Abstract

Empirical research has shed little light on the nature of bank formation as a banking behavior in an unregulated setting, due to the lack of observational data. On the other hand, recent years have witnessed the increasing popularity of peer-to-peer lending platforms which connect borrowers to lenders. An interesting observation is that some users are conducting micro banking activities, freely performing dual roles as both borrowers and lenders. They are referred to as microbanks. The microbanks face few regulatory restrictions or supervisory powers. Seizing this opportunity, we empirically examine the dynamics of free entry behaviors, using a sample of unregulated microbanks from one of the largest online peer-to-peer lending platforms in China. In particular, we explore the formation of microbanks at monthly intervals. Further, we create a quasi-experiment by leveraging the fact that the exact date to receive a repayment is exogenous to the microbanks. We find that a positive liquidity shock is positively associated with microbank formation.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

A dynamic banking sector needs new entrants, like any other competitive industry (McWilliams, 2018). Yet, following the 2008 global financial crisis, the growth of new commercial banks has screeched to a halt, and only a handful of new banks have been chartered over the past decade in the U.S.Footnote 1 The Federal Deposit Insurance Corporation (FDIC) has thus sought to address the de novo drought by promoting new bank formation.Footnote 2 However, in most cases, starting a new bank is a challenging endeavor with a long regulatory review process, mainly attributed to legal barriers (e.g., entry restriction, capital requirement, and more), and further complicated by the uncertain economic environment. While much attention has been placed on policies and regulations, empirical research has shed little light on the nature of bank formation as a banking behavior in an unregulated, laissez-faire setting, due to the lack of observational data. In this study, we aim to explore bank formation in an empirical context, which allows for the free entry of new banks.

Peer-to-peer lending platforms connect borrowers to lenders. An interesting observation is that some users are conducting micro banking activities, freely performing dual roles as both borrowers and lenders, attempting to make profits by charging greater interest rates on money they lend than the interest rates paid on the money they borrow. They are referred to as microbanks. Notably, they face few regulatory restrictions or supervisory powers. Peer-to-peer lending platforms are also reluctant to restrict such activities. Admittedly, microbanks are not identical to traditional banks. The former is more akin to individuals conducting micro banking transactions by switching between the dual roles of borrower and lender in a well-defined financial system, namely the peer-to-peer lending platform, while the latter are chartered financial institutions whose primary tasks include safeguarding monetary deposits and lending money out with government permission. Notwithstanding the differences, microbanks are financial intermediaries that borrow money and issue loans to earn profits, but do not comply with formal regulation or supervision by authorities. In this study, we empirically examine the dynamics of free entry behaviors, by leveraging the unregulated microbanks. We collaborated with one of the largest online peer-to-peer lending platforms in China and obtained a large anonymized dataset of loans, borrowers, and lenders for the year of 2016, and identified a sample of microbanks.

Specifically, we predict the formation of microbanks at monthly intervals. A necessary condition for microbank formation is high creditworthiness. This is natural as it enables a lower interest rate of borrowing than lending, a necessary condition for a profitable banking business. Similarly to traditional banks, microbanks borrow short and lend long. We also demonstrate that the entry of a microbank could be persistent, as the current entry correlates positively with future entry. Namely, if a platform user is a microbank in the current month, she is likely to continue as a microbank in the next month. Also, a higher profit in the current month positively predicts microbank formation in the next month. To make a stronger causal claim, we create a quasi-experimental setting by leveraging the fact that the exact date to receive a repayment is exogenous to the microbanks. We examine the impact of positive and negative shocks to microbank liquidity. We find that a positive shock is positively associated with microbank formation.

Our study makes several contributions. First, analytical models on bank formation usually start with the assumption of free entry or deregulation. However, such theoretical development lacks empirical evidence because the banking industry is highly regulated. Our study contributes to banking literature by providing empirical evidence of entry behavior in an unregulated environment. Second, the concept of microbank, as an informal financial intermediary, is not new. Microbanks mostly exist offline as part of the informal banking landscape. They are not under public scrutiny and, hence, lack observable records. Their behaviors have largely fallen out of the academic spotlight. However, by using data generated by peer-to-peer lending platforms, today, microbanks can be analyzed. Our study unveils the behaviors of microbanks, adding to the broader conversation surrounding informal banking. Third, from the standpoint of peer-to-peer lending platform owners, risk control is critical to promote platform-wide safety and soundness. Given the dual roles of microbanks, their impact on financial contagion and systemic risk cannot be overlooked. Our study serves as the first step to understanding the behaviors of microbanks, providing practical insights to platform owners.

This paper is organized as follows: we provide a comprehensive background to the concept of banking, new bank formation, fintech, and peer-to-peer lending in section “Background”. We then introduce our data context in section “Empirical Context and Data”. Next, we explore the formation of microbanks and present our findings in section “Formation of a Microbank”. We document the impact of shocks on microbank formation in section “Impact of Positive vs. Negative Shocks” and conclude our study in section “Concluding Remarks”.

2 Background

2.1 Concept of Banking

The concept of banking has a long history. In ancient Greece, Athenian banks were already found to conduct credit and deposit activities (Cohen, 1997). At the operational level, a bank is defined as an institution whose current operations consist of granting loans and receiving deposits from the public (Freixas & Rochet, 2008). Given the nature of financial intermediation, banks have two main functions, namely deposit creation and asset management (Fama, 1980). Similarly, Santomero (1984) explained the existence of banking firms by distinguishing between the firms as asset transformers and as brokers, and highlights the two-sided nature of these firms in modeling their behavior. While contemporary banks perform many complex functions including liquidity and payment services, asset transformation, risk management, monitoring, and information processing (Freixas & Rochet, 2008), our study specifically focuses on a microbank’s dual roles as a borrower and as a lender, which correspond to a bank’s core activities of accepting deposits and issuing loans, respectively.

The importance of the dual roles has been widely recognized in developing various paradigms and models for bank behavior. For example, Klein (1971) viewed a commercial bank as a subset of financial intermediaries that secures funds from surplus spending units in the form of time deposits, demand deposits, and ownership claims, and transmits them to deficit spending units by investing in a wide variety of earning assets, including loans and securities. The latter constitutes the main source of bank income. Thus, the Monti-Klein model presents a utility model of a monopolistic bank confronted with a demand for loans and a supply of deposits (Klein, 1971; Monti, 1972). In this paradigm, a banking firm is assumed to be an expected value-maximizer considering revenues on loans minus the expenses incurred from deposits (Santomero, 1984). Another paradigm adapts portfolio theory and regards the bank as a portfolio manager. The bank is expected to select a mean-variance efficient portfolio of risky financial products such as loans and deposits by explicitly taking risk into account (Hart & Jaffee, 1974; Pyle, 1971). In their survey, Baltensperger (1980) and Santomero (1984) summarized several extensions of the Monti-Klein model and the Pyle-Hart-Jaffee model. Further, Santomero (1984) formulated a more general objective function by maximizing a multi-period function of asset inflows minus liability outflows minus the costs incurred.

Notably, managing risks is important for banks. Baltensperger (1980) argued that a bank, as a debtor or borrower, faces a withdrawal or liquidity risk that is associated with its liabilities, while a bank, as a creditor or lender, is also exposed to the credit or default risk that is associated with the assets it holds. More systematically, the risks can be classified into four major types: liquidity risks, default risks, interest rate risks, and market risks (Freixas & Rochet, 2008). The deposit activity of banks is affected by liquidity risk, as banks have to make unexpected cash payments to meet any unexpected massive withdrawal requested by their depositors. The credit activity of banks is affected by default risk, as a borrower might not be able to repay her principal and/or interest. In addition, the maturity transformation activity of banks is affected by interest rate risks, as short-term (deposits) interest rates rise above long-term (loans) interest rates. Lastly, market risks and systemic risks affect the marketable assets and liabilities of banks, as the entire market would be influenced at the same time. On the other hand, banking authorities derive a rich set of regulatory instruments to deal with such risks and the inherent fragility of banks to develop a safe and sound banking system. As commented by Taggart (1984), the regulatory system is perhaps what truly distinguishes the banking sector from other wider financial services industry. In fact, it is practically impossible to examine the behaviour of banks without considering the role of banking regulation (Freixas & Rochet, 2008).

2.2 New Bank Formation

The specifics to start a new bank vary from country to country, but in general, a chartered bank application entails a long organization process and permission from regulatory authorities. The entry restriction and capital requirement are typical regulatory impediments to the entry of new banks. In the banking sector, the entry restriction is an early intervention for authorities to prevent instability and limit competition (Barth et al., 2005). At the same time, a capital requirement requires bank entrants to raise and retain a non-negligible minimum amount of capital to enter the market and support its risk profile, operations, and future growth. For example, in the U.S., the initial capital would be in the millions of dollars (Adams & Gramlich, 2016). Taken together, the regulatory burden means that new bank formation is a non-trivial task.

The existing literature examines the impact of entry barriers mainly through the lens of competition (e.g., Cetorelli & Gambera, 2001; Guiso et al., 2004; Jayaratne & Strahan, 1998). The entry, growth, and exit of de novo banks are susceptible to the economic environment (e.g., Adams & Gramlich, 2016; DeYoung, 1999; Lee & Yom, 2016). As a result, the factors affecting entry into local markets are derived from market conditions such as demographics, market concentration, and merger activity. For example, Amel & Liang (1997) found that market size, market growth, and high profits are strong entry determinants. Berger et al. (2004) found that merger activity has an economically significant positive impact on the probability of entry. However, other than analytical models in which the authors made assumptions to remove restrictions to free entry (Besanko & Thakor, 1992), scant literature provides empirical evidence on bank formation by isolating the effect of regulations. One exception is the work by Adams & Gramlich (2016), which inferred that non-regulatory factors such as low interest rates and a weak economy could depress the entry of new banks, though the authors also acknowledged that the standalone regulatory effect is hardly quantifiable. Hence, bank formation in the absence of regulations remains under-explored.

2.3 Fintech and Peer-to-Peer Lending

Fintech is a portmanteau of financial technology, which describes an emerging phenomenon in the twenty-first century. Broadly, it refers to any technological innovation in the financial sector, including financial services operations (e.g. digital banking and credit scoring), payment services (e.g. mobile payment and digital currency), deposit and lending services (e.g. open banking and peer-to-peer lending), and financial market and investment-related services (e.g. high-frequency trading and social trading). Today, technological forces are undoubtedly transforming almost all areas of financial services, and are mediating between markets, regulators, firms, and investors. As evidenced, Boute et al. (2021) showcased the digitalization journey in financial service operations. Byrum (2021) discussed the use of artificial intelligence in financial portfolio management. Bao et al. (2021) identified the opportunities and challenges in accounting fraud detection using machine learning techniques. Kou (2021) highlighted the privacy and transparency related topics in fintech econometrics. The multi-disciplinary nature, multi-faceted problematization, and multi-level analysis have prompted the burgeoning literature on fintech.

Among the wide range of fintech innovations that design and deliver financial products and services through disintermediation, extension of access, and more (Demirguc-Kunt et al., 2018), peer-to-peer lending platforms have received increasing attention. As a specific type of crowdfunding platform that rallies the public for collective funding through the Internet, online peer-to-peer lending enables individual lenders to make unsecured and collateral-free loans directly to unrelated individual borrowers without the intervention of traditional financial intermediaries such as banks. When a borrower posts a loan request, the platform also allows multiple lenders to fund the loan collectively. While such platforms are efficient and cost-effective, the dis-intermediary and anonymous nature of these platforms exaggerate the extent of information asymmetry compared to traditional financial intermediaries, which operate in a tougher regulatory environment. As a result, a growing strand of research focuses on the mitigation of information asymmetry in online peer-to-peer lending. For example, Lin et al. (2013) posited that online friendship can be a signal of credit quality to alleviate adverse selection and information asymmetry, and Iyer et al. (2016) investigated the potential use of nonstandard soft information for lenders to infer borrower creditworthiness. Another stream of literature explores individual behaviors on the platform, such as rational herding (Zhang & Liu, 2012) and home bias (Lin & Viswanathan, 2016) among lenders.

Many studies that examine peer-to-peer lending are conducted from the perspective of either the lender or borrower. In contrast to the implicit assumption that a user can only perform one role, as a lender or a borrower, our focus is instead on the potential existence of dual roles, as both a lender and a borrower simultaneously. We contend that the concept of banking can be extended from institutions to individuals. We refer to this specific type of platform users as microbanks, by adapting the operational definition of banks at the individual level. However, the lack of research on microbanks is surprising, given the openness and disintermediation of peer-to-peer lending platforms.

Our study unravels the existence of microbanks empirically. It is helpful to start examining the nature of banking with unregulated assumption (Fama, 1980). Thus, we situate our study in a loosely regulated context that imposes few restrictions on entry. In our study, we focus on microbank formation on a peer-to-peer lending platform.

3 Empirical Context and Data

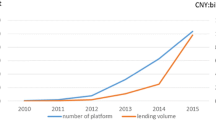

For this study, we collaborated with one of the largest online peer-to-peer lending platforms in China (hereinafter referred to as “the platform”). Since its official launch in 2007, the platform has connected a large number of lenders, stretching across cities and counties in China, to (collectively) offer micro loans to meet borrowers’ immediate credit needs. Borrowers repay the principal loan and interest in monthly installments. As of 2017, the platform has attracted approximately 10.5 million borrowers and 560,000 individual lenders.

The loan application and transaction processes on the platform are simple, convenient, and fast. A borrower can post a loan request with her expected loan amount, interest rate, number of monthly repayments, together with a title and loan description, anytime and anywhere on a website or mobile app, and receive the outcome of initial screening shortly thereafter. The platform does not require any form of collateral or proof of income from the borrower to secure a loan. Instead, borrowers are required to provide their national identity card information and mobile phone number for verification. In addition, borrowers are encouraged to provide optional information about themselves, including education, location, occupation, marital status, e-mail address, and the mobile phone number of one or two alternative contacts. Hereby, the platform builds an extensive database by combining information volunteered by borrowers and data collected from various third-party sources. The platform deploys a proprietary algorithm to automate the initial screening and credit decision.Footnote 3

A list of active loan requests, called listings, is shown to the lenders, with loan request details and bidding progress status, including borrowing amount, interest rate, number of installments, credit grade, percent completed, and time left. The minimum amount to lend is just RMB 50,Footnote 4 and creditors usually provide small amounts to several listings to diversify their risk. As a result, in most cases, a listing will be funded by a number of lenders. When the listing is successfully funded, the borrower receives the amount transferred from lenders. Subsequently, each creditor expects to receive a proportional amount of the borrower’s repayment of principal and interest in monthly installments.

For this study, we obtained the platform’s anonymized backend data, including listings’ details, records of loan issuances and repayments in 2016, as well as user demographics such as age and gender. The details of listings include loan amount, interest rate, number of monthly installments, and audit time. The records of loans issued capture the exact amount that a creditor provides to a listing. The repayment information includes the due amount, due time, paid amount and payment time for each installment of a listing. We constructed a sample by focusing only on a subset of platform users (i.e. microbanks).

We determine whether a platform user i becomes a microbank in month t, denoted by isBank i,t, a binary dependent variable. We define the microbanks at the monthly level, as those that conduct both borrowing and lending activities in the same month, with the monthly average interest rate of lending greater than the monthly average interest rate of borrowing. The former part of the definition is a realization of dual roles, and the latter part relates to the interest rate risk. We want to minimize the exposure to interest rate risk mainly due to two reasons. First, the occurrence of interest rate risk is not a frequent event, and in general, traditional banks make their profits from maturity transformation (Freixas & Rochet, 2008). Second, in our context, where a microbank can decide to perform or not perform both the borrowing and lending activities on a monthly basis, we need a consistent definition that accounts for the rationality behind this behavior. In this regard, the interest rate difference can serve as the motivation to become a microbank to make profits. In our study, rather than conditional prediction, we predict for the unconditional probability of microbank formation in the next month (t + 1), isBank i,t + 1, and includes the current microbank indicator, isBank i,t, as an independent variable.

The aforementioned operationalization results in a total of 6172 focal platform users, each of whom act as a microbank for at least one month in 2016. It is evident that being a microbank is not a common practice in the platform – only around 13% of lenders in 2016 took out loans in the same year.Footnote 5 Summary statistics are detailed in Table 1. Proportion refers to the share of microbanks present in month t. The entry rate is defined as the ratio of the number of non-microbanks at t-1 that become microbanks at t to the total number of non-microbanks at t-1. Similarly, the exit rate refers to the share of microbanks in the previous month t-1 that do not continue acting as microbanks in the current month t. These non-negligible rates, especially the exit rate, imply that acting as microbanks is a dynamic behavior. The share of microbanks is consistently no more than one-third.Footnote 6 Microbanks can enter and exit at little cost, as compared to institutional banks, which have even lower rates (Lee & Yom, 2016).

4 Formation of a Microbank

4.1 Variable Description

We attempt to explore microbank formation as a kind of individual, temporal and voluntary behavior. We posit that the likelihood of being a microbank would be affected by the activities and behaviors on the platform. We classify the activities of a microbank into four categories, based on the dual roles played in prior and current months. First, as a lender, the microbank can perform lending activities in the current month t, captured by lendAmt i,t, lendInstal i,t, and lendCnt i,t. Second, as a borrower, the microbank can perform borrowing activities in the current month t, captured by borrowAmt i,t, borrowInstal i,t, and borrowCnt i,t. Third, as a lender in prior months, the microbank will receive repayments from debtors. We construct two sets of variables, collectAmtOT i,t and collectCntOT i,t, as well as collectAmtD5 i,t and collectCntD5 i,t, by considering the on-time repayments and delayed repayments respectively. Fourth, as a borrower in prior months, the microbank needs to make repayments for her loans. Similarly, we derive two sets of variables, repayAmtOT i,t and repayCntOT i,t, as well as repayAmtD5 i,t and repayCntD5 i,t. In addition, we define a simple profitability measure, profit i,t, by focusing on the earned interests net of paid interests in month t. Furthermore, we estimate the microbank’s capital and normalize the monetary variables accordingly. For each month, we calculate total inflow, defined as the sum of the amounts borrowed and the repayments received at t, and total outflow, defined as the sum of the amounts lent and the repayments made at t. We use the larger of the two as the proxy of capital for microbank i at t. Finally, we construct a directed network based on the flow of funds among microbanks, and the directed edge indicates the direction of fund which goes from one microbank to another. We tend to capture peer influence based on degree centrality, i.e. indegreeBank i,t and outdegreeBank i,t. We use a 10-month period from February to November 2016,Footnote 7 and summarize the list of variables and descriptive statistics among the 6172 microbanks in Table 2.

4.2 Preliminary Analyses

We estimate a logistic model, specified in Eq. 1, where the dependent variable, isBank i,t + 1, is central to our interest. To start, we break down the analysis by fixing the time window to be exactly one month to explore if there exists any pattern or consistency over time. Hence, we run a cross-sectional model on 10 subsets of our sample data, each of which represents a monthly snapshot of the sample.

We compare the results from February to November in 2016 (Table 3). First, the coefficient of isBank i,t, which indicates the status of microbank in the current month t, is consistently significantly positive. This shows that being a microbank in the current month increases the likelihood to continue forming a microbank in the following month, implying stickiness to remain the role of microbank. Second, our results suggest the more profits earned by a microbank in the current month, the more likely it is to act as a microbank in the next month. This also demonstrates our hypothesis that making profits can serve as the motivation to become a microbank on the platform. Next, the lending amount is positively related to microbank formation, whereas the borrowing amount is negatively related.

4.3 Fixed-Effects Logit Model

To analyze panel data, we use a fixed-effects logistic regression model specified in Eq. 2. The explanatory variables include isBank i,t, profit i,t, activities i,t, and centralities i,t . We estimate their parameters by taking the individual fixed effects α i (and time fixed effects γ t) into consideration.Footnote 8

The results are shown in Table 4, based on an unconditional maximum likelihood estimation (columns 1 and 2) (Stammann et al., 2016) and a conditional likelihood estimation (columns 3 and 4) (Gail et al., 1981).Footnote 9 Unlike the results in the previous section, the microbank indicator in the current month is weakly positively associated with microbank formation in the next month. The effect is diminishing after controlling for the time effect in columns 2 and 4. A plausible explanation is that the time effect, in addition to individual effect, is more influential in explaining the variations in microbank formation. Next, profitability has a positive impact on the microbank formation. It may imply that platform users who are capable of making money are more likely to recognize the potential of microbanks. Alternatively, it may also suggest that users are aware of the importance of liquidity to microbanks even without the imposition of regulations. Interestingly, those who tend to borrow smaller amounts for a shorter period but lend larger amounts for a longer term are more likely to become microbanks. On the other hand, receiving repayments or paying installments exerts a negative influence on predicting the formation of microbanks, regardless of being on time or delayed. The seemingly counter-intuitive negative results might correspond to the perceptible exit rates in Table 1. It could also be attributed to the fact that the repayments to receive or installments to pay are accumulated from lending and borrowing activities in any of previous months. Yet, the timings of repayment receipt and installment payment affect a microbank’s cash flow liquidity and profitability. In the following section, we further investigate the relationship between cash flow liquidity and microbank formation.

5 Impact of Positive vs. Negative Shocks

5.1 Quasi-Experimental Setting

Like traditional banks, microbanks are exposed to default risk, which is non-trivial as borrowers on the platform face little recourse and lenders have no collateral to collect after a default event.Footnote 10 As mentioned, a microbank can perform four categories of activities. As a lender or borrower, the microbank can decide to lend or borrow anytime. However, as a prior borrower, the microbank has little freedom to alter the schedule to repay her monthly installments. Meanwhile, as a prior lender, the microbank has no control over the exact time when her borrowers make repayments. That is, the time when the microbank receives the proportional repayments is almost exogenous to her. Therefore, we only focus on the latter two activity categories. To be specific, the inflows obtained by the microbank refer to the repayments she receives, while the outflows refer to the repayments she makes. By comparing the actual time of inflows against the scheduled time of outflows of the microbank, two types of unexpected shocks could occur. Namely, for repayments that are expected after the microbank’s earliest own payment due date, if the microbank receives any of them earlier than her earliest own payment due date, there is an unexpected shock that exerts a positive influence on the microbank’s liquidity, known as positive shock. Similarly, for repayments that are expected earlier than the microbank’s latest own payment due date, when the microbank does not fully receive those amounts before her latest own payment due date, there is an unexpected shock that negatively affects her liquidity, known as negative shock.

Figure 1 depicts an example where the microbank has four repayments to receive and two repayments to make. As illustrated, the repayments to receive are ordered by their due dates chronologically, denoted as inflow (I), inflow (II), inflow (III), and inflow (IV), and the installments to repay are also denoted sequentially as outflow (A) and outflow (B). We argue that the microbank is exposed to a positive shock when the microbank receives any of inflow (II), inflow (III) and inflow (IV) earlier than the due date of outflow (A). In contrast, the microbank experiences a negative shock when she fails to collect the repayments of both inflow (I) and inflow (II) before the due date of outflow (B). In this way, we manage to create a quasi-experiment setting by leveraging the positive and negative shocks. In the next section, we investigate the impact of such liquidity shocks on the formation of microbanks.

5.2 Difference-in-Differences Model with Matched Sample

We define a microbank that has ever been exposed to such shocks as a treated microbank, and create the variable, treated i,t to indicate that the microbank i receives the shock in the month t.Footnote 11 We construct a matched data sample based on the general idea of propensity score matching (PSM). To be specific, we first divide the treatment group into 10 subgroups according to the month when microbanks receive such a treatment. Second, for each treatment subgroup, we compute a score for the propensity of a microbank to be treated using predictors on demographics, microbank status, behaviors, and network centrality.Footnote 12 Third, we adopt a one-on-one nearest neighbor matching with replacement to find each of the treated microbanks (treated i,t = 1) with an untreated microbank (treated i,t = 0) that has the closet propensity score.

We run a difference-in-differences model on the matched sample, specified in Eq.3. For a treated microbank, we set the time variable, after i,t as zero for all the months preceding the treatment, and one otherwise. For each (matched) pair, the microbank in the control group is assigned with the same value of after i,t as her counterparty in the treatment group. The other variables are similar to those in section “Formation of a microbank”.

We derive several variants of the treatment variable, treated i,t. First, we define that treated i,t equals 1 if a positive shock occurs and at least one repayment is received earlier than the microbank’s own earliest due date for more than seven days (i.e. treatedPosBin). Second, we define that treated i,t equals 1 if a negative shock occurs and at least one repayment is received later than the microbank’s own latest due date for more than seven days (i.e. treatedNegBin). In addition to the two binary variable definitions, we also define the third and fourth forms of treatment using amount ratio, namely the total amount of early (or late) repayments the microbank receives earlier (or later) than the due date of her own first (or last) repayment, divided by the amount of the microbank’s repayments to make during the same month. To define the third form of treatment, we set treated i,t as 1 if a positive shock occurs and the early amount ratio is larger than 25% (i.e. treatedPosAmt).Footnote 13 Similarly, we define the fourth form of treatment by setting treated i,t to be 1 if a negative shock occurs and the late amount ratio is larger than 5% (i.e. treatedNegAmt).Footnote 14

We present the results in Table 5. Our results suggest that the impact of a positive shock on microbank formation is significantly positive on being a microbank in the next period, whereas that of a negative shock is non-significant. In general, early repayment is a more frequent event than late repayment on the platform. The asymmetric effects could be due to the asymmetric distribution of positive and negative shocks. Microbanks are more likely to receive a positive shock than a negative shock, as evidenced by the different cutoffs chosen for treatedPosAmt and treatedNegAmt. On one hand, positive shock increases liquidity and improves one’s confidence to become a microbank in the near future. On the other hand, those microbanks-to-be are not bad at risk management, and they are capable of absorbing the negative effect created by a negative shock. Hence, a negative shock does not significantly affect one’s decision towards microbank formation, which implies that microbanks can voluntarily manage the potential risks, even without the imposition of regulations.

6 Concluding Remarks

The banking sector is intensively regulated today. This is hardly surprising, given the critical impact banks have on economic development and human welfare. Regulatory and supervisory policies cover almost every aspect, from the entry of new banks, to how they exit, in hopes of enhancing bank operations and lowering systemic fragility (Barth et al., 2005). From the perspective of banks, however, regulatory compliance also incurs a variety of non-trivial costs (Elliehausen, 1998). The debate on the impact of bank regulatory practices, in conjunction with the complex motivations underlying these regulations (Barth et al., 2005), implies that in the modern banking sector, banking behaviour is more or less shaped by the existence of regulations, and further complicated by the broader political economy context. Empirical data on banking can hardly be collected in isolation from any regulatory force, leaving researchers to wonder how banks will behave in the absence of regulations and restrictions. On the other hand, technological advancements in the financial sector are helping to improve the traceability of financial activities at the individual level. The plethora of immediately accessible data provides us the opportunity to conduct an empirical investigation on microbanks as one of the informal financial intermediaries in the underexplored field of micro and informal finance, and opens up a promising avenue for future empirical research. Our research can also help build insights into the informal banking sector, especially prevalent in third-world and developing economies.

Notes

- 1.

Refer to FDIC website: https://www.fdic.gov/bank/statistical/stats/2020mar/fdic.pdf

- 2.

Remarks by FDIC Chairman Martin J. Gruenberg at the FDIC Community Banking Conference, “Strategies for Long-Term Success,” Arlington, VA. https://www.fdic.gov/news/speeches/spapr0616.html

- 3.

There was a lack of well-established credit bureau scores in China during the sample period of this study.

- 4.

It is equivalent to US$ 7.2, based on the currency exchange rate on December 31, 2016.

- 5.

The sample size can be increased by relaxing the time period requirement. For example, 20,755 platform users can be identified as microbanks on a yearly basis, while our sample consists of 6172 microbanks defined at the monthly level. Although the latter is smaller in size, it allows us to explore the time-varying behaviors throughout 2016.

- 6.

Due to data constraints, we do not explicitly predict for the individual’s entry or exit behavior, which is in the form of conditional probability. Both entry and exit rates are conditional on the behavior of microbanks in the previous month, leading to a reduced sample size for conditional prediction.

- 7.

The earlier and later data (in January and December in 2016) are discarded due to the lack of loan repayment behaviors and the truncation on the lead of dependent variable respectively.

- 8.

To identify the structural parameters, a total of 6170 observations of 617 microbanks with non-varying response are dropped.

- 9.

- 10.

The recovery rate (i.e. the proportion recovered by the lender when the borrower defaults) is also important. However, in this study, we examine a simplified scenario by assuming a zero recovery rate.

- 11.

For simplicity, we focus on the first occurrence of the shock in this study.

- 12.

The original data is in long form. Given a month τ, we only consider the predictors prior to t = τ. We transform the data into wide form and run a simple logit regression to estimate the score. To impose a requirement that isBank i,τ is the same for a matched pair, we run the matching process separately on the two subsets of data where isBank i,τ = 1 and isBank i,τ = 0 separately.

- 13.

We vary the cutoffs such as 33%, 50% and 66%. The size of treatment group is decreasing, but the results are almost consistent.

- 14.

We try larger cutoffs such as 10%. The size of the treatment group is smaller, but the results are consistent. However, when the cutoff is even larger, the size will be reduced dramatically. For example, when the cutoff is 25%, only 17% of original sample receives a negative shock.

References

Adams, R. M., & Gramlich, J. (2016). Where are all the new banks? The role of regulatory burden in new Bank formation. Review of Industrial Organization, 48(2), 181–208.

Amel, D. F., & Liang, J. N. (1997). Determinants of entry and profits in local banking markets. Review of Industrial Organization, 12(1), 59–78.

Baltensperger, E. (1980). Alternative approaches to the theory of the banking firm. Journal of Monetary Economics, 6(1), 1–37.

Bao, Y., Hilary, G., & Ke, B. (2021). Artificial intelligence and fraud detection. In V. Babich, J. Birge, & G. Hilary (Eds.), Innovative technology at the interface of finance and operations (Springer series in supply chain management, forthcoming). Springer Nature.

Barth, J. R., Caprio, G., & Levine, R. (2005). Rethinking bank regulation: Till angels govern. Cambridge University Press.

Berger, A. N., Bonime, S. D., Goldberg, L. G., & White, L. J. (2004). The dynamics of market entry: The effects of mergers and acquisitions on entry in the banking industry. Journal of Business, 77(4), 797–834.

Besanko, D., & Thakor, A. V. (1992). Banking deregulation: Allocational consequences of relaxing entry barriers. Journal of Banking and Finance, 16(5), 909–932.

Boute, R. N., Gijsbrechts, J., & Van Mieghem, J. A. (2021). Digital lean operations: Smart automation and artificial intelligence in financial services. In V. Babich, J. Birge, & G. Hilary (Eds.), Innovative technology at the interface of finance and operations (Springer series in supply chain management, forthcoming). Springer Nature.

Byrum, J. (2021). AI in financial portfolio management: Practical considerations and use cases. In V. Babich, J. Birge, & G. Hilary (Eds.), Innovative technology at the interface of finance and operations (Springer series in supply chain management, forthcoming). Springer Nature.

Cetorelli, N., & Gambera, M. (2001). Banking market structure, financial dependence and growth: International evidence from industry data. Journal of Finance, 56(2), 617–648.

Cohen, E. (1997). Athenian economy and society: A banking perspective. Princeton University Press.

Demirguc-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2018). The global Findex database 2017: Measuring financial inclusion and the Fintech revolution. The World Bank.

DeYoung, R. (1999). Birth, growth, and life or death of newly chartered banks. Economic Perspectives, 23(3), 18–35.

Elliehausen, G. (1998). The cost of Bank regulation: A review of the evidence. Federal Reserve Bulletin, 84(4), 252.

Fama, E. F. (1980). Banking in the theory of finance. Journal of Monetary Economics, 6(1), 39–57.

Freixas, X., & Rochet, J. C. (2008). Microeconomics of banking (2nd ed.). The MIT Press.

Gail, M. H., Lubin, J. H., & Rubinstein, L. V. (1981). Likelihood calculations for matched case-control studies and survival studies with tied death times. Biometrika, 68(3), 703–707.

Guiso, L., Sapienza, P., & Zingales, L. (2004). Does local financial development matter? The Quarterly Journal of Economics, 119(3), 929–969.

Hart, O. D., & Jaffee, D. M. (1974). On the application of portfolio theory to depository financial intermediaries. The Review of Economic Studies, 41(1), 129–147.

Iyer, R., Khwaja, A. I., Luttmer, E. F. P., & Shue, K. (2016). Screening peers softly: inferring the quality of small borrowers. Management Science 62(6), 1554–1577.

Jayaratne, J., & Strahan, P. E. (1998). Entry restrictions, industry evolution, and dynamic efficiency: Evidence from commercial banking. Journal of Law and Economics, 41(1), 239–273.

Klein, M. A. (1971). A theory of the banking firm. Journal of Money, Credit and Banking, 3(2), 205–218.

Kou, S. (2021). FinTech econometrics: Privacy preservation and the wisdom of the crowd. In V. Babich, J. Birge, & G. Hilary (Eds.), Innovative technology at the interface of finance and operations (Springer series in supply chain management, forthcoming). Springer Nature.

Lee, Y. Y., & Yom, C. (2016). The entry, performance, and risk profile of de novo banks. FDIC Center for Financial Research Paper, WP 2016-03.

Lin, M., Prabhala, N. R., & Viswanathan, S. (2013). Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59(1), 17–35.

Lin, M., & Viswanathan, S. (2016). Home Bias in online investments: An empirical study of an online Crowdfunding market. Management Science, 62(5), 1393–1414.

McWilliams, J. (2018, December 6). We can do better on De Novos (opinion). American Banker. https://www.americanbanker.com/opinion/fdic-chairman-jelena-mcwilliams-we-can-do-better-on-de-novos

Monti, M. (1972). Deposit, credit and interest rate determination under alternative bank objective functions. In Mathematical methods in investment and finance (pp. 431–454). North-Holland.

Pyle, D. H. (1971). On the theory of financial intermediation. The Journal of Finance, 26(3), 737–747.

Santomero, A. M. (1984). Modeling the banking firm: A survey. Journal of Money, Credit and Banking, 16(4), 576–602.

Stammann, A., Heiss, F., & Mcfadden, D. (2016). Estimating fixed effects logit models with large panel data. Beiträge zur Jahrestagung des Vereins für Socialpolitik 2016: Demographischer Wandel.

Stammann, A., Czarnowske, D., Heiss, F., & McFadden, D. (2020). bife: Binary Choice Models with Fixed Effects. R package version 0.7. https://cran.r-project.org/web/packages/bife/index.html

Taggart, R. A. (1984). Modeling the banking firm: Comment. Journal of Money, Credit and Banking, 16(4), 612–616.

Therneau, T. M., Lumley, T., Elizabeth, A., & Cynthia, C. (2017). survival: Survival Analysis. R package version 2.41-3. https://cran.r-project.org/web/packages/survival/index.html

Zhang, J., & Liu, P. (2012). Rational herding in microloan markets. Management Science, 58(5), 892–912.

Acknowledgments

We thank Dr. Xuesong Lu for providing valuable suggestions for data cleaning. We gratefully acknowledge the funding support from the Singapore Ministry of Education (Grant R-252-000-A08-112).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 Editors

About this chapter

Cite this chapter

Keppo, J., Phan, T.Q., Tan, T. (2022). Microbanks in Online Peer-to-Peer Lending: A Tale of Dual Roles. In: Babich, V., Birge, J.R., Hilary, G. (eds) Innovative Technology at the Interface of Finance and Operations. Springer Series in Supply Chain Management, vol 13. Springer, Cham. https://doi.org/10.1007/978-3-030-81945-3_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-81945-3_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-81944-6

Online ISBN: 978-3-030-81945-3

eBook Packages: Economics and FinanceEconomics and Finance (R0)