Abstract

Mobile payment has become popular in China recently. However, China’s population is aging rapidly at the same time. Therefore, it is necessary to explore factors that can affect the elderly to accept mobile payment. By adding two constructs of trust and social influence, this study proposed an extended TAM, and a questionnaire survey was conducted among the Chinese elderly. Structural equation modeling (SEM) was used to analyze the data. Results show that the model explains 77.3% of the variance in behavioral intention. Besides, perceived usefulness and social influence significantly and positively affect behavioral intention, while trust does not. This result demonstrates that what matters is the usefulness and influence from important others, but not the promise provided by mobile payment platforms. Based on the results, this study provides suggestions for the future development of mobile payment.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Technology Acceptance Model; Mobile Payment; The Elderly

In recent years, a variety of innovative technologies have made people’s life more and more convenient. However, the problem of population aging is also intensifying, and there will be an increasing number of people over 65 in the world population in the coming decades. According to Seventh National Population Census, the number of elderly people over the age of 65 has reached 190 million, accounting for 13.5% of China’s total population (National Bureau of Statistics of China 2021). In this context, society has begun to increase the care for the elderly, and technology companies have launched corresponding measures to meet the needs of the elderly, like applications for the elderly. In the academic world, studies have gradually turned to focus on the technology acceptance of the elderly, exploring factors that can help the elderly better adapt to the digital life, so as to provide some design suggestions.

Since the rise of mobile Internet technology, people’s lives have undergone earth-shaking changes. Various mobile services are rapidly popularized (like mobile payment, mobile games, mobile food ordering services, etc.), especially mobile payment services, whose market scale keeps expanding. According to the 47th Statistical Report on China’s Internet Development, as of December 2020, China had 853 million mobile payment users (CNNIC February 2021). Due to its convenience, security, and speed, mobile payment attracts users of all ages, even the elderly user group. Some recent studies have focused on the adoption of mobile payment by the elderly. For example, Cham et al. (2021) indicated that the elderly’s psychological obstacles (e.g., lack of trust, technology anxiety) and risk obstacles may lead to their resistance to mobile payment. In addition, Hanif and Lallie (2021) indicated that the elderly’s perceived cyber security risk has a significant influence on their intention to use mobile banking applications. However, research (Li and Jia 2021) also showed that the use of the Internet can improve the mental health of middle-aged and elderly people, and has a greater effect on the mental health of the elderly.

At present, mobile payment is prevalent in China, and the elderly population is gradually increasing. On the one hand, it is an inevitable trend for the elderly to use mobile payment systems. On the other hand, the physical and psychological characteristics of the elderly may hinder their use of mobile payment. In order to better understand the acceptance of mobile payment among the elderly in China and its determinants, this study extended the Technology Acceptance Model (TAM) by adding trust and social influence in the model, and finally provided suggestions for future development of mobile payment based on the research results.

The rest of this paper is organized as follows: Sect. 2 is a literature review on mobile payment, characteristics of the elderly, and TAM. Section 3 presents the research model and research hypotheses. Section 4 presents the research methodology and the analysis results. Section 5 presented discussions of the results and outlines the conclusion.

2 Literature Review

2.1 Mobile Payment

Mobile payment refers to the behavior of users using mobile devices to complete payments. Consumers can use devices like mobile phones to pay for various services or digital and physical goods without cash, checks, or credit cards (Bai 2020). Driven by the Chinese government, telecom operators, third-party payment enterprises, and technological development, the mobile payment market of China has witnessed explosive growth (Zhao et al. 2022). Nowadays, many people can’t live without mobile payment in China, and some of them no longer carry and use cash in their daily life.

Studies found that different people have different perceptions about mobile payment. Chen et al. (2021) showed that users who prefer traditional payment methods tend to find mobile payment risky and not suitable for use. While more innovative users find mobile payment convenient, low-risk, and fun. In terms of different countries, Fan et al. (2018) found that payment culture and perceived security had significantly smaller influences on trust in the United States than in China.

2.2 Physical and Psychological Characteristics of the Elderly

The elderly are often characterized by poor sensory perception and cognitive ability. In terms of sensory, the elderly may have blurred vision, deafness, poor ability to touch accurately, and other problems (Bai 2020; Wang 2021). These problems slow them down and make it difficult for them to respond quickly to a large amount of information. In terms of cognitive ability, the brain processing ability of the elderly decreases, and their ability to capture and understand information may decline (Bai 2020; Wang 2021). These may discourage the elderly from using emerging technologies. In addition, some ideas of the elderly themselves may also hinder their acceptance of technologies. With the rapid development of technology, the cognitive styles of the elderly cannot keep up with the changes of the time, which may lead them to refuse to use emerging technologies or be gullible (Bai 2020; Wang 2021).

Some studies on the use of intelligent technology by the elderly have shown the barriers that the elderly may encounter when using technologies. Chen (2021) indicated that older people tend to have a higher level of trust than young people, which may lead to a greater chance of being cheated by false information. In addition, Li (2014) found that in the process of online consumption, being unfamiliar with the operating procedures will affect the elderly’s intention to use. Similarly, the elderly may face the same problem when using mobile payment.

2.3 TAM and Its Use in the Context of Mobile Payment

The Technology Acceptance Model (TAM) is proposed by Davis (1989) to explain the decisive factors for the wide acceptance of computers. The most important variables in TAM are perceived usefulness and perceived ease of use. They can affect users’ attitude and behavioral intention. TAM has been applied to research in different fields. In order to enhance the explanatory ability of the model, researchers have added some new variables to the original model (e.g., social influence and facilitating conditions), and proposed some adapted models, such as TAM2, UTAUT, and UTAUT2.

With the development of mobile payment technology and the expansion of its market, a number of studies have focused on the adoption of mobile payment by users. Then some research provided a review of those studies on mobile payment adoption. TAM and its adapted model have been widely used. Abdullah et al. (2021) counted the author keywords of the research in the context of mobile payment, and found that TAM appeared nine times, only second to the occurrence of “mobile payment”. This suggests that TAM was widely used by researchers to investigate mobile payment adoption. Besides, Pal et al. (2019) demonstrated that UTAUT and TAM are the two most frequently used models in research on mobile payment adoption and usage, and perceived usefulness and perceived ease of use are the most frequently used factors. In addition, Karsen et al. (2019) showed that the five most important factors in the use of mobile payment are perceived ease of use, perceived usefulness, perceived trust, perceived risk, and social influence. Moreover, Pramana (2021) demonstrated that the five most frequently investigated factors in the theoretical model are perceived usefulness, perceived ease of use, risk, trust, and social influence. Similarly, Pal et al. (2019) showed that the five most frequently appearing factors that influence mobile payment adoption and usage are perceived ease of use, perceived usefulness, risk, trust, and cost. Considering the importance of social influence and trust in using mobile payment for the elderly, which is also shown in the studies above, the present study added the two constructs in the original TAM.

Additionally, although there have been a number of studies on user adoption of mobile payment, Pramana (2021) suggested that, in this research context, developing countries in Asia (excluding India) need to be more active. Therefore, this study applied an extended TAM to investigate the elderly’s acceptance of mobile payment.

3 Research Hypotheses and Research Model

Based on previous studies, this study extended TAM to explore the factors that influence mobile payment acceptance by the elderly in China. The proposed research model is shown in Fig. 1.

3.1 Perceived Ease of Use and Perceived Usefulness

In TAM, perceived ease of use and perceived usefulness are two main factors affecting users’ behavior intention, which are respectively defined as “the degree to which a person believes that using a particular system would be free of effort” and “the degree to which a person believes that using a particular system would enhance his or her job performance” (Davis 1989). In the context of mobile payment, perceived ease of use (Li et al. 2019; Ma et al. 2018; Wiradinata 2018) and perceived usefulness (Li et al. 2019; Wang and Dai 2020; Wiradinata 2018) have been proved to have significant influence on behavioral intention. In addition, perceived ease of use was proved to positively impact perceived usefulness (Li et al. 2019; Ma et al. 2018; Wang and Dai 2020). Similarly, we expect these hypotheses to apply when the elderly in China use mobile payment.

Therefore, we propose the following hypotheses:

-

H1: Perceived ease of use positively impacts perceived usefulness.

-

H2: Perceived ease of use positively impacts behavioral intention.

-

H3: Perceived usefulness positively impacts behavioral intention.

3.2 Social Influence

Venkatesh et al. (2003) defined social influence as “the degree to which an individual perceives that important others believe he or she should use the new system”. For the elderly, suggestions or supports from their family members, friends, or people important to them may affect their intention to use mobile payment.

In the context of mobile payment, studies showed that social influence positively influence perceived usefulness (Conci et al. 2009). Besides, studies also showed that social influence positively influence behavioral intention (Al-Saedi et al. 2020; Conci et al. 2009; Mensah 2019; Patil et al. 2020). Besides, de Luna et al. (2019) studied the social influence in form of subjective norms, and indicated that subjective norms positively affect perceived usefulness and intention to use SMS (Short Message Service), QR (Quick Response), and NFC (Near Field Communication) mobile payment systems. Similarly, we expect these hypotheses to apply when the elderly in China use mobile payment.

Therefore, we propose the following hypotheses:

-

H4: Social influence positively impacts perceived usefulness.

-

H5: Social influence positively impacts behavioral intention.

3.3 Trust

Trust plays an important role in many scenarios. In the use of the mobile payment, users’ trust in mobile payment platforms may affect their adoption of mobile payment. The present study believes that the elderly’s trust in mobile payment platforms will affect their intention to use mobile payment, and specifically, the more the elderly think the mobile payment platforms are reliable, the more willing they are to use mobile payment.

Previous studies have proved that trust has a positive and significant effect on users’ intention to use mobile payment (Kalinic et al. 2019; Liu et al. 2019; Shao et al. 2019). In terms of the relationship between social influence and trust, Qu et al. (2015) showed that social influence has a positive impact on trust. That is, the more seniors perceive that their important others believe they should use mobile payment, the more they trust mobile payment platforms. Similarly, we expect these hypotheses to apply when the elderly in China use mobile payment.

Therefore, we propose the following hypotheses:

-

H6: Social influence positively impacts trust.

-

H7: Trust positively impacts behavioral intention.

4 Methodology

4.1 Data Collection

Mobile payment includes many ways, such as QR Code (Quick Response Code) and NFC (Near Field Communication). In China, the most commonly used payment method is to scan the payment code (QR code) provided by merchants, or provide payment code (QR code or one-dimension bar code) for merchants to scan, and this payment method mainly relies on two platforms, WeChat and Alipay. According to the Research Report of Mobile Payment Security published by China UnionPay (2021), 96% of respondents pay via QR codes. Therefore, the survey in this study focused on the mobile payment that through the payment code.

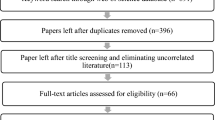

This survey was conducted through online questionnaire distribution. Before the formal distribution of the questionnaire, a simulation test on 5 elderly people over the age of 55 was conducted to judge whether the content of the questionnaire is easy for the elderly to understand. The results show that the respondents can understand the meaning of the topic well and complete the questionnaire independently. A total of 436 questionnaires were collected. By screening, we deleted (1) Questionnaires with respondents younger than 55 years old; (2) Questionnaires that took less than 50 s or more than 1,000 s to complete; (3) All but two (or fewer) answers are the same. Finally, 130 valid questionnaires were used.

According to the statistical results, the proportion of men and women who filled in the questionnaire is average, accounting for 44.62% and 55.38% respectively. In addition, the number of respondents aged 55–59 is the largest, accounting for 65.38% of the number of valid questionnaires. The number of respondents with an education level of junior high school or below is the largest, accounting for 45.38% of the number of valid questionnaires. Most respondents have used mobile payment for more than two years, and may be familiar with mobile payment. It is well representative that the elderly with different ages, different gender, different educational background, and different using experience of mobile payment were included in the questionnaire sample.

There are two parts in the questionnaire. The first part investigates the basic information of the respondents, and the second part uses the 7-point Likert scale to investigate the respondents’ agreement with different statements. The basic information of the respondents is shown in Table 1. And Table 2 demonstrates the items of the second part and their source.

4.2 Data Analysis

We used structural equation modeling (SEM) to analyze the data. The data analysis includes two parts: analysis of measurement model and structural model.

Measurement Model.

Confirmatory factor analysis (CFA) was used to analyze the measurement model.

Table 3 shows the parameters of significant test and item reliability. As the table shows, all the standardized factor loadings are greater than 0.6, and most of them are greater than 0.7, reaching the recommended standard. In addition, all the R-square exceed 0.5, indicating that the item reliability is good.

Table 4 shows the results of composite reliability, convergent validity, and discriminate validity. The CR (composite reliability) of all the constructs is higher than 0.7, which shows acceptable composite reliability (Hairs et al. 1998). AVE (average variance extracted) of all the constructs is higher than 0.5, indicating a good convergence validity (Fornell and Larcker 1981). In addition, the results demonstrated at the diagonal is the square root of the AVE of each factor, each of them is greater than the other figures (the Pearson correlation coefficients with other constructs) in its row and column.

Structural Model.

The model fitting indices are χ2/df, CFI, TLI, RMSEA, and SRMR. The model fitting indices in this study are shown in Table 5. All the indices meet the recommended value, indicating that the structural model fits well.

Table 6 shows the results of the hypotheses. P-value < 0.05 indicates that the hypothesis is supported. There are seven hypotheses in the model, of which five are supported and two are not supported. As the results shows, perceived ease of use positively influences perceived usefulness (β = 0.306, p < 0.01), perceived usefulness positively influences behavioral intention (β = 0.483, p < 0.01), and social influence positively influences perceived usefulness (β = 0.607, p < 0.001), behavioral intention (β = 0.444, p < 0.01), and trust (β = 0.673, p < 0.001). Therefore, H1, H3, H4, H5, H6 are supported. However, H2 and H7 are not supported. In Fig. 2, the results for the research model were shown. Besides, results showed that the model explains 45.3% of the variance in trust, 75.4% of the variance in perceived usefulness, and 77.3% of the variance in behavioral intention.

5 Discussion and Conclusion

5.1 Discussion

By extending TAM, this paper explores the factors that affect behavioral intention of the elderly to use mobile payment.

The results show that social influence is an important factor in mobile payment acceptance by the elderly. Social influence has a significant impact on trust, which is consistent with the previous research results (Qu et al. 2015). This indicates that the positive influence of others will improve the elderly’ trust in mobile payment platforms. In addition, social influence also shows a significant impact on perceived usefulness and behavioral intention, which is also consistent with prior research (Conci et al. 2009). This indicates that when people who are important to the elderly think that the elderly should use mobile payment, the elderly can perceive the usefulness of this payment method and are more willing to use it.

Moreover, it is also consistent with previous studies that perceived usefulness has a significant impact on behavioral intention (Li et al. 2019; Wang and Dai 2020; Wiradinata 2018). However, perceived ease of use does not have a significant impact on behavioral intention. Thus, compared with the ease of use, usefulness is more important in future product design. Besides, results also show that perceived ease of use has a positive impact on perceived usefulness. That is, the more seniors find mobile payment easy to use, the more likely they are to find it useful.

Contrary to our expectation, results shows that trust has no significant effect on behavioral intention. In this study, the construct of trust focuses on security, which is a feeling provided by mobile payment platforms. And it is actually a security promise made by the service providers to the user. This promise, according to the results, has no significant relationship with the behavioral intention of the elderly. Hence, promises or commitments from the service providers are useless, that is, appearing credible is useless. But it is the use and recommendations of people around the elderly that are useful.

Therefore, the promotion will not work well through enhancing the trust by design, while the effective way to promote is to tell the elderly that important others are using it and have good comments. It is a feature of Chinese society, which can also explain why the leading products of mobile payment are particularly preferred in China, because of the herd mentality.

5.2 Conclusion

At present, the problem of population aging is becoming more and more serious. Meanwhile, various technologies develop rapidly. Therefore, how to promote the elderly to use innovative technology is a problem that must be solved. The present study investigated factors that impact the Chinese elderly’s behavioral intention to use mobile payment through an extended TAM.

Results show that perceived usefulness has a significant effect on behavioral intention, but perceived ease of use does not. This suggests that future design should focus more on improving product usefulness than ease of use.

Moreover, in order to better understand factors that affect the elderly’s acceptance of mobile payment, this study added the constructs of trust and social influence into TAM. Results show that social influence has a significant impact on behavioral intention while trust does not have. Through analysis, this study believes that the result may be caused by the prevailing herd mentality of Chinese people. Therefore, designing to enhance trust or security of the products is not a good way to promote, but telling the elderly that people around them are using the products is.

References

Abdullah, K., Khan, M.N., Kostadinova, E.: Determining mobile payment adoption: a systematic literature search and bibliometric analysis. Cogent Bus. Manag. 8(1) (2021)

Al-Saedi, K., Al-Emran, M., Ramayah, T., Abusham, E.: Developing a general extended UTAUT model for M-payment adoption. Technol. Soc. 62 (2020)

Bai, L.: Research on user experience design based on mobile payment dilemma of the elderly group. Tianjin University of Technology (2020)

Cham, T.H., Cheah, J.H., Cheng, B.L., Lim, X.J.: I am too old for this! Barriers contributing to the non-adoption of mobile payment. Int. J. Bank Mark. (ahead-of-print) (2021)

Chen, B.C., Chen, H., Wang, Y.C.: Cash, credit card, or mobile? Examining customer payment preferences at chain restaurants in Taiwan. J. Foodserv. Bus. Res. (2021)

China Internet Network Information Center (CNNIC): The 47th Statistical Report on China’s Internet Development (2021)

China UnionPay: Research Report of Mobile Payment Security (2021)

Chen, Y.: Over-Trust and Vulnerability to Fraud of the Elderly: The Influence of Emotional Arousal on Trust and Trust Learning. Tian Jin Normal University (2021)

Conci, M., Pianesi, F., Zancanaro, M.: Useful, social and enjoyable: mobile phone adoption by older people. In: Gross, T., et al. (eds.) INTERACT 2009. LNCS, vol. 5726, pp. 63–76. Springer, Heidelberg (2009). https://doi.org/10.1007/978-3-642-03655-2_7

Davis, F.D.: Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 13, 319–340 (1989)

de Luna, I.R., Liébana-Cabanillas, F., Sánchez-Fernández, J., Muñoz-Leiva, F.: Mobile payment is not all the same: the adoption of mobile payment systems depending on the technology applied. Technol. Forecast. Soc. Chang. 146, 931–934 (2019)

Fan, J., Shao, M.X., Li, Y.F., Huang, X.M.: Understanding users’ attitude toward mobile payment use. Ind. Manag. Data Syst. 118 (2018)

Fornell, C., Larcker, D.: Structural equation models with unobservable variables and measurement error. J. Mark. Res. (1981)

Hairs, J.F., Anderson, R.E., Tatham, R.L., Black, W.C.: Multivariate Data Analysis. Printice Hall, Englewood Cliffs (1998)

Hanif, Y., Lallie, H.S.: Security factors on the intention to use mobile banking applications in the UK older generation (55+). A Mixed-method study using modified UTAUT and MTAM - with perceived cyber security, risk, and trust. Technol. Soc. 67 (2021)

Kalinic, Z., Marinkovic, V., Molinillo, S., Cabanillas, F.L.: A multi-analytical approach to peer-to-peer mobile payment acceptance prediction. J. Retail. Consum. Serv. 49 (2019)

Karsen, M., Chandra, Y.T., Juwitasary, H.: Technological factors of mobile payment: a systematic literature review. In: 4th International Conference on Computer Science and Computational Intelligence (2019)

Khalilzadeh, J., Ozturk, A.B., Bilgihan, A.: Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 70 (2017)

Li, Z.G., Jia, C.C.: The impact of internet use on mental health of middle-aged and elderly people: a test of heterogeneity and mechanism. Jiangsu Soc. Sci. (2021)

Li, J., Wang, J., Wangh, S.Y., Zhou, Y.: Mobile payment with Alipay: an application of extended technology acceptance model. IEEE Access 7 (2019)

Li, Z.Z.: Online Consumer Behavior of Urban Aging Group in China—With the Case of Quanzhou City. Huaqiao University (2014)

Liu, Z.Z., Ben, S.L., Zhang, R.D.: Factors affecting consumers’ mobile payment behavior: a meta-analysis. Electron. Commer. Res. 19 (2019)

Ma, L.J., Su, X.Y., Yu, Y., Wang, C., Lin, K.Q., Lin, M.Y.: What drives the use of M-payment? An empirical study about Alipay and WeChat payment (2018)

Mensah, I.K.: Predictors of the continued adoption of WeChat mobile payment. Int. J. E-Bus. Res. 15 (2019)

National Bureau of Statistics of China: Bulletin of the Seventh National Population Census (2021)

Pal, A., De’, R., Herath, T., Rao, H.R.: A review of contextual factors affecting mobile payment adoption and use. J. Bank. Financ. Technol. 3 (2019)

Patil, P., Tamilmani, K., Rana, N.P., Raghavan, V.: Understanding consumer adoption of mobile payment in India: extending meta-utaut model with personal innovativeness, anxiety, trust, and grievance redressal. Int. J. Inf. Manag. 54 (2020)

Pramana, E.: The mobile payment adoption: a systematic literature review. In: 2021 3rd East Indonesia Conference on Computer and Information Technology (EIConCIT) (2021)

Qu, Y., Rong, w., Ouyang, Y.X., Chen, H., Xiong, Z.: Social aware mobile payment service popularity analysis: the case of Wechat payment in China. In: Yao, L., Xie, X., Zhang, Q., Yang, L., Zomaya, A., Jin, H. (eds.) APSCC 2015. LNCS, vol. 9464, pp. 289–299. Springer, Cham (2015). https://doi.org/10.1007/978-3-319-26979-5_22

Shao, Z., Zhang, L., Li, X.T., Guo, Y.: Antecedents of trust and continuance intention in mobile payment platforms: the moderating effect of gender. Electron. Commer. Res. Appl. 33 (2019)

Venkatesh, V., Morris, M.G., Davis, G.B., Davis, F.D.: User acceptance of information technology: toward a unified view. MIS Q. 27, 425–478 (2003)

Wang, L., Dai, X.F.: Exploring factors affecting the adoption of mobile payment at physical stores. Int. J. Mob. Commun. 18 (2020)

Wang, B.: Research on bridging the digital divide between urban and rural elderly. Heilongjiang University (2021)

Wiradinata, T.: Mobile payment services adoption_the role of perceived technology risk (2018)

Zhao, C.K., Wu, Y.Q., Guo, J.H.: Mobile payment and Chinese rural household consumption. China Econ. Rev. 71 (2022)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Liu, R., Li, X., Chu, J. (2022). Promising or Influencing? Theory and Evidence on the Acceptance of Mobile Payment Among the Elderly in China. In: Soares, M.M., Rosenzweig, E., Marcus, A. (eds) Design, User Experience, and Usability: UX Research, Design, and Assessment. HCII 2022. Lecture Notes in Computer Science, vol 13321. Springer, Cham. https://doi.org/10.1007/978-3-031-05897-4_31

Download citation

DOI: https://doi.org/10.1007/978-3-031-05897-4_31

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-05896-7

Online ISBN: 978-3-031-05897-4

eBook Packages: Computer ScienceComputer Science (R0)