Abstract

In this research paper we experimentally investigate three state-of-the-art evolutionary multi-objective optimization algorithms and measure their efficiency and effectiveness in problems of multi-objective portfolio optimization. Especially we solve the mean-risk-cardinality portfolio optimization problem with six different measures of risk. Three different modern and state-of-the-art Multi-Objective Evolutionary Algorithms (MOEAs) are employed: Strength Pareto Evolutionary Algorithm (SPEA2), Multi-Objective Evolutionary Algorithm based on decomposition (MOEA/D) and S-Metric Selection Evolutionary Multi-Objective Algorithm (SMS-EMOA). Experimental results show that the best algorithm considering the C metric is MOEA/D while the best algorithm considering the hypervolume metric is SPEA2 while being the fastest approach. This suggests that the best approach for solving the problem is to run all the algorithms for a number of replicates and take the elite non-dominated solutions from the combined pool of solutions generated by the three algorithms.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Portfolio optimization

- Portfolio selection

- Multi-objective evolutionary algorithms

- Multi-objective optimization

1 Introduction

Portfolio optimization constitutes one of the most important problems of financial economics. Actually it is one of the two important problems in financial economics. Financial economics is essentially concerned with two questions: how much to save and how to save, that is, how to invest income not consumed [18]. Generally, the problem consists of finding an optimal distribution of the available funds among various assets. A fundamental theory for solving this problem was given by Harry Markowitz who introduced the mean-variance model [40]. In this model, variance is used to define risk while mean is used to define the performance/reward of the portfolio. The mean-variance model results in a bi-objective quadratic optimization problem. There are two conflicting objective functions, mean and variance. The expected return (mean) should be maximized while variance should be simultaneously minimized. The solution of this multi-objective optimization problem provides a special solution set which is called efficient in modern portfolio theory parlance and gives the best trade-off portfolios between mean and variance. The image of the efficient set in mean-variance space determines the efficient frontier [25]. The only constraints that are utilized in the Markowitz’s mean-variance model are the budget constraint which guarantees that all the available capital is invested (i.e. the fractions invested in each asset must sum to one) and the non-negativity constraints which forbid short-selling (i.e. the fractions invested in each asset must be non-negative). For finding the efficient frontier with these constraints, efficient exact algorithms that rely on quadratic optimization exist. Markowitz himself proposed the critical line method.

The research on portfolio selection is now being focused on three directions: (i) the development of different measures of risk [50], (ii) the introduction of additional objectives (beyond mean and risk) and (iii) the introduction of additional real-world constraints (beyond budget and non-negativity constraints) [2].

Many additional constraints can be considered as objectives. In multi-objective optimization, as pointed out in [55], ‘‘we distinguish an objective from a constraint when it is not easy to fix a right-hand side value for the constraint without knowing the levels of the other objectives’’. In this study we solve the mean-risk-cardinality portfolio optimization problem with various measures of risk. Thus the cardinality constraint is considered as additional objective to the classical mean-risk portfolio model as it is exceptionally hard for the decision maker to know on beforehand the ideal number of assets that should be added in his/her portfolio without looking at all the tradeoffs between risk, return and the cardinality of the portfolio. Regardless, a financial investor may lose significant portfolios with substantial tradeoff between the objectives when he/she is compelled to fix the number of financial securities in the portfolio on in advance. Hence, we focus on the second category of including additional objectives in portfolio optimization problem. Multi-objective optimization is a natural and promising field of study for portfolio optimization.

This paper extends the work done by Anagnostopoulos and Mamanis [2], by considering different risk measures in the mean-risk-cardinality portfolio optimization model. Anagnostopoulos and Mamanis [2] consider only the mean-variance-cardinality portfolio optimization model. Furthermore, the paper of [2] compares only Pareto-based multi-objective evolutionary algorithms (MOEAs). This study compares three modern, state-of-the-art, representative MOEAs as identified in the recent paper of [26].

According to [26], there are right now three fundamental ideal models for MOEA designs. These are the (i) Pareto-based MOEAs, (ii) Indicator-based MOEAs and (iii) Decomposition-based MOEAs. The distinction between these algorithms is primarily because of differences in the selection operators and are these operators that are actually compared. From the first category we choose SPEA2 as it was performed best in the mean-variance-cardinality portfolio optimization problem of [2]. From the second category we choose as representative algorithm the SMS-EMOA (S Metric Selection Evolutionary Multi-objective Optimization Algorithm), [27] as suggested by the tutorial of [26] and for the same reason from the third category we choose MOEA/D (Multi-objective Evolutionary Algorithm based on Decomposition) [64].

The portfolio optimization models that will be studied have been proposed theoretically in the specialized literature but they have never been solved. Their solution consist a contribution to portfolio management. Furthermore, the algorithms have been applied, tested and compared for the first time in this problem thus making a contribution to methodology. The algorithms have proved their effectiveness in artificial test functions but they must also be tested in real-world problems.

The remainder of the paper is organized as follows. In Sect. 13.2 the three-objective portfolio selection problem considered in this research is described. Section 13.3 presents the three multiobjective evolutionary algorithms and how they were implemented in this particular problem. Section 13.4 presents a literature review on multi-objective evolutionary algorithms for portfolio optimization problems. Section 13.5 is devoted to numerical results, and some concluding remarks are presented in Sect. 13.6.

2 Portfolio Optimization

The problem of portfolio selection comprises of finding a best allocation of the available funds among various assets. There are two well established models for portfolio choice under risk and uncertainty: the expected utility maximization/ stochastic dominance approach and the reward-risk models [51].

The classical portfolio optimization model considers a one investment period and n available assets for investment. The investor ought to decide the proportion \(x = \left( {x_{1} ,{\kern 1pt} \ldots ,x_{n} } \right)\) of the primary funds to be invested in the available assets, where the decision variable wi is the weight assigned in risky asset i = 1, …, n. The return on each (risky) asset which is considered for consideration in the portfolio is a random variable Ri. The investor’s objective is to maximize the random portfolio return \(R\left( x \right) = \sum\nolimits_{i = 1}^{n} {x_{i} R_{i} }\) under the constraint that the sum of the weights, being proportions, must aggregate to one \(\sum\nolimits_{i = 1}^{n} {x_{i} = 1}\) (i.e. it is assumed that the investor is fully invested).

Optimality between different random variables is not an obvious concept and the debate on the choice of a criterion with respect to which one should optimize the portfolio optimization is still open [20]. As stated above we will present the bi-objective mean-risk model for portfolio choice and its extension to the multi-objective portfolio optimization models.

Since Markowitz’s fundamental paper, the issue of picking among various random variables R(x) is figured as a mean-risk bi-objective optimization problem, where the mean portfolio return is maximized, while a risk measure is minimized dependent upon a bunch of constraints that characterize the feasible set of portfolios. The problem is multi-objective in nature, actually bi-objective. There are two conflicting objective functions, mean and risk. The expected return (mean) should be maximized while risk should be at the same time minimized. A portfolio that simultaneously optimizes the two objective functions does not exist. Thus, the optimal trade-off portfolios between the two objectives, mean and risk are hunted. These trade-off portfolios form a special solution set which is called efficient in modern portfolio theory parlance. The image of the efficient set in mean-risk space defines the so called efficient frontier [25]. The intention of bi-objective optimization and in general multi-objective optimization is to find the efficient frontier and the set of efficient solutions. This is also in accordance with the Markowitz’s approach for portfolio selection which suggests solving the portfolio choice problem using a two-step process. The first step requires the computation of the efficient frontier and the portfolios that define the efficient set. The second step involves the choice of a portfolio from this frontier that reflects best the investors’ tolerance towards risk. The bi-objective portfolio optimization problem that must be solved is given below.

The set of efficient portfolios is comprised by all feasible portfolios which are not dominated by any other portfolio in the feasible set.

The symbol \(\succ\) stands for the Pareto dominance relation. In the mean-risk portfolio management context a solution x2 is said to dominate a solution x1 if μ(x2) > μ(x1) and ρ(x2) ≤ ρ(x1) or μ(x2) ≥ μ(x1) and ρ(x2) < ρ(x1).

The image of the efficient set in the objective space defines the efficient frontier (or non-dominated frontier).

Harry Markowitz established the mean-variance model [40]. In this model, variance is used to measure the risk ρ(x) while mean is used to define the return on the portfolio. The only constraints that are utilized in the Markowitz’s mean-variance model are the budget constraint which guarantees that all the available funds are invested (i.e. the fractions invested in each asset must sum to one) and the non-negativity constraints which forbid short-selling (i.e. the fractions invested in each asset must be non-negative).

For computing the variance and other risk measures we need the following notation. It is assumed for every asset return a discrete probability distribution with S states of nature. The discrete probability distribution can be produced using any scenario generation technique or by using historical simulation. In this paper, we use the historical approach.

Let rjs be the return of asset j under scenario s. All scenarios are considered equally likely, thus \({p}_{s}\) = 1/S. For any portfolio x its return under scenario s is given by the following equation:

Thus we have a set of S returns equally likely.

The mean of the portfolio is therefore calculated using the formula

It is known from probability theory that the expected return or mean is the sum of the possible values of the random variable times the probability each possible value has. All these theory applies to discrete random variables.

The variance of the portfolio is given by

Variance measures the mean value of the squared distribution of each value of the discrete random variable from its mean or expected value.

Other than variance several risk measures has also been proposed thus defining different mean-risk models according to the risk measure used. The measures of risk that have been proposed are: the Mean Absolute Deviation (MAD), Semi-variance, Value-at-Risk, Expected Shortfall, Maximum Loss [50].

An advantage of these measures of risk is that their implementation does not need any distribution assumption of returns to be made. Accordingly, we count on the non-parametric methods to estimate these quantities [9].

The semi-variance of the portfolio is given by

where N is the total number of observations below the mean.

Semi-variance like variance measures the mean of the squared value of the values of the discrete random variable except that it counts only the values that are below the mean or expected return of the random variable.

The Value-at-Risk (VaR) at a given confidence level α is the maximum level of loss that the portfolio will not exceed with a probability α. Probability α is a user defined parameter and is usually set at a very small number (e.g. 0.01, 0.05 or 0.1) in order to account only for extreme losses. In this study we use α = 0.1. The negative sign in the VaR equation shown below is used in order to describe loss since zs(w) describes return.

where z(j) are the ordered returns such that \(z_{\left( 1 \right)} \left( x \right) \le z_{\left( 2 \right)} \left( x \right) \le \cdot \cdot \cdot \le z_{\left( s \right)} \left( x \right)\) and p(j) their corresponding probabilities of occurrence.

Expected shortfall (ES) is the average loss conditioned that exceeds VaR.

where \({\mathbf{1}}_{{\left\{ {z_{s} \left( x \right)\,\, < - VaR_{a} \left( x \right)} \right\}}}\) is 1 if the expression in brackets is true and zero otherwise. Thus we consider only the returns of the discrete random variable that are below the Value-at-Risk described above and we divide it by the number of occurrences of such numbers. The minus sign is used to define loss since z defines return.

Maximum loss is the minimum value of the possible values of the discrete random variable. The minus sign is used to define loss since z defines returns. For example a return of −2% is equal to a loss of 2%.

The mean absolute deviation is calculated using the following equation:

Recently, numerous researchers have perceived the practicality of incorporating extra objectives beyond mean and risk into the portfolio optimization model [6, 24, 62]. A very good theoretical work on multi-objective portfolio optimization models has been performed in [54,55,56]. In these studies, the authors defined the so-called suitable-portfolio investor who is additionally concerned with the cardinality of the portfolio, the maximum amount invested in any asset, the social responsibility, the amount invested in R&D and so forth. The additional objective functions converts the efficient frontier into a surface in a high dimensional space.

In this research, additionally to risk and return we take into account an extra discrete objective function which minimizes the cardinality of the portfolio. The objective function is included by summing up the number of non-negative proportions in the portfolio and should be minimized.

Including a third objective (in addition to mean and risk) into the portfolio selection model the efficient frontier is transformed into a surface in the three-dimensional space and computing the exact efficient surface is very difficult if not impossible. However, a discrete approximation of the efficient surface is usually acceptable. The Pareto dominance relation described above for the mean-risk portfolio optimization problem should be transformed. In the mean-risk-cardinality portfolio optimization problem we say that a portfolio x2 dominates another portfolio x1 if μ(x2) ≥ μ(x1), ρ(x2) ≤ ρ(x1), card(x2) ≤ card(x1) with at least one strict inequality.

In sum, in this research we study the mean-risk-cardinality portfolio selection problem with non-negativity constraints. Except the added difficulty of the incorporation of a third criterion, there is a special one which is imposed by the non-smoothness of the extra objective function. These issues have led us to investigate the ability of the state-of-the-art evolutionary multi-objective algorithms in order to compute a good approximation of the true efficient surface.

3 Multi-objective Evolutionary Algorithms

Evolutionary algorithms (EAs) are population-based, random search heuristics that imitate the principles of Darwin’s theory of evolution, and are appropriate for tackling optimization problems with tough search landscapes (e.g., large solution spaces, multimodal search spaces, constraints, nonlinear and non-differentiable functions, multiple objectives). The last capacity of EAs to take care of situations with multiple objectives has offered ascend to the field of evolutionary multi-objective optimization. The EAs intended for multi-objective optimization problems are called Multi-objective Evolutionary Algorithms (MOEAs) and they contrast from traditional EAs mainly in the selection operator. The main supremacy of MOEAs is that they produce a good approximation of the efficient frontier in a single run and within little computing time.

In this study we use three modern, representative MOEAs, as are identified in the recent paper of [26] namely SPEA2 [68], MOEA/D [64] and SMS-EMOA [27] to investigate the multi-objective portfolio selection model domain for the optimal trade-off solutions optimistically to give a good estimation of the (unknown) efficient set and its corresponding efficient surface. Furthermore, an additional goal of this study is to compare the three algorithms in the mean-risk-cardinality portfolio optimization problem making a contribution in methodology and showing a new application domain for intelligent algorithms.

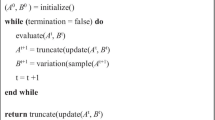

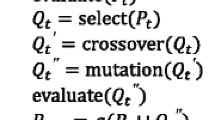

SPEA2 is a prevalent and powerful Pareto-based MOEA. It adopts a typical set of possible solutions-individuals together with a repository-archive so as to guarantee the conservation of good non-dominated solutions. From the outset, the repository is set to the empty set and the population (of size Npop) to a random sample of the solution space. At each iteration-generation, and while a halting criterion is not fulfilled, SPEA2 calculates the fitness of the solutions-individuals from both the repository and the normal population. SPEA2 uses a blended procedure to underline non-dominated individuals dependent on the dominance rank and dominance count method, and a grouping method to preserve diversity. To start with, every solution is appointed a strength value which is equal to the number of solutions that dominates. From that point, the fitness of an individual is basically the sum total of the strengths of its dominators. In this manner, the non-dominated individuals have zero fitness. Minimization of fitness is assumed. The density information is consolidated by adding to the fitness value of every solution a value that is equal to the inverse of the k-th smallest Euclidean distance (measured in objective space) plus two. Next, the repository is hopefully upgraded by the best solutions of the repository and the normal population. The solutions in the archive experience a reproduction scheme which is equivalent to traditional evolutionary algorithms and the outcome (the offspring population) comprises the population of the next generation. At the last iteration the best individuals, portfolios in our case, from both the repository and the final population is supplied by the algorithm.

MOEA/D is another popular and effective multi-objective evolutionary algorithm. In general, MOEA/D breaks down the multi-objective optimization problem into several sub-problems, every last one of them focusing on various parts of the efficient frontier. For decomposing the multi-objective optimization problem MOEA/D works either with Chebychev scalarizations, or other scalarization methods. MOEA/D manages a set of solutions, and every solution is associated with a particular sub-problem i.e. a weight vector. The weight vectors are chosen with such a way so that are equitably dispersed in the search space. For generating an offspring only the neighborhood of the parent solution is considered. Furthermore, to store all non-dominated solutions it produces during the search an unbounded external archive is maintained.

SMS-EMOA [27] is a classical paradigm of indicator-based multi-objective evolutionary algorithms. A performance indicator is a scalar measure that computes the quality of an efficient frontier. The SMS-EMOA utilizes the hypervolume indicator as a performance indicator. An algorithm which maximizes the hypervolume indicator yields efficient points with good proximity and diversification characteristics. The hypervolume indicator calculates the size the efficient frontier dominates bounded by a reference point. SMS-EMOA plans to maximize this indicator by advancing a population of solutions. This is accomplished by considering the contribution of solutions to the hypervolume indicator in the selection technique. Toward the begin the algorithm randomly produces a population of solutions. Next it creates an offspring solution utilizing recombination and mutation operators. At that point this offspring solution replaces that solution from the population which has the minor (exclusive) hypervolume contribution. The hypervolume contribution of a solution is the difference between the hypervolume of the population minus the hypervolume of the population without that particular solution. For applying SMS-EMOA the fast implementation described in [32] has been used as suggested by Emmerich and Deutz [26].

When evolutionary algorithms and of course multi-objective evolutionary algorithms are applied in practical optimization problems, a crucial issue for their performance is the solution representation (coding, chromosomal data structure). For the portfolio selection problem Streichert et al. [57, 58] introduced a hybrid representation, where a binary string is added to indicate the existence or not of a security in the solution portfolio leading in better algorithm performance. In the hybrid solution representation two arrays are used for characterizing a portfolio. A binary vector indicates if a particular financial security participates in the portfolio or not, and a real-valued vector is used to calculate the proportion weights of the budget invested in the available financial securities. Thus we have:

In order to compute the portfolio x associated with the above representation we make the following calculations: first, the weights of the financial securities that are not part of the portfolio are vanished (i.e. wi = 0, if δi = 0). From that point the excess weights are normalized to fulfill the budget constraint. Thus the proportion weight xi is calculated by \(x_{i} = \frac{{w_{i} }}{{\sum\nolimits_{j = 1}^{n} {w_{j} } }}\) for every i = 1, …, n.

For generating the offspring population, the so-called uniform crossover operator in every array of the chromosome has been used. According to uniform crossover operator two selected individuals-solutions produce a single child. The value for each array is selected with equal probability from one or another parent. The offspring population was subject also for mutation. Distinctive mutation probabilities for each array have been utilized. In the real-valued array the Gaussian random mutation was applied with standard deviation 0.05, while in the binary string bit flip mutation in an arbitrarily characterized position was applied.

The algorithms stopped when 150,000 solutions-portfolios were produced. For crossover and mutation probabilities we have used the following values. Crossover probability was set at 0.9, Gaussian mutation probability at 1.0 and bit flip mutation probability at 0.01 for all algorithms. Population size was fixed to 500 individuals for every evolutionary procedure. The archive size for SPEA2 was set to 300 as well. MOEA/D utilizes an unbounded archive size.

4 Multi-objective Evolutionary Algorithms for Portfolio Optimization Problems—A Literature Review

The popularity of metaheuristics to support decision-making in finance is gaining momentum among researchers—which is reasonable due to the complexity of real-life financial problems [1].

A decision maker in practical portfolio management confronts problems of discrete and multi-objective aspects (with two or more objectives). Following the paradigms of multi-objective optimization and the Markowitz approach the investor desires to find the efficient sets of portfolios and their efficient frontiers (or at least a good approximation of them).

In general, the solution of a multi-objective problem can be partitioned in two distinct steps: the optimization of several objective functions and the decision of what kind of tradeoffs are relevant from the decisions maker perspective. Multi-objective optimization techniques are classified by most multi-objective optimization texts as a priori, a posteriori and interactive approaches [16]. The second step involves the selection of the appropriate optimization technique which will explore for the best solution or solutions of the specified optimization problem. Most MOEAs for portfolio selection problems have been embraced a posteriori approaches, i.e. all objectives are viewed as equivalent significant and the target is to compute the set of non-dominated solutions-portfolios from which the decision-maker-investor will choose the most appropriate. In this paper we consider these techniques.

Metaheuristics are a core topic for research in operations research and computer science the last decades [11]. They seem suitable for solving practical and complex portfolio selection models as these models have attributes such as non-convex objective functions and search spaces. Multi-objective evolutionary algorithms (MOEAs), on the other hand, while suitable to handle non-convex objective functions and search spaces are additionally capable to tackle problems with multiple objectives in a natural manner. MOEAs provide a natural tool for solving complex portfolio selection problems with additional objective functions and/or real-world constraints, however they have been less investigated in the specialized literature [36, 39]. The primary preferred position of MOEAs, particularly contrasting them with single-objective metaheuristics, is that they compute the efficient set and the respective efficient frontier in a single run of the algorithm. Single-objective metaheuristics require tackling a few optimization problems in order to produce an estimate of the true efficient frontier.

Multi-objective evolutionary algorithms are applied as early as 1997 in portfolio optimization problems [61]. The majority of papers on portfolio optimization with MOEAs solves bi-objective problems and considers only variance as a risk measure [41]. In this study, we solve the tri-objective mean-risk-cardinality portfolio selection problem with different measures of risk in addition to variance.

4.1 Mean-Variance Portfolio Optimization Using MOEAs

Vedarajan et al. [61] considered a mean-variance optimization model with a top weight bound for every financial security. For solving the problem they applied a multi-objective genetic algorithm namely Non-dominated Sorting Genetic Algorithm (NSGA) [53]. Diosan [22] compared three popular Pareto-based MOEAs, namely: NSGA-II [21], PESA [19] and SPEA2 [68] for solving the classical mean-variance portfolio selection model. Various computational experiments were conducted using real-world data. The outcome of the research shows that PESA outperforms NSGA-II and SPEA2 for the considered experiments. Mishra et al. [43] compared three multi-objective evolutionary techniques on the classical Markowitz mean-variance portfolio selection model. The algorithms compared were: PAES [34], APAES [47], and NSGA-II. They used only the smallest data set from the OR-Library with 31 assets to perform their experiments. NSGA-II was observed to be the best algorithm among the three while PAES was the worst. On the same standard mean-variance model and data set, [44], have also proposed and compared a multi-objective particle swarm optimization algorithm (MOPSO), PESA and microGA [17]. MOPSO was found to be the best algorithm based on a collective summary of quality metrics.

Radziukyniene and Zilinskas [49] experimentally investigated several multi-objective algorithms on the classical mean-variance problem. The multi-objective metaheuristics compared were: Fast Pareto genetic algorithm (FastPGA) [29], Multi-Objective Cellular genetic algorithm (MOCeLL) [45], Archive-based hybrid Scatter Search algorithm [46] and NSGA-II. The experiments have been performed using data from 10 Lithuanian stocks. The results were shown that MOCeLL outperforms the other algorithms.

Duran et al. [23] performed a comparison of various evolutionary multi-objective techniques, namely NSGA-II, SPEA2, and IBEA (Indicator-Based Evolutionary Algorithm) [67]. They constructed a data set using weekly returns of 26 mutual funds that are traded in the Caracas stock exchange. The research showed that NSGA-II performed better than SPEA2 while IBEA achieved a mixed performance. There were instances which IBEA provided the best results while in others the worst.

Streichert et al. [57, 58] raised an important issue in the solution of portfolio optimization problems with metaheuristics (that of solution representation) and showed that the solution representation and the variation operators may considerably affect the performance of the algorithm. In their first study, they compared several solution representations within the context of a MOEA (the authors applied an algorithm based on NSGA-II and its predecessor NSGA) on different portfolio optimization models with cardinality, buy-in and roundlot constraints. They conducted experiments using the smallest data set (with 31 assets) from the OR-Library. At first a binary representation with a 32-bit string for each decision variable xi was used. This representation was compared with a real-valued representation where every variable xi is encoded in a vector of real values between 0 and 1. In both representations, an additional binary string was introduced in order to specify whether a financial security participates in the portfolio (1) or not (0). This extension is called by the authors knapsack representation or hybrid encoding. They found that the hybrid representation outperforms the standard approaches. The best approach was the hybrid encoding with the real-valued vector. They solve a mean-variance portfolio selection model with buy-in thresholds, roundlots and cardinality constraints.

Armananzas and Lozano [5] compared and adapted three notable optimization algorithms, simulated annealing [7], greedy search, and ant colony optimization to the cardinality constrained mean-variance portfolio optimization model. They performed their experiments utilizing the five data sets from the OR-Library. The research has shown that the ACO and the SA heuristics perform the best as observed by visual inspections of the generated efficient frontiers. On the same mean-variance portfolio selection problem with quantity, cardinality and roundlot constraints. Chiam et al. [15] introduced an order-based solution representation and analyzed how the additional constraints affect the evolutionary search progress and the efficient frontier achievable. They compared the newly proposed solution representation with those of hybrid and real-valued solution representations of [57, 58] using three quality metrics. For the standard portfolio problem they observed that the order-based representation and the hybrid encoding were of the same quality considering generational distance. However, for three problem instances the order-based representation was better than the hybrid representation with respect to diversity.

Skolpadungket et al. [52] performed a comparative study of various multi-objective evolutionary algorithms on the mean-variance portfolio selection problem with cardinality constraints, floor constraints and roundlots. The algorithms tested were: Vector Evaluated Genetic Algorithm (VEGA), Fuzzy VEGA, Multiobjective Optimization Genetic Algorithm (MOGA), Strength Pareto Evolutionary Algorithm 2 (SPEA2), and Non-dominated sorting genetic algorithm II (NSGA-II). They based their analysis using data from the OR-Library of the Hang Seng data set which contains 31 assets. SPEA2 performed the best for both of the instances tested.

Chen et al. [14] proposed a novel technique for portfolio selection, namely multi-objective extremal optimization (MOEO) [13]. They utilized the cardinality constrained Markowitz model and they compared their approach to NSGA-II, SPEA2 and PAES. The authors test their proposed technique using the five data sets from the OR-Library. They use the front spread [10] and C (coverage) metrics to compare the performance of the algorithms. The results show that MOEO performs best considering the front spread metric. Concerning the C metric it was observed that MOEO performed better than SPEA2 and PAES and a little worse than NSGA-II.

On the mean-variance cardinality constrained portfolio selection problem [3] compared the effectiveness of five state-of-the-art MOEAs namely: Non-dominated Sorting Genetic Algorithm II (NSGA-II), Strength Pareto Evolutionary Algorithm 2 (SPEA2), Pareto Envelope-based Selection Algorithm (PESA), the Niched Pareto Genetic Algorithm 2 (NPGA2) [28], and e-Multi-objective Evolutionary Algorithm (e-MOEA) [33]. The experimental results demonstrated that SPEA2 is the best technique. Furthermore, NSGA-II and e-MOEA have shown similar performance.

Branke et al. [12] introduced a hybrid algorithm that merges a multi-objective evolutionary algorithm with the critical line algorithm for portfolio selection problems with complex constraints. Especially, they tackled a mean-variance portfolio optimization problem with buy-in threshold and cardinality constraints and a two-objective mean-variance model with the 5–10–40 constraint.

Suganya and Vijayalakshmi Pai [60] proposed a Pareto-archived evolutionary wavelet network (PEWN) to handle the mean-variance version of portfolio optimization models with bounding, class, shortsale and cardinality constraints. The wavelet coefficient shrinkage method was employed for the estimation of the input variables (covariance matrix and expected returns of the assets). Experimental studies have been performed using daily quoted prices from the Tokyo Stock Exchange (Nikkei225 index: March 2002 to March 2007) and Bombay Stock Exchange (BSE200 index: July 2001 to July 2006).

Mishra et al. [42] address a realistic mean-variance portfolio optimization problem considering cardinality, budget and quantity constraints. They propose a new multi-objective optimization technique, which they call non-dominated sorting multiobjective particle swarm optimization (NS-MOPSO) and they compared with four Multi-objective Evolutionary Algorithms based on non-dominated sorting (PESA-II, SPEA2, NSGA-II, 2 LB-MOPSO) and one based on decomposition (MOEA/D). The computational results got from the examination are additionally compared with those of single objective metaheuristics such as the simulated annealing, tabu search, genetic algorithm and particle swarm optimization. The results showed a superiority of (NS-MOPSO).

Lwin et al. [38] studied the Markowitz’s mean-variance portfolio selection problem with quantity, cardinality, roundlot and pre-assignment constraints. An efficient learning-guided hybrid evolutionary multiobjective technique is proposed to handle the constrained portfolio selection model in the extended mean-variance framework. The suggested algorithm was compared against four state-of-the-art multiobjective evolutionary techniques, namely Strength Pareto Evolutionary Algorithm 2 (SPEA2), Pareto Archived Evolution Strategy (PAES), Non-dominated Sorting Genetic Algorithm II (NSGA-II) and Pareto Envelope-based Selection Algorithm II (PESA-II). Experimental results are outlined for openly accessible OR-library datasets from seven market indices including up to 1318 financial securities. Exploratory outcomes on the portfolio selection problem with the additional constraints exhibit that the proposed algorithm fundamentally beats the four notable multiobjective evolutionary algorithms concerning the quality of produced efficient frontier in the conducted experiments.

Zhou et al. [66] introduces a multi-objective genetic algorithm namely DEA-MOEA/D by integrating decomposition method and DEA (Data Envelopment Analysis) method for the mean-variance cardinality constrained portfolio model. The results show that DEA-MOEA/D is better than FDH-MOGA, MOEA/D and NSGA-II, not only for test functions, but also for the portfolio model.

Liagkouras and Metaxiotis [37], introduces a new multi-objective evolutionary Algorithm (MOEA) for the solution of the mean-variance cardinality constrained portfolio optimization problem (CCPOP). The suggested MOEA incorporates an efficient encoding scheme especially designed for the CCPOP. Furthermore, the submitted MOEA included a new mutation and crossover operator tailor-made to perform well with the new representation scheme. Seven different datasets from several stock markets are utilized for testing the proposed algorithm. The performance of the proposed efficiently encoded multiobjective portfolio optimization solver (EEMPOS) is contrasted with two popular and very efficient and effective MOEAs, namely NSGA-II and MOEA/D. The research results demonstrate that the proposed EEMPOS outperforms the two different MOEAs for all performance metrics considered for a fraction of computing time needed by the other algorithms.

4.2 Mean-Risk Portfolio Optimization Using MOEAs

Zeiaee and Jahed-Motlagh [63] apply NSGA-II in a mean-VaR portfolio optimization model. They use data from 12 stocks of the Tehran Stock exchange. They provide the efficient frontier using summary attainment surfaces. The efficient frontier showed an acceptable diversity of portfolios capturing different trade-offs between expected return and VaR. Krink and Paterlini [35] proposed a novel evolutionary multi-objective algorithm for portfolio optimization: DEMPO—Differential Evolution for Multi-objective Portfolio Optimization. They tested their technique with NSGA-II in a classic mean-variance, mean-VaR and mean-ES portfolio optimization problem using daily observations from 219 stocks of the Italian stock market. The results showed that the DEMPO outperformed NSGA-II.

Zhang et al. [65] applied a newly developed algorithm MOEA/D [64] on a portfolio selection model with minimum transaction units, transaction costs and cardinality constraints. Eight test instances with up to 150 decision variables were constructed based on data from the German stock index DAX. For comparison purposes they tested their new approach with NSGA-II having the same reproduction repair and solution representation with MOEA/D implementation. The experimental outcomes demonstrated that MOEA/D is better than NSGA-II in the majority of the problem instances considered.

Anagnostopoulos and Mamanis [4] investigated the ability and compared the effectiveness of NSGA-II, SPEA2 and PESA, on the mean-VaR and mean-ES portfolio selection models with quantity, cardinality and class constraints. To test the proposed algorithms they used daily returns from 96 stocks included in the US S&P 100 index. From the computational experiments it was not observed an apparent dominant technique. All algorithms have shown good quality and robust results as compared also with efficient points obtained using the exact method of CPLEX commercial package.

Baixauli-Soler et al. [8] tackled a mean-VaR portfolio optimization problem with minimum transaction lots and transaction costs and solved it using SPEA2. They used daily data of 50 stocks from the Eurostoxx 50 index. They managed to obtain reliable results from the solution of four models: the standard mean-VaR portfolio selection model, the mean-VaR portfolio optimization model with minimum transaction units, the mean-VaR portfolio selection model with transaction costs and the mean-VaR portfolio selection model including both minimum transaction lots and transaction costs. They also showed that by not including real constraints into the portfolio selection model this lead to inefficient solutions.

4.3 Three-Objective Portfolio Optimization Using MOEAs

Vedarajan et al. [61] proposed a three-objective portfolio selection problem, where the third additional objective measures the transaction cost due to changes in portfolio weights which is to be minimized. For solving the problem they applied the NSGA.

Ong et al. [48] suggested an algorithm which includes the grey and possibilistic regression models to forecast expected return and covariance matrix for a three-objective portfolio selection model with two sources of risk (an uncertainty risk function and the classic variance). In order to handle the multi-objective quadric optimization problem, a multi-objective evolution algorithm which transfers the vector objective function into a scalar was employed. A computational example with six stocks was built in order to compare the suggested method to the classical mean-variance model. The suggested technique has been shown to provide more workable and precise results than the Markowitz model.

Fieldsend et al. [31] formulated the cardinality constrained portfolio optimization problem as a tri-objective problem where they seek to compute all possible tradeoffs between return, risk and the cardinality of the portfolio. This is performed by formulating the number of assets in the portfolio as an extra objective to be minimized. Fieldsend search for the efficient frontiers which represent the trade-off among return, cardinality and variance and using a modified MOEA to compute the efficient surface in one execution of the algorithm. They base their solution approach in a simple (1 + 1)-evolution strategy [30]. They test their method using weekly asset returns from the US S&P 100 index and emerging stock markets for the period January 1992 to December 2003.

Anagnostopoulos and Mamanis [2] have performed a computational study with the state-of-the-art MOEA techniques, on the same three-criterion problem introducing however additional practical constraints (quantity and class constraints). They test the ability of MOEAs to solve large-scale instances with 200 and 300 assets generated randomly. The MOEAs tested and compared were: SPEA2, PESA and NSGA-II. The results revealed a clear win of SPEA2 with PESA coming next while being the fastest approach.

Subbu et al. [59] introduced a hybrid multiobjective optimization technique that merges evolutionary algorithm and linear optimization to simultaneously maximize a return measure and minimize two measures of risk. The return is described by portfolio’s book yield while the two sources of risk are measured by value-at-risk and variance. The constraints are all linear functions of the portfolio weights expressing duration and convexity mismatches. For identifying the efficient frontier they employ Pareto Sorting Evolutionary Algorithm (PSEA).

Radziukyniene and Zilinskas [49] experimentally investigated several multiobjective algorithms on a three-objective mean-variance-annual-dividend-yield portfolio selection model. The multi-objective metaheuristics compared were: Multi-Objective Cellular genetic algorithm (MOCeLL) [45], Fast Pareto genetic algorithm (FastPGA) [29], NSGA-II and Archive-based hybrid Scatter Search algorithm [46]. The experiments have been performed using data from 10 Lithuanian stocks. The results were shown that MOCeLL performs best concerning generational distance and hypervolume while NSGA-II and FastPGA are the best algorithms considering the inverted generational distance.

Based on the above literature review on evolutionary multi-objective algorithms for portfolio optimization we aim to apply the state-of-the-art MOEAs in different mean-risk-cardinality portfolio optimization models. We make a contribution both in finance as we solve problems that have never been solved in the specialized literature and to computer science, comparing and identifying the best representative MOEAs for solving the problems and showing a new application domain for intelligent algorithms. More specifically: The corresponding MOEAs have never been compared in such a problem. Their effectiveness has been proven in other fields and artificial functions but they should be tried in various practical problems as well. Furthermore, as it is shown from the literature review, the majority of papers deal with mean-variance portfolio optimization problems, fewer studies consider different risk measures in a mean-risk framework and even fewer consider tri-objective portfolio optimization problems.

5 Experimental Results

We demonstrate here the computational outcomes acquired by applying MOEAs in the mean-risk-cardinality portfolio selection models just as a cross-algorithm performance comparison. The data required were collected from the yahoo finance webpage and they are referred to the S&P 100 index. Daily returns from 2 October 2012 to 2 October 2017 of 94 assets have been computed and each computed rate of return was considered to define a different scenario, thus the total number of scenarios were T = 1257.

All algorithms have utilized the same parameter settings. A population and archive size of 300 individuals have been used. MOEA/D uses an unbounded archive. A crossover probability of 0.9 was used for all the three algorithms. Mutation probabilities of 0.01 for the Δ array and 1.0 for the W set were used. The algorithms were stopped after 150,000 solutions were generated.

For comparing the three different MOEAs the Set Coverage (C-metric) and hypervolume metric have been employed. The C-metric is calculated as follows: Let A and B be two approximation sets of the efficient frontier. C(A, B) is defined as the percentage of the solutions in B that are covered (it is dominated or it is equal) by at least one solution in A, i.e.,

C(A, B) = 1 means that all solutions in B are covered by some solutions in A, while C(A, B) = 0 implies that no solution in B is covered by a solution in A. According to [69], binary quality measures like C-metric overcome the limitations of unary measures like hypervolume and, if properly designed, are capable of indicating whether A is better than B.

Hypervolume metric can quantify how well the computational methods perform in computing solutions along the full extent of the efficient frontier. It essentially computes the volume of the objective space dominated by the solutions generated by the corresponding algorithm bounded by a reference point. Consequently, the higher the hypervolume metric value the better.

SMS-EMOA and MOEA/D are properly oriented so as to minimize the three objective functions. To express the expected return objective in minimization form, the expected return objective is transformed as μ(x). In order to compute the hypervolume metric SPEA2 is also operates in the minimization problem although this is not a requirement.

All algorithms have been run 10 times for every portfolio problem on identical computers (Intel(R) Core (TM) i5-7200U, 2.5 GHZ, 4.00 GB) and coded using Microsoft Visual C++.

Table 13.1 shows the means of the C-metric values for all portfolio models and Table 13.2 gives the mean computing time used by each algorithm for each problem.

With respect to computational time, as shown in Table 13.2, SPEA2 is the fastest approach followed by MOEA/D and SMS-EMOA. On average, SPEA2 requires about 13.5% of the CPU time that MOEA/D needs and 2.3% of SMS-EMOA. In addition, MOEA/D requires on average only about 17% the time that SMS-EMOA needs.

With respect to C-metric, as presented in Table 13.1, it is observed that SPEA2 is the worst algorithm. On average its solutions are covered by the other two algorithms in approximately more than 41% for all portfolio problems while it covers only approximately 4.7% of the solutions of the other two algorithms. MOEA/D is slightly better than SMS-EMOA since it covers on average roughly 14% of the generated solutions of SMS-EMOA and SMS-EMOA covers only 4.3% of the generated solutions of MOEA/D.

Concerning the hypervolume metric, as shown in Table 13.3 the results are completely different. SPEA2 wins in five of six risk measures as shown with bold font. This suggests that MOEA/D and SMS-EMOA provide solutions with good proximity (that is why they win considering C-metric) but with poor coverage and diversity of the efficient surface. This phenomenon can be seen in the following figures, where we see that SPEA2 approaches areas with more assets in the portfolio (but less risk) than SMS-EMOA and MOEA/D.

Thus we observe that although SMS-EMOA and MOEA/D covers approximately 50% of the solutions generated by SPEA2 this also shows that there are another 50% of solutions not covered by the two algorithms. This recommends that the best technique for tackling the problem is to execute all the algorithms several times and take the efficient portfolios from the combined pool of solutions generated by the three algorithms.

In Fig. 13.1, 13.2, 13.3, 13.4, 13.5 and 13.6 we see the efficient surface for the Mean-Risk-Cardinality portfolio optimization problem generated by all algorithms for different risk measures. It is seen for each cardinality level the mean-risk efficient frontier for different risk measures generated by each algorithm. In general, for the problem, it is seen that as the number of assets in the portfolio increases the risk decreases but the expected return of the portfolio decreases as well. And this is observed independently for each risk measure.

Furthermore, for a fixed level of expected return, there are various portfolios with varying risk but generally portfolios with smaller risk contain more securities and this is certainly a tradeoff since investors prefer to have small portfolios. By examining the above surfaces decision makers can therefore find portfolios that suit to their preferences the best.

6 Conclusion

Multi-objective portfolio optimization is gaining momentum the last years. Portfolio optimization is an inherently multi-objective problem from its origin. However the last years additional criteria has been proposed in the classical mean-risk portfolio selection models. In this research we considered the mean-risk-cardinality portfolio selection model with six different risk measures. Three different state-of-the-art Multi-Objective Evolutionary Algorithms (MOEAs) were employed: Strength Pareto Evolutionary Algorithm (SPEA2), Multi-Objective Evolutionary Algorithm based on decomposition (MOEA/D) and S-Metric Selection-Evolutionary Multi-Objective Algorithm (SMS-EMOA). Experimental results demonstrated that the best algorithm considering the C metric was MOEA/D while the best algorithm considering the hypervolume metric was SPEA2 while being the fastest approach. This recommends that the best technique for tackling the problem is to execute all the algorithms several times and take the efficient portfolios from the combined pool of solutions generated by the three algorithms.

As future research other MOEAs can be used like memetic and convolution-based MOEAs which are alternative MOEAs frameworks in addition to Pareto-based, indicator-based and decomposition-based MOEAs which were considered in this study. Furthermore there are also other less explored but important multiobjective algorithms (from the family of multi-objective metaheuristics and not only evolutionary algorithms) e.g., the multiobjective versions of ant colony optimization, particle swarm optimization, scatter search, simulated annealing, tabu search and GRASP. A comparative study of different approaches seems particularly interesting and necessary.

References

Amparo SD, Angel AJ, Renatas K (2017) A survey on financial applications of metaheuristics. ACM Comp Surv 50(15). https://doi.org/10.1145/3054133

Anagnostopoulos KP, Mamanis G (2010) A portfolio optimization model with three objectives and discrete variables. Comput Oper Res 37:1285–1297

Anagnostopoulos KP, Mamanis G (2011) The mean-variance cardinality constrained portfolio optimization problem: an experimental evaluation of five multiobjective evolutionary algorithms. Exp Syst Appl 38:14208–14217

Anagnostopoulos KP, Mamanis G (2011) Multiobjective evolutionary algorithms for complex portfolio optimization problems. Comput Manag Sci 8:259–279

Armananzas R, Lozano JA (2005) A multiobjective approach to the portfolio optimization problem. In: IEEE congress on evolutionary computation, pp 1388–1395

Bana e Costa CA, Soares JO (2004) A multicriteria model for portfolio management. Eur J Fin 10:198–211

Bandyopadhyay S, Saha S, Maulik U, Deb K (2008) A simulated annealing-based multiobjective optimization algorithm: AMOSA. IEEE Trans Evol Comput 12:269–283

Baixauli-Soler JS, Alfaro-Cid E, Fernandez-Blanco MO (2011) Mean-VaR portfolio selection under real constraints. Comput Econ 37:113–213

Benati S, Rizzi R (2007) A mixed integer linear programming formulation of the optimal mean/value-at-risk portfolio problem. Eur J Oper Res 176:423–434

Bosman PAN, Thierens D (2003) The balance between proximity and diversity in multiobjective evolutionary algorithms. IEEE Trans Evol Comput 7:174–188

Boussaid I, Lepagnot J, Siarry P (2013) A survey on optimization metaheuristics. Inf Sci 237:82–117

Branke J, Scheckenbach B, Stein M, Deb K, Schmeck H (2009) Portfolio optimization with an envelope-based multi-objective evolutionary algorithm. Eur J Oper Res 199:684–693

Chen MR, Lu YZ (2008) A novel elitist multiobjective optimization algorithm: multiobjective extremal optimization. Eur J Oper Res 188:637–651

Chen MR, Weng J, Li X (2009) Multiobjective extremal optimization for portfolio optimization problem. In: IEEE international conference on intelligent computing and intelligent systems, pp 552–556

Chiam SC, Tan KC, Al MA (2008) Evolutionary multi-objective portfolio optimization in practical context. Int J Autom Comput 5:67–80

Coello CAC, Lamont GR, Van Veldhuizen DA (2007) Evolutionary algorithms for solving multi-objective problems, 2nd edn. Springer, Berlin

Coello CAC, Pulido GT (2001) A micro-genetic algorithm for multiobjective optimization. In: Zitzler E et al (eds) First international conference on evolutionary multi-criterion optimization. Lecture notes in computer science 1993, pp 126–140

Constantinides GM, Malliaris AG (1995) Portfolio theory. In: Jarrow RA, Maksimovic V, Ziemba WT (eds) Handbooks in operations research and management science, vol 9, pp 1–30

Corne DW, Knowles JD, Oates MJ (2005) The pareto envelope-based selection algorithm for multiobjective optimization. In: Schoenauer M et al (eds) Proceedings of the parallel problem solving from nature, VI conference, Lecture notes in computer science 1917. Springer, Paris, France, pp 839–848

De Giorgi E (2005) Reward-risk portfolio selection and stochastic dominance. J Bank Fin 29:895–926

Deb K, Pratap A, Agarwal S, Meyarivan T (2002) A fast and elitist multiobjective genetic algorithm: NSGA II. IEEE Trans Evol Comput 6:182–197

Diosan L (2005) A multi-objective evolutionary approach to the portfolio optimization problem. In: Proceedings of the international conference on computational intelligence for modeling control and automation, pp 183–188

Duran FC, Cotta C, Fernandez AJ (2009) Evolutionary optimization for multiobjective portfolio selection under Markowitz’s model with application to the Caracas stock exchange. In: Chiong R (ed) Nature-inspired algorithms for optimisation, SCI 193, pp 489–509

Ehrgott M, Klamroth K, Schwehm C (2004) An MCDM approach to portfolio optimization. Eur J Oper Res 155:752–770

Elton EJ, Gruber MJ, Brown SJ (2014) Modern portfolio theory and investment analysis, 9th edn. Wiley, Hoboken

Emmerich MTM, Deutz AH (2018) A tutorial on multiobjective optimization: fundamentals and evolutionary methods. Nat Comput 17:585–609

Emmerich M, Beume N, Naujoks B (2005) An EMO algorithm using the hypervolume measure as selection criterion. In: Coello Coello CA et al (eds) EMO 2005, LNCS 3410, pp 62–76

Erikson M, Mayer A, Horn J (2001) The Niched Pareto genetic algorithm 2 applied to the design of groundwater remediation systems. In: Zitzler E et al (eds) Lecture notes in computer science, vol 1917, pp 681–695

Eskandari H, Geiger CD (2008) A fast Pareto genetic algorithm approach for solving expensive multiobjective optimization problems. J Heuristics 14:203–241

Fieldsend JE, Everson R, Singh S (2003) Using unconstrained elite archives for multi-objective optimization. IEEE Trans Evol Comput 7:305–323

Fieldsend JE, Matatko J, Peng M (2004) Cardinality constrained portfolio optimization. In: Lecture notes in computer science (including subseries lecture notes in artificial intelligence and lecture notes in bioinformatics), vol 3177, pp 788–793

Guerreiro AP, Fonseca CM (2018) Computing and updating hypervolume contributions in up to four dimensions. IEEE Trans Evol Comput 22:449–463

Hanne T (2007) A multiobjective evolutionary algorithm for approximating the efficient set. Eur J Oper Res 176:1723–1734

Knowles J, Corne D (2003) Approximating the nondominated front using the Pareto archived evolution strategy. Evol Comput 8:149–172

Krink T, Paterlini S (2011) Multiobjective optimization using differential evolution for real world portfolio optimization. Comput Manag Sci 8:157–179

Kumar D, Mishra KK (2017) Portfolio optimization using novel co-variance guided Artificial Bee Colony algorithm. Swarm Evol Comput 33:119–130

Liagkouras K, Metaxiotis K (2018) A new efficiently encoded multiobjective algorithm for the solution of the cardinality constrained portfolio optimization problem. Annals Oper Res 267:281–319

Lwin K, Qu R, Kendal G (2014) A learning-guided multi-objective evolutionary algorithm for constrained portfolio optimization. Appl Soft Comput 24:757–772

Macedo LL, Godinho P, Alves MJ (2017) Mean-semivariance portfolio optimization with multiobjective evolutionary algorithms and technical analysis rules. Exp Syst Appl 79:33–43

Markowitz HM (1952) Portfolio selection. J Fin 7:77–91

Metaxiotis K, Liagkouras K (2012) Multiobjective evolutionary algorithms for portfolio management: a comprehensive literature review. Exp Syst Appl 39:11685–11698

Mishra SK, Panda G, Majhi R (2014) A comparative performance assessment of a set of multiobjective algorithms for constrained portfolio assets selection. Swarm Evol Comput 16:38–51

Mishra SK, Meher S, Panda G, Panda A (2009) Comparative performance evaluation of multiobjective optimization algorithms. In: World congress on nature and biologically inspired computing, pp 1338–1342

Mishra SK, Panda G, Meher S, Majhi R (2010) Multiobjective evolutionary algorithms for financial portfolio design. Int J Comput Vis Rob 1:236–247

Nebro AJ, Durillo JJ, Luna F, Dorronsoro B, Alba E (2006) A cellular genetic algorithm for multiobjective optimization. In: Proceedings of NICSO, pp 25–36

Nebro AJ, Luna F, Alba E, Beham A, Dorronsoro B (2006b) AbYSS adapting scatter search for multiobjective optimization. Technical report ITI-2006-2. Departamento de Lenguajes y Ciencias de la Computación, University of Malaga

Oltean M, Grosan C, Abraham A, Koppen M (2005) Multiobjective optimization using adaptive Pareto archive evolution strategy. In: 5th international conference on intelligent systems design and applications (ISDA’05), Piscataway, NJ, IEEE Press, pp 558–563

Ong CS, Huang JJ, Tzeng GH (2005) A novel hybrid model for portfolio selection. Appl Math Comput 169:1195–1210

Radziukyniene I, Zilinskas A (2009) Approximation of Pareto set in multi objective portfolio optimization. In: Advances in electrical engineering and computational science series. Lecture notes in electrical engineering, vol 39, pp 551–562

Righi MB, Borenstein D (2017) A simulation comparison of risk measures for portfolio optimization. Fin Res Lett 24:105–112

Roman D, Mitra G (2009) Portfolio selection models: a review and new directions. Wilmott J 1:69–85

Skolpadungket P, Dahal K, Harnpornchai N (2007) Portfolio optimization using multi-objective genetic algorithms. In: IEEE congress on evolutionary computation, pp 516–523

Srinivas N, Deb K (1994) Multiobjective optimization using nondominated sorting in genetic algorithms. Evol Comput 2:221–248

Steuer RE, Qi Y, Hirschberger M (2005) Multiple objectives in portfolio selection. J Fin Decis Making 1:1–26

Steuer RE, Qi Y, Hirschberger M (2007) Suitable-portfolio investors, nondominated frontier sensitivity, and the effect of multiple objectives on standard portfolio selection. Annals Oper Res 152:297–317

Steuer RE, Qi Y, Hirschberger M (2008) Portfolio selection in the presence of multiple criteria. In: Zopounidis C et al (eds) Handbook of financial engineering. Springer, Berlin, pp 3–24

Streichert F, Ulmer H, Zell A (2004) Comparing discrete and continuous genotypes on the constrained portfolio selection problem. In: Proceedings of conference on genetic and evolutionary computation. Lecture notes in computer science, vol 3103, pp 1239–1250

Streichert F, Ulmer H, Zell A (2004) Evaluating a hybrid encoding and three crossover operators on the constrained portfolio selection problem. In: Proceedings of congress on evolutionary computation, vol 1. IEEE Press, USA, Portland, pp 932–939

Subbu R, Bonissone PP, Eklund N, Bollapragada S, Chalermkraivuth K (2005) Multiobjective financial portfolio design: a hybrid evolutionary approach. IEEE Congr Evol Comput 2:1722–1729

Suganya NC, Vijayalakshmi Pai GA (2010) Pareto-archived evolutionary wavelet network for financial constrained portfolio optimization. Intell Syst Account Fin Manag 17:59–90

Vedarajan G, Chan L, Goldberg D (1997) Investment portfolio optimization using genetic algorithms. In: Proceedings of the late breaking papers at the genetic programming conference, pp 255–263

Xidonas P, Mavrotas G, Psarras J (2010) Equity portfolio construction and selection using multiobjective mathematical programming. J Glob Opt 47:185–209

Zeiaee M, Jahed-Motlagh MR (2009) A heuristic approach for value at risk based portfolio optimization. In: Proceedings of the 14th international CSI computer conference (CSICC’09), pp 686‒691

Zhang Q, Li H (2007) MOEA/D: a multiobjective evolutionary algorithm based on decomposition. IEEE Trans Evol Comput 11:712–731

Zhang Q, Li H, Maringer D, Tsang E (2010) MOEA/D with NBI-style Tchebycheff approach for portfolio management. IEEE Congr Evol Comput 1–8. https://doi.org/10.1109/CEC.2010.5586185

Zhou Z, Liu X, Xiao H, Wu S, Liu Y (2018) A DEA-based MOEA/D algorithm for portfolio optimization. Cluster Comput. https://doi.org/10.1007/s10586-018-2316-7

Zitzler E, Kunzli S (2004) Indicator-based selection in multiobjective search. In: Yao X et al (eds) PPSN 2004, vol 3242. LNCS, Springer, Heidelberg, pp 832–842

Zitzler E, Laumanns M, Thiele L (2001) SPEA2: improving the strength Pareto evolutionary algorithm, TIK-103. Department of Electrical Engineering, Swiss Federal Institute of Technology, Zurich, Switzerland

Zitzler E, Thiele L, Laumanns M, Fonseca CM, Grunert da Fonseca V (2003) Performance assessment of multiobjective optimizers: an analysis and review. IEEE Trans Evol Comput 7:117–132

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Mamanis, G. (2021). A Comparative Study on Multi-objective Evolutionary Algorithms for Tri-objective Mean-Risk-Cardinality Portfolio Optimization Problems. In: Patnaik, S., Tajeddini, K., Jain, V. (eds) Computational Management. Modeling and Optimization in Science and Technologies, vol 18. Springer, Cham. https://doi.org/10.1007/978-3-030-72929-5_13

Download citation

DOI: https://doi.org/10.1007/978-3-030-72929-5_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-72928-8

Online ISBN: 978-3-030-72929-5

eBook Packages: Business and ManagementBusiness and Management (R0)