Abstract

Over the last 10 years, Russia has faced many external and internal challenges. Using the Financial Stress Index for Russia (the ACRA FSI), which indicates the proximity of the Russian financial system to crisis and its reaction to different events, I show that shocks in the Russian financial system have adverse effects on real economic activity. The VAR model and Toda–Yamamoto augmented Granger causality tests are my research tools. I also estimate a threshold structural VAR model, revealing that the impact of a financial shock is bigger and longer lasting for distressed periods compared to normal periods in the Russian financial system. All my findings are in line with other research studies for both emerging and advanced economies.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL

1 Introduction

The global financial crisis has become a trigger for the emergence of a large number of indicators that assess the state of a country’s financial system or can even predict it. Examples of such indicators are financial stress and financial conditions indices (FSIs and FCIs). They measure the state of financial stability in a particular country or region. In practice, some central banks have adopted them (European Central Bank 2011; Hakkio and Keeton 2009; Kliesen and Smith 2010) to monitor financial stability and conduct monetary policy. Investors also rely on these indices when assessing the overall risk of investing in financial instruments of a country or region. Many international organizations and financial institutions use these indices (Bloomberg, Goldman Sachs, Citi, Bank of America, OECD, IMF, etc.).

Researchers also build FSIs and FCIs, using them for various purposes. For example, they apply these indices to analyze the interconnectedness of financial systems of different countries or to study whether financial stress transmits to the real economy. Indeed, recent financial crises showed that an increase in financial stress can dampen economic activity. Apparently, during the periods of financial instability, firms may decide to postpone their investments until better times. Financial stress is also deemed to increase the cost of borrowing, which leads to lower investment and economic growth. Some researchers suggest that the degree of financial stress transmission on economic activity differs between normal and stressful periods.

As to my knowledge, few of existing studies aim to discover the susceptibility of the Russian economy to financial stress and none of them uses ACRA financial stress index (ACRA FSI) as a proxy of financial stress. Against this backdrop, I decided to carry out such analysis for Russia. Thus, the primary goal of this paper is to analyze whether and to what extent shocks in financial system transmit to real economy in Russia. Meanwhile, I examine whether the effect of financial stress on economic activity differs for normal and distressed periods in the Russian financial system.

In the line with previous researches in this field, I use vector autoregression (VAR) and threshold structural vector autoregression (TSVAR) models and conduct Granger causality tests (Toda and Yamamoto 1995) to take into account non-stationarity of selected time series. I also perform robustness check to determine the credibility of obtained results. The proxy of financial stability in Russia is ACRA FSI, which was proposed several years ago (Kulikov and Baranova 2016, 2017). The rest of the paper is organized as follows. Firstly, I provide a literature review of existing ways to study the relationship between financial stress and economic activity, paying special attention to emerging markets. The next section introduces my research hypothesis and sets up methodological tools used for the analysis. Then, I do robustness check and discuss obtained results.

2 Literature Review

FSIs and FCIs are real-time indicators of financial stability. They can be applied for a variety of academic purposes. Many academic studies use them to examine financial stress transmission to real economy. They usually apply different econometric techniques, for instance, modifications of VAR model, Granger causality tests, and impulse response functions. Some of them take into account potential nonlinearity of shock transmission. In my analysis, I rely on two strands of literature. The first one examines financial stress transmission for advanced economies, the second one focuses on emerging markets. Within the latter strand, I pay special attention on the existing research on Russian economy.

Financial stress can cause recessions (Bloom 2009; Cardarelli et al. 2011). Indeed, when there is uncertainty in financial markets, economic agents may decide to postpone their investments and wait until better times. This can cause decreases in economic activity (Davig and Hakkio 2010). Another view on stress transmission to real economy is “financial accelerator” framework (Bernanke et al. 1999), when an increase in the financial stress (worsening financial conditions of firms) rises the cost of borrowing, lowers investments, and also leads to a decline in economic growth.

Many papers use FSIs and/or FCIs to examine the relationship between financial stress and economic activity for advanced economies. For example, the authors who proposed one of the most popular financial stress index for USA—Kansas City Fed FSI (KCFSI)—(Hakkio and Keeton 2009) examined whether a rise of financial stress entails any change of the net percent of US banks, which tightened their standards over the previous 3 months, and Chicago FED national activity index (CFNAI). They performed prediction tests by running regressions on the lagged values of dependent and independent variables. Their results indicate that financial stress can predict economic slowdown and changes in credit standards. Davig and Hakkio (2010) used KCFSI, CFNAI, and a regime-switching VAR model to illustrate that during the periods of increased financial stress, its effect on real economy is significantly higher than during normal times. Ubilava (2014) used the same variables as a proxy of financial stress (Kansas Fed FSI) and economic performance for USA (CFNAI), but applied a different version of nonlinear VAR, a vector smooth transition autoregressive (VSTAR) model, to account for a potentially greater degree of susceptibility of financial and economic activity during stressful periods. The author’s findings are in line with Hakkio and Keeton (2009). The author of other financial stress index for USA (Monin 2017) also found out that financial stress (OFR FSI) can predict CFNAI. He used a modification of Granger causality test, proposed by (Toda and Yamamoto 1995). Illing and Liu (2003) used TVAR for Canadian FSI and obtained results consistent with Davig and Hakkio (2010). Roye (2011) used a Bayesian VAR model and impulse response functions to analyze the effects of financial stress on real economic activity for Eurozone and Germany, encompassing real GDP growth rates, inflation and short-term interest rate. He found adverse effects of financial stress on the real economy. The authors of financial stress index for the UK (Chatterjee et al. 2017) use a similar procedure to determine whether there is a relationship between financial stress and economic activity, building on the TVAR and generalized impulse response functions. According to their findings, the transmission of shocks in normal and stressful periods is different in the UK. Finally, Aboura and Roye (2017) used a Markov-switching model to show that stressful periods in France generate pronounced economic reactions, which are negligible otherwise.

In comparison with advanced economies, a smaller number of FSIs were constructed for emerging markets. However, they generally use similar econometric models to test how financial instability affects economic activity. For example, Aklan et al. (2016) computed a financial stress index for Turkey and found a significant adverse impact of financial instability on real economic activity by using VAR and Granger causality tests. Polat and Ozkan (2019) also constructed a financial stress index for Turkey and obtained quite similar results, using a structural VAR model. Tng and Kwek (2015) applied the same model to examine the interaction of financial stress and economic activity for the ASEAN-5 countries. Their results are consistent with other studies. Cevik et al. (2016) constructed the financial stress index for four Southeast Asian economies (South Korea, Malaysia, the Philippines, and Thailand) and exploited impulse response functions. According to their results, financial stress causes economic slowdowns. Stona et al. (2018) introduced a FSI for Brazil and used a Markov-switching VAR model to examine its nonlinear relationships with real activity, inflation, and monetary policy.

There are some papers that examine financial stress and economic activity interaction for Russia. For example, Stolbov and Shchepeleva (2016) used Granger causality tests based on the Toda and Yamamoto approach and found the effects of financial stress on industrial production in 9 out of 14 emerging markets, including Russia. Using bivariate VAR models and impulse response functions, Çevik et al. (2013) documented linkages between the fluctuations of economic activity and financial stress for Bulgaria, Czech Republic, Hungary, Poland, and Russia. In particular, they found a significant correlation between composite leading indicators (CLI) of economic activity calculated by OECD and the financial stress index for Russia. The bivariate VAR models showed a strong negative response of industrial production, investment, and foreign trade growth rates to the rise in financial stress for this country.

All the aforementioned studies found strong statistical evidence of the relationship between financial and real sector. However, relatively little attention is paid to the Russian economy. I contribute to the existing literature by addressing the financial stress interactions with economic activity in Russia, taking into account potential nonlinearity of shock transmission. Thus, I depart from Stolbov and Shchepeleva (2016) and Çevik et al. (2013) who also analyzed the impact of financial stress on the economic activity in Russia by using a different financial stress index (ACRA FSI) and applying a TSVAR model. As I use a nonlinear VAR, my analysis is close to Chatterjee et al. (2017), Davig and Hakkio (2010), Ubilava (2014), who adopted such methodology for different countries.

3 Hypothesis Development and Data

This paper has two goals. First, it aims to test for causality between financial stress and economic activity in Russia, Second, it examines a changing degree of response of economic activity to financial stress.

The scatter plot lends preliminary support to hypothesis about the existence of two regimes in the relationship between production index and ACRA FSI (Fig. 1). Indeed, economic activity measured by the production index and financial stress tends to move in opposite directions during distressed periods. There is also a negative relationship between these variables in the normal regime but to less extent. Two black diamonds illustrate the average values for ACRA FSI and production index in normal and stressed periods. They are (0.713; 1.03) and (2.381; −1.001), respectively.

Further, I discuss data used to test my hypotheses. As a proxy for financial instability in Russia, I take the ACRA FSI.Footnote 1 This index captures the financial system’s proximity to a financial crisis. Twelve factors are used for the ACRA FSI calculation (Kulikov and Baranova 2016):

-

Spread between money market interest rates and zero-coupon short-term OFZsFootnote 2 (3 months);

-

Interest rate spread between large issues of liquid corporate bonds and zero-coupon OFZ rate (5 years);

-

Stock market volatility;

-

Financial sector stock price index;

-

Divergence of financial institutions’ stock returns;

-

Spread between the interbank loan interest rate and 1-day liquidity interest rate offered by the Bank of Russia;

-

Differential between crude oil spot and forward prices (1 year);

-

Crude oil price volatility;

-

Currency exchange rate volatility;

-

Inflation;

-

Velocity of the simultaneous stock prices drops of financial institutions and sovereign debt (flight to liquidity);

-

Velocity of divergence between stock prices of financial institutions and quality lender-issued bonds (flight to quality).

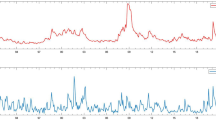

Prior to weighting and summing up, the original factors are transformed in the way that makes their value increase along with financial stress. The transformed factors are normalized to ensure that each of their historical dynamics has a zero sample mean and a single-unit standard deviation within a fixed timeframe. Weights of normalized and transformed factors are calculated as the coordinates of the first principal component. Financial stress is an unobservable phenomenon. Thus, in order to make sure that it behaves correctly in case of financial shocks, one can observe index dynamics after these events. It strengthens the credibility of the indicator (Fig. 2).

I use monthly production index as a proxy of economic activity as a weighted average of six core industries (agriculture, industrial production, construction, retail trade, wholesale trade, and transport). I seasonally adjust it using the Census X-12 method. As the production index is available only at monthly frequency, I transform the ACRA FSI by taking average monthly values. The sample covers the period from January 2006 to June 2019.

4 Methodology and Estimation Results

In order to test the first hypothesis, I apply a VAR model and Granger causality tests (Granger 1969). First, I perform stationarity check for the time series. I use Augmented Dickey–Fuller (ADF) test and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) test (Kwiatkowski et al. 1991). The null hypothesis for ADF test is non-stationarity, while for the KPSS test it is stationarity. I use both tests, as null hypotheses for them are different and to ADF test is sensitive to structural breaks in time series. The results of the tests are presented in Table 1. The ADF test rejects the null hypothesis of non-stationarity at 5%, but does not reject it at 1%. The production index is stationary at any reasonable significance level as well as its first difference. According to the KPSS tests, both series are stationary even in levels. Thus, the results are inconclusive at the 5% significance level for the ACRA FSI.

Hence, I conclude that unit root tests results suggest the maximum level of integration is one. That is, one lag of the ACRA FSI and production index should be included as exogenous variables into a VAR model to perform the Toda–Yamamoto Granger causality test. For this test specification, there is no need for all variables to be stationary or cointegrated. Next, I choose an optimal lag length for VAR model. The results are in Table 2. According to Schwarz Criterion (SC) and Hannan–Quinn information criterion (HQ), three lags should be selected. Thus, in order to perform the Toda–Yamamoto Granger causality test, I should use the VAR model with four lags. The results of the causality tests are in Table 3. Autocorrelation LM test indicates the absence of serial correlation in the residuals of model. Small p-values reject the null hypothesis of no causality when production index is the dependent variable. The generalized impulse response function (GIRF) with 95% confidence band of production index to one standard deviation shock of ACRA FSI is represented in Fig. 3. It captures a negative response of economic activity to financial stress. This result is consistent with Stolbov and Shchepeleva (2016) and Çevik et al. (2013). I perform robustness check by narrowing the sample from January 2012 to June 2019. The results of the robustness check are in line with the full-sample analysis.

Finally, I estimate a TSVAR model. This type of VAR model captures nonlinearities and structural breaks in time series. There are two states of stability of the financial system: normal and distressed regimes. The threshold value of ACRA FSI is 1.2 (Fig. 3). GIRFs for TSVAR model are illustrated in Fig. 4. They suggest that for both types of periods financial stress and real economy are negatively correlated. However, for distressed periods the impact of financial shock is much more pronounced and longer lasting. Indeed, GIRFs show that for these periods one standard deviation increase in financial stress leads to a significant decline of economic activity over several months. This result is consistent with the existing literature.

5 Conclusions

The results of the performed tests indicate that there is a strong statistical evidence that the ACRA FSI helps predict changes in the production index. It implies that the inclusion of financial stress index can significantly improve forecasting accuracy of production and real economic growth. However, one needs to be very cautious when interpreting the results of Granger causality tests, as it does not necessarily indicate causality. That is, the definition of causality is related to the idea of the cause-and-effect relationship, while “Granger causality” is rather a statistical concept, which does not necessarily imply it. Overall, the findings of this research are consistent with those of the aforementioned studies. Thus, the ACRA FSI can contribute to the improvement of forecasting models for economic growth in Russia, as it is a real-time indicator.

The paper also finds that there are different responses of economic activity during normal and stressful regimes. These results are in line with the results for financial stress indices for advanced economies (USA, UK, Canada) and emerging markets (Brazil).

Notes

- 1.

Values of ACRA FSI are published on a daily basis on the official ACRA website: https://www.acra-ratings.com/research/index.

- 2.

OFZs are bonds issued by the Federal Russian government.

References

Aboura, S., & van Roye, B. (2017). Financial stress and economic dynamics: The case of France. International Economics, 149(C), 57–73.

Aklan, N., Çinar, M., & Akay, H. (2016). Financial stress and economic activity relationship in Turkey: Post-2002 period (Türkiye’de Finansal Stres ve Ekonomik Aktivite İlişkisi: 2002 Sonrasi Dönem). Yönetim ve Ekonomi: Celal Bayar Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 22(2), 567–580.

Bernanke, B., Gertler, M., & Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. In Handbook of Macroeconomics (pp. 1341–1393). Cambridge, MA: National Bureau of Economic Research.

Bloom, N. (2009). The impact of uncertainty shocks. Econometrica, 77(3), 623–685.

Cardarelli, R., Elekdag, S., & Lall, S. (2011). Financial stress and economic contractions. Journal of Financial Stability, 7(2), 78–97.

Çevik, E., Dibooglu, S., & Kutan, A. (2013). Measuring financial stress in transition economies. Journal of Financial Stability, 9(4), 597–611.

Cevik, E. I., Dibooglu, S., & Kenc, T. (2016). Financial stress and economic activity in some emerging Asian economies. Research in International Business and Finance, 36(C), 127–139.

Chatterjee, S., Chiu, J., Hacioglu-Hoke, S., & Duprey, T. (2017). A financial stress index for the United Kingdom. SSRN Electronic Journal, 9, 697.

Davig, T. A., & Hakkio, C. S. (2010). What is the effect of financial stress on economic activity. Economic Review, 2, 35–62.

European Central Bank. (2011). Financial Stability Review June 2011.

Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37(3), 424–438.

Hakkio, C. S., & Keeton, W. R. (2009). Financial stress: What is it, how can it be measured, and why does it matter? Economic Review, 2, 5–50.

Illing, M., & Liu, Y. (2003). An index of financial stress for Canada (pp. 3–14). Ottawa: Bank of Canada.

Kliesen, K., & Smith, D. (2010). Measuring financial market stress. Economic Synopses, 2010, 2.

Kulikov, D., & Baranova, V. (2016). Principles of calculating the financial stress index for the Russian Federation. Retrieved from https://www.acra-ratings.com/criteria/129

Kulikov, D., & Baranova, V. (2017). Financial stress index for Russian financial system. Money and Credit, 6, 39–48.

Kwiatkowski, D., Phillips, P. C. B., & Schmidt, P. (1991). Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? (p. 979). London: Elsevier.

Monin, P. (2017). The OFR financial stress index. Risks, 7(1), 25.

Polat, O., & Ozkan, I. (2019). Transmission mechanisms of financial stress into economic activity in Turkey. Journal of Policy Modeling, 41(2), 395–415.

Stolbov, M., & Shchepeleva, M. (2016). Financial stress in emerging markets: Patterns, real effects, and cross-country spillovers. Review of Development Finance, 6(1), 71–81.

Stona, F., Morais, I. A. C., & Triches, D. (2018). Economic dynamics during periods of financial stress: Evidences from Brazil. International Review of Economics & Finance, 55(C), 130–144.

Tng, B. H., & Kwek, K. T. (2015). Financial stress, economic activity and monetary policy in the ASEAN-5 economies. Applied Economics, 47(48), 5169–5185.

Toda, H. Y., & Yamamoto, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics, 66(1–2), 225–250.

Ubilava, D. (2014). On the relationship between financial instability and economic performance: Stressing the business of nonlinear modelling. Macroeconomic Dynamics, 23, 80–100.

van Roye, B. (2011). Financial stress and economic activity in Germany and the Euro area (p. 1743). Kiel: Institute for the World Economy.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Baranova, V. (2021). Real Effects of Financial Shocks in Russia. In: Karminsky, A.M., Mistrulli, P.E., Stolbov, M.I., Shi, Y. (eds) Risk Assessment and Financial Regulation in Emerging Markets' Banking. Advanced Studies in Emerging Markets Finance. Springer, Cham. https://doi.org/10.1007/978-3-030-69748-8_15

Download citation

DOI: https://doi.org/10.1007/978-3-030-69748-8_15

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-69747-1

Online ISBN: 978-3-030-69748-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)