Abstract

One of the hardest problems faced by entrepreneurs is how to finance and give visibility to their company in order for it to grow. Small- and medium-sized enterprises (SMEs) are highly dependent on self-financing and bank financing. Therefore, they require a favorable environment to be able to meet their financing needs, including access to capital markets. Certain alternatives have been launched in Europe in this regard. In Spain, BME Growth is a market aimed at small-cap companies seeking to expand, with tailor-made regulations designed specifically for them and costs and processes adapted to their characteristics. In addition to access to financing, other advantages of being a public company are increased visibility, continuous valuation, and liquidity of the company’s shares. As a prior step for those companies still not ready to join BME Growth but planning to do so in the next 2–3 years, the Pre-Market Environment (known in Spanish as Entorno Pre Mercado (EpM)) accompanies them along the way and helps them become familiar with the operation of financial markets and to gain access to an ecosystem of investors, experts, entrepreneurs, advisors, and financial market professionals. In this chapter, after contextualizing the securities markets for SMEs in Europe, BME Growth for the Spanish case is analyzed in detail: its creation, main characteristics and advantages, requirements for incorporation and permanence, costs, characteristics of listed companies, and success stories of the market. Next, the EpM is defined and analyzed as a step prior to going public in BME Growth. The chapter concludes with the details of a success story, Soluciones Cuatroochenta, a company that first joined the EpM and then moved to BME Growth.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Throughout this book, the different financing options available to entrepreneurs, either through equity or debt, have been analyzed. Once the entrepreneur has gone through the stages from raising their very first money by any of the four Fs (Founder, Family, Friends and/or Fools) until reaching the phase of maturity, the stock market becomes the ideal tool to grow, diversify entrepreneur risk, and offer an exit to those investors in early stages whose objective is not that of permanence in the company. Thus, equity crowdfunding, business angel, venture capital (VC), or private equity (PE) can also act as a “bridge” toward listing on stock markets. The majority of these growing companies that reach this point of maturity are known as small- and medium-size enterprises (hereinafter SMEs).

This chapter’s objective is to discuss how SMEs go public. Stock markets offer growing companies many advantages, such as raising equity to finance growth, increased visibility, constant valuation, and liquidity for their shares. Greater visibility attracts a larger number of investors and, hence, a more efficient way to obtain financing; likewise, a greater number of investors help to increase share liquidity, which in turn helps the company to obtain its target valuation in the market. Nevertheless, going public involves costs, both monetary and in terms of the dissemination of information.

This chapter puts into context the markets for small- and medium-sized enterprises in Europe and then focuses on the Spanish case: BME Growth. It additionally analyzes what requirements a company must meet to join and remain on BME Growth, what advantages it brings, and what costs it must assume. Some characteristics of the listed companies and success stories are also explained. Finally, a step prior to going public on BME Growth is analyzed. This is called the “Pre-Market Environment” (“Entorno Pre Mercado” or “EpM” in Spanish terminology), an exclusive training and networking program for SMEs in expansion to learn about the operation of capital markets and to access private and institutional investors. Its characteristics, the requirements for incorporation, maintenance and costs involved, and the main figures of this environment and some success stories are detailed. A practical example is given of the first company that joined the EpM, which after 3 years of “learning” made the leap to BME Growth and since then had grown exponentially. The chapter ends with a few conclusions that highlight the importance of the stock markets for SMEs.

2 Stock Markets for SMEs: An European Union Objective

SMEs are of huge importance in the European economy as they are the main drivers of economic growth and employment generation in this region. SMEs make up 99% of companies in the European Union, create two out of three private sector jobs, and contribute to over half of the total added value generated by companies in the Union (Gouardères 2021). However, one of the major obstacles they face is the difficulty in finding financial resources as larger companies can in terms of cost and volume. This causes them to be highly dependent on self-financing and bank financing in the short and medium term. One of the alternatives to this dependence is the possibility of equity financing in the stock markets. Nevertheless, some of the main challenges that SMEs encounter in accessing capital markets are (1) the asymmetry of information with respect to large companies, (2) the initial and subsequent incorporation costs, and (3) the regulatory requirements that hinder SMEs accessing the European stock markets.

The European Union, aware of the need to make it easier for small companies to grow by taking advantage of the benefits of being listed, has been putting several initiatives in place during recent decades to promote specific markets for SMEs. Posner (2004), for example, lists 47 SME markets that emerged between 1977 and 2003, some of which never materialized. The markets that have been most successful so far have been the so-called Alternative Markets, according to the classification proposed by Vismara et al. (2012), as opposed to previous “Second Markets” and “New Markets.” In contrast to former regulated markets, the most relevant initiative of the Capital Markets Union was the creation of a new category of Multilateral Trading Facility (MTF) called “SME Growth Market” contained in Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments,Footnote 1 better known as MIFID II (European Parliament 2014).Footnote 2,Footnote 3 The creation of the SME Growth Market under MIFID II aims to facilitate the further development of specialized markets designed to meet the needs of SME issuers and to homogenize quality and transparency standards among growth markets in Europe. Contrary to previous attempts, this latter initiative seems to have been more successful since, by the end of 2022, 18 MTFs in Europe had obtained this rating (European Securities and Market Authority 2023). As a result of these attempts, the number of listed SME companies and the market capitalization of listed SMEs have experienced a remarkable growth, rising from 1.000 companies and 30 million euros in 2014 to nearly 1.500 companies and 110 million euros in 2022, having peaked at 140 million euros in 2021 (Federation of European Securities Exchanges 2023).

Although specific provisions have been included in various European Commission rules that create regulatory relief and incentives tailored for SME issuers trading on the SME Growth Market, both the European Commission and the industry in general continue to work to identify areas for improvement to boost SME access to the markets (European Securities and Market Authority 2021; Technical Expert Stakeholder Group on SMEs 2021), since European capital markets have lagged, and continue to lag, behind other developed economies in terms of the number of Initial Public Offerings (IPO).

Thus, some of the ideas proposed by the Technical Expert Stakeholder Group (TESG) on SMEs to facilitate and encourage the admission process for SMEs in the SME Growth Market is the establishment of a pre-listing sandbox or pre-listing environment. The pre-listing sandbox could provide an interesting support for the pre-admission phase of an SME in terms of individual and personalized advice on the applicable legal requirements during this process. This pre-listing sandbox could be offered through national programs organized by the competent national authorities and the stock exchanges themselves. In this regard, although such a proposal has been incorporated in the report issued by the TESG in 2021 (Technical Expert Stakeholder Group on SMEs 2021), there are already several sandboxes or pre-listing environments in Europe that try to fulfill the abovementioned task. Section 4 presents the Spanish experience called Entorno Pre-Mercado.

3 The Stock Market for SMEs in Spain: BME Growth

In Spain, as in Europe, SMEs are one of the main drivers of the economy: over 99% of Spanish companies are SMEs, employing 80% of the country’s workforce and accounting for 65% of Spanish GDP (BME Growth 2022b). However, they are also highly dependent on bank credit, even more than in the other EU countries.Footnote 4 Thus, following the European trend regarding the creation of alternative markets that facilitate access to the securities markets for SMEs, the Alternative Stock Market for growth companies (known in Spanish as Mercado Alternativo Bursátil – Empresas en Expansión (MAB-EE)) was created in Spain in 2008, a market aimed at small-cap companies seeking to expand, with a special set of regulations designed specifically for them and with costs and processes adapted to their characteristics. In October 2020, this market changed its name to BME Growth, at the same time as it was recognized by the Comisión Nacional del Mercado de Valores (CNMV), the Spanish Security Exchange Commission, of the European category of SME Growth Market (known in Spanish as Mercado de Pymes en Expansión), thus reinforcing its relevance at a global level.

3.1 What Is BME Growth?

BME Growth is a Spanish stock market for SMEs that allows small- and medium-sized growing companies to access the capital markets and, therefore, have access to capital to finance, develop, and expand their business models. It also provides visibility and credibility to companies and offers liquidity, professionalization, and valuation. It is a market aimed at companies from any sector of activity, although there is currently a greater presence of companies from the technology, biotech and health, engineering, telecommunications, and renewable energy industries. The representation of the real estate sector (known in Spanish as SOCIMI) is also highly relevant.Footnote 5 Although the origin is predominantly local, it is open to all companies regardless of their country of origin.

In its legal form, BME Growth is a Multilateral Trading Facility (MTF), and it is the segment for small- and medium-sized companies of the BME MTF Equity market. It belongs to Bolsas y Mercados Españoles, Sistemas de Negociación S.A. (BMESN), a company of Bolsas y Mercados Españoles (BME)-SIX Group, the operator of all the securities markets and financial systems in Spain. BME Growth is subject to the CNMV’s supervision.

BME Growth, as an MTF, is a self-regulated market with its own regulations, circulars, and operating instructions. All these regulations can be consulted on the BME Growth website (https://www.bmegrowth.es/ing/BME-Growth/Normativa.aspx? Accessed 13 November 2022). Unlike markets classified as regulated, BME Growth has a more flexible regulation in terms of admission to trading, maintenance and transparency requirements, since neither the rules applicable to regulated markets nor the regulations applicable to listed companies as defined in the Securities Market Law are of application (Reino de España 2023). As an MTF, it is obliged to have a public operating regulation which must be governed by transparent, objective, and non-discriminatory criteria and must be authorized and registered in the corresponding CNMV registry. Likewise, the Sociedad de Gestión de los Sistemas de Registro, Compensación y Liquidación de Valores (Iberclear) is the entity in charge of the accounting registration of the securities admitted to trading on BME Growth, as well as the settlement of the transactions conducted on the market. Since 2020, it has had the European status of SME Growth Market. The main characteristics of BME Growth are summarized in Box 1.

Box 1 Main Characteristics of BME Growth

“SME Growth Market” seal granted by the CNMV: highest standard of quality, transparency and investor protection at a European level |

For growth companies with an innovative, disruptive and technological profile |

A tailored regulation and requirements ensuring transparency and protection for the investor |

It provides financing, liquidity and visibility |

It promotes the inorganic growth of its companies |

Promoted by BME-SIX and supervised by the CNMV |

For specialized institutional and retail investors |

Agile and flexible incorporation process |

Much lower costs than those of other SME Growth Markets |

Figure 1 shows the expansion of this market in the number of companies incorporated since the market was created.

Evolution of the number of companies in BME Growth in the period 2009–2022. Source: Own elaboration based on Bolsas y Mercados Españoles (2023)

3.2 Why List on BME Growth?

As stated above, the stock market can be an ideal platform for the growth of companies. Access to financing, increased visibility, continuous valuation, and liquidity of the company’s shares are the main advantages that BME Growth offers to growing companies so that they can manage their projects more efficiently and speed up the necessary processes.

Let us take a closer look at these advantages, as each company may have a different objective in its incorporation in the market or, in many cases, several of them.

3.2.1 Financing a Company’s Growth

BME Growth opens up a range of alternatives for companies to obtain financial resources. A capital increase at the time the company goes public or at a subsequent point in time is an ideal way of raising funds to support the expansion of a company with characteristics of strength, flexibility, and financial risk reduction, in addition to maintaining the balance between equity and debt.

Furthermore, thanks to the possibility of going public, BME Growth facilitates the company’s access to a broad investment community, either domestic and international investors or institutional and retail investors, other than venture capital or business angels.

Finally, it helps to consolidate the growth strategy through mergers and acquisitions (M&A) using the company’s own shares as a means of payment in these processes.

Figures 2 and 3 show the number of equity offerings made and financing obtained by BME Growth companies in the period 2009–2022. A total of 532 equity offerings were made during this period, raising more than 6.5 billion euros in financing.

3.2.2 Standing, Visibility, and Brand

Listing on BME Growth provides the company with solvency, transparency, and prestige. A company that is ready to list on BME Growth has achieved a high degree of organization and control. And above all, it has gained the confidence of investors in its project. This prestige is also recognized by the company’s customers, suppliers, and financial partners, which facilitates relations with all of them.

BME Growth is in the news every day, and listed companies enjoy a greater presence in the media, given the greater demand for information from investors and market analysts. This greater visibility increases the company’s prestige and brand image and complements its marketing and communication efforts.

3.2.3 Fair Valuation of the Company

The shares of a company listed on BME Growth have a permanent fair market value, given by investors. The price is established from the combination (matching) of purchase and sell orders. One of the many advantages of this objective valuation is that M&A transactions can be financed, either totally or partially, with shares issued by the company itself. In recent years, a considerable number of BME Growth companies have grown inorganically, thanks to financing their acquisitions with their own shares.

3.2.4 Liquidity

BME Growth provides a level of liquidity to shareholders (the ability of assets to be turned into cash, unreachable to unlisted companies). There are certain circumstances that assist a listed SME to obtain greater liquidity through BME Growth, such as (1) make an effort to be more visible (be proactive in the relationship with investors, analysts, road shows, corporate communication), (2) maintain a generous shareholder spread (without losing control), (3) be aware of the company size, (4) have the help of specialists (liquidity provider, communication consultants, financial advisors) to attract investors, and (5) have “anchor” shareholders/investors to help attract other investors.

Likewise, some shareholders or other types of entities such as venture capital that entered the company in its origins, including the founding partners of the companies, find in BME Growth the counterpart that allows them to reap the benefits of their business career at the most opportune moment, helping, in some cases, to resolve certain issues in family firms with the total or partial exit of some of the company shareholders.

3.2.5 Others

There are many other advantages to joining BME Growth. Being a public company disciplines and stimulates management (both through regulation and shareholder demand) as the transparency and information standards required by the market encourage the organization to have greater professionalization and investors seek companies managed by qualified professional teams. It also serves as an incentive for employees through share-based compensation policies and for other groups (customers, suppliers, etc.) with whom the company wishes to strengthen ties or who should be rewarded for any reason. Finally, it is a great support for internationalization. BME Growth companies take advantage of their information transparency, visibility, and valuation (it serves as a letter of introduction) to access resources from international investors, facilitating their capacity for international expansion. Box 2 summarizes the main advantages offered by BME Growth.

Box 2 Main Advantages Offered by BME Growth to Companies

Financing |

Visibility, prestige, and brand image |

Target valuation |

Share liquidity |

Improved credit rating |

Requirements adapted to the company’s size |

Greater transparency |

Encourages professional management |

Reasonably priced |

State aid available |

Other corporate advantages: Family succession, helps M&A, etc. |

3.3 Common Concerns of Entrepreneurs before Going Public

Entrepreneurs have two main concerns when the decision of going public arises: the loss of ownership control and the dissemination of internal information.

In terms of the first, if the entrepreneur had control over the company before going public, the process of joining BME Growth does not necessarily imply losing that control. Bear in mind that, once listed, the number of shares that can freely fluctuate in the market and, therefore, can change hands (i.e., the so-called free-float) is a decision that is the exclusive responsibility of the company’s shareholders (of course, with a minimum amount of two million euros). As explained in Sect. 3.5, a capital dilution only occurs if the process of going public involves the selling of new shares (primary offering).

In relation to the second concern, entrepreneurs should be aware that investors’ decisions are essentially based on public information regarding the companies. For this reason, companies have certain obligations to fulfil in terms of information: to audit their accounts, report on their economic and financial evolution, communicate information affecting the company, etc. This should be considered as an advantage rather than a concern, since it powerfully contributes to professionalizing and disciplining management, which makes the company work better and, on many occasions, is reflected in better results. Nowadays, even unlisted companies are under legal requirements to perform audits, file accounts with the Companies Register, and have greater surveillance by the tax authorities make companies much more transparent.

Many of the entrepreneurs who have joined BME Growth in recent years recognize that they have been motivated to analyze and, in many cases, restructure their own way of managing the company, orienting their activity in an even more professional and stringent matter, as they have to respond for their activity to a group of shareholders and investment professionals, who demand constant information of the rationality and opportuneness of that management. This change has affected several areas of the company and has contributed to creating a habit of transparency, information, and attention to shareholders and, in general, to those who surround the company’s activity.

3.4 Is My Company Ready to Join BME Growth?

Listing on BME Growth is an important decision for any company. Access to the market requires certain requirements to be fulfilled. These are set out in Table 1.

3.5 How to Join to BME Growth? What Are the Stages in the BME Growth Admission Process?

Once it has been verified that the company meets the requirements for incorporation, it is important to choose the procedure that best suits the company’s needs and objectives.

Companies have two main possibilities to join the market: firstly, through a listing process where the company does not place its shares among new investors but gives its shareholders the possibility to trade their shares on BME Growth without changes in the company shareholding or capital and, secondly, by making a sale of shares at the time of the incorporation, known as Initial Public Offering (IPO). In this second case, there are two options: (1) a primary offering (known in Spanish as Oferta de Subscripción), where the shares offered are newly issued, so that the company gets new funds, and (2) a secondary offering (known in Spanish as Oferta de Venta), where it is the company owner or owners who sell a significant number of shares.

Table 2 shows the different phases of the BME Growth admission process. After the accumulated experience, the market estimates that approximately 3–6 months may elapse from the time a company appoints a Registered Advisor up until it is admitted to the market.

3.6 How to Remain in BME Growth?

Companies listed on BME Growth must report the following information to the market through their corresponding Registered Adviser (Bolsas y Mercados Españoles 2020b).

3.6.1 Regular Information

-

Half-yearly information: A half-yearly financial report equivalent to the entity’s interim financial statements subjected to at least a limited review by its auditor, within the 4 months following the end of the first 6-month period of each year.

-

Annual information: Audited annual financial statements released in the 4 months following the end of the annual reporting period together with the corresponding Directors’ Report.

-

Information on the company’s organizational structure and internal control system to comply with the reporting obligations established by the Market (every year, together with the publication of financial information).

-

Information on the degree of compliance with forecasts, if applicable (every 6 months, together with the publication of financial information).

-

Significant shareholdings: Obligation to report to the market every 6 months a list of shareholders with a position equal to or greater than 5% of the capital stock.

3.6.2 Insider Information and Other Relevant Information for Investors

-

All the insider information and other relevant information from the issuers of securities listed or those who have applied to be listed on the market will be publicly disclosed by the market, in accordance with the provisions of the Spanish Securities Markets Law (Reino de España 2023).

3.6.3 Other Information to be Reported

-

Significant shareholdings: of which the company is informed.

-

Shareholder’s agreements.

-

Information on corporate transactions.

-

Forecast or numerical estimates, if applicable.

3.6.4 Corporate Governance

-

No annual corporate governance report is required.

3.6.5 Issuer’s website

-

The company’s website must include all the public documents that have been submitted to the Market for their incorporation, as well as all the information subsequently submitted to the Market.

3.7 What Are the Fees?

A list of the costs that companies must assume for incorporation and subsequent permanence in BME Growth is given below. Some (BME Growth rates and Iberclear fees) are predetermined and public, and the rest will depend on the negotiation with the agents involved.

BME Growth rates (Bolsas y Mercados Españoles 2022b): A fixed fee of 1500 euros is charged for processing the application. A fixed rate of 10,000 euros plus a variable rate of 0.05 per thousand on the market capitalization of all securities to be admitted based on the opening price on the market is also applied. Thereafter, the fixed annual maintenance fee is 6000 euros.

Iberclear fees (Iberclear 2022): 0.40 basis points of the cash value of the securities are included, subject to a minimum of 500 euros and a maximum of 50,000 euros per issue. Annual fee is 500 euros.

Other costs:

-

Costs related to the preparation of the company to comply with the incorporation requirements (lawyers, auditors, advisors, etc.). These will depend on the actions to be conducted prior to incorporation.

-

If a capital increase/share placement is performed, the underwriter will charge a commission depending on the size of the issuance and its characteristics. This tends to be by far the largest expense.

-

The company must also bear in mind the costs applied by the Registered Advisor and the Liquidity Provider. In both cases, they are negotiable and shall depend on the specific agreements signed.

3.8 Characteristics of BME Growth Listed Companies

Although there is diversity in terms of the size of the BME Growth companies, 76% of BME Growth companies are capitalized in a range between 10 million euros and 250 million euros (see Fig. 4).

Distribution by size (market capitalization) of BME Growth companies in 2022. Source: Own elaboration based on Bolsas y Mercados Españoles (2023)

In terms of industry, the market is currently concentrated in four sectors: pharmaceutical products and biotechnology, electronics and software, engineering and others, and renewable energy, as can be seen in Fig. 5. The REIT industry (which does not appear in Fig. 5) also has a considerable weight in BME Growth as it amounted to 80 of these companies in 2022.

Distribution by sector of listed companies on BME Growth in 2022 (excluding the 80 REITs). Source: Own elaboration based on Bolsas y Mercados Españoles (2023)

3.9 Success Stories

Some of BME Growth’s success stories are listed below. Table 3 shows some companies that are multiplying their fundamentals and value in BME Growth.

Furthermore, several interviews with BME Growth companies explaining why they chose to list on BME Growth or how they fared can be found at the following link https://www.bmegrowth.es/ing/BME-Growth/HistoriasExito.aspx (accessed 22 September 2022).

4 Pre-Market Environment (Entorno Pre Mercado (EpM))

4.1 What Is the Pre-Market Environment (Entorno Pre Mercado (EpM))?

Pre-Market Environment (known in Spanish as Entorno Pre Mercado (EpM)) is a unique training and networking program to provide growing SMEs with information on how capital markets work and how to access private and institutional investors from Bolsas y Mercados Españoles (BME)-SIX Group. It aims to accompany firms that plan to access the capital markets in 2–3 years. This environment is similar to other initiatives or pre-markets already in existence in Europe that aim to provide support to SMEs in the pre-listing phase to a securities market and could be considered as a pre-listing sandbox, as defined by the Technical Expert Stakeholder Group (TESG) on SMEs (Technical Expert Stakeholder Group on SMEs 2021).

It is an initiative that was born at the end of 2017 jointly between Bolsa de Valencia (BME) and the Big Ban Angels Association with the aim of fostering a financial culture in which companies, their managers, and private investors could raise and provide financing in the markets. Initially, it was aimed at companies located in the Valencian Community, but it was quickly opened up to the rest of Spain and is currently global.

The main objective of the Pre-Market Environment is to give startups the support they need to develop the capabilities required by market regulations and to enable them to obtain financing through the capital markets managed by BME. EpM consists of two segments: an initial segment for new companies (startups segment) and a growth segment for veteran companies (growth segment). The open and collaborative nature of the EpM encourages the participation of investors, consultants, and capital market professionals, who interact with the companies in an ecosystem that is enriching for all parties. In this regard, the environment has a series of partners that are associations, foundations, business schools, venture capital firms, crowdfunding platforms, and other interested entities that actively collaborate with the aim of promoting the EpM’s objectives (for more information on the Partners, visit the EpM website https://www.entornopremercado.es/ing/Partners. Accessed 16 September 2022).

EpM connects unlisted companies looking for growth financing with private investors interested in investment alternatives in companies with potential expansion. It allows investors exclusive access to its information by registering in the EpM user register. The relationship between companies, investors, and partners is facilitated through seminars, workshops, conferences, training sessions, and investor’s day, among others.

4.2 Why Join the EpM?

EpM is the best option if a company is thinking of joining BME Growth in the medium term (2–3 years). Let us see what it can offer.

4.2.1 Specialized Training

It offers access to a training program focused on capital markets with sessions that, among other aspects, explain the changes that companies will have to undergo in terms of their capital structure and corporate governance, the key figures involved in the market admission process, information and transparency requirements, etc. Practical cases of how companies become listed on BME Growth are also analyzed (for more information on the training program, visit the EpM website https://www.entornopremercado.es/ing/training. Accessed 16 September 2022).

4.2.2 Practice and Experience

It allows practice to ensure compliance with the requirements to remain part of the EpM, along with recommendations from market professionals, watching companies operate as if they were already listed. It also helps to develop expertise in making financing decisions.

4.2.3 Visibility

Being in the EPM generates greater visibility and a greater presence in the media, supporting access to investment and financing.

4.2.4 High Value Networking

EpM is an ecosystem of investors, entrepreneurs, consultants, and market experts that fosters networking through seminars, events, conferences, and training sessions, encouraging interaction between companies and access to other participants.

4.2.5 Professional Advice

Firms can get direct access to market professionals to resolve doubts and queries.

Álvaro Castro, Surveillance manager and Board Member of BME Growth, explains the advantages of being part of the EpM in the following video: https://youtu.be/xHuaj6Uy-PE (Accessed 17 September 2022).

4.3 What Must I Comply with to Be Part of the EpM?

-

Be a public or private limited company.

-

In operation for at least 2 years (from the date of execution of the deed of incorporation).

-

File audited annual accounts for the year prior to the application for inclusion (or undertake to have them audited within 90 days).

-

Present business forecasts and estimates for the next 3 years.

-

Have financing requirements from 0.5 million euros or to be in an advanced stage and to have expressed interest in financing through the stock markets.

-

Present a document of incorporation to the environment and have the approval of the Advisory and Strategy Committee.

4.4 How to Stay in the EpM?

4.4.1 Regular Information

On an annual basis, within 6 months following the close of each fiscal year:

-

Annual accounts and the audit report.

-

The management report, including important milestones and clarifications to any qualifications, that, when applicable, are reflected in the audit report.

-

Information on the shareholder, management, and organizational structure.

-

Report on degree of business plan compliance.

-

Information on the investment rounds implemented during the year, indicating the total amount received and the resulting Company valuation.

On a biannual basis, within 2 months following the close of the first semester of each fiscal year:

-

The interim financial statements (balance sheet and income statement).

-

Report on degree of business plan compliance.

-

Information on the significant milestones during the period.

4.4.2 Immediately Inform BME of Any Significant Milestone

Information that directly or indirectly affects the valuation, solvency, and prospects of the Company and that may affect any decision to acquire or transfer securities.

4.4.3 Maintain Minimum Solvency Conditions

-

Maintain a positive book value of the equity.

-

Not to incur cause for dissolution or a mandatory capital reduction.

-

Remain up to date with tax authority and Social Security payments.

4.5 What Are the Costs?

The costs to be part of the EpM are as follows:

-

For admission to the EpM and the training program: 2800 euros.

-

The fee for membership of the EpM, use of the facilities, and the dissemination resources of BME facilities: 400 euros per quarter.

Note that 100% of the admission fee will be reimbursed in the event of joining any of the markets managed by BME.

4.6 EpM in Figures

Figure 6 shows the main figures of the EpM.

Main figures of the Entorno Pre Mercado in 2022. Source: Own elaboration based on Entorno Pre Mercado (2023)

Nearly 30 companies have participated in the EpM. At the end of 2022, there were 23 participating companies in EpM of which 3 belong to the Growth segment and 20 companies belong to the Startups segment. The industries to which they belong are highly varied, highlighting the biotechnology, renewables, fintech, technology, and telecommunications sectors.

Regarding the partners, the profile is very varied, mainly being associations, foundations, business schools, venture capital firms, crowdfunding platforms, entrepreneurs’ associations, financial boutiques, advisory firms, law firms, Registered Advisors, and other entities.

4.7 Success Stories

By the end of 2022, six companies had joined BME Growth following their transition to the EpM, thus meeting this environment’s objective.

The first of these was Soluciones Cuatroochenta in October 2020 (see Sect. 5). The second was Parlem Telecom in June 2021. It was followed by Intercity Football Club at the end of October 2021, Enerside in March 2022, and Substrate AI in May 2022. The final one was Energy Solar Tech in December 2022.

5 Soluciones Cuatroochenta. From EpM to BME Growth

Soluciones Cuatroochenta is a success story as it was within the first group of companies that joined the EpM in 2017 and was the first company to join BME Growth from the EpM in October 2020. Since its IPO to BME Growth, it has grown exponentially in both size and turnover.

Soluciones Cuatroochenta is a technology company specialized in developing and implementing digital cloud solutions to meet the challenges and objectives of its clients located in 14 countries of Europe and Latin America. The company, which started as an app development company, has become a solvent technological partner undertaking digital transformations with the most powerful management and cybersecurity solutions.

Founded in November 2011 by Alfredo R. Cebrián (Teruel, 1984), graduate in Advertising and Public Relations and CEO, and Sergio Aguado (Segovia, 1982), senior engineer in Computer Science and CTO, Soluciones Cuatrochenta was born in a meeting of entrepreneurs of the Parc Científic i Tecnològic of the Universitat Jaume I (UJI), the university where they both studied. In 2013, they received the Student Entrepreneurship Award from the Social Council of the UJI. The success of this company founded by these two young entrepreneurs became remarkable in the following years. So much so that in 2017 the company was one of the three selected (from among several applications) to be part of the EpM (https://youtu.be/oOUDbEC4_6o. Accessed 22 September 2022).

Soluciones Cuatrochenta, a limited company, joined EpM in 2017, with revenues in the year prior to incorporation (2016) of nearly one million euros and 25 employees. At the close of 2017, revenues already stood at 1.7 million euros, and it had 37 employees. In 2018, as a part of the preparatory actions to make the leap to BME Growth, it was transformed into a public limited company, performed a stock split, and incorporated new members in its Board of Directors. In that year, its revenues amounted to 1.85 million euros and it had 42 employees.

In 2019, the company added two new board members and, following the latest acquisitions, prepared consolidated financial statements for the first time, with revenues of 4.7 million euros. The number of employees stood at 85.

In 2020, as steps prior to its incorporation into BME Growth, it sets up an audit committee, converted its shares into book entries, and amended its articles of incorporation to bring them into line with market regulations. At the end of September, it made a primary offering for 2.5 million euros in which it received subscription orders for a total amount equivalent to 6.3 times the aforementioned offer. As a result, the capital increase was subscribed by a total of 1105 shareholders (10 former shareholders at that date and 1095 new shareholders). Finally, in October 2020, it was incorporated into BME Growth with a value of 20.8 million euros. That year it obtained consolidated revenues of €11.7 million.Footnote 6 In 2021, the company continued to grow, and revenues rose again, reaching almost €15 million.

As can be seen in Fig. 7, Soluciones Cuatroochenta has increased its revenues more than eightfold since 2017, which represents a growth of 72% Compound Annual Growth Rate (CAGR). In terms of EBITDA, the company has also achieved a very relevant growth, reaching 104% CAGR in the same period. The number of employees has grown from 37 at the end of 2017 to almost 191 at the end of 2021.

Evolution of Cuatroochenta Solutions’ income and EBITDA during the period 2017–2021. Source: Own elaboration based on Soluciones Cuatroochenta (2022)

Soluciones Cuatroochenta has been involved in several corporate and financing transactions in recent years. The company has a successful track record of acquisitions, having closed two relevant acquisitions during its time in the EpM and five transactions since its incorporation in BME Growth. In terms of financing, since its incorporation in 2011 until its entry in the EpM (2017), the company performed two capital increases for a total effective amount of 235 thousand euros. Since that time, Soluciones Cuatroochenta has carried out 14 capital increases (including the primary offering at the time of incorporation to BME Growth) for a total effective amount of 13.5 million euros. Likewise, the company has been establishing strategic relationships with institutional investors to guarantee part of the necessary financing to develop its strategic plan. Of particular note are the framework agreement signed with the Smart Fund of Banco Santander in January 2021 and the investment agreement with Inveready Convertible Finance II FCR in December 2021, which not only provides access to economic resources but also allows the company to add to the project its extensive experience in growth companies and an extensive network of connections with which to establish interesting synergies.

Alfredo R. Cebrián, CEO and co-founder of Soluciones Cuatroochenta, explains the experience of being part of EpM in the following video: https://www.youtube.com/watch?v=Y7TXkygubqo (accessed 17 September 2022) in which Jesús González, Managing Director of BME Growth, also explains what BME Growth is and its main advantages. You can also watch the “opening bell” of the company in its incorporation in BME Growth at the following link: https://youtu.be/saCzHxmU_BU (accessed 17 September 2022). The company’s CEO additionally explains, among other issues, what BME Growth has brought them and their experience of incorporation in the following video: https://youtu.be/t2HF9kfW63k (accessed 17 September 2022). Finally, the evolution of the company in the presentation made by the CFO, David Osuna, at the Medcap Forum held in Madrid in May 2022 can be seen at the following link: https://youtu.be/t7oTFDkkBWQ (accessed 17 September 2022).

6 Conclusions

After a certain time has elapsed since the start of the entrepreneur’s business idea, when the company reaches a certain degree of maturity, a major challenge for the entrepreneur arises: how to continue financing my company in order to grow? In recent years, the EU has promoted the creation of alternative stock markets aimed at opening the capital markets to small companies with strong growth potential, innovative companies, or expanding companies that are looking for partners and financing since one of the biggest obstacles faced by SMEs is the difficulty in finding financial resources under the same conditions as larger companies.

A good example of the effort to bring the market closer to SMEs is the Spanish case, where in March 2008 the Alternative Stock Market for growth companies (known in Spanish as the Mercado Alternativo Bursátil para Empresas en Expansión (MAB-EE)) was created. Currently called BME Growth, a non-regulated market with the status of Multilateral Trading Facility (MTF), it is aimed at trading securities of small-cap companies seeking to expand and was recognized in 2020 by the Spanish Securities and Exchange Commission (Comisión Nacional del Mercado de Valores) as a European SME Growth Market.

Some of the advantages of becoming a public company are access to sources of financing other than banks, increased visibility, continuous valuation, and liquidity of the company’s shares, so that companies can manage their projects more efficiently and accelerate the processes required to do so.

BME Growth has a specifically designed regulation, costs, and processes adapted to the characteristics of this type of companies, maintaining high levels of transparency. The market has a set of Registered Advisors to help companies throughout the process, both in the incorporation phase and later, on a day-to-day basis, to comply with the regulations required by the Market. A large number of companies have developed their growth in this market over the last few years.

In a previous step, for those companies that are not yet ready to join BME Growth but are planning to do so in 2–3 years, the Pre-Market Environment (known in Spanish as Entorno Pre Mercado (EpM)) accompanies them along the way. The role of the EpM is to familiarize them with the stock markets and give them access to an ecosystem of investors, experts, entrepreneurs, advisors, and financial market professionals.

Notes

- 1.

A key objective of the Capital Markets Union is, among others, to facilitate access to diversified sources of finance for smaller companies in the EU. This makes it cheaper and simpler for them to access public markets and ultimately reduces reliance on bank financing, enabling a broader investor base and easier access to equity and debt financing (European Securities and Market Authority 2021).

- 2.

See explanation of Multilateral Trading Facility in Sect. 3.1 below.

- 3.

Article 33(3) of MiFID II sets out the conditions that an MTF must meet when applying to its National Competent Authority for registration. They include a 50% threshold on the minimum number of SME issuers traded on the SME Growth Market, appropriate criteria for initial and continued admission to trading, information to be published by issuers, dissemination of information to the public and compliance with systems and controls under the Market Abuse Regulation (Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse).

- 4.

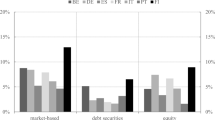

A comparative of the relative weight of market financing vs. bank credit of Spain and other countries in the period 1990–2018 can be found in Cambón and Canadell (2018).

- 5.

SOCIMI stands for Sociedades Anónimas Cotizadas de Inversión en el Mercado Inmobiliario, is the Spanish equivalent to the international figure of Real Estate Investment Trust (REIT), that is, a collective investment vehicles whose purpose is the direct or indirect holding of real estate assets for rental purposes.

- 6.

On the BME Growth website, you can consult the Information Document for Admission to the Market (IDAM). https://www.bmegrowth.es/docs/documentos/Otros/2020/09/05509_Folleto_20200924.pdf. Accessed 21 September 2022.

References

BME Growth (2022a) BME Growth website. Companies. Why list on BME Growth? section. https://www.bmegrowth.es/ing/BME-Growth/Why-List-On-BME-Growth.aspx. Accessed 9 Sept 2022

BME Growth (2022b) BME Growth website. What is BME Growth? section. https://www.bmegrowth.es/ing/BME-Growth/What-Is.aspx#se_top. Accessed 9 Sept 2022

Bolsas y Mercados Españoles (2020a) Circular 1/2020. Requirements and procedure for incorporation and exclusion in the BME Growth trading segment of BME MTF Equity. https://www.bmegrowth.es/docs/normativa/ing/circulares/2020/1_2020_CIRC_INCORPORACI%C3%93N__BME_Growth__1_.pdf. Accessed 15 Sept 2022

Bolsas y Mercados Españoles (2020b) Circular 3/2020. Information to be provided by companies admitted to trading in the BME Growth segment of BME MTF Equity. https://www.bmegrowth.es/docs/normativa/ing/circulares/2020/3_2020_CIRC_INFORMACI%C3%93N_BME_Growth.pdf. Accessed 15 Sept 2022

Bolsas y Mercados Españoles (2020c) Circular 4/2020. Registered advisor in the BME Growth trading segment of BME MTF Equity. https://www.bmegrowth.es/docs/normativa/ing/circulares/2020/4_2020_CIRC_Asesor_Registrado_BME_Growth.pdf. Accessed 15 Sept 2022

Bolsas y Mercados Españoles (2022a) Circular 2/2022. Amendment to Circular 1/2020 of 30 July on requirements and procedures applicable to admission and exclusion from trading in the BME Growth segment of BME MTF Equity and to Circular 3/2020 of 30 July on information to be provided by companies admitted to trading in the BME Growth segment of BME MTF Equity. https://www.bmegrowth.es/docs/normativa/ing/circulares/2022/20220722_Circular_2-2022_Modificaci%C3%B3n_Circulares__1_y_3-2020_en_GB.pdf

Bolsas y Mercados Españoles (2022b) Circular 4/2020. Tarifas aplicables en BME MTF equity https://wwwbmegrowthes/docs/normativa/esp/circulares/2022/Tarifas-BME-MTF-Equity-2023-Circular-4-2022-pdf Accessed 15 Mar 2022

Bolsas y Mercados Españoles (2023) BME growth. A boost for business growth https://wwwbmegrowthes/docs/docsSubidos/Presentaciones-web/Presentacio-n-general-BME-Growth-2023_20230206-ENGpdf Accessed 10 Feb 2023

Cambón MI, Canadell E (2018) La presencia de las empresas españolas no financieras en los mercados de capitales. In: Boletín Trimestral (III). CNMV. www.cnmv.es/DocPortal/Publicaciones/Boletin/Boletin_III_Trimestre_2018.pdf

Entorno Pre Mercado (2023) Entorno Pre Mercado website. https://www.entornopremercado.es/ing/Home. Accessed 8 Jan 2023

European Parliament (2014) Directive 2014/65/EU of the European Parliament and of the council of 15 may 2014 on markets in financial instruments and amending directive 2002/92/EC and directive 2011/61/EU. Off J Eur Union 12:349–496. http://data.europa.eu/eli/dir/2014/65/oj

European Securities and Market Authority (2021) MiFID II review report on the functioning of the regime for SME Growth Markets. https://www.esma.europa.eu/file/112516/download?token=YrfsKlyb

European Securities and Market Authority (2023) European Securities and market Authority website. MIFID/UCITS/AIFMD/EUVECA entities section. https://registers.esma.europa.eu/publication/searchRegister?core=esma_registers_upreg. Accessed 4 Jan 2023

Federation of European Securities Exchanges (2023) FESE Capital Markets Fact Sheet – Q4 2022. https://www.fese.eu/app/uploads/2023/01/FESE-Capital-Markets-Fact-Sheet-2022-Q4.pdf. Accessed 10 Mar 2023

Gouardères F (2021) Las pequeñas y medianas empresas. Fichas temáticas sobre la Unión Europea. Parlamento Europeo. https://www.europarl.europa.eu/ftu/pdf/es/FTU_2.4.2.pdf

Iberclear (2022) Fees for participants. https://www.bmegrowth.es/docs/normativa/esp/circulares/2022/tarifas_Iberclear_desde_27-6-22_ingles.pdf. Accessed 15 Mar 2023

Posner E (2004) Copying the Nasdaq stock market in Europe: supranational politics and the convergence-divergence debate. Institute of European Studies. https://www.semanticscholar.org/paper/Copying-the-Nasdaq-Stock-Market-in-Europe%3A-Politics-Posner/eca0f9728985a99a7931362054962319d14056f5

Reino de España (2023) Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión. Boletín Oficial del Estado, 6 de abril. no. 66. https://www.boe.es/eli/es/l/2023/03/17/6/con

Soluciones Cuatroochenta (2022) Soluciones Cuatroochenta website. Results section. https://cuatroochenta.com/en/investors/#results. Accessed 28 Sept 2022

Technical Expert Stakeholder Group on SMEs (2021) Empowering EU capital markets for SMEs. Making listing cool again. https://ec.europa.eu/info/sites/default/files/business_economy_euro/growth_and_investment/documents/210525-report-tesg-cmu-smes_en.pdf

Vismara S, Paleari S, Ritter JR (2012) Europe’s second markets for small companies. Eur Financ Manag 18(3):352–388. https://doi.org/10.1111/j.1468-036X.2012.00641.x

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Castaño, L., Farinós, J.E., Ibáñez, A.M. (2023). Access to Capital Markets for Entrepreneurs. In: Sendra-Pons, P., Garzon, D., Revilla-Camacho, MÁ. (eds) New Frontiers in Entrepreneurial Fundraising. Contributions to Finance and Accounting. Springer, Cham. https://doi.org/10.1007/978-3-031-33994-3_7

Download citation

DOI: https://doi.org/10.1007/978-3-031-33994-3_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-33993-6

Online ISBN: 978-3-031-33994-3

eBook Packages: Business and ManagementBusiness and Management (R0)