Abstract

The measurement of Equitable and Sustainable Well-being (BES) in Italy is one of the most appreciated monitoring tools by the Scientific Community. The focus on the Economic Well-being domain seems essential around the last serious economic crisis. The use of an innovative composite index can help to measure the multidimensional phenomenon and monitor the situation at European level.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

In this paper, the economic well-being in Europe is focused, taking as a reference point the economic domain of the project BES (Equitable and Sustainable Well-being in Italy) of the Italian National Institute of Statistics (Istat). The BES aims at evaluating the progress of societies by considering different perspectives through twelve relevant theoretical domains, each one measured through a different set of individual indicators. The BES project is inspired by the Global Project on Measuring the progress of Societies of the Oecd (2007), with the idea that the economic well-being is not enough for the developed Countries. However, since 2007, two huge economic crises have affected the households’ economic well-being: the international economic crisis (about 2008–2009) derived from the Lehman Brothers failure; and the European crisis of the sovereign debts, whose effects were more intense in 2011–2012, and can be considered solved in 2014.Footnote 1 In the meantime, the EU fiscal and monetary policies have completely changed, going from very restrictive ones in the international economic crisis and in the first part of the sovereign debt crisis, to more expansive ones (especially the monetary policy) starting from the second part of the sovereign debt crisis till nowadays. This fact has reflected in a great improve of the European household’ economic conditions, as can be seen in the next paragraphs. Then, the economic domain of the well-being still deserves particular relevance within the other dimensions. Following the timeliness described above, the longitudinal analysis is set at 4 relevant years: 2007, 2010, 2014 and 2019.

2 Theoretical Framework

The starting point of our framework is the Istat BES: it measures the economic domain through a set of ten indicators. However, we operate some changes due to operational issues (data availability and comparability with the other countries for the wealth indicators and the absolute poverty indicator) as well as theoretical issues (a couple of indicators can hardly be considered as economic well-being indicators and another one has been excluded in order to avoid a double counting of inequality). Changes and restriction are extensively described in the depiction of the adopted sub-domains and indicators. In this paper, we measure the economic well-being through four sub-domains (Purchasing power, Inequality, Poverty and Subjective evaluation), each one represented by a single indicator coming from the Eu-Silc (European Statistics on Income and Living Conditions) system. Purchasing power can give an evaluation of the average economic standard of a Country; Inequality is an important issue even in case of the rich Countries, since it measures the share of people who are relatively disadvantaged in respect of their social and economic context; poverty measures the share of people who can’t reach a minimum standard of living; and the subjective evaluation is important in order to capture people who feel to have economic problems, even when they do not have difficulties under an objective point of view.

-

1.

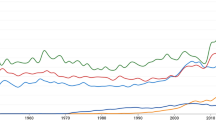

Sub-domain Purchasing Power; indicator: Median equivalised income in purchasing power standards (Pps). The Istat average income per capita is replaced for three reasons. First, the median is a better indicator of a monetary distribution, given its robustness to extreme values. Second, the equivalised form (through the modified Oecd scale) is better in order to consider the different sizes and needs of the households. In the opinion of the authors, also the Istat BES could benefit in changing accordingly. Finally, in the European context, it is essential to consider the different cost of life and purchasing powers in the Countries. The values of this indicator (Fig. 1) positively defined in respect of well-being, range between 2,783 euros (Romania in 2007) to 28,943 (Luxemburg in 2019). Romania presents the lowest values in all the years, even if this Country multiplies its value by 2.6 in the entire period (7,338 euros in 2019), while Luxemburg presents the highest values in all the years. The values in the entire EU27 are 12,927 euros in 2007, 14,235 in 2010, 15,137 in 2014 and 17,422 euros in 2019.

-

2.

Sub-domain Inequality; indicator: At risk of poverty rate (ARP). It is a relative measure of poverty: its threshold is set dependently on the income distribution and, therefore, it merely captures how many individuals are far from the others. That is, relative poverty is an inequality indicator rather than a poverty indicator [7]. Istat measures inequality also through the Disposable income inequality (S80_S20 index, which is the ratio of total equivalised income received by the 20% of the population with the highest income to that received by the 20% of the population with the lowest income). Since they are both representative of the same sub-domain and in order to avoid a double counting of the same domain, only the ARP is selected (as a matter of fact, the correlation coefficient between the two indicators is more than 0.90). As a general rule, it is a good practice to strictly select indicators in the construction of composite indicators. The ARP generally shows the lowest degree of variability across the Countries as well as across the years (Fig. 2). The values of ARP, negatively defined, range between 9.0% (Czechia in 2010) to 25.1% (Romania in 2014). Czechia presents the lowest values in all the years, while Romania presents the highest values in all the years. The values in the entire EU27 are 16.3% in 2007, 16.5% in 2010, 17.3% in 2014 and 16.5% euros in 2019.

-

3.

Sub-domain Poverty; indicator Severe material deprivation (SMD), that is the share of population living in households lacking at least 4 items out of 9 economic deprivations. Far from being a perfect indicator, it is the most similar indicator to the concept of absolute poverty in the EU. Unwillingly, Istat Absolute poverty rate cannot be used even if it is a better measure of poverty (the poverty lines are set independently of the monetary distribution, and also consider the different cost of life in different areas). However, the absolute poverty is officially measured only in Italy and USA, because of the difficulties in its definition, and the European Commission project “Measuring and monitoring absolute poverty—ABSPO” is still in the phase of study [4]. Leaving aside the World Bank measure, which does not fit for developed Countries, the SMD is the only indicator that permits European comparison in this domain, entailing data comparability. The values of this indicator (Fig. 3), negatively defined, range between 0.5% (Luxemburg in 2010) to 57.6% (Bulgaria in 2007). Bulgaria presents the highest values in all the years, but also shows a dramatic fall in the course of the years (19.9% in 2019), partly filling the gap with the other Countries. The values in the entire EU27 are 9.8% in 2007, 8.9% in 2010, 9.1% in 2014 and 5.4% in 2019.

-

4.

Sub-domain Subjective evaluation; the indicator Index of self-reported economic distress, that is the share of individuals who declare to get to the end of the month with great difficulty. The subjective sub-dimension is considered an important one, since it can capture a worsening in well-being for people who feel to have economic problems, even when they have not difficulties with an objective point of view. This is particularly relevant especially in years in which the economic crises could have highly changed the perceptions of the households in a different way between Countries. The values of this indicator (Fig. 4), negatively defined, range between 1.4% (Germany in 2019) to 39.5% (Greece in 2014). Indeed, Germany is the Country that appeared as the leading one in EU in these years, and this fact reflects in the perceptions of the households. At the opposite, the dramatic jump in the 2014 Greek indicator indicates the uncertainty deriving from the consequences of the crisis for the Greek households. The values in the entire EU27 are 9.8% in 2007, 11.2% in 2010, 11.8% in 2014 and 6.5% in 2019.

The remaining four Istat indicators are removed for the following reasons: Per capita net wealth: the sub-domain wealth is certainly a pillar of the households’ monetary well-being. However, correctly measuring the value of wealth is extremely complex [1], since some types of wealth are statistically hidden (e.g., paintings, jewellery etc.), and attributing a value to wealth is arbitrary when some types of wealth, e.g. houses, are not sold/bought. Unfortunately, this exclusion is a relevant issue in the European context, considering the different weight between financial wealth and real estate wealth in the different countries. People living in financially vulnerable households, measured through the percentage of households with debt service greater than 30% of disposable income: to the best of our knowledge, there is not such indicator in the Eu-Silc database. Severe housing deprivation (Share of population living in overcrowded dwellings and also exhibits at least one of some structural problem) and Low work intensity (Proportion of people 0–59 living in households in which household members of working age worked less than 20% of the number of months that could theoretically have been worked) measure important topics, but, according to our views, they can’t be considered as indicators of economic well-being from a theoretical point of view.

3 Methodological Aspects

The composite index was constructed using the Adjusted Mazziotta-Pareto Index—AMPI [5]. This aggregation function allows a partial compensability, so that an increase in the most deprived indicator will have a higher impact on the composite index (imperfect substitutability). Such a choice is advisable whenever a reasonable achievement in any of the individual indicators is considered to be crucial for overall performance [3]. The most original aspect of this index is the method of normalization, called “Constrained Min–Max Method” [6]. This method normalizes the range of individual indicators, similarly to the classic Min–Max method, but uses a common reference that allows to define a ‘balancing model’ (i.e., the set of values that are considered balanced). Thus, it is possible to compare the values of the units, both in space and time, with respect to a common reference that does not change over time.

Let us consider the matrix X = {xijt} with 27 rows (countries), 4 columns (individual indicators), and 4 layers (years) where xijt is the value of individual indicator j, for country i, at year t. A normalized matrix R = {rijt} is computed as follows:

where \(\mathop {{\text{min}}}\limits_{it} {(}x_{ijt} {)}\) and \(\mathop {{\text{max}}}\limits_{it} {(}x_{ijt} {)}\) are, respectively, the overall minimum and maximum of indicator j across all times (goalposts), \(x_{j0}\) is the EU average in 2007 (reference value) for indicator j, and the sign ± depends on the polarity of indicator j.

Denoting with \({\text{M}}_{{r_{it} }}\), \({\text{S}}_{{r_{it} }}\), \({\text{cv}}_{{r_{it} }}\), respectively, the mean, standard deviation, and coefficient of variation of the normalized values for country i, at year t, the composite index is given by:

where:

The version of AMPI with a negative penalty was used, as the composite index is ‘increasing’ or ‘positive’, i.e., increasing values of the index correspond to positive variations of the economic well-being. Therefore, an unbalance among indicators will have a negative effect on the value of the index [5].

Figure 5 shows the effect of normalization on three individual indicators with different shape generated in a simulation.Footnote 2 The first has an exponential distribution with λ = 0.0125 (Exp), the second has a normal distribution with μ = 150 and σ = 15 (Nor) and the third has a Beta distribution with α = 4 and β = 0.8 (Bet). The indicators have different parameters, as they represent the most disparate phenomena. In Fig. 5a, indicators are normalized by the classic Min–Max method in the range [0, 1], and in Fig. 5b, they are normalized by the constrained Min–max method with a reference (the mean) of 100 and a range of 60.

As we can see, the Min–Max method bring all values into a closed interval, but the distributions of indicators are not ‘centred’ and this leads to the loss of a common reference value, such as the mean. It follows that equal normalized values (i.e., balanced normalized values) can correspond to very unbalanced original values. For example, the normalized value 0.2 for the Exp indicator corresponds to a high original value; whereas for the Nor and Bet indicators it corresponds to a very low original value. Moreover, the normalized value 0.5 is the mean of the range, but not of distributions, and then it cannot be used as a reference for reading results (e.g., if the normalized value of a country is 0.3., we cannot know if its original value is above or below the mean). On the other hand, normalized values by the constrained Min–Max method are not forced into a closed interval, they are ‘centred’ with respect to a common reference, and they are easier to interpret: if the normalized value of a country is greater than 100, then it is above the reference value, else it is below the reference value (Fig. 6). Finally, the comparability across time is maintained when new data become available (the goalposts do not need to be updated).

4 A Longitudinal Analysis

In the analysis, the reference value is the Eu27 in 2007 (=100), and each value can be evaluated as the relative distance to 100 (Table 1). The Eu27 indicator is not far from 100 neither in 2010 (100.2) nor in 2014 (99.6). The last year shows instead an increase of the overall index of about 5 point (104.7 in 2019).

Before commenting the different phases, it can be of interest to observe which indicators have the greatest impact in the AMPI. All the four primary indicators (one positively defined and three negatively defined in respect of economic wellbeing) are obviously highly correlated with the AMPI. However, the one that shows the highest correlation is the poverty indicator (severe material deprivation), about −0.90 in the four years, while the one with the lowest correlation is the inequality index (at risk of poverty rate), that decreases from −0.80 in 2007 to −0.75 in 2019 (Table 2).

The first phase, corresponding to the international economic crisis, is the most stable. Indeed, the ranking, based on the AMPI, shows a low level of variability between 2007 and 2010, as well as the values of the AMPI. The highest jump in the AMPI absolute value is observed for Poland, which also passes from the 23rd position to the 19th in 2010. In the second phase, corresponding to the crisis of the sovereign debt, there is a greater mobility in the ranking. Greece shows the highest jump, from 21st to 27th and last position. The Greek AMPI decreased dramatically from 89.2 to 74.6. This fall was mainly due to a dramatic fall in the purchasing power of the households (the median equivalised income in Pps decreased from 12,598 to 8,673 euros). Also, the SMD and the subjective economic distress greatly worsened, respectively from 11.6% to 21.5% and from 24.2% to 39.5%). Indeed Greece was the first country to be hit by the equity markets distrust on the debt sustainability, later followed by Portugal and Ireland and successively by Italy and Spain. In the 2010–2014 phase, Ireland loses two positions (from 12 to 14th), Spain and Portugal one position (respectively, from 18 to 19th and from 21st to 22nd), while Italy gained one position (from 17 to 16th). However, also Italy showed a decrease in the synthetic index, from 96.2 to 94.2 and the overall Italian situation was somewhat preserved by the fact that only the SMD indicator worsened (from 7.4 to 11.6%), while the other three were substantially unchanged. In this time, we can observe a new great advance of Poland (+4 in the ranking, from 19 to 15th), which shows an increase of the MPI from 92.8 to 96.8.

In the opinion of the authors, these data clearly show that the European response to the sovereign debt crisis has done more harm than good. The vexatious conditions imposed to Greece by the European Commission, European Central Bank and International Monetary Fund highly worsened the household economic conditions of the Country and were badly used as a warning for the other indebted Countries. Unsurprisingly, they were instead used by the stock markets’ operators as a sign of permit towards speculation, which quickly enlarged against the other Countries. Luckily, when the entire Eurozone was in doubt, the European institutions changed their policies. IMF was involved less intensely; the ECB completely changed its monetary policy, which originally just looked at an about non-existent inflation and did not foresee an intervention on the stock markets (the Quantitative Easing started in 2012 in order to support the financial system and to save the Euro area; somewhat enlarged its effects on the productivity system in 2014; and started its second and stronger phase in 2015, with an always greater intervention); and the Eurozone, even in a context of a formally stricter balance observation through the fiscal compact, contemplated a series of adjustments which allowed to keep in account a number of factors (e.g., the years of general economic crisis as well as the notion of “potential GDP”) rather than applying in aseptic way the treaties. The new policies facilitated the growth of the GDP as well as an improvement in the households’ economic conditions in Europe, as observed in the data. Indeed, in the last phase, till 2019, the overall Eu27 index passed from 99.6 to 104.7, showing a general increase on the economic well-being of the households, and all the Countries, but Sweden and Luxemburg, increased the value of the index. Some Countries had a particularly great increase (Hungary, Cyprus, Croatia and Ireland, more than +10 points). As concerning the ranking, Hungary showed the greatest increase, + 6 positions, especially due to an improvement in median purchasing power, SMD and subjective economic distress; Luxemburg and Sweden showed the greatest decrease, −5 positions, especially due to an increase of inequality as measured by the ARP rate in a context of general decrease of inequality in the European zone.

Considering the entire time frame, 2007–2019, some Countries greatly increased their economic well-being, in particular, and somewhat obviously given that the economic convergence is one of the targets of the EU, the Countries that started from a disadvantaged situation: Bulgaria (+17.7), Poland (+15.6) and Romania (+13.3). In the case of Poland, this also pushed the ranking, from the 23rd to the 14th position; Bulgaria and Romania still remain at the bottom tail of the ranking, respectively 26th and 25th in 2019, +1 position for both the Countries, but strongly filled the gap in respect of the overall EU27. At the opposite, the Greek indicator has fallen down by 10.1 point (even if it is growing in the last sub-time), completely due to the 2011–2014 time frame. At present, Greece is in the last position of the ranking, 27th (vs 22nd in 2007), while the first position is occupied by Finland. The other two Countries with an important decrease in the MPI indicator are Luxemburg, −4.8 points, and Sweden, −3.5 points, which shifted, respectively, from 1st to 6th position and from 3rd to 12th position.

Summarizing, the overall time frame is divided in the following phases of the international economic crisis: 2007–2010; the phase of the Eurozone crisis, 2011–2014; and the last phase of economic stability, 2015–2019. The first two appear to be a long period of unique crisis, slightly softer and more diffuse in the first part; more intense and localized in a fewer number of Countries in the second part. The particularity of this second phase is that even the Countries which didn’t face the crisis of the sovereign debts didn’t improve their economic well-being, showing that the entire Europe has faced it as well, and the only way for advancing is solidarity and reasonability. The last phase was indeed characterized by a general increase of the European households’ economic well-being, mostly due to a more reasonable and rational use of the fiscal policies and, especially, of the monetary policies. Such measures have permitted to relax the economic distress on the European households.

As concerning Italy, it started 18th in 2007 and is 18th in 2019, with a negative gap in respect of the EU27 which ranged from −4 to −5.5 points in the phase. Looking at the sub-domains, Italy has improved its purchasing power, even though with a grow rate lower than the Eu27; the ARP is very stable along the phase; the SMD indicator shows a high value only in 2014 (11.6% vs a little more than 7% in the other years); the subjective economic distress about halves in the last phase (from 17.9% to 8.2%), even due to a more stable economic situation which reflects on the opinion of the households.

5 Conclusions

In this paper we analysed the economic well-being in Europe in the 2007–2019 time frame at 4 relevant years: 2007, 2010, 2014 and 2019. In order to do so, we have considered the economic domain of the project BES (Equitable and Sustainable Well-being) of the Italian National Institute of Statistics (Istat), changing its definition in accordance with data comparability and theoretical issues. Such domain was measured through four sub-domains: Purchasing Power is measured by the Median equivalised income in purchasing power standards (Pps). Inequality is measured by the At risk of poverty rate (ARP). Poverty is measured by the Severe material deprivation (SMD); and Subjective evaluation is measured by the Index of economic distress.

Following the aforementioned years, the analyses considers 3 relevant phases: 2007–2010, which comprises the international economic crisis; 2011–2014, which comprises the crisis of the European sovereign debts; and 2015–2019, that is characterized by relative stability and recovery. The first two phases appear to be a unique long time frame of crisis, slightly softer and more diffuse in the first part; more intense and localized in a fewer number of Countries in the second part, particularly heavy for Greece. The peculiarity of this second phase is that even the Countries which didn’t face the crisis of the sovereign debts didn’t improve their economic well-being. This fact clearly show that the European response was far from being satisfactory, and the vexatious conditions imposed to Greece by EC, ECB and IMF highly worsened the Greek household economic conditions and were badly used as a warning for other indebted Countries. On the other hand, such measures stimulated the stock markets’ speculation, which quickly enlarged against the other Countries, and the entire Eurozone was put in doubt. Luckily, fiscal and monetary policies have completely changed since then. The IMF was involved less intensely; the Eurozone, even in a context of a formally stricter balance observation through the fiscal compact, contemplated several adjustments which allowed to keep in account different factors; and, mainly, the ECB completely changed its monetary policy (through the quantitative easing that started in 2012 and enlarged its dimension starting from 2015). Such measures have permitted to relax the economic distress on the European households and all European countries have resumed the normal path towards the higher and generalized economic well-being that characterized the whole post-war period. In this regard, it has to be noted that Germany, the Country that undoubtedly has leaded the EU in the considered time frame, does not improve its position neither in the value of the indicator nor in the ranking (8th) till 2014, while it increased the value of the indicator (+4.9 points) and the ranking (+3 positions) in the last phase, when “less German” fiscal and monetary policies were applied (certainly with the agreement of Germany itself), as a further confirmation of the fact that the only way for economic advancing in EU is solidarity and reasonability.

Notes

- 1.

Obviously, we cannot forget the current crisis deriving from the Covid19 pandemic situation. However, the adopted indicators are not still available for 2020 in all the Countries. Moreover, it should be evaluated when the pandemic situation will be officially declared as finished.

- 2.

Note that socio-economic indicators are basically of two types: per capita indicators and percentage indicators. Per capita indicators tend to be open-ended, in particular at the upper end of the range (e.g., GDP per capita); percentage type indicators tend to have severe constraints operating at the upper end of the range, with consequent piling up of observation there (e.g., Adult literacy). Therefore, most of individual indicators have positively or negatively skewed distributions [2].

References

Canberra Group: Handbook on Household Income Statistics. United Nations, Geneva (2011)

Casacci, S., Pareto, A.: A nonlinear multivariate method for constructing profiles of country performance. Int. J. Multicriteria Decis. Mak. 8, 295–312 (2021)

Chiappero-Martinetti, E., von Jacobi, N.: Light and shade of multidimensional indexes. How methodological choices impact on empirical results. In: F. Maggino, G. Nuvolati (eds), Quality of life in Italy, Research and Reflections, pp. 69–103, Springer, Cham (2012)

Cutillo, A., Raitano, M., Siciliani, I.: Income-based and consumption-based measurement of absolute poverty: insights from Italy. Soc. Indic. Res. (2020). https://doi.org/10.1007/s11205-020-02386-9

Mazziotta, M., Pareto, A.: On a generalized non-compensatory composite index for measuring socio-economic phenomena. Soc. Indic. Res. 127, 983–1003 (2016)

Mazziotta, M., Pareto, A.: Everything you always wanted to know about normalization (but were afraid to ask). Ital. Rev. Econ., Demogr. Stat., LXXV 1, 41–52 (2021)

Sen, A.: Poor, relatively speaking. Oxford Econ. Ser. 35(2), 153–169 (1983)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Cutillo, A., Mazziotta, M., Pareto, A. (2022). A Composite Index of Economic Well-Being for the European Union Countries. In: Salvati, N., Perna, C., Marchetti, S., Chambers, R. (eds) Studies in Theoretical and Applied Statistics . SIS 2021. Springer Proceedings in Mathematics & Statistics, vol 406. Springer, Cham. https://doi.org/10.1007/978-3-031-16609-9_1

Download citation

DOI: https://doi.org/10.1007/978-3-031-16609-9_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-16608-2

Online ISBN: 978-3-031-16609-9

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)