Abstract

Our study investigates the impact of the COVID-19 external shock on the stock return volatility of global firms. Using a sample of 30,516 firms, accounting for 60% of listed firms globally, scattered across 63 countries, we evidence that COVID-19 cases (fatalities) have a positive and significant impact on stock return volatility of global firms, measured at different estimation intervals (windows of 30, 60, 90, 180, and 250 days). In particular, a one standard deviation increase in COVID-19 cases (fatalities) is associated with 0.79% (0.86%) increase in firm volatility. Additionally, we inform that the effect of COVID-19 is amplified for companies from Oceania and Asia. Our insights are advantageous to a wide spectrum of stakeholders, including managers, market participants, and policy makers.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

JEL Classification

1 Introduction

The COVID-19 pandemic has triggered the deepest economic recession in nearly a century, threatening health, disrupting economic activity, and hurting well-being and jobs.Footnote 1

The COVID-19 has battered the global market and had drastic consequences for trade, supply chains, and economies, while it has triggered a “massive spike in uncertainty” across the globe (Baker et al. 2020, 2). By evaluating the remarkable transmissibility of the virus and the velocity of its global spread, the World Health Organization (WHO) declared the COVID-19 outbreak a global pandemic on 12 March 2020.Footnote 2 The COVID-19 threat inevitably led to tremendous health and economic damages, since more than 100 million people have been infected worldwide with a total cumulative death of around 2.3 million.Footnote 3 The pandemic has reverberated across economies. In the first quarter of 2020, China proclaimed a drop in GDP of 6.3% compared to the first quarter of 2019 (Hofman 2020), the US economy shrank by 4.8% (Erdem 2020), while Eurostat estimated a 3.8% decrease in GDP of EU member states.Footnote 4 Consequently, the world is expecting to face budget cuts as the total cost of COVID-19 is estimated at $8.8 trillion, while International Monetary Fund’s Fiscal Monitor projects global fiscal deficits to reach 10% of global GDP (Hofman 2020) and the expected growth rate to be −3% in 2020 (Erdem 2020).

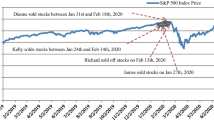

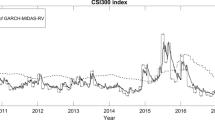

To the extent of the damage, equities drastically plummeted, while market volatility soared upward globally. Stock markets in the US, Europe, and Asia were particularly sensitive. During March 2020, the value of G7 countries’ main indices reached their 20-year lows (Yousef 2020), even at lower levels as compared to the Global Financial Crisis (GFC) of 2008. It is only recently since scholars started investigating the effect of COVID-19 on capital markets in general, and on stock price volatility in particular (e.g., Al-Awadhi et al. 2020; Erdem 2020; Heyden and Heyden 2021; Yousef 2020). Analyzing stock market indices of 75 countries, Erdem (2020) evidence that the pandemic resulted in an increase of volatility and a decrease of index returns. Heyden and Heyden (2021) reveal significant negative market reactions to COVID-19 cases across the US and Europe, while a similar pattern is also evident for China (Al-Awadhi et al. 2020) and Japan (Takahashi and Yamada 2020).

Despite sharing similarities with the aforementioned studies, our study diverges in several fonts. First, we offer insights into the impact of COVID-19 on stock return volatility using firm-level data, and thus deviate from studies concentrating on stock market indices (e.g., Erdem 2020; Yousef 2020). Second, our sample considers firms from 63 countries and thus extends the findings of single-country studies (Al-Awadhi et al. 2020; Takahashi and Yamada 2020). Third, we further understandings at a global scale by engaging a sample that covers around 60% from approximately 51.000 active listed global firms.Footnote 5 Fourth, we capture the effect of COVID-19 on stock return volatility both at the short- and at the long-term, by using a moving variance approach within estimation windows spanning from 30 to 250 days. Finally, we enlighten the reader on the differences of COVID-19 impact across regions, by clustering our analysis, and reveal that the effect of COVID-19 is amplified for companies from Oceania and Asia.

This study contributes to prior literature in the following ways. First, the analysis adds to the existing studies in regards to the impact of external shocks (natural disasters, financial crises) on the stock markets. Second, it extends the existing limited literature examining the impact of COVID-19 across various aspects, including the volatility of stock returns in financial markets. Third, we employ large scale data that capture 60% of global listed firms, and thereby we add to prior literature on the impact of COVID-19 at a global scale. Finally, we conduct regional analyses and inform that the effect of COVID-19 is amplified for companies from Oceania and Asia.

The rest of this paper is organized as follows: Sect. 2 provides the theory and hypothesis development. Section 3 presents the research methodology. Section 4 presents the data and empirical tests, while Sect. 5 concludes the study.

2 Theory and Hypothesis Development

Volatility in financial markets is critical to a wide spectrum of decision makers, including individual and institutional investors, portfolio managers, industry regulators and policy makers. Managing volatility and understanding its determinants is very important for investors, as often portfolio expected returns and volatility are negatively correlated (Li et al. 2005). Prior research suggests that most investors do not hold “fully” diversify their portfolio for several reasons such as (a) transactions costs (Ang et al. 2006), (b) heterogeneity in their preferences (e.g., preferences for stocks with higher volatility) (Goetzmann and Kumar 2008), (c) financial constraints (Xu and Malkiel 2003) etc. Therefore, understanding the drivers of stock price volatility is essential for enhancing investor’s wealth, since under-diversification may result in higher risk (Abdelsalam et al. 2021).

Prior literature has put emphasis on examining how various external shocks (i.e., weather events, earthquakes, recession, and diseases) impact volatility in global financial markets. Empirical evidence indicate sharp movements in stock prices (i.e., higher volatility) during periods of financial distress and recession (e.g., the Great Recession of 1929 (e.g., Romer 1990); the Dotcom bubble of 1999–2001 (e.g., Bakshi and Wu 2010); and the GFC of 2008 (e.g., Kotkatvuori-Örnberg et al. 2013)). On top of these, in recent years we observe an increasing interest on how different types of natural disasters (e.g., hurricanes, earthquakes, floods, bushfires, cyclones, tsunamis) affected the global marketplace (e.g., Bourdeau-Brien and Kryzanowski 2017; Valizadeh et al. 2017).

Bourdeau-Brien and Kryzanowski (2017) find that major natural disasters have a significant impact on stock returns and volatilities of U.S. firms. In the same direction, Worthington and Valadkhani (2004) find similar results when considering the effect of severe disaster shocks (e.g., floods, wildfires, earthquakes, storms, cyclones) on the Australian stock market from 1982 to 2002. They highlight that market returns are more sensitive to shocks provided by natural events like cyclones, bushfires, and earthquakes. Significant negative impact on stock returns have been also shown to pertain in the periods following the California Earthquake of 1989 (Shelor et al. 1990), the occurrence of back-to-back 2005 hurricanes (Katrina and Rita) (Gangopadhyay et al. 2010), and the Great East Japan earthquake of 2011 (Hood et al. 2013; Takao et al. 2013).

In addition to the aforementioned shocks, financial markets have been impacted by an ascending number of infectious diseases such as Ebola virus, MERS CoV, SARS, Lassa fever, Nipah virus, Zika virus etc. The spread of these contagious diseases not only affects people’s health and life but also induces a decline in economic growth (Liu et al. 2020). For instance, Chen et al. (2007) indicate a negative impact of the impact of the SARS outbreak in 2003 on the stock returns Taiwanese tourism firms.

The outbreak of COVID-19 is one of the most recent events on the international scene. Consequently, there is scarce literature examining the stock market behavior during this period. However, various studies emphasized that the spread of the virus is causing great fear or shock to the financial markets that need further investigation. Baek et al. (2020) examined the stock market volatility of 30 industries operating in the U.S. They observe that volatility is affected by different economic indicators and is sensitive to COVID-19 news. In addition, they document that systematic risk is higher for defensive industries (e.g. utilities, telecom) and lower for aggressive industries (e.g., business equipment, automobiles). Heyden and Heyden (2021) investigate the short-term market reactions of US and European stocks to the public information about COVID-19. While the first case of the COVID-19 does not have a significant impact, the announcement of the first death stimulates a negative stock price reaction to the COVID-19.

Liu et al. (2020) analyze the impact of the COVID-19 outbreak on 21 major stock market indices and suggest that stock markets in most vulnerable countries and areas faced higher negative abnormal returns relative to other countries. In another study, Bash (2020) sheds light into the effect of the first registered case of COVID-19 on stock market returns of 30 countries. Results reveal that COVID-19 has a significant negative impact on index return. This finding is in line with Zhang et al. (2020) estimation. They examine the volatility of ten stock markets in the countries with the highest number of confirmed cases between January and February 2020 and find that volatility increased substantially in February due to COVID-19. Baker et al. (2020) used textual analysis of news mentions and found that the COVID-19 pandemic has resulted in the highest stock market volatility among all recent infectious diseases including the Spanish Flu of 1918. Additionally, Zaremba et al. (2020) reveal that governmental interventions (lock-downs and prevention measures) have significantly increased daily stock market volatility.

Building on the work of Al-Awadhi et al. (2020), which reveals that stock markets around the world have reacted to the COVID-19 pandemic with strong volatility, as well as on the aforementioned literature, we form the following hypothesis:

H: The number of COVID-19 cases (fatalities) is positively associated with stock return volatility of global firms.

3 Research Design

3.1 Empirical Model

We conduct our investigations using panel data analysis, in line with relevant studies and due to the daily frequency nature of our data (Zaremba et al. 2020). We evaluate the impact of COVID-19 cases (fatalities) on stock return volatility of global firms by relying on model the specification outlined in the following equation:

The dependent variable (VOLATILITY) is a vector representing the volatility of daily stock returns at different estimating windows. Following prior studies (e.g., Dutt and Humphery-Jenner 2013), we estimate return volatility using a moving variance approach within estimation windows of 30, 60, 90, 180, and 250 days. COVID represents the COVID-19 related measures employed in our study,Footnote 6 namely (a) the total number of COVID-19 cases in each day (LnCASESTOT) and (b) the total number of COVID-19 related fatalities (LnDEATSHSTOT). Both COVID-19 measures are in daily frequency, while in our analyses we transform them into natural logarithms so as to obtain better distributional properties and to reduce the impact of outliers.

Our model also considers several firm-level variables, all measured on a quarterly basis, to control cross-sectional differences in firm characteristics that may influence return volatility. We control for profitability and size using the ratio of earnings before interest and taxes (EBIT) to total assets (ROA) and the natural logarithm of total assets (LnASSETS), respectively, since larger and more profitable firms are more likely to experience lower return volatility (Pastor and Veronesi 2003). As a measure of financial leverage, we use the ratio of total debt over total assets (LEVERAGE) because financially distressed firms are more likely to be leveraged and have higher return volatility (Rajgopal and Venkatachalam 2011). Previous studies provide an association between volatility and firm growth opportunities, since growing firms exhibit more fluctuations in their returns (Cao et al. 2008; Pastor and Veronesi 2003). Therefore, we consider for firm growth opportunities, operationalized as the market-to-book value of equity (MB). The standard errors of all the regression estimates are adjusted using heteroskedasticity-corrected and clustered robust standard errors, clustered on firms.

Finally, we winsorize all continuous variables at the 1st and 99th percentiles to mitigate the effect of outliers, while we also include industry and country indicators in all our estimates to alleviate any concerns for unobserved industry and country effects. \({\upmu }_{d}\) denotes indicator variables with a value of one for industry \(d\), and zero otherwise; \({\upmu }_{c}\) denotes indicator variables with a value of one for country \(c\), and zero otherwise; and \({\varepsilon }_{i,t}\) is the error term. We present the variable definitions in Appendix.

3.2 Data

Our estimation period considers the date the WHO declared COVID-19 as global pandemic (i.e., 12 March 2020) and spans up to 30 September 2020.Footnote 7 Our sample selection considers the entire universe of active and listed firms in the DataStream database, which is the primary source for stock price information and accounting data. We consider the country of the stock exchange as the relevant company location (similar to Dutt and Humphery-Jenner 2013), and match the number of COVID-19 cases and/or fatalities reported each day, available through the World Bank. At this stage, our sample comprises of 31,649 firms (translated into 818,532 observations). Our data requirements for control variables for model (1) further drop 1105 firms, due to missing data. Following previous studies (e.g., Abdelsalam et al. 2021), our sample selection criteria require at least four firms in one country, and thus we eliminate 24 firms. Table 1 describes the sample selection process.

Our final sample comprises 30,516 firms (translated into 783,241 observations; see Table 1 for a description) scattered across 63 countries (see Table 2). Drawing upon Table 2 reveals that companies from three countries predominate, namely Japan (26.01), Australia (19.95), and India (19.51). Additionally, the right part of Table 2 informs on the average number of daily cases and fatalities across our in sample firms. In particular, we observe that the US, Turkey, Brazil, Italy and UK belong to the top five countries in terms of the total number of COVID-19 cases (CASESTOT) and the total number of COVID-19 fatalities (FATALITIESTOT).

4 Empirical Results

4.1 Univariate Analysis

The descriptive statistics for the main variables used in our analysis are provided in Table 3. The results show that volatility is higher in the short term, as compared to the long-term, as indicated by the mean, median, and max values of the Vol30, Vol60, Vol90, Vol180, and Vol250. Indicatively, the mean (max) of Vol30, Vol60, and Vol90 are 0.039 (0.205, 0.194, and 0.187 respectively), as compared to Vol180 and Vol250 which values are 0.037 (0.178 and 0.174, respectively). Moving to the rest of the control variables, the average firm exhibits negative profitability (the mean of ROA is −0.095) and has an average leverage of 0.235, both on a quarterly basis.

Table 4 presents the Pearson correlation coefficients between the sample variables. We observe that all volatility measures are positively correlated with each other, while the same also applies to the COVID-19 measures. Hence, we consider each of them separately in our analyses. Additionally, both COVID-19 measures are positively and statistical significantly correlated with firm return volatility measures. With regards to the remaining pairwise correlation coefficients, none of them is higher than 0.53 (in absolute terms) and thus suggest no serious problem of multicollinearity. This is also verified by the low values of the mean–variance inflation factors (VIFs), which do not exceed 1.4 across all models and are even lower than the conservative cut-off value of 5 (Studenmund 2016).

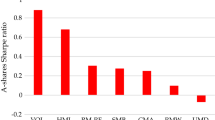

4.2 Multivariate Analysis

We conduct a multivariate analysis to investigate further the association between COVID-19 and firm return volatility. Table 5 reports the panel data analysis of the effect of COVID-19 cases on firm return volatility. The first row shows the dependent variable employed in each model, measured at different estimation windows (30, 60, 90, 180 and 250 days). The empirical results confirm a positive and statistically significant impact of COVID-19 cases (LnCASESTOT) on firm returns volatility, as all coefficients of LnCASESTOT attain positive and statistically significant coefficients at 1%. The effect is economically significant, as one standard deviation increase in the number of COVID-19 cases (3.951) is associated with a 0.79% (0.40) increase in firm volatility (calculated as 3.951 × 0.002 (3.951 × 0.001)), within estimating windows of 30, 60, and 90 (180 and 250) days.

The mean–variance inflation factors (VIFs), do not exceed 1.4 across all models and are even lower than the conservative cut-off of 5 (Studenmund 2016), inferring that multicollinearity is not likely to be of concern. It is worth noting that all control variables have also proven to be important determinants of return volatility. The negative coefficients of ROA and LnASSETS are affirmative to the notion that larger and more profitable firms exhibiting lower return volatility (Pastor and Veronesi 2003); whereas the positive coefficient of LEVERAGE suggests that financially distressed firms are exposed to higher return volatility (Rajgopal and Venkatachalam 2011).

Beyond the total number of cases, we also consider the number of COVID-19 fatalities (LNFATALITIESTOT) as our main variable of interest. Table 6 indicates that (LNFATALITIESTOT) attains positive and significant coefficients, at 1%, across all estimation windows of return volatility. The effect of COVID-19 fatalities is higher as compared to COVID-19 cases, as a one standard deviation increase in the number of COVID-19 fatalities (2.861) is associated with a 0.86% (0.57%) increase in firm volatility (calculated as 2.861 × 0.003(2.861 × 0.002)) within estimating windows of 30, 60, and 90 (180 and 250) days. Moving to the rest of the control variables, we observe that they remain qualitatively similar as previously described.

5 COVID-19 and Return Volatility—Regional Analyses

In this section we extend our analyses and we attempt to reveal potential differences across regions, attributable to the spillover of the COVID-19 across the globe. For this reason, we separate our sample as per region (namely companies listed in Africa, Americas, Asia, Europe, and Oceania) and repeat our empirical tests for all estimation windows (30, 60, 90, 180, and 250 days). We focus on the effect of COVID-19 fatalities, as our main results reveal that its magnitude on return volatility is higher as compared to the number of cases (Table 7).

6 Sensitivity Analyses

We perform additional robustness exercises to probe robustness of our results. First, we use alternative specifications of COVID-19 measures and instead of the total number of cases (fatalities), we use the new number of cases (fatalities). Re-estimating our analyses reveal that both alternative measures attain positive and significant coefficients, while its magnitude is higher and thus reveal that market participants perceive the escalation of COVID-19 cases (fatalities) as more breaking news and thereby increase market volatility. Second, we moderate concerns related to high representation of certain countries in our sample, since Japan (26.01), Australia (19.95), and India (19.51) account for more than 65% of our sample. Therefore, once concern is that our results are an artifact of this disproportionate representation. Although we employ country-fixed effect across all our estimates, we repeat our analysis after excluding firms from the aforementioned countries and observe that our results remain unchanged.

7 Conclusions

This study provides concurrent evidence in regards to the impact of COVID-19 on global markets. The empirical results suggest that both COVID-19 cases and fatalities have a positive and significant effect on stock return volatility of global firms. The magnitude of COVID-19 fatalities is higher as compared to COVID-19 cases, within estimating windows of 30, 60, 90, 180, and 250 days. In particular, regression results indicate higher stock market reaction during the early days of confirmed cases (i.e., Vol30, Vol60, and Vol90). Beyond these, our further investigations reveal that COVID-19 fatalities have a stronger impact among firms from Oceania and Asia, as compared to firms from the Americas and Europe.

Our results add to existing studies exploring the impact of external shocks (natural disasters, financial crises) on the stock markets. Second, we inform on the significant positive effect of COVID-19 cases (fatalities) on the volatility of global firms, via engaging large-scale data that capture 60% of global listed firms. In this light, the study might be advantageous to a wide spectrum of investors, portfolio managers, and decision-makers, since results confirm a significant positive impact on return volatility. Although the COVID-19 external shock has been extended worldwide, not all countries have reacted in the same way. Hence, investigating the impact of COVID-19 on the most affected countries such as Italy, Spain, France, the UK, or the United States, would be a worthwhile contribution to the existing literature.

Notes

- 1.

See https://www.oecd.org/coronavirus/en/themes/global-economy (Accessed 10 February, 2021).

- 2.

- 3.

Further details on Covid-19 infections and fatalities can be found in https://coronavirus.jhu.edu/map.html (Accessed 10 February, 2021).

- 4.

- 5.

See the World Federation of Exchanges https://webcache.googleusercontent.com/search?q=cache:oWYsB4yZzRIJ:https://focus.world-exchanges.org/storage/app/media/statistics/WFE%2520H1%25202019%2520Market%2520Highlights%2520press%2520release%2520draft%25205%252016.08.2019.pdf+&cd=5&hl=en&ct=clnk&gl=gr (Accessed 10 February, 2021).

- 6.

Data on COVID-19 cases and fatalities are available through the World Bank, and in particular through “Our World in Data” (see https://github.com/owid/covid-19-data/blob/master/public/data/README.md (Accessed 10 February, 2021).

- 7.

Since our volatility measures are estimated at windows spanning up to 250 days, we collect stock price data for 250 days trailing the declaration of COVID-19 as global pandemic by the WHO.

References

Abdelsalam, O., A. Chantziaras, J. A. Batten, and A. F. Aysan. 2021. “Major shareholders’ trust and market risk: Substituting weak institutions with trust.“ Journal of Corporate Finance 66: 101784. https://doi.org/10.1016/j.jcorpfin.2020.101784.

Al-Awadhi, A. M., K. Al-Saifi, A. Al-Awadhi, and S. Alhamadi. 2020. “Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns.” Journal of Behavioral and Experimental Finance 27: 100326. https://doi.org/10.1016/j.jbef.2020.100326.

Ang, A., R. J. Hodrick, Y. Xing, and X. Zhang. 2006. “The cross-section of volatility and expected returns.” The Journal of Finance 61 (1): 259–299. https://doi.org/10.1111/j.1540-6261.2006.00836.x.

Baek, S., S. K. Mohanty, and M. Glambosky. 2020. “COVID-19 and stock market volatility: An industry level analysis.” Finance Research Letters 37: 101748. https://doi.org/10.1016/j.frl.2020.101748.

Baker, S. R., N. Bloom, S. J. Davis, and S. J. Terry. 2020. “COVID-induced economic uncertainty.” National Bureau of Economic Research. https://doi.org/10.3386/w26983.

Bakshi, G., and L. Wu. 2010. “The behavior of risk and market prices of risk over the Nasdaq bubble period.” Management Science 56 (12): 2251–2264. https://doi.org/10.1287/mnsc.1100.1256.

Bash, A. 2020. “International evidence of COVID-19 and stock market returns: An event study analysis.” International Journal of Economics and Financial Issues 10 (4): 34–38. https://doi.org/10.32479/ijefi.9941.

Bourdeau-Brien, M., and L. Kryzanowski. 2017. “The impact of natural disasters on the stock returns and volatilities of local firms.” The Quarterly Review of Economics and Finance 63: 259–270. https://doi.org/10.1016/j.qref.2016.05.003.

Cao, C., T. Simin, and J. Zhao. 2008. “Can growth options explain the trend in idiosyncratic risk?” The Review of Financial Studies 21 (6): 2599–2633. https://doi.org/10.1093/rfs/hhl039.

Chen, M. H., S. S. Jang, and W. G. Kim. 2007. “The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach.” International Journal of Hospitality Management 26 (1): 200–212. https://doi.org/10.1016/j.ijhm.2005.11.004.

Dutt, T., and M. Humphery-Jenner. 2013. “Stock return volatility, operating performance and stock returns: International evidence on drivers of the ‘low volatility’ anomaly.” Journal of Banking and Finance 37 (3): 999–1017. https://doi.org/10.1016/j.jbankfin.2012.11.001.

Erdem, O. 2020. “Freedom and stock market performance during Covid-19 outbreak.” Finance Research Letters 36: 101671. https://doi.org/10.1016/j.frl.2020.101671.

Gangopadhyay, P., J. D. Haley, and L. Zhang. 2010. “An examination of share price behavior surrounding the 2005 hurricanes Katrina and Rita.” Journal of Insurance Issues 33: 132–151. http://www.jstor.org/stable/41946307.

Goetzmann, W. N., and A. Kumar. 2008. “Equity portfolio diversification.” Review of Finance 12 (3): 433–463. https://doi.org/10.1093/rof/rfn005.

Heyden, K. J., and T. Heyden. 2021. “Market reactions to the arrival and containment of COVID-19: An event study.” Finance Research Letters 38: 101745. https://doi.org/10.1016/j.frl.2020.101745.

Hofman, B. 2020. “The global pandemic: How COVID-19 has changed the world.” Horizons: Journal of International Relations and Sustainable Development (16): 60–69. https://doi.org/10.2307/48573749.

Hood, M., A. Kamesaka, J. Nofsinger, and T. Tamura. 2013. “Investor response to a natural disaster: Evidence from Japan’s 2011 earthquake.” Pacific-Basin Finance Journal 25: 240–252. https://doi.org/10.1016/j.pacfin.2013.09.006.

Kotkatvuori-Örnberg, J., J. Nikkinen, and J. Äijö. 2013. “Stock market correlations during the financial crisis of 2008–2009: Evidence from 50 equity markets.” International Review of Financial Analysis 28: 70–78. https://doi.org/10.1016/j.irfa.2013.01.009.

Li, Q., J. Yang, C. Hsiao, and Y.-J. Chang. 2005. “The relationship between stock returns and volatility in international stock markets.” Journal of Empirical Finance 12 (5): 650–665. https://doi.org/10.1016/j.jempfin.2005.03.001.

Liu, H., A. Manzoor, C. Wang, L. Zhang, and Z. Manzoor. 2020. “The COVID-19 outbreak and affected countries stock markets response.” International Journal of Environmental Research and Public Health 17 (8): 19. https://doi.org/10.3390/ijerph17082800.

Pastor, L., and P. Veronesi. 2003. “Stock valuation and learning about profitability.” The Journal of Finance 58 (5): 1749–1789. https://doi.org/10.1111/1540-6261.00587.

Rajgopal, S., and M. Venkatachalam. 2011. “Financial reporting quality and idiosyncratic return volatility.” Journal of Accounting and Economics 51 (1): 1–20. https://doi.org/10.1016/j.jacceco.2010.06.001.

Romer, C. D. 1990. “The Great Crash and the onset of the Great Depression.“ The Quarterly Journal of Economics 105 (3): 597–624. https://doi.org/10.2307/2937892.

Shelor, R., D. Anderson, and M. Cross. 1990. “The impact of the California earthquake on real estate firms’ stock value.” Journal of Real Estate Research 5 (3): 335–340. https://doi.org/10.1080/10835547.1990.12090623.

Studenmund, A. H. 2016. Using econometrics: A practical guide. 7th ed. Boston, MA: Pearson.

Takahashi, H., and K. Yamada. 2020. “When Japanese stock market meets COVID-19: Impact of ownership, trading, ESG, and liquidity channels.” SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3577424.

Takao, A., T. Yoshizawa, S. Hsu, and T. Yamasaki. 2013. “The effect of the Great East Japan earthquake on the stock prices of non-life insurance companies.” The Geneva Papers on Risk and Insurance. Issues and Practice 38 (3): 449–468.

Valizadeh, P., B. Karali, and S. Ferreira. 2017. “Ripple effects of the 2011 Japan earthquake on international stock markets.” Research in International Business and Finance 41: 556–576. https://doi.org/10.1016/j.ribaf.2017.05.002.

Worthington, A., and A. Valadkhani. 2004. “Measuring the impact of natural disasters on capital markets: An empirical application using intervention analysis.” Applied Economics 36 (19): 2177–2186. https://doi.org/10.1080/0003684042000282489.

Xu, Y., and B. G. Malkiel. 2003. “Investigating the behavior of idiosyncratic volatility.” The Journal of Business 76 (4): 613–645. https://doi.org/10.1086/377033.

Yousef, I. 2020. “Spillover of COVID-19: Impact on stock market volatility.” International Journal of Psychosocial Rehabilitation 24 (6): 18069–18081. https://doi.org/10.37200/IJPR/V24I6/PR261476.

Zaremba, A., R. Kizys, D. Y. Aharon, and E. Demir. 2020. “Infected markets: Novel coronavirus, government interventions, and stock return volatility around the globe.” Finance Research Letters 35: 101597. https://doi.org/10.1016/j.frl.2020.101597.

Zhang, D., M. Hu, and Q. Ji. 2020. “Financial markets under the global pandemic of COVID-19.” Finance Research Letters 36: 101528. https://doi.org/10.1016/j.frl.2020.101528.

Acknowledgements

This paper is based on Marinela Chamzallari’s dissertation for the MSc in Banking and Finance, at the International Hellenic University, under the supervision of Dr. Antonios Chantziaras. We acknowledge the helpful comments by two anonymous referees. The paper has also benefited from the comments of participants at the 13th International Conference on Economics of the Balkan and Eastern European Countries (Pafos) who provided valuable feedback.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix—Variable Definitions

Appendix—Variable Definitions

Variable | Definition |

|---|---|

Panel A: Volatility measures | |

Vol30 | The variance of daily stock returns over the past 30 days (Data source: DataStream) |

Vol60 | The variance of daily stock returns over the past 60 days (Data source: DataStream) |

Vol90 | The variance of daily stock returns over the past 90 days (Data source: DataStream) |

Vol180 | The variance of daily stock returns over the past 180 days (Data source: DataStream) |

Vol250 | The variance of daily stock returns over the past 250 days (Data source: DataStream) |

Panel B: Main independent variable—COVID-19 measures | |

LnCASESTOT | Natural logarithm of the total number of COVID-19 cases reported in the country the company is listed (Data source: World Bank) |

LnFATALITIESTOT | Natural logarithm of the total number of COVID-19 fatalities reported in the country the company is listed (Data source: World Bank) |

Panel C: Firm fundamentals | |

ROA | Return on assets, measured as the ratio of income before extraordinary items over total assets (Data source: DataStream) |

LnASSETS | Natural logarithm of total assets (Data source: DataStream) |

LEVERAGE | Leverage ratio, measured as total debt over total assets (Data source: DataStream) |

MB | Market-to-book value of equity (Data source: DataStream) |

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Chamzallari, M., Chantziaras, A., Grose, C. (2022). The Impact of COVID-19 on Firm Stock Price Volatility. In: Sklias, P., Polychronidou, P., Karasavvoglou, A., Pistikou, V., Apostolopoulos, N. (eds) Business Development and Economic Governance in Southeastern Europe. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-031-05351-1_24

Download citation

DOI: https://doi.org/10.1007/978-3-031-05351-1_24

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-05350-4

Online ISBN: 978-3-031-05351-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)