probability mass) are concentrated around the average price. But they are skewed right: the electricity price becomes very high in a few cases.

It is possible to derive an average electricity price as a by-product of the model: in each optimization the operating technology with the highest cost sets the marginal price. So there are as many electricity prices as optimization problems. Each portfolio delivers an average price.

Following de Neufville and Scholtes [13], we examine the cumulative distribution functions (or CDFs, sometimes referred to as “target curves”), which present a lot of information in a compact form and thus provide an effective way to compare alternative generation portfolios; see Fig. 13. The target curve under the CB stays always above those of the other portfolios, that is, it stochastically dominates them. Thus the CB portfolio entails a lower probability of surpassing any given level of electricity price (the vertical distance from the target curve to 1.00).

3.6 Environmental Goals: Carbon Emissions

Needless to say, from a social planner’s perspective the generating cost is the relevant measure [4, 6]. In a carbon constrained environment, this cost reflects the emission allowance price to some extent. Yet the amount of carbon emissions can be used as such to assess the four generation portfolios from an environmental point of view.

We computed the average of the 750 cumulative values for the above variables and others. Dividing these by the 20 years in our time horizon we obtained yearly averages.

Each scenario involves different utilization patterns of power technologies thus giving rise to different levels of CO2 emissions. Here again the CB scenario outperforms the others, so in principle there seems to be no trade-off between cost efficiency and carbon objectives. Figure 14 displays the average results. Note that even if the time profile of these emissions is asymmetric (which will render average values unreliable), from an environmental viewpoint it is basically the same whether a ton of CO2 is emitted in 2017 or 2023 (it will stay in the atmosphere for centuries). It is the cumulative emissions from each portfolio that matters. Since the time horizon considered is the same across the four portfolios, the ranking based on cumulative emissions coincides with that based on average yearly emissions.

Nonetheless, the time profile of these emissions is quite asymmetric (as the composition of the generating fleets changes over time) so their yearly averages must be taken with caution. We resort again to the target curves that result from alternative power portfolios; see Fig. 15. The CB portfolio stochastically dominates the other portfolios. In other words, it entails a lower probability of surpassing any given level of carbon emissions. As expected, AG comes second, followed by GG; SP portfolio is last.

3.7 Diversification and Concentration Issues

Depending on the prevailing circumstances, an efficient generation portfolio could in principle concentrate on one or two technologies (and hence primary energy sources). For example, the lack of long-term financial instruments for managing risks may favor technologies that ‘self-hedge’ to some extent; Roques et al. [32]. This reliance on one or two pillars might jeopardize another policy goal, namely security of supply. Indeed, as these authors point out, actual electricity markets may not appropriately signal the need for diversity and flexibility at the macroeconomic level. In other words, there can be a trade-off between efficiency and security.

Further, MVP theory assumes that price shocks are stochastic. However, the fewer technologies a power system relies upon, the fewer (as a rule) the number of suppliers, and the more the system is exposed to the (non-stochastic) effects of collusion and monopoly; Krey and Zweifel [23]. This risk of collusion grows higher as the number of suppliers (or energy sources) becomes lower.

To depict a possible tradeoff between efficiency and security, we use several concentration indexes to quantify fuel mix diversity. Hill [19] identified and ordered an entire family of possible quantitative measures of diversity:

where \( \Delta _{a} \) specifies a particular index of diversity, p i represents (in economic terms) the relative share of option i in the portfolio under scrutiny, and a is a parameter that inversely measures the relative sensitivity of the resulting index to the presence of lower contributing options.

For \( a = 1 \), the above general form reduces to the so-called Shannon-Wiener diversity index:

The higher the SW index, the more diverse the system. If SW < 1, the system is highly concentrated and therefore subject to the risk of collusion or monopoly, leading to interrupted supply and/or price hikes [23].

For \( a = 2 \), the reciprocal of the resulting expression is the Herfindahl-Hirschman concentration index:

The HH index can range from 0 (full diversification) to 10,000 (total concentration). A value HH < 1,000 is taken by antitrust authorities as indicating no concentration. A value of HH > 1,800 has been interpreted as problematic in terms of exposure to supply risk.

Krey and Zweifel [23] apply these two indexes to U.S. and Swiss data to determine the trade-off between economic efficiency and security of supply. As they point out, “both [SW and HH] indices permit evaluation of the security of supply of different power generating technologies thanks to a greater number of suppliers. They therefore complement the MVP approach for policy makers who fear purchases of primary energy to be exposed to collusion or monopoly—a consideration of relevance especially in the markets for natural gas and uranium”. Both indices help to determine whether a power generation portfolio is sufficiently diversified in terms of technologies (this in turn implies diversification in terms of purchases of primary energy sources).

We first looked at the initial capacities and those at the end of the time horizon under each scenario. Table 2 shows that the SW index is always higher than 1; below this threshold the risk of collusion looms. Relative to 2012, the SP portfolio points to a reduction of diversity; the opposite happens with the CB portfolio: it is the most diversified one. The HH index instead suggests that the SP portfolio is the least concentrated while CB is the most so.

It may be of interest to apply the SW and HH indexes not only to installed capacities but to generation levels as well. One or two scenarios suggest that some power technologies will show load factors lower than usual. Table 3 displays the results (based on yearly averages of installed capacities and generation levels).

The SW index surpasses the threshold 1.0 which suggests that the underlying generation portfolio (and hence primary energy sources) is reasonably diversified. A higher SW index means a more diverse system. As before, CB happens to be the most diversified scenario in terms of average capacity while SP scenario is the least so. However, in terms of average production the AG portfolio is the most diversified whereas CB is the least diversified.

The HH index takes on values higher than 1,800 which implies that all generation portfolios are concentrated. Now, a higher HH means a system further away from perfect competition. The CB portfolio is the least concentrated in terms of installed capacity. Conversely, it is the most concentrated portfolio in terms of power generation; more competition among suppliers of primary energy would thus be particularly beneficial. In all, the preeminence of CB portfolio according to MVP analysis comes at a price in terms of the lowest diversification and highest concentration regarding power generation. On the other hand, note that GG and SP overlap in the MVP figure but this is not the case when it comes to the diversity index or the concentration index.

3.8 Sensitivity Analysis: Portfolio Performance Without a Floor Carbon Price

This section shows similar figures as before, under the alternative assumption of an unconstrained carbon allowance price. The standard assumption in the literature is that carbon price follows a GBM, which is a non-stationary process (thus adding significantly to price risk). Figure 16 displays the results under each scenario.

First, comparison with Fig. 11 shows that the average electricity price decreases while the standard deviation increases significantly in the absence of the carbon price floor. The previously overlapping GG and SP portfolios no longer overlap, yet they continue to be close to each other. They do not perform as well as the scenario AG in terms of expected price, but they are relatively less risky. The clear winner again is CB since it lies furthest to the left and to the south.

Regarding carbon emissions, not surprisingly they are higher now than in Fig. 14, since carbon prices can fall more when there is no support; see Fig. 17. Considering each portfolio in isolation, yearly average carbon emissions under GG rise by 8.7 MtCO2, those under SP by 4.7 MtCO2, those under AG by 8.1 MtCO2, and finally those under CB by 2.1 MtCO2.

4 Conclusions

MVP analysis has been increasingly adopted over the last decades to assess the performance of power generating portfolios in a number of countries. This is consistent with the notion that, in liberalized electricity markets, investors and utilities are concerned not only with the average or expected return on their investments but also with their risk. This basic tradeoff is suitably represented in a diagram with a measure of performance on the vertical axis (e.g. expected electricity cost or power per monetary unit) and a measure of risk on the horizontal axis (e.g. the standard deviation of the variable involved).

The traditional framework applies to a generating portfolio that is typically kept constant over the evaluation horizon (say, 20 years). It can be the current portfolio in a given country, or a target portfolio assumed to be in place sometime in the future.

Here we consider a generating portfolio in a dynamic context. We recognize the fact that the fleet of power plants changes over time as new stations connect to the electric grid and older ones cease operation. Further, we evaluate the performance of several generating portfolios in face of a common stochastic path of future demand. There is more to these real facilities than to financial assets, so other metrics beyond expected price and price volatility can be of interest too. Indeed, investors, utilities and policy makers aim at different goals, so the most relevant variables can differ among them.

We develop a valuation model that rests on cost minimization. Our measure of cost naturally includes that of power generation and of unserved load. Regarding the former, power producers under the EU ETS face both stochastic fuel prices and carbon allowance prices. As for the latter, in our model lost load has a non-negligible cost.

Uncertainty in our model extends beyond economic variables. It affects the state of physical infrastructures and/or their output. In sum, we deal with a problem of stochastic optimal control.

At any time, the optimization algorithm provides the level of power generation by technology, served load, aggregate generation costs, carbon emissions, and allowance costs, among other variables. The optimization model is nested in Monte Carlo simulation. A single run determines a number of state variables over \( 60 \times 20 = 1,200 \) consecutive time steps. Under each setting, the optimization problem is solved. Therefore, one simulation run involves 1,200 optimizations. We repeat the sampling procedure 750 times. We thus come up with 750 time profiles of each variable of interest. In particular, our model can assess the performance of a pre-specified generation fleet in terms of the resulting expected price and the standard deviation around that expectation. When several generating portfolios are considered, comparing their relative performance sheds light on their respective advantages and weaknesses.

We illustrate the model by example. Specifically, we look at the British power generation mix over the time horizon 2012–2032. The 2012 Electricity 10 Year Statement envisages three future energy scenarios alongside the contracted background. Under Gone Green, the renewable target for 2020 and the emissions targets for 2020 and 2030 are all met. Under Slow Progression, instead, the 2020 target is not met until between 2020 and 2025; and the 2030 target is not achieved. Under Accelerated Growth renewable and carbon reduction targets are all met ahead of schedule. The Contracted Background portfolio refers to all projects that have a signed connection agreement with National Grid; reductions and closures with an explicit notification or date are also taken into account. Note that, as of 1 April 2013, the UK Government introduced a carbon price support mechanism. It aims at a carbon price floor around 16 ₤/tCO2 in 2013, 30 ₤/tCO2 in 2020, and 70 ₤/tCO2 in 2030 (2009 prices).

Regarding power generation in absolute terms, in the SP and GG portfolios gas turbines are set to be the major producers. However, they only play a minor role in the CB. In the latter, nuclear plants appear as the major providers.

The shares of coal and nuclear in power generation are higher than their shares in installed capacity under the three future energy scenarios. The opposite is true for gas-fired power plants. As for wind, its share of generation falls below that of capacity in all cases except CB, where they are at par (around 30 %).

In the MVP framework we looked at the average electricity price and standard volatility that result from each long-term power portfolio. GG and SP are almost indistinguishable from each other, and AG is very close. CB clearly outperforms all of them on both accounts, whether we focus on the typical scatter diagram or the more informative target curves. On the other hand, carbon emissions can be used to assess the performance of the above portfolios from an environmental viewpoint. Again, the CB portfolio outperforms the others by a wide margin.

Economic efficiency can lead us to rely heavily on a low number of technologies. This can jeopardize security of supply. Further, it can also give rise to anticompetitive practices or market power. We address these concerns by means of the Shannon-Wiener diversity index and the Herfindahl-Hirschman concentration index. When applied to yearly averages of installed capacity and power delivered, the four portfolios as of 2032 are reasonably diversified. CB in particular is the most diversified regarding capacity but the least so regarding production. At the same time, the four portfolios are problematic in terms of exposure to supply risk. CB is the least concentrated regarding capacity and the most concentrated regarding production.

We perform a sensitivity analysis with respect to the carbon price floor. In its absence, carbon price is assumed to evolve according to a standard GBM. As could be expected, the average electricity price is both lower and less volatile in the four portfolios. Again, CB is the clear winner. On the other hand, it is no surprise that carbon emissions are higher now that carbon prices can fall lower. The CB portfolio outperforms the other three also on this ground.

Our model can be improved in several ways. One involves better characterizing the strategic behavior of generators and the exercise of market power. Our model does not address strategic investment decisions such as how much generation capacity to add, and when to add it. These sequential investment decisions call for further research.

Notes

- 1.

This is in contrast to related papers that usually perform economic dispatch on an hourly (or shorter) basis with a time horizon extending over one (or a few) year(s). For example, Delarue et al. [12] take hourly load patterns into account (over 7 weeks) and corresponding dispatch issues as ramping constraints. There would be no major problem in using our model for a yearly period on an hourly basis (8,760 steps) apart from the increase in the time required for computation. Unfortunately, our long-term simulation comes at the cost of framing the optimization problem on a longer time span (for example, a week instead of an hour).

- 2.

See Chamorro et al. [11], Appendix C.

- 3.

This does not mean that investors are risk neutral.

- 4.

When there is a floor price for carbon in place (as in the UK), the carbon price (A) can be different from the allowance price on the EU ETS.

- 5.

As shown in National Grid [28], both peak and baseload electricity prices more or less track natural gas prices at National Balancing Point (which does not happen with coal or oil, for instance). This is relevant when we deal with the profit margin included in generation costs; see Chamorro et al. [11], Appendix C.

- 6.

The wholesale electricity market is operated within the British Electricity Trading and Transmission Arrangements (BETTA). It is based on voluntary bilateral agreements between generators, suppliers, traders and customers. In practice BETTA does not set a unique price: the actual price generators are paid or customers have to pay is different if there is underproduction (for generators) or overconsumption (for consumers).

- 7.

UK Department of Energy and Climate Change [35], Table 5.5, support MC Excel spreadsheet.

- 8.

The Climate Change Act of 2008 introduced a legally binding target to reduce GHG emissions by at least 80 % below the 1990 baseline by 2050, with an interim target to reduce emissions by at least 34 % in 2020. It also introduced ‘carbon budgets’, which set the trajectory to ensure these targets are met. These budgets represent legally binding limits on the total amount of GHG that can be emitted in the UK for a given 5-year period. The fourth carbon budget covers the period up to 2027 and should ensure that emissions will be reduced by around 60 % by 2030.

- 9.

Renewables are governed by the 2009 Renewable Energy Directive which sets a target for the UK to achieve 15 % of its total energy consumption from renewable sources by 2020.

- 10.

- 11.

In models where optimal dispatch takes place on an hourly basis the underlying model is able to determine the effective number of operating hours (ENOH). The load factor equals ENOH/8,760. For instance the model in Delarue et al. [12] determines technology specific load factors by optimization. In our case, such a direct calculation cannot be made. Instead, we can calculate the effective electricity output from each technology in a given period and the maximum possible output in that period. Dividing the former by the latter we could get an indirect measure of technology specific load factors similarly by optimization.

- 12.

These prices can be substantially lower than actual prices under market power [22].

- 13.

This overlap is by no means new in the related literature. Even radically different mixes can have nearly identical risk-return characteristics. As Awerbuch and Yang [5] put it: “There are many ways to combine ingredients to produce a given quantity of salad at a given price”.

- 14.

Lynch et al. [24] calculate (hourly) electricity prices from the (hourly) marginal cost of electricity provision and determine the return of each power technology under least-cost dispatch and marginal-cost pricing.

- 15.

References

Abadie LM, Chamorro JM (2008) European CO2 prices and carbon capture investments. Energy Econ 30(6):2992–3015

Arnesano M, Carlucci AP, Laforgia D (2012) Extension of portfolio theory application to energy planning problem—the Italian case. Energy 39:112–124

Awerbuch S (2000) Investing in photovoltaics: Risk, accounting and the value of new technology. Energy Policy 28:1023–1035

Awerbuch S, Berger M (2003) Energy security and diversity in the EU: a mean-variance portfolio approach. IEA Research Paper, International Energy Agency, Paris

Awerbuch S, Yang S (2008) Efficient electricity generating portfolios for Europe: Maximizing energy security and climate change mitigation. In: Bazilian M, Roques F (eds) Analytical methods for energy diversity and security. Elsevier, Amsterdam

Berger M (2003) Portfolio analysis of EU electricity generating mixes and its implications for renewables. Ph.D. Dissertation, Technische Universität Wien, Vienna

Bazilian M, Roques F (2008) Analytical methods for energy diversity and security. Elsevier, North-Holland

Bar-Lev D, Katz S (1976) A portfolio approach to fossil fuel procurement in the electric utility industry. J Finan 31(3):933–947

Blyth W, Bradley R, Bunn D, Clarke C, Wilson T, Yang M (2007) Investment risk under uncertain climate policy. Energy Policy 35:5766–5773

Bohn RE, Caramanis MC, Schweppe FC (1984) Optimal pricing in electrical networks over space and time. Rand J Econ 15(3):360–376

Chamorro JM, Abadie LM, de Neufville R, Ilić M (2012) Market-based valuation of transmission network expansion: a heuristic application in GB. Energy 44:302–320

Delarue E, de Jonghe C, Belmans R, D’haeseleer W (2011) Applying portfolio theory to the electricity sector: energy versus power. Energy Econ 33:12–23

de Neufville R, Scholtes S (2011) Flexibility in engineering design. The MIT Press, Cambridge

Dixit AK, Pindyck RS (1994) Investment under Uncertainty. Princeton University Press, Princeton

Foley AM, Ó Gallachóir BP, Hur J, Baldick R, McKeogh EJ (2010) A strategic review of electricity systems models. Energy 35:4522–4530

Gotham D, Muthuraman K, Preckel P, Rardin R, Ruangpattana S (2009) A load factor based mean-variance analysis for fuel diversification. Energy Econ 31:249–256

HM Treasury, HM Revenue & Customs (2010) December

HM Treasury, HM Revenue & Customs (2011) March

Hill M (1973) Diversity and evenness: a unifying notation and its consequences. Ecology 54(2):427–432

Humphreys H, McClain K (1998) Reducing the impacts of energy price volatility through dynamic portfolio selection. Energy J 19(3):107–131

Jansen J, Beurskens L, van Tilburg X (2006) Application of portfolio analysis to the Dutch generating mix. Report C-05-100. Energy Research Center at the Netherlands

Kotsan S, Douglas S (2008) Application of mean-variance analysis to locational value of generation assets. In: Bazilian M, Roques F (eds) Analytical methods for energy diversity and security. Elsevier, Amsterdam

Krey B, Zweifel P (2008) Efficient and secure power for the USA and Switzerland. In: Bazilian M, Roques F (eds) Analytical methods for energy diversity and security. Elsevier, Amsterdam

Lynch MA, Shortt A, Tol RSJ, O’Malley MJ (2013) Risk-return incentives in liberalised electricity markets. Energy Econ 40:598–608

Markowitz H (1952) Portfolio selection. J Financ 7:77–91

Murto P, Nese G (2002) Input price risk and optimal timing of energy investment: choice between fossil and biofuels. WP 25/02, Institute for Research in Economics and Business Administration, Bergen

Näsäkkälä E, Fleten S-E (2005) Flexibility and technology choice in gas fired power plant investments. Rev Financ Econ 14:371–393

National Grid (2010) Winter Outlook Report 2010–2011 October

National Grid (2012) Electricity Ten Year Statement (ETYS) 2012 November

Newbery D (2005) Electricity liberalisation in Britain: the quest for a satisfactory wholesale market design. Energy J 26:43–70

Roques F, Newbery D, Nuttall W, de Neufville R, Connors S (2006) Nuclear power: a hedge against uncertain gas and carbon prices? Energy J 27(4):1–24

Roques F, Newbery D, Nuttall W (2008) Fuel mix diversification incentives in liberalized electricity markets: a mean-variance portfolio theory approach. Energy Econ 30(4):1831–1849

Sunderkötter M, Weber C (2012) Valuing fuel diversification in power generation capacity planning. Energy Econ 34:1664–1674

Trigeorgis L (1996) Real options—managerial flexibility and strategy in resource allocation. The MIT Press, Cambridge

UK Department of Energy and Climate Change (2013) Digest of United Kingdom energy statistics, DUKES 2013

UK Department of Energy and Climate Change (2009) Special feature: generation and hydro changes to electricity tables. Energy Trends Articles; 2009, September

Valeri LM (2009) Welfare and competition effects of electricity interconnection between Ireland and Great Britain. Energy Policy 37(11):4679–4688

van Zon A, Fuss S (2008) Risk, embodied technical change and irreversible investment decisions in UK electricity production. In: Bazilian M, Roques F (eds) Analytical methods for energy diversity and security. Elsevier, Amsterdam

Acknowledgments

Abadie and Chamorro gratefully acknowledge financial support from the Spanish Ministry of Science and Innovation through the research project ECO2011-25064, the Basque Government through the research project GIC12/177-IT-399-13, and Fundación Repsol through the Low Carbon Programme joint initiative.Footnote 15 Usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix: Estimation

Appendix: Estimation

Load. Sample period: 2002:01–2013:08, i.e. a total of 140 monthly observations for GB. Tables A.1 and A.2 .

Average deseasonalised load over the last 24 sample months: 24.90418 TWh. With transmission losses included: 27.14556 TWh. Load volatility: 0.1801.

Wind load factor. Sample period: 2006:04–2010:12, a total of 52 monthly observations. Tables A.3 and A.4.

Average wind load factor: 0.27. Wind load volatility: 0.9088.

Pumped load factor. Sample period: 1998:01 to 2013:08, i.e. 188 monthly observations.

Hydro load factor. Sample period: 1998:01–2013:08, or 188 monthly observations. Tables A.5 and A.6.

Average hydro load factor: 0.3432. Hydro load volatility: 1.1099.

Pumped load factor. Sample period: 1998:01–2013:08, i.e. 188 monthly observations Tables A.7 and A.8.

Average pumped load factor: −0.0845. Pumped load volatility: 0.4660.

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Chamorro, J.M., Abadie, L.M., de Neufville, R. (2015). Measuring Performance of Long-Term Power Generating Portfolios. In: Ansuategi, A., Delgado, J., Galarraga, I. (eds) Green Energy and Efficiency. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-319-03632-8_16

Download citation

DOI: https://doi.org/10.1007/978-3-319-03632-8_16

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-03631-1

Online ISBN: 978-3-319-03632-8

eBook Packages: EnergyEnergy (R0)