Abstract

The purpose of this research is to study the effects of neoclassical trade liberalization policies enacted in India in 1991 to determine the effect on levels of poverty and income inequality. This research predicts that poverty and economic inequality will be reduced due to implementation of economic liberalization policies. The research uses empirical data from the National Sample Survey Organization (NSSO), in India and develops a regression model to determine the effects of economic liberalization on income inequality and absolute poverty. The results of the regression model suggest that income inequality and poverty decreased during the year liberalization policies were enacted, but is not statistically proven with enough confidence that liberalization is strongly correlated with a reduction in inequality and poverty. There is a weak statistical correlation that suggests inequality increased in the Indian urban sector, and decreased in the rural sector due to liberalization. In conjunction with a literature review where more robust data and econometric models are applied, the empirical analysis by complimented with the fact that in general income inequality decreased due to economic liberalization policies alone, holding all exogenous factors that affect income inequality constant. The literature review also confirms that poverty levels decreased with economic liberalization, holding all other exogenous factors that affect poverty constant. The implication of this research is that liberalization polices have been successful for overall development in India, and suggests that implementation of liberalization policies may be desirable in nations under similar circumstances as India in the era before its liberalization.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

11.1 Introduction

The modern economy of India is one of the largest in the world, ranking 9th in the world by nominal GDP, and 4th by GDP using purchasing power parity (PPP) [13]. The country has grown rapidly at a pace of roughly 4–9% in the last several decades, and in the process has brought millions out of poverty [23]. India’s fast paced growth makes is a key economic player in the world stage, and has potential to raise the living standard of its population of roughly 1.17 billion in size [13].

Socialist democratic policies such as extensive regulation, protectionism, public ownership, and trade restrictions were central policies during the years 1947–1991, and resulted in slow growth [18]. Since 1991, economic liberalization has opened up markets in India and lead to accelerated economic growth, resulting in India becoming one of the fastest growing modern economies. Two important questions are raised from a developmental economics perspective:

-

1.

What does rapid growth do to alleviate poverty for the poorest individuals?

-

2.

How are the benefits of growth distributed among individuals of an economy?

According to [20], economic development is a gradual process by which the per capita income of a country increases over time given that the number of people below the poverty line does not increase, and that the distribution of income does not become more unequal. Growth that is distributed unequally needs to be evaluated not simply on the basis of overall change but on the grounds of equality. According to [20], there are significant negative effects of increasing income inequality in a country, including economic inefficiency, decreasing social stability, and rise of rent-seeking behaviour.

This research is intended to study the growth of India due to growth liberalization and its effect on absolute poverty and the income inequality. The general consensus among economists is that economic liberalization, and free trade is a unambiguous net gain for society [10], and that economic liberalization has helped the world’s poorest escape from poverty. Based on this consensus, this research predicts that increased growth in India due to neoclassical economic liberalization policies should lead to a reduction in absolute poverty levels and a reduction in income inequality.

This research is divided into several sections, it will first discuss the theory behind economic liberalization, the definition of economic liberalization and the benefits and drawbacks that it entails. Second, a brief economic history of India is discussed, outlining the key economic policies before liberalization and after liberalization. Third, using empirical data from various sources the link between economic liberalization, poverty and inequality will be analyzed. We will use key indicators that are hallmarks of liberalization, such as the Trade Openness Index (TOI). Some examples of poverty and inequality indicators will be Gini coefficient, and Headcount Index of people below the poverty line. Fourth, a literature review will be conducted to survey the results from similar research on this topic. Fifth, the cause and effects of inequality will be analyzed.

11.2 Overview of Economic Liberalization

A brief overview of economic liberalization has been presented in the following three sections based the relevancy of subject matter.

11.2.1 Introduction to Economic (Trade) Liberalization

Economic liberalization broadly refers to the minimization of government intervention in an economy, and greater influence of the private sector in an economy. The argument for liberalization is that it leads to greater efficiency, thus liberalization refers to the “removal of controls”, to encourage economic development [6]. Liberalization may refer to the privatization of government institutions, decreased regulation in labour and factor markets, lowering the rate of corporate taxes and capital gains taxes, and fewer barriers to trade. In the case of developing countries such as India, liberalization primarily refers to decreased regulation and tariffs which result in greater foreign direct investment (FDI), which tends to vastly increase trade. In this research the terms ‘Economic Liberalization’ and ‘Trade Liberalization’ are used interchangeably, as they are linked concepts, and trade openness is arguably the biggest component of economic liberalization.

The rapid growth of the world economy in the past few decades has been driven in part by an even faster rise in international trade [12]. According to [12], the integration of world economy via trade has been a powerful means for countries to promote economic growth, development, and poverty reduction. This integration has raised living standards across the world especially in countries in Asia, where integration has led to a substantial rise in incomes [12].

It is true that economic liberalization is not universally and unambiguously linked to economic growth [21], as there are many exogenous factors that responsible for economic growth. However, it is fair to say that economic liberalization is a component that promotes growth by leading to lower prices, better information, and newer technologies [21]. Economic liberalization must also accompanied by its complementaries such as education, infrastructure spending, and macroeconomic financial policies [21] to have a positive effect on growth.

11.2.2 Benefits and Drawbacks of Economic (Trade) Liberalization

According to [21] most economic literature concludes that trade liberalization leads to an increased welfare derived from an improved allocation of domestic resources. Import restrictions tend to create an anti-export bias by raising the price of imports relative to exportable goods. Trade liberalization removes this bias and creates an incentive for exportable goods, instead of the creation of import substitutes [21]. This results in growth as the new allocation of resources is now in line with a country’s comparative advantage [17]. Trade liberalization offers markets to compete internationally and thus have a potentially positive effect on the Gross National Income (GNI) of a country. It also allows an inflow of technologies into a developing country, which increase the productivity of developing country’s firms. This can potentially increase exports and thus stimulate income growth in a developing country.

According to [5] there are substantial risks in trade liberalization including:

-

1.

Brain Drain: With open markets there are fewer barriers to do business across borders, highly skilled persons in developing countries might be lured to developed countries for higher wages, benefits, and living standards.

-

2.

Financial Sector Instability: Instability in larger financial markets can have a detrimental impact on smaller markets. For example, the housing bubble burst devalued mortgage assets held by foreign banks, bankrupting the financial system in countries such as Iceland.

-

3.

Risk of Environmental Degradation: Pollution controls in developing countries are generally lower than developed nations, thus cheaper production in developing nations will results in greater environmental damage.

However, [5] goes on to say that the risks of economic liberalization are outweighed by the benefits and that what is needed is careful regulation.

11.2.3 Trade Liberalization and Poverty Reduction

According to [21], there are several ways which trade liberalization helps alleviate poverty in developing countries. In general, trade liberalization reduces the prices of imported goods and keeps prices of import substitutes low, thus increasing real incomes. Depending on the flexibility of wages and labour, the shift of resources between industries that occur in trade liberalization has potential to increase wages and employment. For example, if wages are flexible and labour is fully employed, then price changes caused by trade liberalization can impact wages.

11.3 Economic History of India

An attempt is made herein to describe economic history of India piecewise – since country’s independence until 1991 and since 1991–2020.

11.3.1 Pre-liberalization Policies (Independence – 1991)

India gained independence in 1947 as a British colony, and chose to a state-lead industrialization strategy which involved central economic planning, high protectionism, and regulation of economic activity [3]. The key driver behind this strategy was years of colonial rule by the British, which was viewed as an exploitative period in Indian history, and thus economic policies focused on self reliance. Indian economic policy emphasized savings and capital accumulation for achieving economic growth, consistent with the Harrod-Domar model, thus India followed an economic policy of “state-controlled capitalism” [7]. Furthermore, according to [7]. India’s economic policies were based on a socialist ideology, and private enterprise needed permission from the state. This created accompanying “red-tape” which is commonly referred to as License Raj, where licenses and regulations interfered with private enterprise. The impact of these policies resulted in a very slow rate of growth compared to today, and per-capita income growth averaged 1.3% [9]. Also, licenses were required for many key industries such as steel, electricity, and communications; people who acquired licenses developed monopolies [4]. Industries which were open to private investment without licenses were limited.

The first attempt at liberalization was in the 1980s, under the government of Rajiv Ghandi. However since there was still a “dominance of the socialist mindset”, reform was very gradual and implemented slowly [7]. One of the key reforms was reduction of the Monopolies Restrictive Trade Practices (MRTP) act. This was originally put in place to prevent private monopolies and concentration of economic power [7]. Unfortunately, the regulations and controls associated with this act led to increased bureaucracy and inhibited growth of private industry [7]. Under a heavy socialist mindset, real economic reform did not take place until 1991, in response to a balance of payments crisis that India faced.

Until 1991, the Indian currency (rupee) was pegged to a basket of various international currencies, which lead a currency over-valuation. In combination with a current account deficit, and a decline in investor confidence, the rupee experienced a sharp exchange rate depreciation [11]. As a result, the government was very close to defaulting, and could barely afford 3 weeks worth of imports. This resulted in extreme political and economic uncertainty, leading to the downgrade in India’s credit rating. Non-resident Indian investors started withdrawing money they had invested in India resulting in capital flight [7]. This crisis pushed India towards a policy change that embraced economic liberalization.

11.3.2 Post-liberalization Policies (1991 – Present)

Perhaps the biggest reform in India’s economic liberalization was the reduction License Raj, which reduced the bureaucracy and red-tape that plagued India in the past. Public sector monopolies were ended, especially in areas which were not important strategically, or important in terms of security. Foreign Direct Investment (FDI) was considerably easier by replacing existing bureaucratic agencies with the Foreign Investment Implementation Authority (FIIA), to provide “one one-stop service to foreign investors by helping them obtain the necessary approvals and acting as a single point interface to the government” [14]. There was also a huge effort to attract FDI, which was thought to accelerate industrialization, structural change in the modern sector, and inflow of skilled labour and knowledge [7]. A new policy was implemented to automatically approve FDI in 34 key priority industries [7], allowing quick foreign investment without government intervention. A new government department, called the Foreign Investment Promotion Board (FIPB) was established to promote FDI in India [7].

The pegged exchange rate before 1991 was a restriction on imports and exports [14], the rupee was allowed to fluctuate leading to the creation of Indian foreign exchange markets. Before liberalization, tariffs were extremely high: the highest tariff rate was 355% and was reduced to 41% by 1995/1996 [14]. The average tariff rate dropped from 113% to 17% by 1993/1994 [14]. It is important to note that India still has a high rate of tariffs compared to rest of the world, suggesting further liberalization can still occur [14].

Additionally, India was motivated by the economic success of China’s special economic zones, and other economic zones around the world. The government introduced special economic zones (SEZ), and thus far 12 SEZs have been created in India [14]. The primary motivation of this policy was to create a strong export sector which was vital for continued growth. A new five–year foreign trade policy was implemented in 2004–2009 lifting all quantitative restrictions on exports, and announced additional incentives for SEZs that are aimed at boosting exports [14].

11.4 Analyzing Poverty and Inequality in Post-liberalization Era: Trends in Data

Using MATLAB, attempts are made herein to analyze the poverty and inequality in India during the post-liberalization period. Techniques of data analysis and results are presented in the sections below.

11.4.1 Mathematical Techniques for Analysis

The primary mathematical technique used in the research is regression analysis in MATLAB. This is a technique for analyzing the relationship of 2 different variables, to determine how the value of a dependent variables changes with the value of an independent variable. Regression analysis estimates the conditional expectation of the dependent variable given the independent variable, that is, the average value of the dependent variable when the independent variables are held fixed.

Regression models involve the following variables:

-

1.

Unknown parameters β

-

2.

Independent variable X

-

3.

Dependent variable Y

A regression model relates Y to a function of X and β

There main type of regression used in this research is polynomial regression, as an example the model may be of the form:

Then the model can he written as a system of linear equations:

Which when using pure matrix notation is written as

The vector of estimated polynomial regression coefficients (using ordinary least squares estimation) is

For some datasets linear regression, is used. A full explanation is outside the scope of this article. The calculations are all done using MATLAB software commonly used in academia.

11.4.2 Indicators of Poverty, Inequality and Trade Liberalization

This section discusses the raw data used in the analysis and how the raw data represents poverty, inequality and economic liberalization. Comparisons using the raw data and statistical inferences about the papers hypothesis are formed using the data.

11.4.2.1 Gini Coefficient

One of the key indicators of economic inequality is the Gini coefficient, developed by statistician Corrado Gini. It measures the inequality of wealth distribution, and is a dimensionless number between 0 and 1. The closer the Gini coefficient is to 1, the greater the inequality in an economy. Graphically, it can be represented as the ratio of the area between the diagonal and the Lorenz curve divided by the total area of the half-square in which the curve lies.

Mathematically this can be written as the following if the Lorenz curve is represented by Y = L(X):

11.4.2.2 Coefficient of Variation

The coefficient of variation is a normalized measure of the dispersion of a probability distribution, in this case, it is the standard deviation of income divided by the mean of income. A higher coefficient of variation means incomes are more dispersed, and there is greater inequality. The formula for coefficient of variation is:

where σ is the standard deviation of the incomes in a country, and μ is the mean income in a country.

11.4.2.3 Indicators of Economic Liberalization

There are a few indicators that encompass economic liberalization including tariffs applied in trade, and the Trade Openness Index (TOI), which can be calculated as:

11.4.2.4 Indicators of Poverty

We use two main indicators of poverty for which data is readily available:

-

1.

Headcount of persons below poverty line (% of population)

-

2.

Human Development Index (HDI)

The HDI is a composite measure of development which signifies the level of development of a country measured on a scale from 0 to 1. This measure was created by the United Nations Development Programme (UNDP), and a higher HDI suggests greater development in a economy, which can be viewed as less poverty in a economy. Thus, HDI is a like an “inverse proxy” to poverty.

11.4.3 Data Sources

The Gini coefficient data, and coefficient of variation (CV) data come from the National Sample Survey Organization (NSSO), which is part of the Government of India. The NSSO collected Gini and CV data for many states and territories, treating urban and rural sectors of the Indian economy as separate entities. The data used in this research was extracted from a doctoral thesis by [1]; however, the original source of the data is the NSSO. Obtaining data directly from the NSSO requires payment to the organization in India, and a prolonged waiting time for delivery. Comparable statistics are not available from World Bank, IMF, or UNDP sources.

The HDI data is compiled from the UNDP, for the years before and after economic liberalization in India. Data used to compute the Trade Openness Index (TOI) and tariff data are taken from the World Bank.

This research will graphically analyze the Gini coefficient and coefficient of variation (CV) against time to determine whether or not income inequality increased or decreased during the era of liberalization. It also will graphically analyze HDI as a function of time to determine whether or not development increased or decreased during the era of liberalization. Further a regression analysis will show how inequality and poverty changed with changes in economic liberalization, using metrics such as Trade Openness Index (TOI) and tariffs rates as indicators of economic liberalization. Since all indicators are a function of time, time is an independent variable, and no longer considered in the regression analysis. The regression analysis is sufficient to determine any correlation between economic liberalization and inequality/poverty. Note that all observed samples used in regression analysis are from the same time periods.

The results of the regression are also included to provide a measure of statistical accuracy of the regression. In particular coefficient of determination R2 is the proportion of variability in a data set that is accounted for by the statistical model. A higher value of R2 is desirable, but not often possible due to many exogenous factors not accounted for in a particular model.

11.4.4 Graphical Results

The entire raw data used here is analyzed and graphed appropriately. The following sections provide a detailed description and interpretation of the graphs and parameters used in the mathematical analysis.

The Gini coefficient for urban and rural sectors for all of India is plotted below (Figs. 11.1 and 11.2).

The Coefficient of Variation (CV) for urban and rural sectors for all of India are below (Figs. 11.3 and 11.4).

From the analysis we can see that during the year of liberalization, inequality did decrease, however it increased in the following years. In general, we can safely confirm there is no certain long-term trend in inequality, especially in the rural sector. The inequality during the liberalization year of 1991 is lowest in all observed years (1987–2003). Generally rural inequality is less than urban inequality.

The Human Development Index (HDI) over the years before and after liberalization is shown in the Fig. 11.5 below.

HDI has increased almost linearly from 1980 to 2010, even in the liberalization year of 1991. The HDI can be interpreted as a blunt measure of absolute poverty, as it is in index designed to aggregate the well-being of an economy using 3 key metrics: life expectancy, education, and income, which are all inversely correlated with levels of poverty. From the graph, it is clear the growth in the HDI was present during the liberalization year of 1991, but whether or not liberalization was a contributing factor in the growth of HDI is unclear. The rate of increase of HDI has remained roughly constant, even during the liberalization year. Thus, factors outside this model may also be responsible for the constant growth in HDI, such as greater effectiveness of public and private institutions, technology growth, empowerment of women, social changes etc.

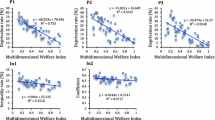

11.4.4.1 Gini Coefficient in Urban Sector vs TOI

The regression results for Gini Coefficient in the Urban Sector vs Trade Openness Index (TOI) are shown in the Fig. 11.6 below.

The regression results indicate that there is weak statistical relation between trade openness and inequality. As the TOI increased, we see the inequality increase slightly. However, with a low R2 the correlation is very weak, suggesting many exogenous factors affect inequality other than trade openness.

11.4.4.2 Gini Coefficient in Rural Sector vs TOI

The regression results for Gini Coefficient in the Rural Sector vs Trade Openness Index (TOI) is shown in the Fig. 11.7 below.

The regression results indicate that there is weak statistical relation between trade openness and inequality. As the TOI increased, we see the inequality decrease slightly. This is in contrast with the urban sector where inequality increased slightly. Again, the R2 value is too low to strongly correlate trade openness and inequality, thus exogenous factors must be at play.

11.4.4.3 Poverty Headcount Index vs TOI

The regression results for Poverty Headcount Index vs Trade Openness Index is shown in the Fig. 11.8 below.

The results of the regression suggest a strong correlation between Poverty Headcount Index (Percentage of population under $1.25 a day) and trade openness. However, our observed sample is quite small, and only consists of 3 points, thus no empirical correlation is established for these two variables despite the strong fit of the regression model. More data is desired to make further conclusions.

11.4.4.4 Gini Coefficient in Urban Sector vs Mean Tariff Rate

The regression results for Gini Coefficient in Urban Sector vs Mean Tariff Rate are shown in the Fig. 11.9 above.

The regression results establish a fairly strong relationship between these two variables. As tariffs are reduced inequality increases in the urban sector.

11.4.4.5 Gini Coefficient in Rural Sector vs Mean Tariff Rate

The regression results for Gini Coefficient in Rural Sector vs Mean Tariff Rate are shown in the Fig. 11.10 below.

The regression results show a weak relationship between these two variables. As tariffs are reduced there is almost constant inequality in the rural sector. The R2 value is quite low thus a definite conclusion cannot be drawn, this regression model is also limited by the low number of observations in the data sample.

11.4.5 Discussion of Results

From our time series graphs, we can see that inequality did decrease during the liberalization year, but increased shortly afterwards. In addition, the HDI did increase during the liberalization year. It is inconclusive if liberalization is the cause of these observations, but it may be a factor at play. From the regression analysis there is a weak trend that economic liberalization has increased inequality in the urban sector. It is observed that increasing the trade openness and decreasing tariffs results in a inequality increase in the urban sector. The trend in the rural sector is harder to understand, as there may be different exogenous factors at play. The regression suggests that inequality may decrease with increased trade openness. The effect of poverty headcount index vs trade openness was unexpected, it was observed that headcount of people living under $1.25 a day increased with trade openness. This may be a statistical fluke as the observed sample data was extremely small, or other exogenous factors may be at play.

In general, the regression analysis suffered from a lack of observable data, and high variability. For most cases, the R2 values were unacceptable high to draw any definite conclusions, thus the regression analysis simply displays possible trends between liberalization and inequality, and liberalization and poverty. For a more definite proof, a literature review will be conducted in the following section, that outlines other papers that examine the topic of liberalization, inequality and poverty. Many of these papers use much more robust data and advanced econometric models in their analysis, resulting in conclusions that are more empirically sound. Although this section did not find a definite link between liberalization and inequality, and liberalization and poverty, we can still make the following conclusions:

-

1.

Overall income inequality did decrease during the year of liberalization

-

2.

The data suggests weakly that liberalization may have resulted in increased inequality in the urban sector

-

3.

The data suggests weakly that liberalization may have resulted in decreased inequality in the rural sector

-

4.

Absolute poverty as reflected by the HDI, decreased during the year of liberalization

11.5 Survey of Various Quantitative Approaches in Literature

The methodology used in this research lead to inconclusive results due limitations of data, and perhaps the simplicity of the regression model. This section explores similar literature, and whether or not others have shown the link between liberalization and inequality, and liberalization and poverty in an empirical fashion.

11.5.1 Literature on Economic Liberalization and Income Inequality

According to [2], analysis using a distributed lag model is better in showing empirically the relationship between trade liberalization and inequality.

In econometrics a distributed lag model is a model for time series data in which a regression equation is used to predict current values of a dependent variable based on both the current values of an explanatory variable and the lagged (past period) values of this explanatory variable. This is used because sometimes the effects of a policy change are not felt immediately, but rath distributed over time periods. Trade liberalization does not have an instantaneous response on income inequality, but rather a gradual response spread over many time periods.

The general distributed lag model can be with one explanatory variable and one dependent variable can be written as:

Using this model [2], assumes that trade liberalization can be represented using export growth and that a Poisson random variable is appropriate for small vales of x. The model in [2] then can be written as:

zt is the growth rate (log difference) of the inequality indicator in period t as measured by either the Gini coefficient or the CV. The variable ut is the growth rate of national exports as measured by either nominal national exports or exports as a percent of GDP. The coefficient a1 measures the effect of an increase in national exports on inequality. Agarwal et al. [2] solved this equation for various Gini coefficient data, CV data, and export data and concluded that: in some cases, liberalization has reduced income inequality throughout the years in a distributed fashion.

However, using distributed lag models, the conclusion for each state is different, and there are some problems with the quality of the data [1].

Similarly, in [16], a empirical strategy based on regression was used to determine that liberalization induced productivity at the firm level gets passed on as industry wages. This in turn decreases the wage inequality between skilled and unskilled workers in India.

In a paper by [19], there was sufficient evidence to conclude that income inequality was increasing along with the presence of persistent poverty. However, there is no causation or link directed towards economic liberalization. Thus, the overall increase of inequality may be attributed for factors besides trade liberalization.

11.5.2 Literature on Economic Liberalization and Poverty

According to [15], wage increases in the urban informal sector brought by trade reform had a favourable impact on urban poverty reduction. Using a simple empirical model and generalized least squares regression, [15] has shown this to be the case. The main result is that trade liberalization in sectors that compete with imports “raises informal wage across occupational types, and expands production and employment in the informal industrial segment”. Since many people stricken by poverty are employed in the informal sector, this improves the development situation of the poor.

Using more robust and complete data extracted from National Sample Survey Organization in India (NSSO), [8] has shown that growth in India has tended to decrease levels of absolute poverty in both the pre-liberalization era and post-liberalization era using indicators such as headcount index of persons below the poverty line, and squared poverty gap index. Using the headcount index as a poverty measure, [8] found the rate of poverty decline increased post liberalization, suggesting liberalization might be a factor that was crucial in alleviating poverty.

It is critical to note that [8] simply observed this trend, and did not link it economic liberalization. There is no formal empirical linkage between liberalization and poverty reduction.

11.6 Cause and Effect of Inequality

In the regression analysis in this paper, there was a weak statistic inference that trade liberalization had an effect on inequality and poverty. Either the observed sample data is badly conditioned, or various other exogenous factors besides liberalization results in inequality. This section discusses some possible exogenous factors that may be at play.

11.6.1 Causes of Economic Inequality

There are some well-defined causes of economic inequality that are exogenous to the analysis in this paper. For example, the labour market can be a significant factor in determining the wage for different occupations, dictated by the supply and demand of different types of occupations. In a pure market economy, the wages are entirely determined by the market, which may skew wages down in occupations where a large amount of supply is available. This will result in income inequalities between professions in a market economy.

A person’s innate ability and level of education may also play a significant role in determining wages paid in the labour market. It is expected that people with lower education, due to lack or access or otherwise, will experience lower wages in the job market. It is also fair to assume that people with higher abilities, perhaps in terms of intelligence will function more effectively within society and command higher wages. The proportion of people with high functioning abilities is assumed to be low compared to the general population, thus these few individuals could potentially command significantly higher wages, thus creating income inequality.

Technological development in the last several decades has automated many labors and manufacturing oriented tasks, and in turn has created a demand for high technology skills to create more technological products. The demand for skilled labour has increased, and this has not been met adequately with supply.

Finally, trade liberalization theoretically can reduce wages in highly developed countries because low wage workers in poorer countries will perform the same production tasks as workers in developed countries. This in turn can have a positive effect on wages in developing countries, such as India.

11.6.2 Effect of Economic Inequality

According to [20], rising inequality can cause capital flight, rich people will spend much of their incomes on imported luxury goods. Thus, the rich will not save and invest in the local economy, “representing a substantial drain on resources”. According to classical growth theories, this will be sure to hamper growth, as economic growth depends on accumulation of savings and capital. Additionally [20] argues that higher inequality tends to overemphasize higher education at the expense of primary education, thus creating more inequality.

High levels of inequality have a negative effect on social cohesion. According to [20] high levels of inequality strengthens the political power of the rich and hence their bargaining power. High inequality leads to rent seeking behaviours, and failure of populist policies. Additionally, crime rates, mental health problems and teen-age pregnancies are lower in countries like Japan and Finland compared to countries with greater inequality such as the US and UK [22].

To complete the discuss about inequality, some mitigating factors that may alleviate economic inequality include: income redistribution via progressive taxation, bridging the educational divide between rich and poor, subsidization of goods and services that are frequently used by everybody, and nationalization of goods and services such as healthcare.

11.7 Conclusions and Future Research

In this research we hypothesized that increased growth in India due to neoclassical economic liberalization policies should lead to a reduction in absolute poverty levels and income inequality. Based on the empirical analysis in the research we cannot say with certainty that there is a reduction in poverty and inequality, due to statistical weakness of the regression models used in this research. The regression analysis suffered from either lack of data, or extremely dispersed data, possibly due to factors exogenous to the regression model. These factors may be other causes of economic inequality discussed in the previous section. The empirical analysis in the research suggests that:

-

1.

Overall income inequality and poverty decreased during the year of liberalization, but is not proven to be strongly correlated with liberalization

-

2.

Weak evidence suggests that inequality increased in the Indian urban sector and decreased in the rural sector due to liberalization

A review of literature strengthens the empirical analysis by confirming that generally income inequality decreases due to economic liberalization. This does not imply that overall inequality decreased, but rather the effect of liberalization has a tendency to reduce inequality. As mentioned before, many factors outside liberalization may be responsible for changes in inequality. Further literature review confirms that economic liberalization does tend to decrease poverty levels holding all other factors that affect poverty constant.

Future areas of research will involve developing a robust model that will more accurately test statistically the effect of liberalization of many indicators of poverty and inequality not covered in this research. More sophisticated regression techniques, along with multiple regression methods can be used to test the effect of various other factors besides liberalization that effect poverty and inequality, to determine which factor has the greatest effect on development.

References

Agarwal, V. (2007). The impact of trade liberalization on income inequality: A study of India. PhD thesis, George Mason University.

Agarwal, V., Paelinck, J., Reinher, K., & Stough, R. (2008). Trade liberalization and income inequality in India: A poisson distributed-lag analysis. Applied Econometrics and International Development, 8, 187–192.

Bajpai, N., & Sachs, J. D. (1997). India’s economic reforms: Some lessons from East Asia. The Journal of International Trade and Economic Development, 6, 135–164.

BBC. (1998). India: The economy. http://news.bbc.co.uk/2/hi/south_asia/55427.stm

Cali, M., Ellis, K., & te Velde, D. W. (2008). The contribution of services to development: The role of regulation and trade liberalisation. Overseas Development Institute (ODI) Project Briefings.

Chaudhary, C. M. (2005). India’s economic policies. Sublime Publications.

Chitke, R. P. (2011). Essays on regional economic growth in India. PhD thesis, University of Oklahoma.

Datt, G., & Ravallion, M. (2011). Has indias economic growth become more pro-poor in the wake of economic reforms? Oxford University Press.

Financial Express. (2004). Redefiningthe hindu rate of growth. http://www.financialexpress.com/news/redefining-the-hindu-rate-of-growth/104268/1

Fuller, D., & Stevenson, G. (2003). Consensus among economists revisited. Journal of Economic Review., 34(4), 369–387.

International Monetary Fund. (2002). What caused the 1991 currency crisis in India? IMF Staff Papers, 49(3).

International Monetary Fund. (2008). Global trade liberalization and the developing countries. http://www.imf.org/

International Monetary Fund. (2011). Report for selected countries and subjects. http://www.imf.org/

Jha, V. (2005). Trade adjustment study: India. www.unctad.info/upload/TAB/docs/.../india_study.pdf

Kar, S., & Marjit, S. (2008). Urban informal sector and poverty. International Review of Economics and Finance, 18(4), 631–642.

Kumar, U., & Mishra, P. (2008). Trade liberalization and wage inequality: Evidence from India. Review of Development Economics, 12(2), 291–311.

McCulloch, W., & Cirera. (2001). Trade liberalization and poverty: A handbook. Centre for Economic and Policy Research.

OECD. (2007). Economic survey of India, 2007. In Policy brief.

Pal, P., & Ghosh, J. (2007). Inequality in India: A survey of recent trends. Economic and Social Affairs.

Todaro, M., & Smith, S. (2009). Economic development. Pearson Education.

Tussie, D., & Aggio, C. (2003). Economic and social impacts of trade liberalization. Trade Analysis Branch – UNCTAD.

Wilkinson, & Pickett. (2009). The spirit level slides (Technical report). Penguin.

World Bank. (2011). World Bank data by country. http://www.worldbank.org/

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Narayan, R., Narayan, S. (2022). Effects of Economic Liberalization on Poverty and Inequality in India – A Case Study of Pre-COVID-19 Period. In: Anandan, R., Suseendran, G., Chatterjee, P., Jhanjhi, N.Z., Ghosh, U. (eds) How COVID-19 is Accelerating the Digital Revolution. Springer, Cham. https://doi.org/10.1007/978-3-030-98167-9_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-98167-9_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-98166-2

Online ISBN: 978-3-030-98167-9

eBook Packages: Computer ScienceComputer Science (R0)