Abstract

Enterprise performance management (EPM) helps in executing a company’s strategy. As transformations towards digital EPM are challenging, the objective of this paper is to develop a forward-looking maturity model to help companies digitalize their EPM. We apply a “zero-quartile” approach. In contrast to the best practices of top performing companies (“first quartile”), a zero-quartile defines the expected (collectively deemed best possible) state of a future EPM leveraging digital technologies. We employ the Rasch algorithm on data of a survey of 203 participants and based on a maturity model, we come up with four design guidelines to help companies digitalize their EPM. (1) A digital enterprise platform is the future single source of truth for planning, budgeting, and forecasting. Backing managers’ experience with data, it combines harmonized ERP outcomes with insights from market analyses, social media, and other sources. (2) Predictive analytics is the first opinion for planning, budgeting, and forecasting. Yet, managers have to learn to accept such outcomes so that they can focus more on irregularities. (3) Standard reports and analyses as well as standard comments will be automated. User-centricity is the “new” normal for a more natural working modus. (4) Managers should overcome their reluctance to work with data and start analyzing in a self-service fashion. Technology will support them from a global view to a line-item level.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Enterprise performance management (EPM)

- Maturity model (MM)

- Benchmarking

- Digital technologies

- Survey

- Rasch algorithm

- Design science research in information systems

1 Introduction

“From bookkeeper to business partner” is a statement often used when talking about the finance function. Enterprise performance management (EPM) is particularly affected by this development because it integrates financial and non-financial information for planning and decision support [1].

Companies often compare their own performance against competitors. In doing so, benchmarking is a continuous process of identifying the highest standards of excellence for products, services, and processes [2]. Most often a “first quartile” approach is applied [3]. It depicts the best practices of top performing companies.

Given that time series from the past define the first quartile, benchmarking is backward-looking. Accordingly, it cannot consider the potential of latest digital technologies such as automation, analytics, and digital enterprise platforms. In other words, digital is disruptive and thus distorts the philosophy of today’s benchmarking in its very essence [4]. We propose a more forward-looking approach, the “zero” quartile benchmarking [5]. In contrast to the best practices of top performing companies, a zero quartile defines the expected (collectively deemed best possible) state of a benchmarking object.

To make this approach more operational, especially to describe a company’s path toward such a future state, we rely on the concept of maturity models (MMs). As maturity can be defined as “the state or quality of being perfect, complete, or ready” [6], MMs are conceptual models that consist of a sequence of discrete maturity levels and represent an anticipated, desired, or typical path of evolution [7].

Examining the body of knowledge, Röglinger et al. [8] and Ahmad et al. [9] mentioned the lack of forward-looking MMs providing “…improvement measures in the sense of good or best practices for each stage.” In turn, practitioner journals described the impact of digital technologies on finance per se [10,11,12] or they evaluated single digital technologies such as automation [13]. However, these studies often lack a rigorous foundation [14]. Consequently, the objective of this paper is to develop a forward-looking MMFootnote 1 to help companies digitalize their EPM. The proposed model will not only serve as a self-assessment for companies to evaluate their as-is situation, but also to derive design guidelines based on substantial differences between different EPM MM levels. We raise two research questions:

-

Which digital technologies are most relevant for EPM at what maturity level?

-

How can one achieve the next level of Digital EPM?

To create things that serve human purposes [16], we follow Design Science Research (DSR) in Information Systems [17, 18], for which the publication scheme from Gregor and Hevner [19] gave us direction. We motivate this article with current challenges associated with EPM leveraging digital technologies (introduction). Building on the state of the art, we highlight research gaps (literature review). Addressing these gaps, we apply the Rasch algorithm with data from a survey (method) and consolidate our findings in a MM—ultimately to lay out four design guidelines that should help companies digitalize their EPM (artifact description). Emphasizing a staged research process with “build” and “evaluate” activities, we review our MM in a next publication with the help of a case study [20]. Comparing our results with prior work and examining how they relate back to the article’s objective and research questions, we close with a summary, limitations of our work, and avenues for future research (discussion and conclusion).

2 Literature Review

Following Webster and Watson [21], we started our literature review with a (1) journal search focusing on leading IS research and accounting journals, complemented by proceedings from major IS conferences.Footnote 2,Footnote 3,Footnote 4 Since our subject of research is also of practical interest, we additionally considered practitioner journals such as MIS Quarterly Executive and the Harvard Business Review. For our (2) database search, we used ScienceDirect, EBSCO host, Springer Link, AIS eLibrary, and Google Scholar.

Assessing the publications through their titles, abstracts, and keywords, we performed an iterative (3) keyword search with the following search string: Enterprise performance management (EPM) OR business process management (BPM) OR corporate performance management (CPM) AND digital technology OR digital transformation AND maturity model OR stage model OR capability model. We also tested variations of this string with singulars, plurals, and abbreviations.

Our first search results were articles such as Ongena and Ravesteyn [25] on the relationship of BPM maturity to company process performance, size and sector, Williams et al. [26] on developing a digital MM for SMEs, Comuzzi and Patel [27] and Imgrund et al. [28] on a big data and digital transformation MM, respectively. Furthermore, we found 24 practitioner articles such as Accenture [12] and The Hackett Group [3]. Finally, we conducted (4) a backward and forward search. Following the “citation pearl growing” approach, we complemented our search whenever we examined relevant new aspects in the retrieved publications [29]. With references from all relevant publications, we identified another 20 publications such as Hess et al. [30] talking about achieving a digital transformation strategy by following their guidelines and ended up with 69 publications in total.

For our gap analysis, we structured these publications with respect to two topics: The benchmarking object encompasses three EPM process activities: that is planning, budgeting, and forecasting, followed by business performance reporting, and finally, analysis and decision support [31]. “Others” subsume articles that do not focus on a specific EPM process activity. (2) The cluster “peer-group partner” refers to what the benchmarking object is compared to [32].

(1) Benchmarking object: EPM, also known as corporate performance management (CPM), business performance management (BPM), and business process management (BPM), aims to improve the performance of the entire company [33]. Examining different domains, EPM addresses internal decision makers [34] and is often at the center of attention [35].

EPM is based on the hypothesis that the better the information available to decision makers, the better their decision should be. This stems from the theory of the homo economicus which has been expanded to the field of neuroeconomics [36]. The performance measurement ensures the alignment of performance with the strategy of the company [37] and has to balance human intuition with the relevant data [38, 39]. This can be achieved by setting more data-driven goals to translate the complex structure of a business into something understandable and actionable [40, 41].

Furthermore authors such as Eckerson [33] or Yaghi et al. [42] began highlighting the integration of IS support in the form of dashboards as a cornerstone of a successful EPM. Not only the underlying data landscape, structure, and contents of data are changing [43], also the visualization of data plays an important role [44]. This technology-based future of performance management is an essential component of leading successful digital transformation, making it more data-driven, more flexible, more continuous, and more development-oriented [43]. Accordingly, today, digital technologies such as finance bots are examined to automate processes like budgeting, forecasting, and analyses [45] or predictive analytics to handle forecasts more fact-driven [46].

In line with Williams et al. [26] we examined that the majority of MMs focuses on digitalizing the production and logistics domain, rather than EPM and clustered articles such as Akdil et al. [47] and Colli et al. [48] as “Industry 4.0” papers. Eckerson [33] described the impact of IS for EPM whereas Cokins [31] examined effects of the “digital revolution” on EPM. Pinto [49] as well as Ongena and Ravesteyn [25] researched the correlation between business process maturity and a company’s business performance. Another fourteen articles such as Plaschke et al. [13] focused on single EPM activities such as planning, budgeting, and forecasting and eleven articles elaborated on standard reporting and analysis.

Detailing digital technologies with automation, analytics, and digital enterprise platform, we followed Mergel et al. [50] and Mayer et al. [51]. We found twenty-one articles covering the impact of automation on EPM. With a focus on standard reporting, companies have already started to automate routine tasks [12]. In doing so, Robotic Process Automation (RPA) is suitable for high-volume, standardized processes [52]. Practitioners such as Eckerson [33] and Cokins [31] predicted a substantial usage of analytics when companies have the capability to easily access all their financial data as well as data from social media listening and the internet of things. Pearson [53] suggested that analytics will increase company productivity, since planning, budgeting, and forecasting processes will no longer require months of negotiating targets, calculating figures in spreadsheets, and performing endless iterations to close gaps between top-down targets and bottom-up budgets. Accordingly, Comuzzi and Patel [27] proposed a MM for measuring organizations leveraging big data analytics in their business processes. Shifting EPM towards a more proactive, forward-looking steering, digital enterprise platforms help as a single source of truth of a company’s data [11, 31]. “Data lakes” contribute to a broader data base [54]. The necessary master data management was examined by Spruit and Pietzka [55].

Accordingly, we derive our first takeaway and, based on that, we propose to expand the body of MMs with a more forward-looking EPM model—based on the zero-quartile definition. In doing so, we will examine the impacts of automation, analytics, and digital enterprise platforms on EPM process activities (for details, see Sect. 3).

(2) Peer-group partner: The term “peer-group partner” refers to whom the organization is compared to in a cluster of similar organizations or other structured entities based on preselected attributes [32, 56, 57]. Internal benchmarking compares different organizational units of a company such as sites [58]. Atkinson [59] is the only article we found on this kind of benchmarking. He carried out a case study at a health care provider where he constructed a framework to plan, act, review, and revise strategies and objectives. This enabled the organization to compare their goals against the fulfillment and adjust objectives, which is similar to how planning is usually conducted in businesses but offered little comparative value for benchmarking.

In turn, we found 68 articles referring to external benchmarking. Of these, industry benchmarking looks at trends within a group of companies of the same industry or market [60]. Ifenthaler and Egloffstein [61] is a good example since they examined digital transformation in the European education sector, a crucial topic due to homeschooling in the past two years, with an n = 222. They opted for a six-dimensional model based on a Likert scale, rating the adopted technology, the strategy, and, industry-specific, the digital learning and teaching capabilities, among other factors, to sort the participants into five maturity categories derived from literature.

Finally, generic benchmarking focuses on processes across industries [2]. 54 out of 68 articles employed such a benchmarking with notable examples such as Imgrund et al. [28] who constructed a digital transformation maturity model for BPM in SMEs and used the existing process and enterprise maturity model (PEMM) which accounts for the heterogeneity of SMEs in different industries. They adapted the model by adding a digital perspective to it. Som and Gamroth [62] constructed a model to measure the digital transformation level in the HR departments of multiple industries across continents with a special focus on data integrity and using a MM with seven dimensions.

In order to ensure sufficient data for our novel form of benchmarking, we propose a generic benchmarking across industries (Sect. 3).

3 Method

Since we aimed to create a MM to benchmark a company’s EPM across industries, which requires a large amount of company-specific data, we opted for a survey-based approach. This is in line with what we also identified as method from several of the MMs reviewed and our synthesis of Sect. 2. With a pre-study we tested the usability of the underlying questionnaire with two EPM process experts from multinational companies and a subject-matter expert from the department of accounting and auditing at Darmstadt University of Technology [63]. For the main study, we opted for an online survey.

We asked members of a manager working group hosted by the Schmalenbach working group “Digital Finance” [64] who regularly meet to discuss trends in digital finance and extended the survey to a broader group of practitioners based on the mailing list of a special interest group. 25% of people who accessed the survey decided not to participate while only 2% abandoned after starting the survey. On average, people spent 15 min answering all questions. The survey was closed after 5 weeks. The characteristics of the data sample are given in Table 1. We differentiated between Industry (manufacturing), Services, Banking and Insurance, IT as well as Public sector and other. Finally, we complement our analysis with design guidelines based on substantial differences between MM levels within the individual EPM process activities.

3.1 Questionnaire

Combining Frolick’s [34] framework and IMA [65] we detailed EPM in terms of three process activities: (1) Planning determines key business drivers and measures business success such as market shares and product margins, in order to create the 3–5 year (strategic) plan [34]. Translating the strategic plan into action, budgeting is the annual planning process for preparing the budgets in terms of sales, earnings, manpower, expenditures for the next year. Forecasting develops, reviews, and consolidates the year-end and rolling outlook reports. Furthermore, forecasting examines gaps between the current performance and the forecast targets, in order to finally set up actions for closing these gaps. (2) Standard reporting and monitoring measures the day-to-day business performance with standard and simple ad-hoc reporting, including management support systems, balanced scorecards, etc. [34]. (3) Analysis and decision support focus on non-regular analyses such as root-cause analyses, what-if, and how-to-achieve requests. Typically performed only a few times a year, this also covers complex special issue analyses regarding pricing or costs [59].

Then, the participants were asked to provide their primary value-creation target for each of the three processes activities. We distinguish between three factors:

-

(1)

Efficiency covers the monetary effects of digital technologies, assuming equal quality. It reflects cost savings such as processing the same number of reports with fewer people or reduced effort. We operationalize cost savings threefold by reducing full-time equivalents (FTE), lowering cost by operating expenditures reductions in terms of ordinary and necessary expenses (OPEX) and capital expenditure (CAPEX) reductions as well as increased speed by time savings [20].

-

(2)

Effectiveness reflects the ability to offer new products and services or reach new customers through a better understanding of their behavior. This consists of five items: (a) Better insights covers the degree to which new information (reports, analyses, KPIs) meet the requirements of the addressees and improve business decisions. (b) Flexibility describes the ability to react to new, but mainly anticipated requirements [66]. We include agility, which additionally covers responses to unexpected requirements [67]. (c) Accuracy covers the provision of correct data [68]. (d) Consistency refers to the integrity of data stored in different sources. (e) Security comprises secure data even in heterogeneous ERP/BI system architectures or the cloud [69].

-

(3)

Experience covers learning effects within the organization or setting up future economies of scale when implementing digital technologies. In order to support efficiency and effectiveness, we differentiate twofold: (a) The use of digital technologies paves the way for future cost and/or FTE reduction (enabling efficiency). (b) Enabling effectiveness addresses how digital technologies shape future organizations.

Ultimately, we focus on three digital technologies, that is automation, analytics, and digital enterprise platform (Sect. 2).

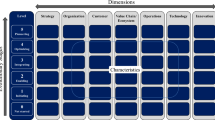

Following the structure of the three process activities of EPM, we created questions with a subdivision into three parts each, accommodating the three technologies. For each question, the participants had to rate the use of a technology now and their expected state in 2025 based on a five-point Likert-scale. Figure 1 shows an excerpt of the questionnaire structure for the third process activity.

3.2 Rasch Algorithm

The Rasch [70] algorithm was initially proposed for measuring discrete dichotomous data, generally about individual performance success or failure when completing certain tasks. The model assumes that answers depend on individual ability, along with the item difficulty. Accordingly, we suggest that highly skilled companies much better implement more difficult items than unskilled ones [71]. Using the Rasch algorithm on our proposed zero quartile benchmarking, the original model was modified in three ways [72]: (1) In order to express opinions rather than simple right or wrong answers, we applied a five-point Likert scale. This conversion uses the approach of a partial credit model [73], which transforms binary values into a floating scale with subordination-probabilities for each category instead of a “yes or no” probability. (2) Secondly, as the impact of a digital technology might not increase monotonically but be limited by an upper bound, we asked the respondents not only to rate their current as-is level, but also to express their expected to-be level for implementing a digital technology. In order to derive an MM that is valid for the complete population, the median was used as the commonly desired to-be level across all companies. The delta between the common expected value (median \({\widehat{D}}_{i}\)) and the company’s individual actual value (\({B}_{ci}\)) represents the anticipated improvement (for positive values). The larger the positive gap, \({X}_{ci}={\widehat{D}}_{i}-{B}_{ci}\), the more difficult an item. To obtain valid item estimates, we re-coded the differences, collapsing them into five categories (\({Z}_{ci}\)) labelled ascendingly from difficult to easy items. (3) Thirdly, as the Rasch algorithm does not yield maturity levels, but only a single ordinal scale representing the maximum log-likelihood estimates (logit values) of each item and company, we defined five maturity levels based on the logit values, representing the difficulty of implementing them for companies.

Applying the aforementioned modifications, we used the eRM package in R [74] in order to create our partial credit model. Evaluating the validity of our results, we used the infit and outfit statistics, which are included in the eRM package to assess our model. Variations around a company’s own maturity level are represented by the infit statistic, whereas outfit is more sensitive to items that are located far from a company’s maturity level (outliers). Both values should be around one, and a value greater than two or smaller than 0.5 is regarded as critical and should be removed [75]. In our case, the statistics were all within a range of 0.75 (outfit for standard reporting and digital enterprise platform, infit for ad-hoc analyses and analytics) and 1.47 (outfit for strategic planning and automation). Hence, we were able to retain all items. In addition to the logit values of the Rasch model, we calculated means for all Likert-scale items to observe the maturity level at which the majority of surveyed participants are positioned.

4 Artifact Description

Enriched by results from our descriptive statistics (Table 2), our MM and its levels following the logit values are presented in Table 3. The descriptive statistics cover distinct parameters measuring the skill of a particular person and are in line with the difficulty β of an item. When the capability is higher than β, a person is more likely able to complete the task. Furthermore, Table 3 highlights advancements that companies should strive for to achieve the next maturity level (▲ symbol). Logit values (model betas) indicate these critical steps as “β (technology, Likert-scale item)”.

Following Esswein et al. [5], for maturity level I “digital beginners”, the item logit values are between −1.73 (Table 3, first column third row for the digital enterprise platform) and −1.6 (Table 3, first column sixth row for the digital enterprise platform), depending on the EPM process activity and the preselected three digital technologies. Such companies are newcomers in leveraging digital technologies and represent 5.8% of our survey participants. Maturity level II incorporates items with logit values between −1.56 and −0.61. In such student companies (21.8% of the survey participants), some early analytics use-cases are explored—but so far, without substantial competitive advantages. Assessment items with a logit between −0.49 and 0.41 define maturity level III and represents the majority of our survey participants (54.9%). These digital practitioners are confident with our preselected three digital technologies, as they have already entered the stage of rollout and mass adoption for analytics and are exploring some initial automation use-cases on a digital enterprise platform. Maturity level IV covers the broader adoption of analytics and a high degree of automation in digital driver companies. Logit values range from 0.58 to 2.36, and 17.5% of our participants can be found here. Maturity level V covers digital masters. Such companies are strongly committed to making the most of digital technologies, whilst addressing even highly difficult use cases (reflected by logit values as high as 4.11 in Table 3, fifth column fourth row for automation). The Rasch algorithm did not put any of our surveyed companies into this category.

In order to make the results of our artefact design more concrete, we finally summarize the key findings in four design guidelines that provide guidance on how to achieve the next levels of maturity. We argue in three steps: (1) We first elaborate on the primary target (efficiency, effectiveness with its subcategories) for each activity. (2) We then combine the descriptive statistics of the present levels of implementation and Rasch-model betas for each of the technologies. (3) Finally, we complement the results with accompanying feedback from the participants and our own interpretation.

4.1 Planning, Budgeting, and Forecasting: Intuition Enriched by Data Insights—A Prime Example of Human–Computer Interaction

Starting with process activity #1 “planning, budgeting, and forecasting,” the majority (62%) of the survey participants stated that effectiveness is the primary target for using digital technologies. Among these answers, 57% targeted future value creation on better insights (31%) and speed (26%). As many companies still rely on traditional spreadsheets, their plans are often too slow or too unrealistic.

85% of the participants answered that they never (61%) or rarely (24%) use automation today Table 2, first row (AUT), (“now”). We allocated them to the first three levels of our MM, since the difficulty of using automation in a prototype stage is ranked quite high at β = 0.9. Even in 2025, about 64% of these companies believe they will never (13%), rarely (24%), or only sometimes (27%) use automation. This indicates that maturity levels IV and V are reserved for companies willing to invest considerably more time and effort than the rest of the surveyed population. This is also apparent in one of the highest logit scores for “always” (β = 2.57, Table 3, fifth column, first row).

While our results show that today, more than two thirds of the surveyed participants use analytics rarely (36%) or never (32%), in 2025, the participants respond that analytics will be their focus technology for these activities. 63% replied that they will use analytics often (47%) or even always (16%). This is reflected in our MM through the fact that analytics is key to achieving maturity level II for use “sometimes”, leading to a more widespread use at level III. To consolidate analyses such as value-driver simulations or market analyses, at maturity level IV, analytics is always used. There is no distinction between maturity levels IV and V for analytics since it is already used to its full potential by level four companies. This levelling off is evident in all of the technologies which are mastered below the current level. The unexceptional use of analytics can entail social media listening and market analyses being fed into the strategy formation process, which is then executed manually or automatically.

Moving towards digital EPM, the digital enterprise platform is a cornerstone for companies as their new single source of truth and central IT backbone. Today, about 50% of the surveyed companies already use such a platform, sometimes (29%), often (18%) or always (7%). In 2025, more than 80% will probably have a digital enterprise platform in use often or always. As a result, a digital enterprise platform can be considered a precondition for achieving higher maturity levels in strategic (business) planning, as it offers quick and better access to company data from a single source.

Accordingly, our first result is that planning, budgeting, and forecasting will no longer solely rely on the intuition of the management. Companies will progressively leverage their unparalleled access to data stored in the ERP and connect other sources such as customer relationship management to one single source of truth. Even third-party data sources such as market analyses or social media will be included in the new digital enterprise platform. We thus present our first design guideline.

First design guideline: A digital enterprise platform is the future single source of truth for planning, budgeting, and forecasting. Backing a managers’ experience with data, it combines harmonized ERP outcomes with insights from market analyses, social media, and other sources.

Based on our information regarding company size, when it comes to forecasting supported by analytics, larger companies with a market capitalization of more than 20 bn EUR are more advanced than mid-sized (<20 bn EUR) and smaller companies (<5 bn EUR). Some critics might argue that predictive analytics neither foresaw the economic crisis of 2008/2009 nor the outbreak of Coronavirus in 2020. Mitigating this issue, for digital-driver companies, analytics provides an efficient baseline forecast, and managers can adjust for known exceptions of which the machine cannot be aware. This process should be flexible and modified rapidly, even over just a month.

Second design guideline : Predictive analytics is the first opinion for planning, budgeting, and forecasting. Yet, managers have to learn to accept such outcomes so that they can focus more on irregularities.

4.2 Standard Reporting and Monitoring—In Real-Time Where Needed

Regarding process activity #2 “standard reporting and monitoring,” the surveyed participants stated that efficiency (46%) and effectiveness (50%) are de facto equal. Of the participants who answered “effectiveness”, 62% stated that better insights (39%) and speed (22%) are the main drivers of digitization. Currently, 75% never (51%) or rarely (24%) use automation. This is reflected in a β of 0.07 for maturity level III which is higher than about half of the participants’ ability logit values. However, for 2025, 45% predicted using it often (33%) or always (12%). This coincides with the progression through our maturity levels, for which, starting from level III, automation is gaining importance at every level (Table 3). Real-time information will be the new normal where it is needed. Standard reports such as sales reports delivered once a day are fully automated. Finally, at maturity level V, automation is always used for generating most standard reports and analyses, and just the push of a button away.

Analytics was attributed a similar level of importance. Today, companies use analytics never (36%), rarely (32%), or sometimes (21%). For 2025, 53% answered that they will use analytics often (38%) or always (15%), with a β of 0.04 and 1.8 respectively. For 79% of the surveyed participants, the digital enterprise platform will be a conditio sine qua non for “modern” standard reporting and monitoring, as it will be used often (39%) or always (40%) in 2025 (Table 2, 6th row). Analytics development starts with helping to comment on standard reports (maturity level II). It is improved at levels III and IV regarding the quantity of use in daily business.

Based on a digital enterprise platform, we believe that pull reports will replace the push reports. Management will gain access to required data with the help of smart frontends (“visual analytics”) and a self-service reporting architecture, even mobile solutions are available for kind of approvals.

Third design guideline : Standard reports and analyses as well as standard comments will be automat-ed. User-centricity is the “new” normal for a more natural working modus.

4.3 Analyses and Decision Support—Event-Driven Self Service from Global to Line-Item Level

The majority (65%) of the survey participants stated that effectiveness is the primary target for using digital technologies. Herein, they specified that better insights (41%), speed (25%) and flexibility (19%) are the main drivers.

Presently, automation is never (67%) or rarely (20%) used. In 2025, automation will be more widely adopted among early adopters, companies plan to do so often (23%, β = 0.9, digital driver) or sometimes (26%, β = −0.3, digital practitioner). Hence, companies will employ semi-automated ad-hoc analyses, for example, by a causal combination of data sources in order to analyze a problem from different perspectives without manual data collection. Today, companies never (40%) or rarely (33%) use analytics. As they answered often (41%) and always (13%), for 2025, they will evidently increase their usage (even in comparison to automation). This indicates that more data will be analyzed at a line-item level, processed and used to model scenarios with as much information as possible. This is considered in our MM (Table 3), marking the key steps for maturity levels II (β (sometimes) = −1.0) and III (β (often) = 0.35). Visual analytics and predictive analytics will go hand in hand at these levels. At present, a digital enterprise platform is used sometimes (24%) or often (18%). In 2025, a digital enterprise platform will be used by 89% sometimes (17%), often (40%), or always (32%).

Ad-hoc analysis is a non-standard activity, which is often triggered by an event. A digital enterprise platform is needed to be able to perform individual requests by drill downs aimed at gaining a deeper understanding of the underlying reasons, and ultimately deriving meaningful business advice. Experienced companies will incorporate ad-hoc analyses even into managers’ workflows, so as to become more flexible rather than adhering to a regular reporting cycle. Today, managers are not often skilled in such analyses, but that will change along the path towards digital EPM. In a digital economy, much will relate to the data needed to offer transparent, and flexible algorithms to answer business questions.

Fourth design guideline : Managers should overcome their reluctance to work with data and start analyzing in a self-service fashion. Technology will support them from a global view to a line-item level.

Summarizing our findings, Fig. 2 depicts the key elements that drive our MM. In stage I, the surveyed companies started to implement a digital enterprise platform supporting a joint IT architecture for all process activities. In stage II they made progress, having their ERP harmonized and external data sources connected. Furthermore, these companies have some initial analytics use-cases with a prototype status.

In stage III, companies are more confident with analytics. Some predictive analytics use-cases, such as net sales forecasts, are implemented and they started testing automation. In stage IV, companies use analytics quite extensively for all researched EPM process activities and they push forward to roll-out automation. In stage V, companies focus on maximizing the benefits of each digital technology. In parallel to this, they aim to realize synergies combining all three digital technologies. In this stage the advanced use of automation is pushed by adding cognitive automation.

5 Discussion and Conclusion

Applying a “zero-quartile” benchmarking approach and taking EPM as our case example, the objective of this paper was to develop a forward-looking MM. We detailed EPM with three process activities and evaluated the use of automation, analytics, and the digital enterprise platform along different levels of maturity (RQ1). Data for the Rasch algorithm was obtained from a survey. In answering RQ2, we derived four design guidelines.

For practice, these design guidelines should help companies evolve towards digital EPM. In comparison to approaches such as Eckerson [33] and Joo et al. [76], our MM goes beyond the traditional (backward-looking) benchmarking. Reflecting the fact that automation is not the starter technology in the EPM domain, this is contrary to other finance processes such as order-to-cash, purchase-to-pay or record to report [77]. For research purposes, our method mix including the Rasch algorithm constitutes a rigorous starting point for examining digital technologies even beyond EPM. Our approach is more comprehensive than Blumenberg [78], who covers only single EPM process activities. In comparison with practitioners like Plaschke et al. [13], who focus on efficiency, we complement it with effectiveness and experience evaluation criteria.

Our research inevitably reveals certain limitations. Accordingly, there are several avenues for future research. With a sample size of 203, our data base is quite sound. However, a first future avenue would be to test for moderating effects of different demographic attributes. Analyses of different working styles, age, gender, education, IS experience, culture, and motivation should complete the results on hand. A second avenue would be to examine the impact of our MM. It should provide companies with a clear direction of their digitalization. Thus, our research should become more multifaceted by initiating use cases applying our MM. Such a subsequent evaluation should indicate whether our findings could be converted into action.

A further limitation of our work lies in the definition of maturity levels across the three technologies and three process activities. The uneven spread of companies across all five levels introduces a bias towards maturity levels II–IV. By choosing equal logit values as thresholds for all three technologies, this bias would have been even stronger. While infit and outfit statistics showed that the Rasch results are valid, different thresholds could have skewed the results towards higher or lower maturity levels respectively.

Last, but not least, we advise to continuously update our results as the pace of digitization is high and there could be more unpredictable developments beyond the current COVID-19 pandemic. For companies, we suggest a continuous benchmarking of their “as is” status in order to track digital progress over time.

Notes

- 1.

Considering the four types of Design Science Research (DSR) in IS artifacts identified by March and Smith [15]—constructs, models, methods, and instantiations—we propose a model. It should serve as an assessment for companies wishing to evaluate their IS investments, ultimately to prepare their implementations through mere experience and gut feeling.

- 2.

Based on the AIS senior scholars’ basket of leading IS Journals [22]: European Journal of Information Systems; Information Systems Research; Information Systems Journal; Journal of the Association for Information Systems; Journal of Information Technology; Journal of Management Information Systems; Journal of Strategic Information Systems; MIS Quarterly.

- 3.

In order to focus on leading accounting journals, we used the Scimago Journal Ranking [23]. We selected the subject area “Business, Management, and Accounting” and, herein, the subject category “accounting.” The resulting top 50 journal ranking includes outlets such as Accounting Review, Journal of Accounting Research, and the Journal of Finance.

- 4.

We followed the AIS’ list of leading IS conferences [24]: Americas Conference on Information Systems; European Conference on Information Systems; International Conference on Information Systems; Pacific and Asia Conference on Information Systems.

References

Cokins, G.: Performance Management: Finding the Missing Pieces (to Close the Intelligence Gap). Wiley and SAS Business Series, vol. 2. John Wiley & Sons Inc, Hoboken, NJ, USA (2004)

Bhutta, K.S., Huq, F.: Benchmarking—best practices: an integrated approach. Benchmarking: Int. J. 6(3), 254–268 (1999)

The Hackett Group: Finding the Right Best Practices Benchmarking Provider. https://www.thehackettgroup.com/best-practices-benchmarking/ (2018). Accessed 9 June 2021

Chanias, S., Hess, T.: How digital are we? Maturity models for the assessment of a company’s status in the digital transformation. Manag. Rep./Institut für Wirtschaftsinformatik und Neue Medien 2016(2), 1–14 (2016)

Esswein, M., Mayer, J.H., Razaqi, T., Quick, R.: Zero-Quartile Benchmarking—a novel method accommodating the impact of digital technologies. In: Baskerville, R., Nickerson, R. (eds.) Bridging the Internet of People, Data, and Things. Proceedings of the Thirty-Eight International Conference on Information Systems (ICIS, 2018), San Francisco, CA, USA, pp. 1–17

Neufeldt, V., Guralnik, D.B.: Collier’s Dictionary. K to Z, 2nd ed. P. F. Collier & Son, New York City (1986)

de Bruin, T., Freeze, R., Kulkarni, U., Rosemann, M.: Understanding the main phases of developing a maturity assessment model. In: Proceedings of the 16th Australasian Conference on Information Systems (ACIS, 2005), Sydney, Australia, pp. 8–19

Röglinger, M., Pöppelbuß, J., Becker, J.: Maturity models in business process management. Bus. Process Manag. J. (Emerald Group Publishing Limited) 18(2), 328–346 (2012)

Ahmad, M., Botzkowski, T., Klötzer, C., Papert, M.: Behind the blackbox of digital business models. In: Proceedings of the 53rd Hawaii International Conference on System Sciences (HICSS, 2020), Wailea, Hawaii, USA, pp. 4547–4557

Axson, D.A.: Finance 2020: death by digital: the best thing that ever happened to your finance organization. https://www.accenture.com/t00010101T000000Z__w__/_acnmedia/PDF-21/Accenture-Finance-2020-PoV-v2.pdf (2015). Accessed 9 June 2021

Lucas, S.: The Benefits of the SAP digital enterprise platform. https://blogs.saphana.com/2016/02/03/the-benefits-of-the-sap-digital-enterprise-platform/ (2016). Accessed 9 June 2021

Accenture: From bottom line to front line. https://www.accenture.com/_acnmedia/pdf-85/accenture-cfo-research-global.pdf (2020). Accessed 9 June 2021

Plaschke, F., Seth, I., Whiteman, R.: Bots, algorithms, and the future of the finance function. Risk Manag. (McKinsey on Finance) 65, 18–23 (2018)

Lasrado, L.A., Vatrapu, R., Andersen, K.N.: Maturity models development in IS Research: a literature review. In: Selected Papers of the Information Systems Research Seminar in Scandinavia (IRIS, 2015), Oulu, Finland, pp. 1–12

March, S.T., Smith, G.F.: Design and natural science research on information technology. Decis. Support Syst. 15(4), 251–266 (1995)

Simon, H.A.: The Science of the Artificial, 3rd edn. MIT Press, Cambridge, Mass (1996)

Hevner, A.R., March, S.T., Park, J., Ram, S.: Design science in information systems research. MIS Q. 28(1), 75–105 (2004)

vom Brocke, J., Winter, R., Hevner, A., Maedche, A.: Accumulation and evolution of design knowledge in design science research—a journey through time and space. J. Assoc. Inf. Syst. 21(3), 520–544 (2019)

Gregor, S., Hevner, A.R.: Positioning and presenting design science research for maximum impact. MIS Q. (Management Information Systems Research Center, University of Minnesota) 37(2), 337–355 (2013)

Mayer, J.H., Hebeler, C., Esswein, M., Göbel, M., Quick, R.: Evaluating a forward-looking maturity model for enterprise performance management. In: Aier, S., Rohner, P. (eds.) Festschrift für Robert Winter. LNISO, vol. 38, pp. 137–153. Heidelberg, New York, Dordrecht (2022)

Webster, J., Watson, R.T.: Analyzing the past to prepare for the future: writing a literature review. MIS Q. (Management Information Systems Research Center, University of Minnesota) 26(2), xiii–xxiii (2002)

AIS: Senior Scholar’s Basket of Journals. https://aisnet.org/page/SeniorScholarBasket (2020). Accessed 14 July 2020

SJR: Scimago Journal & Country Rank. https://www.scimagojr.com/journalrank.php?area=1400&category=1402 (2020). Accessed 6 June 2021

AIS: Conferences. https://aisnet.org/page/Conferences (2020). Accessed 14 July 2020

Ongena, G., Ravesteyn, P.: Business process management maturity and performance. Bus. Process Manag. J. (Emerald Publishing Limited) 26(1), 132–149 (2020)

Williams, C., Boardman, L., Lang, K., Schallmo, D.: Digital maturity models for small and medium-sized enterprises: a systematic literature review. In: Proceedings of the 30th International Society for Professional Innovation Management (ISPIM, 2019), Florence, Italy, pp. 1–15

Comuzzi, M., Patel, A.: How organisations leverage Big Data: a maturity model. Ind. Manag. Data Syst. (Emerald Group Publishing Limited) 116(8), 1468–1492 (2016)

Imgrund, F., Fischer, M., Janiesch, C., Winkelmann, A.: Approaching digitalization with business process management. In: Proceedings of the 26th Multikonferenz Wirtschaftsinformatik (MKWI, 2018), Ilmenau, Germany, pp. 1–12

Rowley, J., Slack, F.: Conducting a literature review. Manag. Res. News 27(6), 31–39 (2004)

Hess, T., Benlian, A., Matt, C., Wiesböck, F.: Options for formulating a digital transformation strategy. MISQE 15(2), 123–139 (2016)

Cokins, G.: Enterprise performance management (EPM) and the digital revolution. Perform. Improv. Conf. - Expert Perspect. 56(4), 14–19 (2017)

Schmaus, P.A.: Peer group benchmarking for the relative performance evaluation of companies. University of St Gallen, Business Dissertations. Epubli GmbH, Berlin, pp. 128 (2018)

Eckerson, W.: Best Practices in Business Performance Management: Business and Technical Strategies. TDWI report series, pp. 1–32 (2004)

Frolick, M.N., Ariyachandra, T.R.: Business performance management: one truth. Inf. Syst. Manag. 23(1), 41–48 (2006)

Suša Vugec, D., Ivancic, L., Milanovic Glavan, L.: Business process management and corporate performance management: does their alignment impact organizational performance. Interdiscip. Descr. Complex Syst.: INDECS (Croatian Interdisciplinary Society) 17(2), 368–384 (2019)

Santos, L.R., Chen, M.K.: The evolution of rational and irrational economic behavior. In: Glimcher, P.W. (ed.) Neuroeconomics: Decision Making and the Brain, 1st edn., pp. 81–93. Academic Press, London, San Diego, CA (2009)

Auguinis, H.: Performance management, 2nd edn. Dorling Kindersley Publishing Pvt. Ltd., Noida (2009)

Kahneman, D.: Maps of bounded rationality: psychology for behavioral economics. Am. Econ. Rev. (American Economic Association) 93(5), 1449–1475 (2003)

Vezard, A.: Understanding the interplay between cognitive and affective decision making processes: Implications for management accounting based on neuroeconomic evidence. Master’s Thesis, Julius-Maximilians-Universität (JMU, 2015)

Vroom, V.H.: Work and Motivation. Wiley, New York, NY, USA (1964)

Locke, E.A., Cartledge, N., Koeppel, J.: Motivational effects of knowledge of results: a goal-setting phenomenon? Psychol. Bull. 70(6, Pt. 1), 474–485 (1968)

Yaghi, B., Youell, N., Neely, A.D.: Enterprise performance management: the global state of the art. SSRN J. Oracle Report/Cranfield University (2008)

Schrage, M., Kiron, D., Hancock, B., Breschi, R.: Performance management’s digital shift. MIT Sloan Manag. Rev. 1–23 (2019)

Farahdel, S.: A visual performance management framework to improve decision making using Lean Six Sigma. Master’s Thesis, Concordia University (CU, 2020)

Moskalenko, V., Fonta, N.: The cascading subsystem of key performance indicators in the enterprise performance management system. In: Nechyporuk, M., Pavlikov, V., Kritskiy, D. (eds.) Integrated Computer Technologies in Mechanical Engineering—2020: Synergetic Engineering. Lecture Notes in Networks and Systems, vol. 188, 1st edn., pp. 704–715. Springer International Publishing; Imprint, Springer, Cham (2021)

Zou, T., Bai, S.: Enterprise performance optimization management decision-making and coordination mechanism based on multiobjective optimization. Math. Probl. Eng. 2021(1), 1–12 (2021)

Akdil, K.Y., Ustundag, A., Cevikcan, E.: Maturity and readiness model for industry 4.0 strategy. In: Ustundag, A., Cevikcan, E. (eds.) Industry 4.0: Managing The Digital Transformation. Springer Series in Advanced Manufacturing, pp. 61–94. Springer International Publishing, Cham (2018)

Colli, M., Berger, U., Bockholt, M., Madsen, O., Møller, C., Wæhrens, B.V.: A maturity assessment approach for conceiving context-specific roadmaps in the Industry 4.0 era. Annu. Rev. Control 48(1), 165–177 (2019)

Pinto, J.L.: Assessing the relationship between bpm maturity and the success of organizations. NOVA Information Management School (2020)

Mergel, I., Edelmann, N., Haug, N.: Defining digital transformation: results from expert interviews. Gov. Inf. Q. 36(4), (2019)

Mayer, J.H., Quick, R., Towara, T.: Digital Technologies for Managers: A Maturity Model from their Business Perspective. In: Krause, S. and Pellens, B. (ed) Betriebswirtschaftliche Implikationen des wirtschaftlichen Wandels. 75 Jahre Arbeitskreise der Schmalenbach-Gesellschaft für Betriebswirtschaft e.V., Sonderheft 17 der Zeitschrift für betriebswirtschaftliche Forschung und Praxis (ZfbF), pp. 241–263 (2017)

The Hackett Group: CFO Agenda: Finances Four Imperatives to Accelerate Business Value. https://www.thehackettgroup.com/key-issues-fin-1801-thankyou/ (2018b). Accessed 8 October 2020

Pearson, M.: Strategies for aligning manufacturing with business and supply chain goals. Logist. Manag. 20–21 (2012)

Karunagaran, S., Mathew, S.K., Lehner, F.: Differential cloud adoption: a comparative case study of large enterprises and SMEs in Germany. Inf. Syst. Front. 21(4), 861–875 (2019)

Spruit, M., Pietzka, K.: MD3M: the master data management maturity model. Comput. Hum. Behav. 51(2), 1068–1076 (2015)

Bizjak, J.M., Lemmon, M.L., Naveen, L.: Does the use of peer groups contribute to higher pay and less efficient compensation? J. Financ. Econ. 90(2), 152–168 (2008)

Albuquerque, A.: Peer firms in relative performance evaluation. J. Account. Econ. 48(1), 69–89 (2009)

Spendolini, M.J.: The benchmarking process. Compens. Benefits Rev. 24(5), 21–29 (1992)

Atkinson, M.: Developing and using a performance management framework: a case study. Meas. Bus. Excell. 16(3), 47–56 (2012)

McNair, C.J., Leibfried, K.H.J.: Benchmarking: a tool for continuous improvement. John Wiley & Sons (1992)

Ifenthaler, D., Egloffstein, M.: Development and implementation of a maturity model of digital transformation. TechTrends 64(2), 302–309 (2020)

Som, O., Gamroth, P.N.: Assessing the digital maturity of human resource management. In: Proceedings of the 30th International Society for Professional Innovation Management (ISPIM) Conference, pp. 1–29 (2019)

Department of accounting and auditing at Darmstadt University of Technology. https://www.rcw.wi.tu-darmstadt.de/; https://www.tu-darmstadt.de/index.en.jsp. Accessed 25 July 2021

Schmalenbach working group “Digital Finance”. https://www.linkedin.com/showcase/ak-digital-finance/?originalSubdomain=de; https://www.schmalenbach.org/index.php/arbeitskreise/finanz-und-rechnungswesen-steuern/digital-finance. Accessed 25 July 2021

IMA: Enterprise Performance Management: Management Accountants Perceptions. https://www.imanet.org/insights-and-trends/performance-measurement-incentives-and-alignment/enterprise-performance-management?ssopc=1 (2014). Accessed 9 June 2021

Winter, R., Schelp, J.: Towards a methodology for service construction. In: 40th Annual Hawaii International Conference on System Sciences (HICSS, 2007), Waikoloa Village, HI, USA, pp. 1–7

Yusuf, Y., Sarhadi, M., Gunasekaran, A.: Agile manufacturing: the drivers, concepts and attributes. Int. J. Prod. Econ. 62(1), 33–43 (1999)

Belhiah, M., Bounabat, B., Achchab, S.: The impact of data accuracy on user-perceived business service’s quality. In: 10th Iberian Conference on Information Systems and Technologies (CISTI), pp. 1–4 (2015)

Takabi, H., Joshi, J.B., Ahn, G.-J.: Security and privacy challenges in cloud computing environments. IEEE Secur. Privacy Mag. 8(6), 24–31 (2010)

Rasch, G.: Studies in Mathematical Psychology: I Probabilistic Models for Some Intelligence and Attainment Tests. Danmarks Paedagogiske Institut, Copenhagen (1960)

Bond, T.G., Fox, C.M.: Applying the Rasch Model: Fundamental Measurement in the Human Sciences. Routledge Taylor & Francis Group, New York (2015)

Lahrmann, G., Marx, F., Mettler, T., Winter, R., Wortmann, F.: Inductive Design of Maturity Models: Applying the Rasch Algorithm for Design Science Research, vol. 6629, pp. 176–191 (2011)

Masters, G.N.: A Rasch model for partial credit scoring. Psychometrika 47(2), 149–174 (1982)

Mair, P., Hatzinger, R.: Extended Rasch Modeling: The eRm Package for the Application of IRT Models in R. Research Report Series/Department of Statistics and Mathematics, vol. 47, no. 1. Department of Statistics and Mathematics, WU Vienna University of Economics and Business (2007)

Linacre, B., Beck, M.: What do infit and outfit, mean-square and standardized mean? https://www.rasch.org/rmt/rmt162f.htm (2002). Accessed 9 June 2021

Joo, S.-J., Nixon, D., Stoeberl, P.A.: Benchmarking with data envelopment analysis: a return on asset perspective. Benchmarking 18(4), 529–542 (2011)

Berger, S., Bitzer, M., Häckel, B., Voit, C.: Approaching digital Transformation—development of a multi-dimensional Maturity Model. In: Proceedings of the 28th European Conference on Information Systems (ECIS, 2020), Marrakech, Morocco, pp. 1–18

Blumenberg, S.: Benchmarking financial chain efficiency—the role of economies of scale for financial processes. In: Proceedings of the 8th Pacific Asia Conference on Information Systems (PACIS, 2004), Shanghai, China, pp. 972–985

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Mayer, J.H., Esswein, M., Göbel, M., Quick, R. (2023). Getting Digital Technologies Right—A Forward-Looking Maturity Model for Enterprise Performance Management. In: Za, S., Winter, R., Lazazzara, A. (eds) Sustainable Digital Transformation. Lecture Notes in Information Systems and Organisation, vol 59. Springer, Cham. https://doi.org/10.1007/978-3-031-15770-7_12

Download citation

DOI: https://doi.org/10.1007/978-3-031-15770-7_12

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-15769-1

Online ISBN: 978-3-031-15770-7

eBook Packages: Business and ManagementBusiness and Management (R0)