Abstract

The steady rise of new digital technologies offers many opportunities for business model innovation in different industries. This also affects more traditional companies, which need to keep up with technological development to be able to compete with innovative firms. Notably, the Industry 4.0 paradigm has largely drawn the attention on digital-driven business model innovation among manufacturing companies, while less is known about how this is developing in other industries. This chapter aims at filling this gap and contributes to an ongoing debate by providing a thorough analysis of a digital-driven business model innovation in a product/service firm, thereby showing how data can act as an enabler of change and innovation in existing organizations.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

Introduction

The increasing complexity of the business context means that business models (BMs) age faster than ever before. Hence, finding new ways of creating, delivering, and capturing value becomes of the utmost importance in maintaining a firm’s competitiveness, alongside product and processes innovations (Müller, 2019; Sorescu, 2017). Therefore, academics and practitioners alike have been devoting increasing attention to companies’ business model innovation (BMI) (Zott et al., 2011).

The literature on business model innovation has long emphasized the pivotal role of technological change in triggering the discovery or the emergence of new business models (BMs) that can potentially alter companies’ value creation and value capture mechanisms (Khanagha et al., 2014; Zott & Amit, 2013). Yet, the research has witnessed an increased interest due to the rise of new digital technologies (DTs), such as cyber-physical systems (CPS), additive manufacturing, augmented reality, virtual reality, robotics, remote monitoring, artificial intelligence, big data, cloud, and smart connected products, which are likely to offer many opportunities for business model innovation in different industries (e.g. Chasin et al., 2020; Kiel et al., 2017; Müller et al., 2018; Sestino et al., 2020). Notably, the growing spread of digital technologies does not only concern companies in the most innovative sectors, but also affects more traditional industries. When it comes to implementing digital technologies most traditional companies are “thrown into panic”, as they believe that digital technologies and business models pose an existential threat to their way of doing business (McGrath & McManus, 2020). If manufacturing firms do not seize opportunities in digitalization and do not transform themselves to embrace the opportunities offered by new digital technologies, they might suffer due to competition from innovative firms able to solve customer problems in more creative and effective ways (Björkdahl, 2020).

This has entailed that DT-driven business model innovation has become the chief focus of manufacturing companies (e.g. automotive, electrical engineering, medical engineering industries), mostly due to the Industry 4.0 megatrend (e.g. Kiel et al., 2017; Müller et al., 2018; Paiola & Gebauer, 2020). Hence, the existing empirical evidence is mostly focused on companies’ implementation of the Industrial Internet of Things (IIoT) in the manufacturing process and its consequences in terms of BMI, while less is known about how data-driven business model innovation unfolds in other industries. This is quite surprising as a positive relationship exists between big data analytics capabilities and business model innovation in different sectors (Alshawaaf & Lee, 2021; Ciampi et al., 2021). Furthermore, digitalization has the potential to affect many other functions beyond the manufacturing process (Björkdahl, 2020) and previous studies have argued that the degree of influence of digital technologies on BM components might depend greatly on the company’s industry (see Arnold et al., 2016; Rachinger et al., 2019).

Therefore, this study aims at filling this gap by providing a thorough understanding of the opportunities and challenges entailed in digital-driven BMI of a product/service firm. Hence, we extend the current debate over the pervasive impact of digital technologies—especially big data—as supportive enablers of change and innovation in existing organizations. By doing so, this book chapter answers previous calls for further research to be conducted on data-driven business model innovation (e.g. Sorescu, 2017; Urbinati et al., 2019).

Business Model Innovation: A Challenging Path for Firms’ Competitive Advantage

A substantial number of studies have addressed the business model concept, as the topic has drawn an increasing research interest across multiple disciplines and research fields, such as entrepreneurship, strategy, and innovation management (Foss & Saebi, 2017; Osterwalder et al., 2005; Schneider & Spieth, 2013). This has led to a general lack of conceptual clarity around the business model concept, with studies developing largely in silos (Foss & Saebi, 2017; Zott et al., 2011). Notwithstanding, a commonly agreed-upon definition is still lacking, the multitude of BM definitions seems to be centred on the notion of value and increasingly converge towards its conceptualization as the sum of at least three complementary elements, namely value proposition, value creation and value capture (e.g. Casadesus-Masanell & Ricart, 2010; Chesbrough & Rosenbloom, 2002; Teece, 2010; Zott et al., 2011). Value proposition primarily relates to the bundle of products and services a firm offers. Value creation refers to the operational activities, resources and competences needed to craft the value proposition; the segments of customers a company addresses, as well as the relationships and interactions with them; and the network of partners involved in the company’s business model. Finally, the value capture component relates to the cost structure and the revenue model describing the way a company makes money through a variety of revenue flows.

The business model offers a holistic and systemic perspective of how companies “do business” (Osterwalder et al., 2005) by representing not only what business do (e.g. what products and services they produce to serve customers) but also on how they do it (Zott et al., 2011). The business model describes a conceptual model for explaining the corporate strategy, able to connect it to daily activities and processes, thus bridging the gap between strategy formulation and implementation (Richardson, 2008). However, the BM construct was initially employed to understand and classify the value drivers of (e-commerce) BMs and as an antecedent of heterogeneity in firm performance (see Foss & Saebi, 2017; Zott et al., 2011); more recently the literature has devoted attention to the business model as a potential unit of innovation (Zott et al., 2011). Hence, BMI is an extension of the BM, and as such its literature mirrors the lack of conceptual clarity characterizing business model research (Casadesus-Masanell & Zhu, 2013; Schneider & Spieth, 2013). At root, business model innovation might be defined as “the search for new logics of the firm and new ways to create and capture value for its stakeholders” (Casadesus-Masanell & Zhu, 2013, p. 464; see also Teece, 2010). Yet, although optimizing internal processes or merely implementing new technologies and activities in an organization do not represent BMI (Bouwman et al., 2018), the literature seems to agree that business model innovation does not manifest solely in a radically reconfigured BM (e.g. Li, 2020; Sorescu, 2017). Firms might innovate their BM when they take ideas from one domain and adapt them for another domain, as long as the innovation affects the core business logic of the firm and its value creation, value delivery and value capture mechanisms (Sorescu, 2017). This perspective adopts a transformational approach towards BM, emphasizing how managers can change firms’ activities and value logics (e.g. Demil & Lecocq, 2010; Johnson et al., 2008). BMI is said to be a necessary response to “strategic discontinuities and disruptions, convergence and intense global competition” (Doz & Kosonen, 2010, p. 370) and a key to firm performance (Zott et al., 2011). Firms can effectively compete through their business models (Casadesus-Masanell & Ricart, 2010).

Yet, the process of BMI might be hindered by internal and external barriers. Existing configurations of assets and processes, which may be subject to inertia, as well as the cognitive inability of managers to understand the value potential of a new BM are important impeding factors (Chesbrough, 2010). As a matter of fact, BMI is a strategic decision-making process and managers might be influenced by perceived threats, perceived performance shortfall, and the lack of perceived opportunity (Osiyevskyy & Dewald, 2015). Interestingly, scholars have also investigated organizational configuration to deal with business model innovation by suggesting two contrasting approaches: separation or integration between the existing BM and the new BM (Kim & Min, 2015). Some studies recommend an organizational spin-off (i.e. separation) so that the dedicated organizational unit is focused on managing the innovation (e.g. Chesbrough, 2010; Chesbrough & Rosenbloom, 2002). In contrast, companies may decide to run multiple BMs concurrently (i.e. integration or business model portfolio) as running multiple business models at the same time enables the exploitation of synergies between them (e.g. Li, 2020). Moreover, Khanagha et al. (2014) show that organization might iterate between structural separation and the integration of new BMs to leverage the potential of experimenting with the new BM.

Digital-Driven Business Model Innovation: The Value of Data

It has been extensively argued that digital technologies drive or enable companies’ business model innovation (see Khanagha et al., 2014; Zott & Amit, 2013). As a matter of fact, business models are fundamentally linked with technological innovation (Baden-Fuller & Haefliger, 2013). Some studies describe BMI as an attempt to seize new opportunities introduced by the advent of, for example, specific digital technologies (Foss & Saebi, 2017). For instance, researchers have focused on the influence of information and communications technologies on the emergence of new BMs in the context of e-commerce (e.g. Sabatier et al., 2012; Wirtz et al., 2010).

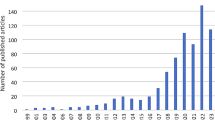

Notably, in recent years, the growing academic interest in how the 4th Industrial Revolution is taking place within companies has led to a steady annual increase in publications addressing the role of digital technologies in firms’ BMI (e.g. Arnold et al., 2016; Frank et al., 2019; Kiel et al., 2017; Müller et al., 2018). In fact, the rapid spread of digital technologies has led to the introduction of new business models that have radically changed entire industries. Many traditional firms have been suffered due to the fast growth of innovative digital entrants, such as Alibaba and Amazon, which have profoundly challenged incumbents (Verhoef et al., 2021). Scholars have highlighted that digital technologies have the potential to affect each BM component, thus showing that implementing DTs within companies is effectively changing how companies “do business”, as changes in value proposition, value creation and value capture mechanisms are strongly interdependent (Burström et al., 2021; Kiel et al., 2017; Ritter & Pedersen, 2020). For instance, digital technologies are playing a major role in driving service-led growth strategies of product firms which have shifted from manufacturing and selling products to innovating, selling, and delivering services (i.e. digital servitization) (e.g. Björkdahl, 2020; Frank et al., 2019; Kohtamäki et al., 2019; Paiola & Gebauer, 2020). In fact, such transformation is so deeply rooted in the product firms’ value architecture that their BMs require innovation.

Indeed, the value proposition appears to be the most affected BM component (Arnold et al., 2016; Kiel et al., 2017). Companies show an improved ability in offering new and more complex products and services (Kiel et al., 2017; Müller et al., 2018; Rachinger et al., 2019; Urbinati et al., 2019). Hence, digital technologies are embedded not only in factories, but also in the products themselves. Manufacturing companies are increasingly integrating DTs in established products to make them more “intelligent” (Björkdahl, 2020). When innovating traditional manufacturing products by making them “intelligent”, firms are able to move downstream and provide new operational and complementary services. Moreover, digital technologies have the potential to make manufacturing firms’ product development more efficient (Björkdahl, 2020). It is noteworthy that the digitalization of product development decreases the need for physical artefacts and prototypes, thus streamlining and easing product design. Also, testing procedures, which are an important part of a firm’s product development activities, can be accomplished quickly, by allowing various outcomes to be checked. In general, the literature has widely emphasized the pivotal role of data mining and analytics in innovating companies’ value propositions. As a matter of fact, DTs provide access to valuable customer data, which allows the customer to be better understood, and product quality and product customization to be enhanced (Cheah & Wang, 2017; Kiel et al., 2017; Laudien & Daxböck, 2016; Müller et al., 2018). Having new data and insights about what customers would like to buy, how they want to pay for and use their products, companies are better equipped to create value for their customers. By using customer-generated data, firms might leverage user-centred innovation and develop co-creation initiatives. This information allows firms to come up with innovative value propositions to differentiate themselves from their competitors.

Moreover, digital technologies might contribute to innovating the value creation component of the BM. In particular, the implementation of new DTs is largely associated with enhanced production efficiency and optimization, in terms of resource and energy usage, time, and equipment effectiveness. Digital technologies allow companies to collect, process, and handle relevant data for production traceability purposes, such as monitoring production status-quo, including bottlenecks and production output (Björkdahl, 2020; Kiel et al., 2017; Müller et al., 2018). In some organizations, these activities are limited to the possibility of integrating machines, thereby obtaining new data, and linking different data sources to improve decision-making processes. In addition, leading firms also perform more advanced activities. For instance, computer visualization systems employing machine learning algorithms to identify defects and flaws in the manufacturing process reduce the need to take products or materials out of the production line and check them manually (Björkdahl, 2020). In this regard, manufacturing firms often employ the “digital twins” of a given product to reflect the entire manufacturing process, thereby allowing enhancements based on the performance of the product in a live environment.

New DTs also guarantee the information transparency of shop floor processes, through systems that show the tasks performed at each machine, task duration, given commands, and eventual failures. They can increase quality, decrease variance, and minimize the number of breakdowns and stoppages by making the manufacturing process more intelligent through the use of digital technologies and more and better data (Björkdahl, 2020). Overall, this improves managers’ speed, reaction capability, and flexibility in responding to malfunctions and problems.

Furthermore, entirely new skills and competencies are required among employees (Arnold et al., 2016; Müller et al., 2018; Rachinger et al., 2019; Urbinati et al., 2019). Firms need to develop or acquire new competencies, such as data analysis or human intervention in the event of machine failures. For instance, a shift might occur from traditional marketing capabilities with the focus on advertising and brand awareness to one-to-one contextual marketing to support personalized offerings driven by data analytics and machine learning.

The actual implementation of DTs also influences companies’ relationships with both customers and partners (Arnlod et al., 2016; Björkdahl, 2020; Rachinger et al., 2019; Urbinati et al., 2019). Hence, digital technologies bring about changes in the existing partner network configuration. For instance, IT suppliers and development partners play an important role for companies in all manufacturing companies (Arnold et al., 2016; Kiel et al., 2017). In this environment of data-driven innovation, customer relationships become more intensive: manufacturers increasingly establish longer term, communicative, and collaborative contacts with customers (Cheah & Wang, 2017; Kiel et al., 2017). Hence, customer relationship changes refer to a growing degree of intensity in terms of communicating with, understanding, and satisfying customers, transforming relationships into partnerships, and integrating customers early. For instance, Müller et al. (2018) highlight that automated online platforms enable wider customer reach, easier order placement, and facilitate customer co-design and co-engineering processes. Furthermore, companies leveraging new DTs show an increasing orientation towards direct sales as direct and close customer contact is necessary to meet the increased consultation requirements of complex digital-embedded products and solutions (Kiel et al., 2017; Laudien & Daxböck, 2016). Therefore, digital technologies seem to improve inter-company connectivity with customers. However, data exchange and information transparency concern the entire supply chain, as digital technologies might also ease suppliers’ access to real-time information (Müller et al., 2018). Despite that, firms might struggle to convince suppliers and partners that digitally linked processes are beneficial for both sides, as they fear to disclose sensitive information and incur high investment costs (Laudien & Daxböck, 2016).

Lastly, the implementation of digital technologies has the potential to affect value capture mechanisms as well. Basically, the data-driven core of DTs leads to changes in the cost structure. On the one hand, companies experience costs savings linked with increased productivity, on the other hand, they incur additional costs due to significant IT-related investments (Arnold et al., 2016). Moreover, digital technologies have the potential to enable the switching from payments per product to new revenue models, such as dynamic pricing, pay-per-feature, pay-per-use, or pay-per output models (Laudien & Daxböck, 2016; Müller et al., 2018). Importantly, although the data-driven nature of the DTs significantly facilitates the implementation of usage fees, these practices are highly related to the company’s industry as more traditional companies, such as manufacturing ones, hardly experience revenue model changes (Kiel et al., 2017), unless they shift from being product manufacturers to being service or solution providers (Müller et al., 2018).

However, despite the increasing potential of recent technological developments, companies are still struggling with making successful digital transformation (McKinsey, 2018; Sund et al., 2021). This process seems to conceal several challenges. Companies are likely to incur high investment costs for the IT infrastructure, as well as costs for hiring and training employees (Müller et al., 2018), who need to possess specific IT and data analytics capabilities, as well as market competence and understanding of customers (Kiel et al., 2017). This might lead to high costs in the short term, while the benefits of implementing new DTs might only become apparent in the long run (Müller et al., 2018). An additional major issue regards data security and privacy concerns (Müller, 2019). Furthermore, companies investing in gathering information through digital technologies often face difficulties in putting the information to commercial use (Müller et al., 2018). There is indeed anecdotal evidence of companies facing a so-called digitalization paradox, which means that they invest in digital offerings, but struggle to achieve the expected revenue growth, despite the proven growth potential of digital technologies (Gebauer et al., 2020; Kohtamäki et al., 2019).

Overall, the effects of implementing new digital technologies can be traced primarily to better performing products with new functionalities and more efficient firm operations and manufacturing processes, thanks to improved production output, fewer breakdowns, enhanced maintenance, and more effective integration across value chains. “Front-end” and “back-end” data analytics allow the data to be transformed into valuable insights and actionable directives, which improves companies’ decision-making processes. “Front-end” data about customers allows to better understand customers’ value creating process, strengthening customers relationships and interactions, while the collection of “back-end” operational and production data through sensors enhanced production efficiency. Therefore, data collection and analysis are critical in allowing firms to access the full potential of digital-driven business model innovation (Laudien & Daxböck, 2016; Paiola & Gebauer, 2020; Parida et al., 2019; Sorescu, 2017).

Despite the growing interest in DT-driven business model innovation, the literature has thus far devoted greater attention to the manufacturing companies (e.g. automotive, electrical engineering, medical engineering industries), mostly due to the Industry 4.0 megatrend (e.g. Kiel et al., 2017; Müller et al., 2018; Paiola & Gebauer, 2020). The existing empirical evidence is mostly focused on companies’ implementation of the Industrial Internet of Things (IIoT) in the manufacturing process and its consequences in terms of BMI, while less is known on how the data-driven business model innovation is impacting product/service firms.

Methodology

A single case study methodology was employed, as this method fits the purpose of the study by allowing for an explorative analysis of a contemporary phenomenon in its real-life contexts (Yin, 2003). Importantly, the main objective of a single case study is to understand and examine a single subject of analysis in a thorough way, instead of aiming at statistical generalization (Stake, 1995). In this regard, qualitative methodologies are largely used in business model and business model innovation literature (Foss & Saebi, 2017), as companies might experience different and unique paths to digital-driven business model innovation (e.g. Frank et al., 2019; Paiola & Gebauer, 2020; Verhoef et al., 2021). Thus, this methodology enhances the understanding of the dynamics and contextual complexities of data-driven business model innovation.

The company GrottiniLab, a technological solution provider which has been experiencing changes in the business model, was selected as the research setting and case study company. The company provides retailers with innovative technological solutions supported by artificial intelligence, deep learning, and machine learning, in order to monitor, analyse and optimize the shopping experience in stores, shopping centres, showrooms, supermarkets, stations, and other centres. Recently, the company developed a new solution named Shopper Science Lab, a retail shop fully equipped with permanent shopper analytics technologies to monitor and analyse shopping behaviours.

The study was conducted between March 2020 and March 2021. Data were collected primarily through semi-structured interviews. In this regard, all the knowledgeable company members who contributed to the design of the new solution as well as to the design of the innovative business model were involved. In particular, the following executives participated in the study: (i) the Chief Growth Officer, (ii) the Head of Data Science—Executive Consultant for Commercial Growth, and (iii) the Digital Communication Manager. Involving multiple key informants who perform different job roles allows stronger evidence to be provided (Eisenhardt, 1989; Yin, 2003). The interview track was based on open-ended questions trying to guarantee a good balance between guidance and consistency, as well as an adequate level of freedom in answering. Furthermore, this allows to identify recurrent themes among participants. The track was based on the current literature on digital-driven business model innovation. Data reduction and condensation procedures were used to remove non-relevant information. The authors also performed manual coding, aggregating data into categories to streamline the analysis (De Massis & Kotlar, 2014; Miles & Huberman, 1994). Moreover, we used direct observation and archival data analysis as additional sources (Eisenhardt, 1989; Yin, 2003). This material provides additional information and makes it possible to verify findings and increase evidence. Since the aim of the study is to analyse the BMI process related to the Shopper Science Lab project, we believe it is useful to describe this process in a narrative way in order to identify and understand how the business model innovation process occurs.

The Business Model Innovation in GrottiniLab: The Shopper Science Lab Experience

The Company

GrottiniLab is an Italian company that was founded in 2011 and is strongly oriented towards technological innovation. The Company operates mainly in the retail sector and its core business is to provide innovative retail analytics solutions. In fact, the company designs and implements solutions aimed at monitoring, analysing, and improving the shopping experience of consumers within stores. The technological configurations are supported by proprietary algorithms. Over the years, GrottiniLab has established itself on the market thanks to a working methodology divided into three phases:

-

Big Insights: this phase is aimed at generating a deep understanding of the consumer’s behaviour, needs and decision-making process for purchasing.

-

Big Data: this is the phase of data collection and analysis aimed at producing information and generating metrics.

-

Big Actions: this is the phase in which data-driven answers are provided to specific business questions posed by client companies.

The New Solution: The Shopper Science Lab

At the beginning of 2020, the company decided to launch a new solution called the Shopper Science Lab, in partnership with an important Italian brand leader in the drugstore sector. According to the Executives, t Shopper Science Lab is configured as a real store equipped with the main technologies that GrottiniLab provides in the field of shopper behaviour analysis. The purpose of this solution is therefore to allow customers to test the performance of their retail and trade marketing activities, and to test the new products and packaging in a realistic shopping context. Thus, within the Shopper Science Lab it is possible to conduct the following types of analysis:

-

Detection of store entrances.

-

Tracking the paths taken by shoppers within the store.

-

Detection of shopper interactions with products on the shelves.

-

Calculation of purchase conversion rates thanks to integration with sell-out data.

Moreover, all this data may be integrated with sales data provided at the store level. The technological equipment available in the Shopper Science Lab is configured as follows:

-

Tracking system: these are technologies based on Real-Time Locating System (RTLS) tags that are applied to both baskets and shopping carts in the store. The RTLS sensors allow the paths taken by shoppers to be detected, including stop times, and also provide a navigation map of the store.

-

Stereoscopic sensors: the reference technologies are mini-personal computers (PCs) and 3D Optical Smart Sensors (OSS); the latter are applied to the false ceiling over the entire surface of the store; like the previous ones, they also contribute to enriching the analysis of the routes by mapping the navigation.

-

Infrared Sensors: mini-PCs and 2D Optical Smart Sensors technologies are adopted; the latter are placed in correspondence with individual shelves or particular areas of interest such as promotional areas. The adoption of these sensors allows the presence and nature of the shopper's interaction with the product category to be detected. Additionally, they provide a mapping of shopper navigation at the shelf level.

-

Image recognition sensors: they are applied in specific areas of interest within the store; they allow aspects such as gender and age group in shoppers to be detected; these data help to elaborate a clustering of shoppers.

This technological configuration allows retailers to collect data in a non-intrusive way and to answer their most frequent questions, such as evaluating the effectiveness of promotional materials within the store, assortment and shelf layout choices, planograms, etc. As mentioned before, it is also possible to conduct tests aimed at monitoring the performance of new product launches or new packaging.

In this scenario, the introduction of the Shopper Science Lab as a new solution in the company portfolio required a new approach to the customers, both in terms of value proposition formulation and communication. It is worth noting that bricks-and-mortar retail stores generally adopt a “traditional” approach to the market. On the one hand, the practices aimed at improving the shopper experience in store are still limited, on the other hand, traditional retailers are still lagging behind when it comes to the “data culture”. While in the online stores data represent a key element to inform decision-making processes, offline retailers largely rest on the sell-out data to make business decisions as well as plan marketing and promotion tactics. Furthermore, consumer knowledge is still acquired using traditional market research methods, such as surveys or direct observation.

As a matter of fact, data generated by the technologies installed within the Shopper Science Lab can be of interest to several customer segments, such as the manufacturers that sell their products through the retail channel, or any other company operating in the retail industry that is looking for valuable consumers’ data on shopping behaviour for marketing research purposes.

This opening to a new pool of potential customers has led the company to design an innovative business model which, when compared to the previous one, has undergone some substantial changes in various aspects within the value proposition and value capture components of the business model. The following sections illustrate the main aspects of the business model innovation.

Business Model Innovation: Value Proposition

The introduction of the Shopper Science Lab led the company to formulate a new value proposition centred on the strengths of the lab’s solution. It is important to point out that the Shopper Science Lab project contributed to consolidating one of the company’s mission, that is, spreading a data-driven culture among retailers through its solutions. Real data to support retailers’ decisions are therefore one of the core elements of the value proposition. With this in mind, the new value proposition is based on two main pillars.

A first element is related to the context: the Shopper Science Lab is not an artificial environment but a real store, already configured and ready for different types of analyses. According to the Chief Growth Officer: “by offering a permanent laboratory, GrottiniLab can guarantee to the user companies a series of advantages such as a data collection on an ongoing basis, the ability to launch multiple tests during the year and to independently manage their duration time as well. The real store, already fully equipped with technology, also allows the user companies to reduce or in some cases delete the kick-off times of the analysis projects”.

The second pillar is related to the data: as previously stated, Shopper Science Lab is equipped with various shopper behaviour analytics technologies; the integrated use of multiple systems allows a very accurate analysis of shopping behaviour. Therefore, data is the core element of the new value proposition which materializes into a new service, consisting in the access to the Shopper Science Lab database to those companies that are not present in the store with their products. In this way, for the first time, GrottiniLab can sell retail insights without installing a complex technological solution on the retail shop floor, providing customers with the ability to access the Shopper Science Lab database containing the history of real data that is produced within it. According to GrottiniLab executives, this aspect represents one of the main new elements that characterize the current business model. In fact, the company is now able to expand its portfolio of solutions in the retail market by presenting itself not only as a technology/service provider, but also as a player competing in the marketing research industry.

Notably, the features of the technologies within the Shopper Science Lab have allowed the company to introduce into its business model not only new activities, but also new combinations of those already existing. From this standpoint, a first aspect concerns the possibility of offering in a single solution a combination of services that are normally offered separately; from the perspective of GrottiniLab Executives, the data generated are processed and transformed into actionable insights that can support the decision-making processes of the brands with regard to their marketing strategies and tactics. These insights are useful, for example, to understand the purchase conversion funnel of shoppers who, once logged into the store, are monitored until the purchase stage. For example, it is possible to analyse the impact of an advertising flyer on the shoppers’ path in the store. By comparing the heatmaps that provide information on shoppers’ behaviour within the store before, during and after they saw the flyer, it is possible to understand if and in which areas there was a greater flow of customers. The heatmaps analysis provides a more complete evaluation than the mere sell-out data evaluation, as it allows to understand how the variations of the paths determine different sell-out performances by answering questions such as: “how has the conversion path changed (purchases / steps in category) in relation to the flyer?” Or: which categories received the greatest benefit during and after the flyer launch?

This is possible thanks to the integration between various areas of analysis such as monitoring the level of attractiveness of the single product category which considers the time spent by each shopper in each single category, shelf, stock keeping unit and product. Data about the number of visitors who stop in front of that product category is combined into the “time spent” metric, and moreover, the average number of interactions per visitor is calculated.

It is also possible to identify the presence of clusters of shoppers that can be segmented by gender and age group, as well as to understand whether shoppers make purchases alone or in pairs/groups.

Business Model Innovation: Value Creation

Value creation is the second-most affected dimension of the business model. In this regard, one of the most important aspects relating to the business model innovation process of GrottiniLab’s business model is its approach to customer segments. As stated by the Chief Growth Officer: “the Shopper Science Lab targets different types of customers: retailers - the traditional market segment of GrottiniLab – and manufacturers. The latter represents a new market segment for the company, and it includes both firms that sell their products through the stores and firms that do not distribute their products through the stores, but who are interested in obtaining shoppers’ insights”. In particular, for the latter type of customer, the value proposition is based on the ability to conduct market research based on real-world and real-time data that are constantly generated.

The introduction of a new solution on the market that is aimed partially at new customers has led GrottiniLab to innovate customer interactions. In particular, also due to the ongoing Covid-19 pandemic, the company intensified the use of social media channels to communicate with its potential customers and present the complexity of the Shopper Science Lab in a smart and engaging way.

In this regard, a social media strategy was developed, mainly based on the professional social network LinkedIn, with the aim of launching the Shopper Science Lab. The content published in the form of infographics, free guides and blog articles had a dual purpose: on the one hand, to increase the brand awareness of the GrottiniLab company as a European leader in the retail analytics sector, and on the other hand to present the Shopper Science Lab solutions in order to generate potential leads that might be interested in having more information.

As the Chief Growth Officer stated: “the content, produced in a clear language, were intended to answer typical questions that a potential customer might have asked to a company salesman, such as: “which type of customer is the Shopper Science Lab addressed to?” Or “what can I do inside a Shopper Science Lab?”.

Each lead acquired was contacted by the company’s sales managers for an in-depth interview and a proposal for a quote that could vary, depending on the characteristics of the customer and the options chosen. Particularly effective in terms of communication was the production and dissemination through the company website and the official LinkedIn profile of use cases through which the company was able to illustrate real examples of application of the Shopper Science Lab. Starting from the identification of the business question formulated by the customer, the use case was intended to present how, thanks to the analysis of the data acquired within the store, it was possible to generate useful insights to solve that particular business question.

The creation of the Shopper Science Lab was made possible thanks to a strategic partnership with the Italian brand leader in the drugstore sector. The leading company in Italy in the drugstore segment has in fact made its own store available, within which all the retail analytics technologies have been installed. In addition to providing the location, the partner supports GrottiniLab by helping to spread its promotional campaigns related to the Shopper Science Lab.

Conclusions

The current literature has shown considerable interest in digital-driven business model innovation (e.g. Khanagha et al., 2014; Sabatier et al., 2012). Recently, academics have been devoting increasing attention to those digital technologies which fall under the Industry 4.0 paradigm (Arnold et al., 2016; Frank et al., 2019; Kiel et al., 2017; Müller et al., 2018). In this regard, scholars have found that digital technologies profoundly affect the BM components, namely value proposition, value creation/delivery and value capture. However, while focusing on those technologies which drive the 4th Industrial Revolution, existing studies are largely focused on understanding digital-driven BMI in manufacturing companies. By doing so, they highlight the tremendous potential of digital technologies to enhance the manufacturing process and operational efficiency. Although the existing empirical evidence somewhat shows that, in manufacturing companies, the value of digital technologies largely lies in the data generated, which allows for uncovering production bottlenecks, products flaws and for a better understanding of customers’ needs and dissatisfaction, less is known about how data-driven business model innovation is developing in other industries.

This chapter contributes to the ongoing debate on the topic by showing how a digital-driven business model innovation might occur in a product/service firm. The study findings confirm the existing empirical evidence in the manufacturing industry by showing that digital technologies might entail a data-driven business model in other industries as well. The study also highlights some differences regarding customer segments, customer relationships and revenue model.

First, the case study company experienced major changes in the value proposition. These findings are in line with previous studies showing that the value proposition appears to be the most affected BM component, among others (see Arnold et al., 2016; Kiel et al., 2017). Specifically, thanks to the Shopper Science Lab, the company can leverage its capabilities to offer a new integrated solution at its best, since the Shopper Science Lab represents a real store equipped with various shopper behaviour analytics technologies. More interestingly, the company is now able to sell retail insights, providing customers with the ability to access the Shopper Science Lab database containing the history of real data generated, without installing the technological solution in the retailer’s store.

The study findings also highlight significant changes in the value creation dimension of the business model.

Importantly, the literature has shown that the implementation of new digital technologies is not directly linked with reaching out to new customers (see Arnold et al., 2016; Kiel et al., 2017), rather it strengthens existing customer relationships. In addition, the study shows that the Shopper Science Lab opens new opportunities in terms of customer acquisition. Two are the new customer categories for GrottiniLab. Firstly, the company that used to sell its technological solutions to retailers can now address manufacturing companies selling their products through the Shopper Science Lab’s retail partner, by offering a real testing environment and retail analytics. Secondly, GrottiniLab can also address both manufacturers which do not sell through the retail channel or are not interested in testing their products and other retailers that are instead interested in buying the retail insights. By doing so the company expands beyond the boundaries of a technology/service provider to become a player competing in the marketing research industry.

The study findings also emphasize changes in customer interactions due to the increased use of social media and digital channels. The company leverages digital communication to create relevant content, such as use cases, aimed at addressing their needs and answering customers’ doubts. This confirms the existing empirical evidence on digital-driven business model innovation that highlights increased contact via digital platforms and eased interaction through digital communication (see Müller et al., 2018). Yet, in contrast to a previous study emphasizing that the use of new digital technologies in manufacturing companies leads to an intensification of existing customers relationships and a somewhat partner-like collaboration (see Kiel et al., 2017), the case study company seems not to have experienced significant changes in customer relationships. There might be a twofold reason explaining these dynamics. Firstly, this might be due to the product/service nature of GrottiniLab whose relationships with customers have always been rather intensive. The company has constantly tried to build long-term partnerships with customers to effectively implement the complex technological solutions offered for the retailers’ shop floor. Secondly, the new value proposition mostly addresses new customer segments, hence new customer relationships are created. Therefore, rather than witnessing an intensification of such relationships, it is likely that the company might build close relationships with customers from the very beginning.

The study also confirms previous findings emphasizing changes in the firm’s key partner network structure in data-driven business model innovation (see Björkdahl, 2020; Müller, 2019; Müller et al., 2018; Urbinati et al., 2019). Digital-driven business model innovation is not limited to the focal firm, rather it involves companies beyond the firm’s boundaries, such as component manufacturers, system suppliers, system integrators, solution providers, operators, distributors, and customers (e.g. Grieger & Ludwig, 2019; Kohtamäki et al., 2019). It is noteworthy that the current literature on manufacturing companies highlights the pivotal role of partnerships outside the firms’ boundaries to overcome a widespread lack of skills and expertise on the technology side. In this regard, we show that also companies other than manufacturing ones, which have already a large expertise in technology, benefit from key partnerships to innovate their business models.

Lastly, the study findings show that companies still experience difficulties in changing the value capture component of the business model. Therefore, although some studies highlight the potential for using data collected through new digital technologies to make changes in companies’ value capture mechanisms by introducing new revenue models such as dynamic pricing and pay-per-use (see Müller et al., 2018), our findings are in line with previous studies showing that those changes are still difficult to observe (see Kiel et al., 2017; Rachinger et al., 2019). On the one hand, this might depend on customers’ resistance in shifting towards unfamiliar billing models (see Kiel et al., 2017). On the other hand, it might be surprising, because companies addressing new customers might leverage data to implement new revenue models based on usage fees. In this regard, the product/service nature of the case company and its strong customer focus might open new opportunities for changes in the revenue model in the future (see Rachinger et al., 2019).

From a managerial perspective, the study confirms the disruptive role that digital technologies are playing even in those companies that cater to customers operating in the more traditional sectors. The work also highlights that the introduction of innovative solutions is effective if the company also pays attention to how they can impact business models. The study findings show that addressing digital transformation processes not only involves the adoption of new technologies within companies, but also the need to design consistent business models capable of making these technologies key elements for new value propositions.

The study is subject to limitations, which however offer fruitful opportunities for future research. A single case study does not allow for statistical generalization (Yin, 2003), yet this was beyond the scope of the present analysis. Of course, the literature would benefit from a multiple case study to enhance external validity (cf. De Massis & Kotlar, 2014; Eisenhardt, 1989) as multiple cases allow for comparisons between different organizations that clarify whether an emergent finding is consistently replicated by several cases. However, a single case study allows a complex phenomenon such as the BMI to be thoroughly represented. In this regard, conducting a longitudinal case study might be appropriate for analysing the BMI as a process which unfolds and changes over time, thereby offering new interesting insights.

References

Alshawaaf, N., & Lee, S. H. (2021). Business model innovation through digitisation in social purpose organisations: A comparative analysis of Tate Modern and Pompidou Centre. Journal of Business Research, 125, 597–608.

Arnold, C., Kiel, D., & Voigt, K. I. (2016). How the industrial internet of things changes business models in different manufacturing industries. International Journal of Innovation Management, 20(08), 1640015.

Baden-Fuller, C., & Haefliger, S. (2013). Business models and technological innovation. Long Range Panning, 46(6), 419–426.

Björkdahl, J. (2020). Strategies for digitalization in manufacturing firms. California Management Review, 62(4), 17–36.

Bouwman, H., Nikou, S., Molina-Castillo, F. J., & de Reuver, M. (2018). The impact of digitalization on business models. Digital Policy, Regulation and Governance, 20(2), 105–124.

Burström, T., Parida, V., Lahti, T., & Wincent, J. (2021). AI-enabled business-model innovation and transformation in industrial ecosystems: A framework, model and outline for further research. Journal of Business Research, 127, 85–95.

Casadesus-Masanell, R., & Ricart, J. E. (2010). From strategy to business models and onto tactics. Long Range Planning, 43(2–3), 195–215.

Casadesus-Masanell, R., & Zhu, F. (2013). Business model innovation and competitive imitation: The case of sponsor-based business models. Strategic Management Journal, 34(4), 464–482.

Chasin, F., Paukstadt, U., Gollhardt, T., & Becker, J. (2020). Smart energy driven business model innovation: An analysis of existing business models and implications for business model change in the energy sector. Journal of Cleaner Production, 122083.

Cheah, S., & Wang, S. (2017). Big data-driven business model innovation by traditional industries in the Chinese economy. Journal of Chinese Economic and Foreign Trade Studies.

Chesbrough, H. (2010). Business model innovation: Opportunities and barriers. Long Range Planning, 43(2–3), 354–363.

Chesbrough, H., & Rosenbloom, R. S. (2002). The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spin-off companies. Industrial and Corporate Change, 11(3), 529–555.

Ciampi, F., Demi, S., Magrini, A., Marzi, G., & Papa, A. (2021). Exploring the impact of big data analytics capabilities on business model innovation: The mediating role of entrepreneurial orientation. Journal of Business Research, 123, 1–13.

De Massis, A., & Kotlar, J. (2014). The case study method in family business research: Guidelines for qualitative scholarship. Journal of Family Business Strategy, 5(1), 15–29.

Demil, B., & Lecocq, X. (2010). Business model evolution: In search of dynamic consistency. Long Range Planning, 43(2–3), 227–246.

Doz, Y. L., & Kosonen, M. (2010). Embedding strategic agility: A leadership agenda for accelerating business model renewal. Long Range Planning, 43(2–3), 370–382.

Eisenhardt, K. M. (1989). Building theories from case study research. Academy of Management Review, 14(4), 532–550.

Foss, N. J., & Saebi, T. (2017). Fifteen years of research on business model innovation: How far have we come, and where should we go? Journal of Management, 43(1), 200–227.

Frank, A. G., Mendes, G. H., Ayala, N. F., & Ghezzi, A. (2019). Servitization and Industry 4.0 convergence in the digital transformation of product firms: A business model innovation perspective. Technological Forecasting and Social Change, 141, 341–351.

Gebauer, H., Arzt, A., Kohtamäki, M., Lamprecht, C., Parida, V., Witell, L., & Wortmann, F. (2020). How to convert digital offerings into revenue enhancement–Conceptualizing business model dynamics through explorative case studies. Industrial Marketing Management, 91, 429–441.

Grieger, M., & Ludwig, A. (2019). On the move towards customer-centric business models in the automotive industry-a conceptual reference framework of shared automotive service systems. Electronic Markets, 29(3), 473–500.

Johnson, M. W., Christensen, C. M., & Kagermann, H. (2008). Reinventing your business model. Harvard Business Review, 86(12), 57–68.

Khanagha, S., Volberda, H., & Oshri, I. (2014). Business model renewal and ambidexterity: Structural alteration and strategy formation process during transition to a Cloud business model. R&D Management, 44(3), 322–340.

Kiel, D., Arnold, C., & Voigt, K. I. (2017). The influence of the Industrial Internet of Things on business models of established manufacturing companies–A business level perspective. Technovation, 68, 4–19.

Kim, S. K., & Min, S. (2015). Business model innovation performance: When does adding a new business model benefit an incumbent? Strategic Entrepreneurship Journal, 9(1), 34–57.

Kohtamäki, M., Parida, V., Oghazi, P., Gebauer, H., & Baines, T. (2019). Digital servitization business models in ecosystems: A theory of the firm. Journal of Business Research, 104, 380–392.

Laudien, S. M., & Daxböck, B. (2016). The influence of the industrial internet of things on business model design: A qualitative-empirical analysis. International Journal of Innovation Management, 20(08), 1640014.

Li, F. (2020). The digital transformation of business models in the creative industries: A holistic framework and emerging trends. Technovation, 92, 102012.

McGrath, R., & McManus, R. (2020). Discovery-driven digital transformation. Harvard Business Review, 2–11.

McKinsey. (2018). Unlocking success in digital transformations. Accessed January 2020. https://www.mckinsey.com/business-functions/organization/our-insights/unlocking-success-in-digital-transformations

Miles, M. B., & Huberman, A. M. (1994). Qualitative data analysis: An expanded sourcebook. Sage.

Müller, J. M. (2019). Business model innovation in small-and medium-sized enterprises. Journal of Manufacturing Technology Management, 30(8), 1127–1142.

Müller, J. M., Buliga, O., & Voigt, K. I. (2018). Fortune favors the prepared: How SMEs approach business model innovations in Industry 4.0. Technological Forecasting and Social Change, 132, 2–17.

Osiyevskyy, O., & Dewald, J. (2015). Inducements, impediments, and immediacy: Exploring the cognitive drivers of small business managers’ intentions to adopt business model change. Journal of Small Business Management, 53(4), 1011–1032.

Osterwalder, A., Pigneur, Y., & Tucci, C. L. (2005). Clarifying business models: Origins, present, and future of the concept. Communications of the Association for Information Systems, 16(1), 1.

Paiola, M., & Gebauer, H. (2020). Internet of things technologies, digital servitization and business model innovation in BtoB manufacturing firms. Industrial Marketing Management.

Parida, V., Sjödin, D., & Reim, W. (2019). Reviewing literature on digitalization, business model innovation, and sustainable industry: Past achievements and future promises. Sustainability, 11(2), 1–18.

Rachinger, M., Rauter, R., Müller, C., Vorraber, W., & Schirgi, E. (2019). Digitalization and its influence on business model innovation. Journal of Manufacturing Technology Management, 30(8), 1143–1160.

Richardson, J. E. (2008). The business model: An integrative framework for strategy execution. Strategic Change, 17(5/6), 133–144.

Ritter, T., & Pedersen, C. L. (2020). Digitization capability and the digitalization of business models in business-to-business firms: Past, present, and future. Industrial Marketing Management, 86, 180–190.

Sabatier, V., Craig-Kennard, A., & Mangematin, V. (2012). When technological discontinuities and disruptive business models challenge dominant industry logics: Insights from the drugs industry. Technological Forecasting and Social Change, 79(5), 949–962.

Schneider, S., & Spieth, P. (2013). Business model innovation: Towards an integrated future research agenda. International Journal of Innovation Management, 17(01), 1340001.

Sestino, A., Prete, M. I., Piper, L., & Guido, G. (2020). Internet of things and big data as enablers for business digitalization strategies. Technovation, 102173.

Sorescu, A. (2017). Data-driven business model innovation. Journal of Product Innovation Management, 34(5), 691–696.

Stake, R. E. (1995). The art of case study research. Sage.

Sund, K. J., Bogers, M. L., & Sahramaa, M. (2021). Managing business model exploration in incumbent firms: A case study of innovation labs in European banks. Journal of Business Research, 128, 11–19.

Teece, D. J. (2010). Business models, business strategy and innovation. Long Range Planning, 43(2–3), 172–194.

Urbinati, A., Bogers, M., Chiesa, V., & Frattini, F. (2019). Creating and capturing value from Big Data: A multiple-case study analysis of provider companies. Technovation, 84, 21–36.

Verhoef, P. C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Dong, J. Q., Fabian, N., & Haenlein, M. (2021). Digital transformation: A multidisciplinary reflection and research agenda. Journal of Business Research, 122, 889–901.

Wirtz, B. W., Schilke, O., & Ullrich, S. (2010). Strategic development of business models: implications of the Web 2.0 for creating value on the internet. Long Range Planning, 43(2–3), 272–290.

Yin, R. K. (2003). Case study research: Designs and methods (3rd ed.). Sage.

Zott, C., & Amit, R. (2013). The business model: A theoretically anchored robust construct for strategic analysis. Strategic Organization, 11(4), 403–411.

Zott, C., Amit, R., & Massa, L. (2011). The business model: Recent developments and future research. Journal of Management, 37(4), 1019–1042.

Acknowledgements

The present chapter was written thanks to the support of GrottinLab S.r.l. Company.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Ancillai, C., Marinelli, L., Pascucci, F. (2022). Digital-Driven Business Model Innovation: The Role of Data in Changing Companies’ Value Logic. In: Ratajczak-Mrozek, M., Marszałek, P. (eds) Digitalization and Firm Performance. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-83360-2_4

Download citation

DOI: https://doi.org/10.1007/978-3-030-83360-2_4

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-83359-6

Online ISBN: 978-3-030-83360-2

eBook Packages: Business and ManagementBusiness and Management (R0)