Abstract

Many studies have proven the relevance of patent characteristics to predict firms’ economic returns. The most studied ones concern the (technological, scientific or radically new) type of knowledge embedded into the patents; the technological impact on society, measured by the forward citations; the economic value attributed by the firms to the patents, measured by their renewal and, more recently, the closeness of the patent to the firm’s technological profile. We build on this literature, focusing on a less studied topic, the characteristics associated to the academic patents held by firms and the profit stream generated by these assets. We empirically examine these research issues using longitudinal data from a cross-industry study of 712 units of observation over a recent 10-year period (1996–2007). The paper focuses on the units’ idiosyncratic effects and the heterogeneous impact of the academic patents. We analyse the effect of academic patents characteristics with a one- and a three-year time lag structure, following the literature indication that academic patents can show a different impact at medium-long term. Contrary to previous findings, what matters for academic patents to improve firms’ economic performance both at short and at long term is not their radicalness or explorative nature, but the stock of technical and scientific knowledge on which inventions are based, measured through the backward citations to patent and non-patent literature and the closeness to firm’s core technologies, in which companies have good competences and invest more resources. These results open the way to more in-depth analyses.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Inventions based on academic research are crucial drivers of innovation. Policymakers often deem academic patents (patents in which at least one inventor is an academic, regardless of assignee) as a vital tool for technology transfer (Lissoni and Montobbio, 2015). The literature considers academic contributions as a way for firms to expand their capacity to engage in exploration, which is essential for their mid- to long-term innovation activities (Nelson & Winter, 1982; Dosi, 1988; March, 1991; Ahuja & Lampert, 2001; Lester & Piore, 2004).

Many scholars have recognized some fundamental differences of academic patents, compared with corporate patents, such as tighter linkages to the scientific literature and a higher degree of generality (much broader applications). This is the consequence of academic patents being a product of the “public” science, whose distinctive features suggest a significant contribution to technological progress and growth. By comparing patents with at least one academic inventor to a control group of pure business patents, researchers showed that academic patents are on average more important, resulting in greater knowledge externalities, as measured by forward citations (Henderson et al., 1998; Sampat et al., 2003; Bacchiocchi & Montobbio, 2009).

A relatively recent literature recognised the importance of distinguishing academic patents by their assignee and looked at the relationship between ownership structure and characteristics of academic inventions. Ljunberg and McKelvey (2012) wrote that university owned and firm owned academic patents differ in their nature (see also Geuna & Rossi, 2011). While the first one may largely result from scientific opportunities, the firm owned academic patents should probably not be considered the result of scientific opportunities transferred to firms, but a by-product of firms involving academics in their invention processes (Azagra-Caro, 2011). Other scholars (Bishop et al., 2011) sustained that while university-owned academic patents may result from a science-push contribution of university to industrial innovation, the firms’ owned ones derive more probably from a demand-pull mechanism.

More rarely researchers have strictly focused on the firm side, by comparing for example the effect of patents with and without academic participation on firm performance: the adoption of the firm perspective and of the relative value of academic patents remains partially unanswered (Geuna & Rossi, 2011; Lissoni, 2012).

In this work, we focus on firms and on their owned academic patents by studying how the characteristics of these patents affect firms’ economic performance. Academic patents owned by firms are particularly relevant because these industrial inventions are those that, by definition, may entail contrasting incentives and structures of both academics and firms (Ljungberg et al., 2013).

The issue with this kind of setting is that most of the previous literature have studied the impact of firms’ patent portfolio on firms’ performance without distinguishing between academic and the other type of patents and often analysing single characteristic individually, without offering a view of the relative impact of each aspect vis-à-vis all the main others.

Our aim is to enhance the existing literature on the relation between firms’ patents and economic performance, looking at the less explored field of firm owned academic patents and to a large account of patent indicators of firm performance in their interaction, heterogeneity and dynamics. The paper focuses on the units’ idiosyncratic effects and the heterogeneous impact of academic patents according to their characteristics.

The paper proceeds as follows: Section 3.2 sets out the theoretical background concerning the characteristics influencing academic patent performance. Section 3.3 presents the dataset and a description of the variables employed in the empirical part. Section 3.4 provides a short explanation of the responsiveness score approach. Section 3.5 illustrates the main results organised in two sub-paragraphs: (i) the effect of academic patents on firms’ profitability, (ii) a short and long term breakdown of the analysis. Section 3.6 provides a brief discussion and conclusion.

2 Theoretical Background of the Factors Influencing the Impact of Academic Patents

In economic terms, patents have generally been regarded as a useful instrument to grant inventors temporary exclusionary rights. However, the potential economic significance of patented products varies remarkably (Artz et al., 2010; Bogner & Bansal, 2007; Encaoua et al., 2006), with only a relatively small number of patents being of such impact to generate significant economic returns (Schankerman and Pakes, 1986). There is also considerable evidence that, in many contexts, patents do not work and there are numerous explanations given for patent ineffectiveness in improving firm performance such as, for example, firms’ defensive or strategic use. The inability of patent counts to distinguish between high-impact and low-impact patents is also well documented (Hall et al., 2001; Trajtenberg, 1990).

In the literature, there is a large number of contributions to the definition and measurement of patent technological and economic value. These indicators mirror different – although interrelated – aspects, sometimes having a mainly technological (backward citations) or preponderantly economic connotation (patent renewals), or both (forward citations, generality). Furtherly, depending on the indicator considered, the meaning of patent impact might be closer to that of private value or of social value (OECD, 2013).

Many studies have proven the relevance of studying patent characteristics. Deng et al. (1999) and Thomas et al. (2001) used patent characteristics to predict stock returns and market-to book ratios; Cheng et al. (2010) to predict return on assets (ROA). Various indicators were considered to evaluate patents’ advantage and their impact through the exploitation of different databases (e.g. CHI Research, Inc.).

We selected patent characteristics based on the relevance they raised in the literature. The list of patent characteristics and the associated indicators is the following:

-

New to the firm knowledge content (measured by patent radicalness);

-

Economic value attributed by the firm (measured by patent renewal);

-

Technological impact (measured by forward citations);

-

Technological knowledge content (measured by backward citations to patent literature);

-

Scientific knowledge content (measured by backward citations to non-patent literature);

-

Exploitative versus explorative character of the academic patent relative to the firm’s technological profile (measured by technological closeness)

In this study, we used the OECD dataset (OECD, 2013) including several measures of academic patents, with the exception of the exploitative/explorative character of the academic patent. This last characteristic was not included in the OECD dataset, however we calculated it in order to account for some interesting theoretical insights raised by a recent literature (Belderbos et al., 2010; Ljungberg et al., 2013; Peeters et al., 2018).

In the following, we report some literature whose goal is to assess the effect of different patent characteristics on firm economic success.

2.1 Characteristics of Academic Patents Affecting Firms’ Profits

How does a new knowledge content of patents impact on firm’ performance? Interest in radical innovation originated with Schumpeter (1934), one of the first to claim that radical technological change is a powerful mechanism that can challenge the power of monopolists and bring to relevant economic results. Many empirical studies have tested Schumpeter’s ideas (Anderson & Tushma, 1990; Henderson, 1993; Cooper & Schendel, 1976; Tripsas, 1997). Compared with incremental inventions, radical inventions imply the start of a new trajectory for the firm, which involves costs of adjustment. More generally, radical inventions can underperform vis-à-vis an established technology, before it catches up and surpasses the old technology (Christensen & Rosenbloom, 1995). The literature tells us that the impact of patent radicalness can be positive, but does not have a strong effect in a short time.

As to the economic value attributed by firms to patents, many industrialized countries charge patent holders’ periodic maintenance with renewal fees. This phenomenon has been exploited by scholars to estimate the patent economic value, measured by the length of patent protection (Pakes & Schankerman, 1984; Schankerman and Pakes, 1986; Pakes, 1986; Lanjouw et al., 1998). Harhoff et al. (1998) found a highly rightward-skewed distribution of patent protection values. Exploring the distribution properties of the tail is important, because with skewed distributions, outlying tail values account for a large fraction of the cumulative value over all observations. The literature tells us that the closer the patents’ renewal is to the full term, the higher is the firms’ expectation of economic returns. However, the relation with the economic returns has a high volatility, meaning that other factors can influence it.

As to technological impact, much of the research on forward citations has the scope to validate them as an appropriate measure. Highly cited patents have been associated to measures of technological importance, such as inventor awards and high-value inventions. Other studies have revealed a positive relationship between forward citations and various measures of economic and commercial success, including stock market valuations (Breitzman & Narin, 2001), stock price movements (Narin et al., 2004) and increased sales and profits (Narin et al., 1987). It has been shown that high-quality, high-impact and valuable patents tend to be cited more frequently by later patents (Breitzman & Mogee, 2002). Many scholars, studying the relationship between patent and corporation performances, have confirmed the positive relation between patent citations and market value in industries, such as manufacturing, pharmaceutical as well as semiconductor industries (Chen & Chang, 2010; Griliches, 1990; Hall et al., 2000, 2005; Lanjouw & Schankerman, 2004). Therefore, we can safely draw the conclusion that high patent citations reflect high knowledge spillovers and (social and private) economic value.

The technological knowledge base is measured by backward citations to the patent literature (PL). In order to evaluate the novelty of the innovation requiring patent protection, patent applicants are asked to disclose the prior knowledge they have relied on. During technical examination, the patent examiner checks such references. Backward citations have been found to be positively related to the economic value of an invention (Harhoff et al., 2003). Large numbers of backward citations may signal the innovation to be more incremental in nature (Lanjouw & Schankerman, 2001). However, Podolny and Stuart (1995) argue that building upon pre-existing innovation can indicate a way to success.

Patent applications can include a list of references to earlier non-patent literature (NPL), scientific papers that set the boundaries of patents’ claims for novelty, inventive activity, and industrial applicability. Non-patent literature consists of peer-reviewed scientific papers, conference proceedings, databases and other relevant literature. Backward citations to NPL can be considered an indicator of the contribution of public science to industrial technology (Narin et al., 1997). They may reflect how close a patented invention is to scientific knowledge and help depict the proximity of technological and scientific developments (Callaert et al., 2006). Cassiman et al. (2008) suggest that patents that cite scientific works may contain more complex and fundamental knowledge, and this in turn may influence the “generality” of patents (a large range of applications), which could bring to a high economic return. We conclude that references to NPL can be an indicator associated to positive economic return to firms.

A new approach links academic patents’ technology content and firms’ technological profile and look at the specific patent performance. Ljungberg and McKelvey (2012) and Ljungberg et al. (2013) in their important contribution studied the relation between patents’ technological content and their technological impact measured by forward citations, by comparing firm-owned patents with and without academic involvement. Before controlling for the technological profile, results showed that academic patents have a significant negative effect on both short-term and long-term citations. However, when these scholars controlled whether firm’s core technologies are involved in patenting, the negative effect of “academic inventor” is weakly statistically significant in the short-term and disappears in the long-term. In sum, their results showed that academic involvement per se is not adequate in order to evaluate the patent impact, which has to be assessed under the consideration of the specific technological profile the patent belongs to and the time lag.

Peeters et al. (2018) regard patent’s novelty in the firms’ technology base as essential to assess knowledge-creation dynamics. They studied the contribution of academics to corporate technology development through self-forward citations. Following Belderbos et al. (2010), Peeters et al. (2018) distinguished between trajectories of an exploitative and an exploratory nature, i.e. academic patents in technologies that are “novel to firms” from those related to firm’s existing technological domains. The firm can make a different use of the academic patent, either if it is familiar with the patent’s underlying technology (exploitation) or not (exploration). The main result of Peeters et al. (2018) is that forward self-citations are higher in exploratory trajectories when academic inventors are involved or in exploitative trajectories without academic involvement. These scholars stress that involving academics in exploitative trajectories seems to have a detrimental effect on firm inventive performance. The presence of dead-end outcomes, measured by zero self-forward citations, might represent the explanation of this result.

By and large, we can conclude that the indicator of the technological content of the academic patent in relation to the firm technological profile is relevant to study firm economic performance. Following the literature, we can expect a negative effect on firm economic return if the academic patent has a technological content similar to those of the firm, stronger at short- than at long-term. However, if we could control for the association of the technological academic patent profile with some indicators of firm “core” technology, the effect is expected to become positive.

2.2 The Impact of Academic Patents’ Characteristics on Short and Long Term

Some literature has found relevant to distinguish the effect of academic patents in short and long term. Two recent studies have found that firm-owned academic patents are associated with short-term technological impact while university-owned patents are associated with long-term technological impact (Czarnitzki et al., 2012; Sterzi, 2013). Ljungberg and McKelvey (2012) and Ljungberg et al. (2013) in their analysis of patent impact explicitly address the differentiation of short-term and long-term value. They assumed that there might be an interaction between the technological profile of a patent and its short-term and long-term impact. In particular, the scholars found that in case of an academic patent content close to the technology knowledge of the firm holding them there is a significant decrease of the negative effect on the long-term citations. We will check the different time effect for each specific characteristics of the academic patents.

3 Data and Variables

Our dataset consists of a panel of Italian firms that owned at least one academic patent, as well as non-academic patents, covering the period from 1996 to 2007. Patents co-owned by a firm and a public institution were excluded. Two large micro-level databases form the basis of this analysis. The first database is the EPO Worldwide Patent Statistics Database (PATSTAT), which contains detailed information on firm patent applications from more than 80 patent offices. The second one is the firm-level commercial database ORBIS developed by Bureau van Dijk. Our sources are a revised version of Lotti and Marin (2013) matching PATSTAT and Bureau van Dijk, and the list of academic patents produced by the Academic Patenting in Europe (APE-INV) project, linked together through patent publication codes.Footnote 1 Budget data are cross-referenced with the patent’s priority date, identifying the invention. Our unit of analysis was the firm/patent pair. After eliminating data on patents whose academic nature was unknown, we had a sample of 31,180 units for analysis, of which 29,748 referred to non-academic patents and 1432 to academic ones. The panel include firms of large, medium and small size as well as manufacturing and service sectors.

We considered six patent characteristics (then used to construct responsiveness scores). The dataset refers to EPO patent applications data. Data are generally presented in the form of normalized indexes ranging between zero and one. These are obtained by dividing the initial results by the maximum score obtained by any patent in the same year and technology field cohort patent, without distinguishing between academic and non-academic ones.

-

Radicalness. Radicalness of a patent is measured as a time invariant count of the number of IPC technology classes in which the patents cited by the given patent are, but in which the patent itself is not classified. The more a patent cites previous patents in classes other than the ones it is in, the more the invention should be considered radical.

-

Renewal. Patent renewals ‘rates can be used to estimate the economic value that firms attribute to patents protection. The OECD patent renewal indicator corresponds to the simple count of years during which a granted patent has been kept alive. Years are counted starting from the year in which a patent has been applied

-

Forward citations are the number of citations received by patent application from its publication. Forward citations are counted over a period of five or seven years after the publication date (OECD, 2013). Their number includes self-citations. We used the number of forward citations per patent over a period of seven years.

-

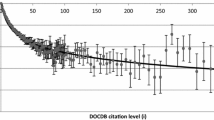

Backward citations to PL are the number of citations per patent made by patent applicants to disclose the prior knowledge on which they have relied. References to non-patent literature have been excluded from the count, whereas self-citations have not. The distribution of backward citations has a very long right tail. 5%-10% of patents do not rely on any prior art, i.e. features zero backward citations and only a very small percentage of patent documents contain more than ten backward citations.

-

Backward citations to NPL are the number of citations per patent made by patent applicants to non-patent literature on which they have relied. The majority of patents generally do not cite any non-patent literature as prior art, the distribution of NPL citations is skewed and it features a very long right tail.

-

Technological closeness. We measured it as the number of 4-digit IPCs in the academic patent that already existed within the firm’s patent portfolio before the academic patent’s priority date. This indicator ranges between zero (maximum technological distance) and one (no technological distance). Maximum distance means that the firm’s portfolio had no IPCs that matched any IPCs in the academic patent before the academic patent’s priority date. For instance, if only one of the academic patent’s IPC categories is present in the four IPC categories of the firm’s existing patent portfolio, the share is 1/4 = 0.25. The closer to one is the share the lower is the distance or differentiation of the technological contribution provided by academic inventors. We excluded so-called first patents, which have not history. There were 4750 first patents, or around 15% of all patents and 155 first academic patents, representing around 11% of all academic patents. After these eliminations, our sample contained 26,000 units of analysis, including 1277 academic ones, once considering all the variables (outcome, treatment, and control variables).

The economic outcome variable (our dependent variable) is represented by the operating profit margin before taxation (OPM), i.e. the ratio between net income and production revenues.

For estimation, we also consider a series of control variables, distinguished between firm- and patent-level covariates. Firm-level controls include: the number of employees, to control for firm size; labour intensity; the ratio between labour costs and production value; labour cost per employee; R&D intensity, the ratio between R&D expenditures and production value; capital stock, the ratio between the firm’s material assets and production value; indebtedness, the ratio between long-term debt and total assets; age, number of years since the firm’s founding.

As for patent-level controls, we used the patent portfolio quality, a composite indicator published by the OECD (2013). This indicator captures both the technological and economic value of inventions and is based on patent citations, claims, patent renewals, and patent family size. It correlates with the social and private value of patented inventions.

4 The Responsiveness Scores Model

The responsiveness scores (RS) model is a regression model where the parameters are random variables instead of fixed numbers. In our study, the model takes the following form (Cerulli, 2017):

The dependent variable y represents the OPM one year after the academic patent’s priority year. Both a and b are random coefficients, with bij representing the responsiveness of firm i’s outcome to academic patent characteristic xj. The vector z represents the set of control variables. As indicated, we considered six academic patent characteristics xj, and calculated how the firm’s economic performance responded to each characteristic. Note that both the regression parameters a and b are both non-constant as they depend on every characteristic except the one being analysed separately (xj in the previous equation).

Responsiveness scores measure the change in a given outcome y when a given factor xj changes, conditional on all other factors x-j. Algebraically, it is the derivative of y on xj, given x-j, allowing each observation to receive its own RS. Responsiveness scores are obtained via an iterated random coefficient regression developed in Cerulli (2017), whose basic econometrics build on Wooldridge (2002). The calculation of responsiveness scores follows this simple protocol:

-

Define y, the outcome (or response) variable.

-

Define a set of factors Q believed to affect y, and specify the generic factor as xj.

-

Define a random coefficient regression (RCR) model linking y to the various genetic factors xj, and extract the unit-specific responsiveness effect of y on the set of factors xj, with j = 1, ..., Q.

-

For the generic unit i and factor j, indicate their effect as bij and assemble all of the effects in a matrix B.

-

Finally, aggregate the bij by unit (row) and/or by factor (column), generating synthetic unit and factor responsiveness measures.

Analytically, an RS is the partial effect of a factor, x, in a random coefficient regression (Wooldridge, 1997, 2002, 2005) defined by the following system of equations:

where ei, uij and vij are freely correlated error terms.

5 Results

5.1 Academic Patents Characteristics: A Descriptive Analysis

Table 3.1 sets out the descriptive statistics of academic patents’ characteristics herein considered.Footnote 2

The mean of the Technological closeness index was 0.84, which is close to one, the value corresponding to pure exploitation. However, half of the observations have values between zero and one, as the median is 1. This result is similar to that of Ljungberg and McKelvey (2012) who found out that academic involvement mainly takes place in inventions highly related to firms’ technology bases. The scholars suggested that firms involve academics mainly for the current problem-solving activities. Similar result is in Peeters et al. (2018): exploitative trajectories still constitute the lion’s share of technology developments in which academics play a role.

Radicalness refers to how much new an invention is in relation to the firm’s previous patented output. In our sample, radicalness has a low mean, which indicates that a large percentage of academic patents cites zero or a low number of previous technologically different inventions.

The Renewal index shows that, on average, firms renewed their academic patent rights for a period around half the typical life of a patent, which varies between 1 and 20 years.

The number of Forward citations received by academic patents over a period of 7 years had a large probability spike at zero and varied between 0 and 36, with a low mean of 1.02 citations.

As for backward citations to PL, the average patent featured four backward citations, with a highly skewed distribution, a long right tail, a median of three citations and a high variation rate. Our results for academic patent held by firms are close to those of OECD for EPO patents in general: average values are around 0.3 and 75th percentile values are around 0.4 (OECD, 2013).

The indicator of linkage to science, Backward citations to NPL, shows an average patent featuring two backward citations to non-patent literature, with a very high variation rate.

Finally, we calculated the correlation among our patent indicators within the estimation sample. Except for the correlation between Backward citations to NPL and Backward citations to PL, which is significant and around 82%, all the other indicators are poorly correlated. This means that it makes sense to consider them as separate treatments in our estimation model.

5.2 Estimation and Analysis of Responsiveness Scores

5.2.1 Academic Patent Effect on Firms’ Profitability

Table 3.2 illustrates the descriptive statistics of the responsiveness scores model with a one-year lag from the patent’s priority year, whereas Fig. 3.1 shows the distribution of the responsiveness score for the different characteristics at short term.

The mean value indicates the average magnitude of responsiveness score to each academic patent characteristic.

Radicalness can be a measure of a firm’s explorative research trajectory. It has the smallest, even if positive, effect on the firm economic performance with an RS of 0.009 in the short term. The score distribution is a pretty bell-shaped one, with the presence of a right tale of higher values of positive response (maximum value is 2.5).

Patent Renewal, meaning firms ‘attribution of economic value to the patent, exhibits the highest effect on profitability, but with the highest variability. A very wide dispersion of results is present and at the 75th percentile the Response Score is equal to 0.9, showing that the extreme values in the right tail drives the mean.

The two indicators of prior art exhibit relatively more important responsiveness scores. Backward citations to PL have a positive mean, meaning that firms’ economic return responds positively to an increase in the stock of cumulated knowledge.

Backward citations to NPL, suggesting a link with science and basic research, have the lowest dispersion of values around the positive mean. Firms’ profit responds rather homogeneously to this factor. An increase in backward citation to scientific literature has a positive effect on the economic return and this support Cassiman et al. (2008) suggestion that patents that cite science contain more complex and fundamental knowledge and this influences positively their generality. Forward citations manifest one of the lowest effects, with a mean RS of 0.02. It has an asymmetric distribution of the responsiveness scores, both on the left and the right sides. Probably the use of only self-forward citations that specifically measure how much the firm applicant builds on a patented invention in its later technological activities (Sørensen & Stuart, 2000; Rosenkopf and Nerkar, 2001; Peeters et al., 2018), could exhibit a stronger and more regular relation with the private economic return.

The Technological closeness of the academic patents to the firms’ technological profile shows a negative sign, i.e. an increase towards a full exploitative trajectory leads to a decrease in the OPM, all other variables held constant. The negative mean score is around −0.03.Footnote 3 However, the distribution shows a right-side skewness with a long tale of positive scores.

It could be interesting to check if any conditions may alter the negative effect of the technological closeness of the academic patents to the technical profile of the holding firm. Ljundberg et al. (2012) showed that when a patent’s technological closeness is associated to a firm core technology, i.e. a technology in which the firm invest a high share of resources and in which it has a competitive advantage, the impact of the patent is positive. We checked if the association of patent technological closeness with patent high renewal value, indicator of firm’s high expectation of patent economic value and consequently of firm’s interest in investing resources in that patent, exhibit a positive score and we found out a confirmation.

Our result denies Peeters et al. (2018) conclusion that when the academic patents are characterised by an exploitative character (closeness to a firm’s technological domain), the effect on the firm technical development is always negative, while the academic inventors’ involvement in technology development can benefit to a firm when they are exploration-oriented. Our result corroborates the statement of Ljungberg and McKelvey (2012) and Ljungberg et al. (2013). The meaning of this result is that where the firm has strong competences in a field and invests resources there, the associated external contributions, complementing firm’s knowledge in some way, can produce a positive return.

Tables 3.3 and 3.4 show that firm’s academic patents characterized by high renewal have a positive score measuring the response of operating profit margin, while academic patents with a low renewal have a negative score. We simply divided the sample into two components: with high and low active life of patents (Renewal). The negative value (−0.133) is higher than the mean value −0.035 without an association to patent renewal (Table 3.3). Note that the responsiveness score of the renewal component is negative for firms with an already high renewal intensity and positive for those with low renewal intensity. This can be interpreted as a scale effect: at high level of renewal intensity, a marginal increase of renewal may have a negative effect on profitability, as the induced costs are higher than the benefits of marginal renewal extension. The opposite occurs when firms start from significantly lower renewal level.

5.2.2 Short and Long-Term Analysis

In this section, we check the presence of different effects of the patent characteristics on firms’ economic performance in the long term. Given data availability, we use a lag of three years. The literature supports our choice: technical knowledge evolves rapidly in most technology fields, losing most of its technical and economical relevance within five years (Ahuja & Lampert, 2001; Hall et al., 2005; Leten et al., 2007). A technology domain remains relatively new and unexplored immediately after a firm embarks on technological activities and it keeps its explorative status for a period of around three consecutive years (Belderbos et al., 2010).

Figure 3.2 plots the relative frequency distribution of the RS with the mean and standard deviation respectively at one year and three years after patent application.

In the short time the better effect is shown by the academic patent’s knowledge base (prior art), whose two indicators exhibit relatively higher and less dispersed positive results. In the long term, it is the technological knowledge base of academic patents (Backward citations to PL) which reveals a positive improvement: there is a higher concentration of response scores around positive values and the left right tail is reduced. As to the scientific knowledge base (Backward citations to NPL) there is a slight increase of the negative response scores, even if the response scores distribution remain bell-shaped and concentrated, indicating that firms’ profits respond rather homogeneously. The long-term effect may reveal possible failures in case of less familiar knowledge base, but only in a few cases.

In the short term an academic patent with a knowledge base new to the firm (Radicalness) manifests the lower positive effect on firms’ profit and in the long term the effect gets worse. The distribution of the response scores changes and exhibits a higher concentration on negative scores; at the same time, it has a bit longer right tail. It seems likely to indicate a strong heterogeneity in the firms’ capacity of commercially exploiting new and unfamiliar technological fields.

When an academic patent has a technological content very similar to the firm’s current knowledge (Technological closeness), the effect (profit response scores) on average is negative at short time, but with a right-side skewness, i.e. a long tale of positive scores, most likely due to idiosyncratic aspects. The distribution’s shape changes at long term, by slightly increasing the frequencies of positive response scores. This would ask for more analysis, in general, when the academic patent is technologically close to the firm’s technological profile, but it concerns a firm’s core field, i.e. a technological field from which firms expect good economic results, the effect of this last characteristic prevails and change the impact on profit for the positive.

6 Discussion and Conclusions

The goal of this study was to analyse the link between academic involvement in firms’ research and firm’s economic performance, through academic patents and their associated technological and economic characteristics. We found only a few contributions in the literature on this specific topic and their results gave little attention to the large heterogeneity characterising both academic patents and their industrial applicants. Mainly focused on average effects, these contributions have provided a polarised view of the academic patents’ contribution to the commercial and economic success of their industrial assignees, i.e. only a small part of firm owned academic patents, those with a more radical and exploration-oriented character, would have a positive effect (mainly in the long term) on firms’ performance.

Our findings support a more nuanced kind of conclusions, opening up to further investigation on this topic. In accordance with the literature, we found that academic patents held by firms have on average a problem-solving characteristic, i.e. they are oriented to help firm to find solutions to difficult or complex current issues, that is different from an activity of explorative research. However, this incremental knowledge contribution given by scientists, probably on aspects that firms cannot manage well, does not bring to dead ends. Our results show that, when we look at the academic patents in the firms’ portfolio, they can produce better results at short and long term mostly when the invention has a strong technical base. The incremental content of these patents, that can be roughly identified with the prior art technological background (Backward citations to PL) has only a small left tail identifying negative response scores of profitability. It has rather concentrated positive scores in the short term, with a score distribution becoming more centred on positive values in the long term. A scientific knowledge base of the invention is also positively relevant for the firm’s economic performance, but at long term some failures appear, probably due to knowledge absorption capacity on the firm side.

The difficulty of managing unfamiliar knowledge is more evident when the invention is the result of an explorative strategy: The Radicalness indicator showed a low and not stable effect at long term. Negative scores and a long right tail reveal a strong heterogeneity in the firms’ capacity of commercially exploiting new technological fields. Entering in a new field is a risky and costly strategy for firms: only some of them are able to become successful.

Our results show a satisfactory degree of coherence. Dealing with the exploitation-oriented character of academic patents (Technological Closeness), i.e. academics’ research contribution on familiar-to-the-firm technical fields, we find again the presence of nuanced effects. There is a strong skewness of firms’ profit response on the right side, showing the presence of positive effects due to idiosyncratic characteristics of industrial assignees or of academic patents. In particular when these academic patents are associated with some indicator of firm’s core technological field-invention on which firms has positive expectations and invest more- the mean of the profit response score is positive.

Finally, if managers are interested in identifying a positive relation between academic patents and firm’s economic return, they have to look for complementing the knowledge base in which firms have an advantage; more radical and distant strategies bring a premium only in a few cases.

The approach we followed in this study presents some limitations. In particular, RS are descriptive measures of the level of firm responsiveness and the long term should be prolonged at a bit more than three years. However, we believe that this work and its empirical approach can contribute to our understanding of the economic effects of academic patents held by firms. Further works should try to assess the robustness of our results, by giving relevance to effects’ heterogeneity as done in this work.

Notes

- 1.

These two good-quality datasets (i.e. Lotti & Marin, 2013 and APE-INV) provide a unique tool to investigate the research questions at hand on a European country. Furthermore, given that the two datasets have already been largely employed (separately) in academic research, they are scientifically validated, thus providing reliability to our results.

- 2.

The descriptive statistics of our sample are extremely close to the statistics of the entire academic patent population. Therefore, the representativeness of our sample, notwithstanding the presence of missing values, is not biased.

- 3.

Precisely a one standard deviation increases in academic patent technological closeness led to a 0.3 standard deviation decrease in the projected OPM, all other variables held constant.

References

Ahuja, G., & Lampert, C. M. (2001). Entrepreneurship in the large corporation: A longitudinal study of how established firms create breakthrough inventions. Strategic Management Journal, 22(6-7), 521–543.

Anderson, P., & Tushma, M. (1990). Technological discontinuities and dominant designs: A cyclical model of technological change. Administrative Science Quarterly, 35(4), 604–633.

Artz, K. W., Norman, P. N., Hatfield, D. E., & Cardinal, L. B. (2010). A longitudinal study of the impact of R&D, patents, and product innovation on firm performance. Journal of Product Innovation Management, 27, 725–740.

Azagra-Caro, J. M. (2011). Do public research organisations own most patents invented by their staff? Science and Public Policy, 38(3), 237–250.

Bacchiocchi, E., & Montobbio, F. (2009). Knowledge diffusion from university and public research. A comparison between US, Japan and Europe using patent citations. Journal of Technology Transfer, 34(2), 169–181.

Belderbos, R., Faems, D., Leten, B., & Van Looy, B. (2010). Technological activities and their impact on the financial performance of the firm: Exploitation and exploration within and between firms. Journal of Product Innovation Management, 27(6), 869–882.

Bishop, K., D’Este, P., & Neely, A. (2011). Gaining from interactions with universities: Multiple methods for nurturing absorptive capacity. Research Policy, 40(1), 30–40.

Bogner, W. C., & Bansal, P. (2007). Knowledge management as the basis of sustained high performance. Journal of Management Studies, 44(7), 165–188.

Breitzman, T., & Mogee, M. E. (2002). The many applications of patent analysis. Journal of Information Science, 28(3), 187–206.

Breitzman, A. F., & Narin, F. (2001). Method and apparatus for choosing a stock portfolio, based on patent indicators. US Patent 61758214.

Callaert, J., Van Looy, B., Verbeek, A., Debackere, K., & Thijs, B. (2006). Traces of prior art: An analysis of non-patent references found in patent documents. Scientometrics, 69(1), 3–20.

Cassiman, B., Veugelers, R., & Zuniga, M. P. (2008). In search of performance effects of (in) direct industry science links. Industrial & Corporate Change, 17(4), 611–646.

Cerulli, G. (2017). Estimating responsiveness scores using RSCORE. The Stata Journal, 17(2), 422–441.

Cheng, Y. C., Kuan, F. Y., Chuang, S. C., & Ken, Y. (2010). Profitability decided by patent quality? An empirical study of the U.S. semiconductor industry. Scientometrics, 82(1), 175–183.

Chen, Y. S., & Chang, K. C. (2010). The relationship between a firm’s patent quality and its market value. The case of U.S, pharmaceutical industry. Technological Forecasting and Social Change, 77(1), 20–33.

Christensen, C. M., & Rosenbloom, R. S. (1995). Explaining the attacker's advantage: Technological paradigms, organizational dynamics, and the value network. Research Policy, 24(2), 233–257.

Cooper, A. C., & Schendel, D. (1976). Strategic responses to technological threats. Business Horizon, 19(1), 61–69.

Czarnitzki, D., Hussinger, K., & Schneider, C. (2012). The nexus between science and industry: Evidence from faculty inventions. The Journal of Technology Transfer, 37(5), 755–776.

Deng, Z., Lev, B., & Narin, F. (1999). Science and technology as predictors of stock performance. Financial Analyst Journal, 55(3), 20–32.

Dosi, G. (1988). Sources, procedures, and microeconomic effects of innovation. Journal of Economic Literature, 26(3), 1120–1171.

Encaoua, D., Guellec, D., & Martinez, C. (2006). Patent Systems for Encouraging Innovation: Lessons from economic analysis. Research Policy, 35(9), 1423–1440.

Geuna, A., & Rossi, F. (2011). Changes to university IPR regulations in Europe and the impact on academic patenting. Research Policy, 40(8), 1068–1076.

Griliches, Z. (1990). Patent statistics as economic indicators - a survey. Journal of Economic Literature, 28(4), 1661–1707.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2001). The NBER Patent Citation Data File: Lessons, Insights and Methodological Tools, National Bureau of Economic Research Working Paper 8498.

Hall, B. H., Jaffe, A., Trajtenberg, M. (2000) “Market value and patent citations: A first look” National Bureau of Economic Research Working Paper 7741. Available at http://www.nber.org/papers/w7741

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2005). Market value and patent citations. RAND Journal of Economics, 36(1), 16–38.

Harhoff, D., Narin, F., Scherer, F. M., & Vopel, K. (1998). Citation frequency and the value of patented inventions. Review of Economics and Statistics, 81(3), 511–515.

Harhoff, D., Scherer, F. M., & Vopel, K. (2003). Citations, family size, opposition and the value of patent rights. Research Policy, 32(8), 1343–1363.

Henderson, R. (1993). Underinvestment and incompetence as responses to radical innovation: Evidence from the photolithographic alignment equipment industry. RAND Journal of Economics, 24(2), 248–270.

Henderson, R., Jaffe, A. B., & Trajtenberg, M. (1998). Universities as a source of commercial technology: A detailed analysis of university patenting, 1965–1988. Review of Economics and Statistics, 80(1), 119–127.

Lanjouw, J. O., Pakes, A., & Putnam, J. (1998). How to count patents and value intellectual property: The uses of patent renewal and application data. The Journal of Industrial Economics, 46(4), 405–432.

Lanjouw, J. O., & Schankerman, M. (2001). Enforcing intellectual property rights. National Bureau of Economic Research Working Paper 8656.

Lanjouw, J. O., & Schankerman, M. (2004). Patent quality and research productivity: Measuring innovation with multiple indicators. The Economic Journal, 114(495), 441–465.

Lester, R. K., & Piore, M. J. (2004). The missing dimension. Harvard University Press.

Leten, B., Belderbos, R., & Van Looy, B. (2007). Technological diversification, coherence and performance of firms. The Journal of Product Innovation Management, 24(6), 567–579.

Lissoni, F. (2012). Academic patenting in Europe: An overview of recent research and new perspectives. World Patent Information, 34(3), 197–205.

Lissoni, F., Montobbio, F. (2015). The ownership academic patents and their impact. Evidence from five European countries. Revue Economique, 66(1), 143–171.

Ljungberg, D., & McKelvey, M. (2012). What characterizes firms’ academic patents? Academic involvement in industrial inventions in Sweden. Industry and Innovation, 19(7), 585–606.

Ljungberg, D., Bourelos, E., & McKelvey, M. (2013). Academic inventors, technological profiles and patent value: An analysis of academic patents owned by Swedish-based firms. Industry and Innovation, 20(5), 473–487.

Lotti, F., & Marin, G. (2013). Matching of PATSTAT applications to AIDA firms: discussion of the methodology and results, Questioni di Economia e Finanza, Occasional Paper, N 166, Banca d’Italia.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71–87.

Narin, F., Noma, E., & Perry, P. (1987). Patents as indicators of corporate technological strength. Research Policy, 16(2-4), 143–155.

Narin, F., Hamilton, K. S., & Olivastro, D. (1997). The increasing linkage between U.S. technology and public science. Research Policy, 26(3), 317–330.

Narin, F., Breitzman, A., & Thomas, P. (2004). Using patent citation indicators to manage a stock portfolio. In H. F. Moed, W. Glänzel, & U. Schmoch (Eds.), Handbook of quantitative science and technology research. Springer. https://doi.org/10.1007/1-4020-2755-9_26

Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Harvard University Press.

OECD. (2013). Measuring patent quality: indicators of technological and economic value, OECD Science, Technology and Industry Working Papers, Organization for Economic Co-operation and Development, Paris. (Authors: Squicciarini, M., Dernis, H., and Criscuolo, C.).

Pakes, A., & Schankerman, M. (1984). The rate of obsolescence of patents, research gestation lags, and the private rate of return to research resources. In Z. Griliches (Ed.), R&D, patents, and productivity. University of Chicago Press.

Pakes, A. (1986). Patents as options: Some estimates of the value of holding European patent stocks. Econometrica, 54(4), 755–784.

Peeters, H., Callaert, J., & Van Looy, B. (2018). Do firms profit from involving academics when developing technology? The Journal of Technology Transfer. https://doi.org/10.1007/s10961-018-9709-x

Podolny, J. M., & Stuart, T. E. (1995). A role-based ecology of technological change. American Journal of Sociology, 100(5), 1224–1260.

Rosenkopf, L., & Nerkar, A. (2001). Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strategic Management Journal, 22, 287–306.

Sampat, B. N., Mowery, D. C., & Ziedonis, A. (2003). Changes in university patent quality after the Bayh–Dole Act: A re-examination. International Journal of Industrial Organization, 21(9), 1371–1390.

Schumpeter, J. (1934). The theory of economic development; and inquiry into profits, capital, credit, interest and the business cycle. Harvard University Press.

Sørensen, J. B., & Stuart, T. E. (2000). Aging, obsolescence, and organizational innovation. Administrative Science Quarterly, 45(1), 81–112.

Sterzi, V. (2013). Patent quality and ownership: an analysis of UK faculty patenting. Research Policy, 42(2), 564–576.

Thomas, P., Research Inc, C. H. I., McMillan, G. S., & Abington, P. (2001). Using science and technology indicators to manage R&D as a business. Engineering Management Journal, 13(3), 9–14.

Trajtenberg, M. (1990). A penny for your quotes: Patent citations and the value of innovations. The Rand Journal of Economics, 21(1), 172–187.

Tripsas, M. (1997). Unravelling the process of creative destruction: Complementary assets and incumbent survival in the typesetter industry. Strategic Management Journal, 18(Summer Special issue), 119–142.

Wooldridge, J. (1997). On two-stage least squares estimation of the average treatment effect in a random coefficient model. Economics Letters, 56(2), 129–133.

Wooldridge, J. M. (2002). Econometric analysis of cross-section and panel data. Cambridge, Mass: MIT Press.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Cerulli, G., Marin, G., Pierucci, E., Potì, B. (2022). The Heterogeneous Impact of Academic Patent Characteristics on Firms’ Economic Performance. In: Azagra-Caro, J.M., D'Este, P., Barberá-Tomás, D. (eds) University-Industry Knowledge Interactions. International Studies in Entrepreneurship, vol 52. Springer, Cham. https://doi.org/10.1007/978-3-030-84669-5_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-84669-5_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-84668-8

Online ISBN: 978-3-030-84669-5

eBook Packages: Business and ManagementBusiness and Management (R0)