Abstract

The existing normative definition of risk, based on probability theory, is a particular definition of risks and does not correspond to the variety of measures for calculating life risks. Calculating risks in other fuzzy measures: likelihood, possibility, confidence, necessity, opens up new possibilities to assign numerical values to objects and complex events. This paper presents a method of design and soft computing in risk matrices, which instead of a single outcome measure called a consequence, represents samples of several qualifiers, evaluation areas, parameters, and semantic rows of natural language. For the first time, the risk matrix definition is presented, a template for designing risk matrices and samples for use in practice are developed. The purpose of risk matrices is to make it possible to assign numerical values to the properties of evaluated objects through expert subjective judgments. The randomness measure absorbs a wide class of soft measures likelihood, necessity, confidence, conviction, possibility, probability. The measure of the magnitude of the outcome combines the concepts of severity, damages, losses, and victims. The method is aimed at direct application of expert assessments of any objects and their components.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

There are numerous concepts of risk in studies of the risks of vital activity: one-dimensional, multidimensional, dependent and not dependent on a person (natural disaster); individual: motivational, active, passive, voluntary, forced; social: personal, group, business, organizational, deterministic (systematic), random (stochastic), accepted, acceptable, voluntary, conscious, perceived, controlled, estimated, regulated, controlled, neglected, acceptable, unacceptable, tolerable, residual, processed. The subject of risk is studied in the human sciences, philosophy, psychology, technosphere activity, economics, and finance as the expectation of negative activity outcomes.

Event management is dominated with approaches to measuring, calculating risks, developing national and global security programs, and managing risks in emergency situations. There are three approaches to study the subject of risk: the measurement of risk, the socio-cultural evaluation, and the psychometric evaluation. Risk measurement focuses on how to transform data on damage, casualties, financial losses, and how risk is influenced. The socio-cultural evaluation looks at the impact of group and cultural variables on risk. Risk psychometry establishes the emotive responses of people to risk situations that form risk judgments [1,2,3].

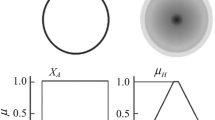

In the understanding of the author, socio-cultural and psychometric risks are assessed qualitative risks as opposed to measurable quantitative risks. It is shown in the diagram. Figure 1.

The risk assessment approach focuses on matrix risk estimation. Out of all the diversity of studying the risks of life activity, this work considers two most important aspects of the problem: (1) identification and the validity of calculating risks, (2) the validity of the approach to assessing risk matrices in the instrumentation. This paper describes a method of design and soft computing (SC) in risk matrices.

2 Problem

The problems of subject risk are as follows: a) the unclear origin of the term “risk”, b) numerous incompatible classifications and definitions of risks, c) groundlessness of the concept of risk measurement, d) groundlessness of risk identification through uncertainty, e) groundlessness of risk identification as a negative consequence through a combination probability and damage.

2.1 Identification and Calculating Risk

Concept of risk measurement and the regulatory standards [3,4,5,6,7] risk is defined as follows: risk (a) is the product of multiplication (b) the probability, and (c) the consequences (impact, damage) of an event (1):

The scientific validity of the shown formula raises many questions: (1) Risk constitutes any content of human life and nature, where outcomes coexist that can be assessed as neutral, negative, and positive. However, the risk in the formula is determined only in the negative understanding of the consequences as damage. (2) Risk contains the expectation of an event in the form of probability, and probabilistic measures are used for the calculation. (3) Events take place in time. The frequency of events is set as an average per unit of time, usually a year. This calculation is mathematically incorrect, especially with uneven distribution of events throughout the year. (4) The ratio (quantification) of consequences and likelihood is reduced to the mathematical multiplication. However, it is impossible to perform a calculation using this formula since the variable consequences also have a probabilistic random nature. The ratio can be summative, multiplicative, unspecified, non-linear. In any case, calculating risks through the product of consequence and probability can be a particular option.

So, the problem of the normative description and standards of risks used by the world community is as follows: why in the formula (1) only probability is used, and no other measures, damage, not positive and neutral outcomes, multiplication, and not others ratio. The scientific basis for the risk formula remains debatable and controversial.

The consequence of these problems is the fact that, in practice, the calculation of risks by the ratio of probability and consequences becomes uncertain. If there are a number of consequences and the probabilities for different outcomes differ, then the total risk is determined by the sum of the mathematical multiplication (2):

This description of risks is met in finance and insurance. They use risks as prime numbers and can be compared. To make decisions, insurance companies do not add or multiply the consequences and probabilities of events but evaluate them exclusively separately, especially when evaluating very large assets. When establishing criteria for what to assess risks, it is common to establish a value threshold against which outcomes and event rates are compared. In conclusion, they subjectively tend to prefer decisions of evaluating events of the type “large consequences with low probability”.

2.2 Assessing Risk in Matrices

Problems of assessing risk in matrices are discussed for a very long time in the scientific literature [2, 8,9,10,11,12,13]. When compiling risk matrices, a fundamental mistake is made when assigning linear numerical values for the matrix’s rows and columns. These numbers are not simple scalars. For example, in the matrix [7 × 7 = 49], the multiplication value in the upper right cell may not be correct because of the probability density functions and the consequences are unknown. When using risk matrices, events are assessed in terms of consequences: negative (red), moderate (yellow), positive (green). However, only the outcome of damage appears in the basic definition of risk. Multidimensional assessments in weak scales are the reason for the long-debated problem of “weak consistency” in strict risk matrix assessment [8, 10]. Therefore, the vast majority of practiced risk management methods cannot be recognized as scientifically justified.

3 Method

This paper presents the development of a new matrix method for event risk soft assessment. The method’s basis is the concept of the richness of natural language (NL) compared with any formal models used for calculating the risks of complex events. The application of the method is demonstrated and shows experimental solutions of practical tasks.

Fuzzy modeling in the theory of fuzzy sets (TFS) solves the problem of describing the properties of objects, their structure and parameters by applying classical optimization methods and metaheuristic algorithms. The difficulties and problems of applying each of these methods are associated with high computational costs of maintaining fuzzy inference. In the scientific literature, there are claims that computational tasks using TFS methods are redundant and cumbersome. The development of a new soft computing approach (SC) in this paper is considered a non-identical TFS. Probably, this circumstance is the reason that the founder of TFS in 1954 (L. Zadeh) proposed the concept of SC 40 years later (1994) [14]. Since that, this concept is developed by many authors, for example [15]. The author does not know the formal definitions of SC in the literature, so the following definition (Def.-i) is proposed.

- Def. 1:

-

Soft computing (SC) defines as a set: hard estimation (HE), soft measurement (SM), soft estimation (SE) in metric and non-metric scales with the ability to simultaneously process quantitative numerical and qualitative linguistic data.

4 The Aim of the Research

The aim of the research is to present a new method of design and soft computing in risk matrices. The task and method of calculating risks in matrix assessments are set out in the following content: a) theoretically justify and present a method for developing matrices of risk SE using fuzzy measures, not only probability measures but also including a wide class of NL assessment concepts; b) develop a definition of the concept of risk matrix; c) develop a design template and samples of risk matrices; d) conduct an experiment of risk soft assessment (SA) and use in practice. The method description assumes a well-founded structured use of NL concepts, which display the parameters and areas of the events in the semantic series of increasing and decreasing estimated events.

5 Method Development

5.1 Risk Matrix Design Template

In this paper, it is proposed to use the following tools that lead to the estimation of the risk value to create event estimation matrix content (3)

It is presented the development of a risk matrix design template. Since there are no definitions related to risk matrices and their elements in the literature, it is suggested the following definitions (Def-i):

- Def. 2:

-

Risk matrix: |xi,j| is a relational table of the (m-n) category consisting of m-rows of names of indicators of the event randomness measure and n-columns of names of indicators of the event outcome measure.

- Def. 3:

-

Risk indicator: is the quantified value of |mi, mj| matrix cells, which displays the value of the estimated state of the object.

- Def. 4:

-

Risk value: is a numeric value, color indication, and name of the risk measure that displays the object status.

Risk assessment in this matrix is carried out on a nominal scale as a combination of the random value of the outcome and the event’s randomness. The symbolic scores in the matrix are the sum of the event outcome value, called severity, and frequency combined with opportunity, Table 1.

The event is observed in the randomness of the outcome and in the measure of the magnitude of the outcome. The purpose of risk matrices is to make it possible to assign numerical values to the properties of the evaluated objects through expert subjective judgments. In this work method, the randomness measure absorbs a wide class of soft measures - likelihood, necessity, confidence, conviction, possibility, probability. The measure of the magnitude of the outcome combines the concepts of severity, impact, damages, losses, victims.

Estimations of values can be performed on the data of the numerical domain for determining pairs of fuzzy qualifiers [0, 1]. Such calculus is called HE. The regions can be expanded on sets of semantic series by a sequence of NL words, which are a chain of increasing and decreasing properties of an object.

To solve the tasks of the SE, it is used the nominal scales of fuzzy qualifiers. To build scales, it is suggested compiling semantic rows of words that set the values of event parameters. Each word is assigned a numerical value of the chosen heuristic school.

- Def. 5:

-

An indicator located in the middle of a semantic row has a value of the norm or normal activity.

The meaning of the words of the definition area (evaluation) is made up in order of strengthening (weakening) of the evaluated property of the object with the corresponding number of increasing (decreasing) numeric values assigned to each qualifier. When creating a table, it is necessary to heuristically align the left and right borders of the definition areas based on the principle of strengthening (weakening) the evaluated object property.

5.2 Establishment of the Parameters Quantification

The solution to the problem of calculating risks is to establish a method of quantification of the parameters. The cell displays one value of the estimated value of risks in natural numbers or in the names of the NL. The method prescribes a sequence in the concepts of NL: a) the search and establishment of an acceptable parameter, b) the establishment of the concept of the domain of definition (estimation), c) the expansion of the domain into a semantic series of words of increasing-decreasing of the estimated properties, d) assigning a numerical value to each of the words. It is possible to set various quantification parameters. In assessing life activity risks, categories are used intuitively and rationally - concepts that have the greatest generalization of meaning. In Table 2, the most used parameters of quantification and areas of HE of event risks are presented: distance, frequency, duration, magnitude, impact, speed.

Below are samples of semantic series of words NL, corresponding to the quantification parameters and samples of matrices: frequency, duration of events, and truisms.

5.3 Evaluating the Frequency of Events

The area of “frequency” [always, never] is expanded by a semantic series of SE object properties: [always, very often, often, regularly, constantly, periodically, rarely, extremely rarely, never], as shown in Table 3.

It is introduced the notation [never, always] and the abbreviation [new, alps] for the convenience of subsequent evaluation procedures by symbolic descriptions. Let’s introduce numerical scale values for expert procedures and quantitative calculations. Since the semantic series we have compiled includes 10 words, you can enter a 10-point scale.

5.4 Events Time Duration Estimation

A semantic row is compiled for the time duration qualifier. Assessments using qualifiers of particular duration overtime should be set in accordance with the goal Table 4.

5.5 Events Truisms Estimation

The words called truisms have the greatest blurring. It is more difficult to compose a semantic row of truisms, Table 5.

To make a row of 5, 7, or 10 words, it is reasonable to choose the same numerical value scale. Truisms are used for evaluation separately and in combination with other qualifiers. For example, truism + frequency qualifier: “most frequently”; truism + duration qualifier: “almost instantly”. A seven-word row for truism qualifiers is composed. The advantage of the above matrices is simplicity; the disadvantage is that you can evaluate a property by one of the states displayed by the meaning of NL row. To overcome this disadvantage, a multidimensional profile of the matrix is developed in this paper.

5.6 Complex Matrices Design Development

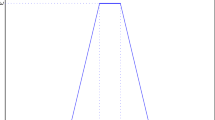

The soft risk assessment matrix is designed for managing complex events. The number of subsets of fuzzy spaces in the set of fuzzy measures is six. This makes up a numerical scale [1 - the greatest fuzziness, 6 - the least fuzziness]. Weights of estimates are indicated by a double-digit, separated by a hyphen; the first digit has an estimate of the object’s structural properties; the second digit evaluates the measures of clarity. The presented matrix has a bit size (6 × 10) and is intended for expert assessment of any events’ risks. The matrix is intended for evaluating events in terms of duration randomness [exs, fev] and fuzziness of the plausibility-conviction measures [pl, con]. The resulting score is a measure of the outcome, denoted as a fuzzy measure of the first kind, and written (4):

It is supposed that the (6 × 10) bit rate is offered as the highest for expert use. The size of the matrix and the number of cells can be smaller by choice for evaluating a specific complex event.

- Def. 6:

-

This symbolic expression is called the profile of the matrix of SE ob-ject values in the selected research area.

Risk assessment using this profile is an alternative probability measure compared to the accepted metric. Unlike analogs, the advantage of the matrix is the resolution of the problem of “weak consistency”: the exclusion of mismatch of color and numeric values of risks.

6 Event Risk Soft Assessment Example

Let’s create a scenario of practical soft assessment method (SAM) application of the risks of the complex event “Readiness of the Olympiad”. No event was existent. Event risk SA example is a thought experiment. Choose a three-color matrix metric: the lower-right cells are red, the upper-left cells are green, and the intermediate cells are yellow. The duration qualifiers are reasonably reduced to six, excluding the top two and bottom two. The extreme right and extreme left measures can be excluded from fuzzy measures, Table 6.

As a result, a reduced 4 × 6 matrix can be used for this practical task. This reduction of the matrix is caused by our common-sense judgments that extreme estimates are improbable since they correspond to the failure of the Olympiad project. Let’s assume that after the calculation, a total expert assessment of the event’s risks is obtained (5):

Where (prob – soon) is the measure of event randomness of expert values in terms of NL, (6–3) is weight values in duration qualifiers, [yellow] is a color estimation of the event according to the heat map method.

General risk assessment in terms of NL can only be carried out in one measure of randomness and considered as {plausible – realistic}. HE matrices require only highly qualified experts. In contrast, the presented matrix solves the possibility of participation of experts of different qualifications. In this case, the assessments can be placed in different cells, which can be combined by brainstorming.

7 Results

A formal definition of the concept of soft computing is presented. Method of design and soft computing of event management in risk matrices is proposed. A risk matrix design template is proposed. Risk matrix, risk indicator, risk value definitions are developed. Definitions allow to formulate the concepts of normal activity in numerical, non-numeric, and color indicators. Examples of evaluating various event parameters are presented: distances, frequency, duration, value, impact, speed. The complex matrix is to be used for expert assessment of risks of any events. Risk assessment using this profile is an alternative to the accepted probability measure metric. In contrast to the analogs, the advantage of the proposed matrix is the resolution of the problem of “weak consistency” of the matrices: the elimination of mismatch of color and numeric values [8, 10].

8 Conclusion

The purpose of risk matrices soft computing is to make it possible to assign numerical values to the properties of evaluated objects through expert subjective judgments. The randomness measure absorbs a wide class of soft measures. The measure of the magnitude of the outcome combines the concepts of severity, damages, losses, and victims. The method is aimed at the direct application of expert assessments of any objects and their components.

This practice is used by insurance corporations to evaluate very complex and large events of great value. They use commercial databases of damage values without calculating the randomness of events in any fuzzy measures, probabilistic or possible due to the high complexity of calculations. To evaluate the measure of the outcome value, in accordance with the method, it is necessary to create a number of semantic qualifiers of the value and perform an evaluation similar to the previous one.

Symbols proposed and used are normative guidelines for practical application. The matrix template allows to select a set of tools to indicate the randomness and magnitude of risks. The content provides a sample design of risk assessment matrices using the developed template using the soft computing method. The details of the method were previously drafted in the author’s works [16, 17].

References

Loewenstein GF, Weber EU, Hsee CK, Welch E (2001) Risk as feelings. Psychol Bull 127(2):267–286

Slovic P, Fischhoff B, Lichtenstein S (1979) Rating the risks. Environment 21(3):14–20, 36–39

Slovic P (1987) Perception of risk. Science 236(4799):280–285

ICAO (2016) Annex 19 to the Convention on International Civil Aviation. Safety Management, Second Edition, July 2016. - 999 Robert-Bourassa Boulevard, Montréal, Quebec, Canada H3C 5H7, 44 p

The Safety Management Manual (SMM) (Doc 9859) AN/474 (2018) Fourth Edition, 999 Robert-Bourassa Boulevard Montréal, Quebec H3C 5H7Canada, 149 p

Gost R (2002) 51897-2002 Risk management. Terms and Definitions. Gosstandart of Russia, Moscow, 8 p. (in Russian)

Gost R (2006) 51898-2002 Safety aspects. Rules for inclusion in standards. Standartinform, Moscow, 8 p

Ale B, Burnap P, Slater D (2012) Risk Matrix Basics. Confidential – Draft for publication, 1 March 2012. https://www.cambrensis.org/wp-content/uploads/2012/08/RiskMatrices-The-Basics3-0.pdf

Cox LA Jr (2009) Cox’s risk matrix theorem and its implications for project risk management. https://eight2late.wordpress.com/2009/07/01/cox%E2%80%99s-risk-matrix-theorem-and-its-implications-for-project-risk-management/

Cox LA Jr (2008) What’s wrong with risk matrices? Risk Anal 28(2):497–512

Slovic P (2002) Perception of risk posed by extreme events. Decision Research and University of Oregon Elke U. Weber Columbia University and Wissenschaftskolleg zu Berlin. This paper was prepared for discussion at the conference “Risk Management strategies in an Uncertain World,” Palisades, New York, 12–13 April 2002. https://www.ldeo.columbia.edu/chrr/documents/meetings/roundtable/white_papers/slovic_wp.pdf/

Sjöberg L (2003) Risk perception is not what it seems: the psychometric paradigm revisited. In: Andersson K (ed) Stockholm VALDOR conference, pp. 14–29

Sjöberg L (2002) Perceived information technology risks and attitudes. https://swoba.hhs.se/hastba/papers/hastba2002_005.pdf

Zadeh L (1994) Fuzzy logic, neural networks, and soft computing. Commun ACM 37(3):77–84

Hodashinsky IA (2007) Soft methods of evaluation: monograph. TUSUR, Tomsk, 152 p. (in Russian)

Plotnikov NI (2018) The development of the subject domain observation complex for management purposes. In: 2018 14th international scientific-technical conference APEIE – 44894, Part 1, vol 1. NSTU, pp 268–272

Plotnikov NI (2013) Resucy bezopasnosty transportnych kompleksov. Monographia. [Transport complex safety resources. Monography], Novosibirsk, Russia, AviaManager Publ. 286 p. (in Russian)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Plotnikov, N.I. (2021). Soft Computing Method in Events Risks Matrices. In: Iano, Y., Saotome, O., Kemper, G., Mendes de Seixas, A.C., Gomes de Oliveira, G. (eds) Proceedings of the 6th Brazilian Technology Symposium (BTSym’20). BTSym 2020. Smart Innovation, Systems and Technologies, vol 233. Springer, Cham. https://doi.org/10.1007/978-3-030-75680-2_64

Download citation

DOI: https://doi.org/10.1007/978-3-030-75680-2_64

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-75679-6

Online ISBN: 978-3-030-75680-2

eBook Packages: EngineeringEngineering (R0)