Abstract

The capital asset pricing model has been object of violent theoretical and empirical criticism in the mainstream financial literature. This chapter overviews the main controversies, presents the most innovative alternatives, and explains why the model, despite its shortcomings, remains the backbone of finance literature and financial practice.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

The capital asset pricing model (CAPM) is the result of the works of Sharpe(1964), Litner (1965), and Mossin (1966). By working independently, they came up with the same model based on the earlier work of Harry Markovitz. In 1990 Professor Sharpe won the Nobel Prize for Economics for this contribution, and sixty years after his seminal paper no innovation has been able to displace it. It is still the centrepiece of MBA investment courses, and it is often the only asset pricing model taught in these courses.

Professor Huerta de Soto had on his radar a critique of the CAPM for decades. He has always been obsessed with researching alternatives to the CAPM that would be consistent with the Austrian School. During the period in which I attended his graduate seminar, from 2002 to 2005, every time a new doctoral student or a finance professional appeared in his class, the professor would systematically test the ground: “Are you familiar with the CAPM? There is a big opportunity in researching alternatives!” I was committed to another research subject, so I did not pick it up myself, but a few years later, David Howden focused his PhD thesis on this subject, laying down the map for an Austrian alternative to the CAPM.

In the financial world, the CAPM has two prominent use cases. First, it is used to estimate the cost of equity of firms. The traditional method for evaluating the present value of an asset (discounted cash flow model, or DCF) requires that one discounts the stream of future cash flows with a “discount rate” that represents an appropriate industry return expectation for such asset. In corporate finance, this discount rate corresponds to the cost of capital, which reflects the return expectations of shareholders. The cost of capital is traditionally estimated using the weighted average cost of capital (WACC), which is the sum of the cost of equity and the cost of debt. The cost of equity is traditionally estimated with the CAPM. Secondly, the CAPM is used to assess the performance of an investment portfolio. Portfolio managers use terminologies such as the “beta” and other “risk factors” to evaluate current portfolios, both in terms of past performance and expected return. Every portfolio manager embeds this number in their calculations, and today there is an ecosystem of modeling and data providers that offer results based on the CAPM and its successive multi-factor evolutions.

What Is the CAPM?

The CAPM rests on three pillars. The first one is portfolio selection theory, introduced by Harry Markowitz with the famous original paper in 1952. According to this theory, investors make portfolio decisions based only on the mean and variance of the investment return. As a result, investors adopt a framework (mean-variance framework) where they choose “mean-variance efficient” portfolios.

The second pillar is the direct outcome of a collaboration between William Sharpe and Markowitz to overcome a limitation of portfolio selection. The calculation of an efficient portfolio consists essentially of a mathematical optimization exercise, where the expected inputs are the returns, variances, and correlations among all the individual assets of the portfolio. With the computational power available in the twenty-first century, this is a trivial exercise, but in the fifties and early sixties, this calculation was extremely onerous, being highly time-consuming as well as costly in terms of computing resources. Sharpe found that by estimating the sensitivity of each security against the market as a whole, the problem was completely bypassed. This idea led to the CAPM, with beta representing the volatility of a stock against the market portfolio. Fama and French (2004) provide a helpful diagram of how the CAPM works (Fig. 1).

The efficient frontier. Source: Fama and French (2004)

The horizontal axis describes the portfolio risk (measured by the standard deviation of portfolio return), while the vertical axis shows the portfolio expected return. The curve abc represents the portfolio’s possibilities curve. The ab portion is called the minimum variance frontier (or efficient frontier) since for every level of risk, it is more efficient to pick the portfolio with the highest expected return. The traditional trade-off between risk and return is apparent in the diagram (to obtain a high return one needs to accept high risk). This trade-off is obviously the outcome of defining risk as the volatility of excepted return, and it is rejected by those, like the value investors, who believe that risk and volatility are different concepts, and that it is possible to achieve high return with low volatility (meaning that it is possible to invest in a portfolio that sits outside the portfolio’s possibilities curve).

If we introduce the assumption that an investor can borrow and lend infinite amounts at a risk-free rate, we add a line to the diagram. A risk-free asset (which could be approximate to an AAA government bond or to a savings account) has zero volatility by default (point Rf). If an investor places a portion of his funds in a risk-free asset and the rest in a portfolio of risky assets (point g), these two points allow to draw the line describing all the possible combinations between these two alternatives. If the investor picks a portfolio on the efficient frontier (meaning, a mean-variance efficient portfolio), the line becomes tangential to the curve at point T.

As a third pillar, the CAPM introduces one of the strictest assumptions: all investors agree on the distribution of expected returns at t+1, therefore they all see the same opportunity set. Hence, all investors hold the same portfolio of risky assets (T), and this portfolio must be the market portfolio. As a result, the expected return on a portfolio consisting of riskless and risky assets is:

where Ri is the expected return on asset i, Rf is the return on a risk-free asset, RM is the expected return of the market portfolio, and βi is the market beta of asset i. Beta is often interpreted as the sensitivity of the asset’s return to the market portfolio’s return (technically speaking, beta is the covariance of the asset return with the market return divided by the variance of the market return). Beta is often called systematic risk, which is the risk that cannot be eliminated through diversification.

The assumption of risk-free borrowing and lending was so unrealistic that Fischer Black (1972) developed a version of the CAPM without it, by allowing unrestricted short sales of risky assets instead. In other words, Black was able to show that the market portfolio is efficient and it represents the minimum variance portfolio. As Fama and French (2004) point out, the assumption that short selling is unrestricted is as unrealistic as the assumption of unrestricted risk-free borrowing and lending. However, the relationship between expected return and beta is lost without this assumption, and the CAPM falls.

CAPM Assumptions

In summary, the CAPM introduces a weighty set of assumptions:

-

1)

All investors make decisions based on the mean-variance framework

According to the mean-variance framework, investors make decisions solely in terms of expected values and standard deviations of portfolio returns. Using this framework, they construct efficient portfolios, built with optimization techniques that aim to maximize expected return while minimizing variance on the return. This framework implicitly embeds the assumption of normal distribution of expected returns because this is the only probability distribution that can be described with only two parameters (mean and variance).

-

2)

All investors have homogeneous expectations of asset returns

All investors have the same expectations about expected asset returns, hence they have identical expected probability distributions concerning the future. Consequently, all investors have identical expectations of inputs required for portfolio decisions: expected return, variance on return, and the correlation matrix (between pairs of assets). This generates a unique and optimal risky portfolio (the market portfolio with expected return RM).

-

3)

All investors look forward with the same time horizon

Investors plan to hold a portfolio for one single period (one year) and assume that all other investors base their decision-making on the same time horizon.

-

4)

Unlimited risk-free borrowing or lending privileges

Each investor can lend or borrow any amount of funds at an interest rate equal to the rate of risk-free securities. Black et al. (1972) substituted this assumption with unlimited short selling, where investors can short any asset, and hold any fraction of an asset. This implicitly means that assets are infinitely divisible.

-

5)

Investors do not affect prices with their trading activity, they are price takers

An individual cannot affect the price of a stock by buying or selling it. This is analogous to the assumption of perfect competition. While no individual investor can influence individual stock prices, investors determine the total share prices.

-

6)

All assets are marketable

All asset types and securities, and all assets, including human capital, can be bought and sold on the market, and all investors have equal access to them.

-

7)

No taxes nor transaction costs

The first implies that the investor is indifferent to dividends versus capital gains. The second means there are no commission costs.

The Empirical Critique of the CAPM

After the CAPM was published, the academic literature was flooded with studies testing its predictions. Testing the CAPM is not a simple task. Beta is not observable from market data and must be estimated. Early tests of the CAPM were usually done in two steps: first, estimating the betas, and second, testing the model’s predictions. The beta of a stock can be estimated in two ways: a) as the covariance between the stock’s excess return (over risk-free rate) and the market portfolio’s excess return, divided by the variance of the market portfolio’s excess return; b) by running a time-series regression of the stock’s excess returns on the market portfolio's excess returns separately for each stock (the slope estimate will correspond to the beta).

The first empirical tests were quite supportive. The University of Chicago economists Eugene Fama and James D. MacBeth published the most supportive study in 1973. Based on monthly stock returns from 1926 to 1968, they showed that the portfolio’s average return was positively related to its beta (Fama & MacBeth, 1973).

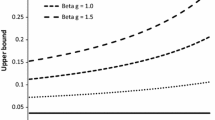

Other studies found significant discrepancies. For example, Black et al. (1972) used the same data set from 1931 to 1965 and found that portfolios with low beta stocks had higher returns than the CAPM predicted (and vice versa for portfolios with high beta). The authors concluded that such evidence was “sufficiently strong to warrant rejection of the traditional form” of the CAPM. Black et al. (1972) proposed an alternative form that would be compatible with the empirical results. He found that by dropping Sharpe’s assumption of unlimited borrowing at the risk-free rate, it was still possible to find an equilibrium with restricted borrowing compatible with the data.

Several early empirical tests supported the Black et al. (1972) version of the CAPM. According to Fama and French (2004), these early results “coupled with the model’s simplicity and intuitive appeal, pushed the CAPM to the forefront of finance.” MacKenzie (2006) describes the role of Wells Fargo, and in particular of John A. McQuown, in attracting and supporting financial economists engaged with financial innovation. “Wells Fargo Bank supported Black, Jensen, and Scholes’s research financially and sponsored the conference at which it was first presented, held at the University of Rochester (where Jensen then taught) in August 1969. Probably at Black’s suggestion, McQuown’s group at Wells Fargo saw a way to exploit the result of the research. If the anomalous finding was the result of restrictions on borrowing, perhaps it could be exploited by an investment company, which could borrow more easily and more cheaply than an individual could? The idea was to invest in low-beta stocks, with what the study by Black, Jensen, and Scholes had suggested was their high return relative to risk, and to use ‘leverage’ (in other words, borrowing) to increase the portfolio’s level of risk to somewhat more than the risk of simply holding the overall market, so also magnifying returns (McQuown interview).”

The push toward CAPM-oriented financial innovation happened even if the same studies consistently rejected the original formulation of the CAPM (by Sharpe (1964), Lintner (1965), and Black et al. (1972)), where the risk premium corresponds to the expected excess market return multiplied by beta. For example, they found that, although a positive relation between beta and average return exists, it is “flatter” than the CAPM prediction.

Empirical evidence against the CAPM piled up in the late 1970s and during the 1980s, even rejecting the Black version of the CAPM. Research showed that expected market return is “unrelated” (term used in Fama and French (2004)) to market beta and is rather sensitive to several other factors. For example, Basu (1977) showed evidence that earnings-price ratios can explain expected return; Banz (1981) documented the size effect (in terms of market capitalization); Bhandari (1988) found that high debt-equity ratios provide higher expected returns; finally, Stattman (1980) and Rosenberg et al. (1985) showed that stocks with high book-to-market equity ratios have higher average returns than the CAPM prediction.

Even early supporters like Professor Fama changed their minds. In 1992 he published, with his University of Chicago colleague Kenneth R. French, what MacKenzie (2006, p. 91) defined as “the most influential empirical critique.” They showed that the relationship between beta and average return predicted by the CAPM holds from 1941 to1965 (and even then, the relationship would drop by modifying the portfolio according to the firm’s size). However, after 1965 the data undeniably falsify the model. At the time, the CAPM was already the most prominent model used in the investment industry, so Fama and French (1992) received significant media attention: The Economist headlined the news as “Beta beaten,” and in an interview with the New York Times, Fama declared that “beta as the sole variable explaining returns on stocks is dead.” Ultimately, it became known as “the ‘beta is dead’ paper.”

In their 1992 paper, Fama and French accomplished two primary objectives: first, they showed that the data supports the CAPM predictions only in certain historical periods; second, they demonstrated that beta alone could not explain stock returns. Indeed, they found that beta alone cannot explain the stock’s expected return. Rather, one must also consider other factors such as size, price-earnings, debt-equity, and book-to-market ratios. Their findings were challenged by studies such as Kothari et al. (1995). The latter was rebutted in Fama and French (2004).

Fama and French (1992) further show that “the contradictions of the CAPM associated with price ratios are not sample-specific.” In Fama and French (2004, p. 36), they finally affirm: “If betas do not suffice to explain expected returns, the market portfolio is not efficient, and the CAPM is dead in its tracks.”

The Theoretical Critique of CAPM

The empirical evidence against the CAPM supported numerous explanations about why the model is faulty. The first explanation relates to the number of factors required to build a good predictive model.

Fama and French (1992) had demonstrated two clear facts. First, the original formulation of the CAPM with one factor (beta) has been disproven. Second, adding additional explanatory factors makes it possible to improve the model predictions. Their 1992 paper proposed a three-factor model based on the beta, the size factor (outperformance of small versus big companies), and the value factor (outperformance of high book/market versus low book/market companies). The latter factor implicitly recognized the point that value investors had always defended: that the CAPM is based on the Efficient Market Hypothesis (EMH), where the market price is always equal to the fundamental (or intrinsic) value, while value investors affirm there is a gap between the two (called “margin of safety”), that can be exploited as an investment opportunity.

All the major accounts of value investing history, such as Buffett (1984), Lowenstein (1995), and MacKenzie (2006), provide an account of the famous 1984 conference at Columbia Business School celebrating the 50th anniversary of the book by Graham and Dodd (1934), which became known as the debate between Michael Jensen and Warren Buffet. Jensen represented the stereotypical position of efficient marketers, claiming that value investors’ success was simply a matter of luck, like the happy winners of a coin-flipping contest. Buffet memorably responded: “I think you will find that a disproportionate number of successful coin-flippers in the investment world came from a very small village that could be called ‘Graham and Doddville’.”

Fama and French (1992) became the catalyst for more empirical studies exploring additional factors that could explain stocks’ expected returns. Carhart (1997) extended their model with the additional momentum factor (which promotes an investment strategy involving buying winners and selling losers). Momentum was first introduced by Jegadeesh and Titman (1993) and by Cliff Asness in his PhD thesis, completed in 1994 under Eugene Fama (Asness, 1994). Fama never liked the results of Asness’s research, and in Asness (2016) he recognized that momentum is one of the most challenging factors to reconcile with the EMH. In Fama and French (2004), Fama had previously admitted that the momentum effect was their three-factor model’s most serious problem. They also insisted that while the original version of the CAPM was doomed, if one identifies the right factors it is possible to build a good predictive model based on regressive historical data. Later, Fama and French (2015) extended their original model by adding two further factors: profitability and investment.

A second explanation is based on Roll (1977). Richard Roll was another of Eugene Fama’s PhD students. In the CAPM, everything rotates around the sensitivity of asset returns to the market portfolio, and Roll was puzzled by how to define it. Econometric tests were based on the S&P 500, the best available proxy for the market portfolio, but one could also have included other types of assets such as corporate bonds, real estate, movable capital, even unobservable elements like the “human capital.” Therefore, while the market portfolio is supposed to be in an optimal equilibrium (on the minimum variance efficient frontier), we will never be able to observe and test it in practice. MacKenzie (2006) explains that Professor Sharpe himself admitted that Roll’s critique was essentially correct. Fama and French (2004) responded pragmatically to this challenge. If one can identify a proxy sitting on the minimum variance frontier, it can be used in a multi-factor asset pricing model to predict expected returns. Besides, Stambaugh (1982), another PhD student at Chicago, had shown that the CAPM is not sensitive to the expansion of the market portfolio to other assets, essentially because the portfolio’s volatility is dominated by stock volatility.

A third explanation is based on behavioral finance. In the market, we can observe stocks with high book value to market price (B/M), which are considered underpriced and called “value stocks.” Eventually, a market correction will result in high growth (vice versa, with low B/M stocks). According to behaviorists, these violations of the CAPM are due to economic agents’ bias, and as a result, assets in capital markets are mispriced (DeBondt & Thaler, 1987; Lakonishok et al., 1994; Haugen, 1995). Consequently, the EMH does not hold, and markets are irrational, meaning that they do not behave according to the neoclassical definition of Rational Choice Theory. Fama and French (2004) concede that when a test rejects the CAPM, one cannot recognize whether one is facing a violation of the rational pricing assumption (the behaviorist view) or a breach of the asset pricing model (Fama and French’s view).

According to the fourth explanation, the CAPM assumptions are unrealistic and over-simplistic. When he first published the CAPM, Sharpe was aware that the model’s assumptions were “highly restrictive and undoubtedly unrealistic” (cited in Mackenzie, 2006, p. 54). He defended this opinion by invoking Milton Friedman’s 1953 essay “The Methodology of Positive Economics.” Revisiting the debate on Friedman’s epistemological viewpoint is not in the scope of this chapter. However, we cannot fail to mention that Professor Markovitz, the father of the foundations upon which the EMH and the CAPM are built, in Markovitz (2005) attacked two of the basic CAPM assumptions: i) investors can borrow risk-free with no limits; ii) investors can sell short without limit to take on long positions. By relaxing these assumptions, the market portfolio no longer needs to be an efficient portfolio. As Bernstein (2007) points out, if the market portfolio is not efficient, then “indexing makes no sense, and perhaps no strategy of broad diversification makes sense.”

The fifth explanation is the Austrian one, and it can be seen as a more sophisticated version of the previous one. It should not come as a surprise that the Austrian stance is identical to the behaviorist critique of the CAPM’s unrealistic assumptions (as expressed, for example, in Ang (2014), a key reference-point for factor investing). After all, both take issue with Chicago’s Rational Choice Theory (to which the EMH and the CAPM belong). Let’s start with the assumptions related to the market (the first two are identical to Markovitz (2005)):

-

a)

Availability of unlimited resources in the market to be lent at a risk-free rate: this is a simplification that does not occur.

-

b)

Unlimited short selling is possible in any market: this is not the case in real life. In many securities, such a market simply does not exist.

-

c)

Negotiability of any asset: any asset can be bought or sold by anyone under the same conditions.

-

d)

The CAPM ignores transaction costs (commissions), which undoubtedly have a powerful impact on the result of any portfolio.

-

e)

The CAPM also ignores taxes (which have a much more significant impact than in the previous case).

-

f)

Investors’ activities do not influence market price movements: this is false since the formation of prices emanates precisely from who buys and sells at any given moment.

Furthermore, the following two assumptions on the behavior of the economic agent are in sharp contrast with Austrian subjective valuation applied to investment decisions (to be precise: Mises subjective valuation assumption and Huerta de Soto’s entrepreneurial function):

-

g)

All investors have the same forecasts about market behavior (probability distribution) and analyze it in the same way (mean-variance framework): in reality, everyone has their subjective expectations. If everyone believed that a given asset was worth the same price, no buying and selling would ever take place.

-

h)

The CAPM assumes that all investors invest with the same time horizon, which is not true in real life either. Such time horizons undoubtedly affect buying and selling decisions, which the CAPM completely ignores.

In addition to the above, the Austrians (and other schools of thought) do not agree with the mainstream definition of risk as the variance of the event under observation. First, if one measures the risk of return as its standard deviation, then the risk of any event can be measured, and risk and uncertainty end up conflated instead of being kept separated according to the well-known Knightian dichotomy. Secondly, standard deviation treats upsides and downsides equally, and while the former is desirable, the latter corresponds precisely to the potential loss the investor seeks to avoid. A significant literature studies the “downside risk,” which defines risk as the negative half of the distribution of return probabilities. According to Grabowski and Pratt (2014), this literature focuses on the risks of an investment loss, as opposed to the symmetrical likelihood of a loss or gain. Finally, from a methodological perspective, the whole CAPM models’ ecosystem is based on the idea that expected future returns could be deduced from the movement of past prices.

Alternatives to the CAPM

The Factors’ Zoo

The proliferation of studies to identify risk factors that explain stock returns has opened the path to the main evolution of the CAPM: “multi-factor models.” The first one to popularize this term was Ross (1976), who developed Arbitrage Pricing Theory (APT). According to this theory, multiple factors best explain security returns. An asset represents a portfolio of risk factors; therefore, its price corresponds to the weighted sum of the risk factors’ price, where the weights are proportional to the exposure to each factor.

In the CAPM and its multi-factor extensions (Fama and French’s three or five factors model, Carhart (1997), etc.), the risk factors are predefined. In the APT, the number and nature of these factors are undefined and can vary over time and across markets. This allows the creation of models in which the expected return of a financial asset is a function of various macroeconomic factors (including inflation, gross domestic product (GDP), gross national product (GNP), yield curves, etc.) or market indices.

The risk factors cannot be directly observed, therefore they must be identified and estimated with statistical techniques (such as principal components’ analysis), where the factors are not pre-specified in advance. This triggers vigorous debates and relegates the challenge of building multi-factor models to essentially a statistical exercise, distinct from the asset’s fundamental or economic valuation. If one wants to explore the issues with factor’s estimation errors, Damodaran (2013), chapter 8, is an excellent place to start.

Since Fama and MacBeth (1973), hundreds of papers have been published to explain expected returns. The trend among those that seek to go beyond the original formulation of the CAPM is to adopt a multi-factor model. The most prevalent factors today are value, growth, size, momentum, low volatility, yield, and quality. However, the number of factors that have been identified (in the decade following Fama and French (2004)) has grown exponentially, since scholars and practitioners have the incentive to gain a reputation for discovering a new factor that explains returns. Cochrane (2011) warned that this body of literature has created a “zoo of new factors,” populated with all sorts of creatures: “at current production rates, in the near future we will have more sources of empirically ‘identified’ risk than stock returns to price with these factors—the so-called factors’ zoo phenomenon” Bryzgalova et al. (2019, p. 3).

To provide a map for this ecosystem, Harvey et al. (2016) and Harvey and Liu (2019) have created a census of the zoo, where all the known factors (almost 400 factors published in top academic journals) are classified and traced in terms of the literature that generated them.

Forward-Looking Alternatives

All the ramifications of the CAPM illustrated so far have one thing in common. They are backward-looking because the model predicts expected return based on stock return’s past behavior. There is a vast literature that warns about the dangers of this approach, emphasizing the fact that past prices are not a good indication of future risks. Therefore, an alternative body of literature has grown to study forward-looking models.

In asset valuation, a key element is the cost of equity, which can be estimated with a forward-looking technique in different ways. The first way is to solve the dividend discount model (DDM) for the cost of equity, assuming that the present value is the market price and forecasting somehow future dividends. This technique is not recommended to value a company since it would lead to circular reasoning: the starting assumption is that the current value is the market price, therefore we would obtain that as a result of the valuation. Instead, the resulting cost of equity (either of the individual company or of the sector it belongs to) can be used as a benchmark. For example, Damodaran (2013) has developed a well-known technique to estimate the market-implied cost of equity of a sector, against which we can compare a beta estimated with the CAPM. There are various similar approaches based on reverse engineering the discounted cashflow model (DCM), accounting based methods, and so on. The reference for this approach is Frank and Shen (2016). The weakest side of the market-implied alternatives is the difficulty of estimating future dividends or cash flows. Some scholars attempted to address that challenge by using equity analysts’ estimates, but we know those analysts’ projections are biased since they tend to overstate the long-term growth of earnings or dividends.

A second way is to use derivative prices to estimate beta (option-implied beta). This family of techniques still relies on the original CAPM idea that expected returns can be estimated based on one or more betas, but instead of estimating betas using regressions on past prices, they rely on option prices. There is a body of literature dedicated to this approach. For example, according to Hollstein and Prokopczuk (2016), a combination of option-implied beta and historical beta outperforms all other techniques. Baule et al. (2016) have found that the predictive performance of implied beta estimators is superior if the time horizon is short (one month), or if options market activity is high.

Conclusions: The CAPM Condrum

Despite its shortcomings and all the available alternatives, the CAPM remains the most widely used method for estimating the cost of equity and for making investment decisions.

Brotherson et al. (2013) surveyed nineteen corporates,Footnote 1 ten financial advisors and investment bankers,Footnote 2 and the six main textbooks. Among their conclusions, two takeaways stand out: i) the CAPM was the dominant model, and only one respondent did not use the CAPM; ii) the variety of cost of equity estimations from different providers is stunning, which is an indicator of how complex and prone to errors are the techniques to estimate beta.

The CAPM is also the preferred model for classroom use in MBA and other advanced finance courses, as Fernandez (2020) confirmed. Finally, the CAPM is still the reference model in courtrooms. For example, Dane (2014, p. 62) shows that when facing the dilemma about which valuation model to use, the Delaware Chancery Court (regarded as a reference for disputes over valuation-related issues associated with merger, acquisition, and recapitalization) did not accept results from alternatives to the CAPM, since they “are not well accepted by mainstream corporate finance theory.”

Brotherson et al. (2013) remind us that in business, we measure with a micrometer, mark with chalk and cut with an axe. In the end, a financial analyst and a portfolio manager need a number (cost of equity) to make a decision. Despite decades of development of sophisticated alternatives to the CAPM, the complexity of these alternatives and the lack of consensus in the academic community mean that an imperfect and even erroneous reference like the CAPM is better than nothing.

This is probably the reason why a commentator cited in Grabowski and Pratt (2014, p. 220) said: “In spite of the lack of empirical support, the CAPM is still the preferred model for classroom use in MBA and other managerial finance courses. In a way it reminds us of cartoon characters like Wile E. Coyote who have the ability to come back to original shape after being blown to pieces or hammered out of shape.”

Notes

- 1.

AmerisourceBergen, Caterpillar, Chevron, Coca Cola, Costco Wholesale, IBM, International Paper, Intuit, Johnson Controls, PepsiCo, Qualcomm, Sysco, Target, Texas Instruments, Union Pacific, United Technologies, UPS, W.W. Grainger, Walt Disney.

- 2.

Bank of America Merrill Lynch, Barclays Capital, Credit Suisse, Deutsche Bank AG, Evercore Partners, Goldman Sachs & Co., Greenhill & Co, LLC, JP Morgan, Lazard, Morgan Stanley, UBS.

References

Ang, A. (2014). Asset Management: A Systematic Approach to Factor Investing. Oxford University Press.

Asness, C. S. (1994). Variables That Explain Stock Returns. Ph.D. Dissertation, University of Chicago.

Asness, C. (2016, February 5). Fama on Momentum. Cliff’s Perspective, AQR Insights. Retrieved January 9, 2021, from https://www.aqr.com/Insights/Perspectives/Fama-on-Momentum

Banz, R. (1981). The Relationship Between Return and Market Value of Common Stock. Journal of Financial Economics, 9, 3–18.

Basu, S. (1977). Investment Performance of Common Stocks in Relation to Their Price-Earnings Ratios: A Test of the Efficient Market Hypothesis. Journal of Finance, 12(3), 129–156.

Baule, R., Korn, O., & Saßning, S. (2016, June). Which Beta Is Best? On the Information Content of Option-Implied Betas. European Financial Management. European Financial Management Association, 22(3), 450–483.

Bernstein, P. L. (2007). Capital Ideas Evolving (a review). Wiley.

Bhandari, L. C. (1988). Debt/Equity Ratio and Expected Common Stock Returns: Empirical Evidence. Journal of Finance., 43(2), 507–528.

Black, F. (1972). Capital Market Equilibrium with Restricted Borrowing. Journal of Business, 45(3), 444–454.

Black, F., Jensen, M. C., & Scholes, M. S. (1972). The Capital Asset Pricing Model: Some Empirical Tests. In M. Jensen (Ed.), Studies in the Theory of Capital Markets. Praeger.

Bryzgalova, S., Huang, J., & Julliard, C. (2019, November 18). Bayesian Solutions for the Factor Zoo: We Just Ran Two Quadrillion Models. Available at SSRN: https://ssrn.com/abstract=3481736

Brotherson, T., Eades, K., Harris, R., & Higgins, R. (2013). “‘Best Practices’ in Estimating the Cost of Capital: An Update”. Journal of Applied Finance, 23(1), 15–33.

Buffett, W. E. (1984). The Superinvestors of Graham-and-Doddsville. Hermes, the Columbia Business School Magazine.

Carhart, M. M. (1997). On Persistence in Mutual Fund Performance. The Journal of Finance, 52(1), 57–82.

Cochrane, J. H. (2011). Presidential Address: Discount Rates. Journal of Finance, 66, 1047–1108.

Damodaran, A. (2013). Equity Risk Premiums (ERP): Determinants, Estimation and Implications–The 2013 Edition. In Managing and Measuring Risk: Emerging Global Standards and Regulations After the Financial Crisis (pp. 343–455).

Dane, C. G. (2014, SUMMER). Valuation-Related Issues as Decided by the Delaware Chancery Court. Judicial Decision Insights.

DeBondt, W. F. M., & Thaler, R. H. (1987, July). Further Evidence on Investor Overreaction and Stock Market Seasonality. The Journal of Finance.

Fama, E. F., & French, K. R. (1992). The Cross-Section of Expected Stock Returns. Journal of Finance, 47(2), 427–465.

Fama, E. F., & French, K. R. (2004). The Capital Asset Pricing Model: Theory and Evidence. Journal of Economic Perspectives, 18(3), 25–46.

Fama, E. F., & French, K. R. (2015). A Five-Factor Asset Pricing Model. Journal of Financial Economics, 116, 1–22.

Fama, E. F., & MacBeth, J. (1973). Risk, Return and Equilibrium: Some Empirical Tests. Journal of Political Economy, 8(1973), 607–636.

Fernandez, P. (2020). The Equity Premium in 150 Textbooks. Journal of New Finance, 1(3), Article 3. https://doi.org/10.46671/2521-2486.1009

Frank, M., & Shen, T. (2016). “Investment and the Weigthed Average Cost of Capital”. Journal of Financial Economics, 119(2), 300–315.

Grabowski, R. J., & Pratt, S. P. (2014). Cost of Capital: Applications and Examples. Wiley.

Graham, B., & Dodd, D. (1934). Security Analysis. Whittlesey House.

Harvey, C. R., & Liu, Y. (2019, February 25). A Census of the Factor Zoo. Available at SSRN: https://ssrn.com/abstract=3341728

Harvey, C., Liu, Y., & Zhu, H. (2016). … and the Cross-Section of Expected Returns. Review of Financial Studies, 29(1), 5–68.

Haugen, R. (1995). The New Finance: The Case against Efficient Markets. Prentice Hall.

Hollstein, F., & Prokopczuk, M. (2016). Estimating Beta. The Journal of Financial and Quantitative Analysis, 51(4), 1437–1466.

Jegadeesh, N., & Titman, S. (1993). Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. Journal of Finance, 48, 65–91.

Kothari, S. P., Shanken, J., & Sloan, R. G. (1995). Another Look at the Cross-Section of Expected Stock Returns. Journal of Finance, 50(1), 185–224.

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1994). Contrarian Investment, Extrapolation, and Risk. Journal of Finance, 49, 1541–1578.

Lintner, J. (1965). The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets. Review of Economics and Statistics., 47(1), 13–37.

Lowenstein, R. (1995). “Buffett: The Making of an American Capitalist”. Random House.

MacKenzie, D. (2006). An Engine, Not a Camera: How Financial Models Shape Markets. The MIT Press.

Markowitz, H. M. (2005). Market Efficiency: A Theoretical Distinction and so What? Financial Analysts Journal, 61(5), 17–30.

Mossin, J. (1966, October). Equilibrium in a Capital Asset Market. Econometrica, 34(4), 768–783.

Roll, R. (1977). A Critique of the Asset Pricing Theory’s Tests. Part I: On Past and Potential Testability of the Theory. Journal of Financial Economics, 4, 129–176.

Rosenberg, B., Reid, K., & Lanstein, R. (1985, Spring). Persuasive Evidence of Market Inefficiency. Journal of Portfolio Management, 11, 9–17.

Ross, S. A. (1976). The Arbitrage Theory of Capital Asset Pricing. Journal of Finance, 13(3), 341–360.

Sharpe, W. F. (1964). Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. Journal of Finance, 19(3), 425–442.

Stambaugh, R. F. (1982). On the Exclusion of Assets from Tests of the Two-Parameter Model: A Sensitivity Analysis. Journal of Financial Economics., 10(3), 237–268.

Stattman, D. (1980). Book Values and Stock Returns. The Chicago MBA: A Journal of Selected Papers, 4, 25–45.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Neri, M. (2023). The Capital Asset Pricing Model: Dead and Kicking. In: Howden, D., Bagus, P. (eds) The Emergence of a Tradition: Essays in Honor of Jesús Huerta de Soto, Volume I. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-031-17414-8_18

Download citation

DOI: https://doi.org/10.1007/978-3-031-17414-8_18

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-031-17413-1

Online ISBN: 978-3-031-17414-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)