Abstract

Electronic payments are among the topics on the top of regulators’ agendas around the globe. This trend gained further momentum with the lockdown and other measures to front the COVID-19 pandemic. The current study aims to explore Kuwaiti small and medium enterprises’ expectations of e-payment services. Semi-structured interviews were conducted with nine participants, either founders or directors of Kuwaiti SMEs. The collected data were analyzed using phenomenological analysis. Findings revealed seven main themes: payment gateway and Infrastructure, clarity, and communications, cost, settlement Period, rigid regulation, perceived benefits, and expected services. The results are meant to give directions that the Kuwaiti Central Bank can build upon to further develop the regulatory framework and infrastructure in a manner that is more inclusive of the SME segment.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Small and Medium Enterprises SMEs play a significant role in developed and developing economies. The World Bank estimates the contribution of formal SMEs to total employment to be up to 60% and its contribution to the national GDP to be up to 40% in emerging economies. These estimates would be even higher when considering the informal SMEs [17]. The active SME sector facilitates greater utilization of local raw materials, transforming domestic savings into productive economic activities, enhancing supply chains, and promoting income equality [20]. These benefits are very much needed in resource-dependent economies [16]. In such circumstances, many countries resort to supporting the SME sector in its diversification and job creation endeavors.

In Kuwait, SMEs comprise a significant segment, with estimated 33,000 enterprises that classify as SMEs [1]. This segment has a potential role in job market reforms given its size. The job market in Kuwait needs structural reforms, amongst which is addressing the excessive reliance on the governmental sector for job creation for Kuwaiti citizens. The Central Statistical Bureau’s data shows that the Kuwaiti government hires 362,133 citizens as of Mar. 31, 2022, whereas the citizens working in the private sector count for only 72,692 the proportion is roughly 83–17% in favor of governmental jobs. Nevertheless, SMEs in Kuwait, as in the GCC region, suffer from financial exclusion [13].

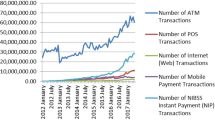

One of the means to support SMEs is to facilitate their access to efficient payment methods. Payments, settlements, and clearance have witnessed rapid development with the advent of new technologies in recent years. Technologies, such as distributed ledger technology DLT, along with the increasing demand for seamless payments, are revolutionizing how payments are made [11]. Conversely, traditional payment methods are witnessing a negative trend in the GCC region [3].

Adopting electronic payments facilitates accessibility to commodities and services, leading to further consumption and eventually contributing to economic growth. Some researchers found a positive correlation between cashless payment transactions and the level of economic development [6]. In addition, the widespread of cashless transactions has positive implications for reducing shadow operations [19]. Given these benefits, e-payments became one of the regulators’ priorities [8].

With the development of e-payments, the role of the regulators is gaining more importance. The role of the regulator expanded to include maintaining the stability and security of the payments system and guaranteeing comprehensive coverage. Regulators are responsible also for setting the standards and overseeing the competition [4]. It is also part of their role to encourage and harmonize schemes among private sector operators and invest in partially or entirely constructing the essential infrastructure. Central banks often directly manage the infrastructure [2]. However, regulators tend to over-regulate e-payments in general. Traditionally, regulation is focused on large financial institutions, and compliance requirements are mainly set accordingly. For smaller fintech, the effort and financial costs of compliance are unaffordable. Add to this the difficulty of classifying financial innovations that fintechs provide under existing financial services categories. This difficulty may invite further tightened regulation to avoid loopholes resulting in an unsupportive regulatory environment. For example, to tackle systemic risks, many regulators require payment service providers to deposit regulatory reserves to cover their risks [9]. According to Porter’s five forces model, this will accumulate more systemic importance to that service provider since it reduces the threat of new entrants, lowers competition, allows higher fees, and tolerates inefficiency. A result that is in total contrast to the purpose of the regulation [9].

Therefore, Barr et al. [5], and Frost [12] argue that regulators should design an inclusive payment system. The regulatory environment must offer moderate and balanced regulation and facilitate and ease entry. Providing e-payment services should be feasible. Frost finds a positive correlation between the strictness of law and the level of investment in financial technologies. New entrants to this market are witnessed more in countries with less strict regulatory environments and higher alternative finance volumes [12].

The literature on e-payment in Kuwait has room for growth as, to date, no known literature to authors has discussed the availability and technical adoption of e-payments by SMEs in Kuwait. The current literature on SMEs focuses primarily on lending and access to credit. In addition, the literature on e-payment leans toward the technical aspects in the broader context of financial technologies, including the impact of the adopted information system, the quality of the communication infrastructure, and the introduction of a given function to a specific payment system. This paper aims to address the current gap by including payment services when discussing the financial inclusion of SMEs. The current paper is structured as follows: Sect. 1 introduced the practical and theoretical foundation for the research Sect. 2 outlines the research design and methods. Section 3 presents the findings and the discussion. Section 4 draws conclusions and presents the contributions and limitations of the research.

2 Methods

2.1 Research Design

To further understand and explore the expectations of e-payment services expectations in Kuwaiti small and medium enterprises and to further develop the regulatory framework and infrastructure in a manner that is more inclusive of the SME segment, a qualitative inductive reasoning approach and exploratory research were conducted because of the scarcity of information and data available in literature or secondary data sources on the subject matter. A cross-sectional time frame was adopted for this study.

2.2 Measurement Development

The semi-structured interview offers flexibility, accessibility, intelligibility, and the ability to reveal necessary and often invisible facets of the interviewee’s behavior [18]. Therefore, semi-structured interviews were used in the current study to collect the data. Sixteen open-ended questions were prepared based on reviewing the literature to collect data from participants. These questions aimed at obtaining socially constructed meanings of e-payments adoption and usage, the hindrances of optimum use of e-payment, insights into the dynamics of using e-payments on the SME level, and the possible measures to enhance the experience and maximize the benefits of using the e-payments. The main categories of the prepared interview questions were (1) Infrastructure, (2) security and trust, (3) regulations and Policies, (4) perceived benefits, and (5) complexity of the e-payment technology [5, 6, 15].

2.3 Sampling and Population

The number of small and medium enterprises in Kuwait is estimated at 33,000 companies [1]. Kuwaiti laws categorize these SMEs under five main fields of those SMEs in Kuwait: industry, agriculture, crafts, services, and technology. The maximum variation sampling strategy, which aims to Identify critical dimensions of variations and then find cases that vary as much as possible [7], was adopted to collect a vast body of data from different fields, namely industry, agriculture, crafts, services, and technology; our target sample includes 1–2 participants from each field.

2.4 Data Collection Techniques and Procedures

Nine face-to-face semi-structured interviews were conducted with either the founders or the directors of Kuwaiti SMEs. The majority, four out of nine- comes from the service sector, one in the industrial sector, one in the crafts, one in the agriculture sector, and two in the technology sector. The duration of each interview ranged from 50 to 60 min. Two interviews were conducted in Arabic the rest were in English. All of the interviews were conducted between May to July 2022. Five interviewees consented to record the interview, while the rest consented to participate without recording. Researchers took field notes for those who preferred not to record, whereas the recorded interviews were transcribed verbatim.

2.5 Data Analysis

This study adopted phenomenological analysis to analyze the collected data. This method explores the underpinning concepts of a given phenomenon and helps to discover the patterns of human behavior about the studied subject [10] The current research utilized a phenomenological analysis process of four steps: (1) Bracketing – where views about the phenomenon research are determined and outlined. In this way, the researcher brackets out the frames and any assumptions to keep the data pure and isolate the genuine phenomenon, (2) Intuiting – in this step, the researcher sticks around and concentrates on the phenomenon’s meaning by the primary research. Also, a common understanding of a phenomenon whatsoever being studied is accomplished. Then, the researcher must come up with the variance of the data until a shared understanding is done, (3) Analyzing – In this step, coding is carried out where categorizing and grasping of the primary meanings of the phenomenon is generated, and (4) Describing – In the descriptive step, realization, and definition of the phenomenon are achieved by the researcher. This is aimed at coming up with the final step that offers significant and pivotal descriptions in both written and verbal form [14].

3 Findings and Discussion

All audio recordings and field notes of interviews were transcribed and recorded. Arabic transcriptions and field notes were translated into English for analysis. The phenomenological analysis revealed seven main themes based on the data collected from the interviews with the sample SMEs’ representatives (Table 1).

3.1 Theme 1: Payment Gateway and Infrastructure

The online payment gateway provided by K-net company was subject to criticism by many participants. Although two participants expressed satisfaction with the service, the rest were critical and less satisfied. The fact that this is the only competitor that has impacted the competitiveness and efficiency of the payment gateway. The main issues projected by the participants fall under the following sub-themes.

3.1.1 Technical Problems

The participants have reported two main technical problems that reoccur frequently. First, the payer pays the transaction online and the banks deducts the amount from the payer’s account. However, the payment gateway does not confirm the completion of the transaction to the payee. In this case, the latter would not take the next step. This issue impacts the payment service providers as they allocate some of their scarce financial and human resources to address such glitches. Allocating human resources or developing automated methods to tackle this issue hints at how frequent it is.

The second technical problem reported by the participants is the frequent interruption of the service. According to one of the participants, when the service is down or if there is any other technical issue, the only communication channel is e-mail.

3.1.2 Lack of Customer Support

To illustrate the magnitude of the problem and how it impacts SMEs, one of the participants gives an excellent example of how difficult it is to communicate with K-net on such technical issues. In their case, it is easier to refund the customer than to go into the hustle of contacting K-net. In most cases, there are no quick fixes when the service is down or when there are overdue payments that the SME cannot afford to refund. A payment service provider describes such a situation as follows:

We have many issues with the payment gateway. Response time is too slow. For online payments, they don’t have 24/7 support; for example, if the payment page is down, the service is completely down, we send them an email. […] K-fast, they [K-net] disabled the feature [K-fast]. It took more than two months for us to get this feature again.

This issue is explained by another participant who stressed the lack of competitiveness of K-net and how it is not a customer-focused entity:

It [k-net] was designed to serve the banks as a third party. It wasn’t designed to be competitive in the market, providing services that help the people.

3.1.3 Underdeveloped Services

Not being designed to provide services for the people may be the reason behind the participants' frequently repeated complaints about the service quality, particularly compared to similar regional entities. Participants noticed that services could be more developed, but the intent and the pace of development could be more robust.

The participants suggested a few areas of enhancement, like the payment mechanism. It is perceived as a complicated process since it involves choosing the bank and entering the account number, PIN code, and OTP. Moreover, a rather specific suggestion was made by one of the participants:

If you want to pay through a link, it has to go through a bank. Why isn’t that done through K-net and universal for everybody?

3.1.4 Lack of Cooperation with Payment Service Providers

According to the participants, the small Fintech firms that provide payment services are swifter in developing new services. They are more capable of understanding their customers’ needs and catering to them. However, these Fintechs are facing many hindrances, amongst which is the lack of cooperation of the payment gateway. They feel that K-net perceives them as competitors and acts upon that.

3.1.5 Complex Procedures and Expensive Fees of Subscription and Integration

There is a consensus among the participants about this point. Subscribing to the K-net service and integrating the gateway to SMEs' websites is expensive and a long process involving much paperwork and back-and-forth correspondence.

One participant described subscribing with K-net as “fricative; they ask for much paperwork, code from the developer, signature proof, and 1000 KD fees, and it takes 1–2 weeks.”

3.2 Theme 2: Regulations Clarity and Communication

Another theme is Regulatory Clarity and Communication. Two of the participants expressed clearly that they expect more clarity in the regulations issued by the central bank. They also expect more effective communication on the part of the regulator. One of the participants expressed a degree of satisfaction with the communication policy adopted by the central bank recently. However, the clarity of the regulation could be more satisfactory. Although the Central Bank of Kuwait has revised it 2018 e-payments regulations, yet, it still has ambiguity for some:

The mandate was not clear. In the beginning, they said the mandates only covered debit cards. Credit card is not part of it. But the banks were not taking any risks to give us the credit card. Up to this date, when we communicate with CBK and tell them we need a credit card, they say, “go to any bank and take it.” When we communicate with the banks, they say, “no, you did not file with us as an agent. We cannot provide it to you”. So, the communication it's not very clear. We don’t have direct communication with CBK. But later, the banks told us there is communication; it’s a one-way correspondence.

This excerpt makes a point of clarity and communication issues so clear. The same article of regulation is understood in different ways by the three parties. The issuer meant something, but the regulated entity (bank) finds it ambiguous, so it prefers to avoid taking any risk, and the SME tries to sort out this miscommunication. Yet, the latter doesn’t have any official communication channel with the central bank on that issue.

3.3 Theme 3: Cost

The participants agreed on the cost aspect as one of the essential elements of choosing the service provider. The cost of e-payment depends on the service providers. Starting with K-net, the charges are split per transaction and subscription fees. The participants repeatedly stressed the cost factor in the interviews with variation when comparing K-net to other payment methods. Following is an example:

If the customer pays using a credit card, we pay 2.5% to the bank on each transaction, deducted from the customer and us. And if he pays using K-net, we pay about 1.5 to the bank.

According to the participants, they also reported high subscription fees ranging between 600 and 1000 KD. Since the payments are primarily processed through K-net, the payment gateway, the other payment providers charge their customer extra fees to cover the cost of transactions paid to K-net. The two-layered price makes it unfeasible for many SMEs to adopt any e-payment service other than the basic service K-net offers. Given the limited services provided, as discussed in theme 1, and the need for more support, this is another pain point for the SMEs in Kuwait.

3.4 Theme 4: Settlement Period

In addition to the high costs of the e-payment, most participants referred to the protracted settlement period with the current e-payment service providers. In some cases, the clearance takes place once a week, and it can be once a month in others.

3.5 Theme 5: Rigid Regulation

Despite some participants commending the enabling regulations for SMEs, particularly licensing home businesses, they still find the rules restricting and rigid. They described e-payments as heavily regulated by the central bank. One participant gave an example of how the regulations prevent saving the subscriber’s information, which requires the payer to manually fill in their information every time they need to pay a subscription or make a new payment.

However, there is more criticism of the regulations, whether of the central bank or the other regulators. In the participants’ perception, compliance is unaffordable as the rules require capital reserves and highly paid compliance specialists, among other requirements.

The regulator tends to focus on big entities when setting regulations. One example of this issue is given by two of the participants. They stated that CBK requires 10% of the company’s capital to be held as a bank guarantee.

In addition, the regulations also require strict measures for anti-money laundering and counter-financing terrorism. These requirements are beyond the capabilities of the SMEs offering payment service.

These requirements will be translated into an additional increase in the service cost, as discussed in theme three above. This is another example of the extensive entity-focused regulations addressed by some participants and the literature.

3.6 Theme 6: Perceived Benefits

Regardless of the critical accounts made by the participants, the e-payment landscape in Kuwait still offers many benefits from their point of view. The demand for cashless transactions by their customers, prospected sales increase, safety, and ease of use, are some of the various benefits reported by the participants.

In general, the participants expressed high trust in the safety and security of e-payments in Kuwait. Reducing cash collection was perceived as essential for eliminating human errors and theft incidents. Adopting e-payments is perceived as secure also from the technical side. For example, one of the participants stated:

As soon as the payment goes through to the K-net portal, I believe the cyber security is transferred to them. And I've never heard of a problem happening.

The participants were aware of the demand for cashless transactions. They perceived various facets of this topic. This includes the impact of COVID-19 on avoiding direct contact with people for cash payments. In addition, there is an increasing demand for e-payments, even in areas where these transactions are rarely adopted, like the crafts sector. Fulfilling the need for e-payments leads not only to a satisfied customer but also to an increase in purchase will. Ease of payment is also among the perceived benefits expressed by the participants.

3.7 Theme 7: Expected Services

The participant SMEs expressed expectations of the e-payment services in Kuwait to be as frictionless as possible, have a universal payment method, and traceability of the payments. Many participants expressed unease with the long payment process made through the payment gateway. The process starts by requesting the payer’s bank information, including the bank, card number, expiry date, and pin code. After that, an OTP is sent to the payer on the phone registered at the bank. Only after entering the OTP is the payment completed.

In addition to that, one of the participants suggested the following:

K-net can create an app where you can pay by POS, barcode, or QR code, or transfer to the phone number.

Furthermore, two participants mentioned that the payment limits are affecting their businesses. The limit of 5000 KD may be reasonable for personal payments since K-net is not a corporate-oriented service. But compared to the other payment methods adopted by corporates, like cheques and bank transfers, payment over K-net is faster and easier. It settles instantly, unlike bank transfers, which may take one working day to be resolved. This is an area where SMEs are underserved. While 5000 KD may be a fair limit for personal transactions, it is not for SME transactions. Besides, SMEs are more sensitive to the delay of bank transfers and cheques than large-scale corporates.

4 Conclusions

The analysis of the data collected from the participant SMEs resulted in seven basic themes: payment gateway and infrastructure, regulations clarity and communications, cost, settlement period, rigid rules, perceived benefits, and expected services. Figure 1 illustrates these themes in relation to the mandate of the e-payments regulator, i.e. the Central Bank of Kuwait. The inner circle encloses the themes which the central bank can address through internal actions. The middle circle is where the central bank intervenes as a regulator. The outer circle encompasses themes that fall beyond the central bank’s mandate.

The objective of this research was to explore the expectations of small and medium enterprises in Kuwait regarding e-payments services. After setting the adopted methodology and reviewing the literature on the topic, data were collected from an SME sample. The data was then analyzed to explore the expectations of the SMEs. The research aims to expand the understanding of the SMEs in Kuwait’s expectations from e-payment service providers and how to expand these services for the benefit of SMEs.

The data analysis revealed different expectations. Some of these expectations are related directly to the central bank’s mandate. For example, the clarity of communication and enhancing the regulatory environment. Other expectations, such as introducing new services, fall beyond the central bank’s mandate. Numerous recommendations were suggested to the central bank to address these expectations that fall under its mandate. On the other hand, the expectations not part of the central bank’s mandate were highlighted to be communicated to the concerned parties.

Further research is recommended to complement the findings of this research. For instance, the sample size of this research limits the generalization of the results. Expanding the sample size would enhance the understanding of the SMEs’ expectations and eventually develop policymakers’ approaches and responses to those expectations. In addition, one must keep in mind that the expectations of SMEs are subject to change along with the development of the service delivered and the technical breakthroughs in e-payments. Quantitative research may be conducted to weigh the factors of each of the various themes found in this research. One of the main limitations is the rapid development in technology and payment solutions which entails continuous changes in customers’ demands and expectations. Furthermore, the projectability of the finding is limited due to the qualitative methodology adopted.

References

Abdolmonem, H., Talha, A., Ismail, T.: Promoting Micro, Small, and Medium Enterprises in The Arab Countries. Retrieved from Kuwait (2019)

Alfonso, V., Boar, C., Frost, J., Gambacorta, L., Liu, J.: E-commerce in the pandemic and beyond. BIS Bullet. 36(9) (2021)

Ali, A., Salameh, A.A.: Payment and settlement system in Saudi Arabia: a multidimensional study (2023)

Bank, W.: Governance of Retail Payment Systems: Keeping Pace with Changing Markets. World Bank (2021)

Barr, M.S., Harris, A., Menand, L., Xu, W.M.: Building the payment system of the future: how central banks can improve payments to enhance financial inclusion. In: U of Michigan Law & Econ Research Paper (20-038) (2020)

Basir, A.A.: Payment systems in Malaysia: recent developments and issues (2009)

Benoot, C., Hannes, K., Bilsen, J.: The use of purposeful sampling in a qualitative evidence synthesis: a worked example on sexual adjustment to a cancer trajectory. BMC Med. Res. Methodol. 16(1), 1–12 (2016)

Carstens, A.: Shaping the future of payments. In: BIS Quarterly Review, March (2020)

Cong, L.W., Li, Y., Wang, N.: Tokenomics: dynamic adoption and valuation. Rev. Fin. Stud. 34(3), 1105–1155 (2021)

Creswell, J.W., Poth, C.N.: Qualitative Inquiry and Research Design: Choosing Among Five Approaches. Sage Publications (2016)

Ehrentraud, J., Prenio, J., Boar, C., Janfils, M., Lawson, A.: Fintech and Payments: Regulating Digital Payment Services and E-money. Bank for International Settlements, Financial Stability Institute (2021)

Frost, J.: The economic forces driving Fintech adoption across countries. In: The Technological Revolution in Financial Services: How Banks, Fintechs, and Customers Win Together, p. 70 (2020)

Gallego, S., LHotellerie-Fallois, P., López-Vicente, F.: The international monetary fund and its role as a guarantor of global financial stability. Econ. Bull. (DEC), 1–16 (2018)

Greening, N.: Phenomenological research methodology. Sci. Res. J. 7(5), 88–92 (2019)

Igudia, P.O.: A qualitative evaluation of the factors influencing the adoption of electronic payment systems (SMEs) by SMEs in Nigeria. Eur. Sci. J. (ESJ) 13(31), 472–502 (2017)

Movchan, A., Zotin, A., Grigoryev, V.: Managing the resource curse strategies of oil17—Dependent economies in the modern era. Carnegie Moscow Center, Moscow, Russia (2017)

Ndiaye, N., Razak, L.A., Nagayev, R., Ng, A.: Demystifying small and medium enterprises’(SMEs) performance in emerging and developing economies. Borsa Istanbul Rev. 18(4), 269–281 (2018)

Qu, S.Q., Dumay, J.: The qualitative research interview. Qual. Res. Acc. Manage. (2011)

Slozko, O., Pelo, A.: The electronic payments as a major factor for futher economic development. Econ. Soc. 7(3), 130 (2014)

Taiwo, M.A., Ayodeji, A.M., Yusuf, B.A.: Impact of small and medium enterprises on economic growth and development. Am. J. Bus. Manage. 1(1), 18–22 (2012)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Hassan, A., Harraf, A., Abdallah, W. (2024). Exploring Small and Medium Enterprises Expectations of Electronic Payment in Kuwait. In: Hamdan, A., Aldhaen, E.S. (eds) Artificial Intelligence and Transforming Digital Marketing. Studies in Systems, Decision and Control, vol 487. Springer, Cham. https://doi.org/10.1007/978-3-031-35828-9_2

Download citation

DOI: https://doi.org/10.1007/978-3-031-35828-9_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-35827-2

Online ISBN: 978-3-031-35828-9

eBook Packages: EngineeringEngineering (R0)