Abstract

By creating credits commercial banks contribute to the national economy and their branches are the catalysts of depositing, lending, and other associated activities. To comprehend the efficiency of commercial banks their branches must be brought under the microscope. The purpose of this chapter is to analyze the comparative efficiency of the bank branches from a micro point of view by introducing environmental changes. Firstly, we utilize Data Envelopment Analysis (DEA) to micro-analyze 18 bank branches of a Chinese commercial bank. Secondly, we decompose the effectiveness into efficiency and productivity to estimate the bank branches’ relative efficiency and productivity. To add, we also examine overall productivity along with average efficiency that assists in understanding each staff’s performance; this is a rarely investigated territory. Thirdly, we employ operating environment factors—a novel approach—with three dimensions (business conditions, competitiveness, and future development) to further detect and rank bank branches efficiency. We found that some branches performed efficiently (inefficiently) even in lower (higher) external environments; hence, locations and individual performance are vital influencers of bank branches’ efficiency. We recommend practical measures to improve the efficiency of inefficient branches in the areas of expense, revenue, and management; this will be beneficial for any commercial bank’s policy-making efforts.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

JEL Classification

1 Introduction

Commercial banks are credit creating institutions belonging to the banking sector that contribute to national economies. Under the circumstances where indirect financing is still dominant, the efficiency of commercial banks directly affects running the vital functions of an economy, and the branches of a commercial bank are its basic units. Hence, studying bank branches’ efficiency has become increasingly important.

The effectiveness (productivity and efficiency) is a composite index to measure the output conditions of a real economy. In the area of traditional manufactory industries, effectiveness can be measured by technical levels, such that the efficiency can be calculated by the raw materials’ input and products’ output. However, it is more complicated to evaluate the efficiency of the banking industry. The efficiency of the banking sector implies a comparative relationship between input and output during operating procedures; and the key point is that it is considered as a measurement of the allocation of resources.

There are several approaches to evaluate bank efficiency. The most popular idea is to apply operation research to maximize the output while minimizing the input: here the main idea revolves around selecting a proper input-output methodology. Overall, there are two types of methodologies that can be applied (Vu et al., 2019): one is parametric that needs to specify the production function and error term distribution, and the other is non-parametric, that does not need to fix the shape for the frontier efficiency; additionally, it does not require a clear definition of a production function in advance. The nonparametric approach is more widely applied; particularly, it can produce robust results when the production function is hard to estimate. Since the banking sector belongs to the service industry, it is difficult to create a production function between inputs and outputs. Therefore, nonparametric methodology is more appropriate for bank efficiency analysis. There are many bank branches and those that are located in the same area hold similar characteristics, which is best examined using Data Envelopment Analysis (DEA) methodology. This chapter adopts one of the nonparametric analyses, i.e., DEA to examine and evaluate the bank branches’ efficiency.

There are several studies that applied DEA to Chinese bank efficiency analysis (e.g., Dong et al., 2016; Liu et al., 2020; Luo et al., 2012; Paradi et al., 2010). However, most of them focused on a few large state-owned banks and stockholding banks through macro perceptions (Chan & Karim, 2010). Some of them examined the overall relative efficiency of large state-owned and stockholding banks. Some of them conducted a comparative analysis of the Chinese city banks (Chen, 2020). Others applied advanced techniques to estimate the Chinese commercial banks’ efficiency (e.g., Antunes et al., 2021).

However, there is a clear lack of studies using a micro-level analysis of bank efficiency. Since different banks have distinctive management traditions, their performance can only be improved according to detailed and feasible policies. Therefore, micro-policies for different banks are more important than the macro counterpart. There are almost no studies on Chinese bank branches' efficiency, although there are a large number of studies on other countries’ bank branches (Wu et al., 2006).

To compensate for the above previous studies’ shortcomings, this chapter, based on the micro point of view, analyzes the comparative efficiency of banks’ basic units—bank branches—and introduces environmental changes to re-examine these banks’ efficiency. Finally, it presents some effective resolutions for improving bank efficiency.

The contributions of this study are listed as follows:

-

Firstly, we apply DEA to the efficiency analysis of the bank branches at the micro-level rather than at the macro-level, which differs from the previous studies. We collected data from all of the 18 bank branches of one large commercial bank in one area of China, and then we apply the DEA to those bank branches.

-

Secondly, we examine both overall and average productivity for these bank branches. Since all bank branches normally are similarly scaled and planned for both personal and capital, it is significant to calculate the average productivity to evaluate the efficiency per capita. This is also dissimilar to previous studies, which may lead to the proposal of reasonable goals and adjustments.

-

Thirdly, we introduce external environment indices and evaluate them on three dimensions (business condition, competitiveness, and room for future development). We evaluate the bank branches’ performance not only at varied environmental levels but also under similar environments, which enabled us to provide suggestions for improvement based on branches’ detailed situations. We introduce environment scores for these branches and reevaluate them using DEA. This micro-level analysis is novel, which may provide beneficial ideas for commercial banks’ decision-making.

The rest of this chapter is organized as follows. Section 2 introduces the previous studies and our motivation for this chapter. Section 3 enumerates the methodology followed in sect. 4, data selection is described. Section 5 employs an empirical analysis to assess the efficiency of bank branches of a Chinese commercial bank. The conclusion as well as the suggestions are given in the closing section.

2 Overview of Previous Studies

In the analysis of bank efficiencies, the concept of comparative efficiency is usually examined by defining a certain efficiency score for the best one out of all the samples as “1.” The efficiency scores are calculated by using operations research. These scores are between “0” and “1.” All the sample banks’ efficiency scores are calculated and then compared to the best one. The closer the score is to the one, the more efficient the bank is; otherwise, it is inefficient. DEA is a nonparametric maximization approach that is widely applied in bank efficiency analysis.

Sherman and Gold (1985) were among the first who adopted DEA to the bank efficiency analysis. They found it difficult to fix a detailed function while using multiple input factors or services to analyze bank efficiency. Only DEA could be utilized for efficiency analysis without defining a real function. Sherman and Gold’s analysis examined the least efficient bank branches and provided improvement suggestions.

Vassiloglou and Giokas (1990) applied Sherman and Gold’s methodology to analyze 20 Greek commercial bank branches. Again, Sherman and Ladino (1995) examined 33 branches of one commercial bank using DEA, and they helped the bank save 20% in personnel costs and six million US dollars in operating costs. Haag and Jaska (1995) made a detailed analysis of a banks’ inefficiency and focused on a technical efficiency analysis. Golany and Storbeck (1999) applied DEA to detect the efficiency of bank branches of a large American bank using 6 quarters of sequential data and discovered seasonal effects on the bank branches’ efficiency. Moreover, Seiford and Zhu (1999) conducted two-stage DEA analysis on 55 American bank branches and concluded that big banks performed well in making profits while small-sized banks were efficient at marketing. Paradi and Schaffnit (2004) employed DEA analysis on the local bank branches of one Canadian commercial bank. They classified the areas according to different economic levels and then investigated those levels as factors effecting the efficiency of those bank branches. Shokrollahpour et al. (2016) applied DEA with a neural network approach to establish more reliable benchmarks for evaluating the bank branches. McEachern and Paradi (2007) compared domestic banks’ and multinational banks’ efficiency and found that their effectiveness and productivity are not completely positively correlated. Interestingly, Paradi et al. (2010) proposed a new adjusted DEA by adding cultural difference factors to the analysis of multinational banks because it was difficult to determine the multinational banks’ efficiency. In addition, Paradi et al. (2011) focused on banks’ output, productivity, and agency functions to analyze more than 800 Canadian bank branches and built a multidimensional assessment approach.

Compared to previous overseas studies, Chinese domestic studies began later. Wei and Wang (2000) analyzed 12 commercial banks using DEA. They calculated the technical efficiency, real technical efficiency, and scale efficiency, respectively; and they also compared state-owned banks with stockholding banks. They proposed some suggestions for improving the macro efficiency. Zhang (2003) analyzed three different types of banks, i.e., state-owned banks, stockholding banks, and city commercial banks, and he calculated the overall banks’ efficiency based on their resource usage. Further, he employed Malmquist index to examine efficiency changes.

Chi et al. (2006) analyzed four state-owned banks and ten stockholding banks. They applied DEA input and output analysis to get the composition efficiency values and calculated inefficiency rate for the low-performing banks. On the other hand, Xu and Shi (2006) applied both DEA and SFA to examine 14 state-owned banks and stockholding banks between 1997 and 2001 by employing both correlation analysis and consistency analysis. They found that the results were similar. He used the DEA input-oriented model to analyze 14 state-owned banks between 2001 and 2004. He further decomposed the data and employed a detailed analysis of the banks, and then did a regression analysis. He found that there is a practical index that affects the banks’ efficiency. Song et al. (2009) analyzed 14 commercial banks focusing on the data of 2007, using DEA priority and non-priority models to rank the banks. Zhou et al. (2010) considered two parts of management: the organization of funds and how the fund is operated. They employed a two-stage DEA model to analyze 15 commercial banks between 2003 and 2007, focusing on technical efficiency analysis, real technical efficiency analysis, and scale efficiency analysis. They concluded that overall, the commercial banks’ efficiencies are lower than the stockholding banks’ efficiencies. Wang et al. (2011) applied DEA to ranking14 banks between 2004 and 2009; they did further analysis on bank efficiency using the Malmquist exponent index and estimated the overall productivity’s shifting tendency. Zhou and Zhu (2017) investigated the efficiency of 12 Chinese commercial banks using a Super-SBM DEA model and the Malmquist index. They found that technological progress is a very important factor that influences the Chinese commercial banks’ efficiency. Niknafs et al. (2020) applied Artificial Neural Network to estimate the efficiency of bank branches. They obtained the dynamic results of the bank branches’ efficiency. Antunes et al. (2021) employed the DEA-RENNA approach to examine Chinese bank efficiency. Wei et al. (2021) applied a Machine Learning Approach to evaluate the rural banks’ performance. Zhao et al. (2021) applied two network models to estimate the efficiencies of banks, examine the efficiencies of Chinese commercial banks in the period 2014–2018. They found the joint-stock commercial banks are most efficient.

Comparing earlier Chinese and overseas studies, it is clear that most overseas studies focused on bank branch analysis; whereas earlier Chinese studies considered overall bank sector and compared the different efficiency levels of large banks rather than bank branches. We assume that the earlier Chinese studies had their limitations. Firstly, there are considerable differences between the large state-owned banks, the stock-holding banks, and the city banks. For example, the Big Four (The Industrial & Commercial Bank of China, the China Construction Bank, the Bank of China, and the Agricultural Bank of China) have received various government policies, even for the same business operation. These different banks also receive varying levels of support from the government. It is hard to compare bank efficiencies under such divergent external and internal environments. Secondly, different banks oversee unlike areas; some banks cover coastal areas while other banks mainly cover rural areas. Therefore, there is little meaning in comparing large banks operating in divergent areas. Thirdly, the macro efficiency analysis can contribute insignificantly to help improve these banks’ performance at micro levels. Lastly, earlier Chinese domestic studies and overseas studies were mainly focused on comparative efficiency analyses. They mostly considered scale efficiency, technical efficiency, and real efficiency. However, studies comparing overall and average efficiency are few in numbers.

This chapter aims to analyze bank branches focusing on micro perceptions. Each bank branch is examined according to its situation and is assessed and graded comprehensively. We decompose the effectiveness as efficiency and productivity and select reasonable indices to conduct efficiency analysis using DEA. Since each bank branch has its differing location and environment, we process the efficiency analysis based on those variations. Consequently, we present improvement proposals for those bank branches that should raise their efficiencies.

3 Methodology

The idea of DEA was based on Farrell (1957) research on assessing British Agriculture Productivity. The approach has evolved and improved since the original context. In 1978, firstly, Chames et al., (1978) proposed an input-oriented DEA model—the Charnes, Cooper, and Rhodes (CCR) model (Chames et al. 1978). It is a nonlinear approach to measure the relative efficiency of a target unit by using multiple inputs and outputs. The efficiency of one unit is calculated as the ratio of a weighted sum of their outputs and inputs. By solving LP problems, the best weights can be found that maximize the efficiency ratios. Those that obtain the best weights are considered as having the best performance and are defined as efficient units so that the best efficiency ratios form the “efficient frontier.” To test whether other Decision Making Units (DMUs) are efficient or not, one only needs to examine whether the results of their efficiency ratios locate on the efficient frontier line or not. If the result of one Decision Making Unit (DMU) locates on the line, then it is relatively efficient; otherwise, it is inefficient.

Since the early 1980s and 1990s, DEA began to be widely used in educational institutions, financial institutions, hospitals, supply chains, and other areas of comparative efficiency analyses. It has contributed toward helpful policy making.

So far, many researchers have been applying DEA to the efficiency analysis of commercial banks. Let us consider that in one area there are n networks, each is an independent DMU. DMUi has m inputs and s outputs. Xij refers the jth input by DMUi, Yik represents the kth output by DMUi. Therefore, the inputs of DMUi can be expressed as a vector as below:

Outputs of DMUi can be written as follows:

Vector Xi and Vector Yi are non-negative, and at least one component is larger than zero. Suppose the input weight vector is uT, the output vector is vT, such that the efficiency of DMUi can be defined as follows:

If we assess the DMU of number i0 (1 ≤ i0 ≤ n), for simplification, we define the DMU as DMU0, input as X0, and output as Y0. Consequently, we can employ C2R model to examine the relative efficiency of number i0’s DMU as follows:

According to LP theory, the above maximization problem can be transformed into its partner problem, i.e., minimization problem, which provides the same information as the original one. This is a way to find out the inefficient DMUs in turn so as to be improved to be efficient. However, it is complex and difficult to solve mathematical problems in this way and it is wise to introduce small variables ϵ and slack variables s+ and s−. Therefore, the primal model can be transformed as follows:

In the formula, \( {e}_1^{\tau }=\left(1,\dots, 1\right) \) is a unit vector, which has m components, and \( {e}_2^{\tau }=\left(1,\dots, 1\right) \) is another unit vector, which has s components. \( {s}^{-}={\left({s}_1^{-},\dots, {s}_m^{-}\right)}^{\tau } \) is input related slack variable while \( {s}^{+}={\left({s}_1^{+},\dots, {s}_s^{+}\right)}^{\tau } \) is output-related slack variable. By solving the LP, the optimized solution can be reached as θ0, \( {\lambda}_i^0 \) (i = 1, …, n), which satisfies the following:

-

1.

if θ0 = 1, s+0 = 0, s−0 = 0, then DMU0 is identified as efficient, that is, when the unit input is X0, it will produce Y0 which lies on the frontier line. It means DMU0 reaches the area of most efficiency compared to other n-1 DMUs.

-

2.

If θ0 = 1, s+0 ≠ 0, s−0 ≠ 0, then DMU0 is identified as weakly efficient, that is, this unit can keep producing Y0 while reducing the input of s−0, or it can raise the output of s+0 with the input unchanged.

-

3.

If θ0 < 1, then the DMU0 is defined as inefficient. In this case, the unit can only keep the output from declining by reducing the input at the θ (0 < θ < 1) times.

4 Data Set

4.1 Indices and Data Selection

This chapter uses micro-data offered by the 18 branches individually. It is important to select reasonable indices to examine each bank branch’s efficiency. Previous studies commonly adopted varied input and output sets, such as fixed net asset, number of employees, and personnel expenses as the input indices along with deposit, loan, cash volume, and transaction volume as the output indices. For example, Matousek et al. (2015) used total personnel expenses, total interest expenses and total operating expenses as input variables, and total net loans, total securities, other earning assets, and nonperforming loans as output variables. This chapter does not use the original raw data, rather, it considers aggregated data. For example, personnel expense is aggregated data compared to the number of employees. Meanwhile, we focus more on a period of time instead of a specific point of time. This enables us to assess a bank’s performance more dynamically.

We employ the following input and output indices based on previous studies and available data.

-

Input indices:

-

(i)

Personnel expenses: This is a measurement of the human resource expense of commercial banks, which is a vital daily cost. It is reasonable to use it as an input factor.

-

(ii)

Operating expenses: Since commercial banks are required to develop diverse businesses and obtain good returns through carrying those businesses, it is reasonable to select this factor as well.

-

(i)

-

Output indices:

-

(i)

Operating income: This reflects the bank branch’s operating ability and their goal of raising their branches’ profits by obtaining higher operating income. Thus, this index is proper for an output index.

-

(ii)

Daily deposit value: Commercial banks deal directly with bank branches of all individual depositors. Therefore, the bank branch’s deposit volume will affect the branch’s performance and future loan allocations from its head bank. Thus, it is also a vital output index.

-

(i)

Additionally, we do not add loan value and net profit because of the following two considerations: (1) loans are not only provided by the bank branches; some resources from public loans are distributed from their head banks. Hence, the loan volume is not a proper index to examine a bank branch’s performance and (2) the profit factor is already embedded in the adopted indices; hence, it is not necessary to add a profit factor.

As mentioned above, this chapter analyzes both efficiency and productivity of commercial banks, unlike other overseas and Chinese DEA studies. We consider one bank branch’s input and output’s overall produced value over a particular period as the overall productivity and the bank branch’s input and output’s average produced value as the average efficiency. This approach includes not only the staff number as an influencing factor but also introduces a new concept, i.e., the average efficiency. This can examine the staff’s performance. This provides more reasonable and complete evidence for assessing a bank branch’s performance.

Further, to have a detailed analysis of the inefficient branches, we introduce business environment factors with three dimensions (business condition, competitiveness, and future development). We collect the business environment data by telephone questionnaires. Data from the 18 bank branches are investigated by visiting those banks individually and the timeline ranges from 2012 to 2014. For privacy reasons, we omit the name of the commercial bank and have removed all the sensitive words that could be linked to the bank. The data is applied in the following empirical analysis.

5 Empirical Analysis

5.1 Model Selection Analysis Process

This chapter analyzes both productivity and efficiency using both CRS (Constant Returns to Scale) and VRS (Variable Returns Scale) models. We approach DEA by setting personnel expenses and operating expenses as the input factors and operating income and daily deposit volume as the output factors. Then, the results are used to examine the overall performance of the bank branches. Further, we collected the staff numbers of all the bank branches and calculated the personnel expenses per employee, the operating cost per employee, the operating income per employee, and the daily deposit volume per employee. Consequently, we use the advanced data to process DEA again and re-examine the bank branches’ performance. In addition, the location of each bank branch varies widely and has a completely different operating environment. Hence, we divide the bank branches into distinguishable groups and conducted a comparative analysis on those groups. Finally, we provide suggestions for the bank branches in the different groups.

5.2 Overall Productivity and Average Efficiency Analysis Based on the Input-Output Model

We may build our DEA model under a linear program or a nonlinear program. These results can be expressed in CRS (Constant Returns to Scale) and VRS (Variable Returns Scale), respectively. Generally, the value of VRS is a bit bigger than CRS due to different assumptions. However, the two different results conform with each other.

In Tables 1 and 2, the level of productivity and efficiency is examined by the value of θ. We can see that the CRS results for overall productivity are in the same string as regards to average productivity. However, the VRS results for overall productivity are lower than that for average efficiency. We find that there is a high correlation between overall productivity and average efficiency. Logically, it can be assumed that the bank branches with lower levels of overall productivity, also have lower levels of average efficiency. This confirms our intuition. As we may state, only raising the average efficiency can drive an increase in overall productivity. Looking at the results judiciously, we find that some bank branches (A, F, G, I, J, M, O, P, and Q) have both low productivity and efficiency. Some bank branches performed worse in some years, i.e., branch K performed soundly in 2012 and 2013 but its performance dropped in 2014; branch R’s performance improved largely from 2012 to 2013; however, in 2014 it returned to the 2012’s level. Additionally, the performance of the branches H, N, and Q remained constant at medium levels. In contrast, branches C, D, E, and L had outstanding performance. Interestingly, branches C, D, and L were highly efficient during the 3 years while branch E’s performance reached to an efficient level in 2013 and 2014.

5.3 Input and Output Analyses under Different Business Environments

We assume that the surrounding environment has three dimensions: management condition, competitiveness, and room for future development (see Table 3). Each dimension has its own identification criteria to quantify the surrounding overall management. The environment score for a bank branch is calculated based on the values of these three dimensions. Next, the highest score is standardized as 100, while the other bank branches’ scores are recalculated and ranked in an ascending order from the smallest to the largest. Table 4 displays the business environment scores of the branches except for A and R. The environment contexts for bank branches A and R could not be measured due to insufficient data.

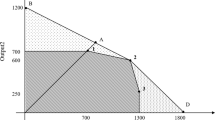

According to the environment scores, two groups are created: one with scores lower than 50, defined as group 1, and the other with scores above 50, defined as group 2. It is reasonable to compare the bank branches in the same group as they have similar environmental conditions. The results of the two groups’ relative productivity and relative efficiency analyses are displayed in Table 5. Here, the value θ is the efficiency value; to simplify, Table 5 only shows the results under the CRS.

Table 5 is ordered in an ascending manner for the business environment. As we can see from Group 1, the relative productivity and efficiency θ is well ordered from low to high, which indicates that the least efficient bank branches have a relatively worse business environment. This finding implies that the branch efficiency may be highly dependent on the external environment. A branch may reach a satisfactory performance because it has a favorable environment. On the other hand, it is worth noticing that, branches B and G have good efficiency levels given that their environment scores are low. Thus, it can be understood that the management levels of these banks are prodigious. However, bank I’s efficiency level is below average despite the fact that its environment score is above average. This means that the branch’s management is weak and needs to be improved. In addition, in 2014, branch M’s performance was dropping year by year. Accordingly, it should receive increased attention.

Looking at the second group, we can see from the results that bank C performs outstandingly even under an ordinary business environment. Bank Q’s performance is distinctly worse than other banks’ performances that match with their business environment. Therefore, overall, following the results of the relative efficiency analysis, we focus on the banks with relatively low-efficiency levels from the above two groups and conduct further analysis on them.

5.4 Analysis of the Low Efficient Bank Branches

From Table 5, six branches (F, I, J, M, P, and Q) are relatively lowly efficient or under unfavorable business environments. Branch J’s performance remains very low and it has a pathetic business environment score of only 7. It implies that there is no room to improve branch J’s performance. Branches F, I, M, and P have relatively poor business environments. Branch Q is in a sound business environment but has comparatively lower efficiency. In order to determine the possible reasons and provide constructive suggestions for these inefficient branches, we apply DEA again to assess these inefficient branches’ performance in 2013 and 2014.

In the following, we employ DEA to the five inefficient branches (F, I, M, P, and Q). Here, we do not further measure Branch J’s efficiency since there appears to be no room to improve the branch’s performance. Then we calculate the possible room for improvement of these branches’ efficiency. This process may enable us to find the possibilities for improvement and make suggestions using the branches’ environmental contexts.

Tables 6 and 7 list improvement rooms for the five bank branches with relatively low-efficiency levels. When we fix the amount of input and raise the efficiency values to 1, an insufficient amount of output occurs, which is the possible amount of output that can be increased if the input is kept unchanged. We define the potential output increase rate as the room for raising output. Table 6 shows the room for raising output in 2013 and 2014. On the other hand, Table 7 displays the possible input to be saved in order to improve the efficiency value θ to 1, given that, the output is kept unchanged. This is the average amount of reduced input. Therefore, the smaller the θ is, the larger the room for raising output will be; and, the less room will be left for saving input. In fact, each bank branch faces a distinctive external environment, such as the number and scale of neighboring districts, the number and scale of enterprises, the density and mobility of population, competitiveness with other bank branches, and other factors affecting business development. Hence, it is difficult to compare the bank branches directly. Therefore, this chapter introduces a new idea of adding the external environments. In Table 8, we present the business environments of the six inefficient branches in a detailed manner.

As seen from Table 8, some bank branches have worse business environments with lower scores; thus, they have no assured room to improve in the future. It is inefficient to input more resources there. Therefore, we may consider reducing the inputs and controlling costs so as to increase efficiency. Interestingly, branches with relatively high-performance indicators have more room for future improvement. Thus, it is necessary to focus on raising their productivity by increasing input and building up feasible business development schemes. Occasionally, branches should consider updating their managers. Further, competition in the same field should be given proper attention since it affects productivity directly. Additionally, befitting policies should be established to compete with the branches of other banks. At the same time, it is recommended to avoid excessive competition.

According to the results of evaluating the three dimensions (business condition, competitiveness, and room for future development), we determine the reasons for inefficiency and then propose solutions and suggestions for improvement.

Branch F’s external environment is at a low state; however, it has a high potential for future development. For this type of lowly efficient branches, it is suggested to save input cost so as to raise the efficiency. Thus, we suggest Branch F to increase business input costs to extend the business scale and raise its output efficiency. Branch I has a decent external environment, interestingly, it is facing fierce competition. It has limited potential as regard to development capacity. Also, the branch’s efficiency in 2014 dropped dramatically. Thus, we suggest adjusting the employees’ structure and restraining human resource expenses to increase its efficiency. As for Branch J, it has a poor external environment and seemingly it is difficult to further develop its business in the future. Since the efficiency value is small, theoretically, there may be more room for development. Nevertheless, if the external environment is too poor, then development goals would barely be realized. Thus, we suggest this branch be closed.

Branch M has a better external environment; however, its competition with the same style of businesses is weak. Hence, there is a potentially large capacity for development. Therefore, we suggest increasing its number of employees, adjusting business costs, improving the employees’ structure, and encouraging employees to raise efficiency. Pursuing the above suggestions will improve business income. For Branch P, its external environment is on the intermediate level, its potential development capacity is limited, its expenses have increased too fast, and efficiency is low. As displayed in Tables 6 and 7, there is a large capacity for improvement. Therefore, we suggest reducing the number of employees, cutting the cost of human resources and business, and improving the management system. Moreover, we suggest the branch’s manager be replaced. Finally, Branch Q has a sound external environment and potentially large output capacity due to an internal disparity between the management and developing direction. Therefore, we suggest focusing on raising its output efficiency, increasing business input costs and human resource expenses, improving management levels, and developing a better plan. It may be necessary to replace the branch’s manager in due course.

Our study focused on the bank branches’ efficiency analysis at the micro-level rather than macro-level. We not only measured the bank branches’ efficiency but also introduced external environment and reevaluate the efficiency. We found some branches’ performance was very high even in lower external environments and some branches performed inefficiently although they were provided with a very favorite environment. Thus, we may examine the efficiency in detail so that we may accordingly propose reasonable suggestions. This micro analysis has rarely been conducted by other researchers.

Further, previous studies mostly considered scale efficiency and technical efficiency. However, studies comparing overall and average efficiency are few in numbers. Since a given bank’s branches normally have similar personnel and facilities, individual abilities and skills influence the bank branch’s performance. Therefore, examining the overall efficiency and the average efficiency are both important.

We established the model analysis of 18 bank branches located in one area of China from the micro point of view which will benefit managers’ decision-making.

6 Conclusion

In China, financing is largely dependent on commercial banks. The performance of commercial banks directly determines whether the Chinese economy is healthy and running efficiently. Commercial banks’ deposit and lending business, especially for private corporations, rely on bank branches. Therefore, bank branches’ efficiency has drawn much attention from both bank managers and policy makers. Based on this concern, this chapter considered both productivity and efficiency and employed input and output analysis via DEA. Compared to previous studies, our novel points are as follows:

Firstly, this study applied DEA to the efficiency analysis of the bank branches at the micro-level rather than at the macro-level, unlike the previous studies. Many Chinese studies have focused on the banks themselves rather than their branches. Since different banks operate in varied business areas, they accordingly have uncommon policies. It is limiting to compare banks only at the macro levels. This chapter selected 18 bank branches of one large commercial bank in China and conducted DEA on those bank branches. It compared both their businesses and their locations.

Secondly, this study divided the effectiveness into productivity and efficiency. Efficiency mainly depicts the effectiveness of input while productivity primarily focuses on the overall output, this is dissimilar to previous studies. The observations from these two views are comprehensive and more convenient for bank branches, which lead to the proposal of reasonable goals and adjustments.

Thirdly, this chapter introduced external environment indices and evaluated them on three dimensions. This evaluation not only classified the bank branch groups according to varied environment levels and compare the branches under similar environments, but also made a detailed analysis which enabled us to propose suggestions for improvement, based on individual branch situations. The environment scores offered significant meaning in providing appropriate and beneficial advice for commercial bank branches.

This chapter conducted efficiency and productivity analyses and applied those using external environment indices. Based on the results, we provided improvement propositions covering three aspects: management level, personnel structure, and financial costs. We suggest that those branches having relatively sound external environments and room for raising output, need to be supported strongly. In contrast, those branches have lower external environments and room for increasing efficiency, need to save on expenditures by improving their management and reducing personnel and operating expenses. We found that better (worse) performed branches normally have favorable (unsatisfied) business environments. This implies that a branch’s location is a vital factor. On the other hand, we also found some branches’ performance was very efficient (inefficient) even in lower (higher) external environments. This implies that individual ability and performance are important. We suggest that bank policy makers conduct a careful selection of both business locations and personal before opening a new bank branch or making a decision of expanding business. Our suggestions are unambiguous and bear practical value.

Our future research will employ DEA at different levels in vertical comparisons, unlike the horizontal analysis. We will adopt time series analyses and observe the changing efficiency of the bank branches to detect similarities and disparities among them. Consequently, we may propose suggestions for those bank branches to improve their management levels, personnel structures, and/or business cost situations. Our future analysis will require additional time series data. Additionally, we may also combine the vertical and horizontal analyses to reach firm practical suggestions for improving bank branches’ efficiency.

References

Antunes, J., Hadi-Vencheh, A., Jamshidi, A., Tan, Y., & Wanke, P. (2021). Bank efficiency estimation in China: DEA-RENNA approach. Annals of Operations Research, 2021. https://doi.org/10.1007/s10479-021-04111-2

Chan, S. G., & Karim, M. Z. A. (2010). Bank efficiency and macro-economic factors: The case of developing countries. Global Economic Review, 39(3), 269–289.

Chames, A., Cooper, W. W., & Rhodes, E. (1978). A data envelopment analysis approach to evaluation of the program follow through experiments in U.S. public school education, management science research report (Vol. No. 432). Carnegie-Mellon University, School of Urban and Public Affairs.

Chen, X. (2020). Exploring the sources of financial performance in Chinese banks: A comparative analysis of different types of banks. The North American Journal of Economics and Finance, 51, 101076. https://doi.org/10.1016/j.najef.2019.101076

Chi, G., Yang, D., & Wu, S. (2006). China commercial Bank comprehensive efficiency research-based on the DEA method. Chinese Journal of Management Science, 5, 52–61.

Dong, Y., Firth, M., Hou, W., & Yang, W. (2016). Evaluating the performance of Chinese commercial banks: A comparative analysis of different types of banks. European Journal of Operational Research, 252(1), 280–295.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, Series A (General), 120, 253–290.

Golany, B., & Storbeck, J. E. (1999). A data envelopment analysis of the operational efficiency of bank branches. Economics of Education Review, 25(9), 273–288.

Haag, S. E., & Jaska, P. V. (1995). Interpreting inefficiency ratings: An application of bank branch operating efficiencies. Managerial and Decision Economics, 16(1), 7–14.

Liu, X., Yang, F., & Wu, J. (2020). DEA considering technological heterogeneity and intermediate output target setting: The performance analysis of Chinese commercial banks. Annals of Operations Research, 291, 605–626.

Luo, Y., Bi, G., & Liang, L. (2012). Input/output indicator selection for DEA efficiency evaluation: An empirical study of Chinese commercial banks. Expert Systems with Applications, 39, 1118–1123.

Matousek, R., Rughoo, A., Sarantis, N., & Assa, A. G. (2015). Bank performance and convergence during the financial crisis: Evidence from the ‘old’ European Union and Eurozone. Journal of Banking and Finance, 52(C), 208–216.

McEachern, D., & Paradi, J. C. (2007). Intra-and inter-country bank branch assessment using DEA. Journal of Productivity Analysis, 27(2), 123–126.

Niknafs, J., Keramati, M. A., & Monfared, J. H. (2020). Estimating efficiency of Bank branches by dynamic network data envelopment analysis and artificial neural network. Advances in Mathematical Finance and Applications, 5(3), 377–390. https://doi.org/10.22034/amfa.2019.1585957.1192

Paradi, J. C., Vela, S. A., & Zhu, H. (2010). Adjusting for cultural differences, a new DEA model applied to a merged bank. Journal of Productivity Analysis, 33(2), 109–123.

Paradi, J. C., Rouatt, S., & Zhu, H. (2011). Two-stage evaluation of bank branch efficiency using data envelopment analysis. Omega, 39(1), 99–109.

Paradi, J. C., & Schaffnit, C. (2004). Commercial branch performance evaluation and results communication in a Canadian bank–A DEA application. European Journal of Operational Research, 156(3), 719–735.

Shokrollahpour, E., Lotfi, F. H., & Zandieh, M. (2016). An integrated data envelopment analysis–artificial neural network approach for benchmarking of bank branches. Journal of Industrial Engineering International, 12, 137–143.

Seiford, L. M., & Zhu, J. (1999). Profitability and marketability of the top 55 U.S. commercial banks. Management Science, 45(9), 1270–1288.

Sherman, H. D., & Gold, F. (1985). Bank branch operating efficiency: Evaluation with data envelopment analysis. Journal of Banking & Finance, 9 2, 297–315.

Sherman, H. D., & Ladino, G. (1995). Managing bank productivity using data envelopment analysis (DEA). Interfaces, 25(2), 60–73.

Song, Z., Zhang, Z., & Yuan, M. (2009). An empirical DEA efficiency research of China Bank industry. Journal of Systems Science and Information, 12, 105–110.

Vassiloglou, M., & Giokas, D. (1990). A study of the relative efficiency of bank branches: An application of data envelopment analysis. Journal of the Operational Research Society, 41(7), 591–597.

Vu, L. T., Nguyen, N. T., & Dinh, L. H. (2019). Measuring banking efficiency in Vietnam: Parametric and non-parametric methods. Banks and Bank Systems, 14(1), 55–64. https://doi.org/10.21511/bbs.14(1).2019.06

Wang, J., Jin, H., & Liang, H. (2011). Analysis on efficiency of China commercial banks - based on SE-DEA and Malmquist index. Techno-economics & Management Research, 4, 124–127.

Wei, L., & Wang, L. (2000). The non-parametric approach to the measurement of efficiency: The case of China commercial banks. Journal of Financial Research, 3, 88–96.

Wei, J., Ye, T., & Zhang, Z. (2021). A machine learning approach to evaluate the performance of rural Bank. Hindawi Complexity, 2021. https://doi.org/10.1155/2021/6649605

Wu, D. S., Yang, Z. J., & Liang, L. A. (2006). Using DEA-neural network approach to evaluate branch efficiency of a large Canadian bank. Expert Systems with Applications, 31, 108–115.

Xu, X., & Shi, P. (2006). Efficiency comparative study on commercial Bank in China Based on DEA and SFA. Journal of Applied Statistics and Management, 1, 68–72.

Zhang, J. (2003). DEA method on efficiency study of Chinese commercial banks and the positivist analysis from 1997 to 2001. Journal of Financial Research, 3, 11–25.

Zhao, L., Zhu, Q. Y., & Zhang, L. (2021). Regulation adaptive strategy and bank efficiency: A network slacks-based measure with shared resources. European Journal of Operational Research, 295, 348–362.

Zhou, F., Zhang, H., & Sun, B. (2010). China commercial Bank efficiency evaluation-based on the two stages DEA model. Journal of Financial Research, 11, 169–179.

Zhou, L., & Zhu, S. (2017). Research on the efficiency of Chinese commercial banks based on undesirable output and super-SBM DEA model. Journal of Mathematical Finance, 7, 102–120.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Chu, M., Zhou, G., Wu, W. (2022). Data Envelopment Analysis on Relative Efficiency Assessment and Improvement: Evidence from Chinese Bank Branches. In: Bilgin, M.H., Danis, H., Demir, E., Zaremba, A. (eds) Eurasian Business and Economics Perspectives. Eurasian Studies in Business and Economics, vol 21. Springer, Cham. https://doi.org/10.1007/978-3-030-94036-2_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-94036-2_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-94035-5

Online ISBN: 978-3-030-94036-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)