Abstract

In this chapter, we examine the hampering factors on innovation, which are financial obstacles. Hampering factors have two possible effects on firms’ decision to introduce innovation, namely, revealed and deterring obstacles. The nature and degree of the perception of financial obstacles to innovation is investigated by firm-level data from Turkish CIS 2006 and CIS 2010. The estimations are done by using ordered probit models. According to our findings, categorizing firms by their size and foreign ownership is useful for the consideration of financial obstacles. The assessments of barriers are important for the firms who engage in five or more innovative activities. Innovatively active firms in CIS 2006 are more likely to face financial barriers to innovation than firms in CIS 2010. Highly innovatively active firms are more likely to assess barriers as highly important.

This Chapter is derived from Ph.D. dissertation entitled “Financial Constraints to Innovation Activities: Revealed Barriers versus Deterring Barriers”, by Hülya ÜNLÜ, under the supervision of Dr. Erhan ÇANKAL in the Department of Banking and Finance at Yildirim Beyazit University Ankara/Turkey in 2016.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Financial obstacles

- Innovation investments

- Innovation

- Community innovation survey (CIS)

- Ordered probit models

JEL Codes

1 Introduction

During the last century, economies have prioritized increasing productivity, ensuring continuity in quality and finding new ways to meet the needs of individuals. However, the innovation they adopt in order to achieve this goal, from knowledge to the final product/service, is a long order and costly.

It is known that the innovative activities are difficult to be financed because of their specific characteristics: main composition of the investments are intangible assets and returns that are expected from innovation investments are highly uncertain (Campello et al., 2010; Carpenter et al., 1998; Carpenter & Petersen, 2002; Lee et al., 2015; Mazzucato, 2013). Innovative firms have been investigated for various aspects. Many researchers showed the determinants of being innovative, cyclical effect on the being innovative and effect of barriers on innovative firms (Amara et al., 2004; Blanchard et al., 2013; D’Este et al., 2012; Iammarino et al., 2009). However, both being innovative, and facing barriers are wide concepts, that should be investigated in more detailed way.

According to the researchers, the completion and sustainability of the innovation process depends on the presence of some talents in the relevant companies (Almeida et al., 2013; D’Este et al., 2012; Guariglia & Liu, 2014; Iammarino et al., 2009). Lack of or partial possession of these capabilities can lead to various barriers to innovative activities (Canepa & Stoneman, 2008; Mohnen et al., 2008; Tiwari et al., 2007).

Some studies are focused on potentially innovative firms (D’Este et al., 2008, 2010, 2012, 2014; Hölzl & Janger, 2014). These studies investigated the barriers faced by innovation-intensive firms and examined the effects of firm-specific characteristics on the perception of barriers for developed countries. Developing countries are less studied (de-Oliveira & Rodil-Marzábal, 2019; De Fuentes et al., 2020; Santiago et al., 2017). However, very few studies have been conducted for Turkey (Çetin et al., 2017; De Fuentes et al., 2020). Barriers are explored in various dimensions, and special attention is paid to financial constraints on R&D spending by firms in OECD countries (Alvarez & Crespi, 2015; Hall, 2002; Hall & Lerner, 2010; Himmelberg & Petersen, 1994; Mulkay et al., 2001). The financial barriers faced by Turkish firms and the transformation of this innovation barriers vis-à-vis innovation intensity have not been examined previously.

It is important to define and highlight the different types of enterprises according to their innovation status and perception of obstacles. A successful innovation process for the enterprises depends on several elements, among which is the financing innovation investments. Enterprises engaging in innovation process perceive difficulties in accesses to finance or costs of the investments as “innovation barriers.” According to their impact on innovative activities, innovation barriers are divided into two main categories, namely, revealed barriers and deterring barriers (D’Este et al., 2012). Although enterprises are affected negatively by revealed barriers, the effects are not strong enough to terminate the innovation process. Deterring barriers, however, are strong enough to prevent the enterprises from engaging in innovative process.

The goal of this chapter is to examine the assessment of introducing innovation and the perception of financial obstacles, whether firms are affected badly but not enough to terminate the innovation process or to prevent the enterprises from engaging in innovative activities. To investigate this relationship, we developed a direct measure of perception of financial obstacles, which takes into account whether a firm has perceived problems as “lack of available finance within the firm,” “lack of available finance from other organizations,” and “high direct innovation costs.” In order to control each perception level of financial barriers, both the revealed and deterred firms have been investigated using the ordered probit model, which allows control of the correlation among financial barriers. The empirical analysis is based on the data from waves of the Turkish Community Innovation Survey (CIS), which are cross-section data, for periods of 2004–2006 and 2008–2010 (we label CIS 2006 and CIS 2010). One may also consider the effect of crises on financial barriers to innovation. Our datasets can be thought as economic boom wave and wave of economic crisis.

In the literature it is seen that each paper has its definition of innovators and non-innovators. Our study needs special care about the definition of innovators and non-innovators. It is important to define and highlight the different types of enterprises according to their innovation status. There are several reasons to have specific definitions; first in this study, as we mentioned before, we use the Community Innovation Survey, which has the information related to innovative activities of enterprises, and we are investigating the definition of the innovation concept, which is based on the Oslo Manual [(second edition from 1997 and third edition from 2005). That is why we stick with the definition of OECD/Eurostat (2005)]. Second, we believe that obstacles’ perception is closely related to the engagement in innovative activities (Marin et al., 2014). Third, and most importantly, we investigate the “revealed and deterring financial barriers.” The interpretations of the financial impediments on the innovation differ according to the perceived effect by entrepreneurs (D’Este et al., 2012). An important point, which is not to be missed out, is filtering out non-innovation-related firms from our sample. It needs to be considered in order to correct a sample selection bias (D’Este et al., 2008, 2010; Mohnen et al., 2008; Savignac, 2008).

This chapter provides a comprehensive analysis of the fundings involved in supporting innovation efforts in firms. This will help decision-makers in designing policies and in monitoring the implementations. In the case of Turkey, the effect of barriers manifests itself in two different ways: deterring barriers and revealed barriers. Our empirical findings are very much in line with the conclusions by D’Este et al. (2008, 2010, 2012) regarding the barrier perception of those participating in innovative activities. We have shown that the assessments of barriers are important for the firms who engage in five or more innovative activities. There is a common pattern among three types of financial constraints. This result is consistent with our expectation of revealed barriers. Innovatively active firms in CIS 2006 are more likely to face financial barriers to innovation than firms in CIS 2010. Highly innovatively active firms are more likely to consider barriers as highly important. If we compare two datasets, then one may say that the revealed effect is higher in CIS 2006 and, on the other hand, lower in CIS 2010.

The rest of the chapter is organized as follows: Sect. 2 analyzes the literature related to financial constraints to innovation. Section 3 describes the data and the econometric methodology. Section 4 shows our main empirical results. Finally, Sect. 5 presents the main conclusions.

2 Financing Constraints to Innovation

Arrow (1962) emphasized the importance of the financing of innovation, where firms are more prone to face credit rationing. Innovation projects show different characteristics. As we mentioned before innovation projects are highly uncertain, intangible, and asymmetrical in nature. Additionally, innovation projects are heterogeneous and accumulative. Innovative activities are different in each firm. It depends on the willingness and other undetermined conditions of the firms. It is seen that companies adopt different approaches to innovation. While there are firms that are not at all interested in innovation, there are firms that focus on only one type of innovation, as well as those that focus their entire concentration on all types of innovation. Bond et al. (2003) demonstrated that being uncertain and the intangible nature of innovation increase firms’ cost of funding and/or limit their borrowing opportunities. That is why innovative firms are more prone to facing financial obstacles. Some authors argued that the existence of financing opportunities for all firms undermines the assumptions of the perfect capital markets (Kamien and Schwartz 1972, 1978). On the contrary, recent researches revealed that the investment decisions for both firms and financiers are different in many ways because of market imperfections and problems arising from asymmetric information.

According to Fazzari et al. (1988):

…investment may depend on financial factors, such as the availability of internal finance, access to new debt or equity finance, or the functioning of particular credit markets. (p. 141)

Kaplan and Zingales (1997) suggested that any firm facing a wedge between internal and external fundings is likely to be financially constrained. When the firm is more financially constrained, the widening of the gap between the internal and external funds is a kind of bilateral effect. Hall (2002) stated that the gap between external and internal funds is not the only constraint expected to limit the funding capabilities of firms and indicated that any firm that faces a wedge between internal and external funds is likely to be financially constrained. It is a kind of a two-sided effect that the wedge between internal and external funds increase, when the firm is more financially constrained. Bond et al. (2003) defined financial constraints as a result of a cost premium for external sources of finance. This cost premium may reflect asymmetric information and conflicts of interest among shareholders, managers, and suppliers of external financing.

Early studies focused on the relationships between R&D investments and the financial factors. The more the project is found to be sensitive to the financial factors, the more the project is financially constrained. Himmelberg and Petersen (1994) examined the small and high-tech firms in the USA. Their findings revealed that there is a significant effect of internal funds on R&D investments. Mulkay et al. (2001) have a similar study to Himmelberg and Petersen (1994). Mulkay et al. (2001) studied a sample of US and French manufacturing firms and found a large impact of cash flow on R&D investments. Bond et al. (2003) examined the cash flow sensitivity of R&D investments and fixed asset investments. They indicated that financial constraints are more significant in British than in German firms who are engaged in R&D.

Canepa and Stoneman (2008) studied the role of financial factors in innovation. Particularly they have examined how these constraints vary across firm sizes and sectors. They used CIS2 and CIS3 data and analyzed them in the UK. In the analysis, they used an ordinal logistic model and found that high-tech firms are more prone to facing financial obstacles than low-tech firms. According to their results, size is also an important matter, in that small-sized firms are more affected by financial obstacles than large-sized firms.

Mohnen et al. (2008) investigated the financial constraint effects on the firms’ decision to have an innovation project. They have examined the innovation projects’ situation, whether they are abandoned, prematurely stopped, seriously slowed down, or not started. By this way they analyzed the degree of obstacles. They used a probit model in which the sample was taken from CIS3.5 for the Netherlands. They found an important and vast negative effect of obstacle on innovative activities. While most of the studies investigated the link between financial disabilities and innovative input or output, Almeida et al. (2013) investigated whether there is a relationship between financial obstacles and innovative efficiency in their work. Innovative efficiency is related to future profitability of innovation. They found that financially constrained firms are more efficiently innovative. According to them, “Tighter constraints (less slack) thus lead to more productive and value-enhancing innovation” (p. 2). According to Guariglia and Liu (2014), most of the outside investors are unwilling to fund innovation investments that are extremely uncertain.

According to Arundel (1997) to D’Este et al. (2014), the existing literature proved that the degree of intensity to be innovative and the perception of obstacles are connected to each other. Iammarino et al. (2009) used two groups of firms in their study. According to their study, innovators (introducing innovations) and non-innovators perceived innovation barriers differently. In addition, researchers found that firms who are more prone to experiencing greater barriers are also more likely to innovate successfully (Arundel 1997 and Iammarino et al. 2009). Baldwin and Lin (2002) and Tourigny and Le (2004) both found that the more the firm has an incentive to innovation, the more the firm faces greater barriers. Our hypothesis is derived from this point of view. We suggest that being innovatively active brings many problems. High costs of developing innovation and lack of access to both internal and external finances are only some of the measurable financial problems (survey-based direct measures are an example). These firms’ willingness to innovate is not lost, even if they face higher impact than barriers. For this reason, these companies are faced with revealed barriers. On the other hand, previously successful companies see their success as sufficient, and discouraged companies lose their tendency to innovate because they feel the barriers. The barriers perceived by this group of companies are deterred barriers. The literature for Turkish businesses is lacking at this point: there is a need to show how firm characteristics differ in perception of financial barriers for innovatively active firms, discouraged firms, and previously successful innovators.

The literature also investigates the effect of firm characteristics. We will give a brief literature to guide our findings. Malerba (2005) suggested that relevant sources of knowledge, stakeholders, and innovative activities are going to be different across sectors. Their incentive to be innovatively active and the perception of the financial obstacles differ between sectors (Baldwin & Lin, 2002; Tourigny & Le, 2004). Carpenter and Petersen (2002) emphasized that high-tech firms are more prone to facing financial barriers because of the nature of innovation investments, which have high uncertainty, greater information asymmetry, less collateral, and long-run projects.

According to Hipp et al. (2000), firm size has effects on the success of innovation. They suggest that larger firms have different business activities; for this reason there are more areas where firms can be innovative. Larger firms have also an advantage in terms of the available sources for innovation, and there is less risk of failure compared with smaller firms. The size of firm and its effects are a bit complicated. While larger firms have a superior advantage, smaller firms tend to be more flexible on the decision-making procedures in the introduction of innovations. According to De Brentani (1995), smaller firms are more excited about introducing innovations. Most of the papers used firm size as a determinant of innovation (Ettlie & Rubenstein, 1987). Early authors accepted the monopoly power of large firms on innovation. Schumpeter (1942) is one of them, and he suggested that risk-taking is an important feature for innovation. However, Scherer (1992) indicated that the more flexible the management structures, the less bureaucracy, and less inertia makes smaller firms more innovative than larger firms.

Schmidt and Rammer (2007) suggested that a firm that belongs to a group of firms and a firm that is not part of a group have totally different innovation strategies. This may be because the headquarter of a group of firms assigns a specific task to a given firm. If a firm belongs to a group and if the headquarter has an incentive to innovate, then it becomes more probably aware of the need of funds. It is easy for them to use their abilities of funding an innovation project for a given firm. Literature suggest that there is a link between innovation and multinational companies (MNCs) (Papanastassiou, 1999; Patel, 1995; Balcet & Evangelista, 2004; Frenz et al., 2005; Frenz & Ietto-Gillies, 2004). Castellani and Zanfei (2003) suggested that foreign-owned firms are in general more productive than domestic firms. The most important advantage of the affiliation of MNCs is that they can learn from the diverse local environments, which support a contagion effect of innovativeness on the locations where they operate. Finally MNCs not only spread the knowledge within the company but also to the countries where the organizations are located (Frenz & Ietto-Gillies, 2004). Pires et al. (2008) stated that the increasing number of foreign-owned firms has an effect on the efficiency of innovation processes. We expect the parent companies of foreign companies to introduce capital opportunities at a lower cost and bring more cash to the firm by selling products in international markets. To sum up foreign-owned firms are less likely to face financial obstacles (D’Este et al., 2014; Desai et al., 2007; Hanson et al., 2005). The advantage of being a multinational firm is having an easy access to resources, assets, and knowledge by using the partner firms’ networks, at both the global and regional levels (Dachs & Ebersberger, 2009; Dachs et al., 2008). We introduced human capital intensity variable as another independent variable (number of employees with PhD degree). Skilled personnel are important to solve clients’ innovative problems; moreover, they are a creative part of firms’ own innovation process. Human capital is also linked to the promotion of innovation (He & Wong, 2009) and the number of highly skilled workers in a firm is related to its absorptive capacity (Cohen & Levinthal, 1989, 1990). Tsang (2000) suggested that innovation and the complexity of the technique behind the innovation force the firms to understand and use external knowledge in their innovation processes. Although the use of external knowledge is necessary for firms, Hottenrott and Peters (2012) suggested that an enterprise with a high level of human capital is more likely to be unprotected against financial constraints. Intangible assets worsen the information asymmetry problems in the market for having an external capital (Lahr & Mina, 2013). Export intensity is also included as a control variable, and the correlation between the perception of financial obstacles and export intensity is expected to be positive. He and Wong (2009) suggested that a firm who is an exporter has a chance to leverage its experience within a foreign country’s customers in a demanding market to present innovative solutions to clients in foreign markets. For this reason an exporter firm expects higher returns from its innovation efforts due to its wide market reach. This also creates financing opportunities for a firm with overseas market access and increases its incentive to innovate because of its wide market reach (Boso et al., 2013; Şeker, 2012).

3 Data and Methodology

3.1 Data Source

The empirical analysis is based on the data from waves of the Turkish CIS, which are cross-section data, for the periods of 2004–2006 and 2008–2010 (we label them CIS 2006 and CIS 2010). The Turkish Community Innovation Survey is collected by the Turkish Statistical Institute. The CIS micro data can be accessed in the Safe Centre (SC) in Ankara. The Turkish CIS data is based on a stratified random sample (A 30 stratum for economic activity and three groups of firm sizes (10–49, 50–249, and 250+) are taken to consider sample sizes.). CIS 2006 was stratified by NACE revision 1.1, and CIS 2010 was stratified by NACE revision 2. NACE is a Statistical Classification of Economic Activities in the European Community. The dataset represents the sector and at the same time the firm size of the whole population of Turkish firms, which have more than ten employees.

CIS has made use of a rich and direct source of a detailed description of innovation and innovative activities, other firm characteristics and factors influencing innovative activity. First and most importantly, the data provides detailed information on the financial hampering factors, “such as lack of available finance within the firm,” “lack of available finance from other organizations,” and “high direct innovation costs.” Second, it allows to see the level of perception of barriers when the tendency of companies to innovate differs; wants to innovate but not being able to, participation in innovative activities, and successful introduction of a new product/process innovation. The advantage of using CIS data is that it allows us to use a direct measure of the key variables rather than using indirect proxies in analysis. The most interesting part of the CIS survey in this study concerns the financial factors that hinder innovation. In line with the questions asked to companies that responded to the surveys at different times in Fig. 1, we first wanted to show whether the behavior of companies that want to innovate is affected differently by financial factors. In this way, unlike previous studies, it will be possible to see both the revealed and deterred effects of obstacles.

In CIS 2012, CIS 2014, and CIS 2016, the questionnaires are different from those of CIS 2006 and CIS 2010, and firms are not asked about barriers if they answer the question of whether they would introduce any innovation with “yes.” In CIS 2018, questions related to innovative activities do not exist. Similarly in CIS 2008, questions related to barriers do not exist. In CIS 2006 and CIS 2010, each firm in the sample was asked to indicate that the financial factors that prevent the firm from making an innovation decision have high, medium, low or no effect. The important point is that all firms were asked to respond to this question without looking at introducing or not introducing any innovation.Footnote 1 We believe that the perception of obstacles needs to be interpreted at each perception level. This is why we prefer to use the ordered probit model in our analysis. Contrarily, most of the previous papers considered that a medium or high effect implies that the firm intends to innovate and is constrained (Canepa & Stoneman, 2008; D’Este et al., 2012). This approach might result in some biases, because the given answers are so sensitive for firms. A firm may state that it underestimates the impact of the barrier, but in reality, this effect can have a strong enough deterrent effect on the decision to innovate. We estimated our model using the entire original sample of 5767 businesses in CIS 2010 and 2172 firms in CIS 2006. Following D’Este et al. (2010), we have excluded primary sectors (agriculture and mining) from our sample (147 firms in CIS 2006 and 223 firms in CIS 2010).

3.2 Relevant Sample: Types of Innovators and Non-innovators

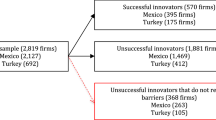

To give a detailed information, we categorize firms into subsamples. Figure 1 presents the types of firm according to innovation positions. We examine firms under two main groups: “Innovators and Non-innovators.” Each group is different in itself.

Non-innovators are non-innovation-oriented firms, non-barrier-related non-innovators, and discouraged firms. The non-innovation-oriented firms, which are excluded from our sample, are not innovatively active, have not introduced any kind of product or process innovation, and have not faced any barriers. Another group of non-innovators are the non-barrier-related non-innovators. Similarly the non-innovation-oriented firms, which are not innovatively active firms, have not introduced any kind of product or process innovations and are different from the previous group of firms. For these firms, the reason for being a non-innovator is that there is no demand at the market for introducing innovation. On the other hand, there exists a special case of non-innovators, which needs to be examined. The discouraged firms can be defined as firms that have not found a chance to innovate or be innovatively active because they are facing financial obstacles. It is seen from Fig. 1 that non-innovation-oriented firms and non-barrier-related firms consist of almost 21% of the samples of CIS 2006 and 22% of the samples of CIS 2010. The common similarity between non-innovation-oriented firms and non-barrier-related non-innovators is that they are not willing to innovate. Such an unwillingness is not related to facing any financial barriers. We are only interested in financial barriers; we have not examined the relationship between the decision to innovate and any other types of barriers. The pure effect of financial barriers is demonstrated in the study. Discouraged firms are the most important subsamples of this study, which account for around 19% of the total sample in both waves (Fig. 1).

Determining innovators is quiet challenging. In the first group of innovators, the successful innovators are determined as having innovation as an output. More precisely, an enterprise is defined as a successful innovator if the firm has done at least one of the following innovations (during the given time period): (i) the firm introduced a new or significantly improved good/service, (ii) the firm introduced a new or significantly improved process that is used for producing a good/service, (iii) the firm introduced a new or significantly improved logistics and delivery methods for supplies, and (iv) the firm produced products or introduced new or significantly improved supporting activities for any of its processes. We are also interested in previously successful innovators, which need to be analyzed in depth and differentiated from non-innovators. A previously successful innovator has not done any innovation (output) but has claimed that it has during the previous time period. Unsuccessful innovators are the ones who did not introduce any kind of product or process innovation while engaging in at least one of the innovative activities. The success of introducing innovations changes over time. As presented in Fig. 1, while the successful innovators account for 35% of the whole sample in CIS 2006, they account for 40% of the whole sample in CIS 2010. This shows that Turkish companies are getting better at introducing innovation when compared with the previous wave of CIS data. Unsuccessful innovators do not seem to change over time and stay at the same level, and they account for 1% of the whole sample. Our findings show that the previously successful innovators account for 20% of the overall sample in CIS 2006 and 15% of the overall sample in CIS 2010. It is seen that a 6% difference exists between CIS 2006 and CIS 2010. One can see that the position of these firms is changed from being previously successful innovators to successful innovators. Again there is a surprising result. While the firms are becoming more successful over time, the ratio of discouraged firms in CIS 2010 is higher than that of firms in CIS 2006. This is why we are interested in drawing an inference between the revealed and deterring effects of obstacles on innovation decisions.

After distinguishing the subsamples, relevant samples can be called potential innovators (Fig. 2). Potential innovators are the ones who are willing to innovate; the keyword here is willingness. There are several ways to determine the willingness of the firms to do innovation, such as having an innovation output, engaging in at least one of the innovative activities, or having a previous innovation output. But there is still a group of firms who are misjudged in the context of potential innovators, which are categorized as discouraged firms. These firms are thought of as non-innovators most of the time. At first sight this group seems to be non-innovators, but at a deeper look, one can see that these firms are a special case of potential innovators. They have willingness to do innovation, but they are deterred of introducing an innovation or even engaging in innovative activities. Our study is different from other studies at this point. We have several subsamples that provide an opportunity to offer more information about the determinants of both revealed and deterred barriers to the policymakers.

Our analyses reveal that a relevant sample composition could be as follows:

Innovatively active firms: These firms are the ones who claimed to engage in at least one of the innovative activities. The overall response rate of these firms who claimed to be innovatively active in CIS 2006 was only 46% of the whole sample of potential innovators (Fig. 3). After excluding the missing data and possible duplication problems, the sample size was 730 firms. For CIS 2010, the overall response rate of those firms who claimed to be innovatively active was around 53% of the whole sample of potential innovators (Fig. 3). After excluding the missing data and possible duplication problems, the sample size was 2276 firms.

Deterred firms by nature: These innovative are the ones who claimed that they were not innovatively active but had willingness to be innovatively active. Unfortunately financial disability was the reason for their failure to introduce any kind of innovation and/or to engage in any innovative activities. In the previous section, we referred to these firms as discouraged firms, which accounted for only 25% of the whole sample of potential innovators in CIS 2006 and 27% of the whole sample of potential innovators in CIS 2010 (Fig. 3). After excluding the missing data, the sample sizes were 396 firms in CIS 2006 and 1147 in CIS 2010.

Deterred firms by the experienced success: These firms are the ones who claimed to have innovation outputs during the previous time period. They also did not have any kind of innovation outputs during the related time period. As we differentiated previously successful innovators from successful innovators by determining whether they introduced any kind of innovation output, we found a special case of an innovator who could not carry on the introduction of any kind of innovation output. Now the important question that comes to our mind is that are they engaged in any kind of innovative activity or are they deterred from any kind of innovative activity? Our investigation has quite surprising findings. We found that according to the result of both time periods (CIS 2006 and 2010), Turkish firms did not engage in any kind of innovative activity or spend on R&D investments if they claimed that they introduced innovation output before the interested time period. It was found that the theory of “success brings success” does not hold in the case of previously successful innovators. These groups of firms account for only 28% of the whole sample of potential innovators in CIS 2006 and 19% of the whole sample of potential innovators in CIS 2010 (Fig. 2). After excluding the missing data, the sample sizes are 438 firms in CIS 2006 and 826 in CIS 2010.

3.3 Determination of Variables and Descriptive Statistics

3.3.1 Dependent Variables

The CIS questionnaire has a special module in which the respondents are asked the following: “During the three years 2008 to 2010, how important were the following factors in preventing your enterprise from innovating or in hampering your innovation activities?” The degree of importance of the financial factors is our main concern (Fig. 4):

-

Lack of funds within your enterprise or group (internal finance)

-

Lack of finance from sources outside your enterprise (external finance)

-

Innovation costs too high (high costs)

There is a natural order of the degree of importance of each category. The ordinal variables are regenerated to take the following values: factor not experienced (1), low (2), medium (3), and high (4).

3.3.2 Independent Variables

The responses from the survey allow us to measure the degree of engagement in innovative activities. The engagement in innovative activity is measured by binary variables. Binary variables are coded 1 for each variable, Zero-active if a firm does not engage in any of the activities, Low-active if a firm engages in one or two activities, Medium-active if a firm engages in three or four activities, and High-active if a firm engages in five or more activities. A non-linear relationship between engagement in innovative activity and perception of obstacles is expected. There is a threshold before a positive relation occurs between the perception of obstacle and engagement in innovative activity. Under this threshold the relation is expected to be negative (D’Este et al., 2010, 2012).

Sector dummies are created according to the NACE revisions of the related sample collection periods.Footnote 2 If the firm belongs to any main sector, it takes the value of 1 and 0 otherwise. Sizes of the firms are categorized into four: small, medium, large, and highly large. Binary variables are coded 1 for each variable if the total number of the firm’s employees is between 10 and 49 (small), between 50 and 249 (medium), between 250 and 999 (large), over 1000 (highly large), and 0 otherwise. Our hypothesis is that the size has an effect on the perceptions of the obstacles on decision to innovate. Larger firms are more protected against obstacles (Blanchard et al., 2013; Cohen & Klepper, 1996; D’Este et al., 2014; Katila & Shane, 2005). If the firm is part of an enterprise group, the binary variable takes the value of 1 and 0 otherwise. The possibility of facing financial barriers is less likely to happen in the case of a corporate group. Foreign-owned firms are determined by looking at the ratio of capital owner. If the foreign partner has more than 50% of the existing capital, then the binary variable takes the value of 1 and 0 otherwise. The human capital variable is determined by the number of employees who have a PhD degree. Receiving Public Financial Support is constructed as a set of binary variables. Each of the binary variables takes the value of 1 if the firm claims that it received that specific public support, 0 otherwise. According to the question, there are three possible public supports: Support from local or regional authorities (funloc), support from central government (including central government agencies or ministries) (fungov), and support from the European Union (funeu). Market Internationalization is determined by the question “In which geographic markets did your enterprise sell goods and/or services during the three years 2008–2010?” We generated an ordinal variable to measure the distance of the markets where the enterprise sell goods and/or services. If the firm gives the answer of yes to the following options then the dummy variables takes the value 1 and 0 otherwise.

-

Local/regional within [your country] (local)

-

National (other regions of [your country]) (national)

-

Other European Union or associated countries (EU)

-

All other countries (other)

3.4 Econometric Model: The Ordered Probit Model

Building on the literature and theoretical background of financing innovation investments given above, we confirm that internal financing of innovation for firms are important, whereas external financing is critical. There exists another important issue, which, in this case, is referred to in the survey as high costs. The investigation of whether these factors have possibly two types of important effects on the decision to innovate, namely, revealed and deterring effects, is performed using the ordered probit model. The dependent variable is sometimes perceived to be different from a binary variable or from a continuous variable. It is possible to examine a dependent variable that has more than two possible outcomes. If the possible outcomes of dependent variable, y, has a natural ordered outcomes, then an ordered probit model can be used for estimation. A good example of a categorical variable could be that respondents are asked to report a particular category, in our case financial obstacle status that is categorized into no effect (1), low effect (2), medium effect (3), and high effect (4). The order of the categories is given in the parentheses; it is obvious that there is natural ordering. The ordered probit model is an extension of the binary probit model (Jones, 2007).

If y is an ordered response, as we suggested above, then we cannot say that the indicators of outcomes are no longer arbitrary. We cannot say that the difference between the high and medium effects of obstacles is twice as important as the difference between the no effect and low effect.

The dependent variable, y, now takes the values {0, 1, 2, 3, 4, …J} for integer J in an ordered response. Like the binary models, the ordered probit models can be derived from a latent variable model. It is again needed to have an error term that is distributed as standard normal.

where X′β is an index function, x is a K × 1 regressor vector (this time it does not contain a constant), and β is a K×1 vector of unknown parameters. The threshold parameters can be expressed as α1 < α2 < α3 < … < αj.(In the case of binary variable, the threshold point is “0”; if the latent variable takes higher than the “0,” y takes the value of 1):

.

.

.

While it is known that the error term has a standard normal distribution, one can derive the conditional distribution of y given X

....

When J = 1, it is same as the binary probit model.

As we determined the probabilities of each outcome above, it is important to mention that unlike the binary probit models, the signs of the “interior” marginal effects are unknown and cannot be completely determined by the sign of the betas of the regression models. For this reason we have investigated the probabilities of possible 4 outcomes by using the mfx STATA command. The mfx command allows us to estimate the marginal effect of a variable in a discrete choice model that depends on the values taken by each of the covariates.

We have three dependent variables which have the form of ordinary nature. Each of the dependent variables take the value {1, 2, 3, 4} if the respondent gives the answer high degree of importance, dependent variables take the value 4, if the answer is medium degree of importance dependent variables take the value 3, if the answer is low degree of importance dependent variable take the value 2, and if the answer is that firm is not effected then dependent variables take the value 1. Our dependent variables are internal financial obstacle (IFo), external financial obstacle (EFo), and high costs (HCo), where “o” means the ordered nature.

Our models can be written as follows:

Model 1

Model 2

Model 3

4 Results

The estimation on the subsamples of different types of firms by deterred and revealed firms was carried out to explore the firm characteristics and engagement in innovative activities that predict the best financial obstacles of firms. It is given that financial obstacle is a polychotomous dependent variable with a natural order. Each table in this chapter shows the results of ordered probit model (OPM) estimations of the financing barriers for both CIS 2006 and CIS 2010. We report the estimated probability that a firm describes financing as a major obstacle depending on the characteristics of firms. Each column of the table represents the probability of assessing internal financing barriers as highly important. Because of the possible heterogeneity problem, it is preferred to use sector dummies as independent variables; hence robust estimation results are found.Footnote 3

Table 1 shows the results for the importance that innovatively active, discouraged and formerly active firms place on internal financial barriers. The results for the importance that innovatively active, discouraged and formerly active firms place on internal financial barriers. For the revealed group of firms, the relationship between assessment of internal financial disabilities and engagement in innovative activities is statistically significant and positive. The probability of assessing high importance to internal financial disabilities is increasing in the case of CIS 2006; contrarily, there is a U-shaped relationship in the case of CIS 2010. The important point that takes our attention is that during the previous time period, firms have changed their way of looking at assessment of internal financial barriers. There is a lower assessment of internal financial barriers for firms who engaged in innovative activities in CIS 2010.

In the case of both CIS 2006 and CIS 2010, being a small and medium-sized firm increases the importance of internal financial barriers to innovation for innovatively active firms in both cases. This is exactly what we expected to find. While we expected to have results of large firms who are protected against internal financial obstacles, for CIS 2010, things are quite different. Large-sized firms perceive lack of internal finance as highly important. However, a firm that is part of a large group is better positioned against internal financial obstacles. This shows that partner cooperation is more likely to offer internal finance opportunities to the firm. It was found that selling goods in national or EU markets implies either an advantage or a disadvantage in overcoming revealed internal financial barriers. One of the independent variables exist only in CIS 2010, which is Human capital. It is not found any significant relationships between highly educated work force and assessment of financial barriers. We found statistically significant and negative relationships between EU grants and assessment of internal financial barriers. The result suggests that if a firm highly innovatively active then it perceives barrier highly important.

For the deterring groups of firms, in columns 3 and 5, medium-sized firms report significantly higher financial obstacles than small ones. In columns 3 and 5, the coefficients of large firms are statistically significant. However, a firm that is part of a large group is better positioned against internal financial obstacles. This shows that partner cooperation is more likely to offer internal finance opportunities to the firm. It was found that selling goods in other than EU markets implies either an advantage for overcoming deterring effects (previously successful innovators (PSIs) and deterred firms (DFs)) of internal financial barriers in CIS 2010.

The probabilities in column 1 of Table 2 show that foreign-owned firms report significantly lower external financial obstacles, and those in column 4 of Table 2 indicate that firms affiliated with a group and foreign-owned firms report significantly lower external financial obstacles. A firm that is part of a large group is better positioned against external financial obstacles. This shows that partner cooperation is more likely to be able to find external finance opportunities for previously successful firms in CIS 2006. For CIS 2010, the results are quite different; not only previously successful firms but also discouraged firms are more advantaged for a being part of a corporate. Even though being a part of a group protects firms against external financial barriers, it would not be enough for not deterred from innovation. This time our findings do not support the “learning by doing” effect on the probability of assessing external financial difficulties. There is not any significant relationship between highly educated work force and assessment of financial barriers as highly important. We also find that there is a significant and negative relationship between foreign ownership and assessment of financial barriers as highly important. Previously successful firms are more advantaged for being part of a corporate than the innovatively active firms. Even if protected against internal financial barriers, it would not be enough to be not deterred from innovation. However, it was found that selling goods in any of the markets implies either an advantage or a disadvantage in overcoming deterring or revealed internal financial barriers. Only in CIS 2010, EU grants and local grants are statistically significant for the deterred firms that are overcoming external financing barriers.

The probabilities in columns 1 and 4 of Table 3 indicate that the firms affiliated with a group and foreign-owned firms report different results. Firms that are part of large groups feel significantly less impacted by higher innovation costs in CIS 2010. In the case of both CIS 2006 and CIS 2010, being a small and medium-sized firm increases the importance of high costs of innovation for innovatively active firms. Additionally, the same relationship exists between large firms and the importance of high costs of innovation in CIS 2010. No significant relationship between highly educated work force and assessment of financial barriers as highly important has been reported. However, it was found that selling goods in national markets implies either an advantage in overcoming revealed barriers in CIS 2010. The results in columns 1 and 4 of Table 3 show significant difference between high-tech and med high-tech firms. As we expected, a firm that is in a higher-tech sector is more constrained in its innovative activities.

5 Conclusion

The goal of this chapter was to examine the nature and the degree of the perception of financial obstacles to innovation using firm-level data from Turkish CIS 2006 and CIS 2010. While it is known that innovation is a key factor for taking advantage over the competitive markets, it does not mean that all firms are skilled, talented, and financially appropriate for introducing innovation. This study puts forward three main contributions.

First of all, it distinguishes different firm groups in accordance with the effects of financial barriers on the decision to innovate. The first group of firms is potential innovators; these firms have an intention to innovate but still face financial barriers that do not prevent them from engaging in innovative activities; revealed barriers. These firms claim to be innovatively active and in CIS 2006 only 46% of the whole sample is potential innovators similarly, around 53% of the whole sample is potential innovators in CIS 2010. The second and third groups of firms have a common feature when they are faced with financial barriers; they are prevented from undertaking any innovative activities (deterring barriers). Our study is different from other studies (i.e., D’Este et al., 2014; Pellegrino, 2014) at this point. It is important to look deeply to the groups of firms that are faced with deterring barriers. Deterred firms by the experienced success are only 28% of the whole sample of potential innovators in CIS 2006 and 19% of the whole sample of potential innovators in CIS 2010, and Deterred firms by nature are only 25% of the whole sample of potential innovators in CIS 2006 and 27% of the whole sample of potential innovators in CIS 2010. Considering several subsamples gives an opportunity to offer more information about the determinants of both revealed and deterred barriers to the policymakers as well as managers of the firms. Second, the nature of the subject requires the use of micro-level data as well as a comparative analysis. For this reason, we used two specific time periods of the Turkish economy: periods of economic downturn and boom. The Turkish example provides evidence that firms have perceptions of both deterring and revealed effects of financial obstacles to innovation. The high engagement of innovative activities has made a statistically significant impact on the revealed financial barriers for innovatively active firms. Third, high costs of innovation barrier were ranked higher for both time periods and for all groups of firms by the respondents of the surveys. In particular, discouraged firms who have not found a chance to innovate or be innovatively active because of financial obstacles seem to assign more importance to all of the financial obstacles independent of time.

To determine which certain firm characteristics alleviate deterring and revealed obstacles, we examined our main hypotheses: “the firm characteristics predict the perception of financial obstacles differently for innovatively active firms, discouraged firms and previously successful innovators” and “The firm is more likely to face higher revealed barriers when the firm has a higher engagement in innovative activities.” These hypotheses were tested by using ordered probit models. Our findings are parallel with those of Beck et al. (2006). In particular categorizing firms by their size and foreign ownership is useful for the consideration of financial obstacles. Our results suggest that multinational companies overcome financial obstacles, and large firms are perceiving obstacles lower than small and medium-sized firms. With regard to the findings of Canepa and Stoneman (2008) and Carpenter and Petersen (2002), high-tech firms are showing a pattern of having difficulties on accessing internal–external finance, and they found high cost of innovation to be a barrier. Differently from D’Este et al. (2014), we have not found any significant effect of human capital.

Our empirical findings are very much in line with the conclusions of D’Este et al. (2008, 2012, 2010) about the relationships between engagement in innovative activities and assessment of the barriers. We have shown that the assessments of barriers are important for the firms who engage in five or more innovative activities. There is a common pattern among three types of financial constraints. This result is consistent with our expectation of revealed barriers. Innovatively active firms in CIS 2006 are more likely to face financial barriers to innovation than firms in CIS 2010. Highly innovatively active firms are more likely to assess barriers as highly important. If we compare two datasets, then one may say that the revealed effect is higher in CIS 2006 but lower in CIS 2010. This means that innovatively active firms are using the revealed effect, which can be called as the learning-by-doing effect for their own advantage. With this result we also proved our reasons for dividing whole samples into three groups. It is possible to conclude that a decrease in the probability of assessing financial barriers may be a result of both the management and policy’s success in Turkey.

One may also consider the effect of crises on financial barriers to innovation. Our datasets can be thought of as economic boom wave and wave of economic crisis. During the completion of the questionnaire, the growth rate in Turkey was around 7% on an average of three years in a yearly basis, whereas during the crisis period, it was around 2%. Larger firms are oversensitive to crisis periods. Being innovative as a hedge against the effects of the crisis creates a good advantage for companies. Our results also suggest that during the crisis period, the firm characteristics that predict the best financial obstacles of a firm are changed. This may also help both policymakers and mangers think about the weaknesses of firms. Innovatively active firms lose their advantage on overcoming financial obstacles when they are large and foreign-owned. It was also observed that being a part of a group was an advantage during the crisis period for firms.

References

Almeida, H., Hsu, P.-H., & Li, D. (2013). Less is more: Financial constraints and innovative efficiency. SSRN 1831786. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1831786

Alvarez, R., & Crespi, G. A. (2015). Heterogeneous effects of financial constraints on innovation : Evidence from Chile. Science and Public Policy, 42(5), 1–14. https://doi.org/10.1093/scipol/scu091

Amara, N., Landry, R., Becheikh, N., & Ouimet, M. (2004). Radical innovations in traditional manufacturing industries. In Druid summer Conference, Industrial dynamics, innovation and development.

Arrow, K. J. (1962). Economic welfare and the allocation of resources for invention. In The rate and direction of inventive activity: Economic and social factors (pp. 609–626). Princeton University Press.

Arundel, A. (1997). Enterprise strategies and barriers to innovation. Innovation Measurement and Policies, 50, 101–108.

Balcet, G., & Evangelista, R. (2004). Global technology: Innovative strategies of multinational affiliates in Italy.

Baldwin, J., & Lin, Z. (2002). Impediments to advanced technology adoption for Canadian manufacturers. Research Policy, 31(1), 1–18. https://doi.org/10.1016/S0048-7333(01)00110-X

Beck, T., Demirgüç-Kunt, A., Laeven, L., & Maksimovic, V. (2006). The determinants of financing obstacles. Journal of International Money and Finance, 25(6), 932–952.

Blanchard, P., Huiban, J. P., Musolesi, A., & Sevestre, P. (2013). Where there is a will, there is a way? Assessing the impact of obstacles to innovation. Industrial and Corporate Change, 22(3), 679–710. https://doi.org/10.1093/icc/dts027

Bond, S., Harhoff, D., & Reenen, J. Van. (2003). Investment, R & D and financial constraints in Britain and Germany Stephen Bond, Dietmar Harhoff and John Van Reenen (December).

Boso, N., Story, V. M., & Cadogan, J. W. (2013). Entrepreneurial orientation, market orientation, network ties, and performance: Study of entrepreneurial firms in a developing economy. Journal of Business Venturing, 28(6), 708–727.

Campello, M., Graham, J. R., & Harvey, C. R. (2010). The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics, 97(3), 470–487. https://doi.org/10.1016/j.jfineco.2010.02.009

Canepa, A., & Stoneman, P. (2008). Financial constraints to innovation in the UK: Evidence from CIS2 and CIS3. Oxford Economic Papers, 60(4), 711–730. https://doi.org/10.1093/oep/gpm044

Carpenter, R. E., Fazzari, S. M., & Petersen, B. C. (1998). Financing constraints and inventory investment: A comparative study with high-frequency panel data. The Review of Economics and Statistics, 80(4), 513–519. https://doi.org/10.1162/003465398557799

Carpenter, R. E., & Petersen, B. C. (2002). Capital market imperfections, high-tech investment, and new equity financing. The Economic Journal, 112(477), F54–F72.

Castellani, D., & Zanfei, A. (2003). Technology gaps, absorptive capacity and the impact of inward investments on productivity of European firms. Economics of Innovation and New Technology, 12(6), 555–576.

Çetin, A. K., Dölarslan, E. Ş., Yakışık, H., & Ünlü, H. (2017). Sanayi ve hizmet sektörlerinde inovasyon bariyerleri. Journal of Social and Humanities Sciences Research, 4(5), 940–955.

Cohen, W. M., & Klepper, S. (1996). A reprise of size and R & D. The Economic Journal, 106(437), 925–951. https://doi.org/10.2307/2235365

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R & D. The Economic Journal, 99(397), 569–596.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152. https://www.jstor.org/stable/2393553

D’Este, P., Iammarino, S., Savona, M., & Von Tunzelmann, N. (2008). What hampers innovation? Evidence from the UK CIS4. SPRU Electronic Working Paper Series Paper. http://www.sussex.ac.uk/spru/

D’Este, P., Iammarino, S., Savona, M., & Von Tunzelmann, N. (2012). What hampers innovation? Revealed barriers versus deterring barriers. Research Policy, 41(2), 482–488. https://doi.org/10.1016/j.respol.2011.09.008

D’Este, P., Rentocchini, F., & Vega-Jurado, J. (2010). Lowering barriers to engage in innovation: Evidence from the Spanish innovation Survey. In International Schumpeter Society Conference 2010 (pp. 1–25).

D’Este, P., Rentocchini, F., & Vega-Jurado, J. (2014). The role of human Capital in Lowering the barriers to engaging in innovation: Evidence from the Spanish innovation survey. Industry and Innovation, 21(1), 1–19. https://doi.org/10.1080/13662716.2014.879252

Dachs, B., & Ebersberger, B. (2009). Does foreign ownership matter for the innovative activities of enterprises ? International Economics and Economic Policy, 6(1), 41–57. https://doi.org/10.1007/s10368-009-0126-3

Dachs, B., Ebersberger, B., & Lööf, H. (2008). The innovative performance of foreign-owned enterprises in small open economies. The Journal of Technology Transfer, 33, 393–406. https://doi.org/10.1007/s10961-007-9058-7

de-Oliveira, F., & Rodil-Marzábal, Ó. (2019). Structural characteristics and organizational determinants as obstacles to innovation in small developing countries. Technological Forecasting and Social Change, 140, 306–314. https://doi.org/. https://doi.org/10.1016/j.techfore.2018.12.021

De Brentani, U. (1995). Firm size: Implications for achieving success in new industrial services. Journal of Marketing Management, 11(1–3), 207–225.

De Fuentes, C., Santiago, F., & Temel, S. (2020). Perception of innovation barriers by successful and unsuccessful innovators in emerging economies. The Journal of Technology Transfer, 45(4), 1283–1307. https://doi.org/10.1007/s10961-018-9706-0

Desai, M. A., Foley, C. F., & Forbes, K. J. (2007). Financial constraints and growth: Multinational and local firm responses to currency depreciations. The Review of Financial Studies, 21(6), 2857–2888. https://doi.org/10.1093/rfs/hhm017

Ender, P. B. (2010). Collin: Collinearity diagnostics. Institute for Digital Research and Education, University of California. http://www.ats.ucla.edu/stat/stata/ado/analysis/default.htm

Ettlie, J. E., & Rubenstein, A. H. (1987). Firm size and product innovation. Journal of Product Innovation Management, 4(2), 89–108.

Fazzari, S. M., Hubbard, R. G., Petersen, B. C., Blinder, A. S., & Poterba, J. M. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 1988(1), 141–206. https://doi.org/10.2307/2534426

Frenz, M., Girardone, C., & Ietto-Gillies, G. (2005). Multinationality matters in innovation: The case of the UK financial services. Industry & Innovation, 12(1), 65–92.

Frenz, M., & Ietto-Gillies, G. (2004). The impact of multinationality on the propensity to innovate: An analysis of the UK Community Innovation Survey 3. In Schumpeter Conference. Milan.

Guariglia, A., & Liu, P. (2014). To what extent do financing constraints affect Chinese firms’ innovation activities? International Review of Financial Analysis, 36, 223–240. https://doi.org/10.1016/j.irfa.2014.01.005

Hall, B. H. (2002). The financing of research and development (NBER Working Paper Series No. 8773). Cambridge.

Hall, B. H., & Lerner, J. (2010). The financing of R & D and innovation. Handbook of the Economics of Innovation, 1(1 C), 609–639. https://doi.org/10.1016/S0169-7218(10)01014-2

Hatzichronoglou, T. (1997). Revision of the high-technology sector and product classification. OECD STI Working papers GD (97) 216.

Hanson, G. H., Mataloni, R., & Slaughter, M. (2005). Vertical production networks in multinational firms. The Review of Economics and Statistics, 87(4), 664–678.

He, Z.-L., & Wong, P.-K. (2009). Knowledge interaction with manufacturing clients and innovation of knowledge-intensive business services firms. Innovations, 11(3), 264–278. https://doi.org/10.5172/impp.11.3.264

Himmelberg, C. P., & Petersen, B. C. (1994). R & D and internal finance: A panel study of small firms in high-tech industries. The Review of Economics and Statistics, 76(1), 38–51. http://www.jstor.org/stable/2109824

Hipp, C., Tether, B. S., & Miles, I. (2000). The incidence and effects of innovation in services: Evidence from Germany. International Journal of Innovation Management, 4(04), 417–453.

Hölzl, W., & Janger, J. (2014). Distance to the frontier and the perception of innovation barriers across European countries. Research Policy, 43(4), 707–725. https://doi.org/10.1016/j.respol.2013.10.001

Hottenrott, H., & Peters, B. (2012). Innovative capability and financing constraints for innovation more money, more innovation? (ZEW Discussion Paper from No. 09–081). http://ftp.zew.de/pub/zew-docs/dp/dp09081.pdf.

Iammarino, S., Sanna-Randaccio, F., & Savona, M. (2009). The perception of obstacles to innovation. Foreign multinationals and domestic firms in Italy. Revue d ’ Économie Industrielle, 125. Retrieved from http://rei.revues.org/3953

Jones, A. (2007). Applied econometrics for health economists: A practical guide (2nd ed.). CRC Press. https://doi.org/10.1201/9781785230141

Kamien, M. I., & Schwartz, N. L. (1972). A direct approach to choice under uncertainty. Management Science, 18(8), B-470.

Kamien, M. I., & Schwartz, N. L. (1978). Self-financing of an R and D project. The American Economic Review, 68(3), 252–261. http://www.jstor.org/stable/1805258

Kaplan, S. N., & Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints? The Quarterly Journal of Economics, 112(1), 169–215.

Katila, R., & Shane, S. (2005). When does lack of resources make new firms innovative? Academy of Management Journal, 48(5), 814–829.

Lahr, H., & Mina, A. (2013). Dynamic financial constraints and innovation : Evidence from the UK Innovation Surveys. 4th European Conference on Corporate R&D and Innovation, (September), 35.

Lee, N., Sameen, H., & Cowling, M. (2015). Access to finance for innovative SMEs since the financial crisis. Research Policy, 44(2), 370–380. https://doi.org/. https://doi.org/10.1016/j.respol.2014.09.008

Malerba, F. (2005). Sectoral systems: How and why innovation differs across sectors. In J. Fagerberg, D. C. Mowery, & R. R. Nelson (Eds.), The oxford handbook of innovation (pp. 380–406). Oxford University Press.

Marin, G., Marzucchi, A., Zoboli, R., Marin, G., Marzucchi, A., & Zoboli, R. (2014). SMEs and barriers to eco-innovation in EU: A diverse palette of greens SMEs and barriers to eco-innovation in EU. A Diverse Palette of Greens.

Mazzucato, M. (2013). Financing innovation: Creative destruction vs. destructive creation. Industrial and Corporate Change, 22(4), 851–867. https://doi.org/10.1093/icc/dtt025

Mohnen, P., Palm, F. C., Van der Loeff, S. S., & Tiwari, A. (2008). Financial constraints and other obstacles: Are they a threat to innovation activity? De Economist, 156(2), 201–214. https://doi.org/10.1007/s10645-008-9089-y

Mulkay, B., Hall, B. H., & Mairesse, J. (2001). Firm level investment and R&D in France and the United States: A comparison. In D. Bundesbank (Ed.), Investing today for the world of tomorrow. Springer. https://doi.org/10.1007/978-3-642-56601-1_19

OECD/Eurostat. (2005). Oslo manual: Guidelines for collecting and interpreting innovation data (The measurement of scientific and technological activities) (3rd ed.). OECD Publishing.

Papanastassiou, M. (1999). Technology and production strategies of multinational enterprise (MNE) subsidiaries in Europe. International Business Review, 8(2), 213–232.

Patel, P. (1995). Pattern of technological activity: Their measurement and interpretation. In Handbook of the economics innovation and technological change.

Pellegrino, G. (2014). Essays on determinants and effects of barriers to innovation.

Pires, C. P., Sarkar, S., & Carvalho, L. (2008). Innovation in services – How different from manufacturing? The Service Industries Journal, 28(10), 1339–1356. https://doi.org/10.1080/02642060802317812

Santiago, F., De Fuentes, C., Dutrénit, G., & Gras, N. (2017). What hinders innovation performance of services and manufacturing firms in Mexico ? Economics of Innovation and New Technology, 26(3), 247–268. https://doi.org/10.1080/10438599.2016.1181297

Savignac, F. (2008). Impact of financial constraints on innovation: What can be learned from a direct measure? Economics of Innovation and New Technology, 17(6), 553–569. https://doi.org/10.1080/10438590701538432

Scherer, F. M. (1992). Schumpeter and plausible capitalism. Journal of Economic Literature, 30(3), 1416–1433. https://www.jstor.org/stable/2728064

Schmidt, T., & Rammer, C. (2007). Non-technological and technological innovation: Strange bedfellows? (ZEW Discussion Papers No. 07–052). Zentrum für Europäische Wirtschaftsforschung (ZEW). http://hdl.handle.net/10419/24623

Schumpeter, J. A. (1942). Capitalism, socialism, democracy. Harper.

Şeker, M. (2012). Importing, exporting, and innovation in developing countries. Review of International Economics, 20(2), 299–314.

Tiwari, A., Mohnen, P., Palm, F. C., & van der Schim Loeff, S. (2007). Financial constraint and R&D investment: Evidence from CIS. Working Paper Series MERIT (31), 1–45.

Tourigny, D., & Le, C. D. (2004). Economics of innovation and new technology impediments to innovation faced by Canadian manufacturing firms. Economics of Innovation and New Technology, 13(3), 217–250. https://doi.org/10.1080/10438590410001628387

Tsang, E. W. K. (2000). Transaction cost and resource-based explanations of joint ventures: A comparison and synthesis. Organization Studies, 21(1), 215–242. https://doi.org/10.1177/0170840600211004

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Ünlü, H., Çankal, E., Çetin, A.K. (2022). Financial Constraints to Innovative Activities Revealed Barriers Versus Deterring Barriers: Evidence from Turkey. In: Leitão, J., Ratten, V. (eds) Strategic Innovation. Contributions to Management Science. Springer, Cham. https://doi.org/10.1007/978-3-030-87112-3_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-87112-3_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-87111-6

Online ISBN: 978-3-030-87112-3

eBook Packages: Business and ManagementBusiness and Management (R0)