Abstract

The falling in production and income due to the COVID-19 pandemic will cause a wide impact on employment. The outcome will depend on the reactivity of the labor market to economic shocks. Specifically, in this work, we propose an analysis to estimate the impact of the COVID-19 crisis on the employment level in the Italian macro-regions: North-West, North-East, Centre, and Mezzogiorno. Using the employment elasticity indicator for the 2015–2019 period, we can observe that the elasticity of employment is greater in the Mezzogiorno in respect to other areas. This result suggests that the job loss in Mezzogiorno will be proportionally higher even if the reduction in income will be lower. The data showed that in southern Italy, the newly unemployed could be a number between 405,000 to more than half a million. Indeed, the estimation of employment elasticity of GDP suggests that the COVID-19 crisis could determine a decline in the occupation rate in the South of 0.83 for each point of GDP loss, which has no comparison with the other Italian regions. These results, due to the particular structure of the southern economy—characterized by low aggregate demand and small dimensions of firms—suggest necessary changes in economic paradigms with respect to the neoclassical approach adopted in the past 20 years. Demand-driven policies, such as basic income and labor redistribution, could avoid or mitigate the socioeconomic tragedy caused by the COVID-19 crisis.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction: Understanding Employment Effect of the COVID-19 Crisis

The structure of the Italian labor market is characterized by different and multiple levels of segmentation, not only for the geographical position (vertical segmentation) but also (horizontally among public and private workers and transversally) by different types of job contracts. Geographically, it is worth mentioning that Italy is arguably the only Western country where regional imbalances still play a major role, even in 2021; the division in terms of GDP between the North and South of Italy is a unicum among the advanced countries of similar size.

Also, if we exclude Eastern Europe, southern Italy is the biggest underdeveloped area within the European Union. During the second half of the twentieth century, the process of convergence toward the income level of North-West, by the other macro areas of the country begins, in the following decades, however, the convergence of the South and islands (or the “Mezzogiorno”) came to a halt, while that of the North-East and Centre accelerated. (Bank of Italy, 2017).

For aforementioned reasons, our analysis focuses on the Italian regions divided into four macro-areas: North-West, North-East, Centre, and Mezzogiorno during the period 2005–2019. In our opinion, this period well reflects the economic structural conditions of today’s Italian economy. Indeed, the geographical distribution of firms and production has been stabilized since the country’s entry into the Euro (Toniolo & Bastasin, 2020), and therefore, it is possible to assume that the COVID-19 crisis could have comparable effects to those of the global financial crisis, in qualitative terms; precisely because the macroeconomic structure has remained basically unchanged.

Learning from the recent international literature, the impact of the COVID-19 crisis on employment “is being clearly asymmetric, with the most vulnerable countries and segments of the workforce being hardest hit by the pandemic” (Fana et al., 2020). The negative impacts on labor market indicators are larger for women, younger workers, part-time workers, minorities, and less-educated workers, indicating that the COVID-19 crisis increases labor market inequalities (see, for instance, Béland et al., 2020). These differences among workers, with different employment statuses and conditions, are related to some degree to the segregation of different types of workers across economic sectors (Palomino et al., 2020). Italy is a paradigmatic example of the segmentation of labor markets because historically, there are differences in industrial structures that determine permanent differences in the employment rate.

In this work, we used the “employment elasticity” to measure the impact of the change in GDP on the employment rate for the different areas of Italy (in the 2005–2019 period). After that, we used the estimated values of the falling of GDP for Italy, due to the COVID-19 crisis, to estimate the potential effects on employment. Indeed, we suppose that the distribution of regional impact between growth and employment will be similar to those that occurred after the global financial crisis of 2006–2008.

In the next section, we will introduce the literature of the employment elasticity indicator that we have selected to develop our empirical analysis (Sect. 2). The estimation procedure, the strategy, and the results are showed and explained in Sect. 3. In Sect. 4, we reflect on the severe consequences of the COVID-19 crisis for the employment structure and the economy of the Italian Mezzogiorno. The results of our analysis suggest some necessary reforms of economic policies that are introduced in Sect. 5. Conclusions follow in Sect. 6.

2 The Employment Elasticity Indicator: A Brief Literature Review Insight

Among the employment-related economic indicators (i.e., employment and unemployment rates), there is the elasticity of employment; a measure of the relationship between employment and economic growth. Indeed, the elasticity of employment indicates the responsiveness of the labor market to changes in the economic growth process as can be represented by fluctuations in GDP. Hence, employment elasticity is a measure of the percentage change in employment induced by a change of one percent in gross domestic product.

Compared to the so-called Okun’s law, the elasticity of employment allows us to avoid some measurement problems of the unemployment rate, particularly those due to different definitions of unemployed persons and to interactions between unemployment and labor force participation (Boltho & Glyn, 1995). Most of the studies in the literature focus on employment elasticities that are at the multinational or national level. However, several authors have introduced a sub-national dimension in the analysis on the relationship between output growth and labor market dynamics.

Given the aims of the present chapter, we mention some works focusing on sub-national levels of analysis of employment elasticity with respect to output. Islam and Nazara (2000), focus on the topic from the perspective of poverty reduction in Indonesian provinces, using different time periods for estimating arc and point employment elasticity (cross-section and time-series approaches). It should be noted that arc elasticity is the elasticity of one variable (i.e., employed people) with respect to another (i.e., GDP) between two different points in time, as opposed to the point elasticity, which measures the percentage change in the number of one variable (i.e., employed people) when the other (i.e., GDP) changes infinitesimally close to zero. Kangasharju and Pehkonen (2001) examined the employment–output relation using panel data on 452 Finnish municipalities grouped into 85 areas to estimate employment elasticity utilizing a dynamic panel approach. Perugini and Signorelli (2006) analyzed co-movements of employment and output for the European regions, calculating simple arc elasticity and correlation indexes. Tadjoeddin and Chowwdhury (2012) examined two different periods, pre and post 1998—in Indonesia at the provincial level—to see the changes in output elasticity of employment before and after the crisis, by using the GMM estimator of dynamic panel data.

Concerning the Italian case, Perugini (2009) used the regional data dividing Italy into four geographical areas (North-West, North-East, Centre, South, and Islands) to estimate employment elasticity to growth over the period 1970–2004, adopting a static panel approach. The author argued that, although remarkable regional differences exist in levels of elasticity, its fluctuating trend is substantially uniform. According to him, this relative “uniformity” of the dynamics of elasticity for the geographical divisions may mean that, at the GDP level, movements of employment elasticity in time do not depend on spatially specific factors, but are probably influenced by complex and interacting aggregate dynamics. Finally, in line with the analysis technique adopted in this work, Busetta and Corso (2008) used a first difference technique to analyze respectively the trade-off between real GDP and the unemployment rate, and between real GDP and the employment rate for the Italian regions over the period 1992–2004. Their results showed greater suitability of the employment rate compared to the unemployment rate in interpreting the relationship between the Italian labor market at a sub-national level and GDP. Indeed, in line with the existing literature, the authors outlined the different territorial dynamics, deriving from the different conditions of the labor market between the regions belonging to the Centre-North and the south of Italy. The latter is characterized by low values of the participation rate on the labor market, compared to the former.

3 The Elasticity of Employment to Output in the Italian Macro-regions

There are several ways of estimating employment elasticity (see Perugini, 2009, for a comprehensive overview). One of the methodologies consists of only measuring the arc elasticity. The equation formula is:

The numerator gives the percentage change in employment in the country i, Ei, between periods t0 and t1, while the denominator gives the corresponding percentage change in output, Yi that is the GDP for the economy as a whole. However, the employment elasticity calculated using this method tends to exhibit a great deal of instability over time (see Islam & Nazara, 2000; Islam, 2004). As a result, we use an alternative estimation method for generating the point elasticity, which involves a double-log linear equation in the first difference (Okun, 1970; Busetta & Corso, 2008) relating employment and GDP for each macro-region (North-West, North-East, Centre, Mezzogiorno). This is given in the following equation:

where Δ represents the difference operator, E is the total employment unit, Y is the real GDP (constant prices 2015), e is a white noise disturbance term, and subscript i denotes macro-regions at time t. β0 is the time-invariant intercept and captures the average growth rate and, therefore, the trend of the dependent variable (Lee, 2000; Virén, 2001; Guajarati, 2003). Coefficient β1 is the estimated elasticity.

We, therefore, prefer here to focus on the simplest form of point elasticity, not distinguishing between short- and long-run effects, which may be obtained by adopting dynamic specifications. The transformation of variables in natural logarithms serves to linearize the relationship between the trend of real GDP and that of employment (Silvapulle et al., 2004), while the use of the first differences allows us to eliminate the unit root from the series (Mankiw, 1994; Lee, 2000). Indeed, if the time series involved was containing unit roots, the results would be misleading. The regression model in the first difference also reduces the problems deriving from the multicollinearity between the variables investigated. One of the reasons behind multicollinearity derives, in fact, from the possibility that the variables move over time in the same direction and their linear transformation into differences represents one of the ways in which this dependence is minimized (Guajarati, 2003). Finally, the linear transformation in the first difference is not affected by the discretion inherent in the estimate of potential GDP, necessary to calculate the gap with current real GDP—as is the case for models that use the output gap.

So, to analyze employment elasticity, with respect to GDP in Italian macro-regions—North-West, North-East, Centre, and Mezzogiorno—for the periods under investigation, we use a first difference regression model outlined in the previous section (Table 1).

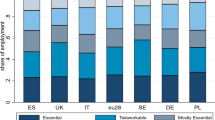

The Pearson correlation is significant for three out of four macro-regions analyzed; indeed, only for the Centre, there is no significant correlation between employment and GDP trends.Footnote 1 For the other macro-regions, the results show an employment elasticity of almost 0.2 for North-West, 0.3 for North-East, and 0.8 for Mezzogiorno, which basically implies that every 1-percentage point of GDP growth (or loss) is associated with employment growth (or loss) for each macro-region of 0.2, 0.3, and 0.8, respectively. Based on these findings, in the next paragraph, we provide a hypothesis on the impact of the current economic crisis on the employment of the Mezzogiorno.

4 The Effects of COVID-19 Crisis on the Mezzogiorno: Where Are We Going?

The impact of the COVID-19 crisis could lead to another drop in production with a similar impact compared to the last financial crisis, but more serious in terms of GDP falling. Indeed, according to the International Monetary Fund (IMF), the Italian economy is forecast to contract by 9.1% this year (IMF, 2020); likewise, SVIMEZ (2020) expects a fall of GDP by 8.5%. The Bank of Italy (2020) provides the worst scenario, assuming a 13% drop in GDP. These negative outlooks are also reflected on the GDP of the Italian macro-regions to a greater extent in the Centre-North than in the South, mainly due to the different industrial structure that characterizes the two areas of the country. The Centre-North is, in fact, the area in which the weight of the industry is greatest, representing the heart of Italy’s production system, and therefore both internal and foreign exchanges undergo a stronger slowdown with a consequent impact on the territory. However, the southern economy, structurally more fragile, would reveal greater difficulties at the moment of the (possible) recovery, since the loss of consolidated income is strongly linked to the drop of employment in a more evident way than in other regions (see Table 1).

Following the path of employment elasticity with respect to GDP, our analysis suggests that for every unit of GDP lost in the South, employment drops by almost 0.83 points. So, for this year, if we assume for the South a drop in GDP between 7.9% and 8.6%, it would correspond to a loss between 6.6% and 7.1% in terms of the employment rate. In the worst-case scenario, the loss would be around 10.1%, if we suppose a 12.2% drop in GDP.Footnote 2 Basically, at the end of 2020, we will have in southern Italy—with a grain of salt—between 405,000 and 439,000 people out of the legal labor market and more than half a million jobs (627,000 thousand) lost in the worst-case scenario.

The scenario is an employment collapse, persistent over time compared to other areas of Italy with permanent destruction of part of the legal employment. The inevitable consequences in terms of a drop in aggregate demand will end up further compressing the size of the southern economy (which is the cause of the balances of underemployment and segmentation). A social and economic plague that needs courageous interventions before the drop in production and employment can challenge the unity of the country itself.

5 Learning from the Past Some Policy Suggestions

Strictly conditioned by the neoclassical view, European and national funds were oriented toward the promotion of new business and investments in training for workers to fight unemployment (Pissarides, 2009). In terms of labor market reforms, the aim was to achieve greater contract flexibility and, consequently, lower wages (Boeri et al., 2019). However, this mix of policies was unable to increase employment in the South. Also, there are two other forms of intervention to change the structure of southern markets and increase its competitiveness: reduce costs for business, support shadow firms to emerge, and reduce the minimum wage only in the South to compare the cost of living. Nevertheless, if we consider the interaction between the different sectors of the economy, there is not sufficient reason to sustain these policies.

In 2001, there was a law for the surfacing of underground companies to reduce costs of “emersion” from shadow to legal. The results were insignificant in terms of firms that emerged. This fact suggests that the costs gap between shadow and legal is greater than a simple tax reduction, and involves the entire production structure in shadow firms, which are unable to pay taxes or legal wages (and relative costs). A new form of wage rationing in the South could have counterproductive effects. If aggregate demand is lower in the South and this affects the dimension of firms, then a reduction in wages can exacerbate this phenomenon instead of producing competitiveness, thus leading to another negative shock. Furthermore, one of the milestones of the “wages reduction policy” is that workers in the South are less productive but have the same wages as their counterparts of the North. Considering the data, this fact is not true, at least for the private sector, where wages in the South are even lower, even before the financial crisis (Bank of Italy, 2009). Besides, if we consider a more detailed breakdown of productivity, the argument of the productivity gap of the southern population seems to be also really fragile (Daniele, 2019). Furthermore, we know that the southern economy is characterized by an underemployment equilibrium, firms suffering, low aggregate demand, and high mobility between formal and informal sectors (both for firms and for workers).

The question is how to deal with the actual crisis. Multiple segmentation of the labor market requires a strategy that considers the above-mentioned conditions (Fields, 2007). As we stated before, a low level of aggregate demand shifts the focus on business costs. To be competitive, the firms have to compress wages, and when they are unable to act in the legal sector, they move into the shadow. Then the first objective of the political economy is to increase workers’ income. Two tools could be used for this: the redistribution of work (Mazzetti, 1997) and a form of basic income (Standing, 2002). The first one can be used to support firms to increase their size and efficiency. Not all firms are “completely shadow”; some of them integrate part of shadow workers in a legal structure, and the redistribution of the work can favor their complete emergence.

The basic income can be used to reduce the base of workers that offer their skills to shadow firms. Also, it should be designed as an “integration” of income and not a replacement for it.Footnote 3 This could have two positive effects: firstly, increasing aggregate demand for consumption; secondly, reducing incentives to work in shadow because the firms could legally integrate their labor force, even for short periods.

On the supply side, southern firms are characterized by their small dimension. The incentives for the birth of new firms are useless and dangerous at the same time. The intervention paradigm has to shift from birth to duration of company activities, by supporting them to have financial assistance, in particular. Firms in the South pay twice as much interest rates for their loans as businesses located in the North (Perri, 2014). So, the necessary contribution to react to this crisis is to have continuity over time and increase the average size. To do these two things, resources are needed for investment.

6 Conclusions

Summarizing what has been said, Italy is a “mature economy” with a declining growth rate for about 30 years. Within this economic framework, we find at least two macro-regions with different productive structures and different reactions to economic shocks. The negative effects of recessions are more severe in the South, where production is falling and there is more difficulty in recovering. That is especially evident after the last financial crisis and it was reflected in the employment rate and its structure. The reasons concern, among others, the dimension of firms, the low level of aggregate demand, the quality of public services, and the presence of organized crime. All these factors determine a particular form of segmentation in the labor market, which has been exacerbated by neoclassical economic policies and reforms. The effects of the COVID-19 crisis could be very serious and very persistent over time. The southern economy is fragile, and the labor market is undergoing transformative impacts with each crisis. Employment drops recover very slowly, and at least a part of the workforce moves into the underground sector while regular companies end up resorting more to underpaid work.

Considering that between 405,000 and more than half a million workers can be lost in the first year after the crisis, the repercussions on aggregate demand and southern income could be catastrophic, well beyond the worst forecasts. For these reasons, it is necessary to change the paradigms of economic policy, above all because the neoclassical instruments have proved ineffective in reducing the economic gap between the South and other areas of the country in terms of employment. It seems necessary that the focus of the interventions move toward individuals’ income, and through forms of redistribution of work and basic income, which allows flexible use of the workforce that does not penalize workers in terms of income.

An effective strategy must be complex, and include infrastructure policies; financial support for the dimensional growth of firms and bureaucratic reforms; and expensive and long-term interventions. Instead, insisting on the same policies of the past 30 years could only represent the maintenance and tolerance of an even more underdeveloped South, where alternatives for workers are underpaid jobs, informal work, or emigration.

Notes

- 1.

One of the possible explanations is the presence of the Lazio region in Centre Italy, which has an enormous concentration of public employees due to the presence of constitutional bodies and ministries. The public employment is insensitive to output variations due to the impossibility to dismiss for redundancy. However, this point needs further investigations, which represent avenues for future research.

- 2.

The first data (7.90%) is estimated by SVIMEZ (2020), while the second (8.56%) and third (12.23%) percentages are our elaborations based respectively on the projections of the IMF (2020) and the Bank of Italy (2020) at the national level, taking into account the proportions with respect to Svimez’s forecasts for the South.

- 3.

There is in this moment in Italy a form of basic income, called “Reddito di Cittadinanza”[citizens’ income] but it has a lot of limits, particularly because it is not compatible with a regular job and then, paradoxically, it finishes being an incentive to work again in the shadow (Perri, 2018).

References

Bank of Italy. (2009). Indagine sulle imprese industriali e dei servizi [Survey on industrial and services companies]. Supplementi al Bollettino Statistico, 38 [PDF]. Accessed August 30, 2020, from https://www.bancaditalia.it/pubblicazioni/indagine-imprese/2008-indagini-imprese/index.html.

Bank of Italy. (2017). The roots of dual equilibrium: GDP, productivity and structural change in the Italian Regions in the long run (1871–2011). Economic History Working Papers. 40(August) [PDF]. Accessed August 30, 2020, from https://www.bancaditalia.it/pubblicazioni/quaderni-storia/2017-0040/index.html?com.dotmarketing.htmlpage.language=1.

Bank of Italy. (2020). L’impatto della pandemia di COVID-19 sull’economia italiana: Scenari illustrativi. [The impact of the COVID-19 pandemic on the Italian economy: Illustrative scenarios] [PDF]. Accessed August 30, 2020, from https://www.bancaditalia.it/media/notizia/l-impatto-della-pandemia-di-covid-19-sull-economia-italiana-scenari-illustrativi/.

Béland, L. -P., Brodeur, A., & Wright, T. (2020). The short-term economic consequences of COVID-19: Exposure to disease, remote work and government response. IZA Discussion Paper Series (13159).

Boeri, T., Ichino, A., Moretti, E., & Posch, J. (2019). Wage equalization and regional misallocation: Evidence from Italian and German provinces. CEPR Discussion Paper n. DP13545. Abstract only. Accessed August 30, 2020, from https://ssrn.com/abstract=3341352.

Boltho, A., & Glyn, A. (1995). Can macroeconomic policies raise employment? International Labour Review, 4(5), 453–470.

Busetta, G., & Corso, D. (2008). La legge di Okun: Asimmetrie e differenziali territoriali in Italia [Okun’s law: Asymmetries and territorial differentials in Italy]. Marche Polytechnic University, Department of Economics, Working Papers [PDF]. Accessed August 30, 2020, from https://www.researchgate.net/publication/4735348_La_legge_di_Okun_asimmetrie_e_differenziali_territoriali_in_Italia.

Daniele, V. (2019). Produttività e salari: i divari Nord-Sud [Productivity and wages: the North-South gaps]. Rivista economica del Mezzogiorno, 33(2), 375–404.

Fana, M., Torrejón, P. S., & Fernández-Macías, E. (2020). Employment impact of Covid-19 crisis: From short term efects to long terms prospects. Journal of Industrial and Business Economic, 47, 391–410.

Fields, G. S. (2007). Employment in low-income countries: Beyond labor market segmentation? In P. Paci & P. Serneels (Eds.), Employment and shared growth: Rethinking the role of labor mobility for development (pp. 23–36). Washington, DC: The World Bank.

Guajarati, D. N. (2003). Basic econometrics (4th ed.). New York: McGraw Hill.

IMF. (2020). World economic outlook. Chap. 1, April. [online]. Accessed August 30, 2020, from https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020#Chapter%201.

Islam, I., & Nazara, S. (2000). Estimating employment elasticity for the Indonesian economy. ILO Technical Note, Jakarta.

Islam, R. (2004). The nexus of economic growth, employment and poverty reduction: An empirical analysis. ILO Report, Recovery and Reconstruction Department, Geneva.

Lee, J. (2000). The Robustness of Okun’s Law: Evidence from OECD countries. Journal of Macroeconomics, 22, 331–356.

Kangasharju, A., & Pehkonen, J. (2001). Employment-output link in Finland: Evidence from regional data. Finnish Economic Papers, 1, 41–50.

Mankiw, N. G. (1994). Macroeconomics. New York: Worth Publishers.

Mazzetti, G. (1997). Quel pane da spartire: Teoria generale della necessità di redistribuire il lavoro [That bread to share: General theory of the need to redistribute work]. Torino: Bollati Boringhieri.

Okun, A. M. (1970). Potential GNP: Its Measurement and Significance – Appendix. In A. Okun (Ed.), The political economy of prosperity. New York: Norton.

Palomino, J. C., Rodríguez, J. G., & Sebastián, R. 2020. Wage inequality and poverty effects of lockdown and social distancing in Europe. INET Oxford Working Paper, 13.

Perri, S. (2014). The effects of banking system transformations on Italian regions’ economic growth. Rivista economica del Mezzogiorno, 1–2, 155–186.

Perri, S. (2018). Mezzogiorno senza reddito e senza cittadinanza [Mezzogiorno without income and without citizenship]. Economiae Politica, 10 (15) [online]. Accessed August 30, 2020, from https://www.economiaepolitica.it/lavoro-e-diritti/lavoro-e-sindacato/mezzogiorno-senza-reddito-e-senza-cittadinanza/.

Perugini, C., & Signorelli, M. (2006). Determinants of (un)employment differentials and dynamics across EU-15 countries and regions. The European Journal of Comparative Economics, 4(2), 209–262.

Pissarides, C. (2009). Labour market adjustment: Microeconomic foundations of short-run neoclassical and keynesian dynamics. Cambridge: Cambridge University Press.

Perugini, C. (2009). Employement intensity of growth in Italy: A note using regional data. Regional Economic Studies, 9(1), 59–105.

Silvapulle, P., Moosa, I. A., & Silvapulle, M. J. (2004). Asymmetry in Okun’s law. Canadian Journal of Economics, 37, 353–374.

Standing, G. (2002). Beyond the new paternalism: Basic security as equality. London: Verso.

SVIMEZ. (2020). L’impatto economico e sociale del covid-19: Mezzogiorno e Centro-Nord [The economic and social impact of Covid-19: South and Centre-North]. April [PDF]. Accessed August 30, 2020, from http://lnx.svimez.info/svimez/report-svimez-su-effetti-pandemia-al-centro-nord-e-al-sud/.

Tadjoeddin, M., & Chowwdhury, A. (2012). Employment function for Indonesia: An econometric analysis at the sectoral level. Journal of Developing Areas, 46, 265–285.

Toniolo, G., & Bastasin, C. (2020). La strada smarrita: Breve storia dell’economia italiana [The lost road: A brief history of the Italian economy]. Gius. Roma: Laterza & Figli Spa.

Virén, M. (2001). The Okun’s curve is non linear. Economics Letters, 70, 253–257.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Perri, S., Di Santo, G. (2021). The Effects of COVID-19 Crisis on the Southern Italian Labor Market: Employment Elasticity Estimation Approach. In: Bilgin, M.H., Danis, H., Demir, E., García-Gómez, C.D. (eds) Eurasian Business and Economics Perspectives. Eurasian Studies in Business and Economics, vol 19. Springer, Cham. https://doi.org/10.1007/978-3-030-77438-7_18

Download citation

DOI: https://doi.org/10.1007/978-3-030-77438-7_18

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-77437-0

Online ISBN: 978-3-030-77438-7

eBook Packages: Business and ManagementBusiness and Management (R0)